Computing Interest Rates Programs

For Use in New State Commercial Finance Laws

Source:

https://www.nav.com/business-loan-calculators/merchant-cash-advance-apr-calculator/

In the old days, late 1960’s and early 1970’s, companies would issue their buy rate for the term and amount for sales representatives’ calculations. They then add the factor to 1.00 and multiply it times the company buy rate. For instance, .0331 and the salesman wanted five points, multiply 1.05 times .0331 and it would be .034755. Then multiply this to the amount being financed to get the monthly payment.

Brokers were taught to tell prospects the rate in add on, not APR. Five year factor of .025 was 18% APR; 10% add on. First and last would increase the interest rate, as well as a balloon or residual at the end.

Today, the most popular calculator software is TValue, available online or software for your computer of smartphone:

https://www.timevalue.com/tvalue-products

You can also purchase the calculator to put on your website by going to: https://www.timevalue.com/tcalc-financial-calculators

There are other financial portals and calculation tools:

Bankrate.com

Kiplinger.com

The Motley Fool

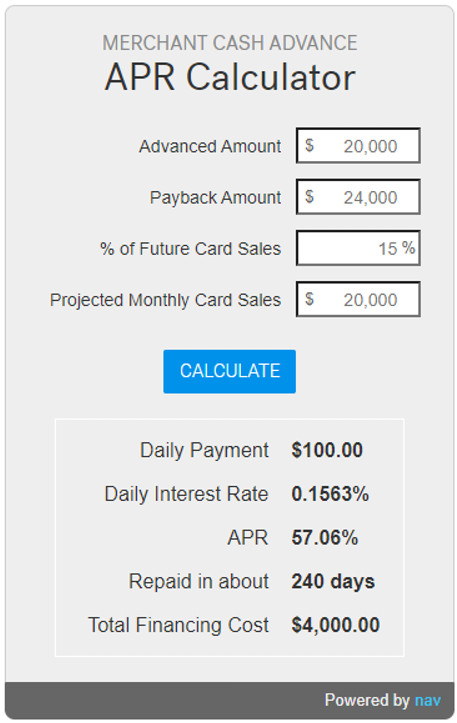

Merchant Cash Advance APR Calculator

Kabbage, OnDeck, plus Term Loan APR Calculator

(upper left on site below, plus add below site to your website)

https://www.nav.com/business-loan-calculators/merchant-cash-advance-apr-calculator/