Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Add me to mailing list

| Search | All Lists | Columnists | Site Map

Advertising| Archives | Classified Ads | This Day In American History

Email the Editor

![]()

Wednesday, April 28, 2021

Today's Leasing News Headlines

Small Business Owner Optimism is Rebounding in 2021

Key Insights about the U.S. Economy, Hiring and Business Growth

CLFP's by Company

Members with Two or More - Updated

Academy for Certified Lease & Finance Professionals

Two Academy in May and Two in June—Only June 17-18 Open

Leasing Industry Help Wanted

Opportunity Available

Quality Matters

Sales Make it Happen by Scott Wheeler, CLFP

Congress Circulates Bill to Return to FTC the Right

to Seek Monetary Relief

By Eric J. Troutman, Esq.

Part 2

Ken Greene, Esq. Report on SFNet Webinar

State Financial Disclosure Legislation:

What You Don’t Know May Hurt You

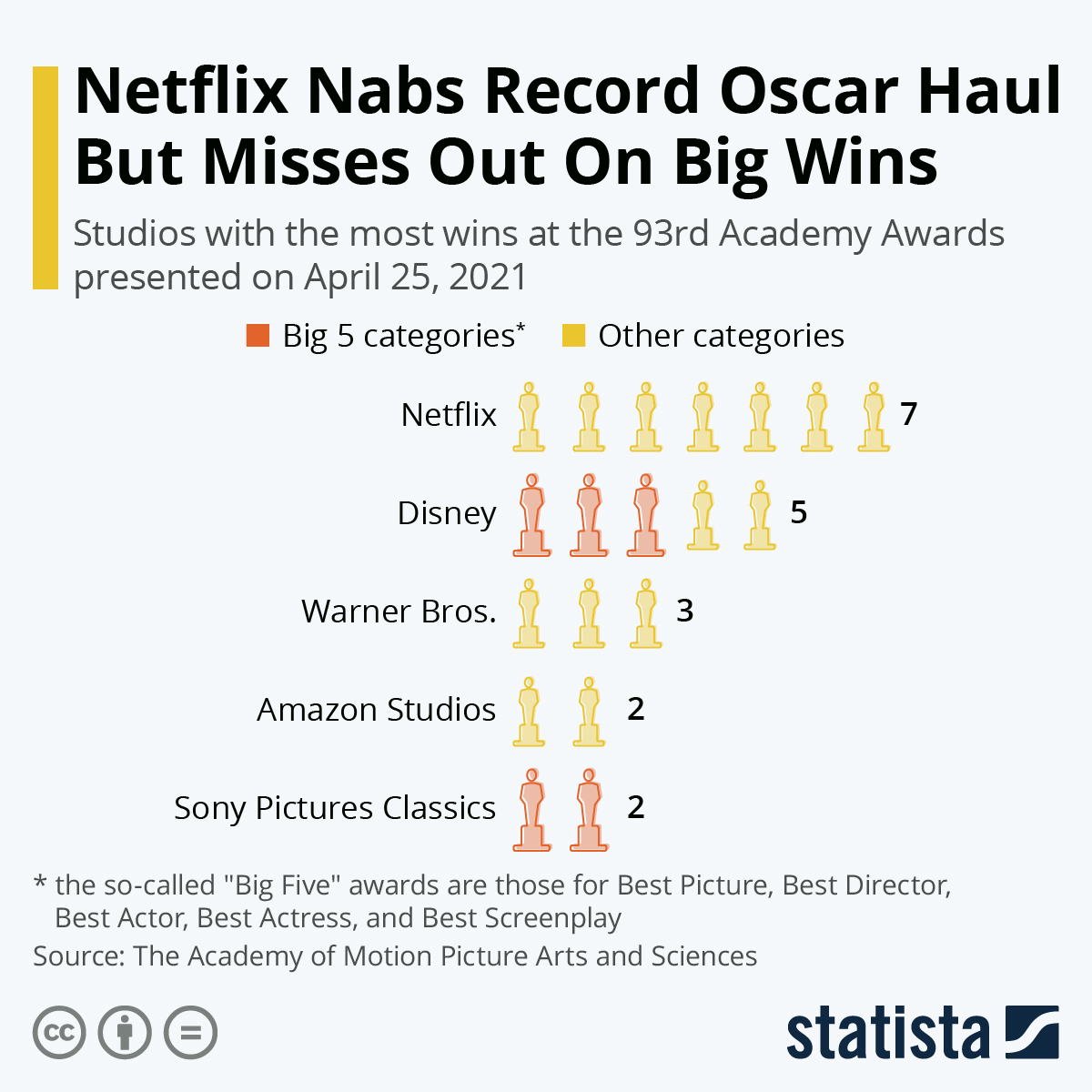

Netflix Nabs Record Oscar Haul '93rd Academy Awards

But Misses Out on Big Wins graphic

Ascentium Capital LLC Announces First Quarter 2021

Funding Volume of $312 Million

The Equipment Leasing & Finance Foundation Extends

Deadline for 2021 School Year Scholarships

Weimaraner/Mix

Seattle, Washington Adopt-a-Dog

ELFA Legal Forum LIVE!

May 04 - May 05, 2021

News Briefs---

Ford to develop, produce its own electric vehicle batteries

wants to do large-scale manufacturing

US pushes back REAL ID deadline until May 2023

Another 19 Months--On Line Procedure Available

Remote workers are being paid $20,000

to relocate to America's small towns

Lumber prices go through the roof

as housing demand soars

Apple will spend $1 billion to open 3,000-employee

campus in North Carolina

Having Internet Delays and Problems?

How to tell when it's time to upgrade your router

You May have Missed---

‘How did that happen?’ Catching covid-19

even after being vaccinated

Broker/Funder/Industry Lists | Features (wrilter's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

Leasing News Icon for Android Mobile Device

Sports Brief----

California Nuts Brief---

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release,” it was not written by Leasing News nor has the information been verified. The source noted. When an article is signed by the writer, it is considered a “byline.” It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

Small Business Owner Optimism is Rebounding in 2021

Key Insights about the U.S. Economy, Hiring and Business Growth

Balboa Capital reports the results of its Q2 2021 Small Business Owner Survey, which was conducted to gauge small business owner confidence, measure the strength of the United States economy, and gain an understanding of recent small business performance. The survey found that half of small businesses saw increased revenues in Q1 2021 and seven in 10 small business owners (SBOs) expect their companies to perform better in 2021. Additionally, 59 percent of SBOs think the nation’s economy will experience moderate to strong growth this year. Balboa Capital’s survey was sent to a sample of SBOs in a wide variety of industries in April 2021.

Kevin Umeda, Balboa Capital Manager of Sales Planning and Coordination, said, “The fog of uncertainty that has lingered over Main Street USA appears to be lifting. The results of our latest survey reveal that small business owners are seeing increased revenues in 2021 and they are feeling confident about the nation’s economy.

“Seventy-one percent of SBOs we surveyed expect their companies to perform better in 2021 and this has translated into plans for long-term business growth. More and more SBOs are eager to invest in capital equipment, hire new employees, and purchase more inventory.”

Key takeaways from Balboa Capital’s Q2 2021 Small Business Owner Survey:

* 50% of SBOs reported increased revenues in Q1, compared to 17% in the previous quarter

* 28% of SBOs reported no change in revenues in Q1, compared to 30% in the previous quarter

* 22% of SBOs reported decreased revenues in Q1, compared to 53% in the previous quarter

* 71% of SBOs think their companies will perform better in 2021 than they did in 2020

* When asked how they think the United States economy will perform in 2021, 20% of SBOs said “strong growth,” 39% said “moderate growth,” and 24% said “flat/no change”

* 73% of SBOs plan to increase spending and/or invest in their companies in 2021

* 8 in 10 SBOs have incurred costs relating to coronavirus safety measures

* 35% of SBOs raised their prices to offset the costs relating to coronavirus safety measures

* 52% of SBOs expect to hire new employees in Q2, up from 25% in the previous quarter

The impact of COVID-19 on sales and productivity is the number-one concern of SBOs in 2021, followed by business tax rates, consumer confidence/spending, operating costs/expenses, and stock market performance.

[headlines]

--------------------------------------------------------------

CLFP's by Company

Members with Two or More - Updated

The membership count now is 986. As soon as the latest test papers’ answers are completed, the CLFP certified count will reach over 1,000

| Company | Count of CLFPs/Associates |

| First American Equipment Finance, | 146 |

| Ascentium Capital LLC | 55 |

| U.S. Bank Equipment Finance | 39 |

| Stearns Bank NA | 31 |

| Financial Pacific Leasing, Inc. | 30 |

| Key Equipment Finance | 28 |

| Amur Equipment Finance | 25 |

| AP Equipment Financing | 22 |

| Oakmont Capital Holdings | 22 |

| DLL | 21 |

| Arvest Equipment Finance | 19 |

| TCF Equipment Finance, | 18 |

| 1st Source Bank | 14 |

| ECS Financial Services, Inc. | 14 |

| KLC Financial, Inc. | 14 |

| IDS | 12 |

| Ivory Consulting Corporation | 12 |

| Stryker | 12 |

| Odessa | 11 |

| Canon Financial Services, Inc. | 10 |

| Fleet Advantage, LLC | 10 |

| Great American Insurance | 9 |

| Orion First Financial LLC | 9 |

| BMO Harris Equipment Finance Company | 8 |

| Navitas Credit Corp. | 8 |

| Northland Capital Financial Services, LLC | 8 |

| Wintrust Specialty Finance | 8 |

| BancorpSouth Equipment Finance | 7 |

| Beacon Funding Corporation | 7 |

| Celtic Commercial Finance | 7 |

| North Mill Equipment Finance | 7 |

| The Huntington National Bank | 7 |

| Alliance Funding Group | 6 |

| Truist | 6 |

| BankFinancial, NA | 5 |

| CoreTech Leasing, Inc. | 5 |

| First Foundation Bank | 5 |

| GreatAmerica Financial Services | 5 |

| Hanmi Bank | 5 |

| LTi Technology Solutions | 5 |

| Univest Capital, Inc. | 5 |

| Cisco Systems Capital Corporation | 4 |

| Commerce Bank | 4 |

| ENGS Commercial Finance Co. | 4 |

| Global Financial & Leasing Services LLC | 4 |

| NCMIC Finance Corporation | 4 |

| UniFi Equipment Finance, Inc. | 4 |

| Bank of the West | 3 |

| Commercial Capital Company, LLC | 3 |

| First National Capital Corporation | 3 |

| FIS | 3 |

| Lease Corporation of America | 3 |

| Northteq, Inc. | 3 |

| Providence Capital Funding, Inc. | 3 |

| Quality Leasing Co., Inc. | 3 |

| Taycor Financial | 3 |

| Western Equipment Finance | 3 |

| American Equipment Financial Services | 2 |

| Anuva Capital | 2 |

| Balboa Capital Corporation | 2 |

| Bryn Mawr Equipment Finance, Inc. | 2 |

| BSB Leasing, Inc. | 2 |

| Channel Partners Capital | 2 |

| Customers Bank Commercial Finance | 2 |

| Dakota Financial, LLC | 2 |

| Dell Financial Services | 2 |

| Diversified Capital Credit Corporation | 2 |

| Falcon Leasing | 2 |

| First Utah Bank | 2 |

| FirstLease, Inc. | 2 |

| FSG Capital, Inc. | 2 |

| Innovation Finance | 2 |

| Koala Capital Group, LLC | 2 |

| Macquarie Group | 2 |

| Madison Capital LLC | 2 |

| Maxim Commercial Capital, LLC | 2 |

| NetJets | 2 |

| NewLane Finance | 2 |

| Northpoint Commercial Credit, LLC | 2 |

| OnPoint Capital, LLC | 2 |

| Pacifica Capital | 2 |

| Padco Financial Services, Inc. | 2 |

| Patriot Capital Corp | 2 |

| Smarter Equipment Finance, LLC | 2 |

| Takeuchi Financial Services | 2 |

| Tamarack Technology, Inc. | 2 |

| The Alta Group LLC | 2 |

| TimePayment Corporation | 2 |

| TopMark Funding | 2 |

| VFI Corporate Finance | 2 |

| Wintrust Commercial Finance | 2 |

[headlines]

--------------------------------------------------------------

Academy for Certified Lease & Finance Professionals

Two Academy in May and Two in June—Only June 17-18 Open

The Academy for Lease and Finance Professionals (ALFP) is a three-day event designed to fully prepare an individual to sit for the CLFP exam assuming the attendee has already self-studied.

During the first two days, all of the required sections of the CLFP exam are covered in-depth and on the third day, the exam is offered, but not mandatory and may be taken on another day.

Students are strongly advised to have read and studied The Certified Lease & Finance Professionals' Handbook prior to attending the class in order to ensure success.

Certified Lease & Professional Handbookhttps://smile.amazon.com/Certified-Lease-Finance-Professionals-Handbook/dp/B0863QD9TH

Academy Days

US Bank ALFP (Registration Closed)

May 3 – May 5

Monday – 9:00 a.m. – 5:00 p.m.

Tuesday – 9:00am – 4:00pm

Exam is proctored online, therefore, it may be taken at any time.

https://clfpfoundation.org/academy-for-lease-and-finance-professionals/2021-us-bank-online-alfp/

Oakmont Capital ALFP (Registration Closed)

May 6 – May 7

Thursday – 9:00 a.m. – 5:00 p.m.

Friday – 9:00 a.m. – 4:00 p.m.

Exam is proctored online, therefore, it may be taken at any time. https://clfpfoundation.org/academy-for-lease-and-finance-professionals/2021-oakmont-capital-online-alfp/

Lease Corporation of America (Online Private ALFP)

June 10 - 11, 2021

Exam is proctored online, therefore, it may be taken at any time. https://clfpfoundation.org/academy-for-lease-and-finance-professionals/2021-oakmont-capital-online-alfp/

Northteq Online ALFP (public)

June 17 - 18

Thursday – 9:00 a.m. – 5:00 p.m. (Central)

Friday – 9:00 a.m. – 4:00 p.m. (Central)

This online ALFP will require attendees to have access to WebEx

Exam is proctored online, therefore, it may be taken at any time. https://clfpfoundation.org/academy-for-lease-and-finance-professionals/2021-oakmont-capital-online-alfp/

Register:

https://clfpfoundation.org/academy-for-lease-and-finance-professionals/2021-northteq-online-alfp/

About Academy

https://clfpfoundation.org/academy-for-lease-and-finance-professionals/

If you are interested in attending, please contact Reid Raykovich, Executive Director: Reid@clfpfoundation.org

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Quality Matters

Sales Make it Happen by Scott Wheeler, CLFP

Originators in the commercial equipment leasing and finance industry are measured by the quality of their transactions. The long-term performance of an originator's personal portfolio matters. Originators' incomes are determined by their daily ability to generate new assets. Career and industrywide reputations are established by ensuring that those generated assets are well performing.

Top originators work with their internal and external partners to ensure they are producing the best performing assets by:

- Recognizing credit professionals as their partners rather than their adversaries. Top originators work closely with their credit departments and funding partners to understand credit criteria. Top producing originators prequalify transactions and seek out the highest quality transactions.

- Trusting their gut feelings about marginal transactions. They shy away from transactions that do not add-up and point out pros and cons of every transaction.

- Avoiding short cuts. Top originators are proponents of knowing the customer, the vendor, and the transaction. Top producers are constantly advocating for having the facts and presenting the facts correctly to their credit partners. Top producers save time and maximize their incomes by doing the process correctly the first time and every time.

- Winning transactions through value-added services rather than commoditized pricing and reduced credit requirements. Top producing originators are long-term players in the market, and they command respect by understanding all aspects of the risk and reward markets in which they participate.

Originators throughout the industry are experiencing strong production opportunities in 2021. Top producers are taking the opportunity to build their reputation within the industry. They know strong production numbers are enhanced when they consist of well performing assets.

Quality matters.

Scott A. Wheeler, CLFP

Wheeler Business Consulting

1314 Marquis Ct.

Fallston, Maryland 21047

Phone: 410 877 0428

Fax: 410 877 8161

Email: scott@wheelerbusinessconsulting.com

Web: www.wheelerbusinessconsulting.com

Sales Makes it Happen articles:

http://www.leasingnews.org/Legacy/index.htm

[headlines]

--------------------------------------------------------------

Congress Circulates Bill to Return to FTC the Right

to Seek Monetary Relief

By Eric J. Troutman, Esq.

The Supreme Court ruled in the AMG Capital case, stripping Federal Trade Commission (FTC) of the self-appointed power to obtain monetary redress from the Courts without the ALJ process mandated by other sections of the FTC Act.

Congress is not even taking a breath here. As noted last week, a hearing before the pertinent subcommittee will take place before the end of the month and now a new bill is being circulated to hand the FTC back the power it never had.

The draft bill is here: H.R. 2668 (Bill to Give FTC Power Back)

Here is the key language:

(1) RESTITUTION; CONTRACT RESCISSION AND REFORMATION; REFUNDS; RETURN OF PROPERTY.—

In a suit brought under subsection (b)(2)(B), the Commission may seek, and the court may order, with respect to the violation that gives rise to the suit, restitution for losses, rescission or reformation of contracts, refund of money, or return of property.

(2) DISGORGEMENT.—

In a suit brought under subsection (b)(2)(B), the Commission may seek, and the court may order, disgorgement of any unjust enrichment that a person, partnership, or corporation obtained as a result of the violation that gives rise to the suit.

The bill already has 13 sponsors; all Democrats but this feels like a bi-partisan bill in the making.

Eric J. Troutman, Esq.

Squire Patton Boggs (US) LLP

National Law Review.com

[headlines]

--------------------------------------------------------------

Part 2

Ken Greene, Esq. Report on SFNet Webinar

State Financial Disclosure Legislation:

What You Don’t Know May Hurt You

Analyzing the new regulations in both California and New York

as they apply to specific types of transactions.

Ken Greene, Leasing News Legal Editor, and Legal Counsel, American Association of Commercial Finance Brokers, webinar report. This is important as the commercial finance market is changing. Connecticut and New Jersey are actively exploring to join California and New York to pass a business loan, capital lease, and merchant cash advance interest disclosure laws. Non-bank companies and brokers will be required to obtain and maintain a license, file an annual report, and abide by the new rules. Editor

THE EMPERORS’ NEW DISCLOSURES

Part Two: Disclosures for Commercial Loans

California defines a commercial loan as one in the principal amount of $5000 or more, or any loan under an open-end credit plan (i.e. credit cards, home equity lines of credit, and the like), the proceeds of which are intended for other than personal, family or household purposes. Pursuant to Cal. Financial Code §22802(b), the following information must be disclosed to the recipient at the time the provider extends a specific commercial financing offer, and the provider must obtain the recipient’s signature on the disclosure before consummating the transaction:

- The total amount of funds provided (further discussed below);

- The total dollar cost of the financing:

- The term or estimated term;

- The method, frequency and amount of payments;

- A description of prepayment policies;

- The total cost of the financing expressed as an annualized rate.

The regulations that are under review by the DFPI include the following explanations and definitions, some of which are clear, and some of which are not. The redlined language represents new regulations under consideration and presently circulating for public review and comment.

(1) “Amount financed” means:

(A) With respect to a closed‐end transaction or sales‐based financing, the amount of funds to be provided by the financer to the recipient or on the recipient’s behalf.

(B) With respect to a commercial open‐end credit plan, the approved credit limit.

(C) With respect to a factoring transaction disclosure made pursuant to section 22802 of the Code, the original advance amount.

(D) With respect to a factoring transaction disclosure made pursuant to section 22803 of the Code, the approved advance limit, less any reserve amounts that would be withheld if an amount equal to the approved advance limit were disbursed to the recipient or on the recipient’s behalf.

(E) With respect to asset‐based lending disclosures made pursuant to section 22803 of the Code and section 3021 of these rules, the amount described in section

3021, subdivision (a)(2)(A) or (a)(3)(A).

(F) With respect to a lease transaction:

i. If the financer does not select, manufacture or supply the goods to be leased, the net cost to the financer to acquire the property to be leased.

ii. If the financer selects, manufactures or supplies the goods to be leased, the price that the financer would sell the goods in a cash transaction, minus any down payment or other deposit to be paid by the recipient.

(2) “At the time of extending a specific commercial financing offer” means:

(A) any time a specific periodic payment or irregular payment amount, rate or price, in connection with commercial financing, is quoted in writing to a recipient;

(B) within one business day of any time a specific periodic payment or irregular payment amount, rate or price, in connection with a commercial financing, is verbally quoted to a recipient, based upon information from, or about, the recipient, and before the commercial financing transaction is consummated;

(C) Within one business day of any time a specific periodic payment or irregular payment amount, rate or price, in connection with a commercial financing, is verbally quoted to a recipient, based upon information from, or about, the recipient, and before the commercial financing transaction is consummated;

(D) Any subsequent time when the terms of an existing consummated commercial financing contract are amended or supplemented changed, prior to the recipient agreeing to the changes, if the resulting changes to the contract would result in an increase to the finance charge, payments, term, or annual percentage rate, regardless of whether those terms were previously disclosed to the recipient.

(E) At the time a specific periodic payment or irregularly (sic) payment amount, rate or price is quoted to a recipient in writing based upon information from, or about, the recipient, or within one business day of the time when a specific periodic payment or irregularly (sic) payment amount, rate or price is quoted to a recipient verbally based upon information from, or about, the recipient, and before the draw or purchase occurs, in connection with each draw on an open‐end credit plan if:

(i) draws occur at the time that a recipient purchases products or services from a retailer or supplier; and

(II) the rate or price varies based upon the retailer or supplier the recipient selects, or the products or services the recipient purchases.

(3) “Finance charge” means the amount of any and all costs of the financing, represented as a dollar amount, as more specifically described in section 3010 of these rules.

(4) “Interest rate” means the periodic rate at which interest accrues on the outstanding principal balance and (if interest is compounded) on accrued but unpaid interest in a commercial financing.

(5) “Initial interest rate” means, in a credit transaction with an interest rate that changes over time and that cannot be calculated in advance for the entire term of the transaction, the rate that would be in effect at the time a disclosure is made, assuming the recipient accepted the financing offer.

(6) “Irregular payment” means any payment made to the financer that is not a periodic payment.

(7) “Sales‐based financing” means a commercial financing transaction that is repaid by a recipient to the financer as a percentage of sales or income, in which the payment amount increases and decreases according to the volume of sales made or income

received by the recipient. Sales‐based financing also includes commercial financing transactions with a true‐up mechanism. “True‐up” means any payment made to a recipient, any charge assessed to a recipient, and any adjustment to recipient’s periodic payments pursuant to a true‐up mechanism.

(8) “Term” means, the length of time that it is anticipated will be necessary for the recipient to fulfill its obligations under a financing agreement.

Another fundamental innovation, as formulated in the pending California regulations, pertains to the format of the disclosures:

(1) At the top of the disclosure, centered on the page or other display medium, the provider shall print the following statement in bold font: “OFFER SUMMARY.”“OFFER SUMMARY FOR” in bold font, followed by a one‐ to five‐word description of the type of product offered (e.g. “Merchant Cash Advance”) which may include the financer’s branding terminology.

(2) At the bottom of the disclosure, below any other information required by this Article, the provider shall print the following statement: “California law requires this information to be

provided to you to help you make an informed decision. By signing below, you are confirming that you received this information.” Below the statement, the provider shall include a space for the recipient to sign the form labeled “Recipient Signature” and a space for the recipient to write the date of their signature, labeled “Date.

(3) If the term or estimated term of a transaction is:

(A) One year or less, the term or estimated term shall be disclosed in days;

(B) Greater than one year, the term or estimated term shall be disclosed in units of years and months, with any remaining days expressed as a portion of a month to the nearest two decimal points.

(4) The disclosures shall be presented to the recipient as a separate document from any other contract, agreement, or other disclosure document provided to the recipient, but may be mailed or transmitted in a package that contains other documents.

(5) The provider may present the required disclosure in fonts and colors and typefaces that are clear, complete, conspicuous, easy to compare with other disclosures, and consistent with the requirements of this Chapter. A provider shall not use colors and fonts that make any enumerated terms required by section 22802, subdivision (b) of the Code more clear or conspicuous than any other term required by that subdivision.

(6) Notwithstanding subdivision (a)(5)(B), a provider may use a font substantially similar in size to Times New Roman 16‐point font for “OFFER SUMMARY FOR” and content appearing in the first and second columns of the disclosure where those columns are not combined with other columns.

(7) A provider shall ensure that the width of the columns in the required disclosure is such that the disclosure does not unnecessarily extend onto multiple pages. A provider that formats the columns in the required disclosure such that the ratio between the first, second and third columns is 3:3:7 complies with the requirements of this subdivision.

(8) Where a provider is required or permitted to provide a “short explanation” under this subchapter, the provider shall provide an explanation of not more than 60 words.

(9) Each of the cells in the required disclosures shall be outlined.

(10) If disclosures are provided to a recipient electronically, the provider shall include a method for the recipient to submit an electronic signature that complies with Civil Code section1633.2, subdivision (h) and automatic date stamp to comply with subdivision (a)(2) of this section and provide the recipient with the ability to receive a copy of the disclosure in a format that the recipient may keep. A format the recipient may keep includes hard copy disclosures, and electronic documents containing the required disclosures that the customer can save indefinitely for future reference.

(11) Numerical values, including but not limited to percentages, dates, and dollar amounts, shall be expressed numerically, such as “23” and not alphabetically, such as “twenty‐three.”

(12) If a provider issues a disclosure where the amount financed includes funds used to pay down or pay off a preexisting financing agreement, and the amount due under that preexisting financing agreement changes prior to consummation of the agreement between the financer and the recipient, the provider need not provide a new disclosure to the recipient solely because the amount due under the preexisting financing agreement has changed.

On July 23, 2020, the New York State legislature passed SB 5470, now known as the Commercial Financing Disclosure Law (“CFDL”), which closely follows California’s SB 1235. It is similar to California law, but not quite as complex. Starting in June 2021, non-banks and fintechs will be required to provide disclosures to small businesses at any point where a “specific offer” of financing is extended. The disclosure must generally include

1) The total amount of the commercial financing, and if different, the disbursement amount;

2) The finance charge;

3) The APR or estimated APR for sales-based or factoring transactions, calculated in accordance with TILA or Regulation Z;

4) The total repayment amount;

6) The term of the financing or estimated term for sales-based transactions;

7) The periodic payment amounts;

8) A description of all other potential fees and charges;

9) Prepayment penalties, if any; and

10) A description of collateral requirements or security interests, if applicable.

In December of 2020, Governor Cuomo indicated an intent to make technical amendments to SB 5470-B, including one notably non-technical change, increasing the dollar amount of covered transactions to $2.5 million or less. Whether or not this “technical” change will become law is unclear at this time.

SB 5470-B applies broadly to commercial financing transactions, including but not limited to closed and open-end loans, and “sales-based financing”, which appears to include factoring and merchant cash advances. Like California, the new law is modeled after the Truth in Lending Act (“TILA”), a consumer protection statute. The new law is currently scheduled to take effect on June 21, 2021. However, legislation is pending to extend the effective date to January 1, 2022. Although, like California, the “CFDL” authorizes the New York Department of Financial Services (“NYDFS”) to promulgate regulations, it will become effective whether or not the NYFDS promulgates such regulations. The reason for this is nothing short of a mystery, since New York’s law creates an implementation conundrum no less baffling than those in California.

There are exemptions under the CFDL for banks and limited exemptions for entities acting as technology service companies for such exempt entities, but the exemptions apply only if the tech company has no interest in the commercial financing. It reminds me of the “referral source” exemption under California’s licensing laws.

Just as in California, the New York law has administrative and enforcement procedures, including penalties up to $2000 per violation and up to $10,000 per willful violation. Injunctive relief is also available to the NYDFS for willful violations.

In the next segment of this series, I will address the laws and regulations that govern the disclosures for less traditional products like factoring and merchant cash advances. I will also briefly discuss the developing disclosure rules in other states which have been spurred by the California and New York laws of enact similar laws to regulate financing for small businesses.

Part One: The Regulators are Coming

http://leasingnews.org/archives/Apr2021/04_26.htm#

[headlines]

--------------------------------------------------------------

This year was a special year at the Oscars as films were not required to have had a theatrical run to be eligible for an award. This was not a concession to new distribution models, however, as much as it was a one-time exception caused by the COVID-19 pandemic’s disruption of the theatrical release model.

Netflix won seven awards overall, including Best Documentary for the surprise fan favorite My Octopus Teacher. Searchlight’s parent company Disney took home five awards in total, with Warner Bros., Amazon Studios and Sony Pictures Classics the only other studios nabbing multiple prizes.

It was a big night for Netflix at the 93rd Oscars on Sunday but, in a way, it was also a disappointing one. Having led the way into this year’s ceremony with 35 nominations, including two nods for “Best Picture” and several in other “Big Five” categories, the streaming giant nabbed more awards than any other studio on Sunday but missed out on the night’s biggest prizes.

Searchlight Pictures “Nomadland” emerged as the big winner from this year’s ceremony, winning Best Picture, Best Director and Best Actress. Winning her second Best Actress Oscar in four years and her third overall, Frances McDormand joined an elite circle by becoming only the third actor/actress beside Katherine Hepburn (4) and Daniel Day-Lewis (3) to win three Best Actor/Actress awards.

By Felix Richter, Statista

[headlines]

--------------------------------------------------------------

##### Press Release ############################

Ascentium Capital LLC Announces First Quarter 2021

Funding Volume of $312 Million

Tom Depping, Executive Vice President, Ascentium Group Manager, Saud, “2021 marks a decade since the launch of Ascentium Capital and first quarter results are a testament to the long-term success of our business model, risk management, and proprietary finance platform.

“We look forward to the country recovering from the pandemic and seeing the positive impact that will have on the clients and communities we serve.”

Ascentium Capital specializes in equipment financing for a broad array of industries including commercial vehicles, energy, franchise, healthcare, industrial, and technology. Customized finance programs are developed for equipment manufacturers and distributors as well as for small to medium sized businesses nationwide. The company plans to continue market penetration during 2021.

To support market expansion, Ascentium plans to grow its sales organization with the hiring of tenured financial sales professionals.

David Lyder, Senior Vice President, Ascentium Sales and Marketing, commented, “Our consistent performance is driven from our value proposition and to meet the demand for our finance programs, we are recruiting across our national footprint. We look forward to capturing even greater market share this year.”

About Ascentium Capital LLC

Ascentium Capital LLC, a subsidiary of Regions Bank, specializes in providing a broad range of business equipment financing, leasing, and loans across the United States. The Company’s offering is designed to benefit equipment manufacturers and distributors as well as direct to businesses nationwide. For additional information about Ascentium and its business financing products and services, please visit AscentiumCapital.com.

About Regions Financial Corporation

Regions Financial Corporation (NYSE:RF), with $153 billion in assets, is a member of the S&P 500 Index and is one of the nation’s largest full-service providers of consumer and commercial banking, wealth management, and mortgage products and services. Regions serves customers across the South, Midwest and Texas, and through its subsidiary, Regions Bank, operates more than 1,300 banking offices and approximately 2,000 ATMs. Regions Bank is an Equal Housing Lender and Member FDIC. Additional information about Regions and its full line of products and services can be found at www.Regions.com.

### Press Release ############################

[headlines]

--------------------------------------------------------------

### Press Release ############################

The Equipment Leasing & Finance Foundation Extends

Deadline for 2021 School Year Scholarships

Three $5,000 Scholarships

The Equipment Leasing & Finance Foundation has announced it is extending the deadline for accepting applications from students interested in the equipment finance industry. Up to three scholarships of $5,000 each will be awarded to full-time undergraduate, and full-time and part-time graduate students focusing on business, economics, finance, or a related discipline. The deadline to apply is May 21, 2021.

The Equipment Leasing & Finance Foundation Scholarship program is part of the Foundation’s academic outreach efforts dedicated to inspiring thoughtful innovation and contributing to the betterment of the equipment finance industry. Learn more about eligibility requirements at: https://www.leasefoundation.org/academic-programs/home/scholarship-program/

#### Press Release #############################

[headlines]

--------------------------------------------------------------

Weimaraner/Mix

Seattle, Washington Adopt-a-Dog

Mario

ID 46137358

Male

1 Years, 5 months

Size: Medium

Color: Tan

Neutered

Declawed: No

Site: Seattle animal Shelter

Location: Dog Kennels

Adoption Fee: $275

Vacinated/microchip

*If you reside in Seattle or King County, you must purchase

a two year pet license at the time of adoption.

Hello, my name is Mario!

I'm a gorgeous, soft and wiggly boy ready to settle into a new home! I'm sometimes a little nervous of new people but once we become friends I will gladly show you how goofy I can be and invite you to give me all the pets! I'm highly food and toy motivated (I LOVE squeaky toys) so having those items will definitely help us become buddies! I would love to have you engage in play with me but I am also happy to show you my adorable side of independent play.

Sometimes I can get overexcited so I'm learning how to express that appropriately with my friends at the shelter. Positive reinforcement training has been a game changer for me and it's so much fun! I'm an incredibly smart boy and I've learned that keeping a squeaky toy in my mouth also helps to keep me calm.

To set me up for success I will need an active home with adults only and no apartments (or apartment-like homes) please. I will need a good size private fenced yard where I can play, train and show you how fun (and adorable) I am! I will need to be the only pet in the household. However, after some training and socialization work I could potentially live with another dog in the future. Overall I do well seeing other dogs on walks. I show a lot of interest in them but don't react so please continue to work on that with me! I enjoy chasing small, furry things so unfortunately no cats or small critter friends for me!

I'm great with my nose so having some fun mental enrichment will be a must! Kongs, puzzle feeders, and snuffle mats are just a few of my favorites! I love learning and my human shelter friends always tell me how smart I am. I learn very well with food praise but also human praise.

My family will need to have interest or experience in working with a professional trainer as I will need to continue improving my learning and socialization skills. I have promising potential and would love for you to help me grow up to be an amazing dog! I should probably confess that I like to eat... well, almost everything (even things that I'm not supposed to). For that reason, I may need a little extra guidance from my new home as to what I should and should not have. The staff at the shelter can tell you more about this and help you figure out what will work best for me!

I'm a sweet boy with a lot of love to give. I've come a long way in my training and really try to be on my best behavior. If you have the patience and dedication to help me work my way up, I'd love to meet you!

**IMPORTANT** This dog is currently being cared for at the Seattle Animal Shelter. To apply to adopt this animal, please fill out the application found in the link below and send it to animalcare@seattle.gov https://bit.ly/36D4hBD

Dog Adoption Survey:

https://www.seattle.gov/Documents/Departments/AnimalShelter/

Seattle Dog Shelter

61 15th Ave W

Seattle, WA, 98119

Phone: (206) 386-7387 (PETS)

[headlines]

--------------------------------------------------------------

ELFA Legal Forum

May 04 - May 05, 2021

The PREMIER EVENT for attorneys serving the equipment leasing and finance industry. The best place to OBTAIN UPDATES ON LEGAL ISSUES that impact your company UNMATCHED NETWORKING OPPORTUNITIES with your peers in the industry.

The Forum will provide attorneys serving the equipment finance industry with critical updates on legal issues, practical takeaways for their daily practice and comprehensive discussions of key market segments.

“In today’s rapidly evolving environment, it’s essential to stay on top of new developments,” said Lisa Moore, Chair of the ELFA Legal Committee, which is involved in planning and hosting the Forum. “At ELFA Legal Forum LIVE! we’ll discuss critical updates and essential hot topics in the law. We’ll reconnect with colleagues we haven’t seen throughout the pandemic, exchange best practices and network on an interactive platform. We look forward to seeing as many members of the ELFA legal community as possible on May 4-5!”

- Highlights at the 2021 Legal Forum:

- Legal Update

- CA, NY, Federal Licensing and Disclosure

- Security Data, Cybersecurity, Privacy

- Air, Rail, Marine

- The Courts, Bankruptcy and Workout Strategies During the Pandemic - What are the Courts Doing?

- E-Docs and Working Remotely/ E-docs Considering the Pandemic

- Inventory Financing/International & Motor Vehicles

- Merger Up & Other Restructures - Lessons Learned

- Managed Bundled Services; Government Finance - Municipal/Tribal

- Cross-Border Lease Transactions; Does your Contract Work Across State Lines?

- Fintech: What is it and How Do I Help My Business Use It?

- UCC Basics and Advanced

- Ethics

- Conference qualifies for CLE

Conference Schedule (9 pages)

https://cvdata.elfaonline.org/cvweb/cgi-bin/documentdll.dll/view?DOCUMENTNUM=2971

Full Brochure (13 pages)

https://cvdata.elfaonline.org/cvweb/cgi-bin/documentdll.dll/view?DOCUMENTNUM=2967

Registration

(Non-Members need to set up an account to register)

https://cvdata.elfaonline.org/cvweb/cgi-bin/eventsdll.dll/EventInfo?SESSIONALTCD=LF21&WRP=Event-Info.htm

[headlines]

--------------------------------------------------------------

News Briefs---

Ford to develop, produce its own electric vehicle batteries

wants to do large-scale manufacturing

https://www.chicagotribune.com/business/ct-biz-ford-battery-ev-electric-vehicles-20210427-sg6xs3mcrncqph575h4atwpkia-story.html

US pushes back REAL ID deadline until May 2023

Another 19 Months--On Line Procedure Available

https://www.mercurynews.com/2021/04/27/us-pushes-back-real-id-deadline-until-may-2023/

Remote workers are being paid $20,000

to relocate to America's small towns

https://www.sfchronicle.com/business/article/Remote-workers-are-being-paid-20-000-to-relocate-16124553.php

Lumber prices go through the roof

as housing demand soars

https://www.stltoday.com/business/columns/david-nicklaus/nicklaus-lumber-prices-go-through-the-roof-as-housing-demand-soars/article_b1f866e2-9901-5de1-a9c2-8877f60b0bf0.html

Apple will spend $1 billion to open 3,000-employee

campus in North Carolina

https://www.cnbc.com/2021/04/26/apple-announces-1-billion-north-carolina-campus.html

Having Internet Delays and Problems?

How to tell when it's time to upgrade your router

https://www.cnet.com/home/internet/how-to-tell-when-its-time-to-upgrade-your-router

[headlines]

--------------------------------------------------------------

You May Have Missed---

‘How did that happen?’ Catching covid-19

even after being vaccinated.

https://www.washingtonpost.com/health/how-did-that-happen-catching-covid-19-even-after-being-vaccinated/2021/04/23/a31983a6-a21b-11eb-a774-7b47ceb36ee8_story.html

[headlines]

--------------------------------------------------------------

Sports Briefs---

Study suggests NFL crowds may have led to coronavirus spikes

https://www.sfchronicle.com/sports/giants/article/Fans-in-the-stands-Study-suggests-NFL-crowds-may-16098496.php

Stanford students turn to protests, graffiti to preserve

11 sports programs targeted for cuts

https://www.sfchronicle.com/sports/annkillion/article/Stanford-students-turn-to-protests-graffiti-to-16130717.php

Bill Belichick can’t really pull off a huge surprise

in this NFL draft, can he?

https://www.bostonglobe.com/2021/04/26/sports/bill-belichick-cant-really-pull-off-huge-surprise-this-draft-can-he/

Detroit Lions OT Taylor Decker says he won't

get a COVID-19 vaccine shot

https://www.usatoday.com/story/sports/nfl/lions/2021/04/27/detroit-lions-taylor-decker-covid-19-vaccine-shot/4862192001/

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

Nearly a quarter of Time’s 100 most influential companies

are in the San Francisco Bay Area/Nearly Half of the list in California

https://www.mercurynews.com/2021/04/27/nearly-a-quarter-of-times-100-most-influential-companies-are-in-the-bay-area/

What everyone is getting wrong about California

losing a congressional seat

https://www.sfgate.com/bayarea/article/2021-04-California-House-Seat-Census-Population-16133275.php

McDonald’s workers want more say over California

labor conditions. This plan would help them

https://www.sacbee.com/news/equity-lab/representation/article250790549.html

Bay Area schools got extra COVID cash.

Here’s how they spent it. Districts break down:

https://www.eastbaytimes.com/2021/04/26/schools-got-extra-money-for-covid-what-did-they-use-it-for/

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

This beloved Marin winery is shutting down,

citing California's drought and climate change

https://www.sfchronicle.com/food/wine/article/Beloved-Bay-Area-winery-Pey-Marin-is-closing-16133318.php

For 9,000 Years, the Process of Winemaking has Stayed

the Same. Tastry's AI Tech is About to Change That.

https://www.winebusiness.com/vendornews/?go=getVendorNewsArticle&dataid=244656

Announcing the Croatian Wine Club for US Wine Lovers

https://www.prnewswire.com/news-releases/announcing-the-croatian-wine-club-for-us-wine-lovers-301277089.html

Free Wine App

https://www.nataliemaclean.com/mobileapp/

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1758 - James Monroe (d. 1831) birthday, Monroe Hall, Virginia. President Monroe served two terms in office, March 4, 1817 to March 3, 1825, as the fifth President of the US.

1788 - Maryland became the seventh state to ratify the Constitution, by a vote of 63 to 11. Named in honor of England's Charles I's queen, Henrietta Maria. Maryland's capital city, Annapolis, is famous as the home of the U.S. Naval Academy. Maryland, the Free State or Old Line State, calls the black-eyed Susan its state flower and the Baltimore Oriole is the state bird. Maryland symbols include: dog - Chesapeake Bay retriever; fish - rockfish; crustacean - Maryland blue crab; tree - white oak; insect - Baltimore checkerspot butterfly. "Maryland, My Maryland" is the official state song. Its state motto: Fatti maschii, parole femine. In English: Manly deeds, womanly words.

1789 - The most famous of all naval mutinies occurred on board HMS Bounty. Fletcher Christian, leader of the mutiny, put Capt. Bligh and 18 of his loyal followers adrift in the open sea in a 23-foot boat. Miraculously, Bligh and all his supporters survived the 47-day ordeal. Meanwhile, Christian put ashore on Tahiti with the remaining crew. They took off with 6 Tahitian men and 12 women and settled on Pitcairn Island. They burned the Bounty and remained undiscovered for 18 years, when an American whaler, the Topaz, called at the island (1808) and found only one member of the mutinous crew surviving. However, the little colony had thrived, and when counted by the British, number 194 persons.

1828 - The birthday of Mifflin Wister Gibbs (d. 1915), Philadelphia. In 1873, he became the first black man to be elected a judge in the US, winning an election for City Judge at Little Rock, AR.

1855 - The first veterinary college was the Boston Veterinary Institute, Boston, MA. The first president was Daniel Denison Slade, MD. Courses were giving in anatomy, physiology, chemistry, pharmacy, and the theory and practice of medicine and surgery.

1884 - Birthday of banjo player Henry Reed, born James Henry Neel Reed (d. 1968) Monroe County, West Virginia.

http://memory.loc.gov/ammem/today/apr28.html

1899 - A tornado struck Kirksville, MO, killing 34 persons and destroying 300 buildings.

1899 - Cameraman G.W. "Billy" Bitzer filmed Professor Leonidas and his troupe of dogs and cats in the film short “Stealing a Dinner.”

(lower half of: http://memory.loc.gov/ammem/today/apr28.html

1921 - A severe hailstorm in Anson County, NC, produced hail the size of baseballs. Gardens, grain fields and trees were destroyed. Pine trees in the storm's path had to be cut for lumber because of the hail damage.

1926 - Birthday of Harper Lee (d. 2016), Monroeville, Alabama. American author famous for her Pulitzer Prize winning race relations novel, “To Kill a Mockingbird.” An international bestseller adapted to the screen in 1962, she modeled the boy Dill after her childhood next-door neighbor, author Truman Capote.

http://www.kirjasto.sci.fi/harperle.htm

1940 - On Bluebird Records, Glenn Miller recorded his signature song, "Pennsylvania 6-5000." According to the original label, on the old 78-RPM disk, it was record number 10754.

1941 - Birthday of actress-singer Ann-Margret Olsson, Stockholm, Sweden. She has won five Golden Globes and been nominated for two Academy Awards, two Grammys, a Screen Actors Guild Award, and six Emmys.

1942 - A destructive tornado swept across Rogers County and Mayes County in Oklahoma. The tornado struck the town of Pryor killing 52 persons and causing two million dollars damage.

1943 - MINUE, NICHOLAS Medal of Honor

Rank and organization: Private, U.S. Army, Company A, 6th Armored Infantry, 1st Armored Division. Place and date: Near MedjezelBab, Tunisia, 28 April 1943. Entered service at: Carteret, N.J. Birth: Sedden, Poland. G.O. No.: 24, 25 March 1944. Citation: For distinguishing himself conspicuously by gallantry and intrepidity at the loss of his life above and beyond the call of duty in action with the enemy on 28 April 1943, in the vicinity of MedjezelBab, Tunisia. When the advance of the assault elements of Company A was held up by flanking fire from an enemy machinegun nest, Pvt. Minue voluntarily, alone, and unhesitatingly, with complete disregard of his own welfare, charged the enemy entrenched position with fixed bayonet. Pvt. Minue assaulted the enemy under a withering machinegun and rifle fire, killing approximately 10 enemy machine gunners and riflemen. After completely destroying this position, Pvt. Minue continued forward, routing enemy riflemen from dugout positions until he was fatally wounded. The courage, fearlessness and aggressiveness displayed by Pvt. Minue in the face of inevitable death was unquestionably the factor that gave his company the offensive spirit that was necessary for advancing and driving the enemy from the entire sector.

1945 - RUIZ, ALEJANDRO R. RENTERIA Medal of Honor

Rank and organization: Private First Class, U.S. Army, 165th Infantry, 27th Infantry Division. Place and date: Okinawa, Ryukyu Islands, 28 April 1945. Entered service at: Carlsbad, N. Mex. Birth: Loving, N. Mex. G.O. No.: 60, 26 June 1946. Citation: When his unit was stopped by a skillfully camouflaged enemy pillbox, he displayed conspicuous gallantry and intrepidity above and beyond the call of duty. His squad, suddenly brought under a hail of machinegun fire and a vicious grenade attack, was pinned down. Jumping to his feet, Pfc. Ruiz seized an automatic rifle and lunged through the flying grenades and rifle and automatic fire for the top of the emplacement. When an enemy soldier charged him, his rifle jammed. Undaunted, Pfc. Ruiz whirled on his assailant and clubbed him down. Then he ran back through bullets and grenades, seized more ammunition and another automatic rifle, and again made for the pillbox. Enemy fire now was concentrated on him, but he charged on, miraculously reaching the position, and in plain view he climbed to the top. Leaping from 1 opening to another, he sent burst after burst into the pillbox, killing 12 of the enemy and completely destroying the position. Pfc. Ruiz’s heroic conduct, in the face of overwhelming odds, saved the lives of many comrades and eliminated an obstacle that long would have checked his unit’s advance.

1946 - Quebec pop singer Ginette Reno was born in Montreal. She performs equally well in both French and English, and in 1972, she won first prize for performance at the Tokyo International Song Festival, singing Les Reed's "I Can't Let You Walk Out of My Life." Reno's recording of "Second Hand Man" was popular in the early '70s.

1946 - No. 1 Billboard Pop Hit: "Prisoner of Love," Perry Como.

1948 - Yom Ha'atzma'ut (Independence Day) celebrates the proclamation of independence from British mandatory rule by Palestinian Jews and establishment of the state of Israel and the provisional government May 14, 1948.

1950 - Top Hits

If I Knew You Were Comin' I'd've Baked a Cake - Eileen Barton

My Foolish Heart - The Gordon Jenkins Orchestra (vocal: Eileen Wilson)

The Third Man Theme - Alton Karas

Long Gone Lonesome Blues - Hank Williams

1950 - Birthday of comedian Jay Leno, New Rochelle, NY

1957 - Mike Wallace, one of television's most respected people was first seen coast to coast, as the host of "Mike Wallace Interviews," a Sunday night program in which Wallace interviews greats, such as Gloria Swanson, Steve Allen and stripper, Lili St. Cyr.

1958 - Top Hits

Tequila - The Champs

All I Have to Do is Dream - The Everly Brothers

The Witch Doctor - David Seville ( hits #1)

Oh Lonesome Me - Don Gibson

1959 - For the last time, Arthur Godfrey was seen, in this the last telecast of "Arthur Godfrey and His Friends" on CBS-TV. Part of CBS for 10 years, the cast included: Tony Marvin (announcer), singers Carmel Quinn, Lou Ann Sims, Frank Parker, Janette Davis, Marion Marlowe and Julius LaRosa. “Howiya, Howiya, Howiya.”

1960 - The 100th General Assembly of the Southern Presbyterian Church (PCUS) passed a resolution declaring that sexual relations within marriage -- without the intention of procreation -- were not sinful.

1961 - Five days past his 40th birthday, Warren Spahn becomes the second oldest pitcher (the oldest: Cy Young - 41 years, three months) to throw a no-hitter. Henry Aaron knocks in the game's only run as Braves beat the Giants at County Stadium, 1-0.

1962 - Jim Grelle became the fourth American runner to break the four-minute mile with a mark of 3 minutes, 59.9 seconds in Walnut Creek, California.

1965 - Barbra Streisand stars on "My Name is Barbra" special on CBS.

1966 - Top Hits

(You're My) Soul and Inspiration - The Righteous Brothers

Bang Bang (My Baby Shot Me Down) - Cher

Secret Agent Man - Johnny Rivers

I Want to Go with You - Eddy Arnold

1967 - Muhammad Ali, born Cassius Clay, refused to join the United States Army. Critics and supporters have discussed the boxing champ’s refusal to serve in the armed forces for years. Although Ali refused because of religious beliefs, his world heavyweight crown taken from him as a result of his actions.

1967 - Gary Lewis and the Playboys received their only gold record - for "This Diamond Ring."

1968 - The rock musical "Hair" opened at the Biltmore Theatre on Broadway. "Hair," the first musical to successfully adapt rock music to the stage, had already played in an off-Broadway version, which opened in October 1967. The melodic soft-rock score by Montreal native Galt MacDermot, with lyrics by Gerome Ragni and James Rado, appealed to people of all ages. The show ran for 1,729 performances, finally closing on July 1st, 1972. By that time, the original cast recordings of the off-Broadway and Broadway versions of "Hair" had sold a total of more than five-million copies. As well, there were numerous hit songs from the show, including the medley of "Aquarius-Let the Sunshine In" and "Good Morning Starshine."

1971 - Samuel Lee Gravely appointed first Black admiral in US Naval history.

1971 - Braves' outfielder Hank Aaron joins Babe Ruth and Willie Mays as the only Major League player to hit 600 home runs. His historic homer, a 350-feet drive over the left field wall, comes off Gaylord Perry in the third inning of a 6-5 ten-inning loss to the Giants at Atlanta's County Fulton Stadium.

1971 - Barbara Streisand gets a gold album for "Stoney End," one of her rare forays into rock music. At 28 years old, Streisand is intent on changing her image and takes to lighting joints onstage in Las Vegas.

1974 - No. 1 Billboard Pop Hit: "Loco-Motion," Grand Funk. This marks the second time the song hits No. 1. The original 1962 dance version is performed by Little Eva. It is covered again in 1988 by Kylie Minogue, who takes it to No. 3.

1974 - Top Hits

TSOP (The Sound of Philadelphia) - MFSB featuring The Three Degrees

Best Thing that Ever Happened to Me - Gladys Knight & The Pips

The Loco-Motion - Grand Funk

Hello Love - Hank Snow

1979 - Blondie's "Heart of Glass" hits #1

1980 - United States Secretary of State Cyrus Vance resigned over the failed commando mission to rescue American hostages in Iran.

1982 - Top Hits

I Love Rock 'N Roll - Joan Jett & The Blackhearts

We Got the Beat - Go-Go's

Chariots of Fire - Titles - Vangelis

Crying My Heart Out Over You - Ricky Skaggs

1984 - The first number-one hit for The Judds, "Mama, He's Crazy," entered the US country charts.

1985 - For the fourth time, Billy Martin is named manager of the Yankees.

1987 - Forty-two cities in the western and south central U.S. reported record high temperatures for the date. The afternoon high of 87 degrees at Olympia WA was an April record, and highs of 92 degrees at Boise ID, 95 degrees at Monroe LA, and 96 degrees at Sacramento CA tied April records. (The National Weather Summary) More than 300 daily temperature records fell by the wayside during a two-week long heat wave across thirty-four states in the southern and western U.S. Thirteen cities established records for the month of April.

1990 – “A Chorus Line” closed on Broadway at the Shubert Theatre. It broke the record for number of performances with 6,237. The musical, written by James Kirkwood, Nicholas Dante, Marvin Hamlisch, and Edward Kleban, opened on July 25, 1975, and was an instant hit. It won the Tony award for Best Musical. “A Chorus Line's” cast, during the 15-year period, employed 510 different members.

1990 - Top Hits

Nothing Compares 2 U - Sinead O'Connor

I Wanna Be Rich - Calloway

How Can We Be Lovers - Michael Bolton

Love on Arrival - Dan Seals

1990 - Thunderstorms produced severe weather in the southeastern U.S. during the day. Severe thunderstorms spawned four tornadoes, including one which injured four persons at Inman SC. There were also more than one hundred reports of large hail and damaging winds, with better than half of those reports in Georgia. Strong thunderstorm winds injured four people at Sadler's Creek SC. In the northeast, twenty-nine cities reported record high temperatures for the date as readings soared into the 80s and lower 90s. Highs of 88 degrees at Binghamton NY, 94 degrees at Buffalo NY, 89 degrees at Erie PA, 90 degrees at Newark NJ, 93 degrees at Rochester NY and 92 degrees at Syracuse NY, were records for the month of April.

1994 - Northwestern University announced that the so-called biological clock, that gene governing the daily cycle of waking and sleeping called the circadian rhythm, had been found in mice. Never before pinpointed in a mammal, the biological clock gene was found on mouse chromosome #5.

1999 - The results of a study on the occurrence of drug references in movies and music are released by the Clinton Administration's top drug enforcement officials. The study finds that 27% of the most popular sound recordings from 1996 and 1997 "contained a clear reference to either alcohol or illicit drugs.

2005 - E.Y. "Yip" Harburg, writer of such well known songs as "Over the Rainbow" from "The Wizard of Oz" and (with Jay Gorney) "Brother, Can You Spare a Dime?", is immortalized on a U.S. postage stamp during a ceremony in New York.

2011 – Jaycee Dugard’s kidnappers plead guilty. Phillip Garrido, 60, and his wife Nancy, 55, plead guilty to the 1991 kidnapping of 11-year-old Jaycee Dugard. The Garridos held Dugard captive at their Northern California property for 18 years, during which time Phillip Garrido fathered two children with her. The 29-year-old Dugard was rescued, along with her daughters, then ages 11 and 15, in 2009.

2014 – Microsoft identified a security issue in its Internet Explorer that can allow hackers to take control of PCs using the browser. Versions 6 through 11 of the software were involved.

2020 – Johns Hopkins University confirmed that COVID-19 cases in the US passed 1 million. The US COVID death toll of 58,365 surpassed that of the US soldiers killed during the Vietnam War.

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

![]()