|

Top Producers Needed to Challenge |

Friday, August 14, 2009

|

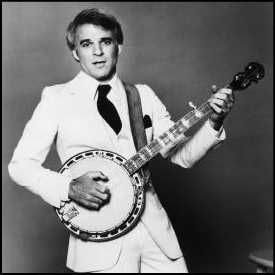

Actor, comedian, writer, playwright, producer, musician, and composer Stephen Glenn "Steve" Martin born August 14, 1945 Waco, Texas, raised in Southern California. He became a writer for the Smothers Brothers Comedy Hour, and later became a frequent guest on the Tonight Show. He also wrote for John Denver (a neighbor of his in Aspen, Colorado, at one point), The Glen Campbell Goodtime Hour, and The Sonny and Cher Comedy Hour. He also appeared on these shows and several others, in various comedy skits. He also wrote and starred in his latest film, "The Pink Panther 2."

http://www.kennedy-center.org/calendar/index.cfm?fuseaction=showIndividual&entity_id=3964&source_type=A |

Headlines---

Classified Ads---Controller

Evans Bank Leasing Portfolio for Sale

Story Credit List ---Up-Date

The List-Up-Dated "July"

Classified Ads---Help Wanted

View from the Top-by Steve Chriest

"Sales Training Doesn't Work-What to Do About it"

Casa Madrona…250 Montgomery St., SF --Foreclosures

by Christopher Menkin

Most Influential Women in Leasing-Susan Carol

Fernando's View by Fernando F. Croce

Julie & Julia/A Perfect Getaway

Gomorrah/Tyson/Julia

IRS Partnership Extension Date

News Briefs----

G.E.'s Earnings Fall 47%, Led by Finance Unit

Colonial May be Largest Bank Failure of 2009

Advanta Reports $330 Million Q2 Loss

India to get $4.78 bn to battle recession

Texas Judge Orders Microsoft to Stop Selling Word

Guitarist, studio wizard Les Paul dies at 94

You May have Missed---

Woman Tells of Affair with Madoff in New Book

California Nuts Brief---

Sports Brief---

"Gimme that Wine"

Today's Top Event in History

This Day in American History

Baseball Poem

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

|

--------------------------------------------------------------

Classified Ads---Controller

| Boca Raton, FL CPA w/ Sarbanes Oxley/ 15 years management exp. as CFO/ Controller/5 yrs w/ PWC Extensive exp providing accounting/ tax guidance for the equipment lease industry. Willing to relocate. Email: bltushin@hotmail.com |

| Chicago, IL experienced in lease accounting, operations, management, and Sarbanes-Oxley. Seeking position with equipment lessor. Would consider contract assignments or relocating. Email: leasecontroller@comcast.net |

|

Southeastern, MI Controller & Management experience w/ equip lessors &broker. MBA, CPA w/ extensive accounting, management, securitization experience with public and private companies. Willing to relocate. Email: Leasebusiness@aol.com |

For a full listing of all "job wanted" ads, please go to:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

To place a free "job wanted" Leasing News ad:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

(Leasing News provides this ad "gratis" as a means to help support the growth of Lease Police) |

--------------------------------------------------------------

Evans Bank Leasing Portfolio for Sale

Evans Bank, Hamburg, New York was one of the first to exit the marketplace doing business with independent leasing brokers, then at the first of the year exited leasing entirely. The leasing division was originally expanded with the purchase of MC Leasing December 31, 2004, who had grown from a vehicle leasing company to doing healthcare business in 50 states.

David J. Nasca

President and Chief Executive Officer

Evans Bancorp

"As we disclosed in the first quarter this year, based upon delinquency and charge-offs in our national lease portfolio we have made the decision to exit that business and market our lease portfolio for sale," said David J. Nasca, President and CEO of Evans Bancorp.

He does not indicate the write-off or delinquency problems, specifically which type of equipment, if it falls into that category, or what the specific problems were, but simply states: "Although it was a strong business for us in better economic times, its national profile and broker-based origination model does not lend itself to growing our core franchise nor fit our community-focused banking strategy. Importantly, our solid capital position enables us to take this step even as we expand our franchise in Western New York through our recently announced acquisition of Waterford Village Bank."

The Evans Bancorp Press Release states:

"The direct financing lease portfolio declined $14.5 million to $40.9 million at the end of the 2009 second quarter as the Company ceased lease originations in the second quarter of 2009. As it was the Company's intent as of June 30, 2009, to sell the portfolio, the lease portfolio was classified as held-for-sale and marked to its market value of $40.9 million. The market value is based on preliminary bids from marketing efforts."

It appears there have been bidders for the Evans lease portfolio: "The Company's lease portfolio was classified as held-for-sale at June 30, 2009, resulting in the leasing portfolio being marked to its market value as determined by preliminary competitive bids received from potential buyers. Consummation of a sale is contingent upon a completed purchase agreement satisfactory to the Company's management, "according to the press release "This mark was the primary factor that there was a net loss in discontinued operations. Since the lease portfolio was classified as held-for-sale at June 30, 2009, the income statement has been presented with discontinued operations for the current and all prior periods presented."

In total, Evans recorded a net loss for the second quarter of 2009 of $1.9 million with net income of $1.4 million in the second quarter of 2008. For the year to date, the net loss was $3.1 million, compared with $3.0 million in net income prior year period.

MC Leasing (purchased December 31, 2004):

"In the early 1970s as success within its local markets drew national attention, the Company expanded further into equipment leasing for the Home Healthcare industry, covering all 50 states by mid 1980s. With its reputation for excellence building nationwide, the Company began partnering with key vendors in industries outside the Healthcare market. During the mid 1990s, the Company introduced a Broker program, which met a critical demand for lease funding, followed by other innovative programs such as a new Referral Program in 2000."

http://www.evansnationalleasing.com/history.htm

Full Press Release:

http://leasingnews.org/PDF/EvansBancorpReports2009.pdf

--------------------------------------------------------------

Story Credit List ---Up-Date

Leasing News is often asked who does ATM's, Restaurants, Truck Owners less than Two Years in Business, Truck Owners, Medical in Puerto Rico, Dentist who pays all his office bills with his credit card, and a host of other requests, including a 650 FICO score. Most often we recommend this list:

|

Name

In Business Since Contact Website Leasing Association |

Employees |

Geo

Area |

Dollar

Amount |

Business Reports |

Financial Pacific Leasing |

115 |

Nationwide |

$5,000-$50,000 |

|

Pawnee Leasing Corporation 1982 Dana Freeman dana@pawneeleasing.com www.pawneeleasing.com EAEL, NAELB & NEFA (A) |

45 |

Nationwide |

$1,000 - $30,000 Does Subprime Leases |

|

20 |

Nationwide |

Vehicles Only $10,000 - $1,000,000 |

||

National Machine Tool Financial Corporation |

20 |

Nationwide |

$15,000 |

|

Boston Financial & Equity Corporation 1968 Debbie Monosson debbie@bfec.com www.bfec.com EAEL, NEFA (J) |

12 |

National |

$100,000 to $1,500,000 Does Subprime Leases |

|

12 |

Nationwide & Canada (except in Quebec) |

$10,000 - $250,000 Does Subprime Leases |

||

Summit Leasing, Inc. 1986 James, Klemens, Kevin, Mike, Mark (800) 736-1530 www.summitleasing.com NEFA (S) |

12 |

CA, ID, MT, OR, WA |

$20,000 - $400,000 |

|

10 |

Western States |

$15K Does Subprime Leases |

||

Dolsen Leasing Company 1958 Joanie Dolsen, 800-959-4002 Joanie@dolsenleasing.com www.dolsenleasing.com NAELB, NEFA (R) |

10 |

11 Western State |

$10,000.00 - $250,000.00 |

|

Allegiant Partners Incorporated 1998 Scott Enbom senbom@allegiant-partners.com (415) 257-4200, x207 www.allegiant-partners.com EFLA, NAELB & NEFA |

9 |

Nationwide, including Alaska & Hawaii |

$20,000---$150,000 |

|

Blackstone Capital Partners, L.P. 2002 Frank Freer Phone: 949.250.8789 Fax: 949.250.8798 FrankF@Blackstonecp.com www.blackstonecp.com ELFA, NAELB, NEFA (N) |

8 |

Nationwide (except LA, AR and AK) |

$50,000 to $2,000,000 Does Subprime Leases |

|

Black Rock Capital 1994 George Booth gkbooth@blackrockcapital.com 203.336-9200 www.blackrockcapital.com EAEL, ELFA (E) |

7 |

US Canada (F) |

$50,000 to $3MM $250,000 average transaction |

|

Forum Financial Services, Inc. 1996 Tim O'Connor 972-690-9444 ext. 225 tim@forumleasing..com 275 West Campbell Road Suite 320 Richardson, Texas 75080 Fax: 972-690-9464 www.forumleasing.com NAELB & NEFA (W) |

7 |

Nationwide |

$50,000 to $1.0 million. Our average size transaction is $250,000. Does Subprime Leases |

|

TEAM Funding Solutions 1992 Christopher Fielder, VP $5000-$70,000 888-457-6700 ext. 106 / 512-258-6700 ext 106 512.692.0500 fax whitney@teamfundingsolutions.com www.teamfundingsolutions.com NAELB & NEFA (Z) |

7 |

All 50 States |

$5000-$70,000 Does Subprime Leases |

|

ABCO Leasing, Inc. 1974 Brad Christensen bradc@abcoleasing.net 971/204-0236 www.abcoleasing.net NAELB, and NEFA (D) |

6 |

Most States |

$50,000 - $450,000 |

|

American Leasefund, Inc. 1999 Tom Davis tom@alclease.com 800.644.1182 - PH 503.244.0845 - FX www.alclease.com NEFA (Q) |

6 |

Idaho, Montana, Oregon, Washington |

$3,500 - $50,000 Does Subprime Leases |

|

Bankers Capital 1990 Larry LaChance - President 508-351-6000 llachance@bankers-capital.com www.bankers-capital.com NEFA (O) |

6 |

Nationwide - 50 States |

$25,000 + |

|

Cobra Capital LLC 2000 Dale Kluga, President dale@cobrallc.com 630-985-3500 www.cobrallc.com ELFA (G) |

6 |

Nationwide |

$50,000 to $1MM $250,000 average transaction |

|

Agility Solutions 2003 Hal Hayden (928) 541-0771 halh@agilitysolutions.com www.agilitysolutions.net NEFA (V) |

5 |

U.S. |

$50,000 - $1,000,000 Does Subprime Leases |

|

| Barrett Capital Corporation |

4 |

United States |

Vehicles Only $10,000 minimum |

|

Standard Professional Services, LLC 1976 Mr. Raphael Lavin, CLP JWhalen@spsllc.net 847-291-7858 www.spsllc.net EAEL, NAELB, NEFA (I) |

4 |

Nationwide & some offshore |

$10,000 - 250,000 ($25,000 - $150,000 desired) |

|

4 |

Nationwide |

$20,000, average transaction size is $200,000 |

||

Gonor Funding 2001 Norman J. Gonor ngonor@gonorfunding.com 818.784.5444 Jason Gonor 818.402.6999 www.gonorfunding.com (Y) |

3 |

USA |

$10,000 to $100,000 with an average of $25,000 - $35,000 Does Subprime Leases |

|

|

Name In Business Since Contact Website Leasing Association |

Employees |

Geo Area |

Dollar Amount |

Business Reports |

Business Reports: Companies listed may make any netiquette comment about their company or reports or other information in the footnote section of their listing. Leasing News recommends readers also view the footnote as well as the section itself or searching reports on the business.

It also should be noted that if a BBB report listing is found by a reader, as there may not have been one when this was last up-dated, please send the link to maria@leasingnews.org so Leasing News may up-date this section.

BBB - Better Business Report | CBB - Leasing News Complaint Bulletin Board

| CNI - Current News Information

-------------------------------------------------------------------------------------------------------

(A) Pawnee Leasing Corporation; Some times we go higher than $30,000, but our marketplace is from $1,000 to $30,000. Broker Qualify - One year time in business

(B)

* Allegiant Partners has expanded their maximum transaction size from $250,000 to $500,000 for the 5 western states of California, Oregon, Washington, Nevada and Arizona.

In addition to increasing the transaction size Allegiant is offering more competitve rates for these A- and B+ transactions. Broker Qualify - For Broker qualification please click here.

Allegiant.pdf

(D) ABCO Leasing, Inc. in Seattle area has been operating since 1974 serving the broker community. We required full financial disclosure on every transaction. We do story transactions, but do not like to refer to them as "C" credits. We think of them as "A" type credits that have not been discovered yet. Broker Qualify contact: Brad Christensen, Broker Relations Manager,971/204-0236 bradc@abcoleasing.net

(E) Black Rock Capital comment: We book anywhere between $15 to 20 million per year. We do no "app only" business and require a full financial package for each transaction. Our average size transaction is approximately $250k and, although, we concentrate in printing, packaging (steel rule die industry) and road construction equipment we do not rule out anything that makes sense. More information can be found at www.blackrockcapital.com. Broker Qualify - Please Call

(F) Black Rock Capital (Ireland) Limited and Black Rock Capital (UK) Limited provide the same services for small to middle market corporations in the European Economic Community and the United Kingdom.

(G) Cobra Capital, LLC. Comments: Our registered trademark "Making impossible possible" is our central marketing tagline for both strong and weak credits. I have developed a 10 year history, (from Cobra and my prior company GALCO), with specialty, non-conforming transactions (story credits) and have a solid reputation for candidly responding to our originators and lessees and working diligently to mitigate deal risk rather than making excuses to turn deals down. Our originators prefer our underwriting approach to non-conforming transactions since unlike most non-conforming funders, we prefer to mitigate risk versus jacking our return. Both Originators and Lessee's prefer our candid approach as we are also frequently asked to advise lessee's and lessors on the best way to structure their bank loans and raise capital due to our 25+ year banking and accounting backgrounds as my partner and I are both former bankers and CPA's.

(H) Barrett Capital Corporatio: Broker Qualify - Please Call

(I) Standard Professional Services. LLC is a non-cookie cutter funder who does not credit score.

(J) Boston Financial & Equity Corporation, most of our leases are venture capital backed startups and turnarounds. We require full financial disclosures, CPA and internal statements, no tax returns. We do not required additional collateral, no PG's or RE needed. Do not send deals with large tax liens, especially if they are payroll taxes. Broker Qualify - A deal in hand and a full package

No Longer do Business with Independent Brokers:

http://www.leasingnews.org/Pages/Out-of-broker-bus.htm

Funder/SuperBrokers looking for broker business:

http://www.leasingnews.org/Funders_Only/New_Broker.htm

|

--------------------------------------------------------------

The List-Up-Dated "July"

--- Mergers, Acquisitions & Changes "The Good, the Bad and the Ugly"- The full alphabetical and chronological list may be accessed here. What follows is the synopsis for July:

http://www.leasingnews.org/list_alpha_new.htm

http://www.leasingnews.org/list_chron_new.htm

ACC Capital, Midvale, UT ( 07/09) down to 15 employees, moves to Midvale, UT (07/09) exits small ticket market, now going back to main stay of the middle market, no deals under $100,000 from brokers.

IFC Credit, Morton Grove, Ill (07/09) IFC Credit files Chapter 7, estimated $150 million owing (07/09) More defaults on loans, more suits filed against IFC Credit (07/09) CoActiv Capital Partners of Horsham, Pennsylvania files suit for over $2 million naming Trebels and Langs as individuals, cites fraud, not paying off leases, servicing deception, 180 page complaint. (07/09) Many lawsuits become public such as $1 million from California investor, $170,000 owed to Askounis & Darcy for legal fees in NorVergence matter. (07/09) Audit continues as Ludwig tries to keep First Corp. together as well as IFC, Trebels-Langs gone.

Westover Financial, Santa Ana, CA (07/09) started by Joe Woodley, CLP, sold 40% to Steve Jones 13 years ago, is dissolving. Semi-retired, except for NEFA post, Woodley has been trying to clean up the mess since Jones left several months ago and joined iFinancial, San Clemente, CA with inside sales crew.

Lakeland Bank , Montville , NJ (07/09)Lakeland Bank, Oakridge, New Jersey takes loss of $12.7 million their second quarter, they state negatively impacted by a loan and lease loss provision of $34.1 million compared to a provision of $8.2 million in the second quarter of 2008, reflecting the Company's decision to reduce exposure in its leasing portfolio. The second quarter provision allocated $28.4 million to leasing, including the previously reported charge-off of $9.5 million on the sale of $33.1 million of lease pools and a write-down for other lease pools held for sale.

CIT Group (07/09) Needs loan to stave off BK

American Leasing Corporation, Camden, NY (07/09) John Manning pleads guilty to embezzling $6.2 million from the company.

Key Equipment Finance (07/09 Key says "no" to copiers. Other changes being made. (07/09) Many cutbacks, changes, no one talking about it. Exits trucking leasing business.

Bank of the West, San Francisco/Dublin, Ca. (07/09) Bank of the West plans to consolidate its 1,600 San Francisco Bay Area employees to a 240,000 square foot facility at Bishop Ranch in San Ramon, California, including leasing division. Bank Hq. to remain in SF.

Commercial Money Center, Southern California (07/09) Sterling Wayne Pirtle and Ronald Allen Fisher pled guilty to evading $1M each in taxes, Fisher to remain in jail, Pirtle to be sentenced Nov. 23, 2009. http://leasingnews.org/archives/July%202009/07-01-09.htm#CMCmaster

|

--------------------------------------------------------------

Classified Ads---Help Wanted

|

Regional Sales Managers: Relationship Manager/Sales Associate: Advantage Funding, a leading national commercial vehicle and transportation equipment leasing and finance company seeks an . Our financing products are offered to new and existing relationships in the commercial coach, limousine, school bus, paratransit, funeral car, minibus and transportation industries. |

|

2 years+ small ticket ($150k and under) experience

ILS is a direct lender specializing in |

|

Top Producers Needed to Challenge |

--------------------------------------------------------------

|

--------------------------------------------------------------

Sales Training Doesn't Work - And What To Do About It

Summary: Since sales training is focused on techniques for improving sales, the results of sales training is usually short-term and not sustainable.

For some time now I've known that sales training doesn't work for most organizations long-term. While sales training can help some salespeople temporarily, senior sales leaders and senior executives must recognize that behavioral change - not sales training - is the key to superior, sustainable sales performance.

While thousands of training companies offer sales training programs for cold-calling, prospecting, planning account strategies, sales call planning, presenting to clients and negotiating, there isn't one sales training program I'm aware of that will, by itself, change a salesperson's behavior. And if you don't change a salesperson's behavior, what is learned from sales training won't last long-term.

So, what is it that changes selling behaviors? The academic answer may be complex, but for us regular folks it's pretty simple - salespeople, like anyone, will change their behavior when they perceive that there is something substantial in it for them to make a change.

Changing behavior is a process, and like all processes it must be managed. Behavior isn't changed in the same way you flip on a light switch. Salespeople almost never raise their hands to request sales training from their managers, and it's difficult to convince most salespeople that they need to change their selling behaviors. After all, their "natural" sales talent has gotten them this far!

An effective prescription for changing selling behaviors will include a consensus among senior managers of the relevance of the sales training to the most important strategic objectives of the business. Senior managers are much more likely to encourage and support a sales training initiative that promises to positively impact critical strategic objectives than sales training that delivers entertainment, and little else, to the sales team.

The next step, and this one is absolutely critical, is to communicate to the sales managers and the sales team the direct connection between the sales training and the strategic objectives of the business. Now, perhaps for the first time, the sales team can see the potential impact of their activities on important business objectives, instead of seeing only their effect on the quarter's top line number and in their commission checks.

Once the sales team understands their role in helping the company achieve strategic business objectives, they must clearly see how changing their selling behaviors will help them directly impact those objectives and how they will personally benefit from the change. Money is always an important factor, but so is personal development and growth.

The failure of sales training costs companies billions of dollars annually and wastes everyone's time. It doesn't have to be that way. When sales training is an integral part of a well thought out plan for changing behaviors to meet strategic objectives, the sales training can deliver desired results. Positive behavioral change benefits the company, customers, managers and sales professionals.

Steve Chriest is a well-respected management and sales consultant who specializes in helping organizations develop comprehensive sales processes that integrate strategy, training, sales tools and management systems to improve sales revenue.

He is the founder of Selling-UpTM, a San Francisco-based sales improvement consulting firm. He developed Selling-Up's exclusive Sales Management Operating SystemTM and is publisher of Sales Journal, a monthly sales strategy publication for an E-suite audience. Steve created Selling-Up's most popular educational offerings, including Strategic Sales RoadmapTM and online courses such as Profits and Cash - The Game of Business and Assertive Negotiating.

Steve is a regular contributor to executive-level publications such as Customer Think and Customer Management IQ. Steve recently completed his first book, Selling The E-Suite, The Proven System For Reaching and Selling Senior Executives, in which he translates his experiences as a CEO into a practical guide for selling to senior executives. Steve can be reached at: schriest@selling-up.com

--------------------------------------------------------------

Casa Madrona…250 Montgomery St., SF --Foreclosures

by Christopher Menkin

((a view showing the original "house turned hotel" at the top, far right, the famous restaurant below with a fantastic view (many chefs, many weddings here) and original individual "guest cottages" named after famous artists (Renoir Room, Artist's Loft, Rose Room and they also had a house boat you could rent) Sausalito, California))

RealtyTrac reports found an increase of almost 7 in the foreclosure rate across the United States for July, 2009. 360,149 foreclosure filings - default notices, scheduled auctions and bank repossessions. More bad news, it was an increase of 32 percent from July 2008.

"July marks the third time in the last five months where we've seen a new record set for foreclosure activity," noted James J. Saccacio, chief executive officer of RealtyTrac. "Despite continued efforts by the federal government and state governments to patch together a safety net for distressed homeowners, we're seeing significant growth in both the initial notices of default and in the bank repossessions."

The bottom line is the banking industry, the finance industry, and the leasing industry cannot get any better until the real estate foreclosures drop and real estate prices induce lenders to make more mortgage loans as well as loans to business, including leasing companies.

Again Nevada, California, and Arizona lead the foreclosure lists. It is difficult to believe, but Zillow.com reports in Las Vegas 82.5% of single-family homes with mortgages in negative equity

In the United States, more than one-fifth (23 percent) of all owners of single family homes with mortgages owe more on a mortgage than their home is currently worth, the Zillow.com study just released reports.

Foreclosure re-sales made up 22 percent of all home sales in June. according to Zillow.com.

Two local San Francisco Bay Area commercial foreclosures, to illustrate the problem nationwide:

Landmark Casa Madrona Hotel & Spa in Sausalito, the first city across the Golden Gate Bridge. The photo above is the hotel. Guest in the old part have a view of the many yachts in births below, including FDR's, along with a beautiful view of City of San Francisco. It is quite romantic. The photo below shows the expansion, who's rooms have also do not have much of a view and are modern, not following the original "bed and breakfast" theme and "quaint cottages" named after famous artists, nor with much of a view, and not romantic, very business like.

The Chapter 11 bankruptcy sale by MHG Casa Madrona of Miami, Fla., was postponed until Oct. 6 a trustee sale of the city's largest hotel as there appeared to be no "serious" buyers. Originally a house converted into a breakfast and bread hotel in 1884, a series of rooms and restaurant were built up the hill and connected to it, then period rooms in the name of artists, with the final expansion on the hillside next-door which originally housed small art galleries (my mother had showings here in the 1960's) and then the art gallery of small shops next door was purchased and turned into a modern hotel. The hotel with two restaurants suffered in the economic decline as tourism as it also lost much of its charm in the modern conversion of rooms. They had over expanded. The historic site was taken over by the Federal Deposit Insurance Corp. this year when owners defaulted on their loan, one of the top reasons Integrity Bank, Alpharetta, Georgia became the 10th bank to fail this year. The unpaid loan balance was more than $24 million.

Other creditors exists, some unpaid and some advanced by

the FDIC, such as the City of Sausalito. Reportedly half of the hotel-motel tax in Sausalito came from Case Madrona." As part of the restitution, FDIC paid the city of Sausalito about $125,000 representing unpaid taxes and $5,600 monthly as payment for the use of parking spaces by hotel guests. Since the FDIC took over, the hotel property has started paying its tax weekly as stated under the city policy."

http://www.foreclosurehomesinvesting.com/foreclosures/california-city%E2%80%99s-largest-hotel-on-foreclosed-property-auction

The 16-story office building at 250 Montgomery Street, San Francisco, is a beauty; right in the heart of the financial district. In bankruptcy was just purchased by George Kaiser's company Argonaut Private Equity of Tulsa, Oklahoma. He picked up it up for $19.9 million. $40.8 million was the loan the building's owner, Foster City's Lincoln Property Co., had defaulted. He picked it up for much less than 50% of the original cost, less any current liabilities. In reality, the building is 53% vacant as many empty lands surround the downtown area which was in the middle of a boom when the economy hit.

Full Reports:

RealityTrac

http://www.realtytrac.com/ContentManagement/PressRelease.aspx?channelid=9&ItemID=7192

Zillow.com

http://zillow.mediaroom.com/index.php?s=159&item=142

|

--------------------------------------------------------------

Most Influential Women in Leasing-Susan Carol

Susan Carol, APR, CEO of Susan Carol Associates, 1989. She has grown her organization from a team of writers and media relations specialists to a full-service communications firm with seasoned expertise in branding, marketing, public relations, advertising and Web development. Her client base has included many technology firms serving the leasing industry, bank lessors, independent lessors, and "the leading global consulting firm serving the leasing industry."

She is always studying how her clients' interests are affected by emerging media, cultural and economic forces. She has spoken to audiences in Australia, Hong Kong and the United States on the subject of business technology applications in equipment leasing. She speaks to business groups regionally on integrating PR, advertising and marketing. Susan has assisted clients through crisis communications scenarios and managed local, state and international media representatives for many types of organizations.

http://www.scapr.com/team/bios/carol.html

Send nominations to: kitmenkin@leasingnews.org

"Influential" as "a person whose actions and opinions strongly influence the course of events" {Online Dictionary}. They must be alive, and do not need to be active any longer in the leasing or finance industry.

They also should meet the caliber of those nominated.

Current List (click on name for nomination description)

Bette Kerhoulas, CLP

Elaine Litwer

Lisa A, Levine, CAE

Shari Lipski, CLP

Terri McNally

Deborah Monosson

June Sciotto

Marci Kimble-Slagle, CLP

Rebecca Smith

Cynthia "Cindy" Spurdle

Rosanne Wilson, CLP

-----------------------------------------------------------------------------------

--------------------------------------------------------------

Fernando's View By Fernando F. Croce

Julie & Julia/A Perfect Getaway

Gomorrah/Tyson/Julia

Fernando's View

By Fernando F. Croce

The lightweight fun of "Julie & Julia" and the smart thrills of "A Perfect Getaway" await theater audiences, while DVD watchers can settle in with "Gomorrah's" hard-hitting drama and the arresting documentary "Tyson."

In Theaters:

Julie & Julia (Sony): Meryl Streep is one of today's acting legends, and it's great to see take a holiday from heavy dramas in this lightweight, enjoyable comedy. Following her Oscar-nominated turn in "Doubt," Streep has a blast playing famous chef Julia Child, whose culinary efforts (including hosting her own TV show) broke through gender prejudices in the 1960s. Meanwhile, in the present, a parallel story follows Julie Powell (Amy Adams), a young blogger and aspiring writer who spends a year following Child's recipes to the letter. Director Norah Ephron ("Sleepless in Seattle," "You've Got Mail") is an experienced hand at dishing out this sort of comedic soufflé, and, even when the combination of the two stories falters, the two actresses remain a joy to watch.

A Perfect Getaway (Rogue Pictures): The summer's most surprising sleeper might just be this modest yet terrifically tense adventure yarn. Cliff (Steve Zahn) and Cidney (Milla Jovovich) are off to Hawaii for a relaxing honeymoon, though relaxation looks like the last thing in sight when they meet another vacationing couple. Nick (Timothy Olyphant) is a wild-eyed war veteran with an odd attraction to knives, and his girlfriend Gina (Kiele Sanchez) seems just as suspicious; will they help the newlyweds make their way through the jungle, or will the tropical paradise turn into hell? The trailers may make the movie seem like another mindless thriller, when in truth director David Twohy's film is a smart and effective film that handles twists and suspense with a pleasantly light touch.

New on DVD:

Netflix tip: Make sure you plan ahead when ordering the newest releases. Though Netflix eliminates the problem of out-of-stock movies, sometimes there's a waiting list for many of the most anticipated titles. Check for release dates, and reserve ahead of time to avoid long waiting periods.

Gomorrah (IFC Films): A mosaic of Italian crime stories that gives "Traffic" a run for its money, Matteo Garrone's brutal and absorbing chronicle of the wide-ranging effects of Mafia operations is a sobering ride. Weaving a dense but always involving web of people, dilemmas and betrayals, the film focuses on such characters as a 13-year-old who is eagerly making his way up the ladder of the Camorrah crime family, a couple of young clods who have watched "Scarface" one too many times, and a money-runner who's faced with issues of loyalty as a gang war threatens to break out. Avoiding clichés and refusing to glamorize violence, the film takes a hard-hitting look at the ways crime infiltrates the least expected corners of society. With subtitles.

Tyson (Sony Pictures Classics): Mike Tyson is a fascinating camera subject in acclaimed director James Toback's ("Fingers") documentary. Reclining on a sofa, his head shaved and face aged, the former world's heavyweight boxing champion faces the camera and talks about the successes and troubles of his life. Tyson remembers his early days in the streets, which earned him a stay at Juvenal Hall, as well as his apprenticeship with Cus D'Amato, the legendary boxing trainer who took the young hopeful under his wing and became a father figure for him. Toback alternates between Tyson's often candid ruminations and footage of his rise and fall in the ring. The one-sided nature of Tyson's comments can be problematic, especially regarding the women in his life, yet even non-fans of boxing should find this an absorbing project.

Julia (Magnolia): The superb actress Tilda Swinton ("The Lion, the Witch and the Wardrobe", "Burn After Reading") delivers a powerhouse performance in this vivid tale about a woman coming to terms with her troubled life and past. Swinton plays Julia, a fortyish hanger-on who barely survives between downing shots of vodka and pulling small-time con jobs. When her lifestyle finally catches up with her, Julia attempts to extort more money by kidnapping a young boy. Will her desperate acts push her deeper into trouble, or will her newfound responsibility for her hostage point her toward an unexpected salvation? Director Erick Zonka, who made the acclaimed "The Dreamlife of Angels," is stronger on atmosphere than plot, but Swinton's fearless work rides over the movie's rough patches.

--------------------------------------------------------------

IRS Partnership Extension Date

The IRS Partnership Extension Date was moved up from October 15th to September 15th for most partnerships. Please consult your accountant.

|

-------------------------------------------------------------

![]()

News Briefs----

|

---------------------------------------------------------------

You May have Missed---

Woman Tells of Affair with Madoff in New Book

http://www.nytimes.com/2009/08/14/business/14madoff.html?ref=business

----------------------------------------------------------------

Sports Briefs----

Michael Vick signs with Eagles

http://www.ajc.com/sports/atlanta-falcons/michael-vick-signs-with-115315.html

Raiders beat Cowboys 31-10 in exhibition opener

http://www.sfgate.com/cgi-bin/article.cgi?f=/n/a/2009/08/13/sports/s221352D76.DTL

Ravens Shut Out Redskins

http://www.washingtonpost.com/wp-dyn/content/article/2009/08/13/AR2009081304080.html?hpid=artslot

Brady back in form/Patriots 27, Eagles 25

http://www.boston.com/sports/football/patriots/reiss_pieces/

Hill to Start for the 49ers

http://blog.pressdemocrat.com/49ers/2009/08/day-17-practice-23-hill-gets-first-shot.html

----------------------------------------------------------------

California Nuts Briefs---

Firefighters race to control coastal blaze before weekend heat

http://www.mercurynews.com/topstories/ci_13060642?nclick_check=1

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2009/08/13/BAHO1982HN.DTL&tsp=1

BART workers to strike after board imposes contract on second-largest union

http://www.contracostatimes.com/top-stories/ci_13052709?nclick_check=1

Wildfires sparked in Lucas Valley, Hamilton

http://www.marinij.com/sanrafael/ci_13054752

----------------------------------------------------------------

![]()

"Gimme that Wine"

Deal Alert: Wine by the Glass Prices Plummet

http://www.nbcbayarea.com/around-town/food-drink/Deal-Alert-Wine-by-the-Glass-Prices-Plummet-53043532.html

WineWeb.com Continues Innovation with Social Media Integration into Winery Websites

http://www.prweb.com/releases/2009/08/prweb2737164.htm

Southwest Wine Travel 101: What is the Temecula Valley?

http://www.examiner.com/x-16812-Southwest-Wine-Travel-Examiner~y2009m8d12-Southwest-Wine-Travel-101--What-is-the-Temecula-Valley

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

The London International Vintners Exchange (Liv-ex) is an electronic exchange for fine wine.

http://www.liv-ex.com/

----------------------------------------------------------------

![]()

Today's Top Event in History

1935-Congress approved the Social Security Act, which contained provisions for the establishment of a Social Security Board to administer federal old-age and survivors' insurance in the US. By signing the bill into law, President Franklin D. Roosevelt was fulfilling a 1932 campaign promise. As a side note, US Senators/Congressmen do not pay into Social Security, and, therefore they do not collect from it. They felt they should have a special plan. When they retire no matter how long they have been in office, they continue to draw their same pay until they die, except it may be increased from time to time by the cost-of-living.

[headlines]

----------------------------------------------------------------

![]()

This Day in American History

1559 - Spanish explorer de Luna entered Pensacola Bay, Florida.

1607 - The Popham expedition reached the Sagadahoc River in the northeastern North America (Maine), and settled there.

1746-Fort Oswego in north central New York was captured by the French under General Joseph de Moncalm de Saint-Veran. General Montcalm surrendered the fort useless for military purposes and returned to Montreal.

1765-- On this morning, the people of Boston awakened to discover two effigies suspended from an elm tree in protest of the hated Stamp Act. From that day forward, that elm became known as the "Liberty Tree". For the next ten years, it stood in silent witness to countless meetings, speeches and celebrations, and often served as the rallying place for the Sons of Liberty. In August of 1775, as a last act of violence prior to their evacuation of Boston, British Soldiers cut it down because it bore the name "Liberty". The American Liberty elm was named after "The Liberty Tree", Our Country's First Symbol of Freedom.

http://www.elmpost.org/

1776- Land grant to deserters from the British Army during the Revolutionary War was authorized by the act of the Continental Congress. The act offered American citizenship to British and Hessian deserters from the British Army and gave each desert or his heirs 50 acres of un-appropriated land in certain states. On August 27, 1776, a similar act was passed to encourage officers in the British forces to desert.

1846-Henry David Thoreau is jailed for tax resistance.

1846-Mormon Elder Sam Brannan preached a sermon in front of Richardson's Casa Grande, San Francisco.

1846--Mormon Elder Sam Brannan preached a sermon in front of Richardson's Casa Grande in

San Francisco.

1848-Congress created the Oregon Territory (Idaho, western Montana, Oregon and Washington).

http://memory.loc.gov/ammem/today/aug14.html

1849-Thomas Tennent began San Francisco Bay Area weather observations from roof of the building at the northeast corner of Union and Dupont. He also recorded earthquakes.

1862-Confederate General Edmund Kirby Smith begins an invasion of Kentucky as part of a Confederate plan to draw the Yankee army of General Don Carlos Buell away from Chattanooga, Tennessee, and to raise support for the Southern cause in Kentucky. Smith led 10,000 troops out of Knoxville, Tennessee, on August 14 and moved toward the Cumberland Gap—the first step in the Confederate invasion of Kentucky. After a Federal force evacuated the pass in the face of the invasion, Smith continued north. On August 30, he encountered a more significant force at Richmond, Kentucky. In a decisive battle, the Confederates routed the Yankees and captured most of the 6,000-man army. The Confederates occupied Lexington a few days later.

http://www.civilwarhome.com/ksmithbio.htm

http://www.spartacus.schoolnet.co.uk/USACWkirby.htm

http://www.amazon.com/exec/obidos/ASIN/0807118001/fast-bkasin-20/

103-5362656-4423850

http://www.aoc.gov/cc/art/nsh/smith.htm

http://18.1911encyclopedia.org/S/SM/SMITH_EDMUND_KIRBY.htm

1863-Birthday of Ernest Lawrence Thayer, poet and journalist, born at Lawrence, MA. He wrote a series of comic ballads for the San Francisco Examiner, of which “Casey at the Bat” was the last. It was published and he received $5 in payment for it. Recitations of the ballad by the actor William DeWolf Hopper greatly increased is popularity. It is said that by 1900 there were few Americans who had not heard of “Casey at the Bat.” Died at Santa Barbara, CA, August 21, 1940.

1883-Birthday of African-American Ernest E. Just, American marine biologist, pioneer of cell division, born at Charleston, SC. He was the first recipient of the NAACP's Spingarn Medal and was a professor at Howard University from 1907 to 1941, where he was head of physiology at the medical school(1912-20) and head of zoology(1912-41). He died October 27, 1941, at Washington, DC.

1900-After a siege of nearly two months, troops from the US ( Marines), Great Britain, France, Russia, Germany and Japan reached Peking and put down the Box Rebellion. Bitter antagonism against all foreigners in China broke into open warfare when a nationalist group, the Boxers, occupied Peking on June 20 and besieged members of the diplomatic corps, their families, and others in the British legation. The Boxers wanted to rid China of all foreigners. Under pressure from the U.S., the other powers agreed not to partition China further. On September 7, 1901, China and eleven other nations signed the Boxer Protocol, by which China agreed to pay 4333,000,000 in indemnity. The U.S. Received $24,5000,000 but in 1908 this amount was reduced and the money was used to educate Chinese students in the U.S.

1909 Jazz Violinist Stuff Smith Birthday

http://www.harlem.org/people/smith.html

http://www.musicweb-international.com/encyclopaedia/s/S138.HTM

1926-Birthday of pianist/singer Buddy Greco, Philadelphia, PA.

http://www.candidrecords.com/buddygreco.html

1926-Birthday of 1926, Alice Adams - U.S. writer and novelist. Her major work consisted of the novels Careless Love (1968), Families and Survivors (1975), Listening to Billie (1978), and her best read book Superior Women (1984). She published 25 short stories in the New Yorker magazine.

1929-Birthday of singer Lorez Alexandria, Chicago, IL

1930—Birthday of vibraphonist Eddie Cost, Atlas, PA.

1935-Congress approved the Social Security Act, which contained provisions for the establishment of a Social Security Board to administer federal old-age and survivors' insurance in the US. By signing the bill into law, President Franklin D. Roosevelt was fulfilling a 1932 campaign promise.

As a side note, US Senators/Congressmen do not pay into Social Security, and, therefore they do not collect from it. They felt they should have a special plan. When they retire no matter how long they have been in office, they continue to draw their same pay until they die, except it may be increased from time to time by the cost-of-living.

1936-Kansas City, MO has its hottest ever temperature with 113.1936 - Temperatures across much of eastern Kansas soared above 110 degrees.. It was one of sixteen consecutive days of 100 degree heat for Kansas City. During that summer there were a record 53 days of 100 degree heat, and during the three summer months Kansas City received just 1.12 inches of rain

1940 - Dash Crofts of Seals & Crofts is born in Cisco, Texas. The group has three top 10 hits, all of which reach No. 6: "Summer Breeze" in 1972, "Diamond Girl" in 1973 and "Get Closer" in 1976.

1941 - David Crosby is born David Van Courtland in Los Angeles. He is a member of the Byrds, then teams up with Stephen Stills and Graham Nash to form Crosby, Stills & Nash in 1968. The group wins the best new artist Grammy in 1969. CSN's two top 10 songs are "Just a Song Before I Go" and "Wasted on the Way."

1945- President Truman's announcement in 1945 that Japan had surrendered to the Allies, setting off celebrations across the nation. Official ratification of surrender occurred aboard the USS Missouri at Tokyo Bay, September 2 ( Far Eastern Time ).

1946-Birthday of Susan St. James - U.S. actor who perfected the airhead characterization who had innate common sense in a number of TV series including the hits MacMillan & Wife and Kate & Allie.

1947-Miles Davis record his first session under his own name, New York City ( Half Nelson, Milestones, Little Willie Leaps).

1947--Birthday of Danielle Steel - U.S. novelist with more than 100 million books in print in 42 countries.

http://www.randomhouse.com/features/steel/

1949---Top Hits

Some Enchanted Evening - Perry Como

Bali Ha'i - Perry Como

Again - Doris Day

I'm Throwing Rice (At the Girl that I Love) - Eddy Arnold

1950 -- Birthday of American cartoonist/humorist Gary Larson.

1953 - David N. Mullany and his 13-year-old son, David A. Mullany, while trying to come up with a ball that would curve every time it was thrown, wound up inventing the Wiffle Ball. The ball had oblong holes on the top half, and a solid bottom. The original Wiffle bat was wood, but for many years it has been a skinny glowing yellow shaped plastic bat.

1953-June Christy records “Something Cool,” Los Angeles.

1953-HAMMOND, LESTER, JR. Medal of Honor

Rank and organization: Corporal, U.S. Army, Company A, 187th Airborne Regimental Combat Team. Place and date: Near Kumwha, Korea, 14 August 1952. Entered service at: Quincy, Ill. Born: 25 March 1931, Wayland, Mo. G.O. No.: 63, 17 August 1953. Citation: Cpl. Hammond, a radio operator with Company A, distinguished himself by conspicuous gallantry and outstanding courage above and beyond the call of duty in action against the enemy. Cpl. Hammond was a member of a 6 man reconnaissance patrol which had penetrated approximately 3,500 yards into enemy-held territory. Ambushed and partially surrounded by a large hostile force, the small group opened fire, and then quickly withdrew up a narrow ravine in search of protective cover. Despite a wound sustained in the initial exchange of fire and imminent danger of being overrun by the numerically superior foe, he refused to seek shelter and, remaining in an exposed place, called for artillery fire to support a defensive action. Constantly vulnerable to enemy observation and action, he coordinated and directed crippling fire on the assailants, inflicting heavy casualties and repulsing several attempts to overrun friendly positions. Although wounded a second time, he remained steadfast and maintained his stand until mortally wounded. His indomitable fighting spirit set an inspiring example of valor to his comrades and, through his actions, the onslaught was stemmed, enabling a friendly platoon to reach the beleaguered patrol, evacuate the wounded, and affect a safe withdrawal to friendly lines. Cpl. Hammond's unflinching courage and consummate devotion to duty reflect lasting glory on himself and uphold the finest traditions of the military service.

1957---Top Hits

(Let Me Be Your) Teddy Bear - Elvis Presley

Love Letters in the Sand - Pat Boone

Tammy - Debbie Reynolds

Bye Bye Love - The Everly Brothers

1959-The formation of the American Football League was announced at a press conference in Chicago. Play was set to begin in 1960 with at least six and possibly eight franchisees.

1959-Birthday of Earvin “ Magic” Johnson, Jr., former basketball player and coach, born Landsing, MI.

1961-Wanda Jackson's biggest hit, "Right Or Wrong" enters the Billboard Pop chart on its way to #29.

1965- Frank Mitchell, age 15, of Springfield, IL, was appointed by Representative Paul Findley, Republican of Illinois, to become a Congressional page, the first African-American to hold this position in the history of the United States.

1965-The McCoys' "Hang On Sloopy" is released.

1965---Top Hits

I Got You Babe - Sonny & Cher

Save Your Heart for Me - Gary Lewis & The Playboys

Unchained Melody - The Righteous Brothers

The First Thing Ev'ry Morning (And the Last Thing Ev'ry Night) - Jimmy Dean

1965-After several minor hits, Sonny and Cher had the number one song in the US when "I Got You Babe" reached the top.

1967 - No. 1 Billboard Pop Hit: "All You Need Is Love," The Beatles. The group's manager, Brian Epstein, dies of an accidental drug overdose while the song is No. 1.

1969 - The New York Mets were 9-1/2 games behind the league-leading Chicago Cubs. The Amazing Mets began a comeback that launched the phrase, “You Gotta Believe,” as they began a drive that took them to the National League pennant and the World Series Championship (over the Baltimore Orioles). It was the first championship for the Mets franchise which began in 1962.

1969—The Woodstock Music and Art Fair opens for three days on Max Yasgur's farm in Bethel, Sullivan County, New York.

1971-Rod Stewart released "Maggie May."

1973---Top Hits

The Morning After - Maureen McGovern

Live and Let Die - Wings

Brother Louie - Stories

Trip to Heaven - Freddie Hart & The Heartbeats

1974-Paul Anka's "You're Having My Baby," is gold despite its denouncement by feminists. The objection is the use of the word 'my' as in "my baby", not "our baby." It is Number One by the end of the summer.

1976- The longest softball game began at 10am and continued until Saturday, 4pm, when it was called because of rain and fog. The game was played at Summerville Field, Monticello, NY between the Gager's Diner and the Bend n” Elbow Tavern. About 70 players, including 20 women participated. Some $4,000 was raised for the construction of a new softball field and for the Community General Hospital. The Gagers made 832 hits and scored 491 runs; the Elbows made 738 hits, scoring 467 runs. There were 31 home runs. To date, this remains the longest softball game on record.

1976 - Nick Lowe's debut solo single, "So It Goes," is released.

1976-The Steve Miller Band's "Rock 'N Me" is released.

1977---77,691 fans, the largest crowd to that date to watch a soccer match in the US, saw the New York Cosmos, led by Pele, defeat the Fort Lauderdale Strikers, 8-3, in a National American Soccer League quarterfinal playoff game at the Meadowlands in East Rutherford, NJ.

1981---Top Hits

Jessie's Girl - Rick Springfield

Endless Love - Diana Ross & Lionel Richie

Theme from "Greatest American Hero" (Believe It or Not) - Joey Scarbury

Too Many Lovers - Crystal Gayle

1982-The first National Navajo Code Talkers Day. Coded military radio transmissions using a Native American language began in 1942, when the Allied and Axis powers were competing to devise communications codes that could not be deciphered by the enemy. Philip Johnston, a missionary's son who had grown-up on the Navajo reservation, proposed the idea of using the Navajo language, a complicated system in which the meaning of a word is often determined by expression and pronunciation. Marine Major General Clayton B. Vogel approved the plan and recruited 420 Navajo “ code talkers” to handle coded radio communications in the Pacific theater. the codes combined everyday Navajo words with about 400 special terms made up by the code talkers. Members of other tribes were employed as well. The Japanese were aware of the Navajo codes, but never broke them. They were kept top secret until 1968.

1984 - IBM released PC-DOS v3.0 for PC/AT (with network support). A 286 processor, 20-30 megabyte hard drive and 256k/512k RAM for somewhere between $6000 and $9000.

1985-Michael Jackson outbids Paul McCartney for the entire ATV music publishing catalogue, which includes most of the Lennon / McCartney songbook. Jackson paid 47.5 million US dollars for the company, in an act that will permanently sour the friendship between the two stars.

1987 - Mark McGwire set the record for home runs by a rookie, as he connected for his 39th round-tripper of the season. He got the homer off of 317-game winner Don Sutton of the California Angels. McGwire led the Oakland Athletics to a 7-6 win -- in 12 innings.

1987- Slow moving thunderstorms deluged northern and western suburbs of Chicago IL with torrential rains. O'Hare Airport reported 9.35 inches in 18 hours, easily exceeding the previous 24 hour record of 6.24 inches. Flooding over a five day period resulted in 221 million dollars damage. It was Chicago's worst flash flood event, particularly for northern and western sections of the city. Kennedy Expressway became a footpath for thousands of travelers to O'Hare Airport as roads were closed. The heavy rains swelled the Des Plaines River above flood stage, and many persons had to be rescued from stalled vehicles on flooded roads.

1988 - Eighteen cities in the northeastern U.S. reported record high temperatures for the date, and the water temperature at Lake Erie reached a record 80 degrees. Portland ME reported a record fourteen straight days of 80 degree weather. Milwaukee WI reported a record 34 days of 90 degree heat for the year. Afternoon and evening thunderstorms resulted in about fifty reports of severe weather in the northeastern U.S. One person was killed at Stockbridge MI when a tornado knocked a tree onto their camper.

1989---Top Hits

Right Here Waiting - Richard Marx

On Our Own - Bobby Brown

Once Bitten Twice Shy - Great White

Timber, I'm Falling in Love - Patty Loveless

1989-Bon Jovi's "New Jersey" LP becomes the first U.S. album to be released legally in the Soviet Union. The Russian label Melodiya pays the group with a truckload of firewood since rubles can't leave Russia.

1990-Denver votes for a 1% sales tax to pay for a baseball franchise.

1992 - Wayne Newton files for Chapter 11 bankruptcy protection. The singer, a former owner of the Alladin Hotel in Las Vegas, is one of the highest paid performers on the Vegas strip.

1995 - Members of the Grateful Dead meet and decide to cancel their fall tour in the wake of Jerry Garcia's death.

1998 -The A's Rickey Henderson's stolen base in the first-inning against the Tigers makes the thirty-nine year old the oldest player to steal 50 bases in a season.

1999 -With Pudge's 20th stolen base in Chicago, Texas backstop Ivan Rodriguez becomes the first catcher in major league history with 20 homers and 20 stolen bases in the same season.

2003-Largest power outage in US history hits the Northeast. By 11 p.m. in New Jersey, power had been restored to all but 250,000 of the nearly 1 million customers who had been in the dark since just after 4 p.m.

--------------------------------------------------------------

Baseball Poem

Catch the Ball that's

Thrown to you

Francis Levy,

New York Times, August 7, 2006

I had my little moment of glory

when I caught a baseball at

Yankee Stadium

and my son looked at me in

disbelief.

He was really proud of me,

thought I hadn't done anything but

grab what was coming my way.

I had to do two things:

stand up

and extract my good fortune

from a biblical

sea of hands.

--------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Ask Andrew

Bank Beat

Cartoons

Computer Tips

Fernando's Review

Leasing 102

Online Newspapers

Placards

Sales Make it Happen

To Tell the Truth

View from the Top