|

|

|

|

|

|

Tuesday,

August 3,2004

Headlines---

Classified

Ads---Doc. Manager / Finance / Legal

Larsen

gets prison term, told to repay investors

Andrew

Thorn says “Goodbye to Leasing”

NorVergence

mastermind no stranger to bankruptcy

NorVergence

bankruptcy leads to charges of scam

National

Lease Funding Source Showcase Finalizes Agenda

ELFF

Newsletter—Starts Campaign

Balboa

Capital Hires Five Leasing Veterans

CFNB

Announces Lower 2004 Earnings/ Strong Origination Volume

BBB

Warns Imposters are Targeting Consumers and Businesses

Resource

America Increases Cash Dividend by 50%

“Minor

Slipage” NACM Credit Manager's Index (CMI) for July 2004

######## surrounding the article denotes it is a “press

release”

-------------------------------------------------------------------------------

Classified

Ads---Doc. Manager / Finance / Legal

Documentation

Manager: New York, NY.

10+ years in equipment

leasing/secured lending. Skilled in management & training, documentation,

policy and procedure development & implementation, portfolio reporting.

Strong work ethic.

Email: dln1031@nyc.rr.com

Finance: Chicago,

IL

Experienced in big

ticket origination, syndication, valuation and workout.

Twenty five years,

MBA, CPA,JD, LLM (Tax), structuring specialist. Inbound and outbound

transactions. Email: pal108381@comcast.net

Transaction Summary

Website: www.tlgattorneycpa.com

Finance: Austin,

TX.

20+ years all facets of lease/finance. Collection and credit management. Equipment & rolling stock structuring. $150k credit authority, $100 million portfolio management.

Email: texmartin@juno.com

Finance: Lyndhurst,

NJ

CFO w/20+ years leasing/financing. Respected by lenders/rating agencies full & fair financial reporting. Outstanding record restructuring debt. Adept at investor relations and mentoring people.

Email: joemcdev@aol.com

Finance: San

Jose, CA.

15+ years sourcing

debt, managing cash and receivables and other treasury functions. Strong

background in credit, contract

administration and

bankruptcy litigation experience. MBA Finance.

Email: raycis@comcast.net

Legal: Los

Angeles, CA

Experienced in-house corporate and financial services attorney seeks position as managing or transactional counsel. Willing to relocate.

Email: sandidq@msn.com

Full list at:

http://64.125.68.90/LeasingNews/JobPostings.htm

------------------------------------------------------------------------------

Larsen

gets prison term, told to repay investors

By Mike Freeman

SAN DIEGO UNION-TRIBUNE STAFF WRITER

A former executive

involved in the notorious PinnFund financial scam was sentenced yesterday

to more than six years in federal prison and ordered to pay nearly $6.7

million in restitution.

Tommy A. Larsen,

55, of Vista, pleaded guilty in December to mail fraud, wire fraud,

money laundering, obstruction of justice and tax evasion. He was sentenced

by U.S. District Judge Marilyn Huff.

Larsen was president

of PinnLease, a subsidiary of Carlsbad- based PinnFund. Prosecutors

contend he orchestrated a complex scheme of bogus equipment leases,

then received kickbacks from those leases for himself and PinnFund.

Larsen also admitted

to lying in a federal court case, evading taxes by charging personal

expenses to PinnFund and structuring his salary to avoid payroll taxes.

Some of the money was hidden in offshore banks.

PinnFund, a mortgage

lender that employed more than 200 people, was at the center of an elaborate

Ponzi scheme that bilked investors out of hundreds of millions of dollars.

Authorities said

PinnFund chief executive Michael Fanghella and associate James Hillman

promised 160 investors double-digit returns for investing more than

$300 million in PinnFund to fund mortgage loans.

Instead, the money

went to cover millions in operating losses at PinnFund, o enrich executives

and to provide previous investors with their monthly returns.

PinnFund collapsed

in 2001 after the Securities and Exchange Commission filed a lawsuit

exposing the scam. Criminal charges followed against several of the

ringleaders, including Fanghella, who was sentenced in February 2003

to 10 years in prison.

Larsen wasn't a central

figure in the initial Ponzi scheme. But prosecutors said he was part

of a scam to raid more investor money through the equipment leasing

subsidiary.

Larsen's son, Kim

A. Larsen, 34, also was sentenced yesterday, receiving 21 months in

prison. Kim Larsen ran Copy Fax, which supplied office equipment to

PinnFund. He was ordered to pay a $5,000 fine.

"These sentences

address an extensive and sophisticated leasing fraud that helped keep

the central PinnFund Ponzi scheme going," U.S. Attorney Carol Lam

said.

Tommy Larsen is in

custody. Kim Larsen is free pending a decision on which federal prison

he'll be assigned to serve his sentence.

Including Larsen,

seven people linked to PinnFund have pleaded guilty to federal fraud

charges. Hillman, one of the top money raisers in the scheme, is fighting

charges. No trial date is set in his case.

( full stories on PinnFund here:

http://www.leasingnews.org/Conscious-Top%20Stories/Pinn_Leasing_Sentencing_postponed.htm

)

-------------------------------------------------------------------------------

Andrew

Thorn says “Goodbye to Leasing”

One of the original

Leasing News advisory board members,

a good, loyal friend says “good-bye” to leasing. For sixteen years

he has operated Thalman

Financial/NowLease in Apple

Valley, Southern California (1)

“

The main question

is what can I do now to make things better. I have been in this business

for 13 years and I have been through a recession. Dan Rather was not

so far off when he closed his broadcast with, "Courage", “

he said June 15,2001 (1).

In June, 2002: “

I am competing in my very first Iron Man Triathlon.

What does this mean? It means I will swim 2.4 miles, ride 112

miles (on a bicycle) and run (or walk or crawl) 26.2 miles in a race

in Provo Utah.”

He left the Leasing

News Advisory Board to spend more time with

his family, his church,

The Church of Jesus Christ-Later Day Saints,

and then earned his MBA at the Graziadio School of Business

at Pepperdine University

He also bought Business

Asset Funding LLC , Hal Hayden and his wife’s company in August, 2002. July,2003,Hal announced he was

leaving Thalman Financial

for the candle business (2)

A very sincere and

dedicated person, he now leaves the direct

leasing business.

Here is the only

picture of Andrew Thorn from our archives, the year 2002:

David

Ross Mayhall-Pacific Capital Leasing, Andrew Thorne, Thalman

Financial,

Curt Lysne, CLP—GE Capital/Colonial Pacific

“Dear Friends in

the Leasing Industry,

“After much consideration,

I decided to retire from Thalman Financial to focus on a new project

and business. I want to thank

many of you for our association over the past 16 years.

The decision to leave the industry in some respects is very difficult.

I enjoy many friends in the industry and I feel very comfortable.

The leasing industry has been very good to me and my family and

I look forward to remaining involved in a new and different way.

“I am leaving to

fulfill a life long desire to teach and to learn.

In the spring of last year I began developing a new company. I went back to school and earned a Masters

in Personal and Executive Coaching, began earning my PhD in Consulting

Psychology at Alliant International University and founded Telios Corporation.

The vision of Telios is to “Evoke Excellence in Others.”

Our mission is to coach, consult and facilitate individuals,

teams and organizations that are passionately pursuing continuous improvement.

“As accountability

and thinking partners, we help create lasting change where it is wanted

and needed. We help transform what is learned into actionable power

skills that are usable in the daily professional and personal leadership

roles. As a result, our clients are more prepared to meet the demands

of the day, giving them more time to focus on what really matters most.

“I would like to

invite you to tour our website at www.telioscorp.com. The site explains more fully our purpose and

vision.

“I would like to

express my thanks to the many individuals and companies that believed

in me and supported me along the way.

I would enjoy keeping in touch and I am sure I will keep an eye

on the industry as it has been a big part of my life.

“Kindest Regards,

“Andrew Thorn

(1) http://two.leasingnews.org/archives/June01/6-15-01.htm

(2) http://www.leasingnews.org/archives/July%202003/7-09-03.htm#hal

----------------------------------------------------------------------------

Classified--- Help Wanted

Account

Executive / Small ticket leasing account reps

|

|

Credit-Funding-Operations

|

Credit Analyst: Seeking an energetic and organized Credit Analyst. At least one to two years of experience as a Credit Analyst in financial services (banking, insurance, leasing, or mortgage) is required. Funding Manager: Seeking a very organized, detail oriented Funding Manager. Minimum two years experience in brokering and discounting commercial equipment transactions is required. Operations Manager: Seeking an experienced Operations Manager with knowledge of all sides of operations. Must have a minimum of five years related experience. Send

email or fax to Ryan Johnson, Corporate Recruiter. |

|

|

Equipment Finance Sales Executive

|

|

Marketing Indirect Origination

|

MARKETING INDIRECT ORIGINATION: New York. One of the largest ind. equip.lessors needs motivated, self-starter to purchase single investor leases from institutional investors; min.transaction $1 million; portfolio of primarily investment grade lessees/good "story credits". Min 3 yrs exp. sourcing/ originating leasing transactions, knowledge of credit and pricing. E-mail: jobposting1@leasingnews.org |

Senior Contract Specialist

|

|

------------------------------------------------------------------------------

NorVergence

mastermind no stranger to bankruptcy

By

MARTHA McKAY STAFF WRITER

The Record, Bergen

County, NJ

Running a phone company

into bankruptcy is nothing new for Thomas N.

Salzano. Before his

ill-fated venture, Newark-based NorVergence, folded last month, Salzano

headed up a different phone company.

In the early 1990s,

after running a freight consulting business,

Salzano founded Minimum

Rate Pricing Inc. in Bloomfield, a reseller of

residential long-distance

phone service that eventually hired hundreds of people but ran afoul

of federal regulators in 1998 when customers complained that MRP illegally

switched their long-distance, a technique known as slamming.

A settlement was

reached, and MRP agreed to pay a $1.2 million fine

to the Federal Communications

Commission. But over the next few months, MRP's business imploded.

The company, which

bought its long-distance service wholesale from

WorldCom (now MCI),

racked up $67 million in debt, according to court papers, and filed

for Chapter 11 bankruptcy protection, along with some related companies,

in February 1999.

"It was out

of control," recalled Brian Engle, a turnaround

specialist brought

in by the creditors.” They weren't looking at their costs; the philosophy

was, more revenue will solve the problem."

Months later, creditors

battled in court for the remaining scraps,

saying in court papers

that Salzano set up "The Telecom Education Trust," a college

trust fund for Salzano's five children, into which was funneled $250,000

in company funds.

Warren Martin, a

New Jersey lawyer who represented the creditors'

committee, said a

judge ordered that money returned.

Creditors also accused

Salzano of transferring $2.7 million in

company funds to

a Swiss bank while the company was in bankruptcy proceedings. But the

creditors decided it wasn't worth the cost and effort to pursue those

charges, Martin recalled. "Essentially, the business went away

and there was nothing left but a bunch of lawsuits," he said.

In the end, the bankruptcy

court allowed WorldCom, the largest

creditor, to buy

the remaining MRP customers, using part of its debt as payment, Engle

said.

MRP customers became

WorldCom customers.

And Salzano started

to plan his next venture: NorVergence.

Martha McKay

Staff Writer

The Record

150 River St.

Hackensack, NJ 07601

201-646-4326

|

Your

One stop solution for training and reference material for the

Leasing Professional

www.theleasinglibrary.com |

NorVergence

bankruptcy leads to charges of scam

( For the first time,

how salesmen sold their product, and

why the scheme finally

caught up to the Salzano’s—a second time.)

By

MARTHA McKAY STAFF WRITER

The Record, Bergen

County, NJ

At the center of

a massive New Jersey bankruptcy that dealt a blow

to 11,000 small businesses

in more than 20 states is a small box called "The Matrix."

Newark-based NorVergence,

a privately held phone-service reseller,

boasted that the

box was packed with enough of the very latest

telecommunications

technology to deliver cheap, unlimited local and long-distance phone,

cell service, and high-speed Internet access.

In fact, the box

was a gimmick. In some cases, it had no practical

use at all.

"It's an unbelievable

scam," said Meredith Wood, who runs an

industrial services

business in West Milford.

"I wish I'd

thought of it," she said with a rueful laugh. "I'd be

calling you from

my private island."

Wood bought unlimited

long-distance and cell phone service from

NorVergence last

year and signed a lease for a Matrix box that NorVergence never even

plugged in. Now, Wood is stuck owing a five-year, $45,000 equipment

lease to U.S. Bancorp for her Matrix, a piece of gear worth about $600.

The story of how

Wood and thousands of other small-business owners

were victimized began

to unfold last month, when NorVergence flamed out in a Chapter 7 liquidation

in U.S. Bankruptcy Court in Newark. The

company, which once

boasted $200 million in annual revenues, left 1,300 employees without

jobs, large phone companies such as Qwest, Sprint, and T-Mobile owed

at least $30 million, and lawyers wondering where all the money went.

Qwest has received

the court's permission to shut off service to

NorVergence's former

customers, leaving Wood and the thousands of

other business owners

potentially without phone service but still owing

hundreds of millions

in payments to banks and finance companies who paid NorVergence millions

for the leases.

Christopher Menkin,

editor of Leasing News, believes the NorVergence

case is "one

of the biggest leasing scandals in the last 25 years."

Corporate culture

Drawn in by NorVergence's deeply discounted phone service and slick,

reassuring marketing materials, many small-business owners probably

didn't think to delve into the company's background.

If they had, they

might have turned up court records showing the man

who ran NorVergence,

Thomas N. Salzano, had piloted another

telecommunications

company that ended in bankruptcy, where creditors accused him of illegally

funneling $2.7 million of company funds into a Swiss bank after filing

for Chapter 11 protection.

By all accounts,

Salzano, who was NorVergence's chief managing

officer and was listed

as a director in a Securities and Exchange Commission filing, ran the

company despite the CEO title of his brother, Peter J. Salzano. He's

described by those who know him as a high-energy executive with a quirky

style who rarely wore ties, instead favoring white leisure suits and

colorful printed shirts.

He's got "a

lot of marketing savvy" and "a lot of ego," those people

said -an arrogant

charmer with a creative business mind.

Neither of the Salzano

brothers responded to requests for an

interview.

By mid-2003, just

two years after it was founded, NorVergence was

buying millions of

dollars worth of phone and Internet service from some of the nation's

largest carriers, including Qwest, Sprint, and T-Mobile,

and reselling at

a deep discount to thousands of small businesses.

The company hired

hundreds, packing so many workers onto two floors

at 550 Broad St.

in Newark that the building's air conditioning was

overwhelmed and NorVergence

had to rent more floors.

Salespeople, many

of whom had previously worked in the

telecommunications

industry, were attracted by promises of hefty commissions. The sales

teams followed a pitch based on a series of scripts hammered home during

a two-week sales tryout in Newark.

Kirk Dennis, a top

salesman in the Chicago area, recalls a boot

camp-like atmosphere

where memorizing the script made the difference between getting a job

and getting kicked out.

The NorVergence trainers

made you sweat with their intimidating

behavior, said Dennis,

describing how they would "catch you in a hallway and say,’ Give

me your script. 'Y" Anyone who floundered was escorted out.

Of the 90 people

who began with Dennis, only 30 were offered a job.

Described by customers

as highly polished and aggressive,

NorVergence salespeople

fanned out across the country as their employer rapidly opened well-appointed

offices in 36 cities.

The pitch, the catch

Armed with their sales pitch, and backed up by a flashy Web site, the

company went after small-business owners with good credit records, most

of whom did not have a telecommunications expert on staff. The salespeople,

known as screening managers, used dense, acronym-rich telecommunications

jargon in their descriptions of the cheap, unlimited phone services

that the "MATRIX unlimited calling solution" would deliver.

According to a sales

script obtained by The Record, a screening

manager would tell

a prospective customer "because we're swamped with so many new

requests, my job is to screen for only qualified applicants down to

just the few allowed for each area."

"They let you

know if they were going to accept you as a customer -

that was their marketing

gimmick," said Carol Marubio, owner of an Illinois roofing company

that signed up.

But by far the bigger gimmick was the Matrix box.

To sell phone service

to their small-business customers,

NorVergence, a reseller,

bought it wholesale from large carriers such as Qwest and Sprint.

But when the sales

team pitched the company's "solution" to

customers, the Matrix

box was key.

What many eager customers

apparently missed was the fact that the

"unlimited"

phone and Internet service NorVergence sold them had no

direct relation to

the box, which performed a limited function in some

customers' cases

(it allocated bandwidth over a T1 line), and no function in others.

Many apparently believed

that the box could be used by other phone

providers.

Most customers didn't

think NorVergence would go out of business.

One former salesman

said they were told that if a customer asked what would happen if the

company ran into trouble, to "just say nothing" and dismiss

the possibility.

And some customers

interviewed had no idea that NorVergence would

sell their Matrix

lease - for cash - to banks and finance companies, in much the same

way a bank might sell a mortgage to a third party.

Those sales funneled

millions to NorVergence, and locked its

customers into long-term

relationships with a bank.

"In my opinion,

[NorVergence's] whole setup was designed to sell

equipment leases,"

said Dan Baldwin, spokesman for TelecomAgent, a non-profit organization

that represents sales agents in the telecommunications business, who

has been looking into NorVergence's business since early last year.

As for the box, David

Silverman, a NorVergence salesman based at the

company's Broad Street

headquarters, told the U.S. Bankruptcy Court

at a recent hearing

that the Matrix box was useless.

"These boxes

serve no purpose; they're worthless," he told the

court. Scores of

local companies and organizations - even the New Jersey

Republican State

Committee offices in Trenton - signed up for NorVergence service, lured

by those promises of deep discounts.

It was hard to turn

down.

The company installed

customers at the rate of 350 a week -

averaging about $6

million in weekly sales - practically up to the bankruptcy filing, said

Oscar Delatorre, a former NorVergence employee who oversaw installations.

That's an estimated

$132 million in sales for the first five months

of 2004 alone.

According to a former

NorVergence vice president who supplied sales

figures to The Record,

new customers signed contracts for $409 million worth of phone systems

from January through June 4. Of that, an estimated 40 percent actually

were installed, bringing the total sales closer to about $164 million.

Last gasp The whole

company was focused on marketing and sales, former employees said.

As its debts rose,

NorVergence ratcheted up its sales effort, and

other parts of the

business began to deteriorate, they said.

"Customer service

and installation was an afterthought," said Jeff

Carlsen, vice president

of facilities engineering.

Around January, the

company told employees it was looking for

investors, but that

effort apparently failed.

On the seven floors

at 550 and 570 Broad St., the signs of

disorganization were

disturbing.

"There were

tables stacked with piles of folders; there was no

particular order

to customer files," said Carlsen. "It was unbelievably

unorganized."

Technical problems

arose with a new 800 service the company tried to

introduce. It had

to pay its mounting bills to Qwest and others - nearing $2 million a

week toward the end - to cover service for its existing customer base.

So it kept adding more and more new customers, selling their leases

to banks, and collecting the cash.

It pushed its sales

staff hard. By some estimates, NorVergence

signed up as many

as 4,000 customers over the last six months, without connecting their

phone service.

After it fell behind

in its payments to Qwest, the Colorado-based

carrier shut off

service for two days in mid-June. Several days later,

NorVergence bounced

hundreds of payroll checks, but asked its employees to keep working.

As creditors closed

in, the normally feisty Tom Salzano appeared

defeated, according

to one person who met with him then.

On June 30, the company

was forced into an involuntary Chapter 11

filing by three banks.

It laid off about

1,000 people that day, owing hundreds back pay and

commissions. As the

Salzanos moved to get the word out, the news spread to other floors

and a few angry, now ex-employees tried to leave the building with office

equipment, former employees said.

Two days later, in

bankruptcy court again after a failed attempt by

some banks to inject

cash to prop up the operation, NorVergence converted to a Chapter 7,

closing for good and liquidating assets.

The aftermath Qwest

received permission from the judge to shut off service to NorVergence

customers, setting off a mad scramble among customers to find new phone

service.

A trustee took possession

of NorVergence offices and began the

process of selling

any assets. (It remains to be seen if there will be anything left. So

far, Qwest is the largest unsecured creditor, with at least $15 million

owed, followed by Sprint with at least $10 million. But before they

get anything, secured creditors will get paid, along with former employees

who file claims.)

About two weeks ago,

frustrated customers began to receive letters

from banks and finance

companies holding the Matrix leases that they'd

better keep paying. Dozens of NorVergence customers have formed

a legal co-op, hiring a lawyer to fight the banks and get them out of

their leases.

There is talk of

a class-action suit. Meanwhile, it's still not clear whether the banks

and finance companies that bought the Matrix leases understood what

they were getting. One source said

it appears that some

of the finance companies were not aware, for

example, that the

Matrix box could not be used by another phone provider in the event

NorVergence shut down.

One source familiar

with the group of 35 banks and finance companies

said they purchased

at least $220 million worth of NorVergence customers' leases. Some banks

are trying to line up new phone-service providers for NorVergence customers.

A spokeswoman for Adtran, which made the boxes and sold

them to NorVergence,

said her company was working with the banks to try to fix the problem.

"Transferring

telecommunications services from NorVergence to a

different carrier

likely requires modification or replacement of equipment

[the Matrix box]

owned primarily by equipment leasing companies," she said.

A spokeswoman for

Popular Leasing, a finance company owned by Banco

Popular, said the

company had no comment on the NorVergence situation. So did Wells Fargo.

And the CIT Group.

Also unclear is the

role Robert J. Fine played in the NorVergence

debacle. Fine was

NorVergence's director of bank relations, who apparently made the connections

between the banks and NorVergence. He recently resigned as president

of the trade group Eastern Association of Equipment Lessors (EAEL),

according to Leasing News.

Before joining NorVergence,

Fine held numerous positions in the

leasing industry.

The EAEL did not return repeated phone calls, and Fine

could not be reached

for comment.

On the last day of

NorVergence's existence last month, Tom Salzano

did not appear in

court but his brother Peter, the CEO, did.

His face beaded with

perspiration, Salzano left the courtroom to

jeers by former employees

who came to the hearing.

He kept his head

down and walked away.

ELFF Newsletter—Starts Campaign

http://www.leasingnews.org/items/ELFF_2004_Annual_Campaign!!!.htm

### Press Release

################################

National Lease Funding Source Showcase Finalizes Agenda

Estimated $1 billion in lease buy/sell

investment resources

ATLANTA, GA – – The Lessors Network has finalized the agenda

and closed attendee registration for the exclusive, high profile National

Lease Funding Source Showcase.

Unlike traditional

industry events, the Lessors Network purposely restricts total attendance

to enhance new business development benefits for an elite audience of

industry professionals. It is estimated that approximately $1 billion

in equipment lease buy/sell investment resources will be represented.

The following professionals,

representing funding sources, technology and service providers will

be showcased August 25-26 from the Ritz-Carlton, Buckhead hotel in Atlanta,

GA:

Maria Gum | President

Asset Solutions | Allied Resource Corp.

Scott Hopkins | Corp.

Dev. | Special Lessors Network Guest

Stu Weinroth | MD

- Capital Markets | Republic Financial Corp

Alan J. Zeppenfeld

| Vice President | GlobalTech Portfolio Services

David Judd | Sales

Manager | International Decision Systems

John Beville | SVP/Nat.

Sales Mgr | SunTrust Leasing Corporation

Tim Cohn | President

| Advanced Marketing Consultants, Inc.

Kurt M. Henning |

Vice President | SunTrust Leasing Corporation

Derrick Bavol | President

| Fortran Group International, Inc.

Richard Snyder |

Vice President | Wells Fargo Financial Preferred Capital

John H. Bella, Jr.

| Senior Director | Fitch Ratings

Bob Neptune | President

| ORIX Public Finance

Larry Bowman | Director

| SG Americas Securities, LLC

Fred S. Summers |

CEO | Vision Financial

Vincente D'Ingianni

III | Mkt Dir | CIT Technology Financing Services, Inc.

Jennifer A/ Coyle

| Syn Mgr | Caterpillar Financial Services Corporation

Rick Daubenspeck,

ASA | SVP | Valuation Research Corporation

Douglas G. Ducray

| SVP | RBS Lombard, Inc,

Ronnie Pearce | SVP

| Bank of America Leasing & Capital, LLC

Kurt Burr | COO -

Cofounder | Burr Wolff

Alex Dunlap | Vice

President | Wells Fargo Financial Resources

Bob Fisher, CLP |

Vice President | Douglas-Guardian Services Corp.

Scott Thacker | Senior

Director | Oracle Corporation

Patricia A. Clifford

| SVP - Syndication | Banc One Leasing Corporation

Chip Ferris | Co-founder

| Burr Wolff

Karen Soule | Compliance

Manager | Burr Wolff

Carol Diggs | Managing

Director | DiGGS! Executive Search

Larry Greer | SVP/CAO

| Vision Financial Group, Inc.

Andrew Decker | Vice

President | Russell Equipment Co., Inc.

Jim Siegel | National

Sales Manager | GE Commercial Finance

John Steindorf |

EVP | Capital Data, Incorporated

Stuart M. Litwin

| Partner | Mayer, Brown, Rowe & Maw LLP

Robert M. Wax | President

| Kingsbury Wax Bova, LLC

Robert W. Merkle

| Consultant | Robert W. Merkle

Brad Crawford | Syndication

Manager | IKON Office Solutions

Tom Williams | President/CEO

| eLease

Merle E. Atkins |

EVP | Marshall-Stevens Inc.

Tom Ingoldsby | Partner

| Sullivan-Worcester LLP

Shari L. Lipski,

CLP | Principal | ECS Financial Services, Inc.

Jim Tiley | Dir.

Leasing | IKON Office Solutions

William A. Gaffrey

| Asset Mgt Officer | Special Lessors Network Guest

David Burch National

Sales Manager | MBNA

Joe DiNicola | Executive

Vice President | MBNA

Brad Pike | SVP |

Creekridge Capital

Sharon Sagert | Director

| Creekridge Capital

George Springsteen

| President | Commonwealth Capital Corp.

Kimberly Springsteen

| EVP/COO | Commonwealth Capital Corp.

Paul Blyler | VP

Sales | Special Lessors Network Guest

Chris Coleman | Region

Manager | Caterpillar Financial Services Corporation

Jerry T Hudspeth

| President/CEO | Portfolio Financial Ser.

Alan G. Thomson |

CEO | Lease Alliance LLC

William Plumer |

Vice President | Special Lessors Network Guest

Jeff Schubert | EVP

| American Bank Leasing Corp.

Dan Firestone | CEO

| Allied Resource Corp

ABOUT THE LESSORS

NETWORK:

The Lessors Network

is a sales & marketing network facilitating new business development

opportunities within the corporate and municipal equipment leasing markets.

Networking showcases are traditionally held from the Ritz-Carlton

in Atlanta each spring and fall. Website programs and services provide

free access to news, events and important resources facilitating funding/syndication,

technology and outsourcing services exclusive to the equipment leasing

& finance markets.

Additional information

can be viewed at www.lessors.com

Contact:

John O. Semon

semon@lessors.com

#### Press Release

################################

|

|

BALBOA

CAPITAL’S COMMERCIAL DIVISION HIRES FIVE LEASING SALES VETERANS

(Irvine, CA) Balboa Capital announces the hiring of five

Middle-Market Leasing Industry veterans in its Commercial Sales Division. Patrick Camp, Allen Hosack, Jeff Almond, Jerry

Dalton, and Pat McKeon bring over 80 years of commercial leasing experience

to the Company. This group of

sales reps, based around the country, was hired over the last three

months to concentrate on growing Balboa Capital’s middle-market presence

with transactions ranging from $ 100,000 to $ 5,000,000.

Northwest Regional Vice President, Patrick Camp, brings sixteen

years of experience including GE Healthcare Financial Services. He closed over $ 100 million in hospital equipment

financing since 1993 and is a member of HFMA.

Allen Hosack joins Balboa as VP of National Accounts specializing

in Electronics Manufacturing. Mr.

Hosack comes to Balboa with 30 years of leasing industry experience

that includes Electronic Circuit Board and Semiconductor markets with

CitiCapital, where he was a member of both the “President’s Club” and

“CitiCapital Platinum Club”. Hosack

is a member of SMTA and IPC.

Southwest Regional Vice President, Jeff Almond, adds ten years of

industry experience including GE Capital and CIT where he specialized

in transactions over $ 1,000,000. Southeast

Regional Vice President,

Jerry Dalton, comes

to Balboa with 25 years of leasing industry experience including Borg

Warner Acceptance, Pitney Bowes Credit, Federated Financial and UPS

Capital. National Account Manager, Pat McKeon adds six

years of middle market leasing experience including Celtic Leasing.

“This group solidifies our middle-market team,” said VP of Commercial

Financing, Don Hansen. “Balboa

is expects tremendous growth from this segment over the next year.”

About Balboa Capital

Balboa Capital provides

equipment leasing and financing to small and mid-sized business in the

United States. The company markets

its products through its direct sales force, broker channel, and vendor

partnerships. The company offers

leases in the range of $ 5,000 to $ 5,000,000.

Balboa Capital is privately held and based in Irvine, CA.

Jonathan Albin

Balboa Capital Corporation

Direct: 949.553.3498

Fax: 949.399.3198

jonea@balboacapital.com

#### Press Release

################################

CFNB

Announces Lower 2004 Earnings but Strong Origination Volume

IRVINE, Calif.----California

First National Bancorp (Nasdaq:CFNB) ("CalFirst Bancorp")

today announced that for the fiscal year ended June 30, 2004 net earnings

decreased 9 percent to $9.8 million, compared to $10.7 million for fiscal

2003. Diluted earnings per share were $0.88 for the fiscal year ended

June 30, 2004, down 8 percent from $0.96 per share reported for the

prior year. For the fourth quarter ended June 30, 2004, net earnings

of $2.3 million also decreased 9 percent from net earnings of $2.5 million

for the fourth quarter of fiscal 2003. Diluted earnings per share for

the fourth quarter decreased 13 percent to $0.20 per share, compared

to $0.23 per share for the fourth quarter of the prior year, reflecting

an increase in fully diluted shares outstanding.

For the fourth quarter ended June 30, 2004, net direct finance

and interest income decreased 9 percent to $4.6 million, compared to

$5.0 million for the fourth quarter of fiscal 2003. This decline is

primarily due to lower direct finance income resulting from lower yields

earned on the company's investment in capital leases, despite an increase

in average balances. This was partially offset by a decrease in the

provision for lease losses, as the overall level of reserves required

against problem leases was relatively constant during the period. Other

income of $3.9 million was unchanged from the fourth quarter of the

prior year, as a slight increase in income from end-of-term transactions

offset a decrease in other fee income. Consequently, gross profit of

$8.5 million for the fourth quarter of fiscal 2004 decreased 5 percent

from $8.9 million reported for the quarter ended June 30, 2003.

For the fiscal year ending June 30, 2004, gross profit increased

slightly to $35.2 million compared to $35.1 million for the year ended

June 30, 2003. This reflected higher other income offset by a decrease

in net direct finance and interest income. Net direct finance and interest

income decreased 6 percent to $18.7 million, compared to $19.9 million

for fiscal 2003. Consistent with the quarterly results, the decrease

reflects a decline in direct finance income resulting from lower yields

earned on the lease portfolio and lower interest and investment income.

This was offset in part by a significant decrease in the provision for

lease losses, as the amounts required for reserves against problem leases

remained relatively unchanged during the year. Other income increased

9 percent to $16.5 million, compared to $15.2 million reported for fiscal

2003. The increase included a significant increase in income from the

sale of leased property that was offset slightly by lower income from

lease renewals.

For the fourth quarter, CalFirst Bancorp's selling, general and

administrative ("S,G&A") expenses of $4.8 million was

unchanged from the fourth quarter of fiscal 2003. For the year, S,G&A

expenses increased by 9 percent to $19.3 million from $17.7 million

during the prior year. The increase in S,G&A expenses for the year

is due to higher costs related to the development of the organization

and expanded marketing programs.

Commenting on the results, Patrick E. Paddon, president and chief

executive officer, indicated that: "Fiscal 2004 has been a year

of progress for CalFirst Bancorp, even though the improvement is not

reflected in the bottom line. In part, the results reflect the expense

of expanding and developing our sales organization and the inherent

delay in recognizing earnings from our expansion programs. Nevertheless,

there are good indicators of progress. Our volume of lease originations

during the fourth quarter and full year were up 42 percent and 35 percent,

respectively. While the volume of leases booked during the year increased

by only 7 percent, our backlog of lease commitments increased by 39

percent and is at the highest level we have seen in over five years.

At June 30, 2004, our net investment in lease receivables was up 7 percent

to $141.6 million from June 30, 2003, and our transactions in process

were up 50 percent to $30.5 million. Looking forward to fiscal 2005,

we should see growth in our direct finance income as the lease commitments

are completed and we benefit from an increase in interest rates. The

portfolio of leases reaching the end of term is expected to be slightly

lower than in fiscal 2004. We plan to continue to invest in the expansion

of the sales organization along the lines seen this past year."

California First National Bancorp is a bank holding company with

leasing and bank operations based in Orange County, Calif. California

First Leasing Corp. leases and finances computer networks and other

high-technology assets through a centralized marketing program designed

to offer cost-effective leasing alternatives. California First National

Bank is an FDIC-insured national bank that gathers deposits using telephone,

the Internet, and direct mail from a centralized location, and will

lease capital assets to businesses and organizations and provide business

loans to fund the purchase of assets leased by third parties.

CONTACT: California First National Bancorp, Irvine

S. Leslie Jewett, 949-255-0500 ljewett@calfirstbancorp.com

### Press Release

###########################

BBB

Warns that Imposters are Targeting Consumers and Businesses

– The Better Business Bureau system today issued a national alert

to warn consumers and businesses about two questionable operations that

are falsely using the BBB name to trick victims. One business is perpetrating

an advance fee loan scam that targets consumers and businesses with

poor credit records. It has provided as a reference fictitious BBB phone

numbers that are answered by representatives who falsely claim to be

with the Better Business Bureau and provide a positive report on the

business in question.

The other entity,

which appears to be a telemarketer, is contacting local businesses,

falsely stating to be from the BBB and calling about a complaint or

to update BBB files. The telemarketer proceeds to ask questions that

have nothing to do with BBB business and leaves as a contact number

1.800.CALL.BBB.

“Bureaus across the

country are reporting calls from victims. These scammers are falsely

using the Better Business Bureau name to try to gain credibility with

potential victims,” said Ken Hunter, president and CEO of the Council

of Better Business Bureaus. “We urge people to double-check with their

local BBB whenever they receive a dubious phone call or see the BBB

name tied to a questionable promotion. We’re easy to find in the telephone

directory or on the web at www.bbb.org.”

Advance Fee Loan

Outfit Uses False BBB Phone Numbers and Fake BBB Report

Kirkland Russell

and Thomson (KRT), supposedly located in Houston, advertises loans to

individuals and businesses. KRT representatives claim that the business

is a member of the BBB and suggest that interested customers call fictitious

phone numbers for the “Southwestern Division of the BBB in Oklahoma

City” and the BBB of Metropolitan Houston to request the company’s BBB

report.

“The company is using

the BBB name as a shill for its business. These are not the phone numbers

of the BBBs in Oklahoma City and Houston. And, neither Bureau has issued

a satisfactory report on KRT. The company has produced and is distributing

a fake, glowing BBB reliability report,” Hunter warns.

According to complaints

to the BBB, KRT tells customers that they have been approved for a loan

and must send a fee for “insurance.” KRT asks that the fee, often about

$2,000, be wired to various addresses in Canada and New York. Consumers

are required to submit personal information, such as Social Security

number, bank account number and pay stubs.

“People have not

received their loan, nor have they had their money refunded,” the BBB

in Houston states. Consumers in Texas, Oklahoma, Florida and other states

have been targeted.

BBB staff members

have confirmed that there is no business by the name of Kirkland Russell

and Thomas at the company-provided address in Houston. The Council of

Better Business Bureaus sent a letter to KRT Financial Group regarding

BBB trademark infringement and false advertising; it has not received

a response.

The BBB warns individuals

and businesses not to pay in advance for a loan and to never send personal

financial information to unknown businesses.

Shady Telemarketer

Gives 1.800.CALL.BBB Phone Number

BBB members in Arkansas,

California, Georgia, Kentucky, Louisiana, Minnesota, Nebraska, Nevada,

Ohio, Texas, Utah, and Washington have reported that they were contacted

by an individual posing as a BBB employee.

The callers generally

claim to be phoning about a BBB complaint or to “update” BBB files.

They attempt to solicit information that is not normally required in

order to conduct business with or be a member of the BBB. The callers

ask for names of various managers (the head of finance or information

technology) and the number of work stations at that business location.

Businesses have reported that the callers became rude and used threatening

language when questioned about the BBB’s need for such information or

the nature of the complaint.

The callers leave

a 1.800.CALL.BBB (225-5222) as their contact phone number. That phone

number, which is NOT owned by the BBB, is constantly busy. Some businesses

report that the caller gave the name “Dave Sebastian”. Other names that

have been used are Claude Ashley and Frank. One caller spoke with a

foreign accent.

“Businesses need

to be aware that any representatives from the BBB would clearly identify

themselves and leave a working phone number. We seek the voluntary cooperation

of businesses to resolve disputes and would not hesitate to provide

details concerning a complaint,” Hunter said. “If you receive a call

from anyone representing the BBB and are unsure as to their authenticity,

we urge you not to disclose any information and to contact your local

BBB immediately.”

The BBB in Colton,

CA contacted the business listed in several Internet 800 yellow page

directories as the owner of the 800.CALL.BBB number. It disclaimed any

knowledge of the calls or individuals initiating them.

BBBs typically send

complaints to businesses in writing. BBB staff members are forthright

about who filed the complaint and how to reach the Bureau, and are always

willing to assist business and consumers to amicably resolve disputes

that may arise.

### Press Release

########################

Resource

America, Inc. Increases Cash Dividend by 50%

PHILADELPHIA--Resource

America, Inc. (NASDAQ:REXI) (the "Company") announces that

its Board of Directors has authorized the payment of an increased cash

dividend on August 31, 2004 in the amount of five cents per share of

the Company's common stock to all holders of record at the close of

business on August 17, 2004.

The Company has continuously paid a quarterly cash dividend to

its stockholders since August 1995. The Company's new quarterly cash

dividend of five cents per share represents a 50% increase from the

Company's former quarterly cash dividend of three and one-third cents

per share. The Company currently has approximately 17.5 million shares

of common stock outstanding.

Resource America, Inc. is a specialized asset management company

that uses industry specific expertise to generate and administer investment

opportunities for its own account and for outside investors in the energy,

financial services, real estate and equipment leasing industries. For

more information please visit our website at www.resourceamerica.com

or contact Investor Relations at investor relations@resourceamerica.com.

Certain matters discussed within this press release are forward-looking

statements within the meaning of the Private Securities Litigation Reform

Act of 1995. Although Resource America, Inc. believes the expectations

reflected in such forward-looking statements are based on reasonable

assumptions, it can give no assurance that its expectations will be

attained. Factors that could cause actual results to differ materially

from expectations include financial performance, regulatory changes,

changes in local or national economic conditions and other risks detailed

from time to time in the Company's reports filed with the SEC, including

quarterly reports on Form 10Q, reports on Form 8-K and annual reports

on Form 10-K.

CONTACT:Resource

America, Inc., Philadelphia Investor Relations: Pamela Schreiber, 215-546-5005

Facsimile: 215-546-5388

### Press Release

#########################

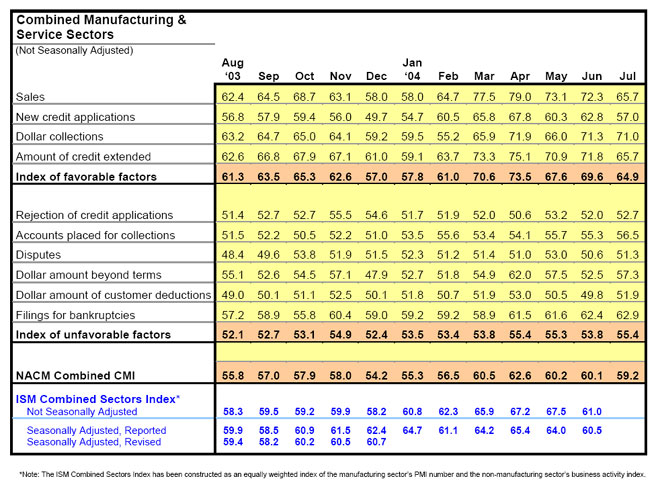

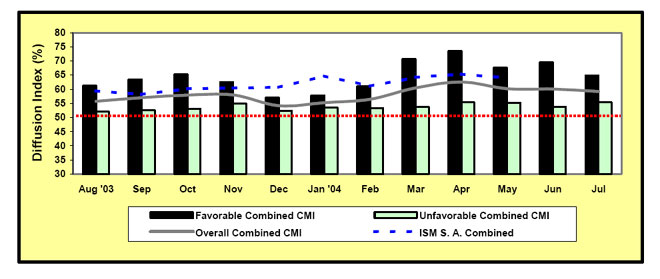

“Minor

Slipage” says NACM Credit Manager's Index (CMI) for July 2004

COLUMBIA, MD: --

The National Association of Credit Management (NACM) has released its

Credit Manager's Index (CMI) for July 2004. The CMI, a monthly survey

of the business economy from the standpoint of credit and collections,

was launched in January 2003 to provide financial analysts with another

strong economic indicator.

Some minor slippage in economic growth occurred in both the manufacturing and service sectors in July. However, growth continues in the economy as evidenced by readings persistently above 50. On a month-over-month basis, growth is still stronger than recorded during the fourth quarter of 2003 and into the first quarter of 2004. August will probably see some further erosion.

The CMI survey asks

credit managers to rate favorable and unfavorable factors in their monthly

business cycle. Favorable factors include sales, new credit applications,

dollar collections and amount of credit extended. Unfavorable factors

include rejections of credit applications, accounts placed for collections,

dollar amounts of receivables beyond terms and filings for bankruptcies.

###

The National Association

of Credit Management (NACM), headquartered in Columbia, Maryland supports

more than 25,000 business credit and financial professionals worldwide

with premier industry services, tools and information. NACM and its

network of Affiliated Associations are the leading resource for credit

and financial management information and education, delivering products

and services which improve the management of business credit and accounts

receivable. NACM's collective voice has influenced legislative results

concerning commercial business and trade credit to our nation's policy

makers for more than 100 years, and continues to play an active part

in legislative issues pertaining to business credit and corporate bankruptcy.

Contact:

Norma Heim, NACM

410-423-1842

#### Press Release

#############################

--------------------------------------------------------------------------

|

The only annually-updated international reference book for the asset financing and leasing industry available. The new 25th edition includes the latest market trends, over 100 authoritative articles and reports on the leasing software and IT market, an exclusive ranking of the top 50 leasing markets by size worldwide with feature profiles from Africa to Venezuela PLUS a directory of over 4,400 contacts.

Alternatively

visit |

News

Briefs ----------

U.S. Oil Nears Record,

Close to $44

http://www.washingtonpost.com/wp-dyn/articles/A35792-2004Aug3.html?nav=headlines

Fifth Third Bancorp

will buy Bankshares of Florida

http://www.usatoday.com/money/industries/banking/2004-08-02-fifth-third-fla_x.htm

Fed to cut Hub jobs

as fewer use checks

http://www.boston.com/business/articles/2004/08/03/fed_

to_cut_hub_jobs_as_fewer_use_checks/

Terra to sell Lycos

unit for $95m, Original Price: $12.5 billion

http://www.boston.com/business/technology/articles/2004/08/03/

terra_to_sell_lycos_unit_for_95m/

Gates Tosses Lofty

Dreams at Summit

http://www.internetnews.com/bus-news/article.php/3389561

--------------------------------------------------------------------------------------------------

“Gimme

that Wine”

Good medicine UCSF

doctor finds a second calling in Mendoza

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2004/07/29/WIG487S66P1.DTL

Jefferson’s Dream

of International Wine Quality begins at Veramar

http://www.vino.com/press/press_release.asp?PRID=395

Latest Wine Country

auction raises $1.1 million for kids; lots combine fine wines, luxury

items at Chalk Hill Winery

http://www1.pressdemocrat.com/apps/pbcs.dll/article?AID=/

20040801/NEWS/408010348/1034/NEWS02

Bid to be the “wine

maker” on eBay

http://cgi.ebay.com/ws/eBayISAPI.dll?ViewItem&item=2260419140

California vintners

are courting a vast Asian market that lacks a big taste for wine

http://www.sacbee.com/content/business/story/10214106p-11134595c.html

Livermore Valley

emerges from the shadow of Napa and Sonoma

http://www.sfgate.com/cgi-bin/article.cgi?file=/chronicle/archive

/2004/07/15/WIG5S7KVAH1.DTL&type=winepage

This

Day in American History

1492---

Christopher Columbus ( Christophe Colombo ) set sail half a hour before

sunrise from the harbor of Palos, Spain. With three ships, Nina, Pinta

and Santa Maria, and a crew of 90, he sailed

“for Cathay” but

found instead a New World of the Americas, first landing at Guanahani

( San Salvador Island in the Bahamas ) October 12. He returned 224 days

later, on March 14, 1493,

to Lisbon, where

he dispatched two letters of identical content, one to Raphael Sanchez

and the other to Luis de Santangel,

to describe the new world he had discovered.

While he never set foot on the mainland of the United States

or even called it America, he described what he thought were

islands of China. He was to return to the area three more times.

During his fourth and final expedition (1502-1504) Columbus ( who’s

Italian name was Cristo Columbo---history changed it to Columbus

on a map written

in Latin ) discovered Martinique, and explored the coasts of present-day

Honduras, Nicaragua, Costa Rica, and Panama.

(lower part of http://memory.loc.gov/ammem/today/aug03.html

)

1492-The

first letter containing a description of America was probably written

by the explorer

Christopher Columbus. He dispatched two letters of identical content,

one to Raphael Sanchez and the other to Luis De Santangel. The first use of the word “America” came from

German mapmaker Martin H. Waldessmuller, who named the new land in a

map in the honor of Italian explorer Amerigo Verspucci of his discoveries

in South America. Other map

makers took copies his maps

and names, including

“America.”

1900- Ernie Pyle

was born at Dana, [N, and began his career in journalism in 1923. After

serving as managing editor of the Washington Daily News, he returned

to his first journalistic love of working as a roving reporter in 1935.

His column was syndicated by nearly 200 newspapers and often focused

on figures behind the news. His reports of the bombing of London in

1940 and subsequent reports from Africa, Sicily, Italy and France earned

him a Pulitzer Prize in 1944. He was killed by machine-gun fire at the

Pacific island of le Shima, Apr 18, 1945.

1900-

Central figure in a cause célèbre (the “Scopes Trial” or the “Monkey

Trial”), John Thomas Scopes was born today at Paducah, KY. An obscure

24-year-old schoolteacher at the Dayton, TN, high school in 1925, he

became the focus of world attention. Scopes never uttered a word at

his trial, which was a contest between two of America’s best-known lawyers,

William Jennings Bryan and Clarence Darrow. The trial, July 10—21,1925,

resulted in Scopes’s conviction. He was fined $100 “for teaching evolution”

in Tennessee. The verdict was upset on a technicality and the statute

he was accused of breaching was repealed in 1967. Scopes died at Shreveport,

LA, Oct 21, 1970.

1904—Use

of “American” as an adjective instead of “United States” was officially

recommended by John Hay, secretary of state, who instructed American

diplomatic and consular officers to adopt it.

1911--Danish

woodcarver Charles Looff delivered

the classic carousel to the Santa Cruz

Beach Boardwalk, California.. A furniture-maker by trade, Looff

began carving carousel animals as a hobby after immigrating to America.

His first carousel was installed at Coney Island in New York in 1875.

The Boardwalk carousel features jeweled horses and a 342-pipe Ruth band

organ built in 1894. The carousel and the park’s Giant Dipper roller

coaster were designated National Historic Landmarks by the US National

Par

1923

- Calvin Coolidge was sworn in as the 30th president of the United States,

following the death of Warren G. Harding. k Service in June of 1987.

http://memory.loc.gov/ammem/today/aug03.html

1926

--Tony Bennett Birthday, born Tony Benedetto.

http://www.jazzdiscography.com/Artists/Bennett/

http://www.tony-bennett.com/newsFr.html

The Gypsy - The Ink

Spots

Doin’ What Comes

Naturally - Dinah Shore

They Say It’s Wonderful

- Frank Sinatra

New Spanish Two Step

- Bob Wills

1948

--Negro League legend Satchel Paige makes his major league debut hurling

seven innings to lead the Indians over the Senators, 5-3.

1954

- For that time, a record divorce settlement was awarded to Mrs. Barbara

(Bobo) Rockefeller when her ex, Winthrop Rockefeller, was ordered to

pay $5,500,000 to his ex-wife.

1954---Top

Hits

Sh-Boom - The Crewcuts

The Little Shoemaker

- The Gaylords

Hey There - Rosemary

Clooney

One by One - Kitty

Wells & Red Foley

1958

- The submarine USS Nautilus began the first crossing of the Arctic

Ocean under ice cap. With a crew of 116 men, the Nautilus was commanded

by William R. Anderson. The Nautilus was the world's first nuclear powered

submarine.

1962---Top

Hits

Roses are Red - Bobby

Vinton

The Wah Watusi -

The Orlons

Sealed with a Kiss

- Brian Hyland

Wolverton Mountain

- Claude King

1963

- The college football all-stars beat the Green Bay Packers 20-17. It

was a huge upset as the college team had been underdogs with odds of

50-1.

1963

- It was the final appearance at the Cavern Club in Liverpool, England

for The Beatles as they weres about to leave their hometown for world

fame and fortune.

1963

- Capitol Records released The Beach Boys’ song, "Surfer Girl".

It became one of their biggest hits, making it to number seven on the

hit music charts on September 14, 1963.

1963

- Warner Brothers Records released comedian Allan Sherman’s summer camp

parody, "Hello Mudduh, Hello Fadduh! (A Letter from Camp)".

The song would go to number two on the pop charts on August 14, 1963.

1968—Birthday

of Rodney Roy “Rod” Beck, baseball player, born Burbank, Ca.

1968

- "Hello, I Love You," recorded by The Doors, jumped into

the top spot on Billboard's hit record charts, and stayed there for

2 weeks.

1970

- Hurricane Celia struck the coast of Texas producing wind gusts to

161 mph at Corpus Christi, and estimated wind gusts of 180 mph at Arkansas

Pass. The hurricane was the most destructive of record along the Texas

coast causing 454 million dollars damage, and also claimed eleven lives

1970---Top

Hits

(They Long to Be)

Close to You - Carpenters

Make It with You

- Bread

Signed, Sealed, Delivered

I’m Yours - Stevie Wonder

Wonder Could I Live

There Anymore - Charley Pride

1978---Top

Hits

Shadow Dancing -

Andy Gibb

Baker Street - Gerry

Rafferty

Miss You - The Rolling

Stones

Only One Love in

My Life - Ronnie Milsap

1979

- "Tonight Show" host Johnny Carson, appeared on the cover

of the Burbank, California telephone directory.

1979 - Jai-alai player

Jose Ramon Areitio threw the fastest ball ever recorded at a speed of

188 mph (301 kph). Jai-alai is a sport that originated in the Basque

region of Spain and France, and it consists of throwing a ball with

a long, curved basket against a wall.

1979-The

Knack hit the top of both the album and singles charts, with their LP,

"Get The Knack" and the single, "My Sharona.

1981

- United States air traffic controllers went on strike, despite a warning

from President Ronald Reagan that they would be fired.

1984

- At the 1984 Olympics held in Los Angeles, American Mary Lou Retton

won gold in all-around gymnastics.

1985

- Mail service was reinstated to Paradise Lake, Florida, a nudist colony,

after residents promised they would wear clothes or at least stay out

of sight when the mailperson came to deliver.

1985-Bruce

Springsteen's "Glory Days" peaks at #5 on the chart, while

Sting's "If You Love Somebody Set Them Free" peaks at #3

1986---Top

Hits

Glory of Love - Peter

Cetera

Papa Don’t Preach

- Madonna

Mad About You - Belinda

Carlisle

Nobody in His Right

Mind Would’ve Left Her - George Strait

1987

- Joe Niekro got a 10 day suspension for throwing scuffed baseballs.

At first he denied the charge made by the home plate umpire, but changed

his tune when an emery board fell out of his pocket during an inspection.

1987

- The Iran-Contra congressional hearings ended, with none of the 29

witnesses tying President Ronald Reagan directly to the diversion of

arms-sales profits to Nicaraguan rebels.

1988-Steve

Winwood's "Roll With It" hits #1 on the chart.

1989

- Thunderstorms representing what remained of Hurricane Chantal drenched

Wichita, KS, with 2.20 inches of rain in four hours during the early

morning. Thunderstorms developing in Minnesota produced wind gusts to

85 mph at Baudette during the afternoon, and softball size hail at Lake

Kabetogama, during the evening. Jamestown, ND, reported a record hot

afternoon high of 103 degrees

2002

--In just the first four innings, Edgar Martinez ties a the major league

record for sacrifice flies in a game with three. The Mariners' designated

hitter becomes the 11th player in history to accomplish the feat doing

it in his first three at-bats in Seattle's 12-4 victory over the Indians.

Baseball

Poem

Life

by Jim "Mudcat" Grant

Life is like a game of baseball

And you play it every day.

It isn't just the breaks you get,

But the kind of game you play.

Stop and look the whole team over,

You've got dedication there.

You're bound to be a winner,

With men who really care.

Your pitcher's name is courage,

You need him in this game.

For trust and faith your keystone men,

The grounders they will tame.

Your centerfielder is very fast,

Though small and hard to see.

So watch him when he gets the ball,

He's opportunity.

At first base there's religion,

He's stood the test of time.

At third base there is brotherhood,

A stalwart of the nine.

Your leftfielder is ambition,

Don't ever let him shirk.

Rightfielder is a husky man,

You'll find his name is work.

Your catcher's

name is humor,

He's important to the scheme.

While honor is pitching from the bull pen,

Your game is always clean.

With love on your bench,

You've perfection, no less.

And a winning team,

With joy and happiness.

The other team is strong,

Greed, envy, hatred, and defeat

Are four strong infielders you'll have to buck,

To make your game complete.

Discouragement and falsehood,

Are the big boys in the pen.

You'll have to swing hard,

When you meet up with them.

Carelessness and a man called waste,

You'll find them playing hard.

And selfishness and jealousy,

None can you disregard.

There's one more man you'll have to watch,

He's always very near.

He's the pitcher for this team,

I'm told his name is fear.

The game will not be easy,

There'll be struggle, there'll be strife.

To make the winning runs,

For it's played on the field of life.

So stand behind your team,

There'll be many who'll applaud.

Just remember you are the player,

And the umpire there is God.

|

www.leasingnews.org |