Monday, December 14, 2009

Actress Anna Marie "Patty" Duke born December 14, 1946 Elmhurst, Queens, New York, who in 1962 won Academy Award for Best Supporting Actress for "Miracle Worker. Her television show "The Patty Duke Show" (1963-1966-104 episodes) was a favorite and she has appeared on many TV shows and series since then. Perhaps her best efforts have been regarding her "bipolar disorder" and the attention she has tried to bring to this disease.

http://www.imdb.com/name/nm0001157/bio

http://bipolar.about.com/cs/celebs/a/pattyduke.htm |

Headlines---

Benchmark Financial Groups, Aliso Viejo, CA

Bulletin Board Complaint

Classified Ads---Senior Management

Bank Beat---Going to get Worse

by Christopher Menkin

Top Stories-December 7-11

Classified Ads---Help Wanted

Letter from Brican America Attorney Lichtman

Kit Menkin Response to Brican America Letter

from Attorney Charles H. Lichtman

Leasing 102 by Mr. Terry Winders, CLP

Customer Communication (Lessee’s View)

Invictus/Everybody’s Fine

Fernando Croce recommends on DVD:

Inglourious Basterds/For laughs:The Hangover

“It’s So Slow…” contest---last Call!

BrixR.com Xmas Gifts

La Jolla, California – Adopt a Pet

Classified ads—Attorneys

IFA Urges passage Small Biz Credit Proposals

News Briefs---

White House economists jobs growth by spring

Putnam Investments, GE Healthcare local layoffs

New housing crisis

Mortgage rates way down, but few can refinance

Boeing Must Prove Itself with Dreamliner

You May have Missed---

Califorinia Nuts

Sports Briefs

"Gimme that Wine"

Today's Top Event in History

This Day in American History

Football Poem

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

--------------------------------------------------------------

Benchmark Financial Groups, Aliso Viejo, CA

Bulletin Board Complaint

On their web site, http://www.benchmarkfingrp.com/, is this plaque, presented by:

"U.S. Commerce Association (USCA) is a Washington D.C. based organization funded by local businesses operating in towns, large and small, across America."

http://www.us-ca.org/AboutUsUsca.aspx?

Also the web site continues to claim the company is a member of the United Association of Equipment Leasing (January 1, 2009 became National Equipment Finance Association--NEFA). NEFA has confirmed that Benchmark is not a member nor appears to be a licensed under the California Department of Corporation Finance Lenders/Brokers License (CFL).

Benchmark is a member of the National Association of Equipment Leasing Brokers, listed as a “broker” member in good standing and abiding by the association code of ethics.

You won’t find this on their web site:

Better Business Bureau Rating: F

http://www.la.bbb.org/Business-Report/Benchmark-Financial-Groups-LLC-100045720

This is the fifth Bulletin Board Complaint on Benchmark this year. Emails, faxes, and telephone calls to owner and President Marcus Davin were not returned.

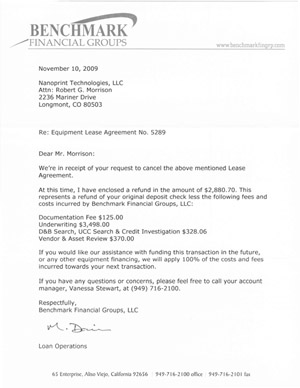

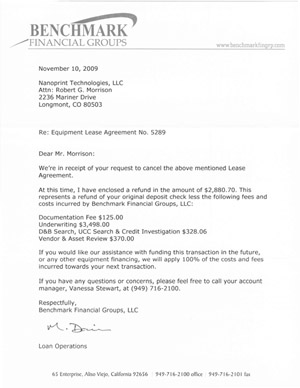

Todd Kannegieter, NanoPrint Technologies:

“Here is the lease agreement from Benchmark Leasing that was signed by NanoPrint Technologies along with a copy of the check that was sent to them for the first and last month's lease payments. They never signed the agreement or forwarded any funds for this lease, but tried to structure it a different way and get more unrelated collateral to cover the lease. They already had a Corporate guarantee and Personal guarantees from the two main owners of NanoPrint Technologies, who combined, own more than 70% of the company.

“Then after about 30 days of them dragging out the process, supposedly looking for ways to make this work for them, I finally requested our funds back and Vanessa Stewart filled out the paperwork and told me it had been processed and that there would be some minimal documentation fees netted out that I thought would be the documentation fees of $125 as mentioned in the lease agreement.

“When we finally got a check they had backed out approx. $4,200 worth of underwriting fees as reflected on their attached letter addressing these deductions.”

Click for larger version

Benchmark Leasing Agreement:

http://leasingnews.org/PDF/Benchmark_Lease_Agreement.pdf

2009

Benchmark Financial Groups, Aliso Viejo, CA

Bulletin Board Complaint

http://leasingnews.org/archives/September%202009/09-24-09.htm#Bulletin1

Benchmark Financial Groups, Aliso Viejo, CA

Bulletin Board Complaint

http://leasingnews.org/archives/September%202009/09-24-09.htm#Bulletin2

Benchmark Financial Group, Aliso Viejo, CA

Bulletin Board Complaint

http://www.leasingnews.org/archives/April%202009/04-06-09.htm#bbc

Benchmark Financial Group, Aliso Viejo, CA

Bulletin Board Complaint

http://www.leasingnews.org/archives/March%202009/03-02-09.htm#bbc

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Bank Beat---Going to get Worse

by Christopher Menkin

There are over 500 troubled community and regional banks, the Fed reports, many will be gobbled up by the larger banks, branches closed, original bank investors money wiped out, and capital used for acquiring---not lending. This is not good for the smaller banks, or the finance and leasing companies.

My advice, enjoy this Christmas while you still can.

If you think 2009 was bad for bank closings just wait until 2010. The FDIC is currently gearing up to close numerous banks after the first of the year. I expect you will see the State of Washington at the top of the list. Florida and Georgia will be above them on the list.

Right now the country may be entering a recovery mode, but most of the independent community banks and even regional banks are being squeezed by margins, costs to the FDIC, and still being rocked by the federal residential real estate loans and unfortunate local commercial real estate loans that followed. Now to add more regulations, and then penalize the local banks, doesn’t make very much common sense. Wall Street may be recovering, but the rest of the country is not (view the Beige books.)

Add to the mix that several Senate and Representatives elections will occur in 2010, it will only add to the lack of any solutions. So enjoy Christmas while you can, as what these means to the leasing industry, more tight credit, scrambling for deals, and a plethora of subprime credits.

Note the major banks shifting operations to other states, such as Key, or even out of the country, and major financial companies admitting to "shrinking," as GE Capital has noted time and time again. If writing the Bank Beat column for over a year has taught me anything, there are still a lot of banks who are in the survival mode, not the lending mode.

Congratulations to CIT, hope they stay around and exit the subprime and student loan programs that got them into so much trouble; great commercial enterprise--stick with what you know best.

That includes leasing. It will be coming back!!! Hang in there.

Kit Menkin, editor

---------------

SolutionsBank is the 133rd FDIC-insured institution to fail in the nation this year.

The six branches of SolutionsBank, Overland Park, Kansas, founded January 1, 1881, were closed Friday by the Office of the State Bank Commissioner of Kansas, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Arvest Bank, Fayetteville, Arkansas, to assume all of the deposits of SolutionsBank.

From September 30, 2008 to September 30, 2009 the bank went from 97 full time employees to 78 employees. Tier 1 risk-based capital ratio 3.33% as of the September 30, 2009 date. Equity in the same period had gone from $38 million to $15.8 million with net income showing a loss in 2008 in this period of $3 million and $26.5 million loss this year.

As of September 30, 2009, SolutionsBank had total assets of $511.1 million and total deposits of approximately $421.3 million. Arvest Bank did not pay the FDIC a premium for the deposits of SolutionsBank. In addition to assuming all of the deposits of the failed bank, Arvest Bank agreed to purchase essentially all of the assets. The FDIC and Arvest Bank entered into a loss-share transaction on approximately $411.3 million of SolutionsBank's assets.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $122.1 million

Full story: Kansas City Star:

http://www.kansascity.com/637/story/1625882.htmlhttp://www.fdic.gov/news/news/press/2009/pr09227.html

The four branches of Republic Federal Bank, National Association, Miami, Florida were closed Friday with 1st United Bank, Boca Raton, Florida, to assume all of the deposits and branches to open under their name. This is the 13th bank to fail in Florida. The FDIC and 1st

United Bank entered into a loss-share transaction on approximately $210.4 million of Republic Federal Bank, N.A.'s assets. 1st United Bank will share in the losses on the asset pools covered under the loss-share agreement. The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $122.6 million.

In the time period of September 30, 2008 to September 30, 2009 it had gone from 119 full time employees to 90; bank equity from $34.1 million to a negative $14.5 million with operating income a minus $16.5 million, income a loss of $7.6 million to a loss of $25.5 million. Tier 1 risk-based capital ratio 0.99%.

Republic Federal Bank Chairman and CEO Walter R. Cook was seeking to raise capital. The southflorida.bizjournals.com wrote, “The bank’s predecessor, Hemisphere National Bank, was founded in 1979. After attracting new investor funds in 2004, it bought Miami-based Pine Bank’s assets and liabilities in 2006 in a move that tripled its assets to $705 million. In 2007, it re-launched under the name Republic Federal Bank.

"Cook said that most of Republic Federal Bank’s late and unpaid loans were on Pine Bank’s books before that acquisition."

It was also noted in the article, "In April, Republic Federal Bank President and COO Daniel M. Schwartz said he was resigning to spend more time with his family. Schwartz co-founded the bank with Cook after both worked with Republic National Bank of New York."

http://southflorida.bizjournals.com/southflorida/stories/2009/05/04/daily11.html

The sole branch of Valley Capital Bank, National Association, Mesa, Arizona was closed with Enterprise Bank & Trust, Clayton, Missouri to assume all deposits and open the branch under its name. It was a relatively young bank, founded November 10, 2006, and had gone from 25 fulltime employees to 20 as of September 30, 2009. Equity in the same period had gone from $9.1 million to a negative $1.3 million; a loss of $2.5 million in September 30, 2008 to a loss of $5.4 million. Tier 1 risk-based capital ratio -4.34%.

As of September 30, 2009, Valley Capital Bank had total assets of approximately $40.3 million and total deposits of approximately $41.3 million. Enterprise Bank paid the FDIC a 2 percent premium for the right to assume all of the deposits of Valley Capital Bank. In addition to assuming all of the deposits of the failed bank, Enterprise Bank agreed to purchase essentially all of the failed bank's assets with a loss-share transaction on approximately $29.8 million of Valley Capital Bank's assets.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $7.4 million.

http://www.fdic.gov/news/news/press/2009/pr09227.html

List of Bank Failures:

http://www.fdic.gov/bank/individual/failed/banklist.html

Previous Bank Beat columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Bank_Beat.htm

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Classified Ads---Help Wanted

Interviewing Leasing Professionals With Proven Track Record and Established Book of Business. Envision Provides: 1) Established Funding Sources, 2) Fun Working Environment, 3) Full Benefits (Health Insurance, 401k), 4) Aggressive Commission Structure.

Resumes To: careers@envisioncapitalgroup.com, Contact: Jeff Edwards (949) 225-1712

Envision Capital Group is dedicated to providing the best in class products and service to our employers, customers, vendors and partners in the small and middle ticket commercial finance industry. With over 50 years of combined experience we have the knowledge, skills, abilities and relationships to help you reach your goals.

|

|

5 years experience with established vendor relationships. We offer great funding capacity for transactions $10k to $10MM. Quail Company's established for over 30 years. Submit resume to: jrudin@quailcap.com

About the company: Quail Equipment Leasing 17 years in

business with the ability to develop specialized programs for

vendors and unique industries: $10K to $10MM. |

www.quailequipmentleasing.com |

[headlines]

--------------------------------------------------------------

Letter from Brican America Attorney Charles H. Lichtman

Via Email: (kitmenldn@leasingnews.org) Christopher ("Kit") Menkin Editor/Publisher, Leasing News

Via Email and Fax: (BoTei@aol.com; (415) 331-6451) Robert Teichman, CLP, Chairman, Advisory Board, Leasing News

Via Email and Fax: (bernieb@leasepolice.com; (972) 692-8091) Bernie Boettigheimer, CLP, President of "Lease Police"

Re: Defamatory Statements Posted on www.leasingnews.org

Gentlemen:

Please be advised the undersigned represents Jean Francois Vincens ("Vinces"), Brican America, Inc. and Brican America, LLC (collectively "Brican"). It has come to our attention that you have published an article entitled, "Alert: DéjàVu---Jean-Francois Vincens," on www.leasingnews.org (the "Article").

The Article contains false, misleading and defamatory per se statements about Vincens and the Brican entities. Had you properly and thoroughly investigated the facts before publishing the Article, and accurately reported the facts, which you did not do, you would have known that Vincens was completely and unequivocally vindicated with respect to the Recomm matter. Since you referenced the existence of the bankruptcy adversary proceeding, you are charged with actual knowledge of the contents of the lawsuit. Your incorrect and incomplete reporting of same plainly leaves one with an impression and innuendo of Vincens' commission of a fraud and or crimes that he did not commit.

What you failed to report is that the United States Bankruptcy Court for the Middle District of Florida granted Vincens' Motion for Summary Judgment and entered judgment in his favor dismissing the case against him. To be sure, the bankruptcy court found that Vincens had nothing to do with Recomm's operations after 1993; thus, clearly establishing Vincens' claims he was not an "insider. In fact, Vincens had left the company three years before any issues with Recomm evolved. Ultimately, the United States District Court for the Middle District of Florida, and then the United States Court of Appeals for the Eleventh Circuit also affirmed the bankruptcy court dismissal. See In Re Optical Technologies, Inc., 246 F.3d 1332 (11th Cir. 2001). 2487706-1

Further, at no time was Vincens the target of any Recomm criminal prosecution, nor was he ever indicted or charged with any crime. He also was never subject to any administrative law proceeding respecting Recomm. Thus, the one time he was sued on a limited Recomm related claim, the court dismissed the lawsuit, specially noting Vincens absence from the company or commission of fraud. Thus, as a matter of law Vincens did not commit fraud and was fully exonerated. The Recomm lawsuit against Vincens was frivolous and your defamatory publication was written with reckless disregard for the truth of the matter.

The Article also mischaracterizes the pending litigation between Brican America, Inc. and NCMIC. Please note, your article also completely mischaracterizes the pending litigation between Brican and PSFS. Had you bothered to review the entire court docket, you would have seen papers that effectively demonstrate that PSFS has admitted away all allegations of the Complaint.

The defamatory Article published to the world instantly caused Vincens and Brican significant damages. As a direct result of seeing the defamatory statements in the Article, two different equipment leasing funding sources immediately withdrew from doing business with Brican, thereby refusing to fund our client's customer's leases. Bricans' damage is potentially in the tens of millions of dollars. In addition, the defamatory Article has caused Vincens and Brican to suffer damage and they will continue to suffer damage to its reputation, goodwill, business relations, competitive business advantage, opportunity and expectancy.

We demand that you immediately (i) remove the Article by the close of business today, (ii) post a formal written apology on the website tomorrow and for the succeeding five business days with language approved by our firm, (iii) cease and desist from publishing or causing to publish any other defamatory, false and misleading statements about Vincens and Brican, and (iv) advise us of the persons who provided you with this false information. Taking this action will potentially limit damages.

Please note, we are in the process of preparing an appropriate lawsuit against you and others for immediate filing in the United States District Court for the Southern District of Florida, so this is your potential opportunity to immediately solve a problem instead of creating a larger one. We intend to seek an injunction from further publication, actual damages and punitive damages for willful and wanton misconduct. PLEASE GOVERN YOURSELVES ACCORDINGLY. 2487706-1

we deliver motive and effective business solutions and counsel

BERGER SINGERMAN

attorneys at law Sincerely,

BERGER SINGERMAN

Charles H. Lichtman

(co-counsel: michael.leichtling, troutmansanders. Editor)

Boca Raton Fort Lauderdale Miami Tallahassee

|

[headlines]

--------------------------------------------------------------

Kit Menkin Response to Brican America Letter

from Attorney Charles H. Lichtman

Mr. Teichman, CLP, serves as honorary head of the advisory board, a committee that is not involved in editorial decisions, as stated in company policy on the web site and noted in each edition. Criticism of news stories should be addressed to me as editor.

Mr. Boettenheimer, CLP, was not being malicious when he informed Leasing News regarding NCMIC Finance Corporation dba Professional Solutions Financial Services (PSFS), Clive, Iowa having a claim against Brican for $38 million involving 1672 lessees. You are really off-base to criticize Lease Police.

In the October 5, 2009 alert Leasing News summed the legal complaint by PSFS:

"15. In fact, there was at least one additional agreement, a "Marketing Agreement," which related to the Goods or Leases provided to the Lessees, that Brican gave to each of the Lessees, which was not included in the documents that were provided to PSFS for each of the leases."

"17. The Marketing Agreement was material to PSFS's decision to underwrite Leases as the payments under the Marketing agreement were designed to offset the cost of the Lease Payments, suggesting that the Lessees would not enter into the Leases or might cease payment under them without the income stream provided by the Marketing Agreement.

18. As a result of Brican's failure to provide the Marketing agreement to PSFS with each packet of the document related to each of the Leases, Brican has breached the agreement."

Both the original complaint by PSFS and Brican America response were made available to readers in the article.

Leasing News was seeking a statement from Brican America. Recentl it received and published in entirety without editing in the most recent article on December 11, 2009, which stated a mediation was in progress as of that date and quote three depositions from the case:

Brican America corporate officer Jean-Francois Vincens, who acknowledges the advertising and ability for the lessee to stop making payments if advertising stops, a bookkeeper, who does the same, an operation person involved in the process December, 1994 to July, 2009, who explains how it worked, and also noted that she was terminated by the company as she stated in the deposition.

In the second story that Jean-Francois Vincens was part of Recomm and substantiated with this court docket:

“The relevant facts are straightforward. Prior to 1994, Raymond Manklow ("Manklow") and Jean-Francois Vincens ("Vincens") were the sole shareholders of the Debtors. In addition, they owned several other entities, known collectively as "the Recomm Companies." Although there was a plan for a merger between the Debtors and the Recomm Companies, no statutory merger was ever completed. Manklow and Vincens sold their interests in the Recomm Companies to three Recomm employees in 1994, and in 1996 the Recomm Companies and the Debtors filed for bankruptcy.”

http://caselaw.lp.findlaw.com/cgi-bin/getcase.pl?court=11th&navby=case&no=0014391OPN

The description by Leasing News Emeritus Advisory Board Director Charlie Lester was a summation:

“The scheme worked for the benefit of all parties for a few years, until mid-1995, when Recomm began to experience cash-flow problems and ceased remitting to the Lessees their portions of the advertising fees. The lessees responded in two ways. First, they quit paying the Lessors the rent due on the kiosk leases; then they sued Recomm. As the law suits multiplied, Recomm turned to the bankruptcy court for relief. In January, 1996, Recomm filed a Chapter 11 petition in the Bankruptcy Court for the Middle District of Florida.”

Is the complaint with the description?

Issues regarding an “insider” were not found or discussed, or if anyone was found guilty or if a crime had taken place. In no manner did Leasing News charge anyone with committing a crime or with having been indicted, convicted or punished for a crime.

As to the information who are the two former salesmen regarding advertising in the Brican America sales pitch (one is known to Leasing News and the other referred by a CFO of a major vendor) and warranty as part of the sale is not germane as the three depositions address this, including Mr. Vincens. It is also the policy of Leasing News to be familiar with those who provide reliable information and with hold their name in the standards of “Freedom of the Press.”

Leasing News has repeatedly requested specific information and documentation from both Mr. Lichtman and his co-counsel attorney Michael Leichtling and Brican America should a correction be made, or for any statement, and as per both our history and policy, all corrections are published at the top of the headlines.

Christopher Menkin

editor/publisher, www.leasingnews.org

President, Leasing News Incorporated

Mission statement:

http://www.leasingnews.org/Mission_Statement.htm

Policy Statement:

http://www.leasingnews.org/policy.htm

Previous Brican America articles:

http://leasingnews.org/archives/December%202009/12-11-09.htm#brican_statement

http://leasingnews.org/archives/December%202009/12-09-09.html#alert

http://leasingnews.org/archives/October%202009/10-05-09.htm#Alert_Brican

[headlines]

--------------------------------------------------------------

Leasing 102

by Mr. Terry Winders, CLP

Customer Communication (Lessee’s View)

To look professional a lease salesperson needs to collect as much information from whatever source available to determine how to propose a lease arrangement. Vendors for equipment information and useful life, Customers for financial capabilities and cash flow requirements, and insurance, tax position, and location. Once you have all this information then you can create your lease structure. The main issue is how to convey your thoughts to the customer.

A written proposal (when complete) does an excellent job for you and allows you to observe the customers or vendors reaction to your plan. If all you do is present payment factors or interest rates then your success rate will be very low. By presenting a lease structure (or two) in print you have the chance to have the customer sign your proposal and commit them to the deal. Assuming, of course, you have a commitment fee attached to the lease that is not refundable if they change their mind prior to documentation.

I once was asked by a lessee, “what should I ask for in a lease proposal” so I responded by creating a list of items that should be included. Most lessee’s do not go to this length to request a proposal from a leasing company but it could be a check list for you prior to preparing one….But remember this list is from the lessee’s point of view

-

Name of Lessor

-

Complete description of Equipment

-

Estimated equipment cost

-

Identification of intended “use” of equipment

-

Request correct accounting treatment (classification) by offering your incremental borrowing rate (average cost of money under like circumstances).

-

Capital lease a, b (depreciation over equipment useful life plus interest expense)

-

Capital lease c, d (depreciation over lease term plus interest expense))

-

Operating lease (no depreciation only rent expense)

-

Request Tax or non Tax Approach

-

Lease payments in dollars as well as in payment factors

-

Terms that match your term of use

-

Term that ends in correct month of the year

-

Terms that offset maintenance costs or down time.

-

Lease payments that match your seasonal cash flow or revenue projections

-

In production equipment request rent delay until equipment productive

-

Rentals in dollars as well as percentages

-

Estimated closing/commencement date

-

Sales tax and property tax requirements

-

Income tax and legal indemnity requirement

-

Insurance requirements for physical damage and general liability

-

Maintenance requirements

-

Notice of intent on termination options

-

End of the Lease options

-

Ability to trade up

-

Intended location of use

-

Define return conditions at termination

-

Return location

-

Proposal termination date

In addition things a lessee may wish to discuss with lessor that may only show up in documentation or be competitive issues:

1. Term of lease including termination date: Some proposals come with additional months required if you do not select the correct “End” of the Lease option.

2. If the purchase option is for the Fair Market Value, what arbitration procedures are included?

3. Request Stipulated Loss schedules to compare early termination fees from

each leasing company

4. Purchase options stated in dollars instead of percentages.

5. Renewal terms that are not bargains; to place the true lease nature of your lease in jeopardy as regards the 80% useful life test.

6. Return requirements that allow the Lessor to require you to return the equipment anywhere in the Continental United States.

-

Look for burdensome return conditions.

-

Stated Rate reflected in actual lease payments as per Advance Vs. Arrears payments.

-

Look for interim payments not included in stated rate

-

Security deposits that increase the rate instead of reducing payments.

-

Additional fees for tax (property tax) compliance.

-

Add up all fees and see effect on rate

-

End of Lease notice periods, lack of notice may require 3 to 6 month extension of lease payments

-

Structured renewals instead of termination

-

Service maintenance contract requirements

-

Understand non-cancelability

-

Understand “ Net Lease” concept

-

High Late charges with short or no grace periods

-

Return fees required if not purchased

-

Who pays legal costs (restrict total)

-

Ask for total fee requirements at lease closing

All of these subjects should be covered with the lessee to place create a good understanding of what each proposal is asking for so the lessee is not blinded by uncompleted presentations or lack of knowledge on how the competitors programs work. I know this is overwhelming; however, to understand it all and know when to use it is important to be a leasing professional.

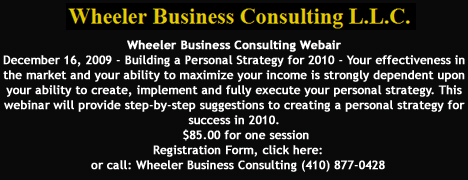

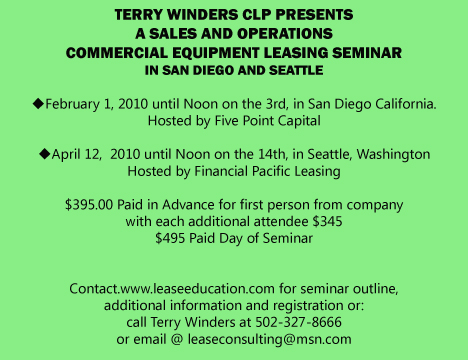

Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty years and can be reached at leaseconsulting@msn.com or 502-327-8666.

He invites your questions and queries.

Previous #102 Columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

Leasing News: Fernando’s View

By Fernando F. Croce

Theater releases find two screen legends (Clint Eastwood in “Invictus” and Robert De Niro in “Everybody’s Fine”) in good form, while new DVDs include two of the year’s best movies (“Inglourious Basterds,” “The Headless Woman”), and one of its funniest (“The Hangover”).

Invictus (Warner Bros. Pictures): After proving (and investigating) the durability of his screen persona in “Gran Torino,” Clint Eastwood proves once again why he’s one of America’s most respected directors with this inspiring, true-story tale set during South Africa’s most trying times. Nelson Mandela (Morgan Freeman) has just been elected president, yet the country remains torn in the shadow of apartheid’s racially divisive policies. In order to bring the people together, Mandela turns to the universal appeal of sports, and tries to get the country’s rugby team into the 1995 World Cup. Though the movie hardly lacks the excitement and crowd-pleasing drama (including the travails of the team’s captain, played by Matt Damon) of conventional underdog sagas, it is also filled with keen cultural observations about a country’s past and humanity’s need to stick together during hard times.

Everybody’s Fine (Miramax Films): More often remembered for his brilliant portrayals of brutal, volatile men (“Taxi Driver,” “Raging Bull”), Robert De Niro gives a beautifully understated performance in this sensitive Christmas family drama. He plays Frank Goode, a recent widower who, upon learning that none of his kids will be able to make it home for the holidays, packs his bags and decides to visit them himself. His son (Sam Rockwell) is a Denver musician, while one daughter (Kate Beckinsale) is a Chicago executive and the other (Drew Barrymore) is a Las Vegas dancer. Will the discoveries he makes about each of them put a strain on the family, or will they bring them closer together? Warmly acted and keenly observed, this is a terrific choice for audiences looking for enjoyable Christmas entertainment.

Netflix tip: After watching a remake, take advantage of Netflix’s vast supply of films to check out the original. This week, for instance, find out about the original “Everybody’s Fine,” a 1990 Italian movie starring the legendary Marcello Mastroianni.

New on DVD:

Inglourious Basterds (The Weinstein Company-Universal): Quentin Tarantino ("Pulp Fiction") shows once again why he's one of modern cinema's most singular voices with his highly anticipated, smashingly satisfying World War II epic. Set in France during the Nazi occupation, the plot follows several characters as they come together in a plan to overthrow Hitler. There are the "basterds" of the title, a group of guerilla soldiers (led by a hilariously gruff Brad Pitt) who specialize in terrorizing the enemy, but there's also a young Jewish girl (Melanie Laurent) who's planning revenge for the murder of her family at the hands of an SS officer (Christoph Waltz). Beautifully combining dialogue and action, humor and suspense, this is the kind of genre-mixing opus that only a passionate movie lover like Tarantino could deliver.

The Hangover (Warner Bros.): Director Todd Philips ("Road Trip," "Old School") has for years been a specialist in rambunctious frat-house hijinks. Set in Las Vegas, his latest comedy will not disappoint his fans. With two days left before his wedding, Doug (Justin Bartha) and his groomsmen (Bradley Cooper, Ed Helms, and Zach Galifianakis) go on a bachelor-party blowout. The only problem is that, when the morning comes, the men notice that the groom is missing. With the clock ticking away, his friends have to trace back their actions and locate Doug, a wacky adventure that gets them in trouble with casino bosses, a mysterious baby, and a certain former world heavyweight champion. The movie won't win any awards for good taste, but it has plenty of hearty laughs.

The Headless Woman (Focus): The title suggests a horror movie, but this is actually a stylish, tantalizingly enigmatic drama from the Argentine director Lucrecia Martel, one of today's most interesting filmmakers. Veronica (Maria Onetto), a wealthy dentist, is driving home from a picnic one day when, distracted by her cell phone, she runs over something. Is it a dog, or could it be a boy? Too dazed to check, Veronica forges ahead with her normal life, but the world around her seems odd since the accident. People she should know become virtual strangers, and everywhere she looks she seems something that reminds her of what she may have done. Martel's unique visuals and refusal to give easy answers may make her an acquired taste, but it's not adventurous audiences should consider. With subtitles.

[headlines]

--------------------------------------------------------------

“It’s So Slow…” contest---last Call! Contest over by 12/16

To ship the wine and See’s Candy in time for Christmas, the contest will be over by December 16th--

"It's so slow that the US Congress is moving faster."

Joe O'Hara

OFE Leasing, Inc

“Business is so slow, I cannot pay attention.”

David M. Rothenberg

Lease One Systems

St. Louis, Missouri

"Things ARE SO SLOW THAT a 120 day account is now considered prompt!"

Rob Yohe

Overland, Kansas

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Classified ads—Attorneys

Birmingham, Alabama

The lawyers of Marks & Weinberg, P.C. have over 30 years experience in dealing with virtually every type of equipment financing and are recognized throughout the industry for prompt, practical solutions and exemplary service. They offer cost-conscious, effective lease enforcement and good counsel.

Email: Barry@leaselawyer.com

Website: www.leaselawyers.com |

California, National: city: Riverside

Ellen Stern - get results, reasonable pricing; numerous industry contacts, nearly 30 yrs exp.in SoCal, 20 yrs equip.: CFL license specialist, documentation, work-outs, litigated collections, recoveries; deal-maker.

Email: leaselaw@msn.com |

Kenneth C. Greene |

California & Nevada

Hamrick & Evans, LLP, Universal City , LA; San Francisco Bay

Area, No.Calif. & Nevada. Call for free consultation (828)763-5292 or

(415) 806-2254,

kgreene@hamricklaw.com |

|

Connecticut, Southern New England:

EVANS, FELDMAN & BOYER, LLC Collections, litigation, documentation, portfolio sales and financing, bankruptcy. We represent many of the national and local leasing companies doing business in this state. Past chairman EAEL legal committee. Competitive rates.

email: rcfeldman@snet.net |

Los Angeles, Southern CA

Seasoned attorney representing secured creditors in auto finance and truck/equipment lease industry. Bankruptcy and State Court litigation. Vincent V. Frounjian (818) 990-0605 or email: vvf@pacbell.net. |

Encino, California: Statewide “ELFA”

Hemar, Rousso & Heald, LLP 30 yr excellent reputation Lessor representation commercial litigation, debt collection, and bankruptcy.

Call Stephen E. Jenkins Esq (818) 501-3800 |

Los Angeles, Statewide: CA. "ELFA" Aggressive creditors rights law firm specializing in equipment leasing handling collection matters on a contingency, fixed fee or hourly cbasis. email:RGarwacki@prodigy.net

|

Los Angeles -statewide: CA "ELFA"

Practice limited to collections, bankruptcy and problem accounts resolution. Decades of experience. 10-lawyer firm dedicated to serving you. Call Ronald Cohn, Esq. (818)591-2121 or email. Email: rrcohn@aol.com

|

Long Beach, CA

Wagner & Zielinski, successfully representing lessees/ lessors. Not a member of any leasing organization, therefore not beholden to special interests. Richard Wagner

(562) 216-2952 www.wzlawyers.com

|

Long Beach CA.

Paul Bent -- 30 years experience in all forms of equipment leasing, secured lending, and asset based transactions, from analysis and deal structuring to contract negotiations to closing to private dispute resolution. (562) 426-1000

www.paulbent.com

|

Law Firm - Service, Dallas, TX. "ELFA"

Mayer regularly practices in leasing, secured financing, project development and finance and corporate finance.

email: dmayer@pattonboggs.com

Website: www.pattonboggs.com |

National: Coston & Rademacher: Business attorneys serving the lease-finance industry since 1980. Transactional, documentation, corporate/finance, workouts, litigation, bankruptcy, portfolio management. Chicago-based national practice. Jim Coston, CLP (Members: ELFA, NEFA).

email: Jcoston@costonlaw.com

Website:www.costonlaw.com |

St. Louis County , MO. - statewide:

Schultz & Associates LLP., collections, negotiation, and litigation. Also register and pursue recovery on foreign judgments. Contingency and reasonable hourly rates.

Ronald J. Eisenberg, Esq. (636) 537-4645 x108

reisenberg@sl-lawyers.com

www.sl-lawyers.com |

NJ,De,Pa:

Specializing in leased equipment/secured transactions. Collections, replevins/workouts reasonable rates. Sergio

Scuteri/Capehart & Scratchard, PA sscuteri@capehart.com / www.capehart.com |

Thousand Oaks, California:

Statewide coverage Spiwak & Iezza, LLP 20+ years experience,Representing Lessors banks in both State/ Federal Courts/ all aspects of commercial leasing litigation.

Nick Iezza 805-777-1175

niezza@spiwakandiezza.com

|

Westport, CT: We represent finance companies, banks, lessors, etc., in replevins/seizures, collections and bankruptcy matters in Connecticut and New York. Flat fee, contingency and hourly rates.

Email: rchinitz@replevinlawyer.com |

|

Posting an Attorney Classified ad—Free

http://www.leasingnews.org/Classified/Attorney/Attorney-post.htm

[headlines]

--------------------------------------------------------------

#### Press Release #############################

IFA Urges passage of Small Business Credit Proposals

WASHINGTON, —The International Franchise Association released a support letter signed by 55 other business trade groups calling for swift action by Congress on legislation to increase access to credit for small businesses. Many of these provisions were among the measures suggested this week by President Obama in his speech at the Brookings Institution.

“We are pleased that the President continued to acknowledge that the lack of credit availability for small businesses is slowing the recovery efforts and stalling the significant job creation potential of small business entrepreneurs,” said IFA President & CEO Matthew Shay. “Small businesses cannot be the engine of our economy if they have to line up in a queue and wait to see if they can gain access to credit. Congress needs to act swiftly and restart the flow of credit to America’s job-creating small businesses or else these entrepreneurs will be left to sit on the sidelines.”

In a letter to members of Congress, IFA and 55 other business groups identified immediate steps that could improve credit access, including an increase in the maximum loan size and the maximum guaranteed portion of Small Business Administration (SBA) loans and called for by President Obama.

The groups urged passage of legislation proposed by Sen. Mary Landrieu (D-LA) and Sen. Olympia Snowe (R-ME), the Chair and Ranking Member of the Senate Small Business Committee, to increase the maximum size of SBA 7(a) and 504 loans from $2 million to $5 million. These bills would also provide a commensurate increase in the statutory maximum guaranteed portion of SBA 7(a) loans.

The groups also urged support appropriations to extend the Small Business Administration (SBA) loan provisions of the America Recovery and Reinvestment Act (ARRA) through all of Fiscal Year 2010. SBA estimates that $479 million in appropriations is needed to fund the extension of the higher guaranty percentages and waiver of borrower fees for the balance of the fiscal year.

“These stimulus provisions have been so successful that the money allocated thus far has been exhausted,” Shay said. “The depletion of funds is proof that the SBA programs were, and continue to be, critically important for our nation’s credit-worthy entrepreneurs.”

Shay added that the Recovery Act provisions have made a real difference for small businesses, but the recovery has not been completed.

“Lenders were returning to the SBA programs and providing loans of all sizes to the nation’s small businesses – and this momentum needs to continue,” he said. “We urge Congress to quickly provide the appropriations necessary to extend the ARRA provisions so small businesses can access the funds they need to hire, expand inventory, purchase machinery and equipment or real estate.”

About The International Franchise Association

The International Franchise Association, the world’s oldest and largest organization representing franchising, is the preeminent voice and acknowledged leader for the industry worldwide. Approaching a half-century of service with a growing membership of more than 1,250 franchise systems, 10,000-plus franchisees and more than 500 firms that supply goods and services to the industry, IFA protects, enhances and promotes franchising by advancing the values of integrity, respect, trust, commitment to excellence, honesty and diversity. For more information, visit the IFA Web site at www.franchise.org.

### Press Release ############################

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

News Briefs----

[headlines]

---------------------------------------------------------------

You May have Missed---

[headlines]

----------------------------------------------------------------

[headlines]

----------------------------------------------------------------

[headlines]

----------------------------------------------------------------

"Gimme that Wine"

Wine Prices by vintage

http://www.winezap.com

US/International Wine Events

http://www.localwineevents.com/

http://www.wine-searcher.com/

Winery Atlas

http://www.carterhouse.com/atlas/

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

The London International Vintners Exchange (Liv-ex) is an electronic exchange for fine wine.

http://www.liv-ex.com/

[headlines]

----------------------------------------------------------------

Today's Top Event in History

[headlines]

----------------------------------------------------------------

This Day in American History

1763 – Fifty-Seven whites enter Conestoga Indian settlement, and in violation of a treaty made between the tribe and William Penn — to last "as long as the sun should shine, or the waters run in the rivers" — shot, stabbed, and hatcheted the three men, two women and one young boy they found there (more on 27 December).

1774—After Paul Revere warns Portsmith of possible attack, Massachusetts militiamen successfully attacked arsenal of Fort William and Mary and confiscate all arms and gun powder. Actually, here was the first shot of the RevolutionaryWar, and not in Boston common as history books today report. . (Revere did not finish his ride, nor did he communicate about the lantern signals, but he did warns several towns and woke up many farmers to warn other farmers about the possible attack, plus made it to the town of Portsmith.)

http://www.nhssar.org/essays/FortConstitution.htm

http://www.seacoastnh.com/history/rev/willmary.html

http://www.seacoastnh.com/arts/please052299.html

1782 --Charleston SC evacuated by British. There were more battles in South Carolina as the British fought to conquer this land more than others in the colonies at the time, and this was a major event in the American Revolutionary war. May 12, 1780 the British had captured Charleston.

http://web.ftc-i.net/~gcsummers/revolution.htm

http://www.patriotsofcharleston.com/

1793- Kentucky was the first state to authorized a road. They authorized Daniel Weisiger, Bennett Pemberton, and Nathaniel Sanders as “ commissioners to receive subscriptions in money, labor or property, to raise a fund for clearing a wagon road from Frankfort, Kentucky, to Cincinnati, Ohio.

1798 - David Wilkinson of Rhode Island patented both the nut and bolt machine, and the screw.

1819- Alabama became the 22 nd state. Deep in the “Heart of Dixie,”(one of the state's nicknames), Alabama was first inhabited by the Creek Indians (Alabama means ‘tribal town'), then explored by the Spanish, settled by the French, and then controlled by the British. The region was ceded to the U.S. following the American Revolution. The Confederacy was founded in Alabama; the state flag still bears a resemblance to the Confederate Battle Flag. Alabama's motto, "Audemus jura nostra defendere – We Dare Defend Our Rights" - has been taken very seriously throughout the state's history, especially in the 1950s and 1960s , as it was the site of landmark civil rights actions. The state tree, pinus palustris or Southern longleaf pine; and the camellia, the state flower, are plentiful throughout the state, as is the state bird, the yellowhammer, which is also the state's other nickname.

1863 - President Lincoln announces a grant of amnesty for Mrs. Emilie Todd Helm, Mary Lincoln's half sister and the widow of a Confederate general. The pardon was one of the first under Lincoln's Proclamation of Amnesty and Reconstruction, which he had announced less than a week before. The plan was the president's blueprint for the reintegration of the South into the Union. Part of the plan allowed for former Confederates to be granted amnesty if they took an oath to the United States

1885-Birthday of Ethel Browne Harvey - U.S. cell biologist, embryologist, most noted for her findings about cell division. Her studies brought her international fame. Using sea urchins, she was able to excite cell division without maternal or paternal nucleus. Harvey speculated that her parthenogenetic meogones might mean that fundamental characteristics. of living matter (such as cell division) were cytoplasmic, while genes controlled later, more specialized characteristics (like eye color). Today sea urchins are very much in demand by connoisseurs, not only for their taste but supposed aphrodisiac ability, attributed to Dr. Harvey's work.

1896- birthday of James Doolittle, American aviator and World War II hero General James Doolittle was born at Alameda, CA. A Lieutenant General in the US Army Air Force, he was the first person to fly across North America in less than a day. On Apr 18, 1942, Doolittle led a squadron of 16 B-25 bombers, launched from aircraft carriers, on the firs US aerial raid on Japan of WWll. He was awarded the Congressional Medal of Honor for this accomplishment. Doolittle also headed the Eighth Air Force during the Normandy invasion. He died Sept 27, 1993, at Pebble Beach, CA.

1897- Birthday of Margaret Chase Smith, American politician Margaret Madeline Chase Smith was born at Skowhegan, ME. As the first woman to elected to both houses of Congress (1941 to the House and 1949 to the Senate). She was also one of seven Republican senators to issue a “declaration of conscience” to denounce Senator Joseph R. McCarthy's communist witch-hunt. She died May 29, 1995, at Skowhegan, ME

1902 - The ship, "Silverton", set sail from the Bay Area to lay the first telephone cable between San Francisco, California and Honolulu, Hawaii. The project was finished by January 1, 1903.

1903 -Wright Brothers make 1st flight at Kittyhawk

http://www.wam.umd.edu/~stwright/WrBr/wrights/1903.html

1910- tenor sax player Bud Johnson born Dallas, Texas.

1911- The elusive object of many expeditions dating from the 7 th century, the South Pole was located and visited by Roald Amundsen with four companions and 52 sled dogs. All five men and 12 of the dogs returned to base camp safely. Next to visit the South Pole, January 17, 1912, was a party of five led by Captain Robert Scott, all of whom perished during the return trip. A search party found their frozen bodies 1l months later.

1920---Trumpet Player Clark Terry birthday

http://hardbop.tripod.com/terry.html

1924 - The temperature at Helena, MT, plunged 79 degrees in 24 hours, and 88 degrees in 34 hours. The mercury plummeted from 63 above to 25 below zero. At Fairfield MT the temperature plunged 84 degrees in just 12 hours, from 63 at Noon to 21 below zero at midnight

1934-The first streamlined steam locomotive was introduced by the New York Central Lines between Albany and Kamer, NY. Built in West Albany, NY, it was named the “Commodore Vandebilt” after the founder of the New York Central Lines. It developed 4,075 horsepower.

1939-- Jimmy Lunceford Band records “ Uptown Blues,” New York City.

1939 - League of Nations, the international peacekeeping organization formed at the end of World War I, expels the Union of Soviet Socialist Republics in response to the Soviets' invasion of Finland on October 30. President Roosevelt, although an "ally" of the USSR, condemned the invasion, causing the Soviets to withdraw from the New York World's Fair. And finally, the League of Nations, drawing almost its last breath, expelled it.

1944--NEPPEL, RALPH G. Medal of Honor

Rank and organization: Sergeant, U.S. Army, Company M, 329th Infantry, 83d Infantry Division. Place and date: Birgel, Germany, 14 December 1944. Entered service at: Glidden, lowa. Birth: Willey, lowa. G.O. No.: 77, 10 September 1945. Citation: He was leader of a machinegun squad defending an approach to the village of Birgel, Germany, on 14 December 1944, when an enemy tank, supported by 20 infantrymen, counterattacked. He held his fire until the Germans were within 100 yards and then raked the foot soldiers beside the tank killing several of them. The enemy armor continued to press forward and, at the pointblank range of 30 yards, fired a high-velocity shell into the American emplacement, wounding the entire squad. Sgt. Neppel, blown 10 yards from his gun, had 1 leg severed below the knee and suffered other wounds. Despite his injuries and the danger from the onrushing tank and infantry, he dragged himself back to his position on his elbows, remounted his gun and killed the remaining enemy riflemen. Stripped of its infantry protection, the tank was forced to withdraw. By his superb courage and indomitable fighting spirit, Sgt. Neppel inflicted heavy casualties on the enemy and broke a determined counterattack.

1944--THOMAS, CHARLES L. Medal of Honor

Citation: For extraordinary heroism in action on 14 December 1944, near Climbach, France. While riding in the lead vehicles of a task force organized to storm and capture the village of Climbach, France, then First Lieutenant Thomas's armored scout car was subjected to intense enemy artillery, self-propelled gun, and small arms fire. Although wounded by the initial burst of hostile fire, Lieutenant Thomas signaled the remainder of the column to halt and, despite the severity of his wounds, assisted the crew of the wrecked car in dismounting. Upon leaving the scant protection which the vehicle afforded, Lieutenant Thomas was again subjected to a hail of enemy fire which inflicted multiple gunshot wounds in his chest, legs, and left arm. Despite the intense pain caused by these wounds, Lieutenant Thomas ordered and directed the dispersion and emplacement of two antitank guns which in a few moments were promptly and effectively returning the enemy fire. Realizing that he could no longer remain in command of the platoon, he signaled to the platoon commander to join him. Lieutenant Thomas then thoroughly oriented him on enemy gun dispositions and the general situation. Only after he was certain that his junior officer was in full control of the situation did he permit himself to be evacuated. First Lieutenant Thomas' outstanding heroism was an inspiration to his men and exemplifies the highest traditions of the Armed Forces.

1947-- part-time auto racer and full-time promoter Bill France, Sr., tried to bring some order to the chaotic world of stock car racing by opening a 3-day meeting at the Streamline Hotel in Daytona Beach, Florida, between several warring factions. The result of the meeting was the creation of NASCAR, the National Association of Stock Car Automobile Racing, the body that has governed the sport ever since.

1951---Top Hits

Sin (It's No) - Eddy Howard

Slowpoke - Pee Wee King

Rudolph, the Red-Nosed Reindeer - Gene Autry

Let Old Mother Nature Have Her Way - Carl Smith

1953 - 19-year old Sandy Koufax signed with the Brooklyn Dodgers. In his life, Koufax reportedly had played no more than 20 games of baseball. During the next 12 seasons, he posted 167 wins, 87 losses and 2,396 strikeouts, to become a baseball legend.

1953--"I Want a Hippopotamus for Christmas", recorded earlier in the year by 10 year old Gayla Peevey, inspired an Oklahoma City fund-raising effort to buy a hippopotamus for the Oklahoma City Zoo. Oklahomans raised $4,000 for the cause, with much of the money coming from children. The zoo bought a 3-year-old hippo named Matilda who had eight offspring and died in 1998.

1954-- birthday of Alan Kulwicki, auto racer born at Greenfield, WI. Kulwicki was NASCAR's rookie of the year in 1987 and Winston Cup champion in 1992. He won 24 NASCAR races in 207 starts. He died in a plane crash, April 1,1993. Maybe Johnny Madden is right to travel by bus. Kulwicki was safer on the race track than in the air.

1959-Guy Mitchell achieves his second Billboard number one hit with "Heartaches By The Number".

1959---Top Hits

Heartaches by the Number - Guy Mitchell

Mr. Blue - The Fleetwoods

In the Mood - Ernie Field's Orch.

The Same Old Me - Ray Price

1961 - In a public exchange of letters with South Vietnamese President Ngo Dinh Diem, President John F. Kennedy formally announces that the United States will increase aid to South Vietnam, which would include the expansion of the U.S. troop commitment. Shortly after President Kennedy was assassinated, there were more than 16,000 U.S. advisers in South Vietnam. Kennedy's successor, Lyndon B. Johnson, rapidly escalated the war, which resulted in the commitment of U.S. ground forces and eventually more than 500,000 American troops in Vietnam.

1963-The Beatles' "I Want To Hold Your Hand" begins a five week stretch at number one on the UK record charts, replacing their own "She Loves You".

1967---Top Hits

Daydream Believer - The Monkees

The Rain, the Park and Other Things - The Cowsills

I Say a Little Prayer - Dionne Warwick

It's the Little Things - Sonny James

1968-Tommy James and the Shondells' "Crimson and Clover" is released.

1968-Iron Butterfly's epic "In-A-Gadda-Da-Vida" goes gold.

1969 — San Diego wide receiver Lance Alworth sets a professional record with a pass reception in his 96th straight game.

1970 - While golfing great Lee Trevino won only two tournaments during the year; he still became the top, golf money-winner with his yearly earnings averaging $157,037.

1970-The National Press Club finally voted to admit women members.

1974-David Crosby and Graham Nash perform together in San Francisco at a benefit concert for the United Farm Workers and Project Jonah, a whale protection media project.

1975---Top Hits

Fly, Robin, Fly - Silver Convention

Let's Do It Again - The Staple Singers

Saturday Night - Bay City Rollers

Love Put a Song in My Heart - Johnny Rodriguez

1977--"Saturday Night Fever" premieres in New York City. It not only makes a star out of John Travolta, but spreads the disco craze throughout the country. The soundtrack is full of recent and soon-to-be dance hits by the Bee Gees, the Trammps, Kool and the Gang, MFSB, K.C. and the Sunshine Band and Yvonne Elliman. It will be one of the biggest-selling albums of all time.

1980-At Yoko Ono's request, at 2 p.m. Eastern Standard Time, John Lennon fans around the world mourn him with ten minutes of silent prayer. In New York over 100,000 people converge in Central Park in tribute and in Liverpool, a crowd of 30,000 gatherers outside of St. George's Hall on Lime Street.

1982-Marcel Dionne of the Los Angeles Kings scored the 500 th goal of his career in a 7-2 loss to the Washington Capitals. Dionne played from 1971-72 through 1988-89 and finished his career with 731 goals.

1983---Top Hits

Say Say Say - Paul McCartney and Michael Jackson

Say It Isn't So - Daryl Hall-John Oates

Union of the Snake - Duran Duran

Tell Me a Lie - Janie Fricke

1985—UCLA defeated American University, 1-0, with a goal in the eight overtime period to win the NCAAA soccer championship in the longest game in US college soccer history.

1985 - Wilma Mankiller became the first woman to lead a major American Indian tribe, taking office as the principal chief of the Cherokee Nation of Oklahoma.

1985 - The United States' high school football coach with the most wins called it quits. After 43 years, Gordon Wood, 71, of Brownwood High School in Central Texas, retired. Wood had a career record of 405 wins, 88 losses and 12 ties. The football stadium at Brownwood High was rebuilt and named after him.

1985 -- Wilma Mankiller takes the oath of office as the principal chief of the Cherokee Nation of Oklahoma, the first time a woman has headed a major American native Indian tribe ERRATA: Several people have written regarding Wilma Mankiller to say that her title was the first time since the European annexation of Amerindian lands and rights that a woman was recognized by the white people as a tribal chief. Evidently women “were” tribal leaders before the coming of the Europe

1986 -- San Diego wide receiver Lance Alworth sets a professional record with a pass reception in his 96th straight game.

http://images.nfl.com/history/images/1214.jpg

1986-Elton John records a live version of "Candle in the Wind" in Australia with the Melbourne Symphony Orchestra. The song is released as a single and hits #6 on the chart.

1986-- the experimental aircraft Voyager, piloted by Dick Rutan and Jeana Yeager, took off from Edwards Air Force Base in California on the first non-stop, non-refueled flight around the world. On December 14, 1986, Yeager and Rutan began their history-making flight in the Voyager, flying the maximum circumference of the globe in nine days, three minutes and forty-four seconds.

1987 - A powerful storm spread heavy snow from the Southern High Plains to the Middle Mississippi Valley, and produced severe thunderstorms in the Lower Mississippi Valley. During the evening a tornado hit West Memphis TN killing six persons and injuring two hundred others. The tornado left 1500 persons homeless, and left all of the residents of Crittendon County without electricity. Kansas City MO was blanketed with 10.8 inches of snow, a 24 hour record for December, and snowfall totals in the Oklahoma panhandle ranged up to 14 inches. Strong winds, gusting to 63 mph at Austin TX, ushered arctic cold into the Great Plains, and caused considerable blowing and drifting of snow.

1988-The Miami Heat defeated the Los Angeles Clippers in Los Angeles to earn the first victory in the franchise's history. The Heat, in their first season, had gone 17 games without a wine, an NBA record for most consecutive defeats at the start of a season.

1989 - High winds and heavy snow prevailed from Montana to Colorado. Snowfall totals in Wyoming ranged up to 20 inches at Burgess Junction, leaving up to 48 inches on the ground in the northeast sections of the state. Wind gusts in Colorado reached 87 mph south of the town of Rollinsville. Strong northwesterly winds continued to produce heavy snow squalls in the Great Lakes Region. Totals in northeastern Lower Michigan ranged up to 29 inches at Hubbard Lake, with 28 inches reported at Posen. Two day totals in northeastern Wisconsin ranged up to thirty inches.

1991---Top Hits

Black or White - Michael Jackson

It's So Hard to Say Goodbye to Yesterday - Boyz II Men

All 4 Love - Color Me Badd

For My Broken Heart - Reba McEntire

1997-- Phoenix Coyote Mike Gartner is 5th NHLer to score 700 goals

http://www.neutralzonehockey.com/gartner.htm

1997-Elton John's tribute to Princess Diana, "Candle in the Wind 1997", was at its ninth week at number 1 on the Billboard chart. The record would eventually pass Bing Crosby's "White Christmas" to become the largest selling single of all time.

1999---Top Hits

Smooth- Santana Featuring Rob Thomas

Back At One- Brian McKnight

I Wanna Love You Forever- Jessica Simpson

I Knew I Loved You- Savage Garden

2002 - A powerful Pacific storm system plowed into the western United States during the 13th-16th, producing high winds, heavy rains, significant mountain snowfall and causing 9 deaths (Associated Press). Rainfall amounts exceeding 10 inches occurred in parts of California, and wind gusts over 45 mph produced up to 1.9 million power outages during the period

[headlines]

--------------------------------------------------------------

Football Poem

American Football Poem

I am the Master of my Fate

Often read before a football game:

Willian Ernest Henley (1875) .

Out of the night that covers me,

Black as a Pit from pole to pole,

I thank whatever gods may be

For my unconquerable soul.

In the fell clutch of circumstance

I have not winced nor cried aloud,

Under the bludgeoning of chance

My head is bloody, but unbowed.

Beyond this place of wrath and tears

Looms but the horror of the shade,

And yet the menace of the years

Finds, and shall find me, unafraid.

It matters not how straight the gate,

How charged with punishments the scroll,

I am the master of my fate:

I am the Captain of my soul.

[headlines]

--------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

[headlines]

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

[headlines]

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

[headlines]

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

http://www.weather.gov/

[headlines]

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

[headlines] |

![]()

![]()

![]()

![]()