Monday, February 1, 2010

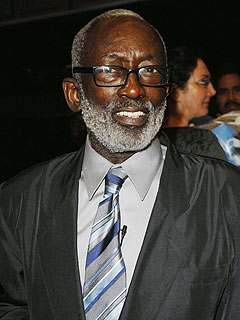

Comedian/Actor Garrett Gonzalez Morris born February 1, 1937 New Orleans, Louisiana. Part of the original Saturday Night Life group, appearing from in 106 episodes from 1975 to 1980. |

Headlines---

Classified Ads---Internet Sites

Bank Beat—Which comes First: Eggs or Chickens?

“Weekly Bulletin Board Complaints”

by Christopher Menkin

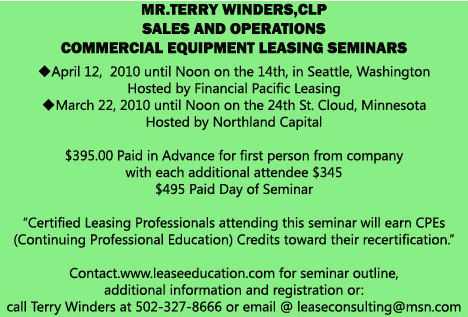

Leasing 102 by Mr. Terry Winders, CLP

Leasing Tax issues for 2010

Cartoon---The latest mortgage program

Classified ads---Help Wanted

Top Stories January 25--29

Automatic Renewals Return for 2010

Classified ads—Finance / Human Resources

Google Still in the Search Lead

Chicago, Illinois ---Adopt-a-Dog

News Briefs ---

GE Capital fights back

In Atlanta, Bank leaves trail of flipping, fraud

Grammy Night Belongs To Beyoncé and Taylor Swift

Michael Jackson Children Tribute to their father

You May have Missed---

Sports Briefs

Gimme that wine

Today's Top Event in History

This Day in American History

Super Bowl Records

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

|

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

[headlines]

-----------------------------------------

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

[headlines]

---------------------------------------------------------------

You May have Missed---

---------------------------------------------------------------

Sports Briefs---

Matt Schaub earns MVP as AFC tops NFC 41-34 in Pro Bowl

http://www.usatoday.com/sports/football/nfl/2010-01-31-pro-bowl_N.htm?loc=interstitialskip

----------------------------------------------------------------

----------------------------------------------------------------

![]()

Today's Top Event in History

[headlines]

----------------------------------------------------------------

![]()

This Day in American History

1790- The Supreme Court of the United States met for the first time in New York City with Chief Justice John Jay presiding.

1859-Considered one of America's greatest composers, Victor Herbert, was born in Dublin, Ireland.

http://memory.loc.gov/ammem/today/feb01.html

1860-The first Rabbi to open the House of Representatives with prayer was Rabbi Morris Jacob Raphall, rabbi of Congregation B'nai Jeshurn, New York City, who delivered the invocation at the first session of the 36 th congress.

1860-Decree from Norton I, Emperor of the United States & Protector of Mexico, orders representatives of the different states to assemble at Platt's Music Hall in Frisco to change laws to ameliorate the evils under which the country is laboring.

http://www.sfmuseum.org/hist1/norton.html

http://www.zpub.com/sf/history/nort.html

1861 - Texas seceded from the Union and joined the Confederate States of America.

1862 - Battle Hymn of the Republic, written by Julia Ward Howe, was first published in the Atlantic Monthly. The song's music was inspired by the song "John Brown's Body." Howe just wrote new words for the existing music.

1865- President Abraham Lincoln's signed into law the 13th Amendment to the US Constitution (abolishing slavery): "1. Neither slavery nor involuntary servitude, except as a punishment for crime whereof the party shall have been duly convicted, shall exist within the United States or any place subject to their jurisdiction. 2. Congress shall have power to enforce this article by appropriate legislation." The amendment had been proposed by the Congress Jan 31, 1865; ratification was completed Dec 6, 1865.

1865-The first lawyer admitted to practice before the Supreme Court who was African-American was John S. Rock,. His admittance was moved by Senator Charles Sumner of Massachusetts. Chief Justice Salmon Portland Chase presided. It would be the last triumphant act in a life overflowing with achievement, for Rock died suddenly on December 3, 1866. He was interred at the Twelfth Baptist Church and buried with full Masonic honors at Woodlawn Cemetery in Everett, MA.

http://www.nps.gov/boaf/johnsrock.htm

http://www.state.nj.us/state/history/rock.html

1878- Hattie Wyatt Caraway, born at Bakersville, TN, Hattie Caraway became a US senator from Arkansas when her husband died in 1931 and she was appointed to fill out his term. The following year she ran for the seat herself and became the first woman elected to the US Senate. She served 14 years there, becoming an adept and tireless legislator (once introducing 43 bills on the same day) who worked for women's rights (once cosponsoring an equal rights amendment), supported New Deal policies as well as Prohibition and opposed the increasing influence of lobbyists. Caraway died at Falls Church, VA, Dec 21, 1950.

1893- The first moving picture studio was built at Thomas Edison's laboratory compound at West Orange, NJ, at a cost of less than $700. The wooden structure of irregular oblong shape was covered with black tar paper. It had a sharply sloping roof hinged at one edge so that half of it could be raised to admit sunlight. Fifty feet in length, it was mounted on a pivot enabling it to be swung around to follow the changing position of the sun. There was a stage draped in black at one end of the room. Though the structure was officially called a Kinetographic Theater, it was nicknamed the "Black Maria" because it resembled an old-fashioned police wagon.

1894—Birthday of rag time pianist/composer James P. Johnson

http://blackhistory.eb.com/micro/727/42.html

http://www.jazzradio.org/jpjohnsn.htm

http://www.jass.com/jamesp.html

1895--Film director John Ford was born at Cape Elizabeth, ME, as Sean Aloysius O'Feeney; he changed his name after moving to Hollywood. Ford won his first Academy Award in 1935 for The Informer . Among his many other films: Stagecoach, Young Mr. Lincoln, The Grapes of Wrath, How Green Was My Valley, Rio Grande, What Price Glory? and Mister Roberts . During World War II he served as chief of the Field Photographic Branch of the OSS. Two documentaries made during the war earned him Academy Awards. He died Aug 31, 1973, at Palm Desert, CA.

1898- Travelers Insurance Company issued the first car insurance against accidents with horses.

1901- actor Clark Gable birthday. His first film was The Painted Desert in 1931, when talking films were replacing silent films. He won an Academy Award for his role in the comedy It Happened One Night , which established him as a romantic screen idol. Other films included China Seas, Mutiny on the Bounty, Saratoga, Run Silent Run Deep and Gone with the Wind , for which his casting as Rhett Butler seemed a foregone conclusion due to his popularity as the acknowledged "King of Movies." Gable was born at Cadiz, OH, and died Nov 16, 1960, at Hollywood, CA, shortly after completing his last film, Arthur Miller's The Misfits , in which he starred with Marilyn Monroe.

1902- birthday of Langston Hughes. African American poet and author, born at Joplin, MO. Among his works are the poetry collection Montage of a Dream Deferred , plays, a novel and short stories. Hughes died May 22, 1967 at New York, NY.

What happens to a dream deferred?

Does it dry up

like a raisin in the sun?

Or fester like a sore--

and then run?

Does it stink like rotten meat?

Or crust and sugar over—

like a syrupy sweet?

Maybe it just sags

like a heavy load

Or does it just explode?

— Langston Hughes, "Dream Deferred"

( lower part of http://memory.loc.gov/ammem/today/feb01.html )

1906-- 1st federal penitentiary building completed, Leavenworth KS. The penitentiary is the largest maximum-security prison in the United States, housing more than 2,200 inmates. Famous inmates over the years included Al Capone, Machine Gun Kelly, and Robert Stroud – the famous “Birdman of Alcatraz.” Actually, Stroud's bird work began at Leavenworth, where he served 28 years before being transferred to Alcatraz. The Immanuel Church, located on the grounds, was made famous in Ripley's Believe it or Not as the only church in which Protestant and Catholic services were conducted simultaneously.

http://www.lvarea.com/data/usp_info.htm

http://www.lvarea.com/data/usp_info.htm#USP%20Background%20Information

http://www.leavenworthdirectory.com/leavenworth.htm

1911- Thomas Jennings was found guilty and sentenced to death for the murder of Clarence B. Hiller in the Criminal Court of Cook County, Illinois. He was convicted because of his fingerprints and is the first to be found guilty. The Illinois Supreme Court rule that fingerprints were admissible evidence.

Hiller was hanged for his crime.

1919 - The first Miss America was crowned in New York City. The winner, Edith Hyde was found by the judges not to be a Miss. She was a "Mrs." named Mrs. Tod Robbins, the mother of two children.

1920 - The North West Mounted Police ("The Mounties") became the Royal Canadian Mounted Police.

1922-Birthday of 1922, Renata Tebaldi - Italian operatic soprano whose rich, sumptuous voice made her the operatic star at the Metropolitan Opera, Covent Garden, and LaScala in the 1950s and 60s. She was known for her acting ability. In 1946, along with Arturo Toscanini, RT performed at the reopening concert of La Scala, which had been closed during World War II. Her great roles included Giacomo Puccini's Mimi ( La Boh è me ) and Tosca , Giuseppe Verdi's Desdemona ( Otello ) and Aida , and Umberto Giordano's Madeleine ( Andrea Ch é nier ).

1934- Bob Shane of the Kingston Trio was born in Hilo, Hawaii. The trio was credited with starting the folk craze of the late 1950's and early '60s with their hit recording of "Tom Dooley" in 1958. The Kingston Trio had a clean-cut collegiate image which helped them win acceptance among the trendy college crowd. The trio broke up in 1968.

1935 -- James T. Farrell finishes his Studs Lonigan trilogy ( Judgment Day ).

1937- Don Everly of the Everly Brothers was born in Brownie, Kentucky. The brothers were one of the most important acts of early rock 'n' roll. Their music, a mixture of close country harmonies over a rocking beat, resulted in two dozen chart entries, including such number-one records as "Wake Up Little Susie," "All I Have to Do Is Dream" and "Cathy's Clown." The brothers broke up in 1973, reunited in 1983 and again in 1985. They were last seen touring with Garfunkle and Simon, who re-united, and confessed on stage, before the introduction, when they started, they were trying to sound like their idols, the Everly Brothers.

1939 - On Victor Records, Benny Goodman and his orchestra recorded "And the Angels Sing". The vocalist for that song went on to find fame at Capitol Records, Martha Tilton.

1940 - For his first recording session, held in Chicago, Illinois, with the Tommy Dorsey Band, Frank Sinatra sang "Too Romantic" and "The Sky Fell Down". Sinatra replaced Jack Leonard as the band's lead singer.

1941 - "Downbeat" magazine reported Glenn Miller had signed a new three-year contract with RCA Victor Records, guaranteeing him $750 a side, the largest record contract signed to that date.

1944---Top Hits

My Heart Tells Me - The Glen Gray Orchestra (vocal: Eugenie Baird)

Shoo, Shoo, Baby - The Andrews Sisters

Besame Mucho - The Jimmy Dorsey Orchestra (vocal: Bob Eberly & Kitty Kallen

Pistol Packin' Mama - Al Dexter

1945-- US Army arrives at Siegfriedlinie, a major defense of the Nazi regime.

http://mohaa.com/forum/viewtopic.ph http://copernicus.subdomain.de/Siegfried_Line p?p=117338&sid=d4b2df326cdcad65d492d560b41a5cc6

1949 - Louis B. Mayer, of Metro Goldwin Mayer (MGM), became a millionaire all over again when he sold his racehorse breeding farm for one-million dollars.

1949 - 1949, RCA Victor introduced the 45 rpm record. It was designed as a rival to Columbia's 33 1/3 rpm long- playing disc, introduced the previous year. The two systems directly competed with each other to replace 78 rpm records, bewildering consumers and causing a drop in record sales.

By the end of 1949, all the major companies, except RCA, had committed themselves to the LP record, seemingly putting an end to the 45. Even RCA itself announced it would issue its classical library on 33 1/3 rpm discs. But RCA was not ready to admit the demise of the 45 rpm record. The company spent $5-million publicizing 45 rpm as the preferred speed for popular music. The campaign worked. Buyers of non-classical records turned increasingly to the 45 rpm record, so that by 1954, more than 200-million of them had been sold. And all the major companies now were producing both 33 1/3 and 45 rpm records.

1951 -50ºF (-46ºC), Gavilan NM (state record)

1951 - The greatest ice storm of record in the U.S. produced glaze up to four inches thick from Texas to Pennsylvania causing twenty-five deaths, 500 serious injuries, and 100 million dollars damage. Tennessee was hardest hit by the storm. Communications and utilities were interrupted for a week to ten days.

1952---Top Hits

Slowpoke - Pee Wee King

Cry - Johnnie Ray

Anytime - Eddie Fisher

Give Me More, More, More (Of Your Kisses) - Lefty Frizzell

1953 - "Private Secretary" debuted on CBS-TV starring Ann Southern as Susie McNamera, the private secretary to New York talent agent, Peter Sands played by Don Porter. With its last show airing on September 10, 1957, the show ran on CBS during the regular television seasons and ran on NBC-TV in the summers of 1953 and 1954.

1953- "Your Are There" premiered on Television. The program began as an inventive radio show in 1947. News correspondents would comb the annals of history and "interview" the movers and shakers of times past. Walter Cronkite hosted the series on CBS for four seasons. The show's concept was revived for a season in 1971 with Cronkite gearing the program toward children.

1951 - The temperature at Taylor Park Dam plunged to 60 degrees below zero, a record for the state of Colorado

1953- General Electric Theater premiered on TV. CBS's half-hour dramatic anthology series was hosted by Ronald Reagan (in between his movie and political careers). Making their television debuts were Joseph Cotten (1954); Fred MacMurray, James Stewart and Myrna Loy (1955); Bette Davis, Anne Baxter, Tony Curtis and Fred Astaire (1957); Sammy Davis, Jr (1958); and Gene Tierney (1960). Other memorable stars who appeared on the series include: Joan Crawford, Harry Belafonte, Rosalind Russell, Ernie Kovacs, the Marx Brothers and Nancy Davis Reagan, who starred with her husband in the premonitory episode titled "A Turkey for the President" (1958).

1954 - On CBS-TV, "The Secret Storm" was shown for the first day of a 20-year run.

1955--Elvis Presley records, "Baby, Let's Play House"

1956 -- Martin Luther King, Jr.'s Montgomery Improvement Association files suit in federal court against Alabama for segregation of buses.

1957--Birthday of Donna Adamek, known as "Mighty Mite", DA dominated women's professional bowling from 1978 through 1981.

She was Woman Bowler of the Year each year and, in that four-year period, she won the Women's Open in 1978 and 1981, the WIBC Queens in 1979 and 1980, and the WPBA National Championship in 1980. Adamek led the WPBA tour in winnings for three consecutive years, 1978 through 1980.

During the 1981-82 season, DA rolled three perfect 300 games. {{The compiler of WOAH whose highest average was 194 (287 game) remembers when ONE 300 GAME was memorable before the change in bowling ball construction and the way bowling lanes are dressed

1958-- Elvis Presley records: "My Wish Came True," "Doncha' Think It's Time," "Your Cheatin' Heart," "Wear My Ring Around Your Neck."

1960- Greensboro Sit-In. Commercial discrimination against blacks and other minorities provoked a nonviolent protest. At Greensboro, NC, four students from the Agricultural and Technical College (Ezell Blair, Jr, Franklin McCain, Joseph McNeill and David Richmond) sat down at a Woolworth's store lunch counter and ordered coffee. Refused service, they remained all day. The following days similar sit-ins took place at the Woolworth's' lunch counter. Before the week was over they were joined by a few white students. The protest spread rapidly, especially in southern states. More than 1,600 people were arrested before the year was over for participating in sit-ins. Civil rights for all became a cause for thousands of students and activists. In response, equal accommodation regardless of race became the rule at lunch counters, hotels and business establishments in thousands of places.

http://www.greensboro.com/sitins/media_headlines.htm

1960---Top Hits

Running Bear - Johnny Preston

Teen Angel - Mark Dinning

Where or When - Dion & The Belmonts

El Paso - Marty Robbins

1962 -- US: Ken Kesey's One Flew Over Cuckoo's Nest is published.

http://wild-bohemian.com/kesey.htm

1963-- Paul Simon graduates from New York City's Queens College.

1964- "I Want to Hold Your Hand" by the Beatles reached number one on the Billboard Hot 100 chart. It stayed there for seven weeks.

1964- The Beatles' "Please Please Me" enters the pop charts

1964-The governor of Indiana declared "Louie, Louie" pornographic. The song was about seven years old when the Kingsmen recorded their version in 1963, and the fantastic legend that grew up in its wake--a legend that even an FCC investigation couldn't kill--seems to have sprung solely from their extraordinary lack of elocution. Berry, who spoke on the subject a while back to a Los Angeles interviewer named Bill Reed, explains the song as the lament of a seafaring man, spoken to a sympathetic bartender named Louie. Here, without further ado, are the "official" published lyrics:

"Louie Louie, me gotta go. Louie Louie, me gotta go. A fine little girl, she wait for me. Me catch the ship across the sea. I sailed the ship all alone. I never think I'll make it home. Louie Louie, me gotta go . Three nights and days we sailed the sea. Me think of girl constantly. On the ship, I dream she there. I smell the rose in her hair. Louie Louie, me gotta go. Me see Jamaican moon above. It won't be long me see me love. Me take her in my arms and then I tell her I never leave again. Louie Louie, me gotta go." (By Richard Berry. Copyright 1957-1963 by Limax Music Inc.)

1966-The first Navy captain who was African-American was Thomas David Parham, Jr., of Newport News, VA, a Presbyterian chaplain, whose rank was raised from commander to captain.

1966-Bill Graham resigns as business manager of the San Francisco Mime Troupe in order to devote himself full-time to the business of acid rock concert promotion, initially at the Fillmore Auditorium.

1966--Birthday of soccer great Michelle Akers.

1967- the American Basketball Association (ABA) was born with 10 teams and George Mikan as commissioner in hits first season. The ABA lasted nine years before four teams, the Denver Nuggets, the Indiana Pacers, the New Jersey Nets and the San Antonio Spurs, were absorbed into the NBA.

1967-- The Beatles record "Sgt. Pepper's Lonely Hearts Club Band"

1968-DIX, DREW DENNIS Medal of Honor

Rank and Organization: Staff Sergeant, U.S. Army, U.S. Senior Advisor Group, IV Corps, Military Assistance Command. Place and date: Chau Doc Province, Republic of Vietnam, 31 January and 1 February 1968. Entered service at: Denver, Colo. Born: 14 December 1944, West Point, N.Y. Citation: For conspicuous gallantry and intrepidity in action at the risk of his life above and beyond the call of duty. S/Sgt. Dix distinguished himself by exceptional heroism while serving as a unit adviser. Two heavily armed Viet Cong battalions attacked the Province capital city of Chau Phu resulting in the complete breakdown and fragmentation of the defenses of the city. S/Sgt. Dix, with a patrol of Vietnamese soldiers, was recalled to assist in the defense of Chau Phu. Learning that a nurse was trapped in a house near the center of the city, S/Sgt. Dix organized a relief force, successfully rescued the nurse, and returned her to the safety of the Tactical Operations Center. Being informed of other trapped civilians within the city, S/Sgt. Dix voluntarily led another force to rescue 8 civilian employees located in a building which was under heavy mortar and small-arms fire. S/Sgt. Dix then returned to the center of the city. Upon approaching a building, he was subjected to intense automatic rifle and machine gun fire from an unknown number of Viet Cong. He personally assaulted the building, killing 6 Viet Cong, and rescuing 2 Filipinos. The following day S/Sgt. Dix, still on his own volition, assembled a 20-man force and though under intense enemy fire cleared the Viet Cong out of the hotel, theater, and other adjacent buildings within the city. During this portion of the attack, Army Republic of Vietnam soldiers inspired by the heroism and success of S/Sgt. Dix, rallied and commenced firing upon the Viet Cong. S/Sgt. Dix captured 20 prisoners, including a high ranking Viet Cong official. He then attacked enemy troops who had entered the residence of the Deputy Province Chief and was successful in rescuing the official's wife and children. S/Sgt. Dix's personal heroic actions resulted in 14 confirmed Viet Cong killed in action and possibly 25 more, the capture of 20 prisoners, 15 weapons, and the rescue of the 14 United States and free world civilians. The heroism of S/Sgt. Dix was in the highest tradition and reflects great credit upon the U.S. Army.

1968---Top Hits

Judy in Disguise (With Glasses) - John Fred & His Playboy Band

Chain of Fools - Aretha Franklin

Green Tambourine - The Lemon Pipers

Sing Me Back Home - Merle Haggard

1968- Green Bay Packers head coach Vince Lombardi resigned after nine seasons, five NFL titles and victories in the first two Super Bowls. Oddly enough, Green Bay's founding coach, Curly Lambeau, resigned on the same day in 1950 after 29 years on the job.

1968- Elvis Presley's only child, Lisa Marie, was born. Elvis and his wife, Priscilla, were married in Las Vegas the previous May. They were divorced in 1973.

1968 -The Jimi Hendrix ExperienceJohn Mayall and the Bluesbreakers, at the Fillmore Auditorium.

1969- Tommy Roe's "Dizzy" enters the pop charts

1969- Tommy James & the Shondells' "Crimson and Clover" hits #1.

1970-Timothy Leary sentenced to 10 years for Texas/Mex marijuana bust.

1971- The Love Story soundtrack album is certified gold.

1974- “Good Times” premiered on TV. A CBS spin-off from "Maude," which was a spin-off of "All in the Family." "Good Times" featured an African American family living in the housing projects of Chicago. The series portrayed the Evans family's struggles to improve their lot. The cast featured Esther Rolle and John Amos as Florida and James Evans, Jimmie Walker as son J.J., Bernadette Stanis as daughter Thelma, Ralph Carter as son Michael, Johnny Brown as janitor Mr. Bookman, Ja'Net DuBois as neighbor Willona Woods, Janet Jackson as Willona's adopted daughter Penny and Ben Powers as Thelma's husband, Keith Anderson.

1975- Neil Sedaka's "Laughter in the Rain" hits #1.

1976---Top Hits

Love Rollercoaster - Ohio Players

Love to Love You Baby - Donna Summer

You Sexy Thing - Hot Chocolate

This Time I've Hurt Her More Than She Loves Me - Conway Twitty

1978- the first postage stamp depicting an African-American woman was issued. It showed the likeness of Harriet Tubman, the escaped slave and abolitionist who led more than 300 slaves to freedom along the Underground Railroad.

1978- Bob Dylan's film "Renaldo and Clara," a documentary of the Rolling Thunder Revue tour mixed with surrealistic fantasy sequences, premieres in Los Angeles.

1979-Patty Hearst released from jail.

1982- "Late Night with David Letterman premiered..” This is when it all began: the stupid pet tricks, stupid human tricks and the legendary top ten lists. "Late Night" premiered on NBC as a talk/variety show appearing after "The Tonight Show with Johnny Carson." Host David Letterman was known for his irreverent sense of humor and daffy antics. The offbeat show attained cult status among college crowds and insomniacs, as many tuned in to see a Velcro-suited Letterman throw himself against a wall. The show also featured bandleader-sidekick Paul Shaffer, writer Chris Elliott and Calvert DeForest as geezer Larry "Bud" Melman. In 1993, Letterman made a highly publicized exit from NBC and began hosting "The Late Show" on CBS.

http://movies.yahoo.com/shop?d=hc&id=1800122204&cf=biog&intl=us

http://199.173.162.18/lateshow/topten/archive/

1984---Top Hits

Owner of a Lonely Heart - Yes

Karma Chameleon - Culture Club

Talking in Your Sleep - The Romantics

The Sound of Goodbye - Crystal Gayle

1985 -69ºF (-56ºC), Peter's Sink UT (state record)

1985 - Snow, sleet and ice glazed southern Tennessee and northern sections of Louisiana, Mississippi and Alabama. The winter storm produced up to eleven inches of sleet and ice in Lauderdale County AL, one of the worst storms of record for the state. All streets in Florence AL were closed for the first time of record

1987 - Terry Williams from Los Gatos, California, won the largest slot machine payoff, to that time, pocketing $4.9 million after getting four lucky 7s on a machine in Reno, Nevada.

1988 - Thirty cities in the eastern U.S. reported new record high temperatures for the date, including Richmond VA with a reading of 73 degrees. Thunderstorms in southern Louisiana deluged Basile with 12.34 inches of rain. Arctic cold gripped the north central U.S. Wolf Point MT reported a low of 32 degrees below zero

1989 - While arctic cold continued to invade the central U.S., fifty- four cities in the south central and eastern U.S. reported new record high temperatures for the date. Russell KS, the hot spot in the nation with a high of 84 degrees the previous day, reported a morning low of 12 above. Tioga ND reported a wind chill reading of 90 degrees below zero

1989- a Spokane, Washington, funeral director revealed that jazz saxophonist and pianist Billy Tipton, who had lived his life as a man, was a woman. Tipton played for years in the US northwest after a career with several big bands. He appeared to have a wife and adopted three sons.

1990---Top Hits

How Am I Supposed To Live Without You- Michael Bolton

Opposites Attract- Paula Abdul (Duet With The Wild Pair)

Downtown Train- Rod Stewart

Two To Make It Right- Seduction

1992 - United States President George Bush and Russian President Boris Yeltsin signed the Camp David declaration which states t hat their two countries no longer regard each other as adversaries

1992--Barry Bonds signs baseball's highest single year contract ($4.7 million)

1993- On Lisa Marie's 25th birthday, it was announced that she wouldn't be taking over her father's estate as provided in his will. Lisa Marie left management of Graceland and other parts of Elvis's multimillion-dollar estate to Jack Soden, head of Elvis Presley Enterprises.

1993-- First Lady Hillary Rodham Clinton is given an office in the West Wing of the White House and named January 25 to head a commission charged with creating a health plan for the nation. It is the most influential position a president's wife has ever had. she bans smoking in the White House February 1. Will she return in the next presidential election?

1995---Top Hits

Creep- TLC

On Bended Knee- Boyz II Men

Another Night- Real McCoy

Take A Bow- Madonna

2000---Top Hits

I Knew I Loved You- Savage Garden

What A Girl Wants- Christina Aguilera

Smooth- Santana Featuring Rob Thomas

Back At One- Brian McKnigh

2003- After a successful 16 day mission, the space shuttle Columbia, with a crew of seven, perished during entry. Kalpana Chawla, 41, emigrated to United States from India in 1980s and became an astronaut in 1994, was one of seven astronauts who died in an explosion that streaked across the Texas sky on a clear, beautiful morning .Laurel Clark, 41, a Navy diving medical officer aboard submarines, then flight surgeon who became an astronaut in 1996. On board Columbia to help with science experiments. Had 8-year-old son. Her home was in Racine, Wis. Commander Rick Husband, 45, Air Force colonel; Pilot William McCool, 41;.Payload commander Michael Anderson, 43; David Brown, 46, a Navy captain, pilot and doctor;Ilan Ramon, 48, a colonel in Israel's air force and the first Israeli in space.

2004--While New England Patriots beat the Carolina Panthers 32-29, it was singer Janet Jackson exposing her breast at half time with Justin Timberlake that made the big news. With just over one minute to play Adam Vinatieri kicked a 41-yard field goal to give New England the lead., 32-29, New England quarterback Tom Brady was named Most Valuable Player for the second time in three years. He set a Super Bowl record for the most pass completions (32). Brady also recorded a 66.7 completion percentage (48 pass attempts), 354 passing yards, 3 touchdowns, 1 interception, and 12 rushing yards. This was the fourth Super Bowl to be decided on a field goal in the final seconds. Super Bowl V was won on a last second kick by Jim O'Brien, Super Bowl XXV as Scott Norwood missed his field goal chance, and Super Bowl XXXVI as Adam Vinatieri made his.

2009- The Cardinals entered the game seeking their first NFL title since 1947, the longest championship drought in the league. The club became an unexpected winner during the season and the playoffs with the aid of head coach Ken Whisenhunt, who was the Steelers offensive coordinator during Super Bowl XL, and the re-emergence of quarterback Kurt Warner, who was the Super Bowl MVP in Super Bowl XXXIV with the St. Louis Rams. Trailing 20–7 at the start of the fourth quarter, Arizona scored 16 unanswered points, including wide receiver Larry Fitzgerald's 64-yard touchdown reception, to take the lead with 2:37 remaining in the game. But then the Steelers marched 78-yards to score on wide receiver Santonio Holmes's 6-yard game-winning touchdown catch with 35 seconds left. Holmes, who caught nine passes for 131 yards and a touchdown, including four receptions for 71 yards on that final game-winning drive 27 to 23.

Super Bowl XXXVI

2004 New England 32-Carolina 29

Super Bowl XLIII

2009 Pittsburgh Steelers 27 Arizona Cardinals 23

--------------------------------------------------------------

Super Bowl team records

* Most Super Bowl victories, 6

Pittsburgh Steelers (IX, X, XIII, XIV, XL, and XLIII)

* Most Super Bowl losses, 4 (tied)

Denver Broncos (XII, XXI, XXII, XXIV)

Buffalo Bills (XXV, XXVI, XXVII, XXVIII)

Minnesota Vikings (IV, VIII, IX, XI

* Most Super Bowl victories without a loss, 5

San Francisco 49ers (XVI, XIX, XXIII, XXIV, XXIX)

* Most Super Bowl Appearances, 8

Dallas Cowboys (V, VI, X, XII, XIII, XXVII, XXVIII, XXX)

* Most Numerous Matchup, 3

Pittsburgh Steelers vs. Dallas Cowboys (X, XIII, XXX)

--------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------