Friday, February 22, 2008

Headlines--- Archives--Who is John Estok? 02/26/2006 Inside Operation Lease Fleece: Part II---Monday ######## surrounding the article denotes it is a “press release”

----------------------------------------------------------------- Archives--Who is John Estok? 02/26/2006 IFC has been on a buying spree the last few years including Blue Dot Funding, Pioneer, First Portland, plus receiving good marks from its line where it has allegedly $9 million in NorVergence leases (and reportedly another $3 million in investor programs), plus recently announced renewal of its $75 million revolving credit facility with Autobahn Funding Company, LLC, an asset-backed commercial paper conduit sponsored by DZ Bank AG Deutsche Zentral-Genossenschaftsbank. The press release above basically says business couldn't be any better, and much of the success seems to be attributed to Mr. Estok, CLP, who reportedly expanded First Portland and is doing the same for IFC Credit in the “small ticket marketplace.” Who is he? First, he is a Certified Leasing Professional. He is one of 174 who passed the exam and has kept his certification current. This is a considered a prestigious designation in the leasing industry. While is title on e-mail and other documents is “Executive Vice-President”, IFC Credit Corporation, Morton Grove, Illinois, the IFC web site and in the above press release, he is listed as "President, Small Ticket Group. Perhaps he is both, executive VP of the corporation and president of the “division.” According to the biography on the web site, Mr. Estok, CLP, began in the leasing industry in 1972. It is assumed in Canada, although the time to 1985 is not stated. The biography notes he was president from 1984 to 1986 of the Equipment Lessors Association of Canada. He most likely served on the board prior to that. The California Finance and Leasing Association notes on its web site they were “...Established in September 1993 through the merger of the Canadian Automotive Leasing Association and the Equipment Lessors Association of Canada, with an initial membership of sixty-one.” The IFC Credit web site notes Mr. Estok, CLP, from 1985-1991, was executive vice president of Norex Leasing, Burlington, Canada . 1991-1995, President and CEO of Industrial Leasing Corporation of Portland, Oregon. 1995-96,Executive Vice President and COO of Hitachi Credit Canada Inc., in Mississauga, Canada. The press release above states, “After 15 years and recognizing that the name First Portland Corporation was being viewed increasingly as tied just to Portland, Oregon, the company registered its trademark FirstCorp in 1995. In 2003, First Portland Corporation was sold to IFC Credit Corporation, and IFC Credit has since continued to position its small ticket business under the FirstCorp brand.” The IFC Credit web site notes Mr. Estok in 1996, “... moved from his native Canada to join FIRSTCORP dba First Portland Corporation,” when it appears the company then gained national prominence in the small ticket market, according to the IFC Credit press release. February, the company had completed its acquisition of First Portland The Fall, 2003 IFC Credit Newsletter noted that John Estok had “…relocated to Morton Grove to lead IFC's operations, credit, collections, and IT staff.” He has recently made the Leasing News editions due primarily to the NorVergence lease mess. The Federal Trade Commission is looking further into the events, particularly after the results: “IFC's Lift Stay Motion (an attempt to obtain another 256 NorVergence Equipment Lease Agreements with a face value of approximately $15 Million on which they claimed that they obtained a security assignment from NorVergence and filed their UCC-1 on June 15, 2004), the Affidavit of John Estok in support of IFC's lift stay motion (where he acknowledges that the "matrix" boxes probably have no value without service included - which is why IFC did not seek to foreclose on the collateral "matrix" boxes, only the ERAs) Recently there are questions regarding whether perjury was committed in a case involving NorVergence leases in Texas. “The real issue with IFC's holdbacks is the filing of affidavits which lied about the amounts paid for the assignments. IFC filed affidavits in two different lawsuits which alleged that the entire assignment amount was paid, as opposed to the amounts which John Estok recently admitted in a deposition and in trial testimony to have been the amounts actually paid due to the holdbacks. The affidavit testimony was, therefore, perjury.” Mr. Estok, CLP, on February 14th asked “..48 hours to determine our response.” In all fairness, Rudolph Trebels wrote Leasing News it was not his company's policy to comment on matters in litigation, and perhaps that is why not response is forthcoming. It appears Leasing News readers will have to wait for court transcripts, as they are public documents or the final out come of these contested matters. (Note: The Federal Trade Commission (FTC) case against IFC Credit, Morton Grove, Illinois has been moved to the end of April, this year. Depositions and transcripts of Mr. Estok are part of FTC’s case -------------------------------------------------------------- Classified Ads---Sales Managers

For a full listing of all “job wanted” ads, please go to: To place a free “job wanted” ad here, please go to: -------------------------------------------------------------- Heritage Pacific Leasing for Sale

Leasing News reported that Ron Mitchell left Heritage Pacific Leasing, Fresno, California, at the end of November as well as others, thus the reason he joined Banclease Acceptance Corporation on January 10, 2008. In fact, the entire sales staff including Rick Gatelli, CLP, the president, and Charlie Litt, Senior Vice-President, were let go. Leasing News held the story as a courtesy to the participates until John Otto, the owner, CEO, confirmed that he has rejected an offer to sell the company to Rick Gatelli, CLP, Charlie Litt, and John He divested himself of his investment in Pentech Financial, Campbell, California, last year, he confirmed, and as readers know closed down Centerpoint Leasing after Gordon Roberts was convicted of theft. Otto was the major investor in the company. He had nothing but high compliments to make of the people who left in November, saying he wanted to get out of direct originations and was now more involved in buying portfolio’s, managing portfolio’s -------------------------------------------------------------- Paul Menzel, CLP, in American Banker: UCC's

Leasing News Person of the Year for 2005, Paul Menzel, CLP, now President LEAF Third Party Funding, formerly senior vice-president of Pacific Capital Bank, Santa Barbara, California. was quoted in the February, 2008 edition of American Banker magazine regarding using UCC's to call prospective leasing leads: "Paul Menzel, the president of Leaf Third Party Funding, a Santa Barbara unit of the asset-based lender Leaf Financial Corp., contends ‘that information from UCC filings can yield worthwhile leads. Just knowing the maturity date of business loans can make marketing more effective,’ he said. "'I think the leasing industry has been ahead of the curve in using UCC filings for marketing purposes,'" Mr. Menzel said. 'Aggressive and savvy banks can use this information to direct market to their competitors' customers'.” The American Banker article was titled "New Service Helps Lenders Track Competitors;" written by By Katie Kuehner-Hebert: "Bankers already monitor rivals' loan activity through Uniform Commercial Code filings, but with competition for commercial loans becoming increasingly fierce, a California data-mining company has developed a service that simplifies the act of surveillance. “LeaseLogic Inc. in Santa Barbara launched the California Community Bank Intelligence service last month. LeaseLogic e-mails subscribing banks a list of UCC filings that competitors made for business loan deals secured by equipment, inventory, or assets other than real estate. “The filings contain the names and contact information of the businesses that took out the loans. For an additional fee, banks can access LeaseLogic's database to read any loan documents attached to the filings, to get more detail on the terms. " ‘This service allows banks to target their competitors' customers, because they are oftentimes the most qualified prospects,’ said Benjamin Kennedy, the chief executive of LeaseLogic. ‘It also helps banks better know their market share and switch rate’." “So far half a dozen community banks are using the service on a trial basis, Mr. Kennedy said, though he would not name them. The service is restricted to UCC filings on loans made in California, but LeaseLogic plans a nationwide rollout within 12 to 18 months. “Scott Loux, a commercial loan pricing consultant with Sheshunoff & Co. Investment Banking in Austin, said that in a slowing economy, quality loans will get harder to find, so anything banks can use to get an advantage would be helpful. "’This will be one of those things that will take time to build momentum, though,’ because banks typically negotiate loan terms with borrowers, Mr. Loux said. ‘But the bank also has to make its profit, and part of that is helping the borrower understand the value the bank brings besides a bag of money, such as being a business adviser. This service can go hand in hand with that type of negotiation’ by giving banks an idea of how their competitors have negotiated deals. "’Once one or two banks do this, I think it will gain momentum, because banks will see that their competitors are looking at them,’ he said. David Taber, the CEO of the $574 million-asset American River Bankshares in Sacramento, said his lenders currently search manually through UCC filings by ZIP code to find commercial loan leads, so he would consider subscribing to this type of service, because it could speed things up. "’We never want to talk badly about our competition, but if we knew whether the competition was a big bank that requires customers to call an '800' number, then we might say, ‘Our CEO is right here, and here's his direct number should you ever need his services,’' ‘ Mr. Taber said. “Customers can get daily, weekly, or monthly reports, and the pricing depends on the number of lenders and counties monitored. For example, a bank that wanted to monitor 10 competitors in three counties for 12 months would pay about $4,470 for 260 reports, or $17.19 per daily report. The database access is $249 a month. “Thomas Hawker, the CEO of the $1.9 billion-asset Capital Corp. of the West in Merced, Calif., said such a service may not be necessary for all types of commercial lenders, since most find good leads with more conventional methods (such as attending local chamber of commerce events), which also give them better opportunities to foster relationships..." Here is the "lead generation" web site for Leaselogic:

-------------------------------------------------------------- Capital Stream sold for $40 million to India company

Capital Stream, 2/08 HCL Technologies, based in India, purchases CapitalStream for $40 million cash (1/04) " a leader in front office automation solutions for commercial and equipment finance operations, today announced that it has acquired CapitalThinking Inc., a leading vendor of process automation and risk management software products for the commercial lending and commercial mortgage industry. The combined companies will continue operating under the CapitalStream name,” stated the press release.(8/03) Loses bid to purchase Decision Systems/IDS-USA. (8/03) John Kruse, Jim Brady, Cliff Monlux Open New Company: MAINSTREET FINANCE. Kruse and Monlux were original founders of CapitalStream, originally System 1 and Capital Advantage (6/03) Raises money for acquisitions, first move is to Buy Decision Systems International American operation. (1/2003) John Kruse has left the building. (10/2002) Corporate take-over by Wired Capital, complete new management team and officers, John Kruse now "salesman." For a full story click here (3/2002) Steve Campbell Resigns as CEO, (8/2001) John Kruse, VP, Account Development, announces another reduction of staff as "... precautionary measures because we don't see an immediate resolution to the economic downturn. We still remain financially healthy, and believe that reducing our capacity is a prudent business decision." Hal Hayden, Jim Buckles, Randy Anderson, many sales people gone. Leasing News, The list Full press release from HCL on the purchase:

--------------------------------------------------------------

Leasing Industry Help Wanted Broker Relations Manager

Controller

Lease Officer

Senior Credit Analyst

--------------------------------------------------------------

-------------------------------------------------------------- Housing Starts hold their own, permits slip by Al Schuler, US Department of Agriculture

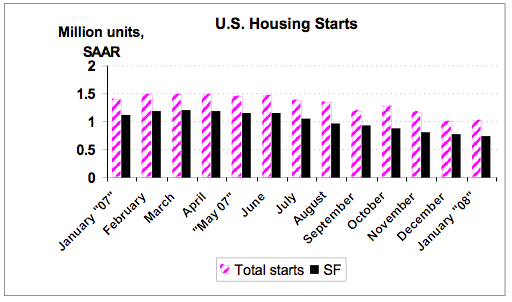

January housing starts increased 0.8%, to 1.012 million (SAAR). The increase in total starts was due to the strength in multi family housing, which was up 22%, while single family activity fell 5.2% to 0.743 million (SAAR).

Regionally, starts were split, down 2.9% in the South and down 9.8% in the West while starts were up 18.9% in the NE and up 12% in the Midwest. Permits continue to slide, down 3% to 1.048 million (SAAR), the slowest pace in fifteen years.

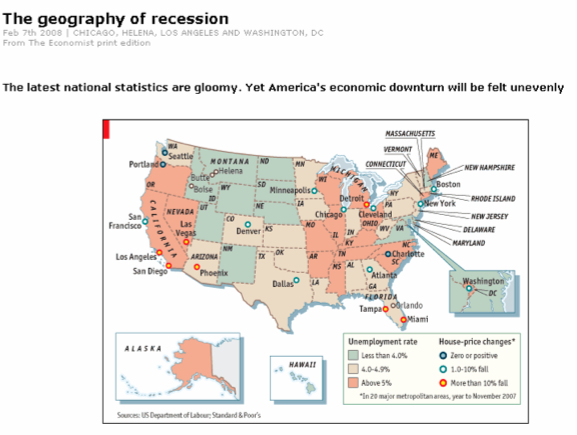

The thing about recessions is that by the time a recession is declared “official”, we are out of the recession. I.e., reliable data to indicate two successive quarters of GDP contraction – the official metric for a recession – is available only with a 3 – 6 month lag. And, even if we’re in recession, it should be short (2 or maybe 3 quarters, as exports are doing fine, thanks to the weaker dollar; employment is still decent; and consumer spending remains relatively healthy). Something good may come from a brief recession too – recently, consumer spending has grown to 70% of our economy compared with an average of 62% during the 1980 – 2000 periods. Too much weight was being placed on the American consumer in my opinion. The economy would be more stable with better balance between the consumer, government spending, net exports, and investment spending. Here is a great graph from the Economist magazine (February 7, 2008) showing that the impact of a recession is felt differently based on your geography. If national data says we’re in recession, chances are that half of the country will be doing fine.

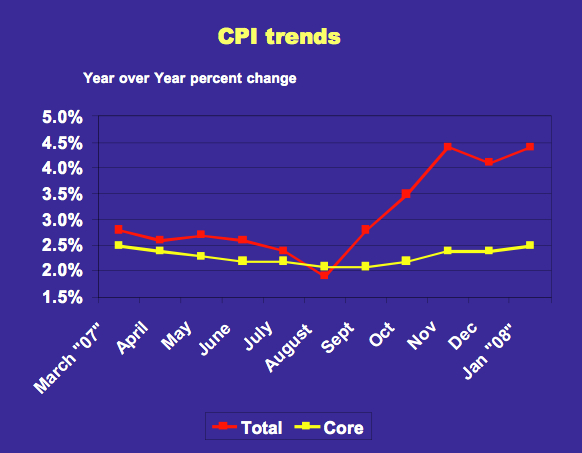

One more comment on the economy – today’s CPI inflation report was not good. The chart below shows consumer inflation trends over the past 10 months. Although core inflation (less food and energy) is still tame, overall inflation trends are disturbing. This may present problems for the Fed when they consider further rate cuts.

Let’s get back to housing. Inventories are still way too high and one of the problems is the relationship between home prices and incomes. I updated the chart below with 2007 data, and it shows that there is still a large gap between home prices and incomes. That gap has to shrink if the population of potential home buyers is to increase enough to bring inventories down to a level where builders start building again.

To end on a positive note – the financial markets are in a mess – the subprime problems are expanding – 1st, it was the borrowers (you and me), then the lenders, and now the mortgage insurers are in trouble. The industry is making some progress on each front, but it will take time because nobody likes to lose money. But, to get out of this mess, some people (e.g., financial sector) are going to have to lose money – lots of money – that’s what happens when we have “bubbles”. That goes for home owners too - once the home prices come down to reality (where homes are affordable to potential buyers), the housing mess will right itself. And, hopefully, that should happen by the end of 2008, and this should provide a good basis for some rebuilding of the market in 2009. --------------------------------------------------------------- Continued Housing Market Distress Causes Fourth Quarter Loss for Thrift Industry

Washington, D.C. — The thrift industry posted a record loss of $5.24 billion for the fourth quarter of 2007, as institutions responded to a downturn in the housing market by taking write-downs, recording restructuring costs and setting aside record levels of provisions for anticipated loan losses, the Office of Thrift Supervision (OTS) reported today. "These are difficult economic times and I expect our thrifts to continue to bolster reserves appropriately for the loan losses anticipated in 2008," said OTS Director John Reich. “The provisions in the third and fourth quarters of 2007 will position our thrifts for these events,” he said. “The bottom line, as performance this quarter shows, is that the economic distress in the mortgage market is an earnings issue and not a capital issue for our industry.” About $4 billion of the overall loss resulted from a write-down by a few thrifts in goodwill, necessary to recognize the reduced value of acquired assets. Another $2.2 billion loss was due to a restructuring charge by a single institution. Income offset those losses in part. Other highlights include: During the fourth quarter of 2007, thrifts set aside $5.1 billion in loan loss provisions, or 1.35 percent of average assets. That’s up from 0.92 percent ($3.5 billion) in the previous quarter and 0.45 percent ($1.6 billion) in the fourth quarter one year ago. For the year, loan loss provisions totaled $11.3 billion, or 0.75 percent of average assets, compared with $3.8 billion in 2006, or 0.25 percent of average assets. Equity capital at the end of 2007 was 9.46 percent of assets, down from 10.72 percent one year ago and 10.16 percent in the third quarter of 2007. At the end of the year, 99 percent of the industry exceeded well-capitalized standards. Net income was $2.87 billion for the year, down from $15.85 billion in 2006. In the fourth quarter of 2007, the net loss of $5.24 billion was down from net income of $657 million in the third quarter and net income of $3.14 billion in the fourth quarter a year ago. Profitability, as measured by return on average assets (ROA), was 0.19 percent for the year, down from 1.06 percent in 2006. In the fourth quarter of 2007, ROA was a negative 1.38 percent, down from 0.17 percent in the third quarter and 0.89 percent in the fourth quarter a year ago. Troubled assets (noncurrent loans and repossessed assets) were 1.65 percent of assets, up from 1.19 percent in the third quarter and 0.70 percent a year ago. OTS supervised 826 thrifts at the end of the fourth quarter. Industry assets were $1.51 trillion, an increase of seven percent for the year. OTS also supervised 475 holding company enterprises with approximately $8.5 trillion in U.S. domiciled consolidated assets. More details, as well as charts and selected indicators, are available on the OTS website at www.ots.treas.gov. ### Press Release ########################### National Vehicle Leasing Association Announces Executive Level Training Program

SAN FRANCISCO---The National Vehicle Leasing Association (NVLA) announced that its Certified Vehicle Lease Executive (CVLE) training program course in Legal and Legislative Issues and the Vehicle Lessor will be held April 24th – 27th, 2008 in San Francisco California at the prestigious Marines’ Memorial Club & Hotel. The Legal and Legislative Issues section of the CVLE program will cover Regulation M, doing business as a foreign Corporation, bankruptcy, collection issues and compliance. This course is designed for leasing company executives and will help protect your business interests with compliance obligation techniques. Attendees will learn valuable procedures for dealing with lessee bankruptcies and a full understanding of Regulation M. The course will help to: 1. Enhance the skills of company principals and management to direct a successful operation. The main presenters for this CVLE session are: Cary Boyden, Esq. Cary Boyden of Davis, California is a graduate of Harvard College and the Georgetown Law Center. His experience in the leasing industry dates back to 1972, when he joined the legal staff of United States Leasing International with responsibilities both in the vehicle and equipment leasing areas. From 1974 to 1977, he served as vice president and general counsel for the Crocker McAllister Companies. Boyden entered into private practice in 1977, and in 1978 became a partner in the Sacramento firm of Boyden, Cooluris, Hauser & Saxe. Boyden is a highly respected name in the vehicle leasing industry. He has been General Counsel for the National Vehicle Leasing Association since 1977, and in 1988 was the recipient of the NVLA’s Samuel Lee Memorial Award given to an individual for lifetime achievement in the vehicle leasing industry. Boyden is the author of an article in NVLA’s Vehicle Leasing Today and a section of a text entitled Foundations of Leasing. Cary Boyden has instructed this class in legal and legislative issues since 1985 and honors students with his working knowledge of their specific needs. Michael Benoit Michael Benoit is a partner in the Washington, DC office of Hudson Cook, LLP. He advises banks, sales finance companies, auto leasing companies, mortgage lenders, auto dealers, and other creditors and technology providers on a wide range of consumer financial services law, including the Truth In Lending Act and Regulation Z, the Consumer Leasing Act and Regulation M, the Equal Credit Opportunity Act and Regulation B, the Fair Credit Reporting Act, the Gramm-Leach-Bliley Act, the Electronic Signatures in Global and National Commerce Act, the Uniform Electronic Transactions Act and the USA Patriot Act. In addition, his practice covers matters involving federal and state laws relating to electronic commerce and online lending, privacy, fair lending, telemarketing, personal and real property financing, and leasing and collection practices. He began his practice in the Cleveland, Ohio firm of Benesch, Friedlander, Coplan & Aronoff, LLP in 1993, and joined Hudson Cook, LLP 4 years later. In 2005 and 2006, he was the Executive Vice President, Chief Legal Officer and Corporate Secretary of Mavent Inc. in Irvine, California, a technology company that provides automated compliance services to the mortgage industry. He rejoined Hudson Cook, LLP in September 2006. Michael holds a Bachelor of Music degree from the University of Miami in Coral Gables, Florida, and a Master of Music degree from the University of Michigan in Ann Arbor, Michigan. After working for several years as a symphony musician and deciding that a better retirement plan was in order, he obtained his law degree, cum laude, from the Case Western Reserve School of Law in Cleveland, Ohio. Ofer M. Grossman Ofer Grossman of Glass and Goldberg is a graduate of Cornell University (1987) with a Bachelor of Arts Degree in Chemistry. He graduated from Boston University School of Law, cum laude, in 1991. Ofer specializes in the areas of equipment leasing, vehicle leasing and secured transactions, real estate transactions, bankruptcy and commercial collections. Ofer has been a contribution author to the United Association of Equipment Lessors Legal Line, the Equipment Leasing Association’s Leasing Law, and has presented for the legal portion of the Equipment Leasing Association’s Principles’ of Leasing Workshop in California. He is a member of the California State Bar, Los Angeles County Bar Association and Equipment Leasing Association, as well as the NVLA. His practice areas are creditors’ rights, bankruptcy, secured transactions, real estate transactions, uniform commercial code, collections and repossessions, and loan workouts. This weekend-long seminar is part of a continuing cycle of seminars which provide the attendee with a solid understanding of the complex issues currently surfacing within the leasing industry and what issues may affect the leasing industry in the future. The CVLE program is just one course of study offered by the NVLA. This program consists of four individual sections of study and is designed for the lessor executive. NVLA also offers a Certified Vehicle Leasing Administrator (CVLA) program online at http://www.NVLA.org. Who should attend? This course is designed for those with corporate management responsibilities and anyone involved in the auto leasing business, including: independent leasing companies, banks, credit unions, vehicle manufacturers, dealers, industry suppliers, legal services and government agencies. About the Certified Vehicle Leasing Executive Program (CVLE) The Certified Vehicle Leasing Executive Program of the NVLA provides upper level vehicle leasing industry management and business owners with hands-on experience and tools to further their success. The prestigious CVLE designation, first awarded in 1985, is earned through the completion of four course sessions over a two-year period, and is only awarded upon the successful completion of all four sessions of study and requisite exams. Currently there are 222 CVLE graduates at work in North America. For more information on the National Vehicle Leasing Association, contact NVLA headquarters at 800.225.NVLA, or info@nvla.org, or visit the NVLA website at www.NVLA.org. About the National Vehicle Leasing Association (NVLA) For 2008, the NVLA is celebrating its 40th Anniversary. NVLA provides educational opportunities, promotes responsible legislation and communicates with members regarding developments and trends in vehicle leasing. NVLA promotes the independent leasing industry while encouraging the highest ethical and professional standards.

### Press Release ###########################

by Christopher Menkin “Roy Williamson” (This is fiction; all names, places, circumstances are fictional.) This was a serious discussion. It was not an after 5pm get together, Frank had a blue-black leather sofa and large matching blue-black His office did have piles of paper all around, but like many accountant or attorneys’ offices, the piles were neatly stacked, seeming organized. His office with the expensive early maps of the San Francisco peninsula and Santa Clara Valley on the wall, would have been more impressive if not for all the clutter, even though in neat piles. He had a lot of things going on, and cared enough to keep them in sight until a decision was made. This late morning Larry was surprised not to see as much clutter What went through Larry’s mind was whether this was going to Frank owned the building and Larry was a tenant, building computers Frank was not smoking, something his wife would have been proud, “I had a visit from Roy Williamson yesterday, “he said. “He gave Larry quickly sat down in the dark-blue leather chair, listening to what “It seems AT&T has closed down their leasing operation. It seems “How’s he going to do that?” “Bring in the lease broker business.” “I thought we decided against that, as we also broker deals “Williamson is high ticket. He has a proven track record. He wouldn’t “He says we are not organized, don’t have any other salesmen, Larry moved around in his chair. He was not comfortable. He and Frank were partners in San Francisco Valley Leasing, 50-50. As the business grew, they found independent leasing companies They both liked the leasing business and were doing more and “So what does Williamson want?” “I never got that far with him, “ Frank answered. “He is really “I don’t know, Frank. He may want to become a partner. I don’t “He didn’t say anything about becoming a partner.” “He has been sales manager, a salesman, knows how to do “How do you know that?” “Once a salesman stops being a salesman and becomes a manager, “Larry, you weren’t even here when he made his pitch.” “You just described it to me. When a salesman learns he controls “Larry, give me a break. The guy is talented for sure, and I believe “ He’s presidential material. He wants to be a partner. In fact, “How big do you want to grow?” “I don’t want to groom brokers, teach them what we know, so “Larry, if he gets a piece of the action, Williamson won’t leave.” “There you said it! If he gets a piece of the action. You know “Larry, he doesn’t need us.” “And we don’t need him!” “This is a great opportunity...” “I don’t want the two of you ganging up on me,” Larry shot back. Frank knew Larry had made up his mind. Cal was going to beat “You’re mind is made up?” Frank asked. Larry shook his head yes, saying not a word. Frank told Larry he would call Williamson and let him know San Francisco Valley Leasing didn’t have a program that fit what he was looking for. --- History perhaps proved Larry right, as Williamson went on to form (This series appears every other Friday. For previous short stories, ----------------------------------------------------------------

News Briefs---- Expect food prices to keep rising, industry says U.S. economic slowdown beginning to look like eve of past recession, group says http://www.signonsandiego.com/news/business/20080221-1349-economy.html First Four out of American Idol: Garrett Haley, Amy Davis, Joanne Borgella, Colton Berry ----------------------------------------------------------------

California Nuts Briefs--- Schwarzenegger Pitches California Food and Wine ----------------------------------------------------------------

“Gimme that Wine” Cheers! France's wine industry has record year in 2007 Sonoma County introduces Vineyard Walking Tours E. & J. Gallo Winery Proudly Toasts 75 Years of Winemaking Excellence and Family Tradition Changes coming to world wine map Wine Prices by vintage ----------------------------------------------------------------

Calendar Events This Day Be Humble Day George Washington's Birthday International World Thinking Day Saint Lucia: Independence Day Teddy Bear Day Walking the Dog Day Saint feast Days

http://www.catholic.org/saints/f_day/feb.php ----------------------------------------------------------------

In 1926, when a Los Angeles restaurant owner with the all-American name of Bob Cobb was looking for a way to use up leftovers, he threw together some avocado, celery, tomato, chives, watercress, hard-boiled eggs, chicken, bacon, and Roquefort cheese, and named it after himself: Cobb salad.

----------------------------------------------------------------

Today's Top Event in History 1879- Frank Woolworth opened his first store at Utica, New York. The store was a great disappointment as it's sales after a few weeks were as low as $2.50 a day. Woolworth moved his store in June 1879 to Lancaster, PA, where it proved a success. He came up with the idea for a five-cent store on September 24,1878, in Watertown, NY, when he originated a “five-cent table” in the store of Moore and Smith during the week of the county fair. The first joint venture of the Woolworth brothers in Harrisburg, PA, was called the “Great 5 Cent Store.” In 1997, the closing of the chain was announced. Macy's, Montgomery Ward, K-Mart, the White House, among others have filed bankruptcy as Wal-Mart and Costco's have changed the "department store" business. [headlines]

This Day in American History 1616-A smallpox epidemic among Indians relieved future New England colonies of the threat of major hostilities with the Indians. The tribes from the Penobscot River in Maine to Narragansett Bay in Rhode Island were virtually destroyed. It was not the white man that defeated the American natives but the diseases they brought with them from the old world. -------------------------------------------------------------- Winter Poem

-------------------------------------------------------------- SuDoku The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler? http://leasingnews.org/Soduku/soduko-main.htm -------------------------------------------------------------- Daily Puzzle How to play: Refresh for current date: --------------------------------------------------------------

http://www.gasbuddy.com/ -------------------------------------------------------------- Provence, France-Vacation http://le-monastier.site.voila.fr/ -------------------------------------------------------------- News on Line---Internet Newspapers Lancaster, PA http://news.lancasteronline.com/2 -------------------------------- |

||||||||||||||||||||||||||

Independent, unbiased and fair news about the Leasing Industry. |

||||||||||||||||||||||||||

Ten Top Stories each week chosen by readers (click here) |

||||||||||||||||||||||||||

Cartoons |

||||||||||||||||||||||||||

Editorials (click here) |

||||||||||||||||||||||||||

|

||||||||||||||||||||||||||

|

||||||||||||||||||||||||||

|