|

Position available for experienced salesperson to solicit direct business for equipment & vehicle leasing company located in Maryland. Madison Capital provides lease financing nationwide, in Canada and Puerto Rico Call either Nancy Pistorio (800.733.5529 ext 7325) or Allan Levine (800.733.5529 ext 7337) About the Company: We are a direct funding source for most types of equipment and all makes of vehicles. We have brokerage capability and experience for equipment transactions up to $10,000,000. |

Friday, February 27, 2009

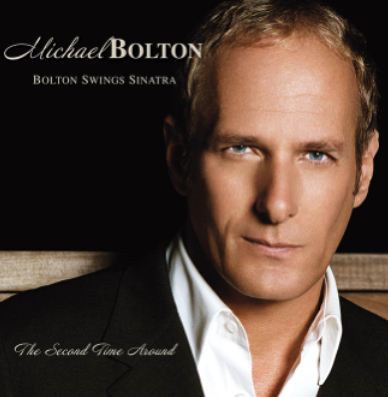

| Singer/Songwriter Michael Bolton, born Michael Bolotin on February 26, 1953 New Haven, Connecticut. He started out in a hard metal band opening for Ozzie Osborne concerts. His achievements include selling 53 million albums, eight top ten albums, two number one singles on the Billboard charts, and awards from both the American Music Awards and Grammy Awards. http://www.michaelbolton.com/ |

Headlines---

Enterprising Capital Partners, Inc. dba

Enterprise Leasing, Spokane, Washington

Bulletin Board Complaint

Classified Ads--- Legal

Leasing Business really not that Bad

by Christopher Menkin

Steve Reid's advice to graduating finance major

Classified Ads---Help Wanted

Leasing Law after NorVergence

Classified ads— Lease Portfolio/Legal

Ask Andrew--- Variable or Fixed Rate

Leasing Association Events-Meetings Open to All

Steve Chriest’s View from the Top

“The Hungry Bulldog”

Two Lovers/Gomorrah/What Just Happened

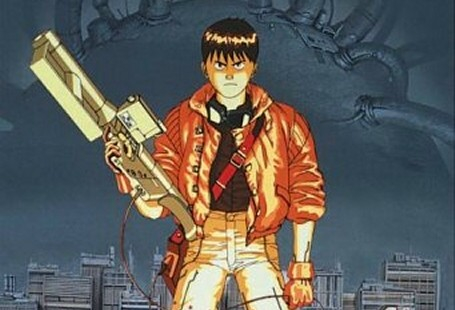

Akira/Hunger--new movies/DVD

Fernando’s View by Fernando F. Croce

Marlin to tell all March 10, 9:00am

Insured Banks and Thrifts Lost $26.2 Billion

Problem List grew 171 to 252 institutions

FDIC Closes on a $1.45B Distressed Loans

U.S. Is Said to Agree to Raise Stake in Citigroup

Investors Overlook Dell's Down Quarter

John Deere's sales declined 25% 1st Quarter

'Consumer Reports' puts Chrysler, GM in bottom spots

Jobless claims jump, durable goods orders plunge

Citizens loses $929m as bad loans proliferate

Franchise Man of the Year---Edible Arrangements

Freddie Mac investigates self over lobby campaign

Elie Wiesel Levels Scorn at Madoff

'American Idol' chooses 3 more finalists

News Briefs---

You May have Missed---

Sports Briefs---

"Gimme that Wine"

Today's Top Event in History

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

|

-------------------------------------------------------------------

Enterprising Capital Partners, Inc. dba

Enterprise Leasing, Spokane, Washington

Bulletin Board Complaint

by Christopher Menkin

Enterprising Capital Partners, Inc. dba Enterprise Capital, Spokane, Washington

The 2004 Journal of Business, Spokane, Washington identifies Kevin Michael Cunningham as "managing director" of a 35 sales and support company. February 10th, 2009, Dave Pitman, First Lake Capitol & Funding Group said the company was not funding leases or paying commissions.

In a telephone conversation with Mr. Cunningham, he admitted to having warehouse loan problems, funding problems, but was working his way out of the situation and said he had only two leases not funding, perhaps a third, which he said was a "paperwork problem." He assured me all the brokers would be paid their commissions. He wanted to know the name of the two brokers I spoke with. I told him it was not our policy to divulge names without permission.

Kevin Michael Cunningham, Managing Director

(photo: Journal of Business, Spokane, Washington)

Since it was only two, and Mr. Cunningham said he was working his way out of this, I told him I didn't see a story as Leasing News would prefer the company to succeed. I reported back to Dave Pitman on the conversation. He responded by email:

"Thanks for looking into this I got a call from their Rep (saul solman) stating they were now not going to pay me due to the fact that I alerted Leasing News. I did not lie when ask if I had called leasing News.

"Kit, I was not using Leasing News to collect my commission, I only wanted to let the broker community be aware of Enterprise Capitol Leasing Partners ability to pay commissions as you know when this happens and you are lied to, the next action could be non-payment of invoices etc. as I had several brokers call me and ask if what I knew about them so it appears they are still marketing to brokers, and in these times they are a lot of brokers who could not be aware of their not paying commission.

"I would guess he could not name any brokers he has paid commissions to in the last 90 days.

"Again thanks for your effort.

"Dave Pitman."

I went further and spoke with Saul Saloman, who I was informed by Dave is the Marketing Representative that was working the S/E out of Atlanta,770-452-0918, as I specifically did not want to see a repercussion that the broker would not be paid because he spoke with Leasing News. He said Kevin Cunningham told him not to give Dave Pitman a commission. I told him if the broker was not paid, then there was a legitimate complaint for Leasing News.

I also informed Mr. Cunningham that if the broker was not paid his commission, it was a legitimate complaint for Leasing News.

End of the month brought this bad news from Dave:

"Regarding our correspondence earlier this month I just thought that you should know that Saul Solmon, their rep in Atlanta, Ga resigned as of yesterday. He informed me of this today when I called to inquire about commission due. He said that he had not received any compensation from Enterprise leasing Partners. He also stated that it was more that 2 brokers that had not been paid. He words were a lot more!!

"Dave Pitman"

Mr. Solaman (spelling?) did not return the telephone call.

Enterprising Capital Partners, Inc. dba Enterprise Capital on their web site to be members of the United Association of Equipment Leasing. The association is now the National Equipment Finance Association (NEFA). Leasing News was told NEFA doesn't yet have the membership list yet on the website. Whether Enterprise Capital is or is not a member of NEFA was not verified.

Article on Enterprise Capital Partners:

http://leasingnews.org/PDF/EnterprisingCap_big_future.pdf

-------------------------------------------------------------

Classified Ads--- Legal

|

San Diego , CA |

| Birmingham, Alabama The lawyers of Marks & Weinberg, P.C. have over 30 years experience in dealing with virtually every type of equipment financing and are recognized throughout the industry for prompt, practical solutions and exemplary service. They offer cost-conscious, effective lease enforcement and good counsel. Email: Barry@leaselawyer.com Website: www.leaselawyers.com |

California, National: city: Riverside Ellen Stern - get results, reasonable pricing; numerous industry contacts, nearly 30 yrs exp.in SoCal, 20 yrs equip.: CFL license specialist, documentation, work-outs, litigated collections, recoveries; deal-maker. Email: leaselaw@msn.com |

||

|

Connecticut, Southern New England: EVANS, FELDMAN & BOYER, LLC Collections, litigation, documentation, portfolio sales and financing, bankruptcy. We represent many of the national and local leasing companies doing business in this state. Past chairman EAEL legal committee. Competitive rates. email: rcfeldman@snet.net |

||

| Los Angeles, Southern CA Seasoned attorney representing secured creditors in auto finance and truck/equipment lease industry. Bankruptcy and State Court litigation. Vincent V. Frounjian (818) 990-0605 or email: vvf@pacbell.net. |

Encino, California: Statewide “ELFA” |

||

Los Angeles, Statewide: CA. "ELFA" Aggressive creditors rights law firm specializing in equipment leasing handling collection matters on a contingency, fixed fee or hourly cbasis. email:RGarwacki@prodigy.net |

Los Angeles -statewide: CA "ELFA" |

||

Long Beach, CA |

Long Beach CA. |

||

| Law Firm - Service, Dallas, TX. "ELFA" Mayer regularly practices in leasing, secured financing, project development and finance and corporate finance. email: dmayer@pattonboggs.com Website: www.pattonboggs.com |

National: Coston & Rademacher: Business attorneys serving the lease-finance industry since 1980. Transactional, documentation, corporate/finance, workouts, litigation, bankruptcy, portfolio management. Chicago-based national practice. Jim Coston, CLP (Members: ELFA, NEFA). |

||

| St. Louis County , MO. - statewide: Schultz & Associates LLP., collections, negotiation, and litigation. Also register and pursue recovery on foreign judgments. Contingency and reasonable hourly rates. Ronald J. Eisenberg, Esq. (636) 537-4645 x108 reisenberg@sl-lawyers.com www.sl-lawyers.com |

Westport, CT: We represent finance companies, banks, lessors, etc., in replevins/seizures, collections and bankruptcy matters in Connecticut and New York. Flat fee, contingency and hourly rates. Email: rchinitz@replevinlawyer.com |

For a full listing of all “job wanted” ads, please go to:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

To place a free “job wanted” Leasing News ad:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

ELFA Career Center: Job Seekers (free):

http://careers.elfaonline.org/search.cfm

--------------------------------------------------------------

Leasing Business really not that Bad

by Christopher Menkin

The new business volume recorded by the Equipment Leasing and Financial Association (ELFA) MLF-25 report actually started falling in October, 2008. September it was $6.8 billion, October $6.4 billion and November $4.3 billion. January it was $4.3 billion. The anomaly happens every December when the volume almost doubles, most likely due to some very large leases from those on the list.

Overall, ELFA still considers the industry to be the "$650 billion equipment finance sector," and in reality, we are not doing as poorly as many other sectors in the United States. (Please see Steve

Reid’s comments in the story that follows. editor)

In comparing January to the four quarters of last year, the overall business volume is stable compared to other industries. January is down from the previous year, 2008, $5.9 billion to this year $4.3 billion. The December, 2008 to January, 2009 month to month comparison of 50.6% does not give a fair picture compared to the quarters of the previous year. The industry in comparison to others making the headlines is not doing as badly, in fact, most likely doing much better than most. Investors should be buying more stocks in leasing companies, making more investments in performing companies. Yes, business is down, but not doing as poorly as many others in today’s marketplace. The leasing industry has a lot to be thankful for, including the positive information provided by ELFA and the Equipment Leasing and Finance Foundation.

Perhaps the most telling of the statistics are the credit approval ratios of all decisions submitted, as there solid evidence of more due diligence and higher standards, a major change in the industry:

“Credit policies and procedures have and will continue to be tested as will the integrity of business models,” observed Kenneth R. Collins, Jr., Chairman and CEO of Susquehanna Commercial Finance, Inc., located in Pottstown, PA, whose company participates in the MLFI. Collins is also ELFA’s chairman-elect.

“We expect credit quality to continue to deteriorate through the second quarter of 2009 and that a number of weaker segments such as transportation, construction and some small businesses that have been surviving on dwindling cash reserves, could be culled by this recession, " he said. " This perception could also lead to declines in overall new business as qualified financing candidates considering capital investments remain sidelined by uncertainty that the economy will stabilize or improve any time soon.”

Aging of Receivables over 30 days was up. Collins remarked,” Although liquidity continues to be a key factor, the focus for many companies is improving the management of their receivables and finding ways to maintain recoveries in an environment where equipment values are rapidly declining."

“Our sector continues to suffer from lack of liquidity and declining demand due to the domestic and global recession,” said ELFA President, Hon. Kenneth E. Bentsen, Jr.

“At the same time, credit quality of our asset class, while showing some signs of deterioration, continues to outperform peers, “Bentsen said. “However, until businesses regain confidence that we’ve reached bottom, and financial markets return to some sense of normalcy, we can expect a continued downward trend in new business originations, further undermining the long-term growth potential of the U.S. economy.”

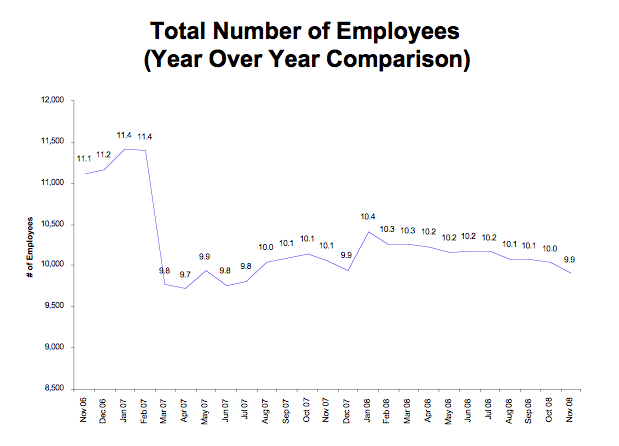

Employment figures are confusing, as the current chart being used does not match the chart used in 2008.* Leasing News asked for an explanation, but did not receive one. Used here is the 2008 chart in comparison to January, 2009.

It is interesting to note there are 25 less leasing companies than the previous year. The MLFI-25 list has four who were not on the January, 2008 list:

Dell Financial Services

Fifth Third Bank

Susquehanna Commercial Finance, Inc.

Tygris Vendor Finance

In addition, the MFLI-25 is 26, as it was on January, 2008.

To set the record straight, the MFLI-25 is a very valuable indicator of business, as well as getting excellent publicity for the leasing industry. It takes a lot of work to get all these company statistics

available. My only conflict is the employment statistics.

The employment reporting is quite a contrast compared to the daily reporting of letting employees go, leasing companies merging or cutting back, as well as the ZRG Partners statistics.

ELFA MLFI-25 January, 2009 Charts:

http://leasingnews.org/PDF/Jan_2009_MLFI_Charts.pdf

* November, 2008 Employment chart

ELFA members reporting:

ADP Credit Corporation

Bank of America

Bank of the West

Canon Financial Services

Caterpillar Financial Services Corporation

CIT

De Lage Landen Financial Services

Dell Financial Services

Fifth Third Bank

First American Equipment Finance

GreatAmerica

Hitachi Credit America

HP Financial Services

John Deere Credit Corporation

Key Equipment Finance

Marlin Leasing Corporation

National City Commercial Corp.

RBS Asset Finance

Regions Equipment Finance

Siemens Financial Services

Susquehanna Commercial Finance, Inc.

US Bancorp

Tygris Vendor Finance

Verizon Capital Corp

Volvo Financial Services

Wells Fargo Equipment Finance

Monthly Survey Archive:

http://www.leasingnews.org/Conscious-Top%20Stories/ELFA-Survey.htm

--------------------------------------------------------------

Steve Reid's advice to graduating finance major

Steve Reid, CLP

714-788-6407

oc49ersteve@sbcglobal.net

Currently unemployed, Steve Reid, CLP is the former Marketing Manager/VP of Marketing for LEAF, Third Party Funding/Santa Barbara Bank & Trust since 1989. He started in leasing in 1982 working for Ron Wagner at the original Heritage Leasing Corp. Prior to entering the leasing industry, Steve spent nine years selling computer system for various companies such as Burroughs and Wang Laboratories. This is where he got his first exposure to leasing as he utilized it in the sale of computer systems.

He has served on the United Association of Equipment Leasing Board of Directors and since February 5, 2004, the Leasing News Advisory Board.

Q. What advice would you give to a graduating finance major looking for a job in May or June of 2009?

"A. Initially, considering my current status, I would have said unequivocally no, but after reconsidering and giving this some thought I would say definitely yes. Looking back on the 25+ years in the leasing industry, I thought about the individuals I have meet, the ones who hired me, my fellow employees, (some close to 20 years at SBBT) the many brokers and lessors who were my customers, and my friendly competitors. I would not have wanted to miss the friendships and relationships that have developed, the challenges and fun that was experienced on a day-to-day basis and the industry has been personally satisfying and rewarding.

"From my past experience we have faced some tough times in the 80’s 90’s and in the first part of this decade, though this is the toughest with the credit markets in shambles today. There are a numerous industries and segments that are also in dire chaos and presently I certainly would not suggest to a son or daughter that they should be an engineer in the auto industry, an architect designing new buildings or a purchasing agent for a retail chain.

“So my advice is, unless you plan on marrying rich, the leasing industry can be a very viable choice for a career, we are just one of many industries going through changes, but we will survive, but maybe in a modified form."

Steve will be covering the National Association of Equipment Leasing Brokers Las Vegas Conference April 30-May 2, 2009 for Leasing News. In the meantime, he continues his favorite hobby, prospecting for gold (Don’t laugh, at almost a $1,000 an ounce, he might be doing very well. Editor)

Steve's Gold Prospecting Vehicle, Nevada City.

Dredging in small streams in the northern part of the state

Shoveling Dirt in the Mojave Desert

|

--------------------------------------------------------------

Leasing Industry Help Wanted

|

Looking for Sales Associate with a following. Your area of expertise should be with any titled rolling stock; New or Used Ambulances, Trucks, Street Sweepers,Tow Trucks, Buses, any commercial vehicle. National Scope. Hi Commission with benefits. Curt Webster, CVLE 516 922-7447 We are an independent automobile, truck, and commercial equipment leasing company with over 36 years serving the best customers in the United States. |

sales

|

Position available for experienced salesperson to solicit direct business for equipment & vehicle leasing company located in Maryland. Madison Capital provides lease financing nationwide, in Canada and Puerto Rico Call either Nancy Pistorio (800.733.5529 ext 7325) or Allan Levine (800.733.5529 ext 7337) About the Company: We are a direct funding source for most types of equipment and all makes of vehicles. We have brokerage capability and experience for equipment transactions up to $10,000,000. |

|

If you are located in the Mid-Atlantic region with a book of customers and limited funding, we should talk. Email resume to: resume@libertyfg.com About the Company: Liberty is a regional self-funded finance company specializing in hard assets at good rates. |

|

The iFinancial Group is looking for highly motivated individuals with experience originating equipment lease transactions . We offer a relaxed work environment, provide leads and offer above industry standard commission. Call Todd Clark 888-852-5155 x223 Ten years providing financing nationwide |

|

Like selling vendor programs and large transactions? CLICK HERE to find out how to have fun again. |

|

Hands-on, professional and personable senior management team member to work with small ticket leases from the third party broker marketplace. Click here for more information. About the company: Founded in 1982, we originate all of our leases through an independent network of lease brokers |

Please see our Job Wanted section for possible new employees.

-------------------------------------------------------------

Leasing Law after NorVergence

ELFA eNEWS

The fallout from the bankrupt NorVergence and its assignees continues through the courts. While the related case law continues to evolve, there are some hopeful developments for lessors.

The takeaway from this is that financing parties may bear a greater risk of accurately determining the business realities giving rise to the assigned payment obligation. However, by imposing this due diligence requirement on financing parties, the courts and government agencies have undermined the clear provisions of the commercial law adopted by each of the states as well as the established case law supporting the enforcement of these statutes.

The Journal of Equipment Lease Financing published by the Equipment Leasing & Finance Foundation, recently offered an article, Leasing Law After NorVergence by Robert W. Ihne and Edward K. Gross in the Winter 2009 issue of the Journal. To download this article visit,

http://www.leasefoundation.org/JELF/Winter09/

The Equipment Leasing & Finance Foundation publishes the Journal three times per year. Subscriptions are available through the Foundation website, www.LeaseFoundation.org

|

-------------------------------------------------------------

Classified ads— Lease Portfolio/Legal

Leasing Industry Outsourcing

(Providing Services and Products)

| Lease Portfolio: Stilwell, KS Looking to buy or sell lease portfolio? 20+ year lease consultant specializing in portfolio placement. Free initial consultation. References available on request. Contact today E-mail:MLOST@aol.com |

Legal: http://www.leaselawyer.com/ "I enjoy brainstorming about all aspects of leasing. I'll be back to you within 24 hours of your call or e-mail!" Barry S. Marks, Esq. E-mail: poetbarry@aol.com |

| Legal: Los Angeles, CA Challenge me with your legal question about leasing. No charge for a "free" consultation. Richard Wagner, Esq. www.wzlawyers.com . E-mail: rwagner@wzlawyers.com |

Legal: Westport, CT We represent finance companies, banks, lessors, etc., in replevins/seizures, collections and bankruptcy matters in Connecticut and New York. Flat fee, contingency and hourly rates. Email: rchinitz@replevinlawyer.com |

All "Outsourcing" Classified ads

(advertisers are both requested and responsible to keep their free ads up to date):

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing.htm

How to Post a free "Outsourcing" classified ad:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing-post.htm

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

-------------------------------------------------------------

Ask Andrew--- Variable or Fixed Rate

This begins a new column feature, primarily about vehicle leasing. Andrew Aldridge is President and principle of GPD Capital Services, Inc. His experience spans 27 years in originating funding for commercial customers needing equipment and titled vehicles financed and or leased. GPD is uniquely established with strong well known funders who primarily do not work with outside originators.

by Andrew Aldridge

Variable rates are always tied to an index. Some of the indices used are LIBOR – London Inter Bank Offered Rate, Swaps, and Treasuries. For variable, the monthly payment would change monthly if the indices change. As an example, I have funded approximately $2.9 million with a company over a two year period using the LIBOR index now at 45 basis pts. At the time setting up this account Prime was 8.25%. Since that time, Prime has dropped to 3.25%, and one month LIBOR has dropped proportionately. This change effectively lowered my client’s payments by approx 5%. This customer has been saving thousands of dollars monthly since inception. Obviously, this customer selected the correct Rate formula when I purchased the truck/equipment.

Currently, fixed rates (on an application only request) up to $250,000.00 are in the 5.5% to 6.9% range for TRAC Leases, with or without end values, or commonly called residuals. Variable rates using LIBOR are in the low 3% to 4% range, with pricing as a mix of the following variables; interest, admin fees, and/or acquisition fees. The interest portion I use now is LIBOR + 250 to 300 basis points or +.45 (e.g., LIBOR/.45% + 2.75% = 3.20%).

TRAC Lease documentation, with or without end values or residuals, is usually the document of choice in the industries I serve. A common example is a term of 48 months to a 20% end value. TRAC means Terminal Rental Adjustment Clause. This style of documentation gives the funder, as well as the end user, flexible benefits in tax and accounting decisions.

The Funder/Lessor is taking the depreciation of the asset and the End User/Lessee is deducting the monthly payment expense. The Lessee also does not carry the debt or asset on their balance sheet. There are exceptions, but I will describe them in later articles.

The Lessee is given implied purchase ability throughout the term but usually none is given implicitly. The TRAC language can be a bit nebulous; however, after 27 years of seeing many TRAC versions, all funders I work with do not want the equipment back. Therefore, changing ownership is always completed with an “in good standing” lessee or with someone the lessee is selling the asset to. The new buyer could be another end user and or dealer for dealer trades into the next unit.

Andrew Aldridge

President, GPD

Direct Voice: 888-331-9781 EXT 12 | Direct Fax: 408-364-0743 | Cell: 408-888-7027

E-mail: Andrew@GPDCSI.com

NATIONWIDE FUNDING: VEHICLES.BUS.COACH.SHUTTLE.TRUCKS.TOW.LIMO.SUV.SUV STRETCH.TOWN CAR.PASS WAGON-DEALER FACTORY ORDERING SVCS & ALL EQUIPMENT TYPES.

|

-------------------------------------------------------------

Leasing Association Events-Meetings Open to All

Calendar: Equipment Leasing and Finance Events & Training

(Many events and meetings are open to non-members, in addition, prospective members are invited, questions may be directed to Donald Ethier VP - Membership and Marketing dethier@elfaonline.org 202.238.3418 )

http://www.elfaonline.org/pub/events/calendar/index.cfm

------------------------------------------------

![]()

Tuesday, March 3, 2009

New York/ New Jersey Regional Luncheon

12:00 p.m. - 2:00 p.m.

Hosted by Steve Geller, Leasing Solutions

Cafe Italiano Ristorante

Englewood Cliffs, NJ

Cost: Members $40; Non-Members $60

geller44@verizon.net

http://www.nefassociation.org:80/displaycommon.cfm?an=1&subarticlenbr=28

![]()

Wednesday, March 11, 2009

Boston Regional Luncheon

12:00 p.m. - 2:00 p.m.

Hosted by Larry LaChance, Bankers Capital

Owen O'Leary's

Southboro, MA

Cost: $25 Members; $50 Non-Members

llachance@bankers-capital.com

http://www.nefassociation.org:80/displaycommon.cfm?an=1&subarticlenbr=28

----------------------------------------------------

![]()

Wednesday, April 8, 2009

Hosted by Doug Welch and Alan Zeppenfeld

Ansley Golf Club

Cost: $20 Members/ Non-Members

http://www.nefassociation.org:80/displaycommon.cfm?an=1&subarticlenbr=28

------------------------------------------------------------

![]()

Wednesday, June 10, 2009

Hosted by Doug Welch and Alan Zeppenfeld

Ansley Golf Club

Atlanta, GA

Cost: $20 Members/ Non-Members

http://www.nefassociation.org:80/displaycommon.cfm?an=1&subarticlenbr=28

----------------------------------------------------------

September 11-12

NAELB 2009 Eastern Regional Meeting

Renaissance Atlanta Airport Concourse Hotel

Atlanta, GA

http://www.naelb.org/calendar.cfm

----------------------------------------------------------------------

![]()

Wednesday, October 14, 2009

Hosted by Doug Welch and Alan Zeppenfeld

Ansley Golf Club

Atlanta, GA

Cost: $20 Members/ Non-Members

http://www.nefassociation.org:80/displaycommon.cfm?an=1&subarticlenbr=28

----------------------------------------------------------------------

November 6-7

NAELB 2009 Western Regional Meeting

Hilton Orange County / Costa Mesa

- Costa Mesa, CA

----------------------------------------------------------------------

To view Leasing Association Conferences in 2009, please click here.

|

-------------------------------------------------------------

The Hungry Bulldog

Imagine your bulldog is hungry. You’ve lost your job, you have no income and your cash reserves have been depleted. Buying dog food for your beloved pet just isn’t in the cards.

At the precise moment of your greatest despair a light bulb goes off in your head, and you remember that your former employer, the investment bank in New York that laid you off recently, gave you a pile

of over-leveraged, securitized paper as part of your severance package. This paper – the same kind of investments you sold to many of your clients over the years – was your reward for long and faithful

service to the firm.

Delighted at this revelation, and relieved that you now can sell some assets and raise cash to buy food for your hungry bulldog, you gather up your over-leveraged, securitized paper and scurry down to your

local bank branch office. You ask to see the branch manager, and in a few minutes she appears, seemingly happy to greet a long-time, highly valued customer.

You explain, with some embarrassment, that the Wall Street investment firm you’ve worked for during the past ten years has laid you off, and that you are short of cash on hand. You do, however, have some over-leveraged, securitized paper that your former Wall Street employer gave to you as part of your severance package and as a reward for your years of high production and faithful service to the firm.

With great confidence, you hand the small stack of paper to the bank branch manager. She thumbs through the papers, looking intently at each individual sheet. Suddenly, a look of overwhelming sadness sweeps across her face. She looks up at you and says, “I’m so sorry, but the current mark to market accounting rules require us to value your paper (mark it) at the value someone is willing to pay for

it today (fair market value). Unfortunately, since no one today is buying this type of investment, we must show its value as zero on our books. I can’t give you any cash for this paper.”

You can’t believe what you’ve just heard. The same type of paper you sold to hundreds of investors, trumpeting its safety with assurances and projections from the credit rating agencies, is now worthless in a down economy because of mark to market accounting rules. When times were good this paper was worth a fortune!

Exuding great empathy for your plight, and with tears in her eyes, the bank branch manager offers a ray of hope for your dismal predicament. She explains that the powerful bankers lobby, members of Congress and others in the business community are pushing for a rewrite of the mark to market accounting rules.

These reformers reason that the mark to market rules unfairly penalize banks and other businesses because their books look bad when the value of assets and property they hold lose some or all of their value.

They reason further that accounting regulators should allow bankers and finance professionals to place a more realistic value on these assets and property. In fact, they suggest that the holders of these assets and property should be allowed to use their best judgment in projecting what the investments may be worth at some future date.

“If we can change the mark to mark accounting rules,” the banker offered with great hope, “we could eliminate transparency in financial reporting, obfuscate corporate balance sheets so no one could rely on them to make sound investment or lending decisions, and end the terrible financial crisis brought on, in part, by these silly accounting rules.”

Encouraged by the ray of hope offered by the banker, and seeing an opportunity to turn a silk purse into a pig’s ear, you rush home to begin lobbying for reform of the mark to market accounting rules. You hope and pray that the SEC regulators come to their senses and allow your bank to guess about the future value of your over-leveraged, securitized paper. Then they can repair their ugly balance sheet, the financial crisis would end and you can sell your worthless investment, raise cash and buy food for your hungry bulldog.

Steve Chriest draws on more than 25 years of experience in senior management, sales management, marketing and business development to produce strategic, customized solutions designed to help organizations achieve and sustain profitable sales revenue. He works with national and international senior executive and sales teams across a wide variety of industries.

Steve is the founder of Selling-UpTM, a San Francisco-based sales improvement consulting firm. He developed Selling-Up’s exclusive Sales Management Operating SystemTM and is publisher of Sales Journal, a monthly sales strategy publication for an E-suite audience. Steve created Selling-Up’s most popular educational offerings, including Strategic Sales RoadmapTM and online courses such as Profits and Cash – The Game of Business and Assertive Negotiating.

You can reach Steve at schriest@selling-up.com.

|

-------------------------------------------------------------

Fernando’s View

By Fernando F. Croce

In Theaters:

Two Lovers (Magnolia Pictures): Something of a specialist in gangster sagas (“The Yards,” “We Own the Night”), director James Gray surprises viewers with this affecting, intimate romantic drama graced by strong atmosphere and performances. Leonard (Joaquin Phoenix) is an aspiring photographer whose unsteady mind following a troubled relationship lands him back at his parents’ house in New York. His family wants him to meet a nice, sympathetic local girl (Vinessa Shaw), but Leonard is more interested in Michelle (Gwyneth Paltrow), a party girl who gives him a taste of Manhattan glamour but, as he soon finds out, has deep problems of her own. Trading underworld guns for raw emotions, Gray and his actors beautifully depict both the exhilaration and the desperation that love can cause.

Gomorrah (IFC Films): A mosaic of Italian crime stories that gives “Traffic” a run for its money, Matteo Garrone’s brutal and absorbing chronicle of the wide-ranging effects of Mafia operations is a sobering ride. Weaving a dense but always involving web of people, dilemmas and betrayals, the film focuses on such characters as a 13-year-old who is eagerly making his way up the ladder of the Camorrah crime family, a couple of young clods who have watched “Scarface” one too many times, and a money-runner who’s faced with issues of loyalty as a gang war threatens to break out. Avoiding clichés and refusing to glamorize violence, the film takes a hard-hitting look at the ways crime infiltrates the least expected corners of society.

New on DVD:

What Just Happened (Magnolia Films): Hollywood pokes fun of itself in this underrated satire, directed by Barry Levinson (“Rain Man,” “Wag the Dog”). Ben (Robert De Niro in fine comic form) is a hurried movie producer who’s running against time to get his latest production finished. Unfortunately, the film’s director (Michael Wincott) refuses to make any changes following a disastrous preview, so Ben has to deal with the man’s artistic ego and the demands of the film’s star (Bruce Willis, slyly playing himself), not to mention his own personal troubles with his ex-wife (Robin Wright Penn) and teenage daughter (Kristin Stewart). Frequently funny lines and a cast that also includes John Turturro, Stanley Tucci and Sean Penn make this worth a rental.

Akira (Infinity Resources): Those who think animated features are exclusively for kids are in for a shock with this famous Japanese modern classic from 1988, now getting a DVD re-release. Playing like a cartoon version of “Blade Runner,” Katsuhiro Otomo’s futuristic fantasy takes place in a devastated Tokyo in 2019, The main character, Kaneda, is a bike gang leader whose search for his missing friends leads him to a mysterious government project known as Akira, which is connected to the secrets that had 30 years earlier led to nuclear war. Mixing eye-filling graphics with startling visionary ideas, it’s a movie that will change the way you look at Disney.

Hunger (Pathe Video): Recreating the plight of Irish prisoners in 1981, British filmmaker Steve McQueen displays a searing stylistic control that’s startling coming from a first-time director. The story focuses on Davey (Brian Milligan) and Sands (Michael Fassbender, in a blazing performance), two men who’ve been imprisoned for their radical political views, as well as Raymond (Stuart Graham), a prison officer whose work affects the other characters in unexpected ways. Brutality reigns supreme both behind bars and outside prison walls, and people live in a tense world where riots and punishment can erupt at any moment. Like “Gomorrah,” it’s often a difficult film to watch, yet few modern films portray the thrust of rebellion and the violence of injustice in such bold strokes.

---------------------------------------------------------------------

#### Press Release ##############################

Marlin Business Services Announces Fourth Quarter and Year End 2008 Earnings

Call and Webcast

MOUNT LAUREL, N.J., - Marlin Business Services Corp. (Nasdaq:MRLN) announces fourth quarter and year end 2008 earnings call.

Date: March 10, 2009

Time: 9:00 AM ET

Listen via Internet: http://www.snl.com/irweblinkx/corporateprofile.aspx?iid=4089372

|

#### Press Release ##############################

Insured Banks and Thrifts Lost $26.2 Billion in the Fourth Quarter

Domestic Deposits Increased by 3.8 Percent

(Problem List" grew during the quarter from 171 to 252 institutions)

Commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reported a net loss of $26.2 billion in the fourth quarter of 2008, a decline of $27.8 billion from the $575 million that the industry earned in the fourth quarter of 2007 and the first quarterly loss since 1990. Rising loan-loss provisions, losses from trading activities and goodwill write-downs all contributed to the quarterly net loss as banks continue to repair their balance sheets in order to return to profitability in future periods.

More than two-thirds of all insured institutions were profitable in the fourth quarter, but their earnings were outweighed by large losses at a number of big banks. Total deposits increased by $307.9 billion (3.5 percent), the largest percentage increase in 10 years, with deposits in domestic offices registering a $274.1 billion (3.8 percent) increase. And at year-end, nearly 98 percent of all insured institutions, representing almost 99 percent of industry assets, met or exceeded the highest regulatory capital standards.

"Public confidence in the banking system and deposit insurance is demonstrated by the increase in domestic deposits during the fourth quarter," FDIC Chairman Sheila Bair said. "Clearly, people see an FDIC-insured account as a safe haven for their money in difficult times."

For all of 2008, insured institutions earned $16.1 billion, a decline of 83.9 percent from 2007 and the lowest annual total since 1990. Twelve FDIC-insured institutions failed during the fourth quarter and one banking organization received assistance. During the year, a total of 25 insured institutions failed. The FDIC's "Problem List" grew during the quarter from 171 to 252 institutions, the largest number since the middle of 1995. Total assets of problem institutions increased from $115.6 billion to $159 billion.

In its latest release, the FDIC cited deteriorating asset quality as the primary reason for the drop in industry profits. Loan-loss provisions totaled $69.3 billion in the fourth quarter, a 115.7 percent increase from the same quarter in 2007. In addition, the industry reported $15.8 billion in expenses for write-downs of goodwill (which do not affect regulatory capital levels), $9.2 billion in trading losses and $8.1 billion in realized losses on securities and other assets.

The FDIC provided data on industry use of the Temporary Liquidity Guarantee Program (TLGP), which was established in mid-October to address credit market disruptions and improve access to liquidity for insured financial institutions and their holding companies. The TLGP, which is entirely funded by industry fees that totaled $3.4 billion as of year-end, has two components. One provides a 100 percent guarantee of all deposits in noninterest-bearing transaction accounts, such as business payroll accounts, at participating institutions. The other provides a guarantee to newly issued senior unsecured debt at participating institutions. At the end of December, more than half a million deposit accounts received over $680 billion in additional FDIC coverage through the transaction account guarantee, and $224 billion in FDIC-guaranteed debt was outstanding.

"The debt guarantee program has been effective in reducing borrowing spreads and improving access to short- and intermediate-term funding for banking organizations," Chairman Bair noted. "In recent weeks, banks have been able to issue debt without guarantees and other corporate borrowers have issued debt more frequently and in larger amounts. These are positive signs."

Financial results for the fourth quarter and full year are contained in the FDIC's latest Quarterly Banking Profile, which was released today. Among the major findings:

Provisions for loan losses continued to weigh on earnings. Rising levels of charge-offs and noncurrent loans have required insured institutions to step up their efforts to increase their reserves for loan losses. The $69.3 billion in provisions that the industry added to reserves in the fourth quarter represented over half (50.2 percent) of its net operating revenue (net interest income plus total noninterest income), the highest proportion in any quarter in more than 21 years.

The rising trend in troubled loans persisted in the fourth quarter. Insured institutions charged off $37.9 billion of troubled loans, more than twice the $16.3 billion that was charged-off in the fourth quarter of 2007. The annualized net charge-off rate of 1.91 percent equaled the previous quarterly high set in the fourth quarter of 1989. The amount of loans and leases that were noncurrent (90 days or more past due or in nonaccrual status) increased by $44.1 billion (23.7 percent) during the fourth quarter. At the end of 2008, a total of 2.93 percent of all loans and leases were noncurrent, the highest level for the industry since the end of 1992.

The FDIC's Deposit Insurance Fund reserve ratio fell. A higher level of losses for actual and anticipated failures caused the insurance fund balance to decline during the fourth quarter by $16 billion, to $19 billion (unaudited) at December 31. In addition to having $19 billion available in the fund, $22 billion has been set aside for estimated losses on failures anticipated in 2009. The fund reserve ratio declined from 0.76 percent at September 30 to 0.40 percent at year end. The FDIC Board will meet tomorrow to set deposit insurance assessment rates beginning in the second quarter of 2009 and to consider adopting enhancements to the risk-based premium system.

The complete Quarterly Banking Profile is available at

http://www2.fdic.gov/qbp/index.asp on the FDIC Web site.

|

#### Press Release ##############################

FDIC Closes on a $1.45 Billion Structured Sale of Distressed Loans

The Federal Deposit Insurance Corporation (FDIC) yesterday announced the conclusion of the sale of $1.45 billion of performing and nonperforming residential and commercial construction loans in distressed markets through the use of two private/public partnership transactions. These structured sales utilize the asset management expertise of the private sector, while retaining for the FDIC a participation interest in all future cash flows generated by the workout of the assets over time.

In the two recent transactions, the FDIC placed the loans, which were exclusively from the failed First National Bank of Nevada, into a limited liability corporation (LLC). The FDIC retained an 80 percent interest in the assets with the winning bidder picking up an initial 20 percent stake. Once certain performance thresholds are met, the FDIC's interest drops to 60 percent. The future expenses and income will be shared on the percentage ownership of the purchaser and the FDIC.

"The FDIC is drawing on its previous successes and those of the Resolution Trust Corporation," said James Wigand, Deputy Director, Division of Resolutions and Receiverships. "During the last banking crisis, when asset values were similarly difficult to ascertain, these types of structures ultimately resulted in superior recoveries relative to the then-depressed market valuations."

By retaining a participation interest in the structure, the FDIC as receiver will benefit in the future return of the portfolio in addition to receiving immediate proceeds from the purchaser for its 20 percent interest in the portfolio.

The successful bidders on the two transactions were Diversified Business Strategies and Stearns Bank NA. The FDIC hired the financial advisor Keefe Bruyette Woods to market the LLC to potential bidders. In all, 18 separate bidders submitted 30 unique bids for both pools of loans.

The closure of this sale brings the total amount of assets sold utilizing private/public partnership transactions to approximately $3.2 billion over the last year, in five separate transactions. Based on the success of the program and the positive feedback received from the private sector, the FDIC anticipates it will utilize this and similar sales strategies in the future.

Congress created the Federal Deposit Insurance Corporation in 1933 to restore public confidence in the nation's banking system. The FDIC insures deposits at the nation's 8,384 banks and savings associations and it promotes the safety and soundness of these institutions by identifying, monitoring and addressing risks to which they are exposed. The FDIC receives no federal tax dollars – insured financial institutions fund its operations.

#### Press Release ##############################

---------------------------------------------------------------------

|

(This ad is a “trade” for the writing of this column.)

![]()

News Briefs----

U.S. Is Said to Agree to Raise Stake in Citigroup

http://www.nytimes.com/2009/02/27/business/27deal.html?_r=1&hp

Investors Overlook Dell's Down Quarter

http://www.businessweek.com/technology/content/feb2009/tc20090226_422725.htm?

chan=top+news_top+news+index+-+temp_technology

John Deere's sales declined 25% first quarter

http://www.marketwatch.com/news/story/10-q-deere-john-capital-corp/story.aspx?guid=

%7BA457E1F0-749C-4BBF-B73C-1B6F893EF425%7D&dist=msr_1

'Consumer Reports' puts Chrysler, GM in bottom spots

http://www.usatoday.com/money/autos/2009-02-26-prius-best-value_N.htm

Jobless claims jump, durable goods orders plunge

http://www.usatoday.com/money/economy/2009-02-26-jobless-durables_N.htm

Citizens loses $929m as bad loans proliferate

http://www.boston.com/business/articles/2009/02/26/citizens_loses_929m_as

_bad_loans_proliferate/

Franchise Man of the Year---Edible Arrangements

http://www.franchise.org/Franchise-News-Detail.aspx?id=43978

Freddie Mac investigates self over lobby campaign

http://www.absnet.net/include/showfreearticle.asp?file=/headlines/3.htm

Elie Wiesel Levels Scorn at Madoff

http://www.nytimes.com/2009/02/27/business/27madoff.html?ref=business

'American Idol' chooses 3 more finalists

http://news.yahoo.com/s/ap/20090227/ap_on_en_tv/tv_american_idol_11

http://www.eonline.com/uberblog/b101972_american_idols_top_12_glass_half_full.html?sid=

rss_topstories&utm_source=eonline&utm_medium=rssfeeds&utm_campaign=rss_topstories

---------------------------------------------------------------

You May have Missed---

Ban on photographing U.S. troops? coffins lifted

http://www.usatoday.com/news/washington/2009-02-26-pentagon-coffins_N.htm

---------------------------------------------------------------

Sports Briefs----

Vick will finish prison sentence in home confinement

http://www.usatoday.com/sports/football/nfl/2009-02-26-vick-update_N.htm

49ers ask Smith to free cap room

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2009/02/26/SP94165NNI.DTL

No. 22 UCLA Beats Stanford 76-71

http://www.nytimes.com/aponline/2009/02/27/sports/AP-BKC-T25-UCLA-Stanford.html?_r=1

----------------------------------------------------------------

![]()

“Gimme that Wine”

Not in Napa? No problem! Join an online tasting this Saturday

http://www.examiner.com/x-4498-SF-Wine-Country-Travel-Examiner~y2009m2d26-Not-

in-Napa-No-problem-Join-an-online-tasting-this-Saturday

Yountville: Culinary capital and a whole lot more

http://www.contracostatimes.com/top-stories/ci_11793451?nclick_check=1

Schaefers sell family wine shop

http://leisureblogs.chicagotribune.com/thestew/2009/02/schaefers-sell-family-wine-shop.html

Santa Barbara's Wine Cask Closes

http://www.winespectator.com/Wine/Features/0,1197,4895,00.html

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

The London International Vintners Exchange (Liv-ex) is an electronic exchange for fine wine.

http://www.liv-ex.com/

----------------------------------------------------------------

![]()

Today's Top Event in History

1864-As chronicled in the book “Andersonville, “the first Union prisoners begin arriving at the Andersonville prison, even thought it was still under construction in southern Georgia. Andersonville became synonymous with death as nearly a quarter of its inmates died in captivity. Henry Wirz, commandant at Andersonville, was executed after the war for the brutality and mistreatment committed under his command. Originally designed for 10,000 men, it soon housed over 33,000 in quite deplorable conditions. The creek banks eroded, creating a swamp, which became part of the compound. Food was scarce, and guards were encouraged to “lessen the population” and were quite brutal and violent to the prisoners.

http://www.cviog.uga.edu/Projects/gainfo/anderson.htm

http://www.libs.uga.edu/hargrett/selections/confed/aville2.html

http://www.cr.nps.gov/seac/andecon.htm

List of Union soldiers who died and their cause of death:

http://www.civilwarindiana.com/andersonville/andersonville.php3

http://memory.loc.gov/ammem/today/nov10.html

http://www.nps.gov/ande/

[headlines]

----------------------------------------------------------------

![]()

This Day in American History

1717 - What was perhaps the greatest snow in New England history commenced on this date. During a ten day period a series of four snowstorms dumped three feet of snow upon Boston, and the city was snowbound for two weeks. Up to six feet of snow was reported farther to the north, and drifts covered many one story homes. |

--------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live.

--------------------------------

Bank Beat

Cartoons

Computer Tips

Fernando's Review

Leasing 102

Online Newspapers

Placards

Sales Make it Happen

To Tell the Truth