Friday, January 4, 2008 Headlines--- Classified ads----Controller Monday: Leasing News Person of the Year for 2007 ######## surrounding the article denotes it is a “press release”

------------------------------------------------------------------ Classified ads----Controller

Boca Raton, FL To place a free “job wanted” ad here, please go to: For a full listing of all “job wanted” ads, please go to: -------------------------------------------------------------- First Republic Bank closing down leasing unit Paul Knowlton, CLP, Managing Director, First Republic Equipment Finance, 2008 president of the United Association of Equipment Leasing (UAEL), confirmed that First Republic Bank, San Francisco, California is closing its leasing division that Knowlton heads.

First Republic Bank was purchased by Merrill-Lynch and in recent news about selling off more of its assets, which previously included Merrill-Lynch Commercial Finance Lease division, Leasing News inquired as to what would happen to Knowlton's unit. "Actually the closure is not due to Merrill-Lynch, The equipment finance product and its transactual nature did not fit well with FRB’s wealth management strategy, "he said. "We are basically in a different business model. This business decision reflects FRB’s continued strategic focus on its core competencies. This is a good quality portfolio and we will begin marketing it shortly. I am looking forward to the next step in my career upon completion of the sale " Republic Bank in San Francisco is more a "retail" bank, active in the mortgage and SBA programs; well-known for its wealth management customer base. Bay Area residents know the bank for its ATM ads: "no extra ATM/foreign exchange fees when you use your ATM card overseas." May 20, 2006 Republic announced that it had purchased Bank of Walnut Creek, across the San Francisco Bay in Walnut Creek, the hub of Contra Costa County. Paul Knowlton then was President of BWC Equipment Leasing. He has been in the leasing industry for the almost 20 years. In 1998, he joined the Bank of Walnut Creek to start up BWC Equipment Leasing which focused on small ticket equipment leasing in Northern California. He worked his way up the chain of officers at UAEL, conference chair as well as serving on other committees. He resides in Oakland California with his wife and two daughters. -------------------------------------------------------------- SunBridge Capital sold

A leader in the commercial trucks, trailers and construction equipment for businesses nationwide, SunBridge Capital, Mission, Kansas, was sold to a group of local private investors on December 31, 2007, for an undisclosed amount. No management changes are expected, they report. The company’s nearly 100 employees operate from three locations in the Kansas City metropolitan area and according to the Leasing News Funding list market the entire 50 United States. The company started in 1989, works closely with leasing brokers in $20,000 - $500,000 marketplace, with average transactions $75,000 to $100,000. They belong to four leasing associations: Eastern Association of Equipment Lessors, Equipment Leasing and Finance Association, National Association of Equipment Brokers, and the United Association of Equipment Leasing. Key Contacts are: Chris Gregory

-------------------------------------------------------------- LEAF FINANCIAL CALLING--for the Record

Robert J Hunter, Chief Marketing Officer & EVP, LEAF Financial Corporation would like to confirm what Paul Menzel, CLP, President, LEAF Third Party Funding reported to Leasing News. "None of the customers of the 'third party originators,' (formerly known as Alco, Dolphin, Pacific Capital, or NetBank Business Finance) will be contacted by the direct or vendor unit of LEAF Corporation or any of the other divisions." In the original article about the telephone calling to the signers of UCC filings, an insider told Leasing News, as quoted in the article, they were not calling the broker customers of LEAF. "We have ‘scrubbed’ any marketing lists that may be used by any LEAF business unit to EXCLUDE customers from the acquired portfolios, " Paul Menzel, CLP, President, LEAF Third Party Funding told Leasing News. "We have a policy that we will not accept a direct, end user application from a customer that was sourced to us (including by way of PCB, NetBank and Dolphin) by one of our Third Party Origination relationships."

-------------------------------------------------------------- World Leasing Map

Free map listing to Professional subscribers for the first quarter of 2008. From Brian Whelan, Director, Interimus Limited “When I started theLeaseBlog.com 12 months ago, little did I know then how large the membership base would become or how geographically diverse it would be. You can now boast to being a member of a global leasing community website that has roughly 800 members in over 20 different countries globally. “The aim of theLeaseBlog.com is to create the largest global network of leasing professionals with the desire to share best practices and facilitate new relationships, but I cannot do this alone. The bigger the group, the more best practice sharing and the wider the opportunities for relationship building, so with that in mind I would like to ask for your help in turning 800 members into 8000 by the year end. “This is how you can help: “1) Recommend: “2) Contribute: “3) Encourage: “4) Put yourself on the Map: FREE sign up to the World Leasing Map extended ! At the end of last year, I trialed a free sign up to the World Leasing Map for leasing professionals. The response was excellent, so I have decided to extend the FREE SIGN UP to the end of March 2008. By developing the World Leasing Map, we will truly get to understand the extent of the LeaseBlog network and it will be easier for all to identify networking opportunities. If you have not yet seen the Map, please visit http://www.theleaseblog.com/world-leasing-map . “Please follow at least one of these simple ideas and together we can build a unique global network of leasing professionals like you that want to make this industry an even better place to work in. “Wishing you all, every success in 2008.” Brian Brian Whelan Telephone: +44 (0) 7768 467 413

-------------------------------------------------------------- Letters---We get eMail!!!

ELFA Vice President / Communications e-mail in entirety

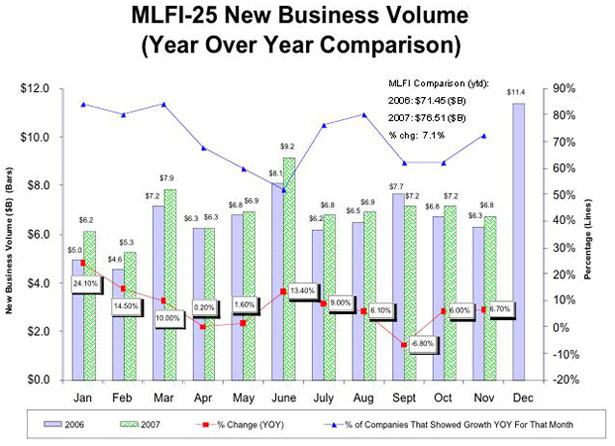

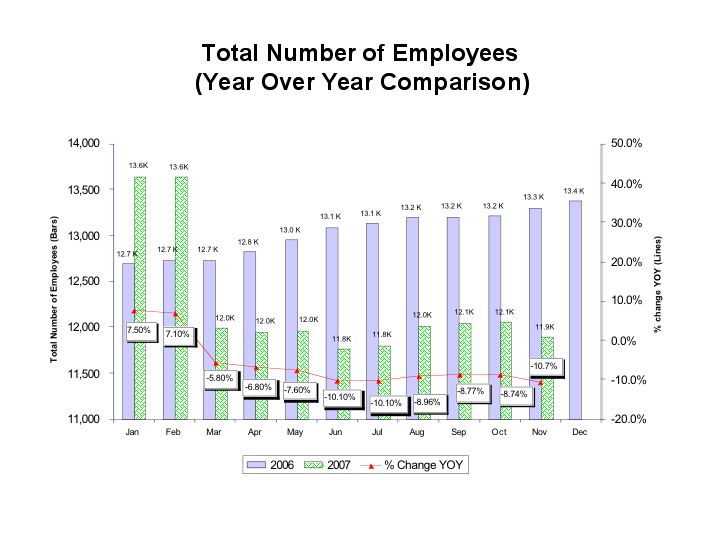

“It appears to us that your recent newsletter of Friday, December 28 made some incorrect analysis/statements that we believe should be corrected because we know that you strive for independent, unbiased material and to provide accurate information to the industry in which you are a practitioner. We ask that you print our letter to the editor in your next issue (eMail rec’d January 2nd. Editor) “First, a sentence in your article (italics, below) says that the MLFI is somewhat accurate. ELFA produces the MLFI-25 report to help member organizations achieve competitive advantage by providing them with leading-edge research and benchmarking information which supports strategic business decision making. Each month, the same five components are included in the MLFI-25 survey: new business volume (originations); aging of receivables; charge-offs; credit approval ratios (approved vs. submitted); and headcount for the leasing and finance business. ELFA member equipment finance companies representing a cross section of the equipment finance sector including small ticket, middle market, large ticket, bank, captive and independent leasing and finance companies are surveyed each month for consistency. Therefore we must argue that our survey is not only consistent but also accurate. “’ Despite the inconsistencies, the MLFI is somewhat accurate, although lumping 25 companies with different marketplaces, dollar transactions, and trying to gauge the climate is like putting one foot in a bucket of ice and the other in a raging fire: on the average, the temperature is comfortable.’ “Second, we believe you are incorrect comparing month to month statistics though our numbers still show a positive trend compared to last year when comparing month to month. In 2006, from Sept to Nov, the monthly volumes declined each consecutive month. ($7.7, $6.8 {-11.7%}and $6.3 (-7.4%}). However, in 2007, the monthly volumes are more level, and do not show the significant decline ($7.2, $7.2 (0%) and 6.8 (-5.6%). December is important because that is typically when the most business is conducted. “Third, in 2006, we should point out that 72% of the companies showed yoy growth (your article mentioned only the larger companies did). “Fourth, we believe it is important to address another sentence below, italics, from your article. The employment numbers are off because one company included their international headcount -- we pulled them out of our survey in March to match all other companies which were providing domestic employment numbers. Our press release in March 2007 clearly stated the reason for the drop in headcount. “’The real indicator is perhaps not the business volume but the employment statistics, which was growing in 2006, but today is down from 13,300 last year to 10,700 in November; that’s over a 20% decline to today’s total of the 25 leasing companies.’ “Thank you for your time and consideration. I have copied my colleagues in research if there are specific questions to direct to them.” Kind regards, Diane Diane Helyne Zyats (Thank you for bringing to our attention the correct employment figures. In addition to not seeing the April press release, in all the subsequent reporting the change in accounting of the employment figures are not mentioned in the press releases, or even in the recent November, 2007 release. No wonder we were confused.

(Going back to April, 2007, the real figure of the 25 reporting then is 11,599. Don't you think the statistics should have been adjusted to the April, 2007, and/or a footnote about the major change? The chart above shows no footnote or adjustment. Confusing, indeed. (By the way, even with the corrected statistics, employment is down to 10,700. This “down statistic” Leasing News saw as a real indicator of what is happing in the equipment leasing and finance industry. (Leasing News viewpoint is to compare business in a monthly and quarterly basis, which I think has more significance to readers than what happened last year to this year. It is an old sales practice from "Beat last month.")

It is also the opinion of Leasing News that quarterly graphs are more accurate in trends:

(The report did not disclose the quarterly figures, but they were obtained by Leasing News from the monthly charts. Originally the reports from ELFA were monthly, not comparing figures with the previous year. There were changes in the start of the monthly reports, and then a period when they were not reported. Readers tell us they find the MLFI-25 reports valuable, appreciate them very much, and hopefully the Equipment Leasing and Finance Association will continue them. We all appreciate the hard work that goes into bringing this information all together in a consistent format. (As to the format, Leasing News was pointing out to readers that comparing smaller ticket leasing companies to larger ones is difficult at best. Reading the press releases from the 25 on their monthly activity, Leasing News and most of our readers know the difference between Caterpillar Financial Services Corporation and Marlin Leasing ticket size and volume, as well as Bank of America or Volvo Financial Services, HP Financial Services, John Deere Credit Corporation, Siemens Financial Services, and Canon Financial Services. (To compare their business volume to each other should be pointed out, and is our job in reporting, being independent and fair. Certainly the consistency has value, but our main point in the article was to note employment is down as an indicator, plus it was more relevant, in our opinion, to compare month-to-month rather than to the previous year in the press release. One of the major problems in the current ELFA reporting of the statistics is going to happen when December, 2006 $11.4 billion is compared to December, 2007, instead of comparing November $6.3 billion to December, 2007? editor)

Leasing News MLFI-25 monthly reports: ---

Remembering Fred Shieman: “I knew Fred very well and sold his company for him a few years before he died... He was the one that talked me into purchasing a Cessna 210 that I owned and flew for ten years...Because of his death I always checked my DG which I understand the FAA said looked like it was not adjusted properly and lead him into the mountain... I personally appreciate you remembering him...” Terry Winders Archive story: ---

“I liked you analysis of mortgage losses. One further point in the overstatement might be the fact that a lot of the mortgages were sold off. I can picture a scenario where an analyst gets information from say B of A about a defaulted 300k mortgage. However this had been sold to say Merrill Lynch, who reports a 300k default, then the ultimate buyer of a CDO reports a 300k default. Presto you have 900k in defaults! Also, take a look at the latest WAMU press release on earnings and info on their mortgage portfolios. If my memory serves me correctly they had 100b in mortgages of which 20b was sub-prime, of which 6b was booked in one quarter of ’06. People should lose their jobs over asset management like that.” Ray Leone (You are correct in your numbers, Ray. WAMU was not alone as evidenced by all that were too greedy to realize what they were getting into... Also left out is the recovery of the asset, meaning it is not 300k, as the real property exists, has value, and often recovering is 50% to 75% or more of the retail selling price, depending on many factors. (By the way, Leasing News readers were aware of WAMU when it left the leasing business: “Washington Mutual Financial (2/05) Bruce Kropschot negotiates to bring full WAMu team to All Points Capital (08/04) Announces exiting the leasing business(12/03) Commercial lending operation purchased by Citigroup.” (editor) --------------------------------------------------------------

Leasing Industry Help Wanted Lease Officer

-------------------------------------------------------------- Leasing Association Conference 2008

April 6th-9th, 2008 ---------------------------------------------------------------------------------

April 10-12 --------------------------------------------------------------------------------------

April 16-17 --------------------------------------------------------------------------------------

May 1-4, 2008 Spring Conference Registration form: ----------------------------------------------------------------------------------

June 11th - 14th, 2008 ----------------------------------------------------------------------------------

October 12-14 --------------------------------------------------- To view Leasing Association Events-Meetings Open to All, please click here. --------------------------------------------------------------- NACM Survey: Sales and Cash Flow Are Drying Up

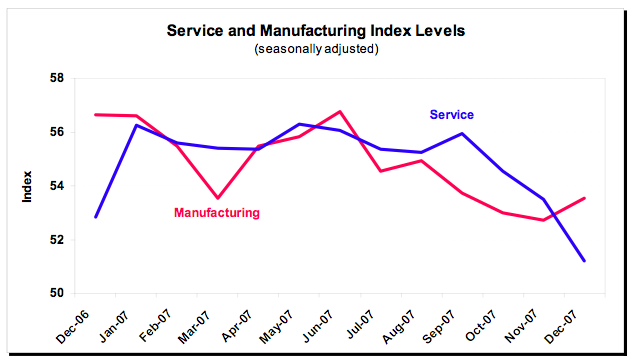

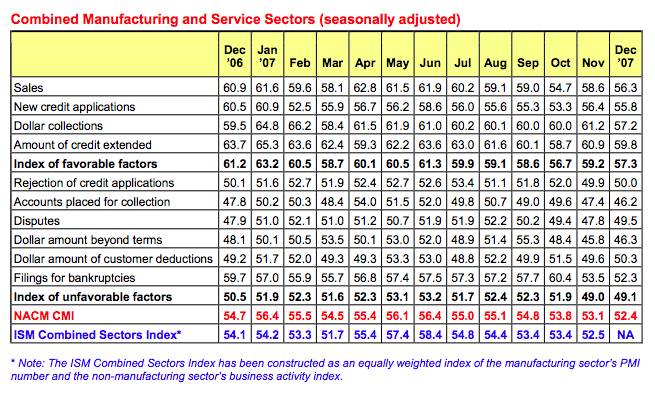

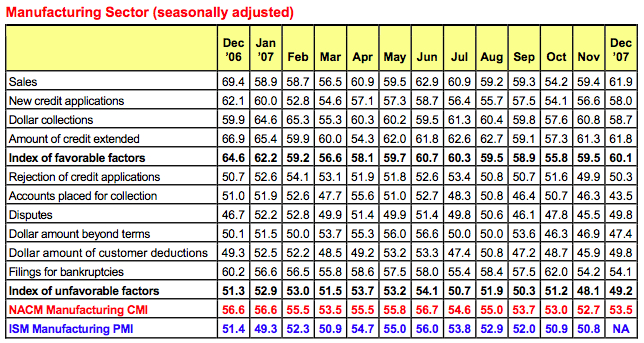

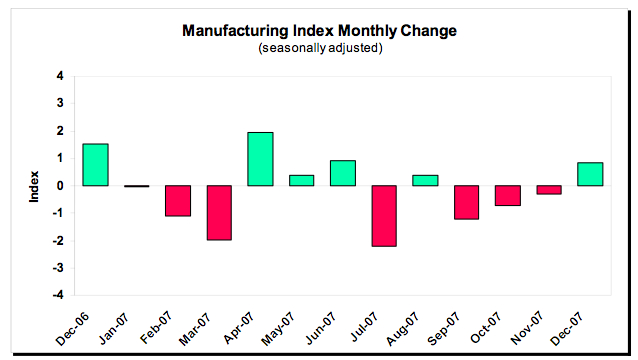

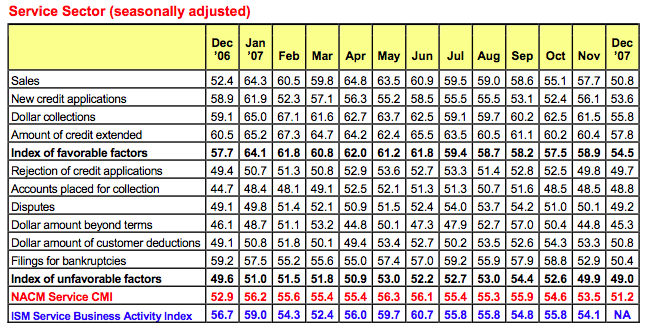

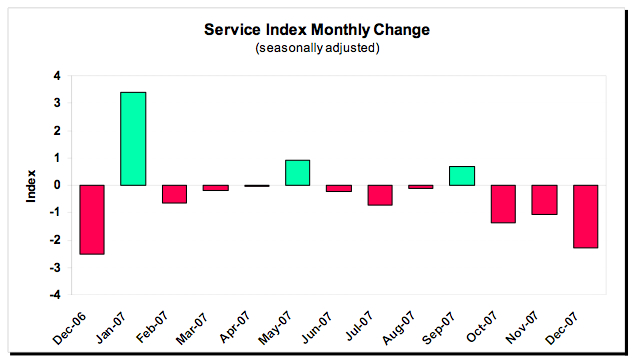

The combined National Association of Credit Manager’s Index fell 2.4% over the past 12 months as eight of the 10 components fell. “The filings for bankruptcies component fared the worst, falling 7.4%,” Daniel North, chief economist with credit insurer Euler Hermes ACI said. “It would appear that trade credit managers are now encountering the same difficulty found in other credit markets, that is, the inability of debtors to pay bills due to insufficient cash flow.” The service sector fell 1.6%, also led by the bankruptcy component which declined 8.8%. In the manufacturing sector, eight of the 10 components fell resulting in an overall drop in the index of 3.1%.

The index lost 0.7%, and dropped to a record low of 52.4%. “While the manufacturing index actually gained 0.8%, it was overshadowed by a loss of 2.3% in the service index, “North said. “The deterioration in the combined index matches that of other major indicators in the macroeconomy, including disappointing holiday sales, a weakening employment market, accelerating declines in housing prices, downgrades of banks and insurers, plummeting consumer confidence, and a rapid increase in delinquencies and defaults on many types of credit. “

For the first time in four months, the manufacturing sector actually gained ground, rising 0.8% to 53.5%. “Most of the increase came from significant improvements in disputes and the dollar amount of customer deductions,” North said. “The data suggest that at least for the month of December, manufacturers’ customers are being less aggressive about holding on to their cash,” he concluded.

The service sector index fell 2.3% in December on a seasonally adjusted basis, led by sharp downturns in sales and dollar collections. It was the seventh decline in sales in the past eight months. North said, “The data suggest that businesses are experiencing an unpleasant combination of slower cash flow and expectations of slower consumer demand. Once again, the housing market continues to wreak havoc in the service sector.” North noted that of the survey responses, one participant described a “Residential housing crisis…(and)…a continuing problem of buyer walk-offs.” Another reported that “Past dues are higher and customers that were robbing Peter to pay Paul are feeling the unavailability of cash.” Finally, there was the almost plaintive comment from a construction material supplier that “It’s been a tough year.”

The CMI, a monthly survey of the business economy from the standpoint of commercial credit and collections, was launched in January 2003 to provide financial analysts with another strong economic indicator. The CMI survey asks credit managers to rate favorable and unfavorable factors in their monthly business cycle. Favorable factors include sales, new credit applications, dollar collections and amount of credit extended. Unfavorable factors include rejections of credit applications, accounts placed for collections, dollar amounts of receivables beyond terms and filings for bankruptcies. A complete index including results from the manufacturing and service sectors, along with the methodology:

The National Association of Credit Management (NACM), headquartered in Columbia, Maryland supports more than 22,000 business credit and financial professionals worldwide with premier industry services, tools and information. NACM and its network of Affiliated Associations are the leading resource for credit and financial management information and education, delivering products and services which improve the management of business credit and accounts receivable. NACM's collective voice has influenced legislative results concerning commercial business and trade credit to our nation's policy makers for more than 100 years, and continues to play an active part in legislative issues pertaining to business credit and corporate bankruptcy. ### Press Release ########################### CIT ranked number one SBA Lender to Women, Veteran and Minority

NEW YORK – – CIT Group Inc. (NYSE: CIT), a leading global commercial finance company, today announced that CIT Small Business Lending Corporation was ranked the number one Small Business Administration (SBA) 7(a) volume lender for the fifth consecutive year to women, veteran and minority-owned businesses. The ranking is based on the 7(a) loan volume for the 2007 SBA fiscal year (October 1, 2006 to September 30, 2007). According to the SBA, CIT provided $236 million in 7(a) loans to 426 minority-owned businesses. “I am very proud of this distinction, which positions CIT again this year as the preeminent SBA financing partner to women-, veteran- and minority-owned businesses,” said Christine Reilly, President of CIT Small Business Lending.

“We value our relationships with small business owners, and we will continue to partner with our customers to craft solutions that help them succeed, “ she said. “We remain steadfast in our commitment to provide the capital and advisory services that these entrepreneurs need in order to start and expand their businesses.” The 7(a) loan program is a popular SBA program offering up to 10-year fully amortized loans, which can mean lower monthly payments for the borrower. Proceeds from the 7(a) program may be used for most business purposes including the purchase of commercial real estate, equipment, inventory, construction, renovation or leasehold improvements and working capital. CIT Small Business Lending is consistently cited as an advocate for small businesses. It was recently named the number one overall SBA 7(a) lender for the eighth consecutive year. Christine "Chris" Reilly began her career at Arthur Andersen LLP. Since joining CIT in 1994, she has held several key senior management positions, including Executive Vice President of Corporate Mergers and Acquisitions, Chief Audit Executive, Vice President of CIT’s Inventory Financing Operation and Chief Financial Officer of CIT Consumer Finance. She is a member of the National Association of Government Guaranteed Lenders (NAGGL) and the American Institute of Certified Public Accountants as well as several other professional organizations. In addition, Reilly serves as Co-Chair of CIT’s Women’s Leadership Council and is Vice Chairman of the Board of Directors of the NJ Metropolitan Chapter of the American Red Cross. She is a Certified Public Accountant and received her MBA from New York University’s About CIT Small Business Lending About CIT ### Press Release ########################### Rafael Castillo-Triana Leaves CIT Group

FORT LAUDERDALE, FL, —The Alta Group announced today that the managing principal of its Latin American Region, Rafael Castillo-Triana, will be leaving his role as the CIT Group Inc.’s head legal counsel for Latin America to dedicate more time to Alta’s clients and projects. Castillo-Triana has served in this role since 1999 under an outsourcing agreement. Through the agreement, he provided international legal support and direction in equipment leasing and financing to CIT’s wholly owned subsidiaries operating in Mexico, Brazil, Argentina , Chile , Colombia , and Puerto Rico . The work was coordinated through CIT Latin American offices in South Florida .

“I am proud that I have accomplished my mission at CIT,” Castillo-Triana said. “I feel privileged to have worked with a wonderful team at CIT headquarters in New York and New Jersey and also with the company’s Latin American employees. CIT has proven to be one of the most reliable players in the vendor financing world in Latin America, and I am pleased to have contributed to the company’s growth. Now, it is time to move on: CIT will need less of my continuous involvement in its day-to-day business, and I need more time to attend to other Alta clients in the equipment financing industry’s emerging markets.”

John Deane, founding principal of The Alta Group, commented, “A strong international presence is very important to many of our clients. Alta has been active in the Latin American Region for more than seven years. With the dramatic growth in equipment leasing and financing activity in this region over the last several years, we are delighted that Rafael will now be able to dedicate 100 percent of his time to meeting the needs of our clients.” The Alta Group is a global consultancy serving equipment leasing and finance companies, investment professionals, manufacturers, banks and government organizations. Founded in 1992, The Alta Group supports clients in North America; Latin America; Western, Central and Eastern Europe; Australia , and China . For more information, visit www.thealtagroup.com. ### Press Release ########################### Alter Moneta Adds New District Sales Manager to

Buffalo, NY,—The U.S. headquarters of Alter Moneta, in Buffalo, New York, announced the recent appointment of Kris Schulz to its Midwest U.S. direct sales force. Effective December 1, 2007, Schulz assumed a role as district sales manager to handle commercial finance business relationships in Michigan, Northern Ohio, and Northern Indiana. Schulz is reporting to Jerilyn Nicholsen, Alter Moneta’s vice president, direct sales, Midwest U.S. “We were very impressed by Kris’s entrepreneurial background and his personality,” says Nicholsen. “He’s a down-to-earth, no nonsense entrepreneur with a wide, diverse background in manufacturing and fantastic networking skills with banks and accounting firms here in Michigan.” Schulz, who lives in Belmont, Michigan, will be focusing Alter Moneta’s sales effort primarily on direct calls to customers financing manufacturing, transportation, and construction equipment, as well as natural gas industry production equipment, in the upper Midwest. Schulz said he was attracted to Alter Moneta because of the opportunity it provides to serve a bigger territory. “I’ve long been interested in a company that would allow me to dip into a larger network, and Alter Moneta gives me precisely that opportunity,” he says. “Alter Moneta is also a younger, rapidly growing company with a great deal of optimism about the opportunities it sees,” he adds, “and that’s exciting.” Schulz comes to Alter Moneta from Fifth Third Bank, in Grand Rapids, Michigan, where he had served for three years as vice president of equipment finance and leasing. Prior to his tenure with Fifth Third, Schulz was president of Grand Capital Funding Corp., a full-service leasing company providing origination, consulting, structuring, pricing, holding, and selling of transactions, which he founded in 1998. For 12 years preceding his ownership of Grand Capital, Schulz held several leasing sales, management, and executive positions with M&I Bank’s leasing division. Schulz got his start in sales and commercial finance in the early 1980s, selling steel and steel-related equipment with Wyckoff Steel and later Thyssen Specialty Steels, both in Detroit, Michigan. Schulz holds a bachelor of science degree in education from Central Michigan University in Mount Pleasant, Michigan. About Alter Moneta Alter Moneta, established in 1998, is one of the fastest growing independent financial services firms in North America, with significant market presence in both Canada and the United States. The company provides funds to purchase or lease new and used revenue- producing equipment for middle-market firms in trucking, warehousing, construction, passenger transport, manufacturing and waste management industries. Through its vendor finance group, Alter Moneta also provides financing programs for manufacturers and dealers. Its Lutex subsidiary, in Quebec, provides auto-leasing services. For more information, visit www.altermoneta.com. ### Press Release ########################### Irwin Financial Reports Fourth Quarter Losses

(Columbus, IN, -- Irwin Financial Corporation (NYSE:IFC), a bank holding company focusing on small business and consumer mortgage lending, today announced that it expects to report a loss from operations for the fourth quarter of 2007 due to the effects of conditions in the mortgage market and housing markets. “During the fourth quarter, we saw continued deterioration of credit conditions in our housing-related portfolios. The bulk of weakness was in our home equity mortgage portfolio, but we have also seen some softening in certain portions of our commercial real estate portfolio. While realized losses have been manageable, we believe it is prudent to take additional provisions to prepare for potential increases in loss rates in 2008. During the fourth quarter, we took several steps to align operational and staffing costs to the current environment. These will be reflected in restructuring charges of approximately $5 million during the quarter; we expect at this point to take less than $2 million more in the first quarter,” said Will Miller, Chairman and CEO of Irwin Financial. “In our home equity segment, we are being negatively affected by the non-core portfolio we transferred from 'held-for-sale' when the secondary market collapsed in the first quarter of 2007. These loans, which were originated for sale and did not meet our core portfolio credit guidelines, are adding to our delinquencies and required provision at a rate that is disproportionate to the portfolio as a whole. In addition, we are seeing greater than expected rate of delinquencies and losses on loans where loan-to-values at origination approached 100 percent. We believe reductions in real estate prices are impacting this portion of the portfolio due to erosion of the limited amount of equity these borrowers had in their homes. Conversely, our portfolio of loans where loan-to-value ratios were above 100% at origination are performing in-line with our delinquency and loss expectations. “We will report an increase in non-performing loans in our commercial banking segment, reflecting weakness in residential real estate in some of our Midwestern and Western markets. We believe our collateral position in each of these loans remains good and, therefore, do not expect material losses will result. Nonetheless, the deteriorating condition of the residential real estate markets suggests some additional reserves are warranted. “We have seen a leveling-off of repurchase requests in our Discontinued Operations. We averaged 13 per month in the fourth quarter, down from an average of 23 per month in the third quarter. Additionally, we are starting to see opportunities for material recoveries from losses we have incurred in representation and warranty claims. Pursuing these opportunities will be a high priority in 2008. “Finally, on a positive note, our commercial finance segment continues to exhibit the strength we have seen all year. We expect the segment will conclude 2007 with another quarter of record net income and good credit quality,” Miller concluded. About Irwin Financial Irwin® Financial Corporation (http://www.irwinfinancial.com) is a bank holding company with a history tracing to 1871. The Corporation, through its principal lines of business, provides a broad range of financial services to small businesses and consumers in selected markets in the United States and Canada. ### Press Release ###########################

News Briefs---- Credit Crisis Finds New Victims SBA budget has 191 earmarks, but no money to cut loan fees Toyota Becomes No. 2 in U.S. Sales Even Trucks Hit the Wall in an Erratic 2007 Late loan payments highest since '01 recession A Challenging Year for Financial Markets Netflix to stream movies directly to TVs Owner to Sell the Weather Channel Video of Sleeping Guards Shakes Nuclear Industry Music album sales plunge in '07 as online purchases soar Sirius Satellite Radio ends 2007 with 8.3 million subscribers, up 38 percent ---------------------------------------------------------------

You May have Missed--- Obama, Huckabee sweep to Iowa victories REPUBLICAN Pct. Dodd/Biden drop out of race

---------------------------------------------------------------

Sports Briefs---- Raiders' Sapp decides to retire ----------------------------------------------------------------

California Nuts Briefs--- California State high court preserves tax breaks for domestic partners ----------------------------------------------------------------

Calendar Events This Day St. Helenan Ray Chadwick named Wine Enthusiast magazine’s ‘Man of the Year’ The U.S. is turned on to wine Wine production increases in Texas 2007: The year in review in Michigan wine country How American sommeliers put their French counterparts to shame. Wine Prices by vintage ----------------------------------------------------------------

Calendar Events This Day Myanmar: Independence Day Spaghetti Day Trivia Day Utah: Admission Day Saint feast Days

http://www.catholic.org/saints/f_day/jan.php ----------------------------------------------------------------

New York City: Tribeca stands for TRIangle BElow CAnal street.

----------------------------------------------------------------

Today's Top Event in History 1954-- A young truck driver named Elvis Presley enters the Memphis Recording Service in Memphis, TN, ostensibly to record a song for his mother's birthday (which was, in reality, many months away). He records "Casual Love Affair" and "I’ll Never Stand in Your Way." It was this recording that would lead MRS head Sam Phillips to call Presley back to record for his Sun Records label. [headlines]

This Day in American History 1780 - A snowstorm hits Washington's army at Morristown New Jersey. -------------------------------------------------------------- Football Poem

(Note: Thursday, 2008 Warren Sapp announced his retirement from football.) -------------------------------------------------------------- SuDoku The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler? http://leasingnews.org/Soduku/soduko-main.htm -------------------------------------------------------------- Daily Puzzle How to play: Refresh for current date: --------------------------------------------------------------

http://www.gasbuddy.com/ -------------------------------------------------------------- News on Line---Internet Newspapers On Line Casino News http://www.onlinecasinonews.com -------------------------------- |

||||||||||||||||

Independent, unbiased and fair news about the Leasing Industry. |

||||||||||||||||

Ten Top Stories each week chosen by readers (click here) |

||||||||||||||||

Cartoons |

||||||||||||||||

Editorials (click here) |

||||||||||||||||

|

||||||||||||||||

|

||||||||||||||||

|