Flash---Sent to all on Leasing News Mailing List (regular edition follows)

CIT Makes It Official

#### Press Release ########## #####################

CIT Announces $3 Billion Credit Facility and Initiates Recapitalization Plan

Creates Immediate Liquidity Enhancement and Commences Cash Tender for Senior Notes Maturing August 17, 2009

NEW YORK--(BUSINESS WIRE)--CIT Group Inc. (NYSE: CIT), a leading provider of financing to small businesses and middle market companies, today announced that it entered into a $3 billion loan facility provided by a group of the Company's major bondholders. CIT further announced that it intends to commence a comprehensive restructuring of its liabilities to provide additional liquidity and further strengthen its capital position.

Today's actions, including a $3 billion secured term loan with a 2.5 year maturity (the "Term Loan Financing"), are intended to provide CIT with liquidity necessary to ensure that its important base of small and middle market customers continues to have access to credit. Term loan proceeds of $2 billion are committed and available today, with an additional $1 billion expected to be committed and available within 10 days.

"We are pleased that CIT is in a position to continue to serve our valued small business and middle market customers," said Jeffrey M. Peek, Chairman and CEO. "We appreciate the loyalty of our customers and the support we have received from numerous industry associations, particularly over the past few weeks. We are also extremely grateful to our employees for their continued hard work and dedication. With today's announcement, our Board of Directors, management team, advisors, and a steering committee of bondholders, who are lenders under the Term Loan Financing, are now actively focused on a restructuring plan that will better position our Company for the long term. We look forward to continuing to work closely with the bondholders and all of CIT's key stakeholders to achieve our objectives."

As the first step in a broader recapitalization plan, CIT has commenced a cash tender offer for its outstanding Floating Rate Senior Notes due August 17, 2009 (the "August 17 Notes") for $825 for each $1,000 principal amount of notes tendered on or before July 31, 2009. Lenders in the Term Loan Financing have agreed to tender all of their August 17 notes. Additional details of the tender offer are described below. The Company and the Term Loan Financing steering committee will work together on the balance of the recapitalization plan, which is expected to include a comprehensive series of exchange offers designed to further enhance CIT's liquidity and capital. Evercore Partners and Morgan Stanley are the Company's financial advisors and Skadden, Arps, Slate, Meagher & Flom LLP and Wachtell, Lipton, Rosen & Katz are legal counsel in connection with the financing and restructuring plan. Barclays Capital is arranger and administrative agent for the Term Loan Financing. Latham & Watkins is legal counsel to Barclays Capital.

Additional information regarding the financing will be available in a Form 8-K to be filed by the Company with the Securities and Exchange Commission. Further, the Company's earnings release and conference call previously scheduled for July 23, 2009, have been cancelled. The Company will report its results for the quarter ended June 30, 2009 when it files its quarterly report on Form 10-Q.

Details About the Tender Offer

As part of the restructuring plan, CIT has commenced a cash tender offer for its outstanding Floating Rate Senior Notes due August 17, 2009 (the "August 17 Notes"), upon the terms and subject to the conditions set forth in its Offer to Purchase dated July 20, 2009 (the "offer to purchase") and the related letter of transmittal (the "Offer"). Pursuant to the Offer, CIT is offering to purchase any and all of its August 17 Notes for $800 for each $1,000 principal amount of outstanding August 17 Notes tendered and not validly withdrawn prior to 12:00 midnight, New York City time, at the end of August 14, 2009 (unless extended by CIT). Holders who validly tender their August 17 Notes prior to 5:00 p.m., New York City time, on July 31, 2009 (unless extended by CIT, the "early delivery time"), and who do not validly withdraw their tenders, will be paid an additional $25 cash for each $1,000 principal amount of outstanding August 17 Notes tendered by the early delivery time. Tendered August 17 Notes may be validly withdrawn at any time prior to 5:00 p.m., New York City time, on July 31, 2009 (unless extended by CIT), but not thereafter. Holders of August 17 Notes accepted in the Offer will also receive a cash payment equal to the accrued and unpaid interest in respect of such August 17 Notes from the most recent interest payment date to, but not including, the settlement date for the Offer.

The Offer is conditioned upon, among other things, holders of August 17 Notes tendering and not withdrawing an amount of August 17 Notes equal to at least 90% of the aggregate principal amount of August 17 Notes outstanding (the "Minimum Condition"). The Minimum Condition may be waived by CIT and the Term Loan Financing steering committee. If the Minimum Condition is satisfied or waived, CIT intends to use the proceeds of the Term Loan Financing to complete the Offer and make payment for the August 17 Notes. There can be no assurances that the restructuring plan or the Offer can be completed successfully.

Morgan Stanley & Co. Incorporated and BofA Merrill Lynch are the Dealer Managers for the Offer. D.F. King & Co., Inc. is the Depositary and Information Agent. Persons with questions regarding the Offer should contact Morgan Stanley & Co. Incorporated toll free at (800) 624-1808 or collect at (212) 761- 5384 or BofA Merrill Lynch at (980) 388-4813, Attn. Debt Advisory Services. Requests for documents should be directed to D.F. King & Co., Inc. toll free at (800) 758-5880 or collect at (212) 269-5550.

About CIT

CIT (NYSE: CIT) is a bank holding company with more than $60 billion in finance and leasing assets that provides financial products and advisory services to small and middle market businesses. Operating in more than 50 countries across 30 industries, CIT provides an unparalleled combination of relationship, intellectual and financial capital to its customers worldwide. CIT maintains leadership positions in small business and middle market lending, retail finance, aerospace, equipment and rail leasing, and vendor finance. Founded in 1908 and headquartered in New York City, CIT is a member of the Fortune 500. www.cit.com

#### Press Release ########################################

|

Monday, July 20, 2009

|

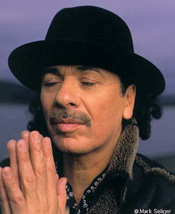

Guitarist/Songwriter Carlos Augusto Santana Alves born 20 July, 1947 Autlán de Navarro, Jalisco, Mexico; best known as the leader of the band called Santana.

http://www.myspace.com/carlossantana http://www.facebook.com/carlossantana?v=box_3 |

Headlines---

Services for Nancy Rosenberg

Classified Ads---Asset Management

CIT Is Said to Obtain Urgent Loan Prevent BK

Equipment Finance Comments GE Earnings Transcript

Bob Bell, CLP, merges with Lanier Funding

Marine-Finance joins "Broker-Lessor List"

Mortgage Brokers Urged to go into Leasing

Leasing is Regulated by Christopher Menkin

Most Influential Women in Leasing

Leasing News Top Stories--July 13--July 17

Leasing 102 by Mr. Terry Winders, CLP

Sale-lease back Transactions

Bank Beat-Four more Banks Fail

IFA: Failure to Support Small-Business Lending

News Briefs---

Bill Mapes sells Leasing Resources

Leasing Companies answer Church Kiosks Leases

CIT's Peek May Be Paid Ahead of Treasury in BK

Bailout Overseer Says Banks Misused TARP Funds

Foreclosure Filings Increase 15% 1st Half year

Silicon Valley jobless rate soars to 11.8%

Porsche chief to get $140M parachute

Coca-Cola hands its fans new bottles to hold onto

You May have Missed---

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

Today's Top Event in History

This Day in American History

Baseball Poem

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

|

--------------------------------------------------------------

Services for Nancy Rosenberg

Services for Nancy will be on Friday, July 24 at 4 P.M. Arizona Community Church, 9325 South Rural RD, Tempe, AZ Phone 480-491-2210.

Donations suggested to Hospice of the Valley, 1515 East Osborn RD Suite 230 Phoenix, AZ 85014.

Bernice Truszkowski

2wonder@prodigy.net

480-949-0710

Nancy Rosenberg passes away

http://leasingnews.org/archives/July%202009/07-17-09.htm#nancyrosenberg

--------------------------------------------------------------

Classified Ads---Asset Management

| Massachusetts, MA Started in credit and collections 30 years ago with a private agency. My skills are negotiating with Attorney's, Insurance Companies & Large & small companies. cityofpa@earthlink.net | Resume |

Minneapolis, MN |

Santa Barbara, Ca. |

United States |

United States |

For a full listing of all "job wanted" ads, please go to:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

To place a free "job wanted" Leasing News ad:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

ELFA Career Center: Job Seekers (free):

http://careers.elfaonline.org/search.cfm

--------------------------------------------------------------

CIT Is Said to Obtain Urgent Loan to Prevent Bankruptcy

http://www.nytimes.com/2009/07/20/business/20bank.html?_r=1&hp--------------------------------------------------------------

Equipment Finance Comments from GE Earnings Call Transcript

"For commercial lending and leasing, the business earned $233 million in the quarter. That is down 74%. Again, the earnings decline was driven by higher credit costs of about $300 million and then lower core earnings and assets were down about 14%. In terms of the loss outlook for CLL it is trending to just slightly above the Fed base case.

"If you look overall, the summary for overall losses and impairments for GE Capital through the first half, we are running just slightly below the Fed base case that we outlined in March. We are also running ahead of our overall cost out projections. For the year we expect cost savings to be more than $3 billion that we said we would have in the first quarter so the team is doing a really good job of controlling the costs.

"More importantly, if you look all the way back since January 2008 we have extended $155 billion in new financings to our commercial customers and $127 billion of credit to over 50 million consumers. Importantly we are not just supporting existing customers but new customers as well. In the first half of this year we added 16,000 new commercial customers and now support 23,000 new small businesses through our retail program.

"We have broad reach and provide a lot of funding through a lot of capital that funds a lot of mid-market and small and medium sized businesses in this country. Lastly, we have maintained our leading position in larger key markets where we have deep domain. We are supporting virtually every U.S. airline and we have been maintaining our leadership possession in [debt earned possession], bankruptcy financing, healthcare financing and energy infrastructure financing. So still a lot of lending activity going on and we are providing a lot of capital to the markets especially in the U.S.

"For healthcare, reported orders of $4 billion were down 11%. Down 7% organically. They were impacted by the stronger dollar. Equipment orders were down 15%, five points of decline from the stronger dollar as well. The U.S. orders were down 13% and the non-U.S. orders were down 7% on an FX adjusted basis. The pressure was pretty much across most of the major product lines. CT, MR, X-ray, Clinical and MDX all down double digits.

"Op profit of $590 million was down 21%. We really were hit by the lower volume. We had some negative price of about 1% in the quarter and negative productivity and services op profit was up 2% in the quarter in that number. It is just a tough healthcare environment that the team is dealing with obviously."

Keith Sherin, Vice Chairman and CEO

"Our credit guys are cautious about it but I think it is a good sign that we have kind of leveled off here in the quarter and now we have to see if that trend continues as we go forward. We have real terms and conditions and rights. We don't have covenant light loans. We don't have no-covenant, no-doc loans and as a result people have to pay us. We are experiencing the delinquency in line with the economic environment our customers are feeling.

"I don't know how it compares to CIT but for us I think this is a good sign on the book and we are going to have to see how it affects us going into the second half. We have shifted so much of our front-end activity into managing accounts, managing and making sure we get our senior secured position back and I think that helps us to manage the delinquency once we get in here. I think it is a positive sign and we will have to see how it comes out in the second half.

"As you can tell, we are extremely committed here. We are out originating new business. We are out providing liquidity. As we showed earlier, even in a tough environment this industrial company is going to generate between $14-16 billion of cash flow. All of that can be applied to strengthening GE Capital and doing more origination in the marketplace. We are very committed to this business model.

"I made two comments in December that I still think are true today. The first one is our priority right now is just to make sure that GE Capital is safe and secure and that we have the opportunity to play offense with GE Capital in the second half of the year. I think we can do that. The second comment I made is we just don't think there are a lot of big transactions that take place. I think what we have seen in the first half supports that."

Jeff Immelt, Chairman and CEO

General Electric Company Q2 2009 Earnings Call Transcript

http://seekingalpha.com/article/149541-general-electric-company-q2-2009-earnings-call-transcript?source=email&page=10

--------------------------------------------------------------

Bob Bell, CLP, merges with Lanier Funding to form United Funding

Long time leasing industry veteran Bob Bell, CLP, owner of Independent Leasing Associates announces his merger with Lanier Funding to form United Funding, LLC.

According to a press release, "Independent Leasing Associates has been servicing the small ticket equipment marketplace with emphasis on computers, printers, imaging equipment and inventory control systems since 1993. Lanier Funding, LLC, formed in 2003, specializes in financing equipment for the waste management market place. Both firms offer competitive financing to small and medium sized businesses without the typical red tape associated with bank lending...

"Working separately over the years, both firms helped develop a state of the art online system to automate the financing process and help vendors close more transactions more quickly thereby increasing their sales and profitability. The system will be called e-Vendor. "

Bob Bell, CLP

"'We have been talking with Lanier for a long time and we are excited that the merger is finally coming to fruition', stated Bob Bell, Independent's owner. 'With all the turmoil in the financial marketplace we are happy to say our sources of funds are still in business and we have money to lend', Bell added."

Bob Bell, CLP

Cummings, Georgia

bbell@unitedfundingllc.com

Business Phone (770) 844-8444

Corey Bell

Chattanooga, Tennessee

cbell@unitedfundingllc.com

Business Phone (877) 777-9660

|

--------------------------------------------------------------

Marine-Finance joins "Broker-Lessor List"

|

Name

City, State Contact Website Leasing Association |

YCS YELB (see above for meaning) |

# of Empl. |

Geographic Area

|

Minimum

Dollar Amount |

Buisness Reports |

A

|

B

|

C

|

D | E

|

Marine-Finance.Com, LLC Island Park, New York Richard J. Pains, Sr., CEO rpaine@marine-finance.com 516-431-9285 Marine-Finance.Com |

2009 |

5 |

North America |

$100,000 Min. |

N |

N |

N |

Y |

N |

A - City Business License | B- State License | C - Certified Leasing Professional |

D - State(s) sales/use tax license |

E - Named as "lessor" on 50% or more of lease contract signed. |

Marine-Finance.Com Launches New Venture and Website

http://www.leasingnews.org/archives/January%202009/01-07-09.htm#mfc

Full Broker/Lessor List:

http://www.leasingnews.org:80/Brokers/broker_Lessor.htm

--------------------------------------------------------------

Mortgage Brokers Urged to go into Leasing

"1. Equipment leasing This is by far the largest growing segment of financing in the country. This year, it is estimated that U.S. companies will finance more than $350 billion of equipment. Rather than drain cash reserves for new equipment, they can finance the equipment with no money down.

"- Typical commission: Seven to 10 percent of the amount financed.

- Typical transaction size: $10,000 to $500,000-plus."

(The Equipment Leasing and Finance Association estimates it to be $650 billion. 10% on a $500,000 transaction? Look for more mortgage brokers to enter the finance and leasing marketplace. editor)

Full Article by National Mortgage Professional Newsletter:

http://nationalmortgageprofessional.com/news12852/mortgage-brokers-discover-six-figure-incomes-non-mortgage-business-loan-opportunities

|

--------------------------------------------------------------

Leasing is Regulated

by Christopher Menkin>

I keep hearing for almost twenty years, maybe longer, that leasing is not regulated. It is. Most states require those involved in finance to be licensed and control "advance rental" and "deposits" (anything but a true lease, not a "disguised" lease, be licensed; many vehicle lessors are not licensed as it pertains not to personal property but vehicles, in addition, most write qualified operating leases with recognized residuals as "FMV." (See your accountant for further definitions re: vehicle leasing. Editor)

There are also many both state and federal commercial lending laws that apply to leasing. There are also local business laws, such as having a business license or obtaining a permit to maintain an office, having insurance, etc. And yes, most cities require a business license if you work out of your house. Not having one is breaking the law, or at least, not following the ethics requirement if you belong to a leasing association.

The question is do many of those in leasing follow the existing laws? As the lists put together by Leasing News, many do not. Worse yet, banks and other funders still do business in states where a license is required but they are not licensed or more prevalent, the entity they do business with is not licensed. Many of them belong to leasing associations who state their members must follow their "code of ethics." These codes are rarely enforced as noticed by Leasing News Bulletin Board Complaints as well as companies not being licensed. They get away with it until caught by a lease or situation that turns sour. The philosophy is prevalent: "Get away with it until you are caught."

These licenses apply to the state you do business in, and are similar to sales tax laws, meaning if you collect sales tax in a specific state, usually over three transactions a year, you need a sales tax license in the state. The same applies to leasing licenses. Several states also do not require a license for a "secured" transaction.

Arizona: All "advance fee loan brokers" must register annually with the state.

Arizona Revised Statutes, sec. 06-1303-1310 (1996)

Registration process: http://azdfi.gov/Licensing/AppPack/ALB_App.htm

Arkansas: All brokers of "a loan of money, a credit card or a line of credit" may not assess or collect an advance fee. In addition, all brokers must register with the Securities Commissioner, post a surety bond of $25.000 and have a net worth of $25,000.

Arkansas Code Annotate sec. 23-39-401 (1995)

California: "In addition to the lending authority provided by the law, the California Finance Lenders Law provides limited brokering authority. A "broker" is defined in the law as "any person engaged in the business of negotiating or performing any act as broker in connection with loans*made by a finance lender." Brokers licensed under this law may only broker loans to lenders that hold a California Finance Lenders license."

http://www.corp.ca.gov/FSD/lender.

(*any transaction that is not a true rent or meets the accounting and tax rules or is re-sold as a loan or discount or has a nominal purchase option is considered under this nomenclature. ) (2)

Florida: Brokers of a "loan of money, a credit card, line of credit or related guarantee, enhancement or collateral of any nature" may not assess or collect an advance fee.

Florida Statues, Chapter 687.14 (1992)

Georgia: A broker of "loans of money, a credit card, a line of credit or related guarantee, enhancement or collateral of any kind or nature" may not assess or collect an advance fee unless such fee is for "actual services necessary to apply for the loan." Official Code of Georgia Annotated, sec. 7- 7-1 (1992)

Idaho: No fee may be collected unless a loan is actually made.

Idaho Code, sec. 26-2501 (1992) Illinois: Code, 815 ILCS 175/15-5.03 Under the Act, a" loan broker" means any person who, in return for a fee from any person, promises to procure a loan for any person or assist any person in procuring a loan from any third party, or who promises to consider whether or not to make a loan to any person. 815ILCS 175/15-5- 15(a)

Specifically excluded from the application of the Act, however, are (1) any bank …regulated by any service loans for the Federal National Mortgage Association… (3) any insurance producer or company authorized to do business in [Illinois], (4) any person arranging financing for the sale of the person's product, (note that this exception does not apply to any person selling someone else's product and only applies to "the" person's product, implying the exception is for the owner of the product arranging for financing), (5) any person authorized to conduct business under the Residential Mortgage License Act of 1987 and (6) any person authorized to do business in [Illinois] and regulated by the Department of Financial Institutions or the Office of Banks and Real Estate. "In the event that the Act is violated by the broker, the Secretary of State is empowered by the statute to make investigations and examinations, suspend or evoke the broker's approval, subpoena witnesses, compel the production of books and records, order depositions and obtain temporary restraining orders and injunctions against the broker. In the vent that a violate is found, the Secretary of State may impose a fine in the amount of $10,000 for each violation and the broker shall be liable to any person damaged in the amount of tactual damages plus attorneys fees." This appears as standard language on most states.

Idaho: No fee may be collected unless a loan is actually made.

Idaho Code, sec. 26-2501 (1992)

Illinois: Code, 815 ILCS 175/15-5.03 Under the Act, a" loan broker" means any person who, in return for a fee from any person, promises to procure a loan for any person or assist any person in procuring a loan from any third party, or who promises to consider whether or not to make a loan to any person. 815ILCS 175/15-5- 15(a) specifically excluded from the application of the Act, however, are (1) any bank …regulated by any service loans for the Federal National Mortgage Association… (3) any insurance producer or company authorized to do business in [Illinois], (4) any person arranging financing for the sale of the person's product, (note that this exception does not apply to any person selling someone else's product and only applies to "the" person's product, implying the exception is for the owner of the product arranging for financing), (5) any person authorized to conduct business under the Residential Mortgage License Act of 1987 and (6) any person authorized to do business in [Illinois] and regulated by the Department of Financial Institutions or the Office of Banks and Real Estate. "In the event that the Act is violated by the broker, the Secretary of State is empowered by the statute to make investigations and examinations, suspend or evoke the broker's approval, subpoena witnesses, compel the production of books and records, order depositions and obtain temporary restraining orders and injunctions against the broker. In the vent that a violate is found, the Secretary of State may impose a fine in the amount of $10,000 for each violation and the broker shall be liable to any person damaged in the amount of tactual damages plus attorneys fees." This appears as standard language on most states.

Iowa: A broker of loans of "money or property" may not assess or collect an advance fee except for a "bona fide third-party fee" and a broker must obtain a bond or establish a trust account and file required documents with the Commissioner or Insurance.

Iowa Code, sec. 535C (19920)

Kansas : Broker is not exempt. Discounter or Lessor is exempt: " 'Creditor' means any person to whom a loan is initially payable on the face of the note or contract evidencing the loan" is exempt. Anyone who earns a fee or accept a deposit, except a bank, financial institution, discounter or lessor, must be registered.

http://www.securities.state.ks.us/rules/loan.rtf

Kentucky: Brokers of "a loan of money, a credit card, a line of credit or related guarantee, enhancement or collateral of any kind or nature" may not assess or collect an advance fee.

Kentucky Revised Statutes Annotated, sec. 367.380 (1992)

Louisiana: A broker of loans of "money or property…whether such agreement is styled as a loan, a lease or otherwise" must obtain a surety bond or establish a trust account in the amount of $25,000. A broker may not collect an advance fee but may collect an "advance expense deposit for commercial loans" only for actual expenses incurred in obtaining the loan. Louisiana Revised Statutes Annotated, sec. 9:3574 (1993); Louisiana Revised Statutes Annotated, Sec. 51:1910 (1992)

Maine: No license required: "the regulation of commercial loan brokers does not fall under the jurisdiction of the Maine Bureau of Consumer Credit Protection. Transactions involving two businesses are legal/contractual in nature. Therefore, disputes involving a commercial loan between a business and commercial loan provider or broker must be settled in the court system."

http://www.maine.gov/pfr/consumercredit/faqs/loan_broker_faq.htm#j

Mississippi: A broker or loans of money may not assess or collect an advance fee and can be fined up to $5,000 for each violation. Mississippi Code Annotated, sec. 81-19-17 (1997)

Missouri: A broker of loans of "money or property" may not assess or collect an advance fee. Missouri Revised Statues, sec. 367 300 (19920

Nebraska: A broker of loans of money may not assess or collect an advance fee. Nebraska Revised Statutes, sec. 45-189 (1993)

New Jersey: Brokers of "loans of money" may not assess or collect an advance fee.

New Jersey Rev. Statutes, sec. 17:10B (1992)

New Mexico: New Mexico currently requires Brokers/Lessors to register for Licensing under the NM Mortgage loan Company or Loan Broker Act with the Financial Institutions Division of the State of New Mexico. Banks with Brick and Mortar within the State of New Mexico are exempt.

Prior to licensing applicants must submit the Following:

Articles of Incorporation

Listing of all principals (including management)

A full financial Package (to meet their minimum requirements of liquidity)

Personal financial statements on all principals

Disclosure of all current or past suits (civil or criminal)

Attach a corporate surety bond

Include a $400.00 registration fee renewable yearly

North Carolina: A broker of "loans of money or property…whether such agreement is styled as a loan, a lease or otherwise" must obtain a surety bond or establish a trust account in the amount of $25,000 and obtain a license. North Carolina General Statutes, sec. 66-106 (1992)

North Dakota: Brokers may not accept an advance fee unless the broker is licensed. North Dakota Century Code, 13-04. 1-09.1 (1993) Ohio: Department of Commerce, Division of Financial Institutions

(Certificate to engage in the business of a credit services organization in accordance with the provisions of Sections 4712.01 to 4712.14 of the revised code of Ohio, subject to all the provisions thereof and to the regulations of the division.) Ohio Department of Taxation requires a "Vendor's License" under provision 5739.17 of the Revised Code (...is hereby authorized to sell tangible personal property and selected services at the retail location specified below.) This also makes the lessor responsible for all taxes with penalties for not doing so.

South Carolina: A broker of "a loan of money, a credit card, a line of credit or related guarantee, enhancement or collateral of any kind or nature" may not assess or collect an advance fee. South Carolina Code Annotated, sec. 34-36-10 91992)

California Law

From Tom McCurnin, Attorney, Barton, Klugman & Oetting:

I'd like to clarify this:

1. First the definition of a "broker" under the Financial Lender's Law is not what you and I consider to be a broker. A broker in leasing often includes someone who writes the lease as a lessor and immediately assigns it to the real lender in a table funding deal. Under the Financial Lenders Law, a broker is only someone who negotiates it or assists in the financing, and who is not the actual lessor. If that "broker" was a lessor, he or she would have to be licensed as a Finance Lender. Indeed, if one was licensed as a broker and actually was a lessor, one wonders whether it would have to assign the lease only to a licensed lender. I advise lessor brokers to be licensed as a lender, not a broker.

2. Finance Lenders may assign to anyone, not merely other Financial Lenders. Servicers, for example, do not have to be licensed.

3. There is no definition in the Financial Lenders Law as to what a "true lease" is. Presumably, the Department of Corporations would have to use the Uniform Commercial Code 1-201(37) [e.g., no nominal consideration for residual and 10% put is not nominal] but nowhere is that defined.

(In a response to a question, Tom added :)

If the "broker" is not in the paper trail, e.g., not a lessor (and just negotiating the deal and not a lessor), than yes, the leasing company accepting the paper must be licensed.

If the "broker" is an actual lessor, and is licensed it can assign to anyone to service. e.g., any licensed finance lender can assign to another lender, who does not have to be licensed. The entity originating the deal must be licensed, others down stream do not have to be licensed, as long as the first in the chain is licensed.

California Finance Lenders Law:

http://www.leasingnews.org/Conscious-Top%20Stories/cal_license.htm

|

--------------------------------------------------------------

Most Influential Women in Leasing

Send nominations to: kitmenkin@leasingnews.org

"Influential" as "a person whose actions and opinions strongly influence the course of events" {Online Dictionary}. They must be alive, and do not need to be active any longer in the leasing or finance industry. You need to provide a description of why you think they should be on the list.

They also should meet the caliber of those nominated.

New Nominees:

June Sciotto-- President of Regal Finance, since 1988. She was one of the original person's that started the National Association of Equipment Leasing Brokers, worked countless hours to get the organization off the ground, then went on to serve on the board becoming as its first Female President. This was back in the day when the term for President was for 2 years and all the work was done by the officers and board with no help from any management group or hired individuals. Several of the policies and procedures that were implemented by June Sciotto helped bring the National Association of Equipment Leasing to become a viable association for the Leasing Broker and also broke the barriers of the other organizations by getting them to recognize the NAELB and to include its members in their meetings.

Full List from Friday-click on the name for the nomination description

:

Elaine Litwer

Lisa A, Levine, CAE

Terri McNally

Deborah Monosson

Rosanne Wilson, CLP

|

--------------------------------------------------------------

Leasing News Top Stories--July 13--July 17

Here are the top ten stories opened by readers:

(1) Editorial---Please Support CIT

http://leasingnews.org/archives/July%202009/07-13-09.htm#supportCIT

(2) American Leasing Pres. Pleads Guilty embezzling $6.2MM

http://leasingnews.org/archives/July%202009/07-15-09.htm#american_leasing_president

(3) Peter C. Platt passes away

http://leasingnews.org/archives/July%202009/07-17-09.htm#peterplatt

(4) IFC Credit struggles while Trebels Plans R&L Leasing

http://leasingnews.org/archives/July%202009/07-15-09.htm#ifc_Credit

(5) IFC's Trebels/Langs Sued for Fraud by CoActiv Capital

http://leasingnews.org/archives/July%202009/07-17-09.htm#ifc_Trebels

(6) Most Influential Women in Leasing

http://leasingnews.org/archives/July%202009/07-13-09.htm#influentialwomen

(7) GE Capital lays off 127; more cuts planned

http://www.stamfordadvocate.com/ci_12829325?source=most_emailed

(8) Weekly Bulletin Board Complaint Report

http://leasingnews.org/archives/July%202009/07-13-09.htm#bulletinboard

(9) Operation Lease Fleece: Up-Date

http://leasingnews.org/archives/July%202009/07-17-09.htm#operation_lease_fleece

(10) Most Influential Women in Leasing

http://leasingnews.org/archives/July%202009/07-17-09.htm#influentialwomen

Extra, not counted for technical reasons:

CIT Announces That Discussions with Government Agencies Have Ceased

http://leasingnews.org/archives/July%202009/07-15-09a.htm

--------------------------------------------------------------

Leasing 102

by Mr. Terry Winders, CLP

Sale-lease back Transactions

In a year where profits are rare and companies are looking for some method to improve bottom line performance some are approaching leasing companies to arrange a sale-lease back. If an asset retains useful life and has a value above its book or tax un-depreciated value then by selling it to a leasing company and passing title but retaining possession, and use, the lessee can book a gain on the sale of a capital asset and improve its bottom line.

The key is the selling price. It needs to be high enough to warrant the work necessary to arrange the transaction. Plus the customer needs to understand both the book and tax effect of the gain. The transaction will in most cases be a capital lease and have a double impact on the balance sheet. The sale cash will increase cash on the balance sheet plus the net present value of the rent stream will be placed as a leased asset. The un-depreciated asset value will come off the balance sheet. Net worth will increase and the net present value of the rent stream will become a lease liability. The difference between the un-depreciated book value and the sale value will show up as a gain on the sale of a capital asset however a recapture of income tax will be required on the difference between the un-depreciated tax value and the selling price. On occasion an operating loss may shelter any tax requirements making the profit more important because it is tax free.

A Sale Lease-back is a lease where the equipment is purchased from the Lessee instead of an equipment vendor. The Lessee retains the possession and use of the equipment, after the sale, but surrenders legal title and ownership to the Lessor. An appraisal of the equipment is necessary to show the Lessor is acquiring the asset(s) at its then Fair Market Value to avoid "fraudulent connivance claims" from other creditors.

When the Asset is sold to the Lessor it must be free of liens requiring the Lessor to check for liens recorded on financing statements (UCC-1) in the State where the lessee has registered his Charter papers and then you should require proof of purchase from the Lessee to establish their clear ownership.

To complete the sale it is recommended that the Lessor take possession of the Asset along with a "bill of sale". If no possession is registered perhaps a disgruntled creditor would argue that "no possession, no sale" because the equipment never left the customer's facilities. Most States require possession to complete the sale. Occasionally equipment is too large, or hard to move, so standing next to the equipment (with your hands on it) and have your picture taken and will help prove you took possession.

In a Sale-Lease-Back the lessee has to look to the cost. If assets are free and clear of liens then they could use it as collateral and borrow any required cash for operations. In a sale lease-back the gains and the tax effect plus the sales tax on the rentals may make it a very expensive way to borrow cash. Therefore a sale lease-back to raise cash is a very poor reason but it is the one we hear most often. Now we are hearing that the cost is offset by the ability to show a better return and keep the company alive.

It is important to dig deep into the financials of any company wanting a sale lease back because the reasons for the request usually indicate a poor financial position.

Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty years and can be reached at leaseconsulting@msn.com or 502-327-8666. He invites your questions and queries.

Previous #102 Columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

|

--------------------------------------------------------------

|

--------------------------------------------------------------

Bank Beat-Four more Banks Fail

Leasing News gave Vineyard Bank as a typical example of smaller and regional banks in trouble almost a year ago

BankFirst, Sioux Falls, SD was closed by the South Dakota Division of Banking, and the Federal Deposit Insurance Corporation (FDIC) was named Receiver. The two offices are now part of Alerus Financial, National Association, Grand Forks, North Dakota, to assume all of the deposits of BankFirst. The bank is the 55th bank to fail this year.

As of April 30, 2009, BankFirst had total assets of $275 million and total deposits of approximately $254 million. In addition to assuming all of the deposits of the failed bank, Alerus Financial, N.A. will acquire $72 million in assets, comprised of cash, securities and loans secured by deposits. The FDIC entered into a separate agreement with Beal Bank Nevada, Las Vegas, Nevada, to acquire $177 million of the failed bank's loans. The FDIC will retain the remaining assets for later disposition.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $91 million. The last bank to be closed in the state was state was First Federal Savings Bank of South Dakota, Rapid City, on April 24, 1992.

http://www.fdic.gov/news/news/press/2009/pr09124.html

First Piedmont Bank, Winder, Georgia with the two offices will to open today as branches of First American Bank and Trust Company, Athens, Georgia. This is the 54th FDIC-insured institution to fail in the nation this year, and the tenth in Georgia.

As of July 6, 2009, First Piedmont Bank had total assets of $115 million and total deposits of approximately $109 million. First American Bank and Trust Company paid a deposit premium of 1.01 percent. In addition to assuming all of the deposits of the failed bank, First American Bank and Trust Company agreed to purchase approximately $111 million of assets,

The FDIC and First American Bank and Trust Company entered into a loss-share transaction on approximately $90 million of First Piedmont Bank's assets. First American Bank and Trust Company will share in the losses on the asset pools covered under the loss-share agreement. The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $29 million.

http://www.fdic.gov/news/news/press/2009/pr09123.html

Temecula Valley Bank, Temecula, California, became the 57th bank to fail this year, the eighth in California. First-Citizens Bank and Trust Company, Raleigh, North Carolina entered into a purchase and assumption agreement with the FDIC.

As of May 31, 2009, Temecula Valley Bank had total assets of $1.5 billion and total deposits of approximately $1.3 billion. In addition to assuming all of the deposits of the failed bank, First-Citizens Bank and Trust Company agreed to purchase essentially all of the assets.

First-Citizens Bank and Trust Company will purchase all deposits, except about $304 million in brokered deposits, held by Temecula Valley Bank. The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $391 million.

http://www.fdic.gov/news/news/press/2009/pr09126.html

Vineyard Bank, National Association, Rancho Cucamonga, California was closed and the sixteen officers were taken over by California Bank & Trust, San Diego, California. In Northern California, they specialized in very expensive home mortgages and development,

were cited several times and on the troubled list for almost a year.

Leasing News wrote about the bank being one of the typical

in trouble almost a year ago:

http://www.leasingnews.org/archives/August%202008/08-15-08.htm#vin

As of March 31, 2009, Vineyard Bank, N.A. had total assets of $1.9 billion and total deposits of approximately $1.6 billion. In addition to assuming all of the deposits of the failed bank, California Bank & Trust agreed to purchase approximately $1.8 billion of assets. California Bank & Trust will purchase all deposits, except about $134 million in brokered deposits, held by Vineyard Bank, N.A. This is a good example of banks with large brokered deposits, paying for CD's and other cash certificates. The FDIC will be paying the brokers.

The FDIC and California Bank & Trust entered into a loss-share transaction on approximately $1.5 billion of Vineyard Banks, N.A.'s assets. The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $579 million. This is the seventh bank to fail in California this year.

http://www.fdic.gov/news/news/press/2009/pr09125.html

List of Bank Failures :

http://www.fdic.gov/bank/individual/failed/banklist.html

|

--------------------------------------------------------------

### Press Release ##########################

Failure to Support Small-Business Lending Raises IFA's Concern

The U.S. government's decision not to prevent the probable bankruptcy of small-business lender CIT Group Inc. was met with disappointment and concern by the International Franchise Association late last week. After urging the Obama administration to take immediate action to aid small-business lending activities by commercial banks, IFA Pres. and CEO Matthew Shay called the move disappointing and a reason to be concerned for the future of the nation's small firms.

Shay had earlier called on U.S. Treasury Sec. Timothy Geithner to aid the ailing lender, noting that the crisis facing CIT Group Inc. is just the latest symptom of the severe credit crunch affecting franchised businesses. In a letter to the secretary, Shay said that CIT may appear too small to merit "too big to fail" consideration, but that in fact, CIT plays a critical role for small-business borrowers nationwide and steps should be taken to keep it solvent.

"Providing critical assistance to a substantial SBA lender such as CIT that has had positive lending outcomes seems a prudent use of government assistance during this challenging time," he said. "We believe that a program of broad federal support for increased franchisee borrowing will result in a significant benefit to the U.S. economy."

Shay said the volume of CIT small-business lending is down dramatically this year, and the industry is concerned that allowing CIT to enter bankruptcy will send the wrong signal to small businesses on Main Street, noting the market withdrawal of many other lenders has left borrowers with few remaining options.

As the economy has deteriorated, Banco Popular, Comerica and UPS Capital have all vacated the SBA lending business nationally (in 2008, these banks were ranked numbers six, nine and 10 respectively in the small-business lending marketplace). GE Capital, another historically-active lender in the small business and franchising markets, has halted virtually all franchisee lending. Banks, such as Wells Fargo and PNC, have also reduced their lending to franchised businesses and tightened lending standards significantly for the loans that they are willing to make. Since 2000, CIT has been the largest originator of SBA-backed franchise loans and was responsible for $766,568,550 in small-business loans in FY 2008.

Shay said that a recent IFA report demonstrates how critical access to financing is to the growth of franchises. For every incremental $1 billion of lending to franchisees, 34,100 jobs and $3.6 billion of additional economic output are created.

"We believe that one of the fastest ways to kick-start the American economy into a sustainable recovery is to target categories of businesses that can create and sustain the most jobs, such as franchising," he said. "Franchising grew nearly four times faster than the overall economy in the four years following the last recession (2001-2005). Economic downturns often lead to a strong infusion of human capital in franchised businesses as workers affected by corporate lay-offs are looking to start their own businesses. The only missing element this time is access to capital." IFA outlined several steps the administration and Congress should consider to make it easier for entrepreneurs to access capital and create jobs:

o Create of a federal program to facilitate the syndication of franchisee loans (perhaps using the Term Asset-Backed Securities Loan Facility as a model).

o Increase the standard SBA 7(a) maximum loan limit from $2 million to $4 million and increase the maximum guarantee amount provided to $3.6 million. The economic downturn has resulted in borrowers having less collateral due to declining home values and reduced investment and savings accounts. Increasing the loan limit will allow more individuals and businesses to take advantage of the 7(a) program, expanding the job creation potential of the program.

o Consider a market-based loan pricing model for the SBA loan programs. The real issue for many small-business borrowers is not as much the cost of funds as it is the basic availability of funds. When SBA programs cap the interest rates that can be charged by lenders, the rules create a competitive disadvantage for small-business borrowers. Despite the best intentions of policymakers, market economics dictate that capital will not flow to markets that offer below-market rates.

"It is imperative that the administration devote key resources to small-business lending activities now, because these tools will result in job creation more quickly than other recovery and reinvestment initiatives," Shay said. "It is widely acknowledged that small businesses account for the majority of new job creation in this country, and the federal government should be empowering them with the tools to lead the economy out of recession."

#### Press Release #############################

|

-------------------------------------------------------------

![]()

News Briefs----

Bill Mapes sells Leasing Resources

http://www.kansas.com:80/business/story/895999.html

Leasing Companies answer Washington AG Church Kiosks

http://www.legalnewsline.com/news/222002-leasing-companies-say-ag-nickles-has-it-all-wrong

CIT's Peek May Be Paid Ahead of Treasury in Case of Bankruptcy

http://www.bloomberg.com/apps/news?pid=20601087&sid=acO4YOJVfBIU

Bailout Overseer Says Banks Misused TARP Funds

http://www.washingtonpost.com/wp-dyn/content/article/2009/07/19/AR2009071901770.html

Foreclosure Filings Increase 15% in First Half Of 2009

http://www.creditcollectionsworld.com/article.html?id=200907162SMZKAD3&from=creditandcollectionnews

Silicon Valley jobless rate soars to 11.8 percent

http://www.mercurynews.com/businessheadlines/ci_12862982

Porsche chief to get $140M parachute

http://www.upi.com/Business_News/2009/07/19/Porsche-chief-to-get-140M-parachute/UPI-60021248040359/

Coca-Cola hands its fans new bottles to hold onto

http://www.ajc.com/business/coca-cola-hands-its-fans-new-bottles-to-hold-onto-83543.html

---------------------------------------------------------------

You May have Missed---

Little banks shared risk, take big hit

http://www.ajc.com/business/little-banks-shared-95026.html

----------------------------------------------------------------

Sports Briefs----

Cink's playoff performance denies Watson at British Open

http://www.usatoday.com/sports/golf/pga/2009-07-19-british-open_N.htm

Cowboys Stadium would look even nicer in Dallas

http://www.dallasnews.com/sharedcontent/dws/spt/football/cowboys/stories/072009dnspotaylor.36159df.html

Purdy: Are the 49ers making S.F. jealous?

http://www.mercurynews.com/49ers/ci_12819028

Sue Burns, a Giants owner and team mom, dies

http://www.mercurynews.com/topstories/ci_12871924

----------------------------------------------------------------

![]()

California Nuts Briefs---

Schwarzenegger postpones budget talks

http://www.sacbee.com/latest/story/2038651.html

----------------------------------------------------------------

![]()

"Gimme that Wine"

Sixth generation steps up to run Bogle Vineyards in Clarksburg

http://www.sacbee.com/topstories/story/2037362.html

Wine lover finalist for dream job

http://www.ajc.com/business/wine-lover-finalist-for-95042.html

Corked! - critically acclaimed wine country mockumentary opens in San Jose

http://www.examiner.com/x-6189-SF-Restaurant-Examiner~y2009m7d19-Corked--critically-acclaimed-wine-country-mockumentary-opens-in-San-Jose

Box Wines That Can Be a Hit

http://www.forbes.com/2009/07/16/wine-packinging-boxes-lifestyle-wine-boxed-wine.html

Remy Cointreau reports 4.5 percent drop in Q1 sales as Champagne sales lose their pop

http://www.chicagotribune.com/business/nationworld/wire/sns-ap-eu-france-remy-cointreau,0,5364055.story

Australia's Leasingham 100 year old winery to close in August

http://www.decanter.com/news/286360.html

Is Constellation in Trouble?

http://www.winespectator.com/Wine/Features/0,1197,5199,00.html

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

The London International Vintners Exchange (Liv-ex) is an electronic exchange for fine wine.

http://www.liv-ex.com/

----------------------------------------------------------------

![]()

Today's Top Event in History

1969 - American astronaut Neil Armstrong, nearly 240,000 miles from earth, spoke these words to millions listening at home: "That's one small step for a man, one giant leap for mankind." A moment later, he stepped of the lunar module Eagle, becoming the first human to walk on the surface of the moon. That first step was taken with Armstrong's left foot.

|

[headlines]

----------------------------------------------------------------

![]()

This Day in American History

1591- Anne Marbury was baptized in Alford, England. America's first female religious leader, Anne Marbury Hutchinson was the daughter of an outspoken clergyman silenced for criticizing the Church of England. Better educated than most men of the day, she spent her youth immersed in her father's library. At twenty-one, Anne Marbury married Will Hutchinson and began bearing the first of their fifteen children. She became an adherent of the preaching and teachings of John Cotton, a Puritan minister who left England for America.

http://memory.loc.gov/ammem/today/jul20.html

1848- the Seneca Falls Convention convened for a second day. On the previous day, convention organizer Elizabeth Cady Stanton had read the "Declaration of Sentiments and Grievances." In the process of reviewing a list of attached resolutions, a group united across the boundaries of gender and race to demand women's right to vote in the United States.

(second part of: http://memory.loc.gov/ammem/today/jul20.html )

1858- Approximately 1,500 baseball fans were charged 50 cents each to watch a baseball game between the New York All-Stars and a Brooklyn team at Fashion Race Course on Long Island. This is the first record “commercial” game of baseball. In a preclude to the next century, New York beat Brooklyn 22-18.

1874 -- General George Custer and first official exploring expedition enters Black Hills with 110 wagons and 1,000 men, in direct violation of treaty of 1868 that barred whites from sacred hills. He was out to make a name for himself

in history.

1885-Birthday of Theda Bara, early Hollywood star whose blatant sexuality (for the time) as a "vamp" (a woman who uses men and throws them away instead of being used and thrown away) was the subject of many a Sunday church sermon. She made more than 40 silent films.

http://www.classicimages.com/1996/july/theda.html

http://www.tartcity.com/thedabara.html

http://silentladies.com/PBara1.html

http://www.bombshells.com/gallery/bara/theda_bio.php

1922---Alto/tenor sax player/arranger Ernie Wilkins born St. Louis, Mo., perhaps best

known for his Count Basie arrangements Died June 5, 1999

http://www.harlem.org/people/wilkins.html.

http://elvispelvis.com/erniewilkins.htm

1930 - The temperature at Washington D.C. soared to an all-time record of 106 degrees. The next day Millsboro reached 110 degrees to set a record for the state of Delaware. July 1930 was one of the hottest and driest summers in the U.S., particularly in the Missouri Valley where severe drought conditions developed. Toward the end of the month state records were set for Kentucky with 114 degrees, and Mississippi with 115 degrees.

1934--- 118ø F (48ø C), Keokuk, Iowa (state record)

1939-Birthday of Judy Chicago, artist who encourages women to do what she did, assimilate female imagery into their art work. She established educational programs for women, was one of the founders of the Los Angeles Feminist Studio Workshop which, among other things, opened the Woman's Building, and creator of a number of exciting woman-related images and sculptures.

http://www.indiana.edu/~scsweb/jchicago/chicago_cu2.jpg

http://www.judychicago.com/

http://www.npr.org/programs/atc/features/2002/oct/chicago/

1940-The first pop music record charts for single songs were published by the music grade newspaper “Billboard.” The first Number on was Tommy Dorsey's “ I'll Never Smile Again,” sung by Frank Sinatra.

1944 President Franklin D. Roosevelt nominated for an unprecedented 4th term at the Democratic convention. Harry S. Truman of Missouri was nominated for

vice-president. In June the allied landed in Normandy and the Russian front was

in full battle, but in mid-June the Germans introduced a new weapon, the V-1 pilot less bombs; they launched it against London and other British cities. In September they followed it with the V-2, a supersonic rocket causing great destruction. The end of June the Republican National Convention nominated

Thomas E. Dewey, governor of New York for the presidency, and Gov. John W. Bricker of Ohio for the vice-presidency.

1945---Top Hits

Dream - The Pied Pipers

The More I See You - Dick Haymes

Sentimental Journey - The Les Brown Orchestra (vocal: Doris Day)

Stars and Stripes on Iwo Jima - Bob Wills

1946-13 year old Petula Clark made her first appearance on British TV

1947 Carlos Santana born Autlan, Mexico

1947--Guitarist/songwriter, Carlos Augusto Santana Alves born Autlán de Navarro, Jalisco, Mexico;best known as the leader of the band called Santana.

http://www.myspace.com/carlossantana

http://www.facebook.com/carlossantana?v=box_3

1950--LIBBY, GEORGE D. Medal of Honor

Rank and organization: Sergeant, U.S. Army, Company C, 3d Engineer Combat Battalion, 24th Infantry Division. Place and date: Near Taejon, Korea, 20 July 1950. Entered service at: Waterbury, Conn. Birth: Bridgton, Maine. G.O. No.: 62, 2 August 1951. Citation: Sgt. Libby distinguished himself by conspicuous gallantry and intrepidity above and beyond the call of duty in action. While breaking through an enemy encirclement, the vehicle in which he was riding approached an enemy roadblock and encountered devastating fire which disabled the truck, killing or wounding all the passengers except Sgt. Libby. Taking cover in a ditch Sgt. Libby engaged the enemy and despite the heavy fire crossed the road twice to administer aid to his wounded comrades. He then hailed a passing M-5 artillery tractor and helped the wounded aboard. The enemy directed intense small-arms fire at the driver, and Sgt. Libby, realizing that no one else could operate the vehicle, placed himself between the driver and the enemy thereby shielding him while he returned the fire. During this action he received several wounds in the arms and body. Continuing through the town the tractor made frequent stops and Sgt. Libby helped more wounded aboard. Refusing first aid, he continued to shield the driver and return the fire of the enemy when another roadblock was encountered. Sgt. Libby received additional wounds but held his position until he lost consciousness. Sgt. Libby's sustained, heroic actions enabled his comrades to reach friendly lines. His dauntless courage and gallant self-sacrifice reflect the highest credit upon himself and uphold the esteemed traditions of the U.S. Army.

1950- the “Arthur Murray Party” premiered on television. This ballroom dancing show appeared on all four networks (ABC, Dumont, CBS and NBC) and was hosted by Kathryn Murray, wife of famed dance school founder Arthur Murray. “Arthur Murray taught me to dance in a hurry. “ He is the uncle of

our good friend Bob Teichman (Murray dropped his middle name for

as Teichman did not rhyme with very many things.)

1953---Top Hits

Song from Moulin Rouge - The Percy Faith Orchestra

April in Portugal - The Les Baxter Orchestra

I'm Walking Behind You - Eddie Fisher

It's Been So Long - Webb Pierce

1954-Elvis Presley performed on one what was probably the smallest stage of his career when he appeared on the back of a flatbed truck outside a Memphis drugstore for its grand opening. Elvis was then a member of The Blue Moon Boys trio with Bill Black and Scotty Moore, who took their name from a song they had recorded just two weeks previously, "Blue Moon of Kentucky".

1958- During the first game of a doubleheader Tiger Jim Bunning no-hits the Red Sox, 3-0. The future Hall of Famer will become the first modern pitcher to toss a no-hitter in both leagues when throws a perfect against the Mets in 1964.

1961---Top Hits

Tossin' and Turnin' - Bobby Lewis

The Boll Weevil Song - Brook Benton

Yellow Bird - Arthur Lyman Group

Heartbreak U.S.A. - Kitty Wells

1963-Lesley Gore released "Judy's Turn To Cry", the follow up to her number one hit, "It's My Party". The record was a continuation of the original story and it too became a Top 5 hit in the US.

1965-Bob Dylan's "Like a Rolling Stone" is released by Columbia records. The disc turns out to be his biggest hit ever climbing to number two on the U.S. pop chart and number four in the U.K.

1965-Kama Sutra Records releases the Lovin' Spoonful's first record, "Do You Believe in Magic." It will reach #9 on the pop chart.

1965- Yankee pitcher Mel Stottlemyre hits an inside the park grand slam against the Red Sox en route to a 6-3 victory.

1967-The City and County of San Francisco put up $200,000 to create a free medical clinic. Dr. Frederick Meyers (d.1998 at 80) helped found the Haight-Ashbury Free Medical Clinic

1968-One thousand mentally retarded athletes competed in the first Special Olympics at Solider Field, Chicago, Il. Today more than one million athletes from 156 countries compete at the local, national and international level.

1968 - Iron Butterfly's album, In-a-Gadda-da-Vida, debuted on the United States pop charts. It featured its now-famous 17-minute title track, which in turn contained one of the longest drum solos in the history of rock music.

1968- Cream's "Wheels Of Fire" LP enters the chart. It hits #1 and features the single "White Room."

1968-Hugh Masakela's instrumental rendition of "Grazing in the Grass" reached the top of the Billboard Hot 100. A year later, The Friends of Distinction would take a vocal version of the song to number 3.

1969---Top Hits

In the Year 2525 - Zager and Evans

Spinning Wheel - Blood, Sweat and Tears

Good Morning Starshine - Oliver

I Love You More Today - Conway Twitty

1969 - American astronaut Neil Armstrong, nearly 240,000 miles from earth, spoke these words to millions listening at home: "That's one small step for a man, one giant leap for mankind." A moment later, he stepped of the lunar module Eagle, becoming the first human to walk on the surface of the moon. That first step was taken with Armstrong's left foot.

1973- White Sox pitcher Wilbur Wood loses both ends of a doubleheader to the Yankees.

1973- Kunckleballer Wilbur Wood of the Chicago White Sox pitched both games of a doubleheader against the New York Yankees. No pitcher has done this since, but Wood lost both games.

1975-Miami" Steve Van Zandt performs for the first time in concert as a member of Bruce Springsteen's E Street Band in Providence, Rhode Island.

1977---Top Hits

Da Doo Ron Ron - Shaun Cassidy

Looks like We Made It - Barry Manilow

I Just Want to Be Your Everything - Andy Gibb

It was Almost like a Song - Ronnie Milsap

1978-Steve Martin's novelty tune "King Tut" became a Top Ten hit in the US. Some of the musicians on the track were members of The Nitty Gritty Dirt Band.

1984 - Ty Cobb's record was broken by baseball great Hank Aaron when Aaron appeared in game number 3,034 of his career. At age 40, Aaron, was already playing in his 20th major-league baseball season.

1985 - Treasure hunters began removing $400 million in coins and silver ingots from the ocean floor in the biggest underwater treasure hunt in history. The money came from the Spanish galleon, "Nuestra Senora de Atocha," which sunk in 1622, 40 miles off the coast of Key West, Florida.

1985-Sting's solo debut, "The Dream of the Blue Turtles" enters the album charts. The LP features the hits, "If You Love Somebody Set Them Free" and "Fortress Around Your Heart."

1985---Top Hits

A View to a Kill - Duran Duran

Raspberry Beret - Prince and The Revolution

Everytime You Go Away - Paul Young

Dixie Road - Lee Greenwood

1986 - The temperature at Charleston, SC, hit 104 degrees for the second day in a row to tie their all-time record high.

1987- Yankee first baseman Don Mattingly ties a major league mark as he is credited with 22 putouts in one game matching Hal Chase's feat of 1906. 1988—The Democratic National Convention nominated Gov. Michael S. Dukakis of Massachusetts for president and Sen. Lloyd M. Bensten,Jr., of Texas for Vice-President.

1988 - The temperature at Redding, CA, soared to an all-time record high of 118 degrees. Showers and thunderstorms produced much needed rains from New England to southern Texas. Salem, IN, was deluged with 7.2 inches of rain resulting in flash flooding.

1989 - Showers and thunderstorms in the Middle Atlantic Coast Region soaked Wilmington, DE, with 2.28 inches of rain, pushing their total for the period May through July past the previous record of 22.43 inches. Heavy rain over that three month period virtually wiped out a 16.82 inch deficit which had been building since drought conditions began in 1985. Thunderstorms in central Indiana deluged Lebanon with 6.50 inches of rain in twelve hours, and thunderstorms over Florida produced wind gusts to 84 mph at Flagler Beach.

1991-Tom Petty and The Heartbreakers' "Into The Great Wide Open" LP enters the chart.

--------------------------------------------------------------

Baseball Poem

THE GRAVITY OF MEMORY

You knew just where he was going

When you saw him press the tips of his fingers

Together as in a prayer or a childhood

Game; you knew he'd gone far away from the

Clatter of cleats on the cement dugout floor.

He wore long gray sideburns then, well after

The glory days; he wore one ring, the '69.

Sometimes, in a close game, you'd see him pull it

Off, slide it on the other way, his chin resting

In his palm, elbow propped against his knee,

Only the gravity of memory

Keeping him in this world

Written by Tim Peeler

"Waiting for Godot's First Pitch"

More Poems from Baseball

Published by McFarland and Company

--------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Ask Andrew

Bank Beat

Cartoons

Computer Tips

Fernando's Review

Leasing 102

Online Newspapers

Placards

Sales Make it Happen

To Tell the Truth

View from the Top