![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial alternate financing,

bank, finance and leasing industries

kitmenkin@leasingnews.org

![]()

Credit Analyst Collateral knowledge of over-the-road trucking assets,

construction equipment, material handling,

Call Maria Borges-Lopez: (203) 354-6090

or e-mail Please click nmef.com/careers/ www.nmef.com |

Friday, March 8, 2019

Today's Leasing News Headlines

Multiple Violations, License Expired, But

Continues Anyway, DBO Fines $230,000

By Tom McCurnin, Leasing News Legal Editor

California Finance Brokers, Funders, Lenders

Annual Report Due March 15, 2019

New Hires/Promotions in the Leasing Business

and Related Industries

Leasing Industry Ads---North Mill Equipment Finance

Searching for Credit Analyst

The Beige Book

Federal Reserve Summary Economic Conditions

Meet Hugh Swandel

Leasing News Advisor

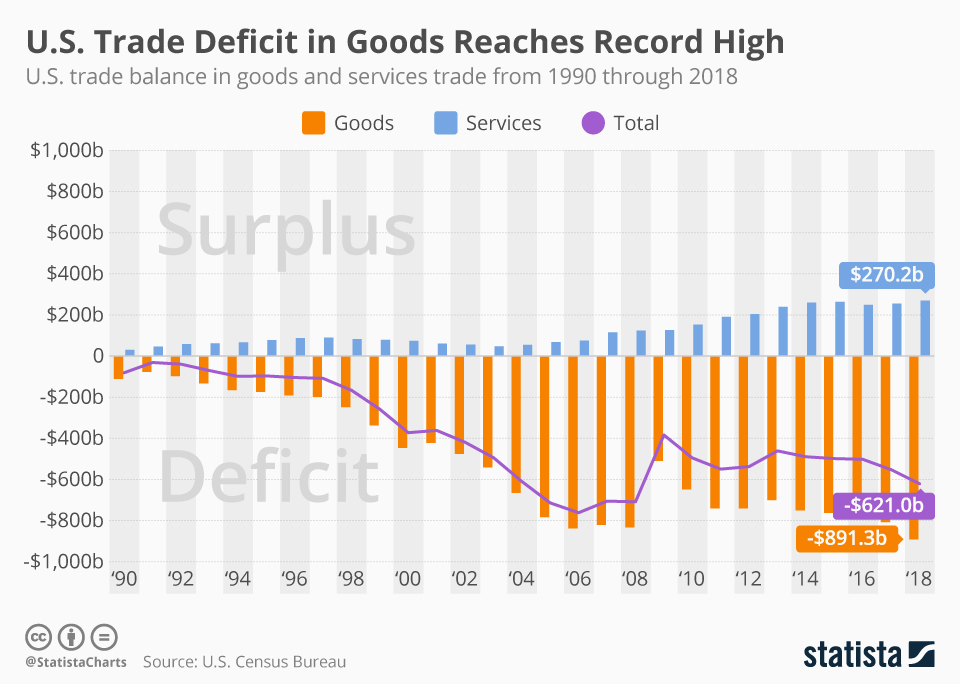

Chart--U.S. Trade Deficit in Goods Reaches Record High

U.S. Trade Balance in goods and Service trade from 1990 to 2018

First-of-its-Kind Study Dimensions $4 Trillion

Secured Commercial Finance Market – Specific Market Highlights

Greta/Apollo 11/Widows

The Sisters Brothers/To Sleep with Anger

Film/Digital Reviews by Leasing News' Fernando Croce

Australian Cattle Dog

Austin, Texas Adopt a Dog

Investors Conference of Equipment Finance

Major Conference Industry Trends and Developments

News Briefs---

Dollar Tree to close up to 390 Family Dollar stores,

reports $2.3 billion loss

US Job Losses Topped 76,000 in February,

Up 117%

Broker/Funder/Industry Lists | Features (wrilter's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

Leasing News Icon for Android Mobile Device

You May have Missed---

Poem

Sports Brief----

California Nuts Brief---

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release,” it was not written by Leasing News nor has the information been verified. The source noted. When an article is signed by the writer, it is considered a “byline.” It reflects the opinion and research of the writer.

Please send a colleague and ask them to subscribe. We are free

Email kitmenkin@leasingnews.org and in subject line: subscribe

[headlines]

--------------------------------------------------------------

Multiple Violations, License Expired, But

Continues Anyway, DBO Fines $230,000

By Tom McCurnin

Leasing News Legal Editor

If There is Any Doubt, Lenders May Not Pay Commissions to Unlicensed Brokers, Even If It Is Your Subsidiary. Lender Required to Pay Fines of $230,000

In re Rate Genius. DBO 603-7920 (December 21, 2018)

I love it when businesses try to cut corners to save a little money without consulting counsel. Usually I can advise a client what to do more cheaply than I can fix a problem after the client is caught. In today’s case, the equipment finance company got caught in three fairly serious violations resulting in fines totaling $230,000. The facts follow.

Rate Genius is an equipment finance company and automobiles finance company out of Austin, Texas. It has been a licensed California lender and broker since 2001. It surrendered in license in 2017. All the violations in this decision occurred before its surrender of its license.

In 2005, it formed a subsidiary called Rate Genius Loan Services which is unlicensed and operates out of the same location. This is the first violation. The DBO requires all licensees to list the businesses that operate out of the licensee’s location and to obtain permission to do so. It is easily disclosed and readily approved.

Rate Genius Loan Services received brokerage commissions from its parent and was not licensed to do so. This is the second violation—a lender may not pay a broker commission to an unlicensed broker…and an unlicensed broker may not receive commission.

Rate Genius issued rate disclosure term sheets to borrowers which did not show the date, amount, and terms of the loan. Rate Genius also used non-licensed brokers to develop leads through a “pre-qualification loan referral process.” This process was new to me and the lender uses non-licensed “lead generators” to post terms and conditions on the lead generator’s web sites which, through the magic of the internet, were in turn submitted directly onto Rate Genius’s web site. The terms and conditions were probably incomplete and the commissions it paid were to non-licensed brokers. Third and fourth violations.

Rate Genius also sold Guaranteed Asset Protection Waivers, called GAP Waivers. This product is sort of like insurance in that it pays the lender for the difference in the value of the vehicle where the amount owed is more than the value of the vehicle, and the vehicle is stolen. The problem is that this product is essentially insurance (sort of) and the sale of this product must be disclosed to the DBO and the lender must receive permission to broker this product. Rate Genius did not disclose the offering to the DBO. his is the fifth violation.

If these repeated violations, stacking one on top of each other, sound frustrating for Rate Genius, they were. As a result of this dog pile, Rate Genius surrendered its license in 2017 and is no longer financing equipment in California.

But that did not end their problems. The DBO required Rate Genius to pay California borrowers $233,352 for the illegal GAP waivers and it is believed that Rate Genius already paid some of the borrowers about $33,352. Rate Genius was represented by Jeremy Meier of the Sacramento office of Greenberg Trauig.

What are the takeaways here?

• First, In Dealing with the DBO, it is Cheaper to Ask Permission Rather Than Forgiveness. I cannot believe that Rate Genius ran any of these violations past a lawyer before implementing them. Given the sheer number of violations, Rate Genius got off cheap.

• Second, California Licensees May Not Pay Unlicensed Brokers Commissions. I don’t know how many times I’ve said this but it is getting old. I noted that the DBO did not require Rate Genius to refund those commissions to the borrower, which I would have expected.

• Third, Location is Important for the DBO. If you move locations, notify the DBO in advance. If you are sharing office space with another entity, you must notify in advance and obtain permission, which is readily given.

• Fourth, Don’t Sell Other Products to the Borrower Without Permission. Licensees may not sell insurance or other financial products to borrower without permission from the DBO, which is readily given.

The bottom line to this nasty case is that lenders need to be aware of the rules and regulations of the DBO, and it is always cheaper to ask a lawyer to research a proposed action rather than to get caught and try to buy your way out of the mess.

Rate Genius (10 pages)

http://leasingnews.org/PDF/rate_genius2019.pdf

Tom McCurnin is a partner at Barton, Klugman & Oetting in Los Angeles, California.

Tom McCurnin

Barton, Klugman & Oetting

350 South Grand Ave.

Suite 2200

Los Angeles, CA 90071

Direct Phone: (213) 617-6129

Cell (213) 268-8291

Email: tmccurnin@bkolaw.com

Visit our web site at www.bkolaw.com

Previous Tom McCurnin Articles:

http://www.leasingnews.org

Previous Tom McCurnin Articles:

http://www.leasingnews.org/Conscious-Top%20Stories/leasing_cases.html

[headlines]

--------------------------------------------------------------

California Finance Brokers, Funders, Lenders

Annual Report Due March 15, 2019

Annual reports for licensees engaged in business under the California Financing Law (CFL) and the Responsible Small Dollar Loan pilot program for calendar year 2018 must be submitted to the DBO no later than March 15, 2019, as required under Financial Code section 22159(a).

No extensions will be granted.

The CFL annual report relies on a web-based filing process and must be completed on the DBO’s website via the self-service portal. Paper or mailed submissions will not be accepted and may result in a penalty assessment or constitute grounds for license revocation. Don’t wait until the last few days as often the website gets overloaded and behind in accepting logins.

Please note that filing a CFL annual report after the deadline will result in penalty assessments. Pursuant to Financial Code section 22715(b), the penalty shall not exceed $100 for each of the first five business days a report is overdue, and thereafter shall not exceed $500 for each business day, not to exceed $25,000.

Please also note that the self-service portal will be temporarily closed and not accessible for filing annual reports on March 16, 2019 from 12:01 a.m. until 12 noon PST. Thereafter, the self-service portal will reopen for late filing.

Failure to file a CFL report will result in summary revocation of your license(s) pursuant to Financial Code section 22715(a). Under Government Code section 11522, a licensee whose license has been revoked or suspended may petition the agency for reinstatement of the license after a period of not less than one year from the date of revocation.

For participating licensees, the 2018 annual report for the Responsible Small Dollar Loan (RSDL) pilot program is also due no later than March 15. Contact CFL.Inquiries@dbo.ca.gov or call (213) 576-7690 with any questions.

Licensees with questions about the CFL report should call (213) 576-7690 or send an email to CFL.Inquiries@dbo.ca.gov.

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Steven Carnegie was hired as Chief Technology Officer, Dext Capital, Portland, Oregon. "He is to be responsible for the development and implementation of the technology strategy for the company." Previously, he was SVP of IT/CIO, Genesis Financial Solutions (February, 2015 - February, 2019); Vice President and Director of Enterprise Product Development, Umpqua Bank (September, 2014 - February, 2015); Sr. Director, Development and Data Services, Genesis Financial Services (October, 2012 - September, 2014); Software Development Manager, CoreLogic (July, 2011 - September, 2012); Chief Information Officer, AirAdvice (July, 2005 - July, 2011); Vice President, Technology, Doba (November, 2004 - June, 2005). Community Service: Volunteer: Board Member, German International School Portland (February, 2011 - September, 2013). Licenses & Certifications: Professional Scrum Master I, Scrum. org, Issued August, 2014, No Expiration Date. IT Infrastructure Library (ITIL3) Foundation, Issued 2009 - No Expiration Date. Project Management Professional (PMP) Project management Institute (PMI). Issued December, 2008. Expired December, 2011). Education: Portland State University, School of Business, MBA, Innovation and Technology (2000 - 2003); Portland State University, BS, Computer Science (1996 - 1998). Reed College, Psychology, 1984 - 1986). https://www.linkedin.com/in/carnegiepdx/

Gary Hanson was hired as Senior Vice President and Managing Director, Sterling National Bank, Novi, Michigan (which acquired Woodford National Bank, his previous employer, where he was Senior Vice President, starting August, 2017). Prior, he was Vice President, Huntington Equipment Finance (fka FirstMerit Equipment Finance) (February, 2013 - August, 2017). Vice President, PNC Equipment Finance (March, 2004 - February, 2013); VP Business Development, Hitachi Capital America (2002 - March, 2004); Director, Business Development, Mellon US Leasing (1999 - 2000); National Sales Manager B of A Lessing (fka Fleet Leasing and Sanwa Leasing) (1997 - 1999); Sr. Account Manager, Verizon Credit (fka GTE Leasing ) 1994 - October, 1997) RSM, Wells Fargo Financial fka Norwest Financial (1998 -1994); Vice President, Operations, United Community Bank Leasing (1986 -1998). Community Service: Volunteer: Leader Dogs for Blind (January, 2012 - March, 2019). Pawsitive Start Volunteer, Michigan Human Society (February, 2012 - December, 2016). Adoption Screening Representative, National Great Pyrenees Rescue (May, 2016 - Present). Education: California Lutheran University, B.S. Business Administration (1978 - 1983).

https://www.linkedin.com/in/gary-hanson-71ba316/

Michael Lefkowitz, CLFP, was hired as AVP, Small Business Credit Manager, WSFS, Wilmington, Delaware. He is located in Philadelphia, Pennsylvania. Previously, he was at Marlin Business Services, starting as Junior September, 2006 - July, 2008. He left July, 2008, to join TD Bank, July, 2008, as AVP, Small Business Underwriter 1 & II; promoted July, 2012, AVP, Small Business Underwriter, Lead 1. He rejoined Marlin Business Service June, 2013, Senior Credit Analyst; promoted, May, 2016, Credit Manager; promoted January, 2018, AVP, Mid-Ticket Credit Leader. He began his career as Marketing Intern, MetLife Financial Services, May, 2005 - August, 2005. Education: Rutgers University, Livingston College, B.A. Economics (2002 - 2006). https://www.linkedin.com/in/michaellefkowitzclfp/

Bradon R. Marshall was promoted to President, C.H. Brown Company, a subsidiary of Platte Valley Bank, Wheatland, Wyoming. Chuck Brown is also now President Emeritus of CH Brown and will continue with the company part time in an advisory role. Marshall joined the firm June, 2015, as Commercial Lender; promoted Chief Operating Officer, December, 2017. Education: Western Texas A&M University, Bachelor of Science, BS, Agricultural Business and Management (2011 - 2015).

https://www.linkedin.com/in/bradon-marshall-ba04a3151/

John Martin, J.D., was hired as Chief Legal Officer, BAMFI, Atlanta, Georgia. He previously was at GE Capital, starting August, 2004, Workout/Recovery Analyst; promoted to Portfolio Risk Manager, July 2006; June, 2011, moved to GE Power as Executive Finance Counsel, GE Global Monetization COE. Petty Officer, Third Class, Hospital Corpsman, US Navy (June, 1984 - August, 1987). Community Service: Volunteer: Advisory Board Member and Mentor, International Factoring Association (2017 - Present). Volunteer Attorney, Pro Bono Partnership of Atlanta (2015 - Present). Attorney Mentor, Street Law (March, 2014 - Present); Mentor, Junior Achievement USA (August, 2007 - Present). Board of Directors and Head Coach, East Cherokee Baseball (August, 2014 - January, 2019). Board of Directors, Henry Players Community Theater (2009 - 2011). PTA Board, Mountain Road Elementary School (Board Member, Treasurer (2015 - 2016). Education: Louisiana State University, MBA, Finance and Risk Management (1999 - 2001). Activities and Societies: Beta Gamma Sigma National Scholastic Honor Society. Southern University Law Center, Juris Doctorate (JD) (1995 - 1998). Activities and Societies: Phi Alpha Delta Law Fraternity. Louisiana State University. Bachelor of Arts (B.A.), Political Science, International Relations (1988 - 1994).

https://www.linkedin.com/in/jfmartin1/

Kevin Merrill was hired as Vice President, Sales, Franchise, Navitas Credit Corporation, Ponte Vedra, Florida. He is located in Hampton Falls, New Hampshire. Previously, he was Vice President, National Business Development Manager, Franchise, Western Equipment Finance (November, 2014 - February, 2019); Regional Sales Manager, Ascentium Capital (August, 2012 - November, 2014); President & Director of Sales, DM Funding Group, LLC (November, 2009 - January, 2013); Senior Business Development Officer, Reliable Capital Source, LLC (May, 2010 - August, 2012); Vendor Program Manager, Harbour Capital Corporation (March, 2009 - November, 2009); Senior Finance Manager, Direct Capital Corporation (October, 2005 - July, 1008). Education: Southern New Hampshire University, B.S., Marketing (2001 - 2005). Activities and Societies: Magna Cum Laude, Varsity Ice Hockey. St. Thomas Aquinas High School, Diploma (1997 -2001).

https://www.linkedin.com/in/kevin-merrill-35b698b/

Christopher Norrito was hired by Hitachi Capital America Corporation, Norwalk, Connecticut, as Director, Credit and Operations. "In his new role, Chris is responsible for reviewing, underwriting, and processing new asset-based lending, enterprise value, and corporate finance transactions in the range of $250,000 to $25MM. He will also assist in formulating and strengthening credit procedures and implementing additional underwriting and portfolio management policies." Previously, he was Chief Credit Officer, Everbank Business Credit, Everbank (May, 2015 - June, 2018); Vice President, Portfolio Management and Underwriting, HVB Capital Credit (September, 2014 - May, 2015); Vice President, Keltic Financial Services/Ares Management (June, 2011 - September, 2014); Financial Consultant, Business (2005 - May, 2011); Vice President, Wachovia Bank, N.A. (2004 - 2005); Vice President, Transamerica (1998 - 2004);Vice President, IBJ Schroder Business Corporation (1995 - 1998); AVP, First Fidelity Bank (1998 - 1995); AVP, Congress Financial Corp. (1986 - 1990). Education: Indiana University Bloomington, Bachelor of Science, Accounting (1982 - 1986). Activities and Societies: Accounting Club. https://www.linkedin.com/in/chrisnorrito/

John G. Rosenlund, CLFP, is an Independent Consultant, Portland, Oregon. Previously, he was Director of Risk Management, retired, Portfolio Financial Service Company (August, 2010 - December, 2018). “After spending 44 years in the finance business, beginning in consumer, retail, commercial asset based lending and in portfolio servicing, I feel it is time to move on from corporate and staff management and let some of my excellent staff here take over. My career spans some very significant financial, regulatory and economic changes this country has seen and if it has happened, I and most of you have seen it and dealt with it in some manner. I have made many friends in this industry and I owe many thanks to a lot of people out there for working with me and being a part of my life, personally and professionally." Education: Western Oregon University, Business, Management, Marketing and Related Support Services (1971 - 1973).

https://www.linkedin.com/in/john-g-rosenlund-93859531/

Natalie Rossi was hired as Sales Support Specialist, Firstlease, Horsham, Pennsylvania. Previously she was Sr. Customer Sales Support, Beneficial Equipment Finance Corp (March, 2017 - April, 2019); Operations Specialist, Firstlease, Inc. (October, 2013 - March, 2017); Customer Service Representative, Co-Activ Capital Partners (June, 2011 - October, 2013); A/P Clerk, Brookfield Global Relocation Services (2007 - 2010); A/P Processor, GMAC ResCap (2000 - 2007).

https://www.linkedin.com/in/natalie-rossi-23928a44/

Lynn Eric Smith was hired as Vice President, Broker Relations, West Coast, Centra Funding, Plano, Texas. He is located in Austin, Texas. Previously, he was in sales at TEAM Funding Solutions, starting as Senior Broker Development, Manager & Sales, (October, 2007 - February, 2018); Credit Analyst, Leasing Representative, Dell Financial Services (September, 1997 - July, 2001); Leasing Representative, IKO Office Solutions (April, 1994 - February, 1997); Consumer Lending Division, American Bank, Corpus Christi (October, 1992 - November, 1995). Sam Houston State University, Finance (1993 - 1995). AHIT Treal Estate Home Inspection, Certified Home Inspection Broker (2008 2009) (Currently hold my real estate home inspection license in the State of Texas). Southwestern University Finance and Criminal Justice (1990 - 1993). https://www.linkedin.com/in/lynnericsmith/

Spencer Sundahl, CLFP, was promoted to Lending Advisor, Equipment Finance, OnDeck, New York, New York. He is located in their Denver office. He joined the firm December, 2018 as Business Consultant. Previously, he was at BSB Leasing, Inc., starting December, 2015 as National Account Manager; promoted April, 2017, AVP, Business Development. Vice President of Leasing, Bank of the Ozarks (June, 2015 – November, 2015); Assistant Finance Manager, Compass Equipment Finance (December, 2013 – June, 2015); Junior Trader, Patak Trading Partners, LLC (June, 2013 – January, 2014). Education: Southern New Hampshire University, Master's Degree, Accounting & Finance (2013 – 2015). Purdue University, Bachelor's Degree, Economics & Statistics (2008 – 2011). Go Boilermakers! Activities and Societies: Member Alpha Sigma Phi Fraternity.

https://www.linkedin.com/in/spencer-sundahl-b4121b68

Chung Yim, CPA, was hired as Senior Vice President, Controller, Dext Capital, Portland, Oregon. Previously, he was Leasing Finance Manager, Joint Ventures, the Greenbrier Companies (May, 2015 - February, 2019); Assurance, Certified Public Accountant, PricewaterhouseCoopers (July, 2014 - May, 2015); Consultant/Corporate Controller, Seaboard Services Corp. (October, 2011 - June, 2014); Assurance, Certified Public Accountant, Davidson & Company, LLP. (April, 2007 - September, 2011); Security Analyst, Monex International Investment (June, 2004 - June, 2006). Licenses & Certifications: Certified Public Accountant, New Hampshire Board of Accountancy. Certified Public Accountant, Oregon Board of Accountancy. Chartered Global Management Accountant. American Institute of CPAs. Education: B.A. Economics. McGill University.

https://www.linkedin.com/in/chung-yim-a0062a23/

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

Credit Analyst Collateral knowledge of over-the-road trucking assets,

construction equipment, material handling, Call Maria Borges-Lopez: (203) 354-6090

or e-mail Please click nmef.com/careers/ www.nmef.com |

[headlines]

--------------------------------------------------------------

The Beige Book

Federal Reserve Summary Economic Conditions

Overall Economic Activity

"Economic activity continued to expand in late January and February, with ten Districts reporting slight-to-moderate growth, and Philadelphia and St. Louis reporting flat economic conditions. About half of the Districts noted that the government shutdown had led to slower economic activity in some sectors including retail, auto sales, tourism, real estate, restaurants, manufacturing, and staffing services. Consumer spending activity was mixed across the country, with contacts from several Districts attributing lower retail and auto sales to harsh winter weather and to higher costs of credit. Manufacturing activity strengthened on balance, but numerous manufacturing contacts conveyed concerns about weakening global demand, higher costs due to tariffs, and ongoing trade policy uncertainty. Activity in the nonfinancial services sector increased at a modest-to-moderate pace in most Districts, driven in part by growth in the professional, scientific, and technical services sub-sector. Residential construction activity was steady or slightly higher across most of the U.S., but residential home sales were generally lower. Several real estate contacts noted that inventories had risen slightly but remained historically low, while home prices continued to appreciate but at a slightly slower pace. Agricultural conditions remained weak, and energy activity was mixed across Districts."

Prices

"Prices continued to increase at a modest-to-moderate pace, with several Districts noting faster growth for input prices than selling prices. The ability to pass on higher input costs to consumers varied by region and industry, and a few Districts noted that demand and the level of industry competition played a role in this variance. A few Districts continued to report upward price pressures from tariffs on certain goods and services. However, several Districts noted that the price of steel, which has been impacted by tariffs, had stabilized or fallen recently. In addition, energy costs, including fuel, declined in some areas. Agriculture commodity prices were mixed, though soybeans and dairy prices were notably weak.

Outlooks remained positive in most districts, except for agriculture: Kansas: "Agricultural conditions remained weak." St. Louis: "Local farmers expressed concerns regarding the near-term status of the industry." Chicago: "Contacts expected crop incomes to be lower in 2019 than in 2018."

There were comments on retail price increases.

Full Report including summaries and 12 District Reports

(32 pages)

http://leasingnews.org/PDF/beigebook_32019.pdf

[headlines]

--------------------------------------------------------------

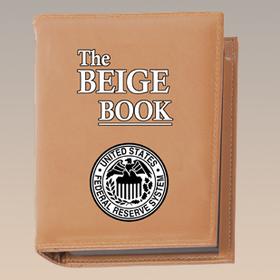

Hugh Swandel

Leasing News Advisor

Hugh Swandel

Senior Managing Director - Canada

www.thealtagroup.com

204.477.0703 direct

204.996.4844 mobile

hswandel@thealtagroup.com

Hugh Swandel is the Senior Managing Director of The Alta Group in Canada and works for clients in both United States and Canada. The Alta Group is a global consultancy practice specializing in the asset-based finance industry. Mr. Swandel is well-known to the industry and a regular session and keynote speaker at industry events. During recent years Hugh Swandel has assisted many top Canadian industry firms on a variety of projects including market entry studies, acquisitions, due diligence, funding and strategic planning.

With extensive North American contacts in the equipment finance and leasing industry, Hugh has a strong reputation as an effective negotiator of win/win agreements involving mergers and acquisitions, business development, market entry, operations and analysis, securitization and other matters of importance to lessors.

Hugh serves on the boards of directors of the Canadian Finance and Leasing Association (CFLA), is Chairman of the CFLA research committee, and is the past President of the National Equipment Financing Association (NEFA, USA). He also is a member of the Equipment Leasing and Finance Association of America (ELFA). He has reported on many events and conferences for Leasing News and is an active participant on the Advisory Board.

In 2006, 2010 and in 2018, Hugh received the Canadian leasing industry’s highest honor when he was named “CFLA Member of the Year.” He is the only person in the Canadian industry to receive the award on three separate occasions.

During the Global Credit Crisis, Hugh was retained by the Canadian Finance and Leasing Industry to prepare materials and provide insight into the impact of the credit crisis on Canadian independent finance companies. Mr. Swandel presented to the advisory committee to the Minister of Finance and was later asked to provide commentary to the CD Howe Institute at a policy development discussion with government and industry representatives. Mr. Swandel has also been published in numerous industry magazines and co-authored a research document for the Equipment Leasing and Finance Foundation (U.S.A.) on the Canadian Commercial Equipment Finance Market.

Mr. Swandel is an active fundraiser and trustee of the Chris Walker Education Fund – an equipment finance industry charity dedicated to furthering research and education in memory of Chris Walker. In addition to supporting industry research, Mr. Swandel and his family also operate an annual fundraising concert of Post-Traumatic Stress Charities in memory of RCMP officer and family friend Ken Barker.

Prior to founding his consulting firm, Swandel and Associates, in 2001, Hugh served as president and chief operations officer of Electronic Financial Group (EFG). EFG was a Canadian company that launched a multi lending web-based credit system. Earlier, Hugh spent 10 years with National Leasing Group in a variety of senior positions. National Leasing Group is a Canadian lessor that has won numerous awards for excellence in management and innovation.

[headlines]

--------------------------------------------------------------

Despite all efforts by the Trump administration to reign in the country’s trade deficit, the gap between imports to and exports from the United States climbed to a 10-year high in 2018. According to figures released by the U.S. Census Bureau on Wednesday, the U.S. trade deficit in goods and services shot up to $621 billion last year, the highest it’s been since 2008. The increase was mainly caused by a historically high deficit in goods trade, which amounted to a record $891 billion, of which $419 billion can be traced back to trade with China alone.

While Trump has often stated his disapproval of America’s large trade deficit, arguing that the U.S. is on the losing side of world trade, there are several factors playing into the growing deficit, not all of which are bad. First and foremost, the U.S. economy is doing very well at the moment, resulting in strong demand for goods, many of which are manufactured abroad. At the same time, economic growth in China has slowed significantly last year, which reduced demand for American goods in the world’s second largest economy. The strong dollar also contributes to the deficit as it makes U.S. goods relatively more expensive to foreign buyers while making imports to the U.S. relatively cheaper.

By Felix Richter, Statista

https://www.statista.com/chart/17281/us-trade-balance/

[headlines]

--------------------------------------------------------------

##### Press Release ############################

First-of-its-King Study Dimensions $4 Trillion

Secured Commercial Finance Market – Specific Market Highlights

Secured Financings Underpin 20 Percent of Transaction Volume in Nation’s GDP; Fuel Over 1 Million U.S. Businesses

NEW YORK - The Commercial Finance Association Education Foundation, soon to become the Secured Finance Foundation, today announced the findings of a comprehensive study of the scope and impact of the secured commercial finance market in the U.S. The 2019 Secured Finance Market Sizing & Impact Study, conducted with the assistance of Ernst & Young LLP (EY), was based on surveys of industry participants, in-depth interviews with subject matter specialists and data from a broad range of sources that track the loan markets.

Richard D. Gumbrecht, CEO of the Commercial Finance Association (soon to become the Secured Finance Network), commented, “The results of this landmark study dimension for the first time the breadth, vitality and interconnectedness of the $4 trillion network of secured finance providers who deploy the capital that fuels our nation’s economy, “This study substantiates a number of never-before-available insights such as the size and characteristics of the market for non-syndicated asset-based lending which offers a lifeline to many small and medium-sized businesses and their employees.”

Report highlights:

- The secured commercial finance market in the U.S. is comprised of several large and distinct, but interrelated, product segments including asset-based lending (ABL), factoring, supply chain finance, equipment finance and leasing, leveraged and cash-flow loans, and asset-backed securities. Collectively, providers of secured financing employ over 60,000 people and deploy capital to over 1 million U.S. businesses.

- The volume of U.S. secured financing for commercial entities was over $4 trillion in 2018, affecting either directly or indirectly about one-fifth of U.S. GDP.

Sector specific findings:

- Asset-Based Lending. The study estimates $465 billion of ABL financing commitments in the U.S. as of year-end 2018, a 6 percent increase over 2017, with growth of 6-7 percent estimated for 2019. Losses on ABL loans have been less than five basis points in each of the past three years. The pace of non-syndicated loan growth has more than doubled that of overall commercial and industrial lending during the last four years. After several years of robust market conditions, survey participants have begun to express concerns about covenant-lite structures and diminishing credit protections—characterizing today’s conditions as “a borrower-driven market.”

- Factoring. The volume of receivables purchased in factoring arrangements by some 900 U.S. factors was about $101 billion in 2018 and could grow in the low single-digit range in 2019, driven by strength in micro, small, and medium enterprises and expansion into nontraditional industry segments.

- Supply Chain Finance. Encompassing purchase order finance, supplier finance and inventory finance, the total U.S. supply chain finance market was estimated to be $416 billion in 2018, a 9 percent increase over the prior year. Supply chain finance helps support U.S. imports and exports and its presence represents an amount equal to 12 percent of total U.S. trade receivables 2018.

- Equipment Finance and Leasing. U.S. private enterprises and public institutions acquired about $1.76 trillion in equipment and software in 2018, representing 8.5 percent of U.S. GDP. Nearly 60 percent of that purchase volume, or about $1.04 trillion, was financed by either lease, loan or line of credit financing. Growth in software purchases outpaced equipment by 200 basis points, underscoring the importance of this component of the equipment finance landscape.

- Leveraged Lending. The Study approximates the total principal outstanding of leveraged loans at year-end 2018 to be about $4.3 trillion. Approximately $726 billion of institutional loan volume was issued in 2018, down from $919 billion in 2017 indicating a cyclical turn. On a combined pro rata and institutional basis, leverage lending was off by 11.6 percent in 2018, but both 2017 and 2018 were materially higher than all prior years. The volume of loans trading in the leveraged loan secondary market grew to over $1.1 trillion in 2018.

- Cash Flow Lending. 2018 was a record year for issuance of investment-grade cash flow loans, rising 26 percent above 2017, reaching $1.035 trillion.

- Asset-backed Securitization. Total outstanding commercial finance-related ABS has grown at a 9.3 percent CAGR since 2010. At $305 billion as of the end of 2018, these securities represent 40 percent of outstanding ABS, not including collateralized loan obligations (CLOs).

Additional observations:

- Combined, the secured finance types covered in the Study provide financings to companies throughout their lifecycle, ranging from recourse factoring agreements for early-stage companies, ABL, leveraged loans and cash flow loans to higher performing companies. And other tightly monitored forms of secured loans for companies in need of a turnaround.

- Based on survey participants, the industry continues to experience strong growth fueled by economic expansion, abundant liquidity and a moderately rising interest rate environment, but faces headwinds from trade policy uncertainty, aggressive deal terms and growing talent shortages.

- Non-traditional market players are adding to overall market size by serving underrepresented segments, particularly in the small and middle market while innovations are driving some blurring of financing product distinctions, likely resulting in more bundled and hybrid solutions over time.

“This study will have a long-term impact as it will spawn more granular research at the industry, product and geographic level over the coming months and years” added Gumbrecht.

About the Commercial Finance Association

Founded in 1944, the Commercial Finance Association, soon to become the Secured Finance Network, is the international trade organization representing the asset-based lending, factoring, trade and supply chain finance industries, with over 1,000 member organizations throughout the U.S., Canada and around the world. CFA provides education, networking opportunities and industry advocacy to the global secured finance community. For more information please visit cfa.com.

About the CFA Education Foundation

Founded in 1990 the CFA Education Foundation, soon to become the Secured Finance Foundation, exists to cultivate education, innovation and charitable works for the betterment of the secured finance community. As a separate entity from the Commercial Finance Association, the CFA Education Foundation is a 501(c)(3) organization that funds crucial initiatives benefiting secured lenders worldwide. For more information or to make a donation, please visit www.cfa.com.

### Press Release ############################

[headlines]

--------------------------------------------------------------

Fernando's View

By Fernando F. Croce

A stylish thriller (“Greta”) and an absorbing documentary (“Apollo 11”) come to theaters, while DVD releases offer taut suspense (“Widows”), an offbeat Western (“The Sisters Brothers”), and a great comedy-drama (“To Sleep with Anger”).

In theaters:

Greta (Focus Features): A specialist in frigid-hot intensity, the redoubtable French actress Isabelle Huppert gets a chance to go deliciously unhinged in this suspenseful thriller, directed by stylishly provocative veteran Neil Jordan (“The Crying Game”). Huppert plays the eponymous Greta, a widowed piano teacher living in New York. Her loneliness is alleviated by a new friend named Frances (Chloe Grace Moretz), a young waitress struggling to cope with a family tragedy. The friendship between the two women quickly escalates into foreboding areas, however, and Greta’s dangerous potential becomes clear when Frances tries to distance herself from her. How far will she go? Though the twists in the plot are hardly new, the film works thanks to Jordan’s pulpy imagination and, above all, to the electric tension between Huppert and Moretz.

Apollo 11 (Neon Releases): The original trip to the moon is brought thrillingly back to life in this inspiring documentary, which would make a terrific double-bill with last year’s “First Man.” The epochal 1969 mission is pieced together from NASA footage, giving a fresh perspective to the journey of astronauts Neil Armstrong, Buzz Aldrin and Michael Collins. Briskly giving emotional background stories to the three men, the film catapults them into outer space, alternating between the interior of the rocket and the army of technicians on the ground. Without relying on narration or interviews, the contents have more suspense or emotion than a superhero blockbuster. Blending the scientific research, cultural impact and the human elements of this “great day for mankind,” director Todd Douglas Miller engineers a magnificent real-life ride.

|

On DVD:

.jpg)

Widows (Fox): Intense Oscar-winning director Steve McQueen (“12 Years a Slave”) lightens up a bit with this pulpy, crowd-pleasing thriller, which features a knockout ensemble cast. The widows of the title are Veronica (Viola Davis), Linda (Michelle Rodriguez), Alice (Elizabeth Debicki) and Belle (Cynthia Erivo), the wives of four thieves killed off in a bank heist. Facing threats from their husbands’ underworld activities, the women decide to team up and go ahead with the daring caper originally planned. Things don’t go as planned, naturally, with the characters’ actions opening up a hidden web of crime and politics. Always a meticulous engineer, McQueen brings eccentric camera angles to the genre mechanics. The film’s best asset, however, remains the performances, with special kudos to Davis, Debicki, Colin Farrell and Robert Duvall.

.jpg)

The Sisters Brothers (Annapurna): Known for his intense studies of people on the edge, French director Jacques Audiard (“A Prophet”) lightens up a bit in his English-language debut, an ambitious, offbeat Western set in the 1850s. Joaquin Phoenix and John C. Reilly star as Charlie and Eli Sisters, fraternal hired gunslingers who scratch and grouse in between shootouts. Their latest job, paid by a shadowy figure known as The Commodore, puts them on the trail of a young chemist (Riz Ahmed) whose invention might just revolutionize the Gold Rush. As they travel from Oregon into California and details emerge, they find their bond as both hunters and brothers tested. Alternating between brutal seriousness and near-absurdist humor, Audiard’s movie benefits hugely from the odd-couple chemistry between Phoenix and Reilly.

To Sleep with Anger (Criterion): One of American cinema’s great unsung artists, director Charles Burnett (“Killer of Sheep”) has a filmography that’s lamentably sparse but profoundly soulful and poetic. Such is the case for this richly layered 1990 comedy-drama, which gives Danny Glover one of his greatest roles. He plays Harry, a vagabond drifting through on devilish charisma, turning up when least expected at the homes of acquaintances. His latest stop is the South Los Angeles household of his old friend Gideon (Paul Butler). His mere presence seems to bring out tensions among the people around him, something that Gideon’s suspicious wife Suzi (Mary Alice) picks up on. Weaving a complex tapestry of moods, Burnett’s trenchant film employs sensitive humor to examine the clash between traditional and modern ways.

[headlines]

--------------------------------------------------------------

Australian Cattle Dog

Austin, Texas Adopt a Dog

Rory

ID #41004092

Male

Age 1 DOB 03/05/2018

43 lbs.

Location: Canine

Adoption Fee: $85.00

Austin Humane Society

124 West Anderson Lane

Austin, Texas 78752

(512) 646-7387

Hours:

Monday to Saturday 12 - 7

Sunday 12 - 5

Adopting is Easy

http://www.austinhumanesociety.org/adopt/adopt-process/

To Find a Specific Breed near where you live,

from more than 17,000 animal shelters & rescues:

https://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

Investors Conference of Equipment Finance

Major Conference Industry Trends and Developments

March 20, 2018 at the Union Club, New York City

This one day event, hosted by IMN and the Equipment Leasing and Finance Association (ELFA), will attract institutional and private investors, alongside key decision makers at the highest level at leasing finance companies.

Who Should Attend:

CEO/CFO/Finance Directors of Equipment Finance Companies

Investors and Providers of Private Capital (Private Equity and Hedge Funds)

Rating Agencies

Investment Bankers

Credit Enhancers

Financial Advisors

Lawyers

Trustees

Technology Service Providers

Covering this One Day Event will be Leasing News Advisor Bruce Kropschot, Senior Managing Director, The Alta Group, who has written about this conference for several years for Leasing News readers.

Registration

https://www.imn.org/structured-finance/conference/Investors-Conference-on-Equipment-Finance-2019/Agenda.html

2019 Agenda

https://www.imn.org/structured-finance/conference/Investors-Conference-on-Equipment-Finance-2019/Agenda.html

2019 Venue

https://www.imn.org/structured-finance/conference/Investors-Conference-on-Equipment-Finance-2019/Venue.html

[headlines]

--------------------------------------------------------------

News Briefs----

Dollar Tree to close up to 390 Family Dollar stores

reports $2.3 billion loss

https://www.cnbc.com/2019/03/06/dollar-tree-to-close-up-to-390-family-dollar-stores-this-year.html

US Job Losses Topped 76,000 in February

Up 117%

https://247wallst.com/jobs/2019/03/07/us-job-losses-topped-76000-in-february-up-117/

[headlines]

--------------------------------------------------------------

You May Have Missed---

8 watches worn by powerful CEOs and corporate executives,

from Jeff Bezos to Satya Nadella

https://ceoworld.biz/2019/02/26/eight-watches-worn-by-ceos-and-corporate-executives/

[headlines]

--------------------------------------------------------------

Raindrops

Raindrops are such funny things.

They haven't feet or haven't wings.

Yet they sail through the air,

With the greatest of ease,

And dance on the street,

Wherever they please.

[headlines]

--------------------------------------------------------------

Sports Briefs---

Lakers Rumors: LeBron James on Minutes Restriction,

Won't Play Back-to-Backs

https://bleacherreport.com/articles/2824251-lakers-rumors-lebron-james-on-minutes-restriction-wont-play-back-to-backs

Is Raiders deal to play 2019 season in Oakland in jeopardy?

https://www.eastbaytimes.com/2019/03/06/is-raiders-deal-to-play-2019-season-in-oakland-in-jeopardy/

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

Editorial: Can Nancy Pelosi save the internet?

https://www.sfchronicle.com/opinion/editorials/article/Editorial-Can-Nancy-Pelosi-save-the-internet-13668498.php

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

Winemaker Trials Tastings for WiVi Central Coast Announced

https://www.winebusiness.com/news/?go=getArticle&dataId=210669

Top Ten Booze Billionaires

https://www.thedrinksbusiness.com/2019/03/top-10-booze-billionaires/

Dodd to co-chair state Senate's Select Committee on Wine

https://napavalleyregister.com/news/local/dodd-to-co-chair-state-senate-s-select-committee-on/article_73839b53-ad65-5e24-a6c3-d75914ca462c.html

Free Wine App

https://www.nataliemaclean.com/mobileapp/

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1717 - On Fishers Island in Long Island Sound, 1200 sheep were discovered to have been buried under a snow drift for four weeks. When finally uncovered, one hundred sheep were still alive.

1775 - An anonymous writer, thought by some to be Thomas Paine, published "African Slavery in America," the first article in the American colonies calling for the emancipation of slaves and the abolition of slavery.

1782 - In Gnadenhutten in the Ohio territory, American militiamen massacre 96 Christian Delaware Indians in retaliation for raids executed by other tribes.

1790 - The first U.S. Census started this month and was completed on August 1. The population was placed at 3,929,625, including 697,624 salves and 59,557 free blacks. The most populous state was Virginia with 747,610 people, and the largest city was Philadelphia, with a population of 42,444. The center of U.S. population was about equally divided among New England, the Middle Atlantic States, and the South. Massachusetts was the only state to report no slaves.

The Encyclopedia of American Facts and Dates

1817 – The New York Stock Exchange was founded.

1841 – Oliver Wendell Holmes (d. 1935) was born in Boston. He was nominated for Associate Supreme Court Justice by President Theodore Roosevelt in 1902 and remained so until 1932.

1855 – The first train crossed the first U.S. railway suspension bridge over Niagara Falls.

1862 - The Confederate ironclad Virginia destroyed two Union frigates at Hampton Roads, Va., whereupon the Virginia retired, leaving the Union blockade intact. The crew of the Monitor, following naval regulations, had been using only half charges in its two 12-inch guns.

1862 - Nat Gordon, last pirate, was hanged in NYC for stealing 1,000 slaves.

1863 - In a daring raid with his commando-style raiders, Colonel John Mosby captured Union General E.H. Stoughton from his headquarters in Fairfax County Courthouse in Virginia. Mosby's irregular forces patrolled a northern area of Virginia that became known as Mosby's Confederacy. Supported by the localpopulace and reviled by his Northern enemies, Mosby's Rangerswere one of the most successful of the Southern irregular forces.

1880 – President Rutherford Hayes declared that the United States would have jurisdiction over any canal built across the isthmus of Panama.

1888 - Susan B. Anthony appeared before the House Judiciary Committee for four days, appealing for the woman's right to vote. On June 15, 1919, they passed what they called the “Anthony Amendment” which the states ratified on August 26, 1920, giving women the right to vote in the United States.

http://memory.loc.gov/ammem/today/mar08.html

1894 - The first animal control law in the US: a dog license law was enacted in the state of New York.

1900 – The National League owners voted to shrink to eight teams. They paid the Baltimore Orioles owners $30,000 for their franchise, with Charles Ebbets and Ned Hanlon reserving the right to sell the players. Cleveland, Louisville, and Washington received $10,000 each, with Louisville owner Barney Dreyfuss sending most of his players to his Pittsburgh Pirates team. The league remained the same until the Boston Braves moved to Milwaukee in 1953.

1909 - The town of Brinkley, AR was struck by a tornado which killed 49 persons and caused $600,000 damage. The tornado, which was two-thirds of a mile in width, destroyed 860 buildings. Entire families were killed as houses were completely swept away by the tornado. Tornadoes killed 64 persons and injured 671 others in Dallas and Monroe counties during the Arkansas tornado outbreak.

1912 - Birthday of Louise Beavers (d. 1962) at Cincinnati, Ohio. Her Hollywood career spanned 30 years and more than 125 films. Though she was forced to play stereotypical roles, such as those of maids, her authentic talent was always apparent. Her starring role in the film Imitation of Life earned her high praise. Beavers was a member of the Black Filmmakers Hall of Fame. She also played the title role in the TV series ‘Beulah' (1951—53).

1913 - The Internal Revenue Service began to levy and collect income taxes. The 16th Amendment to the Constitution, ratified Feb 3, 1913, gave Congress the authority to tax income. The US had also levied an income tax during the Civil War. President Abraham Lincoln signed into law a bill levying a 3 percent income tax on annual incomes of $600—$10,000, and 5 percent on incomes of more than $10,000. The revenues were to help pay for the Civil War. This tax law actually went into effect, unlike an earlier law passed August 5, 1851, making it the first income tax levied by the US. It was rescinded in 1872.

1922 - Carl Furillo (d. 1989) was born at Stony Creek Mills, PA. “Skoonj” played right field for the Brooklyn Dodgers “Boys of Summer” teams of the late 1940's and 1950's. A member of seven National League champions from 1947 to 1959 inclusive, he batted over.300 five times, winning the 1953 batting title with a.344 average – then the highest by a right-handed hitting Dodger since 1900. He compiled a .299 lifetime batting average and was known for his strong throwing arm, giving rise to his nickname, the “Reading Rifle.”

1922 – Al Gionfriddo (d. 2003) was born near Altoona, PA. His brief Major League career is largely unnoticed except for his outstanding catch during the 1947 World Series for the Brooklyn Dodgers that robbed Joe DiMaggio of the Yankees of a home run in Game 6. He never appeared in another Major League game. Dodgers’ announcer Red Barber's call and the accompanying video have endured. The Redhead’s call: "Everyone knows that with one swing of the bat and the big fella’s capable of tying up the ball game. Here's the pitch, swung on -- belted! It's a long one deep into left center -- back goes Gionfriddo! Back-back-back-back-back-back... he makes a one-handed catch against the bullpen! Ohhh-hooo, Doctor! [Pause for crowd noise.] He went exactly against the railing in front of the bullpen and reached up with one hand and took a home run away from DiMaggio.”

1923 - Judge Kenesaw Mountain Landis, MLB Commissioner, allowed former New York Giants pitcher Rube Benton to return. Benton had admitted prior knowledge of the 1919 World Series fix, but remained active but in the minors with St. Paul where he won 22 games. NL President John Heydler disagreed with Landis, calling Benton undesirable, but did not stop the Cincinnati Reds from signing him.

1925 - Bernarr McFadden was a physical culturist who had a radio show in New York City. He failed to show up this day for his daily morning program, causing a young, studio engineer, John Gambling, to ad-lib on the air for a solid hour. As a result, the radio station (WOR) decided to give Gambling the morning announcer's job. John Gambling stayed at WOR for many years, then turned the mike over to his son, who, finally, turned the program over to his son ... all named John. Mr. Gambling's "Rambling with Gambling" program attracted tri-state (New York, New Jersey, Connecticut) audiences in record numbers for over 70 years on the 50,000 watt talk-radio powerhouse at 710 AM on your radio dial from New York each morning.

1927 - Birthday of pianist Dick Hyman, NYC. Perhaps best known as the music director for Arthur Godfrey.

1930 – At a time when nearly all contracts were for one-year, Babe Ruth signed a two-year contract with the Yankees for $160,000. At $80,000 per year, he becomes the highest-paid player of all time. This followed a three-year contract where he was paid $70,000 per. When told he was making more than the president of the US, Ruth replied, “I had a better year than he did.” This was after the Crash of 1929.

1934 - Edwin Hubble photo showed as many galaxies as Milky Way has stars.

1935 - Trumpet player Wingy Manone records “Isle of Capri.”

1935 - Thomas Wolfe's second novel, “Of Time and the River,” is published to great acclaim.

http://library.uncwil.edu/wolfe/wolfe.html

http://www.ah.dcr.state.nc.us/sections/hs/wolfe/wolfe.htm

1935 - Saxophone player George Coleman born Memphis TN

http://entertainment.msn.com/artist/?artist=228859

http://www.duke.edu/~bsb5/jazz/one.html

http://stevekhan.com/coleman.htm

1936 - Guitarist Gabor Szabo (d. 1982) born Budapest, Hungary. http://www.dougpayne.com/bio.htm

http://www.dougpayne.com/bio2.htm

1938 – Lou Gehrig rejected the latest contract offer from the Yankees to a one-year deal worth $39,000. Four days later, Gehrig agreed to the same Yankees offer and end his holdout.

1939 – Pitcher-turned-author-turned entrepreneur Jim Bouton was born in Newark, NJ. After a long career during which he appeared in three World Series with the Yankees, during his final year with the Seattle Pilots, he wrote “Ball Four,” the ground-breaking tell-all that forever changed the writing covering all sports. Once his baseball career ended a second time, Bouton became one of the inventors of “Big League Chew,” shredded bubblegum designed to resemble chewing tobacco and sold in a tobacco-like pouch.

1940 - Cab Calloway Band records “Diz's Pickin' the Cabbage,” perhaps the first Dizzy Gillespie music recorded.

1943 - MATHIS, JACK W. (Air Mission), Medal of Honor

Rank and organization: First Lieutenant, U.S. Army Air Corps, 359th Bomber Squadron, 303d Bomber Group. Place and date: Over Vegesack, Germany, 18 March 1943. Entered service at: San Angelo, Tex. Born: 25 September 1921, San Angelo, Tex. G.O. No.: 38, 12 July 1943. Citation: For conspicuous gallantry and intrepidity above and beyond the call of duty in action with the enemy over Vegesack, Germany, on 18 March 1943. 1st Lt. Mathis, as leading bombardier of his squadron, flying through intense and accurate antiaircraft fire, was just starting his bomb run, upon which the entire squadron depended for accurate bombing, when he was hit by the enemy antiaircraft fire. His right arm was shattered above the elbow, a large wound was torn in his side and abdomen, and he was knocked from his bomb sight to the rear of the bombardier's compartment. Realizing that the success of the mission depended upon him, 1st Lt. Mathis, by sheer determination and willpower, though mortally wounded, dragged himself back to his sights, released his bombs, then died at his post of duty. As the result of this action the airplanes of his bombardment squadron placed their bombs directly upon the assigned target for a perfect attack against the enemy. 1st Lt. Mathis' undaunted bravery has been a great inspiration to the officers and men of his unit.

1945 - Following changes in Navy recruitment and admittance procedures that had previously excluded black women from joining the Nurse Corps. Phyllis Mae Daley received a commission in the U.S. Navy Nurse Corps. She later became the first African-American nurse to serve duty in World War II.

1946 – Randy Meisner was born in Scotts Bluff, NE. A founding member of the Eagles, his main role was that of bassist and backing high-harmony vocalist as both a group member and session musician. He co-wrote the Eagles hit song "Take It to the Limit," which he also sang.

1947 – Carole Bayer Sager was born in NYC. A prolific lyricist and songwriter, she had many hits during the 1970s. With Marvin Hamlisch and Neil Simon, she wrote the lyrics for the stage musical “They’re Playing Our Song,” which was loosely based on her relationship with Hamlisch. The musical ran for over three years on Broadway. Many of Bayer Sager's 1980s songs were co-written with her former husband, the composer Burt Bacharach. Bayer Sager has won an Academy Award for Best Original Song (out of six nominations) in 1982 for "Arthur’s Theme (Best That You Can Do),” which was the theme song of the movie “Arthur,” a Grammy Award (out of nine nominations), and two Golden Globe Awards (out of seven nominations). She was inducted into the Songwriters Hall of Fame in 1987.

1948 - 1960s pop singer Little Peggy March, whose real name is Margaret Battavio, was born in Lansdale, Pennsylvania. She was heard singing at a cousin's wedding, and someone passed the word along to RCA Victor. She was only 14 when she recorded "I Will Follow Him," which topped the Billboard Hot 100 in the spring of 1963.

http://www.peggymarch.net/pm.htm

1951 - Pianist James Williams (d. 2004) born Memphis, TN

http://jameswilliamspiano.com/

http://www.pianospot.net/cat2/1702937.html

1954 - The Milwaukee Hawks and the Baltimore Bullets played the only two-team doubleheader in NBA history. The Hawks won both games, 64-54 and 65-54.

1955 - Top Hits

”Sincerely” - McGuire Sisters

“The Crazy Otto” (Medley) - Johnny Maddox

“The Ballad of Davy Crockett” - Bill Hayes

“In the Jailhouse Now” - Webb Pierce

1959 - Just four weeks after being released, Frankie Avalon's "Venus" tops the US singles chart. Al Martino was offered the song first, but he turned it down.

1963 - Top Hits

“Walk Like a Man” - The 4 Seasons

“Rhythm of the Rain” - The Cascades

“You're the Reason I'm Living” - Bobby Darin

“The Ballad of Jed Clampett” - Flatt & Scruggs

1964 - Malcolm X announces split with Nation of Islam.

http://www.brothermalcolm.net/mxtimeline.html#sixtyfive

1965 - The first U.S. combat forces in Vietnam, more than 3500 Marines, landed in South Vietnam to guard the U.S. Air Force base at Da Nang. They joined 23,500 other Americans serving as “advisers” in South Viet Nam. The United States began supplying Viet Nam with troops to fight the Japanese. In 1945, Lt. Col. A. Peter Dewey, head of American OSS mission, was killed by Vietminh troops while driving a jeep to the airport. Reports later indicated that his death was due to a case of mistaken identity -- he had been mistaken for a Frenchman. in 1945. After World War II, to stop communism, President Truman sent over military advisors. The first American to be killed was an OSS officer. In 1950, more aid was sent; $10 million dollars and 35 troops. Eisenhower continued this policy. During his term, Eisenhower will greatly increase U.S. military aid to the French in Vietnam to prevent a Communist victory. U.S. military advisors will continue to accompany American supplies sent to Vietnam. To justify America's financial commitment, Eisenhower will cite a 'Domino Theory' in which a Communist victory in Vietnam would result in surrounding countries falling one after another like a "falling row of dominoes." The Domino Theory will be used by a succession of Presidents and their advisors to justify ever-deepening U.S. involvement in Vietnam. Kennedy continued this policy. On December 21, 1961 that President Kennedy sent troops to Vietnam, actually 425 helicopter crewmen to provide support and training for South Vietnamese forces. It was not until Johnson had made promises to send in troops on his visit to Viet Nam. In 1961, during a tour of Asian countries, Vice President Lyndon Johnson visits Diem in Saigon. Johnson assures Diem that he is crucial to US objectives in Vietnam and calls him "the Churchill of Asia." It was he who was promoting a war to “stop communism.” He did not want to appear soft. History shows the first ground troops sent to Vietnam were 3,500 Marines who landed at the port of Da Nang in South Viet Nam on March 8,1965, authorized by President Johnson. The Marine's mission was to guard the air base there. They raised the total U.S. troop strength in Vietnam to 27,000. Eventually over 400,000 troops would be in Southeast Asia. It was Johnson's war. It was the reason he did not seek a second term.

http://www.english.uiuc.edu/maps/vietnam/timeline.htm

http://www.landscaper.net/timelin.htm

http://www.historyplace.com/unitedstates/vietnam/index-1945.html

http://mil.citrus.cc.ca.us/cat2courses/HIST155/Briefings/BRIEF1.HTM

1966 - The Baseball Hall of Fame waived one of its election rules and selected Casey Stengel as the newest member of the Hall. Stengel managed the New York Mets for much of the 1965 season before falling and breaking his hip. The injury ended the elderly Stengel's career. Given his age, the Veterans Committee decides to make him immediately eligible for Cooperstown, based upon his record-breaking accomplishments of the New York Yankees from 1949-60, during which time his teams went to 10 World series, winning 7.

1968 - Tommy Moore, 6 years old, made a hole-in-one at the Woodbrier Golf Course in Hagerstown, MD.

1968 - Bill Graham, owner of the Fillmore, San Francisco's legendary rock ballroom, opens Fillmore East in New York City. Opening bill features Albert King, Tim Buckley & Big Brother & the Holding Company.

1968 - Meanwhile, back in the San Francisco Bay area, Cream, James Cotton Blues Band, Jeremy Satyrs, & Blood Sweat & Tears at the Fillmore Auditorium. Over to the Avalon Ballroom is Love, Congress of Wonders, & Sons of Champlin.

http://www.sfmuseum.org/hist1/rock.html

1969 - Sly and the Family Stone began their fourth, and final, week at number one on the pop music charts with "Everyday People." When he was presented with the gold record for this achievement, Sly ripped it out of its case and played it, to hear, "People," by Barbra Streisand. He was heard to utter a few not printable words.

1971 - Top Hits

“One Bad Apple” - The Osmonds

“Mama's Pearl” - The Jackson 5

“Me and Bobby McGee” - Janis Joplin

“I'd Rather Love You” - Charley Pride

1971 - Joe Frazier won a 15-round unanimous decision over Muhammad Ali at New York's Madison Square Garden to become the heavyweight champion of the world. For the night, both Frazier and Ali collected $2,500,000.

1971 - A snowstorm dropped 10 to 20 inches of new snow across Vermont to raise snow depths to record levels. 116 inches was measured on the ground on top of Mount Mansfield, the second highest snow depth ever recorded on the mountain up to the time. The town of Orange measured 88 inches on the ground for a new state low elevation snow depth record.

1975 - Olivia Newton-John reached #1 on the pop charts with "Have You Never Been Mellow." Olivia also reached the top spot with "I Honestly Love You," "You're the One That I Want" (with John Travolta), "Magic" and "Physical."

1976 - Gary Wright is awarded a gold record for "Dream Weaver."

1979 - Top Hits

“Da Ya Think I'm Sexy?” - Rod Stewart

“I Will Survive” - Gloria Gaynor

“Tragedy” - Bee Gees

“Golden Tears” - Dave & Sugar

1986 - Martina Navratilova became the first woman tennis player to pass the $10 million mark in career earnings. She also set the single year record, $2,173,556 in 1984.

1987 - A record 24-hour temperature fall began at Detroit, Michigan. It started at 1:00 PM EST with a temperature of 74 degrees when a sharp cold front dropped the temperature down to 23 degrees at 1:00 PM EST on the 9th. The total temperature fall for the 24 hour period was 51 degrees. Thirty-two cities in the eastern U.S. reported new record high temperatures for the date, including Madison, WI with a reading of 71 degrees. Afternoon highs of 68 degrees at Houghton Lake, MI and 74 degrees at Flint, MI smashed their previous records for the date by fourteen degrees.

1987 - Top Hits

“Livin' on a Prayer” - Bon Jovi

“Jacob's Ladder” - Huey Lewis & The News

“Somewhere Out There” - Linda Ronstadt & James Ingram

“Mornin' Ride” - Lee Greenwood

1990 - Late afternoon thunderstorms produced severe weather in east central Iowa and west central Illinois. Thunderstorms spawned a tornado south of Augusta, IL which traveled 42 miles to Marbleton. Golf ball size hail was reported at Peoria, IL and near Vermont, IL.

1992 - In the first 8 days of March, Las Vegas, Nevada recorded 1.87 inches of rain. This set a new monthly record for rainfall in March. The previous record was 1.83 inches set in 1973.

1994 - Scottie Pippen and Pete Myers of the Chicago Bulls became the first teammates in NBA history to make four point plays in the same game. A four-point play is a three-point field goal followed by a free throw. The Bulls beat the Atlanta Hawks, 116-95.

1994 - A major snowstorm buried sections of Oklahoma, Missouri, and Arkansas. Ozark Beach, Missouri recorded 19 inches of snow, while Harrison, Arkansas checked in with 18 inches. Tulsa, Oklahoma had 12.9 of snow, for its greatest single storm snowfall ever.

1994 - Top Hits

“The Sign” - Ace Of Base

“The Power Of Love” - Celine Dion

“Whatta Man” - Salt-N-Pepa Featuring En Vogue

“Without You/Never Forget You” - Mariah Carey

1996 - Elkins, West Virginia received 2.1 inches of snow on this day to bring its seasonal snowfall to 125.8 inches -- its snowiest winter on record.

1996 - An updated remake of “La Cage Aux Folles,” “The Birdcage” starring Robin Williams, Nathan Lane, Gene Hackman, Dianne Wiest, and Calista Flockhart, opened in United States theaters. The farcical film, directed by Mike Nichols, won a Screen Actors Guild award for Outstanding Performance by a Cast.

1999 – The Yankee Clipper sailed. Yankees Hall of Fame centerfielder Joe DiMaggio died of a lung cancer at age 84. He batted .323 in his first season and helped the Yanks to the 1936 World Championship, the first of four consecutive, then a Major League record for consecutive World Series wins. During his 13-year career, DiMaggio participated in 10 World Series, with his team winning nine times. In 1941, DiMaggio achieved one of sports’ most famous milestones when he compiled a record 56-game hitting streak.

2011 – Major League Baseball named Dodgers Assistant General Manager Kim Ng, the highest-ranking woman in the Majors, as senior Vice-President of Baseball Operations. She will report to former Dodgers manager Joe Torre, who was named Executive Vice-President last month.

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

![]()