Monday, March 24, 2008 Headlines--- Correction: ######## surrounding the article denotes it is a “press release”

------------------------------------------------------------------ Correction: Lease/Loan State License Requirements

The web site has been up-dated for the State of Washington. Nevada has a license requirement and will be added. Here is some brief information. California law appears to be more complicated than it was when described as a personal property broker (basically it is a better category to be a “lender” than a “broker.” From Los Angeles, California Attorney Tom McCurnin: It was stated that in California: "In addition to the lending authority provided by the law, the California Finance Lenders Law provides limited brokering authority. A "broker" is defined in the law as "any person engaged in the business of negotiating or performing any act as broker in connection with loans*made by a finance lender." Brokers licensed under this law may only broker loans to lenders that hold a California Finance Lenders license." I'd like to clarify this: 1. First the definition of a "broker" under the Financial Lender's Law is not what you and I consider to be a broker. A broker in leasing often includes someone who writes the lease as a lessor and immediately assigns it to the real lender in a table funding deal. Under the Financial Lenders Law, a broker is only someone who negotiates it or assists in the financing, and who is not the actual lessor. If that "broker" was a lessor, he or she would have to be licensed as a Finance Lender. Indeed, if one was licensed as a broker and actually was a lessor, one wonders whether it would have to assign the lease only to a licensed lender. I advise lessor brokers to be licensed as a lender, not a broker. 2. Finance Lenders may assign to anyone, not merely other Financial Lenders. Servicers, for example, do not have to be licensed. 3. There is no definition in the Financial Lenders Law as to what a "true lease" is. Presumably, the Department of Corporations would have to use the Uniform Commercial Code 1-201(37) [e.g., no nominal consideration for residual and 10% put is not nominal] but nowhere is that defined. (In a response to a question, Tom added:) If the "broker" is not in the paper trail, e.g., not a lessor (and just negotiating the deal and not a lessor), than yes, the leasing company accepting the paper must be licensed. If the "broker" is an actual lessor, and is licensed it can assign to anyone to service. e.g., any licensed finance lender can assign to another lender, who does not have to be licensed. The entity originating the deal must be licensed, others down stream do not have to be licensed, as long as the first in the chain is licensed. Tom McCurnin As Leasing News did, we recommend readers seek more information for their circumstances from a California attorney familiar with equipment leasing and finance law, as well as an attorney rather than these short synopsis from Leasing News. Lease/Loan State License Requirements (to be revised) -------------------------------------------------------------- Classified ads--Asset Management

Los Angeles, CA Massachusetts, MA New York, NY Seattle, WA United States For a full listing of all “job wanted” ads, please go to: To place a free “job wanted” ad here, please go to: -------------------------------------------------------------- CIT Exposed--- by Christopher Menkin

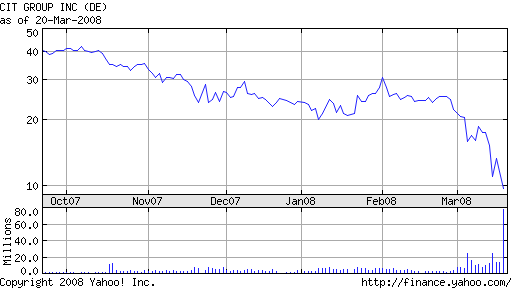

Readers are telling Leasing News that they believe CIT Group is in serious trouble. In this analysis, you will read how other leasing executives view the public information, plus what the financial “They appear to be the next target for a "takeover" sale as JP Morgan and Bear Stearns.” Vice-president of a major, independent leasing company “This means it would cost $2.70 million in one lump sum to insure $10 million in debt for five years, in addition to annual premiums of $500,000 a year. Look at the bank covenants to learn why CIT is taking this action.” “Question: interest rate on "unsecured bank credit facilities" must be way higher than commercial paper and debt maturing 2008. I believe this can only mean they were NOT ABLE to refinance CP or LTDebt, so this is a borrowing of last resort to fund their "core commercial franchises" and pay off maturing paper. What is the maturity of the unsecured bank credit facilities and what are the covenants? Probably exhibits to their SEC filings lay out the terms of the "facilities". What is the profit margin on their "core commercial franchises" and how does that margin compare to the rate on the facilities + allocated overhead? I would guess (uniformed) that it's a negative spread, i.e. I see a last ditch attempt to stay in business. I suspect that if they cannot next take out the facilities lenders they are gone.” “The CIT news prompted me to check Yahoo finance. As of Dec 31, 2007, CIT has stockholder (book) equity of $6.96 billion. Drop the goodwill and intangible assets and the tangible equity figure is $5.8 billion. With 191.23 million shares outstanding (currently), the book value per share is $36.40 and the tangible book value per share is $30.37. “Whether the price is $6.45 (the low) or $9.43 (Thursday's close), it is still well below book. For those Mad Money folks, seekingalpha.com reports Jim Cramer's Stop Trading as referring to "MER (Merrill Lynch), UBS, WM (Washington Mutual) and C (Citigroup) (as) the four horsemen of the pending Apocalypse, and said these four banks cannot afford to fall. He sees Wells Fargo buying WM or Goldman Sachs picking up UBS. While MER will have its share of offers, C is too big to buy, and Cramer thinks it may be resuscitated by sovereign wealth funds… CIT is getting a $7.3 billion bank line to pay its debts and Cramer commented CIT has the "worst single portfolio I know of other than E*Trade" and needs an infusion of capital. “I have been away from the leasing business for a few years but find it hard to fathom that CIT could have allowed its underwriting standards to slip to such a precarious position. Their balance sheet does not report unearned income so it is had to know how much fixed value is locked in their balance sheet, but at a 70% to 80% discount from tangible book, it is hard to see the justification in such a discount. Calamity creates opportunity. “" David Rabinovitz, retired leasing executive “I'd only observe that if aircraft are an extremely low margin product right now it means everybody is RELYING on significant residual value which, when combined with the serious ills the aviation industry faces, is a foolish play. I would offer that no one is really a candidate to buy them out, but the TYCO phase was inexplicable so of course anything could happen. “I bet they file when the extant lines mature OR if they avoid such it will be in concert with massive successful asset sales, and I think they will find the pricing very poor right now.” The company has a lot going for it, but it seems the home lending and student loans took its toll, and it is my opinion the airplane investments were a last ditch effort and also reflect problems on their year-end financial statement. The March 12 announcement of signing contracts with Airbus for 20 new aircraft (fifteen A320 family aircraft and five A330) worth approximately $1.9 billion at list prices appears to be a marketing ploy. The aircraft are scheduled to be delivered beginning in 2011 and continue through 2014. CIT already has commitments on the books to Airbus. Few really understand the airline industry and many think they can play in this ballpark, but only a very, very few, such as Steven Udvar-Hazy, chairman of International Lease Finance understand it. Unicapital saw its demise playing with aircraft, as did several other leasing companies (okay, it was airplane engines, but that still is aircraft.) Leaving their core financial marketplace has cost the company dearly as it appears they have over expended their core base, depending on “good times” to keep their growth going into new fields. Perhaps there are many such banks, finance and leasing companies who are in the same Looking at the 2007 year-end SEC filing, the bottom line for CIT, who had an increase in new business volume (excluding factoring: Net Income (millions): There certainly were indications when CIT sold its interest in Dell Financial Services, their key to understanding the small ticket captive market place that was mention very often in their presentation What was originally misleading was the note in the press release that total new business volume grew 22% over last year “driven by international operations.” The unaudited consolidated income statement revealed in the millions (rounded off) 2006 year end $823, but $1.041 in 2007 as well as credit losses of $68 million in 2006, but $385.5 in 2007 year-end. First, I think significant were the differences in cash and cash equivalents, going from $4,458 million in 2006 to $6,792 million along with $4,398 in non-recourse, secured borrowings to $17,430 in 2007. Management was stretching for more liquidly and willing to pay a higher price for it. What was not highlighted, and someone confusing, until you worked out the numbers on a calculator, were the “Finance Receivables Past Due 60 days or more” that revealed both home lending and student loans were $881 million. The Non-Performing Assets, which were $892 million. Leasing News has been reporting on the changes in upper management, particularly after a major “branding” marketing. It started with the press release of Thomas B. Hallman, announcing he is taking retirement, only a few months after an exclusive interview of his plans for expanding the small ticket market operation he developed in the United States into Europe. He had ideas, plans, and was excited.

He was CIT Vice Chairman, Specialty Finance, responsible they said for “the strategic vision behind CIT’s acquisition of Barclays UK and German vendor finance businesses,” as well as Dell Financial Then, Rick Wolfert, Vice-Chairman, commercial finance, was abruptly let go.

Walter J. Owens was brought in after serving as Chief Marketing Officer for GE Commercial Finance

Then on board came Jay DesMarteau (40) as President of CIT Equipment Finance, worked with General Electric for 15 years in a number of increasingly senior roles

All of a sudden the hiring of ex-GE executives. Something was up, but no one was indicating that the company was in trouble until it appears they could no longer hide it.

Jeffrey Peek, a top executive at Credit Suisse First Boston and onetime leading candidate for the presidential post at Merrill Lynch, joined in 2004. The thrust seemed away from their proven marketplaces to new countries, more large airplanes, subprime mortgages, student loans, growing to offices in more than 30 countries, including Canada, Europe, Latin America, Asia and Australia & In the bad news of the major loss for 2007, CIT announced it Peek in a telephone conference call last week to the media and investors, after issuing an announcement CIT was drawing on $7.3 billion in unsecured loans from about 40 U.S. banks to help conduct daily operations. He told the media that "given the current market environment, we need to run a smaller company." He reported that CIT has been holding discussions with "deposit-rich, asset-poor depository institutions" about perhaps providing the lender with additional funding, while CIT needs sufficient cash to cover $9.7 billion of debt that matures this year, besides its short-term commercial-paper debt; a move that highlights the commercial finance company’s difficulty in raising cash to pay off debt. Drawing on bank lines is often seen as an emergency action for companies unable to get financing elsewhere. The cost to insure CIT’s debt with credit default swaps is trading at distressed levels, costing 27 percent of the sum insured as an upfront payment, in addition to annual premiums of half a percentage point, according to broker Phoenix Partners Group. CIT announced they needed to raise $6 billion and $8 billion in the first two quarters of 2008, said Thursday it was looking at additional financing sources and might sell nonstrategic assets or businesses over the near term. Drawing on bank lines is often seen as an emergency action for companies unable to get financing elsewhere. Joseph Leone, the newly appointed company's CFO, said told the telephone conference call that at least initially, the corporation will keep its core middle-market commercial financing business—trade, corporate, transportation, and vendor financing—off the market, the executives said. "We do see those businesses as our marquee businesses and would like to keep them intact" as much as possible, Leone said, adding that at least for now, those asset sales "wouldn’t impair those lines of business." In 1908, Henry Ittleson founded the Commercial Credit and Investment Company to help fuel the growth of a rapidly-expanding nation. Ninety-plus years and several name changes later, The CIT Group is now stronger than ever, with managed assets of over $50 billion and 11 consecutive years of increased earnings. The following is a timeline detailing the evolution of the CIT Group, from our inception in 1908 to 1999's acquisition of Newcourt Credit Group Inc.: 1908 CIT was founded as Commercial Credit and Investment Company by Henry Ittleson in St. Louis (initial business efforts were in financing receivables). 1915 Company moved its headquarters to New York City and changed its name to Commercial Investment Trust with the identifying initials "C.I.T." 1915 CIT signed an agreement with Studebaker for nationwide wholesale and retail financing of automobiles. This was the first automobile financing program in the U.S. 1920 CIT began to build its industrial financing business alongside its consumer business. 1924 CIT went public and its stock was listed on the New York Stock Exchange. It issued its first annual report. The company had 600 employees and assets of $44.7 million. 1942 CIT Financial Corporation, the company's industrial financing entity, was incorporated. 1933 The company acquired Ford Motor Company's financing arm, Universal Credit Corporation. 1964 Several CIT owned factoring companies were merged to form CIT's Meinhard-Commercial Corporation. William Iselin & Co. was another CIT factoring organization at the time. 1969 CIT began its withdrawal from the automobile financing business. The company refocused energies on industrial equipment financing, factoring and leasing. 1980 RCA acquired CIT. 1984 Manufacturers Hanover Bank purchased CIT from RCA. 1986 The company officially changed its name to The CIT Group. 1987 Albert R. Gamper, Jr., sector executive vice president of Manufacturers Hanover, was named chairman and CEO of CIT. When Dai-Ichi Kangyo Bank purchased 60% of CIT's stock in 1989, he was named president and CEO of CIT. 1988 CIT sold its consumer loan businesses. 1989 Dai-Ichi Kangyo Bank acquired 60% of CIT from Manufacturers Hanover. 1991 CIT acquired Fidelcor Business Credit Corp. and renamed it CIT Credit Finance. 1991 CIT's new equity investment unit, founded a year earlier, made its initial investment. 1992 CIT Consumer Finance was started 'de novo' to offer home equity loans, returning CIT to the home equity loan business. 1992 CIT Venture Capital became a licensed Small Business Investment Corporation. 1994 CIT acquired Barclays Commercial Corp. and merged it with its commercial services unit to create the largest factoring organization in the U.S. 1995 Dai-Ichi Kangyo Bank acquired an additional 20% of CIT from Chemical Banking, the successor company to Manufacturers Hanover. 1995 The CIT group ended the year with a record $17 billion in assets, reached the $225 million mark in earnings and employed approximately 2800 people across the U.S. 1996 Chemical Bank merged with Chase Manhattan. CIT ownership is 80% by Dai-Ichi Kangyo Bank and 20% by the Chase Manhattan Corporation. 1997 CIT launched an initial public offering of 20% of CIT's common stock to acquire from The Dai-Ichi Kangyo Bank, Limited its option to purchase the 20% interest owned by the Chase Manhattan Corporation and to exercise such option. CIT once again lists its stock on the New York Stock Exchange ("CIT"). 1998 CIT completes a successful secondary stock offering, reducing DKB's stake to approximately 44% with the balance of the shares owned by the public. 1999 On January 28, 1999, CIT reports record earnings of $338.8 million with more than $26.2 billion in managed assets. On March 8, 1999, CIT announced it will acquire Newcourt Credit. On November 15, CIT completed acquisition of Newcourt. In the new century, CIT survived a brief acquisition by the ill-fated Tyco Corporation and became 100 percent publicly owned in 2002. Following Al Gamper’s retirement in 2004, new CEO Jeffrey M. Peek worked to maximize CIT’s cross-marketing potential while reorganizing along industry-focused, rather than product-focused, lines. That September, CIT’s purchase of CitiCapital’s vendor financing business in Germany was the company’s first European acquisition. CIT executive changes:

-------------------------------------------------------------- Airline Industry Troubles (Relates to CIT story) by Jeffrey Taylor, CLP, CPA U.S. airlines may face a new round of restructuring amid a stumbling economy and spiraling fuel prices. The turnabout reflects the headwinds that have buffeted the industry as oil prices have risen 75% in the past year and the housing slump has mushroomed into a broader credit crisis, making it hard for many businesses and households to borrow and prompting consumers to cut back on spending. Other industries, from the nation's beleaguered banks to retailers and auto makers, are facing similar pressures. But the major airlines, many of which have spent long periods under bankruptcy protection in recent years, worry they are especially vulnerable. Glenn Tilton, chairman and chief executive of United Airlines told workers earlier in the week, "This industry has serious challenges ahead. Continued uncertainty about the overall U.S. economy, with the price of fuel at historically high levels, has put significant pressure on all U.S. carriers." Consolidation was expected to help insulate the domestic carriers from such difficulties and better prepare them to compete with rich overseas rivals. But a proposed merger of Delta and Northwest appears to have run aground because the airlines' unionized pilots can't agree on a common seniority system. Yesterday, Delta's pilots rejected the Northwest pilots' suggestion that they take their dispute to binding arbitration. It isn't clear whether Delta and Northwest are willing to proceed without a pilots deal, or whether they will throw in the towel on the merger. Merrill Lynch now predicts that the eight largest U.S. carriers will post combined losses of $1.5 billion this year, compared with a previous forecast for a collective profit of $1.7 billion. J.P. Morgan analyst Jamie Baker expects wider industry losses of between $4 billion and $9 billion this year, and a slump in travel demand starting in the second quarter. The airlines have hoarded big piles of cash, estimated at nearly $25 billion at the end of 2007. But while oil prices retreated yesterday, falling $4.94 to $104.48 a barrel on the New York Mercantile Exchange, they remain near all-time highs. And with jet-fuel prices around $132 a barrel, those cash piles could shrink fast, putting carriers in danger of breaching debt covenants with lenders. It was a reduction in travel demand in early 2001 that presaged a severe downturn for the airlines. That plunge was exacerbated by the Sept. 11, 2001, terrorist attacks and a spike in fuel costs. Since 2001, four big airlines and many smaller ones have been through bankruptcy court and others reorganized under the threat of a bankruptcy filing. Collectively, the airlines laid off 170,000 workers -- or about 38% of their labor forces -- cut wages and benefits, and pared other expenses. Airlines continue to hedge some of their fuel needs, but at current prices hedging is extremely costly, and the carriers don't want to lock in historically high fuel costs in case prices fall. Experts expect the airlines to speed up their domestic capacity reductions, attempt more fare increases where they can, fan out even more of their planes to international routes, possibly force their commuter-carrier vendors to jettison inefficient 50-seat jets, and ground more of their own gas-guzzling aircraft. -------------------------------------------------------------- Marlin to depend on its new Industrial Bank

Since Marlin fired key people, after reporting forcing popular CEO Gary Shivers to "retire," the performance and stock has been going down. Friday's low was $7.91. The latest news is a filing to the Security Exchange Commission announcing Marlin deciding not to seek renewal of the $125 million to Deutsche Bank AG, New York. It believes its new industrial “On March 20, 2008, Marlin Leasing Corporation ("Marlin", a subsidiary of the Registrant) sent written notice to Deutsche Bank AG, New York Branch ("Deutsche") informing Deutsche that Marlin has decided not to seek renewal of the $125 million Series 2000-A Warehouse Facility extended by Deutsche to Marlin. The Series 2000-A facility is scheduled to expire pursuant to its terms on March 24, 2008, and there are currently no borrowings outstanding under the facility. “On March 12, 2008, the Registrant announced the opening of Marlin Business Bank (the "Bank"). The Bank provides the Registrant with diversified funding options at more favorable terms than the Series 2000-A Warehouse Facility. The Bank will provide up to $69 million in origination funding capacity in its first year of operations, up to $90 million in its second year, “Management believes that the new funding capacity provided by the Bank renders the Series 2000-A Warehouse Facility unnecessary, resulting in Marlin’s decision not to seek renewal of that facility. “ The venture into factoring was a dude. Reportedly the original president of the bank resigned. This unknown reliance in a marketplace afraid of new banks is questionable, particularly with the loss of revenue and declining stock prices. Please stay tuned. SEC Filing -------------------------------------------------------------- Failure to Give Notice of Lease Renewal Sinks Lessor's Claim for Rent ELFA eNews Daily In Parimist Funding Corp. v. Suffolk Vascular Associates, the leases in question stipulated the automatic renewal policy in writing, but Suffolk claimed it had an oral agreement with Parimist that they could purchase the equipment for $1 at the end of the lease and that the leases were security assignments under the Uniform Commercial Code, which terminates the obligations at the end of the lease. The court rejected Suffolk's claims, finding that the transaction did not constitute a security interest and that oral agreements are not acceptable as evidence, but found that New York contract statutes stipulate that a lessor must give a lessee 15 days' notice of plans to renew a lease, which Parimist failed to do. -------------------------------------------------------------- IFC Credit continues to press for settlements

Leasing News has reported that as the FTC-IFC Credit, Morton Grove, Illinois bench trial moves to April 28, 2008 at 9:30 a.m. before United States District Court, Northern District of Illinois Magistrate Judge Jeffrey Cole, it has been trying to settle as many of the outstanding NorVergence leases. Meanwhile Missouri and Texas Attorneys General await the outcome. As evidence to the thrust to settle cases before the bench trial, attorneys continue to report the move to settle cases. This is from attorney Michael J. Fleck: “I find it curious that IFC spent years fighting for the validity of the forum selection clause to be upheld in Illinois, at considerable cost and expense to both sides, only to covertly negotiate a purported settlement in a distant forum. Further, the terms of that settlement are worse than what other leasing companies settled for years ago before protracted litigation. These terms do not consider the counterclaims that may prevail in Illinois. IFC voluntarily selected Illinois to initiate these hundreds of lawsuits. It was not forced to settle in New Jersey; it chose to settle in New Jersey, completely counter to its successful arguments that the cases belong in Illinois. “We have spent months negotiating standing orders and protective orders to move these consolidated cases forward and not once did IFC inform the Court, the FTC or any Illinois defense counsel of the New Jersey negotiations. Apparently, IFC may be regretting its victory over the jurisdiction issue in Illinois. “My office filed a Motion for Sanctions against IFC concerning its conduct in entering into the purported NJ Class Settlement (attached). Today, Judge Murray, who is presiding over the consolidated IFC/NorVergence cases, issued a preliminary injunction that affects this settlement (attached). This is set for additional hearing on March 27, 2008 at 1:30 PM before Judge Murray. (The hearing, however, may be postponed by IFC Credit until April. editor) Michael J. Fleck It is IFC Credit Corporation policy not to comment on pending litigation. www.flecklawoffice.com Cook County: Motion for sanctions: -------------------------------------------------------------- Leasing Industry Help Wanted Senior Credit Analyst

-------------------------------------------------------------- Top Stories - March 17--March 19

Here are the top ten stories most “opened” by readers last week: (1) Popular Leasing goes Direct (2) Lease/Loan State License Requirements (3) Public/Private Leasing companies (4) Lease Company Stocks Two Days Later (5) Leasing 102 by Mr. Terry Winders, CLP (6) Sales Points from -- ANONYMOUS!! (7) Sales Make it Happen by Linda P. Kester (8) Independent truckers see end of the road (9) Recession is here, economist declares (10) Pictures from the Past--1981 Joe Woodley Not counted due to technical reasons: Extra

-------------------------------------------------------------- Leasing 102 by Mr. Terry Winders, CLP

“ Structuring a Lease” There are many ways to structure a lease and sometimes I think you just use your fingers and toes. Structuring requires a good understanding of how to use a calculator or more importantly a computer based pricing program. I use the term structuring and not pricing because structuring is using the customer’s needs and pricing is placing the Lessor’s requirements into the structure. If you ask the correct questions a lessee will reveal their needs and a structure will emerge. A lease structure depends on the type of lease you are trying to create. Too often Lessor’s ignore the rules and just use a calculator to compute what they think is the appropriate lease payment stream. We have discussed many times in the pass how irregular or seasonal payments are more indicative of leasing, and the benefits it brings, than level payments over three to five years. A creative structure is very hard to do unless you have use of some leasing tools. If you are going to structure a level payment transaction that has a bargain purchase option at lease termination then a standard financial calculator will work. I prefer a HP 17BII because it allows for changing the mode from algebraic to reverse polarity and back again to facilitate the many ways we compute percentages and math problems; plus it contains a complete amortization of the transaction so with a few pushes of the correct button you can compute a payoff. A HP12C does an excellent job of computing payments that are level but it is slow and has way too many limitations. Still old timers hate to change so they purchase them for their subordinates. I think they just do not like having their subordinates knowing more than they do. Staying up with the times is very important. Poor tools result in poor performance. Some people like to use t-value which works well on leases intended as security or disguised conditional sales contracts because they do not have tax consequences. However please do not use it if you are offering transaction with fair market purchase options or fixed price purchase options that are not viewed as a bargain. Those transactions will have tax consequences and with the current economic stimulus act you need to understand the impact on your return. I have presented, in the pass, the effect of income tax on transactions when the payment stream is sold off on a non-recourse basis and the packager retains tax ownership. It would be hard to discover the actual return without a computer tax lease structuring program like Super Trump or Lease Analysis. Many people feel that the ability to structure a deal is a real art because of the many ways there is to create a program that meets both the accounting and tax requirements of the Lessee and the often different accounting and tax needs of the Lessor. In addition it is very often when the Lessor that wins a deal is the one who knew how to structure the deal to take the emphasis off the rate and place it on the structure because it provided value from a cash flow, expense control, or timing issue that had greater value than an interest rate. It is usually plan b, or plan c, that wins the deal and not what the customer originally requested. You should plan to review how you use your lease tools to create structures or lease programs for your customers and begin to ask the questions that will lead the customer away from rate concerns and into a structure that will accommodate fulfilling other needs. A professional lease salesperson without a structuring program is like a boat without a captain. Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty years and can be reached at leaseconsulting@msn.com or 502-327-8666. Previous #102 Columns:

-------------------------------------------------------------- Mr. Terry Winders’ Poker Tables

Terry’s hobby is not only playing poker, but building poker tables. “They are all solid walnut except the Base board. They are therefore very heavy. I sell the plain ones for $2450, the one with a bumper all the way around for $2695 and the one with the red bumper and chip holders for $2995. The color of the bumpers and the color of the felt can be any color the person wants....The purchaser must pay for shipping....” Terry Chairs not included: Bumper all around: Chip holder and bumpers version Get an audit or a CD or training or poker table -------------------------------------------------------------- Leasing Exec. writes Detective Novel

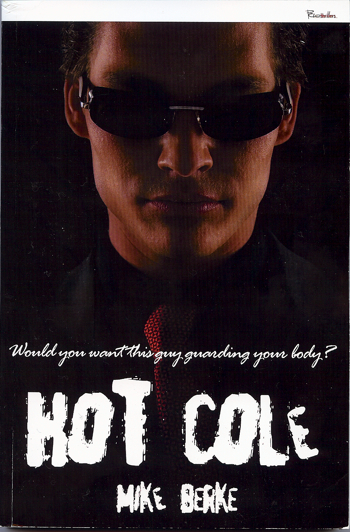

Spending most of his career in equipment leasing sales, Mike Berke’s employers included Leasco Capital Corporation (now Reliance Group, Inc.), Sussex Leasing Corp., Eaton Financial Corporation and AT&T Capital Corporation. During that time he also trained hundreds of personnel from manuals, instructional guidelines and how-to’s he wrote, additionally authoring numerous articles for industry association publications, magazines, periodicals and newsletters. He frequently performed as speaker, moderator, panelist and participant at national, regional, and local industry association conferences arranged by groups including the Equipment Leasing Association (ELA), Eastern Association of Equipment Lessors (EAEL) and National Association of Equipment Leasing Brokers (NAELB). In 1994 he authored the 250-page text Selling Equipment Leasing, published by the AMACOM division of The American Management Association. Currently out of print, the book is still available through resale. An avid reader, mostly of popular fiction, it was that pastime that inadvertently nudged Mike into writing fiction. A couple of years ago he mentioned to a friend, Carroll Suddath, a teacher of creative writing, that he had just read several books by well-known writers, each having seemingly far-fetched or outlandishly contrived endings. Telling her this was not only frustrating as a reader, but also upsetting because of the waste of valuable time, she replied, “You’re a writer. If that’s what you really think, write something better."

About Hot Cole Bobby Cole, a bartender in Manhattan, realizes his life is going nowhere, when suddenly two strangers enter his world and turn it upside-down. Soon Bobby finds himself working for an insurance company, providing bodyguard services for the seriously wealthy…as well as their unspeakably valuable possessions. When Bobby and his girlfriend break up a robbery attempt at a glitzy boating party, they inadvertently infuriate a leader in the Russian Mafia, who swears to take vengeance on them. Plenty of action, fights, chases and suspense ensue as Bobby tries to stay one step ahead of the mob and help police capture a dangerous criminal.

email: m-berke@erols.com ### Press Release ###########################

News Briefs---- JPMorgan in Negotiations to Raise Bear Stearns Bid With Economy Tied to Wall St., New York Braces for Job Cuts ----------------------------------------------------------------

“Gimme that Wine” Wine Prices by vintage ----------------------------------------------------------------

Calendar Events This Day Argentina: National Day of Memory for Truth and Justice Chocolate Covered Raisins Day Dyngus Day (Poland) Easter Monday England: Hallaton Bottle Kicking Houdini Day Luxenbourg: Emaishen Saint Gabiel: Feast day South Africa: Family Day Switzerland: Egg Races United Kingdom: Easter Monday Bank Holiday Saint feast Days

http://www.catholic.org/saints/f_day/mar.php ----------------------------------------------------------------

The first losing candidate in a US presidential election was Thomas Jefferson. He lost to John Adams. George Washington had been unopposed.

----------------------------------------------------------------

Today's Top Event in History 1919-Lawrence Ferlinghetti, poet, author (Coney Island of the Mind), founder of City Lights Bookstore in San Francisco, born Yonkers, NY. Perhaps best known for opening a bookshop called the City Lights Pocket Book Shop. He described City Lights "as a place you could go in, sit down, & read books without being pestered to buy something." The store became a home for the Beat Generation of poets & writers, & Ferlinghetti also turned it into a publishing house -- the first to publish Allen Ginsberg's poem Howl. City Lights published it in 1957 and Ferlinghetti was immediately arrested on obscenity charges. He won the trial and went on to publish William S. Burroughs, Jack Kerouac & Paul Bowles. He wrote a pair of novels, two volumes of plays and over 10 books of poetry. Some say it was the birth of “Beatniks,” a term coin by the late columnist Herb Caen. Today it is a popular tourist attraction in North Beach. * Baseball Canto ( at end) [headlines]

This Day in American History 1664 - Roger Williams was granted a charter to colonize Rhode Island. NCAA Basketball Champions This Date 1956 San Francisco -------------------------------------------------------------- Baesball Poem

Baseball Canto Lawrence Ferlinghetti But Willie Mays appears instead, But it don't stop nobody this time, -------------------------------------------------------------- SuDoku The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler? http://leasingnews.org/Soduku/soduko-main.htm -------------------------------------------------------------- Daily Puzzle How to play: Refresh for current date: --------------------------------------------------------------

http://www.gasbuddy.com/ -------------------------------------------------------------- Provence, France-Vacation http://le-monastier.site.voila.fr/ -------------------------------------------------------------- News on Line---Internet Newspapers Sports -------------------------------- |

||||||||||

Independent, unbiased and fair news about the Leasing Industry. |

||||||||||

Ten Top Stories each week chosen by readers (click here) |

||||||||||

Cartoons |

||||||||||

Editorials (click here) |

||||||||||

|

||||||||||

|

||||||||||

|