Seeking originators with 5+ years small ticket and/or

middle market experience and with established

customer and vendor relationships. Remote

office and on site positions are available.

Please send resumes to: jobs@teqlease.com

Attn: Mike Lockwood or Russ Runnalls CLP

www.TEQlease.com

|

Monday, May 3, 2010

Singer/Songwriter Sonny James, born James Loden May 1, 1929) Hackleburg, Alabama, best known for his 1957 smash hit "Young Love." Now retired, he had a long career and one of many hits such as "I'll Never Find another You," "Here Comes Honey Again,” Is It Wrong (For Loving You)"." From 1960 to 1979 he had more #1 hits than any other country music artist. he spent more time in the Number One chart position than any other artist in country music, according to Billboard Music Magazine.

http://www.amazon.com/Sonny-James/e/B000APVIII |

Headlines---

Barklay Capital, Inc., Costa Mesa, CA

Bulletin Board Complaint

Classified Ads---Asset Management

Investors see Leasing Co. Stock Good Investment

Cartoon---Stock Market

Bank Beat--Why FDIC Took $7 billion hit from 7 banks

Top Stories April 26-30

Placard---Prospective Employee

Classified Ads---Help Wanted

Leasing 102 by Mr. Terry Winders, CLP

Standard and Master Lease Agreements

Archive: From a story in 1998--Note a Joke

Charlie Lester Sells LPI--then has a stroke

Elk Grove Village, Illinois-- Adopt a Dog

New Hires---Promotions

Classified ads—Operations/Remarketing

California Nuts Briefs

Sports Briefs---

Today's Top Event in History

This Day in American History

Baseball Poem

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

[headlines]

--------------------------------------------------------------

Barklay Capital, Inc., Costa Mesa, CA

Bulletin Board Complaint

April 8, 2010:

“I just did a Google search on Barklay Capital owner Matt Hingorani and came across your link and recent story.

“I too am an owner of an amusement rental company in Michigan. I recently sent a check in the amount of $2849.88 as first/last month lease payment (plus processing) on a $30K finance agreement. The check was cashed the day he received it.

“Matt gave me a verbal OK to order equipment - the deal was done. I ordered equipment and even had equipment installed. Every time I would ask for the vendors to get paid (daily), I would get some excuse that it would happen "today". Finally, Matt disclosed that he did not have a finished lease and that I would not get approved.

“I cannot tell you how much this has put me in the hole. Our April 1st Grand Opening of our indoor kids fun center "The Blast Factory" (www.theblastfactory.com) that was heavily advertised, has not opened due to Matt's unfinished deal.

“I have asked that all my funds be returned ASAP. I have not seen anything yet.

“After doing a Google search (something I should have done before sending money) I found many, many red flags about Barklay capital and its owner Matt.

“Can you direct me to any governmental agency in your state that regulates these lease/finance companies?”

Best Regards,

Ken Knapp

President

Eccentric Entertainment Corp

616.785.5200 x11

800.861.FUNN

www.eccentricEnt.com

April 8, 2010 from Matt Hingorani, Barklay Capital, Inc.:

“Please find attached documents signed by Ken Knapp of Eccentric Entertainment and myself. The document which was signed was a proposal for equipment financing and leasing. Barklay Capital, Inc never made the claim that it was OK for Eccentric Entertainment to order equipment. As you are aware leasing companies usually issue PO’s or prefund transactions. I and Ken had the conversation that detailed how the equipment would be ordered and shipped to his location. I was under the impression that Barklay Capital, Inc or its assigns would order the equipment and have it shipped. The preliminary review of the file lead us to believe the deal was an APPROVAL deal but after receiving word from the underwriter that the Paynet was a low 35 we were unable to place the deal anywhere else. After reviewing the information sent back from the underwriter I immediately contacted Ken to let him know we were unable to do the deal for him. I also mentioned we would refund his monies sent in minus the documentation fee listed on the agreement. We have no intention in misleading customers or benefit from retaining customer deposits for no reason. Once Barklay Capital, Inc issues the cashiers check to Eccentric Entertainment we will provide a tracking number and also a copy of the check to both the customer and leasingnews.org.

“Interesting note: Ken and I spoke about the issues and agreed that a refund was going to be issued. I am completely beside myself because it has only been 4 days sense we spoke over the phone. I mentioned in our conversation it would take some time. I have also written emails and left voice messages for Ken to that effect.

Sincerely,

Matt Hingorani

Barklay Capital, Inc

April 19, 2010, when asked about check, this was response:

“Below is the email sent to you, Kit. As soon as we send the deposit back I will forward you a conformation that it has been sent. (email is above stating will be sending a cashier check with tracking number to both customer and Leasing News.)”

Matt Hingorani

Barklay Capital, Inc

April 26, 2010:

Advised if no check by the 29th, the complaint would be posted for the full amount.

Response: "Please refer to the marked section that states 'Proposed lessee understands that all documentation fees are non-refundable'.

Matt Hingorani

Barklay Capital, Inc

Documentation fee is $850.00

No check to date.

BBB Rating: F (18 complaints)

http://www.la.bbb.org/Business-Report/Barklay-Capital-Inc-100016455

BBB Rating: F (18 complaints)

http://www.la.bbb.org/Business-Report/Barklay-Capital-Inc-100016455

Not a member of a leasing association.

A license under the California Commercial Finance Lenders Law was not found for Barklay Capital nor Matt Hingorani.

Previous Complaint:

http://leasingnews.org/archives/Apr2010/4_02.htm#barklay_bbc

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

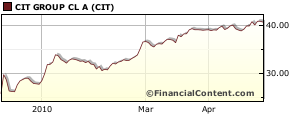

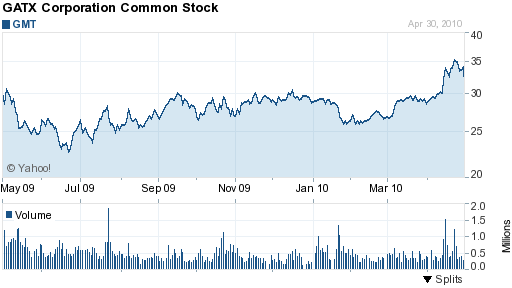

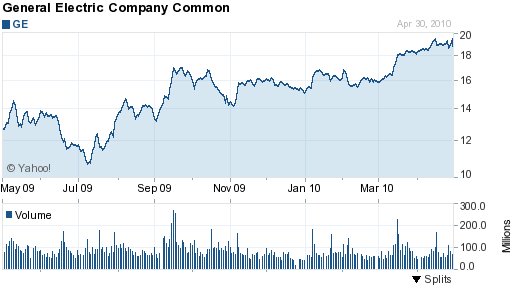

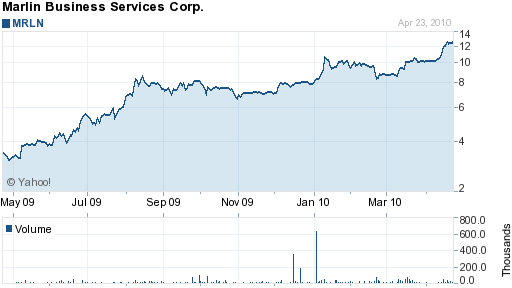

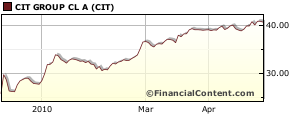

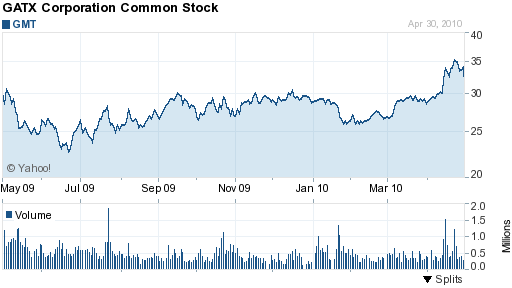

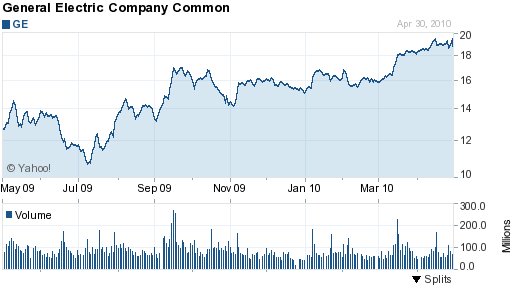

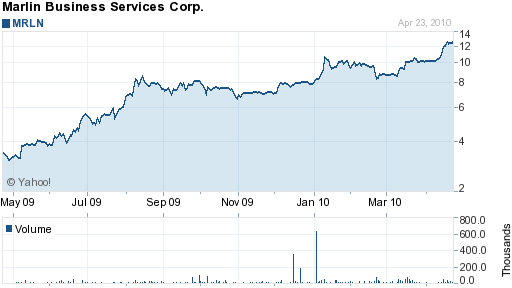

Investors see Leasing Company Stock Good Investment

Leasing company stocks did well especially compared to the downward stock market at the end of last week, the Dow Jones lost 158.7 to a 11,008 from the recent high of 11,309, much of this a lack of confidence or fear from the backing of Greece, perhaps Spain and Portugal, too.

Overall leasing company stock has been rising, Microfinancial as wells as Chesswood, especially Marlin Business Services going from a 52 week low of $2.75 to $11.74 at the closing last Friday. Even the officers are buying their own stock as well as board of directors. Friday, May 7th Marlin will be releasing its first quarter as well as holding a Webcast. They have also gotten back into their original strength, accepting limited independent broker transactions.

Resource America will release its results for the second fiscal quarter 2010 on Wednesday, May 05, 2010. LEAF-Specialty, Dwight Galloway's operation in South Carolina continues not to fund leases and is reportedly down to 12 employees, who are servicing the existing portfolio. Reportedly AJ Batt, former founder of ATEL Capital considered getting back into the leasing business, but appears more interested in the hedge marketplace.

According to a reliable source, banks have looked at the Galloway operation portfolio, and seem interested, but not in the operation itself. Rumored to close down on April 1st, perhaps there are talks going on to be announced on Wednesday with Resource America results.

Lessors report more activity and new leasing companies and divisions are being announced, such as KeyCorp Chairman and CEO Henry Meyer Ill saying the bank is looking “…to expand businesses that have synergy with its community bank, such as its equipment leasing business and some products offered through the capital markets business” as well as the new leasing division at Beverly Bank, Chicago, Illinois.

Despite the crying of business, investors most likely see the demand for financing and leasing on the rise with leasing companies again a good stock investment.

CIT GROUP, INC (NYSE: CIT)

Last Trade: 40.60

Change: 0.17 (0.42%)

Prev Close: 40.77

52wk Range: 24.83 - 42.94

Volume: 1,454,168

Avg Vol (3m): 2,168,190

G A T X CP (NYSE: GMT)

Last Trade: 32.64

Change: 1.46 (4.28%)

Prev Close: 34.10

52wk Range: 22.74 - 35.75

Volume: 659,797

Avg Vol (3m): 440,359

GEN ELECTRIC CO(NYSE: GE)

Last Trade: 18.86

Trade Time: Apr 30

Prev Close: 19.49

52wk Range: 10.50 - 19.70

Volume: 112,133,024

Avg Vol (3m): 81,089,600

Marlin Business Services Corp.(NasdaqGS: MRLN)

Last Trade: 11.74

Trade Time: Apr 30

Change: 0.20 (1.68%)

Prev Close: 11.94

52wk Range: 2.75 - 13.00

Volume: 43,932

Avg Vol (3m): 22,451

MicroFinancial Incorporated (NasdaqGM: MFI)

Last Trade: 4.00

Trade Time: Apr 30

Change: 0.03 (0.74%)

Prev Close: 4.03

52wk Range: 2.12 - 4.20

Volume: 3,302

Avg Vol (3m): 15,289

Chesswood Income Fund (Pawnee Corp.) (CHW.UN)

(Canadian monetary, www.tmx.com)

Last Trade: 4.47

Change: 0.03 (0.67%)

Prev Close: 4.50

Open: 4.47

52wk Range: 1.81 - 4.68

Volume: 230

Avg Vol (3m): 7,624

Resource America, Inc.(NasdaqGS:Rexi)

(LEAF Corp; Leaf Specialty Group)

Last Trade: 5.91

Trade Time: Apr 30

Change: 0.23 (3.75%)

Prev Close: 6.14

52wk Range: 3.60 - 6.86

Volume: 25,763

Avg Vol (3m): 21,992

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Bank Beat--Why FDIC Took $7 billion hit from 7 banks

The FDIC insurance pool took a very heavy hit last week. The three Puerto Banks that closed the FDIC will cost the insurance pool $5.28 billion and four mainland banks $1.7 billion, close to $7 billion. Sixty four bank failures in the first four months. The FDIC receives no federal tax dollars – insured financial institutions fund its operations.

Taking the highest hit of the banks, an estimated $3.31 billion, the 46 branches (all in Puerto Rico) with 1,452 full time employees Westernbank Puerto Rico, Mayaguez, were closed with Puerto Rico Banco Popular de Puerto Rico, San Juan, to assume deposits. In addition to assuming all of the deposits, Banco Popular de Puerto Rico agreed to purchase approximately $9.39 million of the failed bank's assets. This popular bank also once active in the mainland, including offices in supermarkets and other major retail stores, no longer, and at one time, had a very active leasing division lead by Fred Van Etten, today SVP, National Marketing Manager, TCF Equipment Finance, who bought the Banco Popular portfolio.

Westernbank was founded in April 30, 1958. As of December 31, 2009, Westernbank Puerto Rico had approximately $11.94 billion in total assets and $8.62 billion in total deposits. The net equity had increased from $889.4 million the end of 2008 to $920.7 million yar-end 2009 while the bank had a $3.3 million loss in 2008 and $12.9 million loss in 2009. Charge offs year-end were $137.9 million consisting of $71.8 million in construction and land development, $19.2 million secured by nonfarm nonresidential land, $1.9 million in 1-4 multifamily homes, $27.5 million in commercial and industrial loans, $16 million to individuals, and $3.5 million in credit cards, plus $1.35 in "other loans." $1.4 million in non-current loans. But maintained a Tier 1 risk-based capital ratio: 9.62%

This was the largest of the three Puerto Rico banks that failed, who all held one-fourth the islands total assets: $20.4 billion. Total losses on the three failed Puerto Rican banks of $5.3 billion represent 33% of total losses on all 64 failed banks during 2010. It is reported the FDIC was "lucky" to find buyers.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $3.31 billion

http://www.fdic.gov/news/news/press/2010/pr10097.html

Second with the FDIC estimated charge of $1.37 billion are the 51 branches of Frontier Bank, Everett, Washington, closed Friday without any real surprise by the Washington Department of Financial Institutions t with Union Bank, National Association, San Francisco, California, to assume all of the deposits. The is the bank where Leasing News found the story of the president being fired because he had scheduled a Spring Break vacation with his family (1). The bank has been in trouble for quite some time.

The bank had cut full-time employees by 95 from 792 year-end 2008 to 697 year-end 2009. The bank net equity had gone from $346.3 million to $94.5 million in one year, too, losing $12.1 million year-end 2008 to losing $252.1 million year-end 2009. First quarter of this year it had lost $45 million. Non-current loans had gone from $430.3 million to $705.2 million after charges offs of $337.3 million ( $270.9 million construction and land development, $18.7 1-4 family residential property, $10 million nonfarm nonresidential property, plus $39 million commercial and industrial loans, $2.7 million loans to individuals, $760,000 credit cards. Tier 1 risk-based capital ratio:3.23%. It is obvious the president saw the writing on the wall and decided to move forward with the planned family spring vacation of a week and a half in Hawaii. The chairman realized the choice was leaving a sinking ship and the only pleasure he could see in the loss of the bank, his personal investment, and the investment of his family and friends, was to fire the president.

As of December 31, 2009, Frontier Bank had approximately $3.50 billion in total assets and $3.13 billion in total deposits. The FDIC and Union Bank, N.A. entered into a loss-share transaction on $3.04 billion of Frontier Bank's assets.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $1.37 billion.

(1) Bank president fired over spring-break plans

http://seattletimes.nwsource.com/html/businesstechnology/2011498803_frontier02.html

http://www.fdic.gov/news/news/press/2010/pr10100.html

The 22 branches of Eurobank, San Juan, Puerto Rico were closed with Oriental Bank and Trust, San Juan, Puerto Rico, to assume all of the deposits. As of December 31, 2009, Eurobank had approximately $2.56 billion in total assets and $1.97 billion in total deposits. Oriental Bank and Trust paid the FDIC a premium of 1.25 percent to assume all of the deposits of Eurobank. The bank in 2002 had merged with Banco Financiero. The high Puerto Rico employment rate of 15% followed by a lack of margins, loss of business, and major loan losses lead to it being closed by the regulators.

Full time employees had gone from 484 year-end 2008 to 450 year-end 2005; net equity $174.3 million to $97.9 million, with a loss of $9.9 million year-end 2008 to a loss of $70.9 million year-end 2009 with charge offs of $26.3 million in construction and land development, $12.1 secured by nonfarm non residential property, $2.9 million 1-4 multi-family residential; $7.3 million commercial and industrial loans, $2.9 million loans to individuals, $662,000 credit cards, and $732,000 in "other loans." Tier 1 risk-based capital ratio 7.13%

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $1.23 billion.

http://www.fdic.gov/news/news/press/2010/pr10095.html

Fourth highest charge to the FDIC are the 29 branches of R-G Premier Bank of Puerto Rico, Hato Rey, Puerto Rico, $743.9 million, closed Friday with Scotiabank de Puerto Rico, San Juan, Puerto Rico, to assume all of the deposits. The bank had a very high loss in loans to individuals ($17.7 million, $9 million credit cards) as well as a high non-current loan figure of $1.2 billion.

As of December 31, 2009, R-G Premier Bank of Puerto Rico had approximately $5.92 billion in total assets and $4.25 billion in total deposits. Scotiabank de Puerto Rico paid the FDIC a premium of 1.35 percent to assume all of the deposits. The FDIC and Scotiabank de Puerto Rico entered into a loss-share transaction on $5.41 billion of R-G Premier Bank of Puerto Rico's assets.

Full-time employees increased from 954 in year-end 2008 to 1,231 year-end 2009 with net equity dropping from $394 million to $343.4 million same time period and the first quarter of 2010 fount it at $219.8 million. The bank lost $114.1 million 2008 and $68.6 million with non-current loans going from $828.7 million to $1.2 billion after charge offs of $113.3 million ( $65.8 million construction and land development, $5.7 million 1-4 multi-family residences, $18 million in nonfarm nonresidential property, $7 million in commercial and loans, $17.7 million in loans to individuals, $9 million in credit cards.)First quarter of 2010 the bank lost $118.5 million.

It should be noted that Scotia is Canada's third largest bank and has been operating in Puerto Rico for about 100 years. The bank has operations in 50 countries around the world. It recently acquired an interest in a bank in Thailand, as it has plans on expanding into Asia as well as South America.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $743.9 million

http://www.fdic.gov/news/news/press/2010/pr10096.html

Fifth highest with $615.3 million estimated cost to the FDIC was the 22 branches with 362 full time employees of CF Bancorp, Port Huron, Michigan, who were closed with First Michigan Bank, Troy, Michigan, to assume all of the deposits. In order to provide sufficient capital to complete the acquisition of CF Bancorp's assets and assume its deposits from the FDIC as receiver, First Michigan Bancorp raised $200 million of new capital in a private placement transaction with its lead investor WL Ross & Co. LLC. Oppenheimer & Co. Inc. served as the sole placement agent in the transaction. Net equity of CF Bancorp had gone from a positive $99.3 million year-end 2008 to a negative net worth of $22.5 million year-end 2009 and the first quarter of 2010 it was a negative $103.6 million after losing $88.5 million the first quarter of 2010.

The bank had lost $52.8 million year-end 2008 and losing $118.1 million year-end 2009 with $92 million in non-current loans after a charge of $61.6 million ( $27.8 million in 1-4 multi-family homes, $19.8 construction and land development, $10.6 million in commercial and industrial loans, $3.7 million secured by nonfarm non residential loans and $3.3 million loans to individuals).

As of December 31, 2009, CF Bancorp had approximately $1.65 billion in total assets and $1.43 billion in total deposits. First Michigan Bank paid the FDIC a premium of 0.75 percent to assume all of the deposits of CF Bancorp. In addition to assuming all of the deposits, First Michigan Bank agreed to purchase approximately $870 million of the failed bank's assets. The FDIC will retain the remaining assets for later disposition. The FDIC and First Michigan Bank entered into a loss-share transaction on $808.1 million of CF Bancorp's assets.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $615.3 million

http://www.fdic.gov/news/news/press/2010/pr10098.html

The four year old Champion Bank, Creve Coeur, Missouri, was closed with BankLiberty, Liberty, Missouri, to assume all of the

deposits. The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $52.7 million. As of December 31, 2009, Champion Bank had approximately $187.3 million in total assets and $153.8 million in total deposits. The FDIC and BankLiberty entered into a loss-share transaction on $113.5 million of Champion Bank's assets.

There were 37 full time employees in 2008 and 34 full time employees in 2009 for a young bank, established June 30, 2008 in St. Louis County. It had been in trouble for over two years. Net equity had dropped from $19.3 million 2008 year-end to $4.49 million year-end 2009 following two year end losses: $8.2 million 2008 and $17.76 2009 with non-current loans going from $17.1 million 2008 to $31.2 million after charge offs of $11.8 million ($6 million construction and land development, 1.58 million in 1-4 family residential properties, $1.4 million nonfarm nonresidential properties, $2.7 in commercial and industrial loans. Tier 1 risk-based capital ratio 2.65%.

http://www.fdic.gov/news/news/press/2010/pr10099.html

The four branches of BC National Banks, Butler, Missouri were closed with Community First Bank, Butler, Missouri, to assume all of the deposits. As of December 31, 2009, BC National Banks had approximately $67.2 million in total assets and $54.9 million in total deposits. The FDIC and Community First Bank entered into a loss-share transaction on $37.9 million of BC National Banks' assets.

Formed October 15, 1902, the bank opened its second branch January 1, 1934 in Butler, third branch in Lee's Summit, Jackson County, 1998, fourth branch in Peculiar, Cass County, 2008. Employees had dropped from 49 full time employees year-end 2008 to 34 full time employees 2009, net equity going from $9.1 million to $1.44 million, following a $1.6 million loss in 2008 and $7.6 million loss in 2009 with non-current loans going from $2.4 million to $3 million after a charge off of $1.69 million ($1.1 million construction and land development, $208,000 1-4 residential property, $349,000 commercial and industrial loans. Tier 1 risk-based capital ratio 3.48%.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $11.4 million.

http://www.fdic.gov/news/news/press/2010/pr10101.html

List of Bank Failures:

http://www.fdic.gov/bank/individual/failed/banklist.html

Previous Columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Bank_Beat.htm

((click on ad to learn more))

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

Sales

We are looking for experienced business development

professionals with established vendor / client

contacts in general manufacturing equipment,

road maintenance, material handling , radio/TV broadcasting

and other hard collateral.

We have openings for in-house business development positions

and Independent Sales Associates.

Contact or send resumes to: John Martella SVP

800 800 8098 ext 5209 or direct: 248 743 5209

jmartella@leasecorp.com

|

Seeking originators with 5+ years small ticket and/or

middle market experience and with established

customer and vendor relationships. Remote

office and on site positions are available.

Please send resumes to: jobs@teqlease.com

Attn: Mike Lockwood or Russ Runnalls CLP

www.TEQlease.com

|

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Leasing 102

by Mr. Terry Winders, CLP

Standard and Master Lease Agreements

One of the questions I get asked about is when to use a lease agreement and when to use a “master” lease agreement. Occasionally the language is different so it is important to understand what your agreement says and what additional documents are required.

A standard lease agreement usually contains all of the generic lease requirements in the agreement with the equipment described under an attached schedule “A.” The agreement spells out all of the disclaimers, requirement to pay lease payments on time and all of those nasty things we can do to the lessee if they do not live up to the agreement. Whereas a Master lease agreement usually requires a lease schedule that refers back to the master for all of the standard requirements and identifies the equipment and the terms specifically unique to that piece of equipment such as: insurance requirements, end of the lease options, maintenance requirements, and return conditions. All of these issues can be expanded on where required and made specific to the equipment being leased.

It is becoming more important to develop lease agreements for each State, because of the variety and location of conspicuous print requirements and in addition return requirements for each type of equipment or market served. Generic lease agreements even though they use the home State of the Lessor for the venue are sometimes too vague, or too light on requirements, to protect the investment without a lot of court action. A lease agreement specifically designed to cover all the requirements of the home State and the State of the lessee and includes all those expanded issues regarding the care and return of the equipment will go a long way to protect the Lessor.

One of the main reasons to use a master lease agreement is its versatility when dealing with a variety of equipment types in a verity of States. By attaching schedules you can customize each agreement for each piece of equipment and tie it all into a complete package that allows for new business with only a moderate amount of effort.

Usually a master agreement allows you to obtain resolutions for signature authority that allows local personnel to sign future schedules and cuts approval time and problems that may appear for legal review each time a lease is signed. A master agreement also allows you to place a smaller group of like equipment on each schedule so if an early termination occurs for whatever reason it is easier to handle I also like to place equipment on a tax lease schedule that have like terms of depreciation.

Once every few years you should replace the master agreement with each lessee. I would recommend that because it is an “agreement to agree” that it can be done even if no new equipment is contemplated. Sounds strange but there is no pressure at this time and it keeps you in contact with the lessee and the action can sometimes stimulate business.

Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty years and can be reached at leaseconsulting@msn.com or 502-327-8666.

He invites your questions and queries.

Previous #102 Columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

Little Rock, Ark.

Meet and learn from Mr. Terry Winders, CLP

Leasing #102 columnist for Leasing News,

long time educator and trainer

Sales and Operations

click here for course information and to register

June 9, 10, until Noon on the 11th

Little Rock, Arkansas

Hosted by Arvest Equipment Finance

$395.00 Paid in Advance for first person from company

$345 with each additional attendee

"Certified Leasing Professionals attending this seminar will earn CPEs (Continuing Professional Education)

Credits toward their recertification" |

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

Archive: From a story in 1998--

Charlie Lester Sells LPI--then has a stroke two months later.

(This is not a joke)

(Charlie Lester, taken on Father's Day, with his oldest

daughter Sharon Hess on the left, and his youngest

daughter Melanie Milligan)

Leasing Icon Charlie Lester, age 67, told us we can now release the news:

"#1. I am at the office most of the time, but I nap a lot.

"#2. Yes--I will be happy to write articles for Leasing News in the format you request.

"#3. I feel good, not great, but good."

"Thank you for holding the news. As you know, in mid-July, I had a mild stroke that put me in the hospital for a few days. In plain English, I have had a "rapid heart" since my early 20's, but like most medical conditions, it has gotten worse with age and it finally caught up with me in July.

"The recovery was complete as far as we can tell and the doctors are controlling the irregular heart beat with medication for the time being. If it does get any worse, they will install a pacemaker which only takes about 25 minutes with an entry through the neck. In my situation, it took more time than I would have imagined to get my mindset back to positive thinking and rebuilding the stamina level took almost two months.

"Like every bad situation, some good has come of it. The weight is down to somewhere below the Pillsbury Doughboy for a change and my wife Barbara makes sure my eating habits are healthier. With the loving support of my family and God's grace, life is pretty much back to normal and I expect to be around for a long time."

"Since the sale in May, funded volume has been consistently higher than it was when I ran the company which shows you what imagination, youth and energy will do for you. I make a few contributions on the company direction as a consultant, but the 3-K's are the company and deserve the credit. They are good to the point I am beginning to dislike them.

"Barbara is a Stephen Minister and I am on the Board of Trustees of our church as well as being on the Cobb County Civil Service Board. A Stephen Minister is a non-denominational "lay" minister who is assigned to be the spiritual care giver on an "as needed basis" for someone going through a crisis in their life. The Board of Trustees helps manage and protect the assets of the church. The Civil Service Board hears cases and make judgments when Cobb County employees feel they have not been treated fairly by the department they work for.

"You asked me about retirement? The real answer, I am slowing up a bit, but if I ever totally stop, it will be time to send flowers and sympathy cards. I have too many friends in our industry to harass."

His current facility (Altus Hospice):

http://www.altushospice.com/index.php

Altus House

Charlie Lester - Room 6

5411 Northland Drive NE

Atlanta, Georgia 30342

[headlines]

--------------------------------------------------------------

New Hires---Promotions

Mike Goolden has been hired by TLC Capital, a division of North Carolina-based Telerent Leasing Corporation, Raleigh, North Carolina, as its new vice president and general manager. He had an extensive career with GE in various leasing divisions and capacities including President and General Manager of GE's Small Business Finance Group, Region Manager, Chief Marketing Officer and global Quality Leader of multiple GE Units.

Tish Gowgiel, CFO, QuikTrak, Beaverton, Oregon, has been promoted to the position of COO. She joined the firm in 2006 and has been responsible for Quiktrak's finance and accounting departments. She previously was Vice President Private Wealth Services at Columbia Management and Vice President Private Wealth Services at Columbia Management and Manager at Tektronix. Education included Duke University - The Fuqua School of Business and Claremont McKenna College.

Duke Graham was promoted to managing director and business development manager Wells Fargo Capital Finance Lender Finance division. He is based in Atlanta. He has been with the Lender Finance team since 2005 as a business development officer. Before joining Wells Fargo he was director of originations for Asset Backed Conduit Finance at Wachovia Securities in Atlanta. Prior to Wachovia, Luke worked with GE Corporate Financial Services in Atlanta and MBIA in New York City. He received his MBA in Finance from Rutgers Graduate School of Management and his BS in Economics from Penn State.

Mark H. Idzerda has joined the company as Director of the Healthcare Solutions Group, CSI Leasing, St. Louis, Missouri.

He has more than 25 years of healthcare financing experience in both the domestic and international markets and was most recently was senior vice-president, Tygris Asset Finance, Inc. Previously vice-president Oncology and Imaging, MarCap Corporation. He has also served as Managing Director with DVI, Inc.

Eleonara P. Khazanova has joined the law firm of Askounis & Darcy PC, Chicago, Illinois, as Associate Attorney. She previously was with Drinker Biddle & Reath LLP, Albany, New York. She graduated summa cum laude from Northwestern University with a bachelor's degree in political science. She earned her J.D. from Harvard Law School. Prior to law school, she was a development director of a nonprofit organization. During law school, she represented federal inmates in their habeas corpus petitions. Nora is fluent in Russian and proficient in Ukrainian.

Michael R. McKinney was named senior loan officer for TD Bank, Portland, Maine, Federal Leasing team in Vienna, Virginia.

He previous was with Key Government Finance, Superior, Colorado.

Maggie Morris was named federal portfolio loan officer in TD Bank, Portland, Maine, Equipment Finance division. She will be based in an office in Bowie, Md., has more than 25 years of experience in equipment finance, sales, and operations. Prior to joining TD Bank, she was Federal Contract Manager for Key Government Finance, Inc., Washington, DC. in and Federal Contract Manager, GE Finance.

Matthew S. Raczkowski has joined the law firm of Askounis & Darcy PC, Chicago, Illinois, as Associate Attorney. He previously was with Dykema Gossett PLLC, Chicago, Illinois. He was a legal intern with Franklin County Legal Services in the summer of 2006 He graduated 2008 J.D., magna cum laude University of Illinois in 2008 after receiving his BS at Indiana University at Bloomington.

Terry L. Smith was named senior loan officer for TD Bank, Portland, Maine, Federal Leasing team in Vienna, Virginia.

He previous was with Key Government Finance, Superior, Colorado.

Tamara Storey was named commercial banking equipment finance sales executive for Huntington National Bank, Columbus, Ohio, Indiana, Indianapolis area. She was Senior Leasing Representative/Vice President at STAR Financial Bank, Vice President at Chase Equipment Finance, Vice President at JPMorgan Chase. From 2000 to 2008 she served as vice president at Chase Equipment Finance. Prior to that she was a vice president at KeyCorp. Education: Anderson University, Indiana University Bloomington

Jennifer Van Aken has been appointed Director, Investor Relations GATX Corporation, Chicago, Illinois. She joined GATX Corporation in 2006 and has served in a number of finance-related roles. Most recently, she was Director, Corporate Finance in GATX's treasury department. Ms. Van Aken received her bachelor of science in mathematics from Allegheny College and her masters of business administration from Carnegie Mellon University.

[headlines]

--------------------------------------------------------------

Elk Grove Village, Illinios---Adopt-a-Dog

Majesty

This is a beautiful dog that just needs some grooming and loving.

Female

Three Years Old

"I came from a kill shelter as a Westie- surprise! I am the biggest "Westie" the people at Almost Home have ever seen: a jumbo size Westie. Instead they called me a Wirehaired Terrier. Whatever breed name you give me, I am a very unique looking dog, but an absolute sweetheart. I love humans of all ages and get along with dogs, too. We don't know about cats, though. You can leave me alone at home, but when you come back I will greet you like you are the biggest superstar. Well, if you give me my forever home you will be just that- MY superstar and I will promise you a lifetime of loyalty and affection. So what are you waiting for? Come and meet the me, the jumbo Westie, at the next adoption show."

If you are interested in adopting please click here for information and frequently asked questions.

If you have further questions, please leave a message at 1- 630- 582-3738

Email: dogs@almosthomefoundation.org

http://www.almosthomefoundation.org/availableanimals.htm

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Michael Witt, Esq.)

[headlines]

--------------------------------------------------------------

Classified ads—Operations/Remarketing

Operations: Houston, TX

Silverlake Inspections LLC is an independent contracting company for real estate and equipment verification with pictures.

Email: jimh05@sbcglobal.net

|

Operations: Portland , OR

Portfolio Financial Servicing Company provides state of the art portfolio servicing for portfolios of all sizes. 800-547-4905 sales@pfsc.com |

Operations: Roseburg, OR

Tired of paying a full time documentation person? Try outsourcing. Ideal for anywhere in the USA. E-mail or Call Trina Drury

541-673-4116 or 541-784-7973.

email: doc_prep@yahoo.com

|

Remarketing: Nassau Asset Management Specializing in: Repossession, remarketing, plant and fleet liquidation, skip tracing and collections. All types of equipment. Over 160 locations nationwide. We will tailor any remarketing program to your specific requirements. www.nasset.com

Contact: ECast@nasset.com

ELA,NAB T ,EAEL,NAELB,UAEL |

Repossessions: Canada

Cease Bailiff Services Incorporated:

Asset Investigation/Tracing; Asset Recoveries; Asset Protection/Security

Asset Liquidations/Sales; Ottawa, Canada; www.ceasebailiff.ca dave@ceasebailiff.ca; Phone 613 898 7376 ; Fax 613 225 2452 |

Remarketing: Los Angeles, CA

Video, Audio, Film, Computer, IT, Test, Presentation Equipment

We pay cash / 3 million in buying power /Quick Quotes

UBG 800-570-5224

jon@usedvideo.org

|

All "Outsourcing" Classified ads (advertisers are both requested and responsible to keep their free ads up to date:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing.htm

[headlines]

---------------------------------------------------------------

[headlines]

----------------------------------------------------------------

Today in History

1963 -- In Birmingham, Alabama, Police Chief "Bull" Connor orders fire houses and dogs turned on children marching out of the 16th St Baptist Church to keep them from marching out of the "Negro section". This after jailing 900+ yesterday. There was no national radio or television coverage, let alone the internet or cellular telephone pictures or reporting. Imagine if this were to occur today.

[headlines]

----------------------------------------------------------------

This Day in American History

1494-Christopher Columbus cited the island of Jamaica on his second voyage.. He never actually saw nor did his discoveries include the United States, but the island off the continent. It was the Spanish who first brought slavery into the new world. The islands were Europe's main gateway into the New World. The first Revolutionary naval battle was fought here to gain control of this ocean thoroughfare. .

http://memory.loc.gov/ammem/today/may03.html

http://www1.minn.net/~keithp/cctl.htm

1654- Richard Thurlow built the first toll bridge with his own money over the Newbury River at Rowley, MA. The court fixed a rate of toll for animals, but passengers were permitted free passage. It remained until 1680.

http://www.angelfire.com/ny/chickened/thurlowfamily.html

1761 - Large tornadoes swept the Charleston, South Carolina harbor when a British Fleet of 40 sails was at anchor. It raised a wave 12 feet high, leaving many vessels on their beam ends. 4 people drowned.

1774 -a May snowstorm from New York City to Virginia covered the ground. A severe frost killed fruit in North Carolina

1825-Laura Matilda Towne Birthday. After the Civil War, LMT with her close friend Ellen Murray founded one of the earliest and most successful schools for former slaves on the coastal islands of South Carolina. She had studied homeopathic medicine privately and taught school in her native Pennsylvania before volunteering to teach - and in many ways care for - a large population of former slaves of the Sea islands of South Carolina. She taught, acted as physician, and directed relief aid and in 1862 with Murray founded the freedman's Penn School that used the same curriculum as New England schools. For dozens of years Penn School was the only education available for the black population of the islands. Her school was eventually taken over by the South Carolina public school system.

http://www.aaregistry.com/african_american_history/2200/

Laura_M_Towne_was_a_primetime_educator

1862-after nearly a month's siege, General Joseph Johnston's outnumbered Confederate forces evacuated Yorktown, VA, and moved back to Richmond. General McClellan's Army of the Potomac occupied Yorktown the following day. General Johnston is considered one of the top generals of the Confederacy, the United States, and if it were not for the overwhelming amount of money, the ability to “buy” foreign recruits, the war would have gone the way of the Confederacy due to military leaders such as Johnston. With the capture of Yorktown, President Abraham Lincoln left Washington, DC, for Fort Monroe, VA, to observe the ongoing Peninsula Campaign.

http://tennessee-scv.org/camp28/johnstonbio.html

http://ngeorgia.com/site/johnstonstatue.html

http://einsys.einpgh.org:8887/MARION/AAJ-1380

http://www.eaglesongthemusical.com/linkedpages/johnston.html

http://www.civilwarhome.com/johnston1stmanassas.htm

http://www.qmfound.com/BG_Joseph_Johnston.htm

1886-At the height of the movement for the 8-hour day, police opened fire in a crowd of workers participating in a general strike at McCormick Harvester Co. in Chicago. Four workers were killed.

1895 -A f5 tornado carved a 13 mile path through Sioux County in Iowa. 9 people were killed and 35 were injured.

1903-John “Honey” Russell, Basketball Hall of Fame player and coach born at New York, NY. Russell played in more than 3,200 pro basketball games in the sport's early years. In 1936, he became coach at Seton Hall University, remaining there for 11 seasons. He was also a baseball scout, a football scout and a promoter. Inducted into the Hall of Fame in 1964. died at Livingston, NJ, Nov. 15, 1973.

http://www.hoophall.com/halloffamers/RussellJ.htm

1906--Birthday of actress Mary Astor. "She was so beautiful she almost made me faint." said John Barrymore but even beyond her beauty, she was a fine actor of screen and stage appearing in more than 100 movies - and the winner of an Academy Award. She is also the creator of one of the most memorable roles on the screen, Brigit O'Shaughnessy in The Maltese Falcon.

1911-trumpet player Yank Lawson born Trenton, MO. Died Feb. 18,1995

http://www.pudbrown.com/YankLawson.htm

http://www2.cybercd.de/artist/Lawson,+Yank.htm

1913-birthday of playwright William Inge, born in Independence, Kansas. . He won the Pulitzer price for “Picnic,” some of his other plays included “Bus Stop,” “Come Back, Little Sheba.”

http://memory.loc.gov/ammem/today/may03.html

http://www.imagi-nation.com/moonstruck/clsc63.html

1918-tenor Leopold Simoneau, considered one of the most distinguished Canadian singers of the century, was born in St-Flavien, Quebec. Simoneau developed an international reputation in the 1950's as a specialist in the works of Mozart. Among the many highlights of his career was his 1952 appearance in Paris in a production of Stravinsky's "Oedipus Rex," with the composer as conductor and Jean Cocteau as narrator.

1919-birthday of folksinger, songwriter Pete Seegar, born New York, New York. In the 1940's, he performed with Woody Guthrie, before forming the Weavers, who had hits with such folk tunes as "On Top of Old Smokey" and "Goodnight Irene." Seeger was blacklisted by the US government during the '50s. In the following decade, he became a father figure to many younger folk and rock musicians. The Byrds, for example, had a number-one hit with Seeger's "Turn, Turn, Turn."

http://www.peteseeger.com

1920-pianist John Lewis born LaGrange, Il.

http://www.jazclass.aust.com/lewis.htm

http://www.holeintheweb.com/drp/bhd/MJQ.htm

1921-Reece “ Goose” Tatum, basketball player born at Calion, AR. Tatum played football and baseball and came into his own when Abe Saperstein asked him to play basketball with the Harlem Globetrotters. Tatum's best asset was his hands, big enough to allow him to hold the ball with one hand. He perfected the overhand hook shot later used by Wilt Chamberlain, Connie Hawkins and Kareem Abdul-Jabbar. Suspended by Saperstein in 1955, he formed his own team, the Harlem Magicians. Died at El Paso, Texas, January 18,1967

1921- Ray (“Sugar Ray') Robinson, boxer, born Walker Smith, Jr., at Detroit, Ml. Generally considered “pound for pound the greatest boxer of all time,” Robinson was a welterweight and middleweight champion who won 175 professional fights and lost only 19. A smooth and precise boxer, he fought until he was 45, dabbled in show business and established the Sugar Ray Robinson Youth Foundation to counter juvenile delinquency. To this day, his name connotes class, style and dignity. My father took me to his fight in Yankee Stadium when we lived in New York. My father was a great fight fan and took my brother and I to many bouts.

http://www.ibhof.com/robinson.htm

1928- James Brown Birthday, born in Macon, Georgia.

He sold millions of records in the US from the mid- 1950's to the mid-'60s, yet remained virtually unknown to most white Americans. But by the late '60s, the breakthroughs scored by black artists on the Motown and Stax-Volt labels helped bring Brown to the attention of the mass audience as well. James Brown's first hit, with his group the Famous Flames, was "Please, Please, Please" in 1956. It sold more than a million copies - the first of his dozens of million-sellers. Thirty years later, in 1986, he was at the top of the charts with "Living in America" from the soundtrack of "Rocky Four."

In 1996, James Brown celebrated his 63rd birthday with a concert in his hometown of Augusta, Georgia. Musical guests included rock guitarist Slash, country group Sawyer Brown and soul star Isaac Hayes.

http://www.funky-stuff.com/jamesbrown/

1936-Joe DiMaggio made his major league debut for the New York Yankees and collected three hits in their 14-5 victory over the St. Louis Browns. For the year, DiMaggio hit .323 with 29 home runs and 125 runs batted in. He used to visit friends in Los Gatos, California often. I saw him eating lunch and dinner out several times. He was well respected and never bothered in the restaurants here.

There were places here where Marilyn Monroe stayed, sometimes with him and they had great privacy, I am told. He was a very private man.

http://www.baseballhalloffame.org/hofers_and_honorees/hofer_bios/dimaggio_joe.htm

http://www.joedimaggioestate.com/

1937- Frankie Valli, lead singer of the Four Seasons, was born in Newark, New Jersey. They were one of the most popular groups of the 1960's, with more than 30 singles on the best-seller charts from 1962 to 1976. Frankie Valli's falsetto singing was the group's trademark on such hits as "Sherry," "Big Girls Don't Cry" and "Walk Like a Man." Valli began a successful solo career in 1974, and had such hits as "My Eyes Adored You" and "Grease." He has also put together Four Seasons groups for rock 'n' roll revival shows.

http://www.srv.net/~roxtar/valli_frankie.html

http://www.hwcn.org/~ad828/frankie.htm

1943-Robert Frost won the Pulitzer Prize for Poetry, his fourth time. He won it for “A Witness Tree.” His other awards were in 1924 for “New Hampshire: A Poem with Notes and Grace Notes.” in 1931 for “Collected Poems,” and in 1937, for A Further Range.”

http://www.ketzle.com/frost/

http://www.theatlantic.com/unbound/poetry/frost/frostint.htm

http://www.poets.org/poets/poets.cfm?prmID=196&CFID=8427572&CFTOKEN=3561476

http://www.amazon.com/exec/obidos/ASIN/B00000J87V/qid%3D1020016743/

ref%3Dsr%5F11%5F0%5F1/104-4525358-7043961

1948- CBS Evening News began as a 15-minute telecast with Douglas Edwards as anchor. Walter Cronkite succeeded him in 1962 and expanded the news show to 30 minutes. Eric Sevareid served as commentator. Dan Rather anchored the news casts upon Cronkite's retirement in 1981. At one point, to boost sagging ratings, Connie Chung was added to the newscast as Rather's co-anchor, but she left in 1995 in a well-publicized dispute. Rather remains solo, and as Walter Cronkite would say "...that's the way it is."

1952- Eddie Arcaro became the first and only jockey to win the Kentucky Derby five times: 1938, Lawrin, 1941, Whirlaway, Hoop Jr, 1945, Citation, 1948, Hill Gail, 1952.

1952-Historians give credit to Lieutenant Colonel Joseph Otis Fletcher as the first man to set foot on the “North Pole.” The first airplane flight to land at the North Pole was made by a ski-wheeled Air Force C-47, which landed this day in 1952. I took off from Fletcher's Ice Island, about 115 miles from the Pole, carrying 10 air force officials and scientists. It was piloted by Lieutenant Colonel William Pershing Benedict of San Rafael, CA, and copilot Lieutenant Colonel Joseph Otis Fletcher of Shawnee, OK. In 1997, historian Robert M. Bryce published the results of research indicating that no previous explorer succeeded in reaching the Pole, despite two long standing claims, and that Fletcher was the first human known to set foot on it. In addition, Dr. Albert Paddock Crary, who was in this party, on February 12,1961, reached the South Pole by tracked vehicle as part of a scientific expedition. He became then the only explorer to set foot on both the North and South Pole.

1952-CBS became the first network to televise the Kentucky Derby. Eddie Arcaro rode Hill Gail to a two-length victory over Sub Fleet. Blue Man was third. For Arcaro, it was a record fifth Derby win. Trainer Ben A. Jones won for the sixth time, also a record.

1955---Top Hits

Cherry Pink and Apple Blossom White - Perez Prado

The Ballad of Davy Crockett - Tennessee Ernie Ford

Dance with Me Henry (Wallflower) - Georgia Gibbs

In the Jailhouse Now - Webb Pierce

1956 - "Most Happy Fella", a musical by Frank Loesser, opened at the Imperial Theatre in New York City. The show, an adaptation of "They Knew What They Wanted" by Sidney Howard, ran for 676 performances on Broadway. Critics called the show a masterpiece, thanks to the outstanding performances by Robert Weede and Jo Sullivan. Many of the songs made the “Hit Parade.” Frank Loesser's hits included "Standing on the Corner", "I Like Everybody", "Joey, Joey, Joey", "Big Acquaintance" and "Don't Cry".

http://www.frankloesser.com/home.htm

1960 - The play, "The Fantasticks", opened at the Sullivan Playhouse in New York City. It would later become the longest-running off-Broadway play. "Soon It's Gonna Rain" was one of the big hit tunes from the production. Many high schools make this their musical performance for students to present to their community.

1963---Top Hits

I Will Follow Him - Little Peggy March

Can't Get Used to Losing You - Andy Williams

Puff the Magic Dragon - Peter, Paul & Mary

Lonesome 7-7203 - Hawkshaw Hawkins

1963 -- In Birmingham, Alabama, Police Chief "Bull" Connor orders fire houses and dogs turned on children marching out of the 16th St Baptist Church to keep them from marching out of the "Negro section". This after jailing 900+ yesterday. There was no national radio or television coverage, let alone the internet or cellular telephone pictures or reporting. Imagine if this were to occur today.

1964 - Gerry & the Pacemakers make their United States TV debut on the "Ed Sullivan Show" and perform "Don't Let the Sun Catch You Crying."

1968-new owners Tom Cousins and Carl Sanders announced that the St. Louis Hawks of the NBA would move to Atlanta for the 1968-69 season. The team began as the Tri-Cities Blackhawks(1949-51), moved to Milwaukee and then to St. Louis in 1956.1980-Genuie Risk, ridden by Jacinto Vasquez, became just the second filly to win the Kentucky Derby. She posted a one-length victory over Rumbo.

1968-The Beach Boys open a 17-date tour of the U.S. with a show in New York. The second half of the concert is given over to the Maharishi Mahesh Yogi who lectures on "spiritual regeneration." The audiences reaction is so negative, more than half of the tour dates are cancelled.

1968 --Thelonious Monk and Dr. John the Night Tripper at the San Francisco Carousel Ballroom.

1970 -- Ohio Gov. Rhodes vows to "use every weapon" against antiwar protesters at Kent State University. Tomorrow he does.

1971---Top Hits

Joy to the World - Three Dog Night

Put Your Hand in the Hand - Ocean

Never Can Say Goodbye - The Jackson 5

Empty Arms - Sonny James

1975 - Tony Orlando and Dawn's "He Don't Love You (Like I Love You)" hits #1

1978 - Persistent thunderstorms caused widespread flooding in southeastern Louisiana and extreme southeastern Mississippi. Rainfall totals of ten to thirteen and a half inches were reported around New Orleans causing the worst flooding in thirty years. The water depth reached three to four feet in several hundred homes, and total property damage was estimated at one hundred million dollars

1979---Top Hits

Heart of Glass - Blondie

Reunited - Peaches & Herb

Stumblin' In - Suzi Quatro & Chris Norman

Where Do I Put Her Memory - Charley Pride

1987---Top Hits

(I Just) Died in Your Arms - Cutting Crew

Looking for a New Love - Jody Watley

La Isla Bonita - Madonna

Don't Go to Strangers - T. Graham Brown

1991 - Andy Williams, 60, marries former hotel concierge Debbie Haas, 36, in New York City.

1993 - Strong winds buffeted the Owens Valley area and the Eastern Sierra of Southern California. A USGS anemometer on Crowley Lake recorded a wind gust to 140 mph before blowing away. Bishop Airport had a wind gust to 65 mph. One person was killed when he was hit by a flying projectile. Many trees were downed and power outages were widespread.

1995 - The Neville Brothers, the Dixie Cups, Allen Toussaint and Professor Longhair are inducted into the New Orleans Musical Walk of Fame.

1998- Mariner Dan Wilson hits the first inside-the-park grand slam in the franchise's history.

1999-The Dow-Jones Index of 30 major industrial stocks topped the 11,000 mark for the first time.

2000 - Metallica delivers over 60,000 pages of information to Napster's San Mateo, Calif., offices, listing more than 1.4 million copyright violations of 95 Metallica songs and recordings by 335,435 distinct users.

[headlines]

--------------------------------------------------------------

Baseball Poem

Setting the Record

Written by Don Angel © in 10-2001

Published: Baseball Almanac (08-2003)

1998, Mark McGwire was the man.

Three years later would his 70 homeruns stand?

Coming home to the San Francisco Bay.

Three games with the Dodgers were left to play.

One more long ball would bring a new homerun king,

But Barry Bonds would rather have the ring.

Closing in on the record, Bonds has been walking as of late.

Los Angeles brought five runs across the plate.

During the first inning contest, Chan Ho Park would give it his all.

Bonds launched a 1-0 pitch over the right center-field wall.

Millions witness 71.

The Date — October 5, 2001

The night was still young,

His next at-bat was yet to come.

72 would be sent on it's way,

History was made twice today.

Joy would be short lived because of a Dodger's win,

The Giants playoff hopes would end.

Two days later we would see.

Homerun number 73.

[headlines]

--------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

[headlines]

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

[headlines]

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

[headlines]

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

http://www.weather.gov/

[headlines]

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

[headlines] |

![]()

![]()