Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Add me to mailing list

| Search | All Lists | Columnists | Site Map

Advertising| Archives | Classified Ads | This Day In American History

Email the Editor

![]()

Wednesday, May 5, 2021

Today's Leasing News Headlines

Manufacturing Economic Activity Increases in April

Report by IndustryWeek.com

Pied Piper Releases 2021 PSI Internet

Lead Effectiveness Study Results on Motorcycle Leasing

Cash-flooded Bank Balance Sheets

May Come Back to Haunt U.S. Banks

By Yoel Minkoff, Seeking Alpha News Editor

Leasing Industry Ads

---Help Wanted----

First Quarter 2021 Report from

Wheeler Business Consulting

SmartFinancial to Buy Fountain Leasing

Changing Name to Fountain Equipment Finance

Bonnie Michael Named 2021 Recipient of the

Edward A. Groobert Award for Legal Excellence

Meridian Partners with Accord Financial to Expand

Financing Solutions that Help Businesses to Compete

15 Year High National Association Credit Managers

Reports April Credit Manager's April Index

Chesswood Announces the Closing of Its

Previously Announced Transaction with Vault Credit Corporation

Rottweiller Mix

Knoxville, Tennesee Adopt-a-Dog

Nike Bombarded with Liens Totaling Over $100 Million

By Bryan Mason, Editorial Associate, NACM

News Briefs---

GE Kicks the Factoring Habit

a significant change in its management of incoming cash

General Electric shareholders reject

CEO Culp's pay deal

Intel investing $3.5B in New Mexico fab upgrade,

boosting US chip making; along w/$20 Billion 2 New fabs

Cars.com Reaches Milestone: 10 Million Dealership Reviews

From Car Buyers with Recent Growth Spurred by the Pandemic

Pfizer Reaps Hundreds of Millions in Profits from COVID-19 Vaccine

its vaccine generated $3.5 billion first three months of this year

Yellen’s comments on inflation spark confusion,

clarification as White House tries to navigate economic pressures

Willis Lease Finance Corporation Reports

First Quarter Pre-tax Loss of $1.7 million

You May have Missed---

Working from home 'doesn't work for those

who want to hustle': JPMorgan CEO

Broker/Funder/Industry Lists | Features (wrilter's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

Leasing News Icon for Android Mobile Device

Sports Brief----

California Nuts Brief---

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release,” it was not written by Leasing News nor has the information been verified. The source noted. When an article is signed by the writer, it is considered a “byline.” It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

Manufacturing Economic Activity Increases in April

Report by IndustryWeek.com

Struggles remain, however. “Recent record-long lead times, wide-scale shortages of critical basic materials, rising commodities prices and difficulties in transporting products are continuing to affect all segments of the manufacturing economy."

The manufacturing economy grew in April and the overall economy showed an 11th consecutive month of growth, according to the Institute for Supply Management’s monthly Manufacturing ISM Report on Business.

The April PMI of 60.7% was four percentage points lower than the March reading of 64.7% but well above the 50% level that indicates a generally expanding economy. A PMI below 50% indicates a generally declining economy.

Timothy R. Fiore, Chair of the ISM Manufacturing Business Survey Committee, in a news release, commented, “All of the six biggest manufacturing industries — fabricated metal products; chemical products; food, beverage & tobacco products; computer & electronic products; transportation equipment; and petroleum & coal products, in that order — registered moderate to strong growth in April.”

Among the individual indices that comprise the PMI, the New Orders Index, Production Index and Employment Index all showed growth, although at a slower rate than in the previous month. The Backlog of Orders Index and New Export Orders also showed growth, but at an increasing rate. Supplier deliveries slowed and the Inventories Index moved into contraction mode at 46.5%. Customers’ inventories were also registered as “too low,” in the ISM Report on Business.

While the report projected strong economic activity among manufacturers, survey members expressed a number of concerns.

"Survey committee members reported that their companies and suppliers continue to struggle to meet increasing rates of demand due to coronavirus (COVID-19) impacts limiting availability of parts and materials,” Fiore said. “Recent record-long lead times, wide-scale shortages of critical basic materials, rising commodities prices and difficulties in transporting products are continuing to affect all segments of the manufacturing economy. Worker absenteeism, short-term shutdowns due to part shortages, and difficulties in filling open positions continue to be issues that limit manufacturing-growth potential."

Nevertheless, optimism among the panel increased compared with the previous month.

What They Are Saying

The Manufacturing ISM Report on Business also shares comments from their survey respondents. Among those collected in this latest survey:

- “Continued strong sales; however, we have had to trim some production due to the global chip shortage. Hasn’t affected inventories greatly yet, but a continued decrease will begin to reduce available inventories if we don’t recover chip supply shortly.” (Transportation Equipment)

- “In 35 years of purchasing, I’ve never seen everything like these extended lead times and rising prices — from colors, film, corrugate to resins, they’re all up. The only thing plentiful at present, according to my spam filter, is personal protective equipment [PPE].” (Plastics & Rubber Products)

- “Steel prices are crazy high. The normal checks on the domestic steel mills are not functioning — imported steel is distorted by the Section 232 tariffs.” (Fabricated Metal Products)

[headlines]

--------------------------------------------------------------

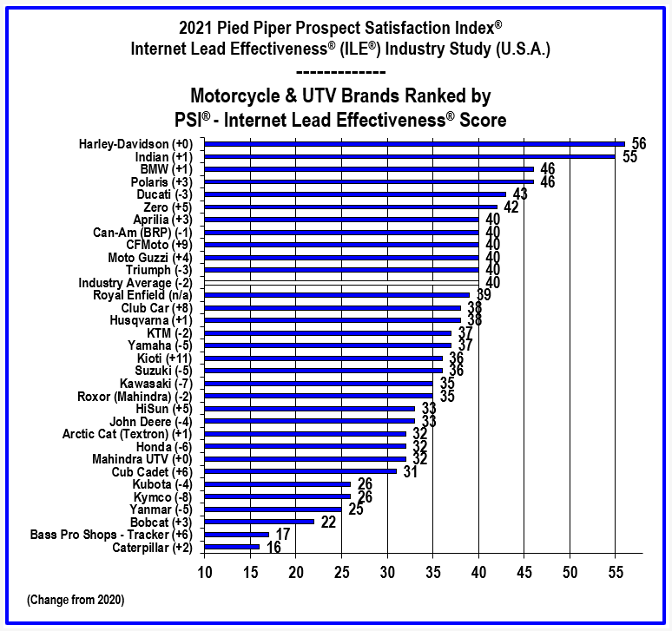

Pied Piper Releases 2021 PSI Internet

Lead Effectiveness Study Results on Motorcycle Leasing

MONTEREY, Calif. – Harley-Davidson dealerships ranked highest in the 2021 Pied Piper PSI Internet Lead Effectiveness (ILE) Motorcycle/UTV Industry Study, which answers the question, “What happens when motorcycle or UTV customers visit a dealer website and inquire about a vehicle?” The Indian motorcycle brand was ranked second, followed by BMW and Polaris.

Dealers for top brands improved their website response behaviors dramatically over the past 2 years, while dealers for other brands failed to improve. For example, the 2021 ILE study results show that dealers selling Harley-Davidson, Indian, BMW or Polaris sent an email or text answering a website customer’s question about 50% of the time on average. 50% leaves plenty of room for more improvement, but in 2019, the figure for the same dealers was only about 35% of the time. In contrast, Honda, Kawasaki, Triumph or Yamaha dealers sent an email or text answering a website customer’s question only about 30% of the time on average in both 2019 and 2021.

To complete the 2021 ILE study, Pied Piper submitted customer inquiries through the individual websites of 6,407 dealerships between July 2020 and March 2021, asking a question about a vehicle in inventory, and providing a customer name, email address and local telephone number. Pied Piper then evaluated how the dealerships responded by email, telephone and text message over the next 24 hours. Twenty different measurements generate dealership ILE scores, which range from zero to 100. Some 17% of dealerships nationwide scored above 70, requiring a quick and thorough personal response, while 44% of dealerships scored below 30, showing failure to personally respond in any way to their website customers.

Now in its 11th year, the ILE study for 2021 implemented a modification to scoring which required answering a customer’s question by email or text as the only way to “stop the timeliness clock.” The industry average ILE score was unchanged by the modified scoring, but the change moved average scores for individual brands by as much as five points. In general, brands whose dealers were more likely to personally respond to customers benefited from this change, in contrast to brands whose dealers relied more on auto-responses and fixed email templates.

Response to customer web inquiries varied by brand and dealership, and the following are examples of performance variation by brand:

Harley-Davidson, BMW, Indian, Polaris, Club Car, HiSun and CFMoto dealers on average sent an email or text that answered the customer’s question within one hour 30% of the time or more. Kawasaki, Kubota, Honda, Caterpillar, Kymco, Bobcat, Yamaha, and Tracker dealers on average emailed or texted an answer within one hour less than 15% of the time.

Harley-Davidson and Indian dealers on average sent a text message more than 30% of the time, while John Deere, Kioti, Kubota, Moto Guzzi, Bobcat, Cub Cadet, Hisun, Tracker, and Yanmar dealers on average texted less than 2% of the time.

Harley-Davidson and Indian dealers, on average, phoned website customers within one hour more than 30% of the time, while John Deere, Kubota, Mahindra, Bobcat, Club Car, Cub Cadet, Kioti, Tracker, Moto Guzzi, HiSun, Yanmar and Arctic Cat dealers, on average, phoned within one hour less than 6% of the time.

[headlines]

--------------------------------------------------------------

Cash-flooded Bank Balance Sheets

May Come Back to Haunt U.S. Banks

By Yoel Minkoff, Seeking Alpha News Editor

- Banks that are flush with cash is usually a good thing, as that generally means lots of lending, but something else is awry in the U.S. financial system. Banks like JPMorgan (NYSE:JPM) and Citigroup (NYSE:C) have recently been advising large corporate clients to move their savings out of deposits and into money market funds. According to the FT, a wave of cash flooding bank balance sheets during the pandemic is responsible for the latest flows and could have profound effects on U.S. lenders.

- What's happening? In recent quarters, big banks have detailed weaker-than-expected loan demand and have pushed out the timeline of when they predict it to bounce back. In the absence of lending, extra deposits can be costly for banks, putting pressure on their regulatory ratios and eventually requiring them to hold more capital. Strategically moving the deposits to money market funds would be advantageous, as the instruments are managed via their asset management divisions and are not included in leverage ratios.

- The four largest U.S. banks - JPMorgan, Citi, Bank of America (NYSE:BAC) and Wells Fargo (NYSE:WFC) - amassed nearly $1T in additional deposits last year due to the scale of fiscal stimulus. Their latest earnings report also revealed that deposits collectively grew by 15% to $6.9T as of March 31, but their combined loan holdings fell 10% to $3.4T. In fact, the loans-to-deposits ratio now sits at 61.5% for all banks in the U.S., the lowest ratio in 48 years. "Even if consumers do draw down to go on trips to Disney World, and companies draw down to build out new warehouse facilities and buy new equipment, they're just not spending fast enough relative to what's coming in," added RBC analyst Gerard Cassidy.

- How long will it last? It's not so clear, but it could be the trend for a while given the scale of fiscal stimulus being released into the economy. Some analysts even think it could take up to seven years, or even longer, for the Fed's balance sheet to begin to come down and for there to be less cash in the system. However, the situation could also turn around if loan growth or demand snaps back faster than most banks are currently expecting.

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

First Quarter 2021 Report from

Wheeler Business Consulting

Scott Wheeler, CLFP

Professionals in the commercial equipment leasing and finance industry are proud of their large relationships and the big deal funded last quarter that put them over the top for production. These wins are derived from being consistently in the market and always pursuing the next level of success. Some professionals and companies are always swinging for the fences. When they connect, the rewards are tremendous, but the alternative may leave them empty handed.

I recently had the opportunity to work with two veteran companies. Both companies:

- Provide services to vendors and end-users

- Have had consistent year-over-year growth for the past decade

- Have up-to-date technology to drive efficiencies

- Have internal funding and syndication capabilities

- Have competitive pricing but are not the lowest in the industry

- Solicit niches that they have extensive experience funding

- Are equipment-centric

- Have proven records of generating exceptional profits for the company and building a strong balance sheet

- Compensate their employees and owners well. They consider each employee part of the team and invest in each member of their team.

- Have career enhancement programs to allow their employees to constantly learn and grow

- Have multiple long-term relationships and are constantly adding new partners because of their uniqueness

- Have portfolios that are performing exceptionally well

- Can proudly point to a few larger relationships or larger transactions that they have funded over the past year.

Both companies are most proud of their ability to consistently fund their bread-and-butter transactions day in and day out and their capability to compete against institutional players on a daily basis and win.

These two veteran companies reminded me that the commercial equipment leasing and finance industry consists of hundreds of organizations that are dependable providers of funds to small and medium-size businesses throughout the U.S. economy. Many participants, similar to these two veteran companies, may not be the largest or the most newsworthy.

These types of participants are strong entities that provide stable work environments and meaningful careers to thousands of professionals throughout the industry. These organizations prove that bigger is not always better. Smaller, more nimble operations are often the breeding ground for the most innovative and forward-thinking solutions that our industry has to offer. These companies celebrate their home runs but are most proud of their ability to consistently score with daily singles and doubles.

Scott A. Wheeler, CLFP

Wheeler Business Consulting

Comments, questions and suggestions are welcome.

Phone: 410-877-0428

email: scott@wheelerbusinessconsulting.com

Wheeler Business Consulting works with banks, independents, captives, origination companies, and investors in the equipment leasing and finance arena. We provide training, strategic planning, and acquisition services. Scott Wheeler is available to discuss your long-term strategy, to assist your staff to maximize outcomes, and to better position your organization in the market.

[headlines]

--------------------------------------------------------------

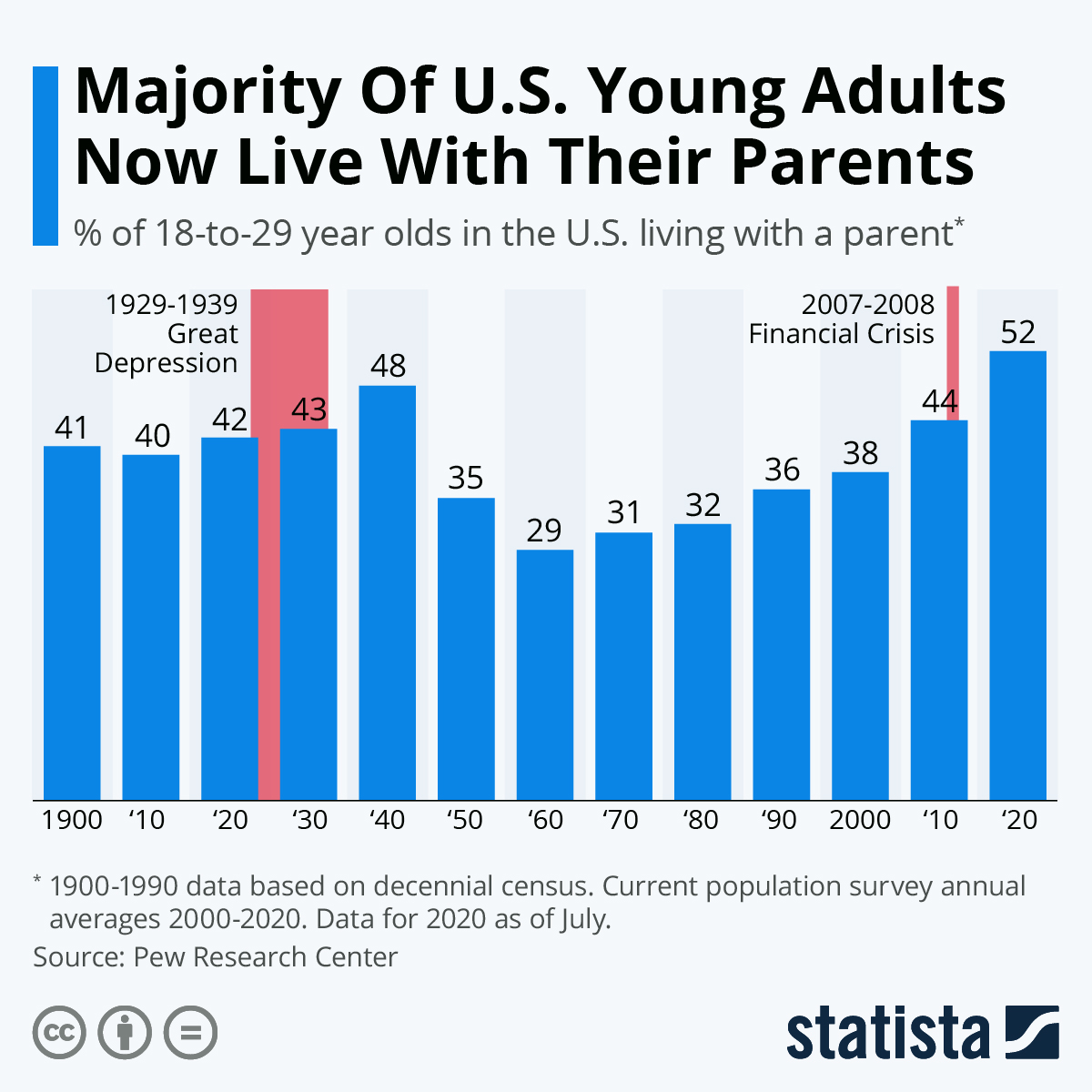

The share of young adults currently living with their parents is higher than any previous measurement recorded in surveys and decennial censuses. The highest historical value was previous recorded in the 1940 census towards the end of the end of the Great Depression when 48 percent of young adults lived with a parent. The share reached its lowest point in 1960 at 29 percent but it has grown steadily ever since, hitting 49 percent by February 2020. The Pew Research Center states that the number of 18-29 year olds living with a parent increased by 2.6 million since February and the total number stood at 26.6 million.

The devastating economic impact of the pandemic in the United States is pushing increasing numbers of young people to move back in with their parents. A recently released Pew Research Center analysis has found that a majority of 52 percent of Americans aged between 18 and 29 now live with a parent, the highest share recorded since the Great Depression era. That figure looked set to rise even further as an estimated 30 to 40 million people across the U.S. were thought to be at risk of eviction. Now that the Centers for Disease Control and Prevention has moved to provide tenants with protection until the end of this year, the likelihood of a catastrophic homelessness crisis has subsided, temporarily at least.

By Niall McCarthy

|

[headlines]

--------------------------------------------------------------

SmartFinancial to Buy Fountain Leasing

Changing Name to Fountain Equipment Finance

SmartFinancial in Knoxville, Tenn., has agreed to buy Fountain Leasing in Knoxville.

The $3.6 billion-asset SmartFinancial said in a press release Monday that it expects to complete the acquisition within the next week. It did not disclose the price.

Fountain, founded in 2006, provides construction equipment financing to small and midsize businesses in the Southeast. The company, which has $56 million of net lease investments, has offices in Atlanta; Charlotte, N.C.; Memphis, Tenn.; and Nashville, Tenn.

SmartFinancial said it plans to expand Fountain’s services across Tennessee and into Alabama and the Florida Panhandle. It also plans to offer insurance services to Fountain’s customers and prospects.

SmartFinancial said it will change the acquired company’s name to Fountain Equipment Finance.

Billy Carroll, SmartFinancial’s President and CEO, said in the release, “We have an extremely high level of respect for Fountain’s leadership and the company they built.

“While Fountain will continue to operate much as it does today, we are excited to introduce the broader array of products and services the SmartBank platform has to offer to Fountain’s clients. The opportunity to diversify our business lines and expand these services across our footprint is what attracted us to this opportunity.”

Performance Trust Capital Partners and Alston & Bird advised SmartFinancial. Gentry, Tipton & McLemore advised Fountain.

Source: biznewspost.com

[headlines]

--------------------------------------------------------------

##### Press Release ############################

Bonnie Michael Named 2021 Recipient of the

Edward A. Groobert Award for Legal Excellence

from the Equipment Leasing and Finance Association

Washington, D.C.—The Equipment Leasing and Finance Association (ELFA) has awarded Bonnie Michael, Vice President Legal and Compliance USA for Volvo Financial Services, the Edward A. Groobert Award for Legal Excellence. ELFA Legal Committee Chair Lisa Moore, Senior Counsel at PNC Equipment Finance, LLC, presented the award to Bonnie on May 4 at ELFA Legal Forum LIVE! in recognition of her significant contributions to the association and the equipment finance industry.

Bonnie has over two decades of experience representing equipment finance companies and the financial services industry. She joined Volvo Financial Services as General Counsel in 2010 and has led the USA legal team since then. In her current role, she monitors the broad spectrum of legal and regulatory areas impacting the company, providing day-to-day advice and guidance, and implementing changes as developments occur.

A leader in her field who is conversant in a wide range of topics concerning equipment finance, Bonnie has contributed to ELFA and the equipment finance industry in a number of ways.

She has served as an information resource for ELFA members regarding legal issues impacting the equipment finance industry. She has been a frequent speaker and participant in the ELFA Legal Forum and other industry events. In addition, she has contributed to ELFA’s Equipment Leasing & Finance magazine and the Equipment Leasing & Finance Foundation’s Journal of Equipment Lease Financing, and led a team of ELFA volunteers in updating the Motor Vehicle State Survey on Financial Responsibility.

Bonnie has served in a number of leadership roles within the association. She is a past member of the ELFA Legal Committee (2010–2012) and past Chair/Co-Chair of the ELFA Motor Vehicle Subcommittee (2010–2016). She also gives back to the industry by serving on the Board of Trustees for the Equipment Leasing & Financing Foundation (2015–present). In 2020, she was the Vice Chair of the Foundation Board. She has served on the Foundation’s National Development Committee, Nominating Committee and Editorial Review Board for the Journal of Equipment Lease Financing.

As a respected industry thought leader, Bonnie has mentored many members of the industry legal community. She has invested time and leadership in serving as a resource to colleagues seeking guidance from her on a range of legal issues.

Outside of ELFA, Bonnie has actively participated as an “observer” in the submissions to and meetings with the Uniform Commercial Code and Emerging Technologies Committee of the American Law Institute/Uniform Law Commission currently undertaking a review of the UCC to determine whether the Code or official comments should be revised or supplemented to reflect emerged and emerging technology.

In addition to her legal responsibilities at Volvo Financial Services, Bonnie created and served as the initial Chair of the Community Involvement program in the U.S., which furthered her passion for giving back, and also created and served as the first Chair of the Engagement Committee in the U.S., helping to foster an even better workplace for all employees to enjoy.

Bonnie holds a J.D. from Chicago-Kent College of Law and a Bachelor of Arts degree in journalism from the University of Wisconsin.

About the Award

The Edward A. Groobert Award for Legal Excellence is named for ELFA’s long-time Secretary and General Counsel Edward A. Groobert, who was active in the legal affairs of the association from the mid-1960s until his retirement in 2010.

About ELFA

The Equipment Leasing and Finance Association (ELFA) is the trade association that represents companies in the nearly $1 trillion equipment finance sector, which includes financial services companies and manufacturers engaged in financing capital goods. ELFA members are the driving force behind the growth in the commercial equipment finance market and contribute to capital formation in the U.S. and abroad. Its 575 members include independent and captive leasing and finance companies, banks, financial services corporations, broker/packagers and investment banks, as well as manufacturers and service providers. In 2021, ELFA is celebrating 60 years of equipping business for success. For more information, please visit www.elfaonline.org.

##### Press Release ############################

[headlines]

--------------------------------------------------------------

##### Press Release ############################

Meridian Partners with Accord Financial to Expand

Financing Solutions that Help Businesses to Compete

Suite of options gives businesses more flexibility

and simplicity in accessing capital

TORONTO /CNW/ - Meridian and Accord Financial Corp. announced a strategic partnership today to provide small and medium businesses with more options for financing. It comes at a time when businesses are looking for ways to ensure they succeed today and be positioned for the post-pandemic future.

Through a partnership program, Meridian is helping Members expand the access to capital they need to keep thriving. That's critical for their prosperity, as well as for Canada's overall economic recovery and growth.

Kevin VanKampen, Vice-President, Business Banking at Meridian, announced, "Our Members have told us that, more than ever, they need additional alternatives for financing their operations and expansion. Our partnership with Accord Financial, a dynamic, trusted and longstanding commercial finance leader, complements our existing suite of products and expands our breadth of offering," says

The new partnership will enable fast access to financing for Canadian small businesses, as well as loans of up to $20 million for larger businesses looking for capital. That includes:

- asset-based lending (i.e. against receivables, inventory at higher margins);

- factoring, based on specific accounts receivables;

- purchase order financing and letters of credit, to pay suppliers for goods that are pre-sold to customers.

"Businesses need to be nimble now, whether in strategizing or responding to unexpected events. The range of financing solutions provided through this partnership gives our Members the flexibility they need," says VanKampen.

Such financing can help business to optimize their cash flow, spearhead a restructuring, execute buyouts or acquisitions, or invest in the next phase of growth.

Simon Hitzig, President & CEO, Accord Financial, commented,

"Canadian businesses are the engine of the economy, and financial liquidity is the fuel that keeps them running. We are pleased to partner with Meridian Business Members to help more businesses navigate the economic cycle, capitalize on emerging opportunities, and position themselves to thrive," says

The partnership complements Meridian's existing suite of financing services, from loans and lines of credit, to business mortgages and commercial owner-occupied lending.

For more information about financing solutions available to businesses through Meridian and Accord Financial, please visit our new co-branded website.

About Meridian Business Banking

Meridian's Business Banking serves more than 25,000 Members in 15 Business Banking Centers located across Ontario, helping our Member businesses grow and build stronger communities. Meridian offers a full suite of banking services for all sizes of businesses, including cash management, financing and Business Visa. In addition, Meridian has specialized industry teams that focus on specific sectors such as Corporate Finance and Real Estate and Development. For more information, see our Small Business and Commercial Banking sites, and visit us on LinkedIn.

About Accord Financial Corp.

Accord Financial is North America's most dynamic commercial finance company providing fast, versatile financing solutions for companies in transition including factoring, inventory finance, equipment leasing, trade finance and film/media finance. By leveraging our unique combination of financial strength, deep experience and independent thinking, we craft winning financial solutions for small and medium-sized businesses, simply delivered, so our clients can thrive. For 43 years, Accord has helped businesses manage their cash flows and maximize financial opportunities.

About Meridian

With more than 75 years of banking history, Meridian is Ontario's largest credit union and the second largest in Canada, helping to grow the lives of more than 370,000 Members and customers. Meridian has $26.5 billion in assets under management (as at December 31, 2020) and delivers a full range of financial services online, by phone, by mobile and through a network of 89 branches across Ontario, and business banking services in 15 locations. Meridian cardholders have access to over 43,000 surcharge-free ATMs in North America with THE EXCHANGE® Network and the Allpoint Network in the United States. For more information, please visit: meridiancu.ca, follow us on Twitter @MeridianCU or see our Facebook site.

SOURCE Meridian Credit Union

### Press Release ############################

|

[headlines]

--------------------------------------------------------------

### Press Release ############################

15 Year High National Association Credit Managers

Reports April Credit Manager's April Index

NACM’s Credit Managers’ Index for April 2021 reached a high not seen for more than 15 years. The monthly combined index for manufacturing and service sectors broke through the 60-mark with a reading of 60.6 after hovering in the high 50s for several months. The last time the combined score surpassed 60 was March 2006. However, at 62.2, April 2004 still holds the record for the CMI’s highest combined score.

NACM Economist Chris Kuehl, Ph.D, notes, “The readings have been on a fairly steady climb since the early days of the pandemic last March and April. Movement in sub-categories have been equally impressive. There doesn’t seem to be a problem with getting paid in many sectors these days. Not only are companies paying what they owe, they are doing it on time. This marks the sixth-straight month without readings falling into the 40s. That is nearly unprecedented as far as the CMI history is concerned.”

At 68.2, the Index of Favorable Factors fell short of the 69.7 high noted in January. The index has held above 60 since June 2020, when it totaled 55.3 as it left three consecutive months of contraction. Month on month, three of the four subcategories registered gains. The Index of Unfavorable Factors reached 55.6—its highest since July 2004 (56.7), and each of its six subcategories also gained month on month.

“For the most part, the past 12 months have been very positive for favorable categories,” Kuehl said. “These are all impressive numbers and reflect the overall gains in the economy noted thus far this year. Today’s economic growth has been about as unexpected as last year’s collapse. Just last year, these readings tallied in the 30s and 40s.”

#### Press Release #############################

[headlines]

--------------------------------------------------------------

#### Press Release #############################

Chesswood Announces the Closing of Its

Previously Announced Transaction with Vault Credit Corporation

TORONTO, CNW/ - Chesswood Group Limited ("Chesswood" or the "Company") (TSX: CHW), a North American commercial equipment finance provider for small and medium-sized businesses, is pleased to announce that it has completed the merger of its subsidiary Blue Chip Leasing with Vault Credit Corporation, which was previously announced on April 8th, 2021. Both organizations received the necessary approvals from their funding partners and are excited to serve the market under one group umbrella.

Chesswood will provide the merged entity access to its funding facilities to facilitate growth in its Canadian equipment finance portfolio.

Ryan Marr, Chesswood's President & CEO, remarked, "We're pleased to complete this merger and welcome Vault's talented staff to the Chesswood family. We are also excited with the opportunity to work with Daniel Wittlin and his senior leadership team to continue growing Chesswood's presence in Canada's alternative lending market".

ABOUT VAULT CREDIT CORPORATION

The Vault Group of Companies is dedicated to delivering a variety of credit products to meet the diverse needs of its originator partners and borrowers. Within the Vault Group of Companies, Vault Credit specializes in equipment leases and commercial loans allowing for customizable financing solutions. Vault Credit serves small to medium businesses across Canada and caters to a wide spectrum of credit tiers, equipment types and industries.

ABOUT CHESSWOOD

Through three wholly-owned subsidiaries in the U.S. and Canada, Chesswood Group Limited is North America's only publicly-traded commercial equipment finance company focused on small and medium-sized businesses. Our Colorado-based Pawnee Leasing Corporation, founded in 1982, finances a highly diversified portfolio of commercial equipment leases and loans through relationships with over 600 independent brokers in the U.S. Located in Houston, Texas, Tandem Finance Inc. provides equipment financing to small and medium-sized businesses in the U.S. through the equipment vendor channel. In Canada, Blue Chip Leasing Corporation (which, as described above, has now merged with Vault Credit Corporation) has been originating and servicing commercial equipment leases and loans since 1996, and today operates through a nationwide network of more than 50 independent brokers. Based in Toronto, Canada, Chesswood's shares trade on the Toronto Stock Exchange under the symbol CHW.

Learn more at: www.Chesswoodgroup.com www.PawneeLeasing.com www.BlueChipLeasing.com and www.TandemFinance.com

#### Press Release #############################

|

[headlines]

--------------------------------------------------------------

Rottweiller Mix

Knoxville, Tennesee Adopt-a-Dog

Mia

ID#46757104

Female

3 Years old

Color: Black/Tan

Site: Young-Williams animal Center

Adoption Fee: $0

Mia is a sweet girl who would do best as the only animal in her furever home. She's very affectionate and loving, once she opens up to you!

Young-Williams AnimalCetner

3201 DivisionStreet

Knoxfille, Tennesee 3919

(865) 215 – 6599

Hours

10am- 6pm

Closed 1pm - 2pm

Open 7 Days a Week

How to Adopt:

https://www.young-williams.org/adopt-a-pet/

[headlines]

--------------------------------------------------------------

### Press Release ############################

Nike Bombarded with Liens Totaling Over $100 Million

By Bryan Mason, Editorial Associate, NACM

A heap of liens is stacking up against Nike and its general contractor following the construction of its monstrous campus expansion near Beaverton, OR. As it stands, about $110 million worth of liens, across several construction companies, have been filed against the corporate powerhouse.

Topping this list is Hoffman Construction, which claims Nike still owes the firm $48 million from its original $433 million contract, according to The Oregonian. However, documents show that Nike has paid $410 million of that contract.

Other companies involved in the numerous lien filings since the beginning of 2021, per The Oregonian, include:

- Performance Contracting - $13.4 million

- Dynalectric - $13.2 million

- Culver Glass - $7.7 million

- Skylab Architecture - $7.1 million

- Siemens - $4.2 million

- Western States Fire Protection Co. - $1.78 million

According to news reports, Nike has declined to address the validity of these lien claims despite the lawsuits that may result from them.

In a statement, the firm said: “A project of this size and scope involves complexity. We are committed to seeing through the successful completion of our expansion. But as we have done throughout this project, we will refrain from sharing details related to costs and contracts.”

Based on information from NACM STS’s Lien Navigator, to have lien rights in Oregon on private construction projects such as this one, subcontractors and material suppliers must serve a first notice within eight business days of first furnishing to the owner. Otherwise, they forfeit their rights to file a lien.

Although not required, also sending the lender a notice would give suppliers super lien priority, meaning a lien for material would have priority over prior recorded mortgages. To be valid, the person furnishing the materials must deliver notice—no later than eight days after delivery of materials—to the mortgage holder either a copy of the notice given to the owner or notice that provides substantially the same information.

Connie Baker, Director of Operations for NACM STS, said,

“If you only notify the owner, you’ll still have lien rights, but your lien will fall behind the bank.”

When selling directly to the property owner, a sub or supplier would not have to file the first furnishing notice. “You have the right to go straight to lien,” Baker said.

The Lien Navigator advises filing a lien prior to the shorter of 75 days from last furnishing or 75 days of substantial completion of construction. “So, it could be based on a suppliers last furnishing date to the job or if you are at the end of the job within 75 days from substantial completion,” Baker explained.

Subscribers can use the Lien Navigator to research lien and bond rights in all 50 states. Companies must take proactive steps to understand their lien rights in states they do business. With projects like Nike’s expansion, construction companies must also be diligent in tracking delays and unexpected costs to avoid the possibility of absent compensation.

[headlines]

--------------------------------------------------------------

News Briefs---

GE Kicks the Factoring Habit

a significant change in its management of incoming cash

https://www.cfo.com/cash-flow/2021/05/ge-kicks-the-factoring-habit/

General Electric shareholders reject

CEO Culp's pay deal

https://www.yahoo.com/finance/news/general-electric-shareholders-reject-ceo-152743299.html

Intel investing $3.5B in New Mexico fab upgrade,

boosting US chip making; along w/$20 Billion 2 New fabs

https://www.cnet.com/news/intel-investing-3-5b-in-new-mexico-fab-upgrade-boosting-us-chipmaking/

Cars.com Reaches Milestone: 10 Million Dealership Reviews

From Car Buyers with Recent Growth Spurred by the Pandemic

https://www.prnewswire.com/news-releases/carscom-reaches-milestone-10-million-dealership-reviews-from-car-buyers-with-recent-growth-spurred-by-the-pandemic-301282722.html

Pfizer Reaps Hundreds of Millions in Profits from COVID-19 Vaccine

its vaccine generated $3.5 billion first three months of this year

https://www.nytimes.com/2021/05/04/business/pfizer-covid-vaccine-profits.htm

Yellen’s comments on inflation spark confusion,

clarification as White House tries to navigate economic pressures

https://www.washingtonpost.com/us-policy/2021/05/04/treasury-yell

Willis Lease Finance Corporation Reports

First Quarter Pre-tax Loss of $1.7 million

https://www.globenewswire.com/news-release/2021/05/04/2222058/9504/en/Willis-Lease-Finance-Corporation-Reports-First-Quarter-Pre-tax-Loss-of-1-7-million.html

[headlines]

--------------------------------------------------------------

You May Have Missed---

Working from home 'doesn't work for those

who want to hustle': JPMorgan CEO

https://www.yahoo.com/finance/news/working-home-doesnt-those-want-151431580.html

[headlines]

--------------------------------------------------------------

Sports Briefs---

Julian Edelman takes exception

to the NFL’s tweet about draft sleepers

https://sports.yahoo.com/julian-edelman-takes-exception-nfl-175612760.html

Several 49ers players called Kyle Shanahan

to tell him they were alive Sunday

https://sports.yahoo.com/several-49ers-players-called-kyle-011114603.html

Terry Bradshaw on Aaron Rodgers:

“Him being upset shows me how weak he is”

https://www.yahoo.com/sports/terry-bradshaw-aaron-rodgers-him-232337435.html

Jimmy Garoppolo: ‘I thought I was going to be

in New England for my entire career’

https://www.bostonglobe.com/2021/05/04/sports/jimmy-garoppolo-i-thought-i-was-going-be-new-england-my-entire-career/

Belt crushes grand slam, Posey homers

in SF Giants’ biggest inning since 2008

https://www.eastbaytimes.com/2021/05/04/belt-crushes-grand-slam-posey-homers-in-sf-giants-biggest-inning-since-2008/

Behind the numbers of Steph Curry’s

Western Conference Player of the Month honor

https://www.eastbaytimes.com/2021/05/04/behind-the-numbers-of-steph-currys-western-conference-player-of-the-month-honor/

Steph Curry scores 41 and Warriors extend

playoff cushion with win over Pelicans

https://www.eastbaytimes.com/2021/05/03/steph-curry-scores-41-and-warriors-extend-playoff-cushion-with-win-over-pelicans/

Watch 49ers go deep vaccinating 68,500 at Levi's Stadium

– that's enough to fill the place

https://www.sacbee.com/sports/nfl/san-francisco-49ers/article251168734.html#storylink=hpdigest_sports

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

San Francisco Bay Area restaurant hiring crisis:

‘I’ve never seen anything like this’

https://www.eastbaytimes.com/2021/05/04/bay-area-restaurant-hiring-crisis-ive-never-seen-anything-like-this/

COVID restrictions: San Francisco, Los Angeles

counties reach yellow tier

https://www.eastbaytimes.com/2021/05/04/covid-restrictions-san-francisco-marin-counties-could-reach-yellow-tier/

COVID economy: Bay Area hotel outlook brightens,

recovery is years away

https://www.eastbaytimes.com/2021/05/04/covid-economy-bay-area-hotel-outlook-brightens-recovery-years-away/

California’s new Prop. 19 property-transfer

law spurs flood of family filings

https://www.northbaybusinessjournal.com/article/article/californias-new-prop-19-property-transfer-law-spurs-flood-of-family-filin/

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

Robert "Randy" Roach Jr., Sues Fred Schrader

Over Involvement in Schrader Cellars

https://www.winebusiness.com/news/?go=getArticle&dataId=245035

New Names, New Wines from Napa

https://www.vinography.com/2021/04/new-names-new-wines-from-napa

Eleven Madison Park Revamps Menu

To Be Entirely Plant-Based

https://www.npr.org/2021/05/03/992993601/eleven-madison-park-revamps-menu-to-be-entirely-plant-based

Colbert Suggests People Pop Bottles Over

Almost Anything to Save Champagne Industry (Video)

https://www.thewrap.com/colbert-pop-bottles-save-champagne-industry-video/

You’re NOT a plonker if you choose the second-cheapest bottle of wine: Assumption that‘s the biggest rip-off is a myth,

experts assure cost-conscious boozers

https://www.dailymail.co.uk/news/article-9536249/Assumption-second-cheapest-bottle-wine-biggest-rip-myth-experts-assure-boozers.html

Free Wine App

https://www.nataliemaclean.com/mobileapp/

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1494 - Columbus discovered Jamaica in 1494, meeting the Arawak Indians, who reportedly celebrated the event with a rum drink. He would eventually enslave or kill all on the many islanders by disease or violence.

The European nations would then bring over mostly African slaves to do the work on the land.

http://www.picturehistory.com/find/p/1405/mcms.html

http://www.hartford-hwp.com/archives/41/038.html

http://www.webster.edu/~corbetre/haiti/history/precolumbian/tainover.htm

1780 – The second oldest learned society in the U.S., the American

1847 - The American Medical Association was organized at a meeting at Philadelphia attended by 250 delegates. This was the first national medical convention in the US.

1864 - The forces of Union General Ulysses S. Grant and Confederate General Robert E. Lee clash in the Wilderness, beginning an epic campaign for the capture of the Confederacy capital. Lee had hoped to meet the Federals, who plunged into the tangled Wilderness west of Chancellorsville, Virginia, the day before, in the dense woods to mitigate the nearly two-to-one advantage Grant possessed as the campaign opened. For the next six weeks, the battle continued off and on.

1867 - Nelly Bly was born Elizabeth Cochran Seaman (d. 1922), Cochran’s Mill, PA. The first woman superstar of journalism, she was a fighter for women's rights and the underdog. She once feigned insanity to get inside asylum to expose the dismal conditions for the emotionally ill. Her fame, however, rests on a publicity race around the world to beat the 80-day around the world fictional trip authored by Jules Verne. Her career started at $5 a week and reached a high point of $25,000 a year. Her first articles were about the slum life of her home area of Pittsburgh and the dismal conditions forced on the working girls of the city because of low wages and social stigmas. She then went to Mexico where she wrote of the poor there and the overt official corruption that kept so much of the culture in poverty while making others super rich. She was expelled from Mexico when the articles appeared. The articles were later collected in “Six Months in Mexico” (1888). She moved to New York to work for Joseph Pulitzer's New York World at a much higher salary. Her first assignment was feigning insanity and being committed to an asylum. Her exposes resulted in a grand jury hearing and some changes in care of the insane. The articles were collected in “Ten Days in a Mad House” (1887). Her career included exposes of sweatshops, the jail system (she was arrested after pretending to shoplift), and even the briberies inherent in the lobbying system that influences legislatures. Then came her high publicized trip around the world to break the Jules Verne fictional record of "Around the World in 80 Days." Traveling alone on whatever transportation was available, she sent back dispatches that were eagerly read by the public so that when she returned to New York in 72 days, 6 hours and 11 minutes, she was the most famous woman in America, perhaps in the world. She published her exploits in a successful “Nellie Bly's Book: Around the World in Seventy-two Days” (1890). She was 23 years old. She also described using a diving bell to descend into the ocean and then floating above the earth in a balloon. The pen name "Nellie Bly" came from a Stephen Foster song.

1891 - The world-famous Carnegie Hall opened in New York. Designed by architect William B. Tuthill and built by philanthropist Andrew Carnegie, it is one of the most prestigious venues in the world for both classical music and popular music. Among the opening night attractions ... Tchaikovsky conducting his "Marche Solennelle." On this date in 1991, a 100th birthday celebration for the hall included two concerts, featuring the likes of violinist Isaac Stern, tenor Placido Domingo, soprano Jessye Norman, cellist Mstislav Rostropovich and conductor Zubin Mehta.

1892 – Congress extended the Chinese Exclusion Act for 10 years. The first significant Chinese immigration to North America began with the California Gold Rush of 1848–1855 and it continued with subsequent large labor projects, such as the building of the Transcontinental Railroad. During the early stages of the gold rush, when surface gold was plentiful, the Chinese were tolerated, if not well received. As gold became harder to find and job competition increased, animosity toward the Chinese and other foreigners increased. The Chinese Exclusion Act signed by President Chester A. Arthur on May 6, 1882, prohibiting all immigration of Chinese laborers. The act followed the Angell Treaty of 1890, a set of revisions to the US–China Burlingame Treaty of 1868 that allowed the US to suspend Chinese immigration. The act was initially intended to last for 10 years and this extension in the Geary Act was made permanent in 1902. The Chinese Exclusion Act was the first law implemented to prevent a specific ethnic group from immigrating to the United States. It was repealed by the Magnuson Act on December 17, 1943.

1893 - Stock Market Crash: Wall Street stock prices took a sudden drop. By the end of the year, 600 banks had closed. The Philadelphia and Reading, the Erie, the Northern Pacific, the Union Pacific and the Atchison, Topeka and Santa Fe railroads had gone into receivership; 15,000 other businesses went into bankruptcy. Other than the "Great Depression" of the 1930s, this was the worst economic crisis in US history; 15-20 percent of the workforce was unemployed.

1895 - Margaret Francis “Peggy” Bacon (d. 1987) was born in Ridgefield, CT. U.S. artist. Her main media were painting, dry point etching, and lithography. She once gave up painting because her husband derided her and made her think her efforts were inadequate. She was able to fashion a great career in caricatures and book illustrations. Her work was often featured in the New Yorker magazine. She resumed serious painting after her divorce at age 45. At age 80, in 1975, she became the first living woman to be given a retrospective at the National Museum of American Art. Her witty, much praised caricatures of the famous of her era were collected in the best-seller “Off with Their Heads” (1934).

1903 - James Beard (d. 1985) birthday at Portland, OR. The Father of American Cooking. In a long and busy culinary career, he penned more than 20 classic cookbooks, appeared on television's first cooking show in 1946 and was an enthusiastic ambassador for the American style of cooking. His Greenwich Village brownstone is America's only culinary historic landmark and serves as the headquarters of the James Beard Foundation.

1904 - Denton True "Cy" Young pitched baseball's first perfect game, not allowing a single opposing player to reach first base. Young's outstanding performance led the Boston Americans in a 3-0 victory over Philadelphia in the American League. Young will eventually complete 24 straight hitless innings, still the record, and 45 shutout innings in a row, a record until broken by Jack Coombs’ 53 scoreless frames in 1910. The Cy Young Award for pitching was named in his honor.

1925 - High school science teacher John Scopes was arrested for teaching evolution in one of Tennessee's public schools

http://lcweb2.loc.gov/ammem/today/today.html

1936 - The first bottle with a screw cap and a pour lip was patented by Edward A. Ravenscroft, Glencoe, Il. The bottles were manufactured by the Abbott Laboratories, North Chicago, Il.

1938 - Soul singer Johnnie Taylor (d. 2000) was born in Crawfordville, Arkansas. One of the mainstays of the Stax-Volt label in Memphis during the late '60s, his best-known recording is his 1968 million-seller "Who's Making Love?"

1942 - Country superstar Tammy Wynette was born Virginia Wynette Pugh (d. 1998) near Tupelo, Mississippi. "D-I-V-O-R-C-E" and "Stand by Your Man," which is also the title of her autobiography, are typical of her country ballads, backed by the lush orchestral arrangements of Billy Sherrill. "Stand by Your Man," which topped the country charts in 1968, was the biggest-selling single by a woman in the history of country music. Her other number-one hits include "The Ways to Love a Man" from 1969, "He Loves Me All the Way" from 1970 and "We're Gonna Hold On," a 1973 duet with George Jones. Wynette and Jones were married from 1968 to 1975. In 1992, she teamed up with pop-pranksters The KLF. Together they scored a modest hit with a reworking of "Stand by your Man," called "Justified and Ancient (Stand by the Jams)."

1945 - In Lakeview, Oregon, Mrs. Elsie Mitchell and five neighborhood children are killed while attempting to drag a Japanese balloon out the woods. Unbeknownst to Mitchell and the children, the balloon was armed, and it exploded soon after they began tampering with it. They were the first and only known American civilians to be killed in the continental United States during World War II. The U.S. government eventually gave $5,000 in compensation to Mitchell's husband and $3,000 each to the families of Edward Engen, Sherman Shoemaker, Jay Gifford, and Richard and Ethel Patzke, the five slain children. The news was never printed in newspapers and other balloons were handled by the army. The Japanese were unaware that the balloons reached the United States. The explosive balloon found at Lakeview was a product of one of only a handful of Japanese attacks against the continental United States, which were conducted early in the war by Japanese submarines and later by high-altitude balloons carrying explosives or incendiaries. In comparison, three years earlier, on April 18, 1942, the first squadron of U.S. bombers dropped bombs on the Japanese cities of Tokyo, Kobe, and Nagoyo, surprising the Japanese military command, who believed their home islands to be out of reach of Allied air attacks. When the war ended on August 14, 1945, some 160,000 tons of conventional explosives and two atomic bombs had been dropped on Japan by the United States. Approximately 500,000 Japanese civilians were killed as a result of these bombing attacks.

1945 - The War Department announces that about 400,000 troops will remain in Germany to form the US occupation force and 2,000,000 men will be discharged from the armed services, leaving 6,000,000 soldiers serving in the war against Japan.

1946 - Birthday trumpet player, composer Jack Walrath, Stuart, FL.

http://shopping.yahoo.com/shop?d=produ

ct&id=1927006563&clink=dmmu.artist&a=b

http://www.jackwalrath.com/bio.htm

1949 - Top Hits

“Cruising Down the River” - The Blue Barron Orchestra (vocal: ensemble)

“Forever and Ever” - Perry Como

“Again” - Doris Day

“Lovesick Blues” - Hank Williams

1949 - “Stop the Music” Premiers. ABC's prime-time musical-game show hosted by Bert Parks. Featured the singing talents of Kay Armen, Jimmy Blaine, Betty Ann Grove, Estelle Loring, Jaye P. Morgan and June Valli, and the dancing numbers of Sonja and Courtney Van Horne. Harry Salter conducted the band.

1955 - The musical, "Damn Yankees" opened in New York City for a successful run of 1,019 performances. The show, at the 42nd Street Theatre mixed both baseball and ballet. It is an adaptation of the book, "The Year the Yankees Lost the Pennant." Gwen Verdon starred in the role of Lola. “Whatever Lola Wants Lola Gets,” including the Tony for Best Actress in a musical for her performance. My mother took me to the matinee and Ray Walton as the devil was my favorite.

1955 - Dodger rookie hurler Tommy Lasorda, making his Major League debut, ties a record by throwing three wild pitches in the first inning of a 4-3 victory over the Cardinals. The future Dodger Hall of Fame skipper doesn't get the decision and will end his playing days after the 1956 season with a lifetime record of 0-4.

1957 - Top Hits

“All Shook Up” - Elvis Presley

“School Day” - Chuck Berry

“A White Sport Coat (And a Pink Carnation)” - Marty Robbins

“Gone” - Ferlin Husky

1961 - Astronaut Alan B. Shepard Jr. became America's first space traveler as he made a 15-minute suborbital flight in a capsule launched from Cape Canaveral

http://www.nytimes.com/learning/general/onthisday/big/0505.html

1962 - "West Side Story" soundtrack album goes to #1 and stays there for 54 weeks which is more than 20 weeks longer than any other album

1962 - No. 1 Billboard Pop Hit: "Soldier Boy," The Shirelles.

1965 - Top Hits

“Mrs. Brown, You've Got a Lovely Daughter” - Herman's Hermits

“I Know a Place” - Petula Clark

“I'll Never Find Another You” - The Seekers

“This is It” - Jim Reeves

1966 - Willie Mays hit home run number 512 of his career. The San Francisco Giants' superstar became the greatest home run hitter in the National League to that time, passing New York Giant Mel Ott.

1967 - "San Francisco" by Scott McKenzie enters the charts and will eventually hit #4. The song became kind of an anthem during the hippie movement.

1968 - Buffalo Springfield played its final show in Long Beach, California. There were reports of persistent squabbling between group members Stephen Stills and Neil Young. But Stills and Young would go on to form Crosby, Stills, Nash and Young with David Crosby and Graham Nash. Buffalo Springfield was together only two years and released just three albums, but their 1967 hit "For What It's Worth" became an anthem for the hippie generation.

1973 - Secretariat, ridden by Ron Turcotte, won the Kentucky Derby in record time of 1:59.2. “Big Red,” as he was known, beat Sham by 2 ½ lengths and went on to win the Triple Crown.

1970 - No. 1 Billboard Pop Hit: "American Woman," Guess Who.

1973 - Top Hits

“Tie a Yellow Ribbon Round the Ole Oak Tree” - Dawn featuring

Tony Orlando

“The Cisco Kid” - War

“Little Willy” - The Sweet

“Behind Closed Doors” - Charlie Rich

1973 - The University of Miami breaks away from the unstated but clearly understood rules and offers the first athletic scholarship ever made to an American WOMAN (Terry Williams). YES - the date was 1973.

1978 - Pete Rose of the Cincinnati Reds got the 3,000th hit of his career, a single off Steve Rogers of the Montréal Expos. Rose played in the Majors from 1963 through 1986 and wound up with 4,256 hits, more than any other player.

1979 - Thirteen years after the original duo of Peaches and Herb split up, Herb Feemster teamed up with a new Peaches, Linda Greene, to enjoy a four-week run at #1 on the US singles chart with "Reunited."

1979 - 28-year-old Suzi Quatro reached #5 on the Hot 100 with a duet with Chris Norman called "Stumblin' In." It would be the only time she cracked the Top 40.

1981 - Top Hits

“Morning Train” (“Nine to Five”) - Sheena Easton

“Just the Two of Us” - Grover Washington, Jr./Bill Withers

“Being with You” - Smokey Robinson

“Rest Your Love on Me” - Conway Twitty

1981 - Mobile, Alabama had its worst flash flooding ever as thunderstorms unloaded 8 to 16 inches of rain over the metro area in a couple of hours. Damage was $36 million.

1982 - No. 1 Billboard Pop Hit: "Chariots of Fire," Vangelis. The performer, whose real name is Evangelos Papanthanassiou, wins an Academy Award for the score to the film "Chariots of Fire."

1986 - Sacramento, California hit the 100 degree mark, breaking the previous record for this day of 92 degrees which was set in 1944. This is the earliest in the season Sacramento has hit the 100 mark.

1987 - Unseasonably hot weather prevailed in the western U.S. A dozen cities in California reported record high temperatures for the date. Afternoon highs of 93 degrees at San Francisco, 98 degrees at San Jose, 100 degrees at Sacramento, and 101 degrees at Redding, were the warmest of record for so early in the season. The high of 94 degrees at Medford OR was also the warmest of record for so early in the season.

1989 - Top Hits

“Like a Prayer” - Madonna

“I'll Be There for You” - Bon Jovi

“She Drives Me Crazy” - Fine Young Cannibals

“Young Love” - The Judds

1989 - Thunderstorms swept across Georgia and the Carolinas during the late afternoon and evening hours spawning seventeen tornadoes. A tornado at Toccoa, GA injured 15 persons, and a tornado at Chesnee, SC killed two persons and injured 35 others. Five tornadoes in North Carolina accounted for five deaths, 88 injuries, and $60 million damage. Thunderstorms also produced baseball size hail at Lake Murray, SC, and wind gusts to 78 mph at Brooklyn, MD.

1990 - A strong Pacific cold front moving rapidly inland caused weather conditions at the east end of the Strait of Juan de Fuca in Washington State to quickly change from sunny and calm to westerly winds of 60 mph and ten-foot waves. Three recreational fishing boats capsized in heavy seas off Port Angeles resulting in five deaths. In California, temperatures soared above 90 degrees across much of the state. The high of 101 degrees in downtown Los Angeles was eight degrees hotter than their previous record for the date

1993 - Microsoft announced it would bundle its popular database software, Microsoft Access, with its Microsoft Office package, which already included MS Word and Excel. Microsoft's competitors, including Lotus and WordPerfect, also added database software to their office software suites.

1995 - A supercell thunderstorm rapidly developed just ahead of a fast-moving bow echo squall line and blasted Tarrant County, Texas. Large hail up to 5 inches in diameter, driven by 80 mph winds, caused a tremendous amount of damage. 10,000 people were caught out in the open at Mayfest in Downtown Fort Worth, resulting in 109 injuries from the large hail. Torrential rains of up to 3 inches in 30 minutes and 5 inches in one hour across Dallas caused unprecedented flash flooding, resulting in 16 deaths. Total damage in Fort Worth alone was estimated at $2 billion, making this the costliest thunderstorm event in U.S. history. This was the third severe hailstorm to strike the area in only a little over a month.

1997 - Crosby, Stills and Nash helped mark the 27th anniversary of the Kent State University shootings with a concert at the Ohio campus. The group performed their hit "Ohio," written by Neil Young after the killings of four students by National Guardsmen during an anti-war demonstration on May 4th, 1970.

1999 - At the 34th annual Academy of Country Music Awards, Garth Brooks is named artist of the decade, Dixie Chicks' critically acclaimed multiplatinum debut "Wide Open Spaces," is named album of the year, and Faith Hill wins top female vocalist, as well as single and video of the year honors for "This Kiss."

2000 - Cardinal first baseman Mark McGwire hits the longest home run in the 30-year history of Riverfront/Cinergy Field, but the 473-foot shot isn't enough as Ken Griffey Jr.'s homer leads the Reds past St. Louis, 3-2.

2005 - Mavis Staples and Charlie Musselwhite lead the field with three trophies each at the 26th W.C. Handy Awards, held in Memphis.

2013 - The world's first plastic gun, produced by a 3-D printer by Defense Distributed fired successfully in Austin, Texas. Security officials fear plastic weapons would not be detected at airport screenings.

2020 - Global confirmed cases of COVID-19 reach 3.65 million, US cases pass 70,000 while the UK becomes the most affected in Europe with 29,427 known deaths.

NBA Champions:

1969 - Boston Celtics

Stanley Cup Champions:

1966 - Montréal Canadiens

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

![]()