![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial alternate financing,

bank, finance and leasing industries

kitmenkin@leasingnews.org

![]()

Monday, November 13, 2017

![]()

Today's Equipment Leasing Headlines

Position Wanted – Asset Management

Work Remotely or Relocate for Right Opportunity

Top Stories: November 6 - November 9

(Opened Most by Readers)

Bank of America Tagged for $45 Million

in Wrongful Foreclosure Case

By Tom McCurnin, Leasing News Legal Editor

Leasing Industry Ads---Help Wanted

Positions Open

Certified Leasing and Finance Foundation Member Milestone

Surpasses 500 Members

Companies with More than Two

Certified Lease & Finance Professionals

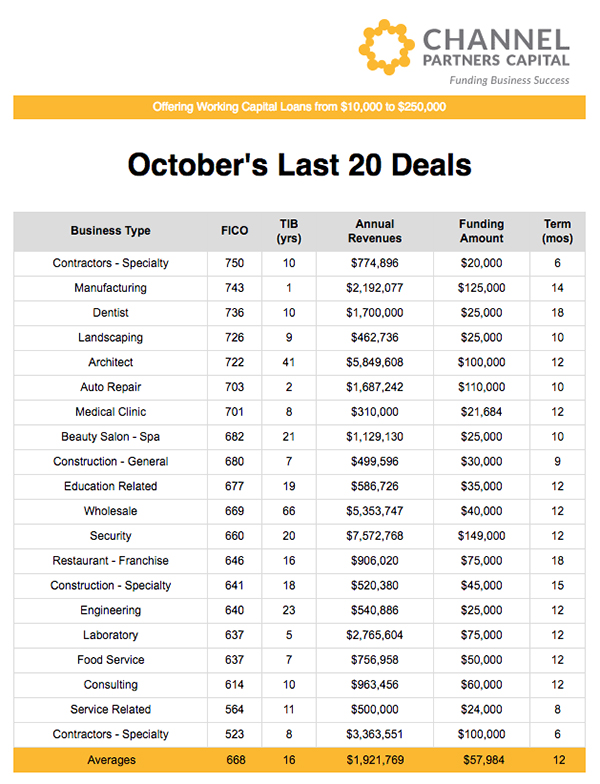

Channel Partners---October Last 20 Deals

Business Type/FICO/TIB/Annual Revenues/Funding/Term

Number of Retail Stores Closing in 2017

Chart

It’s Not Just FinTech or the Internet

Better Serving Customers is the Key

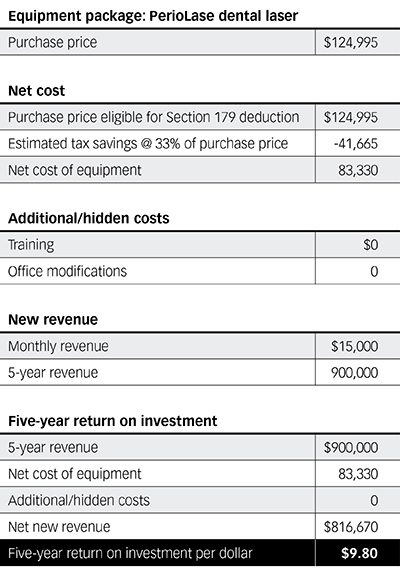

Section 179 Considerations for Dental Practices

By Robert H. Gregg II, DDS. www.dentaleconimics.com

Dachshund Mix

Sacramento, California Adopt a Dog

News Briefs---

Banks Overwhelmingly Embarking Digital Journey

Only a mere 1 percent of banks haven't begun to digitally transform

Ex-American Realty CFO Gets 18 Months in Jail

inflated the value" of the REIT by "brazenly" making up numbers

Emirates Airline Orders 40 Boeing 787 Dreamliners

for $15 billion as Dubai Air Show opens

ICBC Leasing, China Places $1.1B Order CFM LEAP-1B Engines

CFM is in Cincinnati, OH (Jt. venture GE of US. Safran of France)

Broker/Funder/Industry Lists | Features (writer's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

Leasing News Icon for Android Mobile Device

You May have Missed---

Baseball Poem

Sports Brief----

California Nuts Brief---

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send a colleague and ask them to subscribe. We are free.

Email kitmenkin@leasingnews.org and in subject line: subscribe

[headlines]

--------------------------------------------------------------

Position Wanted – Asset Management

Work Remotely or Relocate for Right Opportunity

Each Week Leasing News is pleased, as a service to its readership, to offer completely free ads placed by candidates for jobs in the industry. These ads also can be accessed directly on the website at:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

Each ad is limited to (100) words and ads repeat for up to 6 months unless the candidate tells us to stop. Your submissions should be received here by the end of each week.

Please encourage friends and colleagues to take advantage of this service, including recent graduates and others interested in leasing and related careers.

Asset Management

|

[headlines]

--------------------------------------------------------------

Top Stories: November 6 - November 9

(Opened Most by Readers)

(1) 10% Buyout on Truck Lease Ruled a Security Agreement

Not a True Lease

By Tom McCurnin, Leasing News Legal Editor

http://leasingnews.org/archives/Nov2017/11_08.htm#10

(2) Leasing News Complaints Bulletin Board

BBB Ratings

http://leasingnews.org/archives/Nov2017/11_06.htm#bbb

(3) New Hires/Promotions in the Leasing Business

and Related Industries

http://leasingnews.org/archives/Nov2017/11_08.htm#hires

(4) Are you an Equipment Leasing’s Version

of Blockbuster Video?

http://leasingnews.org/archives/Nov2017/11_08.htm#are

(5) Tips for Obtaining Financing - Despite Challenged Credit

By Doug Houlahan, EVP, Maxim Commercial Capital

http://leasingnews.org/archives/Nov2017/11_06.htm#tips

(6) Sales Makes it Happen

By Scott Wheeler, CLFP

http://leasingnews.org/archives/Nov2017/11_08.htm#sell

(7) The Richest Person on Each Continent

By Jeff Desiardins, Visual Capitalist

http://leasingnews.org/archives/Nov2017/11_06.htm#richest

(8) BBB Leasing & Alt. Finance Company Ratings

November 3, 2017

http://leasingnews.org/archives/Nov2017/11_06.htm#bbb113

(9) Leasing 102 by Mr. Terry Winders, CLFP

Planning for Next Year

http://leasingnews.org/archives/Nov2017/11_06.htm#planning

(10) Hurricanes Reasons for 8th Consecutive Q Loss at OnDeck

Press Release Claims/Also GAAP profitability in 4th Quarter 2017

http://leasingnews.org/archives/Nov2017/11_08.htm#hurricanes

[headlines]

--------------------------------------------------------------

Bank of America Tagged for $45 Million

in Wrongful Foreclosure Case

By Tom McCurnin

Leasing News Legal Editor

Servicing Agents, Lawyers, Made Multiple Errors

and Bank Lied to the CFPB

Sundquist v Bank of America 10-35624 (E.D. Cal. 2017)

Today’s case is not a leasing case, but is a nice study on compound errors made a bank, after the bank wrongfully foreclosed during the pendency of a bankruptcy. The bank was tagged for punitive damages in the sum of $45 million. The lessons lay in financial institutions having systems in place to monitor bankruptcies and adequately trained people to input and interpret that data. Finally, the case demonstrates the necessity of evaluating bad cases early and settling those cases.

The facts follow.

In 2008, Bank of America loaned Erik and Renée Sundquist $587,250 to purchase a home in the Sacramento area. The borrowers struggled to make the $4,500 monthly payments and sought a loan modification in 2009. The bank told the borrowers that the bank would not consider a loan modification unless they were in default. The borrowers stopped making payments and sought another loan modification, which was denied because they were in default. This back and forth went on for over a year. The bank commenced foreclosure proceedings against the property in 2009. The borrowers filed a bankruptcy on the eve of foreclosure and notified the bank.

Most banks have a procedure to catch such bankruptcies prior to the actual foreclosure sale (called a date down), but the bank failed to read its own loan notes, and instead, proceeded with the sale. Most banks have a procedure to catch a wrongful foreclosure within a few days with an updated title report, but the bank failed to catch the bankruptcy a second time.

Instead, the bank commenced an eviction procedure. Most eviction lawyers have systems in place to assure that prior to filing an eviction, no bankruptcy of the borrower took place, but the lawyer failed to catch the bankruptcy. The borrowers contacted the eviction attorney and advised him of the bankruptcy. The eviction went forward. The bank entered onto the property, conducted surveillance of the borrowers, even going so far as to beat on a side door to the property during the pendency of the eviction for unexplained reasons. The borrowers then moved out of the property. Nearly a year later, the bank figured out that there was a bankruptcy and rescinded the foreclosure sale. The bank never told the borrowers of this fact, who continued to reside elsewhere. The bank then started sending mortgage statements, making collection calls for the past due mortgage payments, and threatening yet another foreclosure.

The borrowers tried to move back in, but it took considerable effort just to get the keys to their own home. When they finally moved back in, all the appliances had been removed, the landscaping was dead, and the homeowners’ association demanded $20,000 for fees and penalties. The bank refused to compensate the borrowers for the lost and damaged property. Shockingly, the bank did not dismiss the eviction action for another six months. The borrowers sued in state court.

When the borrowers attempted another loan modification, the bank’s work out notes reflect that the bank sent the borrowers a loan modification application but fully expected to deny it, no matter what it said. The CFPB investigated the matter and the bank made two untrue statements to the Consumer Financial Protection Bureau (CFPB) that there was no active litigation (there was) and there was never a foreclosure proceeding (there was).

In 2013, the borrowers transferred some of the litigation to an adversary proceeding in bankruptcy court. During the three-year ordeal, the borrowers suffered medical injuries including chest pains, lost income, emotional distress, rental expenses, attorney fees, and other expenses.

The bank’s defense was the defense of “my-computer-made-me-do-it” and that the damages were inflated or not proved to the satisfaction of counsel. However, the court found that there were more than six willful stay violations and held that the borrowers had actual damages of nine months of rent, lost income, attorney fees, lost property, damages for 20 loan modifications, medical bills, emotional distress, all totaling $1 million dollars, none of which was disputed by the bank, except to say that the level of proof was not sufficient. The court ordered a total of $45 million dollars in punitive damages, subject to some unusual disbursements to consumer rights organizations. The bank has appealed to the Ninth Circuit Bankruptcy Appellate Panel.

What are the takeaways here?

• First, It’s Obvious That Bank Systems and Training Failed Here. Systems are only as good as the people that input the data and read the entries. Here, it is stupefying that a national bank could go on auto-pilot for six months after a bankruptcy was filed and actually try to evict the borrowers while a bankruptcy was pending.

• Second, There Were Some Ridiculously Bad Facts Here. The eviction proceeding, lying to the CFPB, stalking the borrowers, and the multiple bad faith loan modifications were but a few. One of the borrowers suffered stress chest pains.

• Third, Putting Aside the Bad Facts, Did the Bank or its Counsel Not Realize How Bad the Facts Were? I get it that clients and lawyers often talk themselves into actually believing their case and explaining away bad facts. However, there just are too many bad facts here to ignore.

• Fourth, Where Was The Settlement? Given these bad facts, the bank should have thrown some money at these guys and made the case go away. This is a failure of leadership by bank counsel, whether in house or outside counsel, in failing to recognize this potential nightmare case.

The bottom line to this case is that my father once told me that everyone makes mistakes. It’s how you address those mistakes that define your character as a man. Well, big banks make big mistakes and either counsel or the bank completely failed to recognize and fix those mistakes This is not a case that should have gone to trial.

Bank of America Foreclosure Case (107 pages)

http://leasingnews.org/PDF/boa_foreclosure2017.pdf

Tom McCurnin is a partner at Barton, Klugman & Oetting in Los Angeles, California.

Tom McCurnin

Barton, Klugman & Oetting

350 South Grand Ave.

Suite 2200

Los Angeles, CA 90071

Direct Phone: (213) 617-6129

Cell (213) 268-8291

Email: tmccurnin@bkolaw.com

Visit our web site at www.bkolaw.com

Previous Tom McCurnin Articles:

http://www.leasingnews.org

Previous Tom McCurnin Articles:

http://www.leasingnews.org/Conscious-Top%20Stories/leasing_cases.html

[headlines]

--------------------------------------------------------------

Equipment Leasing Account Executive What sets CoreTech apart from other equipment leasing companies is our team members and impeccable reputation. Are you unhappy with the ethics of your company and the promises made to you? Come to Newport Beach and join us. To learn more, please click here www.coretechleasing.com |

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Certified Leasing and Finance Foundation Member Milestone

Surpasses 500 Members.

Carol Virgin, #500

The Certified Lease & Finance Professional (CLFP) Foundation is proud to announce that last week, the 500th CLFP was added after Carol Virgin, Syndication Manager at CHG-Meridian passed the test. Carol stated, “I am happy to have the opportunity to test and expand my experiences and knowledge beyond the day-to-day demands of my job. Thank you to the previous CLFPs who worked hard to help develop these standards for our industry.”

In addition, the following individuals also recently passed the eight-hour online test leading up to the 500th CLFP:

Tyler Butsko, CLFP

Senior Account Manager

Amur Equipment Finance, Inc.

Michael Clune, CLFP

VP, Syndications

First American Equipment Finance

Marlena Dittmar, CLFP

Broker Relations Representative II

Financial Pacific Leasing, Inc.

James Fallon, CLFP

Credit Manager

Blue Street Capital, LLC

Christina Freds, CLFP

First Vice President, Operations Manager

Commercial Equipment Finance & Leasing

Flagstar Bank, FSB

Jeffery Fry, CLFP

Regional Vice President

Material Handling

Element Fleet Management

Jeff Hedstrom, CLFP

Vice President

Zions Credit Corporation

Jill Miller, CLFP

Co-Founder and CEO

Marketing and Design Mix

Azhar Rahman, CLFP

Analyst, Corporate and Asset Finance

Macquarie Corporate & Asset Finance

Tiffany Reiter, CLFP

Broker Relations Representative

Financial Pacific Leasing, Inc.

Nicholas Stephens, CLFP Associate

Account Executive

Blue Street Capital, LLC

Christine Vaughn, CLFP

Broker Relationship Manager

Financial Pacific Leasing, Inc.

Burke Wiedel, CLFP

Chief Financial Officer

American Capital Group

Mr. Hedstrom stated, “Always striving to better yourself, the CLFP program provides training and knowledge into all aspects of equipment financing and leasing. Knowledge is power and in today’s competitive marketplace, anything to make you stand out from the competition is beneficial. I take get pride being part of an elite group of professionals with this designation.”

The CLFP designation is the only certification for the Equipment Finance industry. There are currently 502 active Certified Lease & Finance Professionals and Associates in the United States, Canada and Australia. For more information, call Executive Director Reid Raykovich, CLFP at (206) 535-6281 or visit http://www.CLFPfoundation.org.

|

[headlines]

--------------------------------------------------------------

Companies with More than Two

Certified Lease & Finance Professionals

| Count | Company |

| 73 | First American Equipment Finance, a City National Bank Company |

| 25 | Financial Pacific Leasing, Inc., an Umpqua Bank Company |

| 19 | AP Equipment Financing |

| 18 | Ascentium Capital |

| 13 | ECS Financial Services, Inc. |

| 12 | Ivory Consulting Corporation |

| 12 | Orion First Financial LLC |

| 10 | Arvest Bank |

| 9 | Northland Capital Financial Services |

| 8 | Bank of the West |

| 8 | Celtic Commercial Finance |

| 8 | KLC Financial, Inc. |

| 7 | Beacon Funding Corporation |

| 7 | BMO Financial Group |

| 7 | Stearns Bank NA-Equipment Finance Division |

| 6 | BancorpSouth Equipment Finance |

| 6 | BB&T Commercial Equipment Capital Corp. |

| 6 | Great American Insurance |

| 6 | GreatAmerica Financial Services |

| 6 | Hanmi Bank |

| 5 | Provident Equipment Leasing |

| 4 | BSB Leasing, Inc. |

| 4 | Commerce Bank |

| 4 | Key Equipment Finance |

| 4 | Marlin Business Services Corp. |

| 4 | Maxim Commercial Capital, LLC |

| 3 | Amur Equipment Finance |

| 3 | Blue Street Capital, LLC |

| 3 | Canon Financial Services, Inc |

| 3 | Clune & Company LC |

| 3 | Diversified Capital Credit Corporation |

| 3 | DLL |

| 3 | FSG Capital Inc. |

| 3 | Innovative Lease Services, Inc. |

| 3 | International Decision Systems |

| 3 | LeaseTeam Inc. |

| 3 | Oakmont Capital Services LLC |

| 3 | Quality Leasing Co. Inc. |

| 3 | Tamarack Consulting, Inc |

| 3 | TEQLease, Inc. |

| 2 | Alliance Funding Group |

| 2 | Dakota Financial, LLC |

| 2 | Direct Capital a CIT company |

| 2 | Finance Capital |

| 2 | First Foundation Bank |

| 2 | Fleet Advantage, LLC |

| 2 | Great Falls Capital Partners dba Pinnacle Capital |

| 2 | NCMIC Finance Corporation |

| 2 | Pacifica Capital |

| 2 | Padco Financial Services, Inc. |

| 2 | Patriot Capital Corporation a Division of State Bank & Trust Company |

| 2 | Portfolio Financial Servicing Company |

| 2 | Providence Capital Funding, Inc. |

| 2 | Western Equipment Finance |

|

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Dachshund Mix

Sacramento, California Adopt-a-Dog

ID#A538669

"I am currently in foster care. If you are interested in meeting me, please contact the K9 foster and rescue coordinator at LRhoades@cityofsacramento.org. Please remember to leave a phone number and the animal ID number.

"The shelter thinks I am about 6 years old.

"I have been at the shelter since Nov 01, 2017."

For more information about this animal, call:

City of Sacramento Animal Care Services at (916) 808-7387

Ask for information about animal ID number A538669

$85 DOG

ADOPTION FEE INCLUDES:

Spay or Neuter Surgery

Bordetella & DHPP Vaccinations

Flea Preventative

Deworming Preventative

Heartworm Test (6 months of age or older)

Rabies Vaccination (4 months of age or older)

Microchip

1-Year Dog License (Sacramento City Residents only)

Personalized Engraved Tag

Free Health Check-Up Voucher

Dog Collar & Leash

City of Sacramento

Front Street Animal Shelter

2127 Front Street

Sacramento, Ca. 95818

Hours:

Wed - Fri 12:00 pm - 5:30 pm

Sat - Sun 12:00 pm - 5:00 pm

Daily adoptions end 30 minutes before closing time.

During adoption promotions or special events, the adoption time

may end earlier in the day due to staffing availability,

customer demand, and adoption wait times.

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

Banks Overwhelmingly Embarking Digital Journey

Only a mere 1 percent of banks haven't begun to digitally transform

https://www.datamation.com/data-center/banks-overwhelmingly-embarking-on-the-digital-transformation-journey.html

Ex-American Realty CFO Gets 18 Months in Jail

inflated the value" of the REIT by "brazenly" making up numbers

http://ww2.cfo.com/fraud/2017/11/ex-american-realty-cfo-jailed-18-months/

Emirates Airline Orders 40 Boeing 787 Dreamliners

for $15 billion as Dubai Air Show opens

http://www.latimes.com/business/la-fi-dreamliners-dubai-air-show-20171112-story.html

ICBC Leasing, China Places $1.1B Order CFM LEAP-1B Engines

CFM is in Cincinnati, OH (Jt. venture GE of US. Safran of France)

https://www.newswiretoday.com/news/165512/ICBC-Leasing-Places-1.1-Billion-Order-for-CFM-LEAP-1B-Engines/

Equipment Leasing Account Executive What sets CoreTech apart from other equipment leasing companies is our team members and impeccable reputation. Are you unhappy with the ethics of your company and the promises made to you? Come to Newport Beach and join us. To learn more, please click here www.coretechleasing.com |

[headlines]

--------------------------------------------------------------

You May Have Missed---

How Alibaba turned an obscure, made-up Chinese holiday into a $17.8 billion shopping extravaganza that's bigger than Black Friday

http://www.businessinsider.com/how-alibaba-made-143-billion-on-singles-day-2015-11

[headlines]

--------------------------------------------------------------

SEE IT THROUGH

by Edgar A. Guest (1881-1959)

When you're up against a trouble, Meet it squarely, face to face; Lift your chin and set your shoulders, Plant your feet and take a brace. When it's vain to try to dodge it, Do the best that you can do; You may fail, but you may conquer, See it through!

Black may be the clouds about you And your future may seem grim, But don't let your nerve desert you; Keep yourself in fighting trim. If the worst is bound to happen, Spite of all that you can do, Running from it will not save you, See it through!

Even hope may seem but futile, When with troubles you're beset, But remember you are facing Just what other men have met. You may fail, but fall still fighting; Don't give up, whate'er you do; Eyes front, head high to the finish. See it through!

Edgar A Guest,. often referred to as the common man's poet. was a staff writer for the Detroit News (Michigan) and had his poetry published in the paper for many years.

[headlines]

--------------------------------------------------------------

Despite threat of boycott, attendance increases at Sunday NFL games

https://www.yahoo.com/sports/despite-threat-boycott-attendance-increases-sunday-nfl-games-234459264.html

Falcons: Offense, defense click in win over Cowboys

http://www.ajc.com/atlanta-falcons-latest-news-today/

49ers outlast Giants for first win under Kyle Shanahan

http://www.mercurynews.com/2017/11/12/49ers-outlast-giants-for-first-win-under-kyle-shanahan/

Whoa, a win: 49ers end streak with 31-21 victory over Giants

http://www.sfgate.com/49ers/article/Whoa-a-win-49ers-end-streak-with-31-21-victory-12351800.php

N.F.L. Week 10: Falcons, Saints and Vikings Win Big Games

https://www.nytimes.com/2017/11/12/sports/nfl-week-10.html

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

How this 1976 dinner changed the way you eat

http://www.cnn.com/interactive/2017/11/specials/jeremiah-tower-menu/

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

California Winegrowers Report Excellent Harvest

http://www.growingproduce.com/fruits/grapes/california-winegrowers-report-excellent-harvest/

Kosta Browne Winery founders to step down from Sebastopol winery

http://www.northbaybusinessjournal.com/northbay/sonomacounty/7618586-181/kosta-browne-winery-founders-to?artslide=0

Kosta Browne reverses course on its lush, ripe Pinot Noir style

http://www.sfchronicle.com/wine/article/Kosta-Browne-reverses-course-on-its-lush-ripe-12338836.php

Winemaker who drained 27,000 litres of rival's wine sentenced

https://www.theguardian.com/australia-news/2017/nov/09/winemaker-who-drained-rivals-barrels-gets-suspended-sentence

Melanie Krause, Cinder Wines use Riesling to top Idaho Wine Competition

http://www.greatnorthwestwine.com/2017/09/20/melanie-krause-cinder-wines-uses-riesling-to-top-idaho-wine-competition/

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1518 - One of Christopher Columbus's officers, Diego Velasquez obtains the Spanish Crown authority to colonize the new countries in the Americas. He conquered Cuba in 1511 and backed Hernando Cortes’ expedition to Mexico, who turned against him. Those sent to bring him back and the riches he found were defeated or joined Cortes. Velasquez died in Havana, 1524.

1765 - Birthday of Robert Fulton (d. 1815), inventor of the steamboat, at Little Britain, PA. Revolutionized transportation, allowing the growth that eventually opened the growth of what are now Central states, but then called “the West.” In 1800, he was commissioned by Napoleon Bonaparte to attempt to design the Nautilus, which was the first practical submarine in history. He is also credited with inventing some of the world's earliest naval torpedoes for use by the British Royal Navy.

http://xroads.virginia.edu/~HYPER/DETOC/transport/fulton.html

http://www.history.rochester.edu/steam/thurston/fulton/

1775 - American troops led by General Richard Montgomery capture the City of Montreal, Canada.

http://memory.loc.gov/ammem/today/nov13.html

1789 - Benjamin Franklin wrote to a friend, "In this world nothing can be said to be certain, except death and taxes." Franklin later repeated it in his newspaper and it has become one of the most popular sayings in the American language.

1789 - President George Washington ended his tour of the New England states that he began on October 15, traveling in a hired coach, accompanied by Major William Jackson, his aide-de-camp, and Tobias Lear, his private secretary, along with six servants, nine horses, and a luggage wagon. He went as far north as Kittery, ME, then part of Massachusetts. As Rhode Island and Vermont had not yet joined the new government, he did not visit those states. Washington’s first tour of the southern states was made from April 7 to June 12, 1791, during which time he made a 1,887 mile trip from his estate in Mount Vernon, VA, through Philadelphia, south through Virginia, and the Carolinas into Georgia, and back to Mount Vernon.

1835 - Texans officially proclaimed independence from Mexico, and called itself the Lone Star Republic, after its flag, until its admission to the Union in 1845.

1854 – 284-300 perished as immigrant vessel New Era foundered off New Jersey coast.

http://www.bruzelius.info/Nautica/Maritime_History/US/USNM(1)_p223.html

1839 - The Liberty Party, an antislavery party, held its first national convention at Warsaw, NY. It nominated James G. Birney of New York for president. Birney, a former Kentuckian, and slaveholder, wielded strong political influence in western New York and the Ohio River Valley. Francis J. Lemoyne was nominated for vice-resident.

1860 - Helen Archibald Clarke with lifetime partner Charlotte Endymion Porter founded, edited, and published “Poet Lore” which introduced Americans to a number of European modern poets. Both were prolific writers and editors of writings by Shakespeare, Browning, Longfellow, and others. Ms. Clarke was also a talented musician and composer.

1861 - President Lincoln pays a late-night visit to General George McClellan, who Lincoln had recently named general in chief of the Union army. The general retired to his chambers before speaking with the president. This was the most famous example of McClellan's cavalier disregard for the president's authority. Lincoln had tapped McClellan to head the Army of the Potomac, the main Union army in the East, in July, 1861 after the disastrous Union defeat at the First Battle of Bull Run. McClellan immediately began to build an effective army and he was elevated to general-in-chief after Winfield Scott resigned on October 31. McClellan drew praise for his military initiatives but quickly developed a reputation for his arrogance and contempt toward the political leaders in Washington. After being named to the top post, McClellan began openly to cavort with Democratic leaders in Congress and show his disregard for the Republican administration. To his wife, he wrote that Lincoln was "nothing more than a well-meaning baboon," and Secretary of State William Seward was an "incompetent little puppy." Lincoln made frequent evening visits to McClellan's house to discuss strategy. On November 13, Lincoln, Seward, and Presidential Secretary John Hay stopped by to see the general. McClellan was out, so the trio waited patiently for his return. After an hour, McClellan came in and was told by a porter that the guests were waiting. McClellan headed for his room without a word and, only after Lincoln waited another half-hour, was the group informed of McClellan's retirement to bed. Hay felt that the president should have been greatly offended, but Lincoln casually replied that it was "better at this time not to be making points of etiquette and personal dignity." Lincoln made no more visits to the general's home. He was not a very good general and the Seven Days Campaign, also known as McClellan’s Peninsula Campaign that started on July 1, 1862, was a disaster. On July 11, Maj. General Henry W. Halleck was named commander-in-chief of the Union armies by President Lincoln. Without McClellan criticizing him, Lincoln, on July 22, wanted to issue an Emancipation Proclamation and told his Cabinet it would also be an effort to cripple Confederate manpower, something McClellan had influenced the administration not to do. Lincoln’s cabinet persuaded him to wait for a more favorable military situation to avoid the appearance of “desperation.” On November 5, Gen. Ambrose E. Burnside was name by President Lincoln to replace Gen. McClellan as commander of the Army of the Potomac. McClellan, in 1864, ran as the Democratic candidate for president. In the North, there was considerable dissatisfaction with the progress being made in defeating the Confederacy, so Lincoln did not think his chances of reelection were good. The Democrats were split between those who supported the war and those who wanted peace at almost any price. General Lee, aware of this, was planning an invasion of Washington, DC, but one of his divisions was accidentally encountered in movement on this plan in Gettysburg (but that is another story). The Democratic nominee was Gen. George B. McClellan, commander of the Union Army, who had let several opportunities for victory slip away. The Democratic platform called for peace through reunification of the states, but did not say how this was to be done. Fortunately for Lincoln and the Republicans and those opposed to slavery, several important military victories were won in time to influence the outcome. In the 1864 election, Lincoln received 212 electoral votes, McClellan, 21. The popular vote was Lincoln 2,216,067; McClellan, 1.807,725. The results and history of the campaigning are revealing as to the attitudes of the time, and are not reflected in many school books that paint the war as simple to understand.

1875 - Bowling rules standardization was undertaken when 27 delegates met at Germania Hall, New York City, and organized the National Bowling Association. The association soon went out of existence, however, as did the American Amateur Bowling Union, which was organized in 1890. The first important bowling convention to standardize rules was held by the American Bowling Congress, when it organized On September 9, 1895, in New York City,

1875 - The first football uniforms were worn in a game at New Haven, CT, by teams from Yale and Harvard. The Yale team wore dark trousers, blue shirts, and yellow caps, which the Harvard team wore crimson shirts and stockings and knee breeches. Harvard won the game 4-0. The game at that time was closer to rugby than to present-day football. Each team had 15 players.

1880 - Severe Santa Ana winds and sandstorms in Southern California cause extensive damage.

1894 - The great Kansas City bandleader Bennie Moten (d. 1935) was born there. Count Basie came from this group, as did many other great jazz musicians.

1913 - African-American Dr. Daniel Hale Williams, pioneering surgeon, becomes a member of the American College of Surgeons.

1914 - The brassiere, invented by Caresse Crosby, is patented.

1921 - Birthday of bass player Eddie Calhoun (d. 1993), Clarksdale, MS

1921 - That great romancer of the silver screen, Rudolph Valentino, starred in "The Sheik," which was released. "The Sheik" firmly established Valentino’s popular reputation as the Great Lover, and his last film, the comical "Son of the Sheik" (1926), sealed that title. But the actor never thought of himself as a conqueror of women, not as a great actor. He found the Sheik films rather silly. Valentino had plans to make more serious films beginning with an ambitious version of "El Cid," to be called "The Hooded Falcon." In town for the premiere of "Son of the Sheik," he collapsed in New York on August 15, 1926. Valentino died eight days later from peritonitis, before he could begin to work on films that would make the public forget his sheikly shenanigans. So, the grandiose romantic persona persists and we remember Rudolph Valentino as the Great Lover.

1927 - The Holland Tunnel, running under the Hudson River between New York, NY, and Jersey City, NJ, was opened to traffic. The tunnel was built and operated by the New York-New Jersey Bridge and Tunnel Commission. Comprised of two tubes, each large enough for two lanes of traffic, the Holland was the first underwater tunnel built in the US.

1928 - Pianist/Composer Hampton Hawes (d. 1977) birthday, Los Angeles.

http://www.mclink.it/com/if/lunati/conti/

http://www.fantasyjazz.com/catalog/hawes_h_cat.html

http://www.allaboutjazz.com/bios/hxhbio.htm

1931 - Arkansan Hattie Ophelia Wyatt Caraway was appointed to the U.S. Senate to fill the seat of her late husband. In 1932, she became the first woman to be elected to the Senate in her own right, re-elected in 1938, introduced an Equal Rights Amendment.

http://womenshistory.about.com/library/bio/blbio_caraway_hattie.htm

1933 - The first dust storm of the Great Dust Bowl era occurred with dust spreading from Montana to the Ohio Valley, then to the east from Georgia to Maine. Black rain fell in New York and brown snow in Vermont. Parts of South Dakota, Minnesota and Iowa reported zero visibility on the 12th. On the 13th, dust reduced the visibility to half a mile in Tennessee.

1933 - In Austin, Minnesota, striking workers at the packing plant of George A. Hormel & Co. hold the first recorded sit-down strike in American labor history. The technique is a variation on earlier methods of striking such as refusal-to-work strikes and stay-in strikes, and proves the most effective of the three in discouraging violence. Sit-downs begin a wave of strikes across the nation and many fear labor is getting too strong

as it begins to win its demands of the last 75 years.

1937 - The first symphony orchestra devoted exclusively to radio broadcasting was the National Broadcasting Company (NBC) Symphony Orchestra under conductor Arturo Toscanini. Television has had no such orchestra.

1940 - U.S. Supreme Court rules in Hansberry v. Lee that African Americans cannot be barred from white neighborhoods.

1940 - Benny Goodman records Eddie Sauter’s ”Benny Rides Again.”

1943 - Leonard Bernstein replaced an indisposed Bruno Walter as conductor of the New York Philharmonic Orchestra.

1944 - Top Hits

“Dance with the Dolly” - The Russ Morgan Orchestra (vocal: Al Jennings)

“I’ll Walk Alone - Dinah Shore

“The Trolley Song” - The Pied Pipers

“Smoke on the Water” - Red Foley

1946 - General Electric scientists produced snow in the Massachusetts Berkshires in the first modern day cloud seeding experiment.

1951 - Janet Collins, ballerina, becomes the first Black dancer to appear with the Metropolitan Opera Company.

1952 - Top Hits

“You Belong to Me” - Jo Stafford

“Wish You Were Here” - Eddie Fisher

“Because You’re Mine” - Mario Lanza

“Jambalaya (On the Bayou)” - Hank Williams

1952 - Harvard's Paul Zoll becomes the first man to use electric shock to treat cardiac arrest.

1953 - Strong southeasterly winds associated with a Pacific cold front reached 70 mph at Sacramento, CA to equal their all-time record. The previous record had been established in a similar weather pattern on December 12th of the previous year.

1955 - NBC showed the first live TV program from a foreign country (noncontiguous). Scenes from Havana, Cuba were seen by viewers of Dave Garroway’s "Wide Wide World" program.

1956 - The Supreme Court ruled that segregation on buses and streetcars was unconstitutional. Southern states either ignored or rebelled against the Supreme Court ruling against segregation in the public schools. In Montgomery, Alabama, blacks boycotted buses.

1958 – NYC Mayor Robert Wagner announced preliminary plans for a third major league. Chairman William Shea of what will become the Continental League, says it is apparent that the National League is going to ignore New York City. He implies that the new league will be free to raid major league rosters. Ironically, many have found that Shea’s uncompromising positions led to the departures of the Brooklyn Dodgers and New York Giants to California.

1960 - Top Hits

“Save the Last Dance for Me” - The Drifters

“Poetry in Motion” - Johnny Tillotson

“Georgia on My Mind” - Ray Charles

“Wings of a Dove” - Ferlin Husky

1961 - The Tokens' "The Lion Sleeps Tonight" is released.

1963 - Birthday of Vincent Frank “Vinny” Testaverde, football player, born New York, NY.

1964 - Forward Bob Pettit of the St. Louis Hawks became the first player in NBA history to reach the 20,000–point mark when he scored 29 points in a 123-106 loss to the Cincinnati Royals.

1965 - James Brown's "I Got You" enters both the pop and R&B charts. The song will reach Number One R&B and #3 pop and will become the Godfather of Soul's most enduring and most readily identifiable songs.

1965 - The McCoys' "Fever" is released.

1966 - The Dead, Quicksilver, and Big Brother and the Holding Company Benefit at the San Francisco Avalon Ballroom for the Zen Mountain Center.

1967 - Carl Burton Stokes became the first black in the US elected mayor when he won the Cleveland, OH, mayoral election. Died April 3, 1996.

1968 – The Beatles movie, "Yellow Submarine," premiered in the U.S. Their single, "Hey Jude," topped the pop music charts (it was in its 7th of 9 weeks at #1).

1968 - Top Hits

“Hey Jude” - The Beatles

“Those Were the Days” - Mary Hopkin

“Love Child” - Diana Ross & The Supremes

“I Walk Alone” - Marty Robbins.

1969 - Crosby, Stills, Nash & Young, Cold Blood, Joy of Cooking, and Lamb perform at Winterland in San Francisco

http://www.sfmuseum.org/hist1/rock.html

http://www.sweetstar.com/song/b00004tyb8

1971 - The first satellite launched from the earth to orbit another planet was Mariner 9, an unmanned American spacecraft that was sent to Mars to photograph the surface and to study the planet’s thin atmosphere, clouds, and hazes, surface chemistry, and seasonable changes. The satellite entered Martian orbit at 7:33pm EST. It mapped 70 percent of the planet’s surface.

1973 - Peter, Paul and Mary's "In The Wind" LP goes gold.

1974 - Karen Silkwood murdered during her investigation of Kerr-McGee Nuclear Power Plant in Oklahoma. All her documentation of safety violations disappeared. Following her mysterious death, which received extensive coverage, her estate filed a lawsuit against Kerr-McGee, which was eventually settled for $1.38 million. This plant experienced theft of plutonium by workers during this era. She joined the union and became an activist on behalf of issues of health and safety at the plant as a member of the union's negotiating team, the first woman to have that position at Kerr-McGee. In the summer of 1974, she testified to the Atomic Energy Commission about her concerns. For three days in November, she was found to have plutonium contamination on her person and in her home. That month, while driving to meet with David Burnham, a New York Times journalist, and Steve Wodka, an official of her union's national office, she died in a car crash under suspicious circumstances. Silkwood was portrayed by Meryl Streep in Mike Nichols’ 1983 Academy Award-nominated film “Silkwood.”

1974 - Vietnam War memorial dedicated, Washington, D.C. The Memorial Wall, by architect Maya Lin, is made up of two 246-foot-9-inch long gabbro walls, etched with the names of the servicemen being honored in panels of horizontal rows with regular typeface and spacing. The walls are sunken into the ground, with the earth behind them. At the highest tip (the apex where they meet), they are 10.1 feet high, and they taper to a height of 8 inches at their extremities. Symbolically, this is described as a "wound that is closed and healing."

1974 - No. 1 Billboard Pop Hit: "Whatever Gets You Through the Night," John Lennon. Elton John plays piano and organ and sings backing vocals on the song.

1975 - "Feelings" by Morris Albert, went gold.

1976 - Top Hits

“Tonight’s the Night” (“Gonna Be Alright”) - Rod Stewart

“The Wreck of the Edmond Fitzgerald” - Gordon Lightfoot

“Love So Right” - Bee Gees

“Somebody Somewhere” (“Don’t Know What He’s Missin’ Tonight”) - Loretta Lynn

1977 - After 43 years as a regular feature in hundreds of newspapers, "Li’l Abner," by creator Al Capp, ended. This was one of the most popular cartoons of its day, including a Broadway musical, and Capp was a favorite guest of late TV shows.

1979 - For the first time in Major League history, two players shared the Most Valuable Player award. The National League co-winners are Willie Stargell, the spiritual leader of the Pittsburgh Pirates, who hit .281 with 32 home runs, and St. Louis Cardinals first baseman Keith Hernandez, who led the NL in runs (116), doubles (48) and batting average (.344).

1981 - A powerful cyclone brought high winds to Washington State and Oregon. The cyclone, which formed about 1000 miles west of San Francisco, intensified rapidly as it approached the Oregon coast with the central pressure reaching 28.22 inches (956 millibars). A wind trace from the Whiskey Run Turbine Site, about 12 miles south of Coos Bay in Oregon, showed peak gusts to 97 mph fifty feet above ground level. The wind caused widespread damage in Washington and Oregon, with 12 deaths reported. As much as four feet of snow fell in the Sierra Nevada Range of northern California.

1984 - Top Hits

“Caribbean Queen” (“No More Love on the Run”) - Billy Ocean

“Purple Rain” - Prince & The Revolution

“Wake Me Up Before You Go-Go” - Wham!

“I’ve Been Around Enough to Know” - John Schneider

1986 - The state of California put Fricot City on the auction block for $8.8 million. The ‘city’ was actually the former ranch/private estate of Desiré Fricot. It had become a California Youth Authority camp in 1945. Located about 60 miles southeast of Sacramento, Fricot City featured some twenty homes, two gymnasiums, two swimming pools, a full twelve-grade school, a fire station, an infirmary and a chapel. http://www.geocities.com/sheepranchca/ ( scroll to bottom to see map )

http://www.oac.cdlib.org/dynaweb/virtual/calher/grass

( go to “container” for pictures”)

http://www.oac.cdlib.org/dynaweb/virtual/calher/grass/

@Generic__BookTextView/128;cs=default;ts=default

1987 - A storm moving off the Pacific Ocean produced rain and gale force winds along the northern and central Pacific coast, and heavy snow in the Cascade Mountains. Cold weather prevailed in the southeastern U.S. Five cities reported record low temperatures for the date, including Asheville, NC with a reading of 21 degrees.

1988 - Low pressure brought rain and snow and gusty winds to the northeastern U.S. A thunderstorm drenched Agawam, MA with 1.25 inches of rain in fifteen minutes. Winds gusted to 58 mph at Nantucket, MA.

1987 - No. 1 Billboard Pop Hit: "I Think We're Alone Now," Tiffany. Tiffany Darwish was born Oct. 2, 1971, making her the first artist with a No. 1 hit to be born in the 1970s.

1989 - After 16 years with the same team, Jim Rice is released by the Red Sox. The Boston outfielder retires from the game with a career .298 average with 382 home runs. Rice was an 8-time All-Star and the 1978 AL MVP. He became the ninth player to lead the major leagues in total bases in consecutive seasons and joined Ty Cobb as one of two players to lead the AL in total bases three years in a row. He batted .300 seven times, collected 100 RBIs eight times and 200 hits four times, and had eleven seasons with 20 HRs. He also led the league in home runs three times, RBIs and slugging percentage twice each. The Baseball Hall of Fame inducted him in 2009.

1989 - Thirty-two cities in the central and eastern U.S. reported record high temperatures for the date as readings warmed into the 70s as far north as Michigan and Pennsylvania. Afternoon highs in the 80s were reported from the Southern Plains to the southern Atlantic coast. Columbia, SC reported a record high of 86 degrees, and the high of 71 degrees at Flint, MI was their warmest of record for so late in the season.

1997 – The UN pulled its weapons inspectors from Iraq.

1998 - New England Patriots quarterback Drew Bledsoe set an NFL record for most passes completed in a game with 45 vs. Minnesota.

1998 – The ball thrown by Boston Red Sox pitcher Howard Ehmke and hit by Babe Ruth for the first home run in Yankee Stadium history sold at an auction for $126,500. Mark Scala found the 1923 historic ball in the attic of his grandmother's home several years ago. Viola Bevilacque, his 87-year-old mother, remembered the ball that had been given to her husband as a prize in 1927 for making the New Jersey all-state high school baseball team. The ball, hit by Ruth on Yankee Stadium's opening day in 1923, was kept in the attic of the house she has lived in since 1946. When he found out about the ball, which was signed by Ruth and carried an inscription identifying it as the first home run in Yankee Stadium, Mr. Scala took it to the Baseball Hall of Fame in Cooperstown, N.Y. There, he met Peter Clark, the curator of collections. The first question he asked was whether Cooperstown had Ruth's first Yankee Stadium home run ball. Mr. Clark confirmed that the ball was not in the museum. He also told Mr. Scala that Ruth's signature on the ball was consistent with his autograph. Mr. Scala then took the ball to authenticators, who decided that Mr. Scala did have the first Yankee Stadium home run ball.

1999 - Lennox Lewis won a unanimous decision over tattooed Evander Holyfield for 12 rounds in Las Vegas to capture the title.

2000 - Becoming the first pitcher to win the American League Cy Young award unanimously in consecutive years, Red Sox hurler Pedro Martinez (18-6,1.74) has copped the 'top pitcher' honor three of the last four seasons. Martinez entered the Baseball Hall of Fame in 2015 in his first year of eligibility.

2001 - Top Hits

“Family Affair” - Mary J. Blige

“I'm Real” - Jennifer Lopez Featuring Ja Rule

“Hero” - Enrique Iglesias

“Fallin'” - Alicia Keys

2002 - The Giants select former Expo veteran skipper Felipe Alou to replace Dusty Baker as their new manager. The 67-year-old Dominican Republic native compiled a 691-717 record during his ten years at the helm with Montreal and was selected as the National League Manager of the Year in the 1994 strike-shortened season. He was replaced at the end of the 2006, but is still involved in San Francisco Giants activities.

2005 - Chicago Bears cornerback Nathan Vasher returns a missed field goal 108 yards for a touchdown, the longest play in NFL history.

2010 - According to China, a report submitted to the U.N. Security Council on violation of the Darfur weapons embargo is ridden with flaws and vaguely worded.

2013 - The largest fancy orange diamond on record was sold at Christie's auction in Geneva; the 14.82-carat stunner sold for $35.5 million. The painting, 'Three Studies of Lucian Freud' by Sir Francis Bacon, sold for a record-high price of $142 million.

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

![]()