|

|

|

|

|

----------------------------------------------------------------------------

Friday,

October 8,2004

Headlines---

Classified---Clients

Looking for an Attorney

Who

is Alex Wolf? by Christopher Menkin

Leasing

Conference Count-Down-Latest News

What

Lessors Are Saying About…”Compensation"

ELA

Fleming at LeaseEurope Conference

Tim

Taylor Joins Dumac Leasing

Cambridge

Capital Group Relocates to Yorba Linda

Group

Financial Services alliance with Z Resource Group

Calazzo’s

Joins LPC “Fast Growing Leasing Company in U.S.

CLEARLINK

Capital Corporation: Normal Course Issuer Bid

Willis

Lease Expands Revolving Credit Facility by $12.5 Million

Edmunds.com

Reports Automakers' True Cost of Incentives

New

Valuation Firm—Vista Consulting Group

Equipment

Financing Group signs with PayNet

######## surrounding the article denotes it is a “press

release”

-------------------------------------------------------------------------------

Classified---Clients

Looking for an Attorney

Long Beach, CA.:

Our company ISPWEST, Inc. had a contract with Norvergence for internet, phone, & cell phones in Carson, California. Norvergence farmed out the lease to CIT financial, then went chapter 7. Now we have received one letter from CIT reminding us that we have no option but to pay the lease to them. They want $16000 for a useless router box. Not only have we not had phone/internet or cell phones for over three weeks, we have lost business because of this matter. We need help to get out of the Norvergence contract (which was farmed out to CIT). Is there any attorney out there who can help us? No one is trying to help the people affected by this mess.

please contact us at

(310)637-2100 or at

Email: deborahp@rock.com

if you can offer

any advice or help. Thank you for your time.

Marina Del Rey, CA.:

Seeking representation/advice

on failed NorVergence lease agreement.

Equipment had been received, but we never received service, we

made first months payment expecting reimbursement from NorVergence.

We returned the equipment to Wells Fargo, registered-insured

US Post, they accepted the return, but still hold us accountable to

the lease. We have not received any statements for payment

due, however their lawyer has informed me today (after I initialized

contact) that we should have been served for being in default. He informed me that the lease agreement is

a

E-mail: marcy@personalcreations.net

Georgia

Macon, GA.:

Am interested in a Chicago area attorney to represent Norvergence customer lessees having rental agreements purchased by IFC. IFC is based in Morton Grove, IL.

Steve Elliott

478.477.4818 x130

E-mail: selliott@mbrweb.net

Post a “free ad”

seeking an attorney who specializing in

http://64.125.68.90/LeasingNews/PostingFormLegal.htm

--------------------------------------------------------------------

Who

is Alex Wolf?

by Christopher Menkin

It is time to change

the graphic from a world unplugged to the

“energizer bunny,”

as the NorVergence problems keep going

and going as customers

and creditors continue to fight each

other over financing

of equipment that has very little value ( the best

bid on eBay was $150 for the heart of the equipment lease: the

Matrix box.)

http://cgi.ebay.com/ws/eBayISAPI.dll?ViewItem&item=

The Texas Attorney

General has joined his counterparts in Illinois, Florida, New Jersey

and Florida, issuing subpoenas to leasing companies involved in the

NorVergence class action lawsuit to stop collecting on related leases,

warning of legal actions. The claim

customer, the user

of the product.

"We request

that you immediately cease all efforts to collect on agreements purchased

from NorVergence," stated a letter from Greg Abbott's office. "Continuing

to attempt collection efforts on agreements secured by fraud could subject

your company to substantial penalties."

First, these are

not “orders” as the attorney general does not

have this authority

for this type of situation. These

are “requests,”

and the response

is not only up to those served, but also to a

court of law to rule

upon ( which may be appealed.)

Many lessees have

viewed the attorney general announcements incorrectly. They believe

they do not have to continue to make lease payments. The publicity seems

to have compounded the

situation.

The internet has

made it much easier to “write letters” and get

government officials,

and even politicians, involved that the

leasing companies

created a conspiracy against them.

The

latest to join the

fray is Senator Hillary Clinton of New York.

Hillary

focuses on Norvergence probe

By DANIEL DUNAIEF

DAILY NEWS BUSINESS

WRITER

Sen. Hillary Clinton

is throwing the weight of her office behind the investigation into the

bankrupt telecom Norvergence.

"I am extremely

troubled by this situation," Clinton told the Daily News. "My

office is currently looking into these serious complaints and has contacted

the state Attorney General's office."

A spokesman for Eliot

Spitzer confirmed the attorney general's office had received a call

from Clinton's office and promised to share the results of the investigation

with her.

As first reported

Monday in The News, Norvergence - through its matrix box - promised

to cut phone bills of small businesses by more than 30%.

When the company

went bankrupt this summer, it left 11,000 customers nationwide with

no phone service.

And it stuck them

with contracts held by leasing companies like Wells Fargo and Commerce

Bank for hundreds of dollars a month that they must keep paying.

The leasing companies

have been playing hard ball with these small businesses, by suing them

or threatening to damage their credit ratings.

"This is jeopardizing

small businesses in the city," said Samantha Kahn, a manager at

Jacobson Printing, which has been paying Wells Fargo more than $240

a month.

Other states have

stepped in on behalf of small businesses.

Texas recently threatened

to take legal actions against the leasing companies if they don't back

off from the small businesses during the state's investigation.

"I'd like her

to act in the same way" other states have acted, said Kahn.

Clinton said she's

eager to find "the result of Spitzer's investigation and to working

to ensure that justice is served for any business that was wronged

---

The above appeared

in the October 7th edition of the New York Daily

News and was sent

to us by a reader.

In the meantime,

the bankruptcy proceedings may

make many of these

lawsuits subject and/or part of the out come. Rosemary Gambardella is

the United States Bankruptcy Judge. As noted the deadline for filing

a proof of claim must be received by the bankruptcy

clerk's office from all creditors (except a governmental unit),

November 29,2004. For a governmental

unit, 180 days from the date of relief. Several

hearings October 4th hearing were postponed

Judge Gambardella

granted Forma Holt & Eliades, LLC “...an extension of time for the

Trustee to assume or reject certain leases; and the court having considered

the papers submitted...Ordered that the time within which the Trustee

may assume or reject the Debtor’s unexpired

U.S.C-365(d).”

There are other such

rulings and documents on file. This is brought

to readers attention

that it appears any preliminary readings

will be made after

the first of the year. Among

the 111 debtors listed,

many are small, expecting

“immediate” relief.

Here are some of

the filings:

»www.thedigest.com/docs/norvergence/

Leasing News has

printed the intentions of the class action suits, who

have sent the names

and addresses of all the state attorney generals

to those with complaints,

or have legal action in their state.

Expect to

see more announcements from other state’s attorney general public

information officers.

As posted in Leasing

News on, the Telecom Agents Association suggests lessees to continue

to make leasing payments:

“First, whatever

the amount of money that needs to be paid per month by an ex-Norvergence

customer to avoid getting sued by the leasing company is much less than

the cost of being sued by the leasing company from a distant state."

"Second, to have a judge decide that the whole Norvergence situation really was a "Ponzi scheme" such that the leasing agreements are invalid, the "whole Norvergence story" must be told in a courtroom where the judge is actually interested in the whole story - not just the small part of the story the leasing company wants to tell in their "nuisance lawsuit". To get an objective hearing of the "whole story" both legal co-ops have endorsed the idea of "going on the offense" by suing the leasing companies as a group through one of several group legal actions that have formed - see

www.NorvergenceClassAction.com.

"

In the defense of

Robert J. Fine, Director of Bank Relations, for NorVergence, it is said

that NorVergence Capital, in which he was allegedly the president, did

not book any leases. It is also

said the man in charge of the day-to-day operations, who previous employees

and others tell Leasing News, was the one they reported to, not either of the Salzano brothers. While the two brothers were in the office almost every day, they

delegated control to Alexander L. Wolf, chief operating officer. Department

heads reported to him. In all the

press releases we

have seen or reviewed, he was the spokesman

quoted for the company.

Leasing News was

told Robert J. Fine reported to Mr. Wolf, his

direct boss, who

explained that what they were leasing was “standard” and the “procedure

in the telecom industry.” He

had come from Nortel, one of the providers, and was an expert in telecommunication

service and sales. Fine was the respected banker entree, more a “public

relations” man than involved in funding, sales, or operation of the

company, Leasing News was told. Insiders

say he is getting

the two as they did

not do business, except he was an employee

of the company. He

worked his way up from committee, to director,

and then to position

of president of a trade association.

These allegedly were

the NorVergence officers:

PETER SALZANO, PRES-CEO

ALEXANDER L. WOLF, COO

STEVE LEIBROCK, CTO

TERRY SKEMER, VP ENGINEERING

ART SCUTTARO, SR VP-APPLICATION SCREENING

JOE O'DONNELL, VP

A memo from the public

relations firm handing the account, sent this

out as a background

for Mr. Wolf.

“Chief Operating

Officer: Mr. Alexander L. Wolf.

“Formerly of Nortel

Networks, (2000-2001) Mr. Wolf was a Senior

Executive within

Nortel Networks' Emerging Markets Group. Mr. Wolf's

areas of responsibilities

within that Nortel Division have included

Business and Market

Planning, Operational Planning & Realization,

Carrier Product Portfolio

Development & Deployment, and Operational

Support System Planning

& Implementation. While at Nortel, Mr. Wolf

also played a major

role in helping emerging companies develop

comprehensive business

& financial plans to support Seed and Stage A

operations. Due to

the close relationship between Nortel and

NorVergence, Executive

Management allowed Mr. Wolf to join NorVergence in October 2001. This

has facilitated interaction between the two firms based on previous

roles and relationships.

“Before joining Nortel

Networks, Mr. Wolf was Head of Northeast Sales

Operations for Payback

Training Systems, Inc., (1999) and pioneer in

the E-Learning industry

that grew to $10 million in revenues before

his departure for

Nortel. Mr. Wolf has more than 7 years of experience

within the Telecommunications

and Data-Communications industries.

Previously, Mr. Wolf

held leadership positions with Datatec (1998)

managing the sub-contractor

relationship to the IBM account, and

Siemens, (1995-1998)

where he developed and implemented cutting-edge technology solutions

for some of the largest Global 100 firms.”

http://www.leasingnews.org/items/Interview%20on%20the%2019th%

From the Fall edition

of Muhlenberg College “Class Notes”

“’Alexander L. Wolf

sends the following update: “My start-up company has gone from business

plan to cash flow positive in its first full month of sales/operations

(January 2002). We are growing very quickly!! I already have 90-plus

employees in Newark, N.J. (Check out www.norvergence.com for details.)’

He also reports that he and wife Jenifer recently celebrated their second

wedding anniversary, “’but it will be a few years before kids’.”

http://www.leasingnews.org/items/Muhlenberg%20Magazine

%20Fall%202002.htm

Before the bankruptcy

of NorVergence, here is their Dun and Bradstreet report, showing chain

of command, plus financial statements and credit ratings:

http://www.leasingnews.org/items/N-DNB.htm

Telecom Agents Association

Review of NorVergence, Inc.

by Dan Baldwin, TAA

Editor-at-Large, December 3, 2003,

explains how the

program works, including the separate

service agreement,

and gives indication that the lessees

were aware of the

dual roles in the NorVergence program:

http://www.leasingnews.org/items/norvergence1.doc

A press release from

NorVergence explains a new program:

http://www.leasingnews.org/items/NorVergence,%20Inc_%20%20NorVergence

%20Expands%20Product%20Offering%20Include%20Specialized%20Phones%

At this time, many

of those who looked at the program, considered it a “scam:”

http://www.leasingnews.org/items/Telecom.doc

The value of the equipment as per eBay bids:

http://cgi.ebay.com/ws/eBayISAPI.dll?ViewItem&item=

Here is the 15 page NorVergence training manual on how

to sell the product and use equipment leasing:

http://leasingnews.org/PDF/SM_Training.pdf

Here is how the story is being printed in the media today:

http://www.tampabaylive.com/stories/2004/09/040922norvergence.shtml

Leasing News for

over a year and a half before the bankruptcy filings was hearing “alarms”

from users, lessees, and funders. As

predicted last June, this is going to steam role into one of the largest

leasing company public relations failures of modern times, and while

early predictions have said there would be more than $3 million in losses,

the ultimate, including costs will be a minimum of $100 million, and

some believe it may wind up at $250 million.

There is no doubt

this publicity has been one of the worst in

recent years, perhaps

turning more businesses away from

entering into equipment

leasing of any kind. It certainly

has gotten the attention

of Hillary Clinton and other politicians,

which may include

state attorney generals who run for office

every four years,

or often seek higher positions.

-------------------------------------------------------------------------------

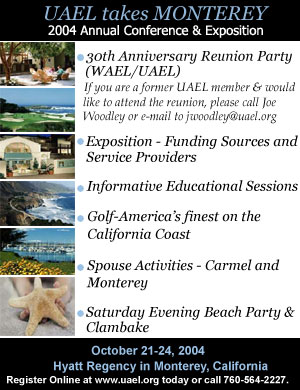

Leasing Conference

Count-Down-Latest News

UAEL Monterey, CA October 21-24

United Association of Equipment Leasing

http://www.uael.org/events/conferences/ace/default.asp

“This will be the

best attended conference in many years. The 30th year Reunion Party

and Welcome Reception on Thursday Evening , October 21, 2004, wail be

a special night. We have attending the Reunion many of the Original

Founding Members of WAEL/UAEL

Thank you.”

Joe

|

|

ELA Palm Desert, CA October 24-26

The Equipment Leasing Association

www.elaonline.org/events/2004/annconv/convhome.cfm

“Will You Make THE LIST?"

“October 14th Last Day to Register to be on the List.”

“What’s THE LIST? Only one of the most important networking tools in the

leasing industry. Distributed onsite at the ELA Convention, October

24 – 26 at the JW Marriott Desert Springs Resort & Spa, Palm Desert,

CA, the final Convention Roster lets the other 1000+ attendees know

you’re there, and helps them seek you out. But October 14 is the last

day to pre-register for the Convention, and thus to make the Roster.

After that, you’re welcome to register onsite.

“Of course, maybe you aren’t planning to attend the ELA Convention.

If not, you may be taking an awfully big risk. After all, the Convention

is where things happen. Can you afford not to be where deals are done,

relationships established, information gathered, insights given, reputations

burnished, cigars smoked and cocktails consumed?

“

If you have not attended an ELA

Conference before, and are a non-member, you will be eligible to attend.

The education, conferences, and information available only to members

on the web site are certainly worth joining)

|

AGLF Rancho Mirage, CA November 10-12

Association for Government Leasing and Finance

www.aglf.org/25AM04_fallpgm.pdf

MAEL Rosemont, Illinois November 18

Mid-American Association of Equipment Lessors

www.mael.org

To learn about these and other leasing associations, please go to:

http://www.leasingnews.org/associations.htm

If you are interested to learn more about the conference, please to the web

site noted.

|

"What Lessors Are Saying About…Compensation"

ELTnews

Equipment Leasing

Association’s “Leasing Industry Compensation Survey” reported that 2004

salary budgets, as a percent of total payroll, declined in all employee

categories. Executive and Middle Management salary budgets for the year

declined 3.3 percent and 3.5 percent, respectively, when compared to

2003 salary budgets. Exempt- and Non-exempt employee pay budgets declined

as well.

David Merrill of

Fifth Third Leasing Company said he was surprised to see the data when

it was released. “Based on our experience, the demand for top producers

and seasoned leaders is high. The recruiters that we work with are very

busy right now.”

Daniel McKew of Suntrust

remarked that “It all depends on how each company does relative to budget.

Many of our parent companies have been used to seeing 20 percent and

plus growth. That cannot be sustained. When you fall below that number,

your compensation is effected.”

Merrill added “I

can only speculate that the reasons [for salary budgets declining] are,

for one, the economy. Most lessors have seen improved volume year over

year but are still behind on their new business volume goals. This slowness

is offset somewhat by a strong improvement in credit quality and profits.

Another reason is the pay mix (salary/incentive based pay) seems to

be becoming more leveraged.”

One lessor, who asked

not to be named said they thought salary budgets did decline and it

was because many lessors were not replacing headcount lost to attrition.

He also cited the industry continuing to shrink as merger activity continues.

So, more volume is being done with fewer players doing it, and this

particularly impacts the executive level. Also, the anonymous source

said too many players are chasing too few deals, making for decreased

spreads for all and decreasing volume for more marginal players.

“I know that we have

utilized more temp help and outside consulting firms this year to get

work done in lieu of hiring additional staff,” said Jeff VanCleve of

Diebold Credit Corp. “Perhaps this is contributing [to down compensation]

along with continued industry focus on improving employee productivity.

The industry is doing better, but the low rate environment has significantly

reduced revenues, and margins are quite low for most, necessitating

a continued focus on controlling costs, especially headcount.”

Will this deter new

people from joining the industry?

“I don't think a

three percent drop will detour new employees from joining the industry.

Overall the leasing industry still offers a competitive wage compared

to the broad financial services/banking industry,” said Merrill.

McKew added, “New players will join the industry when spending begins again. It is a natural economic cycle. We just all have to make it through the

down period.

------------------------------------------------------------------------------

ELA

Fleming at LeaseEurope Conference

ELTnews

"Today the Lease

only has product power through great execution," ELA President

Michael Fleming told delegates to the opening session of the LeasEurope

Conference in Italy Monday.

"However,"

he said, "leasing will be a company by company story as companies

provide value to customers." Fleming told the 400 attendees that

today the leasing business' success stories are of individual company

success involving a lease product, not about the lease per se.

Fleming also described how the problem stories are about lease programs

or lease products as reflected by: Cross Border tax exempt leasing;

Highly structured transactions, and; the "NorVergence matter"

which are calling on necessary commercial finance practices and documentation

such as assignability and hell or high water clauses.

--------------------------------------------------------------------

Classified

Ads---Help Wanted

Brokers

|

About the company: SCL has been in business for 12 years. We are contracted with multiple funding sources which enables us to provide more competitive rates and flexible terms and conditions. |

Funding/Loan Processor

|

CFO / Leasing Sales Leader

[

|

Dealer Credit Finance Analyst / Dealer Credit Finance Services Supervisor

|

Dealer Credit Fin. Services Supervisor, Torrance, CA. Click here for full descrip. & to apply. To learn more about us, please visit: www.toyotafinancial.com/careers |

Vendor Account Executive

|

About the Company: Lease Corporation of America is a well established, 16 year old, national equipment leasing company. |

Cost of classified

help wanted ads:

Two weeks

$400.00 for four

lines for ten days

$50.00 per line the

next four lines

$25.00 per line thereafter

Logo is free.

A description of

your company is free ( not more lines than your ad.)

We will help you

write the ad, add a job description url or point

to your web site

full job description.

http://64.125.68.90/LeasingNews/PostingFormWanted.asp

----------------------------------------------------------------------

### Press Release

########################

Tim

Taylor Joins Dumac Leasing

We are pleased to

welcome Tim Taylor as the new Dumac Leasing Assistant Manager. The Assistant Manager position was created

so that we can continue to provide excellent customer service as our

business grows. We now have

more resources to ensure quick turnaround on lease applications and

to make improvements to our broker program.

With 20 years of

experience in banking and the finance industry, Tim has a solid background

in credit, collections, documentation and sales.

His career began in customer service and he understands how important

that is in retaining excellent relationships.

Prior to joining Dumac, he spent the last 8 years working for

a national leasing company and was involved in nearly all aspects of

the equipment leasing business.

A California native,

Tim has lived in the Santa Rosa area for the last 21 years. In his spare

time Tim enjoys gardening and playing golf.

Tim attended Montclair State University in New Jersey. He graduated with a Bachelor of Science in Business Administration.

We are sure that

you will enjoy working with Tim. He

will gradually get to know you as he works with your lease applications. He may be contacted as follows:

Direct Phone

707-521-5132

Email ttaylor@exchangebank.com

###### Press Release

#####################

The

Cambridge Capital Group Relocates to Yorba Linda

Company

Provides Full-Service Commercial Equipment Financing

Jamie Kaneshina

Yorba Linda, Calif.

– In early September, The Cambridge Capital Group celebrated the grand

opening of their new company headquarters in Yorba Linda’s Savi Ranch

Center. The business is a national, full-service commercial

finance company funding business-essential equipment ranging in cost

from $10,000 – $5,000,000.

The Cambridge Capital

Group funds equipment for a variety of industries including construction,

technology, restaurant, printing and telecommunication to name a few. The company is able to provide flexible payment

structures and 100% financing to preserve customer’s bank lines of credit.

Three industry experts

bring over 35 years of experience to the firm.

Jaime A. Kaneshina, CLP serves as the Director of Finance, Heather

L. Wright runs the daily business as Director of Operations and Mark

Y. Askary will service customers in his role as Director of Business

Development. Mr. Kaneshina recently stated, “Our business aims to provide

customers with knowledgeable, professional and friendly service with

a quick turnaround from application to funding.”

The Cambridge Capital Group is located at

22800 Savi Ranch Parkway, Ste. 204,

Yorba Linda, CA 92887.

For more information call

(714) 221-1488 or visit,

www.thecambridgecapitalgroup.com.

### Press Release

########################

Group Financial Services announces long-term alliance with

Z Resource Group to

expand

originations in Health Care Sector

New York, NY, -- Group Financial Services, a leading originator

of Medical leases and loans, has announced a strategic alliance agreement

with Z Resource Group to help expand the sales team and processing infrastructure

of Group Financial Services.

Under the terms of

the agreement, Z Resource Group will be bringing a combination of consulting

and recruiting services to Group Financial Services and ultimately,

look to support the business with an additional $100 million per year

of originations in the health care channel through the talent acquisition

of top Health Care Leasing and Financing representatives.

Greg Einhorn, Director

Of Sales of Group Financial Services related, “We are excited about

the growth prospects of our organization.

We are pleased with this new partnership with Z Resource Group

that is already paying dividends in our growth plans. The principals

of Z Resource Group understand our business and their executive recruiting

team will assist us in filling several open spots in targeted markets.”

Larry Hartmann, Managing

Director of Z Resource Group stated, “Group Financial has a rich 25+

year history of success as an independent lessor focused in the health

care niche. With their strong funding capabilities in place, coupled

with a comprehensive and creative product offering for the health care

vendor marketplace, GFS is in a strong growth mode. We are looking forward

to helping them achieve their growth plans”.

About Group Financial

Services

Group Financial Services is a Nationwide, 28-year-old business focused in providing leasing and financing products and services to the health care vendor and direct marketplace. The firm provides outsourced solutions as a captive finance arm for a variety of medical dealer associations and manufacturers as well as a strong direct presence in targeted markets. The firm has originated over $700 million in medical leases and loans and is targeted to fund in excess of $100 million this next year. Group Financial Services has offices in Delaware, New York, Pennsylvania, South Carolina, Texas and now New Jersey.

For more information,

contact Greg Einhorn

at 1-800-336-8562 or

visit their web site at

About Z Resource

Group

Z Resource Group is a fast growing, nationwide specialty Executive Search, Staffing and Consulting Firm and a recognized leader in the leasing industry. The company is entering its sixth year of successfully providing value added services to several key markets, including financial services, technology, and healthcare. Headquartered in the Boston, MA area, the company maintains branch offices nationally.

For more information,

contact Larry Hartmann

@ lhartmann@zrgroup.com

or for ore information on the company,

visit www.zrgroup.com.

### Press Release

####################

Calazzo’s

Joins LPC “Fast Growing Leasing Company in U.S.

Wayne, NJ—Leasing

Partners Capital, Inc., one of the fastest growing leasing companies

in the U.S., has added a Telemarketing Manager to its Team.

LPC is pleased to

announce the addition of Frank Caiazzo as Telemarketing Manager located

in Wayne, NJ. Frank will be

developing key programs for LPC’s sales representatives and Territory

Managers. This will allow LPC to launch all of it’s telemarketing

programs internally.

Frank earned his

BA from William Paterson University in Wayne, NJ.

Frank has nearly

twenty years experience in sales and marketing, primarily with several

high profile securities firms.

“About the Company”

Leasing Partners

Capital, Inc. (LPC) is a small to lower-middle-market equipment leasing

company working with vendors and end users, headquartered in Wayne,

NJ. LPC currently has offices in Naples, FL, Louisville,

KY, Atlanta, GA, Pittsburgh, PA, Minneapolis, MN, Houston, TX, San Francisco,

CA, St. Louis, MO, Boston, MA, Detroit, MI, Seattle, WA, Litchfield,

NH, Tampa, FL, Warwick, NY and Ft. Lauderdale, FL.

For additional information or questions about LPC,

contact Bruce Larsen,

National Sales Manager,

877-333-5864 or

email him at blarsen@leasingpartnerscapital.com,

or check out their

web site @ www.leasingpartnerscapital.com.

### Press Release #######################

CLEARLINK

Capital Corporation: Normal Course Issuer Bid

MISSISSAUGA, Ontario--

CLEARLINK Capital Corporation (the "Corporation") (formerly

MFP Financial Services Ltd.) announces that the Toronto Stock Exchange

has approved the renewal of the Corporation's normal course issuer bid

which will commence on October 7, 2004 for a 12 month period until October

6, 2005. The maximum number of shares which can be purchased under the

issuer bid through the facilities of the Toronto Stock Exchange will

be approximately 5% of the common shares outstanding or 449,000. All

shares purchased under the normal course issuer bid will be cancelled.

As of September 21, 2004, 8,994,651 common shares were outstanding and

2,500 common shares had been purchased during the previous year's issuer

bid at an average purchase price of $7.84.

CLEARLINK Capital

Corporation is a leading provider of innovative financial solutions

in technology and equipment leasing, and equipment trading. Based in

Mississauga, Ontario, Canada, CLEARLINK operates throughout North America

and Europe.

2281 North Sheridan

Way

Mississauga, Ontario,

Canada

L5K 2S3

Phone: (905) 855-2500

Fax: (905) 855-2725

### Press Release #######################

Willis

Lease Expands Revolving Credit Facility by $12.5 Million

SAUSALITO, Calif.-----Willis

Lease Finance Corporation (Nasdaq:WLFC) announced today that it has

expanded one of its primary revolving credit facilities by $12.5 million,

bringing the total facility to $138.5 million. The bank syndicate was

expanded to include CDC IXIS, a French bank with assets of more than

EUR 71 billion ($86 billion US), which contributed $10 million to the

facility. National City Bank also increased its commitment by $2.5 million.

This credit facility was renewed in June 2004 for $126 million. The

syndicate of banks was led by Fortis Bank (Nederland) N.V. as structuring

and security agent, and National City Bank as administrative agent.

California Bank & Trust, City National Bank, Wells Fargo Bank, HSH

Nordbank, and State Bank of India are also participants in the credit.

This and other credit facilities support the company and its subsidiaries

in financing the $498.1 million equipment lease portfolio as of June

30, 2004.

"Additional capital is a key component in our ability to meet

rising demand in the market for leased engines," said Charles F.

Willis, President and CEO. "The addition of CDC IXIS to the facility

helps promote our strategy of funding an international business with

a diverse group of lenders from around the world. We are looking to

expand our credit facilities even further, to give us more flexibility

to grow as the global aviation industry continues to improve."

About Willis Lease

Willis Lease Finance Corporation leases spare commercial aircraft

engines, rotable parts and aircraft to commercial airlines, aircraft

engine manufacturers and overhaul/repair facilities worldwide. These

leasing activities are integrated with the purchase and resale of used

and refurbished commercial aircraft engines.

Willis Lease Finance Corporation

Monica J. Burke,

Chief Financial Officer

415-331-5281

### Press Release

#######################

Edmunds.com Reports Automakers' True Cost of Incentives: All-Time Record Incentives Likely Cause of Strong Sales in September;

Domestics Gain Market Share While

Honda,

Toyota and Lexus Slip

SANTA MONICA, Calif.,

-- Edmunds.com (http://www.edmunds.com),

the premier online resource for automotive information, reported today

that the average manufacturer incentives per vehicle sold in the United

States was $3,146 in September 2004, up $425 or 15.6% from August 2004,

and up $524 or 20.0% from September 2003. This is the highest industry average since

Edmunds began tracking manufacturer incentives in January 2002, and

Edmunds.com's experts believe incentives have never been higher.

Edmunds.com's monthly

True Cost of Incentives(SM) (TCI(SM)) report takes into account all

of the manufacturers' various United States incentives programs, including

subvented interest rates and lease programs as well as cash rebates

to consumers and dealers. To

ensure the greatest possible accuracy, Edmunds.com bases its calculations

on sales volume, including the mix of vehicle makes and models for each

month, as well as on the proportion of vehicles for which each type

of incentive was used.

Overall, combined

incentives spending for domestic Chrysler, Ford and General Motors nameplates

was $4,279 per vehicle sold in September 2004, up $428 from August 2004

and up $661 from September 2003. Chrysler

increased incentives spending from $384 to $3,778 per vehicle while

losing 0.7% market share since August 2004.

Ford increased its incentives by $74 per vehicle, setting a new

Ford record TCI of $4,048, and gained 0.8% market share.

GM increased overall incentives by $612, setting a new GM record

TCI of $4,593 per vehicle and gained 3.4% market share.

"The domestics

are focused on clearing out 2004 model year vehicles, and their use

of dramatic incentives have been quite effective," said Dr. Jane

Liu, Vice President of Data Analysis for Edmunds.com.

"Domestic market share is climbing; they gained an impressive

3.5% last month to reach the highest level this year, 61.2%, and are

1.7% ahead of where they were this time last year.

Chevrolet in particular experienced a tremendous sales month

in September, likely because of attractive deals that enticed customers

without destroying the bottom line or the image of their reinvigorated

product line."

In September 2004,

European automakers spent $2,497 per vehicle sold, $744 higher than

September 2003 but $324 less than August 2004, and lost 1.2% market

share. Japanese automakers spent $911, $54 less than

September 2003 but $49 more than August 2004, and lost 0.6% market share. Korean automakers spent $2,207, $823 more than

September 2003 and $325 more than August 2004, and gained 0.1% market

share.

Of all brands, Mini

spent the least on incentives in September, $13 per vehicle sold, while

Scion spent only $89 and Acura spent just $251.

At the other end of the spectrum, Cadillac spent the most on

incentives, $6,281 per vehicle sold, followed by Lincoln at $5,566 and

Mercury at $5,434.

Last month Chevrolet

gained the most market share, growing from 17.0% in August 2004 to 19.7%,

while GMC rose from 3.5% to 4.3% and Ford climbed from 15.4% to 16.1%. Pontiac and Lincoln also experienced noteworthy

gains. During the same period, the Honda brand lost the most market

share, dropping from 7.7% to 6.5%, while Toyota fell from 10.0% to 9.2%

and Lexus slipped from 1.8% to 1.4%.

"Thanks to incentives,

the top five market share gainers last month are domestic while the

three with the biggest declines are Japanese," observed Dr. Liu.

Among vehicle segments,

large SUVs offered the highest average incentives for the sixth straight

month, $5,196 per vehicle, a new market segment TCI record. Other segments with high incentives were large trucks at $4,053

and large cars at $3,838. Compact

cars had the lowest average incentives at $1,783, followed by compact

SUVs at $2,018 and luxury sport cars at $2,084. Large trucks gained

the most market share, up from 15.6% in August 2004 to 17.8% in September

2004, while large SUVs went from 5.6% to 6.7%.

By contrast, compact cars fell from 14.9% to 13.6% and midsize

cars dropped from 15.9% to 14.8%.

"The bargain-hunters

were clearly all over dealership lots in September, responding in droves

to the most generous incentives," stated Dr. Liu.

About Edmunds.com

True Cost of Incentives(SM) (TCI(SM))

Edmunds.com's TCI(SM)

is a comprehensive monthly report that measures automobile manufacturers'

cost of incentives on vehicles sold in the United States. These costs are reported on a per vehicle basis for the industry

as a whole, for each manufacturer, for each make sold by each manufacturer

and for each model of each make. TCI

covers all aspects of manufacturers' various incentives programs (except

volume and similar bonus programs), including dealer cash, manufacturer

rebates and consumer savings from subvented APR and lease programs (including

subvented lease residual values used in manufacturer leasing programs). Data for the industry, the manufacturers and

the makes are derived using weighted averages and are based on actual

monthly sales and financing activity.

About Edmunds.com,

Inc.

Edmunds.com is the

premier online resource for automotive information. Its comprehensive

set of data, tools and services, including Edmunds.com True Market Value(R)

pricing, is generated by Edmunds.com Information Solutions and is licensed

to third parties. For example,

the company supplies over 800,000 pages of content for the auto sections

of AOL and NYTimes.com, provides weekly data to Automotive News and

delivers monthly data reports to Wall Street analysts.

Edmunds.com was named "best car research" site by Forbes

ASAP, has been selected by consumers as the "most useful Web site"

according to every J.D. Power and Associates New Autoshopper.com Study(SM)

and was ranked first in the Survey of Car-Shopping Web Sites as reported

by The Wall Street Journal. The

company is headquartered in Santa Monica, Calif. and maintains a satellite

office outside Detroit.

SOURCE Edmunds.com

CO: Edmunds.com

ST: California

SU: SVY

Web site: http://www.edmunds.com

### Press Release

#####################

New

Valuation Firm—Vista Consulting Group

Rick Daubenspeck,

ASA and Bill Carlson have recently established Vista Consulting Group,

Inc. which is an independent appraisal/advisory firm with more than

25 years of experience in the leasing industry. Vista's unique and broad

experience enables them to focus their efforts from the internal equipment

manager’s perspective as well as that of the equipment appraiser in

order to develop reliable and objective opinions. Vista personnel have

excelled as both equipment managers and appraisers, and they provide

an understand the challenges that equipment lessors are currently facing.

Vista's independence allows them to provide a wide range of services

while enabling their clients to obtain the service they desire in a

cost-effective manner.

Services include

equipment valuations, site inspections, industry and market research,

leasing consulting support and industry studies. For more information

check out their website at www.vistacg.com.

Sites of Reference:

CONTACT:

Rick Daubenspeck,

ASA

Vista Consulting

Group, Inc.

Phone Number: (508)

345-0045

Fax Number: (508)

342-7333

E-mail: rick@vistacg.com

## Press Release

#########################

Equipment

Financing Group, Inc. signs with PayNet, Inc.

Equipment Financing

Group, Inc., Fresno, Ca, has entered into an agreement with PayNet,

Inc. PayNet is a leading provider of web based business credit information

services. This will provide EFG with a secondary source of business

credit information. It will enable EFG along with “Liquid Credit Scoring”

to enhance the companies scoring matrix. For additional information

on this program please contact Morgan Bennett.

mbennett@efginc.net

Phone: 888-808-3065

ext #15

Fax: 888-808-5005

Equipment Financing

Group, Inc. has shown a 131% increase in lease revenue year to date

compared to the same period in 2003. This increase was attributed to

lower cost of funds, new Corp-only programs, and additional deferred

payment options being offered to our sources.

EQUIPMENT FINANCING

GROUP, INC.

Equipment Financing

Group, Inc. (www.efglease.com)

is a leading small ticket funding source located in Fresno California.

The company operates additional offices in Los Angeles, Michigan, and

Pennsylvania. Started in 1992 the company has shown tremendous growth

in the last 12 months. Equipment Financing Group, Inc. also plans to

launch its new automated application site on October, 25th.

### Press Release

######################

------------------------------------------------------------------------

News

Briefs---

Mortgages rates around

U.S. up this week

http://www.boston.com/business/articles/2004/10/07/

mortgages_rates_around_us_up_this_week/

NVCA Q3 Venture-Backed

IPOs

http://www.nvca.org/pdf/IPOQ32004.pdf

More Job Cuts Set

by AT&T; Total to Hit 20% of Staff

http://www.nytimes.com/2004/10/08/business/

Bank of America to

Cut 4,500 More Jobs

http://www.nytimes.com/2004/10/08/business/

Consumer Borrowing

Declines for First Time in Nine Months

http://www.nytimes.com/2004/10/08/business/

Chip-maker AMD reports

higher third-quarter sales

http://www.mercurynews.com/mld/mercurynews/news/9861641.htm

Interest in Election

Helps Fuel Growth in Accessing Internet for News, According to Latest

Harris Poll

http://www.prnewswire.com/cgi-bin/stories.pl?ACCT=104&STORY=/

www/story/10-07-2004/0002268398&EDATE=

---------------------------------------------------------------------------

California

Nuts Briefs---

The recall also-rans

-- where are they now?

Most are still involved,

in their own way

http://www.sfgate.com/cgi-bin/article.cgi?file=/c/a/

Team Arnold hitting

the road to campaign against Props. 68, 70

http://www.sfgate.com/cgi-bin/article.cgi?file=/

chronicle/archive/2004/10/06/BAG9794BPO1.DTL

-------------------------------------------------------------------------------

“Gimme

that Wine”

Tim Mondavi Leaves

as an Employee of Robert Mondavi Corp., Following His Brother's Resignation

http://www.winespectator.com/Wine/Daily/News/0,1145,2620,00.html

Jean-Michel Valette

Named President & Managing Director of Robert Mondavi Winery

http://home.businesswire.com/portal/site/google/index.jsp?

ndmViewId=news_view&newsId=20041006005909&newsLang=en

Wine, Women and a

Pair of Buddies “Sideways”-Eric Asimov

http://www.nytimes.com/2004/10/06/dining/06POUR.html

Direct shipping finds

friends for Supreme date

http://www.sfgate.com/cgi-bin/article.cgi?file=/chronicle/archive/

Living la vida vino

More winemakers of

Mexican heritage are making their mark on the wine world

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2004/

How to drink sweet

wine

http://www.jancisrobinson.com/winenews/2004/winenews1002.html

This

Day in American History

1775

–General George Washington, a slave owner himself in Virginia, convinces

the Continental Army to bar slaves and free blacks from Continental

Army as regular soldiers in a move to appeaser Southern states and recruit

more soldiers, plus financial contributions. As the Revolutionary

War spread through every region, those in bondage sided with whichever

army promised them personal liberty. The British actively recruited

slaves belonging to Patriot masters and, consequently, more blacks fought

for the Crown. In 1777, with

the war going badly and so many blacks joining the British, General

Washington allowed blacks to fight,

but not become regular soldiers. During the Revolution many African

Americans also sided with the British. Particularly for enslaved blacks

in the South, there was little guarantee that they would have any more

freedom under the rule of the colonists than they did under the rule

of the British. Indeed, in November 1775 Lord Dunmore, the royal governor

of Virginia, issued a proclamation that any slaves who fled to his lines

and assisted in suppressing the revolt would be given their freedom.

This was a more enticing offer than the colonists made, as the Southern

colonies generally would not recruit slaves to fight. Over 2,000 slaves

joined Dunmore and became his Ethiopian Regiment. When the fighting

moved South in 1779, thousands of slaves ran away from their masters

and fled to the British lines. There they were often pressed into service

as laborers, building fortifications around Charleston and Savannah.

http://memory.loc.gov/ammem/aaohtml/exhibit/aopart2b.html

http://www.pbs.org/wgbh/aia/part2/2narr4.html

http://www.nyfreedom.com/blacks.htm

1728-

birthday of Rodney Caesar,(OS). Signer of the Declaration of Independence

who cast a tie-breaking vote. Born near Dover, DE, he died June 26,

1784. Rodney is on a quarter issued by the US Mint in 1999, the first

in a series of quarters that will commemorate each of the 50 states.

1777-After the second Battle of Bemis Heights, near Saratoga, NY where the Americans routed a force of some 1500 British, Gen. Bourgoyne retreated

to Saratoga.

1862- Union and Confederate forces fought at Perryville, Kentucky in a one-day battle that repulsed the South's attempt to bring that border state into

the Confederacy.

(lower half of: http://memory.loc.gov/ammem/today/oct08.html

)

1865-

Earthquake in Santa Cruz Mountains (6.5 to 7.5, various ratings)

http://www.sfmuseum.org/hist4/68inter.html

http://www.eqe.com/publications/lomaprie/seismici.htm

http://pangea.stanford.edu/~segall/1868_abs.html

http://www.fostertravel.com/CACRUZ.html

http://www.santacruzpl.org/history/tourism/convent.shtml

http://www.insurance.ca.gov/EXECUTIVE/CatSeries/Earthquake/Earthquake6.htm

1869

-- Inventor J(ames) Frank Duryea born Washburn, Illinois (1869). He

and his brother, Charles, invented the first automobile to be actually

built and operated in the US

http://inventors.about.com/library/inventors/blDuryea.htm

http://www.francesfarmersrevenge.com/stuff/archive/monster/

1871-The

great fire of Chicago began, according to legend, when Mrs. O’Leary’s

cow kicked over the lantern in her barn on DeKoven Street. The fire

leveled 3 ½ square miles destroying 17,450 buildings and leaving 98,500

people homeless and about 250 people dead.

Financially, the loss was $200 million..

http://memory.loc.gov/ammem/today/oct08.html

1871

-- As Chicago blazes away

some 200 miles to the south an even deadlier fire rips through Peshtigo,

Wisconsin, completely razing the town and killing 600 of its inhabitants.

Over a million acres of forest are also consumed. Considered to be the

worst fire in the history of the United States.

http://www.fact-index.com/p/pe/peshtigo__wisconsin.html

http://www.iswonline.com/archives/eclectic/peshtigo.shtml

1890-Birthday

of Edward V. Rickenbacker, American aviator, auto race and hero, born

at Columbus, OH. Died July 23, 1973 at Surich Switzerland.

1893-

birthday of Clarence Williams, Plaquemine, LA, penned Royal Garden Blues,

Gulf Coast Blues, I Aint’ Gonna Give Nobody None of my Jellyroll.

1896.-

Dow Jones began reporting an average of the prices of 12 industrial

stocks in the Wall Street Journal

on this day. In the early years, these were largely railroad stocks.

In 1928 Mr. Dow expanded the number of stocks to 30, where it remains

today. Today, the large, frequently-traded stocks in the DJIA represent

about a fifth of the market value of all US stocks. 1904-Birthday of

great song writer W. C. Handy, Jr.,Clarksdale, MS

1917

Drummer J.C. Heard birthday

http://www.harlem.org/people/heard.html

1918-Sergeant

Alvin C. York, while in the Argonne Forest, France, and separated from

his patrol, killed 20 enemy soldiers and captured a bill. 132 enemy

soldiers and 35 machine guns. He was awarded the US Medal of Honor and

French Crois de Guerra. Ironically, York had petitioned for exemption

from the draft as a conscientious

objector, but was turned down by his local draft board. A movie was

made of this event starring Gary Cooper.

1924-

In New York City, the National Lutheran Conference banned the playing

of jazz music in the local churches.

1930-Birthday

of baritone sax player Pepper Adams, Highland Park, IL

1933-Coit

Tower dedicated in SF, a monument to firefighters .

http://www.guide-to-san-francisco-hotels.com/attractions/coit-tower.html

http://www.danheller.com/sf-coittower.html

http://www.talamasca.com/~cuccia/photos/coit/index.html

1934-

Faith Riaggold birthday, Afro-American artist. Much of her art combines

the feminist viewpoint and the black liberation movement. She changed

her style from being based on white male European to African influences.

She also started to work in fabric and soft sculptures, sometimes

depicting women from Harlem with open mouths because black women need

to find their voices. She has been criticized by some white critics

and especially by black male artists who claim her work should be classified

as crafts, not art. In 1984,

she became professor of art at the University of California, San Diego.

1938-For

the Saturday evening Post cover for this date, Norman Rockwell chose

to portray himself in quandary he frequently had to grapple with---trying

to come up with a cover for the Post on deadline.

1941

- The Benny Goodman Orchestra recorded "Buckle Down Winsocki",

with Tom Dix as featured vocalist, on the Columbia label.

1948-Winchell’s

Donut House Established. Since the grand opening of its first donut

house in Temple City, CA, Winchell’s has offered warm and fresh donuts

from it sown specialty mixes featuring the finest ingredients. Winchell’s

even invented the apple fritter in 1964! For more than 50 years, Winchells

donuts have been an American favorite,

1948-

Facing only thirty batters, Indian rookie pitching sensation Gene Bearden

five-hits the Braves for a 2-0 victory in front of 70,000 fans in Cleveland.

The Tribe takes a 2-1 World Series game lead.

1950-. “Your Hit Parade” premiered on TV. It began as a radio show in 1935. When it finally made it to TV, the format was simple: the show’s cast performed the week’s top musical hits. To keep viewers interest, since many of the same songs appeared wieldy, eye-catching production sequences were created. “YHP” was the starting point for many famous choreographers and dancers, including Tony Charmoli, Ernie Flatt, Peter Gennaro and Bob Fosse. Regulars included Dorothy Collins, Eileen Wilson, Snooky Lanson and Sue Bennett. The show was overhauled many times and switched networks before leaving the air in 1959. A summer revival in 1974 was short-lived. The original sponsor was a

cigarette company.

1950-

“Frank Sinatra Show” premiered

on television. Mr.. Sinatra’s first series was a musical variety show

featuring regulars Erin O’Brien and comic Ben Blue. However, during

its last season this show was cut from an hour to 30 minutes as it could

not compete with “The Texaco Star Theater,” the most popular show of

the time. This was during the period of his decline as a singer and

personality.

1953-

Birmingham bans Jackie Robinson's Negro-White All-Stars from playing

in the city. The white players are dropped from the team as Robinson

gives in to city officials.

1956-

Don Larsen of the New York Yankees pitched the only perfect game in

a World Series history. He defeated

the Brooklyn Dodgers, 2-0, in Game 5. Larson threw 97 pitches, faced

27 batters, struck out 11 and lead the Bronx Bombers to a 2-0 shutout

of the Brooklyn Dodgers in Game 5 of the Fall Classic. Pinch hitter

Dale Mitchell, batting for Dodgers pitcher Sal Maglie, was called out

on strikes for the last out. Game 6 Brooklyn beat the Yankees, 1-0 at

Brooklyn, and the series was tied. Game 7, also at Brooklyn,

the Yankees won 9-0.

Game 7 at Brooklyn

October 10, 1956

Team

1 2 3 4 5 6

7 8 9 R H E

NY 2

0 2 1 0 0 4

0 0 9 10 0

BRO

0 0 0 0 0 0

0 0 0 0 3 1

1956—Top

Hits

Honky Tonk (Parts 1 and 2) - Bill Doggett

Canadian Sunset - Hugo Winterhalter and Eddie Heywood

The Green Door - Jim Lowe

Hound Dog/Don’t Be Cruel - Elvis Presley

1959-

In Game 6, the Dodgers defeat the Go-Go Sox, 9-3, to win the World Series.

Chicago's speed and quickness weren't enough to overcome Los Angeles

hitting and pitching.

1961

- New York Yankees’ pitcher Whitey Ford set the World Series record

for consecutive scoreless innings, while extending his streak to 32

in a 7-0 shutout of the Cincinnati Reds in Game 4. Ford added one more

scoreless inning in the 1962 World Series to bring that consecutive

scoreless inning total to 33. The previous record was 29-2/3 innings,

held by Babe Ruth.

1961

- Green Bay Packer’s running back/kicker Paul Hornung set a Packer records

for points scored in a game: 33. Hornung scored 33 points: four touchdowns,

six extra points and one field goal. (The Packers beat the Baltimore

Colts to, 45-7.)

1964—Top

Hits

Oh, Pretty Woman - Roy Orbison

Do Wah Diddy Diddy - Manfred Mann

Dancing in the Street - Martha and The Vandellas

I Guess I’m Crazy - Jim Reeves

1966

-- A concert featuring Joan Baez, Mimi Fariña, Grateful Dead, Quicksilver

Messenger Service, Ed Keating, and Don Duncan, to raise money for the

Congressional District Write In Committee for Phil Drath and Peace.

http://www.richardandmimi.com/posters.html

1974

- "Then Came You", by Dionne Warwicke and The Spinners, went

solid gold this day. While the editors are poring over the proper spelling

of her name, might we add that due to some superstitious feeling having

to do with astrology, the former Ms. Warwick changed her name for good

luck to Warwicke. It apparently worked. When she went on her own, she changed her name back to the original

spelling. Tunes like, "I’ll Never Love This Way Again", "Deja

Vu" and hits with Johnny Mathis, Luther Vandross and some friends

made it OK to be just Dionne Warwick again.

1975-In the first basketball game played at the Louisiana Superdome in New Orleans, the San Antonio Spurs of the American Basketball Association defeated the Atlanta Hawks of the National Basketball Association, 109-107,

in an exhibition.

1977-Billy

Joel's breakthrough album, The

Stranger, enters the Billboard album chart.

1979

- "Sugar Babies" opened at the Mark Hellinger Theatre on Broadway.

The star of the hit show was also making his debut on the Great White

Way. Mickey Rooney, who had been acting since the 1930s, once again

delighted one and all with his performance.

1984 - Anne Murray won the Country Music Association’s Album of the Year Award this day for "A Little Good News". Murray was the first woman to

win this award.

1986- The first North American Congress on the Holy Spirit and World Evangelization opened in New Orleans. It drew 7,000 leaders from 40 denominations, and stressed the part which the charismatic experience plays

in evangelization.

1987-Chuck

Berry is awarded a star on the Hollywood Walk of Fame. His film biography,

"Hail, Hail Rock and Roll" premiers that night.

1987

- Unseasonably cold weather prevailed from the Upper Mississippi Valley

to the southeastern U.S. Thirty cities reported record low temperatures

for the date, including Madison WI with a reading of 22 degrees. The

low of 28 degrees at Evansville IN was the coolest of record for so

early in the season. Hot weather continued in the southwestern U.S.

Phoenix AZ reported a record high of 104 degrees and a record tying

116 days of 100 degree weather for the year. Tucson AZ established an

all-time record with 72 days of 100 degree weather for the year.

1989

- Morning lows in the 20s were reported from the Northern Plains to

the Upper Great Lakes. International Falls MN and Marquette MI reported

record lows of 22 degrees. Unseasonably warm weather prevailed in central

California as the Oakland Athletics won the American League pennant.

San Luis Obispo CA reported a high of 99 degrees.

1990-Native

American Day was celebrated in South Dakota in place of Columbus Day.

1991

- A U.S. District Court in Anchorage, Alaska, approved a $900-million

settlement (annual payments stretched over ten years) with Exxon Shipping

Company (Exxon Oil Corporation) for the Valdez oil spill. Exxon also

agreed to pay a $250-million fine, which would reimburse the state of

Alaska and the U.S. for the costs of cleanup, damage assessment and

litigation.

1992-The

U.S. Postal Service announces a commemorative stamp booklet that includes

rock legends Bill Haley, Buddy Holly, Elvis Presley and Ritchie Valens

plus RandB stars Clyde McPhatter, Otis Redding and Dinah Washington.

1997-Center Adam Oats of the Washington Capitals scored three goals and two assists to move past the 1,000 mark in career NHL points. Oates finished the night with 1,004 points as Washington defeated the New York Islanders,

6-3.

---------------------------------------------------------------------------

World Series Champions

This Date

1919--Cincinnati

Reds

1922---New

York Giants

1927--

New York Yankees

1930

- Philadelphia Athletics

1939

- New York Yankees

1940

- Cincinnati Reds

1959

- Los Angeles Dodgers

Baseball

Poem

Baseball Canto

by Lawrence Ferlinghetti

Watching baseball

sitting in the sun

eating popcorn

Rereading Ezra Pound

and wishing Juan

Marichal

would hit a hole

right through

the Anglo-Saxon tradition

in the First Canto

and demolish the

barbarian invaders

When the San Francisco

Giants take the field

and everybody stands

up to the National Anthem

with some Irish tenor's

voice

piped over the loudspeakers

with all the players

stuck dead in their places

and the white umpires

like Irish cops

in their black suits

and little black caps

presses over their

hearts

standing straight

and still

like some funeral

of a blarney bartender

and all facing East

as if expecting some

Great White Hope

or the Founding Fathers

to appear on the

horizon

like 1066 or 1776

or all that

But Willie Mays appears

instead

in the bottom of

the first

and a roar goes up

as he clouts the first one into the sun

and takes off

like a

foot runner from Thebes

The ball is lost in the sun

and maidens wail

after him

but he

keeps running

through the Anglo-Saxon epic

And Tito Fuentes

comes up

Looking like a bullfighter

in his tight pants

and small pointed shoes

And the right

field bleachers go mad

With Chicanos

and blacks and Brooklyn beer drinkers

"Sweet Tito! Sock it to heem, Sweet

Tito!"

And Sweet

Tito puts his foot in the bucket

and smacks one that doesn't come back

at all

and flees

around the bases

like

he's escaping from the United fruit Company

as the

Gringo dollar beats out the Pound

and Sweet Tito beats it out

like he's beating out usury

not to mention fascism and anti-Semitism

And Juan Marchial

comes up

and the Chicano

bleachers go loco again

as Juan

belts the first fast ball

out of sight

and rounds first and keeps going

and rounds second and rounds third

and

keeps going

and hits pay-dirt

to the roars of the grungy populace

As some nut presses

the backstage panic button

for the tape-recorded

National anthem again

to save the situation

but he don't stop

nobody this time

in their revolution

round the loaded white bases

in this last of the

great Anglo-Saxon epics

in the Territorio

Libre of baseball

|

www.leasingnews.org |