Balboa Tagged for Stealing Corporate Secrets

- Balboa Capital Tagged for Stealing Corporate Trade

Secrets of TimePayment Systems

(E-Technology Changes Leasing Employment)

Introduction

- Part 1

TimePayment vs. Balboa Capital et. al.

- Part 2

Lessons/Law of Trade Secrets/If a salesperson!

What Lessor Can Do to Stop Trade Secret Theft

Balboa Capital Tagged for Stealing Corporate Trade

Secrets of TimePayment Systems

(E-Technology Changes Leasing Employment)

Lisa Gargiulo, formerly Gunville, flies from Massachusetts

and meets with Phil Silva at a California hotel

Phil Silva

Time Payment Corp v. Balboa Capital, 2013.CV 1:12-10463 (D. Mass. 2012).

Deposition of Lisa Gargiulo

(173 pages)

“Q. Who is Mr. Silva?

A. He is the president of Balboa.

Q. And what is the nature of your relationship with Mr. Silva?”

A. He is the president of my company.

Q. Is he your supervisor?

A. No Directly.

Q. Indirectly?

A. Indirectly. He is the president of the company.

Q. He recruited you to come to Balboa?

A. Yes.

Q. When is the first time Mr. Silva contact you about coming to join Balboa Capital?

A. I, off the top of my head, don’t know.

Q. How did he first contact you?

A. LinkedIn.

Q. What did he say when he first contacted you over LinkedIn?

A. That he wanted to speak to me.”

((1) page 35, Lisa Gargiulo deposition))

In Newport Beach, California:

Gargiulo, forwarded new downloaded files (that a TimePayment employee sent to her at her request) to Balboa Capital officers, Patrick Ontal (joined Balboa, 2007 as vice-president of indirect vendor sales) and Chief Operating Officer Robert “Rob” Rasmussen (since 2004) in early November, 2011, during her first week at the company. The report was conspicuously marked “Confidential Trade Secret Information Do Not Distribute.”

“Q. What is this document?

A. It's an e-mail from Patrick Ontal to Robert Rasmussen. I was cc'd on it and it was the Master2 water list.

Q. So it was forwarding from Mr. Ontal to Mr. Rasmussen the Master2 list that is Exhibit 5?

A. Correct.”

((page 89) Lisa Gargiulo deposition)

David J. Gallagher, Regnante, Sterio & Osborne

(http://www.regnante.com/Attorneys/David-J-Gallagher.html) represented both Lisa Gargiulo (formerly Gunville) as well as Balboa Capital. A settlement was reached which includes a “non-disclosure” agreement, so what follows in Monday’s edition comes from court documents and is written by Tom McCurnin, Leasing News Legal Editor.

Lisa Gargiulo deposition

http://www.leasingnews.org/PDF/DepositionSilvaOntalRasmussen_52013.pdf

Balboa Capital Tagged for Stealing Corporate Trade

Secrets of TimePayment Systems

[Part One of Two Parts]

By Tom McCurnin

Leasing News Legal News Editor

Case Provides Rare Insight into Corporate Raiding of Trade Secrets Uncovered by computer forensic intelligent Lawyer Who Used E-Discovery to Track Emails and Cell Phone Data to Sue Balboa Capital

Having taken a number of business divorces and trade secrets cases into litigation, I’m always amazed that some people actually covet trade secrets and worse still, don’t believe they will get caught. Today’s case provides a rare glimpse into the world of trade secrets, pulling back the curtain on how corporations steal trade secrets using private emails, how they are distributed, and how a computer forensic intelligent Boston lawyer discovered and prosecuted the theft using technology only recently available—called “E-Discovery,” which lifts data, texts, emails, and other activity from cell phones and laptops which the user thought they erased.

The article is long—way too long to put in a single edition of Leasing News. Therefore, this article will be in two parts. The first part will cover how a corporation solicited a key sales person, how that sales person, once employed, hacked into her former employer’s computer system to steal confidential vendor reports and financial data, and how, once the corporation obtained that data, how it was disseminated to the upper echelons of the corporation.

The second part will cover how the lawyer for TimePayment Systems, Burlington, Massachusetts, Kent Sinclair, discovered the theft using state of the art electronic discovery, recovered files and messages thought deleted from cell phones and laptops to discover emails and text messages which the employee thought she had erased. Armed with that information, Mr. Sinclair sought, and was granted, an injunction against Balboa Capital, Newport Beach, California, which ultimately forced Balboa to quickly settle the case.

I’ll also discuss how salespersons can legally solicit former customers, what companies can to protect themselves from such theft or if accused of theft, what companies can do to protect themselves from pesky trade secret lawsuits.

How you feel about trade secrets will affect your view of this case. Some people believe if a confidential customer list falls into their lap, it’s not theft of trade secrets. Other companies take the high road and will not allow new employees to bring over trade secrets. So before this article starts, let’s find out how you, the reader, feel about the theft of trade secrets.

HYPOTHETICAL

You are a leasing executive, interviewing or training a prospective or new employee. The employee tells you that he/she has list of his or her former employer’s customer and vendor list, contact information funding history, default rates, and interest rates and perhaps emails the list to you. The salesman’s former employer is one of your chief competitors. Is there any doubt that having this information would give you information not readily available in the open market place and give you a competitive advantage?

The list is conspicuously marked on all pages, “CONFIDENTIAL TRADE SECRETS: DO NOT DISTRIBUTE” and bears the name of your chief competitor.

You have two choices. Do you:

A. Congratulate the employee. He or she obviously has the skill set and aggression to make a good fit with your company, and you proceed to integrate that list to senior management and to your company’s contact list, with the idea to transition over those new contacts.

B. Express shock to the employee. He or she obviously misjudged you and your company. You would not want such a list, and would not hire an employee who stole trade secrets. You either elect not to hire the prospective employee or fire the new hire, because your company policies expressly forbid the taking of trade secrets from your company or any other company.

Now, that you’ve figured out where you and your company stand on the issue, lets plough into the case at hand, the facts of which are not far off from the hypothetical.

FACTS

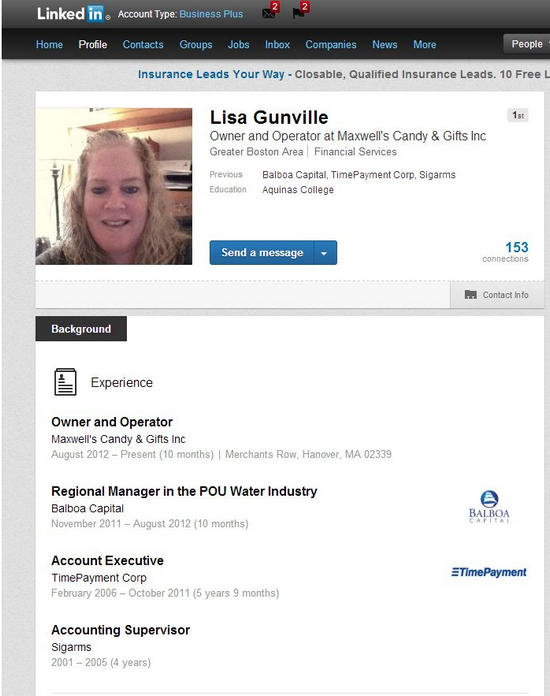

(Photo: LinkedIn)

Lisa Gargiulo as Employee of TimePayment Systems

Lisa Gargiulo aka formerly known as Lisa Gunville, Hull, Massachusetts, started to work at TimePayment Systems, Burlington, Massachusetts, as a salesperson in 2006, where she managed the dealers and secured equipment financings. She signed a confidentiality agreement in her employee handbook. She was trained by TimePayment Systems and promoted in 2009, to an account executive. She did about $18 million in sales for TimePayment Systems and was a top producer, according to court records.

TimePayment Systems takes corporate security seriously. None of the employee’s computers, including corporate laptops have functioning USB ports, so that reports may not be downloaded to an external disk, all employees sign confidentiality agreements and the downloading of reports is monitored carefully. All reports have a footer on them which states: “CONFIDENTIAL TRADE SECRETS: DO NOT DISTRIBUTE.” All such reports also bear the source of the information, TimePayment Systems.

Gargiulo Solicited by Balboa

Lisa Gargiulo was contacted via LinkedIn by Phil Silva, President of Balboa Capital (at Balboa since 2008) to see if she was interested in working for Balboa, one of several direct competitors of TimePayment Systems and the two arranged an interview date of October 23, 2011. Gargiulo flew out to California. But before she arrived, she began an unusual pattern of downloading historical data, customer lists, funding histories, credit information and financials of vendors from TimePayment’s sales software program to her personal laptop computer, and emailing them to herself. While at her hotel in Irvine, waiting for her interview, she downloaded more reports to her personal laptop. The next day, she had her interview with Mr. Silva.

In her deposition, Lisa Gargiulo denied telling Mr. Silva anything about the reports she downloaded the night before. But she was given an offer and she accepted on that same day.

She resigned from Time Payment Systems the following Monday, October 24, 2011. She was told by TimePayment Systems to bring in her laptop and that her server access would be cut off.

Gargiulo While an Employee of Balboa, Convinces TimePayment’s Salesman to Download Reports for Her

After she resigned, and while employed by Balboa, Gargiulo tried to access the TimePayment server four times and ascertained that she was indeed locked out. She convinced a co-worker, Jonathan McBride, to download a report, containing financial and contact data. McBride downloaded the report, containing 3,000 vendor names and financial data, and he sent the report to Gargiulo through McBride’s personal email account.

Gargiulo Distributes Report to Balboa Officers

Gargiulo, in turn, forwarded the report to Balboa Capital officers, Patrick Ontal (joined Balboa, 2007 as vice-president of indirect vendor sales) and Chief Operating Officer Robert “Rob” Rasmussen (since 2004) in early November, 2011, during her training week at the company. As stated, the report was conspicuously marked “Confidential Trade Secret Information Do Not Distribute.”

After Mr. Rasmussen received the report, he reviewed it in detail and in an email to Patrick Ontal he states:

“According to Lisa most of the accounts found on the first spreadsheet you received from her appear here too.”

So there must have been a prior report given to Mr. Rasmussen which is unaccounted for. In any event, the report’s contents was entered into Balboa’s database with the obvious intent to solicit business from TimePayments’ dealers and move TimePayment’s business from TimePayment Systems to Balboa Capital.

Balboa Issues Press Release About Gargiulo

Balboa issued the following press release after the vendor list reports were distributed to the officers:

“11/08/11 - Leading Point-Of-Use Water Industry Professional

Joins Balboa Capital

“IRVINE, California, November 8, 2011 - Balboa Capital Corporation, a leader in equipment financing in the United States, is proud to announce and welcome Lisa Gunville to the company’s Vendor Services Team as Regional Manager of its Point-Of-Use Water Division. Ms. Gunville joins Balboa Capital after a successful tenure at another financing company, where she was the top sales performer for five consecutive years and helped grow its point-of-use water division. Ms. Gunville prides herself on providing customers with results-based financing solutions along with the utmost focus, accessibility and personalized service.

“A recognized leader in the point-of-use water industry, Ms. Gunville has more than 26 years of experience that includes business development, business funding, vendor sales, and financial management and consulting.

“’I am very pleased to welcome Lisa to our Vendor Services Team,’ said Phil Silva, President of Balboa Capital, who adds, ‘She is an accomplished and successful industry professional, and her joining our team reinforces our commitment to the point-of-use water industry. Balboa Capital will continue to innovate and bring real value to manufacturers and dealers in this very important industry for us’.”

Balboa Solicited Jonathan McBride from TimePayment

As the reader might recall, Gargiulo enlisted Jonathan McBride to download secret reports in October. Mr. Silva, after Balboa had possession of the secret reports, contacted McBride on November 22, 2011, and requested him to join Balboa Capital. But there was one precondition, before doing so, Mr. Silva wantedspecific information from Mr. McBride, including a rate sheet for various types of TimePayment credits. It is unknown whether Mr. McBride complied with this request.

The Theft of Trade Secrets is Complete.

And so, as of late November, 2011, Balboa Capital had, through its employee Lisa Gargiulo, successfully raided TimePayment Systems computer system, had in its possession, at least two reports detailing customers, vendors, rates, financial data, default information and contact information. Balboa had obtained one of TimePayment’s leading employees, and was working on another. And as of that date, Balboa was so confident that the theft was undiscovered, that it issued a press release, lauding the acquisition of Ms. Gargiulo, then known as Gunville.

In the next portion of this article, the segment will discuss:

• How TimePayment Systems discovered the theft of its trade secrets using sophisticated state of the art e-discovery

• What TimePayment’s crafty lawyer, Kent Sinclair did to prosecute the case, including suing Balboa, Gargiulo, and McBride.

• What is the law on stealing and receiving trade secrets;

• What salesmen can legally do to solicit former customer without stealing trade secrets

• How companies can protect themselves from employees and competitors stealing their trade secrets

• What companies can do in the hiring process to protect themselves from trade secret lawsuits.

Tune in on Wednesday-- May 22, 2013!#+#!

Same Bat-Time--- Same Bat Channel!#+#!

TimePayment Systems v Balboa/Lisa Gargiulo Complaint

PDF/Complaint_5202013.pdf

Lisa Gargiulo deposition

PDF/DepositionSilvaOntalRasmussen_52013.pdf

TimePayment Systems v McBride Complaint

PDF/TimepaymentMcBrideComplaint_5202013.pdf

Copy of McBrideHearing http://www.leasingnews.org/PDF/JonathanMcBrideHearing_5202013.pdf

Tom McCurnin is a partner at Barton, Klugman & Oetting in Los Angeles, California.

Tom McCurnin

Barton, Klugman & Oetting

350 South Grand Ave.

Suite 2200

Los Angeles, CA 90071

Direct Phone: (213) 617-6129

Cell (213) 268-8291

Email: tmccurnin@bkolaw.com

Visit our web site at www.bkolaw.com

Previous Tom McCurnin Articles:

http://www.leasingnews.org/Conscious-Top%20Stories/leasing_cases.html

Lessons/Law of Trade Secrets/If a salesperson!

What Lessor Can Do to Stop Trade Secret Theft

By Tom McCurnin

Leasing News Legal News Editor

Balboa Capital Tagged for Stealing Corporate Trade

Secrets of TimePayment Systems

[Part Two Of Two Parts]

Phil Silva President Balboa Capital |

|

Patrick Ontal Vice-President, Sales Balboa Capital |

In the last edition of Leasing News, I described how Balboa Capital, Newport Beach, California, solicited and contacted its chief competitor’s leading employee, one Lisa Gargiulo formerly known as Lisa Gunville, to ply her away from TimePayment Systems, Burlington, Massachusetts. Gargiulo, after resignation and after acceptance of employment with Balboa Capital, Newport Beach, California, convinced her former co-worker at TimePayment Systems, one Jonathan McBride, to hack into the TimePayment computer system for her and surreptitiously email secret reports to her at Balboa Capital. The reports detailed thousands of customers and vendors, financial information, default rates, interest rates and contact names. *

All of these reports were disseminated to three of Balboa’s top officers. Balboa then issued a press release for the new hire, and started to work on getting the hacker to go over to the dark side.

In this part of the article, we learn how a computer forensic intelligent Boston lawyer for TimePayment Systems, Kent Sinclair, discovered the theft using sophisticated state of the art “E-Discovery.” Sinclair, in turn, prosecuted the case obtaining an injunction against Balboa, and favorable settlement for TimePayment Systems. Finally, this part of the article will discuss the law of trade secrets and how salesmen can legally contact former contacts, what companies can do to protect themselves from the theft of trade secrets, and for those companies hiring competitor’s employees, how they can insulate themselves from a pesky trade secrets lawsuit.

FACTS

In our last episode, Balboa Capital had completed the theft of the trade secrets and a key employee of its chief competitor. Now we will focus on how it was uncovered by computer forensic intelligent attorney Kent Sinclair.

TimePayment Systems Becomes Suspicious

TimePayment Systems became suspicious of Gargiulo and McBride and attorney Kent Sinclair examined Gargiulo’ s computer, and the computer activity of Gargiulo and McBride from October to December, 2011.

TimePayment noticed that right before she resigned, Gargiulo started downloading reports, including one such download the night before her interview with the president of Balboa Capital, Phil Silva. They also noticed that after she resigned, she tried to access the TimePayment Systems computer systems four times. Because she was close to TimePayment employee Jonathan McBride, they also looked at his download activity and noticed a large report downloaded and sent by his company email to his personal home email.

On December 23, 2011, TimePayment’s lawyer Kent Sinclair wrote Gargiulo a “cease and desist” letter. The letter informed Gargiulo that she had taken confidential trade secrets from TimePayment Systems, and demanded return of the information, as well as an inspection of her personal computers.

She immediately warned McBride that TimePayment Systems knew of the downloading and that he was going to get fired. In her deposition she stated:

“Q: Why did you warn [Mr. McBride] about the fact that he sent you a dealer list on October 25 was about to become public?

“A: Because I knew he was going to be fired.

“Q: Why did you know that?

“A: Because I would think that is a fireable offense that he sent that to me. “

(1)(page 31, Lisa Gargiulo deposition)

After the cease and desist letter, and while employed at Balboa, she also deleted her text messages to and from Mr. McBride (destruction of evidence), and then emailed Balboa Capital President Phil Silva about the cease and desist letter. Mr. Silva engaged counsel to handle the issue. In her deposition, Gargiulo implausibly denies discussing the stolen trade secrets with her boss Phil Silva on December 23 when discussing the cease and desist letter:

“Q: You’re speaking with the president of your employer, Balboa Capital on the phone about a cease and desist letter that makes specific allegations about [your] misappropriation of trade secrets, it is your testimony that the subject of whether or not you actually took confidential information form TimePayment never came up in the conversation?

“A: It could have. I cannot remember.”

(1) (Page 42, Lisa Gargiulo deposition))

Whether or not she took the reports would have been the first thing one would have discussed. Unless of course, Mr. Silva already had them. Certainly, Messrs. Patrick Ontal, vice-president of sales, and Chief Operating Officer Robert “Rob” Rasmussen had them, that much we do know.

While Gargiulo and Balboa Capital attempted to argue that the customer list was meaningless and “public knowledge,” that argument quickly went down the drain, with this deposition exchange between Gargiulo and TimePayment’s lawyer, Kent Sinclair:

“Q: You would agree with wouldn’t you that knowing the value of a competitor’s funded values is useful information to have?

“A: Yes, if it’s accurate.

“Q: You were well paid to develop those relationships?

“A: Yes

“Q: But you think they are yours for the taking?

“A: I think it was the easy way for me to contact these people…I could have found other ways.

“Q: But you decided to take the easy way?

“A: Yes

(1)(Page 75, Lisa Gargiulo deposition)

McBride resigned from TimePayment Systems in February 3, 2012, and sought employment from Balboa, but by that time, he was too hot of a commodity for Balboa to hire.

TimePayment filed suit against McBride two weeks later. The complaint is linked below. It was mediated and settled. TimePayment then filed suit against Balboa on March 12, 2012, and the complaint is also linked below.

(2)

TimePayment Systems sought a Temporary Restraining Order and Preliminary Injunction against Balboa, which was initially opposed by Balboa (on grounds that the information was readily available to anyone). However, once Gargiulo and McBride were deposed, TimePayment had Balboa cold. The injunction was stipulated to and case was settled on May 2012, just three months after it was filed. The settlement terms were confidential except for a permanent injunction against Lisa Gargiulo, McBride, and Balboa (3).

The settlement likely included the payment of TimePayment’s attorney and forensic expert’s fees, a permanent injunction prevent Balboa from contacting those names on the list, deletion of the names on the McBride reports, and a stiff six figure damage award. The original complaint was for a minimum of $200,000 plus attorney fees. (3)

The settlement includes a “non-disclosure” agreement, so what there is to go on are the facts from documents submitted that remain unsealed.

In Balboa Capital’s response to TimePayment, there were “Defendant without knowledge sufficient to either admit or deny allegations” over 68 times, denies 50 others but no actual response, and stipulated to authenticity of all the exhibits. (4)

The TimePayment presentation with over 30 exhibits in support of preliminary injunction, including the deposition of Lisa Gargiulo was quite compelling, but the main blow was the forensic expert of retrieving documents and email, with exhibits on all that Mr. Sinclair discovered from Gargiulo’s computer. (5)

In addition, the expertise of TimePayment attorney Kent Sinclair brought the case to a very speedy conclusion. Gargiulo and Balboa parted ways a few months later. So ultimately, what did she achieve by stealing those trade secrets? Nothing, except cost Balboa Capital a boatload of money.

(Lisa Gunville LinkedIn.com)

THE LAW OF TRADE SECRETS

Most States have enacted the Uniform Trade Secrets Act, which make it illegal to steal or possess the trade secrets of another company. What is a trade secret? A trade secret is any information that possesses economic value to the holder and is kept secret. While Gargiulo and Balboa Capital argued that customer lists, approval rates, financials, default rates and other information was either public or had no value, that argument is belied by Balboa’s attempt to secure it and common knowledge that such information would give a company a competitive advantage. There is also no question that TimePayment Systems vigorously tried to keep the information secret. So, I think it goes without question that the various reports given to Balboa were trade secrets.

Violation of the act can subject the thief to compensatory damages, lost profits, royalties, punitive damages, and even attorney fees. What if, the only appropriate legal target is the disloyal ex-employee, and you cannot prove any specific market harm caused by the misappropriation? Just because the target company cannot prove lost profits or any unfair gain by a competitor doesn’t mean it hasn’t suffered damage by the misappropriation. One federal appeals court has determined that the appropriate measure of damages in such a case was $735,000! Hallmark Cards v Murley No. 11-2855 (2013) In another case, Best Buy was tagged for $22 million in damages.

In additional to severe civil exposure, the taking of trade secrets is a crime. In one of California’s most famous trade secret criminal cases, U.S. v Noral, CR: 00237-EMC-1 (2013) just came back from the jury in April, 2013, and an executive recruiter was found guilty of hacking into his former employer’s computer system and obtaining customer lists, and is facing a five year prison sentence.

This raises the question of how a salesperson can exit a company without violating the Uniform Trade Secrets Act. The answer is that the salesperson does not have to get a lobotomy, he or she can make contact with all the contacts the employee had before, assuming there is not a non-solicitation agreement. The violation is taking the list, not the contact.

The company hiring a salesperson from a competitor should adopt certain policies which will insulate it from liability. First, new employees should be instructed to be “good leavers” from their old company –meaning that they should not take anything with them. Second, because offer letters can become litigation exhibits, the offer letter should instruct new hires not to bring any trade secrets of the former employer. Third, employee handbooks should contain similar provisions which prohibiting the possession of trade secrets. Finally, having such policies will enable the company to fire the offending employee immediately. I was curious why Balboa kept Ms. Gargiulo on another 8 months after her theft of trade secrets was uncovered.

While these policies are no guaranty that a trade secret lawsuit will not be filed, the policies will certainly lower the exposure of the company hiring a competitor’s salesperson.

LESSONS OF THE TIMEPAYMENT CASE

What are the lessons here? Well, it depends on the reader’s status.

If the Reader is a Salesperson:

First, if you think you are not going to get caught taking trade secrets, think again. Computer and cell phone forensic discovery is well developed, evidenced by the great job TimePayment’s lawyer did. If the reader is interested in how this is done, I authored an article on the subject two months ago, and the link is at the end of this article.

Second, there are serious consequences to theft of trade secrets. Do you think that downloading a confidential report is worth a few thousand dollars? Both salespersons were sued personally. Her employment at Balboa, for which she sold her soul, lasted only a few months. She now works for a candy store. Was it worth it?

Third, what does taking trade secrets really say about you, as an employee? Essentially you are stealing your employer’s property, a thief. Is that what you want your reputation to be? Really?

Fourth, there are legal ways to do this. The law does not require the salesman to get a lobotomy, and the salesman is free to contact all his or her prior contacts. I can’t see any reason why contacts information in your cell phone would not be portable. Just don’t steal paper.

The bottom line for salespersons is not to take short cuts. Don’t steal from your employer.

For the Lessor Trying to Stop Trade Secret Theft

First, follow TimePayment’s protocol and make it as difficult as possible to download reports. Some of the things a company can do include:

• Disable all USB ports on work stations, so all downloading had to be done by traceable email.

• Log and analyze all downloading activity.

• Use Microsoft Exchange to synchronize remote devices to the company server, so the company may read the employee’s email, even if deleted from the employee’s device.

• Convert all reports to pdf files so they can “read only” and encrypted with passwords. If passworded, would Balboa’s officers have still opened the file? I hope not.

• Make all terminals “dumb,” e.g., Windows is not loaded onto work stations, and instead, the workstations logon to the server and the employee runs Windows from the server location. This is what the defense department does.

• All employees should sign a confidentiality agreement.

• If the company has a BYOD policy, then consider giving that policy a fresh look. An article I drafted a few months ago is linked below

• Consider using a non-compete or non-solicitation agreement, but with national accounts, and some courts unwilling to enforce them on a national level, this may have limited utility. I’m not a big fan of these restrictions, because they enslave employees.

Second, follow TimePayment’s example and be aggressive in court. They really went after their two employees and Balboa, which will teach your existing employees and your competitors that there are big consequences to stealing trade secrets.

The bottom line to companies wanting to protect trade secrets is that the company must take certain steps to make them secret, and those steps will help the company uncover trade secret theft quickly.

If The Reader is a Company Which Wants to Raid a Competitor, Legally or Otherwise:

First, if offered confidential trade secret information by a prospective employee, run! If a prospective employee has stolen trade secrets from his or her old company, it is likely that that the employee will steal them from you, too.

Second, obtaining confidential trade secret information is a big deal, and could subject the company to compensatory damages, punitive damages, lost profits, royalties, and attorney fees. Is your company willing to take that risk for a few thousand contacts? I hope not.

Third, insulate the company from liability by not only making theft of trade secrets unacceptable, document the company’s policy in offer letters and employee handbooks. Of course, this presumes that your company wants to take the high road.

Fourth, tracing the theft of confidential information has suddenly become easier with the advent of computer forensic firms and smart phones. Companies should have in place strict policies regarding “Bring Your Own Mobile Device” (“BYOD”).

Fifth, if an allegation is made, and it turns out to have merit, do what Balboa did and quickly settle the case with a confidential settlement, hopefully before suit is filed and depositions are taken and made public.

Sixth,, putting aside the practicalities of getting caught, receiving stolen trade secret reports is wrong. Is that really the culture of your company? Do you actually want that kind of reputation amongst customers, vendors, and peers? I hope not.

---

(Coda: Boston attorney was so successful in this case, that he went to work for one of the country’s leading computer forensic firms, Stroz Frieberg, as a managing director:

www.strozfriedberg.com/category/professional_bio_id=214 )

-

Lisa Deposition

PDF/DepositionSilvaOntalRasmussen_52013.pdf

-

a. McBride Coplaint

b. Balboa Capital Complaint

PDF/TimepaymentMcBrideComplaint_5202013.pdf

PDF/TimepaymentMcBrideComplaint_5202013.pdf

c. Balboa Mediated

http://www.leasingnews.org/PDF/Mediation_5222013.pdf

d. McBride Mediated

http://www.leasingnews.org/PDF/McBrideSettlement_5222013.pdf

e. Stipulation of Dismissal

http://www.leasingnews.org/PDF/Stipulationdismissal_5222013.pdf

- Permanent injunction—Stipulated

PDF/PermanentInjunctionGargiulo_5222013.pdf

- Balboa Answers Allegations--Denies most

PDF/BalboaAnswersAllegations_5222013.pdf

- Forensic expert affidavit

PDF/Forensicsexpertaffidavit_5222013.pdf

*Balboa Capital Tagged for Stealing Corporate Trade

Secrets of TimePayment Systems—Part 1

By Tom McCurnin, Leasing News Legal Editor

archives/May2013/5_20.htm#balboa_stealing_secrets

Introduction

Balboa Capital Tagged for Stealing Corporate Trade

Secrets of TimePayment Systems

(E-Technology Changes Leasing Employment)

archives/May2013/5_17.htm#balboa_stealing

Related:

Does Your Company Have a Policy for

B.Y.O.D. Cell Phone Use

archives/May2013/5_17.htm#cellphone

E-Discovery Catches Up with Mobile Devices

/Apr2013/4_12.htm#ediscovery

Tom McCurnin is a partner at Barton, Klugman & Oetting in Los Angeles, California.

Tom McCurnin

Barton, Klugman & Oetting

350 South Grand Ave.

Suite 2200

Los Angeles, CA 90071

Direct Phone: (213) 617-6129

Cell (213) 268-8291

Email: tmccurnin@bkolaw.com

Visit our web site at www.bkolaw.com

Previous Tom McCurnin Articles:

http://www.leasingnews.org/Conscious-Top%20Stories/leasing_cases.html