|

June Update --Leasing Schemes’ Court Cases

HL Leasing, Fresno, Palm Desert, California

John Otto, the alleged perpetrator of the Ponzi scheme, where money was lent by investors for a rate of return for leases that did not exist, committed suicide. Corporate officers were taken to a class action suit in Fresno where a jury ruled for a judgment against Heritage Leasing, MAC dba Heritage Leasing, Kathleen Otto (wife of John where bookkeeping was maintained at their house in Palm Desert (and Air Fred (small airline where they leased planes) for $114.5 million, plus $46.5 million against both Dan Ramirez and Andy Fernandez; $720,000 on top of that against Dan Ramirez. Ara Jabagchourian and Aron K. Liang of Cotchett, Pitre & McCarthy, LLP and Donald Fischbach of Dowling, Aaron & Keeler, Inc. began search for the assets. At this time Appellate briefs have been filed for Kathleen Otto's case. Ramirez has not his brief yet. He has "sold" his home to his wife even though Cotchett, Pitre & McCarthy had a lien on it. Kathleen Otto has sold her vehicles and transferred real estate before she filed personal bankruptcy. Leasing News continues to receive emails from victims who lost retirement, savings for college for their kids, their life savings, as well as were forced to seriously downsize their lifestyle. Previous Stories:

IFC Credit--Rudy Trebels

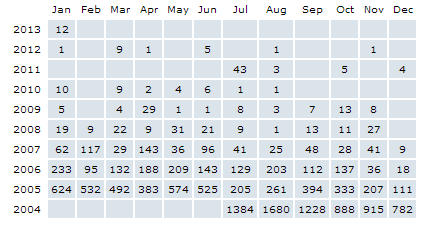

There are six court cases open regarding Rudy Trebels and IFC Credit Corporation. Readers tell me he is still playing golf in Florida, as well as vendors and lessees email Leasing News asking about doing business with him, finding stories written about him in the internet. An Omnibus Claims Objection Procedure was made on May 23, 2013 for the Chapter 7 Bankruptcy of IFC Credit Corporation field on July 27, 2009, seeking all claims: "Upon the Motion ('Motion') of David P. Leibowitz ('Trustee'), chapter 7 trustee for the estate of IFC Credit Corporation ('Debtor') and the following substantively consolidated entities: (a) Augusta Mill Acquisition LLC; (b) Augusta Real Estate Owner, LLC; (c) First Portland Corporation; (d) FP Holdings, Inc.; (e) FPC Leasing, LLC; (f) IFC Capital Funding III, LLC; (g) IFC Capital Funding VII, LLC; and (h) Pioneer Capital Corporation of Texas (collectively, the "SubCon Entities"), for an order establishing omnibus claims procedures, after due and proper notice, for cause shown, and statements made on the record, the Court being advised in the premises of the Motion..." In the only civil case, brought by CoActiv Capital Partners on September 30, 2009, suit is for over $2 million against IFC Credit Corporation, Morton Grove, Illinois, one of their funding groups, and the two main principals, claiming the officers committed fraud as individuals, specifically not paying off leases when the lessee terminated early, and knowing that the company was "essential insolvent" for almost a year. Since Element Financial has purchased CoActive Capital Partners where this will remain in the bankruptcy court is not known. Omnibus Claims Objection Procedure: Rudy Trebels Saga Previous stories: NorVergence

The Aberdeen Kid Yahoo blog has diminished. No change since filing of bankruptcy and no information on case in Lake Charles, Louisiana regarding Thomas N. Salzano, the mastermind behind the 10,629 leases with over 50 bank and leasing companies. It keeps being postponed. Previous Stories: Operation Lease Fleece--Sentencing

Mark McQuitty of CapitalWerks was sentenced for 24 months starting 12 noon, March 21, 2013, plus three years’ probation and other stipulations (1). He was given a Greyhound bus ticket and took a ride with other "low risk" prisoners to Reeves II Federal Penitentiary, Pecos, Texas.

Prison records show McQuitty as inmate 45507-112 51-White-M to get out 12-15-2014 (Could not find a “mugshot.”) Reportedly 47.2% is drug relational, and they have an excellent 18month alcohol and drug rehabilitation program. McQuitty blamed his problems on alcohol, he had four DUI's, and reportedly was anxious to get on first both with the sentencing after pleading and then anxious to start serving his time so he could get out. ISystems President Chant Vartanian signed a plea agreement with the United States Attorney's Office for the Central District of California, represented by Jennifer L. Waier, Assistant Attorney General, who has been the lead on all the "Fleece" cases. He was sentenced to one day and served his time, now out of jail: "JUDGMENT AND COMMITMENT by Judge Cormac J. Carney as to Defendant Chant Vartanian (1), Count(s) 1, Committed on Count 1 of the 3-Count Indictment to the custody of the Bureau of Prisons to be imprisoned for a term of 1 day, which the Court deems has been served in full. Pay $100 special assessment. Pay total fine of $6,000. 3 years supervised release under terms and conditions of US Probation Office and General Orders 05-02 and 01-05. Count(s) 2, 3, Government's motion, all remaining counts ordered dismissed. (mt) (Entered: 10/17/2012)" (2) Sarkus Vartanian, vice-president of ISystems Technology and Solutions, brother of Chant indictment was dismissed without prejudice. Reportedly he told assistant US Deputy Attorney Jennifer L. Waier he had cancer (it was never verified, according to court records and attorneys involved). It seems after the original plea agreements, the next series fought a plea agreement, several wanting jury trials, as does the one waiting now: Ziya Arik, CapitalWerks/Preferred Lease, sentencing before Judge Cormac J. Carney was continued again to October 1, 2013 for a trial. Reportedly one of the toughest salesmen who was rough on customers, competing with Brian Acosta, CLP, for accounts. There were many complaints about his “performance.” It appears the “Orange County Weekly” blames U.S. District court Judge Cormac J. Carney “light sentencings.” (3)

In Operation Fleece the sentencing has been light, even for the two with the longest terms, Adam Zuckerman 37 months Jim Raeder 12 months half-way house, one day jail (equals time served). Michael Scott Grayson got one day of probation although stole $1 million, according to the Orange County Weekly.[**Note: Carney officially sentenced Grayson to one day in prison, and then immediately considered it served.] (3) "Even Assistant United States Attorney Jennifer L. Waier--the prosecutor on Grayson's case and a person not known for advocating tough punishments if she can reach a quick plea bargain that saves her from trial work--argued in her sentencing brief that the interests of justice required that the businessman's huge theft demanded at least a "low end" guideline punishment of 30 months in a federal prison." (3) In my experience, the judge usually goes with the recommendation of the prosecuting attorney, who in these cases seem to give up against those fighting the charge. According to various attorneys over the course of events, it is the dollar figure that also factors into the sentencing, and most important, the creditors, lessors, banks, financing companies never showed up in the sentencing. They did in the Zuckerman case as well as Raeder, who is still not popular in Colorado where he was living (many telephone calls to Leasing News from his "fans.") The long waiting, evidently at the direction of Assistant United States Attorney Jennifer L. Waier may be considered a punishment, as they could not work in their profession (nor can they after being sentenced ever get involved in leasing, financing, or the like occupation) as well as those sentenced are all now felons---- and all on probation, most for three years. In addition, in the “Operation Lease Fleece,” they did not have “victims,” but business owners who participated in the deception of “sales/leasebacks” and/or equipment that did not exist. In reality, they were part of the scam. Not complaining they were not named, due to all the work that would be involved, but the point is the victims were the funders stupid enough to deal with Mark McQuitty and Jim Raeder. But then, there are many like them that funders know about today that they still do business with… Moreover, if the funders really were concerned, they would have gotten more involved in the cases, including sentencing, instead of just writing it off and going back to business (that’s my opinion.) It seems the almighty buck overrules doing business with people you should not be doing business with. Leasing News will do a full wrap-up after the case is finalized, although the various sentences are in the collection. Following the various “Operation Lease Fleece” cases since the beginning, more than any other news media, I give Judge Carney high marks for his patience, ethics, and skill in the entire proceedings. Kit Menkin, editor/publisher (1) McQuitty Other Stipulations: (2) Vartanian Sentence (3) OC Weekly Criticizes Judge Carney ocweekly.com/navelgazing/2013/04/michael_scott_grayson_verizon.php Operation Lease Fleece Stories Sheldon Player—Equipment Acquisition Resources http://leasingnews.org/photos/sheldonplayer1.jpg The Trustee continues to settle claims with the latest May 15, 2013 settlement for Nowlin Excavation to pay $4,000. The bankruptcy was filed 10/23/2009. Sheldon Player has not been arrested for fraud or any other charges. He reportedly has a lot of cash and continues gambling through beautiful escorts he takes to mostly riverboat gambling casinos. Why he is not in jail, you got me Previous Stories:

|

|