Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Add me to mailing list

| Search | All Lists | Columnists | Site Map

Advertising| Archives | Classified Ads | This Day In American History

Email the Editor

![]()

Friday, April 23, 2021

Today's Leasing News Headlines

Happy National Volunteer Week

“We Love our AACFB Volunteers”

U.S. Business Borrowing for Equipment Rises

26% in March, ELFA Reports in Reuters

ELFF Reports Equipment Finance Industry Confidence

at All-Time High in April

New Hires/Promotions in the Leasing Business

and Related Industries

Leasing Industry Ads

Spring into a New Job and Make More Money

Cash Advance Firm to Pay $9.8M to Settle FTC Complaint

It Overcharged Small Businesses

Amur Equipment Finance Successfully Completes

Largest Ever Term Securitization

Maxim Commercial Capital Reports

Strong Q1 2021 Demand

American Association of Commercial Finance Brokers

Announces New Board Members

CIT Names Business Development Leaders

for Northeast, West and Southwest Regions

5 Takeaways from eSigning and eLeasing:

What Do You Want to Know?

Special Oscars Column

By Leasing News' Fernando Croce

Dave (unknown breed)

Richmond, Virginia Adopt-a-Dog

Ken Lubin Podcast: Amanda Russell

-Author of the Influencer Code-

A must for businesses and individuals

News Briefs---

Pregnant women with COVID-19 20 times

more likely to die, UW study finds

California's Coronavirus Case Rate Now the Lowest

in the Continental US

Parent Company of These 6 Restaurant Chains

Just Declared Bankruptcy (Buffet Operations)

Subway Franchisees Demand Change in Open Letter

The operators are requesting six changes

Chipotle Plans for 200 New Restaurants

Company has more than 2,800 Restaurants

Global Automotive Equipment Rental & Leasing Market

to Reach a Revised $552.1 Billion by 2027

You May have Missed---

Local Chefs Win $500,000 Investment

on ‘Shark Tank’

Broker/Funder/Industry Lists | Features (wrilter's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

Leasing News Icon for Android Mobile Device

Sports Brief----

California Nuts Brief---

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release,” it was not written by Leasing News nor has the information been verified. The source noted. When an article is signed by the writer, it is considered a “byline.” It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

“During this National Volunteer Week, we want to thank the dozens of volunteers who dedicate their time and talents to serve on the AACFB board and committees. Their service makes a huge difference! Email info@aacfb.org to find out more about volunteer opportunities with AACFB.”

[headlines]

--------------------------------------------------------------

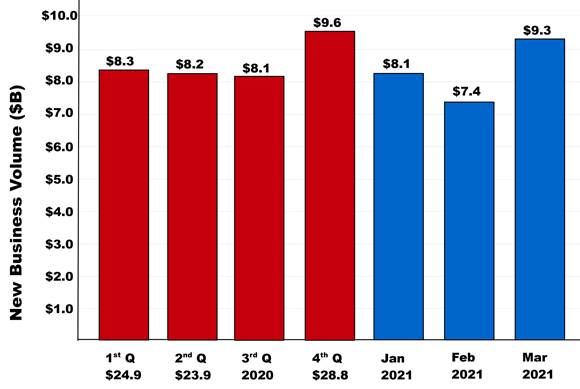

U.S. Business Borrowing for Equipment Rises

26% in March, ELFA Reports in Reuters

U.S. companies' borrowings for capital investments rose 26% in March from a year earlier, the Equipment Leasing and Finance Association (ELFA) said on Thursday. From last year March of $8.9

billion it rose 4%.

The companies signed up for $9.3 billion in new loans, leases and lines of credit last month.

ELFA Chief Executive Officer Ralph Petta:

"The equipment finance industry appears poised to take advantage of an economic tailwind that is manifesting itself in an improving labor market, a continued low interest-rate environment, a strong corporate earnings season, and high business confidence that is creating demand for investment in commercial equipment."

"ELFA member organizations also report improving portfolio quality, which is reflective of their customers' ability to meet their payment obligations as the pandemic's grip on many businesses loosens."

Washington-based ELFA, which reports economic activity for the nearly $1-trillion equipment finance sector, said credit approvals rose to 77% in March, from 75.8% in February.

[headlines]

--------------------------------------------------------------

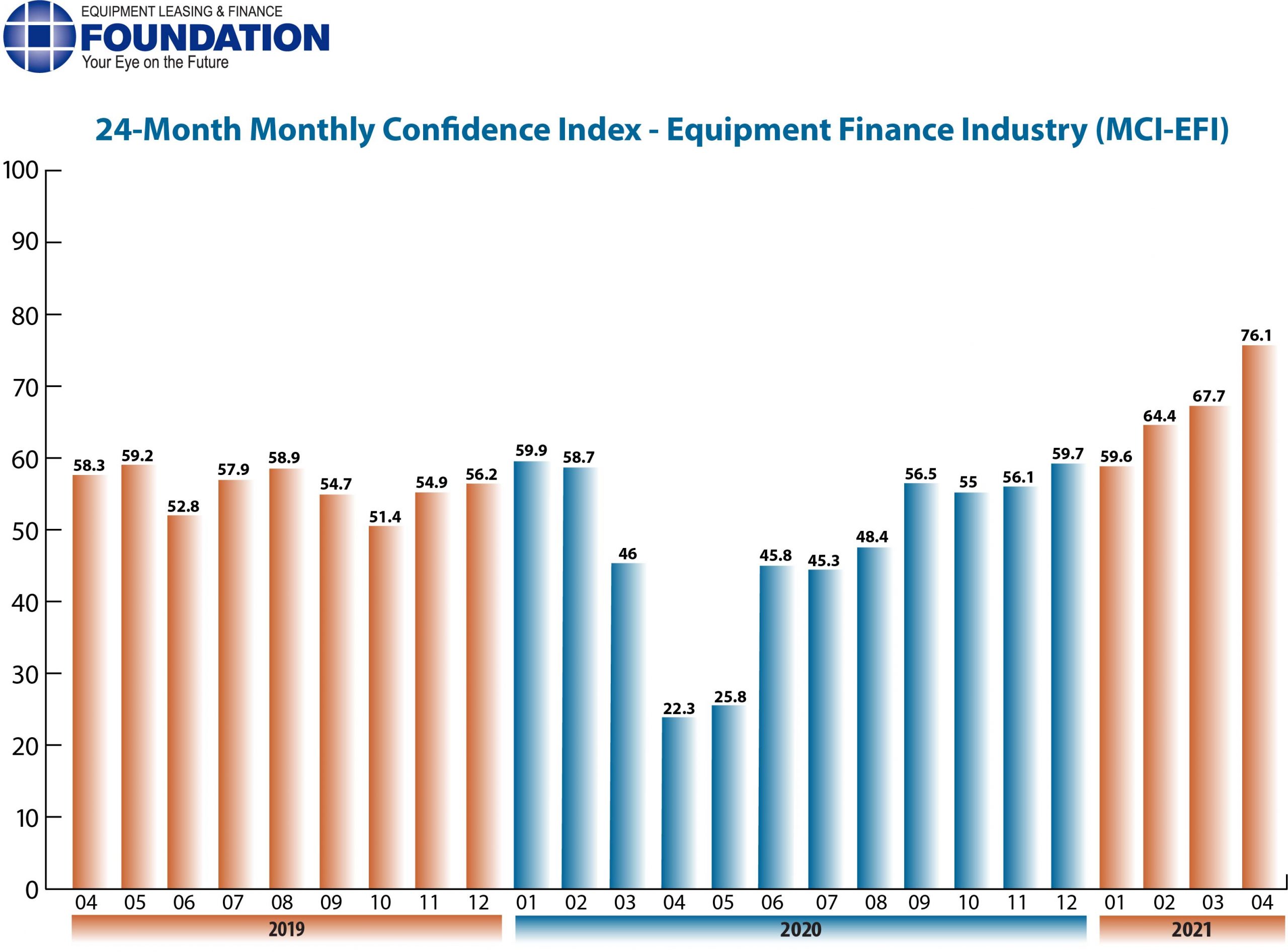

ELFF Reports Equipment Finance Industry Confidence

at All-Time High in April

The Equipment Leasing and Finance Foundation Reports “confidence in the equipment finance market is 76.1, an all-time high and an increase from the March index of 67.7.”

Vincent Belcastro, Group Head Syndications, Element Fleet Management:

“Early concerns are the new Biden tax plan and proposed changes to bonus depreciation. Optimistically, given the rebound in the economy short-term demand for equipment finance should benefit.”

Aylin Cankardes, President, Rockwell Financial Group:

“We are starting to see pent-up demand for goods and services leading to expanded capital budgets for equipment to produce it and transportation to deliver it. With favorable interest rates, businesses are increasing spending again to stay responsive in a rapidly evolving environment.”

David Normandin, CLFP, President and CEO, Wintrust Specialty Finance:

“As vaccination levels continue to increase and confidence to re-enter social environments rises, increased spending will result. This progression to a widening economy should serve to strengthen demand for commercial assets and the financing of those assets. We are optimistic that business will recover, and yet are focused on managing the risk of those that are still highly impacted and will take additional time to find their footing.” David Normandin, CLFP, President and CEO, Wintrust Specialty Finance

Michael Romanowski, President, Farm Credit Leasing:

“We continue to see good demand for capital expenditures from the markets we serve. We have noticed tighter spreads as competition becomes more active.”

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Jeff Clark was hired as Regional Sales Manager, Trimarc, Louisville, Kentucky. He is located in Mansfield, Massachusetts. Previously, he was self-employed as Strategic Financial Services Sales Executive (March, 2020 - March, 2021), He joined, Somerset Capital Group March, 2014, as Senior Regional Vice President, Sales; promoted March, 2016, as Director GSE Capital, Somerset Capital Group; President/Founder, JBA Financial (July, 2011 - March, 2014); Regional Sales Manager, GE Capital (2010 - 2011); Partner, Corporate Leasing Associates (2008 - 2010); Vice President, Business Development, GE Government Finance, GE Capital (2007 - 2008); Partner, Corporate Leasing Associates (2001 - 2007). Education: General Electric Financial Management Training Program. University of Massachusetts, Amherst. Bachelor of Science (BS), Business Administrating and Management. https://www.linkedin.com/in/jeff-clark-1a71204/

Melanie DelValle was promoted to Director, Customer Finance, Ingram Micro, Irvine, California. She is located in Greenville, South Carolina. She joined the firm June, 2014, as Business Development Manager. Previously, she was Credit Manager, Blue Bridge Financial, LLC (December, 2012 - June, 2014); Credit Risk Analyst, Ingram Micro (September, 2010 - January, 2013); Compliance Analyst (Contractor), Citi (February, 2010 - September, 2010); Consumer Credit Analyst, Assistant Vice President, M&T Bank (October, 2001 - December, 2009); Service Learning Project, Canisius College (2009). Education: Canisius College. Master's, Communication & Organization Leadership. (2007 - 2009). State University of New York College at Buffalo. BA, Sociology, American Studies (2000 - 2003). Activities and Societies: Member of the National Sociological Honor Society.

https://www.linkedin.com/in/melaniedelvalle/

Tamara Enright was hired as Director of Vault Credit Corporation, Oakville, Ontario, Canada. Previously, she was Director of Operations, Bluechip Financial Solutions (March, 2020 - April, 2021); Senior Manager, Collections and Asset Management, Meridian OncCap Credit Corp (January, 2017 - March, 2020). She joined De Lage Landen, March, 2007, as Director Portfolio Services; promoted July, 2013, Program and Sales Manager, Office Technology; AVP, Collections and Loss Recovery, CitiCapital Canada (October, 1997 - March, 2007). Education: McGill University. B.Sc., Physiology (1992 - 1996).

https://www.linkedin.com/in/tamara-enright-64534420/

Stephanie Gamm was hired as Senior Operations Manager, Financial Partners Group, Portsmouth, New Hampshire. Previously, she was Senior Funding Manger, CIT (March, 2016 - March, 2021); Service Manager, Texas Roadhouse (February, 2015 - March, 2016); Assistant General Manager, Ocean Properties Hotels, Resorts and Affiliates (March, 2010 - February, 2015). Education: University of New Hampshire. Bachelor's degree, Hospitality Administration/Management (2006 - 2010).

https://www.linkedin.com/in/stephanie-gamm-75600255/

Mike Graziadei was hired as Financial Solutions Manager, Cisco Capital, San Jose, California. Previously, he was Senior Vice President, Insight Financial Services (November, 2018 - April, 2021); Senior Vice President, Wells Fargo (March, 2016 - October, 2018); Senior Vice President, GE Capital (February, 2006 - January, 2016); Senior Vice President Comdisco (July, 1988 - January 2006). Education: San Diego State University. Bachelors, Computer an Information Systems, Security/Information Assurance.

https://www.linkedin.com/in/mike-graziadei-03a7b5175/

(photo)

Ken Ladochi was hired as Vice President of Equipment Finance, First Business Bank, Madison, Wisconsin. Previously he was at Lease Corporation of America, starting March, 2008, as Account Executive; promoted January, 2011, Business Development Officer; promoted December, 2014, Vice President of Business Development. Account Executive, UWM (February, 2004 - February, 2008). Education: Macomb College, Associates, Applied Science 1993 - 1997)) Activities and Societies: Volleyball. Made the Dean’s list every semester. https://www.linkedin.com/in/ken-ladochi-2981548/

Pamela Lenamon was hired as Senior Vice President, Portfolio Manager, Wintrust Commercial Finance, Frisco, Texas. She joined CIT September, 2012, as Director, Underwriting Leader, Capital Equipment Finance; promoted July, 2018 as Director, Portfolio Leader, CIT Equipment Finance. Previously, she was Commercial Portfolio Manager (Consultant), Equipment Finance, Huntington National Bank (April, 2012 - September, 2012); Credit, Private and Business Loans (2009 - 2012), Vice President, Lending, Manager Aircraft (2008 - 2009), Wells Fargo Equipment Finance (September, 2008 - February, 2012); Vice President, Group Co-Manager, Corporate Aircraft Finance, Merrill Lynch Capital (2004 -2008); Assistant Vice President, Equipment Finance, Transamerica (2002 - 2004); Vice President, Investment Control Manager, Aerospace Finance Group, Textron Financial (1994 -2001); Assistant Vice President, Assistant Credit Manager, ITT Commercial Finance (1989 - 1994). Education: Baylor University, Hankamer School of Business. BBA, MBA, Finance, Economics. Activities and Societies, Member Kappa Delta Sorority, Dean's List. https://www.linkedin.com/in/pamlenamon/

Brian Nave, CLFP, was promoted to Community Bank President, Arvest Bank, Shawnee, Oklahoma. He joined the bank July, 2016, as Senior Vice President, Commercial Banker; promoted March, 2019, Senior Vice President, Commercial Banker. Previously, he was Equipment Finance Specialist, Arvest Equipment Finance, a division of Arvest Bank (October, 2014 - July, 2016); Adjunct Professor, Webster University (June, 2011 - December, 2014); Vice President, Arvest Bank (January, 2010 - October, 2014); Senior Vice President, Pinnacle Bank (September 2007 - November, 2009); Vice President, Bank of Rogers (April, 2006 - September, 2007); Assistant Vice President, Arvest Bank (July, 2004 - April, 2006); Centra Office Technician, Salina-Spavinaw Telephone Company (Mary, 2000 - July, 2004); Assistant Manager, Arby's Foundation (1998 - 2000). Certificates: Certified Lease and Finance Professional. Volunteer: Alderman, City of Pea (April, 2006 - December, 2008). Past President, Crawford County Optimist Club (Auguste, 2013 - Present). Education: Northeastern State University, Master Degree, Business Administration (2001 - 2003). Northeastern State University. Bachelor Degree, the Science of Technology Education (1998 - 2001). Salina Public Schools. High School Diploma, General Studies (1986 - 1998.)

https://www.linkedin.com/in/brian-nave-clfp-1418507/

Alex Ohanessian was hired as Vice President of Asset Management, Harbor Capital Group (Insight Material Handling), Minneapolis, Minnesota. He is located in the San Francisco, California Bay Area. Previously, he was Vice President of Asset Management, CIT (October, 2018 - March, 2021). He joined ATEL Capital Group November, 2013 as Portfolio Manager; promoted Senior Portfolio Manager, May, 2016); Commercial Loan and Financial Analyst,, Wells Fargo (October, 2012 - November, 2013); Business Development Assistant, Locaid Technologies (August, 2012 - October, 2012); Marketing/Finance Intern, Talkfree.com (June, 2010 - December, 2011). Education: Saint Mary’s College of California, Bachelor of Science (B.S.), Business Administration and Management, General (2009 - 2012). Activities’ and Societies: Saint Mary's Men's Rugby Football Club, German Club, Gael Force. Saint Ignatius College Prep (2003 - 2007). Activities and Societies: Rugby, Varsity Football, Latin Club. https://www.linkedin.com/in/alex-ohanessian-008a3252/

Keith Riley was hired as Vice President, Capital Markets, Encina Equipment Finance, Westport, Connecticut. He is located in Towson, Maryland. Previously, he was Director, Equipment Finance, Truist Securities (January, 2020 - April, 2021). He joined BB&T July, 2010, Leadership Development Program Associate; promoted May, 2011, Commercial Credit Officer; promoted January, 2014, Assistant Vice President; promoted November, 2016, Vice President. Volunteer: Board of Directors, Executive Secretary, Safe Haven for Youth Ethiopia, ltd. (February, 2012 - June, 2015). Education; University of Maryland, Robert H. Smith School of Business. Master of Business Administration (M.B.A). (2014 - 2017). James Madison University, BBA, Economics (2006 - 2010). Activities and Societies: Alpha Tau Omega Madison Investment Fund. Danbury High. https://www.linkedin.com/in/keith-reilly-62b3787/

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Cash Advance Firm to Pay $9.8M to Settle FTC Complaint

It Overcharged Small Businesses

Yellowstone Capital made unauthorized bank withdrawals and misled business owners, FTC alleged

Yellowstone Capital, a provider of merchant cash advances, will pay more than $9.8 million to settle Federal Trade Commission charges that it took money from businesses’ bank accounts without permission and deceived them about the amount of financing business owners would receive and other features of its financing products.

Merchant cash advances are a form of financing in which a company provides money to a small business up front in exchange for a larger amount repaid through daily automatic payments. In this case, the FTC alleged that Yellowstone and its owners continued withdrawing money from businesses’ bank accounts for days after their balance had been repaid. The complaint alleged that these unauthorized withdrawals left businesses without needed cash and that any refunds from the company could take weeks or months.

The complaint also alleged that, in many cases, Yellowstone misled businesses about the amount of funding they would actually receive, and defendants’ requirements that consumers pledge collateral and make personal guarantees.

Under the terms of the settlement, Yellowstone, Fundry Inc., Yitzhak (Isaac) Stern, and Jeffrey Reece will be required to surrender $9,837,000 to the FTC to be used in providing refunds to affected businesses.

In addition, the settlement permanently prohibits the defendants from misleading consumers about the terms of their financing, including the amount and timing of any fees and whether business owners are required to be personally liable for the financing. The defendants will also be prohibited from making withdrawals from consumers’ bank accounts without their express informed consent.

In connection with other claims they make to consumers, the defendants will be required to clearly and conspicuously disclose any fees that will be paid by consumers for the financing, as well as the actual amount of money that a consumer will receive after the fees are charged. They will also be required to monitor any marketers or funding companies that work on their behalf, to investigate complaints against them, and to terminate their relationship with any such company that fails to abide by the settlement’s requirements.

The Commission vote approving the stipulated final order was 4-0. The FTC filed the proposed order signed by the Commission and the defendants on April 21, 2021 in the U.S. District Court for the Southern District of New York.

NOTE: Stipulated final orders have the force of law when approved and signed by the District Court judge.

[headlines]

--------------------------------------------------------------

#### Press Release #############################

Amur Equipment Finance Successfully Completes

Largest Ever Term Securitization

GRAND ISLAND, Neb., (GLOBE NEWSWIRE) -- Amur Equipment Finance, Inc. (“Amur”) announces the successful closing of its ninth term securitization, its largest ever, in which it issued $346MM in notes secured by equipment loans and leases originated through its platform.

Kalyan Makam, Amur’s Executive Vice President, said, “This issuance was met with incredibly robust and broad investor demand, including many first-time investors, highlighting the market’s appreciation for Amur’s innovative origination platform and strong portfolio performance, especially through the COVID-19 pandemic. “We continue to be thrilled by the capital markets support we receive, which allows us to better serve our core customers - the small business owners across the country that drive our economy.”

This transaction was rated by both DBRS Morningstar and Moody’s, with $264.6MM of the notes rated P-1/R-1H or AAA/Aaa.

Amur is deeply committed to being the Champion of Small Business nationwide with a core focus on serving its small business customers - providing industry-leading customer support, rolling out a nationwide PPP lending platform, and developing innovative financial products to address the rapidly changing needs of small businesses.

Amur has grown into one of the largest independent small business lenders in the United States. The company now employs over 350 leasing professionals across eight offices and is headquartered in Grand Island, Nebraska.

About Amur Equipment Finance, Inc.

Amur Equipment Finance is a Top Five nationally ranked independent commercial equipment finance provider and a certified Great Place to Work®, dedicated to ensuring that its customers and employees around the nation are equipped to grow and succeed. Amur offers customized capital financing programs that draw on its uniquely extensive expertise in the world’s most essential industries – from transportation and technology to manufacturing and medicine – to support its network of over 15,000 vendors and other partners.

#### Press Release #############################

[headlines]

--------------------------------------------------------------

#### Press Release #############################

Maxim Commercial Capital Reports

Strong Q1 2021 Demand

Hard asset-secured lender funded subprime borrowers in 30 states

LOS ANGELES, CALIF. – Maxim Commercial Capital (“Maxim”) announced strong demand during the first quarter of 2021. Its Structured Finance program proved popular during the period, with business owners leveraging their equity in real estate and owned heavy equipment to fund working capital and fuel growth. Despite low inventory of well-priced, low mileage Class 8 used trucks, Maxim closed purchase financings ranging from $12,000 to $53,500 for hundreds of owner-operators across the U.S.

Michael Kianmahd, Executive Vice President, said, “These past three months were starkly different from a year ago, when we were focused on supporting our existing customers to limit delinquencies and adapting to working from home.

“While many of our team members are still working from home, delinquencies are at historic lows and we on boarded over 40 new finance brokers with subprime borrowers needing growth financing.”

First quarter 2021 transactions submitted by finance brokers included a $425,000, 60-month, cash-out term loan secured by a first lien position on commercial and residential real estate and equipment for an experienced business owner in North Carolina with a foreclosure history; $87,400 purchase financing secured by a 2017 John Deere 8345R Tractor for a family business with challenged credit; and, $51,900 purchase financing secured by a 2013 Mack Granite 17’ Alum Dump Truck for a government contractor with a discharged bankruptcy.

Maxim continued to fulfill a void in the truck financing sector, closing deals for start-ups, owner-operators with challenged credit needing to replace trucks, and non-CDL owners of trucking companies. Examples include $55,000 funded for an experienced owner-operator with good credit to get a 2016 Kenworth T800 with 198,000 miles; $22,000 for a non-CDL trucking operator in business for two years to get his second truck, a 2016 Volvo 670 with 492,000 miles; and $26,400 for a start-up owner-operator with 6 years of driving experience to get a 2015 Mack CXU613 with 479,000 miles.

Behzad Kianmahd, Chairman and CEO, declared, “We are optimistic, yet realistic, about the business climate and economic recovery,” said. “The unknown risk of COVID-19 variants and the pace of economic recovery make it difficult to project. Conversely, we anticipate the pending infrastructure bill, strong vaccination rates and pent-up consumer demand will continue to drive strong demand for our financing solutions.”

About Maxim Commercial Capital

Maxim Commercial Capital helps small and mid-sized business owners seize opportunity by providing financing in amounts from $10,000 to $3,000,000 secured by heavy equipment and real estate. Maxim facilitates equipment purchases, provides working capital, and refinances debt for companies across all industries located nationwide. Through Maxim’s tailored financing programs, businesses unlock capital tied up in underleveraged assets, often replacing expensive short-term debt and daily repayment working capital loans with longer term capital. As a leading provider of transportation equipment finance, Maxim funds up to 75% of the acquisition cost of class 8 and class 6 trucks, trailers and reefers for owner-operators and small businesses. Learn more at www.maximcc.com or by calling 877-776-2946.

#### Press Release #############################

[headlines]

--------------------------------------------------------------

#### Press Release #############################

American Association of Commercial Finance Brokers

Announces New Board Members

LOUISVILLE, KY) The American Association of Commercial Finance Brokers (AACFB) announces the election of two new members to its Board of Directors and the election of a new Vice President, Teresa Thacker with Brahma Lending and Leasing. Michael Hong with Taycor Financial and Kalah Sprabeary with HUB Funding Solutions were elected to Director at Large positions. They will begin their service in their new positions in May of 2021.

Current AACFB President, Cindy Downs, announced, “I am pleased to welcome the newest members to our Board of Directors. They will both bring valuable perspectives, which will benefit all AACFB members. I also want to thank AACFB Past Presidents, Paul Burnham and Bud Callahan for their dedication and service to the AACFB as they complete their terms on the Board.”

Please join us in congratulating the 2021-2022 AACFB Board of Directors:

Officers:

• President - Carrie Radloff, CLFP, American Financial Partners

• President-Elect - Laura Estrada, Preferred Capital Funding, Inc.

• Vice President - Teresa Thacker, Brahma Lending and Leasing

• Secretary/Treasurer - Roderick Knoll, CLFP AS, Marathon Commercial Capital

• Past President - Cindy Downs, Heartland Capital Group

Directors-at-Large:

• Michael Hong, Taycor Financial

• Kalah Sprabeary, HUB Funding Solutions

• Amanda Zeken, CLFP, Smarter Equipment Finance, LLC

More about the newest board members:

Michael Hong is President, CEO & board member at Taycor Financial. He began his career in the equipment finance industry as a teenager in the mail room, and over the last 20 years has accumulated a lifetime of lessons by working for and with countless inspiring mentors. Michael is originally from Texas and started his career in equipment finance for a company in Georgia. He worked his way through various sales and business development roles before relocating to California in 2011 and accepting a role as Director of Business Development at Taycor. At Taycor, Michael was responsible for the company’s development of several key technologies and process improvements that led to the organization’s year over year record growth. He was promoted to President and CEO of Taycor in 2015 and has continued to grow and evolve the company’s capabilities and product offerings.

Kalah Sprabeary is co-owner of HUB Funding Solutions and has been involved in the alternative financing sector as a broker and prior direct lender since 2013. HFS offers brokerage services including equipment, working capital, and accounts receivable finance. While their foundation is in the industrial sector, Kalah has worked with her team to provide services for a wide variety of businesses. Kalah was raised in the Lubbock, Texas area and graduated from Texas Tech University. Her experience in multiple industries such as oil and gas, agriculture, construction, and real estate has provided a depth of direct industry knowledge. During her professional career, Kalah has been active on multiple boards in associations across various industries and networking groups. She often participates with the AACFB in speaking engagements and panels, as well as working in the background with the board to coordinate events for the organization.

About American Association of Commercial Finance Brokers (AACFB)

The American Association of Commercial Finance Brokers (AACFB) is the premier trade association empowering independent commercial finance brokers. The AACFB represents the expanding interests of its growing membership by providing best practice education and networking opportunities, while promoting a culture of ethics. For more information visit: www.aacfb.org.

#### Press Release #############################

[headlines]

--------------------------------------------------------------

#### Press Release #############################

CIT Names Business Development Leaders

for Northeast, West and Southwest Regions

NEW YORK — CIT Group Inc. (NYSE: CIT) announced that its Equipment Finance business, part of the Business Capital division, has hired new business development leaders for the Northeast, West and Southwest regions.

Wayne Wagner, Mark Johnson and JP DeStefano join CIT as vice presidents for business development on the Industrial team, where they will be responsible for developing dealer relationships throughout the Northeast, West and Southwest, respectively. All will report to Harold Ray, who directs industrial finance for the Equipment Finance business.

“Industrial companies depend on bankers with the agility and expertise to provide the financing they need to compete and grow,” Ray said. “I am pleased to welcome Wayne, Mark and JP to our team of experienced equipment finance professionals.”

The Industrial group within CIT’s Equipment Finance business provides lending and leasing services primarily to construction, material handling, transportation and manufacturing companies.

Wagner joins CIT after most recently serving as a vice president in the equipment finance division at Bank of the West. He brings extensive experience in working with the construction and material handling industry sectors. Earlier in his career, he was a vice president in middle market equipment finance for TCF Leasing.

Johnson comes to CIT from Engs Commercial Finance, where he served as national program manager. He brings more than 15 years of experience in industrial financing, having worked with both Engs Commercial and Bank of the West.

DeStefano most recently served as national sales manager at Summit Funding. He has more than 10 years of industrial financing experience in the field, having earlier worked in business development positions with Equify Financial and Ritchie Brothers.

CIT is ranked in the Top 10 among equipment finance companies by Monitor magazine, a leading publication covering the industry. In addition, the Business Capital division was recently recognized with a second FinTech Breakthrough award for its innovative online business lending point-of-sale platform.

CIT’s Equipment Finance business works with manufacturers, distributors, resellers, dealers and systems integrators to finance their equipment, software and services to commercial customers.

CIT's Business Capital division empowers small and mid-size businesses by providing equipment financing solutions via technology-enabled platforms and market leading structuring expertise.

About CIT

CIT is a leading national bank focused on empowering businesses and personal savers with the financial agility to navigate their goals. CIT Group Inc. (NYSE: CIT) is a financial holding company with over a century of experience and operates a principal bank subsidiary, CIT Bank, N.A. (Member FDIC, Equal Housing Lender). The company's commercial banking segment includes commercial financing, community association banking, middle market banking, equipment and vendor financing, factoring, railcar financing, treasury and payments services, and capital markets and asset management. CIT's consumer banking segment includes a national direct bank and regional branch network. Discover more at www.cit.com/about

##### Press Release ############################

[headlines]

--------------------------------------------------------------

##### Press Release ############################

5 Takeaways from eSigning and eLeasing:

What Do You Want to Know?

Industry Experts Address Questions During ELFA Webinar

WASHINGTON, D.C.,– In response to the tremendous interest in the topic of electronic documents, the Equipment Leasing and Finance Association presented a webinar on March 24, “eSigning and eLeasing: What Do You Want to Know?” Panelists Stephen Bisbee, Founder of eOriginal; Bob Cohen, Partner of Moritt Hock & Hamroff LLP; and Dominic Liberatore, Deputy General Counsel of DLL, hosted an hour-long discussion moderated by Wendy Hurwitz, Marketing Director, eOriginal. The webinar was a follow up to two previous ELFA webinars presented by this panel and addressed follow-up questions from previous sessions, as well as questions posed during the new presentation.

Bisbee kicked off the webinar with an overview of topics examined during the panel’s Dec. 2 webinar, including COVID as a digital adoption accelerator; emerging digital trends for consumers and funders; methodologies for digitizing the lending process; risk management in a digital world; laws that are applicable for the creation, sale or assignment and management of digital leases; as well as how to make an e-signature implementation successful.

To better understand the how e-signatures and e-leases work in equipment finance, below are five highlights from the webinar.

- Equipment finance companies are recognizing the benefits of e-signing and e-leasing. In addition to the need for contactless, digital transactions during the pandemic, e-signing and e-leasing have numerous long-term advantages over traditional wet-ink-signed paper documents. When set up properly, they create greater efficiency through time-saving contract signings that can be completed in minutes instead of hours. Digital processes do not allow signing to continue until all signature and initial fields are completed correctly. Anecdotal reports suggest that cost savings from eliminating overnight delivery charges more than offset the cost of adopting e-signatures. Customers enjoy greater convenience since documents can be sent to multiple people in different places at the same time. In addition to these practical benefits of electronically signed documents, Cohen also addressed them from a philosophical point of view: “e-signatures are the future, and equipment finance companies need to keep up.” Upcoming generations are accustomed to and expect the convenience of digital transactions, whether in the form of a paper-based lease that the lessee e-signs or a true electronic lease that is e-signed by all parties and is then stored in a Uniform Commercial Code (UCC)-compliant e-vault. Financing sources want to be viewed as smart and forward-looking, not as dinosaurs.

- E-leases are not simply copies of ink-signed documents. The process by which digital documents are electronically signed, stored and managed distinguishes them from photocopies or scans of lease documents. E-signature platforms entail using a front-end vendor to authenticate and verify the identity of the person who signed the document. E-signed documents are electronically signed by both parties in the transaction to create e-chattel, which is stored in an e-vault, unlike scanned copies. The process of e-vaulting a document within a secure, trusted environment fulfills the legal and regulatory requirements for uniqueness and negotiability of the document as a digital financial asset.

- Digital documents are enforceable by three material statutes. The Electronic Signatures in Global and National Commerce Act (E-SIGN), the Uniform Electronic Transactions Act (UETA) and Article 2A of the UCC. E-SIGN is a federal law designed to ensure the validity of electronic signing and contracting and creates a national regulatory framework by preempting non-uniform state versions of the UETA. UETA is a model state law designed to enable the general legal enforceability of digital signatures and records. UETA ensures that an electronic signature, contract or other record can be valid and enforceable. UETA has been adopted in 48 states (excluding New York and Illinois, which have separate statutes that are generally similar in design). E-SIGN specifically provides that the UETA statute is recognized and enforceable. UCC Article 9-105 sets forth rules for digital records as electronic chattel paper for non-real estate assets and was the first law to apply “control” rather than possession for the priority of security interests under the UCC.

- Electronic documents are subject to the same challenges to enforceability as paper contracts. Whether a lease is ink- or e-signed, if a document must be enforced in court it must be proven that the person signed it. For ink signatures, handwriting experts may be used to examine other signature samples (e.g., driver’s license, voter registration card, etc.) from the signee. With e-signatures, multi-factor authentication of the person signing the document enables the verification of the person’s identity as well as his or her intent to enter the contract. Sending a text message with a one-time and time-limited code to a person’s phone is a popular authentication process. Knowledge-based questions that ask about situations that are not current are another form of verifying a person’s identity. For example, questions such as, “Have you ever lived at a certain address?” cannot be answered by an “out-of-the-wallet” test in case a person’s ID and credit cards have been stolen.

- If you don’t have a fully e-signed lease, it can still be converted into e-chattel paper. As Liberatore explained, if an existing lease is ink-signed or one of the parties did not e-sign, there is a proprietary process to convert it into “full-blown” e-chattel paper in compliance with UCC rule 9-105. Paper In® can create an original e-chattel document from the original paper document (not a scan or copy). When creating a new original electronic document, it is critical that the ink original be destroyed (or permanently marked to indicate that it is not the authoritative copy) since there cannot be two originals. Conversely, when you Paper Out®, or convert an asset from digital to an enforceable paper document, the electronic original document must be destroyed.

ELFA has been a proponent of e-signatures and e-chattel technologies for more than a decade through a variety of educational offerings and an ELFA Board of Directors Task Force on e-Leasing, and the Equipment Leasing & Finance Foundation has released a number of articles and studies on the topic. For more information on this topic, visit ELFA’s Electronic Documents webpage at www.elfaonline.org/edocs.

### Press Release ############################

[headlines]

--------------------------------------------------------------

Special Oscar Column

by Fernando Croce

As the big day approaches, the question remains: Who will take home Oscar gold this Sunday night? For the benefit of movie-lovers and audiences, we’ve put together this list of predictions for the main categories of American cinema’s top award.

Picture: “The Father,” “Judas and the Black Messiah,” “Mank,” “Minari,” “Nomadland,” “Promising Young Woman,” “Sound of Metal,” “The Trial of the Chicago 7”

Though a couple of the titles (“Mank,” “The Trial of the Chicago 7”) might qualify as standard “prestige” releases, most of the nominations this year belong surprisingly (and appreciatively) to more idiosyncratic releases. Based on award recognition, the top choice clearly belongs to “Nomadland,” which scored top prizes at festivals in Venice and Toronto as well as various critics’ circles. Despite the surprise win of “Parasite” last year, however, don’t discard the possibility of the Academy opting to go instead with a more traditional crowd-pleaser like “The Trial of the Chicago 7.”

Overlooked: “Da Five Bloods,” “First Cow,” “On the Rocks,” “Small Axe: Lovers Rock,” “Vitalina Verela”

Director: Lee Isaac Chung (“Minari”), Emerald Fennell (“Promising Young Woman”), David Fincher (“Mank”), Thomas Vinterberg (“Another Round”), Chloe Zhao (“Nomadland”)

In a category traditionally filled with veterans, the field is refreshingly populated with first-timers this year. (Fincher is the only previous nominee.) There’s a tendency, particularly in recent years, of Picture and Director awards going to different films, though this year it looks safe to bet on both going to the same title, namely “Nomadland’s” Chloe Zhao. Having swept the awards season, Zhao seems poised to become the first woman to win Best Director since Kathryn Bigelow in 2010 for “The Hurt Locker.” (Her triumph would mark another landmark, as the first female Asian filmmaker to win.)

Overlooked: Spike Lee (“Da 5 Bloods”), Paul Greengrass (“News of the World”), Darius Marder (“Sound of Metal”), Kelly Reichardt (“First Cow”), Leigh Whannell (“The Invisible Man”)

Actor: Riz Ahmed (“The Sound of Metal”), Chadwick Boseman (“Ma Rainey’s Black Bottom”), Anthony Hopkins (“The Father”), Gary Oldman (“Mank”), Steven Yeun (“Minari”)

Keeping with this year’s unconventional choices, the award could very possibly be a posthumous one for Boseman, whose untimely passing gave his electrifying turn an extra layer of poignancy. (The fact that he was not nominated for his work in “Da 5 Bloods” adds to the feeling of the award as a recognition of a brilliant award.) Having already won Oscars before, veterans Hopkins and Oldman have lower odds despite excellent work in their respective films. Yeun and Ahmed would also be deserving picks, each actor endowing their complex characters with emotional urgency.

Overlooked: Ben Affleck (“The Way Back”), Kingsley Ben-Adir (“One Night in Miami”), Willem Dafoe (“Tommaso”), Delroy Lindo (“Da 5 Bloods”), Tom Hanks (“News of the World”)

Actress: Viola Davis (“Ma Rainey’s Black Bottom”), Andra Day (“The United States vs. Billie Holiday”), Vanessa Kirby (“Pieces of a Woman”), Frances McDormand (“Nomadland”), Carey Mulligan (“Promising Young Woman”)

As in the Best Actor field, there’s a mix of veterans and first-timers. Unlike the Best Actor field, however, there’s no consensus for a favorite, giving the category an exciting uncertainty. Kirby and Day enjoyed breakout roles in underseen films, and Mulligan embodied her tricky role with ferocious aplomb. Most eyes however are on the race between Davis and McDormand. Both would be deserving winners, though Boseman’s near-guaranteed win might work against Davis, as rarely Best Actor and Best Actress go to the same film. Would that open the way for a third statuette for McDormand? Tune in to find out.

Overlooked: Jasmine Batchelor (“The Surrogate”), Carrie Coon (“The Nest”), Sidney Flanigan (“Never Rarely Sometimes Always”), Cristin Milioti (“Palm Springs”), Elisabeth Moss (“Shirley”)

Supporting Actor: Sacha Baron Cohen (“The Trial of the Chicago 7”), Daniel Kaluuya (“Judas and the Black Messiah”), Leslie Odom Jr. (“One Night in Miami…”), Paul Raci (“Sound of Metal”), Lakeith Stanfield (“Judas and the Black Messiah”)

The Supporting Actor category is a reliable field for choice acting, and this year is not different. What’s strange is how many of these performances could qualify as leads in their respective movies, especially in the case of Kaluuya and Stanfield. (Co-starring performers cutting into each other’s screen time are not uncommon in Oscar history.) With the same happening to Cohen and Odom Jr., that leaves the favorite spot to a legitimate supporting turn—Raci, whose lived-in quality added immensely to “Sound of Metal’s” sense of veracity and discovery.

Overlooked: Bill Murray (“On the Rocks”), Mark Rylance (“The Trial of the Chicago 7”), David Strathairn (“Nomadland”), Stanley Tucci (“Supernova”), Glynn Turman (“Ma Rainey’s Black Bottom”)

Supporting Actress: Maria Bakalova (“Borat Subsequent Moviefilm”), Glenn Close (“Hillbilly Elegy”), Olivia Colman (“The Father”), Amanda Seyfried (“Mank”), Youn Yuh-jung (“Minari”)

Several first-timers square off against veteran hopefuls and winners. Young actresses often score breakthrough successes in this field, which could help out Bakalova and Seyfried. For many, the battle is between Close (who’s been repeatedly nominated but has yet to win) and Colman (who, in a surprise upset, defeated Close for Best Actress a few years back). Most Oscar experts however are betting on Youn, who is leading the critical wave for “Minari” and who embodies another favorite Academy scenario, the foreign-language seasoned hand discovered by American audiences.

[headlines]

--------------------------------------------------------------

Dave (unknown breed)

Richmond, Virginia Adopt-a-Dog

Dave

ID: 44447357

Male

Color: White/Tan

Size: Medium

Neutered

Adoption Fee: $125.00

Hi, I'm Dave! I'm a great fella with a love for life. I'm looking for the perfect family to relax and spend my days with. I love to play just as much as I love a good, long nap. If you think we could be the best of buds, ask to visit me at the Richmond SPCA today!

Richmond SPCA

The Central Virginia

Humane Society

2519 Hermitage Rd,

Richmond, VA 23220

(804) 521-1300

https://richmondspca.org/

Adoption Hours:

Mon. Noon to 5 p.m.

Tue. – Fri. Noon to 7 p.m.

Sat. 11 a.m. to 6 p.m.

Sun. Noon to 5 p.m.

Dog Adoption Survey

https://richmondspca.org/how-you-can-help/adopt/dogs/dog-adoption-survey/

Included in every dog adoption:

Veterinary examination

Spay or neuter surgery

Microchip

Deworming treatment

DA2PP vaccination

Bordetella vaccination

Heartworm test

Rabies vaccination (pets over 4 months of age)

Low-cost post-adoption veterinary care through the Susan M. Markel Veterinary Hospital

In response to COVID-19 and in order to reduce visitor traffic, observe necessary social distancing and to best protect the health and wellbeing of our staff and members of the public, we have transitioned to adoptions by appointment only. Please review our adoption appointment process.

[headlines]

--------------------------------------------------------------

Ken Lubin Podcast: Amanda Russell

-Author of the Influencer Code-

A must for businesses and individuals

She was an influencer before the term even existed...and when brands like Lamborghini, Cedars-Sinai and Lionsgate want to better understand influencer marketing, they call one person...Amanda Russell.

As an international fitness icon, sought-after speaker and brand strategist, Amanda has been at the forefront of the digital marketing and social media revolution from its infancy.

Amanda designed & co-created UCLA's' Influencer Marketing curriculum, the world’s first fully accredited program in Influencer Marketing and currently teaches this program, along with marketing, branding, and business strategy at UCLA at UT Austin, to a global audience of students and future leaders.

She advises some of the top companies in the world on influencer marketing and how they interact with their customers. Her upcoming book, The Influencer Code, teaches brands how to use collaboration to grow and scale their business.

The Toronto Star calls her the “Real-life Iron Woman” and “the ultimate go-getter”. Amanda is here in [city] to help us all better understand what influence is (and what it’s not), how to collaborate more effectively with influencers and how to use influencer marketing to build our brands and grow our businesses.

https://amandarussell.co/books/the-influencer-code/

https://www.linkedin.com/in/amandarussellfss/

Ken Lubin

Managing Director

ZRG Partners, LLC

Americas I EMEA I Asia Pacific

C: 508-733-4789

https://www.linkedin.com/in/klubin

[headlines]

--------------------------------------------------------------

News Briefs---

Pregnant women with COVID-19 20 times

more likely to die, UW study finds

https://www.seattletimes.com/seattle-news/pregnant-women-with-covid-19-20-times-more-likely-to-die-new-study-finds/

California's coronavirus case rate now the lowest

in the continental US

https://www.northbaybusinessjournal.com/article/news/californias-coronavirus-case-rate-now-the-lowest-in-the-continental-us/

Parent Company of These 6 Restaurant Chains

Just Declared Bankruptcy (Buffet Operations)

https://www.eatthis.com/news-fresh-acquisitions-delcares-bankruptcy/

Subway Franchisees Demand Change in Open Letter

The operators are requesting six changes

https://www.qsrmagazine.com/fast-food/subway-franchisees-demand-change-open-letter

Chipotle Plans for 200 New Restaurants

Company has more than 2,800 Restaurants

https://www.ocbj.com/news/2021/apr/21/chipotle-plans-200-new-restaurants/

Global Automotive Equipment Rental & Leasing Market

to Reach a Revised $552.1 Billion by 2027

https://finance.yahoo.com/news/global-automotive-equipment-rental-leasing-132200837.html

[headlines]

--------------------------------------------------------------

You May Have Missed---

Sonoma Chefs Win $500,000 Investment

on ‘Shark Tank’

https://www.sonomamag.com/local-chefs-win-500000-investment-on-shark-tank/?gSlide=1

[headlines]

--------------------------------------------------------------

Sports Briefs---

'Might have been Trey Lance all along':

Rich Eisen on 49ers' NFL Draft quarterback decision

https://www.sfgate.com/49ers/article/2021-04-Might-have-been-Trey-Lance-all-along-16121901.php

NFL Teams Who Can't Afford to Blow It

in the 2021 NFL Draft

https://bleacherreport.com/articles/2940683-nfl-teams-who-cant-afford-to-blow-it-in-the-2021-nfl-draft

World Series Predictions 2021 & Best World Series

Odds by The Game Day

https://www.prnewswire.com/news-releases/world-series-predictions-2021--best-world-series-odds-by-the-game-day-301268396.html

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

Newsom launches effort to deal with drought;

emergencies declared in two counties

https://www.latimes.com/environment/story/2021-04-21/california-drought-newsom-mendocino-sonoma?utm_id=27755&sfmc_id=1646692

Supervisors explore program to provide air filtration systems

to small businesses, nonprofits

https://www.paloaltoonline.com/news/2021/04/21/supervisors-explore-program-to-provide-air-filtration-systems-to-small-businesses-nonprofits

California’s massive UC and Cal State systems

plan to require COVID-19 vaccinations this fall

https://www.latimes.com/california/story/2021-04-22/uc-csu-to-require

Bayer Berkeley expansion could create 1,000 jobs

“Expected to support about 3,800 jobs directly or indirectly"

https://www.eastbaytimes.com/2021/04/22/bayer-berkeley-expansion-could-create-3800-jobs-report/

Oakland: Kaiser Permanente to pay Black employees

$11.5 million over claimed racial bias

https://www.eastbaytimes.com4/22/oakland-kaiser-permanente-to-pay-black-employees-in-11-5-million-settlement/

Video shows baby whale off California Coast

with fishing gear stuck in mouth

https://www.eastbaytimes.com/2021/04/22/video-shows-baby-whale-with-fishing-gear-stuck-in-mouth/

Tony La Russa’s family speaks out, details alarm

over work culture at the Animal Rescue Foundation

https://www.eastbaytimes.com/2021/04/20/tony-la-russas-family-details-alarm-over-work-culture-and-leadership-at-the-animal-rescue-foundation/

Marin County’s Catalyst Housing Group amasses $1.3B

in California affordable housing for ‘missing middle’

https://www.northbaybusinessjournal.com/article/article/marin-countys-catalyst-housing-group-amasses-1-3b-in-california-affordabl/?ref=mosthome

Take a look: Lush, undeveloped Marin County waterfront

land is for sale

https://www.sacbee.com/news/business/real-estate-news/article250844574.html

Rob Bonta is confirmed as California attorney general

https://www.latimes.com/california/story/2021-04-22/assemblyman-rob-bonta-wins-confirmation-as-california-attorney-general?utm_id=27816&sfmc_id=1646692

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

Record-setting Date for Late Frost in Texas Vineyards

https://www.winebusiness.com/news/?go=getArticle&dataId=244492

Trends in Winemaking:

Two New Approaches to Smoke Taint Mitigation

https://www.winebusiness.com/news/?go=getArticle&dataId=244469

Wine Trade Employment: Shifts and Hustles

Most work for the same company in the same trade tier they did 12 months ago; 10% changed trade tiers; 7% changed employers; 13% are laid off or furloughed, but planning to return.

https://wineopinions.com/wp-content/uploads/2021/04/April_2021_Wine_Opinions_Newsletter.pdf

Napa County declines Fire Boss planes

for the 2021 wildfire season

https://napavalleyregister.com/news/local/napa-county-declines-fire-boss-planes-for-the-2021-wildfire-season/article_2b653c6d-d9c7-50a2-9aa6-fb0b1ae09404.html

Frost hits between 30% and 50% of Bordeaux

https://harpers.co.uk/news/fullstory.php/aid/28697/Frost_claims

Free Wine App

https://www.nataliemaclean.com/mobileapp/

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1635 - The first public secondary school in America opened, the Boston Latin School with a classical curriculum derived from English schools. The first schoolmaster was a Dutchman, Adam Roelantsen, who arrived in New Amsterdam in 1633 and set up the first school in America as part of the Dutch Reformed Church. By 1720, five public schools were maintained in Boston and were so well-regarded, they enrolled students from as far away as the West Indies. The Boston Latin School is still in existence.

1637 – 200 Pequot warriors attacked a settlement in southeastern Connecticut, killing 9 men and women, while stealing 2 girls.

1662 - Connecticut was chartered as an English colony. The first major settlements were established in the 1630s by English proprietors. Thomas Hooker led a band of followers overland from the Massachusetts Bay Colony and founded what became the Connecticut Colony; other settlers from Massachusetts founded the Saybrook Colony and the New Haven Colony. The Connecticut and New Haven Colonies established documents of Fundamental Orders, considered the first constitutions in North America. In 1662, the three colonies were merged under a royal charter, making Connecticut a crown. This colony was one of the Thirteen Colonies that revolted against British rule in the Revolutionary War.

1750 - The first colonial settlement west of the Allegheny Mountains other than military forts and outposts was established by the Loyal Land Company of Virginia. On March 6, a group of six men in the employ of the company, led by Dr. Thomas Walker, a physician, started out from Charlottesville, VA. They searched the future site of Barbourville, KY and, on April 23, and built a house that was completed on April 30.

1789 - President-elect Washington and his wife moved into the first executive mansion, the Franklin House, in New York. George Washington was inaugurated at Federal Hall and lived at 3 Cherry Street in New York City. In 1790, with construction on the new federal capital underway, the government was moved temporarily to Philadelphia, where Washington served out his two terms. He is the only president who never resided in the White House.

1778 – John Paul Jones launched a surprise attack on Whitehaven, England. This was the only US raid of the Revolutionary War on England’s homeland.

1791 - The birthday of James Buchanan (d. 1868), Cove Gap, PA. 15th president who served from 1857 to 1861; the only president who never married. After 10 years in the House, he served as Minister to Russia, Senator for nearly nine years, then Minister to the UK before accepting the Democratic nomination for President for the 1856 election. Shortly after his election, Buchanan lobbied the Supreme Court to issue a broad ruling in the Dred Scott decision which he fully endorsed as president. He allied with the South in attempting to gain the admission of Kansas to the Union as a slave state. In the process, he alienated both Republican abolitionists and Northern Democrats, most of whom supported the principle of popular sovereignty in determining a new state's slaveholding status. His inability to address the sharply divided pro-slavery and anti-slavery partisans with a unifying principle on the brink of the Civil War has led to his consistent ranking by historians as one of the worst presidents in American history. Historians who participated in a 2006 survey voted his failure to deal with secession the worst presidential mistake ever made

1813 - Birthday of Stephen A. Douglas (d. 1861), Brandon, VT. U.S. Congressman, Senator and presidential candidate who ran against Abraham Lincoln after losing as a running mate or President Franklin Pierce to James Buchanan. He was in favor of the new territory and states being allowed to choose whether they wanted to be “slave” or “anti-slave states.” He is also very well known for the series of “Lincoln-Douglas” debates.

http://memory.loc.gov/ammem/today/apr23.html

1856 - Granville T. Woods (d. 1910) was born at Columbus, OH. Known as the “black Thomas Edison,” he invented the Synchronous Multiplex Railway Telegraph which allowed communication between dispatchers and trains while the trains were in motion, thereby decreasing the number of train accidents. In addition, Woods is credited with a number of other electrical inventions and historians continue to compare him favorably to Thomas Edison.

1865 – Confederate President Jefferson Davis wrote to his wife, “Panic has seized the country!” After the surrender of the Confederacy by Gen. Lee, Davis kept moving his government south in order to re-establish rule over the fallen ‘nation.’ He was captured two weeks later by Union troops in northern Georgia, was charged with treason, but was never tried.

1872 - Charlotte E. Ray became the first African-American woman attorney admitted to the Washington Bar, to the Supreme Court of the District of Columbia. History also records her as the first African-American woman to receive a law degree, receiving her LLB. degree from the Howard University School of Law, Washington, DC, on February 27, 1872. She opened a law practice, but both racial and gender prejudice forced her to close the office. She then joined the Women's Suffrage Movement.

http://www2.lhric.org/pocantico/womenenc/ray.htm

http://womenshistory.about.com/library/bio/blbio_ray_charlotte.htm

1879 - Fire burns down the second main building and dome of the University of Notre Dame, which prompts the construction of the third, and current, Main Building with its golden dome.

1885 - The city of Denver, CO was in the midst of a storm which produced 23 inches of snow in 24 hours, and at Idaho Springs, CO, produced 32 inches of snow.

1896 - The first movie was shown at Koster and Bials Music Hall in New York City. Up until this time, people saw films individually by looking into a Kinescope, a box-like "peep show." This is the first time an audience sat together and watched a movie together. What they saw was a series of short scenes, including a ballet scene, a burlesque boxing match, surf breaking on the shore, and a comic allegory entitled," The Monroe Doctrine." Thomas Alva Edison was present for his Vitascope and the audience called for Edison, but he did not appear and refused to take a bow.

1898 – President William McKinley asked for 125,000 volunteers to fight Spain following Congress’ demand that Spain withdraw from Cuba.

1903 – Winning their first game after moving from Baltimore, the New York Highlanders defeated the Washington Senators, 7-2.

1906 - Most of the fires resulting from the April 18 earthquake in San Francisco were extinguished, allowing the rebuilding to finally begin. Estimates placed the loss of lives at 3,000 and 30,000 structures destroyed.

1907 - The steam laundries of San Francisco and vicinity, with the exception of a few, remain on strike after more than four weeks. Soiled linen is becoming a serious problem in many households. The few laundries that are in operation were unable to call for or deliver washing. Patrons who took their wash to the laundries returned with the dirty linen.

1907 - Jack London, on board his yacht, the Snark, pulled out into the harbor from the Franklin Street wharf at 12:30 today amid the cheers of his friends and admirers. He stood on deck with his wife and small crew.

1910 - The temperature at the Civic Center in Los Angeles, CA, hit 100 degrees to establish an April record for the city.

1914 – Wrigley Field opened, then known as Weeghman Park, as the home of the Federal League Chicago Whales. After the league folded in December, 2015, Charles Weeghman bought the Cubs and moved them to the park for the opener of the 1916 season. From 1922, after extensive renovations until 1927, it was known as Cubs Park at which time it was named Wrigley Field after the chewing gum tycoon who had become the team’s owner.

1915 - Birthday of pianist-arranger Joe Lippman (d. 2007), Boston, MA.

1920 - Canadian string instrument builder Francois ‘Frank’ Gay was born in Marcelin, Saskatchewan. In 1953, Gay established a studio in Edmonton, building guitars for such famous country stars as Johnny Cash, Don Gibson and Hank Snow. Three of Gay's guitars - those owned by Johnny Horton, Webb Pierce and Faron Young - have been placed in the Country Music Hall of Fame in Nashville.

1921 - Birthday of baseball Hall of Fame pitcher Warren Edward Spahn (d. 2003), Buffalo, NY. Spahn remains the winningest left-hander in Major League history with 363. He also is the oldest pitcher to throw a no-hitter. At the age of 42, he chalked up a 23-7 record. Spahn enlisted in the US Army after finishing the 1942 season in the minors. He served with distinction and was awarded a Purple Heart. He saw action in the Battle of the Bulge as a combat engineer and was awarded a battlefield commission. Spahn returned to the Majors in 1946 at the age of 25, having missed three full seasons. Had he played those seasons, it is possible that Spahn would have finished his career behind only Walter Johnson and Cy Young in all-time wins.

1928 - Birthday of Shirley Temple (d. 2014), Santa Monica, CA. Child movie star who was Hollywood's greatest box-office attraction by the age of seven. She danced, sang, acted, and beguiled in one escapist musical hit after hit during the darkest days of the Depression. She received a special Juvenile Academy Award in February 1935 for her outstanding contribution as a juvenile performer in motion pictures during 1934. By age 12, her appeal dropped and after a series of flops, she retired. In later years, she became the darling of the Republican Party and was appointed to political and/or ambassadorial posts by three Republican presidents, Richard Nixon, Gerald Ford, and George H. Bush, but surprisingly not by Hollywood's own Ronald Reagan. She was appointed a U.S. Ambassador to Ghana and chief of protocol under President Gerald Ford and then Ambassador to Czechoslovakia 1989 to 1992 by Bush I. Temple was the recipient of numerous awards and honors, including the Kennedy Center Honors and a Screen Actors Guild Life Achievement Award. She is 18th on the AFI list of the greatest female American screen legends of Classic Hollywood cinema.

1932 - Bing Crosby records “Sweet Georgia Brown” with Isham Jones Band.

1934 – Public Enemy #1, John Dillinger is killed by the FBI in Chicago.

1936 - Pioneer rock singer Roy Orbison (d. 1988) was born in Vernon, Texas. His writing and performing in the 1950's helped create a mass market for rock music, including his own recording of "Ooby Dooby," which was a moderate hit in 1956. In 1958, Orbison wrote "Claudette," named for his wife, which became a million-seller for the Everly Brothers. Roy Orbison's sound mellowed somewhat in the following decade and he began his string of million-sellers in 1960 with "Only the Lonely." His other hits included "Running Scared," "Crying" and "Oh, Pretty Woman," a number-one record in 1964. Orbison suffered two personal tragedies in the '60s. In 1966, his wife was killed in a motorcycle accident. Three years later, two of his three children died in a fire at his home near Nashville. Orbison's career took an upswing in 1988 when his collaboration with Bob Dylan, George Harrison and Tom Petty under the name “The Traveling Wilburys.” His honors include inductions into the Rock and Roll Hall of Fame in 1987, the Nashville Songwriters Hall of Fame in the same year, and the Songwriters Hall of Fame in 1989. Rolling Stone placed him at number 37 on their list of the "Greatest Artists of All Time" and number 13 on their list of the "100 Greatest Singers of All Time.” In 2002, Billboard magazine listed Orbison at number 74 in the Top 600 recording artists.

http://www.orbison.com/

http://www.hotshotdigital.com/OldRock/RoyOrbisonDisco.html

http://en.wikipedia.org/wiki/Roy_orbison

1939 – Actor Lee Majors, “The Six Million Dollar Man,” was born Harvey Lee Yeary, Wyandotte, MI.

1939 – Early rock and roller Ray Peterson (d. 2005) was born in Denton, TX. He had two top 10 hits in 1960, “Tell Laura I Love Her” and “Corrina, Corrina.”

1941 - Birthday of Allen Cohen (d. 2004), Brooklyn. Poet, editor of San Francisco Oracle, visionary, champion for peace and justice who inspired his generation. The memory of Allen Cohen will forever live in the hearts of those who loved him and all whose lives he touched with his poetry and his promotion of peace and love.

1942 - Birthday of “Gidget,” Sandra Dee, born Alexandra Zuck (d. 2005), Bayonne, NJ. Singer/actress/heart throb to a generation. A highly publicized marriage to Bobby Darin (1960–1967) ended in divorce.

1943 - The Earl "Fatha" Hines Band, featuring then-unknowns Dizzy Gillespie, Charlie Parker, and a vocalist named Sarah Vaughan, begins a series of engagements at the Apollo in Harlem.

1943 – “Tattoo,” Herve Villechaize (d. 1993) was born in Paris, France. The co-star with Ricardo Montalban on television’s “Fantasy Island,” he burst onto the screen as Bond villain Nick Nack in “The Man With the Golden Gun.”

1944 – Birthday of Anthony James “Tony” Esposito, Sault Ste. Marie, Ontario. Hockey Hall of Fame goalie: NHL: Montreal Canadiens, Chicago Blackhawks. Won Calder Memorial Trophy as NHL's outstanding rookie in 1969-1970; All-star, 1970, 1972, 1980. Shared Vezina Trophy for best goaltender [1972, 1974]; played 886 games in NHL, winning 423, losing 307, earning draw in 151; 76 shutouts with a 2.92 goals-against-average; in 99 playoff games, Tony won 45, lost 53 with a 3.07 average; shared goaltending duties with Ken Dryden in 1972 when Team Canada played the Soviet Nationals in famed Series of the Century in which Canada edged Soviets, four games to three and one tie. Brother of Hockey Hall Fame player, Phil Esposito.

http://www.legendsofhockey.com

1944 – Birthday of Marty Fleckman, Port Arthur, TX. Pro golfer, Univ. of Houston: 3 NCAA championship teams/individual title in 1965 with a two-day total of 135. All-American, 1965; medalist honors at Western Amateur, 1966; Walker Cup team, 1967. Pro: Cajun Classic champ, 1967; Golf teacher: Meyer Park Golf Course, Houston.

1945 – President Harry Truman angrily confronted Soviet Foreign Minister Molotov, accusing the Soviets of breaking the Yalta agreements reached among FDR, Churchill, and Stalin just weeks before FDR died on April 12, 1945.

1948 - Johnny Longden became the first jockey to ride 3,000 career winners as he set the mark at Bay Meadows in San Mateo, CA.

1952 – New York Giants knuckleballer and Hall of Famer Hoyt Wilhelm homered in his first Major League at bat and followed with a triple next time up. Over the next 21 years, covering 1070 more games, he never hit another of either.

1953 - Top Hits

“Doggie in the Window” - Patti Page

“Pretend” - Nat King Cole

“I Believe” - Frankie Laine

“Your Cheatin’ Heart” - Hank Williams

1954 - Henry Aaron of the Milwaukee Braves hit the first home run of his Major League career. It came against Vic Raschi of the St. Louis Cardinals in the Braves' 7-5 victory. Not only did he raise the bar for home runs, but he also established 12 other Major League career records, including most games, at-bats, total bases and RBI's. Aaron won three Gold Glove awards, earned National League MVP honors in 1957, and appeared in a record 24 All-Star Games. Aaron went onto hit 755 homers, more than any other player who did not take PEDs.

1954 - The NBA approved a proposal by Syracuse Nationals owner Danny Biasone to adopt a 24-second clock. The rule stated that “a team in control of the ball must make an attempt to score within 24 seconds after gaining possession of the ball.” Biasone promoted the rule to boost the league's offensive output. He decided on 24 seconds by dividing the total number of shots taken in an average game into 48 minutes, the time played in regulation game.

1956 - High on his recent successes, and at the insistence of Colonel Tom Parker, Elvis Presley begins a disastrous concert stint at the Frontier Hotel in Las Vegas where he opens for comedian Shecky Greene. Despite having "Heartbreak Hotel" at the top of the charts, the middle-aged audience, miles removed from Elvis' teen fan base, are completely indifferent to him and his contract is soon torn up after only one week of a two-week engagement. However, while there, Presley witnesses a band called Freddie Bell and the Bellboys doing a wild rave-up version of Big Mama Thornton's blues hit "Hound Dog." He soon works it into the live act. Presley wouldn't play Las Vegas again for almost 13 years.

1960 - Herman's Hermits released a song called "My Sentimental Friend," which would become a major European hit, reaching number two on the UK pop chart. In the US however, the band was now hopelessly out of style and one of the best songs they ever recorded was ignored completely.

1961 - Birthday of George Lopez, Mission Hills, California; comedian/actor.

1962 – The expansion New York Metropolitans won their first Major League game, beating the Pittsburgh Pirates, 9-1, behind Jay Hook’s 5-hitter. The Mets started the season by losing their first 9 games, prompting manager Casey Stengel to ask whimsically, “can’t anybody here play this game?”

1963 - High school student Neil Young and his band, the Squires, enter a Winnipeg, Manitoba, Canada studio to record their first single, a surf instrumental called "The Sultan."

1961 - Top Hits

“Blue Moon” - The Marcels

“Runaway” - Del Shannon

“Mother-In-Law” - Ernie K-Doe

“Don’t Worry” - Marty Robbins

1963 - Jan and Dean record "Surf City"

1963 - Pete Rose of the Cincinnati Reds got his first hit in the Major Leagues. It was a booming triple off the Pirates' Bob Friend. ‘Charlie Hustle' went on to break Ty Cobb's all-time hitting record more than 20 years later, playing for the Reds, the Phillies and the Expos. He was later banished from baseball for illegal betting on baseball games.

1964 - Ken Johnson of the Houston Astros will certainly never forget this day. Johnson tossed the first no-hit game -- for a loss -- in baseball history. Cincinnati's Reds beat Johnson's no hitter by a score of 1-0. The Reds capitalized on two costly Houston errors.

1966 - Napoleon XIV's "They're Coming To Take Me Away, Ha-Haaa!" hits #1

1966 - Frank Sinatra's “Strangers in the Night” LP hits #1

1966 - Roger Miller's "You Can't Roller Skate In A Buffalo Herd" enters the charts

1966 - President Lyndon Johnson publicly appeals for more nations to come to the aid of South Vietnam.

1968 - NYPD rushed occupied buildings on the Columbia University campus to break up a student protest of a decision to build a gymnasium on public land in Harlem.

1968 – Oklahoma City bomber Timothy McVeigh (d. 2001) was born in Lockport, NY. Domestic terrorist was convicted and executed for the detonation of a truck bomb in front of the Alfred P. Murrah Federal Building on April 19, 1995. The attack killed 168 people and injured over 600. It was the deadliest act of terrorism within the United States prior to the September 11 attacks and remains the most significant act of domestic terrorism in United States history.

1969 - Top Hits

“Aquarius/Let the Sun Shine In” - The 5th Dimension

“You’ve Made Me So Very Happy” - Blood, Sweat & Tears

“It’s Your Thing” - The Isley Brothers

“Galveston” - Glen Campbell

1969 – Sirhan Sirhan received the death penalty for the assassination of Robert F. Kennedy in Los Angeles. In 1972, that sentence was commuted when the State of California abolished the death penalty. I covered the afternoon as news producer ABC-TV News. He is serving a life sentence at the federal correctional facility in San Diego County, CA.

1970 - Show: Joe Cocker (Mad Dogs and Englishmen), Van Morrison, The Stoneman, Metro Toll, Fairport Convention, Salt 'N Pepper, Clouds, Dry Paint, Brotherhood of Light, Little Princess #109 perform at the San Francisco Fillmore West Artist: David Singer.

http://images.wolfgangsvault.com/images/catalog/thumb/BG229-231-PC.jpg

1970 - Norman Greenbaum's "Spirit in the Sky" is awarded a Gold record. The single sold two million copies in 1969 and 1970 and reached number three in the US and number one in the UK.

1977 - Thelma Houston's "Don't Leave Me This Way" hits #1

1977 - Top Hits

“Don’t Leave Me This Way” - Thelma Houston

“Southern Nights” - Glen Campbell

‘Hotel California’ - Eagles

‘She’s Got You’ - Loretta Lynn

1985 - The Coca-Cola Company told the world in a barrage of advertisements that it was changing its 99-year-old secret formula. New Coke was called “the most significant soft drink development” in the company's history. The public did not like it. Fans of the original Coke were instrumental in bringing Classic Coke back. The Coca-Cola did keep the “new” diet Coca-Cola. This year they started introducing cherry coke, lemon coke, and this summer, vanilla. http://memory.loc.gov/ammem/ccmphtml/colahome.html

http://www.coca-cola.com/

1985 - Top Hits

“We are the World” - USA for Africa

“Crazy for You” - Madonna

“Nightshift” - Commodores

“I Need More of You” - Bellamy Brothers

1987 - "Business Week" magazine announced its list of the highest paid executives in the U.S. Lee Iacocca of Chrysler Corporation topped the list, followed by Paul Fireman of Reebok International. The computer revolution did not begin until the 90's, knocking most automobile executives way off the charts.

1988 - The smoking ban on airplane flights went into effect. In compliance with rules issued by the Federal Aviation Administration, airlines banned smoking on domestic passenger flights lasting less than two hours, with the exception of chartered flights and travel club flights. Northwest Airlines voluntarily banned smoking on domestic passenger flights of all durations. The first commercial domestic air service that was entirely smoke-free, including the cockpit, was inaugurated by Delta Air Lines of Atlanta, GA, which banned smoking on all flights beginning January, 1995. Other airlines adopted this policy in the following year.

1988 - An intense winter-like storm brought thunderstorms to southern California and produced snow in some of the higher elevations. Nine girls at Tustin, CA were injured when lightning struck the tree under which their softball team had taken shelter from the rain.

1989 - Salina, KS was the hot spot in the nation with a high of 105 degrees. The high of 105 degrees established an April record for the state of Kansas. A total of eighteen cities in the central U.S. reported record high temperatures for the date.

1989 - "Baywatch" premiered on television. Set on a California beach, this program starred David Hasselhoff and a changing cast of nubile young men and women as lifeguards. Later the program was moved to Hawaii; the last episode was made in 2001. The most widely viewed TV series in the world, the program aired in 142 countries with an estimated weekly audience of 1.1 billion.

1994 - Discovery of the top “quark.” Physicists at the Department of Energy's Fermi National Accelerator Laboratory found evidence for the existence of the subatomic particle called the top quark, the last undiscovered quark of the six predicted to exist by current scientific theory. The discovery provides strong support for the quark theory of the structure of matter. Quarks are subatomic particles that make up protons and neutrons found in the nuclei of atoms. The five other quark types that had already been proven to exist are the up quark, down quark, strange quark, charm quark and bottom quark. Further experimentation over many months confirmed the discovery and it was publicly announced Mar 2, 1995.

1999 - Fernando Tatis becomes the first player in Major League history to hit two grand slams in one inning. The Cardinal third baseman hits both off Dodger starter Chan Ho Park in an 11-run third inning, setting the mark. His eight RBIs in one inning also breaks the old record of six.

2000 - In a 10-7 victory over Toronto, the Yankees’ Bernie Williams and Jorge Posada became the first teammates to hit a home run from both sides of the plate in the same game.

2005 - The first-ever YouTube video, titled "Me at the Zoo," was published by user "jawed."

2013 – Glen Campbell’s (d. 2017) publicist told members of the press that his client is no longer capable of performing on stage due to advancing Alzheimer's disease. Sandy Brokaw went on to say that the 77-year-old Campbell planned on recording one final album called "See You There," which would feature new renditions of old songs. In April, 2014, he was admitted to a nursing home that specialized in Alzheimer’s disease.

2014 – Google is partnering with solar manufacturer SunPower to form a financing program to help families afford solar power for their homes.

2014 – Facebook announced first quarter profits of $642 million, nearly 300% year-over-year.

2015 – A pending merger between Comcast and Time-Warner cable was canceled after regulators expressed concerns regarding the reduction of competition and other public interest issues. TWC was acquired for $78.7 billion by Charter Communications in 2016, prior to which it was the nation’s second-largest cable provider behind Comcast. Charter also acquired Bright House in a separate transaction.

Stanley Cup Champions:

1950 - Detroit Red Wings

-------------------------------------------------------------

SuDoku