Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a website that posts information, news, and

entertainment for the commercial alternate financing,

bank, finance and leasing industries

kitmenkin@leasingnews.org

![]()

Wednesday, June 17, 2020

Today's Leasing News Headlines

Marlin Business Services Announces Further Staff Cuts

Form 8-K Regulation FD Disclosure

Specialists in cannabis and hemp company leasing

Xtraction Services Announces Name Change to XS Financial

Financing Cannabis Funding Sources

Many Work with Third Party Originators

Remember Your “Value-Added”

Sales Makes it Happen by Scott Wheeler, CLFP

U.S. Retail Sales Rebound After Historic Slump

Monthly Retail and Food Services in the United States

The World's Largest Retailers

Top 10 retailers based on global retail sales 2020

Does Insurance Cover Damage and Loss

Due to "Civil Unrest?"

By Colleen Daly-Tinkham, CMO

Police Spending per Capita in Major U.S. Cities

Amount Spent on Policing per Person in 2020

How Much Do U.S. Cities Spend on Policing

Total Police Budget and General Fund Expenditures

FDIC-Insured Institutions Reported Reduced Profitability

but Strong Loan Growth/Stable Asset Quality First Quarter 2020

COVID-19 Related Legislation & Executive Orders Impact

Bankruptcies & Repossessions for Equipment Finance Companies

Labrador Retriever/Mixed

San Diego, California Adopt a Dog

News Briefs---

U.S. bank profits plunge 70%

on coronavirus loss provisioning (see press release in Leasing News)

‘The dollar is going to fall very, very sharply,’

warns prominent Yale economist

How PG&E missed its chance to prevent the Camp Fire:

Damning report on utility’s negligence

As leaders warned of US meat shortages,

overseas exports of pork and beef continued

Fauci said US government held off promoting face masks

because it knew shortages were so bad

24 Hour Fitness has filed for bankruptcy

Closing More than 134 Gyms

List of 24 Hour Fitness Closed Gyms

by State

Ascentium Capital Wants to Finance

Your Drone Enterprise

Coronavirus: Workers group wants Tesla

to give more safety information

What Americans Bought to Prepare for the Pandemic

Eggs/Toilet Paper/Milk/Fresh Meat Alternatives/Pasta & Rice

You May have Missed---

30 Companies - Largest COVID-19 Government Contracts

has committed a combined $15.2 billion to nearly 4,000 companies

Broker/Funder/Industry Lists | Features (wrilter's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

Leasing News Icon for Android Mobile Device

Sports Brief----

California Nuts Brief---

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release,” it was not written by Leasing News nor has the information been verified. The source noted. When an article is signed by the writer, it is considered a “byline.” It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

Marlin Business Services Announces Further Staff Cuts

Form 8-K Regulation FD Disclosure

"As a result of the impact of the COVID-19 pandemic on its business, on June 15, 2020, Marlin Business Services Corp. (the 'Company') implemented a reduction in force that affected approximately 55 employees. All impacted employees were among the approximately 120 employees included in the furlough previously announced by the Company on April 9, 2020.

“Approximately 20 additional furloughed employees have returned, or have been notified of their imminent return, to the workforce. The furlough period for the remaining population of furloughed employees is currently expected to continue through July 15, 2020.

"The Company does not expect the reduction in force to impact its ability to grow origination volume when general business and economic conditions permit. The Company will provide further detail regarding its origination growth strategy on its second quarter 2020 earnings call."

Marlin announced in April, ""Since Friday, March 20, 2020, Marlin’s entire workforce has been working remotely and all business-related employee travel has been suspended. Through the successful execution of the plan, Marlin has not experienced any interruption of its normal business operations."

Marlin in May sent out Press Release Net Loss $11.8M 1st Quarter: Credit Losses $52.1 Million, $30.4 million Increase from 12/31/2019,

http://leasingnews.org/archives/May2020/05_04.htm#marlin

[headlines]

--------------------------------------------------------------

Specialists in cannabis and hemp company leasing

Xtraction Services Announces Name Change to XS Financial

David Kivitz, Chief Executive Officer of XS, said, “We have grown tremendously since inception in 2017, building out our services and refining our business model. The new name clearly identifies who we are and what we do.

About Xtraction Services

Founded in 2017, XS specializes in providing equipment leasing solutions in the United States to owner/operators of cannabis and hemp companies, including cultivators, oil processors, manufacturers, testing laboratories, among others. In addition, XS provides a full range of consulting services, including equipment selection and procurement, through its network of preferred vendor partnerships with original equipment manufacturers and equipment distributors. This powerful dynamic provides an end-to-end solution for customers, which results in recurring revenues, strong profit margins

For more information please contact Xtraction Services:

David Kivitz

Chief Executive Officer

Antony Radbod

SVP, Sales and Marketing

Tel: 1-407-900-4737, Ext. 5

Email: ir@xtractnow.com

www.xtractnow.com

|

[headlines]

--------------------------------------------------------------

Financing Cannabis Funding Sources

Many Work with Third Party Originators

-----------------

Cannabis Equipment Leasing

Forum Financial Services has been involved in the Cannabis/CBD marketplace for over a year, launching a specific website geared for this industry: www.cannabisequipmentlease.com.

Tim O'Connor, Vice President, says, "Over the past year we have written and closed over a dozen leases. Most have been in the medical marijuana space and now we are expanding into the hemp/CBD industry."

"Most of our transactions were direct. We have two approved brokers that we have completed transactions with and are looking to possibly add one or two more. We are funding our own transactions, which makes us unique in the space. Well capitalized companies with solid management are what we have focused on, mostly "corporation only." Although, we have done a couple start-ups based on solid collateral and decent opening balance sheets.”

"As is the case with Forum Leasing, we do not offer ANY type of lease or financing for equipment located in California. We do offer leasing and are open for business for companies that have equipment installed/located in all the other 49 states."

Tim O'Connor

Forum Leasing

tim@forumleasing.com

PH.: 972-690-9444 EXT. 225

Cell: 214-717-2916

www.cannabisequipmentlease.com

www. http://forumleasing.com/

---------------------

Now Open for the Cannabis Industry

International Financial Services dba IFS

"IFS has approved our 1st deal in the cannabis industry! We are now able to consider established companies with accountant prepared financial statements (or tax returns) within the cannabis industry.

“NOTE: We won't consider any start-ups. Must have at least 3 full years in business. Please contact me for more information or to preview a deal."

Dara Dietmeyer, VP

Credit & Syndications

847-932-0912 direct

ddietmeyer@ifsc.com

INTERNATIONAL FINANCIAL

SERVICES CORPORATION

www.ifsc.com

------------------------------

Alliance Commercial Capital, Inc

161 North Clark Street, 16th Floor

Chicago, Illinois, 60601

888-727-9960 Ext# 6078

Fax: 312-664-3021

sam@accleasing.com

www.accleasing.com

Cannabis Program Highlights:

Loan Size: $25,000 - $10,000,000+

Collateral: lighting, HVAC, benching, extractors, irrigation, CCTV & related cannabis equipment

Locations: Nationwide

Business: The owner/tenant must be licensed and regulated by the State. Personal Guarantees required from all owners. Minimum credit score preferred 700. No bankruptcies in the last 7 years. No unresolved state or federal tax liens.

Application Only: $50,000.

Documentation required: Submit with our attached credit application, copy of vendor invoice/quote, Bank statements for the last 4 months and copy of State Cannabis License

Time in Business: 2+ years

Terms are from 2 to 5 years

Interest rates typically average 9-12.75%

Full Disclosure: Over $50,000

Documentation required: Same as above plus Personal and Corporate tax returns for last 3 years, Personal financial statement for all owners, Debt Schedule, Latest interim Financial Statements.

Start-Ups: Unsecured Business Finance (UBF) program up to $150,000/owner based solely on personal credit. Submit with credit application only.

MoneyTrac Technology, Inc. (“MTT”), a subsidiary of Global Payout, Inc. (OTC:GOHE) , has established and is now marketing an alternative banking solution for the Cannabis industry.

MTT currently has the ability to integrate and streamline electronic payment processing such as E-wallet, mobile applications, debit cards, and credit cards. Currently, MoneyTrac Technology has strategic partnerships with top cannabis services such as GreenRush, BlazeNow, High Grade Management Group, and PotSaver, which was a majority acquisition last October.

According to Bloomberg, "MoneyTrac Technology, Inc., through its subsidiary, provides electronic wallet and e-banking financial solutions for the marijuana industry. It offers financial technology, which includes an e-wallet and mobile app that allows users to access financial information. The company also provides white labeling services; mobile platform to manage financial transactions; and solutions for accessing account information, making payments, and online bill pay activities. In addition, it offers transaction management services."

-----------------------

dw@dwevents:

"I do know a bit about canna finance in the US and have actually completed a deal or two (it’s mainly all convertible debt). I ran an event in NYC for over 200 investors at Chelsea Piers and I helped organize, promote and sell out the first Weed Stock conference in Colorado. I have been an investor in the industry since 2013.

"There are no miracle answers for leases (in most states, ownership of canna assets without being licensed as a canna business would prohibit leasing). Most deals are done as loans with a conversion provision and pretty harsh default penalty.

"One thing lenders have to keep in mind is that bankruptcy (other than just a state bankruptcy) isn’t available to canna debtors. Federal judges won’t hear the cases and will dismiss them if they get filed. In fact most disputes that wind up filed in federal court get dismissed and refiled in state court."

Organigram Enters into Letter of Intent

with Farm Credit Canada for $10 Million

http://leasingnews.org/PDF/Organigram2017.pdf

------------------------------

Number 1 Enterprises, Inc.

Funding Cannabis, Marijuana, CBD, Hemp Businesses

“We specialize in structuring your capital infusion. Number 1 is a group of reformed bankers whom grew weary of declining great clients because their loan requests did not fit into the traditional lenders' ‘box’.”

Through a network of over 8,000 Funding Sources: Private Investors, Investor Groups, Lenders, Co-Brokers, Facilitators, Hedge Funds, etc., we help businesses acquire the necessary capital to grow their business:

- Debt and Convertible Notes

- Equity Capital

- Unsecured Business Financing

- Purchase Order Financing

- Accounts Receivable Financing

- Factoring

Companies have funded or in process of funding include:

1. Marijuana Grower, Extractor, Edibles Maker, Wholesaler, and Dispensary in Alaska

2. Medical Marijuana Conglomerate Acquiring a Building and Additional Capital for Operations in Nevada

3. Medical Marijuana Grower in Arizona

4. National Builder whom builds Grow-houses of all sizes

5. Warehouse Builder in North Florida which leases the space to Cannabis Grow-houses

6. Grower in Northern Nevada

7. Builder & Grower in New Jersey

8. Cannaceuticals and Hemp-based Nutritional Product company based in Florida and Pennsylvania

9. CBD Oil Manufacturer

10. CBD Oil Wholesalers

11. CBD Oil Retailers

“We will leave no stone unturned to ensure every available option for acquiring your business capital.

“With Number 1, We get it done!”

Andrew DiAlberto, President

Number One Enterprises, Inc. 3100 NW 46th St.

Suite 208

Ft. Lauderdale, FL 33309

Tel: 954-204-3292

Cell: 954-579-2584

E-Mail: andrew@number1ent.com

----------------------------------------

Vertical Companies

Scott Jordan

Managing Director

Financial Services

Englewood, Colorado

sjordan@vertcos.com

303 887 2750

https://www.linkedin.com/in/thescottjordan/

Scott Jordan leads Vertical’s financial services arm. He has been in Colorado providing access to capital for marijuana business owners since 2009 and has been called “The Marijuana Money Man” by Fox San Francisco and the Denver Post. He created one of the first companies to provide debt-based capital, Dynamic Alternative Finance in 2014, and arranged over $30 million in funding before accepting the position with Vertical as President of the newly created Financial Services division.

---------------------------------------

Marijuana Industry News

http://mjinews.com

|

[headlines]

--------------------------------------------------------------

Remember Your “Value-Added”

Sales Makes it Happen by Scott Wheeler, CLFP

Top originators in the commercial equipment leasing and finance industry are leading with value. They are closing more transactions because they understand and can articulate the value that they offer to each client. Non-commodity, valued-added professionals are in demand by vendors and end-users that want a better buying experience. Value is more important than ever as we proceed through the recovery period. Strong vendors and end-users are willing to pay for value. Below are a few questions that should be addressed as you evaluate your personal value proposition (PVP) during the recovery:

- What is your personal value proposition (PVP)? How have you been able to enhance your PVP during the economic shutdown and now recovery?

- How have your vendors and end-users reacted to your PVP over the past several months?

- Are you explaining your PVP within the context of the recovery?

- Has your PVP allowed you to better serve the needs of your vendors and end-users?

An originator recently explained how he presents himself more aggressively and with more confidence, because he knows that his personal value is important now, more than ever. His clients appreciate his personal service, his personal expertise, and his personal advice. His relationships are becoming deeper and he is offering more than just financing. He feels as though he is building long-term relationships because of the economic disruption. His personal value proposition is more powerful. He is moving forward as others are falling behind.

Remember Your “Value-Added”

Scott A. Wheeler, CLFP

Wheeler Business Consulting

1314 Marquis Ct.

Fallston, Maryland 21047

Phone: 410 877 0428

Fax: 410 877 8161

Email: scott@wheelerbusinessconsulting.com

Web: www.wheelerbusinessconsulting.com

Sales Makes it Happen articles:

http://www.leasingnews.org/Legacy/index.html

[headlines]

--------------------------------------------------------------

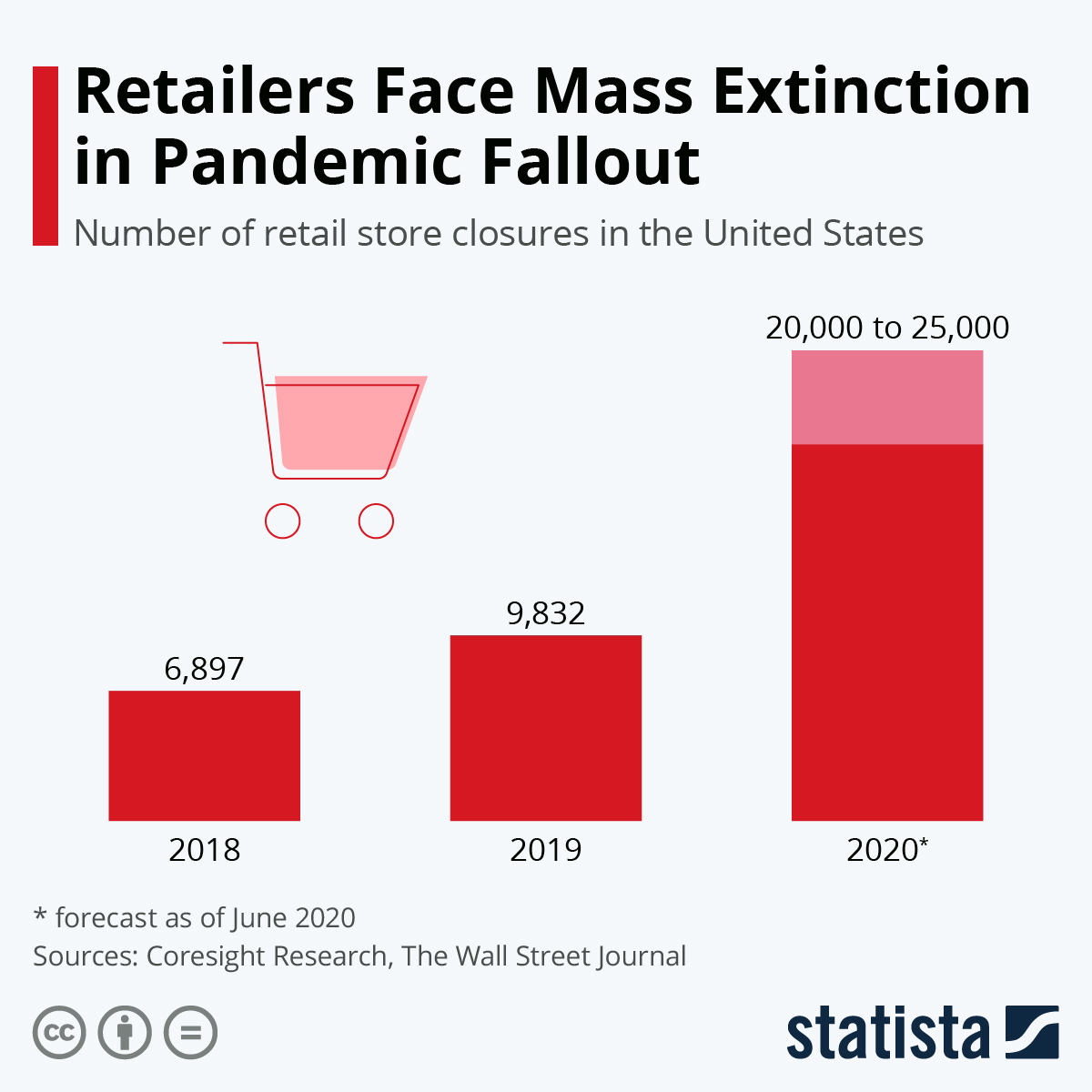

Following an unprecedented plunge in April, U.S. retail sales rebounded sharply in May, according to preliminary figures released by the U.S. Census Bureau on Tuesday. Total retail and food services sales amounted to $485.5 billion in May, up 17.7 percent from the previous month, but still 6.1 percent below last year's May figure.

Due to the widespread lockdown instated to contain the spread of COVID-19, retail sales had plunged 14.7 percent in April, following an already unprecedented 8.2 percent drop in March. To put this in perspective, the highest drop prior to March 2020 had occurred in November 2008, when retail sales declined by less than 4 percent at the height of the financial crisis. As the following chart shows, retail sales have very rarely dipped significantly in the past, with the financial crisis being the most notable exception of the past three decades.

The May rebound was led by those stores hit hardest by the shutdown in the first place, with clothing store sales up 188 percent over April and other specialty stores also seeing high double digit increases in sales. While the quick bounce back in consumer spending is certainly encouraging, it needs to be noted that spending levels are still below pre-crisis levels, and significantly so for many types of retailers. Clothing store sales were still 63 percent below last year's level in May for example, despite the aforementioned spike in sales.

By Felix Richter, Statista

|

[headlines]

--------------------------------------------------------------

The global retail industry has been hit hard by the COVID-19 pandemic and the measures taken to contain it. Not all retailers are created equal, however, and it’s been independent and specialty retailers that took the brunt of the lockdown while larger mass merchants will likely walk away from the crisis (relatively) unscathed. While thousands of small retailers in the United States and internationally are fighting for their existence after having been forced to shutter their stores for weeks, industry giants like Walmart or Amazon are facing a year of disappointing sales growth and lackluster profits at worst.

As the following chart shows, the two aforementioned companies are the world’s largest retailers by far, when looking at projected global retail sales for 2020. Considering the size and global footprint of Amazon, it’s quite astonishing how far ahead of its online rival Walmart still is in terms of retail sales. According to Kantar’s latest estimates, the retail giant headquartered in Bentonville, Arkansas is expected to clock $527.8 billion in sales this year, putting it miles ahead of Amazon’s $268.2 billion in forecast sales. With estimated sales of $156.6 billion Costco completes the global top 3, with Germany’s Schwarz Group (parent of Lidl and Kaufland) the first non-U.S. company in the top 10.

By Felix Richter, Statista

[headlines]

--------------------------------------------------------------

Does Insurance Cover Damage and Loss

Due to "Civil Unrest?"

By Colleen Daly-Tinkham, CMO,

American Lease Insurance Agency Corporation (ALI)

Many businesses are just beginning the slow path to recovery as government-mandated lockdowns due to COVID-19 are being lifted. In the midst of this recovery, there have been widespread protests in support of the Black Lives Matter movement, calling for an end to police violence against minorities. During the mostly peaceful protests, some individuals’ actions, unfortunately, have resulted in damage and loss of property and equipment for businesses. Equipment finance companies may be wondering if insurance will provide coverage for losses due to “civil unrest.”

Does business insurance provide coverage for leased or financed equipment that is damaged due to “civil unrest?”

Loretta Worters from the Insurance Information Institute offers the following guidance: Virtually all business owner and commercial insurance property policies cover business property that has been damaged by ‘riot, civil commotion, vandalism and fire.’ Damage to windows, doors, light fixtures, store windows and plate glass office fronts is typically included. The contents of the building coverage under typical policies would also include leased or financed equipment, furniture, computers, or machinery that may be either damaged, destroyed or stolen.1

If a business closes, does insurance cover losses, including missing leased or financed equipment?

Steve Dinkelaker of American Lease Insurance (ALI) offers the following additional guidance: Theft is a covered cause of loss in business insurance policies with a “special form” endorsement (formerly known as “all-risk” endorsements), which every equipment finance company should require of its customers. Consequently, if a theft loss is discovered and reported before the business closes or when the equipment finance company is in the process of repossessing the equipment, it will be covered by such endorsed insurance.

However, there are some significant differences in coverage between typical business owner policies (BOP) that your lessees may purchase and a customized lease insurance program like the ALI Program that equipment finance companies should consider. Typically, in a BOP:

- Coverage provides for actual cash value (ACV) of the equipment (replacement cost minus depreciation), which may not cover the equipment finance company’s net investment in the equipment

- Coverage for theft excludes cases when there are no visible signs of illegal entry or exit, such as when employees or contractors with access to the lessee’s premises have stolen leased equipment

ALI provides its equipment finance company clients and their customers broader coverage than typical BOP coverage:

- The ALI Program provides replacement cost coverage, which is better than the ACV coverage available through a typical BOP and benefits both you and your lessee

- If the equipment finance company chooses not to replace the equipment, ALI coverage ensures that they will be covered for their net investment in the equipment, which is usually greater than the ACV

- ALI coverage also includes additional causes of loss not included in standard BOP due to “civil unrest,” such as illegal taking, even if there are no visible signs of illegal entry or exit2

In cases of missing leased or financed equipment and damage caused by “civil unrest,” equipment finance companies should consult with their lease insurance provider or their lessee’s insurance provider to determine if they have coverage for these causes of loss. This is also a very good time for equipment finance companies to consider implementing a lease insurance program to ensure their portfolios are protected as we navigate these unchartered waters.

American Lease Insurance (ALI) provides a customized, comprehensive lease insurance program of property and liability coverage and insurance tracking to lessors and finance companies of equipment and commercial vehicles, underwritten by A-rated insurance carriers. Companies insured by the ALI ProgramSM are confident their portfolios are fully protected, and customers financing or leasing equipment or commercial vehicles appreciate affordable insurance charges, responsive customer service and prompt claims adjustment. To learn more about the ALI Program, please contact Colleen.

Colleen Daly-Tinkham

Chief Marketing Officer

American Lease Insurance Agency Corporation

Office: 888-521-6568 x244, 413-658-3100 x244

colleen@aliac.net

www.aliac.net

www.linkedin.com/company/american-lease-insurance

[headlines]

--------------------------------------------------------------

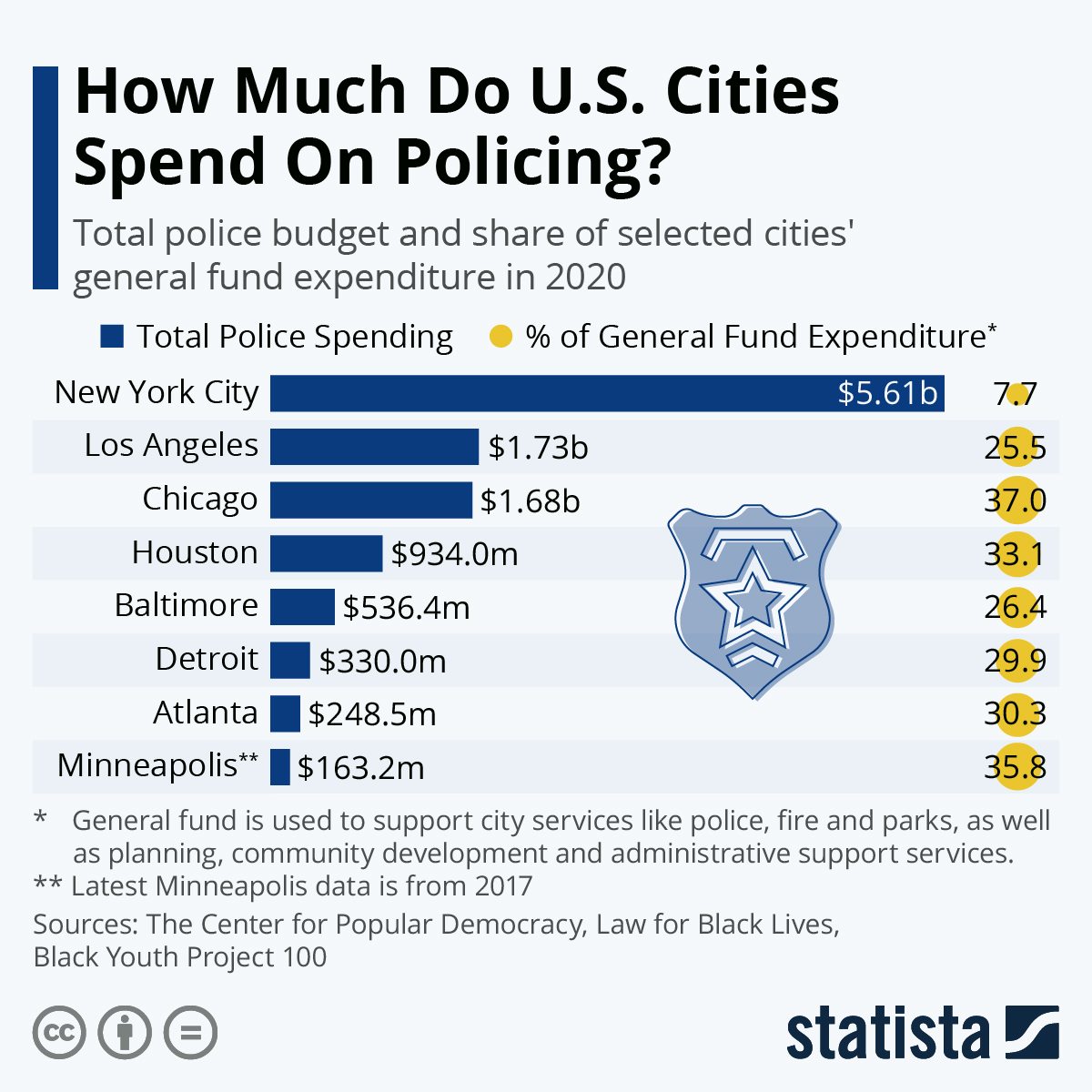

Over the past 30 years, the U.S. has dramatically increased police spending while funding has fallen for mental health services, community outreach programs, housing subsidies and food benefits programs for disadvantaged low-income communities that have to deal with high levels of criminality. Data from The Center for Popular Democracy, Law for Black Lives and the Black Youth Project 100 estimates that the U.S. spends a collective $100 billion on policing per year and another $80 billion on incarceration. It also shows the amount spent on policing per person in a selection of major cities which ranges from $381 to $772.

Well before George Floyd lost his life, an earlier version of the report revealed serious issues about policing in Minneapolis, stating that "racial disparities there are especially stark" and that "black and indigenous people were more than eight and-a-half times more likely than whites to be arrested for low-level offenses." It also said that "black people comprise 19 percent of the Minneapolis population but account for 59 percent of low-level arrests.” Whites, by contrast, comprise 64 percent of the population but only 23 percent of low-level arrests". In 2017, Minneapolis spent $408 per person on its police force. Unfortunately, that figure was not available for 2020, unlike the other cities listed on this infographic.

After Freddie Gray was killed by police officers in 2015, Baltimore also received national attention for its heavy-handed policing and levels of racial division. Back in 2017, the report noted that its police department was under scrutiny due to years of corruption, misconduct and brutality that eroded trust with communities of color. Out of the city's operating budget more than a quarter of funding is allocated to policing, some $536 million. Spending on policing per person is the highest of any major city in U.S. at $904. By comparison the figure in New York was $672 while it was $436 in Los Angeles.

By Niall McCarthy, Statista

[headlines]

--------------------------------------------------------------

In 2017, a report compiled by The Center for Popular Democracy, Law for Black Lives and the Black Youth Project 100 analyzed police budgets in major cities across America. Updated data for 2020 has now been released which shows that U.S. police departments are still receiving an astronomical percentage of discretionary funds compared to other crucial community programs. Police budgets remain high in 2020, ranging from 20 to 45 percent of discretionary funding in major metropolitan areas.

The share of the general fund is far higher in other cities such as Los Angeles. The LAPD has a 2020 budget of $1.7 billion according to the report and that accounts for over a quarter of the general fund. The share is even higher in Chicago at 37 percent with the total police budget approximately $1.68 billion. In Minneapolis, the city where George Floyd lost his life, the 2017 data shows that the police budget accounted for 35.8 percent of the general fund, totalling $163 million.

The same old trends are evident as in previous years in most major cities, however with the NYPD's $5.6 billion budget accounting for 7.7 percent of New York City's general fund. A general fund is used by a city to support municipal services like law enforcement, the fire department and parks, as well as planning, community development and administrative support services.

Niall McCarthy, Statista

[headlines]

--------------------------------------------------------------

#### Press Release #############################

FDIC-Insured Institutions Reported Reduced Profitability

but Strong Loan Growth/Stable Asset Quality First Quarter 2020

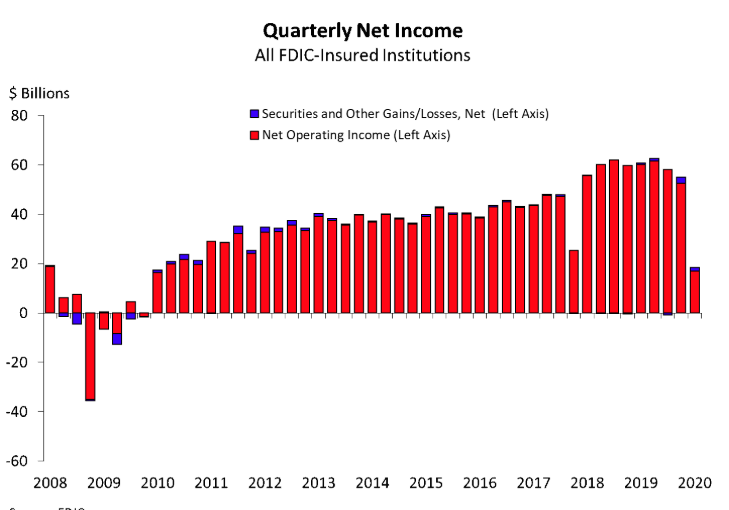

- Quarterly Net Income Fell by 69.6 Percent from First Quarter 2019

*Community Banks Reported a 20.9 Percent Decline in Net

Income from a Year Ago

- Loan and Lease Balances and Deposits Registered Strong Growth

- Asset Quality Metrics Remained Relatively Stable

- The Number of Banks on the "Problem Bank List" Remained Low

- Deteriorating Economic Activity Negatively Affected Banking Industry's Profitability

— FDIC Chairman Jelena McWilliams

“The banking industry has been a source of strength for the economy in the first quarter despite unexpected shocks. Although bank earnings were negatively affected by increases in loan loss provisions, banks effectively supported individuals and businesses during this downturn through lending and other critical financial services.”

For the 5,116 commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC), aggregate net income totaled $18.5 billion in first quarter 2020, a decline of $42.2 billion (69.6 percent) from a year ago. The decline in net income is a reflection of deteriorating economic activity, which resulted in the increase in provision expenses and goodwill impairment charges. Financial results for first quarter 2020 are included in the FDIC's latest Quarterly Banking Profile released today.

"The banking industry has been a source of strength for the economy in the first quarter despite unexpected shocks. Although bank earnings were negatively affected by increases in loan loss provisions, banks effectively supported individuals and businesses during this downturn through lending and other critical financial services," McWilliams said.

"Notwithstanding these disruptions, at the end of the first quarter, bank capital and liquidity levels remain strong, asset quality metrics are stable, and the number of 'problem banks' remains near historic lows."

Highlights from the First Quarter 2020 Quarterly Banking Profile

Quarterly Net Income Fell by 69.6 Percent from First Quarter 2019: The 5,116 FDIC-insured institutions reported aggregate net income of $18.5 billion in first quarter 2020, a decline of $42.2 billion (69.6 percent) from a year ago. The decline in net income is a reflection of deteriorating economic activity, which propelled the increase in provision expenses and goodwill impairment charges. The decline was broad-based, as slightly more than half (55.9 percent) of all institutions reported year-over-year declines in net income. The share of unprofitable institutions increased from a year ago to 7.3 percent. The average return on assets ratio fell from 1.35 percent in first quarter 2019 to 0.38 percent in first quarter 2020.

Net Interest Margin Declined from a Year Ago to 3.13 Percent: The average net interest margin declined 29 basis points from a year ago to 3.13 percent. Net interest income declined by $2 billion (1.4 percent) from a year ago, with falling yields on earning assets contributing to the decline. Less than half (44.6 percent) of all banks reported year-over-year declines in net interest income.

Community Banks Reported a 20.9 Percent Decline in Net Income from a Year Ago: The 4,681 FDIC-insured community banks reported quarterly net income of $4.8 billion, representing a decline of $1.3 billion, or 20.9 percent. Provision expenses grew to $1.8 billion—three times the amount reported in first quarter 2019, hampering community bank profitability despite an increase in net operating revenue. Loan growth held steady at 5.8 percent year-over-year in spite of weakening economic conditions. The decline in average yield on earning assets surpassed the decline in average funding costs, causing the average community bank net interest margin to decline by 12 basis points to 3.55 percent.

Loan and Lease Balances Registered Strong Growth on Quarterly and Annual Basis: Total loan and lease balances increased by $442.9 billion (4.2 percent) from the previous quarter. Almost all major loan categories reported quarterly increases; however, the commercial and industrial loan portfolio reported the largest dollar increase, up $339.4 billion (15.4 percent). Over the past year, total loan and lease balances rose by 8 percent, the highest annual growth rate since first quarter 2008.

Asset Quality Metrics Remained Relatively Stable: Loans that were noncurrent (i.e., 90 days or more past due or in nonaccrual status) increased by $7 billion (7.3 percent) from the previous quarter. Commercial and industrial loans registered the largest dollar increase, rising by $3.6 billion (20.7 percent), but due to strong loan growth, the noncurrent rate increased only 4 basis points to 0.83 percent. The total noncurrent loan rate rose by 2 basis points from the previous quarter to 0.93 percent. Net charge-offs rose by $1.9 billion (14.9 percent) from a year ago, and the total net charge-off rate increased to 0.55 percent.

The Deposit Insurance Fund's Reserve Ratio Declined to 1.39 Percent: The Deposit Insurance Fund (DIF) balance totaled $113.2 billion in the first quarter, an increase of $2.9 billion from the previous quarter. The quarterly increase was led by unrealized gains on available-for-sale securities and assessment income. The reserve ratio declined 2 basis points from fourth quarter 2019 to 1.39 percent, due to the growth in estimated insured deposits.

The Number of Banks on the "Problem Bank List" Remained Near Historic Lows: The number of problem banks increased from 51 to 54 during the first quarter, the first quarterly increase since 2011. However, the number of problem banks remains near historic lows. Total assets of problem banks declined from $46.2 billion in the fourth quarter to $44.5 billion.

Mergers and New Bank Openings Continued in the First Quarter: During the first quarter, two new banks opened, 57 institutions were absorbed by mergers, and one bank failed.

# # #

Quarterly Banking Profile Home Page (includes previous reports and press conference webcast videos)

Charts and Data

Chairman McWilliams’ Press Statement

Congress created the Federal Deposit Insurance Corporation in 1933 to restore public confidence in the nation’s banking system. The FDIC insures deposits at the nation’s banks and savings associations, 5,116 as of March 31, 2020. It promotes the safety and soundness of these institutions by identifying, monitoring and addressing risks to which they are exposed. The FDIC receives no federal tax dollars—insured financial institutions fund its operations.

### Press Release ############################

[headlines]

--------------------------------------------------------------

### Press Release ############################

COVID-19 Related Legislation & Executive Orders Impact

Bankruptcies & Repossessions for Equipment Finance Companies

June 3 Webinar Alerted Participants to

Developments in Different States and Bankruptcy Courts

WASHINGTON, D.C. – Among the many outcomes of the COVID-19 pandemic are the passage of challenging legislation and the issuance of far-reaching executive orders with protections that encompass prohibiting debt collection and repossession. An examination of these actions and their implications were addressed during the Equipment Leasing and Finance Association’s June 3 webinar, “COVID-19’s Hidden Costs: Bankruptcy, Repossessions & Hostile Legislation.”

A total of 235 industry executives participated in the informational online event sponsored by RTR Services Inc. and presented by Alexander Darcy, Shareholder, Askounis & Darcy PC; Arlene Gelman, Shareholder, Vedder Price P.C.; and Scott Riehl, ELFA Vice President of State Government Relations, and moderated by Troy Kepler, General Counsel, Channel Partners Capital. They offered examples of state legislative and executive order overreach, discussed bankruptcy considerations for equipment lessors and secured creditors, and addressed participants’ questions.

Among the wide range of legislative and legal information, below are five highlights presented during the webinar.

- Governors are wielding executive authority under emergency powers in ways not seen since the Great Depression. One example is an Illinois Executive Order that prohibits any vehicle repossessions—commercial or consumer—related to a loan or financing, including equipment finance agreements. It suspends the UCC Article 9-609 right to recover collateral, and suspends the statutory section relating to title transfer of repossessed vehicles. There are some exceptions under the order, and while it doesn’t affect everybody, it is an example of how state legislatures and governors can take steps to restrict lenders’ rights.

- Bankruptcy cases move very quickly initially. Despite the impression that bankruptcies proceed slowly, events tend to move very quickly at the beginning of a bankruptcy case. Therefore, it is very important that your company’s internal procedures are up to par especially now when your company may be slowed by the pandemic. Bankruptcies are increasing and they are proceeding differently due to the pandemic. Check daily for bankruptcy notices and route them to the appropriate people, including in-house and outside counsel and the business person handling the matter.

- An automatic stay occurs upon a bankruptcy filing. The stay applies to all types of collection efforts—repossessions, lawsuits, dunning letters—and there is a clear line of demarcation in which all types of collection activities should stop. If a creditor is found to violate the automatic stay, damages can be assessed against them despite the fact that they are owed by the debtor. If the stay violation is willful, punitive damages may also be levied.

- Call your counsel if you have repossessed but not yet sold collateral at the time of the bankruptcy filing. Even if you are in a jurisdiction where an affirmative duty to return collateral exists, sometimes these situations can be informally resolved with just a phone call to the trustee or the debtor’s attorney to get a consensual lift stay order. Sometimes you will need to return the collateral and move to lift the stay, and you may even have facts that could support filing an emergency lift to the stay. Regardless of what the circumstances are, you should call your counsel when you are notified of a bankruptcy filing and ask what obligations and rights you have.

- Recently enacted legislation is projected to have a large impact on Chapter 11 filings. The Small Business Reorganization Act of 2019 was enacted to make Chapter 11 reorganizations easier and less costly for debtors. Effective in February 2020, the aggregate debt limit for debtors to qualify was increased under the CARES Act to $7.5 million from just over $2.7 million for cases filed after March 27, 2020. Other qualifications are that at least 50 percent of debt must be for commercial or business activities, but the primary activity cannot be owning single asset real estate.

ELFA members are encouraged to be vigilant and let the association know if they become aware that problematic legislation and executive orders are contemplated so the ELFA advocacy team can respond swiftly. It is much easier to address and fix the proposed law before it is enacted. If a second virus wave comes, states may consider drastic measures to limit lenders’ rights and ELFA is prepared to advocate on the industry’s behalf.

Learn More

A recording of the webinar and webinar slides are available at www.elfaonline.org/events/2020/WW060320.

About ELFA Wednesday Webinars

The June 3 webinar was part of ELFA’s “Wednesday Webinar” series designed to help equipment finance professionals navigate the current market and regulatory landscape and anticipate the changing environment in the face of the COVID-19 pandemic. The free webinars include live Q&A sessions so participants can connect with experts and colleagues on the issues they are grappling with. To register for upcoming webinars or view recordings of past events, go to www.elfaonline.org/events/elearning/web-seminars.

About ELFA

The Equipment Leasing and Finance Association (ELFA) is the trade association that represents companies in the nearly $1 trillion equipment finance sector, which includes financial services companies and manufacturers engaged in financing capital goods. ELFA members are the driving force behind the growth in the commercial equipment finance market and contribute to capital formation in the U.S. and abroad. Its 575 members include independent and captive leasing and finance companies, banks, financial services corporations, broker/packagers and investment banks, as well as manufacturers and service providers. For more information, please visit www.elfaonline.org.

### Press Release ############################

[headlines]

--------------------------------------------------------------

Labrador Retriever/Mixed

San Diego, California Adopt a Dog

Bolt

Brown/Chocolate

5 years old, 1 month

60 pounds

Good with Dogs,

Good with Adults,

Eager to Please

Even-tempered

$250 Adoption fee

Forever Home Wanted: Meet Bolt!

...Oh, where to begin...Bolt came to us from the San Bernardino City Shelter. You see...he was left behind when his family moved and for 2 years, Bolt lived on his street waiting for them to come back...they never did. The neighbors fed him and he would play with some of the local kids and dogs, but over time everyone knew he needed off the streets. It took a few weeks but one of the AC’s was able to befriend Bolt and he was taken to the shelter. There he sat...no one was adopting him and there was no rescue interest. No one wanted to give him the helping paw he needed...well, we shouldn’t say no one...

Bolt broke our volunteers heart...we knew he was a great dog, he was dealt a crappy hand and deserved a chance. We knew he needed professional help to trust again and just putting him in a foster home wasn’t going to work and regular boarding was out of the question. Bolt was sick when he first came in so he was in medical boarding for a few weeks and then after that he went to our good friends at For a Civilized Dog in Newport Beach for board and train. The staff immediately fell for Bolt’s sweet and sensitive personality. Over the last few months Bolt has done amazing! We are so proud of him.

Bolt has learning to be comfortable in a home again. He is AMAZING on the leash, walks right by your side and wants to please. He knows his commands, is good with other dogs out and about and just loves human companionship. He bonds quickly and once he does he has a very loving, fun and adorable personality. Bolt is going to need an adopter/foster who will be patient and give him the time he needs to bond, it won’t take long and the reward of Bolt in your life will be priceless. Bolt is a very special dog to all of us and we want to make sure he is never left alone again.

Email dogs@labradorsandfriends.org or fill out our online application:

Adoption Application:

https://www.labradorsandfriends.org/forms/form?formid=1771

Labradors Friends Dog Rescue

2307 Fenton Parkway #107-160

San Diego, CA. 92108

(No Dogs here)

Phone

(619)990-7455

[headlines]

--------------------------------------------------------------

News Briefs----

U.S. bank profits plunge 70%

on coronavirus loss provisioning (see press release in Leasing News)

https://www.reuters.com/article/us-usa-fdic-results/u-s-bank-profits-plunge-70-on-coronavirus-loss-provisioning-idUSKBN23N2GT

‘The dollar is going to fall very, very sharply,’

warns prominent Yale economist

https://nypost.com/2020/06/16/the-dollar-is-going-to-fall-very-very-sharply-warns-prominent-yale-economist/

How PG&E missed its chance to prevent the Camp Fire:

Damning report on utility’s negligence

https://www.sacbee.com/news/california/fires/article243571222.html?

As leaders warned of US meat shortages,

overseas exports of pork and beef continued

https://www.usatoday.com/story/news/investigations/2020/06/16/meat-shortages-were-unlikely-despite-warnings-trump-meatpackers/3198259001/

Fauci said US government held off promoting face masks

because it knew shortages were so bad that even doctors couldn't get enough

https://www.yahoo.com/news/fauci-said-us-govt-held-154828784.html

24 Hour Fitness has filed for bankruptcy

Closing More than 134 Gyms

https://www.wusa9.com/article/news/nation-world/24-hour-fitness-files-for-bankruptcy-closes-134-locations/507-27818d58-c66a-48b1-ac7b-34b9f220c130

List of 24 Hour Fitness Closed Gyms

by State

https://www.24hourfitness.com/health_clubs/club-closures/

Ascentium Capital Wants to Finance

Your Drone Enterprise [Interview}

https://dronelife.com/2020/06/15/ascentium-capital-wants-to-finance-your-drone-enterprise/

Coronavirus: Workers group wants Tesla

to give more safety information

https://www.mercurynews.com/2020/06/15/coronavirus-workers-group-to-demand-tesla-give-more-safety-information/

What Americans Bought to Prepare for the Pandemic

Eggs/Toilet Paper/Milk/Fresh Meat Alternatives/Pasta & Rice

https://247wallst.com/special-report/2020/06/10/what-americans-bought-to-prepare-for-the-pandemic/2/

[headlines]

--------------------------------------------------------------

You May Have Missed---

30 Companies - Largest COVID-19 Government Contracts

has committed a combined $15.2 billion to nearly 4,000 companies

https://247wallst.com/special-report/2020/06/12/30-companies-with-the-largest-covid-19-government-contracts/2/

[headlines]

--------------------------------------------------------------

Sports Briefs---

49ers give head coach Shanahan multiyear extension

https://www.pressdemocrat.com/sports/11036603-181/49ers-give-head-coach-shanahan

Owners, players and the state of baseball:

what a mess

https://www.sfchronicle.com/giants/article/Owners-players-and-the-state-of-baseball-what-a-15344368.php

Finally, we have pictures of Tom Brady

in a Tampa Bay Buccaneers uniform

https://sports.yahoo.com/finally-we-have-pictures-of-tom-brady-in-a-tampa-bay-buccaneers-uniform-172538179.html

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

Suspected cop killer charged in fatal shooting of Oakland

security guard, linked to right-wing extremist group

https://www.sfchronicle.com/crime/article/Suspected-Santa-Cruz-County-cop-killer-Millbrae-15343978.php

PG&E pleads guilty to 84 counts of involuntary manslaughter

over Camp Fire

https://www.sfchronicle.com/california-wildfires/article/PG-E-pleads-guilty-to-84-counts-of-involuntary-15344269.php

CHP overtime costs for George Floyd police brutality

protests estimated at $38.2 million

https://www.sacbee.com/news/local/article243577967.html#storylink=bignews_main

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

DtC, Off-Premise Sales Buoy U.S. Wine Market

https://www.winebusiness.com/news/?go=getArticle&dataId=232356

The World's Most Expensive Italian Wines

https://www.wine-searcher.com/m/2020/06/the-worlds-most-expensive-italian-wines

Richard Dean 1949 - 2020

https://www.legacy.com/obituaries/sfgate/obituary.aspx?n=richard-dean&pid=196334311

WINE ENTHUSIAS PRESENTS

America's 50 Best Wine Retailers

https://www.winemag.com/50-best-wine-shops-2020

Free Wine App

https://www.nataliemaclean.com/mobileapp/

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1579 - The expedition of Sir Francis Drake anchored in a harbor just north of present-day San Francisco Bay in California, during drake's celebrated circumnavigation of the globe. Drake named the land Nova Albion and claimed it for England. The members of the expedition spent a month repairing their ship. Then, on July 26, Drake sailed from California, continuing north and then west across the Pacific Ocean. The precise spot that Drake and his men landed and stayed for a month is a controversy between historians and the actual spot bay is not known. All Drake's records were destroyed for political reasons and this event is also part of the controversy. He was a major slave trader in his day. (Encyclopedia of American Facts, Gordon Carruth).

http://legends.dm.net/pirates/drake.html

1742 - Birthday of William Hooper (d. 1790), signer of the Declaration of Independence, born at Boston, MA. The British in retribution burned his house and farm during the war.

http://www.williamhooper.com/

1775 - Suffolk County, MA, celebrates a county holiday to commemorate the Battle of Bunker Hill. According to the same source quoted above, the Battle of Bunker Hill was actually fought on Breed's Hill. British forces under General Howe assaulted the Continental position three times before the Americans, under Col. William Prescott, ran out of gunpowder and were forced to retreat. The British then occupied Bunker Hill after another skirmish. For this reason, it is referred to as the Battle of Bunker Hill in history books. Today, when you visit Boston and the guide takes you to Bunker Hill, it is really Breed's Hill as historians decided to change the name rather than explain the story.

http://memory.loc.gov/ammem/today/jun17.html

1837 - Strong Vincent (d. 1863) is born in Waterford, Pennsylvania. After working as a lawyer, he went on to become a hero at the Battle of Gettysburg, where he was mortally wounded defending Little Round Top. When hostilities erupted in April 1861, Vincent left the law to become an officer in the Erie Regiment, Pennsylvania Volunteers. By early 1862, he rose to commander of the 83rd Pennsylvania. Vincent served in several campaigns with the Army of the Potomac, fighting at Yorktown, Fredericksburg, and Chancellorsville. He was promoted to colonel after Yorktown and, prior to Gettysburg, Vincent was given command of the Third Brigade, First Division, of the Fifth Corps. On the night of July 1, 1863, Vincent and his men were hurrying toward the battlefield under a bright moon. When the soldiers passed through a small town near Gettysburg, the regiment bands began to play and residents came to their doors to cheer the Yankee troops. Vincent remarked to an aide that there could be a worse fate than to die fighting in his home state with the flag overhead. The next day, as Vincent and his brigade were arriving behind the Union lines, General Governor K. Warren frantically summoned Vincent's force to the top of Little Round Top, a rocky hill at the end of the Federal line. Warren observed that the Confederates could turn the Union left flank by taking the summit, which was occupied by only a Yankee signal corps at the time. Vincent and his men hurried up the hill, arriving just ahead of the Rebels. The brigade held the top, but just barely. Vincent was mortally wounded in the engagement and died on July 7. He was promoted posthumously to brigadier general.

http://members.aol.com/CWSurgeon0/indexV.html

http://www.oldgloryprints.com/What%20Are%20Your%20Orders.htm

http://www.hauntedfieldmusic.com/Vincent.html

1849 - Birthday of African-American Congressman Thomas Ezekiel Miller (d. 1938), Ferrebeeville, SC. After being elected as a state legislator in South Carolina, he was one of only five African Americans elected to Congress from the South in the Jim Crow era of the last decade of the nineteenth century, as disfranchisement reduced black voting. After that, no African Americans were elected from the South until 1972. Miller was a prominent civil rights leader in the South during and after Reconstruction. He was a school commissioner, state legislator, US Representative, and first president of South Carolina State University, an historically black college established as a land-grant school.

http://bioguide.congress.gov/scripts/biodisplay.pl?index=M000757

http://www.scsu.edu/News/lineage.htm

1852 - The New York State Temperance Society met in Syracuse for its annual convention. Susan B. Anthony, Gerrit Smith, and Amelia Bloomer were delegates appointed to the convention by the Woman's State Temperance Society, which Anthony had founded the previous April. Because the convention refused to accept the credentials of the women delegates or allow them to speak, the women and their supporters adjourned to the Wesleyan Chapel where they held their own meeting. Anthony delivered a speech, which was published in the July, 1852 issue of Stone's magazine “The Lily.” The address is one of the earliest given by Anthony who would become the most articulate spokesperson of the movement

1859 - Hot Santa Ana winds in southern California roasted fruit on one side at Santa Barbara.

1863 - Battle of Aldie, VA. As part of the Gettysburg Campaign of the Civil War, Gen, Jeb Stuart’s cavalry screened Gen Robert E. Lee’s Confederate infantry as it marched north in the Shenandoah Valley. The pursuing Union cavalry of Gen. Judson Kilpatrick's brigade, encountered Col. Thomas Munford’s troopers near the village of Aldie, resulting in four hours of stubborn fighting. Both sides made mounted assaults but Kilpatrick was reinforced in the afternoon and Munford finally withdrew toward Middleburg.

http://americancivilwar.com/statepic/va/va036.html

http://members.cox.net/johnahamill/aldie.html

1865 - Dr. Susan LaFlesche Picotte birthday (d. 1915), Omaha Reservation, Nebraska. Native American and U.S. physician. Under the sponsorship of the Women's National Indian Association that was founded in 1880 by Mary L. Bonney and Amelia S. Quinton, Dr. Picotte graduated a 3-year medical course in 2 years. She finished at the head of her class not yet 24 years of age. She returned to practice medicine primarily with the Omaha tribe although her practice at times included almost as many whites as Indians. It has been estimated that this remarkable woman who braved blizzards and dust storms treated every member of the Omaha tribe in the 25 years of her practice.

http://www.americanwest.com/pages/picotte.htm

http://www.nde.state.ne.us/SS/notables/picotte.html

http://www.cfra.org/center/picotte.htm

1871 - Birthday of James Weldon Johnson (d. 1938), Jacksonville , FL. African American poet, diplomat, songwriter and culturist of black history.

http://memory.loc.gov/ammem/today/jun17.html )

1882 - A tornado traveled more than 200 miles across the state of Iowa killing 130 persons. The tornado touched down about ninety miles west of Grinnell, and struck the town and college around sunset, killing sixty persons, and causing more than half a million dollars damage. Traveling at nearly 60 mph, the tornado hit Mount Pleasant about 11 PM causing another half million dollars damage.

1894 - A poliomyelitis epidemic occurred in Vermont between June 17 and September 1. 123 cases appeared in Rutland and Wallingford. The first major urban polio epidemic took place in the summer of 1916 in New York City where 9,000 children were stricken and 2,400 died.

1907 - Jazz reedman Gene Sedric (d. 1963) was born St. Louis, MO.

http://www.rainerjazz.com/Interpreten/Sedric_G_001.htmhttp://www.centrohd.com/biogra/s1/gene_sedric_b.htm

1910 - Country music star Clyde Julian “Red” Foley (d. 1968) was born in Blue Lick, Kentucky. Foley, elected to the Country Music Hall of Fame in 1967, was the first country star to have a network radio show, "Avalon Time," in which he co-starred with Red Skelton, beginning in 1939. Foley's recordings for the Decca label were extremely popular and, in 1950, he had no less than three million-sellers: "Chattanoogie Shoe Shine Boy," "Steal Away" and "Just a Closer Walk With Thee." He continued his success with religious material in 1951, scoring another million-seller with "Peace in the Valley." Foley was a star on the Grand Ole Opry in the 1940's. In 1954, he moved to Springfield, Missouri, where he became the host of "Ozark Jubilee," one of the first successful country TV series. During the early '60s, he starred with Fess Parker in the TV series "Mr. Smith Goes to Washington." Daughter Shirley Lee married actor-singer Pat Boone in 1953. http://www.bellenet.com/foley.html

http://www.countrypolitan.com/bio-red-foley.php

1914 - Birthday of John Hersey (d. 1993) American novelist, born at Tientsin, China. He who wrote “A Bell for Adano,” which won the Pulitzer Prize in 1945. “The Wall” and “Hiroshima” are both based on fact and set in Poland and Japan, respectively, in World War II.

1921 - Clarinetist Tony Scott born Anthony Joseph Sciacca (d. 2007), Morristown, NJ.

http://www.tonyscott.it/

1933 - Birthday of Maurice “Mo” Stokes (d. 1970), basketball player, born at Pittsburgh, PA. Stokes played at St. Francis College (PA) and was drafted by the Rochester Royals of the NBA in 1955. He quickly became a top performer, winning the Rookie of the Year award in 1955-56 and making the All-Star team three years in a row. Following the 1957-58 season, Stokes collapsed and went into a coma. Encephalitis made him an invalid, but teammate Jack Twyman cared for him the rest of his life.

1938 - The first ski lift to operate in the United States was the Cannon Mountain Tramway at Franconia, NH, a 5,400-foot suspension ride. It was suspended by giant cables 40 feet above the trees and ran from the base of Cannon Mountain to one of its peaks. It had two cars, each accommodating 27 persons, making the trip up or down in eight minutes at the speed of a thousand feet a minute.

1940 - Birthday of Alton Kelley (d. 2008), Houlton, ME. Artist of San Francisco rock posters.

http://www.wolfgangsvault.com/tx/search/search/r32p1s1/fc/poster-art/CA.html?t=ALTON+KELLEY+POSTERS

1943 - After planning to return to his hometown and resume his career as a barber, Perry Como is signed to RCA Records. He will not only become a hit singer, but host of one the early television one-hour shows for many years

1944 - Top Hits

“Long Ago and Far Away” - Helen Forrest & Dick Haymes

“I'll Be Seeing You” - The Tommy Dorsey Orchestra (vocal: Frank Sinatra)

“I'll Get By” - The Harry James Orchestra (vocal: Dick Haymes)

“Straighten Up and Fly Right” - King Cole Trio

1943 - Singer-Songwriter-Musician-Arranger-conductor Barry Manilow was born Barry Alan Pincus in Brooklyn, New York (his parents died when he was 2 and he was raised by his maternal grandparents Joseph and Esther Manilow). He is best known for such recordings as "I Write the Songs," "Mandy," "This One’s for You," "Copacabana," "Can't Walk without You," performing regularly in Las Vegas. You love him or you hate him. We have all his albums, also in the car, and we have another set we take on vacations, and have seen many of his shows throughout the year. One of my very good high school and college friends plays first trumpet on his albums and says he is first rate in knowing music. He also extends the red carpet to musicians who attend his shows; “a pleasure to work with, a real nice guy.”

http://www.manilow.com/

http://www.barrymanilow.nl/

1947 - The radio show, “The Adventures of Philip Marlowe,” debuts. Based on Raymond Chandler's groundbreaking series of hard-boiled detective novels, the producers hoped to reproduce the success of the hit radio drama “The Adventures of Sam Spade,” which ran for 13 episodes on ABC in 1946, for 157 episodes on CBS in 1946-1949, and finally for 51 episodes on NBC in 1949-1951. Chandler's character Marlowe had already appeared on the silver screen four times, notably in “The Big Sleep” (1946), starring Humphrey Bogart. The character failed to translate well to the radio, though, and the series lasted only a few months.

1950 - In a 45-minute operation witnessed by 40 visiting surgeons and doctors at Mary Hospital, Chicago, Il, Dr. James Ward West removed a healthy kidney from the body of a woman who had died. Dr. Richard Harold Lawler transplanted the kidney into the renal pedicle of a patient from who a polycystic left kidney had been removed, and the first kidney transplant was complete.

1952 - Top Hits

“Kiss of Fire” - Georgia Gibbs

“Be Anything” - Eddy Howard

“I'm Yours” - Eddie Fisher

“The Wild Side of Life” - Hank Thompson

1954 - The US organized the government of the US Virgin Islands. Columbus named the islands after St. Ursula and the 11,000 Virgins. The official name of the British territory is the Virgin Islands and the official name of the U.S. territory is the Virgin Islands of the United States. In practice, the two island groups are almost universally referred to as the British Virgin Islands and the U.S. Virgin Islands. The Virgin Islands were originally inhabited by the Arawak, Carib, and Cermic, almost all of whom are thought to have perished during the colonial period due to enslavement, foreign disease, and mass extermination brought about by European colonists, as is the case in the rest of the Caribbean. European colonists later settled here and established sugar plantations, at least one tobacco plantation, and purchased slaves acquired from Africa. The plantations are gone, but the descendants of the slaves remain the bulk of the population, sharing a common African-Caribbean heritage with the rest of the English-speaking Caribbean. In 1916 and 1917, Denmark and the United States, respectively, ratified a treaty in which Denmark sold the Danish Virgin Islands to the United States for $25 million in gold.

1954 - Televised Senate Army-McCarthy hearings end. Chaired by Senator Karl Mundt, the hearings convened on March 16, 1954, and received considerable press attention, including gavel-to-gavel live television coverage on ABC and DuMont (April 22–June 17). The media coverage, particularly television, greatly contributed to McCarthy's decline in popularity and his eventual censure by the Senate the following December. Perhaps television’s finest hours exposed Wisconsin Republican Sen. Joseph McCarthy as a charlatan who many were afraid to oppose because they do not want to be labeled a communist. Ironically, McCarthy never exposed one unknown communist.

1955 - After a month of booking gigs in larger venues in Dallas and Houston, Colonel Tom Parker arranges a meeting with Elvis Presley's manager, Bob Neal, which results in an agreement that will see the Colonel handle Presley's show dates and career strategy from now on.

1955 - Eddie Fisher marries Debbie Reynolds in Hollywood. The couple would divorce in 1959 after Fisher was discovered to be carrying on an affair with Liz Taylor. One of the most popular singers of the day, he will lose his audience over the affair.

1960 - Top Hits

“Cathy's Clown” - The Everly Brothers

“Everybody's Somebody's Fool” - Connie Francis

“Burning Bridges” - Jack Scott

“Please Help Me, I'm Falling” - Hank Locklin

1961 - Ben E. King enjoys his biggest hit as "Stand By Me" reaches #4 on the Billboard singles chart. The same song would re-appear on the Hot 100 in 1986, reaching #9 after it was featured in the River Phoenix film of the same name.

1966 - Paul McCartney buys the farm in Kintyre, Scotland, that would later inspire his 1977 megahit ballad "Mull of Kintyre."

1967 - Barbra Streisand sings for 135,000 fans at her concert in New York's Central Park, later released as the CBS-TV special and soundtrack album ”A Happening in Central Park.”

1967 - The Hollies' "Carrie Ann" is released in the US, where it will reach #9.

1968 - The Ohio Express are awarded a Gold record for their Bubble Gum hit, "Yummy, Yummy, Yummy."

1968 - Top Hits

“Mrs. Robinson” - Simon & Garfunkel

“This Guy's in Love with You” - Herb Alpert

“Mony Mony” - Tommy James & The Shondells

“Honey” - Bobby Goldsboro

1971 - Carole King saw her "Tapestry" album hit number 1 in the US for the first of 15 consecutive weeks. The LP contained such classic tracks as "It's Too Late," "I Feel the Earth Move," "So Far Away," "Will You Love Me Tomorrow?" and "You've Got a Friend." Produced by Lou Adler, it is one of the best-selling albums of all time, with over 25 million copies sold worldwide. In the United States, it has been certified Diamond by the RIAA with more than 10 million copies sold. It received four Grammy Awards in 1972, including Album of the Year. The lead singles from the album spent five weeks at number one on both the Billboard Hot 100 and Easy Listening charts. In 2000, it was voted number 74 in Colin Larkin’s All Time Top 100 Albums. In 2003, Tapestry was ranked number 36 on Rolling Stone’s list of the 500 Greatest Albums of All Time.

1972 - Five “plumbers” are arrested for the break-in at Democratic Party Headquarters at the Watergate complex, Washington, DC. They had previously placed wire taps and searched the headquarters on a regular basis but leaving a rear-door unlocked made a building security guard suspicious. The arrests led to revelations of political espionage, threats of imminent impeachment of the president, and, on August 9, 1974, the resignation of President Richard M. Nixon. It is doubly ironic that Nixon was way ahead in the poll primarily because his opponent Senator George McGovern of South Dakota was not strongly supported by the Democratic Party, although he had sworn he would end the Viet Nam War 90 days after he was elected.

http://www.watergate.com/

http://sc94.ameslab.gov/TOUR/watergate.html

1976 - Top Hits

“Silly Love Songs” - Wings

“Get Up and Boogie” (“That's Right”) - Silver Convention

“Misty Blue” - Dorothy Moore

“I'll Get Over You” - Crystal Gayle

1976 - Four teams from the American Basketball Association joined the National Basketball association as the ABA went out of business after nine years. The four teams, the Denver Nuggets, Indiana Pacers, New York Nets and San Antonio Spurs brought the total number of teams in the NBA to 22.

1978 - Andy Gibb became the first solo artist in the history of Billboard's Hot 100 to have his first three releases reach number one, when "Shadow Dancing" hit the top of the chart. Since then, Michael Jackson had four number ones in a row and Mariah Carey had five. "Shadow Dancing" would be the best-selling single in the US in 1978. "Shadow Dancing" reached the number one spot on the pop music charts for the first of seven weeks. Gibb had two other number one hits: "I Just Want to Be Your Everything" and "(Love is) Thicker than Water." Gibb, the youngest of the Gibb brothers who made up the Bee Gees, hosted TV's "Solid Gold" in 1981-82. Andy scored nine hits on the pop music charts in the 1970s and 1980s. He died of an inflammatory heart virus in Oxford, England in 1988.

http://www.andygibb.net/

1978 - Grace Slick is deemed too drunk to go onstage with Jefferson Starship tonight at their concert in St. Goarhausen in West Germany, but does so anyway, singing horribly and verbally abusing the audience with Nazi taunts. The crowd riots, causing over a million dollars in damage and leading Slick to quit the band, not returning until 1983.

1984 - Top Hits

“Time After Time” - Cyndi Lauper

“The Reflex” - Duran Duran

“Self Control” - Laura Branigan

“I Got Mexico” - Eddy Raven

1988 - Microsoft releases MS DOS 4.0

1988 - Thunderstorms produced large hail and damaging winds in Georgia and the Carolinas. Thunderstorm winds gusted to 75 mph at Eden, NC.

1988 - Bruce Springsteen separates from Juliette Phillips

1988 - The Givens' Family reports heavyweight Mike Tyson beats his wife actress wife Robin Givens. They later divorce on the grounds of “extreme cruelty.”

1988 - Top Hits

“Foolish Beat” - Debbie Gibson

“Dirty Diana” - Michael Jackson

“Together Forever” - Rick Astley

“Make It Real” - The Jets

1991 - The body of Zachary Taylor, the 12th US President, was exhumed from a cemetery in Louisville , KY. Taylor died suddenly of acute gastrointestinal illness on July 9, 1850. Some historians suggested that he might have been poisoned. To test this theory, his remains were exhumed (the first presidential body to be exhumed). A coroner's report dated June 26 found no evidence of foul play.

1993 - Top Hits

“That’s The Way Love Goes” - Janet Jackson

“Weak” - SWV

“Knockin Da Boots” - H-Town

“Freak Me – Silk”

1994 - Former football player, NFL and College Football Hall of Famer, and announcer, O.J. Simpson, was arrested in connection with the murder of his wife, Nicole Brown Simpson, and Ronald Goldman. Simpson had fled his home in the morning rather than be arrested. In the evening, he and his friend, Al Cowlings, were in Simpson's white Ford Bronco. They led a horde of police cars on a long but slow car chase on Los Angeles freeways and eventually wound up back at Simpson's home where he was apprehended. Television stations around the country followed these vents live and an estimated 90 million people watched. Simpson was later acquitted. The killer(s) have allegedly never been caught.

1994 – Through July 17, The World Cup of Soccer was played in the US for the first time. The international championship is held every four years. The 1994 games began in Chicago with a match between Germany and Bolivia and ended in Los Angeles with a final between Brazil and Italy with Brazil taking the Cup. Soccer, generally known as football outside the US, is the most popular spectator sport in the world, though it has never achieved great status in the US above the amateur level. The games were watched on television by billions of fans around the world. John Madden has suggested there is not room for television commercials and thus the networks do not broadcast these games.

2008 - Boston Celtics rout LA Lakers, 131-92, to win the NBA Championship. This was Boston's first title since 1986, during the Larry Bird era and their 17th overall.

2009 - 60-year-old Billy Joel and his third wife, 27-year-old Katie Lee Joel announced that were splitting up after nearly five years of marriage. Joel's nine-year union with model Christie Brinkley ended in 1994. His nine-year marriage to Elizabeth Weber, for whom he wrote "Just the Way You Are," ended in 1982. It's believed that Billy had a prenuptial agreement to protect the millions his many hits have earned.

2010 – BP CEO, Tony Hayward, testified before the US about the Gulf of Mexico oil disaster at BP’s Deepwater Horizon rig that caused the worst oil spill in US history. In September 2009, the rig drilled the deepest oil well in history at a vertical depth of 35,050 ft. On 20 April 2010, an uncontrollable blowout caused an explosion on the rig that killed 11 crewmen and ignited a fireball visible from 40 miles. The fire was inextinguishable and, two days later, on 22 April, the Horizon sank, leaving the well gushing at the seabed and causing an ecological catastrophe. In January 2013, Transocean agreed to pay US$1.4 billion for violations of the US Clean Water Act. BP had earlier agreed to pay $2.4 billion but faced additional penalties that could range from $5 billion to $20 billion. In September 2014, Halliburton agreed to settle a large percentage of legal claims against them by paying $1.1 billion into a trust by way of three installments over two years. On 4 September 2014, U.S. District Judge Carl Barbier ruled BP was guilty of gross negligence and willful misconduct under the Clean Water Act (CWA). He described BP's actions as "reckless," while he said Transocean's and Halliburton's actions were "negligent." He apportioned 67% of the blame for the spill to BP, 30% to Transocean, and 3% to Halliburton. BP issued a statement strongly disagreeing with the finding and saying the court's decision would be appealed. On 8 December 2014, The US Supreme Court rejected BP's legal challenge to a compensation deal over the 2010 Gulf of Mexico oil spill. The settlement agreement had no cap, but BP initially estimated that it would pay roughly $7.8bn to compensate victims.

2011 – The first condemnation of discrimination against gays, lesbians and transgender people was issued by the UN Human Rights Council.

2012 - African American construction worker Rodney King, whose videotaped beating by white Los Angeles Police Department officers in March 1991 (and the officers' subsequent treatment by the courts) sparked violent race riots, was found dead in his swimming pool in California.

2014 - US authorities in Philadelphia arrested 89-year-old Johann Breyer after a German warrant charged him with 158 counts of complicity in the killing of Jews while he was a guard at Auschwitz in 1944. Breyer died on July 22, hours before a ruling on his extradition to Germany.

2014 - American Airlines said that it will cut nearly 80 percent of its flights to Venezuela in a dispute over revenue being held.

2015 - In South Carolina, white gunman Dylann Storm Roof shot and killed 9 people at the Emanuel African Methodist Episcopal Church in Charleston. The dead included state Sen. Rev. Clementa C. Pinckney. Roof was arrested the next day in Shelby, NC. On December 15, 2016, Roof was convicted in federal court of all 33 federal charges (including hate crimes) against him stemming from the shooting; on January 11, 2017, he was sentenced to death for those crimes.[4] On March 31, 2017, Roof agreed to plead guilty in South Carolina state court to all state charges pending against him—nine counts of murder, three counts of attempted murder, and possession of a firearm during the commission of a felony—to avoid a second death sentence. In return, he accepted a sentence of life in prison without parole. On April 10, 2017, Roof was sentenced to nine consecutive sentences of life without parole after formally pleading guilty to state murder charges.

2017 - US and Japanese vessels and aircraft searched for seven American sailors who were missing after their Navy destroyer, the USS Fitzgerald, collided before dawn with the ACX Crystal, a container ship four times its size, off the coast of Japan. The search for seven US Navy sailors was called on June 18 off after several bodies were found in the ship's flooded compartments, including sleeping quarters.

2019 - New York State passed a law allowing undocumented migrants to obtain their driving license, a controversial move by the Democratic stronghold intended to thwart the Trump administration's restrictive immigration policy.

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

![]()