Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Add me to mailing list

| Search | All Lists | Columnists | Site Map

Advertising| Archives | Classified Ads | This Day In American History

Email the Editor

![]()

Thursday, October 14, 2021

Today's Leasing News Headlines

California Commercial Financing Disclosure

Regulation (SB 1235) Third Modifications This Year

Banks' Q3 earnings to Reflect Reserve Releases,

Weak Loan Activity, Analysts Say

New Hires/Promotions in the Leasing Business

and Related Industries

Leasing Industry Ads

Equipment Vendor Sales Manager/Sales Team, too

Maximize Profitability

Wheeler Business Consulting

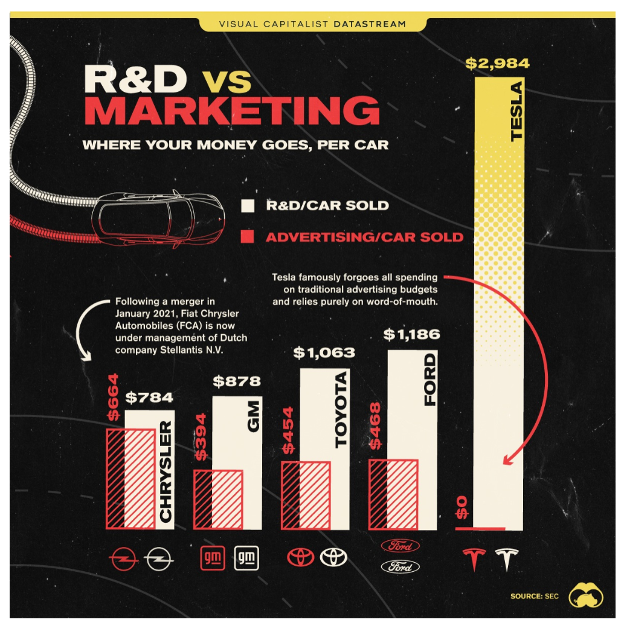

Comparing Tesla’s Spending on R&D and Marketing

Per Car to Other Automakers

Six Types of Bankruptcy - Updated

By Ken Greene, Esq., Legal Editor

Maxim Commercial Capital Funded Deals

in 32 States During Q3 2021

AP Equipment Financing Funds Record-Breaking

$64MM in Q3 2021, 57% Growth

National Funding Announces the Upsize of Their Bank

Bank Credit Facility and the Issuance of Corporate Notes

Q4 Update to 2021 Economic Outlook Forecasts 13.2%

Expansion in Equipment and Software Investment Growth

and 5.3% GDP Growth

Dr. Jekyll and Mr. Hyde (1931), Invasion of the Body Snatchers

(1956) Don't Look Now (1973), Santa Sangre(1989/subtitles)

Sleepy Hollow (1999) Halloween Around the Corner /Fernando Croce

Labrador Retriever

Simi Valley, California

Largest Association Turnout

931 Registered, including 77 Virtual Attendees

ELFA 60th Annual Convention, Oct. 24 -26, San Antonio, TX

News Briefs---

LG paying General Motors up to $1.9 Billion

over Chevy Bolt battery fire recall

Chicago Police union says it will fight vax mandate in court

-have option two COVID-19 Testing a week on their own time

Boeing, one of the St. Louis area’s biggest employers,

mandates COVID-19 vaccination for all U.S. workers

Columbia Banking System And Umpqua Holdings

Combining To Create The West Coast's Leading Regional Bank

Americans quit their jobs

at a record pace in August

You May have Missed---

'This behavior just cannot go on': St. Louis judge

fines NFL owners for missing deadline

Broker/Funder/Industry Lists | Features (wrilter's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

Leasing News Icon for Android Mobile Device

Sports Brief----

California Nuts Brief---

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release,” it was not written by Leasing News nor has the information been verified. The source noted. When an article is signed by the writer, it is considered a “byline.” It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

##### Press Release ############################

California Commercial Financing Disclosure

Regulation (SB 1235) Third Modifications This Year

(Yes, postponed again. Senator Steven Glazer

introduced SB1235 in late 2017 (1)

On September 11, 2020, the Commissioner of Financial Protection and Innovation (Commissioner) published a Notice of Rulemaking Action to adopt regulations under Division 9.5 of the California Financial Code to implement SB 1235 (Chapter 1011, Statutes of 2018). On April 7, 2021, in response to public comments, the Commissioner proposed modifications to the initially proposed text. On August 9, 2021, in response to public comments to the first notice of modifications, the Commissioner proposed modifications to the April 7, 2021 version of the text.

After consideration of public comments to the initial proposed text on September 11, 2020, the modifications to the proposed text on April 7, 2021, and the modifications to the proposed text on August 9, 2021, the Commissioner is now proposing additional modifications.

Today, the Commissioner published a Notice of Third Modifications to Proposed Regulations Under Division 9.5 of the California Financial Code and a revised text for its proposed Commercial Financing Disclosure Regulations (PRO 01/18 - SB 1235). You may find both documents here (2) under the Proposed Regulations heading. Comments on the revisions to the proposed regulation text are due on October 27, 2021.

(1) State Senator Steven Glazer and

the genesis of CA SB 1235 (Part 1 of 3)

https://leasingnews.org/archives/Sep2018/09_17.htm#state

By Tom McCurnin

Leasing News Legal Editor

(2) Proposed Regulations Text due Oct. 27, 2021

https://dfpi.ca.gov/regulations-opinions-releases/

[headlines]

--------------------------------------------------------------

Banks' Q3 earnings to Reflect Reserve Releases,

Weak Loan Activity, Analysts Say

By Liz Kiesche, Seeking Alpha News Editor

Banks start reporting their Q3 results on Wednesday and they're likely to benefit from another quarter of loan loss reserve releases and increased stock buybacks as loan growth remains tepid, analysts said.

- Traditional banking operations remained under pressure in the quarter as they lost market share to competition, loan activity has been weak, and margin pressure persists, writes Odeon Capital Markets analyst Dick Bove in a note to clients.

- Consumer loan activity is expected to show improvement, though it's still below prepandemic levels. "Loan growth isn't this quarter's story, but inflection likely comes by year end," said Morgan Stanley analyst Betsy Graseck in a note.

- She expects stronger guidance for net interest income as 10-year Treasury 12M-forwards moved up ~40 bps from the Aug. 3 trough.

- On the capital markets side of the business, merger and acquisition activity has been "unusually strong", underwriting results are "mostly positive", and trading activity has been "disappointing," Odeon Capital Markets Analyst DickBove Bove said.

- CFRA analyst Kenneth Leon expects standout Q3 results from Goldman Sachs (NYSE:GS), JPMorgan Chase (NYSE:JPM), and Morgan Stanley (NYSE:MS) on capital market and asset/wealth performance.

- Leon notes that Q3 is usually the weakest quarter of the year for banks. Q3 net interest income for large banks are expected to be in the flat to low-single-digit gains, he adds.

- "We are likely to see low to moderate credit risk for credit cards, commercial and industrial loans, commercial real estate, and trading/counterparty losses," Leon said in a note.

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Eric DeHart was hired as Vice President of Sales, CCA Financial, Richmond, Virginia. He is located in the Los Angeles, California, Metropolitan Area. Previously, he was Vice President, U.S. Bank Technology Finance Group (June, 2014 - June, 2021); Relationship Manager, JP Morgan Chase (July, 2013 - June, 2014); Assistant Vice President, City National Bank (December, 20110 - March, 2012); Commercial Account Officer, First American Equipment Finance (June, 2005 - November, 2010). Volunteer: Second Harvest Food Bank of Orange County. Education: University of Southern California, BA, Economics (2000 -2004). Activities and Societies: Blazers Community Youth Project. University of La Verne, MBA, Finance (2010 - 2013). Activities and Societies: Alpha Chi National Honor Society, California Theta Chapter. https://www.linkedin.com/in/deharteric/

Kevin Kelly, CLFP, was promoted to Chief Financial Officer, KLC Financial, Minneapolis, Minnesota. He joined the firm May, 2014, as Controller, promoted May, 2017, Controller and Treasurer, promoted May, 2018, Vice President of Accounting and Finance. He joined Ecolab August, 2011, as Senior Accountant, was both elected to the Ecolab Credit Union Board of Director in August, 2012 and promoted to International Accounting Supervisor, Ecolab. Previously, he was Accountant, L-1 Identity Solutions (June, 2009 - July, 2011); Assurance and Advisory Associate, PricewaterhouseCoopers (July, 2007 -June, 2009); Special Projects Intern, Sinclair Oil Corporation (October, 2006 - May, 2007); Assurance and Advisory Intern, PricewaterhouseCoopers (June, 2006 - August, 2006). Certification: Certified Lease and Finance Professional. Education: Brigham Young University, Master of Accountancy, Accounting (2000 - 2007). Activities and Societies: Member of Beta Alpha Psi.

https://www.linkedin.com/in/kkelly7117/

Keil Kriewall was hired as Sales and Business Development, Honour Capital, Minneapolis, Minnesota. He joined The Toro Company, May, 2014, International Marketing Intern, promoted June, 2016, Commercial Product Marketing Associate, Promoted April, 2019, Corporate Account Representative, promoted November, 2020, Golf Irrigation Marketing Manager. Marketing and Sales Intern, Sportsdigita (January, 2014 - February, 2014). Volunteer: Co-Chairman, Greater Twin Cities United Way, 100 Holes of Golf (September, 2015 - Present). Participant, Students Today Leaders Forever (March, 2014 - Present). Student Ai, Wix Primary School (September, 2013 - December, 2013); Water Station Volunteer, Get in Gear Half Marathon (April, 2014 - Present). Volunteer, Feed My Starving Children (September, 2014 - Present); Minnesota Zoo Clean-Up, The Toro Company (March, 2015 - Present); Playground build, KaBoom! (June, 2015 - Present). Education: University of St. Thomas, Master of Business Administration (M.B.A)) (2016 - 2019). University of St. Thomas, Bachelor's Degree, Marketing Management, (2011 - 2014). Activities and Societies: American Marketing Association, Delta Sigma Pi, London Business Semester Fall of 2013, St. Thomas Football Team. B.A. in Marketing Management (December, 2014). Albert Lea High School, Diploma (2007 - 2011). https://www.linkedin.com/search/results

Jim Newfrock was hired as President, Managing Director ZRG Partners, Princeton, New Jersey. He remains Chair, Anchors Cap 501c3, (February, 2021 - Present); Chief Executive Officer, Wesley Advisory (July, 2020 - Present); Chief Talent Officer, Theia Group, Incorporated (July, 2020 - March, 2021); Senior Partner, Korn Ferry (January, 2016 - March, 2021); Senior Partner, Korn Ferry (January - 2016 - March, 2020); Vice President, Booz Allen Hamilton (August, 2012 - December,2015); Chief Operating Officer, International Schools Services (August, 2010 - August,2012); Partner, JH Cohn (December, 2008 - August, 2010); Senior Director and Practice Leader, Booze Allen Hamilton (April, 1996 - June, 2008); Senor Director. Principal, Booz & Company (1996 - 2008); VP, Capital Markets, CoreStates Bank, NA (1991 - 1996). Education: Fairleigh Dickinson University, MBA, Business Administration and Management, General. University of Delaware, Lerner College of Business and Economics (B.S.), Business Administration and Management, General. https://www.linkedin.com/in/jim-n-85a0321/

Joe Noonan was hired as Vice President of Sales, Honour Capital, Minneapolis, Minnesota. He joined TLC Companies February, 2012, s vice President Sales and Product Development, promoted July, 2020, Senior Vice President of Sales. Previously, he was Vice President, Sales Manager, TCF Equipment Finance (April, 2010 - February, 2012); Director of Sales, T-CheckSystems (April, 2008 - April, 2010); Sales Management, GE Commercial Finance (March, 1997 - March, 2008). License: Preventing Workplace Harassments for Managers, Issued, August, 2017. Expired: August, 2018. Education: University of Nebraska at Omaha, BA, Urban Studies/Transportation (1976 - 1980). https://www.linkedin.com/in/joe-noonan-0b807b12/

James Teal was hired as President and Chief Operating Officer, Vendor Services, Mitsubishi HC Capital America, Inc., New York, New York. He is located in Minneapolis, Minnesota. He remains Director, Peter J. King Family Foundation (2007 - Present). He joined Hitachi Capital America Vendor Services after they acquired Creekridge Capital, June, 2017, as Chief Operating Officer, Vendor Services Division, promoted April, 2018, Hitachi Capital America Vendor Services. Previously, he was Chief Operating Officer (March, 2007 - May, 2016); EVP, Finance and Operations (December, 1993 - August, 2006); Assistant Controller, Space Center (June, 1999 - December, 1993); Auditor, Arthur Anderson & Co. (1986 - 1990). Community Service: Director, Peter J. King Family Foundation (2007 - Present). Director, Christian Cyber Ministries (2015 - President). Education: The University of South Dakota, BS., Accounting (1982 - 1986). https://www.linkedin.com/in/james-teal-941a45b/

[headlines]

--------------------------------------------------------------

Help Wanted Ads

[headlines]

--------------------------------------------------------------

Maximize Profitability

Wheeler Business Consulting

Scott Wheeler, CLFP

The fourth quarter of 2021 is anticipated to be robust for originators throughout the commercial equipment finance and leasing industry. Many are anticipating working harder and longer weeks than ever before to win and close their fair share of business. It is truly a great time to be an originator in the industry. However, I recently reminded a group of originators that being busy, productive, and/or profitable are often three different measurements.

- Being busy is usually a good thing. Being engaged in the market always produces some results.

- Being productively busy requires all activities to contribute to bottom-line results and better relationships for the future.

- Being productively busy while maximizing profitability is the ultimate goal of a top producer. Every action adds exponentially to the bottom line and in turn creates future opportunities and future profits.

I recently challenged a group to dissect their daily activities for the past week and determine which activities were most productive and which activities created the most profitability. Not all relationships, activities, or transactions are equal. Too often, those activities which keep us extremely busy end up being the most unproductive and least profitable. The most profitable transactions and relationships flow more easily through the process and produce the greatest results. Top originators know where their time is best spent. They know how to maximize their profitability and they spend their day focused on (keeping busy) those activities, relationships, and transactions that will produce the greatest results.

It seems simple, but average originators never quite make the distinction. The first step is to dissect and measure your recent activities.

Scott A. Wheeler, CLFP

Wheeler Business Consulting

Comments, questions and suggestions are welcome.

Phone: 410-877-0428

email: scott@wheelerbusinessconsulting.com

Wheeler Business Consulting works with banks, independents, captives, origination companies, and investors in the equipment leasing and finance arena. We provide training, strategic planning, and acquisition services. Scott Wheeler is available to discuss your long-term strategy, to assist your staff to maximize outcomes, and to better position your organization in the market.

[headlines]

--------------------------------------------------------------

Comparing Tesla’s Spending on R&D and Marketing

Per Car to Other Automakers

Source: visualcapitalist.com

[headlines]

--------------------------------------------------------------

Six Types of Bankruptcy - Updated

By Ken Greene, Esq., Legal Editor

Bankruptcy Code, located at Title 11 of the United States Code:

Chapter 7: basic liquidation for individuals and businesses; also known as straight bankruptcy; it is the simplest and quickest form of bankruptcy available.

Chapter 9: municipal bankruptcy; a federal mechanism for the resolution of municipal debts.

Chapter 11: rehabilitation or reorganization, used primarily by business debtors, but sometimes by individuals with substantial debts and assets; known as corporate bankruptcy, it is a form of corporate financial reorganization which typically allows companies to continue to function while they follow debt repayment plans. Since August 23, 2019, there is also a Small Business Reorganization Act for business debts with debts up to $2,725,625. Unlike the normal Chapter 11 process, the debtor remains in greater control of its business and the requirements for confirming a plan are less stringent.

Chapter 12: rehabilitation for family farmers and fishermen;

Chapter 13: rehabilitation with a payment plan for individuals with a regular source of income; enables individuals with regular income to develop a plan to repay all or part of their debts; also known as Wage Earner Bankruptcy.

Chapter 15: ancillary and other international cases; provides a mechanism for dealing with bankruptcy debtors and helps foreign debtors to clear debts.

While bankruptcy cases are always filed in United States Bankruptcy Court (an adjunct to the U.S. District Courts), bankruptcy cases, particularly with respect to the validity of claims and exemptions, are often dependent upon State law. State law therefore plays a key role in many bankruptcy cases and it is often not possible to generalize bankruptcy law across state lines.

Generally, a debtor declares bankruptcy to obtain relief from debt, and this is accomplished either through a discharge of the debt or through a restructuring of the debt. Generally, when a debtor files a voluntary petition, his or her bankruptcy case commences.

The most common types of personal bankruptcy for individuals are Chapter 7 and Chapter 13. As much as 60% of all U.S. consumer bankruptcy filings are Chapter 7 cases. This has steadily decreased since the enactment of the Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA)in 2005. Corporations and other business forms file under Chapters 7 or 11.

In Chapter 7, a debtor surrenders his or her non-exempt property to a bankruptcy trustee who then liquidates the property and distributes the proceeds to the debtor's unsecured creditors. In exchange, the debtor is entitled to a discharge of some debt; however, the debtor will not be granted a discharge if he or she is guilty of certain types of inappropriate behavior (e.g. concealing records relating to financial condition) and certain debts (e.g. spousal and child support, some student loans, some taxes) will not be discharged even though the debtor is generally discharged from his or her debt. Many individuals in financial distress own only exempt property (e.g. clothes, household goods, and an older car) and will not have to surrender any property to the trustee. The amount of property that a debtor may exempt varies from state to state. Chapter 7 relief is available only once in any eight-year period.

Generally, the rights of secured creditors to their collateral continue even though their debt is discharged.

For example, absent some arrangement by a debtor to surrender a car or "reaffirm" a debt, the creditor with a security interest in the debtor's car may repossess the car even if the debt to the creditor is discharged.

The 2005 BAPCPA amendments to the Bankruptcy Code introduced the "means test" for eligibility for chapter 7. An individual who fails the means test will have his or her chapter 7 case dismissed or may have to convert his or her case to a case under chapter 13.

Generally, a trustee will sell most of the debtor's assets to pay off creditors. However, certain assets of the debtor are protected to some extent. For example, Social Security payments, unemployment compensation, and limited values of your equity in a home, car, or truck, household goods and appliances, trade tools, and books are protected. However, these exemptions vary from state to state. Therefore, it is advisable to consult an experienced bankruptcy attorney.

In Chapter 13, the debtor retains ownership and possession of all of his or her assets but must devote some portion of his or her future income to repaying creditors, generally over a period of three to five years. The amount of payment and the period of the repayment plan depend upon a variety of factors, including the value of the debtor's property and the amount of a debtor's income and expenses. Secured creditors may be entitled to greater payment than unsecured creditors, who often receive negligible payments pursuant to a Chapter 13 plan.

Relief under Chapter 13 is available only to individuals with regular income whose debts do not exceed prescribed limits. If you're an individual or a sole proprietor, you are allowed to file for a Chapter 13 bankruptcy to repay all or part of your debts. Under this chapter, you can propose a repayment plan in which to pay your creditors over three to five years. If your monthly income is less than the state's median income, your plan will be for three years unless the court finds "just cause" to extend the plan for a longer period. If your monthly income is greater than your state's median income, the plan must generally be for five years. A plan cannot exceed the five-year limitation.

In contrast to Chapter 7, the debtor in Chapter 13 may keep all of his or her property, whether or not exempt. If the plan appears feasible and if the debtor complies with all the other requirements, the bankruptcy court will typically confirm the plan and the debtor and creditors will be bound by its terms. Creditors have no say in the formulation of the plan other than to object to the plan, if appropriate, on the grounds that it does not comply with one of the Code's statutory requirements.

Generally, the payments are made to a trustee who in turn disburses the funds in accordance with the terms of the confirmed plan, although some payments, particularly secured obligations, may be made directly to the creditor.

When the debtor completes payments pursuant to the terms of the plan, the court will formally grant the debtor a discharge of the debts provided for in the plan. However, if the debtor fails to make the agreed upon payments or fails to seek or gain court approval of a modified plan, a bankruptcy court will often dismiss the case on the motion of the trustee. Pursuant to the dismissal, creditors will typically resume pursuit of state law remedies to the extent a debt remains unpaid.

In Chapter 11, the debtor retains ownership and control of its assets and is re-termed a debtor in possession ("DIP"). The debtor in possession runs the day-to-day operations of the business while creditors and the debtor work with the Bankruptcy Court in order to negotiate and complete a plan. Upon meeting certain requirements (e.g. fairness among creditors, priority of certain creditors) creditors are permitted to vote on the proposed plan. If a plan is confirmed the debtor will continue to operate and pay its debts under the terms of the confirmed plan. If a specified majority of creditors do not vote to confirm a plan, additional requirements may be imposed by the court in order to confirm the plan.

Chapter 7 and Chapter 13 are the efficient bankruptcy chapters often used by most individuals. The chapters which almost always apply to consumer debtors are chapter 7, known as a "straight bankruptcy", and chapter 13, which involves an affordable plan of repayment. An important feature applicable to all types of bankruptcy filings is the automatic stay. The automatic stay means that the mere request for bankruptcy protection automatically stops and brings to a grinding halt most lawsuits, repossessions, foreclosures, evictions, garnishments, attachments, utility shut-offs, and debt collection harassment.

[headlines]

--------------------------------------------------------------

#### Press Release #############################

Maxim Commercial Capital Funded Deals

in 32 States During Q3 2021

Hard-asset based lender fulfilled strong demand

across all lending programs

LOS ANGELES, CALIF. – Maxim Commercial Capital (“Maxim”) saw increased demand across all lending programs during the third quarter 2021. Contractors nationwide are purchasing heavy equipment in response to a surge in infrastructure projects and the active construction industry. Entrepreneurs owning residential, commercial and industrial real estate are leveraging properties to fund immediate business opportunities, and owner-operators of class 8 trucks are upgrading and adding equipment to fulfill strong contracts.

Michael Kianmahd, Executive Vice President, said, “The private lending market is normalizing now that the PPP financing program is over and COVID-19 infection rates are declining in most markets,

“With most students back in school and improving vaccination rates, it’s a very different world than a year ago. We are very optimistic for a stable Q4 and busy 2022.”

Maxim funded numerous truck purchases for start-up and non-CDL buyers with good credit and experienced owner-operators with challenged credit during the quarter. Representative transactions included a 2018 Freightliner Cascadia with 418,000 miles purchased for $70,200 by a start-up owner-operator with an 819 FICO; a 2017 International ProStar with 390,000 miles purchased for $58,570 by a non-CDL owner with a 795 FICO and his partner, with an experienced driver with bad credit; and, a 2015 Peterbilt 579 with 456,000 miles purchased for $53,374 by a newer owner-operator with fair credit.

Transactions for construction equipment included a $103,000 loan to a former client to purchase a 2015 Peterbilt 365 dump truck to expand his business. The borrower minimized his down payment by pledging his paid-off 2010 Peterbilt 365 dump truck as additional collateral. Other representative fundings were $39,400 loan to a Colorado-based contractor with challenged credit to purchase a 2014 Hitachi AX350 LC5 excavator, and a $105,300, 54-month loan to a start-up trucking and hauling company in Florida to buy a 2022 Kenworth T800 Tri-Axle dump truck, thereby eliminating its $3,000 weekly rental expense.

Behzad Kianmahd, Chairman and CEO, commented, “Our borrowers’ demand for financing provides a good barometer for the post-pandemic recovery.

“They are securing strong contracts, adding employees, and investing in additional equipment to grow their businesses. We are on a mission and very pleased to help them achieve the American dream of entrepreneurship.”

About Maxim Commercial Capital

Maxim Commercial Capital helps small and mid-sized business owners seize opportunity by providing financing in amounts from $10,000 to $3,000,000 secured by heavy equipment and real estate. Maxim facilitates equipment purchases, provides working capital, and refinances debt for companies across all industries located nationwide. Through Maxim’s tailored financing programs, businesses unlock capital tied up in underleveraged assets, often replacing expensive short-term debt and daily repayment working capital loans with longer term capital. As a leading provider of transportation equipment finance, Maxim funds up to 75% of the acquisition cost of class 8 and class 6 trucks, trailers and reefers for owner-operators and small businesses. Learn more at www.maximcc.com or by calling 877-776-2946.

#### Press Release #############################

[headlines]--------------------------------------------------------------

#### Press Release #############################

AP Equipment Financing Funds Record-Breaking

$64MM in Q3 2021, 57% Growth

AP Equipment Financing is excited to announce a record-breaking quarter of funding volume in Q3 2021, funding a total of $64MM compared to $40.8MM in Q3 2020, representing a 57% growth. AP is excited to carry this momentum into Q4 2021 and finish the year strong.

Chris Lerma, President of AP, said, "This is a record-breaking quarter of funding volume for AP and it couldn't have happened without every member of the team stepping up to the plate.

"With a focus this year on improving processes across the board, we've been able to improve our efficiencies which have helped instrumentally with our growth. AP continues to leverage technology projects to streamline every team from sales, marketing, documentation and operations, positioning us for continued growth in the future."

AP Equipment Financing utilizes state-of-the-art technology and data to drive its sales process to end-users and dealer partners. Through a seamless digital process and an emphasis on the Power of Personal, AP has built a loyal and satisfied customer base.

AP Equipment Financing is part of the Tokyo Century (USA) group which includes Tokyo Century (USA), WTD Equipment, Work Truck Direct and AP Equipment Financing.

#### Press Release #############################

[headlines]

--------------------------------------------------------------

#### Press Release #############################

National Funding Announces the Upsize of Their Bank

Bank Credit Facility and the Issuance of Corporate Notes

SAN DIEGO, CA -- National Funding, Inc., one of the largest U.S. specialty finance companies serving small- and medium-sized businesses, announced the recent renewal and upsize of a $60.0 million senior secured warehouse line of credit. The facility, which includes an accordion to expand to $75.0 million, was provided by a prominent U.S.-based commercial bank. The facility will continue to be used by the Company to fund new originations and support additional growth of the platform.

Concurrent with the transaction, National Funding also secured a $55.0 million investment-grade-rated corporate note financing provided by a consortium of institutional investors. The transaction was assigned a BBB+ rating by a nationally recognized statistical ratings organization. Having closed this additional financing, National Funding is well-positioned to support its partners and the funding enhances the Company's ability to take advantage of significant market opportunities.

To date, National Funding has provided more than $4.3 billion in working capital and equipment leasing for more than 75,000 small- to medium-sized businesses nationwide.

Dave Gilbert, CEO of the Company, said, "As the economy recovers from the pandemic, this challenging environment is creating opportunities for National Funding to accelerate our growth plans and at the same time provide flexible capital solutions to our client base seeking to expand their businesses," stated. "Our ability to close these transactions with multiple institutional partners has substantially expanded our financial capacity and flexibility and is a validation of the strength of the robust platform that National Funding has built."

Joe Gaudio, President of National Funding, stated, "These new facilities represent the continued evolution of the Company's funding sources, providing National Funding with a unique opportunity to reduce our cost of funding and access more diversified sources of capital. Both investments are a strong endorsement of the stability and success of our Company and of our mission to transform the way small businesses access the capital they need to grow."

Brean Capital, LLC served as the Company's Exclusive Financial Advisor and Placement Agent in connection with the note transaction.

About National Funding

Founded in 1999, National Funding is a leading U.S. specialty finance company serving small- and medium-sized businesses. The Company's foundation serves American small business owners by providing funding solutions to meet their needs to reinvest in their day-to-day operations and help them grow. National Funding's digital funding process has elevated its digital capabilities by delivering a fast and simple online application. For more information about National Funding, visit https://www.nationalfunding.com.

##### Press Release ##########################

|

[headlines]

--------------------------------------------------------------

##### Press Release ##########################

Q4 Update to 2021 Economic Outlook Forecasts 13.2%

Expansion in Equipment and Software Investment Growth

and 5.3% GDP Growth

Washington, DC– Owing largely to the burst of business activity in the spring and early summer that came in part thanks to rising vaccination rates, annual equipment and software investment growth of 13.2 percent is forecast for 2021, according to the Q4 update to the 2021 Equipment Leasing & Finance U.S. Economic Outlook released today by the Equipment Leasing & Finance Foundation. Annual U.S. GDP growth for 2021 is forecast at 5.3 percent. The Foundation’s report, which is focused on the nearly $1 trillion equipment leasing and finance industry, highlights key trends in equipment investment and places them in the context of the broader U.S. economic climate.

Scott Thacker, Foundation Chair and Chief Executive Officer of Ivory Consulting Corporation, said, “The Q4 update indicates that optimism eased somewhat as the spread of the COVID-19 Delta variant began weighing on consumer confidence and economic activity. The trajectory of the virus this fall and winter, inflation, and fiscal policy are the most significant unknowns to consider during the upcoming six months. Fortunately, the overall outlook portrayed in the Q4 update is more optimistic than it was a year ago. Businesses continue to invest despite supply chain issues and labor shortages, which bodes well for the equipment finance industry.”

Highlights from the Q4 update to the 2021 Outlook include:

• Equipment and software investment rose 12.7 percent (annualized) in Q2 and is well above its pre-pandemic level. Business investment has remained strong despite emerging economic headwinds, though these headwinds could begin to weigh on investment later this year.

• The U.S. economy expanded at a robust 6.7 percent (revised) annualized rate in Q2 2021, about the same pace as in Q1. GDP has now eclipsed its level from the end of 2019, just before the pandemic began.

• The U.S. manufacturing sector continues to face historically high levels of demand, although growth decelerated over the last quarter. Meanwhile, U.S. industrial output has been constrained by ongoing supply chain issues and high input prices.

• Business prospects for Main Street have been tempered somewhat since the summer as the resurgence of COVID has reduced consumer mobility, spending, and confidence. Small businesses are also contending with labor shortages, supply chain delays, and inflationary pressures, but are better equipped for headwinds due to healthy lending activity and a slow, steady rise in vaccination rates.

• Federal Reserve officials largely maintain that ongoing inflationary pressures are mostly temporary. However, officials have signaled that the Fed is ready to begin “tapering” its asset purchases soon, which would translate to tighter financial conditions.

• The spread of the Delta variant has dampened activity in some areas and has likely slowed economic growth significantly in Q3. Factors to watch for the rest-of-year outlook include concerns of persistently high inflation, uncertainty surrounding fiscal policy, the potential for tighter financial conditions that could impact equity markets, and the trajectory of the pandemic.

The Foundation-Keybridge U.S. Equipment & Software Investment Momentum Monitor, which is released in conjunction with the Economic Outlook, tracks 12 equipment and software investment verticals. In addition, the Momentum Monitor Sector Matrix provides a customized data visualization of current values of each of the 12 verticals based on recent momentum and historical strength. Eight verticals are showing signs of accelerating investment, and four other verticals are showing signs of peaking. Over the next three to six months, year over year:

• Agriculture machinery investment growth may ease, though year-over-year growth will likely remain in positive territory.

• Construction machinery investment growth will stay elevated.

• Materials handling equipment investment growth should remain robust.

• All other industrial equipment investment growth should remain elevated.

• Medical equipment investment growth will likely remain in positive territory.

• Mining and oilfield machinery investment growth should accelerate.

• Aircraft investment growth will remain elevated, though may have peaked.

• Ships and boats investment growth should remain healthy.

• Railroad equipment investment growth should continue to improve, though upside potential may be limited.

• Trucks investment growth should remain robust.

• Computers investment growth should remain in positive territory and may even accelerate.

• Software investment growth should remain elevated.

The full report of the Momentum Monitor is now available at https://www.leasefoundation.org/industry-resources/momentum-monitor/.

The Foundation produces the Equipment Leasing & Finance U.S. Economic Outlook report in partnership with economic and public policy consulting firm Keybridge Research. The annual economic forecast provides the U.S. macroeconomic outlook, credit market conditions, and key economic indicators. The Q4 report is the third update to the 2021 Economic Outlook and will be followed by the publication of the 2022 Economic Outlook in December.

Download the full report at https://www.leasefoundation.org/industry-resources/u-s-economic-outlook/. All Foundation studies are available for free download from the Foundation’s online library at http://store.leasefoundation.org/.

JOIN THE CONVERSATION

Twitter: https://twitter.com/LeaseFoundation

Facebook: https://www.facebook.com/LeaseFoundation

LinkedIn: https://www.linkedin.com/company/10989281/

Vimeo: https://vimeo.com/elffchannel

ABOUT THE FOUNDATION

The Equipment Leasing & Finance Foundation is a 501c3 non-profit organization that propels the equipment finance sector—and its people—forward through industry-specific knowledge, intelligence, and programs that contribute to industry innovation, individual careers, and the overall betterment of the equipment leasing and finance industry. The Foundation is funded through individual and corporate donations. Learn more at www.leasefoundation.org.

### Press Release ##############################

[headlines]

--------------------------------------------------------------

Special Halloween Edition, Part One

Fernando's Reviews

With Halloween just around the corner, we’ve put together a multi-part catalog of classic frightfests to go with your pumpkin treats. Check back next week for more indelible horror tales.

Dr. Jekyll and Mr. Hyde (Rouben Mamoulian, 1931): Fredric March won a Best Actor Oscar for his performance in this bravura version of Robert Louis Stevenson’s famous novel. He plays Dr. Jekyll, a researcher in Victorian London who becomes obsessed with the split human psyche, with the bestial urges kept in check by society’s rules. When his engagement to a proper lady (Rose Hobart) is delayed, he experiments on himself and unchains his dark side, taking the form of a brutal thug named Mr. Hyde. As Mr. Hyde, he wreaks havoc wherever he goes and starts to terrorize a dance hall girl (Miriam Hopkins). A bold creative force during early sound cinema, director Rouben Mamoulian keeps the story vigorous, atmospheric, and frighteningly modern in its morbid psychological implications.

Invasion of the Body Snatchers (Don Siegel, 1956): Evocative science-fiction meets primordial horror in this remarkably tense and suggestive tale from director Don Siegel. The plot centers on Miles (Kevin McCarthy), a small-town California doctor who’s baffled by a wave of patients who declare that there’s something wrong with their loved ones. With the help of ex-girlfriend Becky (Dana Wynter), looks closer at the matter and discovers that their paranoia is very much justified—an alien species is planning an invasion with emotionless human duplicates. Miles and Becky try bravely to expose the extraterrestrial plot, but can they hang on to their humanity in the process? Often read as a rich allegory for the ‘50s fears of outsiders and blacklists, Siegel’s unsettling classic strikes timeless notes of anxiety.

Don't Look Now (Nicolas Roeg, 1973): A fierce and versatile stylist, Nicolas Roeg reached an unsettling peak with this unforgettably eerie vision, based on a Daphne Du Maurier story. Laura (Julie Christie) and John Baxter (Donald Sutherland) are a married couple whose life takes a tragic turn after the death of their child. To deal with their grief, they travel to Venice, where they turn their attention to the ancient art surrounding the canals. Soon, they begin to experience strange, even psychic signs as they wander through the city. Could it be that the dead daughter is trying to contact them, or could it be a path to something more horrific? Creating a matchless atmosphere of mortality, Roeg's classic gets under the audience's skin and builds to a jaw-dropping revelation.

Santa Sangre (Alejandro Jodorowsky, 1989): Chilean director Alejandro Jodorowsky (“El Topo”) is a visionary who doesn't make films often, but makes every one of them count with his brand of dark poetry. Such is the case for this horror-fantasy, which showcases his singular surreal talents. Unfolding in and around a seedy Mexican circus, the bizarre story focuses on the relationship between Fenix (Axel Jodorowsky), a mentally unstable young man, and his mother Concha (Blanca Guerra), who have grown closer following a series of horrible events. With a series of murders and the sudden appearance of a childhood sweetheart (Sabrina Dennison), can Fenix find a way back to sanity before it's too late? Both macabre and beguiling in its unabashed symbolism, this is an astonishing ride brimming with unforgettable images. With subtitles.

Sleepy Hollow (Tim Burton, 1999): Washington Irving’s gothic tale is a perfect fit for Tim Burton, who here visualizes it with a lustrous, painterly feeling of dread. Johnny Depp stars as Ichabod Crane, an eccentric police constable sent to Sleepy Hollow, a misty town shaken by a recent string of gruesome beheadings. Local legend points to a sadistic mercenary known as the Headless Horseman, who died in battle but can be summoned by witchcraft. The investigation leads Crane to heiress Katrina (Christina Ricci) and her stepmother (Miranda Richardson), as well as to his own memories of supernatural doings. Making vivid use of deep blacks and sanguinary reds, Burton turns the story into a procession of ethereal shocks, half dream and half nightmare. The results are at once creepy and ravishing.

[headlines]

--------------------------------------------------------------

Labrador Retriever

Simi Valley, California 93065

Elvis

Labrador Retriever

Male

65 lbs.

Age: 10 months

Hots Up to Date

Neutered

Housetrained: unknown

Ok with Cats: unknown

Ok with kits: unknown

No Special Needs

Okay with Dogs

Adoption Fee: $500

West Coast Labrador Retriever Rescue

1230 Madera Rd. Suite 5 288

Simi Valley CA 93065

805-277-0307

adopt@wclrr.org

Meet Elvis! He is a handsome male black Labrador Retriever almost one year old. Elvis was surrendered to WCLRR when his previous owner became ill and was unable to provide for him.

Elvis is a young boy who enjoys playing and being loved. He is a higher energy dog who will become a great running partner or hiking buddy. Elvis does well walking on a leash. He knows some basic commands but could use some additional training.

Elvis enjoys playing with other dogs, and it would be great if his new home had another young dog. He is fostered with another Labrador Retriever and two teenage girls whom he adores.

His new family should have an abundance of appropriate chew toys and balls for him. He loves to play with his toys and play ball. So Nylabones and Kongs are an excellent choice to have for him. No stuffed toys!

Elvis will jump and has the potential to knock someone down. Therefore, we cannot place him in a home with children under 12 or a family member unsteady on their feet. His new family needs to work on this behavior. He is housebroken and sleeps throughout the night next to his foster family.

Elvis has been neutered, microchipped, and is current on his vaccines.

If you are interested in Elvis and have already been approved to adopt, please send an email to ADOPT@WCLRR.ORG and put "ELVIS" in the subject line explaining why he is an excellent fit for your family.

If you have NOT filled out an adoption application yet with WCLRR, please click HERE: https://petstablished.com/adoptions/personal-information?application_type=Adopt&donatio

[headlines]

--------------------------------------------------------------

Largest Association Turnout

931 Registered, including 77 Virtual Attendees

ELFA 60th Annual Convention, Oct. 24 -26, San Antonio, TX

Lite Participant List

By Participant Last Name

By Company Name

Only Registered attendees can see the Full Participant Listings

List here:

https://apps.elfaonline.org/events/2021/ac/attend.cfm

Full Brochure (12 pages)

https://cvdata.elfaonline.org/cvweb/cgi-bin/documentdll.dll/view?DOCUMENTNUM=3073

[headlines]

--------------------------------------------------------------

News Briefs---

LG paying General Motors up to $1.9 Billion

over Chevy Bolt battery fire recall

https://nypost.com/2021/10/12/lg-electronics-to-pay-up-1-9b-to-general-motors-over-chevy-recall/

Chicago Police union says it will fight vax mandate in court

-have option two COVID-19 Testing a week on their own time

https://www.chicagobusiness.com/government/chicago-police-union-seeks-court-injunction-against-covid-vaccine-mandate

Boeing, one of the St. Louis area’s biggest employers,

mandates COVID-19 vaccination for all U.S. workers

https://www.stltoday.com/business/local/boeing-one-of-the-st-louis-area-s-biggest-employers-mandates-covid-19-vaccination-for/article_821636c5-317f-5f38-bfe9-dab7872e7877.html

Columbia Banking System And Umpqua Holdings

Combining To Create The West Coast's Leading Regional Bank

https://www.prnewswire.com/news-releases/columbia-banking-system-and-umpqua-holdings-corporation-combining-to-create-the-west-coasts-leading-regional-bank-301397611.html

Americans quit their jobs

at a record pace in August

https://apnews.com/article/business-459c0884721a213985cdf0185a1176f8

[headlines]

--------------------------------------------------------------

You May Have Missed---

'This behavior just cannot go on': St. Louis judge

fines NFL owners $24k for missing deadline

https://www.stltoday.com/news/local/crime-and-courts/this-behavior-just-cannot-go-on-st-louis-judge-fines-nfl-owners-for-missing-deadline/article_9e74f204-bb18-5413-9366-287e4d74e50f.htm

https://www.wsj.com/articles/rodents-the-size-of-st-bernards-swarm-an-exclusive-gated-community-11633882543?st=77dghy6nhyp27bl&reflink=desktopwebshare_permalink

[headlines]

--------------------------------------------------------------

Sports Briefs---

Jon Gruden emails were part of June court

filing by WFT owner Dan Snyder

https://www.latimes.com/sports/story/2021-10-12/nfl-jon-gruden-emails-washington-football-team?utm_id=39531&sfmc_id=1646692

The bitter irony behind Jon Gruden's resignation

https://www.cnn.com/2021/10/13/sport/gruden-raiders-history-race-blake-cec/index.html

NFL power rankings: The Cardinals are on top,

but the Bills and Cowboys are charging

https://www.sacbee.com/sports/nfl/san-francisco-49ers/article254961537.html#storylink=hpdigest_sports

The Giants might already be at a pitching disadvantage

against the Dodgers for Game 5

https://www.sfgate.com/giants/article/Giants-bullpen-Dodgers-Game-5-NLDS-Rogers-McGee-16528843.php

Can the Red Sox actually win the World Series?

The vibe seems to be there

https://www.bostonglobe.com/2021/10/13/sports/can-red-sox-actually-win-world-series-vibe-seems-be-there/

Steve Kerr's son is serious about being funny,

just ask the staff of 'Ted Lasso'

https://www.sfchronicle.com/sports/warriors/article/Steve-Kerr-s-son-is-serious-about-being-funny-16522047.php

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

Study shows California less affected by labor loss

compared to other states, but that's not necessarily good news

https://www.sfchronicle.com/california/article/Study-shows-California-less-affected-by-labor-16530899.php

California lawmakers are done for the year

- but explosive fights are on the horizon

https://www.sfchronicle.com/politics/article/California-lawmakers-are-done-for-the-year-but-16525674.php

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

Performance, Cabernet Sauvignon, $19 a Bottle

Another very inexpensive wine from Trader Vic's. "This wine is excellent! Opened it last night and my wife and I had a glass, “Leasing News Wine Reviewer emailed.” We will have another glass tonight – hoping it aged well in 24 hours.

"Deep-red/purple juice, medium-body, nice complexity and mild tannins on the finish. Smooth oak and hints of vanilla and blackberries. We had it with a plate of pasta and it paired perfectly.

"At $19/bottle, it’s a steal."

Beaujolais Nouveau prices soar by 50 %, a

and shippers are left high and dry

https://www.vitisphere.com/news-95011-Beaujolais-Nouveau-prices-soar-by-50-and-shippers-are-left-high-and-dry.htm

U.S. Supreme Court Declines to Hear Major Wine Shipping Case

https://www.winespectator.com/articles/u-s-supreme-court-declines-to-hear-major-wine-shipping

Free Wine App

https://www.nataliemaclean.com/mobileapp/

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1492 - Columbus leaves San Salvador; arrives in Santa Maria of Concepcion

1644 - Birthday of William Penn (d. 1718), founder of Pennsylvania, born at London, England. President Proclamation 5284, of November 28, 1984, conferred honorary citizenship of the USA upon William Penn and his second wife, Hannah Callowhill Penn. They were the third and fourth persons to received honorary Citizenship, including Winston Churchill and Raoul Wallengber.

(Lower half of: http://memory.loc.gov/ammem/today/oct14.html )

1656 - The first punitive legislation in Massachusetts against Quakers was enacted. (The marriage of church-and-state in Puritanism made them regard the ritual-free Quakers as spiritually apostate and politically subversive). The law provided for a fine of 100 pounds for any ship captain who delivered Quakers “or any other blasphemous heretics” the Massachusetts Bay Colony. Possessing Quaker books and coming to the defense of Quakers was also outlawed and punished with fines, whipping and jailing. Subsequent anti-Quaker laws included the penalties of having their ears cut off and the tongue bored through with a hot iron.

1734 - Birthday of Francis Lightfoot Lee (d. 1797), signer of the Declaration of Independence, at Westmoreland County, VA.

http://www.francislightfootlee.com/

His plantation was called “Menokin.”

http://www.stratfordhall.org/menokin.htm

1735 - Methodist pioneer John Wesley first set sail to America, to minister to the Indians under Georgia Gov. Oglethorpe. On this same date, Wesley began keeping his famous, 55-year-long journal, whose last entry was dated Oct 24, 1790.

1773 - Several of Britain’s East India Tea Company’s ships are set ablaze at Annapolis.

1774 – As a result of the sinking of the ship, ‘Peggy Stewart,’ the Declaration of Rights was passed by the First Continental Congress in Philadelphia, PA. It was known as the “Declaration and Resolves of the First Continental Congress,” stating the colonists “are entitled to life, liberty and property; and they have never ceded to any foreign power whosoever a right to dispose of either without their consent.”

1834 - African-American Henry Blair patents his corn-planting machine. Two years later, on August 31, 1936, he obtained a patent on a cotton seed planter. It is widely believed that this is the first patent grant to an African-American in the US.

http://inventors.about.com/library/inventors/blblair.htm

1834 - In Philadelphia, Whigs and Democrats stage a gun, stone and brick battle for control of a Moyamensing Township election, resulting in one death, several injuries, and the burning down of a block of buildings.

1835 - John Templeton, John Moore, Stanley Cuthbart and Ellen Ritchie were charged in Wheeling, VA (now WV) with illegally teaching blacks to read

1863 - Battle of Bristoe Station. Confederate General Robert E. Lee attempts to drive the Union army out of Virginia but fails when an outnumbered Union force repels the attacking Rebels. The aggressive Lee realized that he had a chance to cut the Union army up piecemeal during the withdrawal. Confederate General Ambrose P. Hill spotted Yankees from General George Sykes's Fifth Corps near Bristoe Station on the afternoon of October 14. Thinking this was the rear of the Union army, Hill attacked and began driving the Federals away in disarray. The Confederates were surprised by the sudden appearance of Union General Governor K. Warren's Second Corps. Warren's men were returning from a small battle at Auburn, Virginia, earlier that morning. Hill decided to attack this new force as well, but the Yankees were well protected by a railroad cut. In a very short engagement, the Confederates suffered 1,400 men killed, wounded, and captured, while the Union lost only 546. "Bury these poor men," Lee somberly told Hill, "and let us say no more about it." The Union army was driven back 40 miles from its original positions, and the Confederates destroyed a large section of the Orange and Alexandria Railroad, a key Union supply line. Nonetheless, the gains were temporary. The next month, Meade drove Lee back behind the Rapidan River.

1863 - Birthday of journalist Winifred Sweet Black (d. 1936), Chilton, WI. She wrote under the name of Annie Laurie and was able to infiltrate Mormon life and expose polygamy in an 1898 series of articles in the Hearst newspapers. But her greatest accomplishment was disguising herself as a boy and becoming the only woman reporter on Galveston Island after the terrible hurricane in 1900. She, unlike others, didn't only report. Using funds donated by Hearst's readers, she opened and administered a hospital on the island to aid the displaced and injured. Another time she faked a collapse to expose graft and mismanagement in San Francisco's receiving hospital. She got an exclusive interview with President Benjamin Harrison, and even got into a leper colony in Hawaii. She also reported on World War I and the Versailles treaty negotiations. She continued reporting on world events well into her 60s.

http://www.school.eb.com/women/articles/Black_Winifred_Sweet.html

http://marian.creighton.edu/~leonardm/annie.jpg

1865 - Cheyenne and Arapaho leaders sign "peace treaty" with the US government, then they were chased out Colorado.

1884 – George Eastman patents paper-strip photographic film

1890 - Birthday of Dwight David Eisenhower (d. 1969), the 34th president of the US, at Denison, Texas. Serving two terms as President, Jan 20, 1953-January 20, 1961, Eisenhower was the first president to be baptized after taking office. (Sunday, February 1, 1953). Nicknamed “Ike,” he was a member of the Class of 1915 of West Point where he played football and was a teammate of future general Omar Bradley. Among their opponents was the legendary Jim Thorpe, whom he tackled, resulting in the torn knee that ended his athletic career. He held the rank of five-star General of the Army, the first such five-star rank bestowed to a US military officer. He resigned that commission in 1952 after becoming President and it was restored by an act of Congress. He served as Supreme Commander of the Allied forces in Western Europe during World War II and developed the logistics and attack plans for the Normandy invasion on D-Day that all but brought Germany to its knees. One of Eisenhower's enduring achievements as President was the Interstate Highway System, believing it essential to American security during the Cold War. Thinking that large cities would be targets in a possible war, the highways would be designed to facilitate their evacuation and ease military maneuvers. Eisenhower's goal to create improved highways was influenced by difficulties encountered during his involvement in the U.S. Army's 1919 Transcontinental Motor Convoy. He was assigned as an observer for the mission, which involved sending a convoy of U.S. Army vehicles coast to coast. The conditions of the roads were inferior, largely unpaved and subject to quagmire during heavy rains. His subsequent experience with German autobahns during World War II convinced him of the benefits of such a network. Noticing the improved ability to move logistics throughout the country, he thought an Interstate Highway System in the U.S. would not only be beneficial for military operations but provide a measure of continued economic growth. The legislation initially stalled in the Congress over the issuance of bonds to finance the project, but the legislative effort was renewed, and the law was signed by Ike in June 1956. In his Farewell Address (January 17, 1961), speaking about the “conjunction of an immense military establishment and a large arms industry,” he warned: “In the councils of government, we must guard against the acquisition of unwarranted influence, whether sought or unsought, by the military-industrial complex. The potential of disastrous rise of misplaced power exists and will persist.”

1893 – Actress Lillian Gish (d. 1993) was born in Springfield, OH. Gish was called The First Lady of American Cinema. She was a prominent film star of the 1910s and 1920s, associated with the films of director D.W. Griffith, including her leading role in one of the highest grossing films of the silent era, Griffith's seminal, “Birth of a Nation” (1915). Her sound-era film appearances were sporadic but included roles in “Duel in the Sun” (1946) and “Night of the Hunter” (1955). She did considerable television work from the early 1950s into the 1980s and closed her career playing, for the first time, opposite Bette Davis in the 1987 film “The Whales of August.”

1894 – Birthday of e e cummings, born Edward Estlin Cummings (d. 1962), Cambridge, MA. Poet, playwright: “Him,” “Santa Claus;” writer: “The Enormous Room.”

http://www.kirjasto.sci.fi/cummings.htm

1899 - Birthday of pianist/song writer Spencer Williams (d. 1965), New Orleans, LA.

1899 - Bandleader/jazz promoter William “Red” McKenzie (d. 1948) birthday, St. Louis, MO.

http://www.redhotjazz.com/mckenzie.html

http://www.redhotjazz.com/mound.html

http://us.imdb.com/Name?McKenzie,+Red

http://www.musicweb.uk.net/encyclopaedia/m/M58.HTM

1905 – The New York Giants’ Christy Mathewson fired his third consecutive shutout in this World Series, leading his team to a 4 games to 1 championship over the Philadelphia A’s. The feat, considered one of the best World Series pitching performances in history, occurred over a six-day stretch during which he gave up only 14 hits.

1906 - The White Sox, known as baseball's 'hitless wonders' complete their unbelievable World Series upset of their powerful crosstown rivals by beating the Cubs, 8-3 at South Side Park. The Cubs had won a record 116 regular season games.

1910 – “The Wizard of Westwood,” John Wooden (d. 2010) was born in Hall, IN. He attended Purdue University and he helped lead the Boilermakers to the 1932 Helms Athletic foundation National Championship, as determined by a panel vote rather than the NCAA tournament, which did not begin until 1939. John Wooden was named All-Big Ten and All-Midwestern (1930–32) while at Purdue, and he was the first player ever to be named a three-time consensus All-American. Following a brief coaching stint at Indiana State, Larry Bird’s alma mater, Wooden was named head coach at UCLA in 1948. In 1964, UCLA under Wooden, began college basketball’s, indeed all of sports, most dominating run of success that compares to the New York Yankees of the 1950s and the Montreal Canadiens in NHL hockey. Through 1975, when he retired, UCLA won the NCAA National Championship ten times including seven consecutively from 1967-73. Beginning in 1962, UCLA reached what is now called the Final Four 12 times. The awards are too numerous to mention and he coached several All-Americans who went on to NBA Hall of Fame careers.

1910 - English aviator Claude Grahame-White lands his Farman biplane on Executive Avenue (now Pennsylvania Avenue) near the White House.

1912 – Teddy Roosevelt is shot while campaigning in Milwaukee. The former President is shot and mildly wounded by John Schrank, a mentally-disturbed saloon keeper. With the fresh wound in his chest and the bullet still within it, Mr. Roosevelt still carries out his scheduled public speech.

1916 - Sophomore tackle and guard Paul Robeson, a future College Football Hall of Famer, actor, and political activist, is excluded from the Rutgers football team when Washington and Lee University refused to play against a black person.

1922 – The first automated telephones are introduced, in NYC.

1922 – Thom McAn opens its first retail shoe store, in NYC.

1926 – The Washington Senators’ great Hall of Fame pitcher, Walter Johnson, retires from active playing and signs a contract to manage the Newark Bears minor league team.

1926 – “Winnie-the-Pooh” by A.A. Milne is first published.

1927 – “Bond, James Bond.” Roger Moore (d. 2017) was born in London. Moore played Agent 007 from 1973-85 and his seven appearances as Bond are the most of any actor in the Eon-produced entries. Prior to his Bond career, Moore enjoyed success in television as cousin Beau Maverick in “Maverick” (1960-61), then played Simon Templar as “The Saint” (1962-69).

1929 – Connie Mack’s Philadelphia A’s set a Major League record by scoring 10 runs in one inning in a World Series on the way to defeating the Chicago Cubs, 4 games to 1.

1930 - Ethel Merman becomes a star overnight with her rendition of "I Got Rhythm," featured in the new Broadway hit, “Girl Crazy”.

1933 – Germany, now firmly under Nazi rule, withdraws from the League of Nations.

1938 - Bob Haggart-Ray Bauduc record “Big Noise from Winnetka (Decca 2208).

1939 - Birthday of Ralph Lauren, born Ralph Lifshitz in The Bronx. The designer and purveyor of a line of popular clothes that sought to capture the "spirit of the West," his claim to fame is the “Polo” brand.

http://about.polo.com/history/history.asp

1938 – Watergate figure, counsel to President Nixon, John Dean was born in Akron, OH.

1940 - Charlie Barnet Band records “Redskin Rumba” (Bluebird 10944).

1943 – During the darkest days of the war, the US Army 8th Air Force lost 60 B-17 bombers during the second mass daylight air assault on Schweinfurt, Germany ball bearing factories.

1944 - Linked to a plot to assassinate Hitler, Field Marshal Rommel, one of the Reich’s few military experts, is forced to commit suicide.

1945 – The Chicago Cardinals, now in Arizona, broke a 29-game losing streak in the NFL by beating the Chicago Bears.

1946 - Top Hits

To Each His Own - Eddy Howard

Five Minutes More - Frank Sinatra

South America, Take It Away - Bing Crosby and The Andrews Sisters

Divorce Me C.O.D. - Merle Travis

1947 - Flying a Bell X-I jet at Muroc Dry Lake Bed, California, Air Force pilot Chuck Yeager broke the sound barrier, ushering in the era of supersonic flight. Yeager, born in Myra, West Virginia, in 1923, was a combat fighter during World War II and flew 64 missions over Europe. He shot down 13 German planes and was himself shot down over France, but he escaped capture with the assistance of the French Underground. After the war, he was among several volunteers chosen to test-fly the experimental X-1 rocket plane, built by the Bell Aircraft Company to explore the possibility of supersonic flight.

1949 – Ezzard Charles TKOs Pat Valentino in the 8th round to win the heavyweight boxing title

1949 - Eleven leaders of the American Communist Party are convicted, after a nine-month trial in a of conspiring to advocate the violent overthrow of the US Government

1950 - “The Adventures of Ellery Queen” premiered on television. The first of many series to portray fictional detective Ellery Queen, it began on the Dumont network, where my father, Lawrence Menkin, wrote many of the episodes, and later moved to ABC. Queen was played by Richard Hart. In the next four series, he would also be played by Lee Bowman, Hugh Marlowe, George Nada, Lee Phillips, Peter Lawford and Jim Hutton. In each series Queen talked to the home audience at the show's climax to see if they were able to identify the killer. Future series were titled, “Ellery Queen” and the “Further Adventures of Ellery Queen.” The last telecast aired on September 5, 1976.

1952 - SCHOWALTER, EDWARD R., JR., Medal of Honor.

Rank and organization: First Lieutenant, U.S. Army, Company A, 31st Infantry Regiment, 7th Infantry Division. Place and date: Near Kumhwa, Korea, 14 October 1952. Entered service at: Metairie, La. Born: 24 December 1927, New Orleans, La. G.O. No.: 6, 28 January 1954. Citation: 1st Lt. Schowalter, commanding, Company A, distinguished himself by conspicuous gallantry and indomitable courage above and beyond the call of duty in action against the enemy. Committed to attack and occupy a key-approach to the primary objective, the 1st Platoon of his company came under heavy vicious small-arms, grenade, and mortar fire within 50 yards of the enemy-held strongpoint, halting the advance and inflicting several casualties. The 2d Platoon moved up in support at this juncture, and although wounded, 1st Lt. Schowalter continued to spearhead the assault. Nearing the objective he was severely wounded by a grenade fragment but, refusing medical aid, he led his men into the trenches and began routing the enemy from the bunkers with grenades. Suddenly from a burst of fire from a hidden cove off the trench he was again wounded. Although suffering from his wounds, he refused to relinquish command and continued issuing orders and encouraging his men until the commanding ground was secured and then he was evacuated. 1st Lt. Schowalter's unflinching courage, extraordinary heroism, and inspirational leadership reflect the highest credit upon himself and are in keeping with the highest traditions of the military service.

1952 - “The Red Buttons Show” premiered on TV. The comedy-variety show starred the well-known burlesque comedian Red Buttons. Regulars included Dorothy Jolliffe, Joe Silver, Jeane Carson, Sara Seegar, Jimmy Little, Ralph Stanley, Sammy Birch, and the Elliot Lawrence orchestra. It later switched networks under a new format in 1953, as a sitcom with Phyllis Kirk and Paul Lynde.

1952 – “Night Court” judge, Harry Anderson (d. 2018), was born in Newport, RI.

1953 – President Eisenhower promises to fire as a Communist any federal worker taking 5th amendment during Congressional House Un-American Activities Committee hearings.

1953 – Three females go into service as the first female police officers in The Netherlands.

1954 - Top Hits

“Hey There” - Rosemary Clooney

“I Need You Now” - Eddie Fisher

“Papa Loves Mambo” - Perry Como

“I Don't Hurt Anymore” - Hank Snow

1955 - Nineteen-year old Buddy Holly and his sidemen, Larry Welborn and Bob Montgomery, open a concert in Lubbock, Texas for Bill Haley and the Comets. Nashville talent agent Eddie Crandell is in the audience and in the next few weeks, arranges for Holly to record his first demo.

1957 - Although it was banned by some US radio stations for its suggestive lyrics, The Everly Brothers' "Wake up Little Susie" reached the top of the Billboard singles chart.

1957 - The Elvis Presley classic, "Jailhouse Rock" is released. It would become his ninth US number one single and stay on the Billboard chart for nineteen weeks. The film clip from the movie where he sang the song is considered by many historians to be the first Rock video.

1960 - At the improbable hour of 1am, then presidential candidate John F. Kennedy spoke impromptu to several thousand students from the steps of the University of Michigan Union building. He asked,”How many of you are going to be doctors are willing to spend your days in Ghana? How many of you (technicians and engineers) are willing to work in the Foreign Service? The response was favorable, and 19 days later in San Francisco, Kennedy formally proposed the Peace Corps, which was created by Executive Order, March 1, 1962.

1961 - The Broadway production "How to Succeed in Business without Really Trying" opened on Broadway, the first of 1415 performances.

1962 - The Cuban Missile Crisis begins, bringing the United States and the Soviet Union to the brink of nuclear conflict. Photographs taken by a high-altitude U-2 spy plane offered incontrovertible evidence that Soviet-made medium-range missiles in Cuba, capable of carrying nuclear warheads, were now stationed in Cuba, 90 miles off the American coastline. Tensions between the United States and the Soviet Union over Cuba had been steadily increasing since the failed April, 1961 Bay of Pigs invasion, in which Cuban refugees, armed and trained by the United States, landed in Cuba and attempted to overthrow the government of Fidel Castro. Though the invasion did not succeed, Castro was convinced that the United States would try again, and set out to get more military assistance from the Soviet Union. During the next year, the number of Soviet advisors in Cuba rose to more than 20,000. Rumors began that Russia was also moving missiles and strategic bombers onto the island. Russian leader Nikita Khrushchev may have decided to so dramatically up the stakes in the Cold War for several reasons. He may have believed that the United States was indeed going to invade Cuba and provided the weapons as a deterrent. Facing criticism at home from more hardline members of the Soviet communist hierarchy, he may have thought a tough stand might win him support. Khrushchev also had always resented that U.S. nuclear missiles were stationed near the Soviet Union (in Turkey, for example), and putting missiles in Cuba might have been his way of redressing the imbalance. Two days after the pictures were taken, after being developed and analyzed by intelligence officers, they were presented to President Kennedy. During the next two weeks, the United States and the Soviet Union would come as close to nuclear war as they ever had, and a fearful world awaited the outcome. The United States established a naval blockade to prevent further missiles from entering Cuba, and indeed, a confrontation on the high seas almost materialized when Russian ships approached US Naval vessels. It announced that they would not permit offensive weapons to be delivered to Cuba and demanded that the weapons already in Cuba to be dismantled and returned to the USSR. The Russian ships stopped in the water while awaiting directions from the Kremlin.

After a period of tense negotiations an agreement was reached between Kennedy and Khrushchev. Publicly, the Soviets would dismantle their offensive weapons in Cuba and return them to the Soviet Union, subject to United Nations verification, in exchange for a US public declaration and agreement never to invade Cuba without direct provocation. Secretly, the US also agreed that it would dismantle all US-built Jupiter MRBMs, which were deployed in Turkey and Italy against the Soviet Union but were not known to the public.

When all missiles and light bombers had been withdrawn from Cuba, the blockade was formally ended on November 20, 1962. The negotiations between the United States and the Soviet Union pointed out the necessity of a quick, clear, and direct communication line between Washington and Moscow. As a result, the Moscow-Washington hotline was established.

1962 - Top Hits

“Sherry” - The 4 Seasons

“Monster Mash” - Bobby “Boris” Picket

“I Remember You” - Frank Ifield

“Devil Woman” - Marty Robbins

1962 – In the fledgling American Football League, the Houston Oilers’ George Bland threw 6 TD passes as they romped over the New York Titans, who would be renamed the New York Jets, 56-17.

1963 - The term ""Beatlemania"" is coined by the British press to describe the scene at the previous night's performance by The Beatles on the TV show “Val Parnell's Sunday Night at the London Palladium.”

1964 - Martin Luther King, Jr. became the youngest recipient of the Nobel Peace Prize when awarded the honor. Dr. King donated the entire $54,000 prize money to furthering the causes of the civil rights movement.

1964 – The M&M boys, Roger Maris and Mickey Mantle, hit back-to-back HRs on consecutive pitches.

1964 – Philips begins experimenting with color television.

1964 - Charlie Watts, drummer for the Rolling Stones, marries his first and only wife, Shirley Ann Shepherd, in Bradford, England. They're still married.

1965 - Dodger ace Sandy Koufax, working on just two days’ rest, pitched a three-hit shutout of the Minnesota Twins to capture the 1965 World Series. Koufax struck out ten Twins on his way to the 2-0 win. Later, Dodgers’ catcher, John Roseboro, confided that after about the 3d inning, Koufax threw nothing but fastballs because the curves hurt too much. Said Twins’ slugger Bob Allison, “We knew what was coming and still couldn’t hit it.” And the Dodgers were World Series champs for the second time in three years. No relief pitchers were used by any of the winning teams in this Series.

1966 - Former R&B cover band Pink Floyd debut an entire set of psychedelic originals at tonight's gig at All Saints Hall in London

1966 - The Paul Butterfield Blues Band, Jefferson Airplane, Big Mama Mae Thornton, play the San Francisco Fillmore Auditorium. Grace Slick makes her first stage appearance with the band Jefferson Airplane.

1967 - Bobbie Gentry's LP Ode To Billie Joe hits #1

1967 - The Who's "I Can See for Miles" is released.

1967 - Folk singer Joan Baez arrested in blockade of military induction center, Oakland, California.

http://baez.woz.org/chronology.html

1968 – J.R. Hines becomes the first man ever to break the so-called "ten-second barrier" in the 100 meter sprint in the Summer Olympics held in Mexico City with a time of 9.95 seconds.

1968 – In an expansion draft for the National League’s two new teams, the San Diego Padres and the Montreal Expos select 30 players each. The Expos became the first Major League team to reside outside the US.

1968 - The Beatles’ “White Album” is released.

1968 – The first live telecast from a manned U.S. spacecraft, Apollo 7, is beamed across the world.

1968 - 27 soldiers are arrested at the Presidio of San Francisco for their peaceful protest of stockade conditions and the Vietnam War. On the same day, the Defense Department announces that the Army and Marines sent about 24,000 soldiers and Marines back to Vietnam for involuntary second tours of duty in the combat zone there.

1970 - Top Hits

“Cracklin' Rosie” - Neil Diamond

“I'll Be There” - The Jackson 5

“All Right Now” - Free

“Sunday Morning Coming Down” - Johnny Cash

1971 - John Lennon and Yoko Ono appear on ABC-TV's The Dick Cavett Show to promote John's new album “Imagine,” Yoko's new book, and their upcoming art exhibition.

1972 - Harold Melvin and the Bluenotes enter the soul chart with "If You Don't Know Me by Now," which, in 16 weeks on the chart, will peak at Number One for two weeks. The song makes it to #3 on the pop chart.

1972 - The Temptations' "Papa Was a Rolling Stone" is released.

1972 – The Oakland A’s’ Gene Tenace becomes the only player to homer in each of his first two World Series at bats. The A’s would go on to win the first of three consecutive World Series, beating the Cincinnati Reds.

1973 – Hall of Famer Willie Mays records the last hit of his great career as his New York Mets defeat the Oakland A’s in game 2 of the World Series. His single put the Mets ahead, 7-6, representing Mays’ last RBI as well. In the 9th, Mays lost a fly ball in the sun and fell down in deep CF. Also, in this game, Oakland owner Charlie Finley attempted to ‘fire’ 2B Mike Andrews for his fielding errors, but Andrews was reinstated by Commissioner Bowie Kuhn. The A’s recovered to become the first team to win back-to-back Series since the 1962 Yankees.

1975 - Kiss' "Rock and Roll All Nite" is released.

1975 – President Gerald Ford escapes injury as his limo is broadsided in traffic.

1976 - The Yankees win their 30th pennant dramatically on Chris Chambliss' bottom of ninth-inning solo homer defeating the Royals, 7-6 in Game Five and deciding contest of the ALCS.

1977 - At the request of the Dodgers, Linda Ronstadt sings the National Anthem at Dodger Stadium to open the third game of the World Series against the Yankees.

1978 - All four solo albums by the members of KISS break through Billboard's Top 100. Gene Simmons effort will prove to be the highest charting at #22, followed by Ace Frehley at #26, then Paul Stanley at #40 and Peter Criss at #43.

1978 – The first television movie derived from a series is aired: "Rescue from Gilligan's Island"

1978 – Rocker Usher was born Usher Raymond IV in Dallas.