![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial alternate financing,

bank, finance and leasing industries

kitmenkin@leasingnews.org

![]()

Friday, September 7, 2018

Today's Equipment Leasing Headlines

National Equipment Finance Association Conference

Gerry and Jamie Egan to Retire

California SB 1235 Will Not Kill

Factoring, Finance, Leasing, Merchant Cash Advance

By Christopher Menkin

New Hires/Promotions in the Leasing Business

and Related Industries

Leasing Industry Ads---Help Wanted

Centra Funding

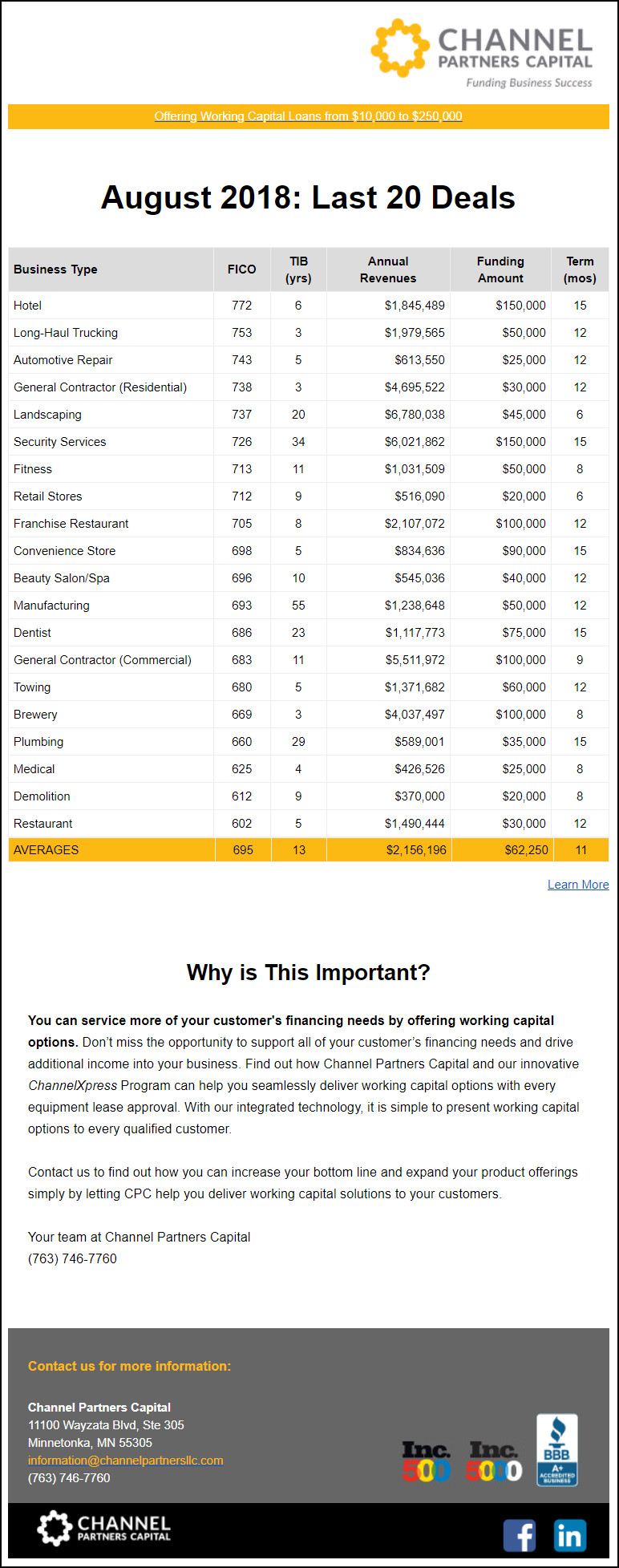

Channel Partners: August, 2018: Last 20 Deals

Business/FICO/TIB/Annual Revenues/Funding Amt/Term

Funders Taking "New" Broker Business List

Updated

Marlin Business Service 10Q

Chief Financial Officer Leaves Company Explanation?

Current Regulations in United States

Not Official, Compiled from Many Sources

Support the Girls/Let the Corpses Tan

Ready Player One/The Rider/Heaven Can Wait

Film/Digital Reviews by Leasing News' Fernando Croce

Boxer

Charlotte, North Carolina Adopt-a-Dog

Twelve Attorneys Against Evergreen Abuse

Updated

News Briefs---

JPMorgan Could Dethrone Wells Fargo

To Become Largest U.S. Bank In Terms Of Total Loans

Booming global stock markets swell ranks of the super rich

people in ultra-high-net-worth bracket increased by 12% last year

Broker/Funder/Industry Lists | Features (wrilter's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

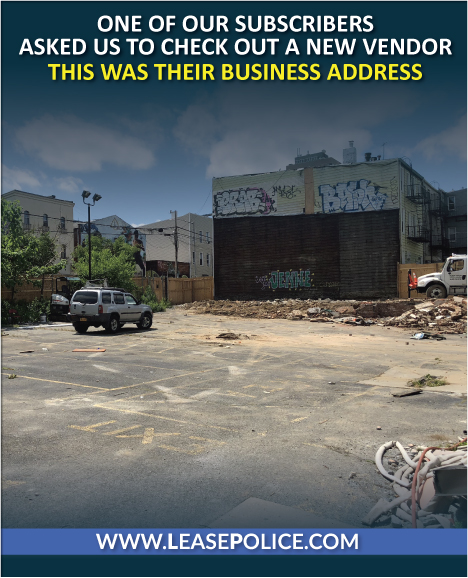

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

Leasing News Icon for Android Mobile Device

You May have Missed---

Poem

Sports Brief----

California Nuts Brief---

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release,” it was not written by Leasing News nor has the information been verified. The source noted. When an article is signed by the writer,

it is considered a “byline.” It reflects the opinion and research of the writer.

Please send a colleague and ask them to subscribe. We are free

Email kitmenkin@leasingnews.org and in subject line: subscribe

[headlines]

--------------------------------------------------------------

National Equipment Finance Association Conference

Gerry and Jamie Egan to Retire

From Gerry Egan:

"This is my last conference as NEFA’s Executive Director. When this conference wraps up, I’ll be retired …for my second time. Who knows, maybe there’ll be a third retirement down the road somewhere. But first …a bunch of doing nothing seems like a really, really good idea!

“Jamie is retiring with me.

"I think it’s drawing a lot of people because they want to come and make sure I really go away!!!"

278 Attending to Date:

https://www.nefassociation.org/events/RSVPlist.aspx?id=995092

Funding Sources Exhibiting:

36th Street Capital Partners LLC

4 Hour Funding

Advantage Funding

American Lease Insurance

AMUR Equipment Finance

Ascentium Capital LLC

AvTech Capital

Baystone Government Finance

Beneficial Equipment Finance Corp

BlueChip Asset Management

Bluevine

Boston Financial & Equity Corp

Bryn Mawr Funding

C.H. Brown Co., LLC

Channel Partners Capital

CLFP Foundation

Copernicus

Dakota Financial, LLC

Dedicated Funding, LLC

ECS Financial Services, Inc.

Financial Pacific Leasing, Inc.

FirstLease, Inc.

Fleet Evaluator

Great American Insurance

Hanmi Bank

Infogroup

instaCOVER, LLC

LEAF Commercial Capital

Leasepath

LTi Technology Solutions

Marlin Business Bank

Monitor

Navitas Credit Corp

NEFA Newsline

Neumann Finance

North Mill Equipment Finance, LLC

Orange Commercial Credit

Orion First Financial, LLC

Pawnee Leasing Corporation

Providence Equipment Finance, dba of Providence Bank & Trust

Quality Leasing Co., Inc.

Quiktrak, Inc.

RapidAdvance

Tamarack

TradeRiver USA, Inc.

Unisearch, Inc.

VFI Corporate Finance

Full Details:

https://www.nefassociation.org/events/EventDetails.aspx?id=995092&group=

[headlines]

--------------------------------------------------------------

California SB 1235 Will Not Kill

Factoring, Finance, Leasing, Merchant Cash Advance

By Christopher Menkin

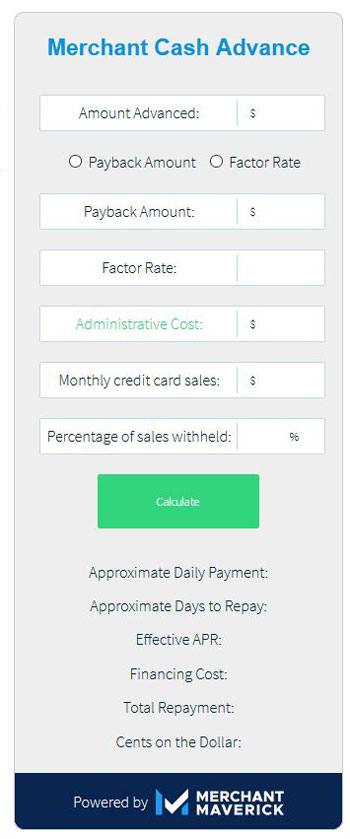

Declaring interest on commercial transactions in California will not greatly affect many lending businesses, including Merchant Cash Advance entities. Getting over rulings that MCA is not a loan, the actual cost in interest is available on most of the MCA websites. Many not only go into detail on how it is included, but include software programs that give you the results.

www.merchantmaverick.com/merchant-cash-advance-calculator/

One of the keys is the factor, which is commonly used in the equipment leasing business (to be covered in "leasing" in this article). How the program works is explained by many of the companies (1). The MCA main clients are small businesses that banks won't consider due to the small dollar amount and/or bank criteria starting with "A" and "B" credits, not considering "C" and "D" credits, combined with an archaic processing system that fundamentally does not put them into competition with financial technology.

The change in law from SB 1235 in California does affect the amateurs in the business but, at the same time, makes the professional more competitive in their abilities to satisfy borrowers with speed, rate, and disclosing all. The smart marketers will take advantage of the California tool in explaining the benefits available with Merchant Cash Advance. It is a win-win when presented by a professional in the business

The same situation applies to business and working capital loans. Again, the market is for small businesses or rapidly expanding businesses that are pushing against their existing account receivable and bank lending abilities, and specifically looking for competitive non-bank transactions. Often the convenience and speed in response overcome a rate concern.

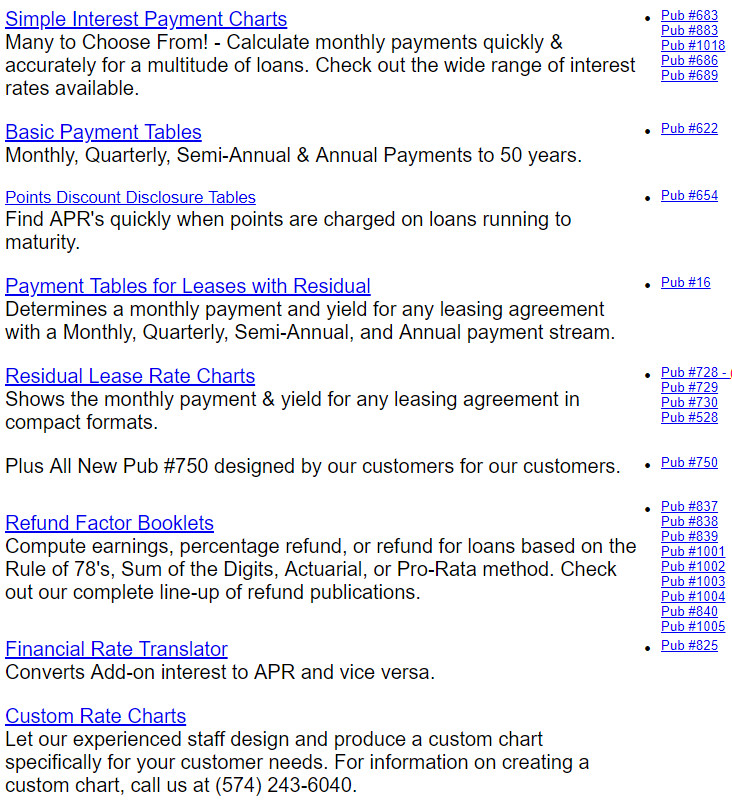

As to rate factors, many brokers, lenders and lessors have software programs on their website to compute payments. Several put in credit criteria and other conditions. Leasing News has been running a feature on this for over 20 years (2)

The key to the programs has always been the factor. It is derived by dividing the payment by the dollar amount borrowed.

For instance, the payment is $250 on $10,000 for sixty months, which turns out to be .025 factor. Brokers add their commission to the factor by multiplying 1.05, for instance, if they wanted five points.

In leasing, advance payments, balloon payments (often called a residual) change the factor. Financial Publishing has been printing for years books and smaller pamphlets on this for years.

http://www.financial-publishing.com/other_pubs.htm

Today, many of these old formats have been replaced with software. One of the most popular and easiest to use is: https://www.timevalue.com/tvalue-products

The impact on advance payments, such as first and last, the balloon at the end, perhaps interim rent, such as on 90-day pay leases, is unknown R this time. Evergreen extended payments will also change the interest rate.

Operating Leases are exempt. Banks are exempt, although it is common that they disclose rates on business loans and Capital Leases.

It is also easy to predict that the professionals, such as Certified Leasing and Finance Professionals, may take up the California disclosure program in other states. It gives them great advantage by utilizing full disclosure, which Senator Steve Glazer said was the purpose of his bill.

SB 1235 awaits Governor Brown’s signature, who appointed him to the California State University Board of Trustees. Ballotpedia states, “Glazer is known as Jerry Brown’s leading political strategist.”

https://ballotpedia.org/Steve_Glazer

When signed, SB 1235 is scheduled to go into effect January 1, 2019.

(1) Google Search: Merchant Cash Advance examples.

https://www.ondeck.com/resources/merchant-cash-advance

https://www.rapidadvance.com/merchant-cash-advance

(2) Free Lease-vs-Buy Calculator

http://two.leasingnews.org/Recommendations/lease-finance.htm

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Mark Bonanno was promoted to Chief Operating Office, North Mill Equipment Finance, Norwalk, Connecticut. He joined the first September, 2016 as Chief Financial Officer; promoted February, 2017 to Executive Vice President. Prior, he was Chief Financial Officer at Advantage Funding and previously spent sixteen years at General Electric in various financial management roles, including Finance Manager of the Corporate Initiatives Group, CFO of Xerox Capital Services and Operational Controller of GE Energy Financial Services. Mr. Bonanno was educated at the University of Massachusetts and is a Certified Black Belt, Six Sigma. He is also a CPA and a graduate of the GE Management Development Course.

https://www.linkedin.com/in/markbonanno/

Nicholas Fong, CLFP, was promoted to CMO & CTO, Allegiant Partners, Inc., Walnut Creek, California. He joined the firm October, 2014, as Marketing Manager; promoted February, 2015, Vice President of Marketing. He previously was Marketing Manager for Allegiant's First Star Capital, joining the company as Marketing Associate, February, 2010 and being promoted to Marketing Manager, June, 2013. Education: California State University-East Bay, MBA, Marketing and Finance (2008–2009); San Diego State University-California State University B.S., Marketing (2005–2007). https://www.linkedin.com/in/nicholas-fong-mba-clfp-792a825/

Cassie Monroe was hired as Director of Business Development, Prompt Capital Funding, LLC., Greater New York Area. Prior, she was Assistant Business Development Manager, Benchmark Merchant Services (March, 2018 - July, 2018); Business Development Manager, Midnight Advance (February, 2017 - March, 2018); Senior Relationship Manager, Fundrock Capital (June, 2017 - September, 2017); Executive Funding Specialist, Small Business Capital Solutions (May, 2106 - June, 2017); Account Manager, 3JM (June, 2015 - April, 2016). Education: Northhampton Community College. Associate of Arts (AA), Business Administration and Management, General. Luzerne County Community College, Business Management. Northhampton Community College. Hotel, Motel, and Restaurant Management.

https://www.linkedin.com/in/cassie-monroe-b61384126/

George Morales was promoted to Manager, Strategic Partnerships, Currency, San Francisco Bay Area. He joined the firm October, 2015, as Senior Account Executive; promoted, May, 2017, Managers, Sales, San Francisco. Prior, he was Relationship Manager, Balboa Capital (May, 2015 - October, 2015). Languages: Spanish. Education: University of California, Berkeley, Mechanical Engineering (2009 -2010).

https://www.linkedin.com/in/george-morales-bb0b9258/

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Funders Taking "New" Broker Business List

BSB

Bankers Capital

Forum Leasing

TimePayment

The following “funders” have informed Leasing News they will consider business from “new” third party originators. Many companies require a certain length of time in business and other requirements, such as a specific volume of business. These “funders” will consider submissions from those new in the leasing and finance business:

Name |

Employees

|

Geo

Area |

Dollar

Amount |

Business Reports

|

A

|

B

|

C

|

D

|

E

|

BSB Leasing, Inc. |

16 |

National |

$10,000 Minimum |

Y |

N |

N |

Y |

Y |

|

Bankers Capital 1990 Larry LaChance - President 508-351-6000 llachance@bankers-capital.com www.bankers-capital.com AACFB, NEFA |

6 |

50 states |

$25,000 + |

Y |

Y |

N |

N |

N | |

Forum Financial Services, Inc. 1996 Tim O'Connor 972.690.9444 ext. 225 tim@forumleasing.com 240 Lake Park Blvd. Suite 112 Richardson, TX 75080 www.forumleasing.com AACFB, ELFA, NEFA |

7 |

Nationwide |

$50,000 - $1.5 million (Our average size transaction is $250,000. Preferred range $100,000 - $500,000) |

N/R |

N/R |

N/R |

N/R |

N/R |

|

Timepayment Corp (Subsidiary of Microfinancial Corp.) Burlington, Massachusetts 1989 Scott Baider scott.baider@timepayment.com 877-868-3800 x7002 www.timepayment.com/lease-brokers AACFB |

175 |

Nationwide

|

$500 to $100,000

|

BBB |

Y |

N |

N |

N |

Y. |

A -Accepts Broker Business | B -Requires Broker be Licensed | C -Sub-Broker Program

| D -"Private label Program" | E - Also "in house" salesmen

|

[headlines]

--------------------------------------------------------------

Marlin Business Service 10Q

Chief Financial Officer Leaves Company Explanation?

Leasing News on Wednesday posted the press release from Marlin Business Services, Mount Laurel, New Jersey, that W. Taylor Kamp was leaving his position as Senior Vice President and Chief Financial Officer.

A reader noted the following from Marlin’s 10Q, “Banking institutions are subject to periodic reviews and examinations from banking regulators. In the first quarter of 2017, one of MBB’s regulatory

agencies communicated preliminary findings in connection with the timing of certain aspects of payment application processes in effect prior to February 2016 related to the assessment of late fees. The Company believes that the resolution of this matter will require the Company to pay restitution to customers. The Company estimated such restitution at $4.2 million, which was expensed and related liability was recorded in the first quarter of 2017.

“The estimated liability has not yet been settled and the ultimate resolution of this matter could be materially different from the current estimate, including with respect to the timing, the exact amount of any required restitution or the possible imposition of any fines and penalties.”

page 22

http://investor.marlinfinance.com/Cache/394509086.pdf

|

[headlines]

--------------------------------------------------------------

Current Regulations in United States

Not Official, Compiled from Many Sources

Please see your financial attorney for a legal opinion.

Any up-dates or additions, please send to kitmenkin@leasingnews.org

Alaska: Money Service License. License required to have exemption from usury rates for loans of $10,000 to $25,000, and 24% rate for $850 to $10,000

http://commerce.state.ak.us/dnn/Portals/3/pub/MoneyservicesStatutes.pdf

Arizona: All "advance fee loan brokers" must register annually with the state. Includes "commitment fees." Stiff penalty and on line form for a complaint for the state to investigate. Arizona Revised Statutes, sec. 06-1303-1310 (1996)

Registration process: http://www.azdfi.gov/Licensing/Licensing-FinServ/ALB/ALB.html

Arkansas: All brokers of "a loan of money, a credit card or a line of credit" may not assess or collect an advance fee. In addition, all brokers must register with the Securities Commissioner, post a surety bond of $25.000 and have a net worth of $25,000.

Arkansas Code Annotate sec. 23-39-401 (1995)

California: On September 22, 2016, California Governor Jerry Brown signed SB 777 into law, a bill that restores a de minimus exemption to the California Finance Lenders Law (CFLL) to allow a person or entity that makes one commercial loan per year to be exempt from the CFLL's licensing requirement, regardless of whether the loan is "incidental" to the business of the person relying on the exemption.

"In addition to the lending authority provided by the law, the California Finance Lenders Law provides limited brokering authority. A "broker" is defined in the law as "any person engaged in the business of negotiating or performing any act as broker in connection with loans*made by a finance lender." Brokers licensed under this law may only broker loans to lenders that hold a California Finance Lenders license."

http://leasingnews.org/archives/May2016/05_02.htm#dob

(*any transaction that is not a true rent or meets the accounting and tax rules or is re-sold as a loan or discount or has a nominal purchase option is considered under this nomenclature. ) (2)

Delaware : License required for More Than 5 Loans Per Year.

http://banking.delaware.gov/services/applicense/llintro.shtml

Florida: Brokers of a "loan of money, a credit card, line of credit or related guarantee, enhancement or collateral of any nature" may not assess or collect an advance fee.

Florida Statues, Chapter 687.14 (1992)

Georgia: A broker of "loans of money, a credit card, a line of credit or related guarantee, enhancement or collateral of any kind or nature" may not assess or collect an advance fee unless such fee is for "actual services necessary to apply for the loan." Official Code of Georgia Annotated, sec. 7- 7-1 (1992)

Idaho: No fee may be collected unless a loan is actually made.

Idaho Code, sec. 26-2501 (1992)

Illinois: Code, 815 ILCS 175/15-5.03 Under the Act, a" loan broker" means any person who, in return for a fee from any person, promises to procure a loan for any person or assist any person in procuring a loan from any third party, or who promises to consider whether or not to make a loan to any person. 815ILCS 175/15-5- 15(a) specifically excluded from the application of the Act, however, are (1) any bank …regulated by any service loans for the Federal National Mortgage Association… (3) any insurance producer or company authorized to do business in [Illinois], (4) any person arranging financing for the sale of the person's product, (note that this exception does not apply to any person selling someone else's product and only applies to "the" person's product, implying the exception is for the owner of the product arranging for financing), (5) any person authorized to conduct business under the Residential Mortgage License Act of 1987 and (6) any person authorized to do business in [Illinois] and regulated by the Department of Financial Institutions or the Office of Banks and Real Estate. "In the event that the Act is violated by the broker, the Secretary of State is empowered by the statute to make investigations and examinations, suspend or revoke the broker's approval, subpoena witnesses, compel the production of books and records, order depositions and obtain temporary restraining orders and injunctions against the broker. In the vent that a violate is found, the Secretary of State may impose a fine in the amount of $10,000 for each violation and the broker shall be liable to any person damaged in the amount of tactual damages plus attorneys’ fees." This appears as standard language on most states.

Iowa: A broker of loans of "money or property" may not assess or collect an advance fee except for a "bona fide third-party fee" and a broker must obtain a bond or establish a trust account and file required documents with the Commissioner or Insurance.

Iowa Code, sec. 535C (19920)

Kansas: Broker is not exempt. Discounter or Lessor is exempt: " 'Creditor' means any person to whom a loan is initially payable on the face of the note or contract evidencing the loan" is exempt. Anyone who earns a fee or accept a deposit, except a bank, financial institution, discounter or lessor, must be registered.

http://www.securities.state.ks.us/rules/loan.rtf

Kentucky: Brokers of "a loan of money, a credit card, a line of credit or related guarantee, enhancement or collateral of any kind or nature" may not assess or collect an advance fee.

Kentucky Revised Statutes Annotated, sec. 367.380 (1992)

Louisiana: A broker of loans of "money or property…whether such agreement is styled as a loan, a lease or otherwise" must obtain a surety bond or establish a trust account in the amount of $25,000. A broker may not collect an advance fee but may collect an "advance expense deposit for commercial loans" only for actual expenses incurred in obtaining the loan. Louisiana Revised Statutes Annotated, sec. 9:3574 (1993); Louisiana Revised Statutes Annotated, Sec. 51:1910 (1992)

Non-Louisiana leasing companies, with or without offices in the state, must qualify to do business in Louisiana, and are subject to payment of state and local occupational license fees. See: Collector of Revenues v Wells Fargo Leasing Corp., 393 So.2d 1255 (La. App. 1981). Common misunderstanding of Louisiana law. Motor vehicle lessors, with or without offices in Louisiana, additionally are required to be licensed by the Louisiana Motor Vehicle Commission in order to lease a motor vehicle in the state. (La. R.S. 32:1254(N)) Common misunderstanding of Louisiana law.

Maine: No license required: "the regulation of commercial loan brokers does not fall under the jurisdiction of the Maine Bureau of Consumer Credit Protection. Transactions involving two businesses are legal/contractual in nature. Therefore, disputes involving a commercial loan between a business and commercial loan provider or broker must be settled in the court system."

http://www.maine.gov/pfr/consumercredit/faqs/loan_broker_faq.htm#j

Maryland: Lending threshold is $6,000 or less, so now need for license if over

this dollar amount

Massachusetts: Lending threshold is $6,000 or less, so now need for license if over this dollar amount.

Minnesota: License required for loans of $100,000 or less

Money Transfer License

http://mortgage.nationwidelicensingsystem.org/slr/PublishedState

Documents/MN-Money-Transmitter-Company-Description.pdf

Mississippi: A broker or loans of money may not assess or collect an advance fee and can be fined up to $5,000 for each violation. Mississippi Code Annotated, sec. 81-19-17 (1997)

Missouri: A broker of loans of "money or property" may not assess or collect an advance fee. Missouri Revised Statues, sec. 367 300 (19920

Nebraska: A broker of loans of money may not assess or collect an advance fee. Nebraska Revised Statutes, sec. 45-189 (1993)

Nevada: Foreign Corporations Foreign corporations engaged in activities in Nevada are subject to the provisions of Chapter 80 of the Nevada Revised Statutes. Specifically, NRS 80.010 through 80.055 set forth the requirements for a foreign corporation to qualify to do business in Nevada. Of primary importance are the statutes that establish (a) the filing requirements to qualify to do business (NRS 80.010); (b) the activities in which a foreign corporation may engage that do not constitute “doing business” so as to require qualification (NRS 80.015); and (c) the penalties to which a foreign corporation will be subject for failing to comply with the qualification provisions (NRS 80.055). The penalties for failure to comply with the qualification statutes include a fine (capped at $10,000) and/or denial of the right to maintain a court action. However, failure to comply will not impair the validity of contracts entered into by a foreign corporation nor prevent such corporation from defending itself in court. Foreign LLCs Foreign LLCs engaged in activities in Nevada are subject to the provisions of Chapter 86 of the Nevada Revised Statutes, specifically NRS 86.543 through 86.549. Foreign LLCs seeking to operate in Nevada must comply with the initial filing and registration requirements in NRS 86.544, and annual filing requirements of NRS 86.5461. The LLC must also maintain certain records, such as a list of current members and managers, in accordance with NRS 86.54615.

Additionally, NRS 86.5483 lists the activities which do not constitute “doing business” in Nevada for purposes of the Chapter. Foreign LLCs that fail to comply with the Chapter risk penalties similar to those facing a non-compliant foreign corporation. Those penalties are outlined in NRS 86.548.

Nevada has no usury statue.

New Hampshire

Any person making small loans, title loans, or payday loans in New Hampshire must obtain a license from the bank commissioner. N.H. Rev. State. Ann. § 399-A:2. This law does not apply to banks, trust companies, insurance companies, savings or building and loan associations, or credit unions. Id. Any person who violates any provision of this chapter shall be guilty of a misdemeanor if a natural person, or a felony if any other person. N.H. Rev. Stat. Ann § 399-A:18.

New Jersey: Brokers of "loans of money" may not assess or collect an advance fee.

New Jersey Rev. Statutes, sec. 17:10B (1992)

Although New Jersey does not require a lessor to obtain a license to conduct a leasing business in the state, the New Jersey Corporation Business Activities Report Act requires foreign corporations to register with the state. See N.J. STAT. ANN. 14A:13-14. In particular, foreign corporations must file a Notice of Business Activities Report with New Jersey's Department of Taxation. Activities that trigger the requirement of a report include: (a) maintaining an office or other place of business in New Jersey; (b) maintaining personnel in New Jersey, even if the personnel is not regularly stationed in the state; (c) owing or maintaining real or tangible personal property directly used by the corporation in New Jersey; (d) owning or maintaining tangible and/or property in New Jersey used by others; (e) receiving payments from residents in New Jersey, or businesses located in New Jersey, that are greater than $25,000.00; (f) deriving any income from any source or sources within New Jersey; or (g) conducting or engaging in any other activity, property or interrelationships with New Jersey as may be designated by the Director of the Division of Taxation. See N.J.S.A. 14A:13-15. Corporations not required to file a report are those which either received a certificate of authority to do business, or filed a timely tax return under the Corporation Business Tax Act, or Corporation Income Tax Act. See N.J. STAT. ANN. 14A:13-16. Reports must be filed annually by April 15th.

New Mexico: New Mexico currently requires Brokers/Lessors to register for Licensing under the NM Mortgage loan Company or Loan Broker Act with the Financial Institutions Division of the State of New Mexico. Banks with Brick and Mortar within the State of New Mexico are exempt. Prior to licensing applicants must submit the Following:

Articles of Incorporation

Listing of all principals (including management)

A full financial Package (to meet their minimum requirements of liquidity)

Personal financial statements on all principals

Disclosure of all current or past suits (civil or criminal)

Attach a corporate surety bond

Include a $400.00 registration fee renewable yearly

New York: No person or other entity shall engage in the business of making loans in the principal amount of twenty-five thousand dollars or less for any loan to an individual for personal, family, household, or investment purposes and in a principal amount of fifty thousand dollars or less for business and commercial loans, and charge, contract for, or receive a greater rate of interest than the lender would be permitted by law to charge if he were not a licensee hereunder except as authorized by this article and without first obtaining a license from the superintendent.

North Carolina: A broker of "loans of money or property…whether such agreement is styled as a loan, a lease or otherwise" must obtain a surety bond or establish a trust account in the amount of $25,000 and obtain a license. North Carolina General Statutes, sec. 66-106 (1992)

https://www.sosnc.gov/Corporations/pdf/FAQ

TreeLoanBrokerAct20130805.pdf

http://www.ncleg.net/EnactedLegislation/Statutes

/PDF/ByArticle/Chapter_66/Article_20.pdf

North Dakota: License Required “Money Broker’s License”. N.D. Cent. Code Ann. § § 13-04.1-02.1 and 13-04.1-01.1 http://www.nd.gov/dfi/regulate/index.html

Brokers may not accept an advance fee unless the broker is licensed. North Dakota Century Code, 13-04. 1-09.1 (1993) Ohio: Department of Commerce, Division of Financial Institutions

(Certificate to engage in the business of a credit services organization in accordance with the provisions of Sections 4712.01 to 4712.14 of the revised code of Ohio, subject to all the provisions thereof and to the regulations of the division.) Ohio Department of Taxation requires a "Vendor's License" under provision 5739.17 of the Revised Code (...is hereby authorized to sell tangible personal property and selected services at the retail location specified below.) This also makes the lessor responsible for all taxes with penalties for not doing so.

Ohio: Ohio law provides that no person may engage in the business of lending money, credit, or choses in action in amounts of $5,000 or less, or exact, contract for, or receive, directly or indirectly, on or in connection with any such loan, any interest and charges that in the aggregate are greater than the interest and charges that the lender would be permitted to charge for a loan of money if the lender were not a licensee, without first having obtained a license from the Division of Financial Institutions. O.R.C. 1321.02. This rule is applied to any person, who by any device, subterfuge, or pretense, charges, contracts for, or receives greater interest, consideration, or charges than that authorized by such provision for any such loan or use of money or for any such loan, use, or sale of credit, or who for a fee or any manner of compensation arranges or offers to find or arrange for another person to make any such loan, use, or sale of credit. O.R.C. 1321.02.

Rhode Island: Any person who acts as a lender, loan broker, mortgage loan originator, or provides debt-management services must be licensed. R.I. Gen Laws § 19-14-2(a). The licensing requirement applies to each employee of a lender or loan broker. R.I. Gen Laws § 19-14-2(b). No lender or loan broker may permit an employee to act as a mortgage loan originator if that employee is not licensed. R.I. Gen Laws § 19-14-2(b) R.I. Gen. Laws § 19-14-2 (2012) No person engaged in the business of making or brokering loans shall accept applications from any lender, loan broker, or mortgage loan originator who is required to be licensed but is not licensed. R.I. Gen Laws § 19-14-2(d). There is an exemption from the licensing requirement for a person who makes not more than 6 loans in the state within a 12-month period. R.I. Gen Laws § 19-14.1-10. Persons lending money without a license are guilty of a misdemeanor and can be fined not more than $1,000, or imprisoned for not more than 1 year, or both; each violation constitutes a separate offense. R.I. Gen Laws § 19-14-26.

South Carolina: A broker of "a loan of money, a credit card, a line of credit or related guarantee, enhancement or collateral of any kind or nature" may not assess or collect an advance fee. South Carolina Code Annotated, sec. 34-36-10 91992)

South Dakota: Money Lending License

Required for individuals or corporations to engage in the business of lending money, including creating and holding or purchasing and acquiring any installment loan ("Capital Lease" or EFA), single pay loan, or open-end loan which may be unsecured or secured by personal property. Requires filing a surety bond application. State and national banks, bank holding companies, other federally insured financial institutions, and the subsidiaries of those institutions are exempt from licensure. In addition, SD chartered trust companies are exempt from licensure. Any individual or corporation holding this license is required to pay the bank franchise tax.

Duration: 1 year

Cost: Application: $600

South Dakota has no usury status

Vermont: In the past, Commercial loan license would apply to EFA and "Capital Leases." Exemptions include transactions over $1 million, and brokers who do not engage in transactions more than $50,000 in one year at rates not exceeding 12 percent per annum. As of May 1, 2017. "Loan solicitation licensees must maintain a surety bond, include a specific disclosure in all advertisements of loans and solicitation of leads, observe record retention requirements, and file an annual report and financial statements with the Commissioner of Financial Regulation."

Full information available here:

http://www.counselorlibrary.com/public/alert.cfm?itemID=2420

Ontario, Canada: General Requirements: 1. Branch Operation If a foreign corporation wants to carry on business via a branch operation, without a Canadian corporate entity, it may have to obtain a provincial license in each province in which it intends to carry on business. Pursuant to the Ontario Extra-Provincial Corporations Act R.S.O. 1990 c. E.27 ("EPCA"), a class 3 extra-provincial corporation (a corporation that has been incorporated or continued under the laws of a jurisdiction outside Canada) is prohibited from carrying on business in Ontario without a license under the Act [s. 4(2)]. Failure to comply with this licensing requirement can lead to a maximum fine of $2,000 for a person and $25,000 for a corporation [s. 20(1)]. Directors, officers and any person acting as a representative of the corporation can be fined up to $2,000 for authorizing, permitting or acquiescing to an offence by the corporation [s. 20(2)]. For the purposes of the EPCA, an extra-provincial business is considered to be "carrying on business in Ontario" if: a. It has a resident agent, representative, warehouse, office or place where it carries on its business in Ontario; b. It holds an interest, otherwise than by way of security in real property situate in Ontario; or c. It otherwise carries on business in Ontario [s. 1(2)]. This last category is a catchall. Recent case law in the area stresses that it is very much a fact-specific analysis hinging on the extent to which business is actually conducted in Ontario. 2. Incorporation: a foreign corporation can also choose to incorporate a subsidiary, either federally or provincially. If a subsidiary is incorporated provincially in Ontario, it may have to obtain an extra-provincial license to carry on business in other provinces. An Ontario-incorporated company does not have to obtain a license to carry on business in Quebec but does have to make annual information filings. 3. Bank Act If the financing company is a bank and intends to carry on business in Canada, it must obtain appropriate approval under the Bank Act 1991 c. 46. Whether an entity will be considered a bank under the Bank Act needs to be reviewed on a case-by-case basis, as there are a number of relevant factors.

[headlines]

--------------------------------------------------------------

--------------------------------------------------------------

Boxer

Charlotte, North Carolina Adopt-a-Dog

Nomi

Female

Large

Age: 3 years

Color: Black/White

Adoption Fee: $150

Humane Society of Charlotte (Main Shelter)

2700 Toomey Avenue

Charlotte, NC, 28203

704-377-0534

Click here for directions

Hours: Tuesday – Sunday 11:00am – 5:00pm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

Twelve Attorneys Against Evergreen Abuse

The original intention of the Evergreen clause in an equipment leasing contract was to have an alternative to when the lessee did not exercise the residual at the end of the contract. Often the clause calls for an automatic additional twelve months when the residual is not resolved.

In most cases, the lessor notifies the lessee that the residual will be due, often ninety days in advance. However, often there is nothing in the contract that requires the lessor to notify the lessee regarding the expiration of the contract.

Contrarily, many small ticket lessors do not notify the lessee, and automatically continue the lease, often via an ACH or continued billing, which often goes unnoticed until many payments have already been made.

Leasing News would like to see an industry standard that lessees are notified in advance of the expiration of their contract regarding its termination. We support the clause, and the notification requirement is wide open, meaning 90, 60, even 30 days and by telephone or mail.

This list of attorneys agrees with this and will be available to lessees, sometimes able to help them without a fee, or at a reduced rate, in an effort to end the abuse of Evergreen clause leases.

Joseph G. Bonanno, Esq., CLFP

Attorney at Law, Massachusetts

Andover Landing at Brickstone

300 Brickstone Square, Ste. 201

Andover, MA 01810

Tel: (781)328-1010

Fax: (781) 827-0866

Email: law@jgbesq.com

"Industry expert witness in litigation, numerous authored and

co-authored published articles and conducting educational

seminars. Very well-known in the industry."

Jim Coston

Coston & Coston LLC

105 W. Adams Street

Suite 1400

Chicago, Illinois 60603

(312) 205-1010

jcoston@costonlaw.com

(In 1998, he was elected to the United Association of Equipment

Leasing Board of Directors, and in 2003-04 was the first

attorney to become UAEL President, very active in his political party.)

Ronald J. Eisenberg

Schultz & Associates LLP

640 Cepi Drive, Suite A

Chesterfield, MO 63005

(636) 537-4645 x108

(636) 537-2599 (fax)

www.sl-lawyers.com

(Proven Leasing Litigator, well respected by all sides)

Ronald P. Gossett

Gossett & Gossett, P.A.

400 Seridan Street, Building I

Hollywood, Florida

954-983-2828

Fax: 954-983-2850

rongossett@gossettlaw.com

(Many cases including NorVergence, Brican, among others, a winner)

Ken Greene

Law Offices of Kenneth Charles Greene

5743 Corsa Avenue Suite 208

Westlake Village, California 91362

Tel: 818.575.9095

Fax: 805.435.7464

Skype: 424.235.1658

kenlaw100@gmail.com

(Ken was involved in the formation of Leasing News and

represented it (pro bono) in the early days.)

Peter S. Hemar, Esq.

Hemar & Associates, Attorneys at Law

2001 Wilshire Blvd., Suite 510

Santa Monica, CA 90403

Telephone: (310) 829-1948

Fax: (310) 829-1352

phemar@hemar.com

(My firm supports the clause giving lessees advance

notice of the expiration of their contract.)

Brandon J. Mark

Attorney at Law, Admitted in Utah and Oregon

Parsons Behle & Latimer

201 South Main Street, Suite 1800

Salt Lake City, UT 84111

Direct Dial 801.536.6958

Facsimile 801.536.6111

www.parsonsbehle.com

BMark@parsonsbehle.com

(His firm represents banks who buy leases, and his

clients refuse to buy these types of leases.)

Barry S. Marks

MARKS & ASSOCIATES, P.C.

Financial Center - Suite 1615

505 North 20th Street

Birmingham, Alabama 35203

P. O. Box 11386

Birmingham, Alabama 35202

barry@leaselawyer.com

www.leaselawyer.com

205.251.8303

fax 278.8905 (Direct) 251.8305 (Main)

(Well-known to the leasing industry, also Alabama Poet)

Tom McCurnin

Barton, Klugman & Oetting

350 South Grand Ste. 2200

Los Angeles, CA 90071

Voice: (213) 617-6129

Fax: (213) 625-1832

Cell: (213) 268-8291

Email: tmccurnin@bkolaw.com

(Leasing News Advisor/Leasing News Legal Editor,

Well-Known top Leasing Litigator)

Frank Peretore

Chiesa Shahinian & Giantomasi

West Orange, New Jersey

http://www.csglaw.com/biographies/frank-peretore

Phone 973-530-2058

fperetore@csglaw.com

(Experienced leasing attorney, aggressive, author, active

National Equipment Finance Association, ELFA, too)

Kevin E. Trabaris, Partner

Culhane Meadows PLLC

30 S. Wacker Drive, 22nd floor

Chicago, IL 60606

Telephone: 847-840-4687

Email: ktrabaris@culhanemeadows.com

llflegal.com/attorneys/kevin-trabaris

"In my career, I’ve repeatedly seen this provision misused

by unscrupulous lessors and think it’s a bad idea for both

the lessee and the lessor."

Michael J. Witt, Esq.

MICHAEL J. WITT LAW OFFICES

4342 Oakwood Lane

West Des Moines, IA 50265

Tel: (515) 657-8706

Mobile: (515) 868-1067

Fax: (515) 223-2352

email: MWitt@Witt-Legal.com

Web: www.witt-legal.com

(Former Advanta Leasing

and Wells Fargo Equipment Finance attorney)

[headlines]

--------------------------------------------------------------

News Briefs----

JPMorgan Could Dethrone Wells Fargo

To Become Largest U.S. Bank In Terms Of Total Loans

https://www.forbes.com/sites/greatspeculations/2018/09/05/jpmorgan-looks-poised-to-become-largest-u-s-bank-in-terms-of-total-loans-this-year/#45759edb1be1

Booming global stock markets swell ranks of the super rich

people in ultra-high-net-worth bracket increased by 12% last year

https://www.theguardian.com/business/2018/sep/05/booming-global-stock-markets-swell-ranks-of-the-super-rich

[headlines]

--------------------------------------------------------------

You May Have Missed---

It's better to rent than to buy in today's housing market

https://www.cnbc.com/2018/09/05/its-better-to-rent-than-to-buy-in-todays-housing-market.html

[headlines]

--------------------------------------------------------------

(This is an acrostic poem, in which the first letter of each line spells out a clue into the poem's meaning.)

Preoccupied

by Nancy Weaver

Victor suffers

In his room, with

Old World strains

Long studied ...

In his hands,

Never mastered.

Boys!

Are better busied

Slinging bats and stealing bases;

Even measuring odds,

Batting averages

Angles and trajectory and ...

Losers, unknown to composers of

Lovely concertos.

[headlines]

--------------------------------------------------------------

Sports Briefs---

Khalil Mack’s Bears jersey rockets up the bestseller list

https://profootballtalk.nbcsports.com/2018/09/06/khalil-macks-bears-jersey-rockets-up-the-bestseller-list/

Raiders’ defensive coordinator defends trading Khalil Mack

https://profootballtalk.nbcsports.com/2018/09/06/raiders-defensive-coordinator-defends-trading-khalil-mack/

Kyle Shanahan: Jerick McKinnon injury “

changes things pretty drastically”

https://www.yahoo.com/sports/kyle-shanahan-jerick-mckinnon-injury-122451522.html

Nike Likely to Win with Bold Kaepernick Move

http://ww2.cfo.com/risk-management/2018/09/nike-likely-to-win-with-bold-kaepernick-move/

Eight NFL coaches who could quickly

land on the hot seat in 2018

https://www.usatoday.com/story/sports/nfl/2018/08/30/nfl-hot-seat-coaches-2018-hue-jackson-dirk-koetter/1125418002/

Rams football games are long gone from St. Louis,

but the legal ones go on

https://www.stltoday.com/sports/football/professional/rams-football-games-are-long-gone-from-st-louis-but/article_af55e70b-7938-5ce9-bba6-1d405d94dcf5.html

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

Oroville Dam repairs now exceed $1 billion

and ‘may be adjusted further’ as work continues

https://www.sacbee.com/news/state/california/water-and-drought/article217824370.html

California’s 2018 wildfire costs so far: At least $845 million

https://www.sacbee.com/news/state/california/fires/article217923885.html

The first of L.A.'s temporary shelters is about to open.

'We have to do something today,' Garcetti says

http://www.latimes.com/local/lanow/la-me-ln-bridge-home-homeless-20180905-story.html#nws=mcnewsletter

California grows most of America’s sushi rice.

The harvest has begun. Watch the action

https://www.sacbee.com/news/state/california/article217949235.html

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

Legendary Alameda winemaker Kent Rosenblum has died unexpectedly

https://www.eastbaytimes.com/2018/09/05/legendary-alameda-winemaker-kent-rosenblum-has-died-unexpectedly/

Napa, Sonoma vineyard value growth cools

as groundwater scrutiny heats up

https://www.northbaybusinessjournal.com/opinion/8693219-181/napa-sonoma-vineyard-valuation-groundwater-regulation

Is Sonoma reaching ‘peak wine’?

https://www.sonomanews.com/news/8681307-181/is-sonoma-reaching-peak-wine

70 Major Buyers Focus on Vinexpo Explorer in Sonoma County

to Drive International Wine Growth

https://www.winebusiness.com/news/?go=getArticle&dataid=202945

Champagne Announces 2018 Harvest Kickoff

https://www.winebusiness.com/news/?go=getArticle&dataid=202928

Which wine app is worth downloading?

https://thetakeout.com/best-wine-app-is-worth-downloading-1828811141

I’m Obsessed with Manischewitz

https://punchdrink.com/articles/obsessed-with-manischewitz-kosher-wine/

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1630 - The Massachusetts town of Trimontaine (Shawmut), was renamed Boston, and became the state capital. It was named after a town of the same name in Lincolnshire, England.

1776 - According to American colonial reports, Ezra Lee made the world's first submarine attack in the Turtle, attempting to attach a time bomb to the hull of HMS Eagle in New York Harbor (no British records of this attack exist).

1778 – During the Revolutionary War, France invaded Dominca in the British West Indies, before Britain became aware of France's involvement in the war.

1816 - Teabout and Chapman launched the Frontenac, the first steamboat “to sail” on the Great Lakes, revolutionizing shipping.

1825 - The Marquis de Lafayette, the French hero of the American Revolution, bade farewell to President John Quincy Adams at the White House.

1857 - The Mountain Meadows massacre was a series of attacks on the Baker-Fancher emigrant wagon train, at Mountain Meadows in southern Utah. The attacks began on September 7 and culminated on September 11, 1857, resulting in the mass slaughter of the party by members of the Utah Territorial Militia with some Paiute Native Americans. The militia, officially called the Nauvoo Legion, was composed of southern Utah's Mormon settlers. Intending to leave no witnesses and thus prevent reprisals, the perpetrators killed all the adults and older children—about 120 men, women, and children in total. Seventeen children, all younger than seven, were spared.

1860 – Grandma Moses (d. 1961) was born Anna Mary Robertson Moses in Greenwich, NY. A renowned American folk artist, having begun painting in earnest at the age of 78, she is often cited as an example of an individual successfully beginning a career in the arts at an advanced age. Her works have been shown and sold in the United States and abroad and have been marketed on greeting cards and other merchandise. Moses' paintings are among the collections of many museums.

1864 - In preparation for his march to the sea, Union General William T. Sherman orders residents of Atlanta, Georgia, to evacuate the city. Even though Sherman had just successfully captured Atlanta with minimal losses, he was worried about his supply lines, which stretched all the way to Louisville, Kentucky. With Confederate cavalry leader Nathan Bedford Forrest on the loose, Sherman expected to have a difficult time maintaining an open line of communication and reasoned that he could not stay in Atlanta for long. The number of troops committed to guarding the railroad and telegraph lines was almost as many as he had with him in Atlanta. For Sherman, the defeated residents of Atlanta could only hinder him in his preparations since they represented mouths to feed in addition to his own army. Furthermore, he did not want to bear responsibility for women and children in the midst of his army. Eviction of the residents was Sherman's most logical solution. Sherman's order surely didn't win him any fans among the Southerners, but he was only starting to build his infamous reputation with the Confederates. In November, he embarked on his march to the sea, during which his army destroyed nearly everything that lay in its path.

1875 – Edward F. Hutton (d. 1962) was born in Manhattan. In 1904, Hutton, his brother, Franklyn, and Gerald M. Loeb founded the American stock brokerage firm E.F. Hutton. Under their leadership, it became one of the most respected financial firms in the United States and for several decades was the second largest brokerage firm in the United States. E.F. Hutton merged in 1988 with Shearson Lehman/American Express.

1876 - In Northfield, MN, Jesse James and the James-Younger Gang attempted to rob the town's bank but were driven off by armed citizens.

1881 - The temperature soared to 101 degrees at New York City, 102 degrees at Boston, and 104 degrees at Washington, D.C.

1892 - At the Olympic Club in New Orleans, James Corbett won the World Heavyweight Championship by knocking out John L. Sullivan in the 21st round. Corbett's new scientific boxing technique enabled him to dodge Sullivan's rushing attacks and wear him down with jabs.

1903 – Taylor Caldwell (d. 1985) was born in Greenwich, CT. Novelist and prolific author of popular fiction, also known by the pen names Marcus Holland and Max Reiner, and by her married name of J. Miriam Reback. In her fiction, she often used real historical events or persons. Best-known works include “Dynasty of Death,” “Dear and Glorious Physician” (about Saint Luke), “Ceremony of the Innocent,” “Pillar of Iron,” “The Earth is the Lord's” (about Genghis Khan) and “Captains and Kings.” Her last major novel, “Answer As a Man,” appeared in 1980.

1903 - The Federation of American Motorcyclists was organized at Manhattan Beach, NY., when the New York Motorcycle Club, which in 1903 merged with the Alpha Motorcycle Club of Brooklyn. The first president was R.G. Betts of the New York Motor Cycle Club. About 200 delegates attended the first meeting, considered the first rumble of motorcyclists in the U.S.

1907 – Walter Johnson of the Washington Senators beat the Red Sox for the first of 38 career 1-0 shutouts. Johnson threw 130 shutouts during his career, 23 more than runner-up Grover Cleveland Alexander.

1908 - Trumpeter Max Kamisnky (d. 1994) birthday, Brockton, MA.

1908 – Dr. Michael DeBakey (d. 2008) was born in Lake Charles, LA. World-renowned American cardiac surgeon, innovator, scientist, medical educator, and international medical statesman. DeBakey is known for his work on the treatment of heart patients and for his role in the development of the mobile army surgical hospital (MASH).

1908 – Put this on the list of things you’ll never see again. On Labor Day, Washington Senators manager Joe Cantillon was forced to start Walter Johnson as one pitcher was sick and another returned to Washington to be with his sick wife. Only three Senators pitchers made the trip to New York. The Big Train shut out the Highlanders for the third time in four days, 4-0, topping Jack Chesbro, allowing just two hits and no walks. In the three games, Walter allowed 12 hits, walked one, and struck out 12.

1909 – Elia Kazan (d. 2003) was born Elias Kazantzoglou in Constantinople, now Turkey. Director, producer, writer and actor, described by The New York Times as "one of the most honored and influential directors in Broadway and Hollywood history." Noted for drawing out the best dramatic performances from his actors, he directed 21 actors to Oscar nominations, resulting in nine wins. He directed a string of successful films, including “A Streetcar Named Desire” (1951), “On the Waterfront” (1954), and “East of Eden” (1955). During his career, he won two Oscars as Best Director and received an Honorary Oscar, won three Tony Awards, and four Golden Globes. A turning point in Kazan's career came with his testimony as a witness before the House Committee on Un-American Activities in 1952 at the time of the blacklist, which brought him strong negative reactions from many liberal friends and colleagues. His testimony helped end the careers of former acting colleagues, along with ending the work of playwright Clifford Odets. Nearly a half-century later, his anti-Communist testimony continued to cause controversy. When Kazan was awarded an honorary Oscar in 1999, dozens of actors chose not to applaud as 250 demonstrators picketed the event.

1912 – David Packard (d. 1996) was born Pueblo, CO. An electrical engineer and co-founder, with William Hewlett, of Hewlett-Packard (1939), serving as president (1947–64), CEO (1964–68), and Chairman of the Board (1964–68, 1972–93). He served as US Deputy Secretary of Defense from 1969 to 1971 during the Nixon Administration. Packard was the recipient of the Presidential Medal of Freedom in 1988 and is noted for many technological innovations and philanthropic endeavors.

1922 - Joe Newman (d. 1992) birthday (Great Count Basie trumpet player-13 years), New Orleans.

1924 – Daniel Inouye (d. 2012) was born in Honolulu. US Senator from Hawaii from 1963 to 2012. He was President pro tempore (3d line the presidential line of succession) of the Senate from 2010 until his death in 2012, making him the highest-ranking Asian American politician in U.S. history. Inouye fought in World War II and lost his right arm to a grenade wound. He was a Medal of Honor recipient, received several military decorations and was a posthumous recipient of the Presidential Medal of Freedom.

1930 - Tenor saxophonist Sonny Rollins was born Walter Theodore Rollins, Sugar Hill in Harlem.

1936 - Singer Buddy Holly (d. 1959) was born Charles Hardin Holley in Lubbock, TX. Musician and singer-songwriter who was a central figure of mid-1950s rock and roll. In 1955, after opening for Elvis, Holly decided to pursue a career in music. He opened for Presley three times that year; his band's style shifted from country and western to entirely rock and roll. In October that year, when he opened for Bill Haley & The Comets, Holly was spotted by Nashville scout Eddie Crandall, who helped him get a contract with Decca Records. Unhappy with their control in the studio and with the sound he achieved there, Holly went to producer Norman Petty in New Mexico and recorded a demo of "That’ll Be the Day” among other songs. In September 1957, as the band now known as Buddy Holly and The Crickets, toured, "That'll Be the Day" topped the US and UK charts. Its success was followed in October by another major hit, "Peggy Sue." In early 1959, Holly assembled a new band, including future country music star Waylon Jennings and embarked on a tour of the midwestern U.S. After a show in Clear lake, IA, Holly chartered an airplane to travel to his next show. Soon after takeoff, the plane crashed, killing Holly, Ritchie Valens, The Big Bopper, and the pilot, in a tragedy later elegized by Don McLean as "American Pie." https://en.wikipedia.org/wiki/Buddy_Holly***

1944 - MAXWELL, ROBERT D., Medal of Honor

Rank and organization: Technician Fifth Grade, U.S. Army, 7th Infantry, 3d Infantry Division. Place and date: Near Besancon, France, 7 September 1944. Entered service at: Larimer County, Colo. Birth: Boise, Idaho. G.O. No.: 24, 6 April 1945. Citation: For conspicuous gallantry and intrepidity at risk of life above and beyond the call of duty on 7 September 1944, near Besancon, France. Technician 5th Grade Maxwell and 3 other soldiers, armed only with .45 caliber automatic pistols, defended the battalion observation post against an overwhelming onslaught by enemy infantrymen in approximately platoon strength, supported by 20mm. flak and machinegun fire, who had infiltrated through the battalion's forward companies and were attacking the observation post with machinegun, machine pistol, and grenade fire at ranges as close as 10 yards. Despite a hail of fire from automatic weapons and grenade launchers, Technician 5th Grade Maxwell aggressively fought off advancing enemy elements and, by his calmness, tenacity, and fortitude, inspired his fellows to continue the unequal struggle. When an enemy hand grenade was thrown in the midst of his squad, Technician 5th Grade Maxwell unhesitatingly hurled himself squarely upon it, using his blanket and his unprotected body to absorb the full force of the explosion. This act of instantaneous heroism permanently maimed Technician 5th Grade Maxwell, but saved the lives of his comrades in arms and facilitated maintenance of vital military communications during the temporary withdrawal of the battalion's forward headquarters.

1950 - “Truth or Consequences” premiered on television. The half-hour show was based on a parlor game: contestants who failed to answer a question before the buzzer (nickname Beulah) went off had to perform stunts (i.e., pay the consequences.) Ralph Edwards created and hosted the show until 1954, then it became a prime-time show hosted by Jack Bailey. My father's very close friend, Morris Burman, was the lead writer. Bob Barker succeeded Bailey in 1966 and hosted it through syndication through 1974. In 1977, the show was revived as “The New Truth of Consequences” with Bob Hilton as host, ending in 1988.

1951 - CRUMP, JERRY K., Medal of Honor

Rank and organization: Corporal, U.S. Army, Company L, 7th Infantry Regiment, 3d Infantry Division. Place and date: Near Chorwon, Korea, 6 and 7 September 1951. Entered service at: Forest City, N.C. Born: 18 February 1933, Charlotte, N.C. G.O. No.: 68, 11 July 1952. Citation. Cpl. Crump, a member of Company L, distinguished himself by conspicuous gallantry and outstanding courage above and beyond the call of duty in action against the enemy. During the night a numerically superior hostile force launched an assault against his platoon on Hill 284, overrunning friendly positions and swarming into the sector. Cpl. Crump repeatedly exposed himself to deliver effective fire into the ranks of the assailants, inflicting numerous casualties. Observing 2 enemy soldiers endeavoring to capture a friendly machine gun, he charged and killed both with his bayonet, regaining control of the weapon. Returning to his position, now occupied by 4 of his wounded comrades, he continued his accurate fire into enemy troops surrounding his emplacement. When a hostile soldier hurled a grenade into the position, Cpl. Crump immediately flung himself over the missile, absorbing the blast with his body and saving his comrades from death or serious injury. His aggressive actions had so inspired his comrades that a spirited counterattack drove the enemy from the perimeter. Cpl. Crump's heroic devotion to duty, indomitable fighting spirit, and willingness to sacrifice himself to save his comrades reflect the highest credit upon himself, the infantry and the U.S. Army.

1951 - KANELL, BILLIE G., Medal of Honor

Rank and organization: Private, U.S. Army, Company I, 35th Infantry Regiment, 25th Infantry Division. Place and date: Near Pyongyang, Korea, 7 September 1951. Entered service at: Poplar Bluff, Mo. Born: 26 June 1931, Poplar Bluff, Mo. G.O. No.: 57, 13 June 1952. Citation: Pvt. Kanell, a member of Company I, distinguished himself by conspicuous gallantry and outstanding courage above and beyond the call of duty in action against the enemy. A numerically superior hostile force had launched a fanatical assault against friendly positions, supported by mortar and artillery fire, when Pvt. Kanell stood in his emplacement exposed to enemy observation and action and delivered accurate fire into the ranks of the assailants. An enemy grenade was hurled into his emplacement and Pvt. Kanell threw himself upon the grenade, absorbing the blast with his body to protect 2 of his comrades from serious injury and possible death. A few seconds later another grenade was thrown into the emplacement and, although seriously wounded by the first missile, he summoned his waning strength to roll toward the second grenade and used his body as a shield to again protect his comrades. He was mortally wounded as a result of his heroic actions. His indomitable courage, sustained fortitude against overwhelming odds, and gallant self-sacrifice reflect the highest credit upon himself, the infantry, and the U.S. Army.

1952 - PORTER, DONN F., Medal of Honor

Rank and organization: Sergeant, U.S. Army, Company G, 14th Infantry Regiment, 25th Infantry Division. Place and date: Near Mundung-ni Korea, 7 September 1952. Entered service at: Baltimore, Md. Born: 1 March 1931, Sewickley, Pa. G.O. No.: 64, 18 August 1953. Citation: Sgt. Porter, a member of Company G, distinguished himself by conspicuous gallantry and outstanding courage above and beyond the call of duty in action against the enemy. Advancing under cover of intense mortar and artillery fire, 2 hostile platoons attacked a combat outpost commanded by Sgt. Porter, destroyed communications, and killed 2 of his 3-man crew. Gallantly maintaining his position, he poured deadly accurate fire into the ranks of the enemy, killing 15 and dispersing the remainder. After falling back under a hail of fire, the determined foe reorganized and stormed forward in an attempt to overrun the outpost. Without hesitation, Sgt. Porter jumped from his position with bayonet fixed and, meeting the onslaught and in close combat, killed 6 hostile soldiers and routed the attack. While returning to the outpost, he was killed by an artillery burst, but his courageous actions forced the enemy to break off the engagement and thwarted a surprise attack on the main line of resistance. Sgt. Porter's incredible display of valor, gallant self-sacrifice, and consummate devotion to duty reflect the highest credit upon himself and uphold the noble traditions of the military service.

1953 - American tennis great Maureen “Little Mo” Connolly became the first woman to win the Grand Slam, the four major tournaments in the same year. She began with the Australian Open, then the French Open and then Wimbledon. At the US championships at Forest Hills, NY, she defeated Doris Hart in the final, 6-2, 5-4. Connolly was so dominating that the match lasted only 43 minutes.

1956 - “The Adventures of Jim Bowie” premiered. My father, Lawrence Menkin, wrote some of the episodes. This half-hour western about the inventor of the Bowie knife starred Scott Forbes as the title character. There was much criticism about the early violence, and as a results action was greatly decreased on this original television series (Bowie rarely used his knife and even fist fights were removed from air.)

1957 - Elvis enters a recording studio to cut "Treat Me Nice," "Don't" and the tracks for his upcoming Christmas album

1958 - Georgia Gibbs performs "The Hula-Hoop Song" on The Ed Sullivan Show, boosting the craze that is sweeping North America. The song would be the last of nine Top-40 hits for Gibbs.

1963 - Three weeks after its release, The Beatles' "She Loves You" hits #1 in England. It remained on the charts for thirty-one consecutive weeks, eighteen of those in the top three.

1963 - The Pro Football Hall of Fame opened in Canton, OH with 17 charter members: Jim Thorpe, Ernie Nevers, Bronco Nagurski, Don Hutson, Cal Hubbard, Pete Henry, Mel Hein, Red Grange, Dutch Clark, Johnny Blood, Sammy Baugh, George Halas, Curly Lambeau, George Preston Marshall, Tim Mara, Joe Carr and Bert Bell. The reasons Canton was selected: The NFL was founded in Canton in 1920 (at that time it was known as the American Professional Football Association); second, the now-defunct Canton Bulldogs were a successful NFL team during the first few years of the league.

1966 - Roy Orbison begins filming his one and only starring role, in the unlikely Western comedy “The Fastest Guitar Alive,” with a cameo by Sam "The Sham" Samudio of "Wooly Bully" fame.

1967 - At Candlestick Park, the Giants tie a National League mark using a record 25 players to beat the Astros in 15 innings, 3-2. Manager Herman Franks uses all his starters and five relief pitchers, sends six pinch hitters to the plate; three players enter the contest as pinch runners along with two defensive substitutions.

1967 - “The Flying Nun” premiered on television, about a nun at a convent in Puerto Rico who discovers that she can fly, starring Sally Fields.

1968 - The Doors' LP “Waiting for the Sun” hits #1

1970 - A lightning bolt struck a group of football players at Gibbs High School in Saint Petersburg FL, killing two persons and injuring 22 others. All the thirty-eight players and four coaches were knocked off their feet

1970 - ENGLISH, GLENN H., JR., Medal of Honor

Rank and organization: Staff Sergeant, U.S. Army, Company E, 3d Battalion, ~03 Infantry, 173d Airborne Brigade. Place and date: Phu My District, Republic of Vietnam, 7 September 1970. Entered service at: Philadelphia, Pa. Born: 23 April 1940, Altoona, Pa. Citation: S/Sgt. English was riding in the lead armored personnel carrier in a 4-vehicle column when an enemy mine exploded in front of his vehicle. As the vehicle swerved from the road, a concealed enemy force waiting in ambush opened fire with automatic weapons and anti-tank grenades, striking the vehicle several times and setting it on fire. S/Sgt. English escaped from the disabled vehicle and, without pausing to extinguish the flames on his clothing, rallied his stunned unit. He then led it in a vigorous assault, in the face of heavy enemy automatic weapons fire, on the entrenched enemy position. This prompt and courageous action routed the enemy and saved his unit from destruction. Following the assault, S/Sgt. English heard the cries of 3 men still trapped inside the vehicle. Paying no heed to warnings that the ammunition and fuel in the burning personnel carrier might explode at any moment, S/Sgt. English raced to the vehicle and climbed inside to rescue his wounded comrades. As he was lifting 1 of the men to safety, the vehicle exploded, mortally wounding him and the man he was attempting to save. By his extraordinary devotion to duty, indomitable courage, and utter disregard for his own safety, S/Sgt. English saved his unit from destruction and selflessly sacrificed his life in a brave attempt to save 3 comrades. S/Sgt. English's conspicuous gallantry and intrepidity in action at the cost of his life were an inspiration to his comrades and are in the highest traditions of the U.S. Army.

1974 - Elton John is awarded a Gold record for "Don't Let the Sun Go Down On Me." The single was #2 on the Hot 100 for four straight weeks, but was kept out of the top spot by John Denver's "Annie's Song," Roberta Flack's "Feel Like Makin' Love" and Paper Lace's "The Night Chicago Died."

1977 - In Washington, President Jimmy Carter and Panamanian dictator Omar Torrijos sign a treaty agreeing to transfer control of the Panama Canal from the United States to Panama at the end of the 20th century. The Panama Canal Treaty also authorized the immediate abolishment of the Canal Zone, a 10-mile-wide, 40-mile-long U.S.-controlled area that bisected the Republic of Panama. Many in Congress opposed giving up control of the Panama Canal--an enduring symbol of U.S. power and technological prowess--but America's colonial-type administration of the strategic waterway had long irritated Panamanians and other Latin Americans. The rush of settlers to California and Oregon in the mid-19th century was the initial impetus of the U.S. desire to build an artificial waterway across Central America. In 1855, the United States completed a railroad across the Isthmus of Panama (then part of Colombia), prompting various parties to propose canal-building plans. Ultimately, Colombia awarded the rights to build the canal to Ferdinand de Lesseps, the French entrepreneur who had completed the Suez Canal in 1869. Construction on a sea-level canal began in 1881, but inadequate planning, disease among the workers, and financial problems drove Lesseps' company into bankruptcy in 1889.

1979 - The Chrysler Corporation asked the United States government for $1.5 billion to avoid bankruptcy.

1986 - Off the coast of Florida, an F-106 “Delta Dart” of the 125th Fighter-Interceptor Squadron encounters a Soviet Air Force Tu-95 “Bear” bomber flying parallel to the twelve-mile limit of U.S. airspace as it makes its way from Russia to Cuba. These are routine flights which are just as routinely met by Air Guard fighters who act as ‘escorts’ to be sure the bombers pose no threat to the U.S. homeland. Since 1953, Air Guard fighter-interceptor units took on an air defense mission, challenging unidentified aircraft flying into American airspace. Air Guard pilots and aircraft stood alert 24 hours a day, every day. This mission grew each year and by 1965, the 22 interceptor squadrons flew 30,000 hours and completed 38,000 alert sorties. By 1988, the Air Guard provided 86% of the Air Force units assigned to national airspace security. In the post 9/11 environment, the Air Guard has continued and expanded its role in homeland defense by flying overhead cover for major cities in times of heightened alert as well as investigating all suspicious air traffic heading toward or across the country.

1988 - Fifty cities across the eastern U.S. reported record low temperatures. The low of 56 degrees at Mobile, AL was their coolest reading of record for so early in the season. The mercury dipped to 31 degrees at Athens, OH, and to 30 degrees at Thomas, WV.

1993 - Dr. Joycelyn Elders, born in 1933 in Schaal, AR, became the first African-American Surgeon General. Elders, the former health director of the state of Arkansas, was confirmed by a Senate vote of 65 to 34.

1996 - In a pre-game ceremony in front of sellout crowd at the Metrodome, the Twins bid farewell to Kirby Puckett, one of team's popular players in recent years. After a remarkable 12-year Hall of Fame career, the talented and personable outfielder was forced to retire in July because of blindness in his right eye caused by glaucoma. He died in 2006.

2001 - During his 30th Anniversary celebration at Madison Square Garden, Michael Jackson is reunited onstage with the Jackson 5 for the first time since 1984.

2008 – On the heels of The Great Recession that was precipitated by a subprime mortgage collapse, the US Government took control of Freddie Mac and Fannie Mae. Following their mission to meet HUD housing goals, GSEs such as Fannie Mae, Freddie Mac and the Federal Home Loan Banks (FHL Banks) had striven to improve home ownership of low and middle income families, underserved areas, and generally through special affordable methods such as "the ability to obtain a 30-year fixed-rate mortgage with a low down payment... and the continuous availability of mortgage credit under a wide range of economic conditions." Then in 2003–2004, the subprime mortgage crisis began. The market shifted away from regulated GSE's and radically toward Mortgage Backed Securities (MBS) issued by unregulated private-label securitization conduits, typically operated by investment banks. Fannie Mae and smaller Freddie Mac owned or guaranteed a massive proportion of all home loans in the United States and so were especially hard hit by the slump. The government officials also stated that the government had also considered calling for explicit government guarantee through legislation of $5 trillion on debt owned or guaranteed by the two companies. On Oct 21, 2010, FHFA estimates revealed that the bailout of Freddie Mac and Fannie Mae will likely cost taxpayers $224–360 billion in total, with over $150 billion already provided

2010 - Trevor Hoffman earns his 600th save, the first Major Leaguer to do so, when he induces pinch-hitter Aaron Miles to hit a grounder for the final out in the Brewers' 4-2 victory over St. Louis at Miller Park. The 42-year-old reliever, baseball's career saves leader, has converted 600 of his 676 save opportunities (89%) during his 18-year career with Florida, San Diego and Milwaukee. Hoffman remains second behind the all-time saves leader, Mariano Rivera, who retired with 652. Hoffman entered the Baseball Hall of Fame in 2018.

2014 - Serena Williams beat Caroline Wozniacki in the U.S. Open final, joining Martina Navratilova and Chris Evert in having won 18 Grand Slam singles victories.

***Internet hoaxes regarding “American Pie” and its meaning:

The airplane Buddy Holly died in was the "American Pie," thus the name of the Don McLean song. http://www.americanleasing.com/resources/virus/index.html

Among internet pages of Buddy Holly and Don McClean, with analysis of the lyrics, actual Civil Aeronautics Review of the crash, and all the information you would want to know, the plane was a rented plane, the crash was pilot error, and the name of the plane was not "American Pie." This is a response from an e-mail to the administrator of the Buddy Holly Fan Club page: AS IN AS AMERICAN as apple PIE, a reference to the loss of innocence "I don't want you to pledge your future, the future’s not yours to give ............" - Don McLean. There are two other opinions, but both are not confirmed and also do not apply to the lyric analysis on the Don McLaren Home page. They are also sent around as trivia and are also false. Another is (not confirmed) in “The Annotated American Pie,” from: rsk@gynko.circ.upenn.edu (Rich Kulawiec) Don McLean dated a Miss America candidate during a pageant and broke up with her on February 3, 1959 (not confirmed).

http://www.levitt.co.uk/interpret.html

The name of the plane or an ex-girlfriend? If you listen to the song, you will realize it could never have been an homage or reference to a rented aircraft by an inexperienced pilot who had very little experience in flying in the weather by instruments on this small aircraft (see http://www.geocities.com/SunsetStrip/Towers/5236 to find out more about Buddy Holly). Listen to the song, and answer the question yourself.

http://www.fiftiesweb.com/amerpie-1.htm

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

![]()