Connect with Leasing News ![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() |

| ![]() Search |

Search | ![]() Stress Release

Stress Release

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

www.madisoncapital.com |

Thursday, April 4, 2013

![]()

Today's Equipment Leasing Headlines

Archives---April 4, 2001

PinnFund millions are 'all gone'

Classified Ads---Credit

Word Count Increased to 50

---Post a Job Wanted

Popular Equipment Finance Back in the Game

Dale Kluga Named President

New Hires---Promotions

Classified Ads---Help Wanted

April 23-24 NVLA Annual Conference

National Vehicle Leasing Association

Sales Makes it Happen

“Sales Managers and Coaching”

by Steve Chriest

Video Production Now Available from Steve

Equipment and Software Investment to Grow 5.6% in 2013

—Includes full ELFF report PDF

Seven Countries Sending the Most People to America

by Douglas A. McIntyre, 24/7WallSt

“Top Jobs” joins Classified Ads

--Employment Web Sites

Labrador Retriever

PAWs Chicago Adopt-a-Dog

News Briefs---

Wait Continues for Lease Accounting Clarity

BancVue Buys Equipment Leasing Company

National Funding Inc. Announces Expansion with Move to UTC Location

Ex-Goldman Trader Pleads Guilty to Fraud

Royal Bank of Scotland faces $6 billion investor action

Man from Battlefield is charged for $785,200 lease fraud scheme

U.S. home prices rose in February by most in 7 years

Kia, Hyundai recalling 1.9 million vehicles

Facebook to unveil HTC phone with Google's Android software

The mobile phone turns 40 years old

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

You May have Missed---

SparkPeople--Live Healthier and Longer

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release” and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send Leasing News to a colleague and ask them to subscribe.

We are free!

[headlines]

--------------------------------------------------------------

Archives---April 4, 2001

PinnFund millions are 'all gone'

By Mike Freeman

UNION-TRIBUNE STAFF WRITER

(Reprinted originally with permission) (Edited here for length)

More than $300 million in investor money is missing in an alleged eight-year Ponzi scheme run out of PinnFund USA in Carlsbad, according to a court-appointed receiver trying to hunt down assets.

The amount came to light in the past week as officials investigated what they are describing as one of the largest cases of securities fraud in Southern California history.

On March 21, the SEC filed civil litigation in U.S. District Court accusing PinnFund, its founder Michael J. Fanghella, Oakland lawyer James L. Hillman, Oakland-based Peregrine Funding and other companies controlled by Hillman of bilking investors.

Promised 17 percent returns, investors were told that their money would be put into a trust account to fund mortgages made by PinnFund.

PinnFund specialized in so-called sub-prime mortgages, lending to people with poor credit. PinnFund said it would sell the mortgages at a profit, which in turn would provide returns to investors.

Lavish lifestyle

Instead of funding mortgages, the SEC contends that more than $100 million went to support Fanghella's lavish lifestyle, including $10 million in gifts to his ex-girlfriend, Kelly Cook, a former porn star.

In addition, the SEC estimates that $95 million went to cover ongoing losses at PinnFund, which had a gym, on-site athletic trainers and a wine cellar at its 95,000-square-foot headquarters in Carlsbad.

The remainder of the $300 million, the SEC speculates, was used to make interest payments to investors as part of the Ponzi scheme. (In a Ponzi scheme, money paid in by later investors is used to pay abnormally high returns to the original investors, thereby attracting more money.)

+ + +

PINN LEASE USA - NSF CHECK

"We recently had a customer who tried to obtain a lease through PinnLease USA in Carlsbad, CA. PinnLease structured a proposal for approval and required the customer to forward an advance payment check to them to process the deal. It turned out they did not approve the deal. Our customer requested a prompt refund in full.' PinnLease, USA did return the check to our customer, and when they deposited the check back into their bank account, they received notification shortly thereafter from their bank that the check was returned for non- sufficient funds... We just want to warn any PinnFund Brokers left.

We request that our name not be mentioned in this post."

NAME WITHHELD

PinnLease USA President Tommy Larsen Pleads Guilty http://www.leasingnews.org/Conscious- Top%20Stories/Pinn_Leasing_Sentencing_postponed.htm

April 9, 2005 Tommy Larsen Passed Away in Jail http://www.leasingnews.org/Conscious-Top%20Stories/Tommy_Larsen.htm

TODAY, March 4, 2012

Michael Fanghella Today, from his LinkedIn page

Michael Fanghella Released from Jail in 2011 for Good Behavior (Under the agreement, Fanghella faces 11 to 14 years in prison, said Assistant U.S. Attorney Kevin Kelly. But his sentence may be reduced, based on how much information he provides to investigators.) http://www.leasingnews.org/Conscious-Top%20Stories/PinnFund.htm

(click to veiw larger)

Linkedin.com shows him still operating Santa Fe Advisory Services. January, 2013, he opened Integrated Management Services.

www.linkedin.com/pub/michael-fanghella/18/b6/286

[headlines]

--------------------------------------------------------------

Classified Ads---Credit

(These ads are “free” to those seeking employment

or looking to improve their position)

Greater Atlanta, GA |

Open to Relocate |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

[headlines]

--------------------------------------------------------------

*****Announcement**************************************

Word Count Increased to 50

Post a Job Wanted

Alexa Ranks Leasing News #1

The number of words allowed in Classified Ads---Jobs Wanted, placed

by those seeking employment or to improve their position has been

changed from 25 to 50 words. All those now advertising will be

contacted regarding the change.

Resume's and photos are continued to be invited.

These ads will continue to be free to those seeking work.

For more information, please go here:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

****Announcement***************************************

[headlines]

--------------------------------------------------------------

Popular Equipment Finance Back in the Game

Dale Kluga Named President

Popular Community Bank, the U.S. banking subsidiary of Popular, Inc., announced the appointment of Dale Kluga to lead its national equipment finance business: Popular Equipment Finance; based out of Rosemont, Illinois.

Appointed to head the entrance back in the game is Dale Kluga, who will be bringing his experience from Cobra Capital as well as background in banking (see News Briefs). His email is: dkluga@bpop.com

Dale Kluga President

Popular Equipment Finance Unit of BPNA

9600 W. Bryn Mawr Avenue Suite 500

Rosemont, Illinois 60018

Cell: 630-675-0828

Office: 847-994-6902

"We will be scaling Cobra's proven business model with the resources of the 36th largest bank in the U.S. which has proven its dedication to Cobra's target small biz market, the key to any jobs recovery and, therefore, any real U.S. economic recovery,” he said.

Asked if they will be taking third party business, he said, "Absolutely, we will fund brokers as I have been a long time funder of brokers since I founded LaSalle's leasing business in 1995."

Founded in 1893, Popular, Inc. is the leading banking institution by both assets and deposits in Puerto Rico and the 36th largest in the U.S. by assets with over 8,000 employees, according to BusinessWeek.

Popular Inc.

(BPOP: Consolidated Issue Listed On Nasdaq Glbl Slct Mrkt)

“We are thrilled that Dale will lead our equipment finance operations. His proven track record of building a highly successful business will help with our expansion,” said Michael McCracken, Illinois region executive for Popular Community Bank. “We continue to work with the business and financial communities to identify opportunities where we can best support their equipment financing and funding needs. Dale’s expertise will help us advance our business growth.”

Originally the name was Popular Leasing, but changed November 28, 2007 as Popular Equipment Finance, Inc. "The subsidiary has

completed a strategic realignment, adding new origination channels, new competitive products, and several new key executive hires." http://www.leasingnews.org/archives/November%202007/11-28- 07.htm#pef

Former president of the banking division was Bruce Horton, who in 2003 had many leases and a close connection with NorVergence, a Ponzi scheme that cost many banks and leasing companies millions of dollars.

http://www.leasingnews.org/archives/August%202006/08-25-06.htm#pop

Fred Van Etten became president and ceo of Popular Equipment Finance in May, 2005.

http://www.leasingnews.org/archives/August%202006/08-02- 06_Flash.htm

In 2007, he was first to introduce to the industry the "e-loan," which was is now what is known as "business loans" by Balboa Capital, Channel Partners, FivePoint Capital, and On Deck, among others. It has become a very popular alternative to both small ticket leasing and bank financing.

In 2008, Bancopopular announced a restructure plan to be finished by June, 2009, closing 40 US branches (many of them at retail locations such as Wal-Mart and Major Supermarkets) as well as consolidate its consumer-finance unit Popular Finance into its retail banking operations. http://www.leasingnews.org/archives/October%202008/10-27-08.htm#error

Popular Equipment Finance sold its portfolio to TCF February 23,2009. http://www.leasingnews.org/archives/February%202009/02-23-09.htm#sold

Van Etten had to let a lot of good leasing people go. He went over to TCF the same month to help manage the portfolio. He stayed on at TCF as senior vice-president, leaving March, 2012. He was recently named Scottrade Bank Equipment Finance, a subsidiary of Scottrade Financial Services, Inc., where Scottrade, Inc. and Scottrade Bank are separate but affiliated companies. http://leasingnews.org/archives/Jan2013/1_17.htm#van

[headlines]

--------------------------------------------------------------

New Hires---Promotions

Kristian M. Decker named vice president of federal sales for Key Government Finance, working out of Orlando, Florida. Previously she was client services manager federal DOD-Air Force & Army, Cisco systems (August, 2011-January, 2013), DoD Cybersecurity Specialist Air force, EMEA/TS Clearance, Cisco Systems (April, 2010-July, 2012), director of US Federal Operations, Speakerbus Ltd (November, 2009- April, 2010), sr. federal account manager/business development manager, Coleman Technologies (October,2008-November, 2009), Cisco Network Security Solutions Sales specialist, Cisco systems (January, 2006-Octobere, 2008), territory sales account manager, McAfee Security (April, 2001-December, 2005), senior systems engineer/TAM, McAfee (200-2006), consultant, federal accounts, BearingPoint Consulting (1999-2000).Palm Beach Community College, ASN, Nursing (1989 – 1992)

www.linkedin.com/in/securitylifestyle

Nancy Eggan was named Senior Vice President of Operations for Onset Financial, South Jordan, Utah. Previously she was executive vice-president, Mazuma Capital Corp. (September, 2005-March, 2013), vice president, Applied Financial, (September, 1985- September, 2005).University of Utah General Ed, Business, Accounting, Fine Arts (1975 – 1978).

www.linkedin.com/pub/nancy-eggan/28/200/199

Michael Gay has been named Senior Managing Director - Group Head at NXT Capital Equipment Finance, working out of the San Francisco Bay Area. A new company: "NXT Capital Equipment Finance offers a full range of flexible financing solutions to middle-market companies nationwide. The group will provide loans and leases from $2 million to $20 million to finance new and used equipment for companies with revenues of $50 million and above across most industries. Products include secured term loans, tax-oriented leases, finance leases, operating leases, TRAC leases and sale-leaseback transactions...NXT Capital provides structured financing solutions to middle-market and emerging growth companies, as well as real estate investors, through its Corporate Finance, Equipment Finance, Real Estate and Venture Finance groups. Based in Chicago, NXT Capital has offices in New York, Atlanta, Boston, Dallas, Newport Beach, San Francisco and Silicon Valley.

Mr. Gay previously was managing director, Banc of America Leasing (June, 2010-January, 2013), director, Key National Finance (September, 2008-June, 2010), senior managing director, FirstLight Financial Corporation (July, 2007-May, 2008), managing director, GE Commercial Finance (2001-2008), vice president, Finova capital Corporation (1998-2000), vice president, Tokai financial services (1993-1998), account executive, Leasepartners (1992-1993). University of California, Berkeley, Bachelor of Arts (B.A.), Political Science (1986 – 1990). www.linkedin.com/in/michaelbodengay

Stephen Gramaglia has been promoted to Executive Vice President of Eastern Funding, LLC, New York, New York. He previously served as the Senior Vice President of Operations, joining the firm in April, 1999.Eastern Funding's Founder and President Michael Fanger said, "The recent promotion of Stephen reflects our consistent focus on a management structure that is aligned with Eastern's core values of building long-term customer relationships, delivering the right financing, and empowering them to succeed." Previously Mr. Gramaglia was loan processing coordinator, Medallion Financial (September, 1997-March, 1999). Pace University- Pleasantville/Briarcliff Campus, BBA, Finance (1993 – 1996).

Brian Haezebroeck promoted to senior vice president, managing director – Vendor Finance CropLife, Rabo AgriFinance. " The promotion of Mr. Haezebroeck to managing director, we now intend to significantly grow our Vendor Finance business even further over the coming years," said Justin Harrison, executive vice president, Business Development." Brian’s industry knowledge, leadership and strategic vision will benefit our Vendor Finance clients and all Rabo AgriFinance clients as we seek to become the premier ag lender in the U.S.” "Rabo AgriFinance is a large-capacity lender with the ability and expertise to handle large-sized operations and all complexities of credit. A global team of analysts provide a competitive edge with insights on industry trends. And a comprehensive portfolio of services includes the right tools for producers to prepare for and take advantage of market opportunities. Whether it's financial lending, crop insurance or risk management support, Rabo AgriFinance's experts guide customers on paths toward greater success."

Mona Janes has been named senior consultant for Benetrends, North Wales, Pennsylvania. The company specializes in franchise and small business funding. “Her knowledge within the financial services industry has allowed her the ability to assist many clients to successfully utilize their retirement funds (401K, IRA), as well as SBA Loans to capitalize their new or existing business," Rocco Fiorentino, CEO of Benetrends stated in the company press release. Previously she was vice-president of Canyon Leasing (April, 2008-March, 2013), executive vice president, Wildwood Financial Group, LTD (October, 1998-June, 2007).

www.linkedin.com/pub/mona-janes/5/721/910

Geralyn Kaiser hired as Marketing Vice President of the Bank Client Group for SunTrust Equipment Finance & Leasing, the company’s subsidiary that provides essential-use equipment financing for businesses, municipalities, colleges, and universities. She will be based in Atlanta, GA and will primarily cover WIM and Commercial. Previously she was vice president, PNC Equipment Finance (March, 2012-Present), vice president, leasing account representative, RBC (November, 2009-March, 2012), senior vice president in Equipment Finance, Branch Banking and Trust (2004-2009), vice president, equipment finance account executive, Bank of America (2003- 2005).Valdosta State University Accounting, Business.

www.linkedin.com/pub/geralyn-kaiser/18/4b/454

Pat Kistler Vice-President Sales at Ascentium Capital, Kingwood, Texas. Previously he was president, Universal Finance & Leasing, consultants for Amerisource Funding, Inc. (2005-Present), president eastern division, Amerisource Funding (2004-2011), vp, marketing, First Sierra Financial (1997-2004) Previous leasing positions were not included nor verified at press time. He graduated from the University of Texas at Austin, Marketing, (1978 – 1981)

www.linkedin.com/pub/pat-kistler/11/105/2b2

Dale Kluga appointed president of Popular Community bank's national equipment finance business: Popular Equipment Finance; based out of Rosemont, Illinois. He is in the process of leaving his company where he founded and served as president, Cobra Capital, formed in August, 1999. According to Michael McCracken, Illinois region executive for Popular Community Bank, "(He)...will leverage Cobra Capital’s successful fee income business model of providing equipment financing to small and mid-size businesses through its national network of direct and indirect origination sources and financial intermediaries. PEF also plans in expanding its operation to include additional forms of small and mid-market financial service products to support the needs of Popular business clients nationwide."

Prior to Cobra Capital, Kluga was founder and president, Great American Leasing Company (April, 1996--August, 1999), founder and senior vice president, LaSalle National Leasing Corporation (April, 1994-April, 1996)."Prior to his position at LaSalle National Bank, Kluga was chief credit officer at LINC where he was recognized as a credit authority and workout specialist." He was often on radio and TV, recognized as critic of the “monster bank” system.

"In 1989 he co-founded a community bank for the second largest Chicago based banking organization at the age of 29 and subsequently founded the parent company’s equipment leasing subsidiary, which was acquired in 2007 by Bank of America. Mr. Kluga is a CPA and 1981 graduate of Northern Illinois University with a B.S. in accounting and is a graduate of Continental Illinois National Bank’s Financial Information Services Training Program and its’ Wholesale Banking Training Program.

http://leasingnews.org/archives/May2012/5_18.htm#kluga

In addition to radio and TV, he is also was a frequent contributor to regional, national newspapers and trade publications such as Leasing News.

www.linkedin.com/pub/dale-kluga/40/47/857

Marin McElhany has been hired as vice present of marketing and sales, Veritas Financial Partners, based out of San Francisco. “Veritas Financial is a leading national financial services firm that provides senior secured credit facilities to small and medium sized businesses. Our loans are fully secured by collateral, including accounts receivable, inventory, equipment, other fixed assets." Previously she was vp of Marketing and sales, US capital Partners (May, 2011-November, 2012), president, M2 Productions (May, 2004-august, 2009), assistant to executive vice president, Wells Fargo Securities (January, 1999-August, 2002). She is a board member of EDCC (January, 2008-present). Speaks Spanish and French. San Francisco State University, College of Business, MBA, Strategic Management & Int'l Markets (2009 – 2011) Activities and Societies: Co-Founder of Sonoma State Cellars Wine Club Published Research for California BIE Wine Grant Northeastern University, B.S International Business, Finance, International Markets (1997 – 2002), Activities and Societies: Delta Phi Epsilon Sorority Northeastern Women's Soccer Team Member Div 1 NE Co-Op Program Van Kasper Securities SF ( 6 Months), The Athenian School, College Prep (1994 – 1997) Activities and Societies: Class 1997 Graduation Speaker Outward Bound Pacific Crest Survival Training 1994 Athenian Wilderness Experience - High Sierra 1996 Foreign exchange studies in Nambour, Queensland Australia Hospitality work in the Great Barrier Reef Whitsundays- Hamilton Island. Certified Wine Professional 2009 - Culinary Institute of America, Advanced Sommelier- Court of Master Sommeliers 2010,Northstar Ski Resort - Star Tyke (Kids under 5) Instructor Award - Winter 2005)

Jody Salino has joined EverBank Commercial Finance as the Office Products Sales Director for the firm’s Western region, working out of the San Francisco Bay area. "“Jody brings an extensive knowledge of the office products industry and will be a major asset to the team as we look to help office imaging dealers grow their businesses in both our Western region as well as across our national network, ”Fred Carollo, General Manager of Office Products at EverBank Commercial Finance, said . “We expect Jody will be instrumental in our continued growth over the next few years and provide our clients with best in class service and financing expertise.” Previously Jody Salino was director, middle market, De Lage Landen (1998-February, 2013), US sales and marketing manager, Cisco Systems Capital (1995-1997), account manager, US Leasing (1994-1995), district manager, Tokai Financial services (1991-1993).,Brooklyn College, Bachelor of Arts (BA), Economic New York University, General Studies, Poly Prep.

www.linkedin.com/pub/jody-salino/a/ba5/418

Marc Stern has been promoted to Executive Vice President of Eastern Funding, LLC, New York, New York. Eastern Funding's Founder and President Michael Fanger noted, "(He)...will continue to hold his role as Chief Credit Officer of Eastern Funding and Eastern Funding's Specialty Vehicle Division. Marc has specifically helped to enhance Eastern Funding's reputation as a national lender, and within the past year, successfully spearheaded the launch and management of Eastern Funding's new Specialty Vehicle Division, which provides direct lending to the tow truck, ambulance, pupil transportation, and specialty commercial vehicle industries...As a leader in financing for the laundromat, dry cleaning, and specialty vehicle industries, Eastern Funding continues to provide customers with commercial leasing and financing solutions. Operating as a direct lender, Eastern Funding provides leases and loans with both fixed and floating rates." Samford University, Cumberland School of Law, JD, (1979 – 1981), Emory University, BA Economics (1973 –1977).

www.linkedin.com/pub/marc-stern/23/62b/684

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

Orange, California Generate documents & addendum's, approve all signed

documents, process, working closely with sales team;

responsible for developing positive and strong working

relationships both internally and externally. www.quickbridgefunding.com |

www.madisoncapital.com |

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

![]()

National Vehicle Leasing Association

April 23-24, 2013 Annual Conference

Worthington Renaissance Hotel

Fort Worth, Texas

NVLA Conference Agenda

PDF

Registration fee: $595

($395 for each additional from same company)

To Register: http://nafassociation.com/NVLA_register_1304.php

The conference provides the most comprehensive program for the auto leasing industry with speakers, sessions and valuable discussions on issues relevant to independent consumer and commercial fleet lessors.

Session highlights:

-

Mike North, Katz, Sapper & Miller, NVLA Accounting Counsel will share an update on both financial reporting and tax issues impacting the leasing industry.

-

Tom Webb, Economist,Chief Economist with Manheim to present the economic outlook for the used car market and vehicle leasing.

-

Tom Webb, Chief Economist with Manheim and David Blassingame, AutoFlex Leasing managing partner will share their insights on residual setting strategies.

-

Ed Kaye, president and CEO of Advantage Funding will lead the funding strategies discussion.

-

Roger J. Camping, CVLE, President, RC Auto Corporation, to lead a discussion on brokered leasing.

-

Kelly Kirkendoll, Founder and President, Thrive PR, will present tactics for keeping your leasing company’s name foremost in the marketplace.

-

Ricky Beggs, Senior Vice President, Editorial Director, Blackbook, will give an analysis of market segments for new car fleet lessors.

-

Angela Maynard-Shovein, Partner, Hudson Cook, LLP - legal climate facing fleet and consumer lessors.

-

Michael Cardello, Partner, Morritt Hock Hamroff & Horowitz LLP - legal climate facing fleet and consumer lessors.

-

Melinda Zabritski, Director of Automotive Credit for Experian Automotive to share overview of the current trends in vehicle leasing.

-

Jim Holman, President of Pinnacle Auto Leasing presenting,

”To Lease or Not To Lease?”-- That is the Question

-

Angela Maynard Shovein, partner, Hudson Cook LLP to provide a legal overview for ”Lease Here Pay Here” operations

Those “buy here/pay here” dealers involved with leasing will have the opportunity to participate in a specialized lease here/pay here program track. The track will comprehensively cover insurance, legal, accounting technology and funding aspects of the market.

Bookmark us

[headlines]

--------------------------------------------------------------

Sales Makes it Happen

“Sales Managers and Coaching”

by Steve Chriest

“Coaching” has become one of the buzzwords of the new millennium. Coaches have always been important in sports, but the idea of coaching has permeated everyday life, including business. For just about anything you can think of, you can find coaches. You can even find so-called Life Coaches who purportedly will coach you into better living habits!

Some of the better sales consulting firms advise sales managers to become effective coaches for their sales teams. While I absolutely agree with this advice, I think it's important to examine the practice of coaching and to understand what makes an effective coach in any discipline.

There are, in my opinion, three types of effective coaches. At the lowest level there is the good coach. The middle level is occupied by the great coach. Extraordinary coaches occupy the very top level of coaching.

All effective coaches share at least one talent – the ability to teach. Teaching techniques for any discipline vary widely, but you cannot coach effectively unless you can teach. It's not so important how coaches teach as it is what they teach that distinguishes the three levels of coaching.

A good coach, for example, effectively teaches the fundamentals, whether it's the rudiments in drumming, the compulsory figures in figure skating, or the basics of the baseline and net game strokes in tennis. Good coaches don't have to be superstars in their fields. The ability to effectively teach fundamentals is the most important attribute of the good coach.

The great coach is not only adept at teaching the fundamentals, but also possesses the ability to extract superb performance from his or her students. The great coach sees in a student what others don't see and, many times, what the student doesn't see. Great coaches know intuitively how to motivate those students with exceptional talent to give exceptional performances. These coaches have the ability to draw out from their students' performances that the students themselves may not believe they are capable of delivering.

Then there is the extraordinary coach. There aren't many of these. These coaches are master teachers of the fundamentals who routinely coax the very best performances from their students. What sets the extraordinary coaches apart from all other coaches is their ability and willingness to teach significant life lessons to their students.

About the author: Steve Chriest is the founder of Selling UpTM (www.selling-up.com), a sales consulting firm specializing in sales improvement for organizations of all types and sizes in a variety of industries. He is also the author of Selling The E-Suite, The Proven System for Reaching and Selling Senior Executives and Five Minute Financial Analyst, Basic CREDIT & Analysis Tools for Non-Accountants. He was the CEO of a very successful leasing company and executive at a major company. You can reach Steve at schriest@selling-up.com.

|

[headlines]

--------------------------------------------------------------

Video Production Now Available from Steve

Steve Chriest in addition to building his main business, Selling-UP, primarily with large corporate accounts, writing articles for leasing news, has completed his new video production facility in San Ramon, California: http://www.srvstudio.com/

"We are producing our own business videos for sale to businesses and we are producing videos for companies and producers in Northern California," Steve said. "We are now working to produce my intellectual property for release and are forming JVs with other folks, some academics, who have consulting properties they want to distribute. They supply the information (scripts etc.) and we produce the videos. Their costs, besides time, is zero to test the markets."

In addition to videos, he is working on what he calls a "Performance Support Library.

"Maybe 1,000 1-2 minute videos that people can access, via a subscription service, 24/7," he says." The info is always available at precisely the time they need it...Webinars can be good, and they can be really bad. The other problem is that they are long. Believe me, people today even think a 3 minute video is long!"

[headlines]

--------------------------------------------------------------

### Press Release ############################

Equipment and Software Investment to Grow 5.6% in 2013

—Includes full ELFF report PDF

Washington, DC, April 3, 2013 –- Investment in equipment and software is expected to grow 5.6 percent in 2013, according to the Q2 update to the 2013 Equipment Leasing & Finance U.S. Economic Outlook from the Equipment Leasing & Finance Foundation.

The Foundation increased its 2013 equipment and software investment forecast to 5.6 percent, up from 2.9 percent growth forecast in its 2013 Annual Outlook released in December 2012. The report, which is focused on the $725 billion equipment leasing and finance industry, forecasts equipment investment and capital spending in the United States and evaluates the effects of various related and external factors in play currently and into the foreseeable future.

The Q2 report predicts growth in the first half of the year will be limited by relatively weak demand and fiscal policy uncertainty. By the second half of 2013, however, investment activity is expected to accelerate due to an improving housing sector, a resurgence of the US manufacturing sector, an energy renaissance and relief from policy uncertainty that will have an unlocking effect on business investment.

William G. Sutton, CAE, President of the Foundation and President and CEO of the Equipment Leasing and Finance Association, said, “As projected in our 2013 Annual Outlook, the Q2 Outlook anticipates that 2013 will be a tale of two halves, with sluggish growth in the first half of the year, followed by a pick-up in overall economic activity in the second half of the year.

“On balance, we expect the positives to outweigh the negatives as businesses begin to feel more confident and ready to invest in capital equipment.”

Highlights from the study include:

- The U.S. economy is expected to generate positive but modest growth of 2.2 percent in 2013

- Equipment and software investment grew at the unexpectedly rapid rate of 11.8 percent (annualized rate) in Q4 2012, a welcome increase after Q3’s 2.6 percent decline. Part of this may have been a “pulling forward” effect as businesses anticipated changes in tax policy in 2013. This suggests that Q1 and Q2 2013 may be a bit weaker than previously anticipated. However, the second half of 2013 is expected to be an improvement over the first half.

- Credit market conditions continue to improve, and many indicators have returned to levels not seen since the onset of the recession.

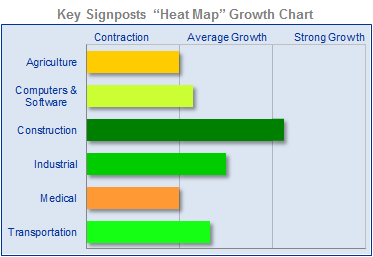

Trends in equipment investment include:

- Agriculture equipment investment is expected to remain negative on a year-over-year basis, with the potential for positive growth in late in 2013.

- Computers and software investment is expected to transition from slow growth in the near future to more normal growth in the second half of the year.

- Construction equipment investment should continue to achieve above average growth over the next three to six months, though the rate of growth will continue to decline from recent highs.

- Industrial equipment investment is expected to grow at a moderate pace over the next six months as positive and negative drivers more or less balance out.

- Medical equipment investment should continue to experience little to no growth in the first half of 2013.

- Transportation equipment investment slowed slightly in the second half of 2012, but should remain near an average rate of growth.

The Foundation produces the Equipment Leasing & Finance U.S. Economic Outlook report in partnership with economics and public policy consulting firm Keybridge Research. The annual economic forecast provides a three-to-six-month outlook for industry investment with data, including a summary of investment trends in key equipment markets, credit market conditions, the U.S. macroeconomic outlook and key economic indicators.

The report will be updated quarterly throughout 2013.

Full 18 Page Report:

http://www.leasingnews.org/photos/Q2_2013_Economic_Outlook.pdf

#### Press Release #############################

Why Choose Advanced Property Tax Compliance?

|

Dedicated to the leasing industry |

[headlines]

--------------------------------------------------------------

Seven Countries Sending the Most People to America

by Douglas A. McIntyre, 24/7WallSt

Roughly 138 million people worldwide, or about 2% of the world’s adult population, want to immigrate to the United States. In China, as many as 19 million adults would like to move to the land of opportunity — the largest number of any country. Based on data provided by Gallup, 24/7 Wall St. reviewed the seven countries where the most people want to come to the United States.

7.

Philippines

Adults looking to move to U.S.: 4 million

Total population: 105.72 million (12th highest)

Pct. of adults looking to move: 7.3%

Pct. living on less than $1 a day: 3.72% (57th lowest)

Pct. approving of U.S. leadership: 64% (27th highest)

Of those in the Philippines looking to immigrate, 4 million would like their new home to be the United States. Many people from the Philippines already have made the move to the U.S., likely contributing to the desire for more to make the move. As of 2011, more than 1.8 million people currently living in the U.S. were born in the Philippines, according to the Census Bureau. Of that, nearly 45% of them live in California, while another 6.2% live in Hawaii. In addition, support for U.S. leadership is high among Filipinos — 64% support U.S. leadership, while 24% disapprove.

6.

Mexico

Adults looking to move to U.S.: 5 million

Total population: 116.22 million (11th highest)

Pct. of adults looking to move: 5.7%

Pct. living on less than $1 a day: 0.34% (30th lowest)

Pct. approving of U.S. leadership: 37% (52nd lowest)

Approximately 5 million adult residents from Mexico would like to move to the United States. According to Gallup’s Jon Clifton, the geographical proximity of the U.S. to Mexico is a major draw, as are the economic opportunities available in the county. In addition, those who wish to move to the U.S. often have a network of family and friends who help facilitate the move. Beginning in the 1970s, a large wave of immigrants from Mexico came to the U.S. They now comprise about 30% of all immigrants and nearly 4% of the entire U.S. population. However, a report by the Pew Research Center in 2012 indicated that the trend has reached a standstill and maybe even be reversing. According to Pew, this change is likely due to factors such as a weakened U.S. economy and the increased danger of crossing the U.S. Mexico border illegally.

5.

Bangladesh

Adults looking to move to U.S: 6 million

Total population: 163.65 million (8th highest)

Pct. of adults looking to move: 5.9%

Pct. living on less than $1 a day: 11.17% (32nd highest)

Pct. approving of U.S. leadership: 37% (53rd lowest)

Approximately 6 million people in Bangladesh would like to move to the United States, representing roughly 5.9% of that country’s adult population. Living standards in Bangladesh are significantly lower than in the U.S. More than 11% of the population lives on less than $1 a day, a higher percentage than the vast majority of countries worldwide and worse than all countries on our list except Nigeria. Bangladesh’s GDP per capita was just $1,909 in 2011, compared to $48,328 in the U.S. According to the United Nations, only 56% of the country’s population over the age of 15 is considered literate, lower than all but a handful of countries worldwide. As of 2011, there were 184,000 people in the U.S. who were born in Bangladesh.

4.

Brazil

Adults looking to move to U.S.: 6 million

Total population: 201.01 million (5th largest)

Pct. of adults looking to move: Less than 5%

Pct. living on less than $1 a day: 3.62% (56th highest)

Pct. approving of U.S. leadership: 34% (45th lowest)

In Brazil, 6 million would like to immigrate to the United States, more than all but three other countries. In recent years, growth in Brazil has slowed significantly — GDP grew less than 1% in 2012, compared to 2.7% in 2011 and 7.5% in 2010. Brazil’s Labor Ministry indicated that while unemployment in the country is still below 5%, job growth was the worst in 2012 in at least a decade. GDP per capita in the South American country was $11,769, less than a quarter of that of the U.S. Nevertheless, 58.7% of residents are considered by Gallup to be thriving, more than the U.S.’s 56.2%.

3.

India

Adults looking to move to U.S.: 10 million

Total population: 1.22 billion (2nd largest)

Pct. of adults looking to move: Less than 5%

Pct. living on less than $1 a day: 7.49% (44th highest)

Pct. approving of U.S. leadership: 26% (18th lowest)

About 10 million people living in India want to immigrate to the United States, more than any country except China and Nigeria. However, due to India’s population of more than 1.2 billion people, the number of willing immigrants represents less than 1% of the population. The people who want to come to the U.S. tend to be better educated than the majority of the population, Clifton noted. Before the 2008 financial crisis, India’s economy was growing at a rate of 8% annually. Growth has slowed, however. According to the country’s Ministry of Statistics and Programme Implementation, GDP growth for the year ended in March 2013 is forecast to be 5%, although growth is expected to rebound in the coming years.

2.

Nigeria

Adults looking to move to U.S.: 13 million T

otal population: 174.51 million (7th largest)

Pct. of adults looking to move: Less than 5%

Pct. living on less than $1 a day: 33.74% (6th highest)

Pct. approving of U.S. leadership: 77% (13th highest)

The reasons that 13 million Nigerians would like to immigrate to the United States are abundant. The African country is extremely impoverished, with more than a third of its population living on less than $1 a day. Corruption is also worse than all but one other country worldwide, according to Gallup. Terrorism, too, has increasingly become a major problem, with the government struggling to enforce security measures. In addition, Nigerians overwhelmingly think favorably of the U.S. leadership. As many as 77% of Nigerians support the U.S. leadership, more than most of the countries surveyed.

1.

China

Adults looking to move to U.S.: 19 million

Total population: 1.35 billion (the largest)

Pct. of adults looking to move: Less than 5%

Pct. living on less than $1 a day: n/a

Pct. approving of U.S. leadership: n/a

More than 19 million Chinese adults want to immigrate to the United States, more than any other country in the world. This represents a very small proportion of the total population of more than 1.3 billion people. As of 2011, 2.2 million people in the U.S. were born in China, more than any other Asian country. Like India, Clifton said, the population that wants to move to the U.S. tends to be more educated than the overall population. China’s middle-class rapidly emerged in the past decade as GDP has grown an average of 10% annually. However, growth has begun to slow. According to a recent Federal Reserve study, China’s GDP growth could be less than 1% by 2030.

John Kenny Receivables Management • Credit Investigations • Asset Searches • Skip-tracing • Third-party Commercial Collections john@jkrmdirect.com | ph 315-866-1167| www.jkrmdirect.com |

(Leasing News provides this ad as a trade for investigations and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

“Top Jobs” joins Classified Ads

--Employment Web Sites

These is more a general site, websites of jobs available to students, fresher and professionals for their career growth and educational know how.

"We are also into the similar field and striving hard to offer worthwhile information in the same field through our site," says Sawan Pareek, Link and Web Manager.

"Top Job Applications.com is an online treasure house for job seekers by offering them printable job application forms that can be downloaded for applying jobs in Department Stores, Fast Food centers,Groceries, Bookstores, Airlines, Pharmacies, Restaurants and Retails. The candidates are also made aware on different level job positions from entry level to management level jobs available in these sectors."

Classified Ads---Employment Web Sites

Here is a list of top internet job web sites, several specializing in financial, money, and leasing, too.

www.adams-inc.com

www.affinitysearch.com

www.bajobs.com

www.careerbank.com

www.careerbuilder.com

www.careerpath.com

www.careerjet.com

www.craigslist.org

www.employmentcrossing.com

www.FinanceLadder.com

http://www.findhow.com/

www.hotjobs.com

www.Hound.com

www.jobapplicationcenter.com

www.indeed.com

www.jobs.net

www.jobs-applications.com

www.jobssearchengine.net

www.jobsearchusa.org

www.JobSpin.net

www.jobsinthemoney.com

www.ladders.com

www.leasingworld.co.uk

www.lessors.com

www.LinkUp.com

www.MarketingJobs.com

www.monitordaily.com

www.monster.com

www.monstertrak.monster.com/

www.Postonce.com

www.RecruiterConnection.com

www.resumeblaster.com

www.snagajob.com/part-time-jobs/

http://thejobfind.info/submit/

www.topjobapplications.com/

www.toplanguagejobs.com

www.vault.com

www.vetjobs.com

www.worktree.com

Please also visit:

Open Positions at Leasing Funders/Various Locations

http://www.leasingnews.org/Classified/open_funder.html

Join leasing news mailing list

|

[headlines]

--------------------------------------------------------------

Labrador Retriever

PAWs Chicago Adopt-a-Dog

Breed: Labrador Retriever

Gender: Male

Age: 1 year Canine-ality: Goofball

Stan is the man!

This handsome pooch came to PAWS originally in March of 2012 from an animal shelter in western Illinois. Poor Stan was sick with the often deadly parvo virus, but thanks to the veterinary staff at PAWS, he made a complete recovery and was adopted. Unfortunately, Stan’s adopter could not continue to care for him due to a demanding work schedule; Stan is back here with his friends at PAWS, although he longs for a forever home.

Stan is now full-grown at 57 pounds, and loves people and other dogs! He can be a little shy at first, but after you give him a few treats, Stan will love you forever. While Stan loves to play with his canine roommate here, he can’t wait for a family to call his own.

According to Stan’s previous guardian, Stan is house-trained and crate-trained. He is great with kids 10+ (may be a little too enthusiastic for younger kids right now, but can be trained about this) and prefers a home without cats. Stan has completed an obedience class so he already knows his basic commands. He still pulls on his leash a bit when he walks, but is otherwise quite well-behaved and passes people and other dogs on the street politely. Stan loves food, so it will be easy for his new parents to keep him motivated while continuing his education.

Stan is a loving guy who can’t wait to share all his joy with a new family. Could Stan be the one for you?

email adoptions@pawschicago.org, or call (773)935-7297. visit the PAWS Chicago Adoption Center at 1997 N. Clybourn, Chicago, IL 60614 -Sat & Sun: 11 a.m. - 5 p.m. Mon - Fri: 12 noon - 7 p.m.

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

Wait Continues for Lease Accounting Clarity http://www3.cfo.com/article/2013/4/gaap-ifrs_lease-accounting-elfa- debt-covenant-issues-fasb-iasb

BancVue Buys Equipment Leasing Company http://www.americanbanker.com/issues/178_63/bancvue-buys-equipment-leasing-company-1057987-1.html

National Funding Inc. Announces Expansion with Move to UTC Location http://news.yahoo.com/national-funding-inc-announces-expansion-move-utc-location-090216344.html;_ylt=AwrNUbDTy1xRzU0AnY7QtDMD

Ex-Goldman Trader Pleads Guilty to Fraud

http://online.wsj.com/article/SB10001424127887324600704578400332210938670.html

Royal Bank of Scotland faces $6 billion investor action http://www.reuters.com/article/2013/04/03/us-rbs-lawsuit-idUSBRE9320VE20130403

Man from Battlefield is charged for $785,200 lease fraud scheme http://www.ky3.com/news/ky3-battlefield-man-charged-in-785200-fraud-scheme-20130403,0,3539843.story

U.S. home prices rose in February by most in 7 years http://www.ajc.com/news/business/us-home-prices-rose-in-february-by-most-in-7-years/nXCBG/

Kia, Hyundai recalling 1.9 million vehicles http://www.ajc.com/news/business/kia-hyundai-recalling-19-million-vehicles/nXBpX/

Facebook to unveil HTC phone with Google's Android software http://www.chicagotribune.com/business/breaking/la-fi-facebook-android-20130403,0,6175415.story

The mobile phone turns 40 years old http://www.usatoday.com/story/tech/personal/2013/04/03/mobile-phone-turns-40/2048889/

Mr. Terry Winders available as a consultant regarding assisting attorneys in resolving disputes or explaining procedures or reviewing documents as utilized in the finance and leasing industry. He is the author of several books, including DVD's, as well as weekly columnist to Leasing News. He also performs audits of leasing companies as an expert on documentation, and has acted as an expert witness on leasing for litigation in legal and tax disputes, including before the IRS. He also has taught the senior bank examiners, how to review a bank leasing department, for the Federal Reserve in Washington D.C. and has trained the examiners for the FDIC on how to prepare a lease portfolio for sale. 502.649.0448/WindersConsulting@yahoo.com |

[headlines]

--------------------------------------------------------------

---You May Have Missed

Dangerous travel: Countries to avoid

http://www.cbc.ca/news/interactives/travel-warnings/

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

SparkPeople--Live Healthier and Longer

Longer The Benefits of Growing Your Own Food

http://www.sparkpeople.com/resource/nutrition_articles.asp?id=1275

[headlines]

--------------------------------------------------------------

Baseball Poem

Alone At the Plate Inside the front cover of the book You Can Teach Hitting, He pulls on a helmet, picks up the bat, The crowd starts to yell, the game's on the line, Dad yells, "Go get it," Mom wrings her hands, Heros are made in seconds such as this, No he'll have forgotten if he was out, hit, or a run, So cheer this boy on, alone with his fate; Spend your time wisely and help in his quest And when the game's over, this boy can stand tall, |

[headlines]

--------------------------------------------------------------

Why is former Rutgers coach Rice reviled and Bob Knight respected? http://www.cbssports.com/collegebasketball/story/22001454/why-is-former-rutgers-coach-rice-reviled-while-bob-knight-is-respected

Exonerated LB Banks signs with the Atlanta Falcons http://sports.yahoo.com/news/exonerated-lb-banks-signs-atlanta-144039169--nfl.html

Tom Brady, Terrell Owens connect http://espn.go.com/boston/nfl/story/_/id/9131199/tom-brady-new-england-patriots-terrell-owens-work-usc-trojans-facility

Newest San Francisco 49er Nnamdi Asomugha ready to answer critics http://www.contracostatimes.com/breaking-news/ci_22942112/newest-san-francisco-49er-nnamdi-asomugha-ready-answer

Battle for the Kings: Sacramento, Seattle officials pitch competing visions

http://www.sacbee.com/2013/04/03/5312860/sacramento-seattle-kings-nba.html

http://blogs.seattletimes.com/nbainseattle/

[headlines]

--------------------------------------------------------------

![]()

California Nuts Briefs---

LucasArts To Lay Off Most of Staff; Will Cease Game Creation http://tv.yahoo.com/news/lucasarts-lay-off-most-staff-cease-game- creation-194242190.html

Disney Cancels Star Wars 1312 and Star Wars: First Assault http://kotaku.com/disney-shuts-down-lucasarts-468473749

Facebook COO Sheryl Sandberg's 'Lean In' feminist manifesto packs in women at Stanford http://www.mercurynews.com/business/ci_22931510/facebook-ceo- sheryl-sandbergs-manifesto-receives-praise-at

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

Wine Enthusiast profiles six women in the industry who prove that the grape game isn't just for the boys. http://www.winemag.com/Wine-Enthusiast-Magazine/May- 2013/Women-Wine/

Truett-Hurst launches IPO http://www.pressdemocrat.com/article/20130403/BUSINESS/1304098 78/1036?Title=Healdsburg-wine-company-seeks-up-to-42M-in-IPO

Adler Fels Releases National Parks Wine Collection to Support the National Park Foundation http://www.winebusiness.com/news/?go=getArticle&dataid=114069

Dunne on Wine: Montevina Winery gives starring role to barbera http://www.sacbee.com/2013/04/03/5310891/dunne-on-wine- montevina-winery.html

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1800- Congress enacted the Bankruptcy Act. It did not permit voluntary bankruptcy and applied to traders only. It was repealed three years later.

1802- Birthday of Dorthea Dix, American social reformer and author, born at Hampden, ME. Left home at age 10, was teaching at age 14 and founded a home for girls at Boston while still in her teens. In spite of frail health, she was a vigorous crusader for humane conditions in insane asylums, jails and almshouses and for the establishment of state-supported institutions to serve those needs. Named superintendent of women nurses during the Civil War. Died at Trenton, NJ, July 17, 1887.

http://www.dhhs.state.nc.us/mhddsas/DIX/dorothea.html

http://www.nursingadvocacy.org/press/pioneers/dix.html

1804 -a large tornado crossed 6 counties in Georgia and killed 11 people near Augusta.

1812 - The territory of Orleans became the 18th state and later became known as Louisiana.

1818—Congress approves the U.S. flag with 13 stripes. On admission of each new state to the Union, another star would be added to the flag, the number and pattern of stripes remaining the same.

1841-- President William Henry Harrison, aged 68, becomes the first president to die in office, just a month after being sworn in. Reportedly he attended his inauguration without the proper attire and it was very cold weather, where he became ill and later died of pneumonia. http://en.wikipedia.org/wiki/William_Henry_Harrison

1859-“ I Wish I Was in Dixie’s Land” (better known as “Dixie” was introduced by Daniel DeCatur Emmett at Mechanics Hall, New York city, and was published by Firth Pond and Company, New York city. It was written and composed by Emmett, a Northerner, expressly for Bryant’s Minstrels, who performed at 472 Broadway, New York City. It was announced as a plantation song an dance.According to some sources, it was based on a song of lament sung by the slaves of a Dutch planter named Dixye, who sold them away to a farmer in Piedmont County, South Carolina, after tryingunsuccessfully to grow tobacco in Harlem, New Amsterdam( the future New York City). African-Americans in Knox County , Ohio, have long claimed that Daniel D. Emmett learned the song "Dixie" from the Snowdens, an African-American family of musicians who performed banjo and fiddle tunes and sang popular songs for black and white audiences throughout rural central Ohio from the 1850s to the early twentieth century.

It was sung at the inauguration of Jefferson Davis as president of the Confederate States on

February 18, 1861.

http://civilwarhome.com/dixie.htm

1865 - President Abraham Lincoln visits the Confederate capital a day after Union forces capture it. Lincoln had been in the area for nearly two weeks. He left Washington at the invitation of general-in-chief Ulysses S. Grant to visit Grant's headquarters at City Point, near the lines at Petersburg south of Richmond. The trip was exhilarating for the exhausted president. Worn out by four years of war and stifled by the pressures of Washington, Lincoln enjoyed himself immensely. He conferred with Grant and General William T. Sherman, who took a break from his campaign in North Carolina. He visited soldiers, and even picked up an axe to chop logs in front of the troops. He stayed at City Point, sensing that the final push was near. Grant's forces overran the Petersburg line on April 2, and the Confederate government fled the capital later that day. Union forces occupied Richmond on April 3, and Lincoln sailed up the James River to see the spoils of war. His ship could not pass some obstructions that had been placed in the river by the Confederates so 12 soldiers rowed him to shore. He landed without fanfare but was soon recognized by some black workmen who ran to him and bowed. The modest Lincoln told them to "...kneel to God only, and thank him for the liberty you will hereafter enjoy." Lincoln, accompanied by a small group of soldiers and a growing entourage of freed slaves, walked to the Confederate White House and sat in President Jefferson Davis's chair. He walked to the Virginia statehouse and saw the chambers of the Confederate Congress. Lincoln even visited Libby Prison, where thousands of Union officers were held during the war. Lincoln remained a few more days in hopes that Robert E. Lee's army would surrender, but on April 8 he headed back to Washington. Six days later, Lincoln was shot as he watched a play at Ford's Theater.

1873-Carrie S. Burnham began her argument, made before the Supreme Court of Pennsylvania. She had been stopped from voting in the October, 1871 and appealed to the Supreme Court, who told her she could not vote because she was a woman and the right to vote only applied to men. http://memory.loc.gov/ammem/today/apr04.html

1887- The first woman elected mayor in the US was Susanna Medora Salter, who was elected mayor of Argonia, Kansas. Her name had been submitted for election without her knowledge by the Women’s Christian Temperance Union, and she did not know she was a candidate until she went to the polls to vote. She received a two-thirds majority vote. Argonia is a city located in Sumner County, Kansas. She received a two-thirds majority vote and served for one year for a salary of $1. As of the 2000 census, the city had a total population of 534. Although her term was uneventful, her election generated worldwide interest from the press, sparking a debate regarding the feasibility of other towns following Argonia's lead, which ranged from objections to a "petticoat rule" to a "wait-and-see" attitude. After only a year in office, she declined to seek reelection. In 1893 she moved to Alva, Oklahoma with her husband and family.

She lived until she was 101. The house she lived in during her tenure as mayor was added to the National Register of Historic Places in September, 1971.

1896 - Birthday of Arthur Murray (Moses Teichman), ballroom dance instructor; "Arthur Murray Taught Me Dancing in a Hurry." (Bob Teichman's grandfather, and one of the reasons Bob is such a great dancer! ). http://www.ask.com/wiki/Arthur_Murray

1896--Birthday of playwright Robert Sherwood. He was also one of the famous Algonquin Round Table participants; he won a Pulitzer for his biography "Roosevelt and Hopkins." He also won an Academy Award for Best Screenplay "The Best Years of Our Lives."

1898-the first musical comedy written by African-Americans for African-American performers was “ A Trip to Coontown,” a musical comedy in two acts by Bob Cole and Billy Johnson, produced a the Third Avenue Theatre at 31st Street in New York City. Cole played the part of the tramp Willie Waysie, and Johnson played Jim Flimflammer, the bunco steerer.

1906--Birthday of trumpet player Frankie Newton, Emory, VA.

1913-bassist Gene Ramey born, Austin, TX

1915-Mobile telephone one-way communication was established by Bell System engineers from Montauk Point, NY, to Wilmington, DE, a distance of 250 miles.

1915-bluesman Muddy Waters, whose real name was McKinley Morganfield, was born in Rolling Fork, Mississippi. He began recording in 1941, and his 1948 hit "I Can't Be Satisfied" helped bring the amplified guitar to the fore in blues music. His Chicago-based band included such notables as James Cotton, Buddy Guy, Willie Dixon and Otis Spann. Muddy Waters played a significant part in developing modern rhythm and blues that came to be known as Chicago or urban blues. It was predominantly from this music that later forms such as rock and roll and soul sprang. Waters' style had a profound effect on pop music in the 1950s and '60s, and he influenced such musicians as Jimi Hendrix and the Rolling Stones. In fact the Stones took their name from a Waters' recording, "Rollin' Stone." And Waters was the one who brought Chuck Berry to the attention of Chess Records in 1955. Muddy Waters died in 1983.

1917-birthday of singer Big Chief Jolley ( George Landry ) New Orleans, LA

1917- The U.S. Senate votes 90-6 to enter World War I on Allied side.

1922—Birthday of motion picture composer Elmer Bernstein, perhaps best known for ‘The Man with the Golden Arm.”

http://www.classical-composers.org/comp/bernstein_elmer

1923 - an F4 tornado killed 15 people and injured 150 at Alexandria and Pineville, Louisiana. 142 homes and businesses in Pineville were destroyed.

1924-Gibert Ray “Gil” Hodges, baseball player and manager, born at Princeton, IN. Hodges was the first baseman on the famous Brooklyn Dodgers” Boys of Summer” teams. ( I got his autograph on a baseball when I was a kid.). He managed the New York Mets to the 1969 World Series title. Died at West Palm Beach, FL, April 2, 1972.

1924--Birthday of Canadian conductor Victor Feldbrill was born in Toronto. Feldbrill conducted the Winnipeg Symphony Orchestra from 1958 to '68, the Toronto Symphony from 1971 to '77 and has often conducted for the Canadian Opera Company. A champion of Canadian music, he has included at least one Canadian work in every concert he has conducted.

1928- -- Birthday of Maya Angelou born Louis, Missouri. African-American poet whose autobiographical work explores economic, racial, & sexual oppression themes. Her first work, I Know Why the Caged Bird Sings (1970), is followed by Gather Together in My Name (1974), The Heart of a Woman (1981), & All God's Children Need Traveling Shoes.

1932-Vitamin C was first isolated by C.C. King at the University of Pittsburgh.

1933 - Pigeon River Bridge, MN, reported 28 inches of snow, which established the state 24 hour snowfall record.

1935- Benny Goodman cuts his first Victor record session.

1939-Glenn Miller records his theme “ Moonlight Serenade) Bluebird 19214)

1939-trumpet player Hugh Masakela born Witbank, So. Africa

1943-the nine-man crew of the World War II American Liberator bomber Lady Be Good bailed out 200 miles off course over the Sahara Desert and disappeared this day. They were returning to their base in Libya after a raid over southern Italy. On Nov 9,1958,15 years after the plane went down and more than 13 years after the war had ended, a pilot flying across the Sahara south of Tobruck sighted wreckage of an aircraft in the sand. Five skeletons and a diary describing the final days of the crew were recovered. The radio, guns and ammunition in the plane were in working order. Life Magazine devoted a full issue to this discovery.

1946---Birthday of the “coach,” Craig T. Nelson, actor, born Spokane, Washington.

1950- Birthday of Judith Resnik, astronaut. The 36-year-old electrical engineer mission specialist was the second US woman in space. She perished in the Challenger explosion, Jan. 28, 1986.

http://www.jsc.nasa.gov/Bios/htmlbios/resnik.html

1952- “Police Story” premiers on TV. Produced by Jerome Robinson, directed by David Rich and narrated by Norman Rose, "Police Story" was an early anthology series on CBS depicting incidents from real-life police files.

1950—Birthday of Jim Lahti’s sister, Christine, acrtress (Emmys for “chicago Hope,” “Swing Shfit, director (Oscar for “LIberman in Love), born Birmingham, MI.

1951—Birthday of Steve Gatlin of country's Gatlin Brothers Band.

1953-the first scholastic fraternity chapter established at an African-American university was the Phi Beta Kappa, at Fisk University, Nashville, TN.

1957--Birthday of American composer Jeffery Cotton,San Fernando, CA.

1960 - Elvis Presley records ``Are You Lonesome Tonight.''

1960 - Eleven Academy Awards were presented to one movie at the 32nd Annual Academy Awards at the RKO Pantages Theater, Los Angeles. "Ben-Hur", the Best Picture of 1959, was the first motion picture to receive that many Oscars. The other categories for which the MGM film, produced by Sam Zimbalist, was honored were: Best Director (William Wyler); Best Actor (Charlton Heston); Best Supporting Actor (Hugh Griffith); Best Cinematography/Color (Robert L. Surtees); Best Art Direction-Set Direction/Color (Edward Carfagno, William A. Horning, Hugh Hunt); Best Costume Design/Color (Elizabeth Haffenden); Best Sound (Metro-Goldwyn-Mayer Studio Sound Department, Franklin E. Milton, Sound Director); Best Film Editing (John D. Dunning, Ralph E. Winters); Best Effects/Special Effects (visual-A. Arnold Gillespie, Robert MacDonald III; audible-Milo B. Lory); and Best Music/Scoring of a Dramatic or Comedy Picture (Miklos Rozsa). "Ben-Hur" lost only one nomination: Best Writing/Screenplay Based on Material from Another Medium. "Room at the Top" (Neil Paterson) took that Oscar home and the Best Actress award, too (Simone Signoret). The Best Supporting Actress award went to Shelley Winters for her performance in "The Diary of Anne Frank", her second Oscar. The moviemakers of "Anatomy of a Murder" had high hopes with six nominations in the ring; but that’s all they were. However, the Best Music/Song Oscar went to "High Hopes" (James Van Heusen-music, Sammy Cahn-lyrics) from "A Hole in the Head". It would be 38 years and a lot of high hopes before one film won 11 Academy Awards again ("Titanic"). And who knows how long before the host is an Award recipient again! (Bob Hope received the Jean Hersholt Humanitarian Award.)

http://www.infoplease.com/ipa/A0148797.html

1961- The Marcels' "Blue Moon" hits #1

1963 - No. 1 Billboard Pop Hit: ``He's So Fine,'' The Chiffons. In 1976 the estate of songwriter Ronnie Mack wins a lawsuit against former Beatle George Harrison. A judge rules that Harrison subconsciously copied his No. 1 song ``My Sweet Lord'' from ``He's So Fine.''

1964 - The Beatles set an all-time record on the Top 100 chart of "Billboard" magazine this day. All five of the top songs were by the British rock group. In addition, The Beatles also had the number one album as "Meet the Beatles" continued to lead all others. The LP was the top album from February 15 through May 2, when it was replaced by "The Beatles Second Album". It was estimated at the time that The Beatles accounted for 60 percent of the entire singles record business during the first three months of 1964. The top five singles by The Beatles this day were:

1) Can’t Buy Me Love

2) Twist and Shout

3) She Loves You

4) I Want to Hold Your Hand

5) Please Please Me

1965 - Actor Robert Downey Jr. is born in New York, NY. Downey Jr. has penned more than 30 original songs, and his version of Charley Chaplin's theme song, "Smile," is included on the soundtrack to the film "Chaplin."

1967 - Johnny Carson quit "The Tonight Show". He returned three weeks later with an additional $30,000 a week! Here’s Johnnnnnnny!!!

http://www.jonnycarson.com/carson4.htm

1967-speaking before the Overseas Press Club at New York City, Reverend Dr. Martin Luther King, Jr, announced his opposition to the Vietnam War. That same day, at the Riverside Church at Harlem, King suggested that those who saw the war as dishonorable and unjust should avoid military service. He proposed that the US take new initiatives to conclude the war.

1968-Martin Luther King, Jr., born on 15 January 1929, is shot and killed by a sniper while standing on the balcony outside his second-story room at the Lorraine Motel in Memphis TN. On this night,April 4, presidential candidate Robert F. Kennedy, just two months away from his own assassination, announced King's death at a political rally in Indianapolis. Urging calm, Kennedy fell into quoting the Ancient Greek tragedian Aeschylus in an effort to articulate the inexplicable tragedy of King's murder: "In our sleep, pain that cannot forget falls drop by drop upon the heart until, in our own despair, against our will, comes wisdom through the awful grace of God." As word of the assassination spread, riots broke out in several major cities, and in Washington, D.C., fires set by enraged protestors devastated portions of the downtown area. The National Guard was subsequently called in, and for several days the armed troops patrolled the streets of the nation's capital. James Earl Ray was convicted of his assassination, but King’s family to this day believe he was killed by others.

1968- Bobby Goldsboro was awarded a gold record for "Honey." The record sold one-million copies within three weeks, and eventually sales were over three-million. "Honey" topped the Billboard Hot 100 chart for five weeks.

1969-CBS canceled the “Smothers Brothers” comedy series. The hour-long show strongly influenced television humor during the two years it aired. Tom and Dick, however, frequently found themselves at odds with the censors over material that would be considered tame today. Guests and cast members frequently knocked the Vietnam War and the Nixon Administration. Acts featuring antiwar protestors such as Harry Belafonte were often cut.

1969-the first heart transplant using an artificial heart took place at St. Luke’s Episcopal Hospital in Houston, Texas ( an exhibit is now at Herman Hospital, University of Texas at Houston ). Dr. Denton A. Cooley ( still in practice), implanted the world’s first entirely artificial heart into Haskell Karpk, age 49, from Skokie, IL. The prosthetic heart was made of Dacron and plastic. Karp lived with the hear for three days, when it was replaced by a transplanted heart. He died on April 8.

1970-Diana Ross makes her first solo concert appearance, in Framingham, Massachusetts.

1970- Crosby Stills Nash & Young's LP Deja Vu hits #1

1971- The Temptations' "Just My Imagination (Running Away with Me)" hits #1

1971 - Veterans stadium in Philadelphia, PA was dedicated this day. It was the largest baseball park in the National League. A total of 56,371 fans could come out to see the Phillies play baseball or the Eagles play football. The stadium has been nicknamed the Vet. Seating was later increased to 63,000.

1973 - Sandia Crest, NM, reported a snow depth of 95 inches, a record for the state of New Mexico.

1973 - No. 1 Billboard Pop Hit: ``The Night the Lights Went out in Georgia,'' Vicki Lawrence. Lawrence is probably best known as the look-alike to the star of ``The Carol Burnett Show.'' The song debuts at No. 100 on the Hot 100.

1973- A taped Elvis Presley concert entitled Elvis: Aloha from Hawaii is telecast on NBC and proves to be a huge success. The total worldwide audience for the show, the first commercial worldwide satellite broadcast, amounts to over a billion people.

1974-- Hank Aaron ties Babe Ruth's home-run record.

1976- Johnnie Taylor's "Disco Lady" hits #1

1978--Birthday of American composer Kevin Ure.

1981-first mayor of a major city of Mexican descent was Henry Gabriel Cisnernos, San Antonio, Texas.

1983 -a snowstorm in the midwest left 11 inches of snow on the ground at Liberal, Kansas and 14 inches at Trousdale, Kansas. Further to the west in Colorado, the storm was in its 2nd day and by the time it was all over on the 5th, 21 inches of new snow was recorded at Fort Collins and Buckhorn Mountain, not to far from Fort Collins, was buried under 64.4 inches.

1984 - Bob Bell retired as Bozo the Clown on WGN-TV in Chicago, IL. Bell was an institution in the Windy City since making his first appearance in 1960. Pinto Colvig was the original Bozo.

1987-Denis Potvin of the New York Islander, the highest-scoring defenseman in NHL history at the time, scored the 1,000th point of his career. Potvin entered the Hockey Hall of Fame in 1991.

1987-- one of the most famous record companies in the world, RCA Records, officially became the Bertelsmann Music Group - BMG for short - upon its takeover by the giant West German publishing, broadcasting and recording company. The new owners said Nipper, the famous Radio Corporation of America dog, would continue as the new firm's logo, and the names RCA, Arista and Red Seal would still appear on BMG record labels.

1987 -New England was in the middle of its second heavy rainstorm in 5 days. Ten persons were killed in a bridge collapse over Schoharie Creek. This was the same storm that produced record snows in the Appalachians. This storm dumped 4 to 7 inches of rain over the area and this, combined with snowmelt and rivers already at bankfull, produced record flooding, especially in Maine. 2300 homes were flooded in Maine with 215 totally destroyed. Record water levels were reached at many dams. Damage in the state alone reached 100 million dollars.

1987-Grace Slick's lead vocals helped Starship reach Billboard's number one spot for the third time with "Nothing's Gonna Stop Us Now". The song was co-written by Albert Hammond, who had scored a number 5 hit of his own in 1972 with "It Never Rains in Southern California".

1990 - A deep low pressure system in northern New York State brought heavy snow to parts of western and central New York during the day. The snowfall total of 5.8 inches at Buffalo was a record for the date, and 9.5 inches was reported at Rochester. Snowfall totals ranged up to 11 inches at Warsaw.

1996- Jerry Garcia's widow, Deborah, and Grateful Dead guitarist Bob Weir sprinkled a small portion of Garcia's ashes into India's holy Ganges River. Deborah Garcia kept her plans secret because she feared thousands of fans might have travelled to India and disrupted the ceremony. The rest of Garcia's ashes were released off San Francisco later that month. The Grateful Dead leader had died of a heart attack following a drug overdose in a rehabilitation facility, Forrest Farm, in Marin County.

1996-- The former general manager of Daiwa Bank's New York branch pleaded guilty to aiding a $1.1 billion cover-up.

1996-- In its IPO, just two days after Lycos and a week before Yahoo!, Search engine Excite's stock opens at $17 and closen at $20.

2000-Michigan State beats Florida 89-76 to win NCAA Title.

http://sportsillustrated.cnn.com/basketball/college/2001/ncaa_tourney/news/

2001/04/02/final_gamer_ap/

2003 -- SMITH, PAUL RAY Medal of Honor

Rank and Organization: Sergeant First Class, 2nd Platoon, B Company, 11th Engineer Battalion, 1st Brigade, 3rd Infantry Division. Place and Date: At Baghdad, Iraq, 4 April 2003. Citation: Sergeant First Class Paul R. Smith distinguished himself by acts of gallantry and intrepidity above and beyond the call of duty in action with an armed enemy near Baghdad International Airport, Baghdad, Iraq on 4 April 2003. On that day, Sergeant First Class Smith was engaged in the construction of a prisoner of war holding area when his Task Force was violently attacked by a company-sized enemy force. Realizing the vulnerability of over 100 fellow soldiers, Sergeant First Class Smith quickly organized a hasty defense consisting of two platoons of soldiers, one Bradley Fighting Vehicle and three armored personnel carriers. As the fight developed, Sergeant First Class Smith braved hostile enemy fire to personally engage the enemy with hand grenades and anti-tank weapons, and organized the evacuation of three wounded soldiers from an armored personnel carrier struck by a rocket propelled grenade and a 60mm mortar round. Fearing the enemy would overrun their defenses, Sergeant First Class Smith moved under withering enemy fire to man a .50 caliber machine gun mounted on a damaged armored personnel carrier. In total disregard for his own life, he maintained his exposed position in order to engage the attacking enemy force. During this action, he was mortally wounded. His courageous actions helped defeat the enemy attack, and resulted in as many as 50 enemy soldiers killed, while allowing the safe withdrawal of numerous wounded soldiers. Sergeant First Class Smith’s extraordinary heroism and uncommon valor are in keeping with the highest traditions of the military service and reflect great credit upon himself, the Third Infantry Division “Rock of the Marne,” and the United States Army.

2010-The Boston Red Sox opened their 2010 campaign in style by having Neil Diamond sing "Sweet Caroline", which plays over the loudspeakers during the 8th inning of every Red Sox home game. Aerosmith front man Steven Tyler took the field during the 7th inning stretch to sing "God Bless America".

NCAA Basketball Champions This Date

1983---North Carolina State

1988---Kansas

1994---Arkansas

2000---Michigan State

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/