Second decade of business, providing sales incentives that require a

commitment and passion for driving sales success.

www.fivepointcapital.com

|

Tuesday, August 24, 2010

Television personality Craig Kilborn born August 24, 1962 Kansas City, Missouri. He was the original host of The Daily Show, a former anchor on ESPN's SportsCenter, and Tom Snyder's successor on CBS' The Late Late Show. He launched The Kilborn File after a six year absence from television on June 28, 2010. The Kilborn File aired on some Fox stations.

http://www.myfoxny.com/dpp/entertainment/television/craig-kilborn-20100625

|

Headlines---

Classified Ads---Syndicator

Allied Health--A Bizarre Story: $50MM & climbing

Leasing 102 by Mr. Terry Winders, CLP

Proposed Accounting Standards Update for Lessee’s

Classified ads—Help Wanted

Top Stories---August 16-August 20

Bank Beat---

Chicago makes Beck, 43 CA Branches change hands

Global Leasing Benchmarking World Leasing Companies

Bulldog Changes Name & to move to new HQ

Alta Advises Lessors on New Accounting Rules

Kansas City, Missouri --- Adopt a Dog

News Briefs---

Balboa Capital Settles w/five DC Churches Lawsuit

EFLA Reports Equipment Financing Up 16.7% July

AIG pays back $4 billion of bailout debt

22-year-old Mexico woman crowned Miss Universe

Park Seed sold for $13M at bankruptcy hearing

Tiger Woods, wife officially divorced

Billionaire Donald Bren's kids say they grew up hurt

'Tax lady' Roni Deutch faces California fraud lawsuit

Even The Donald opposes Ground Zero mosque

You May have Missed---

California Nuts Brief---

Sports Briefs---

"Gimme that Wine"

This Day in American History

Baseball Poem

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer. It is considered “bias” as it is the writer’s viewpoint.

[headlines]

--------------------------------------------------------------

Please send Leasing News to a colleague and ask them to subscribe.

It is free.

[headlines]

--------------------------------------------------------------

Allied Health--A Bizarre Story: $50 Million and climbing

by Christopher "Kit" Menkin

BK Hearing requested to be moved to September 7th

Key Equipment Finance, Superior, Colorado, Kingsbridge Holding, Lake Forest, Illinois, Republic Bank, Oakbrook, Illinois who the filed Involuntary Bankruptcy Chapter 7 against Allied Health Care Services, Orange, New Jersey have filed a petition to have a trustee take property of the estate and move the hearing to September 7, 2010, 12pm. Courtroom 3A, MLK, Jr. Federal Building, Newark, New Jersey. Objections to be received no later than September 3, 2010, 11am.

Perhaps the most important, even more important than the FBI investigation, will be the Medicare, Medicaid, and collateral involved, being used by many whose lives depend on the respirators. Some are required to have three, one as spare if one is being maintained (at least every nine months or specific hours of usage) and always having a back-up. Many also are AID patients and others will serious breathing conditions. This is going to be a nightmare for the workout, as well as extremely difficult for the users. The actual personal property value after all the work will be very small. The problems with the equipment, as in NorVergence, Brican, Royal Carts, should have been the first signal to any credit decision.

Kingsbridge Holding was the first to file a complaint, $1,089,371.14. Of the 19 who have filed since then, the other two joining for an involuntary Chapter 7 (all the way, not reorganization): Key Equipment Finance for $3,768,449 and Republic Bank of Chicago for $3,053,923 were not one of the 19 who filed. There also is a connection with Thomas X. Geisel President/CEO, Sun National Bank and Key Corp., as he worked for the bank before joining Sun.

Combining the numbers of those who have filed complaints and both Key and Republic, the total is now over $50 million. This number does not include others, one bank with a $1 million, nor another that had $2 million (originally), and many others at such as Larry LaChance at $6 million, so this might be one of the largest fraud to hit Leasing in a long time.

Sun National may be the largest, $15 million, who allegedly hold a lien on all Charles K. Schwartz's property, the alleged sole owner (his fomer wife Marilyn never signed any personal guarantees and there is an attorney letter on record with many creditors about this and their tacit agreement to accept her non-involvement.) In the lien agreement with Sun National Bank, he did not lien his house, perhaps in the back of his mind, planning in advance for a personal bankruptcy filing.

Schwartz's September 1, 2009 (before the Sun National liens, used by all leasing companies Kit Menkin spoke to, including brokers, for lease applications and leases after the September 1,2009 date) personal financial statement values his real estate investment at $4,715,000, Allied Health at $16,990,584 and Evenstar Stables at $1.5 million (more on this later in this story.)

All property 100% owned by Charles K. Schwartz (wife not included, nor does she appear as guarantor on any of the leases.)

Several, more than three brokers, asked Kit Menkin for his assistance in understanding and wanted to "sell" the lease and utilized his financial assistance, submitting financial and tax returns personally on Charles K. Schwartz and Bruce Donner and their companies. In addition, several banks who had leases were quite concerned and "off the record" help quite a big in gathering information, sharing information, wanting to get the story public (without their name involvement.) Even tax returns were verified with the signer’s permission, as well as a QuikTrac, published in a previous story.

Credit should go to them for this story and the original alert could not have been written without their direct assistance.

Allied’s Year End 2009 statements: Not since Equipment Acquisition Resources have I seen such an increase in sales and net income. His net profit margins are incredible at over 43%, again, like Equipment Acquisition Resources.

A broker with one of the many packages being hawked the first quarter asked me to come up with questions to ask Charles K. Schwartz. Here are the questions and his responses:

"How many LifeCare units do you have on lease and or own outright?

4,425 Half are leased and they own the other half.

"2) How many people are using these units and what do they pay each month per unit?

1,450 to 1,475 patients and he said that most have 2 to 3 units each for back-up.

(He said they are $1,050 per mo per unit. And that includes peripheral equipment.)

"3) Do you re-sell any of these units? If so how many LifeCare units do you sell versus rent each year?

He didn’t tell me if they re-sell them but he said they don’t sell any units outright. He said they have a useful life of 8 to 12 years."

It should be noted Medicare requires that the patient own the unit after a specific period of time.

Looking at the numbers, here are units Allied is buying at $5,000 each (no sales tax or property tax in New York or New Jersey on this type of equipment) and renting out at $1,050 a month, Schwartz states, so in five months everything after that is free and clear, except for expenses in running the operation. His gross by his own numbers is $1,548,750 a month.

His financial statement shows a $43 million gross not $538,788 and purchases $4.5 million. His lease payments, according to his tax return appear to be about $500,000 a month. Where is the other $1 million going? If the number is $18,500,000.

$43 million gross 2009, gross profit $17 million, net income $18 million. That is after making the $500,000 a month payments in the expense cost. Allied has over a $1 million a month and should no way be behind three months with a lease.

And then there is the vendor's corporate salary and profit, as well as Schwartz.

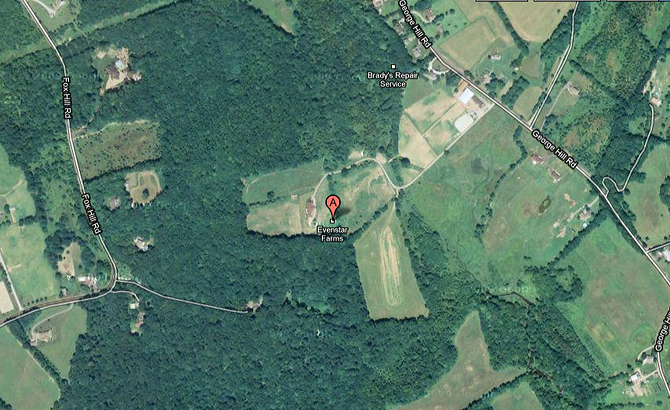

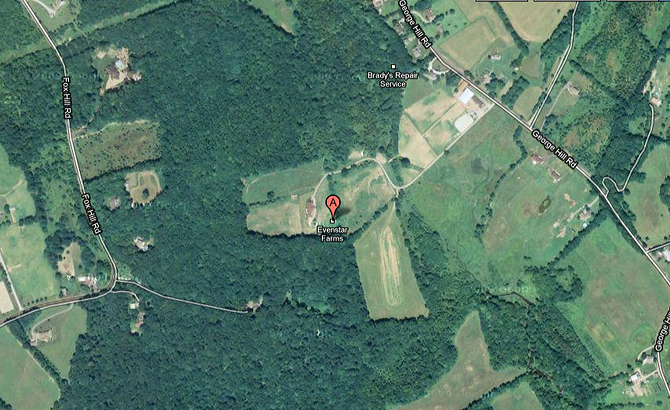

The $1,500,000 on the Schwartz financial statement (from a $585,000 original investment as per his PFS) Evenstar Stable shows an incorporation: Status Report For: EVENSTAR FARM, L.L.C.

Business Name: EVENSTAR FARM, L.L.C. Report Date: 08/16/2010

Business ID Number: 0600170267 Transaction Number: Sequence: 1711872: 1

======================================================

Business Type: DOMESTIC LIMITED LIABILITY COMPANY

Status: ACTIVE

Filing Date: 05/20/2003 Home Jurisdiction: NJ

Status Change Date: Stock Amount: 0

DOR Suspension Start Date: DOR Suspension End Date:

Tax Suspension Start Date: Tax Suspension End Date:

Annual Report Month: 5

Last Annual Report Filed: 07/24/2009

For Last Annual Report Paid Year: 2009

Incorporator:

Agent: CHARLES K SCHWARTZ

Agent Address: 84 MAIN ST P O BOX 738

ORANGE, NJ 07051

Office Address Status: Deliverable

Main Business Address: 86 GEORGE HILL RD

FRANKLIN, NJ 07416

Principal Business Address:

Officers/Directors/Members

1) Title: OTHER

Name: CHARLES SCHWARTZ

Address: ********* ******, NJ

(home address deleted)

A public record finds a purchase of the stable April, 2010, perhaps his original goal when he applied for $6 million in August, 2009 at Sun National Bank:

Property:

Parcel Number − 05−00025−0000−00014

Book − 8742

Page − 851

Property Address: − 86 GEORGE HILL RD, AUGUSTA NJ 07822−2004, SUSSEX COUNTY

Owner Address: **************** SUSSEX COUNTY

Sale Date − 04/19/2010

Loan Amount − $13,684,095

Loan Type − CONVENTIONAL

(leaving the Schwartz home address off.)

The actual address by Google is:

86 George Hill Road, Branchville, NJ 07826

(there are discrepancies in the public records of the actual city.)

Thomas X. Geisel, President/CEO, Sun National Bank came to the bank in January, 2008 after a personal turmoil in New York. His 2008 salary was $1,015,933. "He joined Key in July 1999 in New York City where he served as Managing Director of Investment Banking for the East and West Regions of KeyBanc Capital Markets… In 2002, he was promoted to President of Key's Capital Region New York District and subsequently to Regional Executive for Commercial Banking for which he (and his wife Sandra Beth, a school teacher. editor) relocated to Albany, New York. From 2005 through 2007, served as President for KeyBank's Northeast Region, which comprised eight districts across New York, New England and Florida, with assets of approximately $20 billion and revenue exceeding $550 million. Mr. Geisel's other experience includes representing the U.S. Department of Justice in various capacities domestically and as a diplomat in Latin America and the Caribbean."

http://people.forbes.com/profile/thomas-x-geisel/75272S

Sun had gone from 745 full time employees the beginning of January 1, 2008 to 717 employees by the end of the year. Equity had dropped from $435 million to $431.6 million and net income had dropped to $18.4 from the year end. At the time Schwartz applied for the loan, September 30 shows an increase in net equity to $436.9 million but a large jump in non-current loans from $28.1 million to $84.399 million. The bank was showing a $8.6 million loss due primarily to real estate loans (charge offs: $2.1 million construction and real estate development; $3.8 in 1-4 multifamily homes, $2.3 million in non-farm, non-residential property and $9.5 million in commercial and industrial loans. Year-end equity was down to $430 million, noncurrent loans $95 million and a loss of $14.5 million. The June, 2010 FDIC filing shows an $80.6 million loss.

https://cdr.ffiec.gov/Public/ViewFacsimileDirect.aspx?ds=call&

amp;idType=fdiccert&id=26240&date=06302010

As reported in previous stories, July 7th the bank raised $100 million. The money came from billionaire Wilbur Ross, who now owns a 25 percent interest in the bank, as he invested $50 million, and the majority stock holders of the bank, the Brown family who contributed $30 million; other investors contributed $20 million.

Does Sun have other liabilities in this transaction? What else is going to “pop up.” Leasing News has some ideas, but the story is bizarre enough to end this chapter and to wait for the full disclosure of all debts owed by Allied Health Care Services and the names of the debtors. Stay tuned.

Thomas X.Geisel LinkedIn

http://www.linkedin.com/in/txgeisel

OST Interim Motion:

http://leasingnews.org/PDF/OST_Interim_Trustee_Motion.pdf

Previous stories:

http://www.leasingnews.org/Conscious-Top%20Stories/allied_health.html

((Please Click on Bulletin Board to learn more information))

(Leasing News provides this ad “gratis” as a means

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

Second decade of business, providing sales incentives that require a

commitment and passion for driving sales success.

www.fivepointcapital.com

|

Sales Account Executives: Jacksonville, FL/Philadelphia, PA. Small ticket funder with broad funding and

exceptional vendor service capabilities. E-mail resume to: garyshivers@navitaslease.com

Navitas Lease Finance Corp is an innovator in the Small Ticket Leasing Industry. We offer solutions to small-to-medium-sized businesses looking to acquire and finance equipment.

|

Territory Managers

Originate FMV leases for IT/Communication

equipment.

10+ years direct origination required.

For more info, click here

tipcapital.com

|

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

Leasing 102

by Mr. Terry Winders, CLP

Proposed Accounting Standards Update for Lessee’s

The accounting changes proposed by the Financial Accounting Board on August 17. 2010 will be under review until December 15, 2010. You are invited to send your comments prior to that date. But do not expect much change. It appears they have their minds made up. They want leases “exposed”--- including all of the standard costs associated with it. They expect to implement them some time next year to be in effect for all of 2011.

Gone is the 75% of useful life requirement and the 90% rule. Basically it means operating leases are out. All leases over 12 months will now appear on the lessee’s balance sheet. Instead of listing a lease as a “leased asset” on the lessee balance sheet. it now becomes a “right-of-use asset”. On the liability side, it is a liability to make “lease payments”

To determine the difference between a sale, or a lease, the proposal offers this definition:

“An entity shall not apply this guidance to contracts that meet the criteria for classification as a purchase or sale of an underlying asset. A contract represents a purchase or sale of an underlying asset if, at the end of the contract, an entity transfers to another entity control of the entire underlying asset and all but a trivial amount of the risks and benefits associated with the entire underlying asset. That determination is made at inception and is not subsequently reassessed.

“An entity shall consider all relevant facts and circumstances when determining whether control of the underlying asset is transferred at the end of the contract. A contract normally transfers control of an underlying asset when the contract:

“(a) automatically transfers title to the underlying asset to the transferee at the end of the contract term; or

(b) includes a bargain purchase option. A bargain purchase option is an option to purchase the asset at a price that is expected to be significantly lower than the fair value of the asset at the date that the option becomes exercisable. "

If the exercise price is significantly lower than fair value, it would be reasonably certain at the inception of the lease that such options will be exercised.

An entity that has a bargain purchase option is in an economically similar position to an entity that will automatically obtain title to the underlying asset at the end of the lease term. By exercising its bargain purchase option, the transferee would be able to direct the use of, and receive the benefits from, the whole of the underlying asset for the whole of its life.

Therefore a lease with a bargain purchase option in the future remains mostly the same, for accounting, as it did before with the exception of a few name changes. Except… The lessee will be required to include all fees, or penalties, in the lease in the present value calculations to determine the discounted value that is subtracted from the total rent to determine interest costs.

The interest costs will be charged on the income statement under the interest method. The present value of the total rent will be amortized on a straight line basis. This total rent will include; lease payments over the lease term, expected contingent rentals, expected payments under term option penalties and residual value guarantees. Penalties include requirements for transportation costs to return the asset to the lessor, restocking fees, or any additional fees, or costs, required in the lease.

A lease that does not offer a purchase option will be discounted the same as a lease with a bargain purchase option at the lessee’s incremental borrowing rate. The real difference comes in the term of the amortization. A bargain option lease will be amortized over the assets useful life, to the lessee, regardless of the lease term. A non- bargain option lease (old operating lease) or a lease with no purchase option will be amortized over the lease term unless the useful life is shorter than the lease term.

It appears that a no purchase option lease with an irregular payment schedule driven by an irregular use can have an irregular amortization of the discounted value instead of a straight-line amortization but no instructions are available on how to accomplish it.

When this rule goes into effect next year there will be no grandfather clause, which means that all operating leases will hit the balance sheet of the lessee for the remainder of the lease term. They will be discounted at the lessee’s incremental borrowing rate to determine the breakdown between present value and interest. All additional charges will be added to the rent.

One major problem presented by the new rules has to do with renewals. Renewals must be added to the original term to determine the actual lease term (to determine the discounted value) if it can be reasonably assumed that the lessee will renew the lease. This creates a conflict with the legal nature of the lease because an obligation or liability will exist on the lessee’s books without a legal binding obligation to back it up. It will be interesting how the leasing industry will address this problem without eliminating renewal language altogether.

The original thought process was to avoid lessor accounting for this update, however, the board changed its mind and a large part of the changes will affect lessor accounting. I will address lessor accounting next week!

Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty years and can be reached at leaseconsulting@msn.com or 502-327-8666.

He invites your questions and queries.

Previous #102 Columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Bank Beat---

Chicago makes Beck, 43 CA Branches change hands

The 15 branches of ShoreBank, Chicago, Illinois were closed with Urban Partnership Bank, Chicago, Illinois, a newly-chartered institution, to assume all of the deposits of ShoreBank. It was the 15th bank to fail in the State of Illinois. 118 bank failures in US this year to date.

ShoreBank was able to raise more than $146 million in capital this spring from several big Wall Street institutions. It was unable, however, to secure federal bailout funds it sought from the Treasury Department's Troubled Asset Relief Program.

The FDIC and Urban Partnership Bank entered into a loss-share transaction on $1.41 billion of ShoreBank's assets.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $367.7 million.

The bank had gone from 408 full-time employees March 31,2009 to 351 full-time employees March 31,2010, with a tremendous net equity drop from March 31,2009 of $153 million to $23.8 million, non-current loans rising from $183.7 million to $330.68 million same time period; from a profit of $1.6 million to a loss of $17.3 million after a loss of $2.1 million secured by 1-4 multi-family homes, $9.6 million multifamily residential property, and $567,000 secured by non-farm non-residential property. Tier 1 risk-based capital ratio 2.05%.

Glenn Beck of Fox News talked about cronyism as the fall of the bank:

https://www.sbk.com/system/assets/431/logo-shorebank.jpg?1282356979

He may have gotten the basic information from the Chicago Daily Observer:

http://www.cdobs.com/archive/featured/crony-capitalism-shores-up-shore-bank/

ShoreBank was founded in 1973 with the aid of several dozen institutional backers. The bank has been known for promoting redevelopment, minority business and environmentally responsible lending, and serving low- and moderate-income neighborhoods in Chicago. It was the nation's first community development and environmental bank, branching out from its roots on Chicago's South side to Cleveland, Detroit, the Pacific Northwest and 40 foreign countries.

ShoreBank had indirect ties to a few members of the Obama administration - one of them, presidential adviser Valerie Jarrett, was on the board of a Chicago civic organization led by a ShoreBank director - and powerful supporters, including former top federal banking regulators Ellen Seidman and Eugene Ludwig.

As of June 30, 2010, ShoreBank had approximately $2.16 billion in total assets and $1.54 billion in total deposits. Urban Partnership Bank will pay the FDIC a premium of 0.50 percent to assume all of the deposits of ShoreBank. In addition to assuming all of the deposits of the failed bank, Urban Partnership Bank agreed to purchase essentially all of the assets except for the marketable securities and fixed assets.

http://www.fdic.gov/news/news/press/2010/pr10193.html

The 16 branches of Butte Community Bank, Chico, California were closed with Rabobank, National Association, El Centro, California, to assume all the deposits. They had 217 full time employees and four branches in Chico, two in Paradise, one each in Gridley, Magilia, Oroville, Colusa, Andersen, Redding, Yuba City, Corning, and Red Bluff. This brings Rabobank up to 109 branches in the state, primarily small communities throughout California, and matches their personality and growth plans.

http://www.rankabank.com/Bank-Offices.asp?UNINUM=16381&offset=40

Rabobank Group based in the Netherlands which has been in business for 110 years and has total assets of over $800 billion. The Rabobank website describes Rabobank Group as “one of the largest and safest banks in the world and the only private bank in the world with a triple A credit rating”.

Equity had dropped from $49.5 million March 31, 2009 to $20.5 million while non-current loans in the same period rose from $17.5 million to $65.3 million with a $2.2 million loss following a $1.7 million loss in construction and land developmetn, $383,000 in 1-4 multi-family dwellings, and $453,000 in nonfarm-nonresidential property. Tier 1 risk-based capital ratio 4.34%.

As of June 30, 2010, Butte Community Bank had total assets of $498.8 million and total deposits of $471.3 million. The FDIC and Rabobank, National Association entered into loss-share transactions on $425.4 million of Butte Community Bank's assets.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) for Butte Community Bank will be $17.4 million.

http://www.fdic.gov/news/news/press/2010/pr10194.html

The ten branches of Pacific State Bank, Stockton, California were closed with Rabobank, National Association, El Centro, California, to assume all the deposits. As of June 30, 2010, Pacific State Bank had total assets of $312.1 million and total deposits of $278.8. The FDIC and Rabobank, National Association entered into loss-share transactions million of $249.7million of Pacific State Bank's assets.

Brings Rabobank up to 119 branches in California.

Pacific State Bank had 81 full time employees with four branches in Stockton, one each in Angels Camp, Arnold, Lodi, Tracy, Modesto, Groveland, and Hayward, in the San Francisco Bay Area. Net equity had dropped from $34.9 million March 31, 2009 to $12.7 million March 31, 2010 with $23.9 million non-current loans, a loss of $1.5 million Tier 1 risk-based capital ratio 4.91%.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) for Pacific State Bank, $32.6 million.

http://www.fdic.gov/news/news/press/2010/pr10194.html

The 14 branches of Los Padres Bank, Solvang, California were closed with Pacific Western Bank, San Diego, California, to assume all of the deposits.

"Our branch network, including the Los Padres branches, will now include 82 branches, with 79 in California extending from San Diego County in the south to San Luis Obispo County in the north. Combined with our three branches in Northern California and the three Los Padres branches in Arizona, we have significant coverage across some of the best banking geography in the country. Pacific Western has always focused on financial strength, relationships and service," said Matt Wagner, CEO of PacWest Bancorp and chairman and CEO of Pacific Western Bank.” We look forward to supporting our new customers as Pacific Western Bank customers."

As of June 30, 2010, Los Padres Bank had approximately $870.4 million in total assets and $770.7 million in total deposits.

Pacific Western Bank will pay the FDIC a premium of 0.45 percent to assume all of the deposits of Los Padres Bank. In addition to assuming all of the deposits of the failed bank, Pacific Western Bank agreed to purchase essentially all of the assets.

The bank had gone from 182 full time employees to 157 full time employees March 31, 2010 with net equity falling from $65.9 million to $29.49 million the same time period with $11.9 million non-current loans as loss of $1.8 million March 31, 2009 to a $400,000 profit March 31, 2010 after a charge off of $1.2 million in real estate ($603,000 in construction and land development, $355,000 in 1-4 family residential property, $256,000 nonfarm nonresidential property. Tier 1 risk-based capital ratio 6.10%

The FDIC and Pacific Western Bank entered into a loss-share transaction on $579.8 million of Los Padres Bank's assets.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $8.7 million.

http://www.fdic.gov/news/news/press/2010/pr10195.html

The three branches of Sonoma Valley Bank, Sonoma, California were closed with Westamerica Bank, San Rafael, California, to assume all of the deposits. The bank had two branches in the City of Sonoma and one in Glen Allen. There were 53 full time employees. The problems were quite apparent for the last two years.

As of June 30, 2010, Sonoma Valley Bank had approximately $337.1 million in total assets and $255.5 million in total deposits. Westamerica Bank will pay the FDIC a premium of 2.0 percent to assume all of the deposits of Sonoma Valley Bank. In addition to assuming all of the deposits of the failed bank, Westamerica Bank agreed to purchase essentially all of the assets.

Net equity had almost dropped by one half from March 31, 2009 at $30.9, going to $16 million March 31, 2010 as non-current loans soared from $5.8 million to $30.9 million with the previous time period profit of $741,000 going to a $2.6 million loss with $1.9 million charge off in construction and land development, and $300,000 loss in nonfarm nonresidential property, as well as $366,000 loss in commercial loans. Tier 1 risk-based capital ratio 4.15%.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $10.1 million

http://www.fdic.gov/news/news/press/2010/pr10196.html

The six branches of Independent National Bank, Ocala, Florida were closed with CenterState Bank of Florida, National Association, Winter Haven, Florida, to assume all the deposits. They had 59 full-time employees.

As of June 30, 2010, Independent National Bank had total assets of $156.2 million and total deposits of $141.9 million. Net equity for the bank dropped from $15.5 million to $3.9 million March 31, 2010. Non-current loans had risen in the same year time period from $7.1 million to $22 million. The bank the previous March 31, 2009 lost $989,000 and March 31, 2010 lost $2.7 million; charge off of$464,000 in construction and land development,$365,000 in 1-4 multi-family residential, $485 in nonfarm nonresidential property. Tier 1 risk-based capital ratio 3.29%

http://www.fdic.gov/news/news/press/2010/pr10191.html

Imperial Savings and Loan Association, Martinsville, Virginia, was closed with River Community Bank, National Association, Martinsville, Virginia, to assume all of the deposits. Established January 1, 1929 the bank had six full time employees. March 31, 2009 the bank had a negative $63,000 equity and March 31, 2010 a minus $554,000 equity, with $322,000 non-current loans and $159,000 loss March 31, 2010. Tier 1 risk-based capital ratio 3.68%.

As of June 30, 2010, Imperial Savings and Loan Association had approximately $9.4 million in total assets and $10.1 million in total deposits.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $3.5 million.

http://www.fdic.gov/news/news/press/2010/pr10192.html

Community National Bank, Bartow, Florida was closed with CenterState Bank of Florida, National Association, Winter Haven, Florida, to assume all the deposits. This was a small bank with 14 full time employees. Net equity had dropped from $8.1 million March 31, 2009 to $1.9 million March 32, 2010 with $7 million in non-current loans, and a loss of $2.1 million. There was almost a $1 million charge off in real estate, $101,000 in construction and land development,

$806,000 in 1-4 multi-family residential. Tier 1 risk-based capital ratio 3.94%.

As of June 30, 2010, Community National Bank at Bartow had total assets of $67.9 million The FDIC and CenterState Bank of Florida, N.A. entered into loss-share transactions on $51.9 million of Community National Bank at Bartow's assets.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) for Community National Bank at Bartow will be $10.3 million. The FDIC and CenterState Bank of Florida, N.A. entered into loss-share transactions on $119.7 million of Independent National Bank's assets.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) for Independent National Bank, $23.2 million.

http://www.fdic.gov/news/news/press/2010/pr10191.html

List of Bank Failures:

http://www.fdic.gov/bank/individual/failed/banklist.html

Bank Beat:

http://www.leasingnews.org/Conscious-Top%20Stories/Bank_Beat.htm

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

#### Press Release #############################

Global Leasing Benchmarking World Leasing Companies

Global Leasing Resource (GLR) is in the process of compiling key market and financial leasing data from various leasing economies throughout the world. The data is being gathered through a standard template; the approach has already resulted in garnering information that is comparable, eventually facilitating regional and global benchmarking.

Over 45 countries have either submitted country reports or have committed to do so. When GLR is fully launched, this list is likely to include more than 60 leasing economies. These include: Australia, Brazil, China, Egypt, Finland, India, Italy, Korea, Korea, Mexico, The Netherlands, Russia, Turkey, U.A.E. and the U.S.A.

GLR also accepts free listings from leasing companies seeking to enhance their networking opportunities.

For more information, visit www.globalleasingresource.com

#### Press Release #############################

Bulldog Changes Name & to move to new HQ

Bulldog Truck and Equipment Sales has changed our name to Bulldog Asset Management to more clearly convey our mission: providing comprehensive asset management services to the banking and leasing community nationwide.

We have also purchased a new headquarters location in Georgia. This faclity increases our capacity to over 30,000 square feet of secure indoor storage and over 10 acres of secure outdoor storage to serve our growing client base.

Bulldog Asset Management maximizes the value of your non-performing assets by offering the lowest fee structure in the industry and performing asset recoveries on a contingency basis – if we don’t find it, you don’t pay!

Check out our new website at www.buybulldog.com to discover the Bulldog difference.

Jeff Schubert

EVP

Bulldog Asset Management

678-679-7960

### Press Release ###############################

Alta Advises Lessors on New Accounting Rules

RENO, NEV. --The Alta Group’s new accounting compliance and implementation division led by Shawn Halladay, a principal with the global consultancy, has created an online library of articles, presentations and background concerning the new lease accounting rules. It includes a summary of the exposure draft jointly crafted by the U.S. and international accounting boards and issued Aug. 18.

The much anticipated ruling from the U.S. and international accounting boards which requires leases to be recorded off balance sheet, Halladay said, will spur wide-ranging adjustments in the way that lessors do business--from asset tracking to customer engagement.

In a letter to software providers earlier this month, Halladay said.

“…the operational burden faced by lessors is more significant than many realized. For example, under the Performance Obligation Approach included in the new rules, the Performance Obligation (a new concept and liability) must be linked to the leased asset and receivable.”

Shawn Halladay

The online library at http://www.thealtagroup.com/articles/articles-presentations-on-accounting-rules/articles-presentations is tailored for equipment leasing companies to provide some guidance on adjusting business.

Featured are Halladay’s articles which have appeared in numerous equipment leasing and asset finance trade publications.

(Leasing News article by Mr.Halladay:

http://leasingnews.org/archives/Aug2010/8_20.htm#fasb_residuals )

#### Press Release ##############################

[headlines]

--------------------------------------------------------------

Kansas City, Missouri ---Adopt a Dog

Nettie

German Shepherd Dog

Large Adult Female Dog Pet ID: 6742

"Nettie is a sweet little (well, not that little!) thing who just wants plenty of love and attention. She is seeking a home where she will feel safe and secure. This affectionate pooch would be happy to have a canine roommate and could even share a home with a cat or two. Nettie has lots of love to give, she just needs someone who is ready to receive it!"

•Kansas City & surrounding area adoptions only. No out-of-state adoptions (outside of KS or MO).

•$120 adoption fee includes spay or neuter, microchip identification, DA2PP+C vaccine, bordetella vaccine, rabies vaccine (ages 4 months & up), current heartworm test & preventative (ages 6 months & up), flea treatment, dewormer, 5-pound bag of Science Diet food.

•Log onto www.animalhavenkc.org for more information about our agency.

•Applications available at the shelter.

http://www.vast.com/pets/location-Kansas-City--MO/pet_breed-German-Shepherd

•THANK YOU for welcoming a homeless dog into your life!

.Nettie is up-to-date with routine shots, house trained and spayed/neutered.

My Contact InfoAnimal Haven

Merriam, KS

913-432-7548

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

---------------------------------------------------------------

[headlines]

----------------------------------------------------------------

This Day in American History

1675-Catholic holy orders were conferred by Gabriel Diaz Vara Calderon, Bishop of Santiago de Cuba, on a visit to St. Augustine, FL. Minor orders were conferred on seven candidates.

http://www.tfn.net/~mpna/prehistory.htm

http://www.oah.org/pubs/magazine/spanishfrontier/cowdrey-document.html

http://www.oah.org/pubs/magazine/spanishfrontier/mcewan.html

http://www.xxicentury.org/HCA/Tutorial/Tutorial_3.html

(see age of missions: )

http://www.vernonjohns.org/nonracists/jxfoundr.html

http://www.catholic-hierarchy.org/bishop/bdiazv.html

http://drbronsontours.com/staugustinetimeline.htm

1676-The first court-martial in a colony was held in Newport, RI, by Governor Walter Clarke, Deputy Governor John Crayton and their assistants, Edmund Calvary, who was the attorney general. Quanpen, a Native American sachem, also known as Sowagonish, was found guilty of participation in King Philip’s War against the colonists and ordered shot on August 26. Others who had participated in the war were sentenced to various penalties.

1682 - Duke James of York gave Delaware to William Penn.

1682- The Duke of York awarded Englishman William Penn the three "lower counties" in the American colonies which later became the state of Delaware.

( lower half of: http://memory.loc.gov/ammem/today/aug24.html )

http://www.williampenn.org/

1718- New Orleans was founded by French settlers from Canada and France. The Canadians, generally brought their wives and families with them. French officers, however, usually younger sons of nobility, refused to marry below their rank, inspiring the plea of one of the early governors to France: “Send me wives for my Canadians, they are running in the woods after Indian girls.” Thus Cajuns were born. By the way, Creole meant “native”, born in Louisiana and has nothing to do with race.

http://www.cajunculture.com/

1814-British forces invaded and raided Washington, DC, for two days, burning the Capital, the president’s house and most other public buildings. President James Madison and other high US government officials fled to safety until British troops (not knowing the strength of their position as military is in disarray) departed the city two days later. They set on fire in retaliation for the American burning of the parliament building in York (Toronto), the capital of Upper Canada.

1851-The San Francisco Committee of Vigilance broke down the jailhouse doors, kidnapped the prisoners, and hanged Whittaker and McKenzie from the second story of the Committee's rooms. Sam Brannan addressed the crowd after the hangings.

1853 -- First potato chips prepared by Chef George Crum, Saratoga Springs, NY. Crum was a Native American/African American chef at the Moon Lake Lodge resort in Saratoga Springs, New York, USA. French fries were popular at the restaurant and one day a diner complained that the fries were too thick. Although Crum made a thinner batch, the customer was sill unsatisfied. Crum finally made fries that were too thin to eat with a fork, hoping to annoy the extremely fussy customer. The customer, surprisingly enough, was happy - and potato chips were invented! Crum's chips were originally called Saratoga Chips and potato crunches. They were soon packaged and sold in New England - Crum later opened his own restaurant. William Tappendon manufactured and marketed the chips in Cleveland, Ohio, in 1895. In the 1920s, the salesman Herman Lay sold potato chips to the southern USA (selling the chips from the trunk of his car). In 1926, Laura Scudder (who owned a potato chip factory in Monterey Park, California) invented a wax paper potato chip bag to keep the chips fresh and crunchy - this made potato chips even more popular.

http://www.history.rochester.edu/Scientific_American/mystery/crum.htm

http://home.howstuffworks.com/question579.htm

1857—Major economic panic hits the United States.

http://memory.loc.gov/ammem/today/aug24.html

1862 - The C.S.S. Alabama was commissioned at sea off Portugal's Azore Islands, beginning a career that would see over 60 Union merchant vessels sunk or destroyed by the Confederate raider. The ship was built in secret in the in Liverpool shipyards, and a diplomatic crisis between the US government and Britain ensued when the Union uncovered the ship's birth place.

1869- Cornelius Swarthout of Troy, NY, was issued a patent for a “waffle iron.”

1893 - Fire in the south of Chicago left 5,000 people homeless.

1895-Birthday of Carol Weiss King, attorney who specialized in outstanding legal briefs. Primarily a researcher, her briefs were argued by other attorneys before the U.S. Supreme Court in at least a dozen major cases that changed immigration laws and deportation regulations as well as the civil rights of those accused of criminal acts, such as the right of a fair trial before a fair jury in one of the Scottsboro Boys appeals.

1897--birthday of Charles Dudley Warner, American newspaper editor for the Hartford Courant, published this now-famous and oft-quoted sentence, "Everybody talks about the weather, but nobody does anything about it. " The quotation is often mistakenly attributed to his friend a colleague Mark Twain. Warner and Twain were part of the most notable American literary circle during the late 19th century. Warner was a journalist, essayist, novelist, biographer and author who collaborated with Mark Twain in writing "The Gilded Age" in 1873.

1906 - A cloudburst deluged Guinea, VA, with more than nine inches of rain in just forty minutes.

1909- Sax player Paul Webster birthday (Jazz Trumpeter, in Jimmy Lunceford's orchestra 35-43 and with Cab Calloway 44-52)

1912- parcel post service was authorized. Previously the weight limit of mail had been four pounds. The rates of the parcel post service depended upon the weight of the package and the distance traveled. This was a boon to mail order catalogues and

to people living in the rural area.

1925-Birthday of pianist Louis Teicher (Ferrante and Teicher,) composer, born Wilkes-Barre, Pa.

1932 - Amelia Earhart became the first woman to fly across the U.S. non-stop.

1932- Charles H. Calhoun, Sr. and Jr., at the third hole of the Washington Golf Club, Washington, GA, while playing with a foursome, both shot a hole in 1939 - Louis "Lepke" Buchalter, leader of Murder, Incorporated, turned himself in to New York City columnist Walter Winchell; who turned the underworld leader in to FBI Director J. Edgar Hoover.

1943 - No. 1 Billboard Pop Hit: ``In the Blue of the Evening,'' Tommy Dorsey Orchestra/Frank Sinatra.

1944--- Germany Army by now has sustained 400,000 men killed, wounded or captured, plus 1,300 tanks, 1,500 artillery, and 3,500 aircraft destroyed.

1945-BACON, NICKY DANIEL Medal of Honor

Rank and organization: Staff Sergeant, U.S. Army, Company B, 4th Battalion, 21st Infantry, 11th Infantry Brigade, Americal Division. Place and date: West of Tam Ky, Republic of Vietnam, 26 August 1968. Entered service at: Phoenix, Ariz. Born: 25 November 1945, Caraway, Ark. Citation: For conspicuous gallantry and intrepidity in action at the risk of his life above and beyond the call of duty. S/Sgt. Bacon distinguished himself while serving as a squad leader with the 1st Platoon, Company B, during an operation west of Tam Ky. When Company B came under fire from an enemy bunker line to the front, S/Sgt. Bacon quickly organized his men and led them forward in an assault. He advanced on a hostile bunker and destroyed it with grenades. As he did so, several fellow soldiers including the 1st Platoon leader, were struck by machine gun fire and fell wounded in an exposed position forward of the rest of the platoon. S/Sgt. Bacon immediately assumed command of the platoon and assaulted the hostile gun position, finally killing the enemy gun crew in a single-handed effort. When the 3d Platoon moved to S/Sgt. Bacon's location, its leader was also wounded. Without hesitation S/Sgt. Bacon took charge of the additional platoon and continued the fight. In the ensuing action he personally killed 4 more enemy soldiers and silenced an antitank weapon. Under his leadership and example, the members of both platoons accepted his authority without question. Continuing to ignore the intense hostile fire, he climbed up on the exposed deck of a tank and directed fire into the enemy position while several wounded men were evacuated. As a result of S/Sgt. Bacon's extraordinary efforts, his company was able to move forward, eliminate the enemy positions, and rescue the men trapped to the front. S/Sgt. Bacon's bravery at the risk of his life was in the highest traditions of the military service and reflects great credit upon himself, his unit, and the U.S. Army.

1947-- Margaret Truman, daughter of U.S. President Harry S Truman, presented her first public concert. Margaret sang before 15,000 people at the Hollywood Bowl. The concert did not get great reviews. In fact, the critics didn’t like Margaret’s singing at all. And Margaret’s dad didn’t like the critics, and said so, from the White House.

1949--Birthday of American composer Stephen Paulus, St. Paul, MINN.

http://profile.myspace.com/index.cfm?fuseaction=user.viewprofile&friendid=122300973

1950-- US President Harry Truman orders the Army to take over the railroads to stop a possible strike.

1950- Edith Spurlock Sampson, the first African-American delegate to the United Nations when she was appointed alternate delegate to the fifth General Assembly. Her first assignment, on September 28, 1950, was to the Social, Humanitarian and Cultural Committee.

http://www.aaregistry.com/african_american_history/399/

Edith_Sampson_was_a_steel_city_judge

1950-HANDRICH, MELVIN O. Medal of Honor

Rank and organization: Master Sergeant, U.S. Army, Company C, 5th Infantry Regiment. Place and date: Near Sobuk San Mountain, Korea, 25 and 26 August 1950. Entered service at: Manawa, Wis. Born: 26 January 1919, Manawa, Wis. G.O. No.: 60, 2 August 1951. Citation: M/Sgt. Handrich, Company C, distinguished himself by conspicuous gallantry and intrepidity above and beyond the call of duty in action. His company was engaged in repulsing an estimated 150 enemy who were threatening to overrun its position. Near midnight on 25 August, a hostile group over 100 strong attempted to infiltrate the company perimeter. M/Sgt. Handrich, despite the heavy enemy fire, voluntarily left the comparative safety of the defensive area and moved to a forward position where he could direct mortar and artillery fire upon the advancing enemy. He remained at this post for 8 hours directing fire against the enemy who often approached to within 50 feet of his position. Again, on the morning of 26 August, another strong hostile force made an attempt to overrun the company's position. With complete disregard for his safety, M/Sgt. Handrich rose to his feet and from this exposed position fired his rifle and directed mortar and artillery fire on the attackers. At the peak of this action he observed elements of his company preparing to withdraw. He perilously made his way across fire-swept terrain to the defense area where, by example and forceful leadership, he reorganized the men to continue the fight. During the action M/Sgt. Handrich was severely wounded. Refusing to take cover or be evacuated, he returned to his forward position and continued to direct the company's fire. Later a determined enemy attack overran M/Sgt. Handrich's position and he was mortally wounded. When the position was retaken, over 70 enemy dead were counted in the area he had so intrepidly defended. M/Sgt. Handrich's sustained personal bravery, consummate courage, and gallant self-sacrifice reflect untold glory upon himself and the heroic traditions of the military service.

1951---Top Hits

Too Young - Nat King Cole

Because of You - Tony Bennett

My Truly, Truly Fair - Guy Mitchell

Hey, Good Lookin’ - Hank Williams

1951- St. Louis Browns owner Bill Veeck, one of baseball’s greatest showmen, allowed fans attending a game against the Philadelphia Athletics to participate in the strategy decisions normally made by the team’s manager. More than 1,000 fans were given cards reading ”YES” and “NO: and were asked to vote on what the Browns should do at various point sin the tame. It worked; St. Louis won, 5-3. With the advent of Palm Pilots, Blackberry, and the internet, guess what Bill Veeck could do today.

1957- The Dodgers use eight pitchers in one game tying a major league record. Johnny Podres gives up three home runs in the third including Hank Aaron's first grand slam.

1957 - No. 1 Billboard Pop Hit: ``Tammy,'' Debbie Reynolds. The song is featured in the film ``Tammy and the Bachelor'' and is nominated for an Academy Award.

1959- A headline in Billboard reads, "Rock and Roll Ain't Ready For The Ol' Rockin' Chair Yet." The story says rock & roll was losing popularity a year ago, but the record buyers now like Elvis Presley, Fats Domino and Lloyd Price along with newcomers, the Drifters, Everly Brothers and Ricky Nelson.

1959- Phil Phillips' "Sea Of Love" hits #2 on the pop charts.

1959---Top Hits

The Three Bells - The Browns

Sea of Love - Phil Phillips

Lavender-Blue - Sammy Turner

Waterloo - Stonewall Jackson

1960-Birthday of Calvin Edward “Cal” Ripken,Jr., former baseball player, born Havre de Grace, MD.

1961 - No. 1 Billboard Pop Hit: ``Wooden Heart (Muss I Denn),'' Joe Dowell. The song is a cover of a song Elvis Presley sang in the film ``G.I. Blues.''

1963- Little Stevie Wonder is the first artist to make the Number One position on the pop single chart, the pop albums chart and the R&B singles chart all at one time. In fact, nobody had made the pop single and album charts at the same time. The music from "Wonder World" is the album, "The Twelve Year- Old-Genius" and the single, "Fingertips, Part Two."

1963 -The Little League World Series is televised for the first time . With ABC's Wide World of Sports providing coverage of the championship game, Grenada Hills (CA) beats Stratford (CT), 2-1.

1963-After a couple of flop singles for smaller record companies, The Ronettes scored their only Top Ten hit with their first effort for Phil Spector, "Be My Baby". None of their other records, including "Baby I Love You", "The Best Part of Breaking Up", "Walking In the Rain" and "Is This What I Get for Loving You?" could crack the US Top 20.

1963-Darlene Love's biggest solo hit, "Wait Til' My Bobby Gets Home" enters the Billboard chart, where it will top out at #26. She had greater success when she sang for The Crystals, The Blossoms and Bob B. Soxx And The Blue Jeans.

1963-Stevie Wonder became the first artist ever to score a US #1 album and single in the same week. Wonder was at the top of the album chart with "Little Stevie Wonder / The 12 Year Old Genius" and had the #1 single with "Fingertips part 2", which was also the first ever live recording to lead the hit parade.

1964-- Taking him up on his telegram invitation to help out in any way he can in America, Beatles manager Brian Epstein meets Elvis Presley manager "Colonel" Tom Parker for the first time when they have lunch at the Beverly Hills Hotel.

1964- "Where Did Our Love Go?" by the Supremes topped the charts and stayed there for 2 weeks.

1966 - The U.S. premiere of the motion picture Help!, starring The Beatles, was held for thousands of moviegoers wanting to see the group’s first, color, motion picture. Their first film, A Hard Day’s Night, had been produced in black and white.

1967- Patti Harrison convinces her husband George and the rest of the Beatles to attend a lecture at the Park Lane Hilton given by Maharishi Mahesh Yogi. They go and send a note to him requesting a private audience. In the meeting, the Beatles offer themselves as disciples. He accepts and invites them to an indoctrination course for spiritual regeneration two days later. They attend along with Mick Jagger and his girlfriend Marianne Faithfull. Brian Epstein is invited but declines. Afterwards, John Lennon compares the experience as "going somewhere without your trousers."

1967---Top Hits

All You Need is Love - The Beatles

Pleasant Valley Sunday - The Monkees

Baby I Love You - Aretha Franklin

I’ll Never Find Another You - Sonny James

1967-Big Brother and the Holding Company, Bo Diddley,Bukka White, and Salvation Army Banned @ The SF Avalon Ballroom

Original Poster by Bob Fried

http://images.wolfgangsvault.com/images/catalog/thumb/FD077-PO.gif

1967-Keith Moon, drummer for the Who, drives his Lincoln Continental (not a Rolls Royce, as is often thought), into the swimming pool at the Holiday Inn in Flint, MI to celebrate his 21st birthday, earning the entire band a lifetime ban from the chain.

1967-DAY, GEORGE E. Medal of Honor

Rank and organization: Colonel (then Major), U.S. Air Force, Forward Air Controller Pilot of an F-100 aircraft. Place and date: North Vietnam, 26 August 1967. Entered service at: Sioux City, Iowa. Born: 24 February 1925, Sioux City, Iowa. Citation: On 26 August 1967, Col. Day was forced to eject from his aircraft over North Vietnam when it was hit by ground fire. His right arm was broken in 3 places, and his left knee was badly sprained. He was immediately captured by hostile forces and taken to a prison camp where he was interrogated and severely tortured. After causing the guards to relax their vigilance, Col. Day escaped into the jungle and began the trek toward South Vietnam. Despite injuries inflicted by fragments of a bomb or rocket, he continued southward surviving only on a few berries and uncooked frogs. He successfully evaded enemy patrols and reached the Ben Hai River, where he encountered U.S. artillery barrages. With the aid of a bamboo log float, Col. Day swam across the river and entered the demilitarized zone. Due to delirium, he lost his sense of direction and wandered aimlessly for several days. After several unsuccessful attempts to signal U.S. aircraft, he was ambushed and recaptured by the Viet Cong, sustaining gunshot wounds to his left hand and thigh. He was returned to the prison from which he had escaped and later was moved to Hanoi after giving his captors false information to questions put before him. Physically, Col. Day was totally debilitated and unable to perform even the simplest task for himself. Despite his many injuries, he continued to offer maximum resistance. His personal bravery in the face of deadly enemy pressure was significant in saving the lives of fellow aviators who were still flying against the enemy. Col. Day's conspicuous gallantry and intrepidity at the risk of his life above and beyond the call of duty are in keeping with the highest traditions of the U.S. Air Force and reflect great credit upon himself and the U.S. Armed Forces.

1968 - Lightning struck the Crawford County fairgrounds in northwest Pennsylvania killing two persons and injuring 72 others.

1968-Steppenwolf's "Born To Be Wild" hits #2 on the pop chart.

1969--ANDERSON, RICHARD A. Medal of Honor Rank and organization: Lance Corporal, U.S. Marine Corps, Company E, 3d Reconnaissance Battalion, 3d Marine Division. Place and date: Quang Tri Province, Republic of Vietnam, 24 August 1969. Entered service at: Houston, Tex. Born: 16 April 1948, Washington, D.C. Citation: For conspicuous gallantry and intrepidity at the risk of his life above and beyond the call of duty while serving as an assistant team leader with Company E, in connection with combat operations against an armed enemy. While conducting a patrol during the early morning hours L/Cpl. Anderson's reconnaissance team came under a heavy volume of automatic weapons and machine gun fire from a numerically superior and well concealed enemy force. Although painfully wounded in both legs and knocked to the ground during the initial moments of the fierce fire fight, L/Cpl. Anderson assumed a prone position and continued to deliver intense suppressive fire in an attempt to repulse the attackers. Moments later he was wounded a second time by an enemy soldier who had approached to within 8 feet of the team's position. Undaunted, he continued to pour a relentless stream of fire at the assaulting unit, even while a companion was treating his leg wounds. Observing an enemy grenade land between himself and the other marine, L/Cpl. Anderson immediately rolled over and covered the lethal weapon with his body, absorbing the full effects of the detonation. By his indomitable courage, inspiring initiative, and selfless devotion to duty, L/Cpl. Anderson was instrumental in saving several marines from serious injury or possible death. His actions were in keeping with the highest traditions of the Marine Corps and of the U.S. Naval Service. He gallantly gave his life in the service of his country.

By virtue of an act of Congress approved 24 August 1921, the Medal of Honor, emblem of highest ideals and virtues is bestowed in the name of the Congress of the United States upon the unknown American, typifying the gallantry and intrepidity, at the risk of life above and beyond the call of duty, of our beloved heroes who made the supreme sacrifice in the World War. They died in order that others might live (293.8, A.G:O.) (War Department General Orders, No. 59, 13 Dec. 1921, sec. I). 1969-Three-day Wild West Festival at Kezar Stadium with Janis Joplin, Turk Murphy, Jefferson Airplane, the Dead, Country Joe, Santana, Sly and the Family Stone and the Youngbloods.

1969-Arlo Guthrie's movie, Alice's Restaurant opens in New York and Los Angeles.

1969-John Lennon writes "Cold Turkey", a song about kicking his heroin addiction. He rehearsed the song all afternoon and recorded it that evening with the help of Ringo Starr and Klaus Voorman. When it was released, critics hated it and the BBC refused to play it, yet somehow it still made the UK Top 20 and the US Top 30.

1970- "Make It with You" by Bread topped the charts and stayed there for a week.

1971- Ernie Banks hits his final home run of his career as the Cubs beat the Reds, 5-4. Mr. Cub's 512th home run comes in the first inning off Jim McGlothin.

1971 -- Illinois State Attorney Edward Hanrahan and 13 police officers and police officials are indicted on charges of conspiring to obstruct justice by attempting to thwart criminal prosecution of 8 Chicago patrolmen who raided the apartment of Fred Hampton. This follows August 21 when Panther George Jackson is killed in San Quentin prison during an abortive breakout attempt (three prisoners and three guards are killed in the attempt. Six prisoners are subsequently put on trial for the incident (Fleeta Drumgo, David Johnson, Hugo L.A. Pinell (Yogi), Luis Talamantez, Johnny Spain, and Willie Sundiata Tate). Spain was convicted of murder. The others were either acquitted or convicted of assault. In a side to this story: white attorney Stephen M. Bingham is officially charged with murder in deaths of 2 convicts and 3 guards at San Quentin. Bingham is charged with smuggling guns to George Jackson used in a August 21, 1971 San Quentin breakout attempt. Bingham subsequently flees the country, returning in 1984 to face charges. He was acquitted of murder and conspiracy in 1986.

http://www.sfgate.com/cgi-bin/article.cgi?f=/chronicle/archive/2001/08/19/CM145760.DTL

1973 - No. 1 Billboard Pop Hit: ``Brother Louie,'' Stories.

1974- Santana's "Greatest Hits" LP enters the charts.

1975---Top Hits

Fallin’ in Love - Hamilton, Joe Frank & Reynolds

One of These Nights - Eagles

Get Down Tonight - K.C. & The Sunshine Band

Rhinestone Cowboy - Glen Campbell

1975 - Los Angeles Dodger Davey Lopes set a major league baseball record when he stole his 38th consecutive base. It was in the 12th inning of a game against the Montreal Expos that Lopes got his famous steal. The Dodgers still lost in 14 innings, 5- 3.

1978- Bruce Springsteen appears on the cover of "Rolling Stone."

1979- The Cars perform at New York's Central Park for an audience of a half million people

1981 - Mark David Chapman was sentenced from 20 years to life imprisonment for his self-admitted murder of former Beatle John Lennon.

1985 - Huey Lewis and The News reached the top of the charts with "The Power of Love". The song spent 2 weeks at #1 on the "Billboard Hot 100".

1983---Top Hits

Every Breath You Take - The Police

Sweet Dreams (Are Made of This) - Eurythmics

She Works Hard for the Money - Donna Summer

Love Song - The Oak Ridge Boys

1985-Dwight Gooden of the New York Mets became the youngest pitcher to win 20 games in a season. Gooden defeated the san Diego Padres, 9-3. He was 20 years, nine months and nine days old.

1987 - Autumn-like weather prevailed across the north central and northeastern U.S. Seven cities reported record low temperatures for the date, including Saint Cloud MN with a low of 37 degrees. Temperatures in Florida soared to 98 degrees at Pensacola and 99 degrees at Jacksonville. Thunderstorms produced heavy rain in the Southern High Plains Region, with 5.40 inches at Union NM, and 7.25 inches reported west of Anthony NM

1987- "Who's That Girl" by Madonna topped the charts and stayed there for a week

1987-Donny Osmond released "I'm In It For Love", his first single in 10 years. The record did not crack the Billboard Top 40, but Donny would be back with "Soldier Of Love", which reached #2 in 1989.

1987 - Autumn-like weather prevailed across the north central and northeastern U.S. seven cities reported record low temperatures for the date, including Saint Cloud MN with a low of 37 degrees. Temperatures in Florida soared to 98 degrees at Pensacola and 99 degrees at Jacksonville. Thunderstorms produced heavy rain in the Southern High Plains Region, with 5.40 inches at Union NM, and 7.25 inches reported west of Anthony NM.

1989-Pete Rose is banned from baseball for life by Commissioner Giamatti for gambling. The Reds' manager signs a five-page agreement with Giamatti in which he agrees to a lifetime penalty but does not admit to gambling on the national pastime.

1991- Tom Petty and the Heartbreakers' "Learning To Fly" hits #28 on the pop singles chart.

1991---Top Hits

(Everything I Do) I Do It for You - Bryan Adams

It Ain’t Over ’Til It’s Over - Lanny Kravitz

Fading Like a Flower (Every Time You Leave) - Roxette

You Know Me Better Than That - George Strait

1992- "End of the Road (From Boomerang)" by Boyz II Men topped the charts and stayed there for 13 weeks.

1996-The New York Yankees dedicated a monument to the late Mickey Mantle at Monument Park in Yankee Stadium. The new monument joined three others honoring Babe Ruth, Lou Gehrig and Miller Huggins. Mantle died August 13,1995.

1999- Mariner Ken Griffey Jr. joins Babe Ruth, Ralph Kiner, Duke Snider, Ernie Banks, Harmon Killebrew and Mark McGwire as the only players to hit 40 homers in four consecutive seasons.

2007-- Mark Lindsay of Paul Revere and the Raiders opens Mark Lindsay's Rock And Roll Cafe in his native Portland, OR.

2008-- Scoring at least one run in every inning, Hawaii wins the Little League World Series beating Mexico, 12-3. To advance to the championship game, Waipahu scored six runs in the last inning (sixth), overcoming a four-run deficit, to beat Lake Charles, Louisiana in the semi-finals, 7-5.

[headlines]

--------------------------------------------------------------

|

|

|

|

|

EXCERPTS |

|

|

|

Return Home

Poem of the Day

Books

Comments

Stores

Order Now

Links

|

|

Excerpts from:

"Baseball According to Lao-Tzu" by John W. Hart III, illustrations by Adam R. Factor

You can talk baseball, but not the Eternal Baseball.

Hall of Famers can be named, but not the superstar.

As the beginnings of time, it is nameless. As the beginnings of time, it is nameless.

As the creator of all things, it is named.

So, what is hidden, we inspect its inner essence.

And what is real, we look at its appearance.

The real, the eternal and the nameless, all flow

From the same source, but take different paths.

All is Poetry.

Baseball is Poetry.

When the world has the Tao, When the world has the Tao,

Outfielders race across a sea of green.

When the world is without,

Outfielders jake it on unimportant plays.

There is nothing worse than not knowing when to stop.

Only those who know when to retire

Will always have enough.

The Tao of Baseball is like an empty dish The Tao of Baseball is like an empty dish

That can never be filled up.

It feeds all and is endless.

It cleans pine tar off suspected bats.

It unifies all clubhouse squabbles.

It unites the fans.

It brings absolute harmony during the Seventh Inning Stretch.

Baseball is hidden and timeless.

Baseball is the Universe.

Baseball is a chocolate smile on a child's face.

Baseball is a businessman scouring the box scores during lunch break.

It is the father and mother of all things.

Pitchers who know batters are clever; Pitchers who know batters are clever;

Pitchers who know themselves have insight.

Those who complain show force.

Those who sit are truly strong.

When you know you have enough

You become rich.

It is those who play for the game

And not for the money

Are the ones who are truly rich.

|

|

|

|

, and

our Web Site

Copyright 2002 mear publishers |

|

[headlines]

--------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

[headlines]

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

[headlines]

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

[headlines]

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

http://www.weather.gov/

[headlines]

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

[headlines] |

![]()