Connect with Leasing News ![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

Thursday, August 8, 2013

![]()

Today's Equipment Leasing Headlines

Archives---August 8, 2000

Matsco Sold to Greater Bay Bank

Classified Ads---Collections

Pepperdine Private Capital Survey

"Alarming Low" Application-to-Loan Ratio

73% Small Businesses Optimistic about Economy

Report from OnDeck

New Hires--Promotions

Classified Ads---Help Wanted

Ken Green, Esq. Joins

Lawyers Against Evergreen Clause Abuse

Sales Makes it Happen by Steve Chriest

Financial Statements

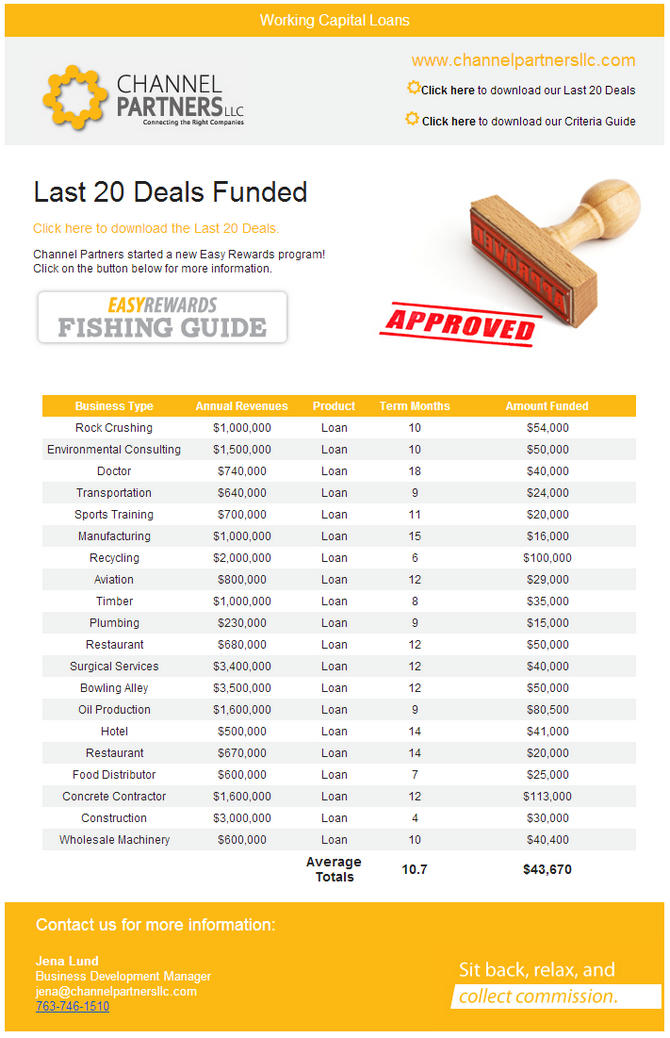

Channel Partners Last 20 Deals Funded

Tom McCurnin

Leasing News Advisor

Using Credit Cards to Improve Your Credit Score

by Blake Morrow

In TARP auction 19, Mo. bank hits Treasury hard

By Andy Pierce and Lindsey White

Ascentium Capital New Multi-Year Facility

to Support Growth Initiatives

Market Conditions Offer Growth Opportunities

in Canadian Financing and Leasing Industry

AIGCAF provides $100 million loan

The Alta Group and CapSol Management Consultants

Add Two Senior Directors, Expanding Services in China

Classified ads—Syndicator

Rhodesian Ridgeback/Labrador Retriever

Pacific Palisades, California Adopt-a-Dog

News Briefs---

Balboa Capital Survey Shows Small Business Owners

Have Increased Confidence And Higher Revenues In 2013

Resource Capital's CEO Discusses Q2 2013 Results

Legal Costs Up at 50 Percent of Companies

Companies may rearrange leases to keep off balance-sheet

Kutcher: Steve Jobs Cared About Consumers First, Not Shareholders

Lamborghini introduces 562-hp Gallardo

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

You May have Missed---

SparkPeople--Live Healthier and Longer

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send to a colleague. Spread the news.

Also ask them to join

our mailing list or bookmark our site.

We are free

[headlines]

--------------------------------------------------------------

Archives---August 8, 2000

Matsco Sold to Greater Bay Bank

Matthew Shieman, President and Chief Executive Officer of Matsco, who will continue to lead Matsco's operations as part of Greater Bay Bancorp, said, "By joining forces with Greater Bay Bancorp, Matsco will have the ability to expand its capabilities in providing financial products and services to the dental and veterinary markets while also allowing us to focus on the equipment leasing needs of Greater Bay Bancorp's clients located in the San Francisco Bay Area."

Matt Shieman (“Matt’s Company”)

(A division from the leasing company started by his father Fred Shieman, who died tragically in an airplane accident and left the business for his son to continue. Matt grew it into a major entity, then running into the changing securitization market, sold to Greater Bay Bank)

Matsco offers a complete range of finance products and services to meet the needs of dentists and veterinarians throughout their professional career. The Company is endorsed exclusively by the American Dental Association (ADA) and California Dental Association (CDA). The principal financial products offered by Matsco include practice start-up financing, practice expansion financing, practice acquisition financing, working capital and financing for retirement planning. These products are structured as either equipment leases or loans.

Today

Matt Shieman

Chairman at Blackhawk Modifications

www.linkedin.com/pub/matt-shieman/4/203/925

"Matt is chairman of the board of Blackhawk Modifications, the leading global provider of products and services that improve a wide variety of single- and twin-engine turboprop aircraft. He brought decades of experience in commercial financial management and business planning when he helped to create Blackhawk in 1999. Serving initially as a corporate director with ownership interest, in 2005 he took a more active role in building strategic relationships with Blackhawk’s supplier network and investment partners. The following year, he accepted more management responsibilities as Blackhawk’s chairman of the board and continues serving the company in that role today."

http://www.bhci.aero/about-us/bio/matt-shieman/

In a move later by Greater Bay Bank, reportedly Matt Shieman was relieved of his position. Keith Wilton, Executive VP, Greater Bay Bank, from his office in Walnut Creek, California, head a committee of Matsco employees who were in charge of running the Matsco Companies in Emeryville, California. Wilton took the job from Dave Hood, who retired. Wilton has other bank responsibilities, such as the SBA program, a bank spokesman told Leasing News.

Wells Fargo purchased Greater Bay Banks May 7, 2007 for $1.5 billion.

http://www.leasingnews.org/archives/May/202007/05-07-07.htm#sold

October 9, 2010 at the American Dental Association meeting it was announced Matsco would change its name to Wells Fargo Practice Finance, which exists today (https://practicefinance.wellsfargo.com/ )

March 23, 2003 Archive Story:

www.leasingnews.org/archives/March%202006/03-23-06.htm#matsco

Pictures from the Past—December, 1978-Fred Shieman

http://www.leasingnews.org/pictures_past/past_10-22-04.htm

[headlines]

--------------------------------------------------------------

Classified Ads---Collections

(These ads are “free” to those seeking employment

or looking to improve their position)

Long Grove, Illinois

Financial services professional with a proven track record of positively impacting corporate finances through effective management of cash flow, collections and financial assets. Strategic thinker capable of analyzing financial issues and processes in order to implement changes that improve efficiency and profit margins. Well-versed in all aspects of corporate financial affairs. roborgaard@aol.com | Resume

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

[headlines]

--------------------------------------------------------------

Pepperdine Private Capital Survey

"Alarming Low" Application-to-Loan Ratio

The Pepperdine University's Graziadio School of Business and Management and Dun & Bradstreet launched the Pepperdine Private Capital (PCA) and Private Capital Demand (PCD) index, a survey of 1,948 businesses from April 4 to April 26,2013. Results found 59% of respondents reporting current business environment as difficulty to raise new business financing. Only 33% of those who applied for business loans for a bank were successful and had their loans approved.

The previous quarter results show that about 54% of private businesses attempted to get a bank loan in the previous year and 40% of them were successful. Today, 33% of businesses were successful in securing a bank loan. The application-to-loan ratio the report stated is "alarmingly low."

Pepperdine Second quarter 2013 survey (5 pages)

http://leasingnews.org/PDF/PepperdinePCA_Q2_2013.pdf

Pepperdine 2013 Survey (42 pages)

bschool.pepperdine.edu/Pepperdine-SMB-Economic-Forecast-2013-Dataset.pdf

[headlines]

--------------------------------------------------------------

73% Small Businesses Optimistic about Economy

Report from OnDeck

A small business survey by OnDeck Main Street Pulse Report reveals "... that 73 percent of small business owners believe the economy is getting better and want to grow their business. One in five small businesses have increased head count over the last six months and two in five plan to in the next six months.

Noah Breslow

CEO, OnDeck

“Our Main Street Pulse Report indicates that the majority of small business owners are optimistic about the economy, but have been stalled by traditional lenders,” said Noah Breslow, chief executive officer, OnDeck. “Despite strong demand for financing, small businesses are struggling to secure the capital they require to grow. Small businesses are a critical component of our economy, and the need for more funding alternatives like OnDeck has become increasingly apparent."

The report states: "Of those who applied for capital, 64 percent were unable to secure any type of financing and 82 percent were denied financing by their bank. Furthermore, small business owners are self-selecting out of the application process: two-thirds of business owners who didn’t apply for funding chose not to because they believed they would be denied by banks, not because they didn’t need capital."

Additional findings from the 2013 Main Street Pulse Report include:

- Small businesses have a median borrowing need of only $44,000

- 84 percent of small business owners use funding for

growth capital

- 29 percent for expansion and facility upgrades

- 16 percent for inventory and equipment purchases

- 39 percent for working capital

- Top 3 small business challenges:

- Access to capital from traditional lenders

- Growing sales

- Navigating taxes

- Top methods for attracting more customers:

- Word of mouth marketing

- Natural website search

- Email marketing

[headlines]

--------------------------------------------------------------

New Hires--Promotions

Tim Bruckner appointed Arizona Regional Manager, Commercial Banking, for BMO Harris Bank. "Bruckner, who most recently held a leadership position with the Arizona team, will now focus on leading the entire team and growing the business throughout the Southwest...Over the past several months, Bruckner has been acquiring key talent to help bolster the Arizona team. He has hired lenders with experience in technical underwriting, dealer-sponsored structured finance, and industry-specific skills including healthcare, transportation and food distribution." Previously he was SVP, M&I Bank(June, 2006-September, 2012), product head, Banc of America Leasing (2003-2006). Creighton University, MBA, Finance (1993 – 1995).

www.linkedin.com/pub/tim-bruckner/7/37/933

Joseph J. Fobbe was named senior vice president, originations at Cole Taylor Business Capital, working out of their Chicago, Illinois office. Previously he was managing director, Regions Business Capital (March, 2008-2013), past president, Turnaround Management Association (2000-2010), regional marketing manager, PNC Business Credit (May, 2000-May, 2007), v.p., First Bank/U.S. Bank (1996-1998), avp, NBD Bank (now Chase) 1992-1996. University of Minnesota - Carlson School of Management, MBA, Finance (1991 – 1992), Activities and Societies: Class Representative -St. Cloud State University Herberger School of Business ,BS, Finance/Mgmt.

www.linkedin.com/pub/joe-fobbe/13/690/637

T. James "Jim" Giordano named to head the new regional sales office in Walnut Creek, California for Cole Taylor Business Capital. He previously was vice-president, Union Bank of California (April, 2009-August, 2013), senior vice president, Guaranty Business Credit (January, 2001-January, 2006), vice president, Finova Capital (January, 1995-January, 2001), vice president, GE Capital, Corporate Finance Group (May, 1994-November, 1995), vice president and loan officer, Sanwa Bank California (January, 1992-January, 1994), vice president and marketing officer, Bank of America/Security Pacific Bank (January, 1990-January, 1992) regional vice president-marketing, Barclays Business Credit (1983-1990). San Diego State University-California State University, BS, Business (1975 – 1979) Activities and Societies: Major in Business Administration (emphasis Marketing) and Minor in Physical Education. Over 3.3 G.P.A.

www.linkedin.com/pub/jim-giordano/13/998/140

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

Los Angeles, California www.maximcc.com |

|

|

1 year experience preferred, salary/benefits |

| www.cflbc.com

Commercial Finance & Leasing Bank of Cardiff, Inc, a finance lender licensed pursuant to the California Finance Lenders Law, license #603G469 |

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

Ken Green, Esq. Joins

Lawyers Against Evergreen Clause Abuse

Kenneth C. Greene

Hamrick & Evans, LLP

Suite 2200

10 Universal City Plaza

@ 111 Universal Hollywood Drive

Universal City, CA 91608

Tel: 818.763.5292 ext. 114

Fax: 818.763.2308

Email: kgreene@hamricklaw.com

(Ken was involved in the formation of Leasing News and

represented it (pro bono) in the early days.)

Ken's Biography:

http://www.leasingnews.org/Advisory%20Board/Greene_Law.htm

Eleven Lawyers Against Evergreen Clause Abuse

http://leasingnews.org/archives/Aug2013/8_06.htm#lawyers

[headlines]

--------------------------------------------------------------

Sales Makes it Happen by Steve Chriest

Financial Statements

As a sales professional, there is at least one sure-fire way to increase your value to your company and to any organization – learn to read and understand financial statements.

An outsider might think that surely everyone in the equipment finance business would know all about financial statements, but that doesn't seem to be true. I am told, in fact, that a great many salespeople in the finance industry don't know much, if anything, about financial statements.

I think most managers would agree that many equipment finance salespeople don't need to become experts in reading financial statements. Unless a salesperson is coincidentally involved in structuring transactions that requires expertise in financial analysis, it may not be necessary to become an expert in analyzing financials. Conversely, understanding the basics of financial statements can't hurt professionally, and can help salespeople personally and professionally.

In keeping with my perspective that people change behaviors only when they perceive something beneficial in it for them to do so, here is my short list of the benefits to leasing salespeople of learning to read and understand financial statements:

The ability to read and understand financial statements will make you appear smarter.

-

You will build credibility in your organization with your managers, credit analysts and senior managers.

-

You will build credibility with your customers as you demonstrate through analysis that you truly understand their business.

-

You will save yourself gobs of time as you learn to reject deals that you know will waste the time of credit analysts and will lead to frustration for everyone.

-

You will gain confidence and independence when making personal investment decisions.

From a selfish perspective, assisting credit analysts with an educated point of view on a deal, or saving them time by discarding deals that don't meet the prescribed credit approval parameters, will naturally position you in the eyes of the credit analysts as a professional who cares about their time and workload. Don't be surprised when most analysts are willing to listen to you when you want to present a deal that doesn't quite fit the credit box, but may deserve consideration based on other criteria.

Finally, achieving some level of expertise in understanding financial statements can actually be fun. When you understand that all businesses, sooner or later, suffer from commoditization and become white elephants, that “profit” isn't the end-game of business, but is instead the ultimate cost of staying in business. Without profits, and real free cash flow, a company is unable to continue the investments it must make to stay competitive. When you reach this point, you begin to look at a company's financials with a different perspective. You may even come up with an idea no one else has thought of for keeping a business profitable or helping a business out of trouble. You then can not only perhaps help the customer financially with a lease or loan, but become a valuable advisor and make a good business friend.

If you are truly looking for a way to become a more valuable resource to your company, and to your customers, learn about financial statements. There are more resources than ever to help you learn--- on line programs as well as books and webinars available---and you will profit professionally and personally!

About the author: Steve Chriest is the founder of Selling UpTM (www.selling-up.com), a sales consulting firm specializing in sales improvement for organizations of all types and sizes in a variety of industries. He is also the author of Selling The E-Suite, The Proven System for Reaching and Selling Senior Executives and Five Minute Financial Analyst, Basic CREDIT & Analysis Tools for Non-Accountants. He was the CEO of a very successful leasing company and executive at a major company. You can reach Steve at schriest@selling-up.com.

Los Angeles, California www.maximcc.com |

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Tom McCurnin

Leasing News Advisor

Leasing News Legal Editor

Mr. McCurnin has written over 100 articles for Leasing News, as well as for many years contributed to other media, including major newspapers as well as bank and law publications. He also has represented and appeared for Leasing News as pro bono attorney for several years. He is the number one legal consultant for news stories and general business matters serving as our Paladin.

Tom McCurnin

Barton, Klugman & Oetting

350 South Grand Ave.

Suite 2200

Los Angeles, CA 90071

D irect Phone: (213) 617-6129

Cell (213) 268-8291

Fax: (213) 625-1832

Email: tmccurnin@bkolaw.com

www.bkolaw.com

Recent Trial Experience:

- Successfully defended major California bank on midnight deadline case

- Successfully defended major California bank on forged endorsement claim

- Prosecuted RICO action on behalf of major national commercial finance company recovering over $1 million dollars

- Successfully defended real estate trust on consumer notice issue

- Successfully defended major California manufacturer on products liability action

- Prosecuted numerous actions on behalf of equipment lessors

- Defended Trade Secret Case

- Defended Usury Claim

Before becoming a principal partner with Barton, Klugman & Oetting, he worked as an inside attorney for Rockford Industries and American Express Business Finance.

He is a member of the State Bar of California; Federal Bar Association; The Association of Trial Lawyers of America; Financial Lawyers Conference-Los Angeles; Independent Bankers Association; California Bankers Association; Los Angeles Commercial Law Committee.

Law School: Drake University (J.D., 1975)

College: University of Iowa (B.A., 1972)

He is an accomplished musician, world traveler, as well as active in animal rescue, particularly Labrador Retrievers. His main hobbies are Class V White Water River Rafting, Wilderness Canoeing and Camping, Woodworking and Home Building, Historic Home Renovation, Muscle Car Restoration, Labrador Retriever Rescue Foundation.

[headlines]

--------------------------------------------------------------

Using Credit Cards to Improve Your Credit Score

by Blake Morrow, ukbeaurtyreview.com

An excellent credit score is a sign of responsible financial management. Mortgages, credit cards, auto loans and even cell phone services add depth to an individual’s credit history and can increase a credit score. Scores influence whether a loan or line of credit is approved, the higher the score the better the chance of securing a mortgage, loan or credit card.

One common misunderstanding of establishing excellent credit is that zero balances on credit accounts will raise a score. But that’s just not the case. Lenders want to know that you can actually manage your account and, as grand a gesture is of paying off the balance every month, it doesn’t reflect an ability to handle debt. So, even if you have the financial stability to pay the balance off each month, allow one or two accounts to carry a small balance to increase the visibility of responsible money management.

Good credit comes from handling a variety of loans and accounts. It’s impacted by how you handle fixed payments, like your car and mortgage payments. But when it comes to credit cards, there are several points that need to be addressed to help secure a healthy score and history:

Inactive Credit Cards – Should cards that are no longer in use be closed? The simple answer is ‘no’. An inactive card has no negative impact by sitting in a desk drawer; plus, older accounts have more value than new ones. In fact, if you cancel a credit card, you may see a drop in your score because your total credit limit will be reduced… an important factor in determining your credit score when compared to total credit card balances outstanding. You want to keep your allowable credit as high as possible, which means inactive cards should remain open. . [NOTE: potential credit grantors now look at cards with zero balances and most recent activity to gauge whether they are being used or sitting in the drawer…with potential negative inferences. Editor.]

Opening New Accounts – Opening a new credit card account does not have a negative impact on your score – unless you apply too often. Every time you apply for a new credit card or loan, the application generates a hard inquiry on your credit report. Too many inquiries may indicate financial trouble and result in the denial of your application and raise your credit score.

An Important Balancing Act – Carrying a balance on your account is not all bad, unless you are nearing the credit limit. You will see a negative effect on your score, if you max out the balance. You should never use more than 50 percent of your credit limit; a lower percentage is always better. For example, if your credit limit is $2,000, you shouldn’t have a balance of more than $1,000.

Credit Increase: Pro or Con – Asking for an increase on your credit limit may temporarily lower your score. The review process that occurs prior to an increase in your credit line may cause a dip in your score. However, an increase in your credit limit may raise the ratio of available credit to debt and raise your score.

Keep Them Active – Financial experts suggest that consumers use every active account at least once every six months. It only takes a small purchase to keep an account open and maintain the credit limit.

The importance of maintaining credit card debt responsibly cannot be understated. Late or missed payments are an absolute deal breaker when looking to earn an excellent credit rating. More than any other type of loan, credit cards reap the biggest boost to your score when managed well.

((Please click on ad to learn more))

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

In TARP auction 19, Mo. bank hits Treasury hard

By Andy Pierce and Lindsey White

A Special Report from SNL Financial

The U.S. Treasury took the biggest hit to date in its 19th round of TARP auctions, led by a sizable loss on a Missouri bank's securities.

After scoring a premium in the past few auctions, the Treasury sold its TARP positions in five financial institutions for an aggregate discount of 60.29%. Prior to this, the Treasury's biggest hit was in auction 12, when it sold its TARP securities at an aggregate discount just shy of 36%.

In auction 19, the Treasury lost $195.93 million on the principal amount of the securities auctioned, before factoring in dividends. This is by far the largest loss in any of the auctions. The government lost $184 million on the principal of First Banks Inc.'s class C cumulative perpetual preferred stock alone — by far the highest loss on a single security in the auctions.

The government only sold about 96% of Clayton, Mo.-based First Banks' class C stock in the auction, due to the fact that it did not receive sufficient bids above the minimum price. "Treasury set a minimum price for each security as part of the auctions in order to protect taxpayer interests," the Treasury said in a news release.

This is not the first time the Treasury has failed to sell all of a bank's securities at auction. In round 14, the Treasury only sold about 96% of the series B preferred stock it held in Aurora, Ill.-based Old Second Bancorp Inc., at a 64.75% discount. In the following auction, the government sold the remaining 4% of Old Second Bancorp's TARP preferred securities at a discount of 62.3%.

Hildene Capital Management portfolio manager Michael Nichol noted that regulators limit the amount of shares any single bidder can purchase of companies where TARP makes up a large percentage of overall equity. In the case of First Banks, that limit was around 99,000 shares per bidder. "I think that was a big reason why this traded at the minimum, because it's going to be tough for the Treasury to get enough bidders in there to bid at that level," Nichol said.

There were also limits on the amount of Community Pride Bank Corp. stock a bidder could purchase in auction 19, Nichol said. Despite such limits, Community Pride was the only bank in the auction to fetch a premium.

Both series of Universal Bancorp's fixed-rate cumulative perpetual preferred stock in the auction sold at a small discount. President and CEO William McNeely said the results came as no surprise. He noted that Bloomfield, Ind.-based Bloomfield State Bank's performance has improved significantly. Although the bank operates under a consent order, holding company Universal Bancorp has never missed a TARP dividend payment.

"We've been in compliance for better than a year now; the trends are all in the right direction; we think that hopefully after our next safety and soundness examination we'll be released from it. But that's not in my hands to determine, unfortunately," McNeely told SNL.

Universal Bancorp used EJF Capital as a designated bidder in the auction. According to McNeely, EJF Capital successfully bid on portions of the bank's series A and B stock.

EJF Capital also bid on shares of Newport News, Va.-based Virginia Co. Bank, according to the bank's president and CEO, Mark Hanna. Hanna told SNL that Virginia Co. Bank's designated bidder, an investor group that included EJF Capital, successfully bid on the bank's shares. "A group of investors won the bid, and we have the opportunity to perhaps repurchase those assets from those investors at a later date," he said.

Both series of Virginia Co. Bank's preferred stock sold at a discount north of 38%. "Our shares are noncumulative, which means essentially, if we miss a dividend we don't have to go back and repay it. And we've got a relatively small issuance," Hanna said. "So we didn't think that it was the most desirable investment type. A lot of the institutional investors weren't interested in the noncumulative shares, so that probably held us down a little bit."

The other bank in the auction with noncumulative shares on the block also sold at a steep discount. Securities of Doraville, Ga.-based First Intercontinental Bank sold about 49% below par.

Hanna described the auction process as a lengthy one. Starting around August 2012, the company tried several times to opt out of the Treasury's pooled auction process. "We weren't successful until this recent one, and then of course our assets went to the auction," he said. At that point, he said, everything ran smoothly. "We're excited at the way it took place and excited about the opportunity that's in front of us," he said.

With the auctions out of the way, Hanna said, Virginia Co. Bank is working on a capital raise. "It would come in the form of selling common shares," he said, adding that these plans are still being worked on in the boardroom. If the capital raise is successful, Hanna believes the company could redeem the TARP shares "at a fairly substantial discount."

Universal Bancorp's McNeely said the Treasury was "very helpful" during the auction process. "I'm not surprised that the government wanted to get out of the business," he said. "[TARP] served a purpose, and our debt is now in the hands of another person. That's fine, and we intend to take care of it and make sure they get paid."

![]()

|

[headlines]

--------------------------------------------------------------

##### Press Release ############################

Ascentium Capital New Multi-Year Facility

to Support Growth Initiatives

KINGWOOD, TX, – To support the company's growth strategy, Ascentium Capital LLC announced today the addition of another financial firm, JP Morgan Chase Bank, to its existing lender group which also includes Bank of America, Credit Suisse and Bank of Montreal/Harris Bank. These strategic, multi-year credit facilities will help drive short and long-term growth initiatives.

Tom Depping

CEO, Ascentium Capital

"Our strong operating performance enables us to continue to diversify our funding sources with leading financial organizations,” stated Tom Depping, Chief Executive Officer of Ascentium Capital. “This allows for significant flexibility to optimize our leadership position in delivering flexible financing to small businesses acquiring equipment assets. The strength and stability of these funding sources further enhance our ability to pursue and seize market opportunities."

Ascentium Capital recognizes the unique capital requirements of small businesses and is an expert advisor that specializes in providing companies with innovative equipment financing solutions. The finance programs benefit manufacturers and distributors as well as direct financing options for businesses. The company serves multiple industries nationwide and the new credit facility will allow for strategic expansion.

Ascentium Capital, as a direct lender, specializes in providing equipment financing solutions that drive growth and profit for small businesses. The company is backed by the strength of Vulcan Capital, the leading private investment firm of Paul G. Allen, and by LKCM Capital Group, LLC, the alternative investment vehicle for Luther King Capital Management, an SEC registered investment advisory firm. More information about Ascentium Capital is available at AscentiumCapital.com.

#### Press Release ##############################

|

[headlines]

--------------------------------------------------------------

#### Press Release ##############################

Market Conditions Offer Growth Opportunities

in Canadian Financing and Leasing Industry

- A Perfect Time To Lease

- Growth Potential in Renewable Energy and in the Cloud

- Expertise Through Market Cycles

NEW YORK---The Canadian financing and leasing industry is seeing continued growth with new opportunities on the horizon, according to Blake Macaskill, Managing Director of CIT Canada at CIT Group Inc., (NYSE: CIT) cit.com, a leading provider of financing to small businesses and middle market companies. This view and others, are presented in “Equipment Financing and Leasing Opportunities in Canada,” (cit.com/macaskill) the latest in a series of in-depth executive video Q&As featured in the award winning CIT Executive Insights video series (cit.com/executiveinsights).

Blake Macaskill

Managing Director, CIT Canada

ca.linkedin.com/in/blakemacaskill

A Perfect Time To Lease

“We’ve always thought leasing is a great alternative to purchasing, but I don’t think there’s ever been a better time in the market to lease than right now,” explains Macaskill. “Interest rates are at an all-time low, so customers get the benefit of financing their equipment at low rates.”

Growth Potential in Renewable Energy and in the Cloud

The renewable energy and technology sectors continue to experience steady growth and are well positioned to benefit from leasing, Macaskill comments, “There’s been a lot of activity recently in renewable energy, both wind and solar. That’s a focus for CIT right now because it aligns extremely well to our expertise.”

He continues, “The other spot that we see some value in is technology finance, the whole idea of cloud financing and how to best go at the market and finance that. I think the financial services organizations that figure that out quickly are going to be the ones that provide the best value to the market.”

Equipment Financing and Leasing Market Needs To Evolve

Commenting on what’s on the horizon for the financing and leasing markets in Canada, Macaskill comments, “The equipment financing and leasing market in Canada needs to evolve. I think that the market has looked at it fairly consistently for decades, which was based on traditional asset based lending, where the asset was the security.

“I think the most successful companies, and the ones that are going to bring the most value to the marketplace, are going to start looking at the total finance solution, including services, in addition to equipment finance. The companies that can do that are the companies that are going to win."

Expertise Through Market Cycles

Canada has long been viewed as a stable banking environment and now more than ever local banks are looking to do business. “Some people see those banks entering the market as a challenge,” comments Macaskill. “We really see it as an opportunity. I think our customers and our partners are going to benefit from that long-term expertise when everybody else has come and gone.”

About CIT Canada

CIT Canada provides lending, leasing and other financial and advisory services to the small business and middle market sectors, with a focus on specific industries, including: Chemicals, Communications, Energy, Entertainment, Gaming, Healthcare, Industrials, Public Sector debt, Information Services & Technology, Restaurants, Aerospace, Retail, Sports & Media and Transportation & Construction. It creates tailored equipment financing and leasing programs for manufacturers, distributors and product resellers across industries that are designed to help them increase sales. Through these programs, it provides equipment financing and value-added services. cit.com/Canada

About CIT

Founded in 1908, CIT (NYSE: CIT) is a bank holding company with more than $35 billion in financing and leasing assets. It provides financing and leasing capital and advisory services to its clients and their customers across more than 30 industries. CIT maintains leadership positions in small business and middle market lending, factoring, retail finance, aerospace, equipment and rail leasing, and vendor finance. CIT also operates CIT Bank (Member FDIC), its primary bank subsidiary, which, through its online bank BankOnCIT.com, offers a suite of savings options designed to help customers achieve a range of financial goals. cit.com

### Press Release ############################

|

[headlines]

--------------------------------------------------------------

### Press Release ############################

AIGCAF provides $100 million loan

![]()

PLANO, TX,– AIG Commercial Asset Finance (AIGCAF) and its affiliates have provided a $100 million senior secured term loan to Pratt Paper (LA), LLC (Pratt), a wholly-owned subsidiary of Pratt Industries, Inc. (Pratt Industries). The loan proceeds were used to refinance existing term debt and to provide additional working capital.

Pratt Industries is the fifth largest corrugated packaging company in the US and it is the world’s largest, privately-held 100% recycled paper and packaging company. The company has more than 4,000 highly-skilled, green-collar employees dedicated to the environment and to sustainability. Headquartered in Conyers, Georgia, Pratt was founded in the US more than twenty years ago. Since then, the company has shown dramatic growth in production and revenues. With sophisticated manufacturing facilities in more than twenty states, Pratt’s paper mills recycle more than six million pounds of recovered paper each day.

Gary Byrd, President of Pratt Holdings, (Director of MidTown Bank) says that Pratt Paper has long standing relationships with AIG through its sister companies operating in Australasia.

“We have built strong and mutually beneficial relationships with several of AIG’s international insurance companies and we’re certain that we can build a similar relationship with AIGCAF. In particular, we appreciate the responsiveness and broad finance expertise that was demonstrated by AIGCAF as it quickly reviewed our initial request and moved promptly to closing and funding.”

Colin Myer

AIGCA VP Direct Originations

AIGCAF’s Vice President of Direct Originations, Colin Myer, said that AIGCAF’s extensive experience in providing structured financing to capital intensive industries contributed to successfully closing the transaction. “Our initial discussions with Pratt’s senior management revealed that they had a unique structuring request and a very limited timeframe to accomplish their objectives. We quickly assembled a highly experienced deal team which included AIGCAF’s structuring, credit and legal personnel. By dedicating the team solely to Pratt’s request, we were able to work closely with the company to ensure that we were able to provide Pratt with a solution that fully met the company’s needs for a prompt response and a tailored structure.”

AIG Commercial Asset Finance (AIGCAF) is a wholly-owned affiliate of American International Group, Inc. AIGCAF is a leading provider of secured and unsecured corporate, project, equipment, and select commercial real estate loans to investment grade companies in a variety of industries including utilities, manufacturing, transportation, healthcare, and high tech. Target customers are located in the U.S., Canada and select international markets.

#### Press Release #############################

[headlines]

--------------------------------------------------------------

#### Press Release #############################

The Alta Group and CapSol Management Consultants Add Two Senior Directors, Expanding Asset Finance Consulting Services in China

RENO, Nev. and BEIJING, China,– The Alta Group, a global consultancy focused on equipment leasing and asset finance, today announced that two new senior directors have joined its firm in China, CapSol Management Consultants, to expand advisory services in the region.

Yankai Qu will work as managing director of professional development in China. Active in China’s equipment finance and leasing industry since its earliest days in 1984, Qu is the industry’s principal advocate before policymakers, regulators and standard setting bodies. He served as the full-time president of China Leasing Association from June 2007 to May 2013.

Zhiping Zhang will work as general legal counsel of legal support services in China. A full-time attorney, she has focused on China’s leasing industry for more than 20 years, working closely with regulators and directly contributing key policies and regulations. In addition to serving with The Alta Group, Zhang is the chief attorney for Beijing Filong Law Firm.

"The Alta Group has been active in China for more than 15 years, providing consulting, M&A, and professional development services. Now, increasing numbers of clients are transacting business in China, and increasing numbers of manufacturers and investors in China are going global," said John C. Deane, CEO of The Alta Group.

"China’s leasing industry has experienced significant growth during the last five years, and we are expecting the industry to triple in size over the next five,” added Jason Zhou, managing partner of CapSol Management Consultants and senior managing director of The Alta Group in the Greater China Region. “We are helping China’s equipment manufacturers and leasing companies expand business globally, and also helping multi-national companies grow in the unique China market."

To contact Zhou, email jason.zhou@capsol.com.cn, jzhou@thealtagroup.com or call +86 10 8478 3636, ext 818.

About The Alta Group

The Alta Group is the leading global consultancy focused on equipment leasing and asset finance. Since 1992, Alta has represented equipment leasing and finance companies, financial institutions, manufacturers and service providers, offering management consulting and expertise in global market entry, vendor and captive finance, professional development, legal support services, asset management and mergers and acquisitions. For more information on the group’s services in North America, Latin America, Europe, the Middle East and Africa, China, and Asia-Pacific, please visit http://www.thealtagroup.com.

About CapSol Management Consultants

CapSol Management Consultants is the leading consulting firm focused on the China asset finance industry, providing management consulting, financial advisory and technology & operational services to leasing and finance companies, investment professionals and equipment manufacturers. Founded in 2007, CapSol has more than 40 professionals in China who work closely with international consultants in The Alta Group. For more information, please visit http://www.capsol.com.cn

### Press Release ###############################

|

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Rhodesian Ridgeback/Labrador Retriever

Pacific Palisades, California Adopt-a-Dog

Sadie

Female

Seven Years Old

Spayed

Up-to-date with routine shots

House trained

Primary color: Apricot or Beige

Coat length: Short

“Sadie LOVES dogs, cats and people (She even tried to play with large porcelain animal figurines)!She has a heart so adorable she's never been heard making a growl. Sadie is also gentle, smart and playful. She is currently being fostered by someone who is active in the rescue community and who also takes care of an elderly lady whose house it is where Sadie is living. Sadie likes dogs, cats and people.

“Even though Sadie has been well taken care of she has spent too much time without consistent companionship. Also, the elderly lady who owns the home is eventually moving to an assisted living community. Ideally, Sadie's forever home would have another dog or cat, someone who comes home at least every 6 hours and plenty of family time.

“Sadie is approximately 7 yrs. old and could really use some consistent connection as she moves into her senior years. She LOVES to play fetch, she loves to play with other dogs, she's got a great personality and has wonderful positive energy.

“This is the first real attempt to find her a forever home and whoever takes her will certainly be getting a bright light in their life! Please contact Scott at 323-333-1464.”

Indie Rescue Team, Pacific Palisades, CA

818 290 3844

stevespiro1@yahoo.com

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

Balboa Capital Survey Shows Small Business Owners

Have Increased Confidence And Higher Revenues In 2013

http://www.sfgate.com/business/press-releases/article/Balboa-Capital-Survey-Shows-Small-Business-Owners-4715836.php

Resource Capital's CEO Discusses Q2 2013 Results

http://seekingalpha.com/article/1613622-resource-capitals-ceo-discusses-q2-2013-results-earnings-call-transcript?source=google_news

Legal Costs Up at 50 Percent of Companies

http://www3.cfo.com/article/2013/8/legal_general-counsel-alternative-dispute-arrangement-fee-structure-contingency-fee-

Companies may rearrange leases to keep off balance-sheet

http://www.accountancyage.com/aa/news/2287403/companies-may-rearrange-leases-to-keep-off-balancesheet

Kutcher: Steve Jobs Cared About Consumers First, Not Shareholders

http://www.siliconbeat.com/2013/08/07/kutcher-steve-jobs-cared-about-consumers-first-not-shareholders/

Lamborghini introduces 562-hp Gallardo

http://blog.sfgate.com/topdown/2013/08/05/lamborghini-introduces-562-hp-gallardo/

[headlines]

--------------------------------------------------------------

--You May Have Missed It

A Mob Tour of Boston

http://www.boston.com/travel/boston/mob/

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

Oatmeal Pancakes

http://recipes.sparkpeople.com/recipe-detail.asp?recipe=356768

[headlines]

--------------------------------------------------------------

![]()

Baseball Poem

Your 95 MPH Fastball Won't Get You In The

Draft Anymore

by Tim Peeler

Like a 1400 on your SAT won't get you into Harvard

And American Express will continually turn you down

Because your salary goes up slower than their expectations.

Who will get through the traffic jam?

Who will grow the nerves to win the new game?

Who will sop up the spoils, raise a toast in the ruins?

Let me write one tremendously long line like the horizontal

bar at the high jump pit---

See how I fail, even at this?

But my failure is merely a failure of margins,

And your 95 MPH fastball is nothing more than a metaphor

These days.

Tim Peeler in “Waiting for Godot's

First Pitch” More Poems from Baseball

published by McFarland and Company

[headlines]

--------------------------------------------------------------

Sports Briefs----

Tiger, Phil share PGA spotlight

http://espn.go.com/golf/pgachampionship13/story/_/id/9544463/tiger-woods-phil-mickelson-sharing-pga-championship-spotlight-golf

Fantasy Football Rankings 2013: Quarterback Rankings

http://www.sbnation.com/fantasy/2013/8/7/4596542/fantasy-football-rankings-2013-quarterback-rankings-aaron-rodgers-drew-brees-peyton-manning

49ers-Broncos: Exhibition opener or Super Bowl preview?

http://www.contracostatimes.com/49ers/ci_23815858/is-san-francisco-49ers-denver-broncos-exhibition-practice

Harbaugh: Kaepernick to play "one or two" series; says McCoy has competition

http://blogs.sacbee.com/49ers/archives/2013/08/harbaugh-kaepernick-to-play-one-or-two-series-says-mccoy-has-competition.html

Colt McCoy competing for 49ers backup job

http://profootballtalk.nbcsports.com/2013/08/07/colt-mccoy-competing-for-49ers-backup-job/?ocid=Yahoo&partner=ya5nbcs

[headlines]

--------------------------------------------------------------

![]()

California Nuts Briefs---

BART strike: Opposing proposals released; two sides $100 million apart

http://www.contracostatimes.com/news/ci_23813632/bart-strike-opposing-proposals-released-both-sides-100

Tesla Motors shares soar as sales drive higher

http://www.mercurynews.com/business/ci_23815673/tesla-motors-shares-soar-sales-drive-higher

Attorney General: Santa Clara DA did not break law with time-off perks

http://www.contracostatimes.com/news/ci_23799883/attorney-general-santa-clara-da-did-not-break

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

New Report Reveals Which States Are Friendliest to Wine Consumers

http://www.winebusiness.com/news/?go=getArticle&dataid=120139

Coconut ‘wine’ hopes to charm Chinese

http://www.thedrinksbusiness.com/2013/08/coconut-wine-hopes-to-charm-chinese/

Second Bordeaux storm destroys 4,000ha costing '20million Euros at the very least'

http://www.decanter.com/news/wine-news/584216/second-bordeaux-storm-destroys-4-000ha-costing-20-million-at-the-very-least

A Taste of Mexico's Wine Country

http://www.forbes.com/sites/forbestravelguide/2013/08/05/a-taste-of-mexicos-wine-country/

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1776 - John Paul Jones was commissioned as a captain and appointed to command the Alfred. His orders were to harass enemy merchant ships and defend the American coast.

1786 - The US Congress adopted the silver dollar and decimal system of money.

1814-Esther Hobart McQuigg Morris was born at Tioga County, NY, but eventually moved to Wyoming Territory, where she worked in the women’s rights movement and had a key role in getting a women’s suffrage bill passed. Morris became justice of the peace of South Pass City, WY, in 1870, one of the first times a woman held public office in the US. She represented Wyoming at the national suffrage convention in 18795. She died April 2, 1902, at Cheyenne, WY.

1844- Brigham Young chosen Mormon Church head following Joseph Smith death.

1854 - Smith and Wesson patented metal bullet cartridges.

1866-Birthday of Mathew Henson, famous African-American explorer, born at Charles County, MD. He met Robert E. Peary while working in a Washington, DC, store in 1888 and was hired to be Peary’s valet. He accompanied Peary on his seven subsequent Arctic expeditions. During the successful 1908—09 expedition to the North Pole, Henson and two of the four Eskimo guides reached their destination Apr 6, 1909. Peary arrived minutes later and verified the location. Henson’s account of the expedition. A Negro Explorer at the North Pole, was published in 1912. In addition to the Congressional medal awarded all members of the North Pole expedition, Henson received the Gold Medal of the Geographical Society of Chicago and, at 81, was made an honorary member of the Explorers Club at New York, NY. Died Mar 9,1955, at New York, NY.

http://www.matthewhenson.com/

http://www.arcticice.org/henson.htm

1866-The first queen to visit the United Sates was Queen Emma, widow of King Kamehameha IV of the Sandwich Islands ( later to be re-named Hawaii), who arrived in New York City from England on the Cuuard liner Java. She was received on August 14,1866 by President Andrew Johnson and introduced to his family. American business had already started to invest in the island, bringing coffee, potatoes, hybrid sugarcane, horses and cattle.

1878 - The temperature at Denver, CO, soars to an all-time record high of 105 degrees.

1899-Birthday Of Russell Markert, American choreographer Russell Markert, born at Jersey City, NJ. He founded and directed the Radio City Music Hall Rocketts from 1932 to 1971. He died December 1, 1990, at Waterbury, CT. 1899 - A.T. Marshall of Brockton, MA patented the refrigerator. It was not practical in cost for many households and “ice” refrigerators were common

until perhaps World War II.

1876-Thomas Alva Edison of Menlo Park, NJ, obtained a patent for a “method of preparing autographic stencils for printing”. He went on to improve the “mimeograph,” who until the advent of the photocopier, was the most widespread method of paper communication and duplication.

1896-Birthday of Marjorie Kinnan Rawlings, American short story writer and novelist ( The Yearling), born at Washington, DC. Rawlings died at St. Augustine, FL, December 14, 1953.

http://memory.loc.gov/ammem/today/aug08.html.

1900-Birthday of bandleader Lucky Millinder, Anniston, AL.

1911 - Membership in the U.S. House of Representatives was established at 435. Every 211,877 residents of the U.S. were represented by one member of Congress.

1918 –Birthday alto Sax player Benny Carter Birthday (Died July 12,2003)

http://www.bennycarter.com/

http://newarkwww.rutgers.edu/ijs/bc/

http://www.riverwalk.org/profiles/carter.htm

1918-Two days after the Battle of Marne ended, the British Fourth Army mounted an offensive at Amiens with the objective of freeing the Amliens-Paris railways from bombardment by the German Second and Eighteenth Armies. More than 16,000 German prisoners were taken in two hours of fighting the first day. The German forces were forced back to the Hindenburg’s line by September 3. This battle is considered a turning point by many historians because of its impact on the psyche o f Germany. August 8 was described by General Erich Ludendorff as a “Black Day” for Germany.

1921--Birthday of American composer Roger Nixon, Tulara, CA.

1923-Birthday of singer Jimmy Witherspoon, Gurdon,AR.

1922-Louis Armstrong, 22 years old, leaves for the Windy City. His autobiography is fascinating to read about his version of the beginnings of jazz. He perhaps is not only the best known jazz musicians, but considered even today to have been quite ahead of his time. On old records, it is easy to pick him out playing the trumpet. He had tone, melody and rhythm that still wants you to sing, dance, or tap your foot.

1923 - Benny Goodman was 14 years old as he began his professional career as a clarinet player. He took a job in a band on a Chicago-based excursion boat on Lake Michigan.

1926-Birthday of trombonist Urbie Green, Mobile, AL.

1932-Birthday of singer/songwriter Mel Tillis, Pahokee,FL. Tillis was the Country Music Association Entertainer of the Year . Equally talented as a singer and as a songwriter, Tillis began his hit-making career in 1958 with "The Violet and the Rose." His top-ten singles have included "Who's Julie," "The Arms of a Fool" and "Memory Maker." Tillis has a speech impediment, but has made his stuttering a part of his act.

1933-Louisiana Governor O.K.Allen pardon’s Huddie William Ledbetter, better known as the folksinger “Leadbelly.,” He got the name while in prison in Texas for being very strong. He was a very big man with an explosive temper, and was in for murder. He was pardoned by Texas Governor Pat Neff from a thirty year sentence, something that was unheard of in Texas and from the very conservative Neff, but it is said, he sang a song of why he should be released that so affect the warden, and then Neff, that they released him. Leadbelly was one of my father’s favorite folksingers, that he played all the time, and my first memories of my father are listening to this music in the forties. I remember sitting on his knee, perhaps the earliest recollection of my father, who I miss more and more as each year goes by.

http://www.nashvillesongwritersfoundation.com/fame/ledbet.html

http://www.blueflamecafe.com/index.html

http://www.mala.bc.ca/~mcneil/cit/citlcleadbelly.htm

1933-The first savings and loan association established by the federal government was the first Federal Savings and Loan Association of Miami, Florida. The creation of savings and loan institutions had been authorized by the Home Owners Loan Act of June 13, 1933, to provide a convenient place for the investment of small and large sums and to lend money to local applicants for first mortgages.

1941 - Les Brown and His Band of Renown paid tribute to baseball’s ‘Yankee Clipper’, Joe DiMaggio of the New York Yankees, with the recording of "Joltin’ Joe DiMaggio" on Okeh Records. From that time on, DiMaggio adopted the nickname, Joltin’ Joe.

http://www.youtube.com/watch?v=1q6odQuCxFU

1942 - The invasion of Guadalcanal continues as the remainder of the first wave of American troops come ashore. Advancing rapidly inland, they capture the Japanese airstrip intact, renaming it Henderson Field. The missions on Tulagi and Gavutu are completed and the islands captured. Due to Japanese air and submarine attacks, Admiral Fletcher decides to withdraw his carriers, leaving the cruisers and transports near the island. This action is probably a mistake.

1942 - US President Roosevelt and British Prime Minister Churchill approve the appointment of American General Eisenhower to command Operation Torch , the proposed Allied invasion of North Africa.

1942- During World War II, six German saboteurs who secretly entered the United States on a mission to attack its civil infrastructure are executed by the United States for spying. Two other saboteurs who disclosed the plot to the FBI and aided U.S. authorities in their manhunt for their collaborators were imprisoned. The Nazis hoped that sabotage teams would be able to slip into America at the rate of one or two every six weeks. The quick capture ended their plans.

1943- Following the American break out from Normandy in July, 1944, the Germans decided that the only way to stop the Allied advance and push them back to the sea was to launch a massive attack in the Avranches region, about 150 miles west of Paris. To do this they moved tanks and men of the XLVII Panzer Corps into place and opened their operation on August 7th. Their main thrust, lead by the 2nd SS Panzer Division, was to cut the American line between Normandy and Brittany, forcing the two groups to fall back on different beach areas, possibly compelling at least one group to withdraw. But almost immediately the Germans were blocked by determined resistance. On Hill 317, near the village of Mortain, their advance was stopped by 700 men of North Carolina’s 2nd Battalion, 120th Infantry, 30th Infantry Division (which also included Guard units from SC and TN). Firing at almost point-blank range their one anti-tank gun and numerous anti-tank rockets (fired from ‘bazooka’s’) the Guardsmen destroyed 40 vehicles including several heavy battle tanks. The Germans bypassed the hill leaving it surrounded. They launched repeated assaults to capture it but these were beaten back with artillery support from the Guard’s 35th Infantry Division (KS, MO, NE) and RAF air strikes on the German positions. After five days of being cut off and with the loss of nearly 300 men the 2nd Battalion was rescued by elements of the 35th Division. For it’s determined and stubborn resistance in blocking the enemy advance the 2/120th Infantry was awarded the Presidential Unit Citation.

1951-Birthday of Randy Shilts, journalist known for his reporting on the AIDS epidemic. One of the first openly homosexual journalists to work for a mainstream newspaper and the author of And the Band Played On: Politics, People and the AIDS Epidemic. Born at Davenport, IA, and died at Guerneville, CA, Feb 17, 1994.

1951---Top Hits

Too Young - Nat King Cole

Mister and Mississippi - Patti Page

Because of You - Tony Bennett

I Wanna Play House with You - Eddy Arnold

1959---Top Hits

Lonely Boy - Paul Anka

A Big Hunk o’ Love - Elvis Presley

My Heart is an Open Book - Carl Dobkins, Jr.

Waterloo - Stonewall Jackson

1960-16 year old Bryan Hyland's novelty tune, "Itsy Bitsy, Teenie Weenie, Yellow Polka Dot Bikini" topped the Billboard Hot 100 and the Cash Box Best Sellers list. Songwriter Paul Vance said he got the inspiration for the song when he saw his two year old daughter at the beach in a tiny little swimsuit.

1960- British Decca destroyed 25,000 copies of Ray Peterson's death-rock song, "Tell Laura I Love Her." The company refused to release a song which it said was "too tasteless and vulgar for the English sensibility." A rival firm, however, had no such compunction, recording a cover version by a singer named Ricky Valance, which went to number one on the British chart. In the US, Ray Peterson's recording of "Tell Laura I Love Her" reached number seven on the Billboard pop chart.

1961-Britain's Lonnie Donegan has his biggest hit in the US when the novelty tune "Does You're Chewing Gum Lose Its Flavour on the Bedpost Overnight" reaches number 5.

1964-"House of the Rising Sun" by The Animals is released in America. Although the band would put 14 songs in the Top 40, this will be their only US number one.

1967---Top Hits

Light My Fire - The Doors

All You Need is Love - The Beatles

A Whiter Shade of Pale - Procol Harum

I’ll Never Find Another You - Sonny James

1968- Race riot in Miami Florida.

1969-Photographer Iain Macmillan took six pictures of the Beatles crossing the street outside their Abbey Road studio in London. A police officer held up traffic while the band walked back and forth several times. Paul McCartney chose one of the pictures for the cover of the "Abbey Road" album.

1970-New York Yankees honor Casey Stengel, retiring his number 37.

1970-CCR's "Looking Out My Back Door" is released.

1970- Janis Joplin bought a tombstone for blues singer Bessie Smith's unmarked grave in a Philadelphia cemetery. Less than two months later, Joplin herself was dead of a drug overdose. Smith had died following an auto accident in 1942 at the age of 37.

1970-Creedence Clearwater Revival's "Looking Out My Back Door" is released in the US

1970-Canadian immigration officials turn back thousands of American fans on their way to the Strawberry Fields Rock Festival in Mosport, Ontario, on the grounds that they "failed to produce adequate monies to support themselves." 8,000 Americans made it there.

1973-Vice-President Spiro T Agnew brands them "damned lies" regarding reports he took kickbacks from government contracts in Maryland. He vowed not to resign; that he was innocent.

1974-President Richard Nixon announced in a televised address that he would resign. Three days earlier he had released tape transcripts revealing he had impeded the Watergate investigation. Nixon told an audience of some 100,000,000, he had made some wrong decisions but that he was resigning because he no longer had enough support in Congress.

1974-Eric Clapton receives a gold record for "461 Ocean Boulevard." It's his comeback album and contains his Number One version of "I Shot the Sheriff." The album reaches the top of the charts.

1974 - Roberta Flack received a gold record for the single, "Feel Like Makin’ Love". Flack, born in Asheville, NC and raised in Arlington, VA, was awarded a music scholarship to Howard University in Washington, DC -- at the age of 15. One of her classmates became a singing partner on several hit songs. Donny Hathaway joined Flack on "You’ve Got a Friend", "Where is the Love" and "The Closer I Get to You". She had 10 hits on the pop charts in the 1970s and 1980s.

1975---Top Hits

One of These Nights - Eagles

Jive Talkin’ - Bee Gees

Please Mr. Please - Olivia Newton-John

Just Get Up and Close the Door - Johnny Rodriguez

1975- country singer Hank Williams Junior suffered severe head injuries when he fell 150 metres while mountain climbing in Montana. When he returned to performing months later, he had switched to a country-rock sound from the pure country style made famous by his father.

1976-The Chicago White Sox made baseball sartorial history by donning shorts for a game against the Kansas City Royals. The Sox won, 5-2, but the shorts, a novelty thought up by owner Bill Veeck, lasted only a while.

1981-Shiaway St. Pat, driven by Ray Remmen, won the Hambletonia, the most important race for three-year-old trotters, contested for the first time at the Meadowlands in New Jersey.

1983---Top Hits

Every Breath You Take - The Police

Sweet Dreams (Are Made of This) - Eurythmics

She Works Hard for the Money - Donna Summer

Your Love’s on the Line - Earl Thomas Conley

1984 - Carl Lewis won his third gold medal at the Los Angeles Olympics. He won the 200-meter sprint. At the same time, Greg Louganis received his first gold medal in diving in the springboard competition.

1986- singer David Crosby, sentenced to a five-year term for drug and weapons charges, was paroled from a prison in Huntsville, Texas after serving only five months. The convictions were overturned by a Texas appeals court in November 1987- Crosby said when he was released that he had kicked a ten-year drug habit and wanted to resume his musical career. He gained fame with the Byrds in the late 1960's, then teamed with Stephen Stills, Graham Nash, and Neil Young.

1987 - Less than three months after they go to No. 1 on Billboard's Hot 100 for the first time with "With or Without You," U2 return to the top of the chart with "I Still Haven't Found what I'm Looking For," the second single from "The Joshua Tree."( A birthday present for the Edge.)

1988-The first night game of Chicago’s Wrigley Field was postponed by rain with the Cubs leading the Philadelphia Phillies 3-1, in the bottom of the fourth inning. The Phillies’ Phil Bradley let off the game with a home run, but in a postponed game, all statistics are washed out.

1990- Iraq annexes Kuwait. The US has been sending troops to Saudi Arabia

and moving the US Navy into the Mediterranean seas.

1991---Top Hits

(Everything I Do) I Do It for You - Bryan Adams

P.A.S.S.I.O.N. - Rythm Syndicate

Summertime - D.J. Jazzy Jeff & The Fresh Prince

She’s in Love with the Boy - Trisha Yearwood

1993-The Dream Team, a specially-assembled team of NBA all-stars, defeated Crotia, 117-85, to win the gold medal at the 1992 Summer Olympics in Barcelona. The Dream Team, coached by Chuck Daly, including Charles Barkley, Larry Bird, Clyde Drexler, Patrick Ewing, Magic Johnson, Michael Jordan, Christian Laettner, Karl Malone, Chris Mullin, Scottie Pippen, David Robinson and John Stockton.

1994- Janet Jackson tied Aretha Franklin for the most gold singles by a female artist - 14 - when "Any Time, Any Place" was certified as having sold more than 500,000 copies.

1995- the Canadian stage production of Disney's "Beauty and the Beast" opened at the Princess of Wales Theatre in Toronto. At $17 million, it was the most expensive stage production in Canadian history.

1998-The largest free jazz festival in the world, San Jose, California, draws 200,000 to hear Sandoval, Broadbent, Schuur, among many others.

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------