5 Years+ Small Ticket or Middle Market Exp.

with Established Customer/Vendor relationships.

Remote Office or On Site/ Jobs@TEQlease.com

Attn: Mike Lockwood or Russ Runnalls CLP

TEQlease Provides Customized Equipment

Leasing Solutions For Businesses Nationwide

www.TEQlease.com

|

Monday, February 8, 2010

Headlines---

Classified Ads---Credit

The Secret of Our Success

by Ed Kaye, Advantage Funding

Classified Ads---Help Wanted

US Bank Manifest to Require California License

Leasing 102 by Mr. Terry Winders, CLP

Burden of Proof “True Lease Requirements”

P&L True Leasing Program

Cartoon---Watch Dog

Bank Beat---Commercial RE Loans Do it Again

Brican America Not Making Ad Payments Bloggers Claim

by Christopher Menkin, Publisher

Top Stories February 1-5

Birmingham, Alabama --Adopt-a-Dog

News Briefs ---

CIT names ex-Merrill CEO Thain as leader

Value of China Medical Equipment Financial Leasing

ePlus Reports Fiscal Third Quarter 2010 Results

Mortgage Bankers Assoc. sells D.C. offices $39 MM Loss

Behind that Leno-Letterman-Oprah Super Bowl promo

Super Bowl Popularity Ad Meter

You May have Missed---

Sports Briefs---

"Gimme that Wine"

Today's Top Event in History

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Michael Witt, Esq.)

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

The Secret of Our Success

by Ed Kaye, Advantage Funding

"I think Advantage Funding is the industry leader in ground transportation finance. PFSC has had the pleasure of working closely with Advantage and has thoroughly enjoyed watching and participating in their success. As a Marubeni Group Company, Advantage Funding has been insulated from the turmoil in the capital markets, allowing them to remain a consistent and reliable financing source in the markets they serve. While many equipment finance companies have faltered, Ed Kaye and his partners have continued to improve upon their leadership position in the leasing industry."

John Enyart, President, Portfolio Financial Servicing Company (PFSC)

Eric C. Coolbaugh, Vice President; Michael P. Kaplan, Secretary Treasurer; Edward P. Kaye, President

Nobody says they want to go into the leasing business when they grow up. But for the three partners that started Advantage Funding, it worked out well.

After 10 year careers with a large independent auto leasing firm, the three account representatives, Edward Kaye, Eric Coolbaugh, and Michael Kaplan found themselves without a home. Their employer decided to relocate from their native New York City to Florida and the three did not like the way the business was heading and decided to start their own firm, Advantage Funding.

“In hindsight, it was the best move of our lives,” says Kaye, the current president and a principal of Advantage. “We each kicked in $7,500, rented a small office, purchased an inexpensive phone system and made cardboard boxes our desks,” he added. “We were very young, worked very hard and had fun every day,” he stated.

“We started out as brokers for the first several months with existing bank and leasing company relationships and quickly realized that we needed recourse leasing lines to grow the business,” said Eric Coolbaugh, vice president and a principal. “The first lender to provide a warehouse line of credit was Ford Motor Credit,” he added. In the late 1990s it was relatively easy to obtain bank lines and the three were able to leverage lines with All Points Capital (now a subsidiary of CapitalOne Bank), Sovereign Bank (now Banco Santander), European American Bank (now Citigroup), and New World Lease Funding, which was all they needed to grow their modest investment into an $80 million portfolio.

With good portfolio performance and disciplined buying habits the company steadily grew, adding staff and eventually moving to larger offices with real desks and furniture. “Although it certainly was not what many people expected to see when they walked into our office, a converted two story dye house in an industrial neighborhood, we called it home. We never believed in investing a lot of capital in window dressing,” said Michael Kaplan, secretary treasurer and a principal. “We always had the same goal of investing in the business for the long term,” he said.

Advantage Funding specializes in direct and indirect niche transportation finance and leasing. Their target transactions are leases and loans of new and used commercial coaches, minibuses, school buses, paratransit vans, ambulances and limousines. They also establish captive finance programs for commercial transportation equipment manufacturers. They do not fund trucks, trailers, or any collateral with residual value risk.

“In 2001 business was very good. New business volume was up, delinquency was down, and we had healthy margins. Then 9/11 happened,” Kaye says.

At the time Advantage was the largest independent finance company to the Black Car industry (prearranged chauffeured sedan transportation) in the City of New York. “We suffered enormous losses but didn’t panic,” Coolbaugh says. “We created special finance programs to liquidate the repossessions,” he added. “We kept the banks informed of our activity, they supported us, and it worked out,” Kaplan says. All of Advantage’s lenders were paid 100% on the dollar after 9/11, according to Kaye.

In 2006, the company caught the attention of Marubeni America Corporation (www.marubeni-usa.com), the North American subsidiary of Marubeni Corporation (www.marubeni.com), the multinational Japanese trading conglomerate. “We were still happy doing what we were doing but decided after 9/11 that having a large partner had its benefits,” Kaplan says.

The main concern for Advantage was management and existing employees remain in place after the acquisition. Marubeni agreed, according to Kaye, and they purchased a majority stake in the company. “Marubeni immediately lowered our internal cost of funds and provided treasury and financial support services that otherwise would not be available to us,” Coolbaugh says.

With Marubeni’s backing, the company self funds all of its transactions and has grown the portfolio to over 4,000 vehicles or $300 million. Marubeni’s involvement was important in growing the business but the three partners give equal credit to their loyal and dedicated sales people, back office staff, and customers.

“We have worked with many of our sales people and employees for close to 20 years. They have devoted their lives to our business and we are fortunate to have such long standing relationships with them,” Kaplan says. “Many of our customers have been with us for 20 years as well,” added Kaye. They were loyal to us before Advantage was formed and stayed with us,” he said.

The three partners function as one unit in managing the daily operation. Given the current challenges the economy is experiencing, the three have a clear direction in how to lead the company through this cycle.

“We each bring something unique to the table and respect each others’ opinions. This is what makes the partnership, and ultimately the company strong” Coolbaugh says. In today’s economy there are a lot of issues to deal with and it helps that we have a clear direction and understanding of what it takes to succeed in difficult times.” “It’s hard enough battling customers, we do not want to spend any energy battling your partners,” Kaplan says.

Advantage has 10 salespeople strategically located throughout the United States and 30 employees in its corporate headquarters in Lake Success, Long Island, New York. The portfolio is serviced by the third party servicing agent, PFSC of Portland, Oregon.

“When we look back at what we’ve accomplished and how we got here, it makes you realize how lucky we have been in a career we each fell into,” Kaye says. “We’ve come a long way and we could not have planned it better.”

Edward P. Kaye, President; Eric C. Coolbaugh, Vice President; Michael P. Kaplan, Secretary Treasurer

[headlines]

--------------------------------------------------------------

Classified Ads---Help Wanted

Sales

Newport Beach, CA / New York, NY

20 openings CA/4 NY - Min. 1yr exp.

Est. customer/vendor a plus. Base plus

comm.

Info@eaglebusinessfinance.com

Eagle Business Finance is a national Leasing company offering brokered and internal funding services from $1,000 to $2,800,000

www.eaglebusinessfinance.com

|

5 Years+ Small Ticket or Middle Market Exp.

with Established Customer/Vendor relationships.

Remote Office or On Site/ Jobs@TEQlease.com

Attn: Mike Lockwood or Russ Runnalls CLP

TEQlease Provides Customized Equipment

Leasing Solutions For Businesses Nationwide

www.TEQlease.com

|

National Business Development Manager

With seven years experience including current existing book of business. Remote Office Okay. Click here for more info.

Western Finance & Lease, a subsidiary of Western State Bank established in 1901, solicits originations throughout the US

and provides

funding solutions for a wide range of industries. .

|

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

US Bank Manifest to Require California License

Effective April 1, 2010 all brokers, discounters and lessors who in California who do business with U.S. Bank Manifest Funding Services will have to be licensed under the California Finance Lenders Law, according to a directive from the bank. This reportedly applies to apply to ALL brokers/lessors who want to be "lessor" on the Documents for transactions in the State of California for non-true lease transactions, even if the broker/lessor is not located in the state.

It will be interesting to see how many who already do business with Manifest are already licensed and who are not.

The list of companies who do business with non-licensed companies in California, and other states, is growing smaller, as states are looking for funds, actively cross checking personal property tax roles, schedule “C” tax filings, and now are sharing information with each other by computer and via the internet at a very low cost and high efficiency. Meaning in the past, many were not caught, until a lease defaulted or a complaint was made against their company.

There are a number of "non-loan" transactions, such as bona fide leases, automobile sales finance contracts (Rees-Levering Motor Vehicle Sales and Finance Act) and retail installment sales (Unruh Act), that are not subject to the provisions of the California Finance Lenders Law.

This does apply to “hard loan” or “subprime” leases where other collateral is required or a “sale/leaseback” is involved, even if a so-called “fair market value.” These transactions may be considered usurious in California.

California Finance Lenders Law (AB 2885, Chapter 1115, Stats. 1994). The regulations under the California Finance Lenders Law are contained in Chapter 3, Title 10 of the California Code of Regulations, commencing with Section 1404 (10 C.C.R. §1404, et seq.) defines "A finance lender is defined in the law as "any person who is engaged in the business of making consumer loans or making commercial loans." A finance lenders license provides the licensee with an exemption from the usury provision of the California Constitution.

In addition to the lending authority provided by the law, the California Finance Lenders Law provides limited brokering authority. A "broker" is defined in the law as "any person engaged in the business of negotiating or performing any act as broker in connection with loans made by a finance lender." Brokers licensed under this law may only broker loans to lenders that hold a California Finance Lenders license.

The requirements for a license are set forth in Section 22100, et seq. of the California Financial Code. The law requires applicants to have and maintain a minimum net worth of at least $25,000 and to obtain and maintain a $25,000 surety bond and be recommend by three licensed companies. In general, principals of the company may not have a criminal history or a history of non-compliance with regulatory requirements.

Companies are required to file an annual report once a year, as well as be audited by the State of California, paying the auditing fees, including travel time.

Companies violating the law can be ordered to “cease and desist” immediately and leases generated may be subject to usury laws in the state as well as other violations.

Find out if company is licensed:

http://www.corp.ca.gov/FSD/licensees/default.asp

Lease/Loan License Requirements in the United States

http://www.leasingnews.org/archives/June%202008/06-25-08.htm#lic

[headlines]

--------------------------------------------------------------

Leasing 102

by Mr. Terry Winders, CLP

Burden of Proof “Tax Lease Requirements”

It appears that there will be a fair amount of tax leasing this year for a number of reasons. So I thought it would be a good idea to review what a true tax lease requires. The problem with understanding what is required is that there really is nowhere to go to learn what is required. You can start with RR 55-540 created in 1955 when leasing was in its infancy and also Revenue Procedure 76-21, a ruling on leverage leasing, however in you have to include a number of federal tax court decisions. In addition many additional rules on leasing from the uniform commercial code and GAAP accounting requirements shaped how the IRS looks at a true lease today.

So you almost need to understand the concept of what the IRS thinks a lessor should act like to understand the current requirements.

To begin with the tax payer (you) has the burden of proof in a tax audit. That means you are required to “prove” you have a lease and not a loan. Also there is not just one issue that makes or breaks the answer and it is not a scale to see if you have more correct answers than wrong ones. You must “prove” your position and the facts at the time of the lease commencement will rule.

The issue is do you have the “right” to obtain capital recovery benefits, know as depreciation, and does your lessee have the “right” to expense the rent? This is not a legal question of ownership because the right to capital recovery benefits goes to the question of who is making a profit from the “use” of the equipment. Clearly the leasing company has provided the lessee with possession and use during the term of the lease and also passed the requirement, under a net lease, for the lessee to maintain and pay all costs, including taxes, associated with the equipment. A strong case against you! The lessor claims that because they are receiving rent they are making a profit but the IRS looks at our mark-up like interest and the fact that we are not in possession of the equipment works against us. So to claim our benefits we start with two requirements. One, the term of the lease “cannot” exceed 80% of the equipments useful life. Two, we must take a “meaningful” residual.

By using an “Equipment description and use form” you can document how the equipment will be used and estimate its useful life by contacting a manufacturer or vendor or a secondary market source to request how long it will be of value, with that use, in the market place. This has nothing to do with how long it will survive. It must have a practical business “use” value. A meaningful residual does not mean it must be worth 20% but it does mean you should be able to extract additional rent for at least another 20% of time. Remember you have the burden of proof here and lack of information or documentation is deadly.

To prevent game playing with the numbers (rent plus residual) the IRS has an additional test to determine if the rent and residual equal what a lessee could have purchased the equipment for using a loan containing a balloon payment as a last payment. This means that if you allow the lessee to purchase the equipment for your residual the transaction has the economics of a loan. Therefore fixed price purchase options equal to the residual are not wise.

The question of purchase options only clouds the discussion because any thought of passing title raises the question of why the lessor is selling the company’s assets. In a true lease you should not offer a purchase option unless pressed by the lessee. For years we thought a fair market purchase option would prevent any problems but in many cases the cost to return some equipment exceeded its value at termination forcing the lessee to purchase to save money. This makes it a loan. So today the return language must take into account the equipments value vs. the cost of freight based on the information “available at the commencement of the lease”. The legal rules or more precisely the definition of a lease for Article 2A required any purchase option to approximate the future value of the equipment and the IRS has adopted the issue by requiring the lessor to have “proof” of the estimated value in the lease folder or any fixed purchase option will be grounds for an audit. The old 10% purchase option is a red flag and unsubstantiated will be proof a loan was the intention of both parties.

The most misunderstood term in the tax requirements is the fact that it is the “intent” of the parties in a lease that must be determined by all the facts. If you think like a money lender and do not take residuals and offer small fixed price purchase options and fail to look at the equipments value, or useful life, I guarantee you are in the lending business and not the leasing business.

One last thought! Be very careful how you characterize your transaction to the lessee. If the lessee is lead to believe the transaction is a true lease, and it is not, we may be held accountable. When we use the term “lease” and have a document that says “lease agreement” and it is not a lease but a loan we are praying on the ignorance of the customer. Small ticket leases are not immune from this issue and in fact receive the most complaints about false comments.

The last thing to remember is that the lessor must not allow the lessee any equity in the equipment which means “no down payments” and no trade-in’s and no equipment cost discounts. The lessor must completely pay the full cost of the equipment. You can take cash as a security deposit but cannot take additional collateral.

One of the problems created in the past that is being talked about today is how the leasing industry puts the burden on the lessee by placing tax indemnification in the lease agreement so if the transaction is rejected by the IRS then the lessee must make up the difference to the lessor. This may be challenged in court on the bases that the lessor is once again praying on the ignorance of the lessee. This indemnification may require you to explain the risk if any of the rules I mentioned here are bent or broken.

Act like a lessor and do your due diligence because it helps the credit decision and maximize your equipment at termination and you will be in the leasing business.

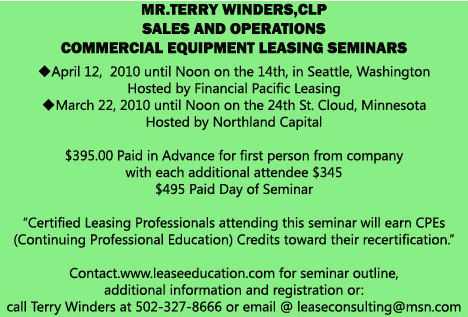

Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty years and can be reached at leaseconsulting@msn.com or 502-327-8666.

He invites your questions and queries.

Previous #102 Columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Bank Beat---Commercial Real Estate Loans Do it Again

1st American State Bank of Minnesota, Hancock, Minnesota became the 16th bank to fail this year. Community Development Bank, FSB, Ogema, Minnesota, will assume all of the deposits. The small bank with six full time employees had two branches, one in Hancock and one in Benson. This is the tenth bank, the third this year, to fail in Minnesota since the economic crisis began about two years ago.

Formed January 1, 1936, the bank equity went from September 30, 2008 of $2.4 million to $424,000 September 30, 2009, a loss of $378,000 in 2008 to a loss of $1.3 million in 2009 after a charge off of $1.8 million, mostly in construction and land development $.9 million, $607,000 in “Secured by nonfarm nonresidential properties.”

Tier 1 risk-based capital ratio :3.38%. Net operating income was a minus $1.3 million.

According to the startribune.com: "Warren Smith, chief financial officer of 1st American, who joined the bank in 2007 after the bad loans were made, estimated the bank bought $4 million in loans from BankFirst; and now more than half of those are uncollectable.

"Smith said 1st American held parts of about 20 syndicated loans originated by BankFirst. They included one for an upscale housing project called [‘Gold Mountain’ near Phoenix that never went forward because it lacked a water source; a failed luxury condominium project at a marina in Portland, and a loan to an Indian casino in Montana that went bad because the collateral, slot machines, were deemed out of date and essentially worthless, Smith said."

The FDIC closed Marshall Bank of Hallock, Minnesota the previous Friday, after state regulators found it also had too many bad BankFirst loans on its books. BankFirst, Sioux Falls, North Dakota was closed July 17, 2009.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $3.1 million.

http://www.fdic.gov/news/news/press/2010/pr10030.html

Previous Bank Beat columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Bank_Beat.htm

List of Bank Failures

http://www.fdic.gov/bank/individual/failed/banklist.html

[headlines]

-----------------------------------------

Brican America Not Making Ad Payments Bloggers Claim

by Christopher Menkin, Publisher

Page from Brican America Sales Brochures (click image to view larger)

Leasing News is told by ex-salesmen that the company has not been making advertising payments and two internet blogs seem to be confirming this information.

Ex-salesman say that Brican America, Miami, Florida is no longer marketing the lease concept, but offering a discount for cash.

Two ex-salesmen told Leasing News that they were told the leasing/advertising plan was “legal” by the company’s attorney, but after learning otherwise, left the company. Colleagues of long-time industry veteran Chuck Brazier, who was involved in placing leasing portfolio’s and business state that he made clear to funders that there was an advertising agreement in the transaction. One funder told Leasing News that was not clear to them. Another was assured the Brican America counsel had devised the leasing agreements by a reportedly well-known attorney active in the Equipment Leasing and Finance Association.

Two internet blogs not only question the value of the collateral, but report “advertising payments” not being made. Here are copies of comments made on “dentletown,” message board not edited: (http://www.towniecentral.com/Dentaltown) (1)

===========================================

“For those who have a Brican system, there is the lease, and then there is the payment that you are supposed to get every month. Towards the end of '09, they offered a one time payment at the beginning of 2010 in lieu of your 4th quarter payment in '09. Well, now Viso, the company that makes the payments is in 'financial difficulty', and there are no payments forthcoming. At the same time, the leases have been sold to another company and they were not aware of the clause that allows us to break the lease if payments are not made.

“SO, that being said, I am now going to attempt to break my lease and return my system as I don't want to pay $500.+/mo for a very average waiting room education system.

“I am wondering if anyone else has already been through this and had any pointers, advice, anecdotes, etc that might make it easier for me and my friends who now have this small issue.”

-----

“I too have not received my payment Brican. When I called Brican, they stated that I would not be receiving my check. When I asked to cancel, they referred me to their legal department. The Brican lease's were sold to another leasing company that apparently did not purchase the "cancellation clause".”

-----

“Keep us updated. I have Brican and didn’t' get the quarterly payment, nor did I get the letter about the payout…I called twice today to no avail. When I first signed up, I had no problems talking to anyone. Now it is one thing after another.....even technical support has been bad lately, when it was excellent in the beginning.....

“I never got paperwork about my lease being sold to another company. Even if they didn't buy the 'cancellation clause' what is our recourse? I signed with Brican and was never told of any other company being due the money.

“Looks like lawyer time?"

-----

“I didn't take the yearly payment, but got my last payment a month or 2 ago. I would love to get out of this crap. It is so mediocre. Any more info on this? “

-----

“Len - I signed up around the same time that you did (at a Rondeau seminar), was getting the same payout (ended up costing the same 25./mo) but haven't gotten a payment since 9/22/09.”

-----

“Reached the headquarters today and told them I was citing Clause K) of the marketing agreement and that I was cancelling the lease due to their violation of the agreement. They told me to send a letter to their legal department. Here is what is going out tomorrow.”

“I'll let you know if I get a response.”

A Blogger said: "I checked with two of my friends that bought the system and they also received their payments in January he got his January payment"

“Len - I would dispute what you are telling me as Brican has admitted that they are no longer sending out payments, and every other person I have discussed this with has not gotten paid. A lot of dentists didn't even realize this was going on and just had their office manager watching over things, and they (the office manager) didn't know they should be looking for any payment, so they didn't realize it was missing.

“I have discussed this with several former promoters of Brican (Ryan Swain, Chris Bowman, Mitchell Josephs, Brock Rondeau), and they all are in the same boat as my contact and me.

“If you have somehow gotten paid, I commend you, but I would double check it.

“If someone wants a copy of a much better legal letter than the one I posted earlier, let me know and I can email it to you. Just drop me a line at gfink75@hotmail.com.” (2)

===========================================

Ex-salesmen have told Leasing News they were not aware of the non-disclosure of the payment procedure in the transaction, that they say was approved by the Brican America attorney as being legal. The latest they refer to is a new contract which “ hell and high water” and the lessee must pay regardless.

Another refers to the cafepharma blog where both lessees and former salesman outline their opinions, also discuss the value of the collateral and selling methods (3)

Leasing News requested a comment from Brican America, but none was received. Leasing News looks forward to printing any comment or statement by Brican American Leasing on “dentletown” blog or “cafepharma.com.”

Sales of the systems to dentists and optometrists are based on advertising revenues reimbursing the purchaser for the system cost, according to an ex-salesman of Brican America, as well as the suit brought by NCMIC Finance Corporation dba Professional Solutions Financial Services (PSFS), Clive, Iowa where there are depositions from an officer and two former employees about the practice.

The operation is very much like the recent Royal Links Golf Carts leased to country clubs based on advertising to pay for the carts and perhaps even make a profit. Jean-Francois Vincens, a principal of Brican America, who states he is a Canadian-French citizen, was one of the original principals in Recomm, who had over $125 million in losses involving over 30 leasing companies, including Colonial Pacific Leasing, Lease Partners, Bell Atlantic TriCon, Finova, GreatAmerica Leasing, Textron, among others. He left the company before it fell into bankruptcy, it is reported, from what was labeled a Ponzi scheme.

This current situation started with an alert regarding NCMIC Finance Corporation dba Professional Solutions Financial Services (PSFS), Clive, Iowa claim against Brican America, Miami, California for $38 million involving 1672 leases. The case concerns not informing the funder regarding the advertisement agreement that made the payments to the lessee who had the right to cancel if the payment was not received.

From the NCMIC Complain now facing a jury trial: It appears very similar to the NorVergence situation but in this case the seller of the equipment in this case specifically provided the lessee with a letter to make lease payments in certain situations, unknown to PSFS, according to the complaint.

"15. In fact, there was at least one additional agreement, a "Marketing Agreement," which related to the Goods or Leases provided to the Lessees, that Brican gave to each of the Lessees, which was not included in the documents that were provided to PSFS for each of the leases."

"17. The Marketing Agreement was material to PSFS's decision to underwrite Leases as the payments under the Marketing agreement were designed to offset the cost of the Lease Payments, suggesting that the Lessees would not enter into the Leases or might cease payment under them without the income stream provided by the Marketing Agreement.

18. As a result of Brican's failure to provide the Marketing agreement to PSFS with each packet of the document related to each of the Leases, Brican has breached the agreement."

A jury trial regarding NCMIC Finance Corporation dba Professional Solutions Financial Services (PSFS) complaint has been set for March 8, 2010 before U.S. District Court Southern District of Florida (Miami) Judge Paul C. Huck.

(1) http://leasingnews.org/images/brican_cancel.pdf

http://leasingnews.org/images/brican_cancel.jpg

(You may have to click on page to have it open fully)

(2) http://leasingnews.org/PDF/Brican_Cancellation_Letter.pdf

(3) http://www.cafepharma.com/boards/showthread.php?t=397139

Brican America Sales Brochure:

http://leasingnews.org/PDF/Brican_Combine.pdf

Previous Stories:

http://www.leasingnews.org/Conscious-Top%20Stories/brican_america.htm

((click on ad to learn more))

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

-----------------------------------------

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

News Briefs----

[headlines]

---------------------------------------------------------------

You May have Missed---

[headlines]

---------------------------------------------------------------

[headlines]

----------------------------------------------------------------

[headlines]

----------------------------------------------------------------

Today's Top Event in History

1931- Birthday of James Dean, American stage, film and television actor. He achieved immense popularity during a brief career. He is considered an "icon" today to several generations. Born at Fairmont, Indiana. Best remembered for his role in" Rebel Without a Cause" with Natalie Wood. Died driving his Porsche convertible at a very high speed on a desert highway near Cholame, CA, Sept 30, 1955, at age 24. Stamp collectors made the US postal stamp bearing Dean's likeness the most popular stamp of 1996.

http://www.jamesdeangallery.com/

http://www.jamesdean.com/index.php

[headlines]

----------------------------------------------------------------

This Day in American History

1517- Francisco Hernandez de Cordova sailed from Cuba with three ships to procure slaves for the mines as Columbus was bringing many slaves back to Europe. He landed on the Isla de las Mujeres, to which he gave this name because the idols he found . He and his crew became the first Spaniards to purposefully reach the mainland of what is now Mexico . He died after an encounter with Mayan Indians. Some say he landed in Florida, where he actually passed away from the wounds from the battle.

http://www.isla-mujeres.net/history.htm

http://www.yucatantoday.com/destinations/eng-campeche.htm

http://www.tourbymexico.com/campeche/champo/champoto.htm

http://www.famousamericans.net/firstspanishgovernorofsouthamericapedrariasdayila/

1690 - French and Indian forces attack Schenectady, New York during King William’s War. The fate of Schenectady was sealed in the middle of January, 1690, when 114 Frenchmen and 96 Sault and Algonquin Indians, started from Montreal to attack English outpost to the south. It was part of the master plan to fulfill the wishes of French King Louis XIV to "build a new empire in America”. During the raid on Schenectady many men, women and children were killed, or taken captive by the French and Indians and marched up into Canada.

1735- The first opera produced in the colonies was performed at the Courtroom, at Charleston, SC. The opera was Flora; or the Hob in the Well , written by Colley Cibber.

1820- Birthday of William Sherman, Union General Sherman, especially remembered for his devastating march through Georgia during the Civil War and his statement "War is hell." Died at New York, NY, Feb 14, 1891.

1829-Birthday of Captain John Newton Sloan, a remarkable man thought found dead during the Civil War, but survived in a heroic manner.

http://www.geocities.com/BourbonStreet/Delta/3843/man.htm

1835 - A severe cold wave gripped the southeastern U.S. The mercury dipped to 8 above at Jacksonville FL, and to zero at Savannah GA. Orange trees were killed to the roots.

1837- The first vice-president elected by the Senate was Richard Mentor Johnson, who was chosen by the Senate because no candidate had received a majority of the electoral votes. He served from March 4, 1837 to March 4, 1841, under President Martin Van Buren. In the future, president and vice-president were to run on one ticket.

1835 - A severe cold wave gripped the southeastern U.S. The mercury dipped to 8 above at Jacksonville FL, and to zero at Savannah GA. Orange trees were killed to the roots.

1851 – Birthday of American feminist writer Kate Chopin born, St. Louis, Missouri.

http://www.accd.edu/sac/english/bailey/chopink.htm

1862 - Union General Ambrose Burnside scores a major victory when he captures Roanoke Island in North Carolina. The victory was one of the first major Union victories of the war and it gave the Yankees control of the mouth of Albemarle Sound, a key Confederate bay that allowed the Union to threaten the Rebel capital of Richmond from the south.

1865- Martin Robinson Delany, received his commission and became the first Army major who was African-American. He was stationed in Charleston, South Carolina.

1881- Frederic Ives, a photographer at Cornell University, Ithaca, NY received a patent for a halftone printing plate for reproducing photographs in books, magazines, and newspapers. In 1878 he converted negative into a screen gelatin relief from which he made a printing plate with good fidelity. He further developed this, which revolutionized the printing industry.

1885-- The City of Tokio arrived in Honolulu carrying the first 944 official migrants from Japan to Hawaii.

1887- President Cleveland signs the Dawes Land Allotment Act, dissolving Indian tribes as legal entities. It distributes territory held in common by American Indian nations to individual families. Each family is to get 160 acres. All other land will be sold, with proceeds going to an educational trust fund.

The Dawes Land Allotment Act entitled each family on the Great Sioux Reservation to own 160 acres. Since the reservation contained twice the land needed for allotments, the law dispossessed the Sioux of half their rightful territory. The Act ultimately results in the loss of tens of millions of acres of treaty land. "The commune shall give way to the dignity and rights of American citizens . . . the heathen idols shall give place to the Christian altars, and . . . the tribal organization shall be broken up and the individuality of the Indian encouraged and developed, and the lands unnecessarily reserved for them opened to the pioneer [so that] intelligence and thrift may find lodging there."

http://www.csusm.edu/nadp/asubject.htm

http://www.csusm.edu/nadp/a1887.htm

1889- the first production of steam tractors were loaded on a car at San Leandro, California, designed and made by Daniel Best. They were called the Best Tractor. Until gasoline powered engines came along, the steam tractor was the Best.

1899- blues guitarist and singer Lonnie Johnson was born in New Orleans. More respected for his playing than his singing, Johnson developed his distinctive style as early as 1927 when he recorded with Louis Armstrong's Hot Five. Johnson's 1948 recording of "Tomorrow Night" was very popular, spending seven weeks on Billboard's rhythm-and-blues chart, and even making the top 20 of the pop chart. From the mid-1960's, he spent much of his time in Toronto. Lonnie Johnson suffered a stroke after a serious accident in 1969, and died the following year.

1906- Birthday of Henry Roth, American author who gained first international fame with his novel Call It Sleep (1934). Originally seen as an important proletarian novel of the 1930s, it was soon out of print and forgotten, but in the 1960s it was hailed as the finest Jewish-American novel of the first half of the century and one of the richest modernist novels to appear in America. Roth published no other novels until 1994, working several jobs, among others as a precision metal grinder, mental nurse, poultry farmer, and teacher. Died 1995.

http://www.kirjasto.sci.fi/henryr.htm

http://www.nagasaki-gaigo.ac.jp/ishikawa/amlit/r/henry_roth21.htm

1906-Birthday of 1906 -- Chester F. Carlson, inventor of the photocopier, born Seattle, Washington.

1910- The Boy Scouts of America was founded at Washington, DC, by William Boyce, based on the work of Sir Robert Baden-Powell with the British Boy Scout Association.

1911-Birthday of American Poet Elizabeth Bishop born Worcester, Massachusetts; winner of a Pulitzer Prize for her book of poems, North and South, in 1956.

1915- The Clansman, or the Birth of the Nation, 12 reels, produced by D.W.Griffith, and starring Henry Walthall and Lillian Gish, with a cast of 18,000 people and 3,000 horses premiered at Clune's Auditorium, Los Angeles. It was based on the Clansman by Thomas Dixon. It was the first movie to gross $50 million, an astronomical sum in those days. Two performances were presented daily. There was a matinee at 2:30pm, admission 25 cents and 50 cents, and an evening show at 8:om, admission 75 cents.

http://memory.loc.gov/ammem/today/feb08.html

1919—trombonist and band leader Buddy Morrow birthday

http://www.spaceagepop.com/morrow.htm

http://www.amazon.com/exec/obidos/tg/stores/artist/glance/-/52924/

ref=pm_dp_ln_m_6/102-6604306-8652139

1925- birthday of Jack Lemmon, Stage, screen and television actor, born John Uhler Lemmon III at Boston, MA. Often paired with actor Walter Matthau, he starred in such films as The Odd Couple, The Fortune Cookie and The Front Page . He was nominated for seven Academy Awards, winning in 1955 for his supporting role inMister Roberts and in 1974 for his leading role in Save the Tiger . Other films included Some Like It Hot, Days of Wine and Roses and Grumpy Old Men . He also starred in television versions of Inherit the Wind and Twelve Angry Men , and won an Emmy in 2000 for the TV movie Tuesdays with Morrie . He was a favorite for many years at the Bing Crosby, now AT&T Golf Tournament in Pebble Beach, CA. He died at Los Angeles, CA, June 27, 2001.

1926- alto sax player Pony Poindexter birthday, New Orleans, LA.

1926- Beat author Neal Cassidy born Salt Lake City, Utah

http://www.rooknet.com/beatpage/writers/cassady.html

http://www.geocities.com/SoHo/Cafe/1010/

http://www.intrepidtrips.com/pranksters/neal/index.html

http://ezone.org/ez/e2/articles/digaman.html

1929- Eddie Condon's Hot Shots ( Jack Teagarden, Mezz Mezzrow, Joe Sullivan ) record: ” I'm Gonna Stomp,” “ Mr. Henry Lee.” Victor V-38046 )

1931- Birthday of James Dean, American stage, film and television actor . He achieved immense popularity during a brief career. He is considered an "icon" today to several generations. Born at Fairmont, Indiana. Best remembered for his role in" Rebel Without a Cause" with Natalie Wood. Died driving his Porsche convertible at a very high speed on a desert highway near Cholame, CA, Sept 30, 1955, at age 24. Stamp collectors made the US postal stamp bearing Dean's likeness the most popular stamp of 1996.

http://www.jamesdeangallery.com/

http://www.jamesdean.com/index.php

1932- birthday of John Williams, pianist, conductor ( formerly with Boston Pops) composer ( scores for Jaws, Star Wars, Jurassic Park, Schindler's List ) , New York City, New York.

http://www.johnwilliams.org/reference/biography.html

1936 - The temperature at Denver CO plunged to a record 30 degrees below zero.

1937-Birthday of Shirley Bassey, Welsh-born popular British and American singer at her zenith in the 60s and 70s. Although her strong voice carried well on records, her forte was concerts and cabaret acts. Among her best known renditions are "For All We Know" and "Never, Never, Never."

1941- folksinger Tom Rush birthday, Portsmith, NH.

http://www.tomrush.com/index.shtml

1944--HUFF, PAUL B. Medal of Honor

Rank and organization: Corporal, U.S. Army, 509th Parachute Infantry Battalion. Place and date: Near Carano, Italy, 8 February 1944. Entered service at: Cleveland, Tenn. Birth: Cleveland, Tenn. G.O. No.: 41, 26 May 1944. Citation: For conspicuous gallantry and intrepidity at risk of life above and beyond the call of duty, in action on 8 February 1944, near Carano, Italy. Cpl. Huff volunteered to lead a 6-man patrol with the mission of determining the location and strength of an enemy unit which was delivering fire on the exposed right flank of his company. The terrain over which he had to travel consisted of exposed, rolling ground, affording the enemy excellent visibility. As the patrol advanced, its members were subjected to small arms and machinegun fire and a concentration of mortar fire, shells bursting within 5 to 10 yards of them and bullets striking the ground at their feet. Moving ahead of his patrol, Cpl. Huff drew fire from 3 enemy machineguns and a 20mm. weapon. Realizing the danger confronting his patrol, he advanced alone under deadly fire through a minefield and arrived at a point within 75 yards of the nearest machinegun position. Under direct fire from the rear machinegun, he crawled the remaining 75 yards to the closest emplacement, killed the crew with his submachine gun and destroyed the gun. During this act he fired from a kneeling position which drew fire from other positions, enabling him to estimate correctly the strength and location of the enemy. Still under concentrated fire, he returned to his patrol and led his men to safety. As a result of the information he gained, a patrol in strength sent out that afternoon, 1 group under the leadership of Cpl. Huff, succeeded in routing an enemy company of 125 men, killing 27 Germans and capturing 21 others, with a loss of only 3 patrol members. Cpl. Huff's intrepid leadership and daring combat skill reflect the finest traditions of the American infantryman.

1950- Man o'War was voted the greatest race horse of the first half of the 20 th century in a poll conducted by the Associated Press. Man o' War raced as a 2- and 3- year old, winning 20 of 21 races and setting five track records.

1951---Top Hits

My Heart Cries for You - Guy Mitchell

Tennessee Waltz - Patti Page

If - Perry Como

There's Been a Change in Me - Eddy Arnold

1952- Webb Pierce entered the Billboard country chart for the first time with "Wondering." Pierce dominated the country charts in the 1950's with his pure honky-tonk sound. Between 1952 and '62, he placed 44 songs on the Billboard chart, 38 of which made the top ten. Pierce's influence can be heard in the music of such contemporary country artists as Ricky Skaggs and Dwight Yoakam.

1954 – Beat author Jack Kerouac, hitchhiking from NY on the 27th of January, visits Neale and Carolyn Cassady in Los Gatos, California, not too far from where I live. . Kerouac's interest in Buddhism begins as he reads Dwight Goddard's A Buddhist Bible; he also begins writing "Some of the Dharma." In March Kerouac settles in San Francisco.

1956-Frankie Lymon and the Teenagers' "Why Do Fools Fall in Love" and the Teen Queens' "Eddie, My Love" enter the R&B chart.

1956- Buddy Holley signs a recording contract with Decca Records, one which mistakenly drops the "e" from his last name. Buddy, knowing a good thing when he sees it, drops the letter from his name as well.

1958-The Quarrymen perform at the Wilson Hall in the Garston section of Liverpool, England. Afterwards, member Paul McCartney introduces his friend George Harrison to John Lennon.

1959---Top Hits

Smoke Gets in Your Eyes - The Platters

The All American Boy - Bill Parsons

Stagger Lee - Lloyd Price

Billy Bayou - Jim Reeves

1960- Bobby Rydell's "Wild One" makes its debut on the Billboard chart, where it will reach number 2.

1960- Mark Dinning's "Teen Angel" hits #1. The song had been written for him by his sister Jean, who also recorded as one of The Dinning Sisters. Some radio stations banned the song.

1960- the US Congress opened hearings on payola, whereby a radio station or its employees, usually a disc jockey, accept payment for broadcasting records. Among those accused were DJs Alan Freed and Dick Clark. Clark was called the most influential person in the popular music industry because of his interests in music publishing and record companies. But he denied any wrongdoing and escaped the inquiry virtually unscathed. Alan Freed was not so fortunate. He had few friends in the music business because of his practice of playing records by black artists rather than white cover versions. When the investigation started, Freed was blackballed. And when he finally came to trial in 1962, he was a broken man. Freed pleaded guilty to two counts of commercial bribery, was fined $300 and received a suspended sentence. He never worked in radio again and died in January 1965. Congress eventually outlawed payola, and the offence was punishable by a maximum $10,000 fine. But the significance of payola was greatly diminished by this time because of the growth of Top-40 radio. Disc jockeys were governed by a rigid play list and were not allowed to choose their own music.

1963- less than two months after defeating the Houston Oilers in the second championship game of the American Football League, the Dallas Texans, owned by Lamar Hunt, moved to Kansas City and were renamed the Chiefs.

1964- during the congressional debate over the 1964 Civil Rights Act, Representative Martha Griffiths delivered a memorable speech advocating the prohibition of discrimination based on sex. Her efforts resulted in adding civil rights protection for women to the 1964 Act. She later successfully led the campaign for the Equal Rights Amendment in the House of Representatives.

1964-Songs released today include the Temptations' "The Way You Do the Things You Do" on Motown, the Beach Boys' "Fun, Fun Fun" is out on Capitol and the album "Beatlemania in the USA!" by the Liverpools is released on Wyngate Records.

1964- The Beatles' "I Saw Her Standing There" enters the pop charts.

1964-Max Firetag, publisher of "Louie Louie" as recorded by the Kingsmen for Wand Records, denies Indiana Governor Matthew Welsh's claim that the song is "pornographic." Firetag offers $1,000 to anyone who can find anything "suggestive" in the song's lyrics.

1964- Billy Kidd and Jim Heuga became the first American men to Win Olympic medals in Alpine skiing when they captured the silver and bronze medals respectively, in the slalom at the IXth Winter Olympics at Innsbruck, Austria.

1965-The Supremes' "Stop in the Name Of Love" is released.

1967---Top Hits

I'm a Believer - The Monkees

Georgy Girl - The Seekers

Kind of a Drag - The Buckinghams

There Goes My Everything - Jack Greene

1969- The Supremes and Temptations' album TCB enters the charts.

1968-Ex-Cream guitarist Eric Clapton and drummer Ginger Baker and ex-Traffic keyboardist and singer Stevie Winwood announce they are forming a new band and auditioning for a bassist, with the addition of ex-Family bassist Rich Grech, the band will become the "supergroup" Blind Faith.

1973- Carly Simon is awarded a gold record for her single "You're So Vain," the only Number One song of her career. Many speculate as to the identity of the song's subject. Many assume it's Mick Jagger, whose voice can be clearly heard singing behind Simon in the chorus. However, it turns out that the subject is actor Warren Beatty.

1975 - For the first time in U.S. history, a woman, Betty S. Murphy is named chair of the National Labor Relations Board, the first woman member of the board. On this same day, for the first time in U.S. history, a woman, Ella Grasso of Connecticut, takes office as the first woman governor elected in her own right.

1975---Top Hits

Fire - Ohio Players

You're No Good - Linda Ronstadt

Boogie on Reggae Woman - Stevie Wonder

Then Who Am I - Charley Pride

1982-- Cher makes her Broadway debut in Come Back To The Five And Dime, Jimmy Dean, Jimmy Dean.

1983---Top Hits

Africa - Toto

Baby, Come to Me - Patti Austin with James Ingram

Shame on the Moon - Bob Seger & The Silver Bullet Band

Inside - Ronnie Milsap

1986- The musical "Evita" ended its eight-year run in London. The show earned 32-million dollars and was performed 2,913 times during its run at the Prince Edward Theatre. Based on the life of former Argentine President Juan Peron and his wife, Eva, the show remained popular even at the height of the Falklands War between Britain and Argentina in 1982.

1987 - A powerful storm produced blizzard conditions in the Great Lakes Region. Winds gusted to 86 mph at Janesville WI and Cleveland OH received 12 inches of snow. North winds of 50 to 70 mph raised the water level of southern Lake Michigan two feet, and produced waves 12 to 18 feet high, causing seven million dollars damage along the Chicago area shoreline. It was the most damage caused by shoreline flooding and erosion in the history of the city of Chicago

1987- Nancy Lopez won the 35 th LPGA tournament of her career, the $200,000 Sarasota Classic, and earned induction into the LPGA Hall of Fame.

1989 - A winter storm over California produced snow from the beaches of Malibu to the desert canyons around Palm Springs, and the snow created mammoth traffic jams in the Los Angeles Basin. Sixteen cities in the western U.S. reported record low temperatures for the date. Marysville CA reported an all-time record low reading of 21 degrees above zero.

1990 - Unseasonably mild weather prevailed across the south central and eastern U.S. Twenty-two cities, including five in Michigan, reported record high temperatures for the date. The afternoon high of 53 degrees at Flint MI surpassed their previous record by ten degrees, and the high of 66 degrees at Burlington IA exceeded their old record by eight degrees.

1991---Top Hits

The First Time - Surface

Gonna Make You Sweat (Everybody Dance Now) - C & C Music

Factory featuring Freedom Williams

Play that Funky Music - Vanilla Ice

Daddy's Come Around - Paul Overstreet

1996- the National Football League approved the transfer of the Cleveland Browns to Baltimore. Owner Art Modell agreed to leave the team's nickname and colors in Cleveland and later decided to call his team the Ravens. The NFL awarded Cleveland an expansion franchise in 1998.

1997-The Detroit Red Wings defeated the Pittsburgh Penguins, 6-5, in overtime, to make Coach Scotty Bowman the first NHL coach to reach the 1,000-win plateau.

2000---Top Hits

I Knew I Loved You- Savage Garden

Thank God I Found You- Mariah Carey Featuring Joe

Columbia

What A Girl Wants- Christina Aguilera

Get It On Tonite- Montell Jordan

2002 -XIX Winter Olympics opens in Salt Lake City UT/Québec City.

[headlines]

--------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

[headlines]

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

[headlines]

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

[headlines]

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

http://www.weather.gov/

[headlines]

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

[headlines] |

![]()

![]()

![]()