Friday, February 17, 2006

This day in 1948, 18 year old Dick Button became the first American and also the youngest male to win a figure skating title and is credited with being the first to complete a double Axel in Olympic competition, St. Moritz, Switzerland. Headlines--- Welcome New Readers ######## surrounding the article denotes it is a “press release”

-------------------------------------------------------------- Welcome New Readers

New readers, welcome aboard. We recommend all readers join our mailing list to get notified when a new edition is “on line,” or to receive “extra's,” such as the notification of the Fed rate increase or “breaking news stories” that concern the industry. Our Web Trend indicates most of our readers “bookmark” our web site, which is a good idea, but if not on the mailing list, they won't get the extras or when we have an edition. We try to have five a week, Monday through Friday, but most often only have three, sometimes four a week. While our goal is to be a daily, we don't print unless there is enough equipment leasing news. We look forward to your comments and try to produce an edition that is worth your time to find an article or two you are interested in reading. For new readers, our best information comes from our “readers” who send us information “on” or “off the record.” There will be no issue of Leasing News on Monday, February 20th , Presidents Day. Please enjoy the long three day weekend. Christopher Menkin, editor -------------------------------------------------------------- Classified Ads---Sales Managers

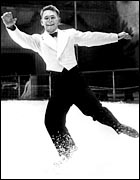

Dick Button executes a jump during a practice session at St. Moritz, Switzerland, January 19, 1948, in preparation for the Winter Olympics.* Atlanta, GA Austin, TX Chicago, IL. Chicago, IL Dallas/Fort Worth, TX. Marlton, NJ New York, NY Pennsauken, NJ. Portland, OR. Scottsdale, AZ For a full listing of all “job wanted” ads, please go to: http://64.125.68.91/AL/LeasingNews/JobPostings.htm To place a free “job wanted” ad, please go to: http://64.125.68.91/AL/LeasingNews/PostingForm.asp

18 year old Dick Button, 1948 *When Button was eleven, he wanted a pair of skates for Christmas, and got them. But he was disappointed. His father had bought him hockey skates instead of figure skates. The skates were exchanged. Button at the time was a chubby 160 pounds at only 5-foot-2 and his first teacher said he would never be a good skater. So his parents took him to another teacher and within five years Button won the first of his seven straight national championships, 1946 through 1952. He also won five straight world championships, 1948 through 1952, and two Olympic gold medals, in 1948 and in 1952. He won the 1949 Sullivan Award as the nation's outstanding amateur athlete, the first time it had ever gone to a figure skater. http://www.olympic-usa.org/26_597.htm http://www.allamericanspeakers.com/speakerbio/Dick_Button.php --------------------------------------------------------------

John Estok, Executive Vice-President of IFC Credit: "I would appreciate 48 hours to determine our response. "Thank you." *********************************** John Estok Executive Vice President FIRSTCORP-IFC Credit Corporation The above response was marked sent before we printed the e-mail on Wednesday, but received by us after publication on Wednesday of "Letters--We get eMails," http://www.leasingnews.org/Pages/IFC.htm Rudy Trebels, president of IFC Credit, earlier commented that he did not want to make any comments on matters in litigation. This issue was regarding what Mr. Estok said about Leasing News in court. It then becomes a public issue. Leasing News hopes Mr. Estok follows through with a response, as we prefer to give all sides equal coverage here. Today's email came from the same party in Wednesday's edition, which today we identify today as an attorney in Dallas, Texas. He prefers to use his e-mail address: storageunit@gmail.com. Other parties “involved” in the NorVergene-IFC Credit most likely know who he is. We invited both parties to the news forum. While he prefers to use his e-mail address only, we still will print his comments. When Leasing News withholds a name and prints a comment, we know who the individual is, and if claims are made, we substantiate them before printing them. Those who think we print anything anyone wants to say should know we have been criticized for not doing this, and for printing things without a party signing their name--- when the fact is we do know who the party is that helps give credence to what they say. Leasing News, nor could most of the journalist community exist without their “reliable un-named sources.” "strorageunit@gmail.com" gave us his "summary of the current situation:" "The smart lease companies have already walked away from the mess and have come to understand that they had better look harder at creators of commercial paper. They can't expect people looking to save a dime on phones to be better equipped than themselves to understand the prospects of a business like NorVergence. "They bought 'commercial paper' under a program agreement with a vendor who was scamming them and the end user with a cash-out scheme. It was a hack of the system that made a few criminals some cool money. The lease firms wanted solid commercial paper, the end user wanted discount phone service. "You can't base commercial paper on service. The solution? The Matrix box. It is simply a box that you finance. Nothing more, just a piece of cheap equipment, priced at an arbitrary value based on the services promised to the end user. "Neither the end user or the lease company got what they paid for. The lease industry needs to tighten up their commercial paper procurement process. One lesson is the value of buying portfolios over vendor agreements. They assume the risk when they buy from a vendor, a portfolio buyer is a plausible holder-in-due course. "It would be funny if they hadn't been hammering thousands of Mom & Pop shops trying to make good on their own horrible judgment. What is worse, most of them seem to feel no guilt in their attempts to do so. "They should just leave the old folks alone, cut the Churches and charities loose, and end this fiasco. "They made astounding errors. What really amazes me is that when Tom Salzano ( he and his brother Peter were founders of the company) emerged from the smoke and mirrors at the June 24th meeting (all the reps from LC's sat down with Tom and Pete and some other scumbags and learned that NorVergence was broke and dying). "The lease company reps (Popular Leasing USA, Inc.,OFC Capital, a Division of ALFA Financial Corporation,Partners Equity Capital Company, LLC) who pushed the Chapter 11 were 'outraged' to learn that Tom was really the power at NorVergence, so outraged in fact that they gave the brothers two million more dollars right then and there! Outraged I tell you. "Please." ---- On 07/14/2004 the NorVergence bankruptcy was changed to Chapter 7: "Lawyers for Denver-based Qwest, which is owed $15 million by NorVergence acknowledged receiving $1.1 million from the company shortly before the hearing. But Qwest's lawyer, Jack Zackin, said the telecom giant needed to be paid in full. "NorVergence's attorneys and some of its other creditors argued that granting Qwest's motion to end its agreement would doom NorVergence. It would also allow Qwest to terminate service to thousands of NorVergence customers without warning. "In addition to Quest, Sprint and T-Mobile are among the $30 millions that NorVergence acknowledged in court that it owes. "In addition to representatives from some of NorVergence's creditors, approximately 20 former employees came to yesterday's hearing. Dressed casually, a handful of the employees complained about bounced and missing paychecks." http://www.leasingnews.org/Conscious-Top%20Stories/Novergence_5.htm --------------------------------------------------------------

Are the NorVergence Lessees being misled? by Christopher Menkin

Yes, the latest news is another state attorney general has achieved a NorVergence lease settlement with a leasing company. This time it is Massachusetts Attorney General Tom Reilly getting the majority of publicity with, "More than 200 small business owners from across the country – including 20 in Massachusetts – will either receive refunds or be cleared of $6 million in debt under the terms of a settlement." The press release said, “The settlement, filed (on Valentine's Day) in Suffolk Superior Court, resolves allegations that BB&T Leasing Corporation ("BB&T") knew or should have known that its financing agreements with more than 200 small businesses were fraudulent. At the center of the deceptive practices is NorVergence, a bankrupt New Jersey-based telecommunications provider, which misled customers into signing long-term contracts with promises of discounts on local, long-distance, wireless and Internet services.”

Massachusetts Attorney General Tom Reilly "This settlement will ease some of the financial pressures small business owners faced when they agreed to do business with NorVergence," AG Reilly said. "Today's action is the latest in a series of steps to hold NorVergence accountable for their scamming and deceptive practices." Wow, where in the release does it say “NorVergence” is making the settlement or paying a fine, or that the two founders will be punished and were responsible for the alleged fraud? This somehow has made the leasing company and NorVergence one and the same. No wonder the NorVergence lessees are blaming the leasing companies. Certainly the other attorneys general in the other states issued press releases, with the same twisted concept, repeated over and over again, so it now appears the 48 leasing companies are NorVergence Corporation and not separate entities. The villain is the leasing company. Here is another fact: only half of those offered the settlements by the 28 attorneys generals and District of Columbia have accepted them. In addition, a highly reliable source tells Leasing News they are the smaller dollar leases. Last year twenty-eight attorney general offices and the District of Columbia who took the leasing companies to task, eventually gaining $28.45 million they claimed to be owed by 1,371 NorVergence customers. The latest makes it 1,571 out of an alleged 10,000 leasing customers. All the lessee had to do was agree to the settlement, often 80% to 90% on the contract, including other costs incurred such as personal property tax, insurance, and late fees. They had 30 days to do this. Then the leasing companies had 30 days to inform the attorney general's office, and then make periodic reports, as payments spread out over a period of time at no interest were also part of the arrangement. "We do not have data yet from all leasing companies, but the data we have received indicates about a 50% acceptance rate (48.2%)." said Melissa A.Merz, Illinois Attorney General Press Room, representing told Leasing News on January 5, 2006. “ All 7 of the AVC we have so far have totaled a potential savings of over $7.28 million for Illinois consumers.” Those that signed the contract believe there are other issues involved, while those that purchased the contract say they were not aware of the NorVergence fraud and what the actual cost of the equipment and warranty is not their responsibility as purchasers of the contract. The leasing companies further claim their are victims. The others claim they are not really victims when they collect all the monthly payments. The lessee is the victim, and they don't want to be---let it be the “l.c.'s” Are the NorVergence lessees being misled?

A highly reliable source tells Leasing News the Federal Trade Commission has not been able to "prove fraud" or "collusion" on the leasing companies to date. There are many other issues that if they do not "pan out," they may be bowing out by as early as September or the latest, at the end of the year. This leaves many state attorney generals trying to enforce the various state laws that may apply to the leases. In several states, they are running for other offices. Whether the new attorney general will take up the same causes, or whether those who do win reelection to their present office, will continue a June, 2004 bankruptcy event. No, the FTC is not giving up, but they have a time frame to produce or move on. Several “blogs” and web sites of groups of NorVergence lessees are “fanatic” that they will get "triple" their money back in fines and penalties. There are three class action suits with over 2,500 putting money into a “war chest” who believe that they will not only get “justice” but land on the “Wheel of Fortune” number and earn “Big Money.” Others are “adamant” in their position. One NorVergence lessee on a listserve said this month his company, which he owns, has spent over $12,000 with his attorney to date. It is now over what he owes. He said he was willing to spend twice that, as he will never pay what the “l.c.'s” claim he owes them “for a $500 matrix box.” The latest rumor making the “blog” rounds is that Popular Leasing, Preferred Capital, IFC Credit, among others are about to throw in the towel. All indications are contrary to this “wish.” To sum it up, the issues appear both “political” and “emotional” directed. Now before we get the hate e-mail, and we get it from both sides, one thinks we are too critical of our industry, the other says we are not only taking the industry side, but speak for them--- let me declare as editor: We want to report the news fairly, without bias, and to be independent, not on one side or the other. As to the discovery of “Holdbacks,” 18% and 30% interest yields, or even higher amounts or huge discounts in buying a lease contract, these are not uncommon in this specific segment of the industry, particularly in an operating lease or true lease (remember, none of the NorVergence leases had a "residual" or "purchase option." The buying and selling of contracts may offend some, but that is the practice of commerce since biblical times. What the leasing company makes should be their business, such as what a restaurant charges for “leg of lamb” or a bottle of wine (some charge the same for a glass of the same wine you can buy the bottle for at retail store.) You don't like the price, don't go to the restaurant. You don't like the leasing company's monthly payment, don't sign the lease. In this NorVergence matter, the lessee thought they were signing a lease and getting service from one company, but the contract was sold to another. As long as they were getting “telephone service,” the lessee evidently didn't care who was collecting the monthly payment. When the service stopped, they wanted to stop making the monthly payments. The issue surrounds whether the leasing companies knew service was involved, and without it, the lease contract would be of little value to the lessee. We hope those involved also read the article we printed: When is a lease not a lease? http://www.leasingnews.org/archives/February%202006/02-14-06.htm#when Here are copies of the Wells Fargo, USB, and CIT settlements: http://leasingnews.org/PDF/Wells%20Fargo%20AVC%205-26-05.pdf http://leasingnews.org/PDF/USB%20AVC%20Final%205-26-05.pdf http://leasingnews.org/PDF/CIT%20AVC%205-26-05.pdf --------------------------------------------------------------

True Leases - True Challenges by Steve Chriest Even industry experts agree that lease accounting standards are arcane and esoteric. It doesn't seem to be a question of “if,” but “when” the SEC gets its way and has the current lease accounting standards rewritten. When this happens, the leasing industry, as it has existed during the last thirty years, will change, and those leasing salespeople involved in so-called structured transactions will have to change the way they sell. It's hard to argue with the SEC's position that off-balance-sheet treatment of leases allow companies to easily make a finance purchase appear like a rental contract. Using current accounting standards, lessees are able to legally keep an estimated $1.25 trillion (undiscounted) in future payment obligations off their balance sheets! Robert Herz, chairman of the Financial Accounting Standards Board (FASB), agrees with the SEC. He questions why companies that acquire even essential assets, and incur a non-cancelable obligation to pay for them over time, want to keep the assets and the payment obligations off their balance sheets. The concern, of course, is with accounting transparency, and with ensuring the ability of investors to accurately evaluate a company's true financial condition. So, how much of the leasing industry would be affected by these accounting rule changes? Since the SEC estimates that 63% of public companies use operating leases, and the estimated total cash flows related to non-cancelable operating leases outweighs the cash flows related to capital leases by more than 25 to 1, a significant percentage of the equipment leasing industry will be affected by the changes. What will lessors and leasing sales professionals do if off-balance-sheet financing disappears and leasing products must be justified solely on economic terms? Without the advantages of off-balance-sheet leases, lessors will somehow have to position themselves as viable alternatives to basic interest-rate-spread lenders. For those involved in structured transactions, now is the time to prepare a game plan for competing in a new accounting environment. The value propositions of lessors will need to emphasize creative financing products that address their customers' pressing business problems, expertise in asset and risk management, and other operational benefits of leasing. The end of true leases will surely present true challenges for the industry. Leasing industry boosters will no doubt argue that just as the industry survived and prospered after the repeal of the Investment Tax Credit, ways will be found to survive future changes in accounting rules. Having met a great many smart, creative leasing industry veterans, I would bet on this argument. Copyright © 2006 Selling UpTM. All Rights Reserved. About the author: Steve Chriest is the founder of Selling UpTM (www.selling-up.com), a sales consulting firm specializing in sales improvement for organizations of all types and sizes in a variety of industries. He is also the author of Selling Up, The Proven System For Reaching and Selling Senior Executives. You can reach Steve at schriest@selling-up.com. ### Press Release ########################### IFC Vendor Division Expands Services in Illinois, Midwest

MORTON GROVE, Illinois, -- The FirstCorp Division of IFC Credit Corporation has expanded the size and scope of its downtown Chicago office to reach additional technology equipment vendors throughout Illinois and the Midwest. Dave Farber, Vice President of Vendor Sales for FirstCorp, says the downtown Chicago office previously focused exclusively on vendors located within the city. In December, FirstCorp moved to a new downtown location in order to double its small-ticket vendor services staff and size of its space. The new office is at 230 W. Monroe, Suite 134, Chicago, Illinois 60606. “The changes have allowed us to enhance service to vendors and lessees in Chicago and reach out to new technology vendors throughout Illinois and the Midwest,” Farber explains. “From Chicago, it's just a short plane ride to most Midwestern cities. We can easily provide on-site education and training to equipment vendors throughout the Midwest.” Vendor services professionals at FirstCorp help manufacturers provide flexible financing options and fast funding to dealers and customers. Farber says the office in downtown Chicago is staffed with twelve leasing professionals, and focuses on transactions ranging from $2,500 to $500,000 in value. About FirstCorp FirstCorp is a division of IFC Credit Corporation, a Morton Grove, Illinois-based capital equipment leasing firm dedicated to providing superior, innovative financial services to small and medium size businesses throughout the United States. IFC's services are offered on a direct basis to middle market businesses, and indirectly through its FirstCorp vendor services group and its third-party funding services unit, Pioneer Capital Corporation. Contact: Brian Cascarano ### Press Release ###########################

-------------------------------------------------------------- Classified Ads—Help Wanted Account Executive

Funding Manager

Independent Regional Sales Manager

--------------------------------------------------------------

Alexa Ranks Leasing Media Web Sites

David G. Mayer's Business Leasing News is not included in the Alexa report list as it does not have its own individual site and Alexa finds Patton Boggs, LLP Attorneys at Law. The rating is not valid as it includes all those who visit and communicate with the law firm. When Business Leasing News has its own individual web site, it will be included in the Alexa survey. These comparisons are compiled by Leasing News using Alexa and should be viewed as a "sampling," rather than an actual count from the website itself. Other than as noted above, we believe the ratings are reflective as most have stayed in the same position, basically, for over a year. The Alexa tool bar works on most browsers. You may download their free tool bar A graph and analysis of the last three months are available. ( Note: the lower the number, the higher you are on the list. It is based on all web sites. Leasing is only a very small part of the various sites such as Yahoo, MSN, Google, etc. )

-------------------------------------------------------------- An Analysis of Leasing Company IPO

Shawn Halladay's www. leasingnotes.com recent edition has James M. Johnson, Ph.D. article that appeared in the Equipment Leasing and Finance Journal, “An Analysis of Leasing Company IPO.” “Initial public offerings (IPOs) in the equipment leasing industry have many similarities to IPOs in general, but leasing company IPOs constitute only a small fraction of the companies that go public. This article analyzes the 24 leasing companies that filed IPOs with the Securities and Exchange Commission between 1994 and 2004.”

James M. Johnson PhD Jamesjohnson@niu.edu James M. Johnson is a professor of finance in the Graduate School of Business at Northern Illinois University, DeKalb, and serves on the board of trustees of the Equipment Leasing and Finance Foundation. He has been a consultant, advisor, and educator of lessors and lessees alike for more than 25 years. Dr. Johnson serves as an expert witness in leasing disputes and has written extensively on lease finance. His most recent books include Power Tools for Small Ticket Leasing (2004), Technology Leasing: Power Tools for Lessees (2002), and the best-selling Power Tools for Successful Leasing (2000), co-authored with Berry S. Marks and Richard Galtelli. All are published by Leasing Power Tools Press. Dr. Johnson serves on this journal's editorial advisory board. 18 page report: http://leasingnews.org/PDF/leasingcompanyIPOs.pdf

-------------------------------------------------------------- Leasing News Valentine Day Present from www.leasingnotes.com

What I like best is the clean, simple writing, and the ability to click to the subject the writer in the article the writer is talking about, and then back to the article itself. Leasing Notes is “state of the art.” One day I hope we write the well and clean, easy to read, and to the point. Shawn Halladay February 14, 2006 Know More: Leasing industry “Leasingnotes got a welcome mention in Leasing News the other day. For those of you who are not familiar with Leasing News, it is a very good site that provides, according to its masthead, “Independent unbiased and fair news about the Leasing Industry,” which is no brag, just fact. It also contains a wealth of other, eclectic information such as classified ads, association data, views on sports and wine, lessee complaints, meeting notices, various lists, and, my personal favorite, This Day in American History. “The List, another of its features, is why I am mentioning Leasing News today. The List tracks the top changes in the leasing industry and is regularly updated. When visiting Leasing News the other day, I was reminded of what a great picture of our changing industry it provides. If a company has changed structure or status it makes it to The List, so it is a great way to stay in touch with the composition of the industry. You can track acquisitions, combinations, spin-offs, and companies that are exiting the industry for whatever reason (some of whom do not do so of their own volition). “The Alta Group used The List extensively when we conducted The Perfect Storms study for the Equipment Leasing & Finance Foundation. The patterns and insights it provided were immensely helpful. We were able to identify the many companies that exited the leasing industry at such a high rate during the late 1990s. From there, we were able to analyze the reasons and contributing factors as to why these companies did exit the industry. As I got to thinking back on this project, I realized that The List is almost like a little microcosm of our industry that reflects many of its major characteristics. “Think about it. The leasing industry thrives on change, which is exactly what The List tracks. Companies are always being purchased or absorbed as lessors change to meet shifting market dynamics and internal needs, or seek growth. Leasing is a risky business, too, as many have found out when they ended up being listed as leaving the industry involuntarily. And, although not representative of the industry, The List also highlights the seamy side of the industry when the occasional scalawag who has scammed others and put his company out of business shows up. It's all there from the best to the worst, and in one place. Check it out!” (One plug deserves another. We also have added your blog to our Alexa list. While not scientific at all, it does give an indication of readership. My bet is your relatively new classy site will climb up to at least the top ten, maybe even top five or higher, utilizing the latest procedure to sign up for your Leasing Notes “column.” Kit Menkin ) ---------------------------------------------------------------### Press Release ########################### Jack C. Phillips, Jr. joins Valley National Bank as Vice-President, WAYNE, N.J. -Valley National Bank, the wholly-owned subsidiary of Valley National Bancorp (NYSE:VLY) announced that Jack C. Phillips, Jr. has joined Valley Commercial Capital, LLC ("VCC") as Vice President and Business Development Officer. VCC is a subsidiary of Valley National Bank that provides commercial equipment leases and general aviation financing.

Jack C. Phillips Phillips will be responsible for cultivating new business relationships in commercial equipment financing and leasing throughout New Jersey, New York, Connecticut and Pennsylvania. He can be reached at the VCC offices located at 1455 Valley Road in Wayne by calling 973-686-3955 or by email at jphillips@valleynationalbank.com. Phillips brings over 20 years of business development, marketing and management experience in the leasing industry to his position. He earned his Bachelor's degree in Business Management from Fairleigh Dickinson University. He is a member of the 200 Club of Bergen County. VCC arranges fixed asset leases in nearly every industry, ranging from computer and medical equipment, to tractor-trailers and production/manufacturing assets. VCC offers a variety of pricing and payment options to fulfill the needs of clients and will engineer financial solutions tailor-made to balance sheets, cash flow, and the seasonality needs of any business. Valley National Bancorp is a regional bank holding company with over $12 billion in assets, headquartered in Wayne, New Jersey. Its principal subsidiary, Valley National Bank, currently operates 163 offices in 106 communities serving 12 counties throughout northern and central New Jersey and Manhattan. Valley National Bank ### Press Release ########################### WestLB Closes USD 75 Million Secured Loan Facility to Finance Equipment Leases and Installment Sales Contracts Originated by Highline Capital Corp. WestLB Capital Markets North America unit is pleased to announce that it successfully closed a USD 75 million Secured Loan Facility to finance Highline Capital Corp.´s origination of equipment lease and installment sales contracts. WestLB acted as Sole Structuring Agent and Lender on the financing. The USD 75 million credit facility, with the ability to expand to USD 125 million, provides Highline with increased financial flexibility and a committed funding source for future growth. "WestLB, as a lender in the equipment leasing space, views Highline Capital as a strategic partner in growth," Brian Statfeld, Executive Director, and Co-Head of WestLB´s Asset Securitization Group, said. "Highline Capital has the level of insight and integrity that exemplifies exceptional value in a partner." The credit facility was structured to finance a cross-section of Highline´s equipment leasing business lines, as well as installment sales contracts originated by Highline Capital Transportation, Inc., a wholly-owned subsidiary of Highline Capital Corp. "We chose WestLB from the numerous alternatives because we were impressed with the professionalism of the Bank´s officers. It turns out we made the right decision for the right reason. WestLB did an incredible job in structuring the credit facility to match Highline´s business needs," said John Mehalchin, Highline´s Chairman and CEO. "WestLB has been very successful so far, having completed several equipment lease financing facilities in the last year across the small-, mid- and large-ticket sectors," said Matt Tallo, a Director in WestLB´s Asset Securitization Group. "This noteworthy transaction is indicative of WestLB´s ability to strategically build on previous successes and relationships in the marketplace and underscores WestLB´s commitment to the equipment leasing sector." About Highline Capital Corp. Highline Capital Corp. (HCC) is a privately-held company that provides leasing and collateralized financing services across all industry segments and all transaction sizes. HCC leases and finances equipment for a broad customer base that includes manufacturers, value-added resellers and end users. The Company´s clients range in size from Fortune 500 to middle and below middle market companies. Highline specializes in vendor private-label programs and services to numerous industries including transportation, medical, industrial, hi-tech, hospitality, franchise and leisure & fitness. About WestLB Capital Markets North America WestLB develops sophisticated structured solutions through a team of highly experienced investment banking and capital markets professionals. WestLB has a long-standing presence in the corporate, structured and asset-backed financing sectors supporting clients´ needs with capital commitments, advisory services and innovative financing solutions. The bank´s global relationships, coupled with its unique understanding of local economies, industries and cultures, help WestLB bankers consistently deliver high quality advice and service. About WestLB WestLB AG is one of Germany´s leading financial services providers with offices in the world´s largest financial centers. The firm provides financial advisory, lending, structured finance, project finance, capital markets and private equity products, asset management, transaction services and real estate finance to institutions. WestLB has total assets of more than EUR 262.4 billion, as of September 30, 2005. For more information, please visit www.westlb.com. In the United States, certain securities, trading, brokerage and advisory services are provided by WestLB´s wholly owned subsidiary WestLB Securities Inc., a registered broker-dealer and member of the NASD and SIPC. ### Press Release ###########################

News Briefs---- Alternative minimum tax could hit 23 million individuals next year Bernanke hints that more hikes in interest rates may be coming Freddie Mac: 30-Year Mortgage Rates Rise Housing Starts Near 33-Year High (as predicted in Leasing News*) *http://www.leasingnews.org/archives/January%202006/01-26-06.htm#housing Bernanke declines comment on Wal-Mart bank bid TD Bank to buy non-prime auto lender VFC Inc. in $326-million deal J.C. Penney says Q4 profits up 65 percent Glacier Melt Could Signal Faster Rise in Ocean Levels Dell Reports Higher Profit, but Expects Less Growth OLYMPICS NO MEDAL WINNER FOR NBC RATINGS or see: 'Idol' ratings ice Olympics Airlines lost 10,000 bags a day in '05 ---------------------------------------------------------------

You May Have Missed Must Be Something in the Water http://www.nytimes.com/2006/02/15/dining/15water.html ---------------------------------------------------------------

Sports Briefs---- Culpepper trade sought More strange Raider doings Plushenko Glides, as Weir Just Slips and Slides ----------------------------------------------------------------

California News Briefs--- Olive oil emerges as California's latest cash crop http://www.contracostatimes.com/mld/cctimes/13870675.htm ----------------------------------------------------------------

“Gimme that Wine” Ma. Lawmakers override Romney veto of wine sale bill California Grape crop was a corker, report shows Oregon wine industry brings in more than $1B If you want to know if you got a value for your wine, or what the wine price is today, go to www.winezap.com Type in the vintage (year) and name of the producer with wine type or geographic area, such as 1995 Chateau Lynch Bages Pauillac. Even 1995 Lynch Bages will work, or 1999 Viader ----------------------------------------------------------------

Calendar Events This Day Great Backyard Bird Count February 17-20. Thousands of volunteers' nationwide track the number and types of birds that live near their homes. Results help researchers monitor species in trouble. www.birdsource.org/gbbc My Way Day Hundreds of people have their opinions as to who we are. Today is the day we decide who's right. Today we determine our identities all by ourself. www.wellcat.com ----------------------------------------------------------------

Today's Top Event in History 1913-The first Modern art exhibition of importance opened at the 69 th Regiment Armory in New York City. The controversial exhibition, organized chiefly by the American modernist painter Arthur Bowen Davies, scandalized the public with such avant-garde works as Marcel Duchamp's “Nude Descending a Spiral Staircase.” More than 250,000 visitors received their first look at paintings by Paul Cezanne, Paul Gauguin, Vincent van Gogh, Edward Hopper, Henri Matisse, John Marin, Charles Scheeler, and others. ----------------------------------------------------------------

This Day in American History 1761-Still surviving today in some East Coast communities, and considered landmarks as they exist today are “milestones” between cities. There were stone blocks with mileage to mark the highways. Originally they were set by the directors of an insurance company known as the Philadelphia Contributionship for the Insurance of Houses from Loss by Fire. On this day, they agreed” to apply their fines ( a forfeiture of one shilling for not meeting precisely at the hour appointed, and two shillings for total absence) in purchasing Stones to be erected on the Road leading from Philadelphia toward Trenton, the distance of a mile from another with the Number of miles from Philadelphia, to be cut in each stone, and Thos, Wharton and Jacob Lewis are requested to Contract for the same. On May 15,1764, at five o'clock in the morning, the two men starting out from front and Market streets, taking with them the Surveyor General of the Province, and plated a stone at the end of every mile. They planed the 29 th milestone near the edge of the Delaware River, and gave their two remaining stones to be planted on the Jersey side of the road to New York. ---------------------------------------------------------------- Winter Poem President George Washington 14 September 1789 An Acrostic--

W hat power of Language can enough extoll

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|