![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial alternate financing,

bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

Wednesday, January 13, 2016

Today's Equipment Leasing Headlines

Correction:

Curt Ritter No Longer at CIT Group

Banks/Funders Pony Up Another $2.5 Million Plus

in Sheldon Player’ EAR Settlements

by Tom McCurnin, Leasing News Legal Editor

United States CEOs Optimistic for 2016

Pepperdine University Survey

Ascentium Capital Achieves 56% Increase Funded Volume

CEO Names Technology Infrastructure Breakthrough & Personnel

Leasing Industry Ads---Help Wanted

Hoping for You

IKEA Job Interview

Cartoon

Sales Make it Happen by Steve Chriest

First Steps to Ending the Crisis in Sales Management

Ladder of Achievement

Placard

ASPEKT, Macedonia

Joins Leasing News Software Company List

With big-bank earnings, attention turns

to rates, credit and global pressures

By Chris Vanderpool and Kevin Dobbs, SNL Financial

Retriever

Charlotte, North Carolina Adopt-a-Dog

Leasing News Classified Ads

Collector / Collections / Consultant / Communications

News Briefs---

Best Captive Technology Finance Team Global 2015

Cisco Capital

New FinTech Lenders Ignore Consumer Credit Ratings

"We Don't Trust FICO Scores"

5 Reasons New Lenders Are Ignoring

FICO Credit Scores

Old National to Buy Anchor Bank

in Madison, Wis., adding 32 to its 160 banks

Raiders Will Not Move To L.A. After NFL Owners Vote;

Relocation Still Possible

Rams Moving to Los Angeles Area,

and Chargers Could Join Them or Raiders

Broker/Funder/Industry Lists | Features (writer's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

Leasing News Icon for Android Mobile Device

You May have Missed---

SparkPeople--Live Healthier and Longer

Poem

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release” and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send to a colleague and ask them to subscribe.

[headlines]

--------------------------------------------------------------

Correction:

Curt Ritter No Longer at CIT Group

Mayor Ritter is SVP, Head of Corporate Communications at

Church Pension Group and left CIT before the recent exodus.

Curt Ritter Sworn in as Mayor of Chatham Township, New Jersey

http://leasingnews.org/archives/Jan2016/01_11.htm#ritter

Curt Ritter, Leasing News Person of the Year 2010

http://leasingnews.org/archives/Jan2011/1_04.htm#ritter

A Look at Why John Thain is Retiring from CIT

by Dale Kluga, Cobra Capital

http://leasingnews.org/archives/Oct2015/10_28.htm#cit

[headlines]

--------------------------------------------------------------

Banks/Funders Pony Up Another $2.5 Million Plus

in Sheldon Player’ EAR Settlements

by Tom McCurnin

Leasing News Legal Editor

Equipment Lessors Pay Massive Amount of Money to Rid Themselves of the EAR Preference Claims. The Trustee is a Huge Winner.

I have been following this, writing about this for Leasing News since 2012, but I must admit I never thought too much about the EAR Trustee suing the leasing companies for fraudulent conveyance. I assumed the cases would just go away -- or would settle early for very nominal amounts. Boy, was I wrong! This is both a major loss and a major precedent!

In the last six months, the “who's who” of major leasing companies ponied up $2.5 million dollars to the bankruptcy court just rid themselves of this nasty litigation brought on by poor underwriting and filing “abundance of caution” proofs of claim. This does not count attorney fees, court costs, or bank officer’s time or travel involved in the cases.

It also does not include the payments not made to the funders or lessors by EAR, or the loss of collateral that was valueless or did not exist, or the court costs, fees, attorney costs, bankers time, in the collection effort by the bank and/or lessor.

These are amounts paid so far to dismiss the case, all from the Northern District of Illinois Bankruptcy Court. Read it and weep.

Lessor |

Case No. |

Amount Paid |

American Bank |

11-02200 |

$90,000 |

CIT Group |

11-02203 |

$440,000 |

Comerica |

11-02218 |

$100,000 |

Hewlett Packard Financial Services. |

11-02220 |

$750,000 |

KLC Financial |

11-02222 |

$150,000 |

Leasing Innovations |

11-02102 |

$1,750 |

Leasing One |

11-02224 |

$300,000 |

Pentech |

11-02231 |

$25,000 |

Peoples Capital |

11-02233 |

$130,000 |

Plains Capital Leasing |

11-02236 |

$425,000 |

SunTrust Leasing |

11-02201 |

$137,500 |

In addition, US Bank and IBM Credit appear on the verge of settling with the Trustee. I say that because the trial is in a few weeks, and I’ve seen no briefs, witness lists, or other documents, which to me means they are talking settlement. Those two ought to be very big settlements as well.

A few other leasing companies were dismissed because they were out of business, or were bank subsidiaries and the FDIC took over the bank.

In addition, two cohorts of Sheldon Player, Mark Anstett (president and co-owner of Equipment Acquisition) and George Ferguson (owner and president of the former Machine Tools Direct, the vendor involved) were indicted by the Grand Jury for wire fraud. Anstett plead guilty in Case No. 14 CR 102-1 (E.D. Illinois) and received five years in prison. He is due to surrender this week. Ferguson appears to be pleading guilty as there is a change of plea hearing set for later this month. Both men are in their 50s and 60s and their prospects look very bleak indeed.

For those of you who don’t remember this huge leasing fraud, some background might be useful.

The Scam

Equipment Acquisition Resources acquired equipment and double, triple and quadrupled the financing of the equipment through a couple dozen leasing companies. Its principal was Sheldon Player. Often the equipment did not exist. The ticket prices were six figure deals, so at least in my leasing background, this would warrant a background check of the vendors and principals, lessees and their principals, and of course a surprise, unannounced physical inspection of the equipment.

Apparently, no one bothered to inspect the equipment or to adequately underwrite Player. And let me emphasize this point that Leasing News wrote about Player and his background in an alert May 2, 2007, including later an interview with Player, published May 4, 2007, which included why he was turned down by several leasing companies. (1) Sheesh, did none of the leasing companies read Leasing News or have a computer and “Google?” I mean really, I don’t get it.

The EAR leasing companies were not rinky dinky strip mall brokers, these were major players. Being a convicted felon, he wouldn’t be able to work for any of the banks or bank subsidiaries by federal law, but they fund him $150 millions? Someone really needs to explain to me how this happened. I know there were several who discovered the discrepancies and did not go ahead with the lease. THAT was the way Leasing News learned about it and searched who Player was and his fraud conviction case with Greyhound Leasing for doing the same he was doing at EAR.

In any event, Player successfully operated the scam as a Ponzi scheme with new leasing company financing paying off old leasing company financing Old, paid off leasing companies thought the deal was so good, that they often came back for more, and did multiple financing. Most of the lessors had multiple deals in the aggregate of seven figures.

As all Ponzi schemes go, the scam crashed on October 23, 2009, when EAR filed for bankruptcy. (2) Player, died November 13, 2013 of prostate cancer. (3).

The Trustee

The court appointed an experience trustee to manage this massive bankruptcy, trustee William Brandt. Brandt is a lawyer and accountant and is widely recognized as one of the foremost practitioners in the insolvency field. He is well connected politically, having served on the Illinois Gubernatorial Transition Team and the Presidential National Finance Board. To call him a heavyweight is probably understating his qualifications. He is known and respected by anyone in the bankruptcy field, is a frequent speaker, and is known as a very aggressive litigator.

The Trustee’s Lawsuits

Brandt filed about three dozen lawsuits within the bankruptcy, called adversary actions against every creditor of EAR who had received any money from EAR pre-bankruptcy. This included, by the way, The Internal Revenue Service. And won! Yeah, this guy takes no prisoners.

The suits in general alleged a fraudulent conveyance of EAR money, alleging that by virtue of their financing, they contributed to the loss and downfall of EAR. Moreover, Brandt alleged, that without the financing, EAR would have cratered sooner.

The Trustee concluded that EAR was a Ponzi scheme, by concluding that the “investors” were the creditors of EAR which supplied EAR with money and goods and expected payment in return. While characterizing EAR as a Ponzi scheme might be a bit of a stretch, such a characterization has an advantage in that there are special rules for Ponzi schemes and fraudulent conveyance actions, because the investors really don’t have specific intent to defraud anyone, they are just ignorant investors. Accordingly, a body of law has developed which presumes intent if the Ponzi scheme is established. Thus, the Trustee could, if a Ponzi scheme was proven, go after the investors for the monies received during the scam, seeking to recover the monies paid to the equipment lessors.

Many of the smaller players settled with the Trustee, but eleven brave lessors stood tall and fought the Trustee—for four years and three sets of pleadings.

The case had a number of procedural twists and turns. As reported last year in Leasing News, the lessors filed motions to dismiss, which were granted, but gave the Trustee leave to amend. When the Trustee amended his Complaint, Brandt again alleged that EAR was a Ponzi scheme and did not allege specific intent on the part of the equipment lessors. The lessors file a second round of motions to dismiss. (4)

After several continuances, the Court reached a ruling in June, 2014 which again granted the motion to dismiss and again gave the Trustee leave to amend, but with one very big development—the Court ruled that EAR was not a Ponzi scheme, and as a result, the Trustee had to allege specific intent on the part of the lessors.

Brandt amended and alleged fraud with specificity against the equipment lessors and the pleadings stuck in 2014.

Several of the leasing companies (CIT Group, Plains Capital) tried to get the United States District Court interested in an interlocutory (discretionary) appeal of this travesty, but to no avail.

The Trustee scheduled no less than ten (10) depositions of Suntrust, TD Bank North Leasing, Leasing One, The CIT Group, together with Mark Anstett (president and co-owner of Equipment Acquisition) and George Ferguson (owner and president of the former Machine Tools Direct). The lessors scheduled a score of depositions of the trustee and other players (no pun intended).

The Legal Fees

Litigation is expensive. Every one of these motions to dismiss involves research, a pleading, reviewing an opposition, drafting a reply, and attending a hearing, or two. While I obviously do not know how much the lessors spent, I would have to guess that each one of the three motions ran $25-30,000. Add to that numerous status conferences and a very large discovery dispute over documents, and each lessor could have easily incurred $100,000 in fees. And this is sunken money—the lessors are never going to get it back, even if they win. And the prospect of 15 depositions all over the United States? These depositions could easily add another $100,000 in fees. And, we haven’t started talking about having a trial on the merits. Taken all the way, this could have been a $400,000 problem.

Brandt typically did not have those attorney fees. Trustees usually strike a deal with their counsel on a percentage or contingency basis, so there is no cost to the estate for continuing the litigation, year after year. To add insult to the situation, typically the lawyers and trustee hold out for big money and settle with bigger players for a lot of money, and throw the low hanging fruit away.

The Settlements

Once a reader understand the economics of this type of litigation, the reader would quickly come to the realization that perhaps Brandt wasn’t giving up, and the legal sink hole will only get deeper and deeper. So perhaps, the wiser course is to offer the trustee some money. I think I would have gotten to that conclusion earlier than later, but frankly, it’s never too late to settle.

So, for the past eight months, the individual lessors worked amongst counsel and structured settlements. It was hard for me to figure out why some lessors paid more, but generally the amount of leases they had (and the corresponding amount of EAR money they received) seemed to be a factor along with whether or not the lessor filed a claim. I’ll get to why filing a claim might have been an issue later.

So at this juncture, eleven of the lessors have settled and two more appear to be on the cusp of settling with Brandt. What a painful lesson this has been.

How This Could Have Been Avoided

Of course, underwriting is the answer here. The lessors could have underwritten the vendor, which was EAR and Player, and could have made him qualify from a credit standpoint just like any other customer of the lessor. I remain puzzled why EAR and Player got such special treatment by the lessors.

Funding protocols is another answer. I was taught that lessors never, ever, fund without pre-approving the vendor and physically inspecting the equipment. Now a $10,000 computer system may not deserve the attention that a $100,000 piece of equipment will, but nevertheless, some funding protocols are necessary. I again remain mystified how this could have happened, especially with the alert and stories in Leasing News.

Filing a claim was also an issue. Back in about 2004, the United States Supreme Court ruled on a relatively benign issue involving the estate of Anna Nicole Smith, the Guess Jeans super model turned whacko reality star. The case, Stern v. Marshall, essentially held that fraudulent conveyance actions may not be “core” proceedings, and thus, the trustee might not be able to sue for such claims within the bankruptcy and the district where the matter is pending. A pile of other more direct cases held that this was the case, but could be waived by a creditor filing a proof of claim, which essentially deems the creditor has consented to jurisdiction where the bankruptcy is pending.

Most of the lessors did file such claims, and thus implicitly consented to Brandt’s suit against them, even if they were not located in Illinois. While some of the lawyers filed motions to drop the bankruptcy adversary case (often called a motion to remove a reference), it was too late for the lessors who had filed their claims. They were stuck in Illinois and stuck with William Brandt.

Takeaways

There a bunch of lessons here, many of which I’ve probably already gone over, but here is the short list:

- First, Look more closely at who referred the deal to you. After this was brought to light, there were five or more brokers who knew what was going on, including one who actually placed several of the same equipment to various funders, and received a commission from EAR for doing so.

- Second, Underwrite the Vendor. Most lease fraud cannot occur without a crooked vendor (fake equipment, kickbacks, over-priced equipment), so figuring out what this equipment is and who is selling it and if they have been in business for a significant period of time is important. Player’s resume had three year gap in it while he was in prison

- Third, Underwrite the Deal. Underwrite the lessee. Any deal over a self-proscribed threshold, say $75,000, a background check or public records search is warranted.

- Fourth, Observe Funding Protocols. No funding check should leave without the equipment being visually inspected by a third party inspector. There were very few, if any site inspections or follow-up inspections during the course of the lease.

- Fifth, Use Common Sense. At American Express, we had a bunch of deals go bad where people in one state were financing equipment from a vendor 300 miles away. Made no sense. At Leaf, we had a chiropractor who financed 50 copier machines for a single location. Made no sense. So the lease administers needs to exercise common sense.

- Sixth, Think Before Filing a Proof of Claim. Creditors instinctively want to file a proof of claim in every bankruptcy they see, whether it is a no asset or the prospects for collection seem poor. My advice is to stop, think, and get good counsel to help decide whether filing that claim makes sense. In EAR’s situation, everyone who read Leasing News knew this was a Ponzi scheme in 2007 and this jailbird and this estate was going down. Everyone knew that there were a bunch of big name lessors involved which make this type of litigation very attractive. This is not to say that a lessor never files a proof of claim, but some thought process has to go into the decision.

- Seventh, Settle Early, Settle Often. From experience, I will tell you that the first people who settle in Ponzi schemes get the best deals, because it fills up the trustee’s coffers and allows him to pursue bigger, fatter targets. I was very surprised that the lessors allowed this litigation to go on for four years.

The bottom line to this case, and the settlements is this—although late in coming, the lessors probably made a smart move in disposing of this litigation, albeit at a very costly sum. Next time, underwrite.

(1) Sheldon Player, Greyhound Leasing, Deja vu?

http://www.leasingnews.org/archives/May%202007/05-04-07.htm#deja

(2) Bankruptcy Filing

http://leasingnews.org/PDF/EAR_Files_BK_11.pdf

(3) Player Death Record

http://leasingnews.org/archives/Jan2014/1_23.htm#confirmed

(4) Lessors Chastised by District Court In E.A.R. Case For Waiting

Three Years To Contest Jurisdiction

—Case Now At Issue with Answers Filed By Lessors

http://leasingnews.org/archives/Nov2014/11_07.htm#lessors

E.A.R. Case Takes Wrong Turn for Equipment Lessors

http://leasingnews.org/archives/Jan2014/1_23.htm#ear

Sheldon Player's Equipment Acquisition Resources

Ropes 18 Equipment Lessors

in Alleged Fraudulent Conveyance Action

http://leasingnews.org/archives/Nov2012/11_19.htm#player2

Sheldon Player/Equipment Acquisition Resources

Typo in Lease Spawns Major Litigation

http://leasingnews.org/archives/Aug2012/8_16.htm#player

Tom McCurnin is a partner at Barton, Klugman & Oetting

in Los Angeles, California.

Tom McCurnin

Barton, Klugman & Oetting

350 South Grand Ave.

Suite 2200

Los Angeles, CA 90071

Direct Phone: (213) 617-6129

Cell (213) 268-8291

Email: tmccurnin@bkolaw.com

Visit our web site at www.bkolaw.com

Previous Tom McCurnin Articles:

http://www.leasingnews.org

Previous Tom McCurnin Articles:

http://www.leasingnews.org/Conscious-Top%20Stories/leasing_cases.html

[headlines]

--------------------------------------------------------------

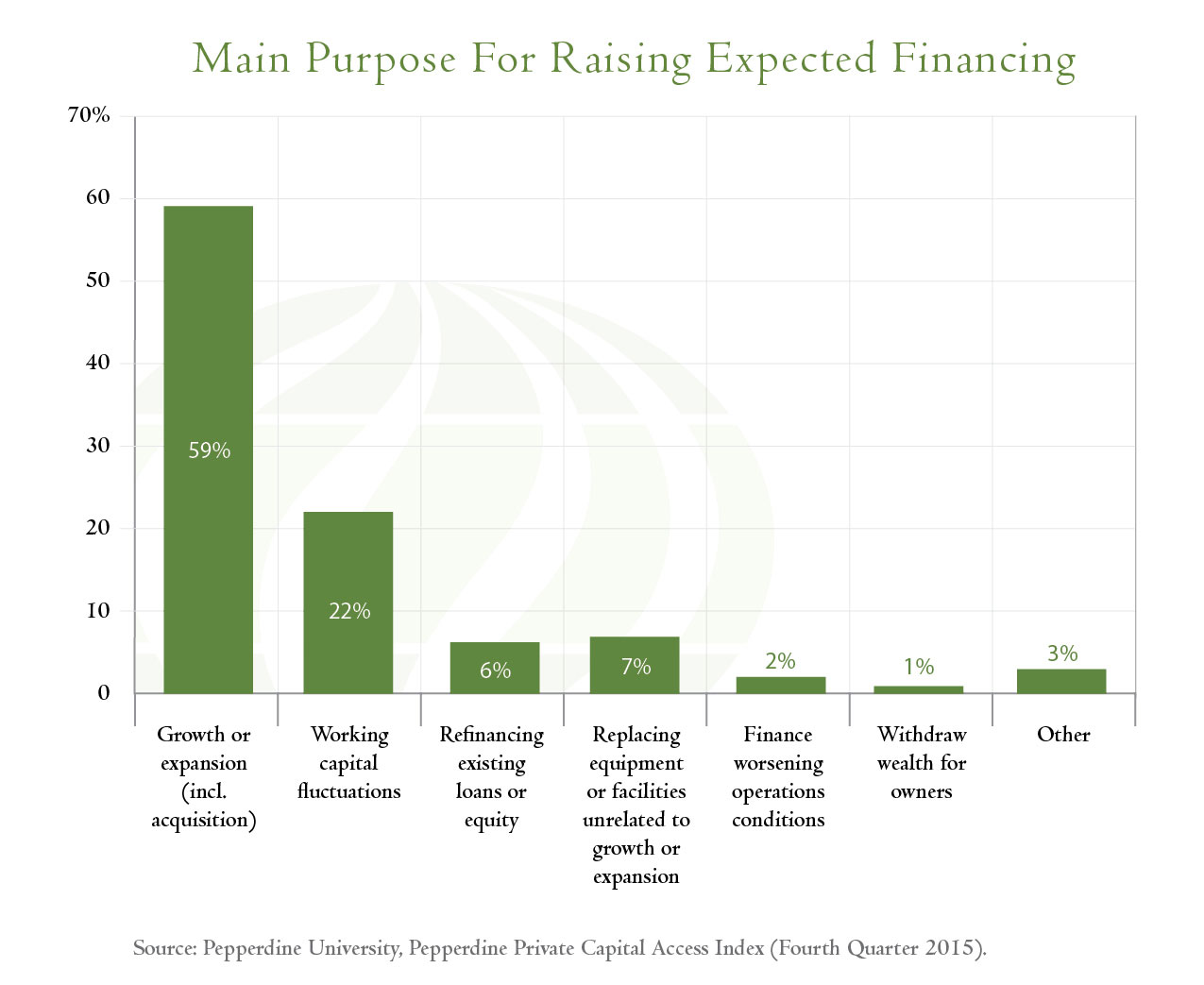

United States CEOs Optimistic for 2016

Pepperdine University Survey

Jeffrey Sweeney, Chairman & CEO, US Capital, reports, "CEOs are feeling increasingly optimistic about the outlook of their businesses." He quotes the recent survey by Pepperdine University, "...where nearly three quarters (72%) of small and medium-sized businesses (SMBs) expect to increase their revenue in 2016 by an average of 10%. Reflecting this, 59% of businesses reported that the main purpose for raising expected financing over the coming six months is growth or expansion, including acquisition."

Jeff Sweeney says, "Most business owners are readying themselves for a year of significant growth." He notes the challenges in sourcing growth capital:

"Because of the increased regulatory constraints placed on banks as well as the fragmented nature of the commercial finance sector, securing sufficient capital to support growth remains a challenge for many SMBs. Even the commercial finance sector is facing increasing constraints on lending because bank leveraged lines are being reduced and underwriting criteria are becoming more stringent for their lines of credit. As a result, nearly two-thirds of Small Businesses reported that it is currently difficult to raise new external financing.

"Many loan applicants seeking additional working capital or growth capital are thriving enterprises that for one reason or other fall outside the standard parameters for traditional bank finance, and now even commercial finance. Often, they approach the wrong type of lender or fail to present their application in the best way from a lender’s perspective."

He invites Leasing News readers to learn more: email Jeffrey Sweeney, Chairman and CEO, at jsweeney@uscapitalpartners.net or call (415) 889-1010.

Recent Transactions:

http://www.uscapitalpartners.net/recent_transactions#cao-group

[headlines]

--------------------------------------------------------------

Leasing Industry Ads---Help Wanted

Time to apply is today

Credit Analyst www.finpac.com |

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees.

Leasing News Help Wanted Classified Ad

Cost Logo on top is free, as well as the web address and information about the address at the bottom. Lines are $595 for the first four and $40 for each additional line or space. The ad will appear for 21 days. For returning advertisers during the year, Leasing News offers 30 days and a reduced rate. Note: most ads point to a full job description as well as click to an email address. Our competitors still use a "classified ad" section, which basically is the company's full job description. It often is "hidden," meaning you have to search for the section. This does not attract attention because you must go to the classified ad site to find the jobs listed. The advertiser is basically missing those who are employed, not actively looking for a job. This is the group the advertiser should be looking for as a primary target. There are at least one hundred websites that offer the same approach, and work great for general jobs, but not the leasing and finance niche, especially for those already employed who may want to improve their position. http://www.leasingnews.org/Classified/Posting_sites.htm http://www.leasingnews.org/Classified/open_funder.html Leasing News puts a "help wanted" on top of the "masthead" so it is the first thing that a reader sees when they open the news edition or go to the website. The ad is changed in each news edition. It is designed to be a "display ad," not a "classified ad." In addition to the masthead position, the "help wanted" ad also appears in the "news briefs" section, the second most-read section, and it is rotated in each news edition. It is not hidden. It is clearly visible. The full section of "help wanted ads” also appears in each news edition, in each edition, as well as appears on the web site. It also is not “hidden.” The idea of the ad is to draw attention, and have the reader interested in what the company offers from the advertisement rather than a "job description." Most ads then direct the reader to their website for a full job description, if interested, or to a separate flyer. The main idea is to get the reader to make an inquiry. Oh, yes, Alexa states Leasing News is read eight times more than our competitors, and they stay on our website longer to read industry news stories. The “help wanted” ad does not hide. Leasing News reserves the right to refuse advertising, |

[headlines]

--------------------------------------------------------------

Ascentium Capital Achieves 56% Increase Funded Volume

CEO Names Technology Infrastructure Breakthrough & Personnel

KINGWOOD, TX, – Ascentium Capital, a leading small business lender and equipment finance company, announced significant growth as the company achieved a 44% increase on total assets and a 56% increase in funded volume year over year.

Tom Depping

Chief Executive Officer

Ascentium Capital.

“In less than five years, Ascentium Capital has become a game changer in the equipment financing sector through its technology infrastructure," CEO Tom Depping. "In addition, our flexible product offering, and customized vendor programs developed by our sales, marketing and service personnel,

has brought us to our goals.

"Our professional talent has helped us achieve transformative results that will continue to drive growth in 2016,” Depping added.

Company Highlights

- $686 million in funded volume in 2015

- $936 million in total assets

- Over 80% of new business driven through the equipment vendor channel

- Healthcare and technology became the company’s fastest growing divisions

- Over 180 financial team members

Richard Baccaro

Chief Sales and Marketing Officer

Ascentium Capital

As a direct lender, Ascentium Capital LLC specializes in providing a broad range of business financing, leasing and working capital loans. The company’s offering benefits equipment manufacturers and distributors as well as direct to businesses nationwide.

The company is backed by the strength of leading investment firms Vulcan Capital and LKCM Capital Group, LLC.

For more information, please visit www.AscentiumCapital.com.

|

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Sales Make it Happen by Steve Chriest

First Steps to Ending the Crisis in Sales Management

Summary: Easing and ending the crisis in sales management will require unwavering commitment to change from senior managers and specific steps for developing sales leaders.There are at least four steps senior managers can take today to ease the crisis in sales management:

1) Develop a strategic objective that commits time and resources to developing and enhancing the capabilities of front-line sales leaders.

2) Stop the automatic practice of promoting great salespeople to the position of sales manager.

3) Stop using sales managers to sell to and supervise important customers, unless extraordinary circumstances require their involvement.

4) Develop a modern position description of the sales manager that emphasizes leadership and mandates the development of their teams and themselves.

Unless senior management develops and ensures execution of a strategic objective that provides for development of front-line sales leaders who are capable of leading their teams in any economy, the crisis in sales management will not end anytime soon.

To be credible to the sales managers, and to the rest of the organization, the strategic objective must be sponsored by the senior-most managers, and it must be specific in its timeline for implementation. Only then will the people targeted for sales management and others in the organization take it seriously.

The second step senior managers can take is to stop the disastrous practice of promoting great salespeople to the position of sales manager. What the psychological profiling experts have told us for years is that when a great salesperson is promoted to sales manager, three things usually occur:

1) The company loses a great salesperson

2) The company gains a mediocre or terrible sales manager

3) The company's customers suffer in the transition

I will add a fourth result of this common and defective practice: The sales superstar, who fails as a sales manager in the eyes of his superiors and his team, exits from the company at the first opportunity.

Senior managers can avoid these unfortunate results by first determining whether or not the salesperson under consideration for a promotion to sales manager possesses the aptitude required for management. Once it is determined that the salesperson can perform the duties of a sales manager, the next step is to determine "if" he or she will perform the duties. Ability without desire will result in a bad promotion decision.

The third step senior managers can take is to end the crisis in sales management is to stop encouraging or allowing sales managers to play frontline, active roles in selling to and managing key customers. Too many sales managers today are "managers" in name only. Their real function is to act as their company's primary sales point with important customers.

As sales managers continue to perform sales duties, they do not have time to perform management functions. Worse, the sales team is robbed of the chance for high-level sales experience and the successes to be gained from interaction with the company's most important customers. The best and brightest sales team members recognize this and plan their exit, seeking employers who are willing to help them gain experience and grow as professionals.

A fourth step is to precisely and unambiguously delineate the specific duties, responsibilities and accountabilities of the company's "sales leaders."

First, the term "manager" should give way to the term "leader." We observe, far too often, that senior executives require their sales managers to perform administrative work and attend endless meetings. Administrative functions are best left to administrative staff.

Front-line sales leaders should instead be focused on coaching the best performance possible from their teams. They should also be focused on continually improving the company's sales organization.

If it is true that the primary work of mangers is setting objectives for individuals and teams, organizing priorities and work to be done, communicating and motivating, measuring performance and developing people, including themselves, sales leaders must be selected, encouraged and trained to do this important management work.

http://www.leasingnews.org/photos/Steve_Chriest.jpg

Steve Chriest is the CEO of Open Advance and author of Selling to the E-Suite, The Proven System for Reaching and Selling Senior Executives and Business Acumen 101. He recently re-named his company from Selling-Up. He produces video and radio blogs, as well as continues as a columnist for Leasing News.

www.openadvance.com/contact/

925-263-2702

www.openadvance.com/

Sales Makes It Happen Articles:

http://www.leasingnews.org/Legacy/index.htm

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Joins Leasing News Software Company List

Aspekt (m)

|

60 |

Aleksandar Ivanovski, CEO |

Aspekt Product Suite represents group of software solutions specialized for financial industry (leasing, banking, microfinance, insurance and insurance broker), supporting workflow adaptation to local regulative and reporting requirements, through process integration and business model scalability. |

Privately Held |

Raiffeisen Leasing Kosovo Maklease Macedonia |

"We have specialized leasing website where visitors can get informed on all key data about the Aspekt Leasing Software and ASPEKT, and are continuously investing in product innovation and dedication to satisfying customer needs. We honestly believe that it will be of interest to your visitors to have access to information on our product offering on your website."

Full Leasing News Software Company list:

http://www.leasingnews.org/Ag_leasing/software.htm

|

[headlines]

--------------------------------------------------------------

With big-bank earnings, attention turns

to rates, credit and global pressures

By Chris Vanderpool and Kevin Dobbs

When the biggest commercial banks report fourth-quarter 2015 earnings, analysts will look for early impacts from higher interest rates alongside anticipated loan growth, but creeping concerns about credit quality and global economic headwinds also are likely to be front and center.

Among 20 major U.S. banking companies analyzed by SNL Financial, analysts on average expect 15 of them to show fourth-quarter revenue levels that are greater than the previous quarter.

Top lines likely were aided by decent loan growth, boosted in part by unseasonably warm weather late in the year that helped keep business development activity rolling in many parts of the country. With favorable conditions, businesses likely were able to wrap up projects and borrow to invest in additional endeavors, analysts say.

Some of the biggest lenders could also show early-stage benefits from modestly higher short-term interest rates. Federal Reserve policymakers in December boosted rates by 25 basis points, lifting them off of a zero-bound range and marking the first hike since prior to the 2008 financial crisis. Analysts say some borrowers inevitably moved before December to lock in loan deals prior to the widely anticipated rate move, and that may modestly benefit some banks' fourth-quarter lending levels.

What's more, several big banks, including Wells Fargo & Co. and Citigroup Inc., acted quickly following the Fed's mid-December rate increase to lift their prime lending rate to 3.50% from 3.25%, while leaving the rate levels they pay on deposits unchanged. From investors' perspective, the long-anticipated hope was that, in a rising rate environment, banks would be able to raise rates on loans faster than on deposits, widening the spread between the two and bolstering interest income levels. Analysts and investors say they will be looking closely for early signs of such a development.

"That's the big one," Sam Pappas, president and CEO of Mystic Asset Management Inc., told SNL. "Especially if there are more rate hikes this year and continued loan growth, the big banks will almost definitely benefit."

But, with loan growth, higher loan-loss provisions eventually follow. Big banks, as a group, have increased lending over the past couple years. Analysts on average are anticipating that 15 of the big 20 banks analyzed by SNL will report fourth-quarter provisions levels that are higher than the previous quarter.

Moreover, competition for loans in many markets was fierce in recent years, leaving analysts to brace for eventual credit quality deterioration as loans won with eased structures mature. A majority of the 20 banks in SNL's analysis are expected to report higher levels of net charge-offs as a percentage of average loans for the final quarter of 2015.

"While credit is not collapsing, we do have concerns in multiple areas," Evercore ISI analyst John Pancari said in a January note to clients.

Higher provisions and credit costs could offset revenue gains.

Top of mind, Pancari said, are oil-and-gas loans at banks active in Texas and other energy-heavy states. Amid an abundance of global supply, U.S. crude oil benchmark prices in early January dropped below $35 per barrel, hovering around seven-year lows. The price slump dates to 2014 and has begun to hurt some energy customers' ability to repay loans. Analysts are closely watching prominent banks such as Zions Bancorp. and Regions Financial Corp. with oil-field services exposure, as well as the likes of Comerica Inc. and others based in Texas that are more leveraged to oil exploration-and-production clients.

But, as Pancari notes, concern is not isolated to energy. In the wake of heavy competition and a choppy economic recovery, analysts foresee potential deterioration in commercial real estate books as well as historically vulnerable areas on the consumer side such as home equity lending.

Additionally, global economic weakness — most notably in China, where government officials recently moved to devalue the yuan amid slower growth and lower corporate earnings — is weighing on U.S. businesses. This is curbing demand for American exports and diminishing domestic manufacturing activity, and it could impact U.S. companies' ability to repay loans, economists say. The Institute for Supply Management said this week that its latest reading of manufacturing activity clocked in at 48.2 in December 2015. A reading below 50 indicates contraction. Following that report, the Federal Reserve Bank of Atlanta estimated that U.S. GDP growth in the final quarter of 2015 was only 0.8%.

"As you put all the pieces together for the fourth quarter, GDP is looking weak and that does not bode well for business strength," Scott Brown, chief economist at Raymond James, told SNL.

And that, he said, makes additional Fed rate increases in 2016 far from sure things.

Meanwhile, analysts do not think big banks got much help from fee income in the fourth quarter. Mortgage banking activity, for one, slowed during the quarter. Analyst Kevin Barker of Piper Jaffray estimated in a January report that overall application volume declined about 5% from the previous quarter. This is likely to lead to dips in both mortgage production revenue and in gain on sale margins, he said.

Megabanks such as Bank of America Corp. with large investment banking units could also get dinged by lower trading revenues — anticipated amid the uneven global conditions and commonly slower activity late in the year.

"We expect institutional fixed income and equity sales and trading revenue to show typical seasonal declines in 4Q from 3Q of 15-25% at the firms with the largest investment banking operations," analyst David Hilder of Drexel Hamilton said in an earnings preview.

All of that adds up to lower earnings per share for many. SNL found that analysts on average expect that a majority of the 20 big banks, including all of the largest five companies examined, will report fourth-quarter EPS results that are lower than the previous quarter.

Add in lofty regulatory and technology costs, "and there is still just a lot standing in the way of stronger results," Pappas said.

(Leasing News provides this ad as a trade for appraisals and equipment valuations provided by Ed Castagna)

[headlines]

--------------------------------------------------------------

Retriever

Charlotte, North Carolina Adopt-a-Dog

Dapper Dan

Sex Male

Size M

Age 10 months

Color Brown

Intake Date 1/7/2016

Neutered

Declawed

Housetrained

No Dogs

No Cats

No Small Kids

Adoption Fee: $125

"Dapper Dan is a delightful boy who knows sit and loves to play. He does well with children, adults, and other dogs. He is active, still growing, and would like a home where his people can exercise him daily and take him on fun outings. If you are interested in meeting Dapper Dan, stop by the Huntersville Adoption Center today."

Humane Society of Charlotte

2700 Toomey Ave, Charlotte, NC 28203

704.377.0534

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

Collector / Collections / Consultant / Communications

| Collector: Atlanta, GA Asset Recovery Specialist. We get your money or we get your > equipment back for you. Physical Asset Recovery Experts! E-mail: mcrouse911@joimail.com |

Collector: Cleveland, OH Huntley Capital & Associates is your solution to late payments, no payments, and asset recovery. Call 216-337-7075. Email: ghpatey@msn.com |

||

| Collections: Dallas, Texas Contingency Fee basis. Receivables Outsourcing. We are a fully bonded nationwide licensed agency. We collect for nationally known banks and leasing companies. 800-886-8088. |

Collector: Los Angeles, CA Expert skiptracers covering Southern California. We locate skips, judgment debtors and collateral. When you can't get the job done in house, give us a call at 1-800-778-0794. E-mail: ceo@interagencyLA.com |

||

| Collector: Louisville, KY We are a full service collection agency with attorney network. 21 years experience. Please call Jon Floyd, VP at 1-800-264-6850 email: jfloyd@collectcsg.com |

Collector: Louisville, KY Euler Hermes/UMA 92 year old Global Receivables Outsourcing. Presence in 143 Countries. Work w/ 4 out of 5 Fortune 500 firms. Contingency Fee Structure. 20% off first time clients.! Andrew.Newton@eulerhermes.com 1-800-237-9386 x 205. |

||

|

|||

Collector: Nationwide |

Collector: Saint Louis, MO Complete commercial collection agency. Licensed bonded in all states and will out performed any other agency! Call 1-800-659-7199 ext.315 E-mail: jfloyd@lindquistandtrudeau.com |

||

| Consultant: Nationwide 25 yrs. experience: Creating/Refining Business Plans to raise capital· Credit Underwriting support/policy/procedure development · Operations Support/policy/procedure development. Call: 610-246-2178, McCarthy Financial, LLC,David.mccarthy@mccarthy-financial.com |

Consultant: Burlington, CT We provide our clients with a full range of consulting services such as portfolio conversions, reconciliation, custom programming and leasing operations utilizing InfoLease. Email: info@new-millennium-assoc.com |

||

| Consultant: Europe 15 years doing deals/running own technology leasing company – looking to advise/ lead new entrants to take advantage the European market opportunity. www.clearcape.co.uk or kevin.kennedy@clearcape.co.uk |

Consultant: Henderson, NV Focus on new business development and process efficiencies to create incremental revenue and profitability. Executive level vendor experience, and satisfied outsourcing clients. Incredible track record. E-mail: rbutzek@cox.net |

||

Consultant: Sausalito, CA |

Consultant: North of Detroit, MI |

||

Consultant: Ridgefield CT. |

Email: dan@danscartoons.com Go to http://www.danscartoons.com |

(Leasing News provides this ad as a trade for investigative

reporting provided by John Kenny)

[headlines]

--------------------------------------------------------------

![]()

News Briefs---

Best Captive Technology Finance Team Global 2015

Cisco Capital

http://cfi.co/awards/europe/2016/cisco-capital-best-captive-technology-finance-team-global-2015/

New FinTech Lenders Ignore Consumer Credit Ratings

"We Don't Trust FICO Scores"

http://www.wsj.com/articles/silicon-valley-gives-fico-low-score-1452556468

5 Reasons New Lenders Are Ignoring FICO Credit Scores

http://www.forbes.com/sites/nickclements/2015/04/21/5-reasons-new-lenders-are-ignoring-fico-credit-scores/

Old National to Buy Anchor Bank in Madison, Wis., adding 32 to its 160 banks

http://www.nbc15.com/home/headlines/Indiana-bank-will-buy-AnchorBank-364993241.html

Raiders Will Not Move To L.A. After NFL Owners Vote; Relocation Still Possible

http://sanfrancisco.cbslocal.com/2016/01/12/raiders-will-not-move-to-los-angeles-after-nfl-owners-vote/

Rams Moving to Los Angeles Area,and Chargers Could Join Them or Raiders

http://www.nytimes.com/2016/01/13/sports/football/rams-moving-to-los-angeles-area-and-chargers-could-join-later.html

Credit Analyst www.finpac.com |

[headlines]

--------------------------------------------------------------

--You May Have Missed It

Say so long to Windows 8, no more up-dates, support

the least popular version of Windows in recent history

http://www.businessinsider.com/windows-8-never-topped-10-percent-2016-1

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

Easy Ways to Eat More Seafood

Go Fish for Better Health!

http://www.sparkpeople.com/resource/nutrition_articles.asp?id=2022

[headlines]

--------------------------------------------------------------

Football Poem

Peyton Manning

Long ago you were just a little boy,

A football came to be your favorite toy.

Your days seemed to fly by,

With daddy Archie and brothers Cooper and Eli.

High School in New Orleans and college in Tennessee,

You were the best quarterback anyone had ever seen.

Now you're with us,

Here in Denver.

Our Colts leader so smart,

Doing good with your kind heart,

You said you grew up with a blessed life,

Others aren't lucky and have had strife.

You're come a long way Peyton Manning,

As a person we find you absolutely outstanding

I know you will win

Because you are also demanding,

The Bronco’s Peyton Manning.

[headlines]

--------------------------------------------------------------

Sports Briefs----

Grant Cohn: 49ers’ soiled rep dragging down coach search

http://www.pressdemocrat.com/sports/5061426-181/grant-cohn-49ers-soiled-rep?artslide=0

Alabama Crimson Tide Wins Its Fourth National Championship

in Seven Years

http://www.nytimes.com/2016/01/12/sports/ncaafootball/alabama-crimson-tide-wins-national-championship.html

((Please Click on Bulletin Board to learn more information))

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

Things You'll Never See again in San Francisco

http://www.sfgate.com/bayarea/article/Symbols-of-a-once-vibrant-San-Francisco-ocean-6746014.php

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

America's Best Value Pinot Noirs

http://www.winemag.com/gallery/americas-best-value-pinot-noirs/

White lies on wine labels:

why your wine is probably boozier than you think

http://www.tucsonnewsnow.com/story/30927489/white-lies-on-wine-labels-why-your-wine-is-probably-boozier-than-you-think

The wine legend who helped put Burgundy on the world map

http://www.thelocal.fr/20160111/the-wine-legend-who-helped-put-burgundy-on-the-map

How IBM is Bringing Watson to Wine

http://fortune.com/2016/01/09/ibm-bringing-watson-wine/

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in American History

1630 – A patent was awarded to the Plymouth Colony in what is now Massachusetts. Founded by the Pilgrims upon their landing there in 1620, it is one of the early successful colonies founded by the British in North America. By 1630, the population has grown to approximately 300.

1733 - James Oglethorpe and 130 English colonists arrive at Charleston, SC

http://georgiahistory.i-found-it.net/georgiahistory1.html

http://www.virtualmuseumofhistory.com/internationalhall/worldleaders/

JAMESOGLETHORPE.COM/

http://ourgeorgiahistory.com/people/oglethorpe.html

http://www.cviog.uga.edu/Projects/jeo300/savanna1.htm

1794 - Congress authorizes an “act making an alteration in the flag of the United States... that from and after the first day of May, 1795, the Flag of the United States be fifteen stripes, alternated red and white; and that the union be fifteen stars, white, in a blue field. The change was made so that Vermont and Kentucky would be represented on the flag. A law passed on April 4, 1818, reduced the number of stripes to 13 to represent the original 13 states, as in the first American flag, and provided one star for each state. A new star was to be added on the Fourth of July following the admission of each new state.

1807 - Birthday of Union General Napoleon Bonaparte Buford (d. 1883), in Woodford, Kentucky. Buford held many commands in the west and was a hero at the Battle of Belmont early in the war. Buford attended West Point and graduated in 1827, sixth out of 38 in his class. After a stint with the frontier military, he was given leave to study law at Harvard. He taught at West Point before leaving the service to become a businessman. He was an engineer and banker in Illinois during the 1840s and 1850s. When the war began, the 54-year-old Buford raised his own regiment, the 27th Illinois. He was commissioned as a colonel, and his unit was sent to Cairo, Illinois, and placed in General Ulysses S. Grant's army. On November 7, 1861, Grant attacked a Confederate camp at Belmont, Missouri, and quickly drove the Rebels away. But Grant's men became preoccupied with plundering the area, and a Confederate counterattack nearly turned to disaster for the Yankees. Buford's regiment was nearly cut off from the main Union force. He rallied his men and they fought their way out of the Confederate trap. Buford was commended for his bravery After Belmont, Buford participated in the capture of Island No. 10, a Confederate stronghold in the Mississippi River, and Buford was left in command after its capture. Buford and his regiment fought at Corinth in October 1862, but the colonel fell seriously ill from sunstroke. He left field command and sat on the court martial of General Fitz John Porter in Washington. Buford returned to the west and was promoted to Brigadier General in charge of the District of Eastern Arkansas. He remained there for the remainder of the war, although his main military action came in chasing off Confederate raiders in the area. Buford generated controversy in his dealings with black troops. He had drawn earlier criticism for not helping refugee slaves, and now he proclaimed his preference for commanding white troops. He justified it by saying that black troops were not as well trained and they were more likely to fall prey to drawn attention from southern bushwhackers. It was also true that Confederate soldiers went out of their way to attack units with Black soldiers, killing all wounded men on the field and shooting prisoners. Buford silenced some of the criticism by implementing programs for freed slaves in Arkansas that generally succeeded in taking care of their immediate needs. Poor health forced his resignation in March 1865, just before the end of the war. He was brevetted to major general following his retirement. He worked in a variety of businesses after the war and died in Chicago in 1883. Napoleon Bonaparte Buford was the older half-brother of John Buford, a Union General who commanded the Union force that first engaged the Confederates.

1808 - Birthday of Salmon Portland Chase (d. 1873) at Cornish, NH. American statesman, US senator, Secretary of the Treasury and Chief Justice of the Supreme Court. Salmon P. Chase spent much of his life fighting slavery (he was popularly known as “attorney general for runaway Negroes”). He was one of the founders of the Republican Party and his hopes for becoming a candidate for President in 1856 and 1860 were dashed because his unconcealed antislavery views made him unacceptable.

1813 - Captain Oliver Hazard Perry arrives in Presque Isle (Michigan) where he will supervise the construction of a flotilla. Two brigs, a schooner, and three gunboats will be constructed from materials transported overland and by inland waterway from Philadelphia, by way of Pittsburgh, in preparation for the naval battle for Lake Erie, where he carried the flag "Don't Give Up the Ship."

1832 - President Andrew Jackson wrote Vice President Martin Van Buren expressing his opposition to South Carolina's defiance of federal authority. South Carolinians agreed and planned to use armed force to prevent duty collection in the state after February 1, 1833. The Nullification Crisis of 1832-1833 was resolved without bloodshed in March, 1833. Henry Clay and John C. Calhoun, who left the vice presidency at the end of 1832 to serve South Carolina in the Senate, drafted a reduced tariff agreement that pacified South Carolina while allowing the Federal government to stand firm.

(Lower half of: http://memory.loc.gov/ammem/today/jan13.html)

1834 - Birthday of Horatio Alger (d. 1899) at Revere, MA. American clergyman and author of more than 100 popular books for boys (some 20 million copies sold). Honesty, frugality and hard work assured that the heroes of his books would find success, wealth and fame.

1846 - President James Polk dispatched General Zachary Taylor and 4,000 troops to the Texas Border as war with Mexico loomed. Mexico had severed relations with the United States in March, 1845, shortly after the U.S. annexation of Texas

1847 – “Capitulation of Cahuenga" ended all organized resistance to American rule in California as Los Angeles surrendered officially this date. All “rebels” were pardoned by Gen. Kearny. On January 14, California was controlled by the United States military.

http://www.aztecclub.com/campo/CapCahuenga.htm

http://www.militarymuseum.org/Cahuenga.html

http://www.campodecahuenga.com/

1850 - Birthday of Charlotte R. Ray (d. 1911) in NYC. She is the first female black lawyer in the United States and certified as the first woman admitted to practice in Washington, D.C. Many say this is because she signed the application C.R. Ray without using her first name. By 1878, in the face of overwhelming sexual and racial prejudice when not even black men would consult her, she returned to teaching in Brooklyn, NY. http://www.womenshistory.about.com/library/bio/blbio_ray_charlotte.htm

http://www.law.howard.edu/alumni/legalgiants/huslgiantoct2k.htm

http://www.stanford.edu/group/WLHP/papers/CharlotteRay.pdf

1864 - Composer Stephen Foster was found critically ill in his hotel room three days earlier, and on this date, died in Bellevue Hospital, New York, at age 37. He only had 35 cents in his pocket, along with a little slip of paper on which he had written, "Dear friends and gentle hearts." While never a great composer, Foster wrote many of the popular songs of the era which remained a part of Americana for more than a century, including “Jeannie with the Light Brown Hair”, “Oh! Susanna”, “My Old Kentucky Home”, and “Old Folks” at Home, also known as “Swanee River”. Many of his songs - including "Oh! Susanna," "Camptown Races" and "Old Black Joe" - are written in black dialect. Foster gained much of his knowledge of blacks through his early experience in traveling minstrel shows. He became a heavy drinker, suffered from tuberculosis, and lapsed into obscurity. His last song, “Beautiful Dreamer”, which he penned just a few days before his death, joined his earlier classics.

1869 - First Convention of the Colored National Labor Union, the first Black labor convention.

http://www.uwm.edu/Course/448-440/national.htm

http://www.africana.com/Articles/tt_631.htm

http://www.afscme.org/about/aframlink.htm

1873 - P.B.S. Pinchback ends service as first black governor of Louisiana.

http://www.africana.com/Articles/tt_1153.htm

http://www.sec.state.la.us/46.htm

http://www.huarchivesnet.howard.edu/9911huarnet/pbs1.htm

http://www.gnocdc.org/orleans/11/73/snapshot.html

http://66.216.8.84/CreoleCulture/famouscreoles/Pinchback/pinchback.htm

1884 - Grand entertainer Sophie Tucker (d. 1966) was born Sonya Kalish in Tulchyn, Ukraine. She was known as "The Last of the Red Hot Mamas" and her career in stage, film, cabaret, radio, TV and recording lasted more than 60 years, beginning with an appearance at her father's cafe in Hartford, Connecticut in 1905. Tucker's most famous songs were "Some of These Days," recorded in 1926, and "My Yiddish Momma," cut two years later.

http://memory.loc.gov/ammem/today/jan13.html

1885 - Birthday of Alfred Carl Fuller (d. 1973), at Kings County, Nova Scotia. Founder of the Fuller Brush Company. In 1906, the young brush salesman went into business on his own, making brushes at a bench between the furnace and the coal bin in his sister's basement.

1886 - A great blizzard struck the state of Kansas without warning. The storm claimed 50 to 100 lives, and eighty percent of the cattle in the state.

1888 - The mercury plunged to -65 degrees at Fort Keough, located near Miles City, MT. The reading stood as a record for the continental U.S. for sixty-six years

1892 - An Atlantic coast storm produced a record 18.6 inches of snow at Norfolk, VA, including 17.7 inches in 24 hours. The storm also produced 9.5 inches of snow at Raleigh, NC, and brought snow to northern Florida for the first time in 35 years.

1893 – US Marines landed in Honolulu from the USS Boston to prevent the queen from abrogating the Bayonet Constitution. This was also known as the 1887 Constitution of the Kingdom of Hawaii, a legal document by anti-monarchists to strip the Hawaiian monarchy of much of its authority, initiating a transfer of power to American, European and native Hawaiian elites.

1909 - Birthday of trombonist Quentin “Butter” Jackson (d. 1976), Springfield, OH. With Duke Ellington from 1948 to 1959.

1910 - Radio pioneer and electron tube inventor Lee de Forest arranged the world's first radio broadcast to the public at New York, NY. He succeeded in broadcasting the voice of Enrico Caruso along with other stars of the Metropolitan Opera to several receiving locations in the city where listeners with earphones marveled at wireless music from the air. Though only a few were equipped to listen, it was the first broadcast to reach the public and the beginning of a new era in which wireless radio communication became almost universal.

1912 - Delta Sigma Theta, sorority, founded on the campus of Howard University.

http://www.deltasigmatheta.org/history/index.htm

1912 - The temperature at Oakland, MD, plunged to 40 degrees below zero to establish a state record.

1919 – Actor Robert Stack (d. 2003) was born in LA. In addition to acting in more than 40 feature films, he starred as Treasury agent Eliot Ness in the ABC-TV television series “The Untouchables” (1959–63), for which he won the 1960 Emmy for Best Actor in a Dramatic Series. He later hosted “Unsolved Mysteries” (1987–2002).

1922 - Former White Sox star Buck Weaver applied for reinstatement to baseball. Weaver, one of the eight "Black Sox" players banned for their involvement in throwing the 1919 World Series, was rejected by Commissioner Landis.

1926 - Birthday of arranger/trombonist Melba Liston (d. 1999), Kansas City, MO.

http://hardbop.tripod.com/liston.html

http://elvispelvis.com/melbaliston.htm

http://www.jazzreview.com/articledetails.cfm?ID=438

1926 - Birthday of Gwen Verdon (d. 2000), Culver City, Los Angeles, CA. One of Broadway's premier female dancers and actresses, many of her most successful roles were choreographed by her husband Bob Fosse. She won Tony Awards for “Can-Can”, “Damn Yankees”, “New Girl in Town” and “Redhead”. She also acted in movies, including “Cocoon” and the film adaptation of “Damn Yankees”. She starred in the original Broadway production, which my mother and father took me to see and I will never forget her performance, especially being a Brooklyn Dodger fan.

http://us.imdb.com/name/nm0893862/

http://www.povonline.com/cols/COL317.htm

1927 - A woman takes a seat on the NY Stock Exchange breaking the all-male tradition.

1929 - Birthday of guitarist Joe Pass (d. 1994) born Joseph Anthony Jacobi Passalacqua, New Brunswick, NJ.

http://www.riffinteractive.com/expguitar/JoePass1.htm

http://www.classicjazzguitar.com/albums/artists_albums.jsp?artist=55

http://www.gould68.freeserve.co.uk/JoePass.html

1930 - The comic strip "Mickey Mouse" debuted in American newspapers, with Floyd Gottfredson as its ghost writer.

1931 - The bridge connecting New York and New Jersey is named the George Washington Memorial Bridge.

1933 - Making her first professional basketball appearance, Babe (Mildred) Didrikson scored nine points as the Brooklyn Yankees defeated the Long Island Ducklings.

1936 - Baptist clergyman B.B. McKinney, 50, wrote the words and tune to the gospel song, "Wherever He Leads, I'll Go," a few days before the opening of a Sunday School convention in Alabama.

1937 - The United States bars Americans from serving in the Civil War in Spain.

1938 - For Victor Records, singer Allan Jones recorded "The Donkey Serenade", which became the song most often associated with him. Allan also sang and acted in several Marx Brothers films including: "A Night at the Opera", "A Day at the Races". The film that made him a star was the operetta, "Firefly" with Jeanette MacDonald. Singer Jack Jones is the son of Allan and his actress wife, Irene Hervey ("The Count of Monte Cristo", "Play Misty for Me").

1941 - The four Modernaires came to sang with the Glenn Miller Band on a full time basis. In 1946, they had a ‘solo' hit with "To Each His Own".

1941 - Charlie Spivak records with own band first time. Okey label.

1942 - Henry Ford patented the plastic automobile, which decreased the weight of a car by 30%.

1942 - German U-Boats begin operations of the US East Coast. The move is called operation Paukenschlag (Drum Roll). Admiral Doenitz has faced arguments from his superiors in the German Navy who do not favor the operation, and he has had the difficulty that only the larger 740-ton U-Boats are really suitable for such long range patrols. When Doenitz gives the order for the attack to begin there are 11 U-Boats in position and 10 more en route. Together they sink more than 150,000 tons during the first month. Intelligence sources have given reasonable warning of the attack but the U-Boats find virtually peace-time conditions in operation. Ship sail with lights on at night; lighthouses and buoys are still lit; there is no radio discipline - merchant ships often give their positions in plain text; there are destroyer patrols (not convoys with escorts) but these are regular and predictable and their crews are naturally inexperienced.

1943 – Richard Moll, who played bailiff Bull Shannon on “Night Court” was born in Pasadena, CA.

1949 - Top Hits

“Buttons and Bows” - Dinah Shore

“On a Slow Boat to China” - The Kay Kyser Orchestra (vocal: Harry Babbitt & Gloria Wood)

“A Little Bird Told Me” - Evelyn Knight

“I Love You So Much It Hurts” - Jimmy Wakely

1953 - Don Barksdale becomes the first Black person to play in an NBA All-Star Game.

http://sports.insidebayarea.com/top50.asp?story=Don_Barksdale

http://thisweek.kqed.org/segments/390/

1955 - Chase National Bank (founded in 1877) and the Bank of Manhattan Company (founded in 1799 as a water company) agreed to merge, becoming the second largest bank in the U.S.

1957 - The Wham-O Company developed the first plastic Frisbee. The most popular theory as to how this flying disc came to be dates back to the 1920s when Yale students invented a game of catch by tossing around metal pie tins from the Frisbee Baking Company in nearby Bridgeport, Connecticut. They would frequently shout “Frisbieeeee” to warn passersby of the oncoming pie plate. Building inspector Fred Morrison puttered with and refined a plastic flying disc that he sold to WHAM-O (for $1 million) on this day in 1955. The disc was introduced to the consumer market in 1957 as the Pluto Platter (the name inspired by the U.S. obsession with UFOs). Wham-O changed the name to Frisbee in 1958, upon hearing the Yale pie-tin story. (Mattel now owns the rights to Frisbee, which has become an American icon.)

1957 - For Victor Records in Hollywood, California, Elvis Presley recorded "All Shook Up" and "That's When Your Heartaches Begin" which became Elvis' ninth consecutive gold record.

1957 - Top Hits

Singing the Blues - Guy Mitchell

The Banana Boat Song - The Tarriers

Moonlight Gambler - Frankie Laine

Singing the Blues - Marty Robbins

1958 - Little Richard releases "Good Golly Miss Molly."

1961 - In the first round of the Los Angeles Open golf tournament, golfing great Arnie Palmer scored an embarrassing 12 strokes on one hole.

1961 – Julia Louis-Dreyfuss was born in NYC. She is best remembered as Elaine in the smash series “Seinfeld” (1989–1998). Subsequently she has appeared in “The New Adventures of Old Christine” (2006–10), and “Veep” (2012–present).

1962 - Singer Chubby Checker set a record, literally, with the hit, "The Twist". The song reached the #1 position for an unprecedented second time in two years. "The Twist" was also number one on September 26, 1960. The song, widely considered one of the most successful singles of all time, was on the Top 100 charts for 39 weeks, longer than any other single except "Red Red Wine" by UB40. When an early recording of "The Twist" by Hank Ballard and the Midnighters became the top dance song on Dick Clark's “American Bandstand” but failed to get much radio play, Clark suggested that a new artist should record a cover. Singer Ernest Evans of Cameo Records recorded the song and changed his name to Chubby Checker as a takeoff on Fats Domino. The song hit the charts in 1960 when it became immensely popular with teenagers, but adults started buying the record in 1962, after Chubby Checker sang "The Twist" on Ed Sullivan's October 22 show.

1962 - First Operation Farm Gate missions flown.

In the first Farm Gate combat missions, T-28 fighter-bombers are flown in support of a South Vietnamese outpost under Viet Cong attack.

By the end of the month, U.S. Air Force pilots had flown 229 Farm Gate sorties. Operation Farm Gate was initially designed to provide advisory support to assist the South Vietnamese Air Force in increasing its capability. The 4400th Combat Crew Training Squadron arrived at Bien Hoa Airfield in November, 1961 and began training South Vietnamese Air Force personnel with older, propeller-driven aircraft. In December, President John F. Kennedy expanded Farm Gate to include limited combat missions by the U.S. Air Force pilots in support of South Vietnamese ground forces. By late 1962, communist activity and combat intensity had increased so much that President Kennedy ordered a further expansion of Farm Gate. In early 1963, additional aircraft arrived and new detachments were established at Pleiku and Soc Trang. In early 1964, Farm Gate was upgraded again with the arrival of more modern aircraft. In October, 1965, another squadron of A-1E aircraft was established at Bien Hoa. Secretary of Defense Robert McNamara approved the replacement of South Vietnamese markings on Farm Gate aircraft with regular U.S. Air Force markings. By this point in the war, the Farm Gate squadrons were flying 80 percent of all missions in support of the Army of the Republic of Vietnam (ARVN). With the buildup of U.S. combat forces in South Vietnam and the increase in U.S. Air Force presence there, the role of the Farm Gate program gradually decreased in significance. The Farm Gate squadrons were moved to Thailand in 1967, and from there they launched missions against the North Vietnamese in Laos.

1962 - Center Wilt Chamberlain of the Philadelphia Warriors set an NBA regular season record by scoring 73 points in a game against Chicago. Chamberlain had scored 78 points in the previous December, but that game had gone into three overtime periods.

1964 - Capitol released in the United States The Beatles' single “I Want to Hold Your Hand/I Saw Her Standing There”.

1965 - Top Hits

“I Feel Fine” - The Beatles

“She's a Woman” - The Beatles

“Love Potion Number Nine” - The Searchers

“Once a Day” - Connie Smith

1965 - After the NBA All-Star game in which San Francisco Warriors center Wilt Chamberlain scored 20 points and grabbed 16 rebounds, the Warriors shocked the basketball world by announcing that they were trading Chamberlain to the Philadelphia 76ers for three minor leaguers and $150,000.

1965 - Bob Dylan releases "The Times They Are A-Changin'".

1966 - On "Bewitched," Elizabeth Montgomery's character, Samantha, gave birth to her first child, Tabitha. The witch's daughter could wiggle her nose with her finger and cause problems for daddy, Darin, just like mom.

1967 - The Dead, Junior Wells' Chicago Blues Band, & the Doors at the Fillmore, San Francisco, California.

1968 - Against the advice of Columbia Records executives, Johnny Cash visits Folsom State Prison in California to record a live album. The resulting LP, "Live At Folsom Prison" would become one of Johnny's biggest selling records, reaching #1 on the Country album chart and #13 on the Hot 200. It also produced one of his most memorable hit singles, "Folsom Prison Blues". In 2003, "Live at Folsom Prison" was certified Triple Platinum by the RIAA for sales of over three million and was ranked #88 on Rolling Stone Magazine's list of the 500 greatest albums of all time.

1968 - Cream's "Sunshine of Your Love" enters the pop charts.

1968 - Dr. K.C. Pollack of the University of Florida audio lab reports tests have found that the noise generated at rock & roll concerts is harmful to teenage ears.

1968 - In a game between the Minnesota North Stars and the Oakland Seals, Minnesota rookie center Bill Masterton was checked into the boards and fell heavily on his head. He suffered massive brain damage and died two days later, the only fatality in NHL history.

1969 - After his triumphant '68 "comeback" special, Elvis Presley decides to take more control of his career and begins recording in Memphis for the first time since he left Sun Records. Over the next three weeks at Chips Moman's American Recording Studios, Elvis records the songs that would return him to the top of the charts ("Suspicious Minds" and "In The Ghetto" chief among them).

1969 - The Beatles release “Yellow Submarine”.

1973 - Carly Simon's album “No Secrets” hits #1.

1973 - Eric Clapton came back from his three-year heroin addiction problem with a concert at the Rainbow club in London. Clapton, helped and encouraged by Pete Townshend of the Who, was back on the album charts in 1974 with "461 Ocean Boulevard”.

1972 – President Nixon announces that 70,000 U.S. troops will leave South Vietnam over the next three months, reducing U.S. troop strength there by May 1 to 69,000 troops. Since taking office, Nixon had withdrawn more than 400,000 American troops from Vietnam. With the reduction in total troop strength, U.S. combat deaths were down to less than 10 per week. However, Nixon still came under heavy criticism from those who charged that he was pulling out troops but, by turning to the use of air power instead of ground troops, was continuing the U.S. involvement in Vietnam rather than disengaging from the war. The last American troops would be withdrawn in March, 1973 under the provisions of the Paris Peace Accords.

1972 - The Beach Boys' "Surfin'" is getting airplay in Los Angeles and enters Billboard, moving up the Hot 100 chart at #118.

1973 - Carly Simon's "No Secrets" was the #1 album in the U.S. for the first of five weeks. The tracks: "The Right Thing to Do", "The Carter Family", "You're So Vain", "His Friends are More Than Fond of Robin", "(We Have) No Secrets", "Embrace Me You Child", "Waited So Long", "It Was So Easy", "Night Owl" and "When You Close Your Eyes".

1973 - Top Hits

“Me and Mrs. Jones” - Billy Paul

“Clair” - Gilbert O'Sullivan

“You're So Vain” - Carly Simon

“She's Got to Be a Saint” - Ray Price

1974 - A Gallup poll on religious worship showed that fewer Protestants and Roman Catholics were attending weekly services than ten years earlier, but that attendance at Jewish worship services had increased over the same period.

1974 - 37 people were injured in a melee outside the Tower Records store in Los Angeles after the crowd discovered that singer Steve Miller was not going to be at a post-concert party at the store. The organizers forgot to invite him. Miller's single and album "The Joker" were riding high on the charts at the time.

1974 - Super Bowl VIII (at Houston): Miami Dolphins 24, Minnesota Vikings 7. The Dolphins win their second straight Super Bowl. Fran Tarkenton and the Vikings are the victims. MVP: Dolphins' RB Larry Csonka whose 145 yards rushing led the way. Tickets: $15.00

http://images.nfl.com/history/images/0113.jpg.

1976 - Sarah Caldwell, The Divine Miss Sarah, became the first woman to conduct an opera at the Metropolitan, Verdi's “La Traviata”. Founder of the highly successful and artistically marvelous Boston Opera Company, she was the second woman in the history of the New York Philharmonic to conduct its orchestra (1975). Devoted to her Boston Opera Company and opera in general, she uses off-beat methods to draw customers by using stage innovations which included such things as motorcycles and circus acts. She was born 03-05-24.

http://www2.worldbook.com/features/whm/html/whm068.html

http://www.smithsonianassociates.org/programs/cassettes/caldwell.HTM

1978 - Elvis Presley's version of Paul Anka's "My Way" goes gold in five months after the King's death. Earlier, it had become one of Presley's 78 Top Twenty-five hits.

1979 – The YMCA sued the Village People for copyright infringement over their song of the same name. The suit is eventually dropped.

1980 - The Grateful Dead, Beach Boys and Jefferson Starship are the featured acts at a benefit concert for the people of Kampuchea, held at the Oakland Coliseum.

1981 - Top Hits

“(Just Like) Starting Over” - John Lennon

“Love on the Rocks” - Neil Diamond

“Hungry Heart” - Bruce Springsteen

“I Think I'll Just Stay Here and Drink” - Merle Haggard

1982 - Air Florida Flight 90, a Boeing 737, attempted to take off from Washington's National Airport in one of the worst blizzards in history. Ice had built up on the wings of the jetliner as it waited its turn to take off, preventing it from gaining altitude. After crashing into the 14th Street Bridge, the plane fell into the Potomac River. 74 of the 79 people on the aircraft were killed in the accident. Four people on the bridge were killed.

1982 - The worst Louisiana rainstorm in more than 100 years came to an end. More than 18 inches fell at Vinton, LA, during the three day storm. Flooding was widespread, and property damage was estimated at 100 to 200 million dollars. President Reagan visited the state and declared ten parishes in northeastern Louisiana disaster areas.

1982 – Hank Aaron and Frank Robinson were elected to Baseball’s Hall of Fame. Aaron established a major league record with 755 HRs, while Robinson led the Baltimore Orioles to two World Championships and was named MVP in both the American and National Leagues. Aaron falls nine votes shy of becoming the first-ever unanimous selection, and his 97.8 election percentage was then second only to Ty Cobb’s 98.2 percent in the inaugural 1936 election. Robinson was also the first African-American manager in Major League history and hit 583 HRs.

1984 - Wayne Gretzky extended his consecutive scoring streak to 45 games, but the Edmonton Oilers winning streak ended at an unlucky 13 when Gretzky and company lost to the Buffalo Sabres, 3-1.

1985 - While not a date in American history, Otto Bucher of Switzerland became the oldest golfer to record a hole-in-one when he aced the 12th hole at a golf course in Spain. Burcher was 99 years old.

1986 - NCAA member schools voted overwhelmingly in convention to adopt Proposition 48, a controversial attempt to raise the academic performance of student-athletes. Prop 48 required incoming freshmen to score 700 or more on the Scholastic Aptitude Test (SAT) or 15 on the American College Testing (ACT) exam or graduate from high school with a 2.0 grade point average in order to be eligible for athletics during freshman year.

1986 - For the first time in about 10 years, "The Wall Street Journal" broke with tradition and printed a real, honest-to-goodness picture on its front page. The story was about artist O. Winston Link and featured one of his works.

1988 - A fast moving cold front ushered arctic cold into the north central and northeastern U.S. Mason City, IA reported a wind chill reading of 51 degrees below zero, and Greenville, ME reported a wind chill of 63 degrees below zero. Winds along the cold front gusted to 63 mph at Rochester, NY, and a thunderstorm along the cold front produced wind gusts to 62 mph at Buffalo with snow and sleet.

1989 - Half a dozen cities in the northeastern U.S. reported record low temperatures for the date, including Elkins, WV, with a reading of 13 degrees below zero. Watertown, NY was the cold spot in the nation with a morning low of 37 degrees below zero

1989 - Top Hits

“Every Rose Has Its Thorn” - Poison

“My Prerogative” - Bobby Brown

“Two Hearts” - Phil Collins

“Hold Me” - K.T. Oslin

1990 – Douglas Wilder became the first elected African American governor as he takes office in Richmond, VA.