Connect with Leasing News ![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

-----------------

Regular Edition to Follow

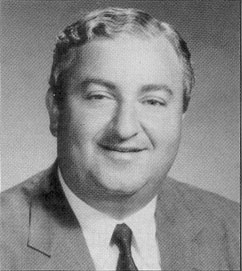

Leasing Icon Ira Romoff Passes Away

2009

Romoff, Ira Z., age 65, beloved husband of Arlene, devoted father of Michael and Heatherlynn Romoff, Emily and James Bronstein, dear brother of Gail Reich and loving grandfather of Evelyn Bronstein.

Service Thursday, 1PM at Gutterman and Musicant, 402 Park Street, Hackensack, New Jersey.

Memorial contributions may be directed to the Center for Hearing and Communication at chchearing.org.

Gutterman and Musicant Funeral Home

“Shiva to follow at my parents' apartment in Hackensack. For details, contact the funeral home.”

Emily Bronstein

emilybronstein@gmail.com

AVP

Franklin National Bank

1970 – 1974

www.linkedin.com/pub/ira-romoff/8/ba9/776

1990

“Ira Z. Romoff has been named managing director of Tilden Management Corporation ( Rosslyn, NY), which was acquired by National Westminster Bank ,NJ (Jersey City, NJ).,the New Jersey subsidiary of National Westminster Bancorp Inc. ( New York)

February, 1990, “Equipment Leasing Today”

(Photo above from announcement)

EVP

National Westminster Bank USA

1991 – 2001

Ran small business banking, was CEO/Managing Director of the Tilden Leasing Companies growing to $1.8 Billion on assets. Assisted in the sale of bank to Fleet (now B of A)

www.linkedin.com/pub/ira-romoff/8/ba9/776

2000

"Ira Z. Romoff is the Executive Vice President of EAB's Leasing Department and a member of EAB's Executive Management Group. Under Mr. Romoff's direction, the EAB Leasing Department has advanced as an integral part of the bank's record growth since 1991. As a result, EAB's Leasing Department ranks among the top fifteen bank leasing companies throughout the United States.

"With more than 25 years in the financial services industry, Mr. Romoff's expertise as a commercial banker and leasing executive is surpassed. He has been a Director with the Eastern Association of Equipment Lessors and the Equipment Leasing Association and is a member of both the United Association of Equipment Leasing and the National Vehicle Leasing Association. Recognized for his numerous contributions to the small business community throughout Long Island, Mr. Romoff was named Financial Business Advocate of the Year by the Small Business Administration. In addition, he is an active proponent of business education, serving as the Executive in Residence of the Department of Management for the College of Business Administration at St. John's University."

- Leasing News, 2000

"Leasing News reported yesterday late afternoon that Citicorp has ordered European American to cease third party origination by June 30. After buying Copelco, they also ended brokerage business here.

Ran Small Business Lending, Leasing, member of Executive Management Group of the bank. Grew Leasing subsidiary from scratch to over $3 Billion in assets. Assisted in sale of Bank to CitiCapital

www.linkedin.com/pub/ira-romoff/8/ba9/776

EAB purchased Fidelity Leasing April 14, 2000, and was the premier lessor when purchased by Citibank on February 12, 2001 for $1.6 billion and $350 million preferred stock."

- Leasing News, 2001

“Viewed as a major blow to the leasing industry, particularly to the East Coast, Citicorp has ordered European American to cease third party origination by June 30. As they did with Copelco, Citicorp does not like brokerage business.

“European American President Ira Romoff has resigned. It is expected Fred Anderson will be on the streets shortly, along with Omar Diaz and Rich Illich

-

Leasing News, 2001

“JUST A QUICK NOTE TO LET YOU KNOW THAT I'LL BE STARTING UP A NEW LEASING COMPANY FOR INDEPENDENCE COMMUNITY BANK IN NYC STARTING 9/1/2004!

Director of Leasing ICB LEASING CORP."

a division of

Independence Community Bank

551 5th Avenue 26th floor

NYC, N.Y. 10176

Leasing News, 2004

http://www.leasingnews.org/Conscious-Top%20Stories/Ire_rommoff.htm

Independence Community Bank, October, 2005, purchased by Sovereign Bank.

http://www.leasingnews.org/Conscious-Top%20Stories/ICB_Sovereign_merger.htm

8/25/2006

Celebrate! Romoff new President: One World

http://www.leasingnews.org/items/SMALL/owl-CARTOON2.jpg

http://www.leasingnews.org/archives/August%202006/08-25-06.htm#owl

"August 25, 2006 when One World Leasing, a leasing co-op, hired him as president they had 17 members. At last count it was 26 and the talk was a merger with a major funder. January 4 he wrote Leasing News he retired from OneWorld Leasing and was looking for a Board Seat at a bank or large leasing company, consulting in banking, leasing or risk management, or a temporary CEO position.”

"Mr. Romoff has had several banks bought out from under him after he developed the leasing division. He was the Executive Vice President of EAB's Leasing Department and a member of EAB's Executive Management Group. Under Mr. Romoff's direction, the EAB Leasing Department has advanced as an integral part of the bank's record growth since 1991. As a result, EAB's Leasing Department ranks among the top fifteen bank leasing companies throughout the United States. EAB was purchased by CITIBANK in early 2001. He then became Director of Leasing, ICB Leasing Corporation, for Independence Community Bank, who in October, 2005 were purchased by Sovereign Bank."

Re-enters leasing as Unicyn Financial Services

http://www.leasingnews.org/archives/May%202009/05-20-09.htm#amigos

Ira's support of Walk4Hearing:

http://leasingnews.org/archives/Sep2011/9_12.htm#walk4

--------------------------------------------

|

|

Positions Available in Irvine and San Diego

1 year experience preferred, salary/benefits |

| www.cflbc.com

Commercial Finance & Leasing Bank of Cardiff, Inc, a finance lender licensed pursuant to the California Finance Lenders Law, license #603G469 |

Wednesday, July 31, 2013

![]()

Today's Equipment Leasing Headlines

Placard—Ten of Gibb’s Fifty Rules

Marlin Business Services Reports $4.5 MM 2nd Quarter

---50% Growth in Six Month to Previous Time Period

Sales Makes it Happen by Steve Chriest

"Rule 23"

Top 50 Quick-Service/Fast-Casual Restaurants

QSRmagazine.com

Why I Became a CLP, Jeff Bartholomew, CLP

Credit Officer, Financial Pacific Leasing

Leasing News Advisor

Armon Mills

Brican America, Miami, Florida Lawsuit

—Up-date: Plaintiff Response

Construction/Land Development Loans Coming Back

SNL Financial Reports "Depends on the Market"

Hey, Let's Hire Ritz Carlton!!!

by Charles Wendel, FIC's SME Newsletter

German Shepherd-Chow Chow Mix

Chicago, Illinois Adopt-a-Dog

News Briefs---

Cole Taylor Bank owner sued over sale

MicroFinancials' Niche Success

From a year ago, unemployment down in 272 cities

US home prices rise 12.2 percent in May,

most in 6 years and sign of stronger housing recovery

Housing’s Rise and Fall in 20 Cities

"NCIS" actress Pauley Perrette not quitting

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

You May have Missed---

SparkPeople--Live Healthier and Longer

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send to a colleague. Spread the news.

Also ask them to join

our mailing list or bookmark our site.

We are free

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Classified Ads---Collections

(These ads are “free” to those seeking employment

or looking to improve their position)

Long Grove, Illinois Financial services professional with a proven track record of positively impacting corporate finances through effective management of cash flow, collections and financial assets. Strategic thinker capable of analyzing financial issues and processes in order to implement changes that improve efficiency and profit margins. Well-versed in all aspects of corporate financial affairs. roborgaard@aol.com | Resume |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

[headlines]

--------------------------------------------------------------

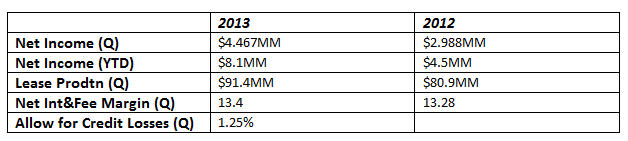

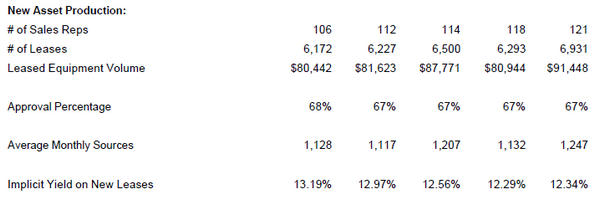

Marlin Business Services Reports $4.5 MM 2nd Quarter

---50% Growth in Six Month to Previous Time Period

Marlin Business Services, Mount Laurel, New Jersey (Nasdaq: MRLN) reports second quarter 2103 net income of $4.467 million, compared to $2.988 in Quarter 2, 2012;six month income went to $8.1 million 2013 from to $4.5 million in 2012.

Second Quarter:

-

Net income of $4.5 million for the second quarter of 2013, an increase of 50% compared to the second quarter of 2012

-

New lease originations of $91.4 million for the second quarter of 2013

-

Risk adjusted net interest and fee margin of 11.93% for the quarter

-

$461.5 million of insured deposits, up 63% year-over-year

-

Strong capital position, equity to assets ratio of 26.68%

-

Total risk-based capital ratio of 30.86%

Quarter Ended: 6/30/2012 9/30/2012 12/31/2012 3/31/2013 6/30/2013

Daniel P. Dyer

Co-Founder/CEO

Marlin Business Services

"Our performance results reflect upon the favorable growth trends and attractive operating metrics of our business," Daniel P. Dyer, co-founder and Chief Executive Officer, said.

"We continue to see attractive growth opportunities by focusing on serving small and midsize businesses and their credit financing needs by delivering quality products with exceptional service."

Second quarter 2013 lease production was $91.4 million based on initial equipment cost, 13% higher than first quarter 2013 and 14% higher than the second quarter of 2012.

Net interest and fee margin of 13.4% is down 14 basis points from the first quarter of 2013 and is up 14 basis points from the second quarter of 2012. The Company's cost of funds improved 12 basis points from the first quarter of 2013 and 84 basis points from the second quarter of 2012. The improvement resulted from the Company's use of lower-cost insured deposits issued by the Company's subsidiary, Marlin Business Bank, as its primary funding source.

The allowance for credit losses as a percentage of total finance receivables is 1.25% at June 30, 2013, and represents 218% of total 60+ day delinquencies.

Leases over 30 days delinquent were 0.95% of the Company's lease portfolio as of June 30, 2013, 4 basis points lower than the first quarter of 2013. Leases over 60 days delinquent were 0.50% of the Company's lease portfolio as of June 30, 2013, down 7 basis points from 0.57% at March 31, 2013. Second quarter net charge-offs were 1.55% of average total finance receivables versus 1.25% for the quarter ended March 31, 2013 and 1.04% a year ago.

The Company's efficiency ratio was 53.0% for the quarter ended June 30, 2013, compared to 54.7% at March 31, 2013 and 60.0% at June 30, 2012.

The Company's consolidated equity to assets ratio is 26.68%. Our risk based capital ratio is 30.86%, which is well above regulatory requirements.

It should be noted that on July 1, 2013 Marlin Business Services Corp. and Union Bank, N.A., have formed a strategic alliance to provide financing solutions for Union Bank's customers throughout the United States. Union Bank, N.A., is a full-service commercial bank providing an array of financial services to individuals, small businesses, middle-market companies, and major corporations. The bank operated 443 branches in California, Washington, Oregon, Texas, Illinois, and New York.

Full Press Release with Finance Statement

http://leasingnews.org/PDF/Marlin2ndQuarter_72013.pdf

[headlines]

--------------------------------------------------------------

Sales Makes it Happen

by Steve Chriest

"Rule 23"

Rule #21

- Everyone in an organization is a salesperson.

Rule #22

- Not everyone believes rule number one.

Rule #33

- Everyone has customers.

The most successful, customer-centric organizations we encounter work hard to create a culture that champions all customers, including the company's employees.

Managers in these organizations recognize that they oversee a volunteer workforce, and they realize that their success as managers depends, to a large degree, on their ability to persuade employees to work at fulfilling the company's mission.

We've noticed that these same managers faithfully follow their company's sales process when interacting with subordinates.

We don't think it is an accident that companies that are satisfied with their implementation of highly complex CRM (Customer Relationship Management) systems share a common approach to managing their employees.

Instead of simply announcing the arrival of new CRM software, managers solicited input from all affected business units during the project's planning phase, launched modules in stages to promote user adoption, and addressed the cultural shift issues that a major change in software often entails. In short, they approached their employees as customers of the new software system!

A willingness to accept the three rules that apply to all organizations today, and a commitment to treat everyone in the organization as a "customer," helps create a true customer-focused enterprise.

About the author: Steve Chriest is the founder of Selling UpTM (www.selling-up.com), a sales consulting firm specializing in sales improvement for organizations of all types and sizes in a variety of industries. He is also the author of Selling The E-Suite, The Proven System for Reaching and Selling Senior Executives and Five Minute Financial Analyst, Basic CREDIT & Analysis Tools for Non-Accountants. He was the CEO of a very successful leasing company and executive at a major company. You can reach Steve at schriest@selling-up.com.

[headlines]

--------------------------------------------------------------

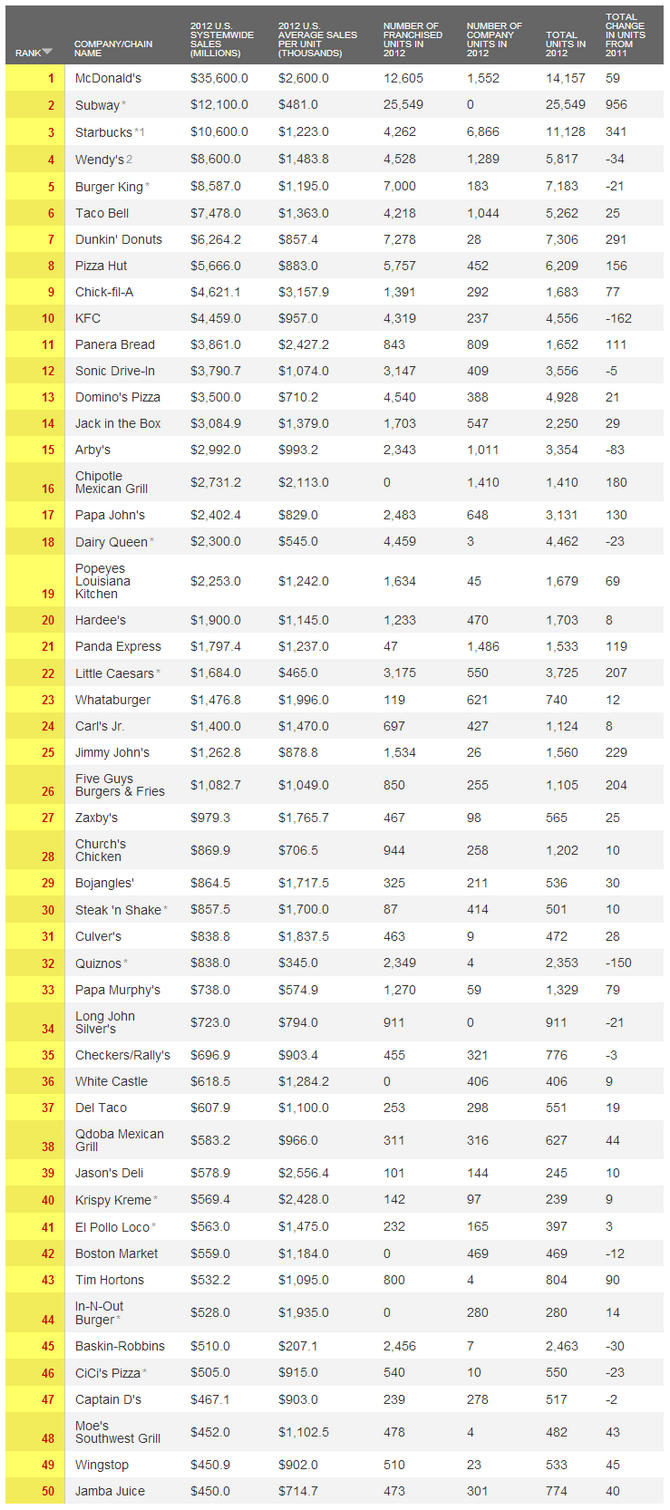

Top 50 Quick-Service/Fast-Casual Restaurants

QSRmagazine.com

The oldest operating McDonald's restaurant was the third one built, opening in 1953. It's located at 10207 Lakewood Blvd. at Florence Ave. in Downey, California.- Wikipedia

McDonalds is still number one. nearly tripling runner-up Subway’s domestic sales. Chick-fil-A surpassed KFC to become the best-selling chicken chain, Jimmy John’s and Five Guys joined the billion-dollar-brands club, and fast-growing Wingstop and Moe’s Southwest Grill climbed into the limited-service industry’s upper echelon for the first time.

QSR Chart that you can click column headers to sort:

http://www.qsrmagazine.com/reports/qsr50-2013-top-50-chart

| Working Capital Loans $10,000-$250,000 | |

|

|

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

Los Angeles, California www.maximcc.com |

|

|

Positions Available in Irvine and San Diego

1 year experience preferred, salary/benefits |

| www.cflbc.com

Commercial Finance & Leasing Bank of Cardiff, Inc, a finance lender licensed pursuant to the California Finance Lenders Law, license #603G469 |

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

Why I Became a CLP

Jeff Bartholomew, CLP

Credit Officer

Financial Pacific Leasing

My career in the Leasing Industry began about 18 years ago in a small family owned broker shop. My introduction was a bit of a “baptism by fire” experience in that I was hired as “Credit Manager”---I had never even seen a credit bureau report prior to my first day on the job!

Long story short is that I quickly became aware that this small family run business had every intention to grow. In relatively short period of time our sales force grew from 2 sales people to somewhere in the neighborhood of 12-15 sales people. Of course ,and as is so often the case, the administrative staff was not increased, meaning I was left with the task of creating processes and procedures that would keep the sales staff happy, and at the same time, keep our lenders happy with both quality and quantity of applications.

I survived because of the experience of my old VP and mentor Jack Stewart. Additionally I spent an exceedingly large amount of time gleaning information from our lenders (including Alan Kissinger, now a CLP and vice-president of credit her at Financial Pacific Leasing). I learned the hard way which was to thoroughly research and present a transaction with the highest level of success at submittal. And to do it quickly.

As time went on and we continued to grow, I was tasked with hiring additional staff, including my replacement as I moved into a more funding-centric and overall operational management role. I had learned the hard way. In the 10 years that I was employed I wore many hats and gained a great deal of knowledge which brings me to the end of 2005 when I came to my current home, Financial Pacific Leasing. Having transitioned from Broker to actual Lender I was excited to see things from the other side of the desk. I was also looking forward to the additional growth that my new role would provide. Not only was I getting hands on, for the first time, I had help in making decisions, rules and guide lines and a professional approach to making credit decisions. It was a new world!!!

Financial Pacific Leasing has always encouraged their employees to take their Leasing experience to the next level and channel it into the well-rounded role that the Certified Leasing Professional designation provides. This was especially true for me. Financial Pacific Leasing’s staff not only has the most CLP’s on board (17), but is rich with mentors for the CLP exam. It was through the encouragement and support of long time CLP designees ,especially my direct supervisor LaDonna Fosback CLP, that I made the decision to sit for the CLP exam.

Preparing for a test of this nature is no easy task. While I had up to that point had “hands-on” experience with most of the subject matter, there were a few things like Lease Accounting that were rather foreign to me. Months of reading, studying flash cards and group study sessions (thank you Jim McCommon) was huge commitment to make but in the end very worthwhile.

As a Credit Officer at Financial Pacific Leasing I am compensated for making decisions. I have never doubted my decision to become a CLP. Studying for the CLP exam tied all of the knowledge I had gained over the years into a cohesive accessible reference. I feel with all certainty that my doing so has added a level of my employers’ confidence to the decisions I make as well as to that of our customers.

I would encourage anyone with the experience required to make the commitment to take their professional standing to the next level and become a CLP. I am very proud to have the designation after my name.

Jeff Bartholomew, CLP

CLPs in Good Standing

http://www.clpfoundation.org/members/members.php

Why I Became a CLP series:

http://www.leasingnews.org/CLP/Index.htm

|

((Please Click on Bulletin Board to learn more information))

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

Leasing News Advisor

Armon Mills

Armon Mills joined the Leasing News Advisory Board on February 5, 2004. In reality, he was quite instrumental and was the first to give Kit Menkin advice to incorporate, trade mark, and develop what were originally e-mails about what was happening in the equipment leasing industry sent to friends. Kit served on all Armon’s advisory boards; is a personal friend of he and his family. He and Armon often had lunch together often when Armon was located in San Jose, California. They also both served on community non-profit organizations as officers, including chairmen and presidents, working on projects together. Armon has been a mentor to several publishers, many of them across the nation, running the various Business Journals and other media.

Armon Mills, Director

Practice Development

Southern California Region

J.H. Cohn, LLP

4180 Ruffin Road, Suite 235

San Diego, CA 92123

Direct phone: 858-300-3443

Mobile: 858-220-5443

Email: amills@jhcohn.com

Armon recently left his position as President and Publisher of the San Diego Business Journal that he had joined April, 2004, and has returned to his original career as director for the Southern California Region for the national CPA firm of J.H. Cohn, LLP.

He began his career in public accounting, earning his CPA certificate in 1967. He went on to work in public accounting at Fox & Company for 20 years. Armon knows the world of business publishing well, changing his career path and signing on as President and COO of American City Business Journals, Inc. He served as Publisher of the Business Journal in Phoenix, Arizona; San Diego, California; the San Jose Silicon Valley Business Journal and Silicon Valley Biz Ink.

Armon has been active in many community organzations, including the Board of Directors of the San Jose/Silicon Valley Chamber of Commerce, San Jose Convention and Visitors Bureau, Boy Scouts of America, YMCA, Salvation Army and the Silicon Valley Chapter of the Commonwealth Club of California. He was also an active member of the San Jose Rotary Club.

Armon is continuing his strong commitment to the community here in San Diego. He is a member of the Rotary Club #33, and has accepted positions on the Board of Directors of Junior Achievement, the Salvation Army, the YMCA and is currently a member of the Finance Committee of the San Diego Convention and Visitors Bureau, the Pacific Life Holiday Bowl Committee, and is active in the board of the United Way of San Diego.

[headlines]

--------------------------------------------------------------

Brican America, Miami, Florida Lawsuit

—Up-date: Plaintiff Response

(Here is the original October 5, 2009 alert)

This was brought to Leasing News attention by Bernie Boettigheimer, CLP, of Lease Police. It appears Brican may be in the process of trying to sell parts of its lease portfolio and in doing an investigation, found NCMIC Finance Corporation dba Professional Solutions Financial Services (PSFS), Clive, Iowa has a claim against Brican for $38 million involving 1672 leases. It appears very similar to the NorVergence situation but in this case the seller of the equipment specifically provided the lessee with a letter to make lease payments in certain situations, unknown to PSFS, according to the complaint.

"15. In fact, there was at least one additional agreement, a "Marketing Agreement," which related to the Goods or Leases provided to the Lessees, that Brican gave to each of the Lessees, which was not included in the documents that were provided to PSFS for each of the leases."

"17. The Marketing Agreement was material to PSFS's decision to underwrite Leases as the payments under the Marketing agreement were designed to offset the cost of the Lease Payments, suggesting that the Lessees would not enter into the Leases or might cease payment under them without the income stream provided by the Marketing Agreement.

18. As a result of Brican's failure to provide the Marketing agreement to PSFS with each packet of the document related to each of the Leases, Brican has breached the agreement." (1)

April 23, 2010 there appeared to be three class actions suits, which have spiraled down to one main one, which Leasing News has been following regarding Ronald Gossett, Gossett & Gossett, class action attorney and case in Iowa. (2)

At this time the plaintiffs are awaiting a ruling on the cross-motions for a summary judgment. The Florida U.S. District Court Judge Patricia A. Seitz requested the plaintiffs whether "this is a 'paper case" limited to the alleged misrepresentations in the various versions of the Advertising Agreement, including Plaintiffs' reasoning in support of this position."

Ronald Gossett responded (eight pages):

http://leasingnews.org/PDF/PlaintiffResponse_72013.pdf

(1) Alert--Brican America, Miami, Florida

http://leasingnews.org/archives/October%202009/10-05-09.htm#Alert_Brican

(2) Three Class Action Suits re: Brican America

http://leasingnews.org/archives/Apr2010/4_23.htm#class_actio

Brican Stories:

http://www.leasingnews.org/Conscious-Top%20Stories/brican_america.htm

John Kenny Receivables Management • Credit Investigations • Asset Searches • Skip-tracing • Third-party Commercial Collections john@jkrmdirect.com | ph 315-866-1167| www.jkrmdirect.com |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

Construction/Land Development Loans Coming Back

SNL Financial Reports "Depends on the Market"

In reporting bank failures in "Bank Beat" the highest charge-offs have not been in commercial loans or leasing or even consumer loans, but construction and land development lending, followed by nonfarm-nonresidential loans, somewhat related.

While non-current loans have been highest in first and second mortgages, and residential real estate mortgages tied to syndications have been serious, residential construction and land development appear most in charge offs.

SNL Financial reports: Aggregate residential C&D loans were at $36.1 billion in the first quarter, down from $177.3 billion in 2007, while nonresidential C&D loans were at $150.8 billion, down from $370.1 billion in 2007. Residential C&D loans accounted for almost one-third of total C&D loans in 2007 but now account for less than one-fifth.

SNL Financial reports:

But whether C&D lending remains on the decline or is starting a reversal depends on the market. Charles Valade, chief lending officer at West Springfield, Mass.-based United Financial Bancorp Inc., told SNL that in certain parts of Connecticut — especially south of Hartford — the company is starting to see demand pickup on the residential side. United Financial had a C&D portfolio of $80.4 million at the first quarter of 2013, which was almost double from $41.7 million a year ago because of the New England Bancshares Inc. acquisition. The company's C&D delinquency rate of 3.54% was improved from 5.35% one year ago. C&D currently accounts for 4.36% of United's total loans.

But even with the improvement, the Connecticut region is probably a little bit behind the western and central parts of Massachusetts. He said the entire region bounced back quicker and stronger, aided in part because it did not have as many problems and issues as other parts of the country. "In terms of our portfolio, we're encouraged by what we see happening with the developers we have and the new projects that we're looking at in terms of the movement of units," he said.

Camden, Maine-based Camden National Corp. President and CEO Gregory Dufour told SNL that, overall, the company has seen some improvement in construction and land development in the Maine market, but the sector has not returned to pre-recession levels. Camden's C&D portfolio of $28.5 million at the first quarter was down from $29.6 million a year ago. The company's C&D delinquency rate of 1.70% was improved form 2.47% one year ago, and C&D currently accounts for 1.81% of its total loans.

Demand varies from market to market, he said. Camden is experiencing an increase in commercial development in the Portland, Maine area and to a lesser extent in Maine's smaller markets, he said. "On the residential side, development also varies by market with the more populated areas seeing some moderate size projects being started and in other areas projects are more on an individual basis," Dufour said.

SNL Financial reports:

Quincy, Calif.-based Plumas Bancorp President and CEO Andrew Ryback recently singled out C&D loans as a lending line the bank is trying to get away from. In a press release about second-quarter results, Ryback said the bank has been able to diversify its loan portfolio and move balances away from "higher risk" construction and land development loans. He said the balances have been reduced from more than $73 million, or 20% of Plumas' loan portfolio at December 31, 2008, to $12 million, or less than 4% of its loan portfolio at June 30, 2013. "During this same period our auto lending, commercial real estate and government-guaranteed lending product lines have become key revenue and profit generators," he said.

United's Valade said the commercial and land development portion of its portfolio is performing very well, and recent developments in its markets add further optimism. CSX Corporation recently moved its dry goods operations out of Austin Texas to Worcester and spent $125 million. Also, a new cancer research facility was built at the University of Massachusetts for $550 million. "And it goes on and on in terms of the money being spent," he said. "So we're pretty encouraged by what's happening in our market place."

Full SNL Financial Article:

http://www.snl.com/InteractiveX/Article.aspx?cdid=A-18620932-13611

|

[headlines]

--------------------------------------------------------------

Hey, Let's Hire Ritz Carlton!!!

by Charles Wendel

FIC's SME Newsletter

Water Tower Place, Chicago, Illinois

(Banks, Lenders, Business find your niche. Editor)

In the last few weeks I have heard several banks mention the idea of attending a session with or bringing in experts from Ritz Carlton to provide a training program (of up to six hours!). Their courses focus on leadership, service, passion, exceeding expectations, and other qualities that most customers view banks as lacking. But, for many banks, bringing in Ritz Carlton for a day serves only as a "feel good" program that allows managers to believe that they are doing something transformative when, in fact, they are in most cases just checking off another training box.

Do not get me wrong. I like Ritz Carlton. Their service is great. Service and customer care serve as a major part of the hotel's core philosophy. I know no one, including me, who has ever had a bad experience there. But, remember when JC Penney hired the exec who developed the Apple stores. That was viewed as a transformative event, something that would lift that crummy store to the heights of Bergdorf. He is gone now with the strategy he introduced. The fact is that JC Penney can never provide the Apple store experience, and banks have fundamental issues to address before they can hope their customers view them with the same positive anticipation most feel when entering a Ritz Carlton.

Think about why Ritz Carlton is Ritz Carlton. First, they seem to have designed themselves with the customer in mind. They are friendly, efficient, courteous, and smart. In a sense they have also trained all of us to think of them positively because they deliver every day. Even after, perhaps especially after, a day of work, you enter a world in which that company has created a sense of eagerness and relief in the mindset of a customer opening the front door (actually someone else will likely open the front door for you). You enter the lobby and know that people will be nice to you, that the entire experience is intended to be hassle free and relaxing. If you are a businessperson, you look forward to crossing the threshold as if you have completed a tough race (and, given work or travel today, you have).

The reality is that too often banks are hassle-full. Despite the marketing, many appear to be getting worse because of attitude, compliance, and other CYA requirements, no matter the best intentions of top management. People (you and me) want to be in a Ritz Carlton. People (you and me) want to exit a bank branch or end our conversation with a banker as quickly as possible. Going to a bank is more like going to a dentist (a chore) than going to an Apple store.

Of course, some notable exceptions exist. Probably Umpqua Bank has garnered the most publicity both for its changes to branch design and, more important, the way it has rethought the customer experience. A May American Banker article cites Umpqua having made the decision ten years ago "to try to turn its physical properties into places that people wanted to linger in, rather than speed past." And speed pass most customers do, with a noted retail industry consultant stating that people actually do pick up their pace when they walk by a branch in a city setting. Umpqua looked at non-banks like the Ritz, Disney, and others in thinking about how it served the customer and its President, Ray Davis, is largely on target when he comments, "The best ideas bankers can get will come from outside the industry."

Companies like Umpqua can take full advantage of programs such as the Ritz offers because they have rethought their operating model and look at non-bank programs with the intent of implementing the best practices they offer. Most banks offer the six-hour Ritz Carlton program and then largely forget about it the next day, going back to their old ways of doing business. Unless you are willing to exploit a program like the Ritz's, unless you are willing to focus on how to make their best practices part of your own DNA, you are wasting your time. The Ritz program, or others like it, does not come with a Pauline moment whereby the attendees decide to change the way they do business forever more. From its very inception banks like Umpqua have operated with a customer emphasis. The amount of change that most banks require is daunting, but the need for change increases every day.

For many banks Umpqua itself has now become Ritz Carlton-like with bankers traveling from around the world to learn from the bankers in Portland. Despite all Umpqua and a few others like it have to offer, once back home the memory of the banker's trip quickly fades.

Banks need to deal with some difficult basics:

-

Honestly, today, what is the customer experience like? Is it consistent across your footprint or does it differ based upon the personalities and whims of individual employees?

-

What customer pain points do you need to eliminated

-

What is your strategy? What do you stand for?

-

Who are your key customers and why?

-

What differentiates you from the other thousands of banks and credit unions and alternative lenders?

But, all this is hard and most banks only give these considerations lip service. Instead, they can hire a firm that gives them hope for six hours and transports them to another world outside banking, an easy choice that we might all make. But, it is too short-term a choice when more fundamental questions remain unanswered.

Last week, a friend recounted the agony he was going through to refinance his mortgage at a BIG bank he also happened to work for. Unsympathetic and tone-deaf staff basically could have cared less about him, even thought he was their colleague. Maybe they need a Ritz Carlton six-hour program!

Financial Institutions Consulting Web Site

--Sign up for FIC Newsletter

http://www.ficinc.com/

[headlines]

--------------------------------------------------------------

German Shepherd-Chow Chow Mix

Chicago, Illinois Adopt-a-Dog

Breed: German Shepherd-Chow Chow Mix

Gender: Female

Age: 7 years

Canine-ality: Constant Companion

"I'm in a foster home! Use the contact form to arrange a meeting with me!"

Tessa is a precious 7 year-old Shepherd hoping to find her forever home! Tessa spent the last few years living in a house with an elderly woman. When Tessa’s owner became ill and there was no one left to care for Tessa, the family gave her up to PAWS. Because Tessa is used to a quiet life, she is hoping to find a peaceful place where she can relax and just be herself.

Poor Tessa was overfed in her last home, so she is looking for an adopter who can help her get back in shape. When she arrived, she weighed over 90 pounds, but has slowly and steadily made it down to 77. Tessa’s vet has recommended that she aim for a goal weight of 60 pounds. Luckily, Tessa likes taking walks, and is gradually building her stamina back up. She enjoys her time outside so it will be easy for her future adopters to encourage activity!

Tessa’s favorite things in the world are snuggling, lounging in the sun, getting her belly rubbed, and generally being affectionate and lovable. She tends to prefer the company of people to other dogs, but does have one dog buddy at PAWS (a female Terrier mix). Because she can be overwhelmed by busy urban environments and people approaching too quickly, Tessa prefers a relaxed home with just adults, ideally in a suburb or quiet area of the city.

Come meet this curvaceous canine and give her a home today!

email adoptions@pawschicago.org, or call (773)935-7297

to arrange a meeting as Tessa is in foster home.

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

Cole Taylor Bank owner sued over sale

http://www.chicagotribune.com/business/breaking/chi-cole-taylor-bank-owner-sued-20130730,0,3061797.story

MicroFinancials' Niche Success May Foretell A Lynchian 10-Bagger

http://seekingalpha.com/article/1567692-microfinancials-niche-success-may-foretell-a-lynchian-10-bagger?source=google_news

From a year ago, unemployment down in 272 cities

http://www.upi.com/Business_News/2013/07/30/From-a-year-ago-unemployment-down-in-272-cities/UPI-72681375222415/

US home prices rise 12.2 percent in May, most in 6 years and sign of stronger housing recovery

http://www.washingtonpost.com/business/us-home-prices-rise-122-percent-in-may-most-in-6-years-and-sign-of-stronger-housing-recovery/2013/07/30/606c4bce-f918-11e2-a954-358d90d5d72d_story.html

Housing’s Rise and Fall in 20 Cities

http://www.nytimes.com/interactive/2011/05/31/business/economy/case-shiller-index.html?ref=business

"NCIS" actress Pauley Perrette not quitting

http://omg.yahoo.com/photos/top-shots-week-of-july-29-2013-1375124604-slideshow/?cache=clear

[headlines]

--------------------------------------------------------------

How to make Zuni Cafe's Balsamic Bloody Mary

http://www.sfgate.com/food/slideshow/How-to-make-Zuni-Cafe-s-Balsamic-Bloody-Mary-67226.php

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

Eight Things to Consider when Choosing a Gym

http://www.sparkpeople.com/resource/fitness_articles.asp?id=450

[headlines]

--------------------------------------------------------------

![]()

Baseball Poem

WHAT DOES HE KEEP IN HIS BAG?

The slugger keeps something in his bag,

The dark green canvas one that he lugs

To practices and games alike, carrying

His glove separately and his cap on his head

And his cleats already laced tightly.

There is something else that he keeps

In the bag that sits with him on the bench,

That he places carefully in the corner

When he takes the field and checks it

First when he clomps back in.

Everyone has seen him unzip

The long zipper across the top and

Reach inside for something, then pull

His huge hand back without powder

On it or anything sticky. When

Whatever it is moves around, it does

Not create the bulging straight lines

Of books or notebooks. From the way

He carries the bag, it does not appear

To be heavy; in fact, several players

Have discreetly checked the weight,

Jiggling it like a Christmas present.

The slugger is friendly, even to rookies,

And earns his magnanimous salary

Over and over, but he has this green

Canvas bag with something in it

That worries us all.

Written by Tim Peeler

“Waiting for Godot's First Pitch”

More Poems from Baseball

Published by McFarland and Company

[headlines]

--------------------------------------------------------------

Sports Briefs----

Change of Sox for Peavy

http://www.boston.com/sports/baseball/redsox/extras/

A-Rod fighting suspension

http://sports.yahoo.com/news/sources--players-involved-in-biogenesis-scandal-ready-to-accept-suspensions--but-a-rod-fights-on-233912861.html

San Francisco 49ers' receiver situation is a growing concern

http://www.contracostatimes.com/49ers/ci_23760994/san-francisco-49ers-receiver-situation-growing-concern.html

The Huddle

http://www.usatoday.com/sports/nfl/

[headlines]

--------------------------------------------------------------

![]()

California Nuts Briefs---

New restrictions on foreign jets at SFO

http://www.sfgate.com/news/article/New-restrictions-on-foreign-jets-at-SFO-4696669.php

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

Vermeil Wines Opens Tasting Room in Napa

http://www.winebusiness.com/news/?go=getArticle&dataid=119692

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1498- Christopher Columbus first sighted the island that he called La Trinidad. The island was inhabited by two tribes of “Indians, the Arawaks, who were peaceful fishermen and farmers, and the more belligerent Caribs. Upon his return to Spain, Columbus described the islands to the King as very lush and pleasant, and soon the Spaniards began to colonize them. Trinidad and Tobago remained under Spanish rule from 1498 until Feb 18, 1797, when the Spanish Governor, Chacon, surrendered the islands to the British Navy. British rule continued until 1962 when Trinidad and Tobago gained their independence, after having been self-governing since 1956. The chief export were slaves. Those that were not captured were killed and many maimed in the battles between well-armed soldiers on horses and Indians with primitive weapons at best.

http://www1.minn.net/~keithp/cctl.htm

http://www.visittnt.com/General/about/general.html

http://users.carib-link.net/~richjob/trinidad.htm

http://latino.si.edu/rainbow/education/historyandpeople.htm

1777-The Vermont state constitution made it the first state to abolish slavery and adopt universal male suffrage, without regard to property. It was followed to a lesser degree by other New England states, which with Vermont were destined to become strongholds of abolitionism in the 1850s. Vermont had declared itself an independent state on Jan. 16,1777 and has been known for its “independence” ever since.

1777 - The Marquis de Lafayette, a 19-year-old French nobleman, was made a major-general in the American Continental Army.

1790-The US Patent Office opened its doors. The first US Patent was signed by George Washington and Thomas Jefferson. It went to Samuel Hopkins of Vermont for a new method of making pearash and potash, useful in the many application, including bleaching cotton.

1792- the cornerstone of the Philadelphia Mint, the first US Government building, was put in place.

1811-Jane Currie Blaikie Hoge birthday, author also well-known for caring for orphans. After seeing some of the deplorable conditions suffered by soldiers in the Civil War, she became one of the leaders in sanitary reform (collecting and distributing clothing, providing nursing care, medical and hospital supplies, food, just about everything else for sanitary and health care that the army never supplied to its men). The women of the sanitary reform movement did unbelievably hard and effective work. The women of the commission received adulation immediately after the war and then their names and work were forgotten while the names of battles and how they were fought (usually forgetting the gruesome results) were glorified.

http://www.britannica.com/women/articles/Hoge_Jane_Currie_Blaikie.html

1816-Birthday of CSA General George H. Thomas, born in Southampton County, Virginia. Known as the "Rock of Chickamauga.”

( lower half of http://memory.loc.gov/ammem/today/jul31.html )

1816- Lydia Moss Bradley birthday - U.S. financier and philanthropist. LMB, although left a wealthy widow, increased the estate astronomically through wise investments and real estate transactions that rank her as a major financial genius. Her philanthropic gifts included a home for older women. In 1876 she endowed Bradley University with $2 million and 28 acres in honor of her six children who all died young.

http://www.search.eb.com/women/articles/Bradley_Lydia_Moss.html

http://www.alliancelibrarysystem.com/IllinoisWomen/files/br/htm1/bradley.cfm

1831- Helena Petrovna Hahn Blavatsky birthday, founder of the Theosophy religion/belief/philosophy that combines various religions and spiritualism and the occult. She wrote a number of books the most important being The Secret Doctrine, The Synthesis of Science, Religion, and Philosophy (1888) and Key to Theosophy (1889) that are the basic texts of the movement. She died at the home of Annie Besant who carried on the movement that still has millions of followers today.

http://school.eb.com/women/articles/Blavatsky_Helena_Petrovna.html

http://www.blavatskyarchives.com/natcyclop.htm

http://www.crystalinks.com/blavatsky.html

1846-The “Brooklyn” arrived in port with 230 Mormons under the leadership of 26-year-old

Samuel Brannan. He was to meet other Mormons who were crossing the country from Illinois.

http://www.sfgate.com/cgi-bin/article.cgi?file=/chronicle/archive/

1996/07/26/MN64895.DTL

1846-The "Brooklyn" arrived in port with 230 Mormons under the leadership of 26-year-old Prophet Samuel Brannan. He was to meet other Saints who were crossing the country from Illinois.

1849-Revolutionizing warfare, Benjamin Chambers,Sr., obtained a patent for a “Breech-loading cannon.” It was the most successful and simple operation, which he called “ an improvement in movable breeches for fire-arms and the locks and appurtenances of the same.” His wooden model was discovered in an old smithy and became part of the collection of the Virginia Historical Society.

1854-Capt. Ulysses Grant resigned his commission in the Army at Ft. Humboldt because his commanding officer said his weakness for liquor was cause for court martial or resignation. Capt. Grant then came to San Francisco and lived at the What Cheer House.

1854-Capt. Ulysses Grant resigned his commission in the Army at Ft. Humboldt because his commanding officer said his weakness for liquor was cause for court martial or resignation. Capt. Grant then came to San Francisco and lived at the What Cheer House

1860- Mary Morris Vaux Walcott birthday - U.S. artist. Four hundred of her watercolors of wild flowers and descriptions were published by the Smithsonian Institution as the five-volume North American Wild Flowers. Her paintings are magnificent and accurate.

http://www.britannica.com/women/articles/Walcott_Mary_Morris_Vaux.html

http://scolar.vsc.edu:8003/VSCCAT/AAK-0141

1874- Father Patrick Francis Healy, first Black man to receive a PhD, named President of Georgetown University.

http://memory.loc.gov/ammem/today/jul31.html

1918- Pianist Hank Jones birthday

http://www.npr.org/programs/jazzprofiles/archive/jones_h.html

http://www.jazzradio.org/hank.htm

1921-Birthday of Whitney Young, former Executive Director of the National Urban League

http://blackhistory.eb.com/micro/650/67.html

1931-Birthday of great guitarist Kenny Burrell, Detroit, MI'

http://www.hopper-management.com/kb_bio_e.htm.

1942-Harry James Band with Helen Forrest cut “ I've Heard that Song Before.” All phonographs are banned the next day due to the war until 1945.

1943-KISTERS, GERRY H. Medal of Honor Rank and organization: Second Lieutenant (then Sergeant), U.S. Army, 2d Armored Division. Place and date: Near Gagliano, Sicily, 31 July 1943. Entered service at: Bloomington, Ind. Birth: Salt Lake City, Utah. G.O. No.: 13, 18 February 1944. Citation: On 31 July 1943, near Gagliano, Sicily, a detachment of 1 officer and 9 enlisted men, including Sgt. Kisters, advancing ahead of the leading elements of U.S. troops to fill a large crater in the only available vehicle route through Gagliano, was taken under fire by 2 enemy machineguns. Sgt. Kisters and the officer, unaided and in the face of intense small arms fire, advanced on the nearest machinegun emplacement and succeeded in capturing the gun and its crew of 4. Although the greater part of the remaining small arms fire was now directed on the captured machinegun position, Sgt. Kisters voluntarily advanced alone toward the second gun emplacement. While creeping forward, he was struck 5 times by enemy bullets, receiving wounds in both legs and his right arm. Despite the wounds, he continued to advance on the enemy, and captured the second machinegun after killing 3 of its crew and forcing the fourth member to flee. The courage of this soldier and his unhesitating willingness to sacrifice his life, if necessary, served as an inspiration to the command.

1944- Sherry Lansing birthday - U.S. movie executive. SL is the first woman to be placed in charge of production at a major film studio, and 01- 02-1980, she became president of production at Twentieth Century Fox. She had been a story editor and vice-president of creative affairs to MGM and then vice-president of production at Columbia Pictures. Her mother fled Nazi Germany and raised SL and her sister by working in real estate.

http://centerstage.net/theatre/whoswho/SherryLansing.html

http://www.ucop.edu/regents/regbios/lansing.htm

http://www.lukeford.net/profiles/profiles/sherry_lansing.htm

1948-New York's International Airport at Idlewild Field was dedicated by President Harry S. Truman. It was later renamed John F. Kennedy International Airport.

1946-Birthday of singer Gary Lewis, born New York, NY.

http://www.members.aol.com/oldies1/lewis.htm

http://www.tsimon.com/lewis.htm

1951- Evonne Goolagong, outstanding Australian aborigine (First People) tennis player who won Wimbledon 1971 and 1980 and was named AP woman athlete of the year in 1971.

http://www.abc.net.au/btn/australians/goolagon.htm

http://www.hickoksports.com/biograph/goolagonge.shtml

http://www.teachers.ash.org.au/thwaites/goolag.htm

http://www.tennisfame.org/enshrinees/evonne_goolagong.html

1952- Faye Marder Kellerman birthday- U.S. novelist specializing in mysteries that feature authentic Orthodox Jewish life.

http://www.amazon.com/exec/obidos/search-handle-form/103-5362656-4423850

1956---Top Hits

The Wayward Wind - Gogi Grant

Hound Dog/Don't Be Cruel - Elvis Presley

Whatever Will Be Will Be (Que Sera Sera) - Doris Day

I Walk the Line - Johnny Cash

1960-Elijah Muhammad, leader of Nation of Islam, calls for a black state.

1961-President John F. Kennedy agreed during talks held with General Chen Cheng( July 31—Aug 1,1961), to support Nationalist China in its bid for UN membership and oppose the admission of Communist China to the United Nations.

1964 --Top Hits

Rag Doll - The 4 Seasons

A Hard Day's Night - The Beatles

The Little Old Lady (From Pasadena) - Jan & Dean

Dang Me - Roger Miller

1966- Charles Whitman wounds 46 and kills 5 at University of Texas

http://www.crass.com/killer/whitman.html

1968 - The Beatles record "Hey Jude." It tops Billboard's Hot 100 singles chart for nine weeks, making it the megagroup's biggest hit.

1968-The Beatles laid down the bed tracks for "Hey Jude" during the first of a two day session in London. A 36 piece orchestra will be added tomorrow.

1970- Chet Huntley retires from NBC, ends "Huntley-Brinkley Report"

http://www.museum.tv/archives/etv/H/htmlH/huntleychet/huntleychet.htm

1971-the first astronauts to ride a vehicle on the moon were Colonel David Randolph Scott and Lieutenant Colonel James Benson Irwin, who rode the four-wheeled electric cart “Rover,” an LRV ( Lunar Roving Vehicle) alongside the 1,200 foot deep canyon Hadley Hills on the moon ( Apollo 15).

1971-Hamilton, Joe Frank and Reynolds had the top tune on the Cashbox Best Sellers list with "Don't Pull Your Love". Dan Hamilton, Joe Frank Carollo and Tom Reynolds enjoyed their first taste of success in 1965 with a group called The T-Bones when they scored the Top Ten hit "No Matter What Shape" that was used in Alka Seltzer commercials.

1971-James Taylor scored his only Billboard number one record with the Carole King written, "You've Got A Friend". The song would go on to win the 1971 Grammy Award for Best Pop Vocal Performance, Male.

1972 - Thomas Eagleton, the Democratic vice-presidential candidate, withdrew from the ticket with presidential candidate George McGovern following disclosure that Eagleton had once undergone psychiatric treatment for depression. Eagleton was replaced by Sargent Shriver, who, incidentally, was the only Democratic vice-presidential nominee who did not serve in Congress at any point in his or her career.

1972 -Top Hits

Alone Again (Naturally) - Gilber O'Sullivan

Brandy (You're a Fine Girl) - Looking Glass

(If Loving You is Wrong) I Don't Want to Be Right - Luther Ingram

It's Gonna Take a Little Bit Longer - Charley Pride

1972- White Sox Dick Allen becomes the seventh major leaguer to hit two inside-the-park HRs in one game. The homers helps pace the White Sox over the Twins, 8-1.

1974 - One of the President Nixon's main men, John Erlichman was sentenced to prison for his role in the break-in at the office of Daniel Ellsberg's psychiatrist. Ellsberg was the Pentagon consultant who leaked the "Pentagon Papers" (which purportedly told Americans how and why the U.S. really got into the Vietnam War). Ehrlichman also created the White House unit that was called the ‘plumbers' because it was intended to plug leaks.

1976 - A stationary thunderstorm produced more than ten inches of rain which funneled into the narrow Thompson River Canyon of northeastern Colorado. A wall of water six to eight feet high wreaked a twenty-five mile path of destruction from Estes Park to Loveland killing 156 persons. The flash flood caught campers, and caused extensive structural and highway damage. Ten miles of U.S. Highway 34 were totally destroyed as the river was twenty feet higher than normal at times.

1978 - No. 1 Billboard Pop Hit: "Miss You," The Rolling Stones. The song is the band's eighth No. 1 single.

1980 -Top Hits

It's Still Rock & Roll to Me - Billy Joel

Magic - Olivia Newton-John

Cupid/I've Loved You for a Long Time - Spinners

Bar Room Buddies - Merle Haggard & Clint Eastwood

1981- African-American Arnette Hubbard installed as first woman president of the National Bar Association, started in 1925 for African-American attorneys.

http://www.nationalbar.org/about/index.shtml

http://www.siu.edu/~oirs/Stan/walloffame.html

1981 - The seven-week baseball players' strike came to an end as the players and owners agreed on the issue of free agent compensation.

1984- US men's gymnastics team won team gold medal at LA Summer Olympics

http://www.nationalbar.org/about/index.shtml

1986 - The temperature at Little Rock, AR, soared to 112 degrees to establish an all-time record high for that location. Morrilton, AR, hit 115 degrees, and daily highs for the month at that location averaged 102 degrees.

1987 - The deadliest tornado in 75 years struck Edmonton, Alberta, killing 26 persons and injuring 200 others. The twister caused more than 75 million dollars damage along its nineteen mile path, leaving 400 families homeless. At the Evergreen Mobile Home Park, up to 200 of the 720 homes were flattened by the tornado.

1987 - Afternoon highs of 106 degrees at Aberdeen, SD, and 102 degrees at Ottumwa, IA, and Rapid City, SD, established records for the date. It marked the seventh straight day of 100 degree heat for Rapid City. Baltimore, MD, reported a record twenty-two days of 90 degree weather in July. Evening thunderstorms produced golf ball size hail at Lemmon, SD, and wind gusts to 80 mph at Beulah, ND.

1988 Top Hits

Roll with It - Steve Winwood

Hands to Heaven - Breathe

Make Me Lose Control - Eric Carmen

Don't We All Have the Right - Ricky Van Shelton

1988 - Twenty-one cities in the north central U.S. reported record high temperatures for the date, including Sioux City, IA, with a reading of 107 degrees. The reading of 105 degrees at Minneapolis, MN, was their hottest since 1936. Pierre and Chamberlain, SD, with highs of 108 degrees, were just one degree shy of the hot spot in the nation, Palm Springs, CA.

1990-Nolan Ryan of the Texas Rangers won the 300 th game of his career, defeating the Milwaukee Brewers, 11-3. Ryan pitched in the major leagues from 1966 until 1993 and finished with 324 wins.

1993—Top Hits

Can t Help Falling In Love (From "Sliver")-- UB40

Whoomp! (There It Is)- Tag Team

Weak,-SWV

I'm Gonna Be (500 Miles)- The Proclaimers

1994-The San Francisco Giants joined the battle against AIDS by staging their first “Until There's A Cure” Day at Candlestick Park. The Giants wore red ribbons sewn on their uniforms. Together with the visiting Colorado Rockies, they joined 700 Aids volunteers to form a giant human red ribbon on the field. One dollar from the price of every ticket sold went to Bay Area AIDS organizations. The Giants won the game, 9-4, behind home runs by Barry Bonds, Darryl Strawberry and Matt Williams, who hit tow.

1995-Heat Wave in Chicago, Illinois; 525 deaths attributed.

http://www.sws.uiuc.edu/atmos/statecli/1995chicago.htm

1995 - Selling 331,000 copies, Selena's "Dreaming of You," her first English album, debuts at No. 1 on the Billboard chart. The slain Tejano singer becomes the first Latin artist ever to debut at No. 1.

1997 - In New York City, police seized five bombs believed bound for terrorist attacks on city subways. 2 potential suicide bombers were shot and wounded in an explosives laden Brooklyn apartment. Gazi Ibrahim Abu Mezer (23) and Lafi Khalil (22) were recovering from wounds. In 1998 Khalil was acquitted and Gazi Ibrahim Aby Mezer was convicted of plotting to bomb a subway station.

1998-Top Hits

The Boy Is Mine- Brandy

You're Still The One- Shania Twain

My Way- Usher

Adia,-Sarah McLachlan

1999 - The U.S. heat wave -- linked to at least 94 deaths -- continued. As Chicago baked in 100-degree weather, thousands of hot and sweaty residents were forced to endure the heat without air conditioning or fans, due to sporadic power outages and brownouts.

http://hpccsun.unl.edu/nebraska/heatwave99.html

http://www.disastercenter.com/guide/heat.html

2002- A plan to sell beer outside Boston's Fenway Park is approved on a trial basis by city officials. During the 14 games, brew will be available three hours before game time to one hour after games start to game ticket-holders who pass through a turnstile.

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------