|

|

|

|

|

|

|

|

San Francisco, CA. College Degree plus contract/ lease administration experience required. For a full description, click here. Email resume to |

Thursday, July 7, 2005

Headlines---

Classified Ads--Collector/Controller/Contract Admin.

CIT to cut 200 jobs in North America

Last Call---Story Credit Lessors' List

Lessors...Building Customer Loyalty

Leasing business rises from dark past

Leasing Meetings Open to Non-Members

Home equity sub spreads show signs of widening

Classified—Help Wanted

GE Com. Fin. Acquires $1 BB Aircraft Portfolio

CIT Announces Sale of Corporate Aircraft Portfolio

Butler Capital ranked No. 90 in 2005 Monitor 100

Latin America's Top 100 Leasing Companies

Edmunds.com Reports True Cost of Incentives

News Briefs---

Sports Briefs---

"Gimme that Wine"

Today's Top Event in History

This Day in American History

Baseball Poem--- Nancy Pham

The List---2nd Quarter-Tomorrow

######## surrounding the article denotes it is a “press release”

Classified Ads-----Collector/Controller/Contract Admin.

Collector

Boston, MA .

Challenging position where my skills, professional experience, organization, leadership, strategic thinking, creativity, energy, passion, competitive nature will enable me to define opportunities and personal development.

Email: bernd.janet@verizon.net

Beaverton, Oregon

20 year experience in equipment leasing in the Portland, OR metro area as an Asset & Collection Manager.

Email: pbost2004@yahoo.com

Jacksonville, East Brunswick, FL .

13 years experience with collection, recovery,re-marketing and legal on commercial loans and leases. Expertise with distressed portfolios, Six Sigma trained. Willing to relocate.

Email: RichardB12364@aol.com

Controller

Seattle, WA

CPA w/ Sarbanes Oxley/ 15 years management exp. as CFO/ Controller/5 yrs w/ PWC Extensive exp providing accounting/ tax guidance for the equipment lease industry. Willing to relocate.

Email: bltushin@hotmail.com

Southeastern, MI.

Controller & Management experience w/ equip lessors &broker. MBA, CPA w/ extensive accounting, management, securitization experience with public and private companies. Willing to relocate.

Email: Leasebusiness@aol.com

Contract Administrator

New York, NY.

10+ years in equipment leasing/secured lending. Skilled in management & training, documentation, policy and procedure development & implementation, portfolio reporting. Strong work ethic.

Email: dln1031@nyc.rr.com

Portland, OR.

6+ years small ticket leasing/financing. Documentation/funding Policy development &implementation, management &training, process mapping, customer service, broker, vendor, portfolio experience.

Email: susanc777@hotmail.com

Full listing of all ads at:

http://216.66.242.252/AL/LeasingNews/JobPostings.htm

----------------------------------------------------------------

|

CIT to cut 200 jobs in North America

CIT Group Inc. said on Wednesday that it will cut its work force by about 200 employees in North America in the second and third quarters of 2005 as it consolidates some of its units and technology systems. Rumors have been circulating that many will be let go from the Tempe, Arizona operation. Several insiders say they will close the division, but those in the know say they would love to move back to Atlanta, Georgia, but they don't think they will be so lucky.

CIT expects a second-quarter charge of about $25 million for expenses related to the job cuts.

----------------------------------------------------------------

Last Call---Story Credit Lessors' List

Companies are listed for free on our new list, and this will be our last call to readers who believe their company qualifies to be on the list. If you think a company should be listed, please contact them and let them know we have 25,000 readers and it may be of benefit to be on the list. As important, these companies are truly lessors with good Better Business Bureau and no complaints at Leasing News, and have been verified that they are true lessors, not super brokers or brokers.

We will continue to up-date or add to the list, but are not planning to run again in our newsletter. This is the “last call.” It will be posted on line, and stay in the “top stories” section, especially if new companies are added.

Contact: kitmenkin@leasingnews.org if you think your company qualifies to be our the Story Credit Lessors' List.

Story Credit Lessors

These companies specialize in "C" and "D" credits, often news businesses, or businesses where the principal(s) have Beacon score around 600 or previous difficulties; meaning to become comfortable with the credit and financial situation you need to learn the "story" to make a positive decision, often requiring further security, shorter term, or additional guarantors. Many of these companies may also be a "B," but appear otherwise without the "story" to understand the full financial picture.

(To qualify for this list, the company must be a lessor and not a broker or superbroker, along with an acceptable Better Business Bureau Rating and no history of complaints at Leasing News. We reserve the right to not list a company who does not meet these qualifications.)

Rank |

Name In Business Since Contact Website Leasing Association |

Employees |

Geo Area |

Dollar Amount |

Broker Qualify |

1 |

Pawnee Leasing Corporation 1982 Scott Woodring, Vice President/Sales & Marketing scott@pawneeleasing.com www.pawneeleasing.com EAEL, NAELB & UAEL (A) |

45 |

Nationwide |

$1,000 - $30,000 |

One year time in business |

2 |

Pentech Financial Services, Inc. 1983 Peter C. Eaton Vice President-Intermediary Markets Group Phone - 608.661.9536 Fax - 608.661.9533 peter@pentechfinancial.com www.pentechfinancial.com ELA, NAELB, UAEL (H) |

32 |

Nationwide |

$250,000 - $3,000,000 |

Contact Peter Eaton |

3 |

Sunrise International Leasing Corporation 1975 Carrie Halvorson or Jim Teal, 800-950-3211 www.sunriseleasing.com ELA (I) |

20 |

U.S., Canada, Latin America |

$1,000 minimum no hard cap in place for maximums |

One year time in business |

4 |

Boston Financial & Equity Corporation 1968 Debbie Monosson debbie@bfec.com www.bfec.com EAEL, UAEL (J) |

12 |

National |

$100,000 to $1,500,00 |

A deal in hand and a full package |

5 |

Allegiant Partners Incorporated 1998 415.257.4200 Doug Houlahan ext. 205 Paul Foster ext. 206 www.allegiant-partners.com ELA, NAELB & UAEL (B) |

9 |

Nationwide, including Alaska & Hawaii |

$70,000 to $250,000 |

For Broker qualification please click here |

6 |

Black Rock Capital 1994 George Booth gkbooth@blackrockcapital.com 203.336-9200 www.blackrockcapital.com EAEL, ELA (E) |

7 |

US Canada (F) |

$50,000 to $3MM $250,000 average transaction |

Please Call |

8 |

6 |

Nationwide |

$50,000 to $1MM $250,000 average transaction |

Please call |

|

9 |

ABCO Leasing, Inc. 1974 Don Shipley VP and General Manager dons@abcoleasing.net Phone: 800.995.1897 www.abcoleasing.net ELA, NAELB, and UAEL (D) |

5 |

Western U.S. |

$25,000 - $350,000 |

Broker Qualification, contact: Rowan Clark, Credit Manager rowanc@abcoleasing.net Phone: 800.995.1897 |

10 |

Barrett Capital Corporation |

4 |

United States |

Vehicles Only $10,000 minimum |

Please Call |

(A) Pawnee Leasing Corporation; Some times we go higher than $30,000, but our marketplace is from $1,000 to $30,000.

(B) Allegiant.pdf

(D) ABCO Leasing, Inc. in Seattle area has been operating since 1974 serving the broker community. We required full financial disclosure on every transaction. We do story transaction, but do not like to refer to them as "C" of "D" credits. We think of therm as "A" type credits that have not been discovered yet. In actuallity, we do not really like to look at what most describes as "D" credits.

(E) Black Rock Capital comment: We book anywhere between $15 to 20 million per year. We do no "app only" business and require a full financial package for each transaction. Our average size transaction is approximately $250k and, although, we concentrate in printing, packaging (steel rule die industry) and road construction equipment we do not rule out anything that makes sense. More information can be found at www.blackrockcapital.com.

(F) Black Rock Capital (Ireland) Limited and Black Rock Capital (UK) Limited provide the same services for small to middle market corporations in the European Economic Community and the United Kingdom.

(G) Cobra Capital, LLC. Comments: Our registered trademark "Making impossible possible" is our central marketing tagline for both strong and weak credits. I have developed a 10 year history, (from Cobra and my prior company GALCO), with specialty, non-conforming transactions (story credits) and have a solid reputation for candidly responding to our originators and lessees and working diligently to mitigate deal risk rather than making excuses to turn deals down. Our originators prefer our underwriting approach to non-conforming transactions since unlike most non-conforming funders, we prefer to mitigate risk versus jacking our return. Both Originators and Lessee's prefer our candid approach as we are also frequently asked to advise lessee's and lessors on the best way to structure their bank loans and raise capital due to our 25+ year banking and accounting backgrounds as my partner and I are both former bankers and CPA's.

| Partners Bio | LaSalle Bank Reference | Cole Taylor Bank Reference |

(H) Pentech is the lessor partner with Manifest Funding Services for their Navigator, Navigator Plus & Navigator Direct. This is through our sister company Pentech Funding Services, located in San Diego and headed up by Ron Wagner.

(I) Sunrise International Leasing Corporation Comment: The broker program is "...an informal program as our primary business is still vendor leasing."

(J) Boston Financial & Equity Corporation, most of our leases are venture capital backed startups and turnarounds. We require full financial disclosures, CPA and internal statements, no tax returns. We do not required additional collateral, no PG's or RE needed. Do not send deals with large tax liens, especially if they are payroll taxes.

-----------------------------------------------------------------

|

|

What Lessors Are Saying About…Building Customer Loyalty

ELTnews

Customer relationships are key in business, and building customer loyalty is more important than ever in the competitive leasing industry. Whether delivering customer loyalty initiatives on a case-by-case basis or through a systematic approach, lessors realize their importance and are implementing programs to build their customer relationships.

Steve Grosso, President and COO, Partners Equity Capital Company, said that customer relationships are the foundation of his firm, and building them is a core focus. “Customer relationships create the real value in our business and a sustainable revenue stream,” he said. “Partners Equity strategically focuses on building long-term relationships and it's ingrained in our mission, our values and our vision.”

For Grosso, building a customer relationship is about more than doing deals. The key, he observed, is determining whether there is an alignment of objectives that creates value for both parties. He underscored the significance of this criteria when he noted, “Not everybody is for us.”

In addition to the alignment of objectives, Grosso identified Partners Equity's dedication to quality operations that build customer loyalty. Expertise in their customers' verticals enables a deep understanding of their overall business as well as leasing objectives.

Operational excellence, is critical. Grosso said, “The idea of creating and implementing high value programs means that you deliver on what you have promised for your partners.”

Patrick Byrne, President and CEO, Balboa Capital Corporation said that customer retention continues to be a bright spot at Balboa Capital and one of the measures they use to gauge success. Byrne said, “Based on our achievements in 2004, we raised our goal again for 2005.”

Balboa Capital takes a multi-faceted approach to enhancing customer loyalty through relationship management, technology and data mining. For the firm's relationship management program, its sales, service, and support departments are all held accountable for building customer loyalty. Byrne said, “We have processes in place for both recovery of dissatisfied customers and appreciation of satisfied customers.”

Leveraging technology, Balboa Capital released Compass last year, an online processing system for users to submit applications, check status, download documents, and facilitate electronic communication. Byrne said they will be making more enhancements to Compass in 2005. In addition, Balboa Capital utilizes a system of tracking, reporting, surveying and profiling customer information in order to enhance the user experience and meet new demands.

Janet Horton, Vice President of Client Services and Support, International Decision Systems (IDS), said her firm takes a highly refined approach to building, implementing and evaluating their customer loyalty initiatives, and observed, “Our investment in our customers is good for our business.” This is not the case for many companies with which she comes in contact. She said, “Most businesses are painfully aware that it is much more expensive to gain new customers than it is to retain existing ones. However, I consistently hear from companies that they struggle with the right process for implementing customer-centric strategies.”

Horton explained the most important success factors identified by IDS for building customer loyalty:

• The presence of "the voice of the customer" in every strategic decision to ensure that it is considered in our choices.

• A program to facilitate employee education and enthusiasm to create momentum and a culture of change.

• An accurate data base of customers and the attributes you wish to measure against to help you make decisions.

• Expertise in surveying techniques and statistical analysis to ensure that the data you are collecting is usable and actionable.

• Persistence that pushes for continuous improvement. Don't start until you know you can dedicate energy to it.

• Patience - acceptance that it is a multi-year strategy.

Horton said that at IDS they have identified their value-creating hand-off points and focused on the improvements that would have the biggest impact. She concluded, “Since initiating our own value strategies, we can measurably see that satisfied customers do more business with us and are more consistent in their buying behaviors.”

Serving the micro to middle ticket markets, Steve Trollope, CEO, Arrow Capital Corporation, said they consider loyalty incentive programs at the outset of customer relationships. Understanding a potential partner's needs for incentives, beyond rates and customer service, is a critical factor in deciding how to engage with that partner.

Arrow Capital serves as a financial arm for its small to medium-sized vendor partners, and they distinguish themselves through their flexibility and thinking “outside-the-“box to service their partner's unique needs. Trollope said, “We deploy these programs to be more competitive and to distinctly set ourselves apart in the marketplace.”

Arrow's customer loyalty initiatives are designed to strengthen its vendor relationships, so Arrow Capital continues to provide its partners with added value through the continued introduction of new tactical programs. Among them are referral programs in which customers get a credit toward a lease payment when they refer a new customer, short-term equipment rental programs, credit line programs wherein customers can finance a broader range of equipment outside of Arrow's vendor partner's equipment, and commission/cash rewards to channel partners.

Trollope said that the most successful customer service programs he sees are those that are strongly supported by top management. Those that don't receive buy-in at the very top management levels, he said, tend to flounder.

Citing an example of the need for personal attention in building customer loyalty, Allen Rice, President, C And J Leasing Corp., said that at his firm anyone calling in gets a live person on the telephone. C And J tries to structure everything so it's customer friendly and not over-automated, and enables the personal contact that is key to growing and maintaining the relationship. Rice said, “Each time we have contact with a customer is an opportunity to build our business.”

----------------------------------------------------------------

|

Leasing business rises from dark past

By ANDREW SCOTT

Fairfield County Business Journal

www.fairfieldcountbusinessjournal.com

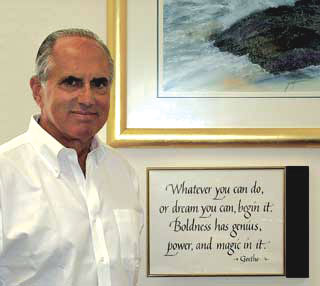

Pedro Wasmer uses the words of Johann Wolfgang Von Goethe as inspiration to push his Bridgeport-based equipment leasing business to new heights.

Checks and balances aren't only for the branches of government, as Pedro Wasmer found out. Customers were flocking to his equipment leasing company in the 1990s. But for some strange reason the business was not making any money.

Wasmer, convinced the company's coffers should have been growing, hired an outside accountant to figure why they were not. The accountant found nothing. Then Wasmer hired a manager and pleaded: "You've got to help me find out what the heck is wrong with the company."

Sure enough, the manager did

The chief financial officer had defrauded the business and clients of more than $2 million. Wasmer's jaws dropped when the individual, a partner in the business, admitted the fraud to him before the manager had a chance to reveal what was draining the business financially.

The partner's actions cost the business $5 million and the partner seven months in jail.

Wasmer said those days were hard ones but it was the best thing that could have happened to the business.

"It's like having a cancer and not knowing it. When we learned what was going on, we had to go through our own form of chemo," Wasmer said.

That included meeting with clients, vendors, banks and insurance companies who were victims of the company's false transactions.

Wasmer sold off his assets, including property, and slashed his salary to help pay back what was owed to companies. The business relocated from Westport to less expensive office space in Bridgeport to cut back on operating costs.

Within two years the company paid back all it owed to the affected businesses.

In the process, Wasmer hired a new chief financial officer and implemented checks and balances to help ensure that the business would not repeat what it had gone through.

Today, Wasmer mentions the ordeal when dealing with financial institutions.

"I make it a point to talk about it so that people don't find out later," Wasmer said.

Being honest about what happened and not being flustered about it has proven to be a key part of the company's recovery from its dark days. Investors and financial companies that saw the stance it took in correcting the wrong continued to do business with the company.

When the veil lifted, Wasmer, as chief executive officer, realized that the business, Somerset Capital Group Ltd., was truly experiencing formidable growth.

This year the nonprofit organization, Initiative for a Competitive Inner City, which promotes inner-city revitalization, ranked Somerset Capital 50th on its list of the top 100 fastest-growing businesses in the country.

The company also ranked No. 40 in Hispanic Business magazine's listing of the 500 largest Hispanic-owned companies. Wasmer was born in Cuba.

Somerset Capital has garnered such recognition because it currently manages a half billion dollars in assets. Last year alone, the company leased equipment worth $150 million.

It leases office machinery, computers, telephone systems, forklifts, factory equipment and satellite networks among an array of other items. The company has remained in the forefront by continually diversifying the portfolio of items it leases.

A typical lease consists of $250,000 to $500,000 worth of equipment but the company can accommodate clients with $10,000 to $35,000 leases.

One area the business has failed to get involved in is leasing airplanes, freight cars, or trucks.

"I prefer to lease assets that have a shorter defined life span because we are investing in what the value of the equipment will be after the lease has expired," Wasmer explained. Also, it's more costly.

Competitive and capital intensive

"The business is very capital intensive," said Evan Bokor, chief financial officer. A good relationship with banks and investors is key so that the company can have enough money when needed to buy more equipment to lease, Bokor explained.

The industry is also fiercely competitive "because there isn't as much good volume (of customers) as their used to be," Bokor said.

Potential customers are choosing to purchase their own equipment rather than lease, or are saving their money instead of investing in facilities or growing their business. "In the past, we were comparing and competing with other leasing companies, now we're competing with clients and their check books, "Bokor said.

But according to the Equipment Leasing Association, Arlington, Va., the value of equipment which will be leased this year is expected to grow to $248 billion, a 13 percent increase over last year.

Ralph Petta, vice president of industry services at the association, said that apart from competitiveness, "looming on the horizon are changes in the accounting framework for leasing. It will have an impact, but it's hard to tell." He said the legislative changes could result in more leasing options resulting in savings for clients, but affecting the pockets of leasing companies in the end.

Despite these variables, Somerset Capital continues to rake up growth. With 58 employees, the company's revenues last year jumped to $160.4 million, a 56 percent increase over the previous year.

Its client roster includes the Kellogg Co., Battle Creek, Mich., and Greenfield Online, Wilton.

Two sales offices, one in Las Vegas and the other in Greeley, Colo., help the business to expand its reach across the country; while a warehouse in Scottsdale, Ariz., stocks the items it leases. In the last two years, a computer program was developed internally to keep track of the various pieces of equipment.

With the challenge the business faced behind him, Wasmer continues to stick to one guiding principle to help the business succeed: "What you can do, or dream you can do, begin it. Boldness has genius, power and magic in it." The words from Johann Wolfgang Von Goethe hang on the wall of Wasmer's office and serves as a reminder for him to continue to pursue newer heights for the company.

Keeping in line with the credo, Wasmer said: "We plan to continue to grow the business at 10 to 15 percent per year in volume which will affect our bottom line in three to four years."

----------------------------------------------------------------

Leasing Association Meetings Open to Non-Members

![]()

July 14, 2005

----------------------------------------------------------

July 14th, NAELB, Scottsdale, Arizona

The Gainey Ranch Golf Club in sunny Scottsdale, AZ on July 14 from 11:30 a.m.- 2 p.m. PDT for the Integrity Selling Seminar and Luncheon featuring Debbie Irving.

Click here for more information about Debbie Irving

$35 for Registration, click here for form

-----------------------------------------------------------------------------------

![]()

July 15 Chicago, Illinois

Hey, batter, batter, batter.........Swing

Batter!!!

Spring is here and that means

BASEBALL!!!

UAEL Midwest Chapter presents

A day with the Chicago Cubs at the beautiful and

Scenic Wrigley Rooftop!!

July 15, 2005

1:20PM

Chicago vs Pittsburg

Wrigley Rooftop

3639 North Sheffield Ave

Chicago, IL 60613

Tickets are limited so make your reservation today!!

Seats are not guaranteed until payment is received.

Price per Person $118.00

Food & Beverages are included in your ticket price.

Payment will ONLY be accepted by check. Please make all checks payable to UAEL and Remit to Bill Griffith.

For more information please contact

Padco Lease Corp.

Bill Griffith

800-347-5884

100 West Monroe Street

Ste 706 5 th Annual Midwest

Chicago, IL 60603 Regional Cubs Outing

------------------------------------------------------------

![]()

July 28, 29 & 30, 2005

For more info click here.

-------------------------------------------------------------

Tuesday August 2 nd , Phoenix Arizona

Arizona Equipment Leasing Association

Meeting and Networking:

Pizzeria Uno 4:30 P.M.

· Arizona Center

· 455 N 3 rd St .

· Phoenix AZ 85004

Followed by:

Arizona Diamondbacks vs. the Houston Astros

BOB 6:40 P.M.

for more information and registration, click here:

-------------------------------------------------------------

![]()

August 3rd, 7:05pm, UAEL So. Calif.

United Association of Equipment Leasing Southern California Region

Presents

Our 4th Annual Angel Game Night

Take me out to the Ball Game!

Date: Wednesday August 3rd, 2005

Time: 7:05 PM (Anaheim Angels vs. Baltimore Orioles)

Place: Angel Stadium, Anaheim, California

Ticket Includes: Field Box Seating

$15.00 per / Ticket

Company Employees are invited to attend. Family and Friends are welcome!

Non-members welcome, too.

Reserve your tickets today by emailing Kim at the UAEL Office: kim@uael.org. Or please contact Kim at 760-564-2227. Please RSVP by July 23rd, 2005.

-------------------------------------------------------------

(August 3rd, Costa Mesa, Ca. Broker Workshop)

-this is an association of companies who have

gotten together to not only present their programs

but to provide a forum to instruct and education

those who submit leases to funding sources---

"It's being held the same day as the 4th Annual Angel Game Night - Take me out to the Ball Game! Brokers can attend the workshop during the day, attend the ball game at night. Initial response has been excellent. In the past we have had anywhere from 15 to 35 brokers attend our "free lunch" but we're expecting over 100 brokers to attend this workshop. Space is limited and that's why we're encouraging reservations."

Norm Malkowiski

Structured Leasing - That’s Where The Money Is!

An Equipment Leasing Broker Workshop - August 3, 2005

Location: Experian Building, Costa Mesa, California

Mesa Leasing has been sponsoring lunch meeting for all equipment leasing brokers in southern California for over 2 years. The meetings have helped to educate each of us about what is going on in our industry locally. It has also opened eyes to new opportunities through the sharing of knowledge. This workshop continues that effort to educate and offer new opportunities to brokers within the industry.

The enclosed flyer provides a brief overview of the “workshop” Mesa Leasing is producing. The workshop is designed to offer brokers insight into a market niche we and other Funding sources target – C & D Credits. Several funding Sources have committed to attend the workshop and share with the brokers what is necessary to put more money in their pocket.

The workshop consists of 2 specific areas of interest. First, each Funding Source is helping to sponsor this workshop. They will have a designated area where several brokers can meet and discuss the niche served by a specific lender. Brokers will learn what special areas of interest each source might have. Brokers will share in the knowledge gained by the questions asked by other brokers at the table. Brokers will come prepared with questions and a willingness to share.

The second part of the workshop involves a 20 to 30 minute presentation by each funding source to those of interest. In a classroom environment, each Funding Source will present their program and educate the Brokers as to how to generate more business with them.

Brokers are encouraged to come prepared to discuss specific applications they may have had turned down by other funding sources. Perhaps they may walk out with an approval turning that “turn-down” into income.

This workshop will be of special interest to brokers “on the street”. They will learn what questions to ask – the first time you meet with the customer!

Space is limited! Brokers are encouraged to reserve their spot- NOW! There is a small cost of $10 to the Broker. But when one considers the information obtained, and that lunch is included, this is an excellent workshop. Brokers don’t want to miss an opportunity never before available in southern California.

http://leasingnews.org/PDF/CCreditFlyer1.pdf

For information or reservations contact: Lauren@mesaleasing.com or 858-541-1002

Norm Malkowski

Mesa Leasing, Inc.

"Funding Sub-Prime Credits in California"

4180 Ruffin Road, #205

San Diego, CA 92123

858-541-1002 Phone

858-541-1006 Fax

619-743-7111 Mobil

------------------------------------------------------------

August 10, 2005

UAEL PRESENTS AN EVENING OUT WITH:

Colorado Rockies

VS.

Pittsburgh Pirates

IN THE OWNER'S BOX!

WHEN: Wednesday August 10, 2005 at 7:05 PM|

WHERE: Coors Field at the Owner's Box

HOW MUCH: $35.00 Per person

Please remit payments to Kim at UAEL

78120 Calle Estado, Ste 201

La Quinta, CA 92253

760-564-2227

INCLUDES: Ticket to owners box, food and beverages.

For more information please contact:

Scott Woodring at Pawnee Leasing # 970-482-2556 ext 255

or

Skep Wehner at BSB Leasing # 800-945-3372 ext 334

COMPANY EMPLOYEES ARE INVITED AS WELL AS FAMILY AND FRIENDS!!

AVAILABILITY IS LIMITED – GET YOUR TICKETS NOW!!

----------------------------------------------------------------

----------------------------------------------------------------

Home equity sub spreads finally show signs of widening

ABSnet

Of the homes purchased in 2004, 23% were purchased for investment purposes; 14% were second homes; 42% first-time purchases and 25% of all homebuyers made no down-payment on their home purchases in 2004; more than 60% of new mortgage loans in California are either IO loans or include negative amortization features; and adjustable-rate mortgages account for 50% of new-loan production in the states with the highest level of home price appreciation.

Subordinate home equity spreads widened this week, as some speculated that investors began to grow nervous of risk involved in the deals, and a number of analysts released sour outlooks on residential mortgage performance, particularly in the subprime market. Some deals in secondary trading are trading south of where they've been in recent months, on the anticipation that the price buyers are willing to pay is headed further in the same direction, according to industry sources.

The widening did not come as a surprise to distressed debt buyers that have been waiting for such an opportunity, such as United Capital Markets, whose traders pointed to wider spreads on home equities in secondary trading last month. The question is if the spreads will continue to widen. And if so, by how much?

Subordinate home equity spreads widened from five to 25 basis points last week, from double-A down to double-B plus, according to JPMorgan Securities. Analysts at the bank anticipate what could be a slow widening in spreads as a compliment to continual Federal Reserve tightening wringing some of the excess liquidity from the market. On Thursday, the Fed raised the federal funds target rate another quarter point, to 3.25%, bringing it to the highest level since August 2001. “While spread widening may well prove to be relatively contained over the near term, a result of the ever-present CDO bid, we think the event highlights the fundamental overvaluation of the sector and the risks for which investors remain largely uncompensated,” JPMorgan analysts stated.

JPMorgan analysts did warn of widening home equity ABS spreads highlighting the risk of the structured finance CDOs they back. “Ultimately, that interconnectedness could cause spreads in both the ABS and CDO sectors to move potentially sharply wider, most likely when there is a clear and present danger from the housing market, but for now it simply represents a risk to be aware of.” JPMorgan downgraded the sector to underweight on double As through triple Bs for CDOs and structured finance CDOs, citing that its immediate CDO concern lies with cash CDOs of mezzanine ABS because of the abundance of home equity ABS in the deals.

Echoing much of the sentiment in the industry, Mark Adelson, head of structured finance research at Nomura, said he has more of a pessimistic outlook on collateral quality in the next 12 to 24 months, but not as much so over the next six months. For the second half of the year, Nomura is predicting spreads on triple-A rated home-equity ABS to continue to widen, but they will not reach the widest levels of 2004.

Lehman Brothers reported similar findings, and in addition to that, in recent originations, close to 30% of loan-to-value ratios are north of 80%. According to the investment bank, around 15% of recent loans are made to borrowers who would not have qualified if it weren't for “affordable” products offered by lenders. “Layer in the potential payment shocks down the road, and the picture for consumer balance sheets and mortgage credit looks quite bleak

-----------------------------------------------------------------

Classified—Help Wanted

Account Executives

|

|

Account Executives to work from our corp. office Aliso Viejo, CA. Exper. only, aggressive, 4 yr college degree required. Lucrative uncapped commission plan/environment conductive to success. To learn more, click here. |

|

Account Executives, Four year degree plus lease sales experience required. Learn more www.providentleasing.com |

Account Representatives & Sales Coaches

|

About the Company: At Dell Financial Services, we aspire to fuel your potential with the kind of challenging opportunities and hands-on support you need to grow. We're the exclusive provider of leasing and finance services for Dell technology systems worldwide. |

Lease Administrator

|

|

|

San Francisco, CA. College Degree plus contract/ lease administration experience required. For a full description, click here. Email resume to |

Lease pricing division economic analysis / analytical support

| San Francisco Office

Two openings lease pricing division |

|

SFBI Recruiters |

|

Contact: Fred St Laurent, SFBI Professional Recruiting. Email: Fred@sfbirecruiter.com |

|

|

|

In business since 1958, DLC is an independent funding source servicing the $10K-250K market in 11 western states. |

Tax Manager

|

|

Seeking Tax Manager for Marshall, MN Headquarters. Responsible for management of USBancorp small ticket leasing division for a multi - billion dollar portfolio including oversight of compliance with all sales, use, rental, property, excise and miscellaneous taxes pertaining to the business of leasing. Four-year college/ university degree; or 2-4 years related work exp. and/or training; or equivalent combination of education and experience. For complete description and application, click here. |

-----------------------------------------------------------------

### Press Release ######################

GE Commercial Finance Acquires $1 Billion Corporate Aircraft Portfolio from CIT; GE Further Strengthens Corporate Aircraft Portfolio and Creates Additional Opportunities for Growth

STAMFORD, Conn.--(----GE Commercial Finance, the business-to-business financial services unit of General Electric (NYSE:GE), announced it has agreed to acquire approximately $1 billion in aircraft assets from CIT Group Inc. (NYSE:CIT), a leading commercial and consumer finance company. The acquisition expands GE's corporate aircraft market reach, diversifies its customer base and creates additional cross-selling opportunities.

The sale of a majority of the assets closed on June 30, 2005. The balance of the sold assets will be transferred during the third quarter of 2005. Terms of the deal were not disclosed.

The acquisition by GE Commercial Finance includes the leases and loans on approximately 380 aircraft from CIT's corporate aircraft portfolio. The acquired assets will be integrated into Commercial Finance's existing Corporate Aircraft business, an industry leader in the leasing and loan financing of corporate aircraft and helicopters worldwide.

"We're confident we have the necessary scale, resources and commitment to ensure the highest quality of service to these new customers," said Paul Bossidy, Senior Vice President, GE Commercial Finance. "In addition, we will provide them with an entry into the entire GE company, delivering an extensive range of both financial and non-financial products and services in an effort to address whatever specific business needs they might have."

"GE is a business steeped in a rich tradition of service in the aviation industry. This acquisition allows us to build upon this core competency, while adding substantial new customer relationships in this sector," said Dave Labrozzi, Senior Vice President, GE Commercial Finance, Corporate Aircraft.

About CIT

CIT Group Inc. (NYSE:CIT), a leading commercial and consumer finance company, provides clients with financing and leasing products and advisory services. Founded in 1908, CIT has nearly $60 billion in assets under management and possesses the financial resources, industry expertise and product knowledge to serve the needs of clients across approximately 30 industries. CIT, a Fortune 500 company and a component of the S&P 500 Index, holds leading positions in vendor financing, factoring, equipment and transportation financing, Small Business Administration loans, and asset-based lending. With its Global Headquarters in New York City and Corporate Offices in Livingston, New Jersey, CIT has approximately 6,000 employees in locations throughout North America, Europe, Latin and South America, and the Pacific Rim. For more information, visit http://www.cit.com.

About GE Commercial Finance, Corporate Aircraft

With more than $24 billion of corporate aviation underwriting experience worldwide, GE Commercial Finance, Corporate Aircraft is an industry leader in the leasing and loan financing of corporate aircraft and helicopters. For more information, visit the business Web site at www.gecorporateaircraft.com. (Please note that the business is a separate unit from GE Commercial Aviation Services (GECAS) and GE Transportation, Aircraft Engines.)

About GE Commercial Finance

GE Commercial Finance, which offers businesses around the globe an array of financial products and services, has assets of over $230 billion and is headquartered in Stamford, Connecticut. GE (NYSE:GE) is Imagination at Work - a diversified technology, media and financial services company focused on solving some of the world's toughest problems. With products and services ranging from aircraft engines, power generation, water processing and security technology to medical imaging, business and consumer financing, media content and advanced materials, GE serves customers in more than 100 countries and employs more than 300,000 people worldwide. For more information, visit the company's Web site at www.ge.com.

Caution Concerning Forward Looking Statements: This document includes certain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on management's current expectations and are subject to uncertainty and changes in circumstances. Actual results may differ materially from these expectations due to changes in global political, economic, business, competitive, market and regulatory factors. More information about those factors is contained in GE's filings with the Securities and Exchange Commission.

GE Commercial Finance Mike Sergott,

203-796-5678

michael.sergott@ge.com

### Press Release ######################

CIT Announces Sale of Corporate Aircraft Portfolio

NEW YORK, -- CIT Group Inc. (NYSE: CIT), a leading provider of commercial and consumer finance solutions, announced the sale of the majority of its corporate aircraft portfolio to GE Commercial Finance. The sale is a result of CIT's risk-adjusted capital discipline and will allow for the redeployment of capital into higher-returning businesses.

The transaction includes approximately $700 million in loans and $200 million in leases on 380 aircraft including business jets, turbo props and helicopters. The sale of a majority of the assets closed on June 30, 2005. The balance of the sold assets will be transferred during the third quarter of 2005. Terms of the deal were not disclosed.

"This is a thoughtful, strategic move for CIT. We will reinvest the capital from the sale of this portfolio into other Commercial Finance businesses which have stronger growth opportunities and better returns for our investors," said Rick Wolfert, Vice Chairman, Commercial Finance.

The balance of the company's corporate aircraft portfolio, approximately $500 million in assets including fractional aircraft shares and aircraft leased to select client relationships, will be transferred to CIT Aerospace, which currently manages more than $5 billion in assets, from the Equipment Finance unit. The company will continue to finance fractional aircraft shares and select corporate aircraft utilizing its aircraft manufacturer relationships, tax structuring and capital markets expertise.

About CIT:

CIT Group Inc. (NYSE: CIT), a leading commercial and consumer finance company, provides clients with financing and leasing products and advisory services. Founded in 1908, CIT has nearly $60 billion in assets under management and possesses the financial resources, industry expertise and product knowledge to serve the needs of clients across approximately 30 industries. CIT, a Fortune 500 company and a component of the S&P 500 Index, holds leading positions in vendor financing, factoring, equipment and transportation financing, Small Business Administration loans, and asset-based lending. With its Global Headquarters in New York City and Corporate Offices

in Livingston, New Jersey, CIT has approximately 6,000 employees in locations throughout North America, Europe, Latin and South America, and the Pacific Rim. For more information, visit http://www.cit.com.

SOURCE CIT Group Inc.

### Press Release ######################

### Press Release ######################

Butler Capital ranked No. 90 in 2005 Monitor 100

Hunt Valley firm is sole independent lender

headquartered in Maryland to qualify

Hunt Valley, MD-based Butler Capital Corporation has been ranked 90th in the 2005 Monitor 100 listing of the nation's largest equipment leasing firms and 80th in overall new business volume among the Monitor 100 companies.

Butler is one of four Maryland firms included on the list and the only independent financial services company of those four. Nationally, only 19 independent firms qualified.

The Monitor, the leasing industry's leading independent trade publication, published this year's Monitor 100 survey in its June issue. The annual ranking is based on a compilation of information on the top 100 leasing companies in the U.S. Ranked by asset size, the Monitor 100 leasing companies are generally regarded as the “who's who” in the equipment leasing industry. The Monitor 100 report also includes a separate ranking based on new business volume, and Butler Capital placed 80th in this category. The Monitor 100 appearances represent Butler Capital's first-ever inclusion in the survey.

Established in 1977, Butler Capital is an independent, national funder that provides general business loans and leases plus financing in the fast-casual franchise restaurant, car wash, convenience store, drycleaning, and office furnishings/equipment markets. In addition, Butler maintains an active lessor/broker unit to purchase individual transactions and portfolios from brokers, lessors, and financial institutions nationwide.

Adam Minakowski

Butler Capital Corporation

10944-A Beaver Dam Road

P.O. Box 677

Hunt Valley, MD 21030-0677

443-589-1509 (Voice) / 410-771-9614 (Fax)

aminakowski@butlercapital.com

The New 2005 Monitor 100 Report is Now Available!

Includes Top 50 U.S. Bank Report

$20 to subscribers $60 to non-subscribers

https://www.monitordaily.com/md_pdf/step1.aspx

### Press Release ######################

To order call +44 (0) 20 7779 8999 or toll free in the US +1 800 437 9997 to receive your 10% discount. You can also order on line at |

Report Reveals Latin America's Top 100 Leasing Companies

The Alta Group Ranks Brazil's Itauleasing No. 1, Chile's Santander No. 2, Surprises include Size of Industry in Chile, Mexico and Colombia

FORT LAUDERDALE, FL, – A ranking of the 100 leading equipment leasing companies in Latin America was released today by The Alta Group in a report believed to be the first to identify major players throughout the region.

The AltaLAR100 report breaks ground by naming and ranking the most prominent equipment leasing companies in Latin America based on their reported portfolio of leased assets in 2004, said Rafael Castillo-Triana, a principal for The Alta Group Latin American Region (Alta LAR). Alta LAR provides consulting, legal and research services to equipment leasing and finance interests in Mexico, Central America, South America and most of the Caribbean.

The 10 leading companies in the AltaLAR100 are, in order:

Cia Itauleasing de Arrendamento Mercantil (Brazil)

Banco Santander-Santiago-Leasing portfolio (Chile)

Safra Leasing (Brazil)

POPULAR AUTO (Puerto Rico)

Banco de Chile-Leasing portfolio (Chile)

Bradesco (Brazil)

SULEASING (Colombia)

IBM Brasil Leasing (Brazil)

BCI- Banco de Crédito e Inversiones –Leasing Portfolio (Chile)

CorpBanca –Leasing Portfolio (Chile)

“Nine of the 10 largest leasing companies in Latin America are bank affiliated, and the tenth, IBM Brasil Leasing, is a manufacturer's captive,” Castillo-Triana said.

“The AltaLAR100 also revealed some surprises,” he added. “We had not anticipated that Chile's leasing industry was so large. Chile tied with Brazil for the most leasing companies in the Top 10 and contributed a total of 12 in the AltaLAR100. We also were surprised by the similar size of the leasing industries in Mexico and Colombia, since the Mexican economy is more than five times the size of the Colombian economy.”

Alta LAR developed the rankings based on data published by the corresponding country leasing associations, Central Banks of regulatory entities and in some cases from data provided by individual companies. The group plans to update its report regularly to reflect new data.

Castillo-Triana said there is no charge for the AltaLAR100 list. For a copy, please visit www.thealtagroup.com. Alta LAR also offers paid services for additional research on companies listed in the report and/or Latin American leasing markets.

Other Recent Projects

Alta LAR provides consulting, legal and research services to manufacturers, banks and leasing companies working in Latin America. It also develops studies for organizations. Recent projects include reports on the emerging leasing industries in Nicaragua and Honduras, which were sponsored by the International Finance Corporation (IFC), an affiliate of the World Bank Group. In 2003, a study by Alta LAR that was sponsored by Colombia's leasing association, FEDELEASING, led to passage of an equipment investment tax incentive in that country.

About The Alta Group

The Alta Group, established in 1992, provides a broad array of strategic consulting and advisory services, education and training programs, merger and acquisition and dispute resolution services for companies in the global equipment leasing and asset finance industries. Its clients include manufacturers, banks, independent lessors of various sizes and others in the industry. The Alta team is made up of more than 25 international professionals committed to the asset finance business, including former CEOs, company founders and industry thought leaders who are active in their areas of expertise. They collaborate and share their in-depth knowledge and insights with today's business leaders who face a range of challenges, both old and new. The firm has built a reputation on creative thinking, trust and professionalism. The Alta Group supports clients in North America, Latin America, Europe and the Middle East, as well as Greater China and Asia Pacific. For more information, visit www.thealtagroup.com.

Media Contacts:

Rafael Castillo-Triana, The Alta Group LAR

Phone: (954) 389-7943; Email: rafael.castillo@thealtagrouplar.com

Ricardo Muñoz-Medina, The Alta Group LAR

Phone: (305) 931-2748; Email: ricardo.munoz@thealtagrouplar.com

### Press Release ######################

Edmunds.com Reports True Cost of Incentives: General Motors' Incentives Expense Relatively Low Despite Success of

Employee Discount Program

SANTA MONICA, Calif., -- Edmunds.com, the premier online resource for automotive information, reported that the average manufacturer automotive incentive in the United States was $2,736 per vehicle sold in June 2005, down $11, or 0.4%, from June 2004, and up $170, or 6.6%, from May 2005.

Edmunds.com's monthly True Cost of Incentives(SM) (TCI(SM)) report takes into account all of the manufacturers' various United States incentives programs, including subvented interest rates and lease programs as well as cash rebates to consumers and dealers. To ensure the greatest possible accuracy, Edmunds.com bases its calculations on sales volume, including the mix of vehicle makes and models for each month, as well as on the proportion of vehicles for which each type of incentive was used.

The industry's aggregated incentives spending totaled a record high $4.6 billion in June. Domestic manufacturers spent $3.74 billion or 82.0% of the total cost, Japanese manufacturers spent $496 million or 11.0%, European manufacturers spent $190 million or 4.2%, and Korean manufacturers spent $130 million or 2.8%.

Overall, combined incentives spending for domestic Chrysler, Ford and General Motors nameplates averaged $3,655 per vehicle sold in June, up $131 from May 2005. Chrysler decreased incentives spending $188 to $3,696 per vehicle sold in June. In the same period, Chrysler's market share decreased 1.2% to 13.1%. Ford increased incentives spending by $249 to $3,188 per vehicle sold in June while its market share decreased 1.7% to 15.9%. General Motors increased incentives spending by $136 to $3,865 per vehicle sold in June while its market share increased 6.7% to 32.1%, the highest U.S. market share for GM since December 2002. The combined market share of the Big Three increased to 61.2% in June, up 3.9% from May.

"Thanks to GM's innovative 'Employee Discount for Everyone' promotion, the company had an outstanding sales month while only marginally increasing its incentives spending, having lowered cash rebates and special financing programs in order to subsidize the promotion," observed Dr. Jane Liu, Vice President of Data Analysis for Edmunds.com. "Customers like the one-price, no-haggle aspect of the program, and continue to respond to it. The result was an undeniable success for GM in June."

From May to June, European automakers increased incentives spending by $35 to an average of $1,912 per vehicle sold; their market share slid 0.2% to 5.9%. Japanese automakers decreased incentives spending by $61 to an average of $1,047 per vehicle sold; their market share fell 3.7% to 28.3% -- the lowest point since September 2004. Korean automakers increased incentives spending by $37 to an average of $1,846 per vehicle sold; their market share decreased 0.2% to 4.2%.

Comparing all brands in June, Mini spent only $11 on incentives while Scion spent $93 and Porsche spent $270 per vehicle sold. At the other end of the spectrum, Lincoln took over the spot for the biggest spender at $6,357, followed by Cadillac at $6,075 and Mercury at $4,654 per vehicle sold. Looking at incentives expenditures as a percentage of MSRP for each brand, Mercury spent the most, 15.8%, while Mini and Porsche spent the least, 0.1% and 0.4%, respectively.

Among vehicle segments, large SUVs continued to offer the highest average incentives, $4,839 per vehicle sold, while sports cars had the lowest average incentives per vehicle at $738. Looking at incentives expenditures as a percentage of MSRP for each segment, large trucks were the highest, 11.6%, while sports cars were the lowest, 2.5%.

Midsize cars have lost the most market share since June 2004, decreasing from 16.8% to 13.5%, while large trucks have gained the most market share during that period, up from 14.0% to 17.0% of the new vehicle market.

About Edmunds.com True Cost of Incentives(SM) (TCI(SM))

Edmunds.com's TCI(SM) is a comprehensive monthly report that measures automobile manufacturers' cost of incentives on vehicles sold in the United States. These costs are reported on a per vehicle basis for the industry as a whole, for each manufacturer, for each make sold by each manufacturer and for each model of each make. TCI covers all aspects of manufacturers' various incentives programs (except volume and similar bonus programs), including dealer cash, manufacturer rebates and consumer savings from subvented APR and lease programs (including subvented lease residual values used in manufacturer leasing programs). Data for the industry, the manufacturers and the makes are derived using weighted averages and are based on actual monthly sales and financing activity.

### Press Release ######################

----------------------------------------------------------------

![]()

News Briefs----

Factory orders post significant gain in May

http://www.boston.com/business/articles/2005/07/06/

factory_orders_post_significant_gain_in_may/

Oil Prices Climb to New Highs

http://www.nytimes.com/aponline/business/AP-Oil-Prices.html

Boeing discloses new CEO's deal

http://www.stltoday.com/stltoday/business/stories.nsf/story/

8A834B83AF971A1A86257037000BF255?OpenDocument

$1.7B purchase of Amegy moves Zions into Texas

http://www.usatoday.com/money/industries/banking/

2005-07-06-zions_x.htm

FTC toughens stance against consumer fraud

http://www.usatoday.com/money/companies/regulation/

2005-07-05-ftc-fraud_x.htm

Silicon Valley property value jumps

http://www.mercurynews.com/mld/mercurynews/classifieds/

real_estate/12064212.htm

Concerto will buy rival for $1 billion

http://www.boston.com/business/technology/articles/

2005/07/06/concerto_will_buy_rival_for_1_billion/

Fannie Mae: The incredible shrinking portfolio

http://www.absnet.net/include/showfreearticle.asp?

file=/headlines/1.htm

----------------------------------------------------------------

Sports Briefs----

Brown to retire as Raider

http://www.sfgate.com/cgi-bin/article.cgi?f=/n/a/2005/07/06/

sports/s174512D20.DTL

Tech Rolls With Tour de France

http://www.internetnews.com/bus-news/article.php/3518086

----------------------------------------------------------------

![]()

“Gimme that Wine”

Kendall-Jackson Wines Continue to Evolve

http://biz.yahoo.com/prnews/050705/sftu073.html?.v=18

Eric Asimov on Parker “Tell All” Book

http://www.nytimes.com/2005/07/06/dining/06pour.html ?

Make Your Own Wine

http://www.modbee.com/columnists/moran/story/

10804318p-11579907c.html

Underground winery draws heat

http://www.napanews.com/templates/index.cfm?template=story_full

&id=01B241B2-7E1D-40D6-8494-B7E75D3E77C4

----------------------------------------------------------------

Today's Top Event in History

1906-Birthday of legendry pitcher Leroy Robert "Satchel" Paige.

“Sometimes I feel like I will never stop

Just go forever

Till one fine morning

I'll reach up and grab me a handful of stars

and swing out my long lean leg

and whip three hot strikes burning down the heavens

and look over at God and say

How about that!”

— Samuel Allen, "To Satch"

http://memory.loc.gov/ammem/today/jul07.html

----------------------------------------------------------------

This Day in American History

1586- Birthday of Thomas Hooker, colonial American pastor and an originator of the earliest system of federal government in America.

http://www.u-s-history.com/pages/h544.html

http://nvnv.essortment.com/thomashooker_rlfj.htm

http://www.famousamericans.net/thomashooker/

http://www.colonialwarsct.org/1636.htm

1754 - In New York City, Kings College opened. For its first year of operation, the institution admitted eight students and one faculty member, Dr. Samuel Johnson, who would also serve as the school president. In 1784, Kings College was renamed Columbia College, and later would became Columbia University. Many prestigious awards hail from the university today, including the Columbia Award for Journalism and the Pulitzer Prize for Journalism that was named after former Columbia professor, Joseph Pulitzer.

1802 - Created by Robert Rusticoat in Hudson, New York, the first comic book to ever be published was "The Wasp."

1846 - Commander J.D. Sloat of the United State Navy raised the American flag in Monterey, proclaiming United States citizenship for California.

1851-birthday of Lillian Jane Martin, founder of Mt. Zion Hospital in San Francisco, the first mental hygienic clinic for normal pre-school children, famed psychologist who started the field of gerontology by opening a clinic for the aged in 1929, when she was 78. She lived to an advanced age, doing such things as traveling through the jungles of South America at 87. In her "before" career, she worked through the ranks at Stanford to become a full professor of psychology in 1911. She was the first woman to head any department there. After mandatory retirement at 65, she got bored and began feeling old so she taught herself to type and then did strenuous exercises to strengthen her body. In 1920 (at 69) she founded Mt. Zion Hospital in San Francisco, the first mental hygienic clinic for normal pre-school children. In 1929 at 78, she started the work which has resulted in reinventing old age.

http://www.webster.edu/~woolflm/martin.html

1851- Birthday of Charles A. Tindley, African-American Methodist preacher and songwriter. His most enduring gospel hymns include 'Stand By Me,' 'Nothing Between,' 'Leave It There'and 'By and By.' Died July 26, 1933, Philadelphia, Pennsylvania

http://www.cyberhymnal.org/bio/t/i/tindley_ca.htm

http://www.aaregistry.com/african_american_history/1903/

Charles_A_Tindley_was_a_servant_of_the_Lord

http://www.templeumc.org/archives/Charles_Tindley.html

1861-Birthday of Dr. Nettie Maria Stevens - U.S. biologist who in 1905 announced that chromosomes X and Y were responsible for the sex of the individual. She was never rightfully given full credit for her discovery.

http://www.dwwood.com/wise/science.html#stevens

1863-Lt. Colonel Christopher "Kit" Carson ( whom I was named after as my father was writing the radio series in 1942) leaves Santa Fe with his troops, beginning his campaign against the Indians of New Mexico and Arizona. A famed mountain man before the Civil War, Carson was responsible for waging a destructive war against the Navajo that resulted in their removal from the Four Corners area to southeastern New Mexico. Carson was perhaps the most famous trapper and guide in the West. He traveled with the expeditions of John C. Fremont in the 1840s, leading Fremont through the Great Basin. Fremont's flattering portrayal of Carson made the mountain man a hero when the reports were published and widely read in the east. Later, Carson guided Stephen Watts Kearney to New Mexico during the Mexican-American War. In the 1850s he became the Indian agent in Taos for New Mexico, a position he left in 1861 to accept a commission as lieutenant colonel in the 1st New Mexico Volunteers. Although Carson's unit saw action in the New Mexico battles of 1862, he was most famous for his campaign against the Indians. Despite his reputation for being sympathetic and accommodating to tribes such as the Mescaleros, Kiowas, and Navajo, under orders of the US Military, Carson waged a brutal campaign against the Navajo in 1863. When bands of Navajo refused to accept confinement on reservations, Carson terrorized the Navajo lands--burning crops, destroying villages, and slaughtering livestock. Carson rounded up some 8,000 Navajo and marched them across New Mexico for imprisonment on the Bosque Redondo, over 300 miles from their homes, where they remained for the duration of the war. Kit Carson guided Stephen W. Kearny's party from New Mexico to California during the Mexican War and his bravery saved the company. Kit Carson was appointed in 1853 as Indian agent for Taos, New Mexico. Kit Carson was extremely qualified and helped calm the Apaches on several different occasions that appeared nearly hopeless short the entrance of his masterful skills During the Civil War Kit Carson joined the Union's Army 1st New Mexican Volunteers he was promoted to brigadier general for his outstanding campaign record After the Civil War Kit Carson commanded Fort Garland garrison in Colorado. When he retired, he moved his family back to Taos, New Mexico, where he died May 23, 1868.

http://members.aol.com/RVSNorton/Lincoln5.html

http://www.civilwarphotos.net/files/images/201.jpg

http://www.desertusa.com/mag99/jan/papr/kitcarson.html

http://www.findagrave.com/cgi-bin/fg.cgi?page=gsrandGScid=38154

1865 - Mary E. Surratt became the first woman to be executed by the US government after being found guilty of conspiring with John Wilkes Booth to assassinate Abraham Lincoln. Her conviction was a subject of controversy as the only crime she appeared to have committed was to own the boarding house where Booth planned Lincoln's assassination. The president and those living in the area condemning her for allowing the plot to be hatched in her house. Whether she was part of the plot or knew of it was never proven. Three others, also convicted in the conspiracy, were hanged along with Mary E. Surratt: Lewis Payne, David E. Harold and George A. Atzerodt. This took place at Buzzard Point, site of the first U.S. Penitentiary. She was the first woman hanged in the United States. Her son, one of the original conspirators whose plan it was to kidnap Lincoln, broke with Booth at the suggestion of assassination. Mary Surratt and the three men who were actually part of the conspiracy were hung after a trial replete with suppression of evidence, legal errors, etc. According to President Andrew Johnson, she "kept the nest that hatched the egg," and that was enough to kill her by an official act of the United States Army. Her son who had escaped to Canada was later was tried by a civilian court. He went free when the majority of the hung jury voted for his acquittal. The complicity of Mary Surratt in the plot was never completely proven. Sightings of the ghost of Mary Surratt have been made here, at her boarding house on K Street, and at the site of the Old Brick Capitol (now the site of the Supreme Court). The ghost of Anna Surratt, is said to be heard occasionally banging at the White House door to plead for the life of her mother as she did in fact on the eve of the execution.

http://members.aol.com/RVSNorton/Lincoln26.html

http://www.surratt.org/documents/dmarye.html

1876 - The most notorious train robber of the American West, Jesse James, held up the Missouri-Pacific train and robbed about $15,000. Accompanied by his gang, Jesse James came to typify the hazards of the 19th-century frontier as it has been portrayed in motion-picture Westerns.

1887- Beatrice Fox Auerbach birthday - Hartford, Connecticut, business executive and philanthropist who established a foundation to train women's groups in the techniques of community organization. She succeeded her father as president of Hartford's G. Fox and Company and developed it into the largest privately- owned retail store in the nation. Died 1968.

http://www.us-israel.org/jsource/biography/fox.html

http://www.cwhf.org/browse/auerbach.htm

1896-The Presidential campaign was, in many ways, a battle over money. As was expected, the Republican campaign, led by the party's presidential nominee, Ohio governor William McKinley, centered on maintaining the gold standard. On the other side of the fence, the Democrats took a cue from the Populist party and latched on to the free coinage of silver as one of their guiding issues. While the Democrat's decision to support silver shocked a number of political observers, their nominee for the Oval Office proved to be even more surprising. The Democrats had already settled on their issue, but the summer of 1896 found them without a clear candidate for the Oval Office. That all changed at the party's national convention in Chicago on July 7 when William Jennings Bryan, then just a young scribe from Nebraska, stepped to speak before the Democrat's 20,000 delegates. An ardent supporter of the silver movement, Bryan seized the reins of the party by railing against the Republican's and their "demand for a gold standard." During his speech, Bryan laid down his now famous vow against gold and the Republicans: "You shall not press down upon the brow of labor this crown of thorns, you shall not crucify mankind upon a cross of gold." These indelible words sent the delegates into frenzy and effectively sealed Bryan's unlikely nomination as the Democrat's candidate for President. Alas, Bryan's fiery oratory proved to be no match for McKinley's fat coffers: backed by the money and influence of the nation's business leaders, the Republicans were able to lavish roughly $7 million on their campaign. Bryan, on the other hand, spent a scant $300,000 and ultimately lost his bid for the White House. The electoral vote was McKinley, 271; William Jennings Bryan, 176. The popular vote was McKinley 7,103,779, Bryan 5,402,925. The Republicans not only gained the White House but four seats in the Senate to lead 47-34, seven seats going to minor parties. In the House, the Republicans lost 40 seats but still held a 204-113 majority, 40 seats going to minor parties. The Republican party was free to have its way and on January 12 the new National Monetary Conference met at Indianapolis, Ind, and endorsed the existing gold standard.

1898-Hawaii was annexed by the US. President William McKinley signed a resolution annexing Hawaii. No change in government took place until 1900, when Congress passed an act making Hawaii an “incorporated” territory of the US. This act remained in effect until Hawaii became a state in 1959.

1905--- 127ø F (53ø C), Parker Arizona (state record)

1906-Birthday of legendry pitcher Leroy Robert "Satchel" Paige.

“Sometimes I feel like I will never stop

Just go forever

Till one fine morning

I'll reach up and grab me a handful of stars

and swing out my long lean leg

and whip three hot strikes burning down the heavens

and look over at God and say

How about that!”

— Samuel Allen, "To Satch"

http://memory.loc.gov/ammem/today/jul07.html

1907 -- Robert A. Heinlein birthday (1907-1988). Prolific American writer, grand master of science fiction. His first stories appeared in action-adventure pulp magazine "Astounding Science Fiction" in 1939. His first novel, Rocket Ship Galileo appeared in 1947 and paved way to children's science fiction. Wrote The Green Hills of Earth , the militarist Starship Troopers , and the 60s hippie oriented Stranger in a Strange Land (a favorite of mass murderer Charles Manson). In 1975 Heinlein was awarded the first Grand Master Nebula.

http://www.nitrosyncretic.com/rah/

http://www.wegrokit.com/

http://www.amazon.com/exec/obidos/ASIN/0451912535/

inktomi-bkasin-20/002-2909458-5798421

1908- Harriette Louisa Simpson Arnow birthday - U.S. author who described the Souther Appalachian life and people with honesty and authenticity. She earned a college degree, which shocked her family who were descendants of original Kentucky settlers that didn't believe in women's education. She had to move to Cincinnati to live. Her most critically acclaimed best seller was Hunter's Horn (1949)

http://athena.english.vt.edu/~appalach/writersA/arnow.html

http://www.oriscus.com/kywriters/arnow.htm

http://webpages.marshall.edu/~broyles2/overv1.html

1913-Birthday of sax player Hank Mobley, Eastman GA Died May 30, 1986

http://members.tripod.com/~hardbop/mobley.html

http://www.wright.edu/~martin.maner/mobley.htm

http://www.metroactive.com/papers/metro/11.20.97/jazz-9747.html

1915-birthday of black author Margaret Walker, writer, born Birmingham, Alabama, died November 30, 1998

http://www.olemiss.edu/depts/english/ms-writers/dir/

alexander_margaret_walker/

http://www.ibiblio.org/ipa/walker/

http://dept.english.upenn.edu/~afilreis/50s/walker-margaret.html

1917-Birthday of jazz guitarist Lloyd "Tiny" Grimes guitar Newport News VA Played with Charlie Parker and later became a rock'n'roll guitarist.

http://www.geocities.com/bighollowtwang/TinyGrimes.html

http://www.geocities.com/bighollowtwang/TinyGrimes.html

http://www.centrohd.com/biogra/g2/tiny_grimes_b.htm

http://www.geocities.com/doo_wop_gino/cats.htm

1917- John (Lonzo) Sullivan of the country comedy duo of Lonzo and Oscar was born in Edmonton, Kentucky. John's Brother, Rollin, was Oscar. The brothers' original songs included such ditties as "I'm My Own Grandpa" - a hit before the Second World War - "You Blacked My Blue Eyes Too Often" and "Take Them Cold Feet Out of My Back." In 1947, Lonzo and Oscar began a 20 year association with the Grand Ole Opry which ended in June 1967 with John Sullivan's death. Died June 5, 1967.

1923-Famed San Franciscan Lefty O'Doul, who will become an outstanding major league hitter later in his career, gives up 13 runs in the sixth inning as the Indians rout the Red Sox, 27-3. He will finish his 11-year stint in the majors with a lifetime batting average of .349.

1927- trumpeter and conductor Doc Severinsen born Arlington, Oregon, perhaps best known as the band leader for the “Johnny Carson Show.”

http://www.delafont.com/music_acts/Doc-Severinsen.htm

http://www.pianodesk.com/oldpage/doc.htm

http://www.dwerden.com/doc/

1928- singer Mary Ford, who had a series of pop hits with her husband, guitarist Les Paul, in the 1950's, was born in Pasadena, California. Their successes included "Mockin' Bird Hill," "How High the Moon" and "Waiting For the Sunrise." Their recordings were among the earliest to use the technique of multitracking, and featured Ford's voice answering Paul's talking guitar. The hits stopped in 1961, and Les Paul and Mary Ford were divorced two years later. Ford died on September 30th, 1977.

http://us.imdb.com/Name?Ford,+Mary+(I )

http://www.reevesaudio.com/visitlesandmary.html

http://www.gould68.freeserve.co.uk/Les'n'MaryCol.html

1934 -- F. Scott Fitzgerald, Thomas Wolfe, & Maxwell Perkins, lunch together. Fitzgerald advises Wolfe, struggling with Perkins over revisions to Of Time & the River: "You never cut anything out of a book you regret later."

1937- With President Franklin D. Roosevelt in attendance at Griffith Stadium in Washington, Yankees' first baseman Lou Gehrig drives in four runs with a home run and a double to lead the AL to an 8-3 victory over the National League in All-Star action.

1948 - Satchel Paige was signed to pitch for the Cleveland Indians. Paige, who became a baseball legend playing in the Negro leagues, put on a major league uniform for the first time in his 23-year career. While he claimed to be 39, many speculated that he was actually in his 50's.

1946-Pope Pius XII presided over the canonization ceremonies for Mother Frances Xavier Cabrini, as she became the first American to be canonized. She was the founder of the Missionary Sisters of the Sacred Heart of Jesus and her principal shrine is at mother Cabrini High School, New York, NY. Carbrini was born at Lombardy Italy., July 15, 1859 and died at Chicago, IL, December 22,1917. Her feast day is celebrated on December 22.

1948---Top Hits

You Can't Be True, Dear - The Ken Griffin Orchestra (vocal: Jerry Wayne)

Nature Boy - Nat King

Woody Woodpecker Song - The Kay Kaiser Orchestra (vocal: Gloria Wood and The Campus Kids)

Bouquet of Roses - Eddy Arnold

1949 - Jack Webb's "Dragnet" made its radio debut on NBC radio. This was the first program to dramatize actual cases from police files. Each episode, on both radio and television, began with the announcement: "The story you are about to hear [see] is true; the names have been changed to protect the innocent;" and ended with the sentence the criminal was given. After a successful television preview on "Chesterfield Sound-Off Time," "Dragnet" made the permanent leap to television in January 1952. From 1952 to 1956, the show enjoyed simultaneous runs on radio and television, continuing on television until 1959. After a seven year hiatus, the show resurfaced as "Dragnet '67" to distinguish itself from its own reruns. This first real-life police drama series was such a success that it remains in syndication today.

1953- R'n'B singer Peter Brown, who had a Top Ten hit in 1978 with "Dance With Me."

http://www.oldies.com/product/index.cfm/id/003497.html

http://www.ostlyrics.com/s/summerofsam/007.htm

1954--Two versions of "Sh-Boom" hit the top-10. The original version by the Chords was at #9 and the cover version by The Crew Cuts was at #5

1954- Memphis disc jockey Dewey Phillips became the first DJ to play an Elvis Presley record when he premiered "That's All Right" on his "Red, Hot and Blue" show on station WHBQ. Phillips also interviewed Presley on the program. "That's All Right" and its flip side, an updating of the country tune "Blue Moon of Kentucky," were hits in the Memphis area.

1956-- The Platters' "My Prayer" is released.

1956---Top Hits

The Wayward Wind - Gogi Grant

Be-Bop-A-Lula - Gene Vincent and His Blue Caps

Born to Be with You - The Chordettes

Crazy Arms - Ray Price

1962 - With "The Stripper," orchestra leader David Rose reached the number 1 spot on the popular music charts. The song stayed at the top spot for one week. Rose's previous success on the music charts was with "Holiday for Strings" in 1944.

1962 - Riding Big Steve at Chicago, Illinois's Arlington Park, jockey Bill Hartack won his 3,000th race.

1964---Top Hits

I Get Around - The Beach Boys

My Boy Lollipop - Millie Small

Memphis - Johnny Rivers

Together Again - Buck Owens

1971-- Commissioner Kuhn and Hall of Fame president Paul Kirk announce former Negro League players will have full membership in the Cooperstown shrine, not a separate wing as previously planned.

1972---Top Hits

Song Sung Blue - Neil Diamond

Outa-Space - Billy Preston

Lean on Me - Bill Withers

Eleven Roses - Hank Williams, Jr.

1975-“Ryan's Hope” premiered on TV. This ABC soap ran until 1989 and was set mostly at the fictional Ryan's Tavern on Riverside Hospital at New York City.

1980---Top Hits

Coming Up - Paul McCartney and Wings

The Rose - Bette Midler

It's Still Rock and Roll to Me - Billy Joel

He Stopped Loving Her Today - George Jones

1981 - President Reagan nominated Sandra Day O'Connor to become a Supreme Court justice; she became the first woman member of the Supreme Court in September.

1981--, Parts of Montana in a rare snow storm that dumped 10 inches at Glacier National Park with winds to 90 mph. Not far to the south, Denver was setting a record high with 101!

1984 - 1984--"When Doves Cry," the first single to be released from Prince's 1984 album Purple Rain, hits the top of the charts. The song stayed on top for five weeks and became the best-selling single of 1984. Meanwhile, the album topped the charts for 24 weeks and sold more than 10 million copies.

1986 - Jackie Joyner-Kersee was the United State's biggest success at the Goodwill Games. At the event held in Moscow, Russia, she broke the heptathlon world record with 7,148 points. The same year, Jackie broke her own record when she scored 7,158 points in the United States Olympic Sports Festival where she won all the heptathlon's seven events.

1987--Temperatures fluctuate at Greensburg, KS from 75 at 7 am to 95 in a few minutes then drop back to 86 by 8 am. This was accompanied by dust devils and strange clouds.

1988 - Thirty-eight cities in the north central and northeastern U.S. reported record low temperatures for the date. Youngstown, OH, hit 100 degrees, and for the second day in a row, Flint, MI, reached 101 degrees, equaling all-time records for those two cities.

1988---Top Hits

Dirty Diana - Michael Jackson

The Flame - Cheap Trick