Connect with Leasing News ![]()

![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() |

| ![]() Search |

Search | ![]() Stress Release

Stress Release

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and entertainment for the commercial leasing and finance industry. The News Edition is updated Monday, Wednesday and Friday.

![]()

|

Equipment Leasing Opportunities throughout the U.S. Controller: West Coast • Copier Sales Reps: Florida |

Friday, June 24, 2011

Today's Equipment Leasing Headlines

Classified Ads---Controller

Navitas Lease Corp. Not Licensed in California

California Licenses and Checking Them

Loan/Lease Statute Up-Date

Filing Shows Marcus Davin was Cobalt Funding

Collateral Specialists Joins "Site Inspection List"

Marquette Equipment Finance Quarterly Report

Classified Ads---Help Wanted

The Tree of Life (one of the year's very best)

Page One: Inside the New York Times

Movie and DVD Reviews by Fernando F. Croce

Cedar rapid/Unknown/Kiss Me Deadly

Lease Business Up 10% from April, 27% Last Year

Equipment Finance Industry Confidence Declines in June

Ecologic Leasing Services Launches Two Subsidiaries

Saratoga, California---Adopt-a-Dog

News Briefs---

Major quakes strike in Pacific off Alaska

NBC Gives Donald at Trump-sized raise to $160MM

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

Long Elusive, Mob Legend Ended Up a Recluse

You May have Missed---

Sports Briefs---

California Nuts Briefs

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release” and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer. It is considered “bias” as it is the writer’s viewpoint.

[headlines]

--------------------------------------------------------------

Classified Ads---Controller

(These ads are “free” to those seeking employment

or looking to improve their position)

| Chicago, IL experienced in lease accounting, operations, management, and Sarbanes-Oxley. Seeking position with equipment lessor. Would consider contract assignments or relocating. Email: leasecontroller@comcast.net |

|

Southeastern, MI Controller & Management experience w/ equip lessors &broker. MBA, CPA w/ extensive accounting, management, securitization experience with public and private companies. Willing to relocate. Email: Leasebusiness@aol.com |

Southern CA |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

|

[headlines]

--------------------------------------------------------------

Navitas Lease Corp. Not Licensed in California

In noting that LEAF Financial Corporation's new company LEAF Commercial Capital, Philadelphia, Pennsylvania, is not a licensed as a Financial Lender in California, neither is Navitas Lease Corporation, Ponte Vedra Beach, Florida, who has started a new broker division being lead by Dwight Galloway, formerly head of LEAF Specialty Finance, Columbia, South Carolina.

In the discussion with the California Department of Corporation office, they are active in conducting audits (paid for by the licensee, including mileage of the auditor) and enforcement, stating a company needs to be licensed to conduct business here, especially with other license holders who would also be violating their license to do so. Asked if an application pending would qualify, they said they don't issue "driver learner permits" as does the Department of Motor Vehicles. You need a license.

In notifying Dwight Galloway, he responded, "Yes, of course, any entity that has a role 'negotiating' a lease/loan for a CA customer should be licensed. (CA atty's tell us that obviously includes brokers). "Navitas, of which RLC Funding is a division, applied for our/their license well before we joined them.

"We are accepting many broker requests and are in the process of signing on broker/lessors. "

Asked where to contact him, he replied:

“Here is the information. It has been hectic setting up, getting systems and communications all in place, all the while answering the great many calls from interested broker/lessors, most of whom we have known for many years.”

Dwight Galloway

Senior V.P. Broker Operations

dgalloway@RLCfunding.com

803-566-8245 Ext. 102

803-728-0196 Fax

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

California Licenses and Checking Them

AdvanceMe, Inc. recently lost a $23.4 million law suit for not being licensed in California, and the new entry here On Deck also does not have a California license, although both were doing loans. In a discussion with founder and chief executive officer Mitch Jacobs, his attorneys said he didn't need one to make loans in California.

Neither took an offer for a free consolidation with Tom McCurnin of Barton, Klugman & Oetting, Los Angles whose number one lessor for the lender is"

"▪ Get licensed. If lenders are doing personal property loans, then the appropriate licensing agency is the Department of Corporations for a California Financial Lenders License. If the lender is doing a real estate loan it must be arranged by a licensed real estate broker."

(1)

CALIFORNIA FINANCE LENDERS LAW

"In addition to the lending authority provided by the law, the California Finance Lenders Law provides limited brokering authority. A "broker" is defined in the law as "any person engaged in the business of negotiating or performing any act as broker in connection with loans made by a finance lender." Brokers licensed under this law may only broker loans to lenders that hold a California Finance Lenders license."

Find out if company is licensed:

http://www.corp.ca.gov/FSD/licensees/default.asp

Cease and Desist Information:

http://www.corp.ca.gov/ENF/list/default.asp

License information:

http://www.corp.ca.gov/FSD/lender.asp

-

UNLICENSED LENDER AND SECURITIZATION PARTNERS GET TAGGED FOR USURY http://leasingnews.org/archives/Jun2011/6_02.htm#tagged_usury

-----------------------------------------------------------------

Loan/Lease Statute Up-Date

This is a summary and should not be viewed as a legal interpretation or containing all the requirements. Consult an attorney with leasing experience is highly recommended.

Most states exempt banks. This is commercial business only.

Whether some states mix consumer and commercial loans today is not know, although current court cases are recognizing personal guarantees and proprietorships to fall under some consumer guidelines.

Arizona: All “advance fee loan brokers” must register annually with the state. Arizona Revised Statutes, sec. 06-1303-1310 (1996)

Registration process:

http://azdfi.gov/Licensing/AppPack/ALB_App.htm

Alabama: A simple business, vocational, occupation license is required.

Alaska: Alaska Small Loan act does not distinguish between consumer and commercial loans, one of the reasons many leasing companies do not do business in this state. Requires a license on transactions under $25,000.

Arizona: Requires a state license not difficult to obtain to those who have applied to be on a Leasing News list.

Arkansas: All brokers of “a loan of money, a credit card or a line of credit” may not assess or collect an advance fee. In addition, all brokers must register with the Securities Commissioner, post a surety bond of $25.000 and have a net worth of $25,000. Arkansas Code Annotate sec. 23-39-401 (1995)

California: No person shall engage in the business of a finance lender or broker without obtaining a license from the Commissioner, unless a bank or conducting true “operating” leases. California Financial Code, Division 9, Chapters 1 and 3

Connecticut: Brokers of “unsecured loans” may not assess or collect an advance fee. Connecticut General Statues, sec. 369-616 (1997) A license to make small loans of under $15,000 is required. This is aimed at “retail buyers” and whether a capital lease or commercial entity is defined is not known at this time.

Delaware: License required for commercial lessors for “finance or small loan agencies.”

Florida: Brokers of a “loan of money, a credit card, line of credit or related guarantee, enhancement or collateral of any nature” may not assess or collect an advance fee. Florida Statues, Chapter 687.14 (1992)

Georgia: A broker of “loans of money, a credit card, a line of credit or related guarantee, enhancement or collateral of any kind or nature” may not assess or collect an advance fee unless such fee is for “actual services necessary to apply for the loan.” Official Code of Georgia Annotated, sec. 7- 7-1 (1992)

Idaho: No fee may be collected unless a loan is actually made. Idaho Code, sec. 26-2501 (1992)

Illinois: Code , 815 ILCS 175/15-5.03 Under the Act, a ”loan broker” means any person who, in return for a fee from any person, promises to procure a loan for any person or assist any person in procuring a loan from any third party, or who promises to consider whether or not to make a loan to any person. 815ILCS 175/15-5- 15(a)

Specifically excluded from the application of the Act, however, are (1) any bank …regulated by any service loans for the Federal National Mortgage Association… (3) any insurance producer or company authorized to do business in [Illinois], (4) any person arranging financing for the sale of the person's product, (note that this exception does not apply to any person selling someone else's product and only applies to “the” person's product, implying the exception is for the owner of the product arranging for financing), (5) any person authorized to conduct business under the Residential Mortgage License Act of 1987 and (6) any person authorized to do business in [Illinois] and regulated by the Department of Financial Institutions or the Office of Banks and Real Estate.

“In the event that the Act is violated by the broker, the Secretary of State is empowered by the statute to make investigations and examinations, suspend or evoke the broker's approval, subpoena witnesses, compel the production of books and records, order depositions and obtain temporary restraining orders and injunctions against the broker. In the vent that a violate is found, the Secretary of State may impose a fine in the amount of $10,000 for each violation and the broker shall be liable to any person damaged in the amount of tactual damages plus attorneys fees.

This appears as standard language on most states.

Iowa: A broker of loans of “money or property” may not assess or collect an advance fee except for a “bona fide third-party fee” and a broker must obtain a bond or establish a trust account and file required documents with the Commissioner or Insurance. Iowa Code, sec. 535C (1992)

Kentucky: Brokers of “a loan of money, a credit card, a line of credit or related guarantee, enhancement or collateral of any kind or nature” may not assess or collect an advance fee. Kentucky Revised Statutes Annotated, sec. 367.380 (1992)

Louisiana: A broker of loans of “money or property…whether such agreement is styled as a loan, a lease or otherwise” must obtain a surety bond or establish a trust account in the amount of $25,000. A broker may not collect an advance fee but may collect an “advance expense deposit for commercial loans” only for actual expenses incurred in obtaining the loan. Louisiana Revised Statutes Annotated, sec. 9:3574 (1993); Louisiana Revised Statutes Annotated, Sec. 51:1910 (1992)

Personal Property Lessor License required.

Minnesota: Regulated Loans License. No person “shall engage in the business” of making loans not exceeding $100,000 without first obtaining license from Commerce Division. Violation is a misdemeanor and loan is void. This will apply to “capital leases.”

Mississippi: A broker or loans of money may not assess or collect an advance fee and can be fined up to $5,000 for each violation. Mississippi Code Annotated, sec. 81-19-17 (1997)

A license is required for conditional sales contracts.

Missouri: A broker of loans of “money or property” may not assess or collect an advance fee. Missouri Revised Statues, sec. 367 300 (1992)

Montana: A person who knowingly engages in the business of a sales finance company in Montana without a license can be punished by a fine of not more than $500 and/or imprisonment of not more than six months.

Nebraska: A broker of loans of money may not assess or collect an advance fee. Nebraska Revised Statutes, sec. 45-189 (1993) Installment sales license required except for state banks and trust and loan companies regulated by Nebraska or any other state or chartered by the United States.

Nevada: Requires license for each office or other place of business, considers capital lease as loan and “lending.”

New Hampshire: Requires small loan license, whether applies to Capital Leasing not known.

New Jersey: Brokers of “loans of money” may not assess or collect an advance fee. New Jersey Rev. Statutes, sec. 17:10B (1992)

New Mexico: Currently requires Brokers/Lessors to register for Licensing under the New Mexico Mortgage loan Company or Loan Broker Act with the Financial Institutions Division of the State of New Mexico. Banks with Brick and Mortar within the State of New Mexico are exempt. Prior to licensing applicants must submit the Following:

Articles of Incorporation Listing of all principals (including management) A full financial Package (to meet their minimum requirements of liquidity) Personal financial statements on all principals Disclosure of all current or past suits (civil or criminal)

Attach a corporate surety bond

Include a $400.00 registration fee renewable yearly

New York: Any advance payment or deposit must go into an escrow account until a transaction proceeds. License is required to make business and commercial loans less than $50,000.

North Carolina: A broker of “loans of money or property…whether such agreement is styled as a loan, a lease or otherwise” must obtain a surety bond or establish a trust account in the amount of $25,000 and obtain a license. North Carolina General Statutes, sec. 66-106 (1992) Lenders who advance more than $1 million annually, in aggregate, in NC are exempt.

North Dakota: Brokers may not accept an advance fee unless the broker is licensed.

North Dakota Century Code, 13-04. 1-09.1 (1993)

Ohio: Department of Commerce, Division of Financial Institutions (Certificate to engage in the business of a credit services organization in accordance with the provisions of Sections 4712.01 to 4712.14 of the revised code of Ohio, subject to all the provisions thereof and to the regulations of the division.) Ohio Department of Taxation requires a "Vendor's License" under provision 5739.17 of the Revised Code (...is hereby authorized to sell tangible personal property and selected services at the retail location specified below.) This also makes the lessor responsible for all taxes with penalties for not doing so.

Ohio: No person shall engage in the business of lending amounts of $5,000 or less without a license.

South Carolina: A broker of “a loan of money, a credit card, a line of credit or related guarantee, enhancement or collateral of any kind or nature” may not assess or collect an advance fee. (South Carolina Code Annotated, sec. 34-36-10 91992) A license is required for the “business of lending in the amounts of $7,500 or less” regarding consumers. Has won cases against finance for business involving individual guarantees.

Texas: Consult an attorney familiar with Texas finance and lending laws.

Vermont: Commercial lenders and sales finance companies must obtain a license. Does not apply to true leases and leases for security (finance leases.) Does apply to Equipment Finance Agreements.

Here is a 2006 Equipment Leasing and Finance Association forum list.

(It is not known if the list has been up-dated and is available for the public.)

http://www.leasingnews.org/PDF/CommercialLessorLicenseRequirements.pdf

Comprehensive personal property tax outsourcing services |

[headlines]

--------------------------------------------------------------

Filing Shows Marcus Davin was Cobalt Funding

The story was correct that Benchmark Financial Groups, Aliso Viejo, California with many complaints on many web sites, was about to start under a new name. While denied by a spokesman, the actual filing shows the corporate name was MD Capital Partners, Inc. with “Mark Davin” as the serving agent. Marcus Davis is the principal of Benchmark.

The complaint that lead to the story appears to have been resolved, so it most likely will not be appearing the Leasing News Bulletin Board complaint. When the check is received and clears the bank will be the resolution.

It should be noted that neither Benchmark Financial Group nor MD Capital Partners appear to be licensed under the California Finance Lenders Law.

MD Capital –Cobalt Funding fictitious business name filing:

http://leasingnews.org/PDF/MDCapitalCobaltFunding.pdf

Benchmark Did Not Change its Name

http://leasingnews.org/archives/Jun2011/6_17.htm#name_change

| John Kenny Receivables Management www.jrkrmdirect.com • End of Lease Negotiations & Enforcement The Solution to Your Credit & Accounts Receivable Needs |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

"Site Inspection List"

Collateral Specialists Inc. 1995 Paul G. Hanson 770-891-1325 phanson@csina.comwww.csina.com ELFA, NAELB, NEFA |

30 |

pt/or ind. con 650 |

- Equipment Inspections (pre-funding and deliquency) -Business verifications - Floor Plan (inventory) inspections - Dealer Monitoring Services |

Site Inspection List:

http://www.leasingnews.org/Site_Insp/Default.htm

[headlines]

--------------------------------------------------------------

Marquette Equipment Finance Quarterly Report

Dorran Sampson, Vice-President, Broker Relations, for Marquette Equipment Finance, wanted to bring attention to "Broker Relations Quarterly." He briefly discusses "...relevant leasing news, industry insight and overcoming obstacles as well as give some examples of the kinds of deals we are funding and looking for."

801 233 6837

dorran.sampson@meqf.com

Leasing Industry Help Wanted

Equipment Leasing Opportunities throughout the U.S. Controller: West Coast • Copier Sales Reps: Florida |

NATIONWIDE SALES POSITIONS AVAILABLE |

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

Fernando's View

By Fernando F. Croce

A spiritual masterpiece (“The Tree of Life”) and an absorbing documentary (“Page One: Inside the New York Times”) make for a top-flight night at the movies, while DVD watchers will have their choice of sleepers (“Cedar Rapids”), hits (“Unknown”), and classics (“Kiss Me Deadly”).

In theaters:

The Tree of Life (Fox Searchlight Pictures): Terrence Malick, the reclusive and brilliant director of “The New World,” offers another visually astounding, profoundly moving story of spiritual turmoil and redemption with perhaps his most personal work yet. Alternating between a modern-day city and a small Texas neighborhood in the late 1950s, it chronicles a boy’s childhood as he learns about life in strikingly different ways from his loving yet domineering father (Brad Pitt) and gentle mother (Jessica Chastain). As he experiences brushes with joy, anger and tragedy, the film emerges as an impressionist portrait of childhood lost and of deep bonds with nature. Using a fragmented yet lush storytelling style to depict the flow of memories, Malick’s film (one of the year’s very best) makes for challenging but soul-stirring viewing.

Page One: Inside the New York Times (Magnolia Pictures): The collision between the new media and old-fashioned journalism is the subject of this riveting documentary, set mostly inside the cubicles and newsrooms of the New York Times. Given unprecedented access to the legendary newspaper’s behind-the-scenes machinations, director Andrew Rossi takes audiences on an invigorating tour of a media giant in the middle of a particularly hard period. As seasoned writers find themselves struggling to remain relevant and the Times scrambles to avoid being left behind with the rise of YouTube and Facebook, the workings and influences of this particular are analyzed with energy and insight. Packing as much drama as “All the President’s Men,” the movie should fascinate newspapers buffs and casual readers alike.

Netflix Tip: A filmmaker legendary for both the ambition of his films and the privacy of his personal life, Terrence Malick is one of modern cinema’s most fascinating figures. Though he has directed less than half a dozen movies, the quality of his works puts him in the pantheon of greats. Check out his previous films at Netflix, from “Badlands” (1973) and “Days of Heaven” (1979) to “The Thin Red Line” (1998) and “The New World” (2006). |

On DVD:

Cedar Rapids (Fox): Proving that Zach Galifianakis wasn’t the only breakout star in “The Hangover,” Ed Helms gives an inspired performance in this engaging comedy from director Miguel Arteta. Helms plays Tim, a former go-getter who finds himself stuck in his old hometown, selling insurance to cover other people’s dreams while neglecting his own. His naïve worldview is in for a shake-up when he’s assigned to a company convention in Cedar Rapids, Iowa, and becomes friends with Joan (Anne Heche), Zeigler (John C. Reilly) and Wilkes (Isiah Whitlock Jr.), three more experienced salespeople who open his eyes to the world and, maybe, to love, too. Arteta directs the picture with a rowdy and sweet twinkle, helped by hilarious turns by Sigourney Weaver, Stephen Root and Rob Corddry.

Unknown (Warner Bros.): After scoring a box-office hit with the international thriller “Taken” a few years back, Liam Neeson again proves his action-star mantle with this suspenseful drama set in Germany. Neeson stars as Dr. Harris, an American bio-technician whose trip to Berlin takes a most dramatic turn after he’s involved in a car accident and wakes up from a coma with a shaky memory. Suddenly, his wife (January Jones) can’t recognize him, his scientific work is lost, and sinister government agents are on his trail. It’s up to Harris and a cab driver (Diane Kruger) to find out the truth before it’s too late. Directed by Jaume Collet-Sera with punchy action scenes and a strong feeling of atmosphere, this is muscular intrigue reminiscent of the early Hitchcock of “The Lady Vanishes.”

Kiss Me Deadly (Criterion): One of the seminal movies of the 1950s deservedly getting the Criterion treatment, this wildly original 1955 thriller remains as startling as ever. Based on the pulp crime novels of Mickey Spillane, it follows the adventures of Mike Hammer (the underrated Ralph Meeker, at the top of his brutishly charismatic game), a private detective whose vicious behavior often makes him undistinguishable from the criminals he deals with. His latest case, however, may literally be his most explosive to date: It involves tracking down a mysteriously glowing suitcase that’s wanted by both murderous hoodlums and government officials. Can he find this “Pandora’s Box” before the wrong people open it? Directed with wicked inventiveness by Robert Aldrich and featuring an unforgettable supporting cast, this is an unmissable noir classic.

[headlines]

--------------------------------------------------------------

### Press Release ############################

ELFA-MLFI-25 Lease Business Up 10% from April, 27% Last Year

Washington, DC,— The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity for the $521 billion equipment finance sector, showed overall new business volume for May was $5.6 billion, up 30 percent from volume of $4.3 billion in the same period in 2010. Compared against April volume, May volume increased by 10 percent. Year to date, new business volume is up 27 percent over last year.

(Chart: Leasing News)

Credit quality continues to improve. Receivables over 30 days decreased 12 percent to 2.9 percent in May from 3.3 percent in April, and declined by 28 percent compared to the same period in 2010. Charge-offs remained unchanged at 0.8 percent in May from the previous month, and decreased by 51 percent from the same period in 2010.

Credit standards remained unchanged in May from the previous month at 76 percent. Sixty-eight percent of participating organizations reported submitting more transactions for approval during the month, an increase from 45 percent in April.

Finally, total headcount for equipment finance companies in May decreased two percent and was down one percent year-over-year. Supplemental data shows that the construction and trucking sectors continued to lead the underperforming sectors.

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for June is 52.6, down from the May index of 63.2, indicating industry concerns over the sputtering economic recovery and uncertainties regarding lease accounting changes. For more detailed information on the MCI-EFI visit www.LeaseFoundation.org

ELFA President and CEO William G. Sutton, CAE, said: “Directionally, there is good news both in the amount of new business generated during the period and the rebound in credit quality. However, some industry sectors continue to lag, and an atmosphere of uncertainty prevails.”

“New business volume improvements continue but in an uneven manner across different industries,” said Harry Kaplun, President, Frost Leasing, located in San Antonio, TX. “This lack of a uniform trend suggests some weakness in the overall recovery. If the recovery can be more universal, the current availability of capital and improving portfolio performance has the equipment finance industry well positioned to serve the future needs of U.S. industry.”

About the ELFA’s MLFI-25

The MLFI-25 is the only index that reflects capex, or the volume of commercial equipment financed in the U.S. The MLFI-25 is released globally at 9 a.m. Eastern time from Washington, D.C., each month, on the day before the U.S. Department of Commerce releases the durable goods report. The MLFI-25 is a financial indicator that complements the durable goods report and other economic indexes, including the Institute for Supply Management Index, which reports economic activity in the manufacturing sector. Together with the MLFI-25 these reports provide a complete view of the status of productive assets in the U.S. economy: equipment produced, acquired and financed.

The MLFI-25 is a time series that reflects two years of business activity for the 25 companies currently participating in the survey. The latest MLFI-25, including methodology and participants is available below and also at http://www.elfaonline.org/ind/research/MLFI/

MLFI-25 Methodology

The ELFA produces the MLFI-25 survey to help member organizations achieve competitive advantage by providing them with leading-edge research and benchmarking information to support strategic business decision making.

The MLFI-25 is a barometer of the trends in U.S. capital equipment investment. Five components are included in the survey: new business volume (originations), aging of receivables, charge-offs, credit approval ratios, (approved vs. submitted) and headcount for the equipment finance business.

The MLFI-25 measures monthly commercial equipment lease and loan activity as reported by participating ELFA member equipment finance companies representing a cross section of the equipment finance sector, including small ticket, middle-market, large ticket, bank, captive and independent leasing and finance companies. Based on hard survey data, the responses mirror the economic activity of the broader equipment finance sector and current business conditions nationally.

ELFA MLFI-25 Participants

ADP Credit Corporation

Bank of America

Bank of the West

BB&T

Canon Financial Services

Caterpillar Financial Services Corporation

CIT

De Lage Landen Financial Services

Dell Financial Services

EverBank Commercial Finance

ifth Third Bank

First American Equipment Finance

GreatAmerica

Hitachi Credit America

HP Financial Services

John Deere Financial

Key Equipment Finance

M&I Equipment Finance

Marlin Leasing Corporation

Merchants Capital

PNC Equipment Finance

RBS Asset Finance

Siemens Financial Services

Stearns Bank

Susquehanna Commercial Finance

US Bancorp

Verizon Capital Corp

Volvo Financial Services

Wells Fargo Equipment Finance

About the ELFA

The Equipment Leasing and Finance Association (ELFA) is the trade association that represents companies in the $521 billion equipment finance sector, which includes financial services companies and manufacturers engaged in financing capital goods. ELFA members are the driving force behind the growth in the commercial equipment finance market and contribute to capital formation in the U.S. and abroad. Its over 600 members include independent and captive leasing and finance companies, banks, financial services corporations, broker/packagers and investment banks, as well as manufacturers and service providers. In 2011, ELFA is celebrating 50 years of equipping business for success. For more information, please visit www.elfaonline.org.

ELFA is the premier source for statistics and analyses concerning the equipment finance sector. Please visit http://www.elfaonline.org/ind/research/ for additional information.

The Equipment Leasing & Finance Foundation is the non-profit affiliate to the Equipment Leasing and Finance Association, providing future-focused research to the equipment finance industry. For more information please visit the website at www.leasefoundation.org

#### Press Release #############################

Equipment Finance Industry Confidence Declines in June

Washington, DC, –- The Equipment Leasing & Finance Foundation (the Foundation) releases the May 2011 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $521 billion equipment finance sector. Overall, confidence in the equipment finance market is 52.6, down from the May index of 63.2, indicating lingering industry concerns over the sputtering economic recovery and uncertainties in lease accounting changes.

When asked about the outlook for the future, survey respondent Thomas Jaschik, President, BB&T Equipment Finance, said, “I expect new business volume will gradually increase over the next two years. However, I do not anticipate volume levels returning to pre-recessionary levels in the near term. Market reaction to potential changes in lease accounting is unknown at this point.”

Independent, Large Ticket

An executive of a large-ticket Independent is “generally optimistic as capex spending and refinancing have been steady the last six months.”

Bank, Middle Ticket

Harry Kaplun, President, Frost Leasing

“New business volume growth is continuing but it is a fragile trend that could cease. Much of the growth is replacement equipment with some equipment acquisitions for business expansion.”

Independent, Small Ticket

Valerie Jester Hayes, President,

Brandywine Capital Associates, Inc

“We are in a long slow recovery and the small business owner has been most affected by declining home prices and continued weaker demand for their products and services. This has affected the markets we serve. Until some of these factors stabilize and the trend is reversed we will continue to see weak demand for equipment acquisitions.”

June 2011 Survey Results:

The overall MCI-EFI is 52.6, a decrease from the May index of 63.2.

· When asked to assess their business conditions over the next four months, 5.0% of executives responding said they believe business conditions will improve over the next four months, a decrease from 30% in May. 79.5% of respondents believe business conditions will remain the same over the next four months, an increase from 70% in May. 15.4% of executives believe business conditions will worsen.

12.8% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, a decrease from 22% in May. 77% believe demand will “remain the same” during the same four-month time period, a slight decrease from 78% the previous month. 10% believe demand will decline.

23% of executives expect more access to capital to fund equipment acquisitions over the next four months, down from 44% in May. 77% of survey respondents indicate they expect the “same” access to capital to fund business, up from 56% the previous month. In the last seven months’ surveys, no one responded that they expect “less” access to capital.

When asked, 33.3% of the executives reported they expect to hire more employees over the next four months, down from 41% in May. 53.8% expect no change in headcount over the next four months, an increase from 52% last month, while 12.8% expect fewer employees, an increase from 7.0% in May.

66.7% of the leadership evaluates the current U.S. economy as “fair,” down from 93% who did in May. 33.3% rate it as “poor,” up from 7.0% last month.

Five percent of survey respondents believe that U.S. economic conditions will get “better” over the next six months, down from 30% in May. 82% of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months, up from 63% in May. 12.8% responded that they believe economic conditions in the U.S. will worsen over the next six months, up from 7.0% who believed so last month.

In June, 28% of respondents indicate they believe their company will increase spending on business development activities during the next six months, down from 37% in May. 69% believe there will be “no change” in business development spending, up from 56% last month, and 2.6% believe there will be a decrease in spending, down from 7.0% who believed so last month.

Depending on the market segment they represent, executives have differing points of view on the current and future outlook for the industry.

The Equipment Leasing & Finance Foundation is a 501c3 non-profit organization that provides vision for the equipment leasing and finance industry through future-focused information and research. Primarily funded through donations, the Foundation is the only organization dedicated to future-oriented, in-depth, independent research for the leasing industry. Visit the Foundation online at http://www.LeaseFoundation.org.

#### Press Release #############################

Ecologic Leasing Services Launches Two Subsidiaries

Global vendor captive lessors and corporate lessees better served

GREAT FALLS, Virginia, Ecologic Leasing Services, a global provider of outsourcing, software, and capital sourcing services to both equipment lessees and vendor captive lessors, today announced the launch of two subsidiaries, Ecologic Lessee Services and Ecologic Vendor Services.

“For the last 11 years, Ecologic has served both lessee clients and captive vendor lessor clients through one company, one management team, and one brand”, explains Michael J. Keeler, CEO. “By creating a distinct subsidiary for each line of business and reorganizing the management, we can sharpen our focus on each client base, listen to their unique needs, and create a more valuable, differentiated, and responsive offering.”

Keeler adds, “We will now deliver sales, marketing, and our outsourcing services and global capital sourcing services through each subsidiary. This will allow us to align the expertise of our experienced staff with the specific needs of each type of client. The move will also enable us to capitalize on our common infrastructure, especially the software and global lessor network, while we improve our positioning and messaging and clarify the value proposition for each type of client”.

Doug Slais, VP of Client Services for Ecologic Lessee Services and a long-time veteran of the equipment leasing industry, states, “The objective is to create more value by getting closer to our clients and organizing around their needs. This is a great step towards accomplishing this.”

More Information: http://www.ecologicleasing.com

About Ecologic Leasing Services:

Ecologic offers software services and outsourcing services to lessees and vendor captives that need to finance equipment competitively around the world. The Company currently supports lease transactions in 44 countries. Large corporate and non-profit lessees deploy Ecologic’s software and outsourcing services to save 10-25% on their equipment lease portfolio annually. Vendor captives employ Ecologic’s services to help them finance the sale of their equipment to their customers at the point-of-sale using the best available funding sources where ever they operate around the world. Founded in 2000, the Company is headquartered in Northern Virginia, with offices in Montreal, San Francisco, and Mumbai.

### Press Release ###############################

[headlines]

--------------------------------------------------------------

Saratoga, California-- Adopt-a-Dog

Bob

Catahoula Leopard Dog/Australian Shepherd Mix

“Hi! I'm Bob. I'm a 7 yr. old, Catahoula/Australian Shepherd Mix? (also possibly Pointer since I've been seen pointing at birds), neutered male, weigh approx. 40 lbs. and a very healthy guy with great looking teeth.

“Catahoula's are not very common in the Western part of the U.S. but very common in southern states like Tennessee, Mississippi and Louisiana where I'm the state dog! I'm current on my vaccines and microchipped.

“I'm a sociable guy but need a strong handler. I'm an active, assertive, intelligent dog (true to...Tennessee, Mississippi and Louisiana where I'm the state dog! I'm current on my vaccines and microchipped.

“I'm a sociable guy but need a strong handler. I'm an active, assertive, intelligent dog (true to my herding/hunting breed) and need to be in an active home where I'll get lots of attention and outside activity.

“I'm an affectionate guy and frequently will jump in my foster mom's lap - Yikes, a 40 lb. lap dog!! I love to run and it's been said that I'm poetry in motion!! I love the outdoors, long walks, the beach, lakes and swimming pools. Fetching a ball is high on my activity list too. Love it thrown way up in the air so I can catch it in my mouth and bring it back to you. I can catch ropes as well and will shake it around and also bring it back to you so you can throw it to me again or play a little tug of war! I also know commands like sit, down and shake. Plus I'm a good car traveler. My house manners are quite good. I'm housebroken, been in a crate but prefer to sleep near your bed or where you decide to put my bed. I'm an excellent watch dog as well. I'm usually fine with other amiable dogs my size or smaller but if they're bigger than me and I don't know them yet, I may get a little uncomfortable. I've not lived with cats and consider them prey. Therefore, I need to be part of an "active" household where someone is home most of the time to interact with me. Id' be fine as the only dog but could also be OK with another amiable dog close to my age and size if we were compatible. My foster home typically has smaller dogs and I'm fine with them but some of them are older and not up to my activity level. My owners also need to be experienced dog owners who know something about my breed with older children (16 and up).

“Inactivity would be a major problem for me. Come and meet me soon.”

Note: PLEASE read the info at dogbreedinfo.com on my breed to make sure I'm the right dog for your family and lifestyle.

More about Bob

Spayed/Neutered • Up-to-date with routine shots • House trained • Prefers a home without: cats, dogs, young children • Primary color: Tricolor (Brown, Black & White)

Bob's Contact Info

The Pet Network Inc., Saratoga, CA

•408-450-2452

•Email The Pet Network Inc.

•See more pets from The Pet Network Inc.

•For more information, visit The Pet Network Inc.'s Web site.

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

|

![]()

--- News Briefs

Major quakes strike in Pacific off Alaska

http://www.reuters.com/article/2011/06/24/quake-alaska-idUSN1E75M25620110624

NBC Gives Donald at Trump-sized raise to $160MM

http://www.nypost.com/p/news/business/reality_pay_check_4D92mHK7Lnq9C65xf8NBuL

You May Have Missed--

Long Elusive, Mob Legend Ended Up a Recluse

http://www.nytimes.com/2011/06/24/us/24bulger.html?hp

Sports Briefs----

The Huddle

http://content.usatoday.com/communities/thehuddle/index

![]()

California Nuts Briefs--

Orchard Supply Hardware to be spun off by Sears

http://www.mercurynews.com/business/ci_18341702?nclick_check=1

![]()

“Gimme that Wine”

'Judgment in Paris' marked global arrival of California wine

http://westernfarmpress.com/grapes/judgement-paris-marked-global-arrival-california-wine

Winemakers to blame for rising alcohols in California

http://www.thedrinksbusiness.com/index.php?option=com_content&task=view&id=12908&Itemid=66

French wine industry ponders radical shift in marketing strategy

http://www.france24.com/en/20110623-france-french-wine-industry-ponders-shift-in-marketing-strategy#

Charlottesville to be first East Coast site for wine bloggers' conference

http://www2.dailyprogress.com/business/2011/jun/21/charlottesville-be-first-east-coast-site-wine-blog-ar-1124393/

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

Please send to a colleague---Leasing News is Free

![]()

This Day in American History

1497-the first European to set foot on the North American continent after the Vikings was John Cabot ( also spelled Cabot, Cabotto, Caboote, Gabote, Calbot, or Talbot), a mariner who was probably born in Genoa, Italy. In 1496, King Henry VII of England granted Cabot a charter to sail west to Asia and set up a spice-trade monopoly. Cabot's ship, a 70-foot caravel called the Matthew, embarked from Briston, England, on May 27, 1497, and arrived on the coast of Newfoundland---or possibly Maine---on June 24. After planting the English and Venetian flags, Cabot and his men spent a few hours exploring the landing site, then returned to their ship.

http://www.nmm.ac.uk/education/fact_files/fact_cabot.html

http://etext.lib.virginia.edu/journals/EH/EH33/croxto33.html

1579-the first Christian religious service in English on the Pacific Coast was the Holy Communion service conducted at San Francisco Bay, CA, by the Reverend Francis Fletcher, who read from the Book of Common Prayer of the Church of England. Fletcher was chaplain on Sir Francis Drake's ship, the Golden Hind, during its voyage of cirumnagation from 1577 to 1580. Drake named the place Nova Albion, Latin for New England. A 57 foot marble cross commemorates the event in Golden Gate Park, San Francisco, Ca. There is a controversy this day to where he actually anchored, many think it is Bolinas Bay in Marin County, as his log so indicates, and a plaque so describes ( but that is another story ). He navigated the North Coast of California.

http://www.longcamp.com/nav.html

1647-The first woman in America to appeal for the right to vote was Margaret Brent, a niece of Lord Baltimore, the founder of the colony of Maryland. She came to America from England in January,1638, and was the first woman in Maryland to own property in her own name. She became one of the colony's principal landowners and a person of influence, raising troop of soldiers in 1644. On June 24, 1647, she appealed for the right to vote in the colonial assembly by virtue of her position as secretary to Governor Leonard Calvert, asking for a “place and voyce,” but was ejected from the meetings. At the death of Calvert, she became his executor and acting governor, president over the General Assembly, but was refused a voice in the affairs of the government as “it would set a bad example to the wives of the colony.” She moved to Virginia in 1650.

http://www.earlyamerica.com/review/1998/brent.html

1714-considered the birthday of Matthew Thorton, signer of the Declaration of Independence, born at Ireland . He died this date ,1803,at Newburyport, MA. http://www.ushistory.org/declaration/signers/thornton.htm

1813-birthday of Henry ward Beecher, famous American clergyman and orator, born at Lichfield, CT. Died March 8, 1887, at Brooklyn, NY. His dying words were, “ Now comes the mystery.” http://www.spartacus.schoolnet.co.uk/USASbeecher.htm

1816 - The cold weather of early June finally gave way to several days of 90 degree heat in Massachusetts, including a reading of 99 degrees at Salem.

1842 -- Ambrose Bierce born (1842-1914) Meigs County, Ohio. American newspaper columnist, satirist, essayist, short-story writer and novelist, disappeared in the Mexican Revolution. Presumably died in the siege of Ojinega, January 1914. Strongly influenced by Edgar Allan Poe. His experiences in the Civil War marked him for life.

http://www.literature-web.net/bierce

http://www.creative.net/~alang/lit/horror/abierce.sht

1846-Col. Castro's forces from Monterey, under the command of Joaquín de la Torre, fought the "Battle of Olompali" north of San Rafael with Frémont's troops from Sonoma. Two Americans and five or six Californios were killed. (one time home of the Grateful Dead)

http://www.parks.ca.gov/default.asp?page_id=22728

http://www.chezbabcock.com/genealogy/histories/Olompali.txt

1850--The San Francisco Town Council passed an ordinance for the proper organization of the Fire Department. Rules and regulations were adopted for the first time. Destruction by fire was common in the West, as it was earlier in the East, and having a fire department was paramount for survival in a city due to all the buildings being made of wood and light by gas or oil wick.

1869-Abolitionist Mary Ellen "Mammy" Pleasant is named Voodoo Queen of San Francisco. http://www.kn.pacbell.com/wired/BHM/mepleasant.html

1880- "O Canada," with music by Calixa Lavallee and French lyrics by Judge A.B. Routhier, was performed for the first time at the Skaters' Pavilion in Quebec City. Three bands, playing together, performed "O Canada" during a banquet at a national convention of French Canadians. Canada's future national anthem was reported to have been recieved enthusiastically.

1880- Agnes Nestor birthday - U.S. labor leader. AN emerged as the leader of the 1898 women glove-maker's strike in Chicago when she was only 18. The strike victory ended the pay deduction women had to pay for the rental of the machines the women used to sew gloves. A short time later she led the women into their own union because men did not always support women's needs. She held posts with the International Glove Workers Union for the rest of her life and served as president of the Chicago Women's Trade Union League 1913-1948. She was a long time advocate of the eight-hour day that became a reality in 1937. Child labor, minimum wage, maternity-health, and women's suffrage were also part of her life's work.

http://www.kentlaw.edu/ilhs/images/hall/nestor.jpg

http://womenshistory.about.com/gi/dynamic/offsite.htm?site=

http://www.spartacus.schoolnet.co.uk/USAWkenney.htm

http://historymatters.gmu.edu/d/5728/

http://www.spartacus.schoolnet.co.u

http://womenshistory.about.com/library/bio/blbio_nestor_agnes.htm k/USAWnestor.htm

1880, "O Canada," with music by Calixa Lavallee and French lyrics by Judge A.B. Routhier, was performed for the first time at the Skaters' Pavilion in Quebec City. Three bands, playing together, performed "O Canada" during a banquet at a national convention of French Canadians. Canada's future national anthem was reported to have been received enthusiastically.

1885-the first Episcopal bishop who was African-[American was the Reverend Samuel David Ferguson, who was elected to the House of Bishops of the Protestant Episcopal Church. He was consecrated in 1885, at Grace Church, New York City as the successor of the Missionary Bishop of Liberia.

http://newark.rutgers.edu/~lcrew/blackexperience.html

1895-birthday of William Harrison “Jack” Dempsey, boxer born at Manassa, CO. Dempsey boxed under several pseudonyms in western mining camps, came east and picked up Jack “Doc” Kearns as his manager. After defeating all available heavyweights, Dempsey took on champion Jesse Williard in Toledo, OH, on July 4, 1919. Dempsey won when Willard failed to answer the bell for the fourth round. He reigned as champ for seven years but defended his title only six times, losing to Gene Tunney in 1926. Following his boxing career, he became a successful New York restaurateur. Died at New York, NY, 1983.

900-Blues singer-guitarist Memphis Minnie born Algiers, LA.

http://www.blueflamecafe.com/index.html

http://www.ping.be/ml-cmb/mmindex.htm

1916-birthday of John Ciardi, American poet, citric, translator, teacher, etymologist and author of children's books, born at Boston, MA. John Anthony Ciardi's criticism and other writings were often described as hones and sometimes as harsh Died at Edison, NJ, March 30, 1986.

http://www.poets.org/poets/poets.cfm?prmID=697&CFID=9794231

&CFTOKEN=6584556

1916 - The most lucrative movie contract to the time was signed by actress, Mary Pickford. She inked the first seven-figure Hollywood deal. Pickford would get $250,000 per film with a guaranteed minimum of $10,000 a week against half of the profits, including bonuses and the right of approval of all creative aspects of her films. Not a bad deal for the former vaudeville and stage actress, who once appeared on Broadway with Cecil B. DeMille in "The Warrens of Virginia" for a measly $25 a week.

1917- Portia White birthday - Afro-Canadian concert and operatic contralto. Died 1968.

http://www.ac.wwu.edu/~jay/pages/docs/who.html

http://www.acappellacanada.ca/cdwhite/portia.html

1922 - The American Professional Football Association took on a new name. They decided to name themselves the National Football

1924 - Six men at a rock quarry south of Winston-Salem, NC, sought shelter from a thunderstorm. The structure chosen contained a quantity of dynamite. Lightning struck a near-by tree causing the dynamite to explode. The men were killed instantly. League.

1929-Bessie Smith records sound-track for her only movie, “St. Louis Blues.”

http://www.blueflamecafe.com/index.html

1930-Dr. Albert Hoyt Taylor and Leo C. Young of the Naval Aircraft Radio Laboratory, Anacostia, DC (now part of Washington DC), discovered radar by noting that airplanes reflect radio waves even though they fly above the transmitter and receiver, rather than between them.

1931- Lili de Alvarez shocks social propriety by playing at Wimbledon in shorts instead of the longish, hampering dresses that were de rigueur.

1936-Mary Jane McLeod Bethune, born in Mayesville, SC, in 1875, the daughter of slaves, became the first Federal administrator who was an African-American woman. President Franklin Delano Roosevelt named her director of the Negro Division of the National Youth Administration, thus becoming the first African-American woman to receive a major federal appointment. In 904, Bethune founded the Daytona Normal and Industrial Institute for Negro Girls, later known as Bethune-Cookman College, located in Daytona Beach,Fl. She was also the founder and first president of the National Council of Negro Women. In 1991, he home and offices in Washington, DC, were designated a national historic landmark.

http://www.whitehouse.gov/kids/dreamteam/marybethune.html

http://www.nahc.org/NAHC/Val/Columns/SC10-6.html

1942- Mick Fleetwood, drummer with Fleetwood Mac, was born in London. Originally a blues band when it was formed in 1965, Fleetwood Mac developed into a pop group that put out one of the world's best-selling albums, "Rumours," in 1977. It sold 15-million copies. In 1980, Mick Fleetwood recorded a solo album in Ghana with African musicians. Fleetwood Mac made a comeback in 1987 with the album "Tango in the Night."

1944-- Jeff Beck, one of the great rock guitarists, was born in Surrey, England. Beck's first important band was the Yardbirds, where he was the replacement for Eric Clapton in 1964. In 1967, he formed the Jeff Beck Group with Rod Stewart and Ron Wood. The beginnings of heavy metal could be heard in the group's blues-based songs. The Jeff Beck Group broke up after only two albums, and Beck was then sidelined for 18 months with a fractured skull suffered in a car accident. A new Jeff Beck Group put out two more LPs before Beck formed a band with two former members of Vanilla Fudge, Tim Bogert and Carmen Appice. But that group dissolved as well, in 1974. Beck then began playing fusion music, often in collaboration with keyboards player Jan Hammer. Jeff Beck has made only rare appearances since 1980, but his aggressive style has heavily influenced rock guitarists who followed him.

1944—Pianist Bruce Johnston was born in Chicago. He joined the touring version of the group in 1965 when Brian Wilson decided to quit touring after a nervous breakdown. Johnston has continued to be associated with the Beach Boys over the past quarter century, both as performer and producer.

http://www.allmusic.com/cg/x.dll?UID=2:55:11|PM&p=amg&sql=B18553

http://www.del-fi.com/albumcovers/ac71228.html

(My high school friend, who also played piano in my band, and he would reciprocate when someone was sick in his band and he needed a replacement. I ran into him in Monterey and he did not remember me, but of course, I not only wear glasses now, weigh fifty pounds more—in high school I weighed 144, plus am bald, and go by the name of “Kit,” as I forgot in high school and college I was known by Larry, named after my father. I called myself Kit to him. )

1948-In the early days of the Cold War, the Soviet Union challenged the West's right of access to Berlin. The soviets created a blockade, and an airlift to supply some 2,250,000 people resulted. The airlift lasted a total of 321 days and brought into Berlin 1,592,787 tons of supplies. Joseph Stalin finally backed down and the blockage end May 12, 1949.

1948-Thomas Dewey of New York became the first presidential candidate to be re-nominated after a defeat. He lost to Franklin Delano Roosevelt in 1944 and won re-nomination this day in 1948. He was defeated in the 1948 election by Harry S. Truman, Roosevelt's vice-president who assumed office after the death of the president in office. The newspapers of the day had printed up early morning editions that “Dewey Won,” but Truman who stomped for election all over the United States pulled one of the biggest American political upsets. He won 24,104,836 popular votes to Dewey's 21,969,500; the electoral vote was 304 to 189. Dewey actually received 22,006,285 votes in 1944 but only 99 electoral

votes. In the 1948 election, Strom Thurmond, States Right Democrat, 1,169,312; Henry A. Wallace, Progressive, 1,157,172, which pollsters said would draw votes from Truman in the South. The key was Truman went out and worked for the votes, train stop- to-train stop, where the mustached Dewey and his advisors thought he had the election in the bag.

1949-“Hopalong Cassidy” premiered on television this day in 1949. A western series starring William Boyd in the title role as a hero who wore black and rode a white horse, Topper. The original episodes were segments edited from 66 movie features of Hopalong Cassidy and his sidekick, Red Connors ( Edgar Buchanan). The films were so popular that Boy produced episodes especially for TV with Gabby Hayes as his sidekick. During his reign, Hoppy had many sidekicks. It was popular for us boys to wear his two six guns and black hat. Television was about to introduce many Western heroes, as all the Saturday Western movies were brought back to the tube.

http://www.yesterdayland.com/popopedia/memories/show

_mem.php?ID=S1564

1951---*BENNETT, EMORY L. Medal of Honor Rank and organization: Private First Class, U.S. Army, Company B, 15th Infantry Regiment, 3d Infantry Division. Place and date: Near Sobangsan, Korea, 24 June 1951. Entered service at: Cocoa, Fla. Born: 20 December 1929, New Smyrna Beach, Fla. G.O. No.: 11, 1 February 1952. Citation: Pfc. Bennett a member of Company B, distinguished himself by conspicuous gallantry and intrepidity at the risk of his life above and beyond the call of duty in action against an armed enemy of the United Nations. At approximately 0200 hours, 2 enemy battalions swarmed up the ridge line in a ferocious banzai charge in an attempt to dislodge Pfc. Bennett's company from its defensive positions. Meeting the challenge, the gallant defenders delivered destructive retaliation, but the enemy pressed the assault with fanatical determination and the integrity of the perimeter was imperiled. Fully aware of the odds against him, Pfc. Bennett unhesitatingly left his foxhole, moved through withering fire, stood within full view of the enemy, and, employing his automatic rifle, poured crippling fire into the ranks of the onrushing assailants, inflicting numerous casualties. Although wounded, Pfc. Bennett gallantly maintained his l-man defense and the attack was momentarily halted. During this lull in battle, the company regrouped for counterattack, but the numerically superior foe soon infiltrated into the position. Upon orders to move back, Pfc. Bennett voluntarily remained to provide covering fire for the withdrawing elements, and, defying the enemy, continued to sweep the charging foe with devastating fire until mortally wounded. His willing self-sacrifice and intrepid actions saved the position from being overrun and enabled the company to effect an orderly withdrawal. Pfc. Bennett's unflinching courage and consummate devotion to duty reflect lasting glory on himself and the military service.

1951 - Twelve inches of hail broke windows and roofs, and dented automobiles, causing more than fourteen million dollars damage. The storm plowed 200 miles from Kingmand County KS into Missouri, with the Wichita area hardest hit. It was the most disastrous hailstorm of record for the state of Kansas.

1951—Top Hits

Too Young - Nat King Cole

On Top of Old Smokey - The Weavers (vocal: Terry Gilkyson)

How High the Moon - Les Paul & Mary Ford

I Want to Be with You Always - Lefty Frizzell

1952- President Harry Truman signs the bill that directs women be commissioned officers in the Army, Navy, and Air Force as various medical specialists such as dentists, doctors, osteopaths, and veterinarians.

1952 - Thunderstorms produced a swath of hail 60 miles long and 3.5 miles wide through parts of Hand, Beadle, Kingsbury, Miner and Jerauld counties in South Dakota. Poultry and livestock were killed, and many persons were injured. Hail ten inches in circumference was reported at Huron SD

1952 - Eddie Arcaro set a thoroughbred racing record for American jockeys by winning his 3,000th horse race.

1953 - Al Kaline signed with the Detroit Tigers on this day (following his graduation from high school). The future all-star of the Tigers was 18 years old. http://www.baseballhalloffame.org/hofers_and_honorees/

hofer_bios/kaline_al.htm

1955- In an effort to speed up the game, primarily for television viewers, major league baseball announces a new rule which requires a pitcher to deliver the ball within 20 seconds after taking a pitching position.

1957-Duke Ellington and Ella Fitzgerald session on Verve “ Take the A Train.”

1959—Top Hits

Personality - Lloyd Price

Lonely Boy - Paul Anka

Along Came Jones - The Coasters

The Battle of New Orleans - Johnny Horton

1961-President John F. Kennedy assigned Vice-President Lydon Johnson with

unifying the US satellite program, who played a significant role in bringing the

communication and space age to a leader in the world.

http://memory.loc.gov/ammem/today/jun24.html

1964--Sam Cooke starts a two week stay at New York's Copacabana Club. A 70-foot billboard announcing the engagement is erected in Times Square

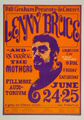

1966--Lenny Bruce Mothers of Invention @ S.F. Fillmore Auditorium

Artist: Wes Wilson & Edmund Shea

http://www.wolfgangsvault.com/dt/lenny-bruce-postcard/BG013-PC.html

1966--Show: Zig-Zag Man Big Brother and the Holding Company Quicksilver Messenger Service

Bill Ham @ SF Avalon Ballroom

Artist: Stanley Mouse

http://www.wolfgangsvault.com/dt/big-brother-and-the-holding-company-poster/FD014-PO.html

1967-Procol Harum's "A Whiter Shade of Pale" enters the Billboard chart, where it will peak at #5. The song was written by the band around a melody composed by the group's organist, Matthew Fisher, who was inspired by the chord progression of Johann Sebastian Bach's "Orchestral Suite in D", composed between 1725 and 1739.

1967—Top Hits

Groovin' - The Young Rascals

She'd Rather Be with Me - The Turtles

Windy - The Association

All the Time - Jack Greene

1970-On an amendment offered by Senator Robert Dole (R-Kansas) to the Foreign Military Sales Act, the Senate votes 81 to 10 to repeal the Tonkin Gulf Resolution. In August 1964, after North Vietnamese torpedo boats attacked U.S. destroyers (in what became known as the Tonkin Gulf incident), President Johnson asked Congress for a resolution authorizing the president "to take all necessary measures" to defend Southeast Asia. Subsequently, Congress passed Public Law 88-408, which became known as the Tonkin Gulf Resolution, giving the president the power to take whatever actions he deemed necessary, including "the use of armed force." The resolution passed 82 to 2 in the Senate, where Wayne K. Morse (D- Oregon) and Ernest Gruening (D-Alaska) were the only dissenting votes; the bill passed unanimously in the House of Representatives. President Johnson signed it into law on August 10. It became the legal basis for every presidential action taken by the Johnson administration during its conduct of the war.

1972 - "I Am Woman", by Helen Reddy, was released by Capitol Records. The number one tune (December 9, 1972) became an anthem for the feminist movement. Reddy, from Australia, made her stage debut when she was only four years old. She had her own TV program in the early 1960s. Reddy came to New York in 1966 and has appeared in the films "Airport 1975", "Pete's Dragon" and "Sgt. Pepper's Lonely Hearts Club Band". Reddy also had four million-sellers: "I Am Woman", "Delta Dawn", "Leave Me Alone (Ruby Red Dress)" and "Angie Baby". She had a total of 14 hits on the pop music charts. http://www.helenreddy.com/

1983-Pitcher Don Sutton of the Milwaukee Brewers struck out Alan Bannister of the Cleveland Indians, the 3,000th strikeout in his career. The Brewers won, 6-2. Sutton wound up his career with 3,574 strikeouts.

1973- In his first year of eligibility, Warren Spahn receives 316 of the 380 votes cast to become a member of the Hall of Fame. The southpaw, who recorded thirteen 20-win seasons, retired as the winningest left- handed pitcher in big league history with 363 victories.

1975—Top Hits

Love Will Keep Us Together - The Captain & Tennille

When Will I Be Loved - Linda Ronstadt

Wildfire - Michael Murphey

You're My Best Friend - Don Williams

1975--The U.S. Attorney in Newark, New Jersey hands down indictments to 19 music industry executives in a two year investigation. Counts of income tax evasion and payola are leveled. Among those named include: Clive Davis, former president of Columbia Records and Kenny Gamble and Leon Huff, architects of the Philadelphia sound of the 70's.

1977-Madison Wisconsin Police Detective Bruce Frey witnessed one of the strangest events of his career when he saw Elvis Presley jump out of his limo and stop two teenagers who were beating up a younger lad at a local gas station. Elvis said, "I'll take you on." Frey remembers; "They looked up at him, froze in mid-punch and the victim ran into the gas station." The pair quickly apologized and Elvis got back into the limo and headed for his hotel room at the Sheraton.

1980-- Nelson Doubleday and Fred Wilpon purchase the Mets for an estimated $21.1 million. The price tag is the highest amount ever paid for a baseball franchise.

1983—Top Hits

Flashdance...What a Feeling - Irene Cara

Time (Clock of the Heart) - Culture Club

Electric Avenue - Eddy Grant

You Can't Run from Love - Eddie Rabbitt

1984-Joe Morgan of the Oakland A's hit the 256th home run of his career to break the record held by Rogers Hornsby for most home runs by a second baseman.

1985 - The 1983 Heisman Trophy winner, Mike Rozier, jumped from the United States Football League to the Houston Oilers of the NFL. Rosier signed for more than two million dollars over a four-year period.

1987 - Thunderstorms spawned six tornadoes in eastern Colorado. Baseball size hail was reported near Yoder, CO, and thunderstorm winds gusting to 92 mph derailed a train near Pratt, KS. The town of Gould, OK, was soaked with nearly an inch and a half of rain in just ten minutes.

1988 - Forty-three cities reported record high temperatures for the date. Valentine NE reported an all-time record high of 110 degrees, and highs of 102 degrees at Casper, WY, 103 degrees at Reno, NV, and 106 degrees at Winnemucca, NV, were records for the month of June. Highs of 98 degrees at Logan, UT, and 109 degrees at Rapid City, SD, equaled June records. Lightning killed twenty-one cows near Conway, SC

1989- Paul Simon brought his "Graceland" tour to Moscow, playing the first of two concerts before 5,000 people in Gorky Park. It was Simon's first appearance in the Soviet Union.

1991—Top Hits

Rush, Rush - Paula Abdul

Losing My Religion - R.E.M.

Unbelievable - EMF

The Thunder Rolls - Garth Brooks

1992 - Portland, Oregon became the first city outside of New York to host the NBA (National Basketball Association draft). At the Portland Memorial Coliseum, the first overall pick went to the Orlando Magic who picked 7'1" center Shaquille O'Neal of LSU.

1998 - AT&T announced that it was buying cable TV giant TCI for $31.7 billion. The deal let AT&T move closer to its goal of providing local phone and high speed Internet service to millions of U.S. homes

1999-Eric Clapton puts 100 of his guitars up for auction in New York at Christie's to raise money for his drug rehab clinic, the Crossroads Centre in Antigua. His 1956 Fender Stratocaster, named Brownie, was sold for a record $497,500. The guitar was used to record "Layla." The auction helped raise nearly $5 million for the clinic.

2001-- Believed to be an historical first, sixty-eight major league umpires participate in a pre-season session to practice calling strikes as defined by the rule book. With the help of minor leaguers wearing tapes nine inches above their belts, the men in blue get a good look at pitches, normally called balls, which now will considered a strike as the correct interpret ion of the zone will be enforced this upcoming season.

Stanley Cup Champions This Date

1995 New Jersey Devils

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------