Connect with Leasing News ![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() |

| ![]() Search |

Search | ![]() Stress Release

Stress Release

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

Leasing Operations Coordinator Well-established asset-based direct funding source

for transactions $10,000 up to $250,000. |

Monday, June 24, 2013

![]()

Today's Equipment Leasing Headlines

Banks and Leasing Regulations

Question from Banker

Classified Ads---Sales

Leasing/Finance Biz Holds Steady in May,

But up 21% Prior Year, Notes ELFA MLFI-25

Small Business Growth Is Happening Right Now

By Dave Choate, Direct Capital "Point Blank"

Alexa Top Leasing Sites

“How do I deal with a ‘poor interviewer’?”

Career Crossroad---By Emily Fitzpatrick/RII

Placard---If plan “A” didn’t work

Leasing 102 by Mr. Terry Winders, CLP

"The Ignorance Plea"

Big asset-sensitive banks stand to benefit from rising rates

By Kevin Dobbs and Tyler Hall

Texas Court Puts Road Block in Way of Servicer

Suing on Behalf of Creditor

By Tom McCurnin

Credit unions continue record strong membership growth

By Harish Mali and Kiah Lau Haslett

10 Top Stories June 18-June 20

(You May Have Missed)

Armstrong elected to chair Farm Foundation Board

Classified ads—Asset Management

Chihuahua

Murray, Utah Adopt-a-Dog

News Briefs---

Car Leases gain popularity across market

Out-of-Northeast Ohio banks buying roots in region

Wells Fargo Wins SBA’s 2013 7(a)

---Large Lender of the Year Award

Watch Movies for Free

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

You May have Missed---

SparkPeople--Live Healthier and Longer

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Announcement this Wednesday---New “Link”

Leasing News will be kicking it up another notch!

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send Leasing News to a colleague

and ask them to subscribe

Contact: kitmenkin@leasingnews.org

[headlines]

--------------------------------------------------------------

Banks and Leasing Regulations

Question from Banker

"I appreciate your article on ‘Loan/Lease Regulations --- Update’. After reading, we asked ourselves the question, ‘How does this apply to Continental Bank.’ We purchase transactions from third parties, obviously our third party agreements needs to address compliance with the laws in the States they operate.

"In addition we participate with Leasing (Lessors) in transactions throughout the United States, hence the need to insure our compliance again with State laws and regulations. We quickly realized that our resources for advising us on these issues were limited. We have been under the assumption that FDIC institutions may be exempt, but wanted to get an opinion. Do you have anyone that you could recommend?"

Gary L. McBride

Executive Vice President

Continental Bank

Salt Lake City, Utah

gmcbride@cbankus.co

(In all states I have reviewed regarding the list of commercial license regulations in order to keep it current: banks are exempt and do not need a license.

(To confirm this, I asked the best expert I know on licensing, Attorney Tom McCurnin, Leasing News Legal Editor, who emailed back:

"The common thread among licensing statutes is that if the entity which should otherwise have a license, is licensed by another government agency (real estate brokers is one example), then no license is required."

(As noted in California, an unlicensed originator can do business with a bank and vice-versa: the bank can do business with them. As well in all states "True leases" seem to be exempt as they are not loans, capital leases, or "finance leases." whatever they are called. This does not apply to mortgage loans or to consumer personal property transactions.

(While California is considered tough, I think Alaska and a few other states not only charge more for licensing and have stiff penalties, but also have more restrictive laws, especially states where they have tough usury laws and other requirements, such as Texas.

(Most businesses that are considered “professional” have licenses and regulations they must abide by. Leasing has less regulations and rules than most professional groups.)

Kit Menkin, editor

Loan/Lease Regulations --- Update

http://leasingnews.org/archives/Jun2013/6_20.htm#regs

[headlines]

--------------------------------------------------------------

Classified Ads---Sales

(These ads are “free” to those seeking employment

or looking to improve their position)

Montgomery, AL

Individual with 10 years advertising sales exp. &

7 years insurance sales exp. Wants independent contractor

situation in Alabama.

Work with leasing company or broker. 334-590-5133

E-mail: billmcneal2003@yahoo.com

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

[headlines]

--------------------------------------------------------------

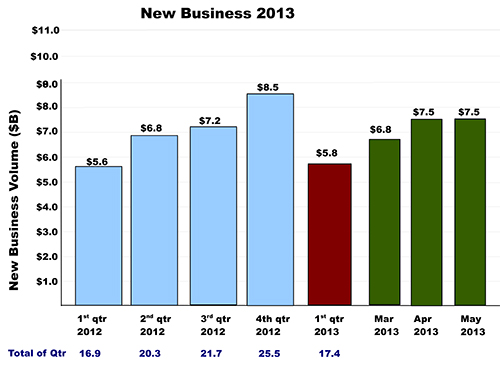

Leasing/Finance Biz Holds Steady in May

But up 21% Prior Year, Notes ELFA MLFI-25

(Chart: Leasing News)

The Equipment Leasing and Finance Association (ELFA) May, 2013 MLFI-25 report from 35 ELFA members shows May, 2013 matched April, 2013: $7.5 billion in new business; up 21% from May, 2012.

MLFI-25 New Business Volume (Year Over Year Comparison)

|

(Chart: ELFA)

William G. Sutton, CAE

ELFA President

"May MLFI-25 data suggest an equipment finance sector on the verge of a breakout performance," said ELFA President and CEO William G. Sutton, CAE, "While recent key indicators show an overall improvement in lending to the small business sector, the May numbers provide concrete evidence of growing demand for productive assets by a cross section of the business community."

Robert Rinaldi, Sr. VP

CSI Leasing

“The fact that all of the metrics are going in the right direction is really encouraging, "said Robert Rinaldi, Senior Vice President, CSI Leasing, Inc., said." Many lessors have seen these ups in new business volume (NBV) followed by subsequent down months, evidenced in the ‘saw-tooth’ pattern of the NBV chart"

The May, 2013 MLFI-25 report showed "...receivables over 30 days were at 1.6 percent in May, matching an historic low, and down from the previous three months at 2.0 percent. Delinquencies declined from 2.7 percent in the same period in 2012. Charge-offs were unchanged for the past three months at the all-time low of 0.3 percent.

"Credit approvals totaled 78.8 percent in May, up from 77.2 percent in April. Sixty-three percent of participating organizations reported submitting more transactions for approval during May, down from 72 percent the previous month."

ELFA President Sutton remarked, "... historic lows in delinquencies and charge-offs mean American businesses are better able to meet their financial obligations, creating a favorable environment for additional capital investment and job creation. We hope that these trends will continue into the summer.”

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for June is 57.3, an increase from the May index of 56.7.

In the report, Thomas Jaschik, President, BB&T Equipment Finance, said, “Demand for equipment leases has increased significantly over the last 60 days. Whether this is a seasonal factor or an indicator of an improving economy is subject to debate. If demand continues throughout the summer than perhaps we can give the nod to an improving economy.”

Anthony Cracchiolo, President and CEO, Vendor Services, U.S. Bank Equipment Finance, said, "“The industry outlook is trending in a positive direction. However, the recent data reflects a single month and isn't yet indicative of a larger trend. While we are currently in a positive environment, U.S. Bank is well positioned to capitalize on the current market conditions.”

Russell Nelson, President, CoBank Farm Credit Leasing, commented: “Continued market uncertainty and volatility in the U.S. and abroad, mixed economic and industry results, and consideration by the Fed to reduce its stimulus program and increase interest rates are challenging customers on the timing of future capex replacement and/or expansion. Numerous industry segments experiencing modest to robust sales growth and replenished cash reserves during the past 18 months are moving forward with capex plans, contributing to strong performance for the equipment finance industry during the remainder of 2013 and into 2014.”

ELFA MLFI-25 Charts

Aging of Receivables:

click to make larger

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

click image to make larger

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

click image to make larger

(Year Over Year Comparison)

click image to make larger

ELFA MLFI-25 Participants

ADP Credit

BancorpSouth Equipment Finance

Bank of America

Bank of the West

BB&T Bank

BMO Harris Equipment Finance

Canon Financial Services

Caterpillar Financial Services

CIT

De Lage Landen Financial Services

Dell Financial Services

Direct Capital Corporation

EverBank Commercial Finance

Fifth Third Equipment Finance

First American Equipment Finance, a City National Bank Company

GreatAmerica Financial Services

Hitachi Credit America

HP Financial Services

Huntington Equipment Finance

John Deere Financial

Key Equipment Finance

M&T Bank

Marlin Leasing

Merchants Capital

PNC Equipment Finance

RBS Asset Finance

SG Equipment Finance

Siemens Financial Services

Stearns Bank

Suntrust

Susquehanna Commercial Finance

US Bancorp Equipment Finance

Verizon Capital

Volvo Financial Services

Wells Fargo Equipment Finance

[headlines]

--------------------------------------------------------------

Small Business Growth Is Happening Right Now

by Dave Choate, Direct Capital “Point Blank”

Happily, we can continue delivering good news. We recently conducted a survey of our customer base, which numbers tens of thousands of small businesses from across the United States. The question we asked was a simple one: Is business better or worse today for your business than it was a year ago?

Here’s a breakdown of the answers we received:

Better – 53%

Worse – 26%

The same – 21%

Your immediate reaction likely matches ours. If over 50% of American small businesses say they’ve experienced growth, that’s a cause for celebration. It also jibes with everything we’ve seen here at Direct Capital, from the strong showing for small business lending in our monthly index to the rise in consumer confidence we’ve been seeing of late.

We’ll need to re-visit the results of this survey at the end of the year, because we still have more than six months for things to change. Right now, though, we couldn’t be more encouraged by the way the small business community has grown and thrived after enduring difficult circumstances in recent years.

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

Leasing Operations Coordinator Well-established asset-based direct funding source

for transactions $10,000 up to $250,000. |

Small Ticket Leasing Sales Reps |

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

Alexa Top Leasing Sites

Position on the web with the lower the number,

the ranking such as #1 Facebook,#2 Google, #3 YouTube.

http://www.alexa.com/topsites

U.S. |

World Wide |

Links |

Web Site |

|

| 1 | 42,026 |

191,445 |

341 |

LeasingNews.com |

| 2 | 135,887 |

682,657 |

135 |

Monitordaily.com |

| 3 | 193,566 |

1,048,586 |

248 |

Elfaonline.org |

| 4 | 246,176 |

750,388 |

52 |

Equipment Finance Advisor |

| 5 | 319,529 |

1,963,798 |

61 |

NEFAssociation.org |

| 6 | 332,158 |

1,262,031 |

103 |

NAELB.org |

| 7 | 449,207 |

1,728,377 |

129 |

Commercial Finance Association |

| 8 | 478,009 |

1,538,603 |

70 |

Worldleasingnews.com |

| 9 | 547,925 |

1,483,086 |

83 |

Lessors.com |

| 10 | No Data |

3,390,096 |

21 |

CLPfoundation.org |

| 11 | No Data |

3,957,812 |

81 |

Equipment Leasing Finance Assoc. |

| 12 | No Data |

18,089,175 |

13 |

Assoc. Gov. Leasing/Finance |

[headlines]

--------------------------------------------------------------

“How do I deal with a ‘poor interviewer’?”

Career Crossroad---By Emily Fitzpatrick/RII

Question: How do I deal with a “poor interviewer”?

Answer: Often a poor interviewer may not be aware of their situation.

Most often they are unprepared or base their hiring decision on a “gut feeling”. Often the interview is more a conversation and you end the interview with the interviewer knowing nothing about you or your skills. However, you can turn this situation to your advantage. Understand that a poor interviewer can be a wonderful manager; however, interviewing skills are learned, they are not inherited or created. Here are some identifiers of a poor interviewer:

-

The interviewer’s desk in cluttered and the resume and/or application that was handed to him/her a few minutes before cannot be found

Solution: Relax; be prepared with an extra resume in your briefcase.

-

The interviewer experiences constant interruptions

Solution: Make note on your writing pad of where you were in the conversation and refresh the interviewer when the conversation resumes –(The pause will give you some time to compose a follow-up to the point made prior to the interruption.)

-

The interview starts with an explanation of why you are both sitting there, and then gives a lengthy criticism of the company and/or position

Solution: Show interest in the company and conversation; when there is a pause, ask the interviewer to tell you some of the job requirements; as the interviewer describes the job functions, you can interject appropriate information.

-

The interviewer begins with or breaks into the drawbacks of the job or is describing the position in negative terms

Solution: This usually means the interviewer has had bad experiences hiring for the position - ask the interviewer what some of the biggest challenges of the position are, be positive in your responses.

-

The interviewer spends a considerable time early in the interview describing their culture and types of employees at XYZ Co.

Solution: Great – you have always wanted to work for a company with this type of atmosphere

-

The interviewer asks close-ended questions, one that demand no more than a yes/no answer - you must handle them effectively

Solution: Treat each closed-ended question as if the interviewer has added, “Please give me a brief yet thorough answer”

-

The interviewer has difficulty looking at you while speaking

Solution: The interviewer is someone who finds it uncomfortable being in the spotlight – try to help him/her to be a good audience.

-------------

Being able to identify these types of interviewers and responding accordingly will make a favorable first impression

– No one forgets first impressions!

Emily Fitzpatrick

Sr. Recruiter

Recruiters International, Inc.

Phone: 954-885-9241

Cell: 954-612-0567

emily@riirecruit.com

Invite me to Connect on LinkedIn

www.linkedin.com/pub/emily-fitzpatrick/4/671/76

Also follow us on Twitter #RIIINFO

Career Crossroads Previous Columns

http://www.leasingnews.org/Conscious-Top%20Stories/crossroad.html

Small Ticket Leasing Sales Reps |

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Leasing 102

by Mr. Terry Winders, CLP

"The Ignorance Plea"

Once in a while we forget that the Lessee must be given the lease documents with sufficient time for them to read, and hopefully understand, the transaction. This applies to all size leases, as even middle market leases are often "quick sign here."

In the small ticket marketplace, many times we place the documents in front of the Lessee and say sign here, here, and here. We may even put an “x” where they are to sign. The lessee is busy. They want to sign quick and get you out of there so they can go back to work.

I also think the internet has sped this up, as contracts are now sent by the world wide web and the lessee told where to sign. Even when sent overnight, there is the rush to order the equipment, sign the documents, send back right away.

Then later on, when everything goes sour, the Lessee stands in front of a judge and pleads Ignorance. The usual statement is; that they were not given time to read the documents. It was sent by the internet or overnight, and I was told to sign it and get back right away. Even if they did receive by internet or overnight, I did not understand its content.

If you are dealing with a small company be prepared for this argument.

Also attorneys tell me they hear this from larger companies, too, especially it was explained by the salesman it was a $1.00 out, even though it said, "fair market value," as that was for "tax reasons."

You should always give the Lessee a completed copy of the documents with all signatures and dates completed. This may not happen until the deal is funded so a good check list of facts should be explained to the Lessee at the time of closing.

You don't have to make it a part of the contract, but perhaps just a quick synopsis.

Here is a list of the proper comments and it would not be a bad idea to have a Lessee sign the list after they check off each item:

[] This is a non-cancelable contract

[] The Lessor is not the supplier of the equipment and you must look to the dealer or distributor for equipment defects or performance issues.

[] This is a net lease and you must provide insurance against the loss, theft of or damage to the Equipment, for the amount of the applicable casualty value from time to time, naming Lessor as a loss-payee, and in addition; general liability, public liability, workers' compensation liability, environmental hazard liability and property damage insurance, naming Lessor as an additional insured.

[] You will be responsible for property taxes which will be paid by the Lessor and then billed to you with immediate payment responsibility

[] You may not relocate or sublease the equipment without our permission

[] You must maintain the equipment throughout the lease term according to the maintenance requirements of the manufacture.

[] You acknowledge that the lessor is the owner of the equipment and you may not encumber it with any mechanic or lender liens.

[] Your obligation to pay rent is unconditional

[] Any additions or modifications to the equipment require our permission and will become Lessor property at termination.

[] The equipment will be inspected by an industry expert, at termination, to determine if it meets the return conditions.

[] All payments must be made on time or a late charge will be assessed.

[] We will stop by from time to time, with notice, to inspect our equipment.

Or……. another approach I have used is to place the following statement at the bottom of the acceptance agreement (You may want to contact your own leasing attorney for better wording):

“Lessee acknowledges that it has received a copy of this document as executed by Lessee, with all blanks completed. Lessee acknowledges that it (a) has READ THIS DOCUMENT, HAS CAUSED THIS DOCUMENT TO BE EXAMINED BY LESSEE'S REPRESENTATIVES OR ADVISORS; (b) is thoroughly familiar with the transactions contemplated in this document; and (c) together with Lessee's representatives or advisors, if any, has had the opportunity to ask such questions to representatives of Lessor, and receive answers thereto, concerning the terms and conditions of the transactions contemplated in this document as Lessee deems necessary in connection with Lessee's decision to enter into this Lease and any Schedules and/or Supplements. “

This may seem a bit much for small ticket Lessor’s but it is important that the Lessee understand the content of the lease agreement. The court system takes a dim view of Lessor’s that “prey” on the ignorance of the lessee and get them to agree to transactions that they expect to function just like a loan because the Lessor’s salesperson said so.

Salespersons for leasing need to be trained in the rules and regulations of leasing so as to not jeopardize the legal standing of you documents. Most of all they need to be trained in how to close a lease. If you fully explain the type of transaction the Lessee is about to sign, many current and future problems will be eliminated.

Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty-five years and can be reached at terrywinders11@yahoo.com or 502-649-0448

He invites your questions and queries.

Previous #102 Columns: http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

Mr. Terry Winders available as Expert Witness. 35 years as a professional instructor to the top equipment leasing and finance companies in the United States, author of several books, including DVD's, as well as weekly columnist to Leasing News. He also performs audits of leasing companies as an expert on documentation, and has acted as an expert witness on leasing for litigation in legal and tax disputes, including before the IRS. He also has taught the senior bank examiners, how to review a bank leasing department, for the Federal Reserve in Washington D.C. and has trained the examiners for the FDIC on how to prepare a lease portfolio for sale.

Mr. Winders received his Master of Business Administration and his Bachelor of Science degrees from the College of Notre Dame. 502.649.0448/terrywinders11@yahoo.com |

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

Big asset-sensitive banks stand to benefit from rising rates

By Kevin Dobbs and Tyler Hall

As Federal Reserve policymakers attempt to signal to the markets their intentions on easy-money policies that have kept interest rates low, banks are trying to position themselves for a future era of higher rates that could boost the profitability of loans.

Generally, asset-sensitive banks — those that hold a high level of assets that are of shorter duration than their liabilities — will be able to more quickly re-price and capitalize on higher rates. Liability-sensitive firms, in contrast, are more prone to pain from increasing funding costs tied to rising rates.

Fed Chairman Ben Bernanke said June 19 that if the economy continues to advance as projected by the central bank's Federal Open Market Committee over the remainder of this year, the Fed could start to scale back on its level of monthly asset purchases — its third round of so-called quantitative easing — as the close of this year approaches. Such a move would ease downward pressure on interest rates.

Rates have already climbed some in recent weeks against a backdrop of market anticipation that the Fed will yet this year begin to taper its current $85 billion per month rate of asset purchases under QE3, as Jack Ablin, chief investment officer at BMO Harris Bank, points out.

Further increases in rates could boost earnings for asset-sensitive banks, which would help to reverse a multi-quarter stretch of shrinking net interest margins — a stretch brought on by the Fed's efforts to keep rates low in order to juice economic activity and bolster the job market.

SNL Financial took a look at the largest bank holding companies doing business in the U.S. and found that the majority have positive gap ratios — a positive ratio indicates a lender is asset sensitive — including megabanks JPMorgan Chase & Co., Bank of America Corp. and in particular Wells Fargo & Co., which for the first quarter boasted a one-year gap ratio of 31.24%. Several large regional banks also have favorable ratios. Citigroup Inc. stands apart with a negative ratio.

Wells and others have shied away from short-term profits made by investing heavily in assets that re-price long-term with an expectation of boosting profits when rates rise.

That noted and despite recent rate climbs and anticipation of more, Wells, for one, is not yet betting on a steady climb in rates this year.

"What we saw this quarter is exactly what we saw last quarter," Wells CFO Timothy Sloan said while speaking at a conference this month, noting that rates rose some earlier this year before falling again and hovering around historic lows. He cautioned that, like last quarter, rates could fall again before eventually climbing steadily. "I don't know where rates are going to go."

One big concern is that rates rise too fast. Former FDIC Chairman Sheila Bair said that risk is her top worry for big banks. A sudden and big jump in rates could hammer institutions with large bond portfolios and jack up the costs of borrowing to a level that loan demand could sink. In that scenario, it would not matter that loans would be more profitable with higher rates because banks would not have enough customers to lend to in order to grow their books.

"Interest rates have been low for a really long time and the bond markets are overinflated," The Wall Street Journal, which hosted Bair at a conference this week in Washington, quoted the former regulator as saying.

JPMorgan Chairman and CEO Jamie Dimon, speaking at a different conference this month, said timing a steady rate rise is difficult and he suggested that a spike in rates would of course be unwelcome. But, he added, a rate rise looms. When the economy gathers momentum and unemployment comes down another percentage point from the 7.6% level it is at now, the Fed will have to pull back on its stimulus efforts, and increasing economic activity will naturally push rates up — likely via a series of steps toward a historical average as opposed to a feared surge.

"You all should be ready because rates are going to go up," Dimon said. "The best case to me is that America starts to grow … 300,000 jobs a month for five or six months, unemployment is coming down. … We will all applaud a normalization of rates under a good scenario like that. … And if that happens and we are booming and the economy is up and people have jobs and profitability is high, which is what happens when the economy starts to grow rapidly, no one is going to care."

In that case, the likes of JPMorgan will be able to lend more, because of the stronger economy, and they will earn more on those loans because of the higher rates.

The normalization itself could create "some volatility in the marketplace," Dimon cautioned. "Again, that's okay, you're just going to read about it all the time. There is going to be more bond volatility, people get — some people get very nervous about it. People have to re-hedge portfolios. But if it's all in the normalization under the good environment or even close to a good environment, we'll be fine. I would prefer to see normalization sooner under a good environment."

But will that be this year or next?

Ablin said the Fed seems to be saying one thing while doing another.

Investors, he said in an email, "should pay more attention to what the central bank does versus what it says. Since the introduction of the Fed's quantitative easing program last September, the unemployment rate, Bernanke's "barometer of success, has ticked down a scant 0.2% [and] a far cry from the desired 6.5% figure that is often mentioned as a policy goal."

Bernanke, he added, "would like to keep the pedal to the floor with stimulus in an effort to spur as much growth and employment for as long as possible," Ablin continued. "At the same time, the Fed will continue to employ a Federal 'Open Mouth' policy" — reminding investors that a stimulus tapering is coming at some point — "to keep stocks and housing from rising too much further above fair value. This 'watch-what-we-do, not-what-we-say' policy will likely continue as long as the Fed can effectively manage the markets."

| Working Capital Loans $10,000-$250,000 | |

|

|

[headlines]

--------------------------------------------------------------

Texas Court Puts Road Block in Way of Servicer

Suing on Behalf of Creditor

By Tom McCurnin

Leasing News Legal News Editor

Sub-Servicer’s Suit Against Borrower Sidetracked by Texas Court Which Considers Whether Sub-Servicer Actually Owned Rights to Service Loan

Green Tree Servicing v Woods, 2012 wl 3222360 (Tex. Ct. App. 2012).

How many times has a Servicer gone into court and sued on behalf of the owner of the stream of payments? Hundreds of thousands of times? How many times has a borrower actually contested the right of the servicer to sue? Not many times.

But in today’s case, a clever borrower’s attorney contested the standing of a sub-servicer with some measure of success and almost got away with it. The facts follow:

Ralph Woods bought a manufactured home from Palm Harbor Homes, who assigned the contract to Green Tree. Green Tree, in turn, assigned the contract to Conseco Finance Corp. What happened next is confusing. Conseco assigned the contract, along with others to U.S. Bank, as trustee for a securitization pool. Conseco and U.S. Bank also entered into a servicing contract which purported to give the servicing rights back to Conseco, who in turn appointed Green Tree as the successor servicer. Green Tree, in turn, assigned the servicing rights to a related entity, Green Tree Servicing.

When Woods defaulted, Green Tree Servicing sued Woods, who defended the action claiming (1) Green Tree lacked standing to sue them, (2) that Green Tree had no capacity to sue them, and (3) there was no proper chain of title from the original seller to Green Tree.

Surprisingly, Green Tree offered little in the way of documentary evidence to establish the chain of title, at least to the satisfaction of the trial court, which summarily entered judgment in favor of the borrower. Green Tree appealed.

On appeal, the Court of Appeals reversed the trial court holding that the record of the various transfers was so confusing, that the Court was uncertain as to the chain of title, and therefore, summary judgment was inappropriate. Usually, if one of the parties fails to meet their burden of proof, the appellate court will simply affirm. Here, it’s as if Woods was required to disprove Green Tree’s standing, so the Court of Appeal bailed out the Servicer.

I’ve been involved in enough securitizations to know that the chain of title is confusing, from the original lessor, to a special purpose entity, to a pool, to a trustee for the pool, to a servicer, and ultimately to a sub-servicer. And often the paper is assigned “for purposes of collection only.” And if one actually tries to locate the original lease or contract, it’s a miracle if the trustee will let loose of the paper, or in a worst case scenario, the contract cannot be located or is illegible.

The lessons here for those servicers that have the power to sue the borrower seem obvious—get your paper trail to the servicer perfected before the servicer files suit. Here, the process took over a year from lawsuit to appeal and back. Wouldn’t it have been easier to just line up the papers in advance? Alternatively, if the servicer is in a particularly nasty piece of litigation, then pull out the original contract or lease and get the named lessor on the contract to assign it to the current owner via an "alonge" or a series of "alonges" (a paper evidencing assignment attached to the contract). At least at that point, the servicer can point to the alonges on the contract itself without resorting to a series of biblical purchase agreements, often with illegible or missing schedules.

Here the record was such a mess, that two courts couldn’t figure it out and the Court of Appeals bailed out the Servicer. They must have been living right, but it didn’t have to be that way with a little foresight.

Conseco Finance Servicing Corp. Case

http://www.leasingnews.org/PDF/ConsecoFinance_6242013.pdf

Tom McCurnin is a partner at Barton, Klugman & Oetting in Los Angeles, California.

Tom McCurnin

Barton, Klugman & Oetting

350 South Grand Ave.

Suite 2200

Los Angeles, CA 90071

Direct Phone: (213) 617-6129

Cell (213) 268-8291

Email: tmccurnin@bkolaw.com

Visit our web site at www.bkolaw.com

Previous Tom McCurnin Articles:

http://www.leasingnews.org

Previous Tom McCurnin Articles:

http://www.leasingnews.org/Conscious-Top%20Stories/leasing_cases.html

[headlines]

--------------------------------------------------------------

Credit unions continue record strong membership growth

By Harish Mali and Kiah Lau Haslett

The credit union industry saw impressive membership growth by adding 677,000 members during the first quarter of 2013

The nonprofit institutions have increased the total number of members to 95.7 million as of March 31, an increase of 2.11% from 93.8 million one year ago. The industry reported quarterly increase of more than 600,000 members in four of the last five quarters. Credit unions have added 2.7 million members in the last five quarters, which is greater than the combined total of previous 11 quarters.

Anthony Demangone, Senior Vice President and COO of the National Association of Federal Credit Unions (NAFCU), claimed the credit union industry still basks in the benefit of National Bank Transfer Day and a discontent with large money-center banks. Activity ahead of the October 2010 grassroots movement nearly broke the servers of the NAFCU's credit union locator website, he said.

Total membership growth had been less than 1% at federal credit unions prior to the October 2010 grassroots movement; he said it now remains more than 2%. The representative association for federal credit unions also made promotional videos available to members and continues "a not new" push on strategic growth discussions at annual conferences. The push, while technically not a recently implemented effort, may finally be sinking in with credit union conference attendees.

The trickle-down of banking and imaging technology has also played a role in keeping credit unions, which generally tend to be focused in membership and modest in asset size, competitive with larger financial institutions. Many credit unions belong to nationwide ATM networks, and many also offer Internet and mobile banking, complete with remote deposit capture capability.

"Your members can reach you now five or six different ways that they never could before," said Demangone. "It really has allowed the Davids to get in there and mix it in with the Goliaths."

Demangone also said more credit unions are focusing on onboarding new members, borrowing a word typically associated with new hires and employment. New members who may have only joined for a specific product such as a car loan are oriented and introduced to other features of the institution, as early as 90 days to six months of membership. The orientation efforts are intended to grow the financial relationships with the new members in hopes of gaining more wallet-share and deposits.

SNL Financial picked out top credit unions with the highest membership growth in both percentage terms and total number during the twelve months ended March 31, 2013. The list of the credit unions with the highest percentage growth is limited to those with at least 10,000 members at March 31, 2013. Almost all saw positive effect of membership growth on their loans and deposits.

The largest credit union in the country, Vienna, Va.-based Navy Federal Credit Union tops the list with the highest increase in number of members. The institution grew its members by 10.15% or 0.4 million to 4.3 million at March 31, 2013 from 3.9 million a year ago. Navy FCU was also able to transform that increase into more business. During the same period, it recorded double-digit growth rates in its loans and deposits of 11.33% and 11.19%, respectively.

Navy FCU is more than double in size than its closest rival, Raleigh, N.C.-based State Employees' Credit Union. This second largest credit union also appeared on the list in the fourth spot by adding 67,080 members during the year ended March 31, 2013. The credit union faced rough water last year due to the confusion stemming from an NCUA official's comment about its health, but it soon after that cleared the air. The institution launched SECU Life Insurance Company this year.

Greenbelt, Md.-based Educational Systems Federal Credit Union chose to grow non-organically by combining with Derwood, Md.-based Montgomery County Teachers FCU. The deal more than doubled its members to 90,104 at March 31, compared to 39,800 one year ago. It stood fourth on the list of highest increase in number of members and second highest in terms of percentage growth.

Another non-organic grower, Columbus, Ohio-based Pathways Financial Credit Union Inc. recorded the highest percentage growth in members during the year ended March 31, 2013. Erstwhile Powerco Credit Union was christened as Pathways Financial CU after an uncommon three-way merger with Columbus, Ohio-based Members First Credit Union and Columbus, Ohio-based Western Credit Union Inc. in September 2012. The new institution subsequently finished two more acquisitions soon after, acquiring Columbus, Ohio-based Burgess & Niple Employees Credit Union and Marysville, Ohio-based WECU Credit Union.

All of the credit unions, save one, on the list of the highest percentage growth in members were between $50 million to $500 million in size and almost all of them saw growth in lending during the twelve months ended March 31, 2013.

![]()

|

[headlines]

--------------------------------------------------------------

--------------------------------------------------------------

Chihuahua

Murray, Utah Adopt-a-Dog

DUKE - ID#A046219

“I am a neutered male, tan and white Chihuahua - Smooth Coated.

“The shelter staff think I am about 3 years old.

“I have been at the shelter since Feb 02, 2013.”

This is a very cute, energetic dog. Please see video:

Video

www.youtube.com/watch?feature=player_embedded&v=oZJ78BBcZXY

Adoption Process:

http://www.utahhumane.org/adoptions/adoption-process

application:

www.utahhumane.org/sites/default/files/docs/Adoption%20Application.pdf

Human Society of Utah

(801) 261-2919

4242 S. 300 W. Murray, UT 84107

Adoption Hours

Monday - Saturday: 10:00 AM - 7:00 PM

Sunday: 12 Noon - 4:00 PM

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

Car Leases gain popularity across market

http://www.daytondailynews.com/news/business/leases-gain-popularity-across-market/nYRcs/

Out-of-Northeast Ohio banks buying roots in region

http://www.crainscleveland.com/article/20130623/SUB1/306249986

Wells Fargo Wins SBA’s 2013 7(a) ---Large Lender of the Year Award

http://www.cutimes.com/2013/06/21/wells-fargo-wins-sbas-2013-7a-large-lender-of-the

Watch Movies for Free

http://vodly.to/

[headlines]

--------------------------------------------------------------

---You May Have Missed

The Paperless Office

http://www.qsrmagazine.com/sustainability/paperless-office

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

3-Minute Leg Stretching Routine on Mat

http://www.sparkpeople.com/resource/videos-detail.asp?video=93

[headlines]

--------------------------------------------------------------

Baseball Poem

A Baseball Game (Free verse)

The ump showed up early.

Sharply dressed

His pants, meticulously creased.

His gold watch glinting in the 4 o'clock

End of March southern California sun.

He held a sour look

It was his first line of defense.

The manager of the Astros

Was what you might call

An easy going type.

A long-time bachelor, and a slob to boot.

He always had a quick sly grin

Popped his gum unceasingly.

His face like an old first-baseman's glove;

Tanned brown with wear,

The stitching undone,

Staggeringly wrinkled from so much daily use.

He strolled over to home,

Tugging at the bottom of his extra-large shirt

Which barely covered the expanse of his girth,

Slapped the ump on the back

and announced that the teams

were a little behind getting the field ready

and could we start the game at a quarter past?

The ump looked at his watch without saying a word

Held up his right hand for a moment,

Then brought it down like an ax,

"Play Ball!" he shouted

2 inches from the Astros manager's leathery face.

[headlines]

--------------------------------------------------------------

Sports Briefs----

Clippers, Celtics reach deal for Rivers

http://espn.go.com/nba/story/_/id/9415256/los-angeles-clippers-agree-principle-doc-rivers-deal-sources

Serena apologized to Sharapova

http://espn.go.com/tennis/story/_/id/9414508/serena-williams-already-apologized-maria-sharapova

Cops scour Hernandez mansion for clues

http://bostonherald.com/news_opinion/local_coverage/2013/

[headlines]

--------------------------------------------------------------

![]()

California Nuts Briefs---

LA mayor exits after bumpy term, looking ahead

http://www.sacbee.com/2013/06/23/5517810/la-mayor-exits-after-bumpy-term.html

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

Loire shows off Sauvignon skills

www.thedrinksbusiness.com/2013/06/loire-shows-off-sauvignon-skills/

Wine tourism growing in France

www.shelbynews.com/articles/2013/06/21/news/doc

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1497-the first European to set foot on the North American continent after the Vikings was John Cabot ( also spelled Cabot, Cabotto, Caboote, Gabote, Calbot, or Talbot), a mariner who was probably born in Genoa, Italy. In 1496, King Henry VII of England granted Cabot a charter to sail west to Asia and set up a spice-trade monopoly. Cabot's ship, a 70-foot caravel called the Matthew, embarked from Briston, England, on May 27, 1497, and arrived on the coast of Newfoundland---or possibly Maine---on June 24. After planting the English and Venetian flags, Cabot and his men spent a few hours exploring the landing site, then returned to their ship.

http://www.nmm.ac.uk/education/fact_files/fact_cabot.html

http://etext.lib.virginia.edu/journals/EH/EH33/croxto33.html

1579-the first Christian religious service in English on the Pacific Coast was the Holy Communion service conducted at San Francisco Bay, CA, by the Reverend Francis Fletcher, who read from the Book of Common Prayer of the Church of England. Fletcher was chaplain on Sir Francis Drake's ship, the Golden Hind, during its voyage of cirumnagation from 1577 to 1580. Drake named the place Nova Albion, Latin for New England. A 57 foot marble cross commemorates the event in Golden Gate Park, San Francisco, Ca. There is a controversy this day to where he actually anchored, many think it is Bolinas Bay in Marin County, as his log so indicates, and a plaque so describes ( but that is another story ). He navigated the North Coast of California.

http://www.longcamp.com/nav.html

1647-The first woman in America to appeal for the right to vote was Margaret Brent, a niece of Lord Baltimore, the founder of the colony of Maryland. She came to America from England in January,1638, and was the first woman in Maryland to own property in her own name. She became one of the colony's principal landowners and a person of influence, raising troop of soldiers in 1644. On June 24, 1647, she appealed for the right to vote in the colonial assembly by virtue of her position as secretary to Governor Leonard Calvert, asking for a “place and voyce,” but was ejected from the meetings. At the death of Calvert, she became his executor and acting governor, president over the General Assembly, but was refused a voice in the affairs of the government as “it would set a bad example to the wives of the colony.” She moved to Virginia in 1650.

http://www.earlyamerica.com/review/1998/brent.html

1675 – In colonial New England, King Philip’s War begins when a band of Wampanoag warriors raid the border settlement of Swansee, Massachusetts, and massacre the English colonists there. In the early 1670s, 50 years of peace between the Plymouth colony and the local Wampanoag Indians began to deteriorate when the rapidly expanding settlement forced land sales on the tribe. Reacting to increasing Native American hostility, the English met with King Philip, chief of the Wampanoag, and demanded that his forces surrender their arms. The Wampanoag did so, but in 1675 a Christian Native American who had been acting as an informer to the English was murdered, and three Wampanoag were tried and executed for the crime. King Philip responded by ordering the attack on Swansee on June 24, which set off a series of Wampanoag raids in which several settlements were destroyed and scores of colonists massacred. The colonists retaliated by destroying a number of Indian villages. The destruction of a Narragansett village by the English brought the Narragansett into the conflict on the side of King Philip, and within a few months several other tribes and all the New England colonies were involved. In early 1676, the Narragansett were defeated and their chief killed, while the Wampanoag and their other allies were gradually subdued. King Philip’s wife and son were captured, and on August 12, 1676, after his secret headquarters in Mount Hope, Rhode Island, was discovered, Philip was assassinated by a Native American in the service of the English. The English drew and quartered Philip’s body and publicly displayed his head on a stake in Plymouth. King Philip’s War, which was extremely costly to the colonists of southern New England, ended the Native American presence in the region and inaugurated a period of unimpeded colonial expansion.

1714-considered the birthday of Matthew Thorton, signer of the Declaration of Independence, born at Ireland . He died this date ,1803,at Newburyport, MA. http://www.ushistory.org/declaration/signers/thornton.htm

1813-birthday of Henry ward Beecher, famous American clergyman and orator, born at Lichfield, CT. Died March 8, 1887, at Brooklyn, NY. His dying words were, “ Now comes the mystery.”http://www.spartacus.schoolnet.co.uk/USASbeecher.htm

1816 - The cold weather of early June finally gave way to several days of 90 degree heat in Massachusetts, including a reading of 99 degrees at Salem.

1842 -- Ambrose Bierce born (1842-1914) Meigs County, Ohio. American newspaper columnist, satirist, essayist, short-story writer and novelist, disappeared in the Mexican Revolution. Presumably died in the siege of Ojinega, January 1914. Strongly influenced by Edgar Allan Poe. His experiences in the Civil War marked him for life.

http://www.literature-web.net/bierce

http://www.creative.net/~alang/lit/horror/abierce.sht

1846-Col. Castro's forces from Monterey, under the command of Joaquín de la Torre, fought the "Battle of Olompali" north of San Rafael with Frémont's troops from Sonoma. Two Americans and five or six Californios were killed. (one time home of the Grateful Dead)

http://www.parks.ca.gov/default.asp?page_id=22728

http://www.chezbabcock.com/genealogy/histories/Olompali.txt

1850--The San Francisco Town Council passed an ordinance for the proper organization of the Fire Department. Rules and regulations were adopted for the first time. Destruction by fire was common in the West, as it was earlier in the East, and having a fire department was paramount for survival in a city due to all the buildings being made of wood and light by gas or oil wick.

1864 – Colorado Governor John Evans warns that all peaceful Indians in the region must report to the Sand Creek reservation or risk being attacked, creating the conditions that will lead to the infamous Sand Creek Massacre.

1869-Abolitionist Mary Ellen "Mammy" Pleasant is named Voodoo Queen of San Francisco. http://www.kn.pacbell.com/wired/BHM/mepleasant.html

1880- Agnes Nestor birthday - U.S. labor leader. AN emerged as the leader of the 1898 women glove-maker's strike in Chicago when she was only 18. The strike victory ended the pay deduction women had to pay for the rental of the machines the women used to sew gloves. A short time later she led the women into their own union because men did not always support women's needs. She held posts with the International Glove Workers Union for the rest of her life and served as president of the Chicago Women's Trade Union League 1913-1948. She was a long time advocate of the eight-hour day that became a reality in 1937. Child labor, minimum wage, maternity-health, and women's suffrage were also part of her life's work.

http://www.kentlaw.edu/ilhs/images/hall/nestor.jpg

http://womenshistory.about.com/gi/dynamic/offsite.htm?site=

http://www.spartacus.schoolnet.co.uk/USAWkenney.htm

http://historymatters.gmu.edu/d/5728/

http://www.spartacus.schoolnet.co.u

http://womenshistory.about.com/library/bio/blbio_nestor_agnes.htm k/USAWnestor.htm

1880, "O Canada," with music by Calixa Lavallee and French lyrics by Judge A.B. Routhier, was performed for the first time at the Skaters' Pavilion in Quebec City. Three bands, playing together, performed "O Canada" during a banquet at a national convention of French Canadians. Canada's future national anthem was reported to have been received enthusiastically.

1885-the first Episcopal bishop who was African-[American was the Reverend Samuel David Ferguson, who was elected to the House of Bishops of the Protestant Episcopal Church. He was consecrated in 1885, at Grace Church, New York City as the successor of the Missionary Bishop of Liberia.

http://newark.rutgers.edu/~lcrew/blackexperience.html

1895-birthday of William Harrison “Jack” Dempsey, boxer born at Manassa, CO. Dempsey boxed under several pseudonyms in western mining camps, came east and picked up Jack “Doc” Kearns as his manager. After defeating all available heavyweights, Dempsey took on champion Jesse Williard in Toledo, OH, on July 4, 1919. Dempsey won when Willard failed to answer the bell for the fourth round. He reigned as champ for seven years but defended his title only six times, losing to Gene Tunney in 1926. Following his boxing career, he became a successful New York restaurateur. Died at New York, NY, 1983.

900-Blues singer-guitarist Memphis Minnie born Algiers, LA.

http://www.blueflamecafe.com/index.html

http://www.ping.be/ml-cmb/mmindex.htm

1916-birthday of John Ciardi, American poet, citric, translator, teacher, etymologist and author of children's books, born at Boston, MA. John Anthony Ciardi's criticism and other writings were often described as hones and sometimes as harsh Died at Edison, NJ, March 30, 1986.

http://www.poets.org/poets/poets.cfm?prmID=697&CFID=9794231

&CFTOKEN=6584556

1916 - The most lucrative movie contract to the time was signed by actress, Mary Pickford. She inked the first seven-figure Hollywood deal. Pickford would get $250,000 per film with a guaranteed minimum of $10,000 a week against half of the profits, including bonuses and the right of approval of all creative aspects of her films. Not a bad deal for the former vaudeville and stage actress, who once appeared on Broadway with Cecil B. DeMille in "The Warrens of Virginia" for a measly $25 a week.

1917- Portia White birthday - Afro-Canadian concert and operatic contralto. Died 1968.

http://www.ac.wwu.edu/~jay/pages/docs/who.html

http://www.acappellacanada.ca/cdwhite/portia.html

1922 - The American Professional Football Association took on a new name. They decided to name themselves the National Football

1924 - Six men at a rock quarry south of Winston-Salem, NC, sought shelter from a thunderstorm. The structure chosen contained a quantity of dynamite. Lightning struck a near-by tree causing the dynamite to explode. The men were killed instantly. League.

1929-Bessie Smith records sound-track for her only movie, “St. Louis Blues.”

http://www.blueflamecafe.com/index.html

1930-Dr. Albert Hoyt Taylor and Leo C. Young of the Naval Aircraft Radio Laboratory, Anacostia, DC (now part of Washington DC), discovered radar by noting that airplanes reflect radio waves even though they fly above the transmitter and receiver, rather than between them.

1931- Lili de Alvarez shocks social propriety by playing at Wimbledon in shorts instead of the longish, hampering dresses that were de rigueur.

1936-Mary Jane McLeod Bethune, born in Mayesville, SC, in 1875, the daughter of slaves, became the first Federal administrator who was an African-American woman. President Franklin Delano Roosevelt named her director of the Negro Division of the National Youth Administration, thus becoming the first African-American woman to receive a major federal appointment. In 904, Bethune founded the Daytona Normal and Industrial Institute for Negro Girls, later known as Bethune-Cookman College, located in Daytona Beach,Fl. She was also the founder and first president of the National Council of Negro Women. In 1991, he home and offices in Washington, DC, were designated a national historic landmark.

http://www.whitehouse.gov/kids/dreamteam/marybethune.html

http://www.nahc.org/NAHC/Val/Columns/SC10-6.html

1942- Mick Fleetwood, drummer with Fleetwood Mac, was born in London. Originally a blues band when it was formed in 1965, Fleetwood Mac developed into a pop group that put out one of the world's best-selling albums, "Rumours," in 1977. It sold 15-million copies. In 1980, Mick Fleetwood recorded a solo album in Ghana with African musicians. Fleetwood Mac made a comeback in 1987 with the album "Tango in the Night."

1944-- Jeff Beck, one of the great rock guitarists, was born in Surrey, England. Beck's first important band was the Yardbirds, where he was the replacement for Eric Clapton in 1964. In 1967, he formed the Jeff Beck Group with Rod Stewart and Ron Wood. The beginnings of heavy metal could be heard in the group's blues-based songs. The Jeff Beck Group broke up after only two albums, and Beck was then sidelined for 18 months with a fractured skull suffered in a car accident. A new Jeff Beck Group put out two more LPs before Beck formed a band with two former members of Vanilla Fudge, Tim Bogert and Carmen Appice. But that group dissolved as well, in 1974. Beck then began playing fusion music, often in collaboration with keyboards player Jan Hammer. Jeff Beck has made only rare appearances since 1980, but his aggressive style has heavily influenced rock guitarists who followed him.

1944—Pianist Bruce Johnston was born in Chicago. He joined the touring version of the group in 1965 when Brian Wilson decided to quit touring after a nervous breakdown. Johnston has continued to be associated with the Beach Boys over the past quarter century, both as performer and producer.

http://www.allmusic.com/cg/x.dll?UID=2:55:11|PM&p=amg&sql=B18553

http://www.del-fi.com/albumcovers/ac71228.html

(My high school friend, who also played piano in my band, and he would reciprocate when someone was sick in his band and he needed a replacement. I ran into him in Monterey and he did not remember me, but of course, I not only wear glasses now, weigh fifty pounds more—in high school I weighed 144, plus am bald, and go by the name of “Kit,” as I forgot in high school and college I was known by Larry, named after my father. I called myself Kit to him. )

1948-In the early days of the Cold War, the Soviet Union challenged the West's right of access to Berlin. The soviets created a blockade, and an airlift to supply some 2,250,000 people resulted. The airlift lasted a total of 321 days and brought into Berlin 1,592,787 tons of supplies. Joseph Stalin finally backed down and the blockage end May 12, 1949.

1948-Thomas Dewey of New York became the first presidential candidate to be re-nominated after a defeat. He lost to Franklin Delano Roosevelt in 1944 and won re-nomination this day in 1948. He was defeated in the 1948 election by Harry S. Truman, Roosevelt's vice-president who assumed office after the death of the president in office. The newspapers of the day had printed up early morning editions that “Dewey Won,” but Truman who stomped for election all over the United States pulled one of the biggest American political upsets. He won 24,104,836 popular votes to Dewey's 21,969,500; the electoral vote was 304 to 189. Dewey actually received 22,006,285 votes in 1944 but only 99 electoral

votes. In the 1948 election, Strom Thurmond, States Right Democrat, 1,169,312; Henry A. Wallace, Progressive, 1,157,172, which pollsters said would draw votes from Truman in the South. The key was Truman went out and worked for the votes, train stop- to-train stop, where the mustached Dewey and his advisors thought he had the election in the bag.

1949-“Hopalong Cassidy” premiered on television this day in 1949. A western series starring William Boyd in the title role as a hero who wore black and rode a white horse, Topper. The original episodes were segments edited from 66 movie features of Hopalong Cassidy and his sidekick, Red Connors ( Edgar Buchanan). The films were so popular that Boy produced episodes especially for TV with Gabby Hayes as his sidekick. During his reign, Hoppy had many sidekicks. It was popular for us boys to wear his two six guns and black hat. Television was about to introduce many Western heroes, as all the Saturday Western movies were brought back to the tube.

http://www.yesterdayland.com/popopedia/memories/show

_mem.php?ID=S1564

1951---*BENNETT, EMORY L. Medal of Honor Rank and organization: Private First Class, U.S. Army, Company B, 15th Infantry Regiment, 3d Infantry Division. Place and date: Near Sobangsan, Korea, 24 June 1951. Entered service at: Cocoa, Fla. Born: 20 December 1929, New Smyrna Beach, Fla. G.O. No.: 11, 1 February 1952. Citation: Pfc. Bennett a member of Company B, distinguished himself by conspicuous gallantry and intrepidity at the risk of his life above and beyond the call of duty in action against an armed enemy of the United Nations. At approximately 0200 hours, 2 enemy battalions swarmed up the ridge line in a ferocious banzai charge in an attempt to dislodge Pfc. Bennett's company from its defensive positions. Meeting the challenge, the gallant defenders delivered destructive retaliation, but the enemy pressed the assault with fanatical determination and the integrity of the perimeter was imperiled. Fully aware of the odds against him, Pfc. Bennett unhesitatingly left his foxhole, moved through withering fire, stood within full view of the enemy, and, employing his automatic rifle, poured crippling fire into the ranks of the onrushing assailants, inflicting numerous casualties. Although wounded, Pfc. Bennett gallantly maintained his l-man defense and the attack was momentarily halted. During this lull in battle, the company regrouped for counterattack, but the numerically superior foe soon infiltrated into the position. Upon orders to move back, Pfc. Bennett voluntarily remained to provide covering fire for the withdrawing elements, and, defying the enemy, continued to sweep the charging foe with devastating fire until mortally wounded. His willing self-sacrifice and intrepid actions saved the position from being overrun and enabled the company to effect an orderly withdrawal. Pfc. Bennett's unflinching courage and consummate devotion to duty reflect lasting glory on himself and the military service.

1951 - Twelve inches of hail broke windows and roofs, and dented automobiles, causing more than fourteen million dollars damage. The storm plowed 200 miles from Kingmand County KS into Missouri, with the Wichita area hardest hit. It was the most disastrous hailstorm of record for the state of Kansas.

1951—Top Hits

Too Young - Nat King Cole

On Top of Old Smokey - The Weavers (vocal: Terry Gilkyson)

How High the Moon - Les Paul & Mary Ford

I Want to Be with You Always - Lefty Frizzell

1952- President Harry Truman signs the bill that directs women be commissioned officers in the Army, Navy, and Air Force as various medical specialists such as dentists, doctors, osteopaths, and veterinarians.

1952 - Thunderstorms produced a swath of hail 60 miles long and 3.5 miles wide through parts of Hand, Beadle, Kingsbury, Miner and Jerauld counties in South Dakota. Poultry and livestock were killed, and many persons were injured. Hail ten inches in circumference was reported at Huron SD

1952 - Eddie Arcaro set a thoroughbred racing record for American jockeys by winning his 3,000th horse race.

1953 - Al Kaline signed with the Detroit Tigers on this day (following his graduation from high school). The future all-star of the Tigers was 18 years old. http://www.baseballhalloffame.org/hofers_and_honorees/

hofer_bios/kaline_al.htm

1955- In an effort to speed up the game, primarily for television viewers, major league baseball announces a new rule which requires a pitcher to deliver the ball within 20 seconds after taking a pitching position.

1957-Duke Ellington and Ella Fitzgerald session on Verve “ Take the A Train.”

1959—Top Hits

Personality - Lloyd Price

Lonely Boy - Paul Anka

Along Came Jones - The Coasters

The Battle of New Orleans - Johnny Horton

1961-President John F. Kennedy assigned Vice-President Lydon Johnson with

unifying the US satellite program, who played a significant role in bringing the

communication and space age to a leader in the world.

http://memory.loc.gov/ammem/today/jun24.html

1962- The longest game ever played in Yankee history ends thanks to a home run hit by Jack Reed in the 22nd inning. The Mississippi native's lone big league career homer helps the Bronx Bombers beat Detroit in Tiger Stadium, 9-7.

1964--Sam Cooke starts a two week stay at New York's Copacabana Club. A 70-foot billboard announcing the engagement is erected in Times Square

1966--Lenny Bruce Mothers of Invention @ S.F. Fillmore Auditorium

Artist: Wes Wilson & Edmund Shea

http://www.wolfgangsvault.com/dt/lenny-bruce-postcard/BG013-PC.html

1966--Show: Zig-Zag Man Big Brother and the Holding Company Quicksilver Messenger Service

Bill Ham @ SF Avalon Ballroom

Artist: Stanley Mouse

http://www.wolfgangsvault.com/dt/big-brother-and-the-holding-company-poster/FD014-PO.html

1966--- John Lennon's second whimsical book of original prose, poetry, and drawings, entitled A Spaniard In The Works, is published in his native England

1966--- In an watershed moment for the brother/sister duo later known as the Carpenters, the jazz combo known as the Richard Carpenter Trio wins the Hollywood Bowl's "Battle of the Bands" contest.

1966--- With the McCoys and the Standells opening, the Rolling Stones' 1966 tour begins at the Manning Bowl in Lynn, Massachusetts, inciting yet another crowd riot that the police counteract with tear gas. Rock concerts are banned from the venue for nearly two decades.

1967-- 5th Dimension make their TV debut performing their hit single "Up, Up And Away" on ABC's American Bandstand.

1967 -- Guitarist Zal Yanovsky quits the Lovin' Spoonful after their gig at the Forest Hills Music Festival in New York.

1967-Procol Harum's "A Whiter Shade of Pale" enters the Billboard chart, where it will peak at #5. The song was written by the band around a melody composed by the group's organist, Matthew Fisher, who was inspired by the chord progression of Johann Sebastian Bach's "Orchestral Suite in D", composed between 1725 and 1739.

1967—Top Hits

Groovin' - The Young Rascals

She'd Rather Be with Me - The Turtles

Windy - The Association

All the Time - Jack Greene

1968 - Jim Northrup becomes the sixth big leaguer to hit two grand slams in the same game. The “Slammer’s” power surge in the fifth (off Eddie Fisher) and sixth (off Billy Rohr) frames enables the Tigers to rout the Indians at Cleveland Stadium, 14-3.

1970-On an amendment offered by Senator Robert Dole (R-Kansas) to the Foreign Military Sales Act, the Senate votes 81 to 10 to repeal the Tonkin Gulf Resolution. In August 1964, after North Vietnamese torpedo boats attacked U.S. destroyers (in what became known as the Tonkin Gulf incident), President Johnson asked Congress for a resolution authorizing the president "to take all necessary measures" to defend Southeast Asia. Subsequently, Congress passed Public Law 88-408, which became known as the Tonkin Gulf Resolution, giving the president the power to take whatever actions he deemed necessary, including "the use of armed force." The resolution passed 82 to 2 in the Senate, where Wayne K. Morse (D- Oregon) and Ernest Gruening (D-Alaska) were the only dissenting votes; the bill passed unanimously in the House of Representatives. President Johnson signed it into law on August 10. It became the legal basis for every presidential action taken by the Johnson administration during its conduct of the war.

1972 - "I Am Woman", by Helen Reddy, was released by Capitol Records. The number one tune (December 9, 1972) became an anthem for the feminist movement. Reddy, from Australia, made her stage debut when she was only four years old. She had her own TV program in the early 1960s. Reddy came to New York in 1966 and has appeared in the films "Airport 1975", "Pete's Dragon" and "Sgt. Pepper's Lonely Hearts Club Band". Reddy also had four million-sellers: "I Am Woman", "Delta Dawn", "Leave Me Alone (Ruby Red Dress)" and "Angie Baby". She had a total of 14 hits on the pop music charts. http://www.helenreddy.com/

1972 --- At tonight's show in Fort Worth, TX, the Rolling Stones film the performance that would become the quadrophonic concert documentary Ladies And Gentlemen, The Rolling Stones..

1973-- After an extensive two-year investigation, 19 major music label heads, including Clive Davis of Arista and the Gamble-Huff team behind Philadelphia International, are indicted by the state of New Jersey for "payola" practices and income tax evasion

1973 -- Legendary rock organist Al Kooper rejoins his first band, Blues Project, onstage during a concert in Central Park.

1983-Pitcher Don Sutton of the Milwaukee Brewers struck out Alan Bannister of the Cleveland Indians, the 3,000th strikeout in his career. The Brewers won, 6-2. Sutton wound up his career with 3,574 strikeouts.

1973- In his first year of eligibility, Warren Spahn receives 316 of the 380 votes cast to become a member of the Hall of Fame. The southpaw, who recorded thirteen 20-win seasons, retired as the winningest left- handed pitcher in big league history with 363 victories.

1975—Top Hits

Love Will Keep Us Together - The Captain & Tennille

When Will I Be Loved - Linda Ronstadt

Wildfire - Michael Murphey

You're My Best Friend - Don Williams

1975--The U.S. Attorney in Newark, New Jersey hands down indictments to 19 music industry executives in a two year investigation. Counts of income tax evasion and payola are leveled. Among those named include: Clive Davis, former president of Columbia Records and Kenny Gamble and Leon Huff, architects of the Philadelphia sound of the 70's.

1977-Madison Wisconsin Police Detective Bruce Frey witnessed one of the strangest events of his career when he saw Elvis Presley jump out of his limo and stop two teenagers who were beating up a younger lad at a local gas station. Elvis said, "I'll take you on." Frey remembers; "They looked up at him, froze in mid-punch and the victim ran into the gas station." The pair quickly apologized and Elvis got back into the limo and headed for his hotel room at the Sheraton.

1980-- Nelson Doubleday and Fred Wilpon purchase the Mets for an estimated $21.1 million. The price tag is the highest amount ever paid for a baseball franchise.

1983—Top Hits

Flashdance...What a Feeling - Irene Cara

Time (Clock of the Heart) - Culture Club

Electric Avenue - Eddy Grant

You Can't Run from Love - Eddie Rabbitt

1984-Joe Morgan of the Oakland A's hit the 256th home run of his career to break the record held by Rogers Hornsby for most home runs by a second baseman.

1985 - The 1983 Heisman Trophy winner, Mike Rozier, jumped from the United States Football League to the Houston Oilers of the NFL. Rosier signed for more than two million dollars over a four-year period.

1987 - Thunderstorms spawned six tornadoes in eastern Colorado. Baseball size hail was reported near Yoder, CO, and thunderstorm winds gusting to 92 mph derailed a train near Pratt, KS. The town of Gould, OK, was soaked with nearly an inch and a half of rain in just ten minutes.

1988 - Forty-three cities reported record high temperatures for the date. Valentine NE reported an all-time record high of 110 degrees, and highs of 102 degrees at Casper, WY, 103 degrees at Reno, NV, and 106 degrees at Winnemucca, NV, were records for the month of June. Highs of 98 degrees at Logan, UT, and 109 degrees at Rapid City, SD, equaled June records. Lightning killed twenty-one cows near Conway, SC

1989- Paul Simon brought his "Graceland" tour to Moscow, playing the first of two concerts before 5,000 people in Gorky Park. It was Simon's first appearance in the Soviet Union.

1989-- The Beatles finally get a US #1 Country hit when Rosanne Cash's cover of "I Don't Want To Spoil The Party" reaches the top spot.

1991—Top Hits

Rush, Rush - Paula Abdul

Losing My Religion - R.E.M.

Unbelievable - EMF

The Thunder Rolls - Garth Brooks

1992 - Portland, Oregon became the first city outside of New York to host the NBA (National Basketball Association draft). At the Portland Memorial Coliseum, the first overall pick went to the Orlando Magic who picked 7'1" center Shaquille O'Neal of LSU.

1992-- Billy Joel's old alma mater, Hicksville High in Long Island, NY, awards the singer-songwriter an honorary diploma in place of the one he never stayed in school to receive.

1993-- Hank Williams' illegitimate daughter Jett, is awarded a piece of the country legend's estate from his son, Hank Jr.

1998 -- Johnny Cash makes his first public appearance since announcing his battle with Shy-Drager Syndrome, walking onstage at Kris Kristofferson's latest Nashville concert to sing Cash's hit "Sunday Morning Coming Down," written by Kris.

1998 - AT&T announced that it was buying cable TV giant TCI for $31.7 billion. The deal let AT&T move closer to its goal of providing local phone and high speed Internet service to millions of U.S. homes

1999-Eric Clapton puts 100 of his guitars up for auction in New York at Christie's to raise money for his drug rehab clinic, the Crossroads Centre in Antigua. His 1956 Fender Stratocaster, named Brownie, was sold for a record $497,500. The guitar was used to record "Layla." The auction helped raise nearly $5 million for the clinic.

2001-- Believed to be an historical first, sixty-eight major league umpires participate in a pre-season session to practice calling strikes as defined by the rule book. With the help of minor leaguers wearing tapes nine inches above their belts, the men in blue get a good look at pitches, normally called balls, which now will considered a strike as the correct interpret ion of the zone will be enforced this upcoming season.

2004 -- US President George W. Bush awards the Medal of Freedom to Doris Day.

2012----Billboard.com named Olivia Newton-John's 1982 hit, "Physical" as The Sexiest Song Of All Time. Other classic Rock songs that made the top ten were Rod Stewart's "Tonight's The Night", Marvin Gaye's "Let's Get It On", Donna Summer's "Hot Stuff" and another Rod Stewart contribution, "Da Ya Think I'm Sexy".

Stanley Cup Champions This Date

1995 New Jersey Devils

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Asset Management

Asset Management