Set Yourself Apart and Prosper

Interviewing highly skilled professionals Motivated by success, rooted in integrity Exclusive funding sources. Full Med/401(k) Click Herefor more information. Submit Resume To: smiscovich@stradacapital.com About the Company:

With over 10 years in business, Strada Capital Corporation exists to provide customized commercial finance solutions through our unique customer-centric approach. Our boutique firm is steadfast in providing personal attention, swift turnaround and extraordinary customer experiences. |

Monday, March 15, 2010

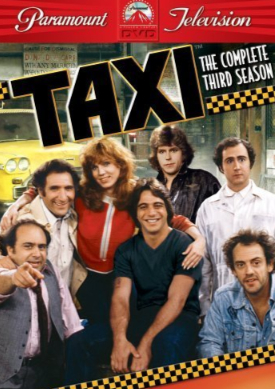

(Second from left)

Actor Judd Hirsch born March 15, 1935 Bronx, New York, most known for playing the characters Alex Rieger on the television comedy series Taxi (114 episodes, 1978-1983) and Alan Eppes on the current CBS series Numb3rs (114 episodes, 2005-2010). "Dear John" ((74 episodes, 1988-1992) "Delvecchio" (22 episodes, 1976-1977) and many other series and television shows since 1971 as well as Broadway "I'm Not Rappaport" and "Conversions with My Father." |

Headlines---

LEAF-Specialty–A Real Up-Date!

by Christopher Menkin

Classified Ads---Credit

Is the Broker/Discounter System Broken?

by Christopher Menkin

Leasing Companies out of the Broker Business

Randy Haug on NEFA Dallas Conference

Truck Repo’s Decline/Construction & Printing Up

Bank Beat---Florida's 4th, Louisiana 1st since 2002

Two New York City Bank Investors at Fault?

Classified Ads---Help Wanted

Top Stories March 8—12

Leasing 102 by Mr. Terry Winders, CLP

Vendor Support Agreements

Honolulu, Hawaii--Adopt-a-Dog

News Briefs---

GCR Leasing Judy DiVincenzo Resolved all complaints here, but...

BBB: F

Jeffery Taylor of Scottsdale, Ariz $200,000 on 12 credit cards

Falfurrias Capital Partners Invests in Commercial Credit Group

Apple iPad enjoys strong early interest

Tomato king sees his empire crumble

Simon's £1m egomobile

You May have Missed---

Sports Briefs---

"Gimme that Wine"

Today's Top Event in History

This Day in American History

Winter Poem

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

[headlines]

---------------------------------------------------------------

You May have Missed---

Simon's £1m egomobile

http://www.dailymail.co.uk/tvshowbiz/article-1257585/Simons-1m-egomobile-High-maintenance-miles-clock--does-love--wheels-woman.html

Former starting SF QB Hill traded to Lions

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2010/03/14/SPEV1CFR6P.DTL

Other NFL News:

http://content.usatoday.com/communities/thehuddle/index

Masoli-Embry Out for the Season at Ducks--Stealing

http://content.usatoday.com/communities/campusrivalry/post/2010/03/oregon-discipline-for-jeremiah-masoli-and-lamichael-james/1

http://blog.oregonlive.com/behindducksbeat/2010/01/jeremiah_masoli_garrett_embry.html

[headlines]

---------------------------------------------------------------

[headlines]

----------------------------------------------------------------

![]()

Today's Top Event in History

[headlines]

----------------------------------------------------------------

![]()

This Day in American History

1493 - Christopher Columbus returned to Spain, concluding his first voyage to the Western Hemisphere.

1697 - A band of Abnaki Indians made a raid on Haverhill, Massachusetts. Twenty-seven women and children were killed in the raid. Less than a week from childbed, Hannah Duston was captured along with her infant daughter and a nurse, Mary Neff. Hannah's husband managed to escape with their seven other children. The baby was brutally killed, and Hannah and Mary were taken northward by their captors. After a march of 100 miles, the party paused at an island (afterward known as Penacook, or Dustin, Island) in the confluence of the Merrimack and Contoocook rivers above the site of present-day Concord, New Hampshire. There the two women were held and told that after a short journey to a further village they would be stripped and scourged. On the island they met Samuel Lennardson (or Leonardson), an English boy who had been captured more than a year earlier. During the night of March 30, Hannah and the boy secured hatchets and attacked their captors; 10 were killed, 9 of them by Hannah. The three captives then stole a canoe and escaped, but Hannah turned back and scalped the 10 corpses so as to have proof of the exploit. They reached Haverhill safely and on April 21 presented their story to the General Court in Boston, which awarded the sum of 25 pounds to Hannah Duston and half that to each of her companions.

1744 - After signing the Second Family Compact with Spain, France joins the Spanish war against England. Known in the American colonies as King George’s War, and in Europe as the War of the Austrian Succession, this conflict will last until 1748. Hostilities between the French and the English in North America will continue to escalate.

1767- Andrew Jackson Birthday, 7th president of the US (Mar 4, 1829-Mar 3, 1837) was born in a log cabin at Waxhaw, SC. Jackson was the first president since George Washington who had not attended college. He was a military hero in the War of 1812. His presidency reflected his democratic and egalitarian values. Died at Nashville, TN, June 8, 1845. His birthday is observed as a holiday in Tennessee.

1781 - In the Battle of Guildford Courthouse, North Carolina, British General Cornwallis achieves a Pyrrhic victory over the American forces of General Greene and General Morgan. Cornwallis suffers such severe losses that he abandons the campaign to establish British control over the Carolinas. It is the largest, most hotly-contested action of the Revolutionary War's climactic Southern Campaign. Major General Nathanael Greene and his army of 4,400 Americans contested the British invasion of North Carolina at Guilford Courthouse. Lt. Gen. Charles, Earl Cornwallis, commanded the tough professional force of 1,900 British soldiers. Greene deployed his men into smaller groups to take advantage of the terrain. The Courthouse battle was fierce. The veteran British troops were severely crippled. Cornwallis lost a quarter of his army and almost a third of his officers. Greene lost only six percent of his men. With greatly diminished ranks and depleted supplies, Cornwallis withdrew to the coast, 200 miles away.

1783- General George Washington addressed a meeting at Newburgh, NY, of Continental Army officers who were dissatisfied and rebellious for want of back pay, food, clothing and pensions. General Washington called for patience, opening his speech with the words: "I have grown gray in your service." Congress later acted to satisfy most of the demands.

1820- Maine became the 23rd state, prior to this date it was part of Massachusetts. The name of the state comes for its first use to distinguish the mainland from islands offshore. Maine was also thought to be named in honor of Henrietta Maria, Charles I of England's queen. She owned a province in France titled, Mayne. Augusta is the capital of Maine (not Georgia). As part of the Missouri Compromise between the North and the South, Maine is admitted into the Union as the 23rd state. Administered as a province of Massachusetts since 1647, the entrance of Maine as a free state was agreed to by Southern senators in exchange for the entrance of Missouri as a slave state. In 1604, French explorer Samuel de Champlain visited the coast of Maine and claimed it as part of the French province of Acadia. However, French attempts to settle Maine were thwarted when British forces under Sir Samuel Argall destroyed a colony on Mount Desert Island in 1613. Sir Ferdinando Gorges, a leading figure in the Plymouth Company, initiated British settlement in Maine after receiving a grant and royal charter, and upon Gorges' death in 1647 the Massachusetts Bay Colony claimed jurisdiction. Gorges' heirs disputed this claim until 1677, when Massachusetts agreed to purchase Gorges' original proprietary rights. As part of Massachusetts, Maine developed early fishing, lumbering, and shipbuilding industries and in 1820 was granted statehood. In the 19th century, the promise of jobs in the timber industry lured many French Canadians to Maine from the Canadian province of Quebec, which borders the state to the west. With 90 percent of Maine still covered by forests, Maine is known as the "Pine Tree State" and is the most sparsely populated state east of the Mississippi River.

http://memory.loc.gov/ammem/today/mar15.html

1827-Freedom's Journal, first Black newspaper, published by John Russwurm and Samuel Cornish

http://www.shsw.wisc.edu/library/aanp/freedom/index.html

1848-"The Californian" reported gold was discovered along the American River at a sawmill owned by Capt. John A. Sutter. News was not widely believed in San Francisco.

1848-The San Francisco Californian of March 15, 1848, says: "We entertain several reasons why slavery should not be introduced here. First, it is wrong for it to exist anywhere. Second, not a single instance of precedence exists at present in the shape of physical bondage of our fellow men. Third, there is no excuse whatever for its introduction into this country (by virtue of climate or physical conditions). Fourth, Negroes have equal rights to life, liberty, health and happiness with the whites. Fifth, it is every individual's duty, to self and to society, to be occupied in useful employment sufficient to gain self-support. Sixth, it would be the greatest calamity that the power of the United States could inflict upon California. Seventh, we desire only a white population in California. Eighth, we left the slave states because we did not like to bring up a family in a miserable, can't-help-one's-self condition. Ninth, in conclusion we dearly love the 'Union,' but declare our positive preference for an independent condition of California to the establishment of any degree of slavery, or even the importation of free blacks." Ten days later the other local journal, The California Star, said editorially; "While we sincerely entertain these views, and value the union with the United States as highly as we should, the simple recognition of slavery here would be looked upon as a greater misfortune to the territory than though California had remained in its former state, or were at the present crisis, abandoned to its fate. * * We believe, though slavery could not be generally introduced, that its recognition would blast the prospects of the country. It would make it disreputable for the white man to labor for his bread, and it would thus drive off to other homes the only class of emigrants California wishes to see, the sober and industrious middle-class of society. We would, therefore, on the part of 90 per cent of the population of this country, most solemnly protest against the introducing of this blight upon the prosperity of the home of our adoption. We should look upon it as an unnecessary moral, intellectual and social curse to ourselves and posterity."

1849-Gen. Smith, military commander of California, declared the Yerba Buena harbor to be poor because the seas are too rough and it is located on a peninsula with little water and few food supplies.

1849-Gen. Smith, military commander of California, declared the Yerba Buena harbor to be poor because the seas are too rough and it is located on a peninsula with little water and few food supplies.

1865- Battle of Averasboro NC

http://www.averasboro.com/The%20Battle.htm

http://www.jeanwellstravel.com/ncinthecivilwar.htm

http://www.averasboro.com/

1907-trumpet player Jimmy McPartland born, Chicago, Il

http://www.redhotjazz.com/McPartland.html

http://www.lib.uchicago.edu/e/su/cja/mcpphotos.html

1912-birthday of guitarist/folksinger Lightin' Hopkins, Centerville, TX His career spanned more than 30 years, even though he did not begin performing in earnest until middle age. Hopkins spent most of his life in the Houston area, recording his first hits, "Short Haired Woman" and "Baby Please Don't Go" for the local Gold Star label in 1947. Texas blues fell from favor in the mid-1950s, and Hopkins was not heard from again until 1959 when he began playing folk and blues festivals. Lightnin' Hopkins's last performance was at Carnegie Hall in 1979. He died of cancer in 1982.

http://www.blueflamecafe.com/index.html

1913-the first small claims court established for small debtors, was authorized by Kansas, to deal with cases involving not more than $20. Plaintiffs and defendants appeared without legal representation. Judges served without fee, pay, or award and were not required to be lawyers. Appeals could be take to the district court.

1916 –Trumpet player/bandleader Harry James birthday

http://www.davidmulliss.com.au/HarryJames/index.htm

1930- USS Constitution (Old Ironsides) floated out to become a national shrine.

http://www.ussconstitution.navy.mil/historyupdat.htm

http://www.ussconstitution.navy.mil/

1933-Birthday of Ruth Bader Ginsburg, U.S. Supreme Court judge appointed 1992, lifelong advocate of women's rights. She won five of the six cases that she argued before the Supreme Court, establishing the unconstitutionality of unequal treatment for men and women. She was the editor of the Harvard Law Review. Ginsburg graduated first in her class of 1959, but she was unable to find a job in a law firm; neither mothers nor Jews were being hired. She eventually found employment as a clerk with a federal district judge in New York with the proviso that a male appointee would be waiting when she failed. She was the first female tenured professor at Columbia University and former director of the Women's Rights Project of the ACLU. President Bill Clinton nominated Ginsburg to the Supreme Court on June 15, 1993, and the Senate overwhelmingly (96—3) approved her nomination. She took the oath of office on August 10, 1993

1937-the first birth control clinic run by a state government was opened in Raleigh, NC, by the state board of health, including a program setting up contraceptive clinics for poor married women in local maternity and child health services.

1937-the first blood bank to preserve blood by refrigeration for future use in transfusions was established by the Cook County Hospital, Chicago, IL.,

1941- Mike Love of the Beach Boys was born in Los Angeles. Love is a cousin of the three Wilson Brothers - Brian, Carl and Dennis. With their friend, Al Jardine, they formed a high school group which played under such names as the Pendletones, Kenny and the Cadets and Carl and the Passions. Mike Love and Brian Wilson wrote "Surfin'," which was a California hit in 1961 for the group, now called the Beach Boys. Murray Wilson, the father of Brian, Dennis and Carl, got the Beach Boys a contract with Capitol Records. Their hits began - "Surfin' Safari," "Surfin' USA" and "Surfer Girl." These were the songs that launched the surf music fad. They went to University High School, as I did, played in some of their pick-up bands, and yes, they really were surfers, who got up at 5am to go surfing before going to school—before the days of wet suits, too.

1941 - the most severe blizzard in modern history struck North Dakota and Minnesota. The blizzard hit on a Saturday night while many were traveling and resulted in the tragic loss of 71 lives. Winds gusted to 75 mph at Duluth, Minnesota and to 85 mph at Grand Forks, North Dakota. Snow drifts reached 12 feet in north central Minnesota.

1944-Sly Stone ( Sylvester Stewart) singer, musician born Dallas, Texas

http://www.artistinformation.com/sly_&_the_family_stone.html

1945--HERRERA, SILVESTRE S. Medal of Honor

Rank and organization: Private First Class, U.S. Army, Company E, 142d Infantry, 36th Infantry Division. Place and date: Near Mertzwiller, France, 15 March 1945. Entered service at: Phoenix, Ariz. Birth: El Paso, Tex. G.O. No.: 75, 5 September 1945. Citation: He advanced with a platoon along a wooded road until stopped by heavy enemy machinegun fire. As the rest of the unit took cover, he made a 1-man frontal assault on a strongpoint and captured 8 enemy soldiers. When the platoon resumed its advance and was subjected to fire from a second emplacement beyond an extensive minefield, Pvt. Herrera again moved forward, disregarding the danger of exploding mines, to attack the position. He stepped on a mine and had both feet severed but, despite intense pain and unchecked loss of blood, he pinned down the enemy with accurate rifle fire while a friendly squad captured the enemy gun by skirting the minefield and rushing in from the flank. The magnificent courage, extraordinary heroism, and willing self-sacrifice displayed by Pvt. Herrera resulted in the capture of 2 enemy strongpoints and the taking of 8 prisoners.

1946-Nat “King” Cole records “Route 66” written by Bobby Troupe.

1947-Ensign John W. Lee of Indianapolis, IN was commission an officer, becoming the first in the U.S. Navy. He was assigned to the U.S. S. Kearsarge.

1948- Parcel Post Air Service between the United States and 21 countries in Europe and Africa began. Service late in the year began to South America and then to the Pacific.

1954---Top Hits

Make Love to Me! - Jo Stafford

I Get So Lonely - The Four Knights

Answer Me, My Love - Nat ‘King' Cole

Slowly - Webb Pierce

1955- Fats Domino records "Ain't It a Shame" which will top the US R&B standings and reach #10 on the Pop chart by July. Pat Boone's cover version, "Ain't That a Shame" would rise to #1 on the Pop chart the same month.

1955-Colonel Tom Parker becomes Elvis Presley's manager. Parker's previous show-business experience included managing country stars Hank Snow, Eddy Arnold and Gene Autry. Parker manages Presley all his life and after his death.

1956 - The musical, "My Fair Lady", opened on Broadway. The show ran for 6-1/2 years before 2,717 audiences. It became, thanks to Rex Harrison and an outstanding cast, the longest-running musical to that time.

1957-Caorl Heiss of Ozone Park, Queens , New York City won her first National Women's figure skating championship at Berkeley, CA: her second and third in 1958 and 1959; and her fourth consecutive title on January 29, 1960k,at Seattle, WA.. She won again.

http://www.worldskatingmuseum.org/chjhof.htm

1958--- Elvis Presley performs his last concert before leaving for the Army, a show at Memphis' Russwood Park. Aside from two benefit shows in 1961, this would be the last Presley concert until 1969.

1959-- The musical, No Strings, opened on Broadway at the 54th Street Theatre. Richard Kiley and Diahann Carroll starred in the show. Also featured was the show´s composer in an acting role, singing his own lyrics. The composer was Richard Rodgers.

1960- the Key Largo Coral Reef Preserve, an area 21 miles long and 3.5 wine in the Atlantic Ocean was made an Undersea park by proclamation of President Dwight David Eisenhower. This wildlife refuse contains 40 of the 52 known coral species.

1962---Top Hits

Hey! Baby - Bruce Channel

Midnight in Moscow - Kenny Ball & His Jazzmen

Don't Break the Heart that Loves You - Connie Francis

Misery Loves Company - Porter Wagoner

1966-Winners of the eighth annual Grammy awards for 1965 are announced. Record of the Year is "A Taste of Honey" by Herb Albert and the Tijuana Brass. Album of the year is Frank Sinatra's "September of My Years." Song of the Year is "The Shadow of Your Smile" by Paul Francis Webster and Johnny Mandel.

1964- My Fair Lady, by Lerner and Loewe, opened on Broadway. It ran for 6-1/2 years before 2,717 audiences. It became, thanks to Rex Harrison and an outstanding cast, the longest-running musical to that time.

1965- Elvis Presley begins filming his 19th movie, Harum Scarum, in Los Angeles.

1967-SARGENT, RUPPERT L. Medal of Honor

Rank and organization: First Lieutenant, U.S. Army, Company B, 4th Battalion, 9th Infantry, 25th Infantry Division. Place and date: Hau Nghia Province, Republic of Vietnam, 15 March 1967. Entered service at: Richmond, Va. Born: 6 January 1938, Hampton, Va. Citation: For conspicuous gallantry and intrepidity in action at the risk of his life above and beyond the call of duty. While leading a platoon of Company B, 1st Lt. Sargent was investigating a reported Viet Cong meeting house and weapons cache. A tunnel entrance which 1st Lt. Sargent observed was booby trapped. He tried to destroy the booby trap and blow the cover from the tunnel using hand grenades, but this attempt was not successful. He and his demolition man moved in to destroy the booby trap and cover which flushed a Viet Cong soldier from the tunnel, who was immediately killed by the nearby platoon sergeant. 1st Lt. Sargent, the platoon sergeant, and a forward observer moved toward the tunnel entrance. As they approached, another Viet Cong emerged and threw 2 hand grenades that landed in the midst of the group. 1st Lt. Sargent fired 3 shots at the enemy then turned and unhesitatingly threw himself over the 2 grenades. He was mortally wounded, and his 2 companions were lightly wounded when the grenades exploded. By his courageous and selfless act of exceptional heroism, he saved the lives of the platoon sergeant and forward observer and prevented the injury or death of several other nearby comrades. 1st Lt. Sargent's actions were in keeping with the highest traditions of the military services and reflect great credit upon himself and the U.S. Army.

1968 - "LIFE" magazine called Jimi Hendrix, “the most spectacular guitarist in the world.”

1968-Blood, Sweat and Tears opened at the S.F. Avalon Ballroom.

1970---Top Hits

Bridge Over Troubled Water - Simon & Garfunkel

Travelin' Band/Who'll Stop the Rain - Creedence Clearwater Revival

The Rapper - The Jaggerz

It's Just a Matter of Time - Sonny James

1971 - CBS-TV announces it will cancel The Ed Sullivan Show, then the longest-running TV show in history, after 23 years.

1972-Singer Robert John scores with a remake of the Tokens' Number One hit "The Lion Sleeps Tonight." John's version goes Top Fifteen and earns him a gold record

1972-Los Angeles Radio station KHJ is raided by L.A. police after calls from listeners who feared there'd been a revolution at the station from 6:00 to 7:30 in the morning. DJ Robert W. Morgan had played Donny Osmond's "Puppy Love" over and over. The police left without making any arrests.

1975- Olivia Newton-John enjoyed her second US #1 album with "Have You Ever Been Mellow".

1977- “Eight is Enough” premiers on TV. This one-hour comedy-drama was set in Sacramento and starred Dick Van Patten as Tom Bradford, a columnist for a local paper and a widower with eight children. Diana Hyland played his wife Joan; she died from cancer after filming five shows. The children were played by Grant Goodeve, Lani O'Grady, Laurie Walters, Susan Richardson, Dianne Kay, Connie Needham, Willie Aames and Adam Rich. In the fall of 1977 Betty Buckley joined the cast as tutor Abby Abbott, who later married Tom. Most of the cast was reunited for Tom's 50th birthday on "Eight Is Enough: A Family Reunion" shown on Oct 18, 1987.

http://www.becoming.net/eie/

http://www.tvtome.com/tvtome/servlet/ShowMainServlet/showid-691/

1977-“Three's Company” appears on TV. This half-hour comedy featured two girls and a guy sharing an apartment. In order for the landlord to go along with the living arrangements, Jack Tripper, played by John Ritter, had to pretend he was gay. Cast included Joyce DeWitt, Suzanne Somers, Norman Fell, Audra Findley, Richard Kline, Don Knotts and Priscilla Barnes. The last telecast aired on Sept 18, 1984.

http://www.threescompany.com/tcompany/www/

http://www.sitcomsonline.com/threescompany.html

1978---Top Hits

(Love Is) Thicker Than Water - Andy Gibb

Night Fever - Bee Gees

Lay Down Sally - Eric Clapton

Mamas Don't Let Your Babies Grow Up to Be Cowboys - Waylon & Willie

1978-"American Hot Wax," a film about a week in the life of pioneer rock & roll disc jockey Alan Freed, premieres in New York. The soundtrack features Jackie Wilson, Buddy Holly, the Moonglows, Drifters, Spaniels, Cadillacs, Zodiacs and others.

1981-the National Football League prohibited the use of any sticky substances on the body uniform or equipment of any player. The rules change was largely aimed a the defensive unit of the Los Angeles Raiders, winners of the 1981 Super Bowl, and in particular at LA defensive back Lester Hayes, who coated his arms and chest with Stickum and intercepted 13 passes during the 1980 season.

1984- Severe thunderstorms in Arkansas produced 2 violent (F4) tornadoes. The first tornado tracked 48 miles through Van Buren, Cleburne, and Independence counties. 2 people were killed and 13 were injured. 63 homes and 22 mobile homes were destroyed. The tornado lifted the highway 16 bridge and threw it into Greers Ferry Lake. The bridge was 1/4 mile long and had a large steel superstructure. The second tornado tore through Jackson and Poinsett counties with 5 people killed and 12 injured

1985- “Mr. Belvedere” premiers on TV. A sitcom about a sarcastic, talented, wise British housekeeper and his love-hate relationship with a Pittsburgh family. It starred Christopher Hewett as Lynn Belvedere, former baseball player Bob Uecker as his employer/antagonist sportswriter George Owens, Ilene Graff as George's wife Marsha, a law student, Rob Stone as Kevin, Tracy Wells as Heather and Brice Beckham as mischievous Wesley. At the end of each episode, Mr. Belvedere narrated the day's lesson as he wrote in his journal, and ended the show on a funny note. The last telecast aired July 8, 1990.

http://www.sitcomsonline.com/mrbelvedere.html

http://us.imdb.com/title/tt0088576/

1986---Top Hits

Sara - Starship

These Dreams - Heart

Secret Lovers - Atlantic Starr

I Could Get Used to You - Exile

1987-Bryan Adams' "Heat of the Night" becomes the first commercially released cassette single, or cassingle, in the U.S.

1987 - The place: Orlando, Florida. The golf course: the Arnold Palmer-designed Bay Hill layout. The tournament: the Bay Hill Classic. Don Pooley showed the golf world what a true million-dollar swing looked like, as he made a hole in one during the final round. The tournament sponsor had offered a million dollars to anyone making an ace. Pooley didn't win the tourney, but won a lot more than anyone else.

1987 - Andrew Lloyd Webber's "Starlight Express" opened on Broadway. This was the first ever roller-skating musical.

1988- “The Wonder Years” premiere on TV. A coming-of-age tale set in suburbia in the 1960s and 1970s. This drama/comedy starred Fred Savage as Kevin Arnold, Josh Saviano as his best friend Paul and Danica McKellar as girlfriend Winnie. Kevin's dad was played by Dan Lauria, his homemaker mom by Alley Mills, his hippie sister by Olivia d'Abo and his bully brother by Jason Hervey. Narratator. Daniel Stern was the voice of the grown-up Kevin. The last episode ran Sept 1, 1993 but it remains popular in syndication.

http://www-personal.umich.edu/~kpearce/wy.html

http://www.imdb.com/title/tt0094582/

1988 - More than one hundred hours of continuous snow finally came to an end at Marquette MI, during which time the city was buried under 43 inches of snow. Unseasonably cold weather prevailed in the southeastern U.S., with forty-one cities reporting record low temperatures for the date.

1989- The Rolling Stones sign a contract for $70 million -- the largest ever amount to that time -- for their upcoming US tour.

1990 - Fifty-three cities reported record high temperatures for the date as readings warmed into the 70s and 80s from the Gulf coast to the Great Lakes Region. Charleston WV was the hot spot in the nation with a record high of 89 degrees. It was the fourth of five consecutive days with record warm temperatures for many cities in the eastern U.S. There were 283 daily record highs reported in the central and eastern U.S. during between the 11th and the 15th of March.

1993 - 69 daily low temperature records were broken over the eastern US as cold air persisted behind the "blizzard of '93". Elkins, West Virginia recorded 5 degrees below zero to break its old record by 15 degrees and New Orleans, Louisiana dropped to 31 degrees to break its old record by 9 degrees. Fort Myers, Florida shivered at 39 degrees.

1994- .9 inches of snow on this day brought the seasonal snowfall total at Binghamton, New York to 123.2 inches -- the city's snowiest winter ever.

1997-Dave Andreychuk of the New Jersey Devils became the 26 th player in the National Hockey League and the second in two days to score 500 regular-season goals. Andreychuk's goal helped the Devils beat the Washington Capitals, 3-2.

1997-The University of North Carolina men's basketball team defeated Colorado, 73-56, in the second round of the NCAA tournament to give coach Dean Smith the 877 th victory of his career, one more than Adolph Rupp. Smith's win, his 63 rd in NCAA play, came in his 36 th season as a head coach.

1999-Paul McCartney, Bruce Springsteen, Billy Joel, Dusty Springfield, the Staples Singers, Del Shannon, Curtis Mayfield and Beatles producer George Martin are among those inducted into the Rock and Roll Hall of Fame. Springfield died just 11 days before.

2003--Many thousands of anti-war demonstrators marched in SF, Washington DC and around the world.

2004 - The Rock And Roll Hall Of Fame inducts Bob Seger, George Harrison, The Dells, ZZ Top, Jackson Browne, Prince, and Traffic at their annual ceremony in New York City.

2006 - Remnants of Fats Domino's three pianos are discovered and saved by the Louisiana State Museum after attempting to salvage his Ninth Ward home after Hurricane Katrina.

2008 - The musical I Am Who I Am, based on the life of singer Teddy Pendergrass, opens in Chicago.

[headlines]

--------------------------------------------------------------

Winter Poem

Beware the ides of March

Men at some time are masters of their fates:

The fault, dear Brutus, is not in our stars,

But in ourselves, that we are underlings.

But, for my own part, it was Greek to me.

Think you I am no stronger than my sex,

Being so father'd and so husbanded?

These things are beyond all use,

And I do fear them.

Cowards die many times before their deaths;

The valiant never taste of death but once.

Of all the wonders that I yet have heard,

It seems to me most strange that men should fear;

Seeing that death, a necessary end,

Will come when it will come.

— Cæs. The ides of March are come.

Sooth. Ay, Cæsar; but not gone. Act iii. Sc. 1.

The Ides of March: In the Roman calendar the days of the month were not numbered sequentially. Instead, each month had three division days: kalends, nones and ides. Days were numbered from these divisions: e.g., IV Nones or III Ides. The ides occurred on the 15th of the month (or on the 13th in months that had less than 31 days). Julius Caesar was assassinated on this day in 44 BC. This system was used in Europe well into the Renaissance. When Shakespeare wrote "Beware the ides of March" in Julius Caesar his audience knew what he meant. Beware of what was to happen on March 15th

--------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------