Friday, March 18, 2011

(Leasing News first logo, used for eight years: still Independent)

Share Leasing News

Today's Equipment Leasing Headlines

Reaction to Leasing News New Masthead and Features

Classified Ads---Asset Management

Reliant National Finance Closed

Leasing Companies Out of Business

plus No Longer taking Broker/Discounting Business

One World Joins with Independent Bankers Group

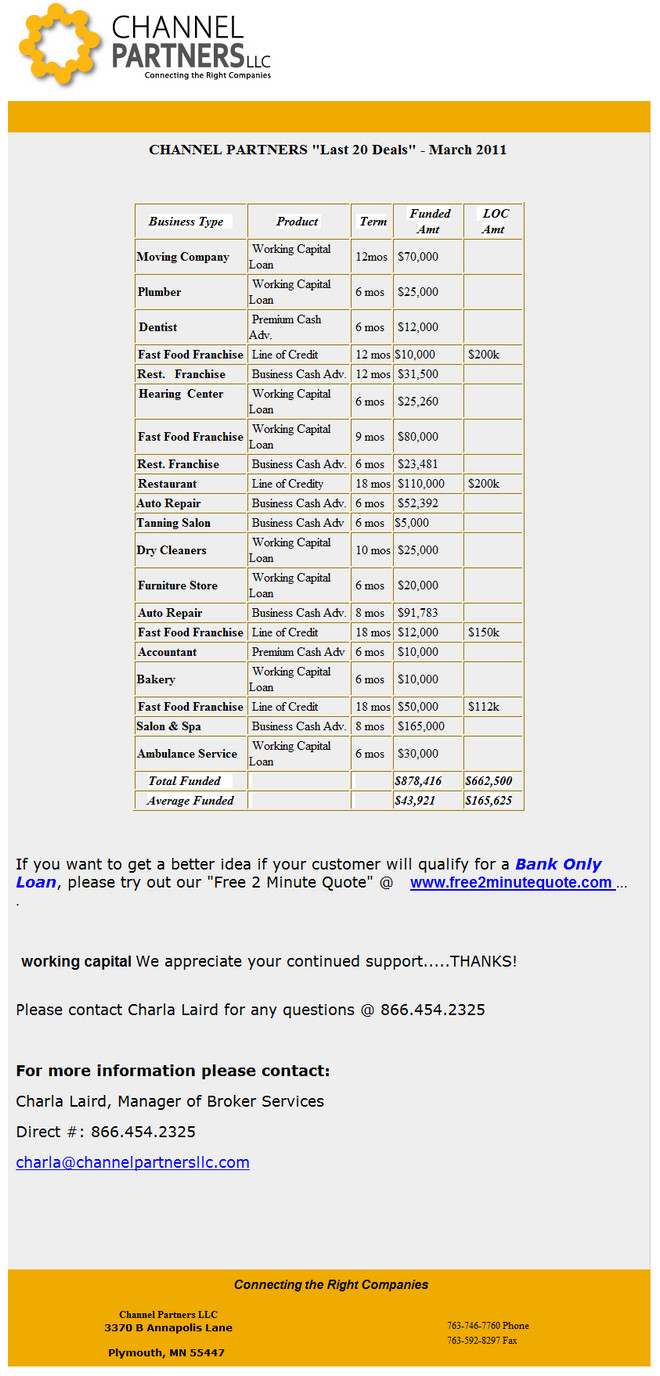

One Channel Partners Latest Fundings

Bank of the West Leasing/Finance Managed Services Moves

IMN/ELFA 10th Annual Investor Conference

by Bruce Kropschot, The Alta Group

New Hires---Promotions

Placard---Important Words

Classified Ads -- Help Wanted

Leasing Portals

Lease Accounting: more concessions and simplifications

by Andy Thompson

Counsel's Evolving Role in E-Discovery (e-Mail)

by Bari J. Gambacorta, Esq.

Win Win/Uncle Boonmee Who Can Recall His Past Lives

Movie/DVD Reviews by Fernando Croce

How Do you Know/Midnight run/Our Hospitality

DriveItNow’s New Pre-Qualified Payment Marketing

Portland, Oregon Adopt-a-Dog

News Briefs---

$200 Million Investment Scheme Uncovered in Ohio

OnLine Invoicing Free 3 Month Trial--unlimited use of service

Group of 7 to Intervene to Stabilize Yen’s Value

Japan woes wipe out US stock gains for year

Disaster May Deal Blow to Tourism in Hawaii

Quake takes bite out of Big Apple tourism

Japan crisis, Fed send mortgage rates down

Japan crisis to hit U.S. auto industry

Soaring food prices send millions into poverty, hunger

TFC Financial Raises over $220 Million on Stock Offering

New York Times web free to subscribers, other $15-$35

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

Top Ten and Top 66 Worst Catastrophes

You may have missed

Ted's Nugget's Video Blog - World Climate Agreement

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

Golf Joke

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer. It is considered “bias” as it is the writer’s viewpoint.

[headlines]

--------------------------------------------------------------

Reaction to Leasing News New Masthead and Features

"I like the look. Very clean and good contrast for the advertisers. Less clutter makes the ads stand out with importance. "

Ed Castagna

Nassau Asset Management

"The look, over time, has evolved to a non cluttered site. It is easy to navigate through the new data and retrieve archived items. From a content perspective, there is plenty of info and easy to get too."

Allan Levine

Madison Capital

"Thumbs Up! Looks great."

Ginny Young

former Brava Capital

"Looks great....to quote my favorite songwriters, it's getting better all the time!!"

Ken Greene, Esq.

Hamrick & Evans

"I like it. Leasing News keeps getting better and better!"

Bruce Kropschot

The Alta Group

“Looks good. Not a social media guy myself, but their inclusion speaks to currency of the publication.”

Shawn Halladay

The Alta Group

"Easier to send. And people like myself who like to email certain articles from Leasing News to others, I still have that option. I don't tweet :) It looks good Kit."

Rosanne Wilson, CLP

1st Independent Leasing

"I like it, too, but I miss the motto, ‘Independent, unbiased and fair news about the Leasing Industry’.

"The new description is like saying that gold is a soft, heavy metal. It may be accurate, but it leaves out the character.

"Please put back the motto."

Bob Teichman

Teichman Financial Training

(Will put back the "Gadsden Flag" which ran for eight years in the masthead. It is important to note Leasing News now has readers from all over the world and Wednesday’s edition had 221,000 visits. Editor)

New Description:

Leasing News is a web site that posts information, news, and entertainment for the commercial leasing and finance industry. The News Edition is updated Monday, Wednesday and Friday.

[headlines]

--------------------------------------------------------------

Classified Ads---Asset Management

(These ads are “free” to those seeking employment

or looking to improve their position)

Minneapolis, MN

16 years leasing experience from micro to large ticket market, variety of equipment. Most recently calling on vendor telecom dealers in Upper Midwest.

golfadm@yahoo.com |

Santa Barbara CA (will relocate)

Experienced Asset Manager of various portfolio's for a bank, broker and leasing company. Utilized specialized remarketing companies to maximize collateral values. Worked remote two years.

geoff.taylor@verizon.net | Resume

| Reference 1 | Reference 2 |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

[headlines]

--------------------------------------------------------------

Reliant National Finance Closed

A well-informed source has told Leasing News that Reliant National Finance, Jacksonville, Florida, has closed. The web site states the company is no longer doing business in the U.S.

http://www.reliantnational.com/Getting_Started.html

The founder of the company is John Adams on Linkedin.com where it appears he now in the "investments" business.

http://www.linkedin.com/in/johnadams11

[headlines]

--------------------------------------------------------------

Leasing Companies Out of Business

plus No Longer taking Broker/Discounting Business

Companies with an * are no longer in business. The others are companies that were taking broker business, but announced that they no longer are accepting broker business. Many have also down-sized or are managing an existing portfolio.

More details are available in this list by company name:

http://www.leasingnews.org/list_alpha_new.htm

Advantage Business Capital, Lake Oswego, Oregon

AEL Financial, Buffalo Grove, Illinois

(No longer taking new broker business)

Alliance Financial, Syracuse, New York

Balboa Capital, Irvine, Ca

Bankers Healthcare Group, Weston, FL.

*C and J Leasing Corp, Des Moines, Iowa

*Carlton Financial Corporation, Wayzata, Minnesota

*Chesterfield Financial, Chesterfield, Missouri

*Churchill Group/Churchill Leasing, Jericho, NY

CIT Group (limited)

Columbia Bank Leasing, Tacoma, WA

Commercial Equipment Lease, Eugene, Oregon

Concord Financial Services, Long Beach, California

Court Square, Malvern, Pennsylvania

*Creative Capital Leasing Group, LLC, San Diego, CA

Direct Capital, Portsmouth, New Hampshire

Diversified Financial Service, Omaha, NE

Dolsen Leasing, Bellevue/Yakima, Washington

Equipment Finance Partners, a division of Altec, Birmingham, Alabama

Evans National Leasing, Inc., Hamburg, NY

Enterprise Funding, Grand Rapids, Michigan

*Excel Financial Leasing, Lubbock Texas

*First Corp.(IFC subsidiary), Morton Grove, Illinois

First Federal Financial Services, Inc., Menomonee Falls, Wisconsin

First Republic Bank, San Francisco, CA

Frontier Capital, Teaneck New Jersey

*GCR Capital, Safety Harbor, Florida

GE Capital, Conn (limited)

Global Funding LLC., Clearwater, FL

*Greystone, Burlington, MA

*Heritage Pacific Leasing, Fresno, CA

Hillcrest Bank Leasing, Overland Park, KS (Parent bank sold)

Huntington Equipment Finance, Vendor Finance Group, Bellevue, Washington

*IFC Credit Corp., Morton Grove, Illinois

Irwin Financial (Irwin Union Bank), Columbus, Indiana

Irwin Union Bank, F.S.B. (Louisville, Kentucky)

Lakeland Bank, Montville, NJ

LaSalle Systems Leasing

*Latitude Equipment Leasing, Marlton, New Jersey

*Leaf Specialty Finance, Columbia, South Carolina

*LEAF Third Party Funding, Santa Barbara, Ca.

Lombard, part of Royal Bank of Scotland, worldwide

Marlin Business Services, Mount Laurel, NJ (accepting no new brokers, they may have opened for a select fee, but no more at this time, they say.)

M&T Credit (Bank)

*MericapCredit, Lisle, Illinois

Merrill Lynch Financial

Midwest Leasing Group, Livonia, Minnesota

National City, Cleveland, Ohio

*Navigator (Pentech subsidiary) San Diego, California

OFC Capital, Roswell, Georgia

Old National Bank, Evansville, Illinois

Pentech Financial, Campbell, CA

*PFF Bancorp, Inc, Pomona, CA

Pinnacle Business Finance, Fife, Washington

*Pioneer Capital Corporation, Addison, Texas

PredictiFund, a subsidiary of Capital Access Network, Inc

Popular Finance, St. Louis, Missouri

Radiance-Capital, Tacoma, WA

Rational Technology Solutions, Rolling Meadows, IL

*Reliant National Finance, Jacksonville, Florida

Sandy Springs, Olney, MD

Sovereign Bank, Melville, New York

Specialty Funding, Albuquerque, NM

Sun Trust Equipment Finance & Leasing, Baltimore, Maryland

*SunBridge Capital, Mission, Kansas

Suncoast Equipment Funding Corp., Tampa, Florida

TCF Equipment Finance, Minnetonka, Minnesota

TechLease, Morgan Hill, California

Textron Financial

*Triad Leasing & Financial, Inc., Boise, Idaho

*Union Capital Partners, Midvale, Utah

US Bank, Manifest Funding, Marshall, Minnesota

(new requirement: large yearly funding)

US Bank, Middle-Market, Portland, Oregon

Velocity Financial Group, Rosemont, Illinois

VenCore, Portland, Oregon (former company Len Ludwig)

*Vision Capital, San Diego, California

Wachovia Bank Leasing

*Washington Mutual Financial

Western Bank, Devils Lake, ND

*Westover Financial, Inc., Santa Ana, California

(Note: Should a company policy have changed, please contact kitmenkin@leasingnews.org)

Funders looking for new Brokers:

http://www.leasingnews.org/Funders_Only/New_Broker.htm

"Broker/Lessor" looking for broker business:

http://www.leasingnews.org/Brokers/brokerlessor_bussiness.html

NAELB Broker Exchange

http://www.leasingnews.org/Pages/broker_exchange.html

[headlines]

--------------------------------------------------------------

One World Joins with Independent Bankers Group

The largest equipment leasing cooperative, 25 members in 2010, as well as a membership in the Independent Community Bankers of America (ICBA) announces they have been approved as a "Preferred Service Provider for community bank equipment leasing and financing for members of ICBA." One World Business Finance states on their web site they have "Preferred Funder relationships with approximately 20 commercial lenders and funding sources." http://oneworldleasing.com/index.php?option=com_content&task=view&id=4&Itemid=14

Dan Clancy, ICBA Senior Vice-President

“ICBA is pleased to have OneWorld Business Finance as a Preferred Service Provider,” said Dan Clancy, ICBA senior vice president of services in a press release. “OneWorld will enable ICBA member banks to compete for leases and equipment finance transactions from its customers through OneWorld’s leasing exchange and allow them to fund loans secured by equipment leases.”

"The Independent Community Bankers of America, the nation’s voice for community banks, represents nearly 5,000 community banks of all sizes and charter types throughout the United States and is dedicated exclusively to representing the interests of the community banking industry and the communities and customers we serve."

Benefits Stated in One World Press Release:

• Application-only transactions up to $150,000 and up to $20 million with full financials;

• Operating and capital leases, finance contracts and loans;

• Terms of 2-6 years and in some cases up to 10 years;

• A wide range of acceptable credits from investment grade to “C” credits and industries such as: municipal, agriculture, manufacturing and healthcare. |

“OneWorld Business Finance is thrilled to be named as an ICBA Preferred Service Provider and looks forward to helping the nation’s Main Street community banks grow their business in the equipment leasing and financing space,” said Lou Manitzas , President of OneWorld Business Finance, in a press release.

April, 2010 One World Co-Op membership

(list of current members no longer on the company web site)

5280 Financial

AccuLease (Lease-It Capital Corp.)

Alternative Capital (the Future Group, Inc.)

Avon Leasing, Inc.

Bevenco

The Cambridge Capital Group

Central Leasing Corporation

Charter Capital

ComCo-OneWorld, Inc.

eLease Funding, Inc.

Enterprise Financial Solutions, Inc.

Florida National Equipment Finance

Fujifilm Financial Services (American Leasing Alliance, Inc.)

Harry Fry & Associates (Winfield Corp.)

KLC Financial, Inc.

Leasing Resources, Inc. (North Carolina)

Leasing Resources, Inc. (Kansas)

Mantis Financial, LP

National Equipment Leasing Company, Inc.

OneSource Financial Corp.

Prolease (AAW Capital Corp.)

Select Equipment Leasing Co.

Target Equipment Leasing, Inc.

Team Equipment Leasing

US Energy Capital Corporation

Community Bank Leasing

http://www.youtube.com/watch?v=bDRPCykU51Y

(2:54 minutes)

For more information on the Independent Community Bankers of America, visit www.icba.org.

Why Choose Advanced Property Tax Compliance?

|

|

Dedicated to the leasing industry

click here to

learn more.

Hear What Our Clients say about us

click here

Gary DiLillo, President

216-658-5618 or gary@avptc.com |

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Bank of the West Leasing/Finance Managed Services Moves

As the finance/leasing office in the San Francisco, California area moved its offices from Dublin to San Ramon, the Portland office with Eric Gross as Director-Managed Services is also moving next week.

3 |

Bank of the West Equipment Finance - Managed Services Group

1989 founded as Trinity

(2002 purchased by

Bank of the West)

Eric Gross

Director -

Managed Services Group

Eric.Gross@bank

ofthewest.com

Bank of the West

222 SW Columbia Suite 900

Portland OR 97201-6600

Office (503) 225-1607

Fax (503) 225-1751

Mobile (503) 840-5165

bankofthewest.com

|

80 -In Servicing |

Eric Gross |

Complete Primary & Backup Servicing solutions for independent Lessors and captive finance companies. |

N/A |

United States |

Providing 3rd party servicing since 1989 |

Address has been up-dated in "Back Office List:

http://www.leasingnews.org/Ag_leasing/backoffice.htm

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

IMN/ELFA 10th Annual Investor Conference

by Bruce Kropschot, The Alta Group

The 10th Annual Information Management Network and Equipment Leasing and Finance Association meeting in New York Investor conference in New York yesterday was well attended. The brochure stated 300.

A wide range of topics was covered by knowledgeable experts from the leasing industry and service providers. Many attendees go primarily for the networking opportunities, and during several of the programs there appeared to be more people networking outside the meeting room than were listening to the presentations.

The mood was generally upbeat, both with regard to the leasing business and the interest of debt and equity investors.

Bruce Kropschot,

Senior Managing Director

Merger & Acquisition Advisory Practice Leader

The Alta Group, LLC

2352 Clearwater Run The Villages, FL 32162

(352) 750-3588

www.thealtagroup.com

www.kropschot.com

[headlines]

--------------------------------------------------------------

New Hires---Promotions

Dennis Alexander has been named Vice President of Business Development for Balboa Capital Corporation, Irvine, California. He previously was Business Development Officer, Vendor Program Originations for TCF Equipment Finance (July, 2009--March, 2011), Vice-President Huntington National Bank Equipment Finance (December, 2007-December, 2008), Senior Vice President, Originations, Banc of America Leasing (2004-2008), Vice-President of Business Development Fleet Capital Leasing (acquired by Banc of America) (2000-2004), Vice-President National Accounts, American Express Business Finance (1999-2000),Vice-President, Transamerica Distribution Finance (1997-1999), Vice-President Dana Commercial Credit (1988-1997), Sales Manager Gestetner Corporation (1983-1987). University of Northern Colorado.

http://www.linkedin.com/pub/dennis-alexander/8/170/36

Joe Bannick joins First Sound Bank, Seattle, Washington as "vice president of sales with the responsibility of leading the business development efforts of First Sound Bank and its business finance division," including Puget Sound Leasing. Previously he was Vice-President Sales, Greystone Equipment Finance (July, 2007-June, 2009), Vice-President, Irwin Commercial Finance (July, 2002-June, 2007), Vice-President Business Development, ABB Financial (August, 2000-July 2002), SVP Sales, BankVest Capital (June, 1996-August, 1999), Sales Manager, AT&T Capital (June, 1988-June, 1996). He has a BA Communications from University of Washington.

http://www.linkedin.com/pub/joe-bannick/a/455/134

David D’Antonio, 47. has joined EverBank Commercial Finance, Parsippany, New Jersey, to lead the Lender Finance Group to provide credit facilities ranging from $10 million to $50 million. "He formerly was Managing Director and Founder Diversity Capital L.L.C. As managing director and founder of Diversity Capital LLC, Dave D'Antonio is in charge of marketing and corporate strategy. Diversity, headquartered in Cinnaminson, NJ, is a five-year-old boutique investment banking group specializing in providing financial service to the commercial finance and equipment leasing industries. Prior to forming Diversity, Dave was a director at First Union Capital Markets and a senior vice president at CoreStates Bank N.A., where he was responsible for the management and development of the Lease Finance Group, which had over $1 billion in loans and securitized assets. A former member of the Equipment Leasing Association's board of directors, Dave has been involved in a number of finance industry groups at the most senior levels. He recently published a number of articles about liquidity and leasing in The Equipment Finance Journal and The Monitor. Dave graduated cum laude from LaSalle University in Philadelphia (BS-Finance) and Drexel University (MBA-Finance)."

Kimberly A. Esposito has returned as Senior Vice President and Chief Operation Officer for Independent Equipment Company, Clearwater, Florida. Here duties will include sales and marketing, complicated equipment inspections, appraisals / residual value analyses, and remarketing. She previous was Assistant Vice-President at M&T Bank (March, 2008-March, 2011), Vice-President LaSalle National Leasing/Banc of America Leasing (November, 2005-December, 2007), Principal Esposito Holdings (January, 1999-July, 2004), Vice-Presdient, Independent Equipment Company (March, 2199-Augusts, 1999). She has a B.A. in Economics from the University of Connecticut.

http://www.linkedin.com/in/kimesposito

Lynne Gregg has been hired by Balboa Capital, Irvine, California to its "Office Imaging Team:" Compass 2.0 to our dealers, which provides online application entry, 24/7 reporting, as well as support for Rental, Cost-Per-Copy, and Private Label programs all with the famous Balboa Capital Evergreen Clause. Mr. Gregg previously was with Tygris Commercial Finance (2006-2010) and Citicorp Vendor Finance (formerly Fidelity Leasing) (1997-2004). Compass 2.0 to our dealers, which provides online application entry, 24/7 reporting, as well as support for Rental, Cost-Per-Copy, and Private Label programs.

http://www.linkedin.com/pub/lynne-gregg/4/8/731

S. Scott Gates, 41, has joined EverBank Commercial Finance, Parsippany, New Jersey, newly created Lender Finance Group. Previously to forming Diversity Capital (January 2000), he was vice-president of CoreStates Financial (September, 1991--December, 1999), Vice-President, Wachovia (1991-1999). Lafayette College (1987-1991), and is on the Pastoral Nominating Committee for Carmel Presbytery Church (2005-2007).

http://www.linkedin.com/pub/scott-gates/5/a72/880

Jessica Geltzeiler has been named major account manager for GSG Leasing, Brooklyn, New York. She previously was "...serving in a number of roles at Strada Capital Corporation and more recently as director of operations at a leasing company in southern California where she analyzed and booked lease transactions."

Rich Johnston was promoted to Vice-President-Capital Markets for AIG Commercial Equipment Finance, Dallas, Texas. He joined AIG in 2004. Previously he was vice-President Siemens Financial Services, Indirect originations of large ticket leasing transactions (August, 1999-December, 2004), Syndication Manager, Copelco Capital (1999), Vice-President, Citigroup, (1996-1999), Vice-President, The CIT Group(1990-1996). He has an MBA from Fordham University, Graduate School of Business Administration and BS Finance from Fairfield University where he was on the swimming team (1981-1986). He graduated Half Hollow Hills High School West (1978-1982).

http://www.linkedin.com/pub/rich-johnston/12/350/4ab

Michael A. Petruski has been appointed by Great American Group, headquartered in Woodland Hills, California, as executive VP and general manager of its machinery and equipment valuation practice.

He joined the company in June, 2009. Previously he was Director and Unit Manager, Collateral Evaluation, Wachovia, A Wells Fargo Company (January, 1996-June, 2009), Vice-President, Structured Finance, Citi Group (1987-December, 1995). He has an MSA, Human Resources from Western Connecticut State University (1979-1981) and a BA, Biology, West Virginia University (1968-1972).President, Charlotte, NC Chapter of the WVU Alumni Assn. Chairman, Board of Directors, WVU Alumni Assn.- 2009-2010.

http://www.linkedin.com/pub/michael-a-petruski/b/285/129

Anna Savoy has been hired by Balboa Capital, Irvine, California to its "Office Imaging Team:" Compass 2.0 to our dealers, which provides online application entry, 24/7 reporting, as well as support for Rental, Cost-Per-Copy, and Private Label programs all with the famous Balboa Capital Evergreen Clause. Ms. Savoy was previously Director, Vendor Relationship Development, GreatAmerica Leasing (April, 2005-March, 2011), Manager/originator, People's Advantage Mortgage (2004-2006), South Dakota School of Mines and Technology (1991-1994).

http://www.linkedin.com/pub/anna-savoy/7/980/b75

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

Marketing Genius

Riverside, California

Create, Design, Coordinate convention/trade shows

marketing calls, remarketing assets/website

Send resume: Dreynolds@a-zresources.com

www.a-zresources.com

A-Z Resources captive affiliate to a major business distributor founded in 1975,

join our staff, generating over $120 million in combined sales.

|

Documentation Administrator

Los Angeles, CA

Mininum two years experience, competitive salary,

plus benefits, click here for more information

www.julesandassociates.com

Jules and Associates, Inc. has been

in

business for over 20 years.

|

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

Leasing Portals

bizwiz.com

businessfinance.com

capital-connection.com

#1 There are two tiers to the site, one is free, and the other is a subscription for "leads" or "sources". http://www.cfol.com/index.html?content=loginpage The success of Internet portals such as My Yahoo! have inspired companies to develop Enterprise Information Portals (EIPs) as a way to allow business users to access corporate information.

[headlines]

--------------------------------------------------------------

Lease Accounting: more concessions and simplifications from IASB/ FASB

(Shawn Halladay, The Alta Group, states: “Things continue to improve for the industry with the direction the Boards are going, and it looks like we are going to end up with two different lease classifications, instead for just one. “)

Written by Andy Thompson

(Reprinted with permission from AssetFinance International)

Note: Story at end has information on April 6 Free Accounting Webair

—Register now---(limited to 700)

This week the joint Boards of global standard setters have continued their progress towards finalising the new leasing standard. On 14-15 March they considered accounting for two broad types of contract with very different residual value ( RV) profiles – those with purchase options for the lessee, and short term leases (i.e. running for less than 12 months from inception).

In general the Boards' decisions on these areas continued along the road adopted in recent weeks, of revising and simplifying some of the proposals that attracted criticism in last year's exposure draft (ED).

http://www.youtube.com/watch?v=ZghuIiiodBA&feature=player_embedded

This podcast is produced in association with International Decision Systems

Hire purchase/Credit Bail

Firstly the Boards considered the treatment of bargain purchase option (BPO) contracts, where the customer can take title to the asset at the end of the contract on payment of a nominal option fee. These are generally known as hire purchase (HP) in the UK and some other countries, or crédit-bail in France.

The issue here has never been about the accounting rules as such, but rather about which accounting standard they should fall under, and consequently how much guidance may be given in the relevant standard.

BPO contracts are accounted for as finance leases (i.e. putting the underlying asset on a corporate lessee’s balance sheet, with the lessor or financier accounting for a financial transaction) under existing accounting rules. It has never been intended that this substantive accounting should change as a result of the new leasing standard.

However, the ED proposed that these contracts should be scoped out from the leasing standard, to be covered by a separate convergence standard on revenue recognition (RR), which is being developed by the Boards on the same time scale. This was first proposed at a time when it was envisaged that all lessor accounting might be based on the complex “performance obligation” model, which would not have been suited to leases without RVs

A staff recommendation

However, the Boards have now adopted a staff recommendation to reverset hat proposal, and keep BPO deals in the leasing standard. A minority of International Accounting Standards Board (IASB) members were opposed to this decision, but members of the US Financial Accounting Standards Board (FASB) were unanimous.

It seems not entirely clear at present which standard will govern contracts where the lessee is obliged to take title at the end of the contract. In the UK market these contracts, known as “conditional sale” agreements, tend to be offered in the same markets as HP deals, and the two are regarded as readily interchangeable in finance companies' documentation options.

Some FASB members suggested at this week's meeting that conditional sale agreements should still be scoped out from the leasing standard. A general definition of a lease remains to be considered by the Boards later, so it is possible that the conditional sale issue will be resolved then.

The IASB staff member leading the RR project told the Boards that if some finance contracts were left under the RR standard, it would need some guidance for them which its present draft does not contain.

Non-bargain options

The Boards also considered the accounting rules in respect of the value of the purchase option itself or the cost of exercising it. In the case of BPOs this is immaterial. However, it can be of considerable importance for non-bargain purchase options (NBPO), where the exercise price is substantial.

In Europe NBPOs tend not to be common in business asset finance agreememts, largely for tax reasons. In many countries they would not allow either the lessor or the lessee to claim fiscal depreciation for corporate income tax purposes; and the harmonised VAT rules in the EU also tend to favour pure leases without purchase options for business customers.

However, NBPO contracts are common in consumer finance markets, especially in the form of personal contract purchase (PCP) in the car market. Although these involve no lessee accounting, the finance company's accounting will be affected by the leasing standard.

There are also some equipment finance markets outside Europe where NBPOs will affect accounting by both lessees and lessors.

The ED had proposed to leave option exercise prices out of accounting until the point when options might be exercised. Many respondents pointed out that this was in sharp contrast with what was then proposed for lease renewal options.

Significant incentive

The Boards have now decided to treat purchase options consistently with the modified treatment which they agreed last month for renewal options. They will be accounted for from inception where there is a “significant economic incentive” for the lessee to exercise the option.

Board members felt that the “significant incentive” test would be met in the case of a wider range of contracts than BPOs with a merely nominal exercise price. They could extend to any contracts where the exercise price was significantly lower than the forecast RV.

The Board then considered the extent to which this test should have to be reassessed at each financial reporting date while the finance agreement is running. It was provisionally agreed to require such reassessment, subject to further “outreach” consultations with some leasing companies and others who have commented on these issues.

Having agreed last month to retain a form of lease classification for both lessees and lessors, the Boards agreed to one limitation on the scope of the proposed reassessment requirement for purchase option values. No such reassessment will require a contract to be “migrated” in either direction as between the “financing” and “other than financing” accounting models. It may, however, require a revision to balance sheet numbers within the model required at inception.

Short term leases

For lessees, the Boards have agreed to go significantly further towards simplified accounting for short term leases. These are to be defined as leases which at commencement have a maximum possible term, including any renewal options, of less than 12 months.

Short term leases are relevant to both equipment and real estate transactions. Within equipment finance, they include sectors like construction plant hire; voyage charters and some other chartering facilities in shipping; and vehicle daily rental, which has lessee accounting implications where used by corporate customers.

The ED had proposed a much more simplified treatment for these leases in the case of lessors than for lessees. Whereas it accepted that lessors should be allowed to keep these lease receivables off-balance-sheet (while of course retaining the underlying asset on-balance-sheet), lessees were to be required to bring them on-balance-sheet as in the case of other operating leases.

Right of use

The only concession then proposed for lessees was to exempt short term leases from the requirement to apply a discount rate to the future liabilities to derive the valuation of the “right of use” asset. Many respondents pointed out that this was hardly a real concession, since applying a discount rate was not among the most onerous parts of the proposed accounting requirements.

In reviewing the issue this week, both Board members and their staff were divided. Some members even favoured withdrawing all exceptions for short term contracts, for lessors as well as lessees.

For example, IASB member Warren McGregor suggested that after recent simplifications on renewals, contingent rentals and lease classification, if concessions were made for short term leases “it would become a complex and messy standard, and some constituents will not think it improves lease accounting.”

However, a clear majority on the IASB favoured allowing lessees as well as lessors to keep short term rentals off-balance-sheet. Most FASB members agreed to concur with this in order to achieve convergence, although some of them had preferred other options. It was therefore agreed.

Some IASB members indicated that their acceptance of this was conditional on appropriate disclosure and presentation rules being adopted for short term rental costs in the profit and loss (P&L) account. A separate report on that subject was deferred at this week's meeting, and it will be considered later together with other lease presentation and disclosure issues.

It was, however, agreed that the basic P&L reporting profile for short term lease rentals for both lessors and lessees should remain on the same basis as for operating leases under current rules.

The ED had proposed that the concessions for short term leases should be optional, and that free elections could be made on a lease-by-lease basis. Having agreed to extend the basic scope of the concessions on the lessee side, however, the Boards have now decided to limit the elective aspect.

They considered various alternatives for either permitting or requiring the use of the exceptional accounting for short term leases. They decided that it should be an elective option, but should have to be either adopted or not for any class of assets as a whole, rather than on a lease-by-lease basis.

WEBINAR: Lease Accounting Update

Wednesday, April 6, 2011

11am Eastern Time Zone; Europe (Mainland): 5pm; Europe (UK): 4pm Register now for Asset Finance International and International Decision System’s next lease accounting webinar - the second in a series of authoritative and independent lease accounting briefings. Registration is free – but with over 700 registrations for the January event - places for this event will be allocated on a first come first served basis.

Speakers include:

•Alan Leesmith (Chair), Director IAA-Associates;

•Mark Venus, IASB/FASB Joint Working Group;

•Rodney W Hurd, Chair of the ELFA Financial Accounting Committee;

•Katie Emmel, Director of Product Management, International Decision Systems; and

•Andy Thompson, Regulatory Editor, Asset Finance International

Targeted at senior equipment lessors worldwide, participants will be brought up to date with the latest findings of the accounting standards boards; hear what our panel believes may be learned from recent IASB/FASB Board meetings and what the final outcomes might be as a consequence; and discover what steps leasing organizations now need to take to be prepared, and what the timetable is likely to be.

This webinar will update participants on provisional decisions announced by FASB and IASB since our last webinar on January 27 2011.

Register for webinar (Free but limited to 700):

To subscribe to AssetFinance International (free)

[headlines]

--------------------------------------------------------------

Counsel's Evolving Role in E-Discovery (e-Mail)

(Also emails are never erased as servers and ISP providers

have copies, as well as those servers and ISP provides

the message was received by. Editor)

by Bari J. Gambacorta, Esq.

(reprinted with permission)

Will there come a time when every file referred for collection, replevin or work out will require a litigation hold? In this e-mail driven commercial world it is hard to imagine accounts monitored by collection personnel that do not contain significant discoverable material stored in a lender’s data network. My purpose in authoring this article is to inform clients of the types of concerns their local council could and should have in this regard. Counsel’s decision to request a litigation hold is often difficult but the failure to do so and then monitor its progress may be calamitous.

Spoliation

Spoliation is the concept that a litigant deliberately destroys, modifies or conceals evidence for strategic advantage. In the current commercial e-mail environment where it is customary to maintain e-mails for a specific period pursuant to a corporate policy, it is extremely difficult to explain the premature elimination of e-mails. At the point the opposition establishes that communications are missing and that they relate to the litigation at hand, the burden shifts and the other party (known as the spoiling party) must go forward and show why the documents were lost or destroyed. Should the deleting party be found guilty of spoliation, sanctions will apply which could include dismissal of the case with prejudice. The number of e-discovery sanctions skyrocketed in the past three years and remains a considerable threat to the unwary lender that fails to recognize its obligations when a litigation hold is requested.

When?

The cases clearly indicate the “litigation hold” should take effect at the time litigation was contemplated. Surely at the time the file was placed for collection with local counsel, any material from that date forward should be available for inspection and discovery purposes. The cases suggest that not every e-mail exchange between coworkers is discoverable but clearly those actors with key roles in the accounts, the account’s underwriting and their collection effort must be included.

It is well established that the duty to preserve evidence arises when a party reasonably anticipates litigation. Once a party reasonably anticipates litigation, it must suspend its routine document retention/destruction policy and put in place a “litigation hold” to ensure the preservation of relevant documents. This duty is more often triggered before litigation commences for plaintiffs, in large part because plaintiffs control the timing of litigation. By now it should be abundantly clear that the duty to preserve means what it says. The failure to preserve records – paper or electronic – and to search in the right places for those records will inevitably result in charges of spoliation of evidence.

The Court's Role

Conduct is either acceptable or unacceptable. Once it is unacceptable the only question is how bad it is. That is a judgment call that must be made by a court reviewing conduct from the backward lens called hindsight. It is well established that negligence involves unreasonable conduct that creates a risk of harm to others, but willfulness involves intentional or reckless conduct that is so unreasonable that harm is highly likely to occur. The Court is charged with making such findings where spoliation has occurred.

How?

The first step in any discovery effort is the preservation of relevant information. Failure to preserve evidence resulting in the loss of relevant information is surely negligent and, depending on the circumstances, the Court may determine it to be grossly negligent or willful after the duty to preserve has attached.

The failure to initiate a written “litigation hold” constitutes gross negligence because that failure is likely to result in the destruction of relevant information. Once a party reasonably anticipates litigation it must suspend its routine document retention/distraction policy and put in place a “litigation hold” plan to ensure the preservation of relevant documents. For example, in Connor the nonproduction of a relevant e-mail deleted no more than 10 days prior to the case being filed implicated that other relevant e-mails were not produced. (Case citations are available by contacting the author at bgambacorta@stark-stark.com.)

Sanctions may include monetary sanctions granted in favor of the moving party as in Green; ordering an adverse inference instruction, Arista Records LLC versus Usenet.com; excluding evidence from being introduced at trial, Brown versus Colema; or granting default judgment for intentional destruction of evidence, Gutman v. GT MAM.

In addition courts will impose sanctions on the spoiling party and award fees to the innocent party to compensate their reasonable costs incurred in bringing the spoliation motion. In the Citgo case this included time spent for reviewing the declarations of those charged with the “litigation hold” efforts and conducting additional depositions in order to bring the actual spoliation motion.

Concerns of Local Counsel

There is ample authority to suggest that the attorney who fails to properly instruct his client of the responsibilities to preserve relevant information may also be sanctioned. Thus when litigation is anticipated it is appropriate for local counsel to issue an instruction that requires those e-mails, memos and personal notes of key actors be maintained and protected. His failure to do so may result in sanctions from the Court for his firm and himself and while there is no bright line here his responsibilities go beyond simply issuing the “litigation hold” instruction.

Where counsel simply telephoned, and sent an e-mail and distributed memorandum instructing his various client contacts to override the normal purging process, his actions were found to be deficient by the Pension Committee Court. The court noted that this instruction did not meet the standard for “litigation hold” in that it did not direct employees to preserve all relevant records – both paper and electronic – and didn't create a mechanism for collecting and preserving records so that they may be searched by someone other than the employee that created the document. Rather the directive placed total reliance on the same key employee that participated in and created the relevant material and allowed him or her to select what that employee believed to be responsive records without any supervision from counsel. Counsel Vincent’s monthly case status memoranda which included additional requests for the related documents, including electronic documents, likewise fell short of the Court’s requirements. The Court opined that these memoranda never specifically instructed anyone not to destroy records so that Counsel could monitor their collection and production. The Court held that counsel in this instance failed in his responsibilities.

In Adams versus Dell, the “litigation hold” failed because the defendant’s preservation practices placed operation level employees in the position of deciding what information was relevant. Attorney oversight of the process is critical, the Court found, and this includes the ability to review, sample or spot check the collection efforts. Adequacy of each “litigation hold” must be evaluated on a case-by-case basis. It is not sufficient to notify all employees of a “litigation hold” and expect that each employee (many unfamiliar with the requirements of the Court’s Discovery mandates) would then retain and produce all of the relevant information.

In the Pension Committee case the court required each key person (“declarant”) to submit a certification as to what they knew and how they implemented the “litigation hold.” Thereafter depositions were scheduled in order to evaluate whether their efforts met the requirements of the discovery rules. Each plaintiff was directed by the court to submit a declaration summary documenting search efforts for various periods of time as well as any steps taken in between. Almost every plaintiff submitted a declaration that was intentionally vague and attempted to mislead the defendants, according to the Court. In addition most declarants had no knowledge of how the company’s data was stored, where to find relevant communications, which files were searched, how the search was conducted and who was asked to search what. All these topics were reasonably within the scope of the Court’s mandate and unsurprisingly, the Court found several plaintiffs and their counsel had not met their duty.

How They Failed

Among the Court’s serious concerns were 1) the notification of all the players concerning the “litigation hold,” 2) preservation of the evidence and 3) their duty to search in all databases and files for relevant information. The court also held in addition to failing to institute a timely written “litigation hold” that the spoiling parties failed to collect and preserve electronic documents as of critical dates, continued to delete electronic documents after the duty to preserve arose, did not request documents from the key players, delegated search efforts without any supervision from management, destroyed backup data potentially containing responsive documents from the key players and/or submitted misleading or inaccurate declarations. For this misconduct, the court had no difficulty finding that spoliation of critical evidence had occurred.

One of declarants in the Pension Committee case testified that although he served as the lead contact with counsel, he did not recall getting instructions for gathering and producing documents. He testified that he never took any steps to ensure that e-mails relating to the funds in question were not destroyed nor was he aware of anyone else at his company doing so. He further testified he did not recall ever getting instructions from anyone to preserve the related documents and never received any instructions from counsel on this point. Needless to say this was not a record the Court treated lightly. Local counsel should be far more proactive in this situation.

One of the declarants testified that she had no experience conducting searches, received no instructions on how to do so, and had no supervision during the collection and no contact with counsel during the search. This declarant stated that she'd searched only the investment team’s drive on the London computer network even though she was aware that not all e-mails from these key players would be on that drive. At her deposition she admitted that the communication for the “litigation hold” for documents pertaining to the Cape Town office occurred during a brief telephone conversation without any instructions about how to complete the request. She further testified that she did not search the organization’s backup tapes for related documents and that she was unaware of anyone else doing so. The Court found that the declarant, Hartman, was ill-equipped to handle the e-discovery obligations without supervision from counsel. Given her inexperience, Hartman should have been taught proper search methods, remained in constant contact with counsel and been monitored more closely by management. She searched only one network drive, permitted the key employees to conduct their own searches and delegated the Capetown office search without any follow up or monitoring on her part. This finding by the court suggested counsel has an ongoing duty to make certain that the delegated contact has both the requisite skills and necessary background or has sufficient access to resources to make the search meaningful. Such rulings cannot help but make local counsel uneasy in this new supervisory role.

As a result of the court's finding in the Pension Committee case the sanctions included the following jury charge:

The defendants have argued that plaintiffs destroyed relevant evidence or failed to prevent the disruption of relevant evidence. This is known as this spoliation of evidence.

Spoliation is known as obstruction of evidence or the failure to preserve property as evidence pending work reasonably material to the litigation. Defendants must establish that relevant evidence was destroyed after the duty to preserve arose. Evidence is relevant if it would have clarified a fact issue at trial and otherwise would have been introduced into evidence.

I instruct you as a matter of law that each of these parties failed to preserve evidence after a duty to preserve arose and this failure resulted from negligence in performing their discovery obligations. As a result you may presume, if you do so choose that such lost evidence was relevant and that it would be unfavorable to the defendants. In deciding whether to adopt a presumption you may take into account the seriousness of the plaintiff's conduct in failing to preserve the evidence.

The court further determined the defendants were entitled to an award of reasonable costs including attorneys fees associated with reviewing the declarations submitted, deposing those declarants and their substitutes and the cost of bringing the spoliation motion.

The Take Away

Every lender should currently have a “litigation hold” plan which will allow its management to work with local counsel (or indeed in-house counsel if they are available) to easily sort, separate and preserve their e-mail communications. It is critical that the “litigation hold” procedures provide for the identification and securing of all written loan documents, notes and other underwriting documents to safe storage until the litigation is complete. The local counsel’s concerns on this issue are driven by the increased number of e-discovery applications and sanctions. Lenders must have the ability to act quickly and intelligently upon the “litigation hold” request. These will become increasingly more common, involve larger numbers of communications and drive the cost of litigation much higher. The role of local counsel to implement the “litigation hold” and then supervise the resulting discovery is evolving. His concern is to preserve the evidence and avoid a finding of spoliation and the certain sanctions that such a finding will bring. The law continues to expand in this increasingly technical area, and so too have the Courts have imposed greater duties on local counsel. It is little wonder that counsel find their rapidly evolving e-discovery role more discomforting than ever.

Bari J. Gambacorta is a Shareholder and member of Stark & Stark’s Bankruptcy & Creditor’s Rights Group where he concentrates his practice in foreclosures, bankruptcies, collections and replevins. He has lectured on these topics for New Jersey’s Institute of Continuing Legal Education, the New Jersey Banker’s Association, and the Camden County Bar’s Debtor-Creditor Relations Committee. Bari is a contributor to the Library of New Jersey Civil Complaint Forms published in the New Jersey Law Journal in October 2009. His reported decisions include Associates Commercial Corp. v. Wallia, 211 NJ Super. 231; Heritage Bank v. Vilsmeire Auction Co. 218, NJ Super. 440; and Associates Commercial Corp. v. Sheba Langston, 236 NJ Super. 236 Cert. den. 118 NJ 229. Stark and Stark is a LEAN member firm in Delaware and New Jersey, and they are also members of ELFA and NARCA.

LEAN is a nonprofit association of well known law firms throughout the country with a practice concentration in the enforcement of equipment leasing and finance obligations. LEAN law firms are carefully selected for their expertise in leasing law and are highly regarded by top leasing companies and financial institutions. For more than a decade, clients have turned to LEAN firms for cost effective solutions. For a complete list of LEAN members, visit their online directory at www.leasecollect.org.

John Kenny Receivables Management

www.jrkrmdirect.com

• End of Lease Negotiations & Enforcement

• Fraud Investigation

• Credit Investigations

• Asset Searches

• Skip-tracing

• Third-party Commercial Collections

The Solution to Your Credit & Accounts Receivable Needs

John Kenny

315-866-1167 | John@jkrmdirect.com

|

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

Fernando's View

By Fernando F. Croce

“Win Win” and “Uncle Boonmee Who Can Recall His Past Lives” offer movie fans a double-bill of familiar and strange crowd-pleasers, while comedy gems both past (“Our Hospitality” and “Midnight Run”) and present (“How Do You Know”) await DVD watchers.

In theaters:

Win Win (Fox Searchlight Pictures): Director Thomas McCarthy follows “The Station Agent” and “The Visitor” with another humanistic comedy-drama anchored by fine performances. Mike Flaherty (Paul Giamatti) is an attorney who doubles as a wrestling coach at the local high school as a way to help him deal with the disillusionment he feels for his life and career. Things take an interesting turn when he starts to watch over Kyle (Alex Shafer), the teenage grandson of one of his clients, who turns out to be the kind of strong athlete that Mike needs in his team. But just as things seem to be going his way, Kyle’s troubled mom (Melanie Lynskey) enters the scene. Full of gentle human observation and quirky humor, the movie earns its cheers honestly.

Uncle Boonmee Who Can Recall His Past Lives (Strand Releasing): The title is just the first unique thing about this marvelous Thai fantasy, the surprise winner of last year’s coveted Palme d’Or at the Cannes Film Festival. The uncle of the title (played by Thanapat Saisaymar) is an aging farmer who, while on his deathbed, receives a visit from his ghostly wife and son, who have come to prepare him for the next world. The plot suggests a horror movie, but director Apichatpong Weerasethakul instead offers a warm and funny look at the fluidity of spirituality and fate. Without compromising his singular cinematic style, Weerasethakul weaves a beguiling mosaic of reincarnation and ghosts that’s at the same time remarkably sophisticated and light as air, challenging and immediately accessible. With subtitles.

Netflix Tip: After years of one-of-a-kind filmmaking, acclaimed Thai director Apichatpong may have a breakout hit with the highly appealing “Uncle Boonmee Who Can Recall His Past Lives.” To better appreciate his unique approach to storytelling, check out his previous features, all of them available on Netflix: “Blissfully Yours” (2002), “Tropical Malady” (2004) and “Syndromes and a Century” (2006). |

On DVD:

How Do You Know (Sony): Though it did disappointing box-office business when it opened in theaters last December, James L. Brooks’ romantic comedy deserves a second shot with DVD viewers. At its center is a very eccentric triangle, which kicks off as Lisa (Reese Witherspoon), a professional softball player, gets rejected for supposedly being “past her prime.” She finds some support with George (Paul Rudd), a young corporate executive, and Matty (Owen Wilson), her hedonistic former boyfriend. As George faces serious business trouble with his shady dad (Jack Nicholson) and Matty becomes increasingly serious about relationships, who will Linda pick? A veteran purveyor of Oscar-winning humor (“Terms of Endearment,” “Broadcast News”), Brooks is also an expert on surprising emotions, and his warm touch and the performances guide the film beyond the realms of sitcom.

Midnight Run (Universal): Though most famous for intensely serious roles, Robert De Niro has long had a fondness for comic material and, long before his “Meet the Parents” films, he showed his humorous side in this first-rate action-comedy from 1988. De Niro stars as Jack Walsh, a tough-as-nails bounty hunter whose latest job, bringing a meek, crooked accountant nicknamed “The Duke” (Charles Grodin) to justice, seems like a cinch. However, FBI agents, gangsters and rival bounty hunters, not to mention his prisoner’s unexpectedly sneaky side, make sure this will be an assignment Jack will never forget. Bringing as much attention to the exciting action chases as to the hilarious chemistry between De Niro and Grodin, director Martin Brest (“Beverly Hills Cop”) fashions a blend of thrills and laughs worth revisiting.

Our Hospitality (Kino): A contemporary and equal of Charles Chaplin, Buster Keaton was not only one of the silent ear’s greatest clowns, but one of its greatest filmmakers. In this great 1923 comedy, Keaton brings his trademark character, a deadpan loner facing overwhelming odds, to the 19th-century American South. He plays Willie McKay, a city youngster who goes back to his Kentucky hometown only to find himself caught in a feud between warring families. When he falls in love with a lovely woman (Natalie Talmadge) who turns out to be the daughter of the enemy clan’s patriarch, Willie is forced through a series of daring adventures in order to both win her hand and save his own skin. Full of breathtaking gags and stunts, this is a must for every Keaton fan and a great discovery for beginners.

[headlines]

--------------------------------------------------------------

### Press Release ############################

DriveItNow’s New Pre-Qualified Payment Marketing

Cincinnati, OH – DriveItNow, a service of Automobile Consumer Services, Inc. (ACS), will release the next generation of its Pre-qualified Payment Marketing service at the upcoming 10th Digital Dealer conference in Orlando, Florida.

DriveItNow is the first and only system that instantly provides consumers with car loan payments based on their actual credit eligibility and a dealer’s finance guidelines. Consumers need to know what payments they qualify for in order to make a purchase decision.

DriveItNow 2.0 will include enhancements to help build on the dramatic success dealers have seen with the current version.

To see the next generation of online payment marketing, visit DriveItNow at Booth 122 during the 10th Digital Dealer conference in Orlando, FL, April 19-21. More details about the conference are available at: http://www.digitaldealerconference.com/

About DriveItNow (http://www.DriveItNow.com)

DriveItNow’s patent pending payment marketing technology is a service of Automobile Consumer Services, Inc. (ACS). ACS leads the industry with innovative proprietary technology, superior customer service, and over twenty years of financing and leasing experience.

-Tarry E. Shebesta, OCLC (Certified Lease Consultant)

President, ACS Financial / DriveItNow / LeaseCompare.com

Past President, National Vehicle Leasing Association (NVLA)

tarry@acscorp.com / 513.527.7700 ext. 11

#### Press Release #############################

[headlines]

--------------------------------------------------------------

Portland, Oregon -- Adopt-a-Dog

BLAZE

March 17, 2011 – 6:07 pm

Chow Chow/Labrador Retriever Mix

8 weeks old

Female

10 pounds

"I’m Blaze, but let’s be blunt, I am one cool puppy! So yeah, I’m gonna keep this straight and to the point. Less talkin’ and more adoption! I’m a confident boy ready to get out and experience this great big world. I’m fun, playful, smart, outgoing, and just plain awesome. A great dog in the making, no doubt. Let’s play! Let’s go to training class! Let’s make each other happy!"

8 weeks old-10lbs. My adoption fee is $260 and includes; microchip, reduced cost spay and $25 rebate, reduced cost Training Class, 1 month pet health insurance, free veterinary exam, leash/collar, food sample, toy & Treat packet.

Family Dogs New Life

9101 SE Stanley Ave

Portland, Oregon 97206.

Phone: 503-771-5596 (automated system only)

Or better yet send us an e-mail at bark@familydogsnewlife.org

Adoption Hours-

We are open the following days and hours:

Saturday: 11am to 6pm

Sunday: 12pm to 6pm

Monday: 12pm to 7pm

Tuesday: 12pm to 7pm

Wednesday: 12pm to 7pm

Thursday: CLOSED

Friday: CLOSED

http://www.familydogsnewlife.org/?page_id=22#

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

----------------------------------------------------------------

This Day in American History

1543- the first record of a flood in the United Sates observed by the Spanish explorer Hernando de Sota. he noted the Mississippi River began overflowing its banks and continued until it crest on April 20. by the end of May, the flood had receded. Desoto introduced wild pigs into the wilderness that environmentalist changed the animal population considerable, including introducing smallpox that killed millions of Indians and when expeditions returned a hundred years late, they questioned Desoto's reports because of the major changes to the landscape. ( see the March edition of Atlantic Magazine:

http://www.theatlantic.com/issues/2002/03/

1644 - In Virginia the Opechancanough Indians rise up against the settlers but after two years they will be defeated decisively. They will be forced to give up all the land between the James and York Rivers. The resulting peace will last until 1675.

1692 - Following the accession of William III to the English throne, Pennsylvania is declared a royal colony and New York governor Benjamin Fletcher is declared governor of Pennsylvania, depriving William Penn of his proprietary powers. The Crown takes over Pennsylvania because the pacifist Quakers refused to involve themselves in the war against France and because William Penn had maintained friendly relations with the former English monarch, James II

1748- George Washington visited the public spa at a mineral spring opened to the public( deeded to the colony of Virginia in 1756 by Thomas Fairfax, sixth Baron Fairfax “ to be forever free to the publick for the welfare of suffering humanities.” The spa was located in Bath , Berkeley County , VA ( now Berkeley Springs, Morgan County, WV ).

1782- birthday of John Calhoun, American statesman and first vice president of the US to resign that office (Dec 28, 1832). Born at Abbeville District , SC , died at Washington , DC , Mar 31, 1850,consider the South's strongest advocate for slavery. The vice-presidents ran as separate offices in his day and he served under John Quincy Adams from March 4, 1825 to March 4, 1829 and under President Andrew Jackson from March 4, 1829 to December 28,1832. He resigned to fill the vacancy in the Senate caused by the resignation of Robert Young Hayne, senator form South Carolina . Calhoun was elected to fill the vacancy on December 12, 1832. He had been secretary of war, secretary of state. He was too weak and ill to read his speech or oppose Daniel Webster's brilliant oratory that brought about the “Missouri Compromise” regarding limited slavery in the Western territory. Senator Daniel Webster argued in favor of the compromise. He both cautioned Southerners that disunion would lead to war and advised Northerners to forgo antislavery measures. The Compromise of 1850 was passed and Calhoun died soon after on March 31, 1850.

http://memory.loc.gov/ammem/today/mar18.html

1806-Birthday of African-American Norbert Rillieux, inventor of sugar refining.

http://inventors.about.com/library/inventors/blrillieux.htm

http://gibbsmagazine.com/Rillieux.htm

1813 - David Melville of Newport , Rhode Island patented the gas streetlight. He first installed these lights in front of his own house on Pelham Street Soon everyone in the neighborhood wanted one.

1837, the 22nd and 24th president of the US was born Stephen Grover Cleveland at Caldwell , NJ ,1837. Terms of office as president: March 4, 1885—March 3, 1889, and March 4, 1893—March 3, 1897. He ran for president for the intervening term and received a plurality of votes cast but failed to win electoral college victory for that term. Only president to serve two nonconsecutive terms. Also the only president to be married in the White House. He married 21-year-old Frances Polsom, his ward. Their daughter, Esther, was the first child of a president to be born in the White House.

1848--"California Star" reported that non-Native population of San Francisco

was 575 males, 177 females and 60 children

1856-birthday of African-American Dr Daniel H. William, who performed first successful open heart operation

1886 - Edward Everett Horton (narrator: Fractured Fairy Tales on The Bullwinkle Show; actor: It's a Mad, Mad, Mad, Mad World, Lost Horizon, Sex and the Single Girl, Arsenic and Old Lace; died Sep 29, 1970)

1901-- William H. Johnson was born in Florence , South Carolina. , a famous African American artist. Johnson spent many years in Europe painting expressionist works. He was strongly influenced by the vivid styles and brushstrokes of Henry 0. Tanner, Vincent van Gogh, Paul Gauguin, Edward Munch and Otto Dix. He left Europe when Hitler began destroying art that had primitivist or African themes. Back in the US , Johnson developed a new, flatter style and delved into subjects of his own experience as well as historical African-American figures and events. Going to Church (1940—41) and Mom and Dad (1944) are examples of his later work.\

1902--29-year-old Italian opera singer Enrico Caruso was paid $50 each to record 10 songs on wax for the Gramophone and Typewriter Company in Italy; $500. He would go on to become the world's first recording star. Two years later, he began recording in America for the Victor Talking Machine Company (later RCA Victor). Over a 16-year span, he would earn millions of dollars in royalties from the retail sales of his 260 recordings.

1907 - The lawyers prosecuting alleged grafters score point after point in the proceedings before the grand jury and announce that they have sufficient evidence to prove that the United Railroads, the Pacific States Telephone Co., Home Telephone Co., the Prize-Fight Trust and the Gas Co., have bribed San Francisco supervisors and other city officials.

1911-March 18, Dean Kinkaide Birthday ( noted big band arranger, Dorsey's “Boogie Woogie,” Goodman's “Bugle Call Rag”. Had many of his arrangements in my high school/college big

1925 - the 'Great Tri-state Tornado' tore a 219 mile path through Missouri , Illinois , and Indiana , resulting in the greatest US tornado disaster ever. 695 people were killed, the largest death toll from a single tornado in US history. 234 deaths occurred at Murphysboro , Illinois , the biggest death toll within a single city from a tornado on record. At one point, the tornado was moving at a record setting 73 mph. This tornado was easily an F5 on the Fujita scale with winds exceeding 260 mph. Instead of occurring along a cold front or in a squall line, the tornado was closely associated with a surface low pressure area. In all respects, it was a remarkable tornado and stands alone in its own class of tornadic events

1926 - Peter Graves (Arness) born Minneapolis, MN ;actor: Mission Impossible, The Winds of War, Airplane, Airplane 2, Stalag 17, The President's Plane is Missing, The Night of the Hunter; brother of actor James Arness, who lived near us and took my brother and I to University High School often—Our next door neighbor James Whitmore turned down the “Gunsmoke” role and recommended Arness instead.)

1931- the first electric razor was manufactured by Schick company of Stamford , CT , was delivered today. Remington introduced the dual-headed electric shaver in 1940. The electric shaver was invented by Colonel Jaco Schhick, who recognized that soldiers in the field needed a razor that did not require soap or hot water. he patented a tiny electric motor in 1923, and received pate4nts on his “shaving implement” on November 6, 1928. He could not convince anyone to manufacture his invention, so raised money himself to start his own company..

1932- author John Updike born, Shillington , PA

http://www.hycyber.com/HF/updike_john.html

1932- Casa Loma Band cuts “Smoke Rings.”

1938- singer, former minor league baseball player, Charley Pride born Sledge, MS. He is considered to be the most successful black entertainer in country music. Mississippi . By the early 1970's, Pride had become RCA Victor's biggest-selling artist since Elvis Presley, with hits such as "Is Anybody Going to San Antone?" "Kiss and Angel Good Morning" and "Wonder Could I Live There Anymore." When his first record, "Snakes Crawl at Night," was released in 1965,there was almost no publicity and few people realized that Pride was black. But by the following year, Pride had gained a huge hit and a Grammy Award nomination for "Just Between You and Me."And in 1967 he was introduced on the Grand Ole Opry by Ernest Tubb.

1940- Casa Loma Band cuts “No Name Jive, “ Decca)

1941- Wilson Pickett, one of the great soul singers of the 1960's, was born in Prattville , Alabama . Pickett joined a Detroit group called the Falcons in 1962, and sang lead on their hit, "I Found a Love." But Pickett, on the suggestion of the Falcons' producer, soon began a solo career. He signed with Atlantic in 1964, and had the first of his many hits with "In the Midnight Hour." His backing group on this record was Booker T. and the MG's. Pickett's other successes included "Land of 1,000 Dances," "Funky Broadway" and "I'm a Midnight Mover."

1945-the first professional hockey player to score 50 goals in one season was Joseph Henri Maurice “Rocket” Richard of the National Hockey League's Montreal Canadiens, who scored his 50 th goal in the 17 th minute 45 th second of the third and last period against the Boston Bruins at the Boston Garden , Boston , MA . He retired in 1960 with 544 goals in 16 regular seasons.

1945- The Japanese released mechanized flying bombs piloted by young Japanese men. These suicide bombs, directed against the US aircraft carrier fleet attacking the Japanese fleet in the Kure-Kobe area, inflicted serious damage on the Enterprise , Intrepid and Wasp .

1945 - About 1300 American bombers, with some 700 escorting fighters, drop 3000 tons of bombs on Berlin, despite heavy anti-aircraft defenses, including numerous jet fighters. The US fleet loses 25 bombers and 5 fighters.

1945---TREADWELL, JACK L. Medal of Honor

Rank and organization: Captain, U.S. Army, Company F, 180th Infantry, 45th Infantry Division. Place and date: Near Nieder-Wurzbach, Germany, 18 March 1945. Entered service at: Snyder. Okla. Birth: Ashland, Ala. G.O. No.: 79, 14 September 1945. Citation: Capt. Treadwell (then 1st Lt.), commanding officer of Company F, near Nieder-Wurzbach, Germany, in the Siegfried line, single-handedly captured 6 pillboxes and 18 prisoners. Murderous enemy automatic and rifle fire with intermittent artillery bombardments had pinned down his company for hours at the base of a hill defended by concrete fortifications and interlocking trenches. Eight men sent to attack a single point had all become casualties on the hare slope when Capt. Treadwell, armed with a submachinegun and hand grenades, went forward alone to clear the way for his stalled company. Over the terrain devoid of cover and swept by bullets, he fearlessly advanced, firing at the aperture of the nearest pillbox and, when within range, hurling grenades at it. He reached the pillbox, thrust the muzzle of his gun through the port, and drove 4 Germans out with their hands in the air. A fifth was found dead inside. Waving these prisoners back to the American line, he continued under terrible, concentrated fire to the next pillbox and took it in the same manner. In this fort he captured the commander of the hill defenses, whom he sent to the rear with the other prisoners. Never slackening his attack, he then ran across the crest of the hill to a third pillbox, traversing this distance in full view of hostile machine gunners and snipers. He was again successful in taking the enemy position. The Germans quickly fell prey to his further rushes on 3 more pillboxes in the confusion and havoc caused by his whirlwind assaults and capture of their commander. Inspired by the electrifying performance of their leader, the men of Company F stormed after him and overwhelmed resistance on the entire hill, driving a wedge into the Siegfried line and making it possible for their battalion to take its objective. By his courageous willingness to face nearly impossible odds and by his overwhelming one-man offensive, Capt. Treadwell reduced a heavily fortified, seemingly impregnable enemy sector.

1945--*WILKIN, EDWARD G. Medal of Honor

Rank and organization: Corporal, U.S. Army, Company C, 157th Infantry, 45th Infantry Division. Place and date: Siegfried Line in Germany, 18 March 1945. Entered service at: Longmeadow, Mass. Birth: Burlington, Vt. G.O. No.: 119, 17 December 1945. Citation: He spearheaded his unit's assault of the Siegfried Line in Germany. Heavy fire from enemy riflemen and camouflaged pillboxes had pinned down his comrades when he moved forward on his own initiative to reconnoiter a route of advance. He cleared the way into an area studded with pillboxes, where he repeatedly stood up and walked into vicious enemy fire, storming 1 fortification after another with automatic rifle fire and grenades, killing enemy troops, taking prisoners as the enemy defense became confused, and encouraging his comrades by his heroic example. When halted by heavy barbed wire entanglements, he secured bangalore torpedoes and blasted a path toward still more pillboxes, all the time braving bursting grenades and mortar shells and direct rifle and automatic-weapons fire. He engaged in fierce fire fights, standing in the open while his adversaries fought from the protection of concrete emplacements, and on 1 occasion pursued enemy soldiers across an open field and through interlocking trenches, disregarding the crossfire from 2 pillboxes until he had penetrated the formidable line 200 yards in advance of any American element. That night, although terribly fatigued, he refused to rest and insisted on distributing rations and supplies to his comrades. Hearing that a nearby company was suffering heavy casualties, he secured permission to guide litter bearers and assist them in evacuating the wounded. All that night he remained in the battle area on his mercy missions, and for the following 2 days he continued to remove casualties, venturing into enemy-held territory, scorning cover and braving devastating mortar and artillery bombardments. In 3 days he neutralized and captured 6 pillboxes single-handedly, killed at least 9 Germans, wounded 13, took 13 prisoners, aided in the capture of 14 others, and saved many American lives by his fearless performance as a litter bearer. Through his superb fighting skill, dauntless courage, and gallant, inspiring actions, Cpl. Wilkin contributed in large measure to his company's success in cracking the Siegfried Line. One month later he was killed in action while fighting deep in Germany

1949---Top Hits

Far Away Places - Margaret Whiting

Powder Your Face with Sunshine - Evelyn Knight

Cruising Down the River - The Russ Morgan Orchestra (vocal: The Skyliners)

Don't Rob Another Man's Castle - Eddy Arnold

1953- in baseball's first franchise shift in half a century, the Boston Braves announced that they would become the Milwaukee Braves. The team remained in Milwaukee through the 1965 season after which it moved to Atlanta .

1957---Top Hits

Young Love - Tab Hunter

Round and Round - Perry Como

Little Darlin' - The Diamonds

There You Go - Johnny Cash

1957- “Tales of Wells Fargo” premiered on TV. This half-hour western starred Dale Robertson as Jim Hardie, agent for Wells Fargo Transport Company. In the fall of 1961, the show expanded to an hour. Hardie bought a ranch, and new cast members were added, including Jack Ging as Beau McCloud, another agent, Virginia Christine as Ovie, a widow owning a nearby ranch, Lory Patrick and Mary Jane Saunders as Ovie's daughters and William Demarest as Jeb, Hardie's ranch foreman. Jack Nicholson appeared in one of his first major TV roles in the episode "The Washburn Girl." My father Lawrence Menkin wrote many of the episodes.

1959 - Bill Sharman of the Boston Celtics began what was to be the longest string of successful consecutive free throws (56 in a row) to set a new National Basketball Association record.

1959 - President Eisenhower signed the Hawaii statehood bill

1962-Gary "U.S." Bonds appears on The Ed Sullivan Show performing his latest hit, "Twist, Twist, Senora", which will reach #9 in April.

1963 the first doomed sports stadium that was fully enclosed started to be built this day. It was the Astrodome, Houston , TX , formally known as the Harris County Domed Stadium. The overall cost was $35.5 million. The arena could accommodate 66,000 people. The first baseball game under the dome was played on April 9, 1965 between the Houston Astros and the New York Yankees, who lost 2-1. The first football game was played on September 11,1965, when the University of Tulsa defeated theUniversity of Houston 14-0.

1964--Birthday of Bonnie Blair, speed skater. Born on March 18, 1964, in Cornwall, N.Y. She moved with her parents to Champaign, Ill., when she was 2 and began skating at that time. In 1988 Blair won the gold medal in the 500 meters at the Winter Olympics in Calgary, and a bronze in the 1,000 meters. In the 1992 games in Albertville, France, she won two gold medals at the same distances, becoming the first American Woman to win three gold medals in the Winter Olympics and in 1994 she added more.