Connect with Leasing News

Connect with Leasing News ![]()

![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() |

| ![]() Search |

Search | ![]() Stress Release

Stress Release

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Independent, unbiased and fair news about the Leasing Industry

kitmenkin@leasingnews.org

![]()

|

Wednesday, March 21, 2012

Today's Equipment Leasing Headlines

Co-Founder Trinity Leasing James Halow Passes Away

Classified Ads---Asset Management

Lease Fleece Adam S. Zuckerman Sentenced

Chesswood Declares Year-End Net Income $6.5 Million

Pawnee Leasing is the Star

Pawnee Leasing 30th Year Anniversary

Letters?!!!---We get eMail---

LinkedIn is better than Facebook

(for identity thieves looking for rich victims)

Willingboro, New Jersey Adopt-a-Dog

In Memory of Warren Luening, Jr.

News Briefs---

Islamic Bank Arcapita Files for Bankruptcy Protection as Debt Talks Fail

US builders requested more permits in any month since October 2008

Meg Whitman to merge printing/PC groups: major HP reorganization

Coca-Cola holds top spot, but category keeps losing market share

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

Networking tips offered to get next job

You May Have Missed

7 Things that Separate Weight-Loss Winners & Losers

SparkPeople--Live Healthier and Longer

Sports Briefs---

Spring Poem

California Nuts Briefs---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer. It is considered “bias” as it is the writer’s viewpoint.

|

[headlines]

--------------------------------------------------------------

Co-Founder Trinity Leasing James Halow Passes Away

James Halow, age 72, died at home following a seven-month battle with pancreatic cancer. An alumnus of U. S. Leasing and Stanford Business School, Jim and his wife Donna formed Trinity in 1981 in San Francisco. They focused on business development, industry relations and maintenance of Trinity's high standards and reputation. Primarily specializing in nationwide vendor leasing programs for manufacturers in specific vertical markets vendor operation, the company developed into a major "back office" for small banks and leasing companies. In November, 2002 Bank of the West acquired the company which then had a portfolio of $160 million.

At the time, " 'This acquisition underscores Bank of the West's commitment to equipment leasing as a core product line,' said Jerry Newell, Bank of the West's Equipment Leasing manager."

http://two.leasingnews.org/archives/Nobember_2002/11-13-02.htm

"Friends are invited to celebrate Jim's life at 11:00am on Friday, March 23 at St. Leo's Church, 601 W. Aqua Caliente Road, Sonoma, with a reception following at the Sonoma Golf Club. Memorial donations may be made to Salesian Boys and Girls Club in San Francisco (www.salesianclub.org) or the Valley of the Moon Boys and Girls Club College Bound program (www.bgcsonoma.org).

San Francisco Chronicle Obituary:

“James Halow I am but waiting for you For an interval Somewhere. Very near. Just around the corner. Jim died March 18 at home at age 72 after a seven-month battle with pancreatic cancer. Jim had time during the progress of this disease to receive and reflect on the love and adoration of his family and so many others he had influenced, mentored and touched during his life. Jim used this interval to tell life stories with humor, giving his final guidance and personal philosophy to his children, daughter-in-law, and close nieces and nephews.

“Jim was born in Altoona PA and grew up in Chevy Chase MD. He graduated in engineering from Carnegie Tech University and was awarded his Ph. D. in physics from Catholic University of America. He taught physics at Drexel University before entering Stanford Business School for his MBA. Jim founded Trinity Capital Corporation, which he ran with his wife, Donna, for several decades. He took personal pride in the long-term continuity of one hundred employees and the equipment financing of hundreds of thousands of small businesses throughout the United States.

“Jim lived a wonderful life and enjoyed his work, his family and friends and his many passions including basketball, tennis, mathematics and golf. He was a respected coach for the boys and their friends throughout their lives and inspiration to many. The wonderment and fullness of the many phases of Jim's life came together in his final months. Ongoing calls and letters from his Chevy Chase friends helped recall and shape the happy memories and great depth of their friendships of over half a century. His long-time friends from Stanford Business School were staunchly here with him throughout his illness. Jim's love and work for the University High School basketball team, and the boys he influenced there, was memorialized in a heart-felt video tribute by one of its great players.

“The many notes, videos and calls from the staff and clients at Trinity brought Jim right back into that close circle of colleagues. His neighbors, tennis buddies, golf buddies, and friends-from family life in San Francisco to retirement living in Sonoma-reminded Jim on a daily basis how much he was an ongoing part of their lives. Jim is survived by his wife of 37 years, Donna, sons James and Michael, daughter-in-law, Gina, his brother, Joe (Elisabeth), sisters Eva (Arnold), Mary, and Gloria (Osama), Donna's family, Evelyn (John), Kris (Carol) and Janet (Frank), nine very close and beloved nieces and nephews, and his close cousin, Linda. Jim has joined his father and cherished mother, two brothers, George and Fred, and his most beloved niece, Michelle. "

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2012/03/20/MNHALOWJA03209.DTL

[headlines]

--------------------------------------------------------------

Classified Ads---Asset Management

(These ads are “free” to those seeking employment or looking

to improve their position)

| San Francisco, CA Ten years experience setting residuals, negotiating leases and remarketing equipment across a broad spectrum of large ticket asset types including marine, intermodal, mining, energy, manufacturing. geoffwalshe@yahoo.com |

| Located near Dallas Extensive experience in valuation/remarketing of IT and telecom assets. Established network of customers and vendors. Strong leasing background Located near Dallas contact: leasevalue@gmail.com |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

[headlines]

--------------------------------------------------------------

Lease Fleece Adam S. Zuckerman Sentenced

Adam S. Zuckerman, Laguna Beach, California, head of BrickBanc, Costa Mesa, California, and reportedly found to be the ringleader in Operation Lease Fleece, was sentenced to 37 months in federal prison with three years of supervised release by Judge Cormac J. Carney. Zuckerman may be able to take 10% to 15% off the sentence for good behavior, as well as will be in a half-way house upon the last six months of his term.

Zuckerman testimony and files were left sealed in his case, as the investigation is considered “on going.”

The prosecutor, Jennifer L. Waier, Office of US Attorney, would make no comment on the case to Leasing News.

The two major founders of CapitalWerks, Preferred Leasing, Mark McQuitty, sentencing is scheduled for May 14, 2012, and James Raeder, sentencing for June 4, 2012.

Zuckerman sentencing was originally set for October 24, 2012, but moved forward, and may be due to such events as found on this web site: www.stopzuckerman.com

According to the interview with many of those sentenced, the original program was instituted by CapitalWerks in disguised "sale/leaseback" or leases that exceeded the action costs, and included software and installation not spelled out. Accordingly Zuckerman took it one step further, sending out faxes for working capital, and actually setting up phony bank accounts, trade references, fake vendors, and really pushing the program far over the line from what CapitalWerks originally started.

Left to be sentenced besides McQuitty and Raeder:

Leigh Dorand, 42, Tech Capital, Phoenix, Arizona sentencing continued until 7/23/2012 10:00 AM before Judge Cormac J. Carney.

Ziya, Arik, 38, CapitalWerks, continuing Sentencing hearing to 4/30/2012 11:00 AM before Judge Cormac J. Carney

Michael Scott Grayson, Axis Communication, Tarzana sentencing continued to 6/25/2012 11:00 AM before Judge Cormac J. Carney

A joint trail seems left also:

Chant Vartanian, president of ISystems Technology and Solutions, currently operating under several business names, trial date is continued to April 24, 2012 at 9:00 a.m. IT IS FURTHER ORDERED that the status conference is continued to April 16, 2012 at 9:30 a.m.

Sarkus Vartanian, vice-president of ISystems Technology and Solutions, currently operating under several business names, "trial date is continued to April 24, 2012 at 9:00 a.m. IT IS FURTHER ORDERED that the status conference is continued to April 16, 2012 at 9:30 a.m.

In the group of previous stories, this one is the most complete about Adam Zuckerman, told from his point of view, how he got involved in Operation Lease Fleece:

http://leasingnews.org/archives/Oct2010/10_12.htm#unpublished

Operation Lease Police Stories:

http://www.leasingnews.org/Conscious-Top%20Stories/Lease_Fleece.htm

[headlines]

--------------------------------------------------------------

Chesswood Declares Year-End Net Income $6.5 Million

Pawnee Leasing is the Star

Pawnee remains the star of the Chesswood Group, Ltd., Toronto, Canada.

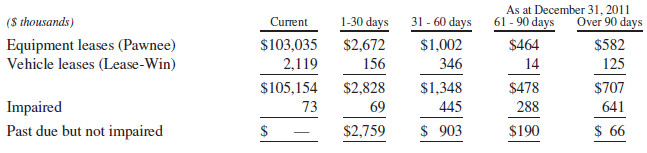

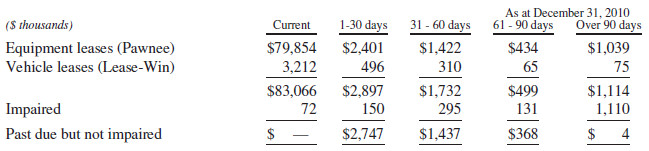

Lease Receivables

(Annual Report, page 83)

(Annual Report, page 84)

"Chesswood has a loss of $2.6 million 2010 and net income of $6.5 year-end 2011. Paid a cash dividend of almost $6.6 million, with a cash equivalent at the beginning of the year at $12.8 with an end of year period $7.3 million."

(Annual Report, page 64)

"For the year ended December 31, 2011, the Company reported consolidated net income of $6.5 million compared to a net loss of $2.7 million in the year ended December 31, 2010, an increase of $9.2 million year-over-year.

"The $9.2 million increase in net income year-over-year was the result of:

• Pawnee’s net income increased by $2.5 million, predominantly from a $1.3 million increase in finance income, a $1.8 million reduction in provision for credit losses and an $864,000 reduction in the mark-to market loss interest rate swaps from the prior year, offset by a $1.6 million increase in income tax expense.

(Annual Report, page 26)

"• Corporate overhead decreased $7.2 million predominantly from the $6.5 million reduction in IFRS adjustments required in the 2010 comparatives as a result of being an income fund in 2010. The $6.5 million in 2010 IFRS adjustments include a $4.5 million loss in fair value on other liabilities due to IFRS treatment of certain Fund Equity items as liabilities, $1.3 million in distributions to Unit holders that were expensed under IFRS in 2010, and $729,000 higher income tax expense in 2010 as the Fund was required to apply the Unit holders’ marginal tax rate to undistributed income.

(Annual Report, page 26)

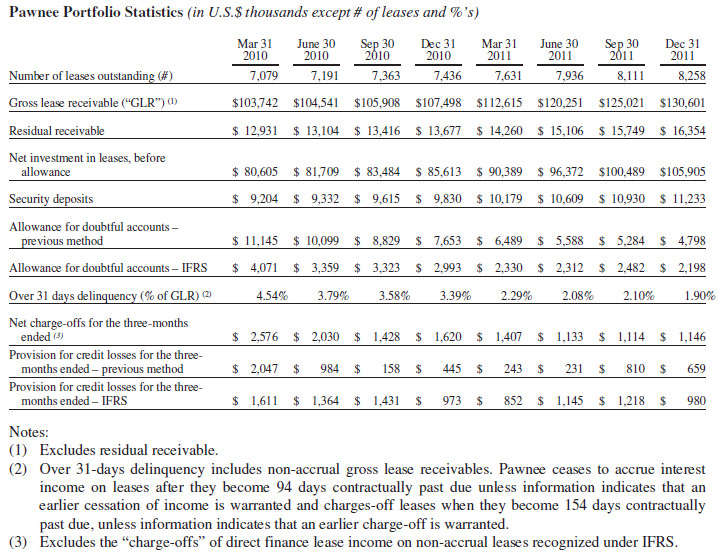

"Pawnee is an equipment finance company that provides lease financing on micro and small-ticket business equipment. Pawnee focuses on small businesses (with a particular focus in the start-up and “B” credit segment of the U.S. equipment finance market), servicing the lower 48 states through a network of approximately 550 independent brokers. As of December 31, 2011, Pawnee administered 8,258 leases in its portfolio, with remaining scheduled lease payments of approximately U.S. $130.6 million over the next five years.

(Annual Report, page 2)

"Assessed as lower risk business than Pawnee’s traditional “B” business, “B+” lessees receive funding based on rates that typically range from 14-26%. At December 31, 2011, approximately 47% of Pawnee’s lease receivables consisted of the “B+” product. Pawnee expects its “B+” product to continue to grow.

• no state represented more than 10.3% of the number of Pawnee’s total active leases, with the exception of California which represented 12.2%;

• Pawnee financed over 70 equipment categories, with its five largest categories by volume, being restaurant, auto repair, titled trucks and trailers, beauty salon and computer equipment, which combined accounted for 54.4% of the number of active leases;

• its lessees operated in over 85 different industry segments, with no industry concentration accounting for more than 14.8% of its number of active leases;

• no lessee accounted for more than 0.01% of its total lease portfolio; and

• its largest source of lease originations accounted for 18.9% of its leases in the year ended December 31, 2011, and its ten largest origination sources accounted for 40.4% of its leases.

"As of December 31, 2011, Pawnee employed approximately 40 full-time equivalent employees, over one-third of whom are dedicated to collection and default remediation."

(Annual Report, Page 3)

Forecast of Future Minimum Lease Payments Receivable

2012 $58,609

2013 $40,921

2014 $21,593

2015 9,557

2016 2,141

2017

Total $132,821

Residual 16,832

(Annual Report, page 82)

2011

Charge Offs (7,272)

Recoveries 2,337

2010

Charge Offs (10,908)

Recoveries 2,210

(Annual Report, Page 84)

Late Fees, insurance, or security interest were not found in the report, although:

"The majority of the $11.5 million (December 31, 2010 – $9.9 million) in customer security deposits relates to security deposits held by Pawnee. Pawnee’s primary lease contract requires that the lessee provide two payments as security deposit (not advance payments), which are held for the full term of the lease and then returned or applied to the purchase option of the equipment at the lessee’s request, unless the lessee has previously defaulted (in which case the deposit is applied against the lease receivable). Historically, a very high percentage of lessees’ deposits are either applied to the purchase option of the leased equipment at the end of the lease term or used to offset charge-offs.

(Annual Report, page 36)

(Annual report, Page 20)

It should be noted from the Annual Report, "June 10, 2011 Chesswood acquired Case Funding which acquires "Quick Cash, Inc." a provider of litigation financing to plaintiffs and attorneys through the Unite States...Case Funding's advance rate is a maximum of 20% of the expected total fees. Only cases already in progress are eligible for an inclusion in a bask."

(Annual Report page 4)

Chesswood Limited Annual Report (133 pages):

http://leasingnews.org/PDF/ChesswoodAnnualReport_3202012.pdf

Gary DiLillo, President

440.871.0555 or gary@avptc.com |

[headlines]

--------------------------------------------------------------

Pawnee Leasing 30th Year Anniversary

Rob Day, Founder Pawnee Leasing, President 1982-1999

Sam Leeper, President 1999-2005

Gary Souverein, President 2005--Present

Rob Day, an optometrist and business entrepreneur, had a Bank of America lease form, obtained a bank line of credit, and started leasing for an Apple Computer store he had an investment interest in Sterling, Colorado July, 1982. He called the company after the name of the street where he lived: Pawnee.

Computer customers came back as well as leads to other potential lessees, and after doing leases for four Apple Computer stores, Day decided to expand and moved the operation to Fort Collins, Colorado, to service other Apple Computer stores in the neighboring states.

In 1990, Dave Malucky, a one-man lease brokerage in Denver introduced them to the lease broker business. By 1991 the stores accounted for less than 10% of their volume and had faded completely by 1993. Pawnee was committed to the broker market and has never looked back since.

Rob Day, Founder Pawnee Leasing, President 1982-1999

“Century Bank had been our only bank and we had a seven figure revolving line with them, our only significant credit facility, “Rob Day explains." This was a time in Colorado banking history when the ‘Minnesota Twins’ arrived on the scene. First Bank and Norwest, both of Minneapolis, started purchasing many of the banking assets in Colorado and their actions set off a buying binge by other national banks that feared missing out on the Colorado market. Unfortunately for us Century Bank was purchased by Key Bank and our type of business did not fit with the new organization. We had 90 days to pay off our note. That was a stressful time and I was left with the notion that I was going to be funding deals right out of my wallet!"

“I had met Sam Leeper, a senior executive with Affiliated Banks of Colorado, when in 1991 they provided a small line of credit for a leasing partnership we had formed in connection with Pawnee. By late 1993, his bank had been purchased by Bank One and they were my plan for survival. Fortunately for us, the transition from Affiliated to Bank One had been difficult and longer than anticipated so that by late 1993 Bank One was ready to do business and needed to make up for some lost time. In less than 45 days, Sam and his team came through with a credit facility to replace Key Bank and to provide funds for expansion."

"We grew with Sam and Bank One into the golden era of specialty finance where leasing companies were highly sought after and premiums were high. Every company has capital issues and they are either solved internally or you sell out to a larger organization that can provide the external solution. Pawnee needed more capital to fuel our growth and we had a suitor in early 1997 that could do that. I agreed to a buyout contingent upon both of us completing due diligence. I was reacting like a typical founder; as the due diligence progressed I began to question whether my buyer was the kind of company I really wanted my employees and me to join. I thought our business model was superior to theirs. I thought our team was better than theirs. That kind of thinking was not going to produce harmony and we had a mutual understanding to terminate the discussions. No deal, we were back looking for capital like a coyote looking for his next meal.

“Our banker from Bank One (now JPMorgan Chase Bank), Sam Leeper, was aware of our needs and introduced Pawnee to Dick Monfort. Sam had handled the Monfort family’s banking affairs for some time. The Monfort family is a household name in the Colorado community and Dick and his brother are well known as owners of the Colorado Rockies Major League Baseball team. In the spring of 1997 he introduced us to Dick Monfort and discussions began for Dick to buy out my minority partners and for Sam to join Pawnee.

“In May we completed the transaction and the next month Sam started his career at Pawnee. The ‘trade’ was Dick’s purchase of the minority shareholders’ interests in Pawnee and the concurrent hiring of Sam Leeper to succeed me. Dick met Pawnee’s capital needs and Sam was precisely the ingredient Pawnee needed; Sam, with engineering and finance training, was methodical, structured and a master of systems and process building. Sam subtly shifted our focus from thinking of ourselves as a leasing company to being a risk management and collection company”.

"Pawnee had grown past the point of quick decisions executed by noon and our structure protocols needed some overhauls. We had external auditors in Arthur Anderson as was required by our credit facilities, thus compliance and systems became more in focus. It is often said that entrepreneurs come in two forms, “sprinters” and “runners”. I was a sprinter, Sam was a runner. I knew that Sam was going to be the best choice to take Pawnee forward."

Sam Leeper, President 1999-2005

"Pawnee had around 11 employees when I joined in 1997, “Sam Leeper, President 1999-2005, said. " During my first month, Pawnee's banker, my former associates at JPMorgan Chase, visited our facility, which was a single floor of some 800 square feet of a commercial office tower. I was ribbed by my former associates at the fact that I had just booked my first credit for Pawnee - a $3,000 transaction - as my last transaction at the bank involved several million dollars. While my new Pawnee authority level was tough on my psyche, it firmly established for our bankers that Pawnee was truly a prudent risk manager. The visit and subsequent discussions resulted in an increase in the bank facility to $15 million. In addition, our partner Dick provided a $2 million mezzanine loan and we were set to pursue the growth we anticipated.

"Rob continued as CEO. He performed his responsibilities remotely from his California home primarily offering strategic advisement to the ‘day-to-day’ I was running, as well as active in leasing association.”

Rob Day, 2000 United Association of Equipment Leasing Conference

" Our Board of Rob, Dick, and myself provided what proved to be a perfect combination, “ Leeper explains, “Rob and Dick provided the inspiration to grow while I and the Tribe, the name we coined our employee team, provided the perspiration to evaluate, formulate, organize, and execute the many ideas for making Pawnee the best niche leasing company in the country.

"Our partner Dick Monfort provided an increased mezzanine line and we were attracted to the rates available through securitization and we briefly turned to this financing method. However, we soon found this approach to be terribly inefficient and inflexible for our type of portfolio. Foothills Capital, a Wells Fargo affiliate, replaced the securitized portion of the portfolio to augment our JPMorgan facilities."

At this point, our growth was tremendous and everyone was working very hard to fund deals as fast as they came in.

Friday

Part II Chesswood Income Fund and Gary Souverein

Bruce Kropschot Introduces Barry Shafran

|

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

Letters?!!!---We get eMail---

(Mostly In chronological order as received:)

Why the Evergreen Clause is important to Marlin Leasing

http://leasingnews.org/archives/Mar2012/3_09.htm#marlin

"Marlin should get back to doing business with more brokers. I certainly miss Manifest and Marlin. I never had a problem with $1.00 out leases with them, as well as I always was in contact with my customer.

Please don't use my name as I would like to get back to them once they start to accept broker business again."

(Name withheld)

"I have been dealing with Marlin for over ten years and find them the best company to deal with. The brokers they cut off had high percentages of not getting deals funded that were approved. I find them a great company to work with."

(Name withheld)

"Just funded a deal today as a matter of fact with Marlin for this vendor. I saw your article about the Evergreening and Marlin. Very interesting. I only do $1.00 buyout leases with Marlin and they do not Evergreen on those. I love their quick approvals under 2 hours, their quick funding, and their simple One Page lease with everything on it. No muss no fuss. They even do Corp Only deals for me even now"

(Name withheld)

"I couldn't ask for a nicer rep. He told me they are only taking a handful of brokers and it is very small. I felt very lucky to have been invited. He told me it was because my packages were always perfect and I had zero delinquency on the deals I had done. Holy Cow! They completely revised their Broker Agreement and it is really Broker Friendly."

(Name withheld

"Very nice article on Marlin today."

(Name Withheld)

(Due to the position the last person has with his company, he was not authorized to make a statement. Ironically with the broker accolades about Marlin, Leasing News Tuesday afternoon just received a new complaint today regarding a lessee being billed three extra payments and Marlin demanding the next in an Evergreen clause. It came from a broker who originally sent to deal to Marlin:

(I’ve been in this industry for about twenty years and although the past three have been rough, overall it has been a great experience. We have worked closely with so many quality people over the years, many who unfortunately are no longer around. Over the past ten years we have worked closely with Dwight Galloway and have become close to him. I know you are aware of all the struggles he has endured as you have written about him in a positive light so many times. It seems like his new company is doing well – hopefully he has found a solid parent. Over the years I have regularly read your report. It is a great resource and a valuable piece of our industry -- thank you. I’m looking for some help, and hoping you may be able and willing. One of our Lessee’s contracts, that had been sold to Marlin, was put into auto renewal because the Lessee neglected (forgot) to exercise their purchase option. The contract was originally structured with two payments in advance as security deposit, followed by 60 monthly payments, and a 10% purchase option. They’ve recently realized they have now made 65 payments (five extra). In an effort to settle, they have offered to pay Marlin an additional $1,500 and to forfeit the return of their security deposit. This is a $25,000 contract with a $2,500 purchase option. The security deposit amount is $1,196.36. So, they are offering $1,500 plus $1,196.36 to settle the $2,500 purchase option. If accepted, this would give Marlin an additional 5 full payments plus $196.36. Marlin has declined the offer and in turn has requested an additional $3,000 payment as well as forfeiture of the security deposit. Can you help with this? Please let me know. Thanks!

(In the process of gathering all the documents. Editor)

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Sales Professional-Nationwide

www.ascentiumCapital.com |

"I noticed you had a new company called Ascentium listed today. Nice website and it Looks like another Tom Depping’s company. I was curious to know who was funding the company. Do you know?"

(Name with held)

In August, 2011, “KINGWOOD, Texas---Ascentium Capital today announced its launch as a lender focused on the important but underserved market for small-balance commercial loans and leases in the United States. Ascentium Capital is backed by Vulcan Capital, the private investment group of Paul G. Allen, and a group of investors led by LKCM Capital Group, LLC (“LKCM”), the alternative investment vehicle for Luther King Capital Management.

“We see a tremendous opportunity to meet the lending needs of small businesses. We believe Tom and his team are well positioned to capitalize on this opportunity given their outstanding long-term track record and proven commitment to high standards of integrity and customer service”

Ascentium Capital will acquire a $150 million portfolio of commercial loans and leases from Main Street Bank (“Main Street”), as well as a state of the art small business origination and servicing platform. Separately, Main Street has reached an agreement to sell its branches and deposits to Green Bank, N.A. Following the completion of the sale of assets to Ascentium Capital and the branch/deposit sale, Main Street will liquidate and terminate its banking charter. Ascentium Capital does not intend to operate under a banking charter.

Ascentium Capital will be initially capitalized with $75 million of equity and a $250 million warehouse facility led by UBS Investment Bank. The company will also have access to an additional $35 million of equity capital to fund future growth. Ascentium Capital will be headquartered in the Houston metropolitan area of Kingwood, Texas, and led by the existing Main Street senior management team, including Chairman Tom Depping. The company will originate loans and leases through a national sales staff that will work with equipment manufacturers, distributors and resellers, as well as vendors, franchisors and selected equipment lease brokers.

“We see a tremendous opportunity to meet the lending needs of small businesses. We believe Tom and his team are well positioned to capitalize on this opportunity given their outstanding long-term track record and proven commitment to high standards of integrity and customer service,” said Geoff McKay, a managing director of Vulcan Capital."

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

"I have changed direction and will no longer be pursuing a career in leasing. I have started my own business consulting business and I am having great success with small to medium size companies. My website is under construction by I am sending you my link in the event you cross paths with an entrepreneur, existing or start up business in need of consulting services. Thank you and I think what you are doing for those in the industry is great."

Carmela DeNicola

FYI Business Consulting

www.fyibusinessconsulting.com

carmela.denicola@gmail.com

"FYI develops Action Based Business Plans, Marketing Plans, Web Design & Development Plans in close partnership with our clients to achieve specific, measurable goals and results. We back our Plans with Interactive Consulting and Action Oriented, Success Based Implementation Processes, Steps and Plans. We look forward to helping you succeed with your business."

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Abby and Fiona

"I know you love dogs Kit. Wanted to share our children with fur.

"These adorable happy Rat-Hunting sisters just got promoted to VP's of Vermin Control at Edison."

Jim Gibbons

Edison Capital Leasing LLC

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Don Wood, winemaker, Kristen Wood, event director with their two sons

Please find attached our updated winery photo!

Thanks for your help!

Don Wood

Icicle Ridge Winery

(In 2006, in an effort to draw attention to Classified Ads--Help Wanted, for over a year ran a different small winery with photo and information. September 11, 2006 Icicle Ridge Winery in the foothills of the Cascade Mountains near Leavenworth, Washington was featured. Claim to fame was white merlot, chocolate cherry wine, and estate grown Lemberger.)

http://www.leasingnews.org/archives/September%202006/09-11-06.htm#ads

More photos and about the winery:

http://www.icicleridgewinery.com/about_People.cfm

--------------------------------------------------------------

LinkedIn is better than Facebook

(for identity thieves looking for rich victims)

http://www.itworld.com/security/258456/linkedin-better-facebook-identity-thieves-looking-rich-victims

(The latest are emails saying you have a LinkedIn inbox message, click here---and it is a virus. Of course, these emails also have been used as if from Twitter, and also Facebook)

|

[headlines]

--------------------------------------------------------------

Willingboro, New Jersey-- Adopt-a-Dog

Danny Boy

Beagle

Primary color: Tricolor (Brown, Black & White)

Coat length: Short

"Danny Boy is a 5 year old beagle. He is a very handsome man and needs a new home. His first family had to move and could not take him with them. He is a very friendly dog and good with people. If you are looking to adopt a really nice dog give this guy a try."

Burlington County Animal Alliance, Willingboro, NJ

jajachris@aol.com

Petfinder.com Pet Inquiry: Danny Boy PFId#22422412

Web Site: http://www.bcaaofnj.org/

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

In Memory: One of my very best friends in high school, who I stayed in touch with and had dinner and visited not as often as I would have liked.

Warren Luening, renowned studio trumpeter dies

http://www.allaboutjazz.com/php/news.php?id=95560

from This Day in American History:

1916- Billy May Birthday (one of the great big band arrangers with his own band, Frank Sinatra, Nat “King” Cole, and his recreation of the Jimmie Lunceford band album is one of my favorites. His arrangement of “Lean Baby” was one my favorites that my band played. Another was “String of Pearls” where Warren Luening, Jr. and Chris Morgan would duel on the solos.

----

We went to see the Count Basie Band at a special preview and concert at Santana Row, San Jose. I have many great memories of seeing the Basie band since I was 14 years old and stood outside the kitchen at a club in Los Angeles, to seeing at many other places, and shaking his hand with my kids at Circle Star, San Carlos, California. When I had my dance band in high school and college, we had many of his band's arrangement in our book. While I have many favorites from the Atom Bomb album to the Newport Jazz Festival, one of my favorites is the 1966 Frank Sinatra at the Sands with the Count Basie Band. Sinatra just turned 50 and makes jokes about it with Basie, and the band never played better, and Sinatra was terrific, also. "Sent for You Yesterday..." We had Warren Luening, Jr., playing lead trumpet in the band, and Chris Morgan on third (think Dave Silverman played second or fourth, can't remember, except he was primarily a Dixieland trumpet player). All three were cut ups, had two many girls at rehearsal, but no one could hit the high notes that Warren could hit and hold. And he played things right the first time. He could read, had great rhythm and was born with perfect pitch. He went on to graduate from UCLA and then the Air Force band during the Viet Nam war. He had great class then. And still does, today. Great dresser, too; always stylish. He can be heard on movie recordings, studio recordings, and is in great demand in Hollywood. I'm really looking forward to tonight. I wish Warren and his lovely wife, Stella, had been with us...

http://www.leasingnews.org/archives/August_%202003/8-08-03.htm

|

![]()

News Briefs----

Islamic Bank Arcapita Files for Bankruptcy Protection as Debt Talks Fail

http://www.bloomberg.com/news/2012-03-19/arcapita-bank-files-for-chapter-11-bankruptcy-protection.html

US builders in February requested the most permits in any month since October 2008

http://www.washingtonpost.com/business/economy/us-builders-began-work-on-fewer-homes-in-february-but-permits-for-new-homes-jumped-5-pct/2012/03/20/gIQAZ3yEPS_story.html

Meg Whitman plans to merge printing and PC groups: major HP reorganization

http://www.mercurynews.com/business/ci_20214719/hp-computers-printers-whitman-hewlett-packard

Coca-Cola holds top spot, but category keeps losing market share

http://www.ajc.com/business/coca-cola-holds-top-1391860.html

[headlines]

--------------------------------------------------------------

You May Have Missed---

Networking tips offered to get next job

http://www.upi.com/Business_News/2012/02/05/Networking-tips-offered-to-get-next-job/UPI-94881328474097/\

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

7 Things that Separate Weight-Loss Winners & Losers

http://www.sparkpeople.com/resource/motivation_articles.asp?id=1732

[headlines]

--------------------------------------------------------------

Sports Briefs----

Smith contract completed, QB to ink three-year deal

http://blog.sfgate.com/49ers/2012/03/20/report-49ers-alex-smith-nearing-a-deal/

Mets owners sold stakes for $240M, paid down debt

http://www.nypost.com/p/news/business/mets_stakes_sold_wWQuZovYtYWmintqPZnXrK

| John Kenny Receivables Management www.jrkrmdirect.com • End of Lease Negotiations & Enforcement The Solution to Your Credit & Accounts Receivable Needs |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

Spring Poem

SPRING IS HERE

Winter is gone, just look around and see;

The snow is turning into slush,

Joining the singing river going down to the sea,

And over all there is a mysterious hush.

The soft warm winds are whispering,

"The bride in all her finery will soon be here!"

The bride (we call her Spring) — she's frolicking

Over the landscape, without fear.

She laughs at the trees' bare limbs

Till they tremble and call forth their leaves

To make a dress so green and trim,

Then joyfully they sway with the breeze.

The flowers sleeping beneath the ground

Awake and send up their blossoms to hear,

Then coquettishly join with the singing birds all around,

Acclaiming, "Spring is here, Spring is here!"

Bee Samann

“Easy Reading Poems”

Vantage Press, NYC

[headlines]

--------------------------------------------------------------

![]()

California Nuts Briefs---

San Francisco mayor suspends embattled sheriff

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2012/03/20/MNKP1NNI9F.DTL

Cal State trustees OK pay hikes for 2 Presidents

http://www.sacbee.com/2012/03/20/4353407/cal-state-trustees-decry-enrollment.html

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

Raise your glass to a California vintage reformation

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2012/03/16/FDI71NKQJ6.DTL&type=wine

From 1982, Glasses More Than Full

http://www.nytimes.com/2012/03/21/dining/reviews/tasting-bordeaux-from-1982.html?_r=1&ref=dining

Wine Enthusiast Magazine Launches Mandarin Edition in China

http://www.reuters.com/article/2012/03/20/idUS136635+20-Mar-2012+GNW20120320

Parker: influence is “scary”

http://www.thedrinksbusiness.com/2012/03/parker-influence-is-scary/

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1595- Pocahontas, daughter of Powhatan born near Jamestown, VA; leader of the Indian union of Algonquin nations, helped to foster good will between the colonists of the Jamestown settlement and her people. Pocahontas converted to Christianity, was baptized with the name Rebecca and married John Rolfe Apr 5, 1614. In 1616, she accompanied Rolfe on a trip to his native England, where she was regarded as an overseas "ambassador." Pocahontas's stay in England drew so much attention to the Virginia Company's Jamestown settlement that lotteries were held to help support the colony. Shortly before she was scheduled to return to Jamestown, Pocahontas died at Gravesend, Kent, England, of either smallpox or pneumonia. According to the March edition of Atlantic Magazine, the Indians had no immune system to ward off European diseases, including smallpox and pneumonia.

1713-birthday of Francis Lewis, signer of the Declaration of Independence, born at Wales. Died Dec 31, 1802, at Long Island, NY His house was destroyed by the British and his wife kidnapped, dying shortly thereafter, and he died in poverty, losing all his home and business to the British.

http://www.francislewis.com/

1851 - Yosemite Valley was discovered (by non-natives) in California. The 58 men of the Mariposa Battalion under Major James D. Savage were the first whites to enter Yosemite Valley. Their first view of the valley was from the plateau later named Mount Beatitude. They expelled Chief Tenaya and his band of Ahwahneechee Indians. Dr. Bunnell, a physician in the battalion, named the valley Yosemite to honor the local Indians. He did not realize that the word “yohemeti” meant “some of them are killers” and was an insult against the valley people.

1864-- Nevada and Colorado territories admitted into the Union.

1865-- Battle of Bentonville ends, last Confederate effort to stop Sherman.

1869-birthday of Florenz Ziegfield, legendary showman.

http://memory.loc.gov/ammem/today/mar21.html

1882-- birthday of Bascom Lunsford, folk song writer and folklorist who authored the folk song "Mountain Dew," Lunsford started the first folk music festival in 1928 at Asheville, NC. This event, which led to the formation of the National Clogging and Hoedown Council, is held to this day. He was known as the "father of clogging dance" and the "king of folk music." He recorded some 320 folk songs, tunes and stories for the Library of Congress. Born at Mars Hill, NC, Lunsford died Sept 4, 1973, at South Turkey Creek, NC.

1910- American vintner Julio Gallo was born at Oakland, CA. He is best known for his role in the Ernest and Julio Gallo Winery, of Modesto, CA, which at one time claimed about 26 percent of the US wine industry. He died May 2, 1993, near Tracy, CA.

1916-Frank James Marshall of New York City met 105 local players at the National Press Club, Washington DC. He played them all simultaneously, winning a total of 82 games, lost 8, and drew 15.

1917- Loretta Walsh, age 18, of Philadelphia, Pennsylvania was sworn in as chief yeoman on this day. She is the first woman to become a petty officer in the U.S. Navy

1918-pianist Sir Charles Thompson born Springfield, Ohio.

http://www.delmark.com/delmark.450.htm

1918-March 21-April 4: Second Battle of Somme, over 500,000 men lost their lives. General Erich Ludendorff launched the Michael offensive, the biggest German offensive of 1918, on Mar 21 with a five-hour artillery barrage. The Central Powers objective was to drive a wedge between the British and French forces and drive the British to the sea. Although they did not accomplish this objective, in the south they captured Montdidier and advanced to a depth of 40 miles. They managed to create a bulge in the front south of Somme and end what had effectively been a stalemate. The Allies lost nearly 230,000 men and the Germans almost as many in the Battle of Somme.

1928 -- President Calvin Coolidge gives the Congressional Medal of Honor to Charles Lindbergh for his first trans-Atlantic flight.

1932 - A tornado swarm occurred in the Deep South. Between late afternoon and early the next morning severe thunderstorms spawned 31 tornadoes in Alabama, Mississippi, Georgia and Tennessee. The tornadoes killed 334 persons and injured 1784 others. Northern Alabama was hardest hit. Tornadoes in Alabama killed 286 persons and caused five million dollars damage.

1934-Babe Didriksen, perhaps the greatest women athlete of all time, pitched one inning of baseball for the Philadelphia Athletics in an exhibition game against the Brooklyn Dodgers. Babe hit the first batter she faced and walked the next. The third hit into a triple play.

1938-Eddie Duchin, with Pat Normal vocal, records “ Ol’ Man Mose”

1939 - A song, written by Irving Berlin in 1918 as a tribute by a successful immigrant to his adopted country, was recorded by Kate Smith for Victor Records on this day. Ms. Smith had introduced the song on Armistice Day, November 11, 1938, at the New York World’s Fair. It was a fitting tribute to its composer, who gave all royalties from the very popular and emotional, "God Bless America" to the Boy Scouts. The song became Kate Smith’s second signature after "When the Moon Comes Over the Mountain"; and the second national anthem of the United States of America

1946-trombonist Dicky Wells Big Seven records “ Drag Nasty”.

http://blackhistory.eb.com/micro/727/45.html

1946-One year before Jackie Robinson began playing major league baseball, Kenny Washington broke the NFL’s color line. Washington sighed a contract to play for the Los Angeles Rams.

http://www.africana.com/Utilities/Content.html?&../cgi-bin/banner.pl?banner=

Lifestyle%20&../Articles/tt_216.htm

1952---Top Hits

Cry - Johnnie Ray

Wheel of Fortune - Kay Starr

Anytime - Eddie Fisher

(When You Feel like You’re in Love) Don’t Just Stand There - Carl Smith

1952- At the Cleveland Arena, influential DJ Alan Freed holds what is today considered the first true "rock and roll concert," as his Moondog Coronation Ball features Billy Ward and the Dominoes, Tiny Grimes, and Paul Williams and the Hucklebuckers. With ten thousand attendees (and twice that many outside, waiting to get in), the local police shut the concert down prematurely for fire code violations, causing a near-riot.

1953- Patti Page's "How Much Is That Doggie in the Window?" hits #1

1955 - No. 1 Billboard hit: ``The Ballad of Davy Crockett,'' Bill Hayes.

1956-Rock 'n' Roll pioneer Carl Perkins received four broken ribs and a broken shoulder in a car accident that killed his brother Jay while the two were on their way the way to appear on The Perry Como Show in New York. Perkins would spend several months in the hospital and by the time he is well, Elvis Presley had covered his song, "Blue Suede Shoes".

1956 - The 28th Academy Awards were celebrated at the RKO Pantages Theater, Los Angeles, California. Hosting the festivities were comedian/actor/singer/producer Jerry Lewis in Hollywood, plus actress Claudette Colbert and writer/producer/director Joseph L. Mankiewicz in New York City. "Marty", produced by Harold Hecht, was a big winner: Best Picture; Best Director (Delbert Mann); Best Actor (Ernest Borgnine); and Best Writing/Screenplay (Paddy Chayefsky). Best Actress was Anna Magnani for "The Rose Tattoo"; Best Supporting Actor was Jack Lemmon for "Mister Roberts"; Best Supporting Actress was Jo Van Fleet for "East of Eden"; and Best Music/Song to Sammy Fain (music), Paul Francis Webster (lyrics) for "Love Is a Many-Splendored Thing" from "Love Is a Many-Splendored Thing". 1955 was a great year for other great movies, too: "Picnic"; "Bad Day at Black Rock"; "The Man with the Golden Arm"; "Rebel Without a Cause"; "Pete Kelly’s Blues"; "The Court-Martial of Billy Mitchell"; "The Seven Little Foys"; "Blackboard Jungle"; "To Catch a Thief"; "The Bridges at Toko-Ri"

http://www.infoplease.com/ipa/A0148661.html

1960---Top Hits

The Theme from "A Summer Place" - Percy Faith

Wild One - Bobby Rydell

Puppy Love - Paul Anka

He’ll Have to Go - Jim Reeves

1963-Alcatraz the world's most secure prison, closes. Only one man ever escaped the island in San Francisco Bay in 30 years -- only to be arrested when reaching the mainland.

1964 - Singer Judy Collins made her debut at Carnegie Hall in New York City and established herself “in the front rank of American balladeers.” She would first hit the Top 40 in 1968 with "Both Sides Now", a Joni Mitchell song. Her versions of "Amazing Grace" and "Send In the Clowns" also became classics.

1964-The Beatles replaced one Billboard chart topper with another when "She Loves You" took over from "I Want To Hold Your Hand".

1965- more than 3,000 civil rights demonstrators led by Dr. Martin Luther King, Jr., began a four-day march from Selma, Alabama, to Montgomery, Alabama to demand federal protection of voting rights. There were violent attempts by local police, using fire hoses and dogs, to suppress the march. A march two weeks before on Mar 7. 1965, was called "Bloody Sunday" because of the use of night sticks, chains and electric cattle prods against the marchers by the police. As a young news editor for KFRC radio in San Francisco, I interviewed live marchers, plus recorded interviews with sheriff spokesmen, who were surprised that a San Francisco radio station would be interested in the event and their comments were quite candid. I had interviewed Dr. King, Jr., several times, but he was at the lead of the demonstration and could not come to the telephone booth on the parade route. The marchers were also not allowed bathroom privileges, food and water were also a problem, and there was no television coverage in those days, plus film camera were held off by the local police. This was the beginning of true equality for Black people in all parts of the United States.

1967--HOSKING, CHARLES ERNEST, JR. Medal of Honor

Rank and organization: Master Sergeant, U.S. Army, Company A, 5th Special Forces Group (Airborne), 1st Special Forces. Place and date: Phuoc Long Province, Republic of Vietnam, 21 March 1967. Entered service at: Fort Dix, N.J. Born: 12 May 1924, Ramsey, N.J. Citation: For conspicuous gallantry and intrepidity in action at the risk of his life above and beyond the call of duty. M/Sgt. Hosking (then Sfc.), Detachment A-302, Company A, greatly distinguished himself while serving as company advisor in the III Corps Civilian Irregular Defense Group Reaction Battalion during combat operations in Don Luan District. A Viet Cong suspect was apprehended and subsequently identified as a Viet Cong sniper. While M/Sgt. Hosking was preparing the enemy for movement back to the base camp, the prisoner suddenly grabbed a hand grenade from M/Sgt. Hosking's belt, armed the grenade, and started running towards the company command group which consisted of 2 Americans and 2 Vietnamese who were standing a few feet away. Instantly realizing that the enemy intended to kill the other men, M/Sgt. Hosking immediately leaped upon the Viet Cong's back. With utter disregard for his personal safety, he grasped the Viet Cong in a "Bear Hug" forcing the grenade against the enemy soldier's chest. He then wrestled the Viet Cong to the ground and covered the enemy's body with his body until the grenade detonated. The blast instantly killed both M/Sgt. Hosking and the Viet Cong. By absorbing the full force of the exploding grenade with his body and that of the enemy, he saved the other members of his command group from death or serious injury. M/Sgt. Hosking's risk of his life above and beyond the call of duty is in the highest tradition of the U.S. Army and reflects great credit upon himself and the Armed Forces of his country.

1968---Top Hits

(Sittin’ On) The Dock of the Bay - Otis Redding

Love is Blue - Paul Mauriat

Simon Says - 1910 Fruitgum Co.

A World of Our Own - Sonny James

1969-JOHNSTON, DONALD R. Medal of Honor

Rank and organization: Specialist Fourth Class, U.S. Army, Company D, 1st Battalion, 8th Cavalry, 1st Cavalry Division. Place and date: Tay Ninh Province, Republic of Vietnam, 21 March 1969. Entered service at: Columbus, Ga. Born: 19 November 1947, Columbus, Ga. Citation: For conspicuous gallantry and intrepidity in action at the risk of his life above and beyond the call of duty. Sp4c. Johnston distinguished himself while serving as a mortar man with Company D, at a fire support base in Tay Ninh Province. Sp4c. Johnston's company was in defensive positions when it came under a devastating rocket and mortar attack. Under cover of the bombardment, enemy sappers broke through the defensive perimeter and began hurling explosive charges into the main defensive bunkers. Sp4c. Johnston and 6 of his comrades had moved from their exposed positions to 1 of the bunkers to continue their fight against the enemy attackers. As they were firing from the bunker, an enemy soldier threw 3 explosive charges into their position. Sensing the danger to his comrades, Sp4c. Johnston, with complete disregard for his safety, hurled himself onto the explosive charges, smothering the detonations with his body and shielding his fellow soldiers from the blast. His heroic action saved the lives of 6 of his comrades. Sp4c. Johnston's concern for his fellow men at the cost of his life were in the highest traditions of the military service and reflect great credit upon himself, his unit, and the U.S. Army.

1970 - The Beatles established a new record. "Let It Be" entered the "Billboard" chart at number six. This was the highest debuting position ever for a record. "Let It Be" reached number two a week later and made it to the top spot on April 11, overshadowing Simon & Garfunkel’s "Bridge over Troubled Water".

1970-ABC" by the Jackson Five is released. The song is the group's second hit and also their second hit to go to #1!

1973-Frank Mahovlich of the Montreal Canadiens scored the 500th goal of his career in a 3-2 victory over the Vancouver Canucks. Mahovlich finished his career with 533 goals and entered the Hockey Hall of Fame in 1981.

1975 - No. 1 Billboard hit: ``My Eyes Adored You,'' by Frankie Valli. The song helps revive the careers of both Valli and his former group, the Four Seasons. The group has its fifth No. 1 single - ``December 1963 (Oh What a Night)'' - exactly one year after ``My Eyes Adored You.''

1976---Top Hits

December 1963 (Oh, What a Night) - The Four Seasons

Dream Weaver - Gary Wright

Lonely Night (Angel Face) - Captain & Tennille

Faster Horses (The Cowboy and the Poet) - Tom T. Hall

1980--President Jimmy Carter announces that, in response to the Soviet invasion of Afghanistan started in December 1979, the US will boycott the 1980 Olympics in Moscow. It is the only time that the US has boycotted the Olympics. It does not stop the Russians in Afghanistan and it hurts the Olympics.

1981-New wave pop rockers, Blondie, enter the soul LPs chart with "Autoamerican," which peaks at #7 in 25 weeks on the chart. It has climed to #7 on the pop chart. One song off the album, "Rapture" is one of the first big crossover raps hits. It's goes to Number One for two weeks and another tune "The Tide is High" makes to the head of the class as well.

1984 - No. 1 Billboard hit: ``Jump,'' by Van Halen. Eddie Van Halen writes the music for ``Jump'' two years before band member David Lee Roth agrees to write the lyrics and record it.

1984---Top Hits

Jump - Van Halen

Girls Just Want to Have Fun - Cyndi Lauper

Somebody’s Watching Me – Rockwell

Elizabeth - The Statler Brothers

1984- John Lennon's widow, Yoko Ono, dedicates a section of New York City's Central Park as a place of meditation called Strawberry Fields. Every December 9, thousands of fans converge on the spot to remember her last husband, who was murdered by a deranged fan on that day in 1980.

1986- Debi Thomas becomes the first black woman to win the gold medal in a world skating competition.

1988 - Bitterly cold weather prevailed across the northeastern U.S. Portland ME reported their coldest spring day of record with a morning low of 5 above, and an afternoon high of just 21 degrees. Marquette MI reported a record low of 15 degrees below zero.

1989-Madonna's "Like A Prayer" LP is released.

1990 - The first full day of spring was a cold one for the eastern U.S. Freezing temperatures damaged 62 percent of the peach crop in upstate South Carolina, and 72 percent of the peach crop in the ridge area of South Carolina. Elkins WV, which a week earlier reported a record high of 82 degrees, was the cold spot in the nation with a morning low of 16 degrees.

1994 - Actress/Comedienne Whoopi Goldberg hosted the 66th Annual Academy Awards show at the Dorothy Chandler Pavilion. The film that was created so the world would never forget the Holocaust -- the inhumanity of mankind to other humans -- received the highest honors this evening. The Academy of Motion Picture Arts and Sciences (AMPAS) awarded "Schindler’s List", nominated in no less than 12 categories, with seven Oscars: beginning with Best Writing/Screenplay Based on Material from Another Medium (Stephen Zaillian); Best Art Direction-Set Decoration (Allan Starski, Ewa Braun); Best Cinematography (Janusz Kaminski); Best Film Editing (Michael Kahn); Best Music/Original Score (John Williams); Best Director (Steven Spielberg); and culminating with Best Picture (Producers Steven Spielberg, Gerald R. Molen and Branko Lustig). "Schindler’s List" was not the only film to receive multiple golden statuettes. "Philadelphia" (nominated five times) scored two awards, Best Actor (Tom Hanks) and Best Music/Song, "Streets of Philadelphia" to Bruce Springsteen. "The Piano" (nominated in eight categories) won both Best Actress (Holly Hunter)and Best Supporting Actress (Anna Paquin), and Best Writing/Screenplay Written Directly for the Screen (Jane Campion); "Jurassic Park" received the Best Sound award (Gary Summers, Gary Rydstrom, Shawn Murphy, Ron Judkins), the Best Effects, Sound Effects Editing award (Gary Rydstrom, Richard Hymns), and the Best Effects, Visual Effects award (Dennis Muren, Stan Winston, Phil Tippett, Michael Lantieri). Tommy Lee Jones picked up the Best Supporting Actor award for "The Fugitive", a film nominated in seven categories.

http://www.infoplease.com/ipa/A0149895.html

1992- intense snow squalls associated with a stalled cold front and a "norlun" instability trough buried Kennebunkport, Maine under 14 inches of snow in only 4 hours. Goose Rocks Beach reported an amazing two feet in the same time period. Portland, Maine recorded 4 inches of snow in just one hour with a total of 11.4 inches. Nearly 6 inches of snow fell in one hour in the Beverly, Massachusetts area, resulting in a 27 car pile up on route 128 and the closing down of the route for 1.5 hours.

1995—Top Hits

Take A Bow- Madonna

Candy Rain- Soul For Real

Creep- TLC

Red Light Special- TLC

1999 - the 71st Annual Academy Awards ceremony was hosted comedienne Whoopi Goldberg, who modeled the beautiful, and sometimes bizarre, costumes from the movies nominated in the Best Costume Design category. (And the Oscar went to Sandy Powell for "Shakespeare in Love".) Gwyneth Paltrow, emotionally accepted the Best Actress Oscar for her role in "Shakespeare in Love". The film with 13 nominations and seven wins including the upset win of Best Picture of the 1998 year; Best Supporting Actress (Dame Judi Dench); Best Writing/Screenplay Written Directly for the Screen (Marc Norman, Tom Stoppard); Best Art Direction-Set Decoration (Martin Childs, Jill Quertier); and Best Music/Original Musical or Comedy Score (Stephen Warbeck). This was the first time in nine years that the film that won Best Picture did not win for Best Director. Steven Spielberg was the winning director for "Saving Private Ryan" (which also won four more of the golden statuettes). Best Supporting Actor Oscar was awarded to James Coburn ("Affliction"), his first Academy Award nomination in over 70 films. It was the longest running Academy Award ceremony to date, including Sophia Loren , who said, “and the Oscar goes to Roberto!” (Best Actor: La Vita è bella - Roberto Benigni). In plain English, "Life is Beautiful". Roberto Benigni was the first actor in a foreign language film to receive an Oscar. Coincidentally, Ms. Loren had been the first actress to be so honored. Benigni had received an Oscar earlier in the evening for Best Foreign Film ("Life is Beautiful") when he pirouetted on top of seat backs, hopping and dancing to the stage.

http://www.infoplease.com/ipa/A0774113.html

2000---Top Hits

Say My Name- Destiny s Child

Maria Maria- Santana Featuring The Product G

Amazed- Lonestar

Breathe- Faith Hill

2004-George Michael scored his fifth UK #1 album with "Patience".

2006-After a six-year legal battle, the three surviving daughters of African musician Solomon Linda are awarded one-quarter of all future royalties from the Tokens' 1961 hit "The Lion Sleeps Tonight." The court ruled that the song, which the Tokens adapted from a Pete Seeger song called "Wimoweh," which was actually Linda's 1939 adaptation of a native folk song. Linda, who died in 1962, had nothing to leave to his family, who were destitute at the time of the ruling.

NCAA Basketball Champions This Date

1959 California

1964 UCLA

1970 UCLA

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------