Connect with Leasing News ![]()

![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() |

| ![]() Search |

Search | ![]() Stress Release

Stress Release

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

Extra---Extra

Northern Leasing systems Settles $11 Million NY AG Suit

Press Release #####################################

Companies Drained Millions From Bank Accounts; Settlement Provides Restitution For Tens Of Thousands In New York And Nationwide; A.G.

Schneiderman: Deceptive Practices Will Be Uncovered, Perpetrators Will Be Penalized And Victims Made Whole

(NEW YORK) – As part of National Consumer Fraud Week, Attorney General Eric T. Schneiderman today announced that his office has reached a multi-million dollar settlement with a group of New York City-based business equipment leasing companies that schemed to drain nearly $11 million from the bank accounts of small business customers in New York State and across the country.

Northern Leasing Systems, Inc., and its affiliates provided credit card processing machines and other equipment to small businesses – many of them mom-and-pop stores. As part of a coordinated effort, these companies siphoned over $3.6 million in unauthorized fees from the bank accounts of nearly 110,000 former customers before the scheme was discovered and they were stopped – preventing them from completing their plan to steal nearly $7 million in additional funds. This settlement concludes a lawsuit filed by the Attorney General in Manhattan Supreme Court in April 2012 against NLS and its partners.

“My office will go after companies who cheat the marketplace and use shell companies to pick the pockets of unsuspecting and hard-working business owners in New York and across the country,” said Attorney General Schneiderman. “This settlement sends a clear message that deceptive business practices will not be tolerated in New York, and we will take action to help protect consumers and small businesses from fraud.”

As part of the settlement, the companies agreed to fully refund the more than $3.6 million they drained from their customers’ accounts in the spring of 2011. They also agreed to refrain from any efforts to collect the remaining approximately $7 million from customers targeted in the scheme – in some cases, up to 11 years after their victims’ equipment leases had expired. The companies are required to make automatic refunds to certain former customers and there will be a claims process for all other customers. Each customer participating in the settlement will receive 100% of the amount debited.

The companies will also pay $575,000 in costs, penalties and fees to the State of New York.

To disguise the scheme, Northern Leasing used a shell company, SKS Associates LLC, to mislead customers and avoid harming its business reputation. The scheme came to light when former customers, from New York to Texas and California, discovered automatic debits from their bank accounts by a company they had never heard of.

The settlement agreement with Northern Leasing and its affiliates – Lease Finance Group LLC, MBF Leasing LLC, Golden Eagle Leasing LLC and Lease Source-LSI, LLC – is the result of the Attorney General’s investigation into the SKS collection scheme. All of the companies operate out of 132 W. 31st St. in Manhattan.

The companies’ leases required customers to reimburse them for property taxes and “administrative fees” through automated debits. The leases were vague about the exact amount and the timing of the payments. While Northern Leasing claimed it failed to collect these amounts from some customers while their leases were still active, it could not show that the deducted tax amounts were ever owed or paid to taxing authorities, nor could it provide any proof that the or justify the tax and fee amount debited from individual customers was correct.

The companies, which debited some victims as much as 11 years after they had ceased to do business together, devised the scheme in late 2010 and started the unauthorized debits in March 2011. The scam was halted April 2011 by court order in California related to a private class-action lawsuit filed in that state.

When Northern Leasing began seizing money years after the leases expired, they channeled the collections through SKS. SKS began withdrawing money from former customers before it was even legally registered to conduct business in New York. Some notice letters were sent out, but many were sent out the same day or only one day before the debits. When SKS was flooded with telephone calls from upset customers, it stopped sending notice letters altogether and took money from former customers’ bank accounts with no notice at all.

Former customers also faced an additional web of misrepresentations, including the false claim that an “audit” was conducted on the customer’s account, which had supposedly revealed that taxes and fees were still owed. When customers asked for proof that the charges were legitimate and accurate, SKS failed or refused to provide any. And when some customers tried to verify the charges on their own, they discovered that the amounts were not accurate.

Besides monetary refunds and penalties, the companies will modify future lease agreements to clearly and conspicuously disclose information about tax and related administrative fees on the first page of the lease agreement. Other reforms include that the companies will not debit or otherwise collect taxes and related administrative fees unless the companies have paid or will pay such taxes to a taxing authority.

Marking the beginning of National Consumer Protection Week Monday, Attorney General Schneiderman highlighted the scams most reported by New Yorkers and offered tips on how to avoid them in the future.

This case is being handled by Assistant Attorney General Tristan C. Snell and Consumer Frauds and Protection Bureau Deputy Bureau Chief Laura J. Levine, under the supervision of Bureau Chief Jane M. Azia and Executive Deputy Attorney General for Economic Justice Karla G. Sanchez.

### Press Release #################################

Thursday, March 7, 2013

Placard---Do It!

Classified Ads---Controller

Demand Up for Small Business Lending

-- Direct Capital report

U.S. Bancorp Davis Remains Optimistic,

but Cautious

Beige Report---Business and Loans Improve

Ag lending rises,

while farmland values give regulators pause

by Andrew Wolcott, SNL Financial

Commercial National Bank "Funder A" List--Update

New Hires---Promotions

Classified Ads---Help Wanted

Top Five Leasing Web Sites—

Why These Companies Are Growing in Sales

California Case Demonstrates

Perils of Leasing Franchise Restaurant Equipment

--- By Tom McCurnin

Quiznos Franchisee Reaches 100th Restaurant Milestone

DriveItNow, CarSoup.com Partner

with Real Payment Offers

Leasing Conferences---Update

Learn What You are Missing by Not Going

Stoker/Leviathan/Wreck-It Ralph

Holy Motors/This Is Not a Film

Film/DVD Reviews by Fernando Croce

Classified ads—Asset Management

News Briefs---

Yahoo CEO Mayer gets $1.1 MM bonus

for her first 5 months

Increase in U.S. bank lending could spur more jobs

One In Five Americans Have Errors In Their Credit Reports

With Legal Reserves Low, BofA Faces a Big Lawsuit

Hertz and Donlen launch equipment finance program

Carlyle ‘Hopeful’ on Coates Hire Sale

Japanese pilots union highlights 787 power panel concerns

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

You May have Missed---

SparkPeople--Live Healthier and Longer

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

|

Please send Leasing News to a colleague and ask them to subscribe.

We are free!

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Classified Ads---Controller

(These ads are “free” to those seeking employment

or looking to improve their position)

| Chicago, IL experienced in lease accounting, operations, management, and Sarbanes-Oxley. Seeking position with equipment lessor. Would consider contract assignments or relocating. Email: leasecontroller@comcast.net |

| Southeastern, MI Controller & Management experience w/ equip lessors &broker. MBA, CPA w/ extensive accounting, management, securitization experience with public and private companies. Willing to relocate. Email: Leasebusiness@aol.com |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

Comprehensive personal property tax outsourcing services |

[headlines]

--------------------------------------------------------------

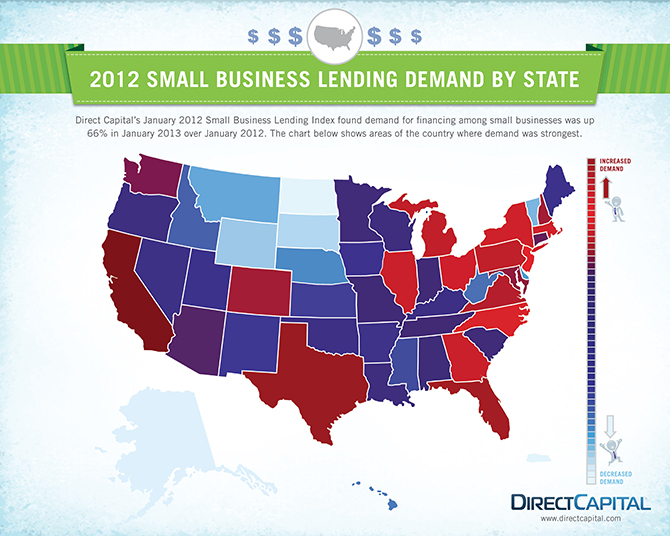

Demand Up for Small Business Lending

Direct Capital report

Direct Capital, Portsmouth, New Hampshire, predicts a strong demand for small business financing. It basis it on its experience in 2012 for equipment leasing, working capital loans, and vendor financing. It reports that demand for financing in January, 2013 compared to January, 2012 was up 66%, while the number of small businesses approved for financing also increased to 60%.

Steve Lankler, SVP

"Demand for lending is one of the strongest indicators of economic growth, and this shows us that the potential for growth in 2013 is very real," said Steve Lankler, Senior Vice President at Direct Capital. "Ensuring small businesses have access to the capital they need is our major focus for this year."

February 11,2013 Direct Capital announced it had completed a $163 million term securitization of equipment lease backed notes.

The transaction was a private offering made to qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended. The company issued five classes of notes, which were rated 'AA' to 'BB' by Standard and Poor's. DBRS rated the senior notes 'AAA'. Direct Capital Funding IV, LLC, a special-purpose entity wholly owned by Direct Capital, served as issuer. Guggenheim Securities acted as the initial purchaser of the notes. Guggenheim is also involved with investments in LEAF Commercial Capital.

|

[headlines]

--------------------------------------------------------------

U.S. Bancorp Davis Remains Optimistic, but Cautious

U.S. Bancorp chairman, CEO, President Executive Committee and member of Risk Management Committee, addressed the US Financial Services Conference.

Two months into 2013, U.S. Bancorp (USB) CEO Richard Davis is seeing nothing to change his expectation this will be a difficult year for growing revenue. One reaction, "Is he laying people off? No, but he's not hiring only to find out the business isn't there."

"Now in terms of loans and deposits at the balance sheet, likewise, you can see that continues to grow nicely," he stated." I do expect both of these to grow throughout the year. I will tell you that I gave you my last terms of the forecast that loans would grow into 4% to 6% annualized rate. That's about 1% to 1.5% a quarter. I know you can do the math. We're looking at the low end of that now. We're looking right now in this quarter right at the bottom of that 1% to 1.5% because we're just not seeing the kind of robustness that we might have hoped to have as the year -- as the quarter starts to age. So 4% to 6% will still be our monitor, I hope as the year ages, we can get well into that range. But for quarter 1, we'll be at that bottom end because I just think it's important that we don't stretch. And in this company we'll not stretch on structure, and we will not do loans and lose money for a loan and find a way to make it upright. That is not the way we're going to do it...

The Bartlett study just came out last week and indicated that for the fifth year in a row, we've continued to exceed all performances of other banks in small business. It -- I wish I could get your attention by ringing a bell or something. Small Business is kind of a perfect proxy for the difference between a consumer who has an intent to manage their businesses kind of at a personal level, and the middle market manages at the business level. Small business is a great proxy.

“If you're growing small businesses, you're probably doing some of the best work you could do as a bank because you're serving customers' personal and business needs and under the patriotic aspect, you're really helping America grow in one small business at a time.

“USB plans to remain active in acquisitions, but not purchases of other banks as owners have too fanciful an idea of what they're worth," he said.

[headlines]

--------------------------------------------------------------

Beige Report---Business and Loans Improve

Loan demand was steady or increased across all the Districts that reported. Auto lending increased in the Cleveland and Atlanta Districts, and Philadelphia and Dallas cited growth in energy-related loan demand. San Francisco continued to report a slowdown in venture capital and private equity activity, but contacts noted an increase in the number of private technology companies moving toward an IPO.

Asset quality improved at banks in the Philadelphia, Kansas City and San Francisco Districts. Philadelphia, Richmond, Atlanta and San Francisco lenders reported high competition for qualified borrowers. Borrowing standards were reported to have been loosened in some Districts. Atlanta contacts noted additional loan capacity, but continued to be cautious with loan activity.

Cleveland bankers considered cost cutting measures, including layoffs, due to shrinking net interest margins. New York contacts indicated a decrease in loan spreads for all loan categories, particularly residential mortgages, and bankers in the Chicago District said that very few mortgage originations were being kept on their balance sheets and that interest rate swaps were being utilized to hedge against a potential rise in interest rates.

Bankers were generally optimistic about future activity in the Philadelphia and Dallas Districts for the near term, but Atlanta bankers expected activity to ease toward the middle of the year.

[headlines]

--------------------------------------------------------------

Ag lending rises,

while farmland values give regulators pause

By Andrew Wolcott, SNL Financial

Agricultural production and farmland loan balances at U.S. commercial banks have increased above and beyond pre-financial crisis levels. According to an analysis conducted by SNL, loans secured by farmland rose to roughly $72 billion at the end of 2012, up from over $52 billion at the end of 2006, representing a 38% increase. Over the same time period, loans made for the purpose of financing agricultural production rose just over 19%, a rate less than that of farmland loans, but still above the 17.7% increase registered by banks' total loan and lease portfolios.

It is interesting to note the seasonality in agricultural production lending. Loan balances tend to rise over the course of a year peaking in the third or fourth quarter, only to retreat in the first quarter of the following year. This phenomenon is reflective of the U.S. planting and harvesting cycles. As an example, Illinois corn farmers' planting and harvesting seasons fall during or between the second and fourth calendar quarters of each year. According to an analysis conducted by the U.S. Department of Agriculture, the most active "usual planting dates" fall between April 21 and May 23, while the most active "usual harvesting dates" lie between Sept. 23 and Nov. 5.

Agricultural production and farmland lending has risen drastically over the past six years, recently registering year-over-year growth rates of 5.73% and 6.28%, respectively, for the period ended Dec. 31, 2012. While these growth rates are impressive, both types of lending represent relatively small portions of total loan and lease portfolios. Together, agricultural production and farmland lending represented 1.94% of total U.S. commercial bank loan portfolios at the end of 2012, up from 1.78% at the end of 2006.

Banks have witnessed sharp divergences in the quality of their loan portfolios over the past six years. At the end of 2006, past due and nonaccrual rates stood between 1% and 2% for bank's agricultural production, farmland and total loan and lease portfolios. However, over the course of six years, loan quality for these types of loans has taken very different paths. The percentage of agricultural production loans that were either past due or nonaccrual stood at 1.28% at the end of 2012, only 19 basis points higher than the 1.09% logged in the fourth quarter of 2006 and down from recent highs of 3.48% in the first quarter of 2010.

While agricultural production loan quality stands close to pre-financial crisis levels, the portion of farmland loans that are either past due or nonaccrual remains elevated. Farmland loans registered a past due or nonaccrual rate of 2.59% at the end of 2012, a full 128 basis points above the 1.31% recorded at the end of 2006. Within the context of the total loan portfolio, both loan types still compare favorably. Starting at the end of 2006, the portion of total loans and leases that were either past due or nonaccrual stood at 1.78%; over the course of the next six years the rate rose to 7.55% in the first quarter of 2010 only to fall back down to 4.77% at the end of 2012.

Farmland loan balances have increased right along with farmland values. So much so that many fear a farmland bubble could be forming. Esther George, president and CEO of the Federal Reserve Bank of Kansas City, stated in a speech Jan. 10 that farmland prices were of particular concern. "We must not ignore the possibility that the low-interest rate policy may be creating incentives that lead to future financial imbalances. Prices of assets such as bonds, agricultural land, and high-yield and leveraged loans are at historically high levels. A sharp correction in asset prices could be destabilizing." Despite George's cautions, farmland values continued to rise through the end of 2012.

For the fourth quarter of 2012, regional Federal Reserve banks in the Midwest reported significant year-over-year increases in farmland values. The Federal Reserve Bank of Kansas City reported that "both irrigated and non-irrigated cropland values posted year-over-year gains of more than 20 percent for the seventh consecutive quarter … [while] ranchland values surged nearly 20 percent." In addition, the Federal Reserve Bank of Chicago stated that "after adjusting for inflation, the district's 2012 annual increase in agricultural land values (14 percent) was the third largest in 35 years. … [F]armland values experienced a cumulative rise of 52 percent over the period 2010–12, matching the fastest gain of the 1970s boom (over the period 1974–76) in real terms." Because farmland values represent the value of the collateral underlying farmland loans, the loan-to-value ratios for these loans could be in jeopardy if farmland values were to retrace.

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

California Case Demonstrates

Perils of Leasing Franchise Restaurant Equipment

By Tom McCurnin

Some Franchises Have Rapid Turnover Which Equates to a

Default on the Lessor’s Equipment Lease. Almost as Much Investigation of the Franchise is Needed as the Franchisee. .

The first Quizno's Subs restaurant

Kazar v San Gabriel Plaza 2011 WL 6062019 (Cal., 2011)

I get calls a couple times a year from lessors which leased restaurant equipment for a restaurant. That might be a problem. But the real heart break is when the lease is to a lessee who is part of what I consider to be a troubled franchise.

In today’s case, the restaurant owner leased premises for a Quiznos sandwich shop. The fixtures totaled about $30,000 and were leased. The location was not fruitful, and the owner sold the location and the restaurant to his daughter. The daughter had no skin in the game, worked the location for a while, informally sold it, and then took it back. The landlord ultimately evicted her and seized the restaurant equipment and auctioned it off. While the equipment lessor was not immediately involved in the dispute, the case raises the question when and how an equipment lessor should finance trade fixtures for a franchisee.

Without some protection from landlord, the equipment lessor is at the mercy of the Franchisor and landlord who often combine to get a new franchise in the space and seek to severely discount the value of the leased equipment. Some franchises are so troubled that many franchisors turn locations multiple times over 2-3 years, keeping the same fixtures and equipment in place while shuffling franchisees.

So the question for today is whether an equipment lessor may safely lease equipment to a franchisee, and if so, what can be done to maximize the recovery and minimize the risk. At the core is understanding three things—the nature of the equipment as trade fixtures, the financial viability of the franchisee, and the health of the franchise.

The term “Trade Fixtures” in many states, other than in California, is defined as fixtures used in a trade, business or profession, and enjoys a protected status as between the lessee, on the one hand, and the real estate landlord. The typical example of a trade fixture would be grills, ovens, hoods, and other equipment attached to the real estate, but part of the restaurant’s operation. Most States protect trade fixtures from the clutches of the landlord. In California, there is no distinction, so a UCC fixture filing is necessary, and perhaps the lessor should obtain a landlord’s waiver.

But having solved the equipment issue, two financial questions remain, the financial strength of the lessee/franchisee and whether the franchise is strong and cooperative. The former may be easily ascertained with financial statements and tax returns. However, the latter is equally important, because if the franchise is not strong, or the franchisor is churns the location with serial franchisees, the lessor’s equipment lease will soon be at risk, and it is challenging to determine the financial strength and honesty of the franchisor.

In this case, the equipment lessor ended up with its equipment sitting in storage and the franchisee walking away from the business after a year. So the ultimate question for today is what can a lessor do to protect itself when leasing to a franchisee?

First, understand that the lessor’s success is directly dependent on the franchisee’s success and therefore, an aggressive franchisor with coercive terms in the agreement and a poor track record will impact the lessor’s risk. What is the overall success rate of the franchise, e.g., what percentage of franchisees fail each year? Anything above 10% would evidence a poorly run franchise. Some franchisees won’t tell the equipment lessor this number.

Second, if the lessor intends to finance the franchisor’s customers, it would not too much to ask for, and review, the master franchisee agreement and failure rates to assess the risk.

Third, the lessor may want to interview former and existing franchisees. Some of the questions I would ask would include: How did the franchisee’s initial investment compare to the estimates the franchisor provided in the Franchise Disclosure Document? What benefits dis the franchisee see from being a part of the franchise system generally?

Third, the lessor might want to consult franchisee web site forums, franchise research websites and franchise industry publications can all be valuable sources of information. The California franchise registrar currently scans and posts all registration submissions to its website, and this resource is available to the public free of charge. Of course, a franchisor’s California Franchise Disclosure Document will not necessarily mirror the document that it offers in other states. A handful of negative reviews is not unusual, but if there is consistent griping about the franchisor and a high failure rate, the lessor might not want to finance that particular franchise.

Fourth, since the lessor is financing possible fixtures, get a landlord waiver and do a fixture filing, even in those States which recognize trade fixtures.

Fifth, because a default is possible, and upon such default a new franchisee under the same franchise might be interested, investigate whether there are existing franchise locations within five miles. Obviously, a competing franchise nearby will impact both the success of the lessor’s present financing and the possibility of recouping payment from a successor franchisee. Some franchises pack franchisors into small areas, which accelerates defaults and makes obtaining a new franchisee challenging.

Finally, because franchises are inherently risky, if there is a failure, the franchisee’s guaranty is probably worthless. Therefore, the lessor should underwrite the deal with eye towards the percentage likelihood of failure, the amount of working capital the franchise has to carry him 24 months, and the wholesale value of the equipment if the franchisee walks away.

Tom McCurnin is a partner at Barton, Klugman & Oetting in Los Angeles, California.

Tom McCurnin

Barton, Klugman & Oetting

350 South Grand Ave.

Suite 2200

Los Angeles, CA 90071

Direct Phone: (213) 617-6129

Cell (213) 268-8291

Email: tmccurnin@bkolaw.com

Visit our web site at www.bkolaw.com

Previous Tom McCurnin Articles:

http://www.leasingnews.org

Previous Tom McCurnin Articles:

http://www.leasingnews.org/Conscious-Top%20Stories/leasing_cases.html

Bookmark us

[headlines]

--------------------------------------------------------------

### Press Release ###############################

Quiznos Franchisee Reaches 100th Restaurant Milestone

QSR International First Quiznos Franchise Group

to Open 100 Quiznos Restaurants

DENVER, / -- Quiznos marked a significant business milestone this month when QSR International (QSR) opened its Quito, Ecuador location, making QSR the first international Quiznos franchise group to license and open 100 plus Quiznos restaurants. Quiznos commemorated the event by inducting Richard Eisenberg , QSR president, into the Quiznos International 100 Club. As one of the world's premier quick service restaurant chains, Quiznos recognized the significance of Eisenberg's achievement and the impact he's had toward the continued expansion of the brand.

"An accomplishment like this doesn't happen overnight. QSR International and the Quiznos brand have flourished under Richard's direction for almost 15 years," said Stuart Mathis , chief executive officer for Quiznos. "Richard represents the franchise model we want to attract and nurture. He serves as an example to the entire franchise system that hard work, dedication and a solid partnership will help everyone realize their goals of continued growth and success. "

QSR International is a 141-unit multi-brand master franchise quick-service restaurant developer conducting business in 15 countries throughout Latin America and the Caribbean. QSR owns the Master Franchise for Quiznos restaurants, the largest brand in QSR's restaurant portfolio, in Latin America and the Caribbean where they currently have 101 licensed Quiznos restaurants operating and four restaurants under development. Additionally, QSR purchased and was awarded 46 more Quiznos Franchises, which, through Development Agreement commitments, will be opened in the next several years.

Eisenberg, a Quiznos master franchisee, credits the groups' ongoing success to a premium quality product, a menu which meets consumer insights, open communication and a cooperative working relationship with Quiznos.

"Working with Quiznos has been a wonderful experience. They have provided great support and systems while still being flexible enough to give us some leeway to experiment to meet our consumers' needs. That has paid off with great dividends," said Eisenberg. "We have the best sandwich in the marketplaces we operate in, and an exceptionally well-trained team. Bottom line, we do it better than our competition."

About Quiznos

Denver‐based Quiznos is a chain designed for today's busy consumers who are looking for a tasty, freshly prepared alternative to traditional fast‐food restaurants. With locations in 50 states and 30 countries, Quiznos is one of the world's premier quick‐service restaurant chains and pioneer of the toasted sandwich. Quiznos restaurants offer creative, chef‐inspired sandwiches, salads, and soups using premium ingredients. Quiznos was founded in 1981 by chefs who discovered that toasting brought out the best in every sandwich ingredient. For more information, please visit www.quiznos.com.

#### Press Release #############################

|

[headlines]

--------------------------------------------------------------

#### Press Release #############################

DriveItNow, CarSoup.com Partner

with Real Payment Offers

New partnership helps car buyers to determine monthly payment affordability

Cincinnati, OH – DriveItNow, a leader in online payment marketing, announced a new joint agreement with CarSoup.com to offer real payment options on new and used vehicle listings on the CarSoup.com website.

A vital part of the buying process for most consumers is credit eligibility and monthly payment affordability. This new partnership brings financing transparency and gives CarSoup.com shoppers the ability to complete more of the buying process online.

“Before making a decision to buy a car, consumers need to know the monthly payment they credit qualify for,” says Tarry Shebesta, President of DriveItNow. “DriveItNow is the only service in the industry that gives car shoppers real payment options resulting in a better buying experience. This helps dealers sell more cars.”

"We know payment information is important when consumers are car shopping, so we’re very excited to partner with DriveItNow to provide payment quotes as a new service," said Ben Miller, Director of User Experience for CarSoup.com. "The partnership also helps our participating dealers showcase their payment offers making it easier for consumers to find a car that fits their budget.”

As a reseller, CarSoup.com will also offer the DriveItNow service to all of its participating dealers for use on their own websites.

About DriveItNow® (http://www.DriveItNow.com)

DriveItNow® is a patent pending payment marketing technology service of Automobile Consumer Services, Inc. (ACS). ACS leads the industry with innovative proprietary technology, superior customer service, and over twenty years of online experience in direct-to-consumer auto financing and leasing.

About CarSoup.com (http://www.CarSoup.com)

CarSoup.com is an online venue for buying, researching and selling new cars, used cars and other vehicles including motorcycles, boats, RVs, ATVs and more. CarSoup.com lists more than 1.4 million new and used vehicles nationally from both private sellers and nearly 10,000 participating dealers.

##### Press Release ############################

((Please Click on Bulletin Board to learn more information))

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

Leasing Association 2013 Conferences

Dwight Galloway, CLP, RLC Funding, will be

covering the Equipment Finance Summit for Leasing News.

Any comments or observations for readers, please see Mr. Galloway.

March 14, 2013

2013 National Equipment Finance Summit

Hyatt Regency Albuquerque

Topics:

"Finding Good Employees & Succession Planning"

"What and How We've Changed to Survive"

"Working with New Funding Sources.

-- Perspectives in Today's Marketplace"

"Reduce Costs and Improve Your Customers’ Experience

– Process Improvement Using Six Sigma & Lean Me"

Workshop Speakers

Barry Ferns

Ferns, Adams & Associates

Barry Marks

Marks & Weinberg, P.C.

Bob Cohen

Moritt Hock & Hamroff, LLP

Bob Ingram

Lakeland Bank

Bruce Smith

Divesified Capital Credit Corporation

Cameron Krueger

Equipment Leasing and Finance Foundation

Chris Ewer

Cashmere Valley Bank

Dan Feeney

North Star Leasing

Dan Powers

LeaseTeam, Inc.

Daryn Lecy

Stearns Bank

Dave Schaefer

Orion First Financial, LLC

David Normandin

PacTrust Bank Equipment Finance

Frank Peretore

Peretore & Peretore, P.C.

Greg Best

Leasepath

Jesse Johnson

LeaseTeam, Inc.

John Donohue

Direct Capital Corporation

John Rosenlund

Portfolio Financial Servicing Company

Marshall Goldberg

Glass & Goldberg, A Law Corporation

Nancy Geary

ECS Financial Services, Inc.

Nicholas Ross

Bank of the West

Randy Haug

LeaseTeam, Inc.

Scott Wheeler

Wheeler Business Consulting

Tom Allen

Great American Insurance

Registration:

https://m360.nefassociation.org/calendar.aspx

Pricing:

Pricing Sheet

http://nefassociation.org/displaycommon.cfm?an=1&subarticlenbr=252

Hot-Air Balloon Ride

http://www.nefassociation.org/displaycommon.cfm?an=1&subarticlenbr=258

Full Schedule:

https://m360.nefassociation.org/frontend/event/schedule.aspx?EventId=57523

CLP Master Review Class

Thursday - March 14th (8:00 am - 4:00 pm)

This comprehensive eight-hour program is taught by Certified Lease Professionals (CLP) and is an excellent opportunity for a CLP candidate to ask specific questions of the instructors on the six toughest subjects in equipment financing.

Below is the schedule:

8:00 - Financial Accounting led by

Nancy Geary, CPA, CLP - ECS Financial Services

9:30 - Law, Documentation & Collections led by

Barry Marks, Esq., CLP - Marks & Weinberg, PC

12:30 - Lease Pricing led by

Nick Ross, CLP - Bank of the West

2:30 - Classification & Terminology led by

Jim Merrilees, CLP - Tip Capital

The class if free to attend for conference attendees; however the materials may be purchased for a nominal price. The materials are typically $150 for a printed and bound copy and $100 for a digital version; however we offer a special to conference attendees: the materials are $50 for a printed and bound copy and $25 for a digital version.

If you are not already registered to take this class, please notify Reid Raykovich, CLP (reid@clpfoundation.org).

Bruce Kropschot, the Alta Group, is covering this

important conference for Leasing News and will have

a special report.

Conference Agenda:

http://www.imn.org/Conference/Investors-Conference-EquipmentFinance/Agenda.html

Register:

http://www.imn.org/Conference/Investors-Conference-Equipment-Finance/Register.html

Paul Menzel, CLP, President, Financial Pacific, will be covering the

National Funding Conference for Leasing News

April 9-11, 2013

25th Annual National Funding Conference

Fairmont, Hotel, Chicago

This is the top "A" funding conference, many do not attend other conferences, and registered meetings are always "over booked" followed by much networking in and out of meetings

For More Information:

http://www.elfaonline.org/events/2013/nfc/

Dwight Galloway, CLP, RLC Funding, will be covering

the Annual Conference for Leasing News. Be sure to look for him with any

news you want to share with Leasing News readers.

April 18-20, 2013

Annual Conference

Las Vegas, Nevada

Keynote Presentation: How to Have Your Best Year Ever

Presented by: Bryan Dodge, Dodge Development, Inc.

Building a Team That Works Without You

Presented by: Bryan Dodge, Dodge Development, Inc.

Work/Life Balance

Presented by: Bryan Dodge, Dodge Development, Inc.

Professional Development

Presented by: Patrick Sponsel, Sharpe Equipment Leasing, Inc

Broker 101: The Foundation (Part 1) [CLP-CPE Credit]

Presented by: Charles (Bud) Callahan, Jr., CLP, BPB,

National Equipment Leasing, Inc.

Broker 101: The Foundation (Part 2) [CLP-CPE Credit]

Presented by: Charles (Bud) Callahan, Jr., CLP, BPB,

National Equipment Leasing, Inc.

There’s Gotta be a Pony Under Here Somewhere! [CLP-CPE Credit]

Presented by: Bob Teichman CLP, Teichman Financial Training

7th Annual Women in Leasing Luncheon, April 18th 2013

Please contact Katie or Marci for more details at 801-733-8100

Schedule of Events

Schedule PDF

Registration (includes registration fees)

Look For:

What Does Your Face Reveal?

Mac Fulfer

2013 Featured Presenter - Mac Fulfer

Face reading gives you an advantage before you even finish shaking hands. Acclaimed face reader Mac Fulfer will explain how the face is a road map with a language of its own, and how understanding its meaning will build relationships that will transform your business. Attendees will receive information that they can see and use immediately. The presentation will cover the scientific basis for face reading and give participants interactive information about what is being said but not spoken. Mac promises "You will never look at another person the same way again!"

About Mac: Mac Fulfer practiced law for nearly 22 years and initially became interested in the practice of face reading for the purpose of jury selection. He quickly discovered that face reading changed his perspective, allowing him to see people more compassionately through the experiences reflected on their faces. Since then, he has researched and developed these skills and presented ideas in workshops across the country. His workshops are in great demand from lawyers, educational institutions, Fortune 500 companies and other venues that have an interest in understanding people.

34 Exhibitors

(As of 3/5/13)

-

360 Equipment Finance

AIG Commercial Asset Finance

Allegiant Partners Incorporate

AmeriMerchant

Amerisource Funding

Axis Capital, Inc.

Bankers Capital

Baystone Financial Group

Belvedere Equipment Finance

Blackstone Equipment Leasing, LLC

Blue Bridge Financial, LLC

Bryn Mawr Funding

BSB Leasing, Inc.

Capital Relay, LLC

Channel Partners, LLC

CLP Foundation

Commerce National Bank

Dakota Financial, LLC

Diversified Lenders, Inc.

Financial Pacific Leasing

FirstLease, Inc.

Maxim Commercial Capital, LLC

Merchant Cash and Capital, LLC

MicroBilt Corporation

On Deck Capital

Onset Financial, Inc.

PacTrust Bank

Pawnee Leasing Corporation

Preferred Business Solutions

Quiktrak

RLC Funding

Summit Leasing

TEAM Funding Solutions

Varilease Finance, Inc.

![]()

National Vehicle Leasing Association

April 23-24, 2013 Annual Conference

Worthington Renaissance Hotel

Fort Worth, Texas

NVLA Conference Agenda

PDF

Registration fee: $595

($395 for each additional from same company)

To Register: http://nafassociation.com/NVLA_register_1304.php

Speakers Include:

Jim Holman

President of Pinnacle Auto Leasing presenting,

”To Lease or Not To Lease?”-- That is the Question

Angela Maynard Shovein

partner, Hudson Cook LLP

to provide a legal overview for ”Lease Here Pay Here” operations

Tom Webb

Chief Economist with Manheim and David Blassingame,

AutoFlex Leasing managing partner will share their insights

on residual setting strategies.

Mike North

director at Katz, Sapper & Miller

will lead an accounting discussion on financial reporting and tax issues that impact the leasing industry.

Ed Kaye

president and CEO of Advantage Funding will lead

the funding strategies discussion.

September, 2013

Sep 12, 2012

2013 Funding Symposium

September 27-28, 2013

2013 NAELB Western Regional

Irvine, California

October 20-22

ELFA 52nd Annual Convention

JW Marriott Grand Lakes-Orlando, Florida

November 1-2, 2013

2013 Eastern Regional

Nashville, Tennessee

|

[headlines]

--------------------------------------------------------------

Fernando's View

By Fernando F. Croc

A pair of intense visions ("Stoker" and "Leviathan") shake up the box-office, while a spunky animated adventure ("Wreck-It Ralph") hits DVD shelves along with two of last year's greatest films ("Holy Motors" and "This Is Not a Film").In Theaters:

In Theaters:

Stoker (Fox Searchlight Pictures): Acclaimed, controversial Korean director Chan-wook Park makes his English-language debut with this wicked, visually alluring thriller about dark family secrets. Set in Tennessee, the plot centers on India (Mia Wasikowska), a young woman whose wealthy upbring can't hide her lonesome, troubled sides. When her beloved father dies in a car crash, her mysterious, sinister Uncle Charlie (Matthew Goode) suddenly arrives and moves in with her mother Evelyn (Nicole Kidman). It soon becomes clear that this stranger in the nest is up to no good, but India gradually finds that her horror toward him is spiked with fascination. The florid, Gothic material is right up the alley of Park, who lets his flamboyant camera move and spin along with the decadent characters. Overflowing with mood and style, this is a perversely enjoyable coming-of-age fable.

Leviathan (The Cinema Guild): Marine life never seemed more nightmarishly alive than in this unusual, breathtaking documentary, directed by Lucien Castaing-Taylor and Verena Paravel. Shot aboard a huge commercial fishing vessel as it makes its rounds in the North Atlantic Ocean, the film details the arduous work that goes into hauling masses of fish out of the sea. Rather than realistic data, however, the film focuses startlingly in the disorientating visceral sensations of the voyage, making remarkable use of cameras that allow audiences to feel like they're right there in the rusty hull of the ship. As a result, familiar sights like nets full of fish and furnaces achieve the surreal dimension of a real-life "Alien" movie. The unrelenting intensity may not appeal to everyone, but adventurous viewers will emerge from it shaken and stirred.

Netflix Tip: Having made his American debut with "Stoker," will Chan-wook Park adapt to Hollywood or will he go back to his native Korea? In the meantime, catch up with his bold, often controversial earlier films, which include "Vengeance for Mr. Vengeance" (2002), "Oldboy" (2004), "Lady Vengeance" (2005), and "Thirst" (2009). |

On DVD:

Wreck-It Ralph (Walt Disney Pictures): In the tradition of “Schrek,” here comes another animated ogre with a good heart, only this time he’s living inside an arcade game. Taking place in a world full of video-game characters, this breathlessly inventive movie follows Ralph (voiced by John C. Reilly), a luckless big lug who’s tired of his role as unloved bad guy while his opponent Fix-It Felix (Jack McBrayer) gets all the praise. Determined to fulfill his dream, Ralph ventures into other worlds and meets spunky Vanellope (Sarah Silverman), a racer who holds a secret of their arcade universe. Can they get to the finish line before the King Candy (Alan Tudyk)? Featuring eye-popping design and hilarious voice performances, this splashy adventure (directed by “Simpsons” veteran Rich Moore) is a pop-culture feast for all ages.

Holy Motors (Indomina Group): After a decade away from feature films, one-of-a-kind French filmmaker Leos Carax returns with profoundly weird and weirdly profound view of art in the new century. Denis Lavant, the director’s sublimely homely muse, stars as a mysterious man known as Mr. Oscar, seen mostly being driven from one assignment to another in a limo by Celine (Edith Scob). A master of disguises, Oscar over the course of a day portrays old beggars, maniacal kidnappers, lethal killers, disappointed fathers and melancholy lovers. A description of the storyline can’t begin to do justice to its cinematic creativity and wild humor. One of last year’s strangest and greatest releases, Carax’s movie is a dark comedy about the death of cinema that nevertheless restores the viewer’s faith in it. With subtitles.

This Is Not a Film (Palisades Tartan): Accused of subversion, Iranian director Jafar Panahi has his filmmaking rights revoked and is forced into house arrest while waiting for his sentence. Out of this real-life Kafkaesque situation emerges one of a truly unique first-person documentary, in which Panahi slyly makes a passionate cinematic statement about his own (as well as his country's) predicament. Addressing his friend's camera while padding around his Tehran apartment, he talks about the movies that got him into trouble in the first place, acts out the roles of his new screenplay, chats with friends and family, and tends to his pet iguana. The result is a multi-layered yet immediately accessible examination of an artist's dilemma which, despite the anxieties hanging over the scenario, brims with humor and hope. Yes, it is indeed a film, and one of last year's very best. With subtitles.

[headlines]

--------------------------------------------------------------

Classified ads—Asset Management

Leasing Industry Outsourcing

(Providing Services and Products)

Asset Management: Atlanta, GA |

Asset Management: Boston, MA Nationwide appraisals, remarketing, audits, inspections and more! Over 15-years industry experience and dedicated to deliver personal, prompt, professional services. Call Chris @ 508-785-1277. Email:email |

Asset Management: Minneapolis, MN |

Asset Management: Monroe, NC Recover a greater return on your investment. We specialize in the woodworking, pallet, sawmill and forestry industries. Carolinamachinerysales.com/ Melinda Meier (704)288-1904 x103 |

| Asset Management: Nationwide BUYER/LENDER BEWARE. Don't sign anything until Collateral Verifications Inc. goes onsite, knocks on the door and gets the facts. http://www.i-collateral.com Email: mark@i-collateral.com |

Nationwide |

Asset Management: NorthWest Sequent provides collateral recovery, remarketing, and storage services to lenders with assets located in the greater Pacific Northwest. Professional services at reasonable pricing. Contactrossr@sequentam.com |

Asset Management: Orange City, FL We help Lessors Liquidate un-wanted Assets valued at $750,000+. It's an effective method of Liquidating Assets such as Jets, Planes, Helicopters, Freighters, etc. Eric R. Sanders Tel 386-789-9441 www.ValuedAssetSales.com www.The-RandolphCapital.com EQPMNTLEASING@aol.com |

| Asset Storage/Re-Marketing: Ohio & surrounding states. Providing no cost warehousing, condition reports, digital photos and remarketing of off-lease forklifts & industrial equipment. NAFTA wide dealer network. Email to GCochran@OhioLift.com |

Asset Management Asset ManagementMelville, New York Auctions, Appraisals, National Repossessions. ALL asset classes. 20+ year team works for you. Spend less, Net More… Fast! Ed Castagna 516-229-1968ecastagna@inplaceauction.com |

| Asset Management: South East US- AllState Asset Management Recovery, remarketing, inspections. 25 years experience, dedicated to deliver, prompt, professional services. Call Brian @ 704-671-2376. |

Asset Management: Global Specializing in Semiconductor and Electronic Test Equipment collateral. Lender services include Consignment Sales, Remarketing, Portfolio Purchases, Inspections, De-installation, Repairs and Warehousing. www.testequipmentconnection.com |

| Bulldog Asset Management provides recovery and remarketing services with a difference. Contingent repos, free storage and industry experts to remarket. Email:Jamie@bulldogasset.com www.bulldogasset.com |

Asset Management: Portsmouth, NH |

All "Outsourcing" Classified ads (advertisers are both requested and responsible to keep their free ads up to date

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing.htm

How to Post a free "Outsourcing" classified ad:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing-post.htm

| John Kenny Receivables Management www.jrkrmdirect.com • End of Lease Negotiations & Enforcement The Solution to Your Credit & Accounts Receivable Needs |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

Rottweiler (A very good looking dog)

Orange, California Adopt-a-Dog

SPLINTER

Pet ID: A1235735

Sex: M

Age: 1 Year

Color: BLACK - TAN

Breed: ROTTWEILER - MIX

Kennel: 075

eMail: occrocpetinfo@occr.ocgov.com

OC Animal Care

561 The City Drive South

Orange, CA. 92868

714-935-6848 OR 949-249-5160

714-935-6373 Fax

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

|

![]()

News Briefs----

Yahoo CEO Marissa Mayer gets $1.1 MM bonus for her first 5 ½ months

http://blogs.sacbee.com/49ers/archives/2013/03/49ers-cut-david-akers-free-up-salary-cap-space.html

Increase in U.S. bank lending could spur more jobs

http://www.commercialappeal.com/news/2013/mar/05/increase-in-us-bank-lending-could-spur-more-jobs/

One In Five Americans Have Errors In Their Credit Reports, Study Finds

http://news.yahoo.com/one-five-americans-errors-credit-reports-study-finds-110233796.html;_ylt=AwrNUbEC.zdReUcAO7nQtDMD

With Legal Reserves Low, Bank of America Faces a Big Lawsuit

http://dealbook.nytimes.com/2013/03/06/with-legal-reserves-low-bank-of-america-faces-a-big-lawsuit/

Hertz and Donlen launch equipment finance programme

http://www.khl.com/magazines/access-international/detail/item83470/HERC-and-Donlen-launch-equipment-finance-programme

Carlyle ‘Hopeful’ on Coates Hire Sale

http://blogs.wsj.com/dealjournalaustralia/2013/03/07/carlyle-hopeful-on-coates-hire-sale/

Japanese pilots union highlights 787 power panel concerns

[headlines]

--------------------------------------------------------------

---You May Have Missed

Forbes top 500 Richest Billionaires

http://www.forbes.com/sites/edwindurgy/2013/03/04/the-worlds-richest-billionaires-full-list-of-the-top-500/

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

SparkPeople--Live Healthier and Longer

Cut Your Arthritis Risk with Fruits & Veggies

http://www.sparkpeople.com/resource/nutrition_articles.asp?id=653

[headlines]

--------------------------------------------------------------

Winter Poem

We've Only Just Begun

by Paul Williams and Roger Nichols

We've only just begun to live,

White lace and promises

A kiss for luck and we're on our way.

And yes, We've just begun.

Before the rising sun we fly,

So many roads to choose

We start our walking and learn to run.

And yes, We've just begun.

Sharing horizons that are new to us,

Watching the signs along the way,

Talking it over just the two of us,

Working together day to day

Together.

And when the evening comes we smile,

So much of life ahead

We'll find a place where there's room to grow,

And yes, We've just begun.

[headlines]

--------------------------------------------------------------

49ers cut David Akers, create salary-cap space

http://blogs.sacbee.com/49ers/archives/2013/03/49ers-cut-david-akers-free-up-salary-cap-space.html

The 20 Grumpiest Old Men in Sports

http://bleacherreport.com/articles/1552205-the-20-grumpiest-old-men-in-sports

[headlines]

--------------------------------------------------------------

![]()

California Nuts Briefs---

George Lucas proposes Presidio museum

http://www.sfgate.com/art/article/George-Lucas-proposes-Presidio-museum-4331417.php

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

Canadian Wine and Grape Industry Contributes $6.8 Billion in Economic Impact to Canadian Economy

http://www.winebusiness.com/news/?go=getArticle&dataid=112861

Gundlach Bundschu Winery Celebrates 155th Anniversary

http://www.winebusiness.com/news/?go=getArticle&dataid=112861

2008 PENFOLDS GRANGE GAINS 100 POINTS

http://www.thedrinksbusiness.com/2013/03/2008-penfolds-grange-gains-100-points/

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

http://www.estevanico.org/history.html

http://www.tsha.utexas.edu/handbook/online/articles/view/EE/fes8.html

http://www.rra.dst.tx.us/c_t/people/ESTEVANICO.cfm

1644-First Whaling Industry: Southampton, NY, a town on the coast of Long Island where whales were often cast ashore, established the first whaling industry. The town was divided into four wards of 11 persons each to attend to the whales. Two persons from each ward were employed to cut them up so that each inhabitant obtained an equal portion. The popularity grew to the point a whaling franchise was granted to a Mr. Whiting in 1647 for the waters of Long Island Sound between Stonington, CT, and Montauk Point, NY.

1638 -Controversial colonial churchwoman Anne Hutchinson, 47, and nineteen other exiles from the Massachusetts Bay Colony settled in Rhode Island, at the site of modern Portsmouth.

http://www.annehutchinson.com/anne_hutchinson_biography_001.htm

http://www.rootsweb.com/~nwa/ah.html

1717 - The "Great Snow", a composite of four winter storms to hit the eastern U.S. in nine days, finally came to an end. Snow depths averaged 60 inches following the storm. Up to four feet of snow fell around Boston MA, and snow drifts 25 feet high were reported around Dorchester MA.

1729- Henrietta Johnston, self-taught portrait artist born in Ireland about 1655 and immigrated to the United States with her husband in 1707 and settled in what is now Charleston, SC. Her husband immediately became ill and while she nursed him and took care of her children and home in abject poverty, to raise money she began to draw portraits of local dignitaries in the new form of pastels.

Almost 50 portraits are credited to her and she is considered to be the first American woman artist. Her technique was straight forward with little adornment. Almost nothing is known about her life. She may have moved to New York to work after her husband's death.

http://askart.com/Biography.asp

http://desertfun.bestreadguide.com

http://www.amazon.com/exec/obidos/ASIN/0945578032/avsearch-df1-2-20/

102-1682336-8966565

1774---The British close port of Boston to all commerce

1776 - Lead by General William Howe, the British evacuate Boston. Howe’s army and a group of 1000 loyalists will set sail for Halifax, Nova Scotia on 17 March.

1778 -Captain James Cook first sights Oregon coast, at Yaquina Bay

http://www.neworegontrail.com/lighthouse/yaquina.bay.htm

http://www.newportnet.com/coasthistory/RoadTrip.htm

http://www.newportnewstimes.com/1

1782 -Ohio Territory militiamen began a two-day massacre of the Moravian Indian town of Gnadenhutten (modern New Philadelphia, Ohio). In all, 96 Christian Indians of the Delaware tribe were slaughtered, in retaliation for Indian raids made elsewhere in the Ohio Territory.

http://www.usgennet.org/usa/topic/colonial/pioneer/chap16.html

1799 -- John Fries launches a rebellion in Pennsylvania against the imposition of the "direct tax" enacted by Congress 1 July 1798, on lands, houses & slaves. Fries' mob was dispersed by the Militia after a march on Bethlehem. Fries was arrested & sentenced to be hanged for treason, before being pardoned by the President.

1802 -In Washington, D.C., the first Baptist church was organized with six charter members. Their first pastor Obadiah Brown was hired five years later, and Brown remained in that pulpit while involving himself in every important local Baptist program for the next 43 years!

1848- In Hawaii, Great Mahele (division of lands) signed

http://hotspotshawaii.com/nalostuff/May96/GreatMahele.html

http://www.amazon.com/exec/obidos/ASIN/0870221256/avsearch-df1-2-20/

102-1682336-8966565

1849- Luther Burbank, American naturalist and author, creator and developer of many new varieties of flowers, fruits, vegetables and trees. born at Lancaster, MA.. Luther Burbank's birthday is observed in California as Bird and Arbor Day. He died at Santa Rosa, CA, Apr 11, 1926.

http://ci.santa-rosa.ca.us/lbhg/gardens.asp

1850-Slave States Balance: the acquisition of territory following U.S. victory in the Mexican War revived concerns about the balance of free and slave states in the Union. This day Senator Daniel Webster delivered his famous three hour "Seventh of March" speech urging sectional compromise on the issue of slavery. Advising abolition-minded Northerners to forgo antislavery measures, he simultaneously cautioned Southerners that disunion inevitably would lead to war. He endorses the Compromise of 1850 proposed by Kentucky Senator Henry Clay on 29 January 1850, as a means of preserving the Union. It called for California to be admitted as a free state; for the passage of an inhumane Fugitive Slave law; for new territories in the Southwest to he allowed to organize without restrictions on slavery; for protecting slavery in the District of Columbia while abolishing domestic slave trade there; and for a settlement of $10 million to Texas if the state would relinquish claims to one-third of its territory (now in New Mexico, Oklahoma, Kansas, Colorado, and Wyoming). The compromise would be adopted on 09 September 1850.

http://www.dartmouth.edu/~dwebster/speeches/seventh-march.html

Following the lead of senators Henry Clay and Stephen Douglass, Webster endorsed Clay's plan to assure sectional equilibrium in Congress. Passed after eight months of congressional wrangling, the legislation admitted California to the Union as a free state, permitted the question of slavery in Utah and New Mexico territories to be decided by popular sovereignty, settled Texas border disputes, and abolished slave trading in the District of Columbia while strengthening the Fugitive Slave Act. This speech by Daniel Webster supported Senator Henry Clay’s compromise, who had run for president, lost, and come back to the U.S. Senate as a most influential politician. It brought together the U.S. Senate for a brief period of time. He espoused the provisions of the Fugitive Slave Bill. It is said, John Greenleaf Whittier had Webster in mind when he wrote in his poem: “Ichabod:”

“ All else is gone from those great eyes

The soul has fled;

When faith is lost, when honor dies

The man is dead.”

http://www.lib.umd.edu/RARE/RareCollection/danielwebster.html

http://www.danorr.com/webster/7thofmarch-text.html

1854- Charles Miller of St. Louis, MO, patented a sewing machine to stitch buttonholes,revolutionizing the garment industry.

1860- -- 6,000 shoemakers joined by 20,000 other New England workers in Lynn, Massachusetts strike. During the great New England shoemakers strike, about 1,000 women workers in Lynn, Massachusetts, strike for a union & against wage cuts. Marching through a blizzard, the women carry signs proclaiming: "American Ladies Will Not Be Slaves."

In 10 days, a procession of 10,000 workers marches through Lynn in the largest labor protest prior to the Civil War. Within a month, shoe manufacturers offer higher wages to bring strikers back to the factories. But the companies refuse to recognize a union.

1862 - Union forces under General Samuel Curtis defeat the army of General Earl Van Dorn at Pea Ridge, located in an extreme northwestern section of Arkansas. Confederate General Ben McCulloch was killed in one of the attacks. The Yankees suffered 1,384 men killed, wounded, or captured out of 10,000 engaged; the Confederates suffered a loss of about 2,000 out of 14,000 engaged. The Union won a decisive victory that also helped them clear the upper Mississippi Valley region on the way to securing control of the Mississippi River by mid-1863.

1862 -- Battle of Elkhorn Tavern, Day 2, Generals McCulloch, McIntosh and Slack killed. Union Army gains control of Missouri.

http://civilwartraveler.bravepages.com/PR/PRPAN12.htm

http://www.oldalgonquin.net/civilwar/36th/pearidge/indexpearidge.htm

http://www.cwbattlefields.com/virtualtours/pearidgebattle.html

http://www.civilwarhome.com/pearidge.htm

http://stellar-one.com/civil_war/battle_of_pea_ridge_23.htm

http://www.lsjunction.com/people/mccullob.htm

http://www.members.cox.net/confed/third/mcculloch.html

http://www.2020site.org/texas/lesson58.html

http://stellar-one.com/civil_war/battle_of_pea_ridge_39.htm

1865- Michael A. Healy of Georgia, became the first Coast Guard serviceman who was African-American. He was appointed this day to the Revenue Cutter Service, the predecessor of the Coast Guard. He became captain on March 3, 1883, and was commanding officer of the Bear from 1886 to 1895.

1865 - Lieutenant Commander Hooker, commanding a naval squadron consisting of U.S.S. Commodore Read, Yankee, Delaware, and Heliotrope, joined with an Army unit in conducting a raid at Hamilton's Crossing on the Rappahannock River six miles below Fredericksburg. Hooker reported that the expedition succeeded in "burning and destroying the railroad bridge, the depot, and a portion of the track....; also the telegraph line was cut and the telegraphic apparatus brought away. A train of twenty-eight cars, eighteen of them being principally loaded with tobacco, and an army wagon train were also captured and burned. A considerable number of mules were captured and some thirty or forty prisoners taken. A mail containing a quantity of valuable information was secured." Throughout the war, rivers were avenues of strength for the North, highways of destruction to the South, which enabled warships and joint expeditions to thrust deep into the Confederacy.

1865-Battles round Kinston NC

http://www.aboutthecivilwar.com/uscivilwar5/1577470273AMUS116707.shtml

1869- the Suez Canal opened. This waterway across Egypt connecting the Mediterranean and Red seas was built by the French. In 1956, Egyptian president Nasser nationalized the canal, prompting an invasion by the British, French and Israelis. The Six-Day War in 1967 shut down the canal for eight years.

1872 -8º F in Boston MA

1888 Alcide “Slow Drag” Pavageau Birthday

http://user.tninet.se/~rrr043f/slow_drag.htm

1876 - Patent #174,465 was issued to Alexander Graham Bell for his telephone.

1893-(Alice) Lorena Hickok, highest paid woman newspaper reporter of her day with Associated Press, political reporter, and later became investigator for Harry Hopkins in the Department of Commerce after her involvement with Eleanor Roosevelt made her step out of journalism. She actually lived in the White House with Mrs. Roosevelt and slept in ER's apartment.

1908 -Cincinnati Mayor Mark Breith stood before city council & announced that, "women are not physically fit to operate automobiles"

1911- Willis S. Famsworth of Petaluma, CA received two patents, one for a coin-operated locker, and one with William H. Reed on a coin receptacle “magazine-hinge and conveyor” The insertion of a coin in a slot released a key to open and close the locker. The “magazine hinge” enable newspapers

and magazines to be purchased from a locked stand.

1911 - Twenty thousand US troops are sent to the Mexican border as the Mexican Revolution continues.

1917- Drummer Lee Young born, New Orleans, LA.

1917-- "The Dixie Jass Band One Step," by Nick LaRocca's Original Dixieland Jass Band (Victor 18255), becomes the first jazz recording released for sale in the US.

1923 -- Robert Frost's poem, "Stopping by Woods on a Snowy Evening," is published in the New Republic magazine. Proud of the poem, he said the lines, "Whose woods these are, I think I know, his house is in the village though..." contained everything he ever knew about how to write.

http://writersalmanac.publicradio.org/programs/2006/03/06/

1935-Monopoly was invented this day by Charles Darrow. While unemployed during the Depression, Charles Darrow devised this game and he sold it himself for two years. Monopoly was mass marketed by Parker Brothers beginning in 1935. Darrow died a millionaire in 1967.

1936 - Nazi leader Adolf Hitler violates the Treaty of Versailles and the Locarno Pact by sending German military forces into the Rhineland, a demilitarized zone along the Rhine River in western Germany. Two years later, Nazi Germany burst out of its territories, absorbing Austria and portions of Czechoslovakia. In 1939, Hitler invaded Poland, leading to the outbreak of World War II in Europe.

1938-Janet Guthrie, an aerospace engineer, was one of the first four women to qualify for the scientist- astronaut program of NASA, the first woman to race in the Indianapolis 500 races, finishing ninth in 1978. (She was forced to withdraw two other times because of engine trouble. Her other entries in 1977 and 1979 were aborted because of engine trouble. No women were even allowed in the repair and refueling pits at the Indy 500 until a lawsuit in 1972.)

http://www.janetguthrie.com/

http://www.britannica.com/women/articles/Guthrie_Janet.html

http://www.writetools.com/women/stories/guthrie_janet.html

1939-- Guy Lombardo and his Royal Canadians record "Auld Lang Syne," a New Year's favorite for a very long time, perhaps 30 years.

1945-A small advance force of the US first Army captured the Ludendorff railway bridge across the Rhine River at Remagen -the only bridge across the Rhine that had not been blown up by the German defenders-thus acquiring the first bridgehead onto the east bank, a turning point in World War II. Not since the days of Napoleon had an invading army crossed the Rhine. Tanks of the US Third Corps reach the Rhine River opposite the small German town of Remagen, Germany, and find the Ludendorff Bridge damaged but still usable The bridge, which had miraculously survived the massive Allied air assaults on Nazi Germany and then the country's own efforts to protect its interior from the Allied invasion, is an unexpected strategic coup for the US First Army. Troops and vehicles are immediately rushed across, and for the first time, the US forces secure a foothold on the eastern side of the fortified Rhine River shore. Nazi dictator Adolf Hitler is so furious to learn of the US'o use of the intact Ludendorff Bridge that he fires General Gerd von Rundstedt as commander of western German forces. German bombers attempt to destroy the bridge, but the US troops continue to move across and expand the beachhead on the other side. On 17 March, after transporting thousands of troops and military vehicles across the Rhine, the bridge collapses, killing twenty-five Americans. Nevertheless, the Allies now hold the area and engineers erect other bridges nearby. Supreme Allied Commander General Dwight D. Eisenhower later says that the discovery of the intact bridge "put victory just around the corner."

1945--LEIMS, JOHN HAROLD Medal of Honor

Rank and organization: Second Lieutenant, U.S. marine Corps Reserve, Company B, 1st Battalion, 9th Marines, 3d Marine Division. Place and date: Iwo Jima, Volcano Islands, 7 marches 1945. Entered service at: Chicago, Ill. Born: 8 June 1921, Chicago, Ill. Citation: For conspicuous gallantry and intrepidity at the risk of his life above and beyond the call of duty as commanding officer of Company B, 1st Battalion, 9th Marines, 3d Marine Division, in action against enemy Japanese forces on Iwo Jima in the Volcano Islands, 7 March 1945. Launching a surprise attack against the rock-imbedded fortification of a dominating Japanese hill position, 2d Lt. Leims spurred his company forward with indomitable determination and, skillfully directing his assault platoons against the cave-emplaced enemy troops and heavily fortified pillboxes, succeeded in capturing the objective in later afternoon. When it became apparent that his assault platoons were cut off in this newly won position, approximately 400 yards forward of adjacent units and lacked all communication with the command post, he personally advanced and laid telephone lines across the isolating expanse of open fire-swept terrain. Ordered to withdraw his command after he had joined his forward platoons, he immediately complied, adroitly affecting the withdrawal of his troops without incident. Upon arriving at the rear, he was informed that several casualties had been left at the abandoned ridge position beyond the frontlines. Although suffering acutely from the strain and exhausting of battle, he instantly went forward despite darkness and the slashing fury of hostile machinegun fire, located and carried to safety 1 seriously wounded marine and then, running the gauntlet of enemy fire for the third time that night, again made his tortuous way into the bullet-riddled deathtrap and rescued another of his wounded men. A dauntless leader, concerned at all time for the welfare of his men, 2d Lt. Leims soundly maintained the coordinated strength of his battle-wearied company under extremely difficult conditions and, by his bold tactics, sustained aggressiveness, and heroic disregard for all personal danger, contributed essentially to the success of his division's operations against this vital Japanese base. His valiant conduct in the face of fanatic opposition sustains and enhances the highest traditions of the U.S. Naval Service.

1946—Top Hits

Let It Snow - Vaughn Monroe

Symphony - The Freddy Martin Orchestra (vocal: Clyde Rogers)

Oh, What It Seemed to Be - The Frankie Carle Orchestra (vocal: Marjorie Hughes)

Guitar Polka - Al Dexter

1946 - Grauman’s Chinese Theatre on Hollywood Boulevard was the site of the 18th Annual Academy Awards celebration. Bob Hope hosted the first half of the show with James Stewart stepping up to the mike for the second half. The Best Motion Picture of 1945 was Paramount’s "The Lost Weekend", produced by Charles Brackett. It also won for Best Director (Billy Wilder), Best Actor (Ray Milland), and Best Writing of a Screenplay (Charles Brackett and Billy Wilder). The Oscar for Best Actor in a Supporting Role went to James Dunn for "A Tree Grows in Brooklyn". Best Actress was Joan Crawford for her performance in "Mildred Pierce". The votes for The Best Actress in a Supporting Role prize went to Anne Revere for "National Velvet". The Best Music/Scoring of a Musical Picture Oscar went to George Stoll for "Anchors Aweigh" and Best Music/Song was "State Fair" by Oscar Hammerstein II and Richard Rodgers.

http://www.infoplease.com/ipa/A0148306.html

Make Love to Me! - Jo Stafford

Young-At-Heart - Frank Sinatra

Cross Over the Bridge - Patti Page

Slowly - Webb Pierce

1951--BRITTIN, NELSON V. Medal of Honor

Rank and organization: Sergeant First Class, U.S. Army, Company I, 19th Infantry Regiment. Place and date: Vicinity of Yonggong-ni, Korea, 7 March 1951. Entered service at: Audubon, N.J. Birth: Audubon, N.J. G.O. No.: 12, 1 February 1952. Citation: Sfc. Brittin, a member of Company I, distinguished himself by conspicuous gallantry and intrepidity above and beyond the call of duty in action. Volunteering to lead his squad up a hill, with meager cover against murderous fire from the enemy, he ordered his squad to give him support and, in the face of withering fire and bursting shells, he tossed a grenade at the nearest enemy position. On returning to his squad, he was knocked down and wounded by an enemy grenade. Refusing medical attention, he replenished his supply of grenades and returned, hurling grenades into hostile positions and shooting the enemy as they fled. When his weapon jammed, he leaped without hesitation into a foxhole and killed the occupants with his bayonet and the butt of his rifle. He continued to wipe out foxholes and, noting that his squad had been pinned down, he rushed to the rear of a machine gun position, threw a grenade into the nest, and ran around to its front, where he killed all 3 occupants with his rifle. Less than 100 yards up the hill, his squad again came under vicious fire from another camouflaged, sandbagged, machine gun nest well-flanked by supporting riflemen. Sfc. Brittin again charged this new position in an aggressive endeavor to silence this remaining obstacle and ran direct into a burst of automatic fire which killed him instantly. In his sustained and driving action, he had killed 20 enemy soldiers and destroyed 4 automatic weapons. The conspicuous courage, consummate valor, and noble self-sacrifice displayed by Sfc. Brittin enabled his inspired company to attain its objective and reflect the highest glory on himself and the heroic traditions of the military service.

1954 - No. 1 Billboard Pop Hit: ``Make Love to Me,'' Jo Stafford.

1955-Carl Perkins' "Blue Suede Shoes" enters the R&B chart. It is the first time a C&W artist has made the R&B chart.

1955 - "Peter Pan", with Mary Martin and Cyril Richard, was presented as a television special for the first time. The complete Broadway cast production was also broadcast in color on WRCA, Channel 4, New York City on “Producer’s Showcase.” It could also be seen in black and white on the NBC network.

1956 - Lonnie Donegan’s hit song, "Rock Island Line", was doing well on the pop music charts from across the big pond. The popular music from Great Britain’s ‘King of Skiffle’ ushered in the new music craze called ‘skiffle’. Donegan was born in Glasgow, Scotland and was a member of Chris Barber’s Jazz Band. He had one other major hit on the U.S. pop charts even bigger than "Rock Island Line". In 1961, Donegan’s "Does Your Chewing Gum Lose It’s Flavor (On the Bedpost Over Night)" made it to the top five in America. The song was a top-10 hit in 1924 by Ernest Hare and Billy Jones. However, instead of "Chewing Gum" in the original title, it was "Spearmint". Donegan recorded his version of the song in 1959, two years before it became a hit. Incidentally, John Lennon and George Harrison of The Beatles both started their careers in skiffle bands.

1957-- The Tune Weavers record "Happy Happy Birthday Baby," one of the top hits for the year.

1962—Top Hits

Duke of Earl - Gene Chandler

Hey! Baby - Bruce Channel

Break It to Me Gently - Brenda Lee

Walk on By - Leroy Van Dyke

1964-The Beatles "I Want to Hold Your Hand" and "She Loves You" are, according to Billboard, "neck and neck" for the top spot on the singles chart.

1964 -- Capitol Records is besieged with requests for heavyweight boxing champ Cassius Clay's album, "I Am the Greatest." It's in big demand because of Clay's defeat of Sonny Liston last month. Columbia expects to sell 500,000 copies & Clay (aka, Muhamed Ali) says, "I'm better & prettier than Chubby Checker."

1965 -- First US "combat" troops sent to Vietnam. (As opposed to "advisers" & troops who are in a defensive roll.) The Johnson administration tries to hide this policy change & denies rumors, but a State Department spokesman "mistakenly" spills the beans a couple months later.

http://distefano.com/

1965-Selma, Alabama March: 525 people began a fifty-four mile march from Selma, Alabama to the state capitol in Montgomery They were demonstrating for African American voting rights and to commemorate the death of Jimmie Lee Jackson, shot three weeks earlier by an state trooper while trying to protect his mother at a civil rights demonstration. On the outskirts of Selma, after they crossed the Edmund Pettus Bridge, the marchers, in plain sight of photographers and journalists, were brutally assaulted by heavily armed state troopers and deputies. Here is their story with photographs:

http://memory.loc.gov/ammem/today/mar07.html