Syndication Manager

Rancho Cucamonga, CA

Knowledge of transportation industry a plus,

but not required. Compensation commensurate

with experience

contact: wdalton@crlease.com

We can finance or lease any make or model

of truck, bus, or equipment

|

Monday, May 2, 2011

Bennett Receives 30 Year Prison Sentence

Bennett Funding---Archives May 2, 2000

Classified Ads---Senior Management

Franchise Industry Report

by Bob Rodi, CLP

Bank President Found Dead, Georgia takes two hits,

including CEO indicted by Feds over TARP money---

Charlie Chan Sayings….

Leasing 102 by Mr. Terry Winders, CLP

“Additional Vendor Programs”

Classified Ads---Help Wanted

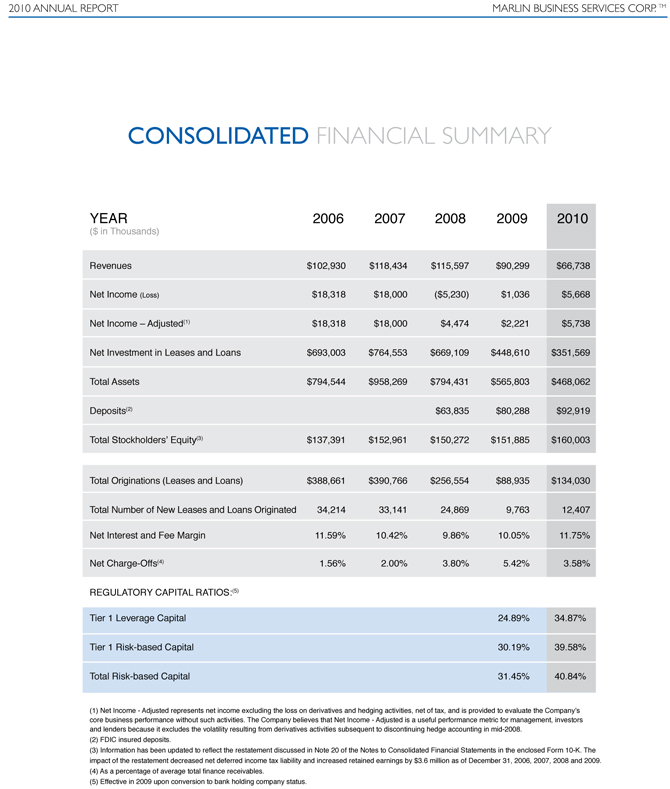

Marlin to Reveal Year End/First Quarter May 6

Top Stories---April 25--April 29

Birmingham, Alabama Adopt-a-Dog

News Briefs---

Obama Announces Killing of Osama bin Laden

More on Bin Laden Dead-Bush calls "momentous achievement"

Buffett frets on bank profit outlook, likes Wells/US Bank

Equipment leasing/renting: The fleet bridge to the future

The Independent Truck Leasing Company is Alive and Well

Pacific Rim David C. Mirsky Saluted at Stanford

1/5th employees Americans Have Raided Retirement Accounts

NBC Expected to Pick Ann Curry as ‘Today’ Co-Host

Which TV Shows are safe, may be gone, or cancelled

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

Help Tornado Pet Victims

You May have Missed---

Sports Briefs

California Nuts Briefs

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer. It is considered “bias” as it is the writer’s viewpoint.

[headlines]

--------------------------------------------------------------

Bennett Receives 30 Year Prison Sentence

Bennett Leasing---Archives May 2, 2000

(This was the largest Ponzi scheme until Bernard Madoff came along)

Patrick Bennett, the accused mastermind of one of the biggest Ponzi schemes in U.S. history, was sentenced Friday (4/28/00) to 30 years in prison. Bennett was chief financial officer of the family-owned Bennett Funding Group, a Syracuse, NY, firm that allegedly bilked some 12,000 people out of $700 million using phony office equipment leases.

U.S. District Judge John S. Martin postponed sentencing several times to allow Bennett and his wife, Gwen, more time to turn over assets to a trustee for the investors.

Last month, the judge offered to sentence Bennett to 20 years on the condition he turn over additional assets, such as the sprawling upstate New York horse farm registered in his wife's name. But Judge Martin said in Manhattan federal court that Bennett had failed to turn over assets and that "damage was done, and continues to be done, to people who lost life savings while [Gwen Bennett] lives in luxury."

Before the sentencing, Bennett called the judge's handling of the case "illegal, unethical and un-American" and continued to maintain his innocence. Bennett was convicted in June on 42 counts of fraud and money-laundering, although the jury deadlocked on 11 counts, including the securities-fraud charge related to the pyramid scheme.

He was ordered to forfeit $109 million, the amount of money he was found guilty of laundering. His attorney, Michael D. Pinnisi, said Bennett would appeal the conviction and sentence. Because he wasn't convicted on the most serious charges, Bennett should only have received a sentence of a few years, Pinnisi said.

Prosecutors said Bennett used his company to sell securities based on phony office-equipment leases. Bennett Funding filed for bankruptcy protection in 1996.

(Bennett appealed the decision based on the sentence contingent on his wife turning over assets, and won, but the SEC Commission sentenced him to 22 years in prison and to forfeit almost $110 million. He appealed it and tried to go the Supreme Court, he denied his "writ of certiorari on January 12, 2004; finally July 26, 2004 the judgment was rendered regarding "$400 million in ill-gotten gains" and then satisfied by "bankruptcy trustee for the Bennett entities.")

http://www.sec.gov/litigation/litreleases/lr19094a.htm

(Over ten years, and perhaps Sheldon Player is going try to go for this record as he has more experience in dealing with the FBI and US Attorney’s office, but he will go to jail. As the former FBI Director Edgar J. Hoover said, “The FBI always gets their man.”

More about the case:

http://www.cnylink.com/cnynews/view_news.php?news_id=1229696876

And finally over, March 3, 2009:

http://www.syracuse.com/news/index.ssf/2009/03/bennett_funding_bankruptcy_fin.html

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

Classified Ads---Senior Management

(These ads are “free” to those seeking employment

or looking to improve their position)

Europe

25+ yrs exper. management roles Chase, AT&T Capital, Heller Financial, SFS. Develop biz from “scratch to success”. Looking for challenging & pioneering job.

Email: frans@alliedproperty.net |

Philadelphia, PA

27 yrs. exp. sales, ops., credit, strategy, P&L mngmet. Most recently created & executed the biz plans for 2 highly successful Bank-owned small ticket leasing subsidiaries.

email: mccarthy2020@comcast.net |

Philadelphia Metro Area - 30 Years experience Healthcare sales/ management- 3 years experience newly create "small-ticket" healthcare division.

Good success - Mitch Utz

215-460-4483

Email: mitutz@msn.com

|

Southern CA

20 years exp. as hands-on leasing CFO, managing accounting, treasury, FP&A, including securitizations, Great Plains/FRx, budgets, risk management. MBA. Also available as interim Controller/CFO, consultant.

Email: leasecfo@gmail.com

|

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

[headlines]

--------------------------------------------------------------

Franchise Industry Report

by Bob Rodi, CLP

(Long time leader in the leasing industry who for the last ten years, perhaps longer, has specialized in franchise lease financing, in fact spending more time with the International Franchise Association than leasing associates as he has done in the past.)

It’s hard to believe that ten years has passed since I wrote the article that was reprinted last Monday in leasingnews.org as the Archive story for April 25, 2001. It was true in 2000-2001 and is true today---perhaps more worrisome. Ten years ago, most of the problems that faced the specialty finance industry were “home grown”. They were the result of chasing too much volume, loose credit criteria and either a fundamental misunderstanding of the risk associated with financing tens of millions for dot com startups, or simply ignoring the risk. What we didn’t have back then were the systemic and structural problems that we currently have in the banking and finance industry.

Case in point--I recently attended a “financial summit” in Washington DC. This summit was convened by the IFA (International Franchise Association) and the purpose was to bring together government policy makers, members of the banking and lending community, and prominent franchisors and franchisees. The IFA, recognizing that lending (or the lack thereof) is a major obstacle to franchise growth and therefore significant job creation was really trying to do a good thing for its membership in attempting to get all of these constituencies singing from the same page in the choir book. Not only were they not singing from the same page, they weren’t even in the same concert hall.

One major topic that is at the front of everyone’s mind is defining what is being called the “New Normal”. Basically this “New Normal”, for many of us that have been around a while is simply a return to prudent underwriting standards. The fact that the specialty finance industry showed a lot of resilience during this recession stems from the fact that many of us generally adhered to sound underwriting and risk management strategies. These may have been lessons learned from the last recession when our industry suffered a lot of pain.

Both Franchisors and Lenders are struggling with this. Many franchisors are realizing that there is currently no 800lb Gorilla and the securitization market may find it harder than Charlie Sheen to make a total comeback. The Bankers told the franchisors that they had better get used to being part of the risk equation and many of them are struggling with the idea of forming captive finance companies or entering into some type of recourse arrangement. The bottom line is that if your franchisees can’t find financing your franchise system can’t grow.

The bankers also admitted their ignorance and lack of knowledge of the franchise industry. Only a few understand that offering financing to brand name QSR or fast casual food service chains is not the same as financing a restaurant. If the place serves food, it’s a restaurant. Restaurants are risky—end of story. It will be up to Franchisors to educate bankers and learn their criteria so that they can match candidates with bank underwriting programs. Bankers also want “relationships”. They are not really interested in “national” loan programs unless they can also get the opportunity to do money management, sell insurance and manage investments too. By the way, if you are a “small business” with 250 employees your banker will probably “like” you on Face book. If you are real small business don’t expect to get your “friend request” returned.

There were some light moments during the summit as follows:

1. Karen Mills, SBA director for the Obama Administration, stated that the current administration is the most “business friendly” in 35 years. (A lot of chuckles and groans from all the entrepreneurs present).

2. Health care is not going to be as big a cost to small business as everybody thinks and the administration officials brought out the fuzzy math stats to prove it.

3. The Vice Chairman of the FDIC informed the audience that the FDIC is cracking down on banks who are not following their charters to the letter (imagine our surprise at hearing that). He also abruptly walked off the stage when he was asked to take questions. (It was really funny, if you were there).

The summit was interesting but it certainly demonstrated that the road to recovery is going to be long and hard. At the current 2.5-3% growth that economists are predicting it will take 7-8 years to replace the jobs that were lost in the last 2 years. At any rate, may of us have been here before but, if you’re like me, this time it hurts a little bit more.

Bob Rodi, CLP

President

Mount Pleasant Capital Corp.

drlease@mountpleasantcapital.com

1-800-321-5327 x101

www.mountpleasantcapital.com

Bob Rodi (History Repeats Itself?)

Archives April 25, 2001

http://leasingnews.org/archives/Apr2011/4_25.htm#archives_rodi

[headlines]

--------------------------------------------------------------

Bank Beat---Bank President Found Dead, Georgia takes two hits,

including CEO indicted by Feds over TARP money---

The distinction of the 39th bank to fail this year falls to the five branches of Community Central Bank, Mount Clemens, Michigan with the mystery of the death of the president unresolved. Historically, Mount Clemens' largest industry was the mineral baths that were scattered throughout the city from 1873 until 1974. Over the years, noted visitors such as film actors Clark Gable and Mae West, athletes Babe Ruth and Jack Dempsey, news magnate William Randolph Hearst, and the Vanderbilt family vacationed in the city for the bath industry. The town has grown to a city with a population of 17,312.

David Widlak, 62 years old, the bank president of this struggling small bank disappeared last fall. In he was found dead with a gunshot wound to the head in a marshy area of Lake St. Clair. Days after his death, depositors withdrew $33 million in deposits, which added to the banks ability to find investors to increase its capital. He had been trying to increase the bank capital to keep it alive.

According to the Detroit News, Widlak's wife and brother claimed it was murder, perhaps by a possible bank investor. According to Widlak's wife, a few days before he disappeared he had called a private investigator about his concerns for his life.

The Macomb Daily reports stories about an arrangement regarding an estate and his involvement, as well as bank worries, as sheriff investors revealed, "In the hours before Mount Clemens banker David Widlak’s life ended, he took time to erase material in his personal iPad, work computer files and the GPS navigational system in his car.

They believe Widlak had taken steps to remove information that otherwise may have shown where he had been and what was on his mind.

“The experts we talked to say it was a sign of someone erasing his life,” said Macomb County Sheriff Mark Hackel. “Something’s not normal there.”

Deleting the information was one of several indicators that led Macomb County authorities to conclude that Widlak likely committed suicide, although investigators are leaving open the possibility of foul play.

“There’s a strong likelihood this was self-inflicted,” the sheriff said at a news conference Monday. “The totality of all of the evidence indicates this may have been self-inflicted.”

Other details released Monday include:

A scrap of paper was found in Widlak’s hand when his body was found in Lake St. Clair, but it fell apart from being in the water for several weeks and no message was legible.

LINK

"A second autopsy, commissioned by Widlak’s family, found he died from an “execution style” gunshot wound to the back of the head."

LINK

Asked by a reporter if Widlak could have shot himself in the back of the head, the McComb County reporter said possible, but unlikely, and it appears the case has never been resolved.

Talmer Bank & Trust, Troy, Michigan, formerly known as First Michigan Bank, assumed all of the deposits of Community Central Bank. Founded October 28, 1996, the bank had 87 full time employees with offices in Grosse Pointe Farms, Grosse Pointe Woods, Mount Clemens, Port Huron, and Rochester Hills.

As of December 31, 2010, Community Central Bank had approximately $476.3 million in total assets and $385.4 million in total deposits. Talmer Bank & Trust will pay the FDIC a premium of 0.25 percent to assume all of the deposits of Community Central Bank. The FDIC and Talmer Bank & Trust entered into a loss-share transaction on $362.4 million of Community Central Bank's assets.

Bank equity had dropped from $34.9 million year-end 2009 to $8.6 million year-end 2010 with non-current loans growing from $22.9 million to $40.3 million in the same period of time. The bank had lost $15.9 million year-end 2009 and $26.2 million with charges offs of $13.3 million in nonfarm nonresidential properties, $1.7 million secured 1-4 family residential properties, $389,000 commercial and industrial loans and $278,000 in loans to individuals. Tier 1 risk-based capital ratio 2.37%

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $183.2 million. http://www.fdic.gov/news/news/press/2011/pr11080.html

About David Widlak:

LINK

The week before last there were no bank failures, but two weeks ago there were six bank failures costing the FDIC insurance $588.1 million and last week five failures costing the FDIC Insurance $643.2 million.

Community Central had cost $183.2 million, but the highest came from the closing of the 12 branches of The Park Avenue Bank, Valdosta, Georgia for $306.1 million.

There were several indictments filed regarding real estate conspiracy including a $3 million loan allegedly support by a $21 million account at another bank that was non-existent but involved a bank officer of the other bank, as well as money laundering, and events similar that closed Omni National Bank in Georgia, as well as the handling of TARP funds, which brought an indictment.

No March 31, 2011 report was available at press time.

The bank was one of two acquired by Bank of the Ozarks, Little Rock, Arkansas, last week the banking operations and branches ( 20 offices from both banks). Their website states they have 100 locations throughout the Southeast (14 in Georgia, bringing the total now to 33 and 120 in the Southeast).

The Park Avenue Bank had gone from 270 full time employees the end of 2009 to 182 full-time employees year-end 2010. Founded originally in 1934 and part of PAB Bankshares August 1, 1956 and joining the FDIC March 1, 1968, there were three offices in Valdosta, two in Bainbridge, and one each in Athens, Cairo, Lake Park, Oakwood, Ocala, McDonough, Ocala, Stockbridge, and one in Florida.

The Park Avenue Bank had total assets of $953.3 million and total deposits of $827.7 million as of December 31, 2010. Te loss-share transaction for The Park Avenue Bank was $514.1 million.

Bank equity had gone from $62 million year-end 2009 to $17 million year-end 2010 with non-current loans at $109.6 million.

Net income was a loss of $49.3 million year-end 2009 and a lost of $43.7 million year-end 2010. 2009 charge offs were $41.2 million with $21.2 million in construction and land development, $1 million farmland, $3 million

1-4 family residential properties and $4.9 million in nonfarm nonresidential properties. 2010 the charges offs were $23.8 million with $13.9 million in construction and land development, $3.5 million farmland, $3.2 million secured by 1-4 family residential properties, $1 million nonfarm nonresidential properties and almost $2 million in commercial and industrial loans. Tier 1 risk-based capital ratio 2.79%.

CEO charged with fraud (6:33):

http://video.foxnews.com/v/4106665/federal-regulators-seize-park-avenue-bank

Park Avenue Bank Puts it's Experience to Work for You (1:10)

http://video.google.com/videoplay?docid=-1471538319405680169#

http://www.fdic.gov/news/news/press/2011/pr11079.html

If these are samples of banks that have are having capital problems, there definitely must be a back log. Small and regional banks seem to be having great difficulties in attracting investors.

The six branches of First National Bank of Central Florida, Winter Park went from a $33.5 million net equity year-end 2009 to a minus $439,000 net equity March 31, 2011 after sustaining a $31 million loss year-end 2010 and a $5.9 million March 31, 2001 with most of the problems following what was happening to other banks in Florida: construction and land development loans.

Premier American Bank, National Association, Miami, Florida, acquired the banking operations, including all the deposits. Since its formation in April 2009, Bond Street has raised approximately $740 million and its wholly-owned subsidiary Premier American has acquired certain of the assets and assumed certain liabilities (including substantially all deposits) of 6 failed banks in Florida from the FDIC. First National Bank of Central Florida was founded in July 15, 1985 and had 74 full time employees with two offices in Orlando, one each in Apopka, Heathrow, Longwood, and Winter Park.

They had some serious loan problems as equity dropped from $33.5 million in year-end 2009 to $5.3 million year-end 2010 to a minus $439,000 net equity March 31, 2011 in FDIC filings.

At year end 2010: Non-current loans at year end were $68.3 million as the bank sustained a $6.3 million loss in 2009 and $31 million loss in 2010 after charges offs of $6.2 million in construction and land development, $2.9 million in nonfarm nonresidential property, $4.1 million in commercial and industrial loans. Tier 1 risk-based capital ratio year-end 2010 was 1.96% and .002489 at March 31, 2011.

The loss-share transaction for First National Bank of Central Florida was $270.0 million.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) for First National Bank of Central Florida will be $42.9 million

http://www.fdic.gov/news/news/press/2011/pr11078.html

The two branches of Cortez Community Bank, Brooksville, Florida, were closed with again Premier American Bank, National Association, Miami, Florida, acquiring the banking operations, including all the deposits. The bank was founded January 26, 2004 and had 19 full time employees with an office in Brooksville and Springhill.

Community Bank had total assets of $70.9 million and total deposits of $61.4 million. The loss-share transaction for Cortez Community Bank was $51.3 million.

Equity had dropped from $11.5 million year-end 2009 to $3.6 million year-end 2010 carrying a minus $15 million in undivided profits and by March 31, 2011 the equity was rewritten to a minus $460,000 after restating the December 1, 2010 to a minus $5.7 million, according to the most recent filing.

Non-current loans at year end were $15.4 million as the bank had lost $5.4 million in 2009 and almost $8 million in 2010 charging off $4 million in construction and land development, $825,000 nonfarm nonresidential properties and $193,000 in commercial and industrial loans. The bank lost $460,000 March 31, 2011.

Year-end Tier 1 risk-based capital ratio 0.1489%

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) for Cortez Community Bank, $18.6 million.

http://www.fdic.gov/news/news/press/2011/pr11078.html

The eight branches of First Choice Community Bank, Dallas, Georgia were closed with Bank of the Ozarks, Little Rock, Arkansas, acquired the banking operations. Founded April 9, 2007 the bank had 70 full time employees at 8 offices, two each in Carrolton and Newnan, one in Dallas, Douglasville, Senoia, and Sharpsburg.

This is the third bank in the particular geographic area to fail; First Coweta and Neighborhood Community Bank. A consent order to the bank in 2010 directed the bank to lower its reliance on brokered deposits raised through third-party brokers and to depend on local depositors. The bank was reportedly able to take care of 80% of brokered deposits with replacement by local depositors.

As of December 31, 2010, First Choice Community Bank had total assets of $308.5 million and total deposits of $310.0 million. Bank equity year-end 2009 had gone from $16.1 million to minus $7.6 million year-end 2010. Non-current loans at that period were $79.5 million.

The bank had lost $1.4 million year-end 2009 and $42.4 million year-end 2010, charging off $20.2 million in construction and land development, $765,000 in commercial and industrial loans, $334,0000 in 1-4 family residential properties, and $115,000 in farmland. Tier 1 risk-based capital ratio -2.96%.

March 31,2011 the bank reported a loss of $42.4 million charging off $12.3 million in 1-4 family residential construction loans, $7.9 million in land development loans and $115,0000 in farmland, as well as $788,000 in commercial and industrial loans. Bank equity was a minus $7.58 million. Tier 1 risk-based capital was-2.96%

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) for First Choice Community Bank will be $92.4 million

http://www.fdic.gov/news/news/press/2011/pr11079.html

Tracking Bank Failures Map:

http://graphicsweb.wsj.com/documents/Failed-US-Banks.html

List of Bank Failures:

http://www.fdic.gov/bank/individual/failed/banklist.html

Bank Beat:

http://www.leasingnews.org/Conscious-Top%20Stories/Bank_Beat.htm

|

Gary DiLillo, President

216-658-5618 or gary@avptc.com

To learn more about the benefits of

outsourcing personal property tax,

please click here.

|

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Leasing 102

by Mr. Terry Winders, CLP

Additional Vendor Programs

Last week’s #102 lesson centered on “Structuring and Pricing for Vendors.” I received many requests for examples as outlined, and it seems many were looking for more programs to form vendor relationships.

Here is one I did not outline. If you are close to your vendor, you might suggest that he offer you a discount that would allow him to advertise leasing at prime rate with a $100 purchase option. If your yield requirement on 60 months was 8% and prime rate was 4%, you would need an 8.87% discount. This way you get 8% and the lessee pays 4%.

Low rates are more attractive than discounts to the purchasers of equipment as seen by the way cars are sold. It appears discounts are expected, but a very low rate is the caveat or icing on the cake. It also closes out the competition because a run at the numbers shows that the lessee is only paying the 4% and there are no hooks in the lease. In this manner, the vendor doesn’t discount the retail price, but offers a prime rate to get the sale.

Next, vendors like to run specials so get them to guarantee a buy back at lease termination so you can increase your residual assumption and lower the lessee’s payment. This may only be available on assets that maintain a good value at termination, but the vendor is in a better position to remarket used assets than you are and he gets to control the return because the return conditions require the lessee to return the asset to the vendor. The vendor is in a better position to inspect the asset and compare it to the return conditions. You both win because the vendor gets the customer back and you get your return with only a credit risk.

This is also common approach in the copier leasing business where often an “Evergreen clause” is the answer to the residual when the lessee doesn’t notify the lessor that they intend to purchase. It is legal in most states. It puts the burden on the lessee to recognize the end of the original termination of the lease contract. Whether it is ethical or not, which I think it is not, it is practiced on equipment that does not have a high obsolescence and you should be aware of this as you can sell against it because most often the end user will not come back to company that put them in this predicament.

Whatever program you do with a vendor needs to be placed down on paper so there is no misunderstanding of who is responsible for what. Occasionally verbal communication is understood differently by both parties or you forgot to discuss certain important issues. It does not have to be prepared by attorneys, but you need to put it in letter form as a letter of understanding and make sure to follow a check list of responsibilities. I would also recommend that you keep your check list and add to it each time you discover a few missing subjects. Everyone wants to keep it short, but it is like a short hanging rope. The longer the rope, the longer you have until the end.

Recourse programs work best if a reserve fund is established from each lease like say 1% or 2%. The days of getting 10% are long gone, except for a tough credit that the vendor wants to service.

Be prepared to make exceptions. Remember over time the reserve will grow to a point where it should cover the short fall from a repossession sale. The vendor will always sell the repo fast if it is coming out of his shorts or the reserve ---if the reserve carries a provision for an annual payment of any amount over 20% to the vendor. Sometimes this is called a dealer participating non-recourse.

Some vendors are willing to assign a lease in their name to you for servicing. This means you are sending out the request for payments in their name and the funds go to a lock box for your collection. Therefore they are taking the credit risk. The agreement spells out that they must repurchase the deal if it goes beyond 60-90 days late. If the lessee thinks the vendor holds the reins, then they expect the vendor would repossess faster with greater efficiency that a financial institution would do. This is usually reserved for lesser credits or start-ups. Generally that is the only way these types of credits get handled. The reason being that the vendors mark up is greater than ours and they understand who is at risk.

If you are going to pay any compensation to the vendor or his sales staff you should have a first look at any transaction. Your vendor agreement should state this and there should be a penalty if the agreement is breached. A penalty sounds harsh but sometimes the sales staff does not see the compensation and they may seek outside lessors that will pay them a finder’s fee directly. A penalty should cover the loss of any reserve they may have a call on.

Vendors are always putting pressure on their financial sources looking for lower rates, a larger cut of the lessor’s margin and pushing poor credits or larger residuals. Creating a good relationship comes from holding your ground and servicing the vendor with ample turn-around time and good, not short, documentation. Plus giving the vendor monthly reports on the status of the lessees he has sent you so he does not forget that these customers are yours and he knows when to approach them for more business.

It is not enough to provide a quick response in today’s market place. You must provide a valued service to help your vendor increase their sales and treat you as if you are part of their sales team, not an outsider.

Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty-five years and can be reached at leaseconsulting@msn.com or 502-649-0448

He invites your questions and queries.

Previous column:

Structuring and Pricing for Vendors

http://leasingnews.org/archives/Apr2011/4_25.htm#pricing

Previous #102 Columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

High Compensation to High Achievers

Leasing Subsidiary of a National Bank Holding Company looking for experienced professionals (10+ years of experience in commercial finance industry) who can originate a volume of bank-qualified credits (primarily SEC reporting companies). Average transaction size from $1-20MM. Enjoy private

office in our Southern California location.

We offer excellent commission with a draw.

Send resume in strictest confidence to:

rose.jones98@yahoo.com

|

Syndication Manager

Rancho Cucamonga, CA

Knowledge of transportation industry a plus,

but not required. Compensation commensurate

with experience

contact: wdalton@crlease.com

We can finance or lease any make or model

of truck, bus, or equipment

|

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

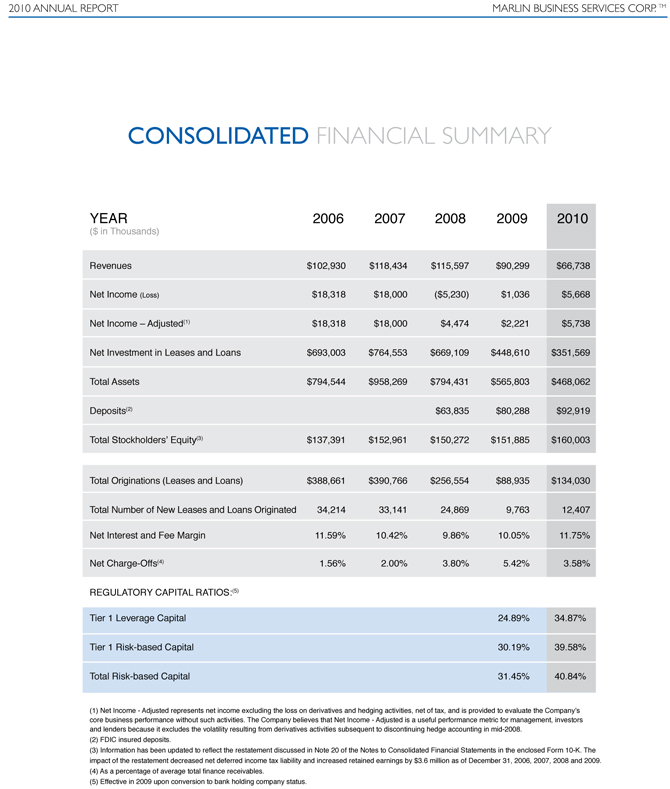

Marlin to Reveal Year End/First Quarter May 6

Marlin Business Services, Mount Laurel, New Jersey reveals its year-end comparative numbers and will introduce its first quarter on Friday, May 6th. Whether its "Evergreen Clause" continues its profit will be presented then.

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Birmingham, Alabama-- Adopt-a-Dog

Domino

Pet ID #: 116206

Sherman Shepherd/Labrador Retriever Mix

Will grow to 61 to 90lbs

Male

Neutered

Eight weeks at this posting

Greater Birmingham Humane Society

Phone: (205) 942-1211

Let 'em know you saw "Domino" on Adopt-a-Pet.com!

E-mail: adoptions@gbhs.org

Fax: (205) 942-1213

Website: http://www.gbhs.org

Address: 300 Snow Drive

Birmingham, AL

35209

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

--- News Briefs

Obama Announces Killing of Osama bin Laden

http://thelede.blogs.nytimes.com/2011/05/01/bin-laden-dead-u-s-official-says/?hp

More on Bin Laden Dead-Bush calls "momentous achievement"

http://www.chicagotribune.com/news/nationworld/la-naw-george-w-bush-osama-statement-20110502,0,5322184.story

Buffett frets on bank profit outlook, likes Wells/US Bank

http://www.reuters.com/article/2011/04/30/us-berkshire-banks-idUSTRE73T1LD20110430

Equipment leasing/renting: The fleet bridge to the future

http://fleetowner.com/management/news/equipment-leasing-renting-0425/

The Independent Truck Leasing Company is Alive and Well

http://news.yahoo.com/s/prweb/20110428/bs_prweb/prweb8346943_2

Pacific Rim David C. Mirsky Saluted at Stanford

http://pr-usa.net/index.php?option=com_content&task=view&id=710038&Itemid=30

Nearly one-fifth of full-time employed Americans have raided retirement accounts in the past year to cover emergencies, according to a national Bankrate survey.

http://www.bankrate.com/finance/consumer-index/april-2011-raiding-retirement-fund.aspx?ic_id=tsFS1

NBC Expected to Pick Ann Curry as ‘Today’ Co-Host

http://www.nytimes.com/2011/05/02/business/media/02nbc.html?ref=business

Which TV Shows are safe, may be gone, and cancelled

http://www.tvsquad.com/2011/04/28/canceled-shows-returning-series/?ncid=webmail

You May Have Missed----

Donate Now To Assist Pets Affected By 4/27 Tornadoes

The tornadoes of April 27th are some of the worst that we have witnessed in recent history. Many communities across six states have been devastated and many lives destroyed. We at the Greater Birmingham Humane Society have been tasked by the EMA to help with the relief effort through services provided by our shelter. Please assist us in our efforts by making a monetary donation today.

Help Pets By Donating Much-Needed Supplies!

To provide assistance for the pets displaced by the tornadoes on 4/27/2010, we are requesting donations of the following items:

Dog Food- Small bags, and moist cases needed most

Cat Food- Small bags, and moist cases needed most

Crates

Water

Dog Beds, Food & Water Bowls

Towels

treats

Cat litter

Bleach, Paper towels, & Other cleaning supplies

Office Supplies- copy paper and sharpie markers

If you are an individual, an organization, or a company and you would like to provide specialized assistance for animal tornado victims, please call 205-942-1211, ext. 200 and leave a voicemail if we do not immediately answer. We are asking that you do NOT email info@gbhs.org, as we are unable to keep up with the large volume of emails we are currently receiving.

You can also help by making monetary contributions and in-kind donations. Check out our list of supplies needed and know that any gift is greatly appreciated.

http://www.gbhs.org/site/PageServer?pagename=gbhs_home

Sports Briefs----

Kings owners have decided; team's future to be announced Monday

http://www.sacbee.com/2011/05/01/3593596/kings-owners-will-announce-teams.html

Sharks beat Red Wings to take 2-0 series lead

http://www.mercurynews.com/sharks/ci_17970103?nclick_check=1

The Huddle

http://content.usatoday.com/communities/thehuddle/index

“Gimme that Wine”

Wine Laws Changing in up to 7 States

http://www.winespectator.com/webfeature/show/id/44924

PR Buena Vista Carneros, California's Oldest Premium Winery, Joins The Boisset Family Estates Collection

http://www.winebusiness.com/news/?go=getArticle&dataid=87039

Social Media has little impact on Online Retail Purchases

http://mashable.com/2011/04/27/social-media-retail-purchases/

North Coast wine prices on rebound

http://www.pressdemocrat.com/article/20110427/BUSINESS/110429507/1036/business?Title=North-Coast-wine-prices-on-rebound

As wines gain weight, Chronicle to print alcohol levels

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2011/04/24/FD311J4I7H.DTL

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

This Day in American History

1670 - King Charles II of England grants a permanent charter to the Hudson's Bay Company, made up of the group of French explorers who opened the lucrative North American fur trade to London merchants. The charter conferred on them not only a trading monopoly but also effective control over the vast region surrounding North America's Hudson Bay. Although contested by other English traders and the French in the region, the Hudson's Bay Company was highly successful in exploiting what would become eastern Canada. After Canada was granted dominion status in 1867, the company lost its monopoly on the fur trade, but it had diversified its business ventures and remained Canada's largest corporation through the 1920s.

1776 - France and Spain agreed to donate arms to American trying to free themselves from England.

1837-birthday of our Sue Robert's relative, Henry M. Robert (General, US Army), author of Robert's Rules of Order, today the standard parliamentary guide.

1803-- That Land Grab in Louisiana, actually signed. During the early moments of the nineteenth century, the United States government wheeled and dealed its way into what is generally regarded as the "greatest land bargain" in the nation's history, the Louisiana Purchase. The deal, which was dated 30 April 1803, though it was in fact signed on 02 May, had been in the works since the spring of 1802. It was then that President Thomas Jefferson had learned of Spain's decision to quietly transfer Spanish Louisiana to the French; fearful of the strategic and commercial implications of the Spanish swap, Jefferson ordered Robert Livingston, the US minister in Paris, to broker a deal with the French either for a slice of land on the lower Mississippi or a "guarantee" of unmolested transport for US ships. Negotiations dragged on for months, but took a crucial turn when Spanish and US trade relations collapsed in the fall of 1802. With Spain now barring American merchant ships from transferring goods at the port in New Orleans, Jefferson set his sights on purchasing a far larger chunk of land. In early 1803, James Monroe headed to Paris to broker Jefferson's deal. With France teetering on the brink of war with Great Britain, and mindful not only of the fiscal repercussions of such a conflict, but of the possibility of a renewed US-English alliance, Napoléon's negotiators acceded to a deal to sell the whole of Louisiana. All told, the Louisiana Purchase cost the US $15 million: $11.25 million was earmarked for the land deal, while the remaining $3.75 million covered France's outstanding debts to America. Thus, for the prime price of 5 cents a hectare, the United States bought 2'145'000 square kilometers of land, which effectively doubled the size of the young nation

1853 - Franconi’s Hippodrome opened at Broadway and 23rd Street in New York City. The 4,000-seat facility opened in grand style for a hippodrome (an arena for a circus or games) with a chariot-and-ostrich race. It was popular for five years. http://www.nypl.org/research/chss/spe/art/print/exhibits/movingup/no29.htm

http://www.public.iastate.edu/~calel/hippo.html

1843-Elijah McCoy was born in Colchester, Ontario. His parents escaped slavery in Kentucky by traveling along the Underground Railroad. This famous African-American inventor is credited with over 50 patents and his lubricating oil and systems were quite famous in its day. His most famous was the McCoy Lubricator. McCoy invented a device to oil the machinery while it was working. It was soon used on engines, train locomotives, on Great Lake steamships, on ocean liners and on machinery in factories. His invention became so popular that no engine or machine was considered complete until it had a McCoy Lubricator. The phrase "The Real McCoy" soon caught on as a way of saying that people were getting the best equipment available.

http://www.bccns.com/elijah.htm

http://www.princeton.edu/~mcbrown/display/mccoy.html

http://www.blackinventor.com/pages/elijahmccoy.html

1863-General Stonewall Jackson, leading a large part of Gen. Lee’s army, delivered a devastating blow on Gen. Hooker’s right flank. Reconnoitering with his staff at day’s end, Jackson and his group were mistaken for Union soldiers and fired on by their own forces. Jackson’s shattered left arm had to be amputated. While he was hospitalized pneumonia set in; his death came on May 10.

http://norfacad.pvt.k12.va.us/project/sjackson/sjackson.htm

http://www.waysideofva.com/stonewalljackson/

1885-Good Housekeeping magazine makes its debut, becoming one of the most popular magazine for decades, setting many styles and standards for its day. It is still popular in this century.

http://memory.loc.gov/ammem/today/may02.html

1876- the first baseball players to hit home runs were Ross Barnes of the Chicago White Stockings and Charles Wesley “Baby” Jones of the Cincinnati Reds, at Cincinnati, OH. Chicago won 15-9. (sorry, books don’t tell which hit the first home run. editor).

1899 - A storm buried Havre, MT, under 24.8 inches of snow, an all-time record for that location. The water equivalent of 2.48 inches was a record 24 hour total for the month of May.

1923- the first transcontinental nonstop airplane flight was made by Lieutenants Oakley G. Kelly and John A. Macready of the Navy Air Service. They took off from Roosevelt Field, NY at 11:36pm and arrived at Rockwell Field, Coronado Beach, CA, at 12:26pm the next day, covering a distance of 2,700 miles in 26 hours.

http://www.nasm.si.edu/nasm/aero/aircraft/fokker_t2.htm

1903-birthday of Benjamin Spock, pediatrician and author, born at New Haven, CT. His book on childrearing, Common Sense Book of Baby and Child Care later called Baby and Child Care, has sold more than 30 million copies. In 1955 he became professor of child development at Western Reserve University at Cleveland, OH. He resigned from this position in 1967 to devote his time to the pacifist movement. Spock died at San Diego, CA, Mar 15, 1998.

http://www.drspock.com/about/drbenjaminspock/0,1781,,00.html

http://creativequotations.com/one/1007.htm

1904---singer and actor Bing Crosby was born in Tacoma, Washington. He sang with dance bands from 1925 to 1930, and in 1931 began work in radio and films. Crosby gained enormous popularity for his crooning style, which was ideally suited to the new radio medium. His recording of "White Christmas" is said to be the best-selling record of all time. In 1944, he won an Academy Award for his performance in the film "Going My Way." His other notable films included "The Country Girl" in 1955, "High Society" in '56 and the remake of "Stagecoach" in 1965. Bing Crosby had a lifelong love affair with the game of golf. In 1977, he dropped dead after completing a round on a golf course in Spain.

1905--Birthday of Charlotte Armstrong - U.S. author and playwright. Her science fantasy books regarding dragons have made her one of the most popular authors in the nation.

1906--Birthday of Aileen Riggin (Soule) - U.S. athlete. She won three Olympic medals and was the first competitor to win a medal in both the swimming and diving events in the same Olympics. Only 14 at the 1920 Olympics in Antwerp, Belguim, she was the first woman to win the gold in springboard diving. In 1924 she won a silver in springboard and a bronze in the 100-metre backstroke. She stood 4'7" tall and weighed 65 pounds.

1908-birthday of “Pinky Lee,” born Pincus Leff. Born at St. Paul, MN. When young, Leff had dreams of becoming an attorney, but abandoned the idea when classmates laughed at his lisp. His show business debut was in burlesque in the 1930s. He is best remembered for "The Pinky Lee Show" which telecast from Los Angeles in the early 1950s. Pinky Lee died Apr 3, 1993, at Mission Viejo, CA.

http://www.tvparty.com/lostpinky.html

http://www.yesterdayland.com/popopedia/shows/saturday/sa1353.php

1904- singer and actor Bing Crosby was born in Tacoma, Washington. He sang with dance bands from 1925 to 1930, and in 1931 began work in radio and films. Crosby gained enormous popularity for his crooning style, which was ideally suited to the new radio medium. His recording of "White Christmas" is said to be the best-selling record of all time. In 1944, he won an Academy Award for his performance in the film "Going My Way." His other notable films included "The Country Girl" in 1955, "High Society" in '56 and the remake of "Stagecoach" in 1965. Bing Crosby had a lifelong love affair with the game of golf. In 1977, he dropped dead after completing a round on a golf course in Spain.

http://www.globalicons.com/Legends/Crosby/

http://www.crosby.circle.btinternet.co.uk/

http://www.globalicons.com/Legends/Crosby/index.html

1920 - A swarm of tornadoes in Rogers, Mayes and Cherokee Counties in Oklahoma killed 64 persons.

1924-birthday of singer/actor Theodore Bikel, Vienna, Austria

http://www.bikel.com/

1929 - Virginia's worst tornado disaster occurred. Six tornadoes, two of which were west of the Blue Mountains, killed 22 people. Twelve children and a teacher were killed at Rye Cove, in Scott County. Four schools were destroyed.

1930-First game of National Negro Baseball League, played in Indianapolis,

http://www.gnofn.org/~mmcgee/baseball/Rube_Foster.htm

http://www.execpc.com/~sshivers/foster.html

http://library.thinkquest.org/3427/data/fosterru.htm

1930--- In Des Moines, Iowa, a Western League contest against Wichita becomes the first night baseball game to be played under permanent lights. The unique event, which draws 12,000 fans instead of the usual 600 patrons, is the beginning of a concept which will spread quickly through the minors and spare many organizations from the on-slaught of the Great Depression.

1931- Jazz organistRichard “Groove” Holmes Birthday

http://www.duke.edu/~mbc5/

http://theatreorgans.com/grounds/groove/holmes.html

( Warren Luening and I along with Chris Morgan and/or Dave Silverman

saw Richard “Groove” Holmes in person on the Hollywood Strip, plus

Mose Allison, Cannoball Adderly, and others in the early 60’s.)

1935- Link Wray, one of the more influential rock guitarists of the 1950's, was born in Fort Bragg, North Carolina. Wray introduced the distorted fuzz-tone guitar sound on his single "Rumble," which by 1958 had sold a million copies. It is said to have been recorded as early as 1954. Link Wray's playing was a tremendous influence on such British rock stars as Jeff Beck, Pete Townshend and John Lennon

http://www.vh1.com/artists/az/wray_link/bio.jhtml

http://www.rockabilly.nl/artists/linkwray.htm

1938-Ella Fitzgerald, with Chick Webb’s band, records “ A Tisket A Tasket,” ( Decca)

http://persweb.direct.ca/fstringe/oz/a144.html

http://museum.media.org/ella/

1939-New York Yankees first baseman Lou Gehrig asked manager Joe McCarthy to take him out of the lineup for the game against the Detroit Tigers. By his sittting out, Gehrig’s record streak of consecutive games played, begun May 25, 1925, stopped at 2,130. The slugger complained of fatigue, but he was really suffering from A.L.S. , amyotrophic lateral sclerosis, a condition later known as Lou Gehrig’s disease. Gehrig never played again.

http://www.lougehrig.com/

1945-BUSH, ROBERT EUGENE Medal of Honor

Rank and organization: Hospital Apprentice First Class, U.S. Naval Reserve, serving as Medical Corpsman with a rifle company, 2d Battalion, 5th Marines, 1st Marine Division. Place and date: Okinawa Jima, Ryukyu Islands, 2 May 1945. Entered service at: Washington. Born: 4 October 1926, Tacoma, Wash. Citation: For conspicuous gallantry and intrepidity at the risk of his life above and beyond the call of duty while serving as Medical Corpsman with a rifle company, in action against enemy Japanese forces on Okinawa Jima, Ryukyu Islands, 2 May 1945. Fearlessly braving the fury of artillery, mortar, and machinegun fire from strongly entrenched hostile positions, Bush constantly and unhesitatingly moved from 1 casualty to another to attend the wounded falling under the enemy's murderous barrages. As the attack passed over a ridge top, Bush was advancing to administer blood plasma to a marine officer lying wounded on the skyline when the Japanese launched a savage counterattack. In this perilously exposed position, he resolutely maintained the flow of life-giving plasma. With the bottle held high in 1 hand, Bush drew his pistol with the other and fired into the enemy's ranks until his ammunition was expended. Quickly seizing a discarded carbine, he trained his fire on the Japanese charging pointblank over the hill, accounting for 6 of the enemy despite his own serious wounds and the loss of 1 eye suffered during his desperate battle in defense of the helpless man. With the hostile force finally routed, he calmly disregarded his own critical condition to complete his mission, valiantly refusing medical treatment for himself until his officer patient had been evacuated, and collapsing only after attempting to walk to the battle aid station. His daring initiative, great personal valor, and heroic spirit of self-sacrifice in service of others reflect great credit upon Bush and enhance the finest traditions of the U.S. Naval Service.

1945-FOSTER, WILLIAM ADELBERT Medal of Honor

Rank and organization: Private First Class, U.S. Marine Corps Reserve. Born: 17 February 1915, Cleveland, Ohio. Accredited to: Ohio. Citation: For conspicuous gallantry and intrepidity at the risk of his life above and beyond the call of duty while serving as a rifleman with the 3d Battalion, 1st Marines, 1st Marine Division, in action against enemy Japanese forces on Okinawa Shima in the Ryukyu Chain 2 May 1945. Dug in with another marine on the point of the perimeter defense after waging a furious assault against a strongly fortified Japanese position, Pfc. Foster and his comrade engaged in a fierce hand grenade duel with infiltrating enemy soldiers. Suddenly an enemy grenade landed beyond reach in the foxhole. Instantly diving on the deadly missile, Pfc. Foster absorbed the exploding charge in his own body, thereby protecting the other marine from serious injury. Although mortally wounded as a result of his heroic action, he quickly rallied, handed his own remaining 2 grenades to his comrade and said, "Make them count." Stouthearted and indomitable, he had unhesitatingly relinquished his own chance of survival that his fellow marine might carry on the relentless fight against a fanatic enemy, and his dauntless determination, cool decision and valiant spirit of self-sacrifice in the face of certain death reflect the highest credit upon Pfc. Foster and upon the U.S. Naval Service. He gallantly gave his life in the service of his country.

1946 – 1960's teen star Lesley Gore was born in Brooklyn, New York; later moving with her family to Tenafly, New Jersey. She was only 16 when she signed with Mercury records, and became a top star with such hits as "It's My Party" and "Judy's Turn to Cry." Until 1966, Lesley Gore was one of the most successful American teen singers. An attempt in the 1970's to establish herself as a singer geared to the adult market was not particularly successful, and she later turned to performing her hits at oldies concerts.

http://www.swinginchicks.com/lesley_gore.htm

http://members.tripod.com/~Lesley_Gore/bio.html

http://www.lesleygore.com/pages/668081/index.htm

http://www.patswayne.com/lesley/

1950 - No. 1 Billboard Pop Hit: "The Third Man Theme," Anton Karas.

1950- Lou Gramm, lead vocalist with Foreigner, was born in Rochester, New York. By the beginning of the 1980's, their hard rock music had gained them worldwide sales of more than 21- million records. Their 1977 debut album yielded three hit singles - "Feels Like the First Time," "Cold as Ice" and "Long, Long Way From Home." Their subsequent million-sellers included "Hot-Blooded" and "Double Vision," both from 1978, "Waiting For a Girl Like You" from 1981 and 1984's "I Want to Know What Love Is." Gramm departed Foreigner in 1990 to continue a solo career that had begun several years earlier. He had had a top-five hit in 1987 with "Midnight Blue."

http://www.foreignerfiles.com/members/lougramm/

http://www.geocities.com/missmoonlight82/stillvidclipsanpics.html

1950 - No. 1 Billboard Pop Hit: "The Third Man Theme," Anton Karas.

1950 - Foreigner vocalist Lou Gramm is born in Rochester, N.Y. He has solo top 10 hits with "Midnight Blue" and "Just Between You and Me."

1953 - Dark Star defeated the heavily favored Native Dancer to win the Kentucky Derby. A $2 wager to win on this dark horse would have put $50 in your pocket as Dark Star was a 25-1 long shot.

1954---Top Hits

Wanted - Perry Como

Young at Heart - Frank Sinatra

Make Love to Me - Jo Stafford

Slowly - Webb Pierce

1954-Stan Musial of the St. Louis Cardinals hit five home runs in a doubleheader against the New York Giants in St. Louis, setting a major league record. The Cardinals won the first game, 10-6, but fell to the Giants in the nightcap, 9-7.

http://www.stan-musial.com/

1956 -- For the first time in Billboard history, five records appear in both the pop and R&B Top 10. They are: Elvis Presley's "Heartbreak Hotel" , Carl Perkin's "Blue Suede Shoes" , Little Richard's "Long Tall Sally", the Platters' "Magic Touch" and Frankie Lymon & the Teenagers' "Why Do Fools Fall in Love". Presley's & Perkins' hits are also in the country & western Top Ten at #1 & #2 respectively.

1957- Elvis Presley recorded "Jailhouse Rock," a Leiber and Stoller song that would become the title of Presley's next movie.

1960- Ben E. King ended his association with the Drifters by signing a solo contract with Atlantic Records. King was the lead on such Drifters' hits as "There Goes My Baby," "Save the Last Dance For Me" and "This Magic Moment." King's first hit on his own was "Spanish Harlem," produced by Phil Spector.

http://www.vh1.com/artists/az/king_ben_e_/bio.jhtml

http://www.delafont.com/music_acts/Ben-King.htm

1960 - Harry Belafonte presented his second Carnegie Hall concert in New York City.

http://w1.871.telia.com/~u87125666/index.htm

1962---Top Hits

Good Luck Charm - Elvis Presley

Soldier Boy - The Shirelles

Stranger on the Shore - Mr. Acker Bilk

Charlie’s Shoes - Billy Walker

1964-- Posting a 7-3 victory, the Twins become only the third team in major league history to hit four consecutive home runs as Tony Oliva, Bob Allison, Jimmie Hall and Harmon Killebrew all go deep against A's pitchers Dan Pfister (3) and Vern Handrahan (1) in the top of the 11th inning at Kansas City's Municipal Stadium.

1966 - No. 1 Billboard Pop Hit: "Monday, Monday," The Mamas & the Papas.

1967-WRIGHT, RAYMOND R. Medal of Honor

Rank and organization: Specialist Fourth Class, U.S. Army, Company A, 3d Battalion, 60th Infantry, 9th Infantry Division. Place and date: Ap Bac Zone, Republic of Vietnam, 2 May 1967. Entered service at: Moriah, N.Y. Born: 5 December 1945, Moriah, N.Y. Citation: For conspicuous gallantry and intrepidity at the risk of his life above and beyond the call of duty. While serving as a rifleman with Company A, Sp4c. Wright distinguished himself during a combat patrol in an area where an enemy ambush had occurred earlier. Sp4c. Wright's unit suddenly came under intense automatic weapons and small-arms fire from an enemy bunker system protected by numerous snipers in nearby trees. Despite the heavy enemy fire, Sp4c. Wright and another soldier leaped to the top of a dike to assault the position. Armed with a rifle and several grenades, he and his comrade exposed themselves to intense fire from the bunkers as they charged the nearest one. Sp4c. Wright raced to the bunker, threw in a grenade, killing its occupant. The 2 soldiers then ran through a hail of fire to the second bunker. While his comrade covered him with his machinegun, Sp4c. Wright charged the bunker and succeeded in killing its occupant with a grenade. A third bunker contained an automatic rifleman who had pinned down much of the friendly platoon. While his comrade again covered him with machinegun fire, Sp4c. Wright charged in and killed the enemy rifleman with a grenade. The 2 soldiers worked their way through the remaining bunkers, knocking out 4 of them. Throughout their furious assault, Sp4c. Wright and his comrade had been almost continuously exposed to intense sniper fire from the treeline as the enemy desperately sought to stop their attack. Overcoming stubborn resistance from the bunker system, the men advanced into the treeline forcing the snipers to retreat, giving immediate chase, and driving the enemy away from the friendly unit so that it advanced across the open area without further casualty. When his ammunition was exhausted, Sp4c. Wright returned to his unit to assist in the evacuation of the wounded. This 2-man assault had driven an enemy platoon from a well prepared position, accounted for numerous enemy casualties, and averted further friendly casualties. Sp4c. Wright's extraordinary heroism, courage, and indomitable fighting spirit saved the lives of many of his comrades and inflicted serious damage on the enemy. His acts were in keeping with the highest traditions of the military service and reflect great credit upon himself and the U.S. Army.

1968-BENAVIDEZ, ROY P. Medal of Honor

Rank and Organization: Master Sergeant, Detachment B-56, 5th Special Forces Group, Republic of Vietnam. Place and Date: West of Loc Ninh on 2 May 1968. Entered Service at: Houston, Texas June 1955. Date and Place of Birth: 5 August 1935, DeWitt County, Cuero, Texas. Master Sergeant (then Staff Sergeant) Roy P. Benavidez United States Army, who distinguished himself by a series of daring and extremely valorous actions on 2 May 1968 while assigned to Detachment B56, 5th Special Forces Group (Airborne), 1st Special Forces, Republic of Vietnam. On the morning of 2 May 1968, a 12-man Special Forces Reconnaissance Team was inserted by helicopters in a dense jungle area west of Loc Ninh, Vietnam to gather intelligence information about confirmed large-scale enemy activity. This area was controlled and routinely patrolled by the North Vietnamese Army. After a short period of time on the ground, the team met heavy enemy resistance, and requested emergency extraction. Three helicopters attempted extraction, but were unable to land due to intense enemy small arms and anti-aircraft fire. Sergeant Benavidez was at the Forward Operating Base in Loc Ninh monitoring the operation by radio when these helicopters returned to off-load wounded crewmembers and to assess aircraft damage. Sergeant Benavidez voluntarily boarded a returning aircraft to assist in another extraction attempt. Realizing that all the team members were either dead or wounded and unable to move to the pickup zone, he directed the aircraft to a nearby clearing where he jumped from the hovering helicopter, and ran approximately 75 meters under withering small arms fire to the crippled team. Prior to reaching the team's position he was wounded in his right leg, face, and head. Despite these painful injuries, he took charge, repositioning the team members and directing their fire to facilitate the landing of an extraction aircraft, and the loading of wounded and dead team members. He then threw smoke canisters to direct the aircraft to the team's position. Despite his severe wounds and under intense enemy fire, he carried and dragged half of the wounded team members to the awaiting aircraft. He then provided protective fire by running alongside the aircraft as it moved to pick up the remaining team members. As the enemy's fire intensified, he hurried to recover the body and classified documents on the dead team leader. When he reached the leader's body, Sergeant Benavidez was severely wounded by small arms fire in the abdomen and grenade fragments in his back. At nearly the same moment, the aircraft pilot was mortally wounded, and his helicopter crashed. Although in extremely critical condition due to his multiple wounds, Sergeant Benavidez secured the classified documents and made his way back to the wreckage, where he aided the wounded out of the overturned aircraft, and gathered the stunned survivors into a defensive perimeter. Under increasing enemy automatic weapons and grenade fire, he moved around the perimeter distributing water and ammunition to his weary men, reinstilling in them a will to live and fight. Facing a buildup of enemy opposition with a beleaguered team, Sergeant Benavidez mustered his strength, began calling in tactical air strikes and directed the fire from supporting gunships to suppress the enemy's fire and so permit another extraction attempt. He was wounded again in his thigh by small arms fire while administering first aid to a wounded team member just before another extraction helicopter was able to land. His indomitable spirit kept him going as he began to ferry his comrades to the craft. On his second trip with the wounded, he was clubbed from additional wounds to his head and arms before killing his adversary. He then continued under devastating fire to carry the wounded to the helicopter. Upon reaching the aircraft, he spotted and killed two enemy soldiers who were rushing the craft from an angle that prevented the aircraft door gunner from firing upon them. With little strength remaining, he made one last trip to the perimeter to ensure that all classified material had been collected or destroyed, and to bring in the remaining wounded. Only then, in extremely serious condition from numerous wounds and loss of blood, did he allow himself to be pulled into the extraction aircraft. Sergeant Benavidez' gallant choice to join voluntarily his comrades who were in critical straits, to expose himself constantly to withering enemy fire, and his refusal to be stopped despite numerous severe wounds, saved the lives of at least eight men. His fearless personal leadership, tenacious devotion to duty, and extremely valorous actions in the face of overwhelming odds were in keeping with the highest traditions of the military service, and reflect the utmost credit on him and the United States Army.

1968-VARGAS, M. SANDO, JR. Medal of Honor

Rank and organization: Major (then Capt.), U.S. Marine Corps, Company G, 2d Battalion, 4th Marines, 9th Marine Amphibious Brigade. Place and date: Dai Do, Republic of Vietnam, 30 April to 2 May 1968. Entered service at: Winslow, Ariz. Born: 29 July 1940, Winslow, Ariz. Citation: For conspicuous gallantry and intrepidity at the risk of his life above and beyond the call of duty while serving as commanding officer, Company G, in action against enemy forces from 30 April to 2 May 1968. On 1 May 1968, though suffering from wounds he had incurred while relocating his unit under heavy enemy fire the preceding day, Maj. Vargas combined Company G with two other companies and led his men in an attack on the fortified village of Dai Do. Exercising expert leadership, he maneuvered his marines across 700 meters of open rice paddy while under intense enemy mortar, rocket and artillery fire and obtained a foothold in 2 hedgerows on the enemy perimeter, only to have elements of his company become pinned down by the intense enemy fire. Leading his reserve platoon to the aid of his beleaguered men, Maj. Vargas inspired his men to renew their relentless advance, while destroying a number of enemy bunkers. Again wounded by grenade fragments, he refused aid as he moved about the hazardous area reorganizing his unit into a strong defense perimeter at the edge of the village. Shortly after the objective was secured the enemy commenced a series of counterattacks and probes which lasted throughout the night but were unsuccessful as the gallant defenders of Company G stood firm in their hard-won enclave. Reinforced the following morning, the marines launched a renewed assault through Dai Do on the village of Dinh To, to which the enemy retaliated with a massive counterattack resulting in hand-to-hand combat. Maj. Vargas remained in the open, encouraging and rendering assistance to his marines when he was hit for the third time in the 3-day battle. Observing his battalion commander sustain a serious wound, he disregarded his excruciating pain, crossed the fire-swept area and carried his commander to a covered position, then resumed supervising and encouraging his men while simultaneously assisting in organizing the battalion's perimeter defense. His gallant actions uphold the highest traditions of the Marine Corps and the U.S. Naval Service.

1968-Moby Grape appears at the San Francisco Fillmore Auditorium.

http://www.wolfgangsvault.com/image.aspx?ItemNumber=BG118&ProductTypeID=PO&

IsDoubleImage=False&Pos=1&Total=103&KeySetID=f22b8204-9df1-459d-88cb-b

665f7829485

1970-Diane Crump of Oldsman, FL, became the first woman to ride in the Kentucky Derby, riding “Fathom” in the 1.25 96th Kentucky Derby, Churchill Downs, KY. In the 17-hourse race, she finished 15th.

1970---Top Hits

ABC - The Jackson 5

American Woman/No Sugar Tonight - The Guess Who

Love or Let Me Be Lonely - The Friends of Distinction

My Woman My Woman, My Wife - Marty Robbins

1974 - Stevie Wonder wins four Grammy Awards: Pop Vocal Performance (Male), R&B Song (Male), R&B Vocal Performance (Male) and Album of the Year.

1975 - The biggest snowstorm of record for so late in the season paralyzed Chicago, IL. Up to 20 inches of snow fell in extreme northeastern Illinois, and 10.9 inches of snow closed Chicago's O'Hare Airport.

1976 - No. 1 Billboard Pop Hit: "Welcome Back," John Sebastian. The song is the theme of the TV show "Welcome Back Kotter."

1977-More than three years after its release, Bruce Springsteen's "The Wild, the Innocent and the E Street Shuffle" goes gold.

1978-The Bee Gees receive their second platinum single awarded in less than two months for "Night Fever." It was preceded by "Stayin' Alive," both cuts are off the soundtrack "Saturday Night Fever."

1978---Top Hits

Night Fever - Bee Gees

If I Can’t Have You - Yvonne Elliman

Can’t Smile Without You - Barry Manilow

Every Time Two Fools Collide - Kenny Rogers & Dottie West

1981 - Scottish singer Sheena Easton made it to the top spot on the pop music charts for her first -- and only -- time. "Morning Train (Nine to Five)" knocked "Kiss on My List", by Daryl Hall and John Oates, out of the top of the music charts. "Morning Train" pulled into the top spot for a two-week stay. Easton had been an actress, appearing as a singer in the 1980 BBC TV documentary, "The Big Time"; and this time she made it to the big time, winning the 1981 Best New Artist Grammy Award. On U.S. TV, she is remembered as Sonny Crockett’s wife in five episodes of "Miami Vice" in the 1980s and for singing the title song in the James Bond flick, "For Your Eyes Only". Easton scored 14 hits on the charts between 1981 and 1991. Seven of those hits made it to the top ten. "The Lover in Me" in 1988 was the closest she ever came to having another number one hit. It stopped climbing at number two.

http://www.sheenaeaston.com/

1982 - Severe thunderstorms spawned fifty-six tornadoes in the central U.S., including seventeen in the Red iver Region of Texas and Oklahoma. The tornadoes claimed thirty lives, and injured 383 other persons. A violent tornado near Messer OK left only the carpet tack strips on the slab of a house it destroyed, and carried a motel sign thirty miles.

1985 - The General Motors X-Cars rolled off the assembly line in Detroit, MI for the final time on this day. The cars were a dismal failure, despite being a hit in the beginning, as many claimed they were brought out too early and not “tested.”. The X-Cars were subject to massive recalls which cost G.M. many millions of dollars.

http://members.tripod.com/seributra_d/X.htm

1986---Top Hits

Kiss - Prince & The Revolution

Addicted to Love - Robert Palmer

West End Girls - Pet Shop Boys

Now and Forever (You and Me) - Anne Murray

1986 - The photo essay, "A Day in the Life of America", began as two hundred photojournalists covered the USA to take 350,000 pictures. For publication of the beautiful coffee table book, only 350 pictures were selected. It is considered a collector’s item today.

http://images.isbn.nu/000649207X/price

http://www.amazon.com/exec/obidos/tg/detail/-/000217734X/002-9713331-5503223?

vi=glance#product-details\

1987 - Eleven cities in Florida reported record low temperatures for the date, including Tallahassee with a reading of 31 degrees. The low of 48 degrees at Key West smashed their previous record for the date by 13 degrees.

1988-- Pete Rose becomes the first manager to be suspended for an on-field incident as National League president Bart Giamatti issues a thirty day suspension for his shoving of umpire Dave Pallone.

1988---Top Hits

Anything For You- Gloria Estefan & Miami Sound Machine

Shattered Dreams- Johnny Hates Jazz

Wishing Well- Terence Trent D'Arby

One More Try- George Michael

1990 - Fourteen cities in Florida, Georgia and South Carolina reported record high temperatures for the date as readings soared into the 90s. Tampa FL reported a record high of 97 degrees, and Fort Stewart GA was the hot spot in the nation with a reading of 100 degrees.

1990 - Thunderstorms produced severe weather in North Carolina and Virginia during the afternoon and evening. Thunderstorms produced golf ball size hail, and spawned a tornado near Chester VA which caused half a million dollars damage. A storm system produced snow and gale force winds across northern Michigan, with 8.3 inches of snow reported at Marquette. Temperatures in the north central U.S. soared from morning lows in the 20s and 30s to afternoon highs in the 60s and 70s. Eight cities reported record highs for the date, including Havre MT with a reading of 77 degrees.

1990-- The Mormon church says it is dropping some secret rituals that are viewed as offensive to women. It retains the requirement that a woman must be married and taken into heaven by her husband.

1993---Top Hits

Freak Me- Silk

That s The Way Love Goes- Janet Jackson

Informer- Snow

Love Is (From "Beverly Hills, 90210")- Vanessa Williams/Brian McKnight

I Have Nothing (From "The Bodyguard")- Whitney Houston

1998----Top Hits

Too Close- Next

My All, Mariah Carey

You re Still The One- Shania Twain

Everybody [Backstreet s Back]- Backstreet Boys

2001-One hundred million copies of J. K. Rowling's four Harry Potter children's books have been sold since the first one in 1995, including translations into 42 languages, her agent announces. The best-selling books of all time are The Bible with an estimated [how?] 6 billion copies sold, followed by Quotations from the Works of Mao Tse-Tung (the "Little Red Book") with approximate sales of 900 million.

2003-- The players' association agrees to a two-year experiment in which the winning league of the All-Star Game will have home-field advantage during the World Series. Other changes include roster increase by 2 to 32 players, a separate ballot of managers, coaches and players to be done during the week prior to the game to name the additional nine position players and eight pitchers for each team.

Stanley Cup Champions This Date

Toronto Maple Leafs

[headlines]

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

[headlines]

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

[headlines]

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

[headlines]

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

http://www.weather.gov/

[headlines]

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

[headlines] |

![]()

![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() |

| ![]() Search |

Search | ![]() Stress Release

Stress Release![]()

![]()