Connect with Leasing News ![]()

![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() |

| ![]() Search |

Search | ![]() Stress Release

Stress Release

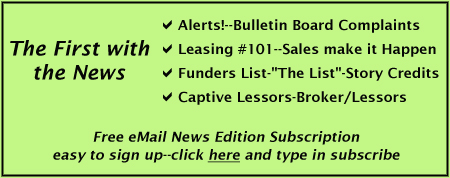

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and entertainment for the commercial leasing and finance industry. The News Edition is updated Monday, Wednesday and Friday.

![]()

Friday, May 13, 2011

Today's Equipment Leasing Headlines

Evergreen Illegal in Which States?

Classified Ads---Operations

Navitas joins "Funder 'A' /Looking for Broker Lists

The Strange Case of Sheldon Player

Accounting Profit for SquareTwo Financial

New Hires---Promotions

Charlie Chan saying….

Two Sons of CLP's Become CLP's

Bridesmaids/13 Assassins

Movie/DVD Reviews by Fernando F. Croce

The Great Dictator/The Mechanic/Shoeshine

United Capital Finances $1MM for Five Guys Burgers

IASB/FASB Issue Common Fair Value Measurement

Tampa Bay, Florida Adopt-a-Dog

Classified ads—Signing/Site Inspection

News Briefs---

Panic along the Mississippi

Ex-bank executive gets 10 years for fraud scheme

Tri-Valley bank plans $7 million private offering

Oh, No! James Durbin voted off 'American Idol'

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

Sports Briefs

California Nuts Briefs

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release” and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer. It is considered “bias” as it is the writer’s viewpoint.

[headlines]

--------------------------------------------------------------

Evergreen Illegal in Which States?

Attorney Michael J. Witt in his article "Automatic Renewal: A Different Perspective," wrote:

"The inclusion of automatic renewal (or 'evergreen') clauses in true leases has been a fairly common practice from time immemorial. There is no question that these clauses provide important protections to the lessor. If the lessee has no intent to renew, the lessor has in interest in knowing it before the end of the term so that he can start planning for remarketing or some other disposition of the equipment.

"However, the question of whether a lessee should be reminded by the lessor of the notice deadline in plenty of time for the lessee to react is an entirely different question. As most of us know, some states (namely, New York and Rhode Island) have statutes requiring commercial equipment lessors to provide a written notice – a fair warning – before the notice deadline date arrives."

This was first written February 19, 2010 and re-printed as Leasing News has been writing about the Equipment Leasing and Finance Association opposing laws requiring a written notice in each of the states, as the abuse has reached the desks of legislators.

If there is an attorney, or authority on this subject, would like a complete list of states where it is necessary to so inform the lessee or lender about the termination of the initial lease contract.

This is an unofficial list:

New York

Rhode Island

Texas

Illinois

(Consumer, may affect commercial,

especially a proprietorship,

partnership or personal guarantee)

Please contact kitmenkin@leasingnews.org

"Automatic Renewal: A Different Perspective"

http://leasingnews.org/archives/Feb2010/2_19.htm#renewal

[headlines]

--------------------------------------------------------------

Classified Ads---Operations

(These ads are “free” to those seeking employment or looking

to improve their position)

| Acton, MA Strong experience in lease accounting, operations, & systems. Implemented lease plus, Great Plains, networks. Excellent financial reporting and analysis skills. Looking for new opportunity. alexanderzlenz@gmail.com| Resume |

30 years equipment leasing, credit, collections experience. I want to work for a funding source with the broker/lessor community. Email - Resume |

Seasoned Ops, Broker Development, Credit, Legal, Strategy, P & L Management detail oriented team player seeks position with Small ticket direct lender. Wgriffith61@yahoo.com | Resume |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

[headlines]

--------------------------------------------------------------

Navitas joins "Funder 'A' /Looking for Broker Lists

"We call on Vendors and also fund brokers," says Gary Shivers, founding president of Marlin Business Services, started Navitas Lease Corp. September, 2008, Ponte Vedera Beach, Florida. “We are always looking for sales talent, particularly in Southern N.J. and Jacksonville, FL, where we have offices.

“We fund leases nationwide. We have a series of announcements that we will be making this year and intend to be a leading independent lessor."

Shivers says his company will be notifying end users before the initial lease term expires.

“We will be making a big announcement soon about our Broker business," he told Leasing News. "Stay tuned!"

A -Accepts Broker Business | B -Requires Broker be Licensed | C -Sub-Broker Program

| D -"Private label Program" | E - Also "in house" salesmen

Name |

Employees

|

Geo

Area |

Dollar

Amount |

Business Reports

|

A

|

B

|

C

|

D

|

E

|

Navitas Lease Corp. Florida and New Jersey 2008 Gary Shivers 904-543-2575, ext. 102 garyshivers@navitaslease.com www.navitaslease.com ELFA, NAELB |

28 |

National |

$3,000 plus |

Y |

N |

N |

Y |

Y |

Gary Shivers told Leasing News he has been waiting for a turn around in the small ticket marketplace, which he now sees, and recently announced a three year $25 million Senior Securities Credit Facility with Wells Fargo Capital Finance, part of Wells Fargo and company.

The company’s aim “… is to provide equipment financing to small and medium sized businesses nationally, primarily through development referral programs with equipment vendors.” He has established multiple sources of financing to support the growth plan.

Funders "A" List:

http://www.leasingnews.org/Funders_Only/Funders.htm

Funders Looking for New Broker Business:

http://www.leasingnews.org/Funders_Only/New_Broker.htm

Comprehensive personal property tax outsourcing services |

[headlines]

--------------------------------------------------------------

The Strange Case of Sheldon Player

(While the web site that displayed the press release about becoming a “Jackson Hole” bottled water franchisee (Sheldon was Franchisor) creditors who had met him as a “consultant” to Equipment Acquisition Resources, say the photo in the press release was not Player).

This episode left off where Sheldon Player of Equipment Acquisition Resources claimed in court he filed personal bankruptcy and it stopped the action of other lawsuits, but to date, no record seems to have been found or produced to show the documents filed.

Here is a re-cap as they would do in television, such as at “24” or the continuation of the previous week’s story:

The last article was "The Curious Case..." but now it has turned strange, if it wasn't before. This includes apparently playing the same game that got him convicted in Greyhound Leasing, 1985, same "M.0.", the large gambling forays at many casino's around the United States, getting caught by the FBI in Denver, Colorado with a duffle bag containing $900,000 in cash (he told them money he won gambling and they let him go), the Jackson Hole land he bought to sell bottled water (but the water came from a neighbor's well that he paid "rent" to take water (but it all didn’t' come from here, it was just promotion), to his not being president of Equipment Resource America, but his wife was, but on all documents and even tax returns her name was Donna Malone, to the land in Wyoming being "gifted" to Donna Malone's children for a state tax gimmick, and the latest is the Equipment Resource America bankruptcy finally gets to move forward after the IRS and Trustee agree to a settlement on taxes paid by Player for sales never made or income received but used to disguise financial and more importantly tax returns, then the separate cases all come to a halt because he claims to have filed bankruptcy.

That's where it gets strange again.

Normally in the Pacer and West Law copies of documents it is not uncommon for the cases to be closed by the filling of a principal's bankruptcy, meaning any actions have to go to the bankruptcy court, claims, if any, and often the program changes as parties realize there is very little to get, and often the process goes longer. But in all the cases to date where this happens, a copy of the bankruptcy papers is submitted. Even Justica could find not such case.

That was strange, but perhaps not uncommon, Leasing News was told (although have always seen the filings in all cases written about to date).

A search on Pacer and West Law could not find any filings of Sheldon Player's bankruptcy record. Searches by other parties as requested by Leasing News also could not find any filings.

A search easily found Donna Malone, Bankruptcy Petition #10-40067 filed September 7, 2010 in the Northern District of Illinois: Chapter 7, Voluntary.

Calls to attorneys involved in the matter have not been returned, as it appears no one has been able to answer where are copies of Sheldon Player's personal bankruptcy filing.

Previous Episodes:

http://www.leasingnews.org/Conscious-Top%20Stories/Sheldon_Player.htm

[headlines]

--------------------------------------------------------------

Accounting Profit for SquareTwo Financial

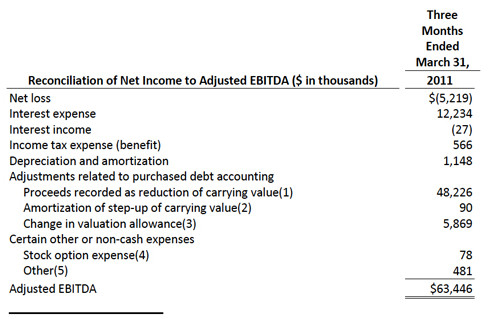

Paul A. Larkins, former senior executive vice-present, Key Equipment Finance and 2006 Leasing News Person of the Year, now president and CEO of SquareTwo Financial Corporation, Denver, Colorado, announced a $5.2 million loss, compared to a new loss of $2.5 million for the asset recovery and management company's first quarter, 2011.

In the accounting method utilized, "cash proceeds" are applied to the carrying value of purchased debt rather than recorded as revenue. In an adjusted basis, the bottom line would be $63.4 million positive.

Cash proceeds on purchased debt were $108.3 million, a 20% increase over the $89.9 million in the same period of the prior year.

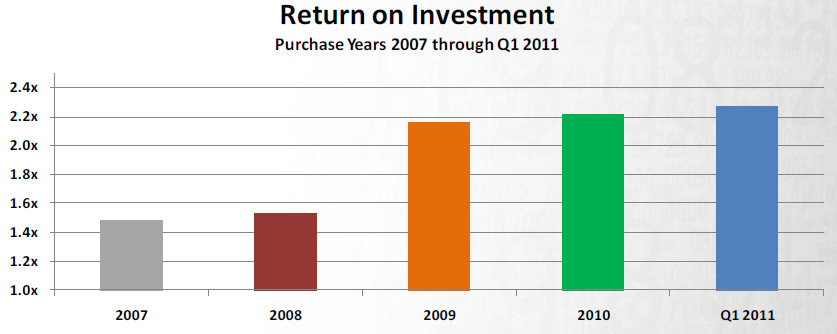

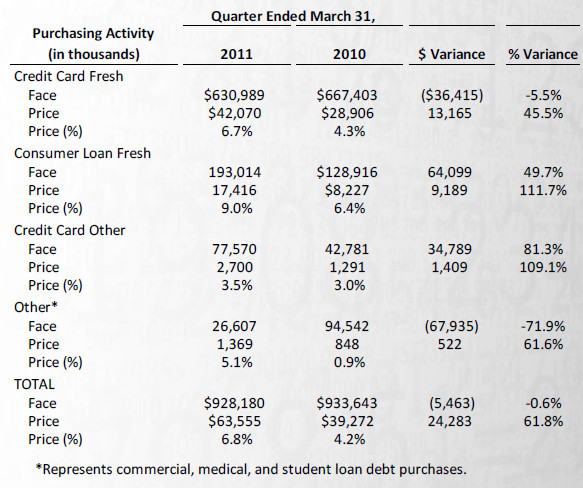

Investment in purchased debt was $63.6 million, to purchase $928.2 million in face value of debt, compared to $39.3 million, to purchase $933.6 million in face value of debt in the same period of the prior year. The total investment in Purchased Debt was a 61.8% increase from the same period of the preceding year.

Paul A. Larkins, President/CEO SquareTwo Financial

"We had an exceptionally strong first quarter, including the best collection month on our owned portfolios in the company's history, " Larkins said, adding "... we are seeing clear evidence that our major operational initiatives are producing sustainable financial results. Most significantly, first quarter performance by our franchise partners exceeded our expectations."

In the telephone conference call, Larkins calls the current economy “choppy.” It is noted the balance sheet was not available at press time, but will be in the SEC filing soon. It is noted they have utilized $135 million of their line, can go up to $180 plus have an additional $15 million in their revolver line. Their goal is to buy debts at 8 cents on the dollar, if the quality is good. They note there is competition from all avenues, and it is growing.

Telephone Conference Call:

http://www.squaretwofinancial.com/wp-content/uploads/2011/05/SquareTwo-Financial-Q1-2011-Financial-Results-Call.mp3

--------------------------------------------------------------

New Hires---Promotions

Laird Boulden has been named president of Corporate Finance Group, combining Capital Source's Corporate Asset Finance and Leveraged Finance, into this new entity which will focus on software, technology and healthcare.

He was founder of Tygris Commercial Finance where he served as President of Tygris Asset Finance and was a member of the corporate leadership team. Prior to founding Tygris, Mr. Boulden served as President and CEO of RBS Asset Finance, Inc., a division of RBS Citizens, N.A., and a member of the Royal Bank of Scotland Group. Reporting directly to the President of Citizens Financial Group (CFG), he was a member of the Executive Policy Committee for CFG, a management committee with responsibility for $150 billion in assets. While in this position, Mr. Boulden oversaw three business lines for CFG including Asset finance, ABL, and Dealer Finance with a combined total of approximately $10.5 billion in assets.

Prior to RBS Asset Finance, Mr. Boulden was President of RBS Lombard–a group he launched for RBS in 2001–where he was responsible for the consolidation and integration of the U.S.-based RBS equipment finance businesses (the former RBS Lombard, ICX, and Citizens Leasing) under the CFG umbrella. Prior to his tenure at RBS, Mr. Boulden was a co-founder of the Commercial Equipment Finance Group for Heller Financial, Inc., was subsequently promoted to President of that group, and served as a member of the Heller Executive management team. He is a long-time member of the Equipment Leasing and Finance Association, previously serving as its Vice Chairman, and was a long-term member of the ELFA's Board of Directors and Executive Committee.

Curtis C. Brantl has been appointed Operations & Process Leader for EverBank commercial Finance, Parsippany, New Jersey.

"Curt joined EverBank Commercial Finance after an impressive ten year career with GE Capital where he served in a number of leadership capacities. Curt was the Quality Leader for order-to-remittance and held the Operations Leader position for Capital Markets. He was previously Vice President and General Manager of Xerox Capital Services (XCS) in Chicago, one of GE Capital's largest vendor programs. XCS provided specialized financing programs for Xerox North America Fortune 500 customers and dealers.

"Curt holds a BA in Economics from Albertus Magnus College and an MBA from the University of Connecticut. He is a GE certified Six Sigma Master Black Belt."

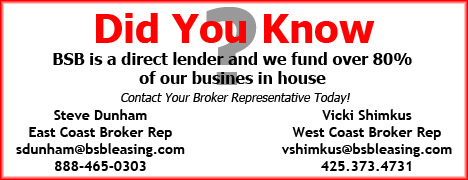

Steve Dunham has been appointed Eastern Regional Broker Service Representative, BSB Leasing, Denver, Colorado. He joined the company in October, 2010. He was active in the formation of the Western Association of Equipment Lessors in 1972, serving as first president, now the National Equipment Finance Association, and operated Leasing Associates, Mountain View, California. He will be working from Boothbay, Maine. 888-465-03030. sdunham@bsbleasing.com.

http://www.linkedin.com/in/stevedunham

Michael Holck appointed to Vice President, Irontrax, Cleveland, Ohio. He is based in Omaha, Nebraska and will be responsible for all transportation projects. Irontrax assists clients with appraisals and remarketing in the construction and transportation industries. Mike Holck was formerly assistant manager appraisal services for Taylor & Martin (August, 1999-May, 2011)

http://www.linkedin.com/pub/mike-holck/11/b75/499

Dave Johnson was hired as Senior Vice President of Sales and Marketing, Willis Lease Finance Corporation, Novato, California. Previously he was vice president marketing, ILFC (January 2010-April, 2011), pilot for American Airlines (March, 1992-June, 2004). He earned his JD at the University of California, Los Angeles where he also was managing editor of UCLAWLJ (1994-1997), MBA in management and Finance from Louisiana Tech University (1988-1991), BSAN Aeronautical Engineering from the United States Air Force Academy (1981-1985). He served as a pilot and B-52 combat crew commander in the United States Air Force for six years, rising to the rank of captain.

Captain Johnson also serves on the Board of Directors of the Heritage Flight Museum in Bellingham, Washington, which is the aviation and space museum founded by USAF Major General and Apollo 8 Astronaut William A. Anders and family.

http://www.linkedin.com/pub/david-johnson/4/757/247

Linda K. Nelson was named Chief Financial Officer, First America Equipment Finance, Fairpoint, New York. She has been Chief Financial Officer, Executive Vice President and Secretary since July 2008 at Birds Eye Foods, Inc. Since February 2008, Ms. Nelson served as Senior Vice President of Finance & Logistics at Birds Eye Foods, Inc. From 2006 to 2007, she served as Chief Accounting Officer of Birds Eye Foods, Inc. From 1997 to 2007, she served as a Controller and from 1997 to 2006, served as its Vice President. From 1995 to 1997, she served as Director of Internal Audit at Birds Eye Foods, Inc.

Prior to joining Birds Eye Foods, Inc., Ms. Nelson worked at Price Waterhouse for 10 years, holding various positions as Senior Audit Manager. Ms. Nelson is a certified public accountant, and graduated with a Bachelor of Science in Accounting from Binghamton University State University of New York.

Lindsey S. Rheaume was appointed executive vice-president, commercial lending manager, Virginia Commerce Bank, Arlington, Virginia. He will manage the bank’s team of commercial lenders and will oversee new business development opportunities. He most recently from SunTrust Bank where he was a senior vice president in the special assets division and government and technology division. He has also held positions with GE Capital as portfolio management group leader and Bank of America as senior vice president, business credit.

Linda G. Ross was promoted to manager of project management and support services, Key Equipment Finance, Superior, Colorado. She joined the company 2007 to manage sales process improvement. Previously, she was deputy chief operating officer for Denver Public Schools. Prior to that, she served as the director of project management for Creation Chamber Interactive (now Xylem CCI Inc.) and was operations manager at the University of Denver.

Throughout her career she has also held various operations positions in the education field, including developing education programs in Chile, Korea and Greece. Ross has a bachelor’s degree in history from Queen’s University in Canada and a bachelor’s degree in liberal arts from Excelsior College (SUNY), as well as a master’s degree in applied communication and corporate training from the University of Denver.

http://www.linkedin.com/pub/linda-g-ross/25/920/67

[headlines]

--------------------------------------------------------------

*****Announcement***************************************

Two Sons of CLP's Become CLP's

"The Board of Directors of the Certified Lease Professional Foundation is excited to extend its congratulations to the Equipment Leasing and Finance Industry’s two new Certified Lease Professionals. These two new CLPs are also sons of two current CLPs, giving the CLP Foundation our first two Father and Son Certified Lease Professionals. The letters "CLP" behind their names are a visible recognition of their experience in the industry and their professional achievement in having passed the CLP Exam.

Stephen Lahti, CLP

(Son of James Lahti, CLP since 1996)

Affiliated Investment Group, Inc.

Cedar Park, Texas

Matt Padden, CLP

(Son of James Padden, CLP since 1999)

Padco Financial Services, Inc.

Chicago, Illinois

"The CLP Foundation is the official governing body for the Certified Lease Professional ("CLP") Program. The CLP designation sets the standard for professionalism in the leasing industry. This designation identifies and recognizes individuals within the leasing industry who have demonstrated their competency through continued education, testing and conduct. The letters "CLP" behind their name represent a visible recognition of this professional achievement and status. The CLP Program is the only recognized certification program in the entire world wide equipment leasing and finance industry.

"We invite you to visit our site -- www.clpfoundation.org for detailed information about the CLP Foundation and the CLP Program. For further information about our Mentor Program and Anonymity Program please contact:

Cynthia W. Spurdle

Executive Director

CLP Foundation

PH: 610/687-0213

FAX: 610/687-4111

E-mail: cindy@clpfoundation.org

www.clpfoundation.org

******Announcement**************************************

|

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

Fernando's View

By Fernando F. Croce

High-octane doses of comedy (“Bridesmaids”) and action (“13 Assassins”) await moviegoers this weekend, while DVD watchers can have their pick of slam-bang sleepers (“The Mechanic”) and re-issued classics (“The Great Dictator,” “Shoeshine”).

In theaters:

Bridesmaids (Universal Pictures): Long relegated to killjoy secondary roles in frat-guy comic hits like “Knocked Up” and “The Hangover,” women take the center stage with riotous results in this tart tale of female friendship, competition and cattiness. Best known for her “Saturday Night Live” characters, Kristen Wiig shines as Annie, whose messy life takes a sharp turn when she serves as the maid of honor for her best friend Lillian (Maya Rudolph). Making sure the wedding ceremony is all set sounds like a simple enough job, but with the accident-prone Annie saddled with four wacky bridesmaids (Rose Byrne, Ellie Kamper, Wendi McLendon-Covey and Melissa McCarthy), nothing is sure to go as planned. Directed by Paul Feig, this is a rollicking ensemble comedy that remains sharp and endearing even at its crudest.

13 Assassins (Magnet Releasing): Takashi Miike, the prolific Japanese filmmaker responsible for some of the most hair-raising movies of the last twenty years (“Audition,” “Ichi the Killer”), goes classical with this straightforward, rousing adventure set in 19th-century Japan. Depicting a world of corrupt noblemen and wandering warriors, it builds up to the titanic confrontation the group of fighters hired by a samurai (Koji Yakusho) and the 200 bodyguards of a bloodthirsty feudal lord (Goro Inagaki). The sprawling battle is a marvel of cinematic mayhem, though Miike has enough unpredictable tricks up his sleeve to ensure that getting there is only half the fun. Full of action, mood and panache, this tribute to the sagas of Akira Kurosawa (“Seven Samurai”) might be the unique director’s breakout film with mainstream audiences. With subtitles.

Netflix Tip: “13 Assassins” may make his name known to American viewers, though Takashi Miike has been churning out one-of-a-kind films at an alarming pace for decades. Visit Netflix and catch up with this no-holds-barred virtuoso’s vast output, ranging from such disturbing fare as “Gozu” and “Visitor Q” to such surprisingly lyrical tales as “Japan Underworld” and “The Bird People in China.” |

On DVD:

The Mechanic (Sony): Charles Bronson’s 1972 actioner gets an enjoyable makeover with this pulpy thriller, directed by thrill-machine specialist Simon West (“Con Air”). Perhaps the only current action star to be able to fill Bronson’s macho shoes, Jason Statham stars as Arthur, a professional killer with a high reputation among underworld types. His deadly professionalism is put to the test, however, when he’s assigned to murder his mentor and friend Harry (Donald Sutherland). Things grow more complicated when Arthur decides to go rogue, with gangsters as well as Harry’s son Steve (Ben Foster) on his trail. Dripping with atmosphere and stunts, this is a prime example of a well-made genre movie, thanks in no small amount to Statham’s inimitable brand of muscular charisma.

Shoeshine (Entertainment One): One of the leading lights of the great postwar film movement known as Italian Neorealism, director Vittorio De Sica became famous for heartbreaking classics like “Bicycle Thieves” and “Umberto D.,” which made revolutionary use of non-professional actors and real location. In many ways, this 1946 gem (finally being released on DVD) may be De Sica’s masterpiece, with an emotional purity that continues to resonate through the years. Set in Rome in the aftermath of World War II, it follows Pasquale (Franco Interlenghi) and Giuseppe (Rinaldo Smordoni), poor boys who make a living shining the shoes of American soldiers. Their friendship and dreams of owning a horse are tested, however, by their shady surroundings. A harsh yet uplifting emotional drama, it is a must for every movie-lover. With subtitles.

[headlines]

--------------------------------------------------------------

### Press Release ############################

United Capital Finances $1 million

for Five Guys® Burgers and Fries Operator

HUNT VALLEY, MD —- United Capital Business Lending, a subsidiary of BankUnited, announced today that it is providing $1 million in financing to Five Guys® Burgers and Fries owner, Franchise Kings, LLC. United Capital refinanced two existing stores for the New Jersey based franchisee and will also provide funding to open one additional Five Guys® location. With the new site, Franchise Kings, LLC will own and operate five Five Guys® restaurants.

United Capital Business Lending, which recently acquired the small business lending operations of Butler Capital, is a subsidiary of BankUnited, the largest bank in Florida with over $11 billion in assets. The newly formed United Capital Business Lending now brings the prior experience of Butler Capital together with the financial strength of BankUnited.

"The United Capital team is excited to be a part of the Five Guys® franchise's continued growth and success," says Trey Grimm, business development officer for United Capital. "With the solid financial resources of our parent company BankUnited, United Capital has the ability to fund franchisees' new restaurant development and to refinance existing locations with very competitive pricing."

In addition to Five Guys®, the United Capital team has financed franchisees for Burger King®, Subway®, Dunkin' Donuts®, Taco Bell®, Checkers®, Denny's®, Wing Stop®, Jimmy John's® and Buffalo Wild Wings® among others.

For information about financing for franchise acquisition, new restaurant development, remodeling or refinancing, call United Capital at 866-218-4793.

#### Press Release ###########################

John Kenny Receivables Management • End of Lease Negotiations & Enforcement The Solution to Your Credit & Accounts Receivable Needs |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

#### Press Release ###########################

IASB and FASB issue common fair value measurement

and disclosure requirements

Boards conclude major convergence project - important element of response to the financial crisis

The International Accounting Standards Board (IASB) and the Financial Accounting Standards Board (FASB) issued new guidance on fair value measurement and disclosure requirements for International Financial Reporting Standards (IFRSs) and US generally accepted accounting principles (GAAP).

The guidance, set out in IFRS 13 Fair Value Measurement and an update to Topic 820 in the FASB’s Accounting Standards Codification® (formerly referred to as SFAS 157), completes a major project of the boards’ joint work to improve IFRSs and US GAAP and to bring about their convergence.

The harmonisation of fair value measurement and disclosure requirements internationally also forms an important element of the boards’ response to the global financial crisis.

Completion of the project is the culmination of more than five years’ work to improve and align fair value measurement and disclosure requirements. The requirements, which are largely identical across IFRSs and US GAAP, have benefited from extensive due process and public consultation, including input from a Fair Value Expert Advisory Panel and the FASB’s Valuation Resource Group.

The requirements do not extend the use of fair value accounting, but provide guidance on how it should be applied where its use is already required or permitted by other standards within IFRSs or US GAAP.

For IFRSs, IFRS 13 Fair Value Measurement will improve consistency and reduce complexity by providing, for the first time, a precise definition of fair value and a single source of fair value measurement and disclosure requirements for use across IFRSs.

For US GAAP, the Update will supersede most of the guidance in Topic 820, although many of the changes are clarifications of existing guidance or wording changes to align with IFRS 13. It also reflects the FASB’s consideration of the different characteristics of public and non-public entities and the needs of users of their financial statements.

Non-public entities will be exempt from a number of the new disclosure requirements.

Sir David Tweedie, Chairman of the IASB, said:

“The finalisation of this project marks the completion of a major convergence project and is a fundamentally important element of our joint response to the global financial crisis. The result is clearer and more consistent guidance on measuring fair value, where its use is already required.”

Leslie F Seidman, Chairman of the FASB, said:

“This Update represents another positive step toward the shared goal of globally converged accounting standards. Having a consistent meaning of the term ‘fair value’ will improve the consistency of financial information around the world. We are also responding to the request for enhanced disclosures about the assumptions used in fair value measurements.”

#### Press Release #############################

[headlines]

--------------------------------------------------------------

Tampa Bay, Florida-- Adopt-a-Dog

Ralph

Animal ID: 13052647

Breed: Retriever/Mix

Age: 2 years

Sex: Male

Size: Large

Color: Red

Neutered

Humane Society of Tampa Bay

Location: Dog Patio

Intake Date: 5/9/2011

Adoption Price: $75.00

3607 North Armenia Avenue , Tampa, FL 33607 *| (813) 876-7138

http://www.humanesocietytampa.org/Home.aspx

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

Classified ads—Signing/Site Inspection

Leasing Industry Outsourcing

(Providing Services and Products)

| Signing Service: New Jersey Mobile NJ Lease Signing Service We are New Jersey mobile lease signers and Notaries.We bring lease to clients, expedite signing and return docs. Same day. Jim Lissemore, Pres www.Flexo-Notaries.com |

Site Inspection: Placentia, CA On site verifications, document signing or collections. Quick, accurate and professional. Reports with photographs e-mailed direct. Agents throughout US. Contact for coverage and rates. E-mail:pwright@yk2bizsolutions.com |

Site Inspection: US & Canada Quiktrak performs equipment inspections within 24 hours of your job placement anywhere in the US. Order, check status & receive reports & photos online. E-mail:sdresser@quiktrak.com |

Site Inspection: National Property Tax Compliance Services to the leasing industry. Over 60-years experience and fifty Lessors as clients. References and free quotes available, (216) 658-5618, |

| Inspection: Tampa /St. Pete, FL Contact Dick Mitchell @ Randolph Lynn Associates for prompt professional pre-funding equipment inspections, collateral "visits", and related lessee/vendor contacts. (Florida locations) 727-302-9144 E-mail:dmrla@gte.net |

Site Inspection plus: Greater Baltimore area C. and A. Courier Services™, TA / Andreas Klepp-Egge Jr., Baltimore MD 21229.Field Appraisal Inspection Service, 410-746-6355, candacourier22@aol.com. |

| Asset Inspections / Lender Services: Serving Michigan, N.Ohio, N.Indiana – Lender services including asset inspection, business/vendor verification, collections, and lease/loan signings. 25 years experience leasing/financial. www.michiganclosingsandmore.com sheri@michiganclosingsandmore.com |

Site Inspection: Nationwide Division of RTR Services, Jim Merrilees, Vice-President, jimmerrilees@is-rtr.com Wes Peterson, Inspection Quality Administrator, wespeterson@is-rtr.com www.is-rtr.com |

All "Outsourcing" Classified ads (advertisers are both requested and responsible to keep their free ads up to date:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing.htm

How to Post a free "Outsourcing" classified ad:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing-post.htm

|

((Please Click on Bulletin Board to learn more information))

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

![]()

--- News Briefs

Panic Along the Mississippi

http://www.washingtonpost.com/national/in-louisiana-a-choice-between-two-floods/2011/05/11/AFrjFotG_story.html

Ex-bank executive gets 10 years in prison for fraud scheme

http://www.ajc.com/news/ex-bank-executive-gets-943696.html

Fixed Mortgages hit lowest level for 2011

http://www.usatoday.com/money/economy/housing/2011-05-12-mortgage-rates-2011-low_n.htm

Tri-Valley bank plans $7 million private offering of stock to help the bank expand to new markets|

http://www.mercurynews.com/breaking-news/ci_18051527

Oh, No! James Durbin voted off 'American Idol'

http://www.mercurynews.com/crime-courts/ci_18053254?source=most_viewed

Sports Briefs----

Guts and glory: San Jose Sharks win!

http://www.mercurynews.com/ci_18054168

The Huddle

http://content.usatoday.com/communities/thehuddle/index

McDonald Mansion opens its doors in Santa Rosa

http://www.pressdemocrat.com/article/20110512/ARTICLES/110519754/1350?Title=McDonald-Mansion-opens-its-doors-

![]()

California Nuts Briefs---

California exports rise for 17th Month

http://www.sacbee.com/2011/05/12/3620671/california-exports-rise-for-17th.html

Unabomber Kaczynski's personal effects, including his manifesto, will be auctioned online starting Wednesday

http://www.sacbee.com/2011/05/12/3623448/unabomber-kaczynskis-personal.html

Woman's wedding ring returned after Sacramento airport custodian finds it in washroom

http://www.sacbee.com/2011/05/12/3620716/womans-wedding-ring-returned-after.html

![]()

“Gimme that Wine”

Hundreds gather to remember life of Jess Jackson

http://www.pressdemocrat.com/article/20110512/ARTICLES/110519792/1350?Title=Hundreds-gather-to-remember-Jess-Jackson

Chinese executive in 'Lafite' scandal disciplined

http://www.decanter.com/news/wine-news/525292/chinese-executive-in-lafite-scandal-disciplined

Vineyard Economics: Sunny Forecast

http://www.winesandvines.com/template.cfm?section=news&content=87629&

;htitle=Vineyard%20Economics%3A%20Sunny%20Forecast

Parker 'only wine critic' to get Spanish gong

http://www.decanter.com/news/wine-news/525181/parker-only-wine-critic-to-get-spanish-gong

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in American History

1607- the first permanent English settlement was established in Jamestown , VA. One hundred and five from Blackwell , England , on three ships. Most of them were 'gentlemen adventurers," gentlemen who did not work and brought servants., quite British, you know. Captains John Smith and Christopher Newport were among the leaders of the group of royally chartered Virginia Company settlers who had traveled from Plymouth , England , in three small ships: Susan Constant, Goodspeed and Discovery. The colony was named after England 's King James I on this date.

1612-tobacco cultivation was undertaken at Jamestown , VA by John Rolfe, the future husband of Pocahontas, who had arrived with the Jamestown settlement. Rolfe was the first settler to come up with a method of curing tobacco, which made it possible grow tobacco drops for export to England . The smoking, chewing, and snuff became very popular and soon was the most important export to Europe . Nicotine made this not only popular, but a daily necessity. It was definitely a "cash crop" for the New World .

1846- although fighting had begun days earlier, Congress officially declared war on - Mexico on this date. The struggle cost the lives of 11,300 American soldiers and resulted in the annexation by the US of land that became pads of Oklahoma , New Mexico , Arizona , Nevada , California , Utah and Colorado . The war ended in 1848.

1864-the first soldier buried at Arlington National Cemetery was a Confederate soldier.

http://memory.loc.gov/ammem/today/may13.html

1908-President Theodore Roosevelt declares "Conservation is a nationa

duty." (lower half of http://memory.loc.gov/ammem/today/may13.html)

1911-birthday of pianist Maxine Sullivan, Homestead , PA.

http://www.harlem.org/people/sullivan.html

http://www.ddg.com/LIS/InfoDesignF96/Ismael/jazz/1940/sullivan.html

1912- jazz arranger and composer Gil Evans was born in Toronto. Evans, whose career was almost entirely in the US, first became known for his innovative writing for the Claude Thornhill orchestra in the 1940's. In the following decade, Evans collaborated with trumpeter Miles Davis for such classic jazz LPs as "Miles Ahead," "Porgy and Bess" and "Sketches of Spain." He died in Mexico on March 20th, 1988. He is my favorite jazz composer/arranger. I have all his records; every one.

http://www.artistdirect.com/music/artist/bio/0,,428387,00.html

?artist=Gil+Evans

http://www.miles-davis.com/GilEvans/

http://gilevans.free.fr/biographie_us/biographie.htm

http://www.nprjazz.org/feature/gevans.html

http://www.chass.utoronto.ca/~chambers/miles.html

http://www.culturekiosque.com/jazz/miles/rhemiles4.htm

http://www.pbs.org/jazz/biography/artist_id_evans_gil.htm

http://www.melmartin.com/html_pages/Articles/miles.html

http://www.walmart.com/catalog/product.gsp?product_id=1540795&

sourceid=0100000010991440602498

http://www.edkeane.com/About

%20the%20Artists/Miles%20Evans/Mile-Evans.htm

http://www.cd-music.org/music/51379Helen-Merrill-w-Gil-Evans.html

1914-Birthday of Joe Louis, world heavyweight boxing champion, 1937-49, nicknamed the "Brown Bomber, Joseph Louis Barrow was born near Lafayette, AL. He died Apr 12, 1981, at Las Vegas, NV. Burial at Arlington National Cemetery. (Louis's burial there, by presidential waiver, was the 39th exception ever to the eligibility rules for burial in Arlington National Cemetery.)

http://www.cmgww.com/sports/louis/louis.html

1923-birthday of Pianist Red Garland, Dallas, TX.

http://www.allaboutjazz.com/bios/rxgbio.htm

http://rollingstone.com/artists/default.asp?oid=7408

http://www.amazon.com/exec/obidos/tg/stores/artist/glance/-

/41495/103-9368180-9796616

1926--Birthday of Beatrice Arthur, U.S. actor and singer. BA won Tony for best supporting actress in Mame (1966). Her TV series Maude was a hit during the 1970s and she was one of the Golden Girls, another long running TV hit series.

1930 - A man was killed when caught in an open field during a hailstorm northwest of Lubbock TX. It was the first, and perhaps the only, authentic death by hail in U.S. weather records.

1933-birthday of saxophonist Buddy Catlett, Long Beach, CA

http://www.ponyboyrecords.com/files/nova/trio/nova_trio.html

http://members.aon.at/jazzclub-life-salzburg/images/Musiker/

http://www.oldpop.net/musics/Donna.htm catlett.htm

1938-- Louis Armstrong records "When the Saints Go Marching In"

1941-50s rock 'n' roll singer Ritchie Valens was born in Pacoima, California. He was signed by Del-Fi Records in 1958, and had three big hits that year with "Come On, Let's Go," "Donna" and "La Bamba." Valens was killed in a plane crash with Buddy Holly and the Big Bopper in February 1959. There was a resurgence of interest in Valens' music in 1987 with the release of the movie biography "La Bamba." He died "...the day music died." Feb.3,1954

http://www.fiftiesweb.com/crash.htm

http://www.oldpop.net/musics/Donna-RichieVallens(LosLobos).htm

http://www.geocities.com/roger-brasil/rock/la_bamba.mid

1943- General Sir Harold Alexander telegraphed Winston Churchill, who was in Washington attending a conference, "It is my duty to report that the Tunis campaign is over. All enemy resistance has ceased. We are masters of the North African shores." About 250,000 Germans and Italians surrendered in the last few days of the campaign. This Allied victory in North Africa helped open Mediterranean shipping lines.

1943-birthday of singer Mary Wells, probably best known for her song, "My Guy." She was one of the group of black artists of the 60's who helped end musical segregation by being played on white radio stations.

Mary Wells died July 26, 1992,at Los Angeles, California at the age of 49.

http://www.cmgww.com/music/wells/

1949---Top Hits

Cruising Down the River - The Russ Morgan Orchestra (vocal: The Skyliners)

Forever and Ever - Perry Como

Careless Hands - Mel Torme

Lovesick Blues - Hank Williams

1950- Stevie Wonder, whose real name is Steveland Morris Hardaway, was born in Saginaw, Michigan. He sang and played the harmonica so well that Ronnie White of the Miracles brought him to Motown records, where Berry Gordy signed him on the spot. Wonder's third single, "Fingertips-Part Two," shot to the top of the Billboard Hot 100 in the summer of 1963. Since then, Stevie Wonder has developed into one of the greatest pop composers and vocalists of our time. His songs, such as "For Once in My Life," "Signed, Sealed, Delivered, I'm Yours" and "You Are the Sunshine of My Life," appeal to a wide range of the public taste. Almost all of his albums have sold enough to qualify for gold records. The one notable exception was 1977's "Journey Through the Secret Life of Plants," a mostly instrumental album which failed to catch on with the public.

http://www.motowndiscography.com/pages/Artists/Stevie.html

http://www.stevie-wonder.com/

1950- The Birthday of the Prophet Muhammad: Mawlid Al Nabi. Different methods of recalculating the visibility of the new moon crescent at Mecca are used by different Muslim groups.

US date may vary.

1954- President Dwight Eisenhower signed legislation authorizing US-Canadian construction of a waterway that would make it possible for oceangoing ships to reach the Great Lakes.

1954 - "The Pajama Game" made its debut on Broadway in New York City at the St. James Theatre. Harold Prince produced "The Pajama Game", his first Broadway endeavor. The show ran for 1,063 performances. John Raitt and Janis Paige starred in the leading roles. Carol Haney came to national fame for her rendition of the song, "Steam Heat". The movie version also starred Raitt -- along with Doris Day.

1955-At tonight's show in Jacksonville, FL, Elvis Presley tells the girls who make up the majority of the 14,000-plus crowd that he'll "see (them) backstage." The crowd proceeds to do just that, ripping the King's clothes, causing Elvis' first-ever riot and, reportedly, convincing Tom Parker about Elvis' popularity once and for all.

1957---Top Hits

School Day - Chuck Berry

A White Sport Coat (And a Pink Carnation) - Marty Robbins

So Rare - Jimmy Dorsey

All Shook Up - Elvis Presley

1957--Elvis begins filming his third movie, Jailhouse Rock, in Hollywood.

1958-Stan Musial of the St. Louis Cardinals got the 3,000th hit of his career, a pinch-hit double off Moe Drabowsky of the Chicago Cubs. Musial finished his career in 1963 with 3,630 hits, 1,815 at home and an equal number on the road.

http://www.stan-musial.com/

1960-- The juvenile delinquent movie Platinum High School, starring Conway Twitty, opens in New York.

1965-- Elvis Presley's sixteenth movie, Tickle Me, premieres in Hollywood.

1965---Top Hits

Mrs. Brown You've Got a Lovely Daughter - Herman's Hermits

Count Me In - Gary Lewis & The Playboys

Ticket to Ride - The Beatles

Girl on the Billboard - Del Reeves

1967-Slugging outfielder Mickey Mantle of the New York Yankees hit the 500th home run of his career against Stu Miller of the Baltimore Orioles. The homer propelled the Yankees to a 6-5 victory. Mantle finished his career in 1968 with 536 home runs.

http://www.mickeymantle.org/

1969--DUNAGAN, KERN W. Medal of Honor

Rank and organization: Major, U.S. Army, Company A, 1st Battalion, 46th Infantry, Americal Division. Place and date: Quang Tin Province, Republic of Vietnam, 13 May 1969. Entered service at: Los Angeles, Calif. Born: 20 February 1934, Superior, Ariz. Citation: For conspicuous gallantry and intrepidity in action at the risk of his life above and beyond the call of duty. Maj. (then Capt.) Dunagan distinguished himself during the period May 13 and 14, 1969, while serving as commanding officer, Company A. On May 13, 1969, Maj. Dunagan was leading an attack to relieve pressure on the battalion's forward support base when his company came under intense fire from a well-entrenched enemy battalion. Despite continuous hostile fire from a numerically superior force, Maj. Dunagan repeatedly and fearlessly exposed himself in order to locate enemy positions, direct friendly supporting artillery, and position the men of his company. In the early evening, while directing an element of his unit into perimeter guard, he was seriously wounded during an enemy mortar attack, but he refused to leave the battlefield and continued to supervise the evacuation of dead and wounded and to lead his command in the difficult task of disengaging from an aggressive enemy. In spite of painful wounds and extreme fatigue, Maj. Dunagan risked heavy fire on 2 occasions to rescue critically wounded men. He was again seriously wounded. Undaunted, he continued to display outstanding courage, professional competence, and leadership and successfully extricated his command from its untenable position on the evening of May 14. Having maneuvered his command into contact with an adjacent friendly unit, he learned that a 6-man party from his company was under fire and had not reached the new perimeter. Maj. Dunagan unhesitatingly went back and searched for his men. Finding 1 soldier critically wounded, Maj. Dunagan, ignoring his wounds, lifted the man to his shoulders and carried him to the comparative safety of the friendly perimeter. Before permitting himself to be evacuated, he insured all of his wounded received emergency treatment and was removed from the area. Throughout the engagement, Maj. Dunagan's actions gave great inspiration to his men and were directly responsible for saving the lives of many of his fellow soldiers. Maj. Dunagan's extraordinary heroism above and beyond the call of duty, are in the highest traditions of the U.S. Army and reflect great credit on him, his unit, and the U.S. Army.

1970--WINDER, DAVID F. Medal of Honor

Rank and organization: Private First Class, U.S. Army, Headquarters and Headquarters Company, 3d Battalion, 1st Infantry, 11th Infantry Brigade, Americal Division. Place and date: Republic of Vietnam, 13 May 1970. Entered service at: Columbus, Ohio. Born: 10 August 1946, Edinboro, Pa. Citation: Pfc. Winder distinguished himself while serving in the Republic of Vietnam as a senior medical aid man with Company A. After moving through freshly cut rice paddies in search of a suspected company-size enemy force, the unit started a thorough search of the area. Suddenly they were engaged with intense automatic weapons and rocket propelled grenade fire by a well entrenched enemy force. Several friendly soldiers fell wounded in the initial contact and the unit was pinned down. Responding instantly to the cries of his wounded comrades, Pfc. Winder began maneuvering across approximately 100 meters of open, bullet-swept terrain toward the nearest casualty. Unarmed and crawling most of the distance, he was wounded by enemy fire before reaching his comrades. Despite his wounds and with great effort, Pfc. Winder reached the first casualty and administered medical aid. As he continued to crawl across the open terrain toward a second wounded soldier he was forced to stop when wounded a second time. Aroused by the cries of an injured comrade for aid, Pfc. Winder's great determination and sense of duty impelled him to move forward once again, despite his wounds, in a courageous attempt to reach and assist the injured man. After struggling to within 10 meters of the man, Pfc. Winder was mortally wounded. His dedication and sacrifice inspired his unit to initiate an aggressive counterassault which led to the defeat of the enemy. Pfc. Winder's conspicuous gallantry and intrepidity in action at the cost of his life were in keeping with the highest traditions of the military service and reflect great credit on him, his unit and the U.S. Army

1971 - Aretha Franklin, the 'Queen of Soul', received a gold record for her version of "Bridge over Troubled Water", originally a Paul Simon and Art Garfunkel tune.

http://webhome.globalserve.net/ebutler/

http://www.rollingstone.com/artists/default.asp?oid=457

1973---Top Hits

Tie a Yellow Ribbon Round the Ole Oak Tree - Dawn featuring Tony Orlando

You are the Sunshine of My Life - Stevie Wonder

Little Willy - The Sweet

Come Live with Me - Roy Clark

1973 - Tennis star Bobby Riggs defeated Margaret Court in a televised tennis match that was seen worldwide. He went on to face Billy Jean King, in a typical "Don King" hype, after appearing on many radio and television shows saying a man tennis player can always beat a woman tennis player. At that time Billy Jean King, his opponent was still in the closet, and she whipped his butt at the Houston Astrodome. The event allegedly brought women's tennis to the forefront as a competitive sport with a growing legion of fans. It certainly made Riggs a lot of money, plus put him on a circuit for more as the man for women to beat. Died Oct. 27,1995

http://www.washingtonpost.com/wp-srv/sports/longterm/

memories/1995/95pass5.htm

1978- Paul Anka opened a disco in Las Vegas named after his early gospel-disco number "Jubilation."

1981---Top Hits

Morning Train (Nine to Five) - Sheena Easton

Just the Two of Us - Grover Washington, Jr./Bill Withers

Bette Davis Eyes - Kim Carnes

Am I Losing You - Ronnie Milsap

1981 - A tornado 450 yards in width destroyed ninety percent of Emberson, TX. People did not see a tornado, but rather a wall of debris. Homes were leveled, a man in a bathtub was hurled a quarter of a mile, and a 1500 pound recreational vehicle was hurled 500 yards. Miraculously no deaths occurred in the tornado.

1982-The Chicago Cubs, charter members of the National League won the 8,000th game in their history, beating the Houston Astros in the Astrodome,5-0. the Cubs began their existence as the Chicago White Stockings in the National Association (1871, 1874-75) and moved to the National League in 1876. The team changed its name to the Colts in 1890, to the Orphans in 1898, and the Cubs in 1902.

1984 - "The Fantasticks", playing at the Sullivan Theatre in Greenwich Village in New York City, became the longest-running musical in theatre history with performance number 10,000 on this night. "The Fantasticks" opened on May 3, 1960.

1985-During the siege of the radical group MOVE at Philadelphia, PA, police n a helicopter reportedly dropped a bomb containing the powerful military plastic explosive C-4 on the building in which the group was housed. the bomb and the resulting fire left 11 persons dead (including four children) and destroyed 61 homes.

1985 - Tony Perez became the oldest major-league baseball player to hit a grand slam home run. Perez hit the grand slam for the Cincinnati Reds -- helping the Reds to a 7-3 win over the Houston Astros. Perez was just a month shy of his 43rd birthday when he connected for the big dinger...

1985 - 'The Boss', Bruce Springsteen, married actress/model Julianne Phillips in ceremonies in Lake Oswego, OR. The couple went their separate ways in 1989. Springsteen's hit, "I'm on Fire", was in the top ten when the couple tied the wedding knot. Springsteen remarried in June of 1991, this time to a member of his E Street Band, Patti Scialfa. Despite his popularity, Springsteen has never had a number one song. His closest to the top of the pop music charts was a four-week stay at number two with "Dancing in the Dark" (June/July, 1984). Springsteen has had 11 hits in the top ten.

http://www.brucespringsteen.net/

http://www.springstomania.com/content.html

http://www.nj.com/springsteen/

1989---Top Hits

I'll Be There for You - Bon Jovi

Real Love - Jody Watley

Forever Your Girl - Paula Abdul

Is It Still Over? - Randy Travis

1989 - Thunderstorms developing along a warm front produced severe weather in the Southern Plains Region during the afternoon and night. A thunderstorm at Killeen TX produced wind gusts to 95 mph damaging 200 helicopters at Fort Hood causing nearly 500 million dollars damage. Another thunderstorm produced softball size hail at Hodges TX.

1990 - Thunderstorms developing ahead of a cold front spawned ten tornadoes from eastern Wyoming to northern Kansas, including seven in western Nebraska. Thunderstorms forming ahead of a cold front in the eastern U.S. spawned five tornadoes from northeastern North Carolina to southern Pennsylvania. Thunderstorms over southeast Louisiana deluged the New Orleans area with four to eight inches of rain between 7 AM and Noon.

1991-A way ahead of its time, Apple introduced an improved version of its Macintosh system software, called System 7.0, on this day in 1991. The new system let all Macintoshes share files in a network without the intervention of a server, and it also introduced "balloon help"-pop-up text windows offering helpful hints.

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------