Connect with Leasing News ![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() |

| ![]() Search |

Search | ![]() Stress Release

Stress Release

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

Broker/Lessor Relationship Manager www.finpac.com |

Monday, May 13, 2013

![]()

Today's Equipment Leasing Headlines

Balboa Capital, Newport Beach, California

Bulletin Board Complaint #12--Decisive

By Christopher "Kit" Menkin, Publisher

Classified Ads---Credit

Public Sector Finance Forum Report

By Darrel Peters, CLP, Arvest Bank

Real Estate Takes Another Bank Down in Georgia

Fraud closes Second Bank in Asheville, North Carolina

(Home of Thomas Wolfe "You Can't Go Home Again")

Several States Fail to Meet July 1, 2013 Deadline

for Enacting Amended UCC Article Nine

By Tom McCurnin, Leasing News Legal News Editor

Leasing 102 by Mr. Terry Winders, CLP

Return Equipment

“What is the true goal of a resume?”

Career Crossroad---By Emily Fitzpatrick/RII

Classified Ads---Help Wanted

Top Stories May 6-May 9

(You May Have Missed)

Leasing Attorneys

Great Pyrenees/Labrador Retriever

Fayetteville, Arkansas Adopt-a-Dog

News Briefs---

Mortgages rise for 1st time since March

Economists: Recovery advancing despite budget cuts

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

You May have Missed---

SparkPeople--Live Healthier and Longer

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release” and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send Leasing News to a colleague and ask them to subscribe.

We are free!

[headlines]

--------------------------------------------------------------

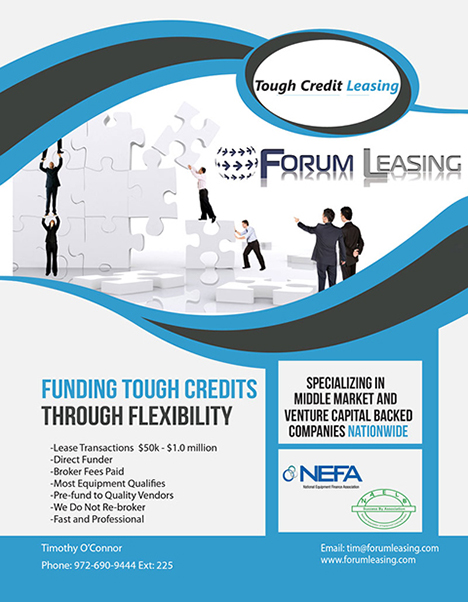

Balboa Capital, Newport Beach, California

Bulletin Board Complaint #12--Decisive

by Christopher "Kit" Menkin, Publisher

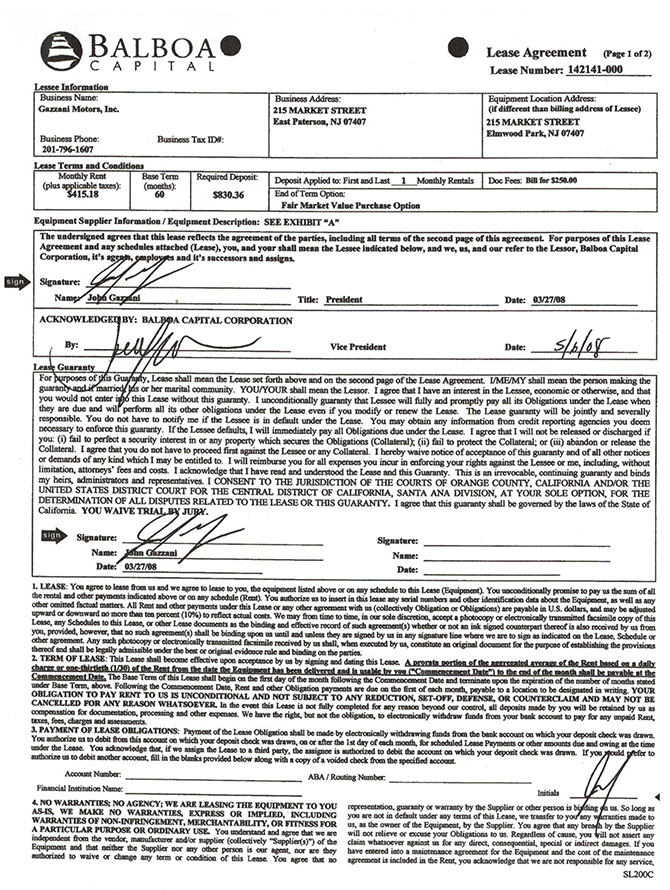

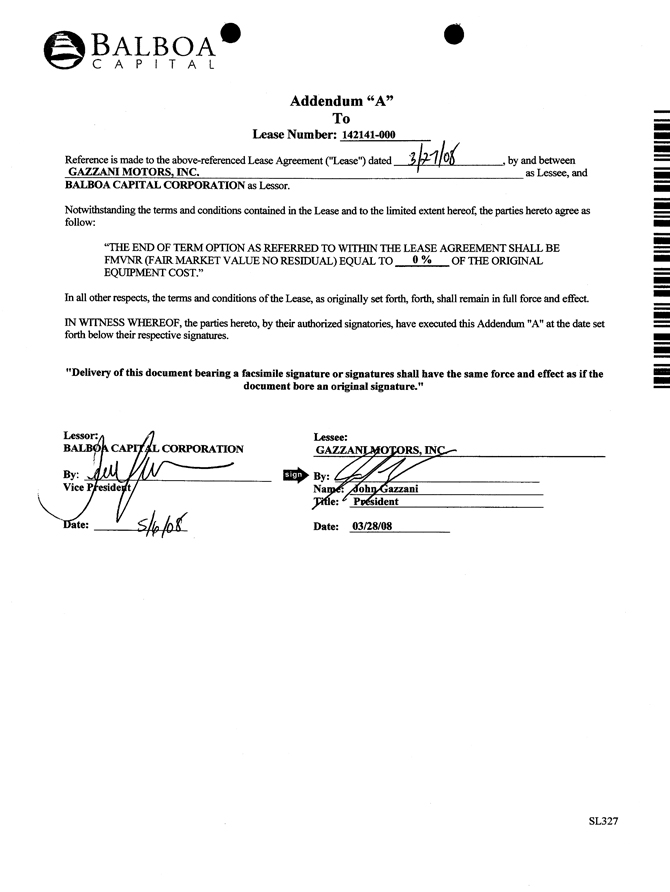

This is a complaint that verifies a procedure from many other complaints about "fair market value" on the face of the contract and a "side letter" stating it is "0" percent that Leasing News has been receiving for years. This email on April 18, 2013 comes from John Gazzani, Gazzani Motors, Inc., Elmwood Park, New Jersey, who was closed for two weeks, hit by Hurricane Sandy.

"My name is John Gazzani from Gazzani Motors Inc. in N. J. I was reading some of the horror stories on your web site about Balboa Capital end of lease nightmares. I also have a 5 year lease on a truck lift that was supposed to end on 5/01/2013. I called them about getting the title and they told me about the 'letter of intent' I was supposed to mail them 6 months before the lease ended. Like everyone else, I never read paragraph 16 of the lease and they never told me about this 5 years ago. Now they have extended my lease for 12 more months.

"The only thing different about my lease was it said: 'The end of term option as referred to within the lease agreement shall be FMVNR (FAIR MARKET VALUE NO RESIDUAL) equal to 0% of the original equipment cost' (see copy of lease attached).

"I do remember that was the case and I had them send the second letter that said '0' %. I was still concerned about why they (Tina Wei, Account Executive) told me it was $1.00 buyout and would not put it in writing. She said that the 0% was the same thing and I let it go. I am also not sure if they are counting the first check I sent them as 2 payments (first and last)." (1)

He sent in all the documentation overnight to prove his position, as well as a letter from his attorney to Balboa:

"Enclosed please find everything you asked for regarding my lease with Balboa Capital. The only other correspondence I have had with Balboa was a phone call to them about getting the title at the end of my lease. That was when they informed me about my lease being extended for another year and I did not send them a letter in intent as per paragraph 16 in the original lease. Of course I had no idea I was supposed to send a letter. They told me they mailed a "reminder" 6 months ago but I do not remember getting it. (We are in the part of N.J. that was hit by Hurricane Sandy last October. We were closed for 2 weeks and many of the Post Offices were under water. There was a lot of mail that was unaccounted for.) My Lawyer (on April 9th) sent them a letter (copy enclosed) and there has been no reply as of yet." (2)

Balboa Lease (front page with

“Fair Market Value Purchase Option”

Balboa "Side Letter"

During the years of complaints from Balboa Capital, several were resolved and not posted, several of them more a compromise that a full solution, as well as others that Leasing News could not help (emails and documents have been saved). One involving three leases with a machine shop in Santa Cruz, California, where they were supposed to be a $1.00 at the end and the experience on two leases had documentation, but not the third and the lessee said he would never have made a "fair market value" on the equipment because it holds is value very high, and there were other $1.00 outs with "Evergreen payments," as well as a mobile park owner on the value of a large electric generator, leases assigned to GE Capital, but the two that stand out is the one from a New England Swimming School that thought they had a "0" percent but went to Evergreen and "Fair Market Value" on the water filter system which would have cost almost the same to remove that it did to install and he would have never signed for a "fair market value" on this equipment, and the other is a bulletin board complaint posted with a copy the lessee made of the "side letter," evidently never sent back signed as Balboa called it a forgery by the machinist:

(3)

The documents sent in by John Gazzani were forwarded to Balboa Capital officers Pat Byrne, Phil Silva, Robert Rasmussen several times, through two different email addresses by Leasing News, with this response three days later:

4/26

"Thank you for bringing this to our attention. We have already contacted Mr. Gazzani and notified him that no additional monies are due on lease #142141-000."

Robert J. Rasmussen

Balboa Capital Corporation

Chief Operating Officer

This email was sent to Mr. Gazzani:

"Mr. Gazzani,

“I want to apologize for any miscommunication which may have occurred in regards to your lease agreement #142141-000 with Balboa Capital Corporation. When I attempted to speak with you today, my intent was to advise you that your lease #142141-000 has been closed out and no additional monies are due. A Bill of Sale will be processed and sent to you early next week. We appreciate your business, please let me know if you have any further questions"

Regards,

Robert Rasmussen

Chief Operating Officer

The original request was for the overpayment (4) to be returned as well as attorney fee reimbursement, including a "Bill of Sales" and UCC-3 release. Communication was sent several times by two different email addresses to the three officers.

15 days later, May 10, 2013 Mr. Gazzani told Leasing News he had not received a bill of sale, returned overpayment, and no communication at all from Balboa Capital since the email of April 26, 2013.

- John Gazzani letter http://www.leasingnews.org/PDF/GazzaniLetter_52013.pdf

- Letter from attorney

http://www.leasingnews.org/PDF/AttorneyLetter_52013.pdf - Bulletin Board complaint

http://leasingnews.org/items/Balboa_cap_addB.gif - Payment record http://www.leasingnews.org/PDF/PaymentsMade_52013.pdf

John Kenny Receivables Management • Credit Investigations • Asset Searches • Skip-tracing • Third-party Commercial Collections john@jkrmdirect.com | ph 315-866-1167| www.jkrmdirect.com |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

Classified Ads---Credit

(These ads are “free” to those seeking employment

or looking to improve their position)

Greater Atlanta, GA |

Open to Relocate |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

| Working Capital Loans for Small Businesses | |

|

Channel Partners is now offering a new Easy Rewards program that allows you to earn rewards on EVERY deal over $15,000 in EVERY state! |

|

[headlines]

--------------------------------------------------------------

Public Sector Finance Forum Report

by Darrel Peters, CLP, Arvest Bank

During the Association for Governmental Leasing and Finance/ Equipment Leasing and Finance Association (AGLF/ELFA) Public Sector Forum in Chicago, Illinois from May 8 to May 10, approximately 120 attendees experienced well -prepared educating sessions.

The perception that the economy is on an “uptick” and the positive energy about the Forum brought along 20 first time attendees.

There was a good mix of Bank Finance companies, Leasing Companies and Legal service companies. All of whom had their team of Government and Municipal Lease experts at the Forum. Plenty of time was allowed for networking and one on one meeting among the different groups.

The mood was positive during the Forum, heightened by the well prepared Keynote speakers and panelists presenting on the various topics. Plenty of interaction and Q &A time was allowed before each session ended.

There was a lot of discussion about what to expect as the U.S. economy has begun its bumpy recovery which was the focus of the session named “Economic Outlook for 2013” : The possible Implications for the Public Sector - keynote speaker Rick Mattoon; Senior Economist and Economic Advisor at the Federal Reserve Bank of Chicago, who presented a positive picture about the current and future growth forecast of our economy.

Whether you were new to Government Leasing or a seasoned expert, the Forum had all who attended in mind. Topics from the Basics of Municipal leasing to sessions about Tax exempt status of Government Municipalities, Municipal Bankruptcy, Affordable Care ACT, and an in depth Presentation about Washington and who is steering the ship. There was something for every attendee to walk away with.

Eric Eshuis and the 2103 AGLF/ELFA Public Sector Financing Forum Planning Committee deserve a big round of applause for putting together a lineup of Keynote speakers and Forum panelists whom are recognized as experts in their fields. Also for topics at the Forum that dealt with the common issues as well as changes that are evolving within the Government/Municipal Leasing Sector.

All of the AGLF members were very enthusiastic about the upcoming 2013 Fall AGLF Conference in November at Boca Raton, Florida.

Darrel Peters - CLP

Equipment Finance Specialist

Arvest Equipment Finance, a Division of Arvest Bank

[headlines]

--------------------------------------------------------------

Real Estate Takes Another Bank Down in Georgia

Fraud closes Second Bank in Asheville, North Carolina

(Home of Thomas Wolfe "You Can't Go Home Again")

Fraud closes Second Bank in Asheville, North Carolina

(Home of Thomas Wolfe "You Can't Go Home Again")

Pisgah Community Bank, Asheville, North Carolina, was closed with Capital Bank, National Association, Rockville, Maryland, to assume all of the deposits. Founded May 15, 2008 the bank had 5 full time employees as of December 31,2012. As noted above, this was one of two banks closed that were controlled by Capital Bancorp. All of the 11 banks controlled by Capitol Bancorp are on the unofficial Problem Bank List and eight are operating under Prompt Corrective Action notices.

In May 2010, Pisgah signed a Consent Order with regulators for engaging in unsafe and unsound banking practices. 20 January, 2012, a "Prompt Corrective Action Directive" was issued by the FDIC:

http://www.leasingnews.org/PDF/FDICPisgahDirective_52013.pdf

In 2008, Yahoo! Real Estate: Asheville was named

as one of the top ten places to live.'

Citizen-Times.com reports on April 25, 2012: "Thomas 'Ted" Durham, 57, former Pisgah Community Bank president, pleaded not guilty to the bank fraud and money laundering charges at his arraignment hearing and requested a jury trial.

"The charges are related in an alleged effort to obtain fraudulent bank loans to finance the stalled Seven Falls development in Etowah. The project's developer, Asheville resident Keith Vinson, 53, is among those facing charges.

"The remaining defendants are Avery Ted "Buck" Cashion III, 58, a Lake Lure real estate investor; his wife, Joan Lusk Cashion, 55, a Lake Lure real estate agent and investor; and Raymond "Ray" Chapman Jr., a Brevard real estate investor."

Justice Department press release with full details:http://www.leasingnews.org/PDF/JusticeDepartmentDunham_52013.pdf

The case arrives from the former Bank of Asheville President George Gordon "Buddy" Greenwood found guilty of a fraud scheme involving the failed Seven Falls development, ordered to pay $9 million in restitution, liable for $5.86 million to the FDIC has received for Bank of Asheville, which failed in January, 2001, and $3.25 million to another victim of the bank, as well as serve four years in prison.

According to a court brief filed, Greenwood was involved in illegal loans totaling nearly $6.8 million made to developer Keith Vinson, who also faces bank fraud charges, and Vinson's failed Seven Falls development, also named in the former Pisgah Community Bank president case. In addition to the loss in the development, many were what are known as straw loans. Involved were former Pisgah Community Bank officials Robert Craig Gourlay and David G. Smith and minister and real estate investor Nicholas Dimitris.

Reportedly Greenwood had been prominent in local banking circles for years. He was appointed president of Bank of Asheville in January 2000. He previously was senior market manager for Centura Bank and was one of three officers in the startup of First Commercial Bank, which later merged with Centura.

The Bank of Asheville five branches were closed with the First Bank, Troy, North Carolina, to assume all deposits.

Besides many literary and other figures born and raised here, such as the author of many American classics, such as Thomas Wolfe “You Can’t Go Home Again.” it is also known for the Biltmore Estate, built by George Washington Vanderbilt III with 250 rooms. Over a million visit the historic US landmark each year.

http://en.wikipedia.org/wiki/Biltmore_Estate

The “Charge Offs” in 2010 shows the main reason for the bank's demise:

(in millions, unless otherwise)

Charge Offs

2008 0

2009 $153,000 ($150,000 construction/land,$3,000 individuals)

2010 $9.1 ($6.2 construction/land, $1.2 commercial/industrial, $1.0 1-4 family,$478,00 nonfarm/nonres.,$152,000 multifamily, $17,000 individuals

2011 $326,000 ($201,000 construct./land,$124,000 commercial/ind.,$88,000 nonfarm/nonres.,$80,000 farmland, -$156,000 multifamily,-$8,000 indiv., -$3,000 1-4 family)

2012 $582,000 ( $314,000 commercial/ind.,$140,000 farmland, $85,000 nonfarm/nonres., $49,000 1-4 family, $9,000 indiv., -$15,000 const./land). 3/31 $92,000--construction/land development

Construction and Land, 1-4 family multiple residential, Multiple Family Residential, Non-Farm Non-Residential loans.

Non-Current Loans

2008 $100,000

2009 $401,000

2010 $7.0

2011 $3.7

2012 $2.9

Profit

2008 -$920,000

2009 -$1.4

2010 -$10.3

2011 -$3.0

2012 -$1.96

3/31 -$1,000

Net Equity

2008 $7.7

2009 $6.2

2010 $252,000

2011 $615,000

2012 $562,000

3/31 $561,000

Tier 1 risk-based capital ratio .037 3/31/2013

As of March 31, 2013, Pisgah Community Bank had approximately $21.9 million in total assets and $21.2 million in total deposits. In addition to assuming all of the deposits of the failed bank, Capital Bank, National Association agreed to purchase approximately $19.8 million of the failed bank's assets. The FDIC will retain the remaining assets for later disposition.

The FDIC estimates that cost to the Deposit Insurance Fund will be $8.9 million.

http://www.fdic.gov/news/news/press/2013/pr13037.html

The three branches of Sunrise Bank, Valdosta, Georgia, were closed with Synovus Bank, Columbus, Georgia, to assume all of the deposits. Founded June 21,2006, the bank had 23 full time employees as of December 31,2013 at their offices in Atlanta (acquired 7/30/2010, Jeffersonville (acquired 7/30/2010) and Valdosta.

Sunrise Bank is the 12th FDIC-insured institution to fail in the nation this year, and the third in Georgia

Sunrise Bank Hq. at Woodrow Wilson Drive, Valdosta

Sunrise was the second closed bank of the day that was controlled by Capitol Bancorp. The FDIC shuttered one in Asheville NC too. The troubled holding company that holds 11 different banks in nine different states. All of the 11 banks controlled by Capitol Bancorp are on the unofficial Problem Bank List and eight are operating under Prompt Corrective Action notices.

The Valdosta Daily Times reported August 3, 2010, "Sunrise Bank of Atlanta, Bank of Valdosta and Peoples State Bank of Jeffersonville are now operating as Sunrise Bank. Each had previously operated under distinct charters.

Clinton Dunn, formerly the interim CEO and chairman of Sunrise in Atlanta, has been named chairman and CEO of the consolidated bank."

It is interesting to note the CEO background was all in banking in Texas, in major cities, and moving him in charge of a small town bank in Georgia was evidently not a very good move. No disparaging on Mr. Dunn's ability, as here is his background:

"Clinton Dunn was born in Baton Rouge, Louisiana (1947) and received a B.S. degree in Chemical Engineering from Louisiana State University and a MBA from the University of Houston. He is currently the Regional President, Texas and Georgia, with Capitol Bancorp, LTD. Previously, Clinton was Sterling Bank Regional CEO, Dallas and Southwest Houston Regions and held various other banking positions in Houston. Additionally, he has worked in the petroleum industry for Humble Oil and Refining (ExxonMobil) as a Process Engineer."

http://www.zoominfo.com/p/Clinton-Dunn/76297725

He was regional CEO for Sterling Bank (1999-2006) http://www.linkedin.com/pub/clinton-dunn/4/b03/231

"In March, regulators slapped the banks and Capitol Bancorp with a consent order, and directed the Lansing, Mich.-based bank holding company to sell its interests in the tiny community lenders." http://valdostadailytimes.com/business/x1936219134/Bank-of-Valdosta-now-Sunrise-Bank

Last year, Sunrise Bank acting President and CEO Richard Cathy said he was “very optimistic” that the bank would raise the needed capital to stay open.

Americanbanker.com: "Time is starting to catch up with Capitol Bancorp (CBCRQ)...The failures could tangle the Lansing, Mich., company in what the Federal Deposit Insurance Corp. calls the cross-guarantee liability, meaning that the agency has the ability to charge Capitol's nine surviving banks with the cost of the failures.

"The FDIC expects the failures to cost a combined $26.2 million; that kind of hit could be detrimental to Capitol. The company is in a negative equity position and its surviving banks are all in various stages of duress...Last year, Capitol filed for bankruptcy with the hopes of restructuring all of its stakeholders into a 53% equity stake in the company. The restructuring was expected to be paired with a new investor who planned to invest $70 million to $115 million in exchange for a 47% stake. One investor emerged, but later backed out. The company has pushed back the confirmation of its bankruptcy plan several times."

http://www.americanbanker.com/issues/178_91/regulators-seize-two-banks-owned-by-capitol-bancorp-1059036-1.html

Capital Bancorp stock

The reality is Sunrise Bank was never profitable from the get-go:

(in millions, unless otherwise)

Profit

2006 -$822,000

2007 -$423,000

2008 -$139,000

2009 -$1.6

2010 -$8.4

2011 -$5.6

2012 -$3.8

3/31 -$701,000

Net Equity

2006 $5.2

2007 $4.7

2008 $5.2

2009 $3.8

2010 $2.5

2011 $1.8

2012 $1.4

3/31 $885,000

Nearby is Moody Air Force Bank and Waterfront Lake (Redwood Lake, GA.)

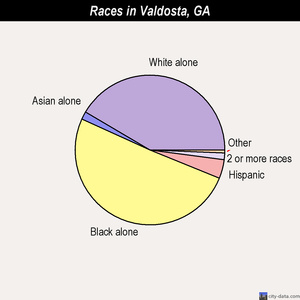

According to Wikipedia, the 2000 census shows 54,518 people, 20,280 households, and 11,876 living in Valdosta. .The median income for a household in the city was $31,940, and the median income for a family was $39,295. Males had a median income of $33,230 versus $25,689 for females. The per capita income for the city was $19,003. About 20.3% of families and 28.2% of the population were below the poverty line, including 34.3% of those under age 18 and 13.1% of those age 65 or over."

http://en.wikipedia.org/wiki/Valdosta,_Georgia

http://www.city-data.com/city/Valdosta-Georgia.html

2011 statistics shows the city did not grow much: 54,978 compared to 2000 54,518 and the estimated per capital income went down to $17,210 from $19,003 in 2000."Mean prices in 2009: All housing units: $153,276; Detached houses: $157,092; Townhouses or other attached units: $140,276; In 2-unit structures: $140,944; In 3-to-4-unit structures: $117,718; In 5-or-more-unit structures: $111,020; Mobile homes: $65,256.Median gross rent in 2009: $697."

http://www.city-data.com/city/Valdosta-Georgia.html

The building permit record basically shows how overbuilding and the sudden change in the real estate market affected the bank:

Single-family new house construction building permits:

- 1997: 183 buildings, average cost: $62,900

- 1998: 224 buildings, average cost: $51,600

- 1999: 163 buildings, average cost: $60,300

- 2000: 127 buildings, average cost: $69,400

- 2001: 141 buildings, average cost: $84,500

- 2002: 254 buildings, average cost: $98,500

- 2003: 320 buildings, average cost: $103,000

- 2004: 196 buildings, average cost: $129,800

- 2005: 256 buildings, average cost: $122,900

- 2006: 427 buildings, average cost: $108,600

- 2007: 365 buildings, average cost: $93,900

- 2008: 216 buildings, average cost: $102,400

- 2009: 118 buildings, average cost: $94,800

- 2010: 73 buildings, average cost: $91,800

- 2011: 67 buildings, average cost: $86,300

Note below the non-current loan major drop in 2010, as well as the charge offs that began the same year.

(in millions, unless otherwise)

Non-Current Loans

2006 0

2007 0

2008 0

2009 $1.2

2010 $10.4

2011 $8.4

2012 $9.0

Charge Offs

2006 0

2007 $4,000 ($4,000 loans to individuals)

2008 $90,000 ($90,000 construction & development)

2009 $432,000 ($224,000 construction/development, $117,000 nonfarm/nonres.,$91,00 commercial & industrial)

2010 $4.0 ($2.00constr./develop.,$732,000 nonfarm/nonres.,$692,000 commercial/ind.,$557,000 1-4 family res.,$31,000 multifamily,$39, indiv.)

2011 $2.2 ($1.2 1-4 family,$531,000 construction/land,$287,000 multi-family, $69,000 individual loans, $60,000 nonfarm/nonres.,$35,000 credit cards)

2012 $1.2 ($492,000 1-4 family, $390,000 nonfarm/nonres.,$356,000 construction/development, $102,000 commercial/ind.,$59,000 individuals

3/31 $169,000 ( $39,000 1-4 family, $55,000 nonfarm/nonres., $40,000 commercial/industrial, $19,000 construct./land, $16,000 individuals)

Construction and Land, 1-4 family multiple residential, Multiple Family Residential, Non-Farm Non-Residential loans.

Tier 1 risk-based capital ratio .0208 3/31/2013

As of March 31, 2013, Sunrise Bank had approximately $60.8 million in total assets and $57.8 million in total deposits. In addition to assuming all of the deposits of the failed bank, Synovus Bank agreed to purchase approximately $13.2 million of the failed bank's assets. The FDIC will retain the remaining assets for later disposition.

The FDIC estimates that cost to the Deposit Insurance Fund will be $17.3 million

http://www.fdic.gov/news/news/press/2013/pr13038.html

List of Bank Failures:

http://www.fdic.gov/bank/individual/failed/banklist.html

Bank Beat:

http://www.leasingnews.org/Conscious-Top%20Stories/Bank_Beat.htm

[headlines]

--------------------------------------------------------------

Several States Fail to Meet July 1, 2013 Deadline

for Enacting Amended UCC Article Nine

By Tom McCurnin

Leasing News Legal News Editor

New York, Puerto Rico, and South Dakota, Among Others Throw a Monkey Wrench to What Was Supposed to be a July 1, 2013 Deadline. Other States Add New Conditions Making Article 9 Less Uniform

As reported here last month, Article 9 has been revised to provide certainty for filings involving individual names, using driver’s licenses as the source document. The revisions take effect July 1, 2013. But several States, most notably, New York, haven’t even begun to address the amendments and enact them, leaving secured creditors in limbo as to the looming deadline.

As reported here, Amended Article 9 provides certainty as to both corporate and individual names of debtors, providing secured creditor with a safe harbor for those names. In the case of a corporation, it is the “organic public filings” of the corporation, e.g., the Articles of Incorporation and any Amendments thereto (not just the stuff on the Secretary of State’s Web Site). In the case of a human being, the Amendments provide a safe harbor if the secured creditor uses a driver’s license name, no matter how inaccurate that name is. The effective date is July 1, 2013.

The following information is current as of May 1, 2013:

- New York is the only State which has not even considered the proposal, or even written a bill, let alone introduced it. So at least in the near future, all filings in New York will be filed under the old way, with the secured creditor guessing what the debtor’s real name might be.

- Illinois has adopted the Amendments but requires Times New Roman 12 point font.

- Indiana has also adopted the Amendments but requires the secured creditor to send a copy of the UCC-1 filing to the debtor with modest penalties for non-compliance.

- Wyoming requires certain long collateral descriptions over 300 characters to be submitted electronically on a diskette as a text file. (By the way, what is a diskette?)

- Colorado has adopted the Amendments but has mandated electronic filings. So don’t bother typing out a UCC-1 for Colorado.

- South Dakota has adopted the Amendments, but insisted that the filer use the old forms with the TIN of the debtor. But the new forms which South Dakota has approved, do not have a space for the TIN. (So where do we write it? Just scrawl any old place on the form?)

- Wyoming as adopted the Amendments, but has increased the effective date of UCC-1 financing statements to 10 years. While that sounds like a good idea, as a searcher, the UCC Report would come back with a lot of extraneous, old, outdated, and expired UCC-1s. This creates new problems.

- Puerto Rico has adopted the Amendments but requires signatures on the forms. The new forms do not have a space for signatures. (Where does the secured creditor put the signature?)

- California has the bill pending, but has put its own effective date as July 1, 2014. ( It is not ready yet and may consider electronic filing, like Colorado, which makes sense to me. Why fool with paper?)

The bottom line is that the 2012 Amendments were, like all Article 9 Amendments, strove to provide uniformity and several States have not gotten on the program. As secured creditors, equipment lessors now need to navigate through a maze of multi-state laws. My advice is to hire a service to do the filings for the creditor.

Tom McCurnin is a partner at Barton, Klugman & Oetting in Los Angeles, California.

Tom McCurnin

Barton, Klugman & Oetting

350 South Grand Ave.

Suite 2200

Los Angeles, CA 90071

Direct Phone: (213) 617-6129

Cell (213) 268-8291

Email: tmccurnin@bkolaw.com

Visit our web site at www.bkolaw.com

Previous Tom McCurnin Articles:

http://www.leasingnews.org

Previous Tom McCurnin Articles:

http://www.leasingnews.org/Conscious-Top%20Stories/leasing_cases.html

[headlines]

--------------------------------------------------------------

Leasing 102

by Mr. Terry Winders, CLP

Return Equipment

Distance is a key factor in the consideration of return of equipment. Many of us have a statement in our lease that states that the lessee must return it to a location of our choosing in the Continental United States. If the equipment is large or bulky and shipping costs high then this language may be considered “onerous”. Usually language that requires the lessee to return the equipment to the dealer that sold it, or a like vendor, or to your closest physical location would be acceptable.

In 1988 the introduction of Article 2A of the Uniform Commercial Code on equipment leasing stated very clearly that even a fair market purchase option is a bargain and will be considered a disguised conditional sales contract if the cost “to return” the equipment is greater than the value of the equipment, causing the lessee to purchase to avoid the cost of return.

One of the problems with equipment values is that the rules require us to prove that there is at least 20% useful life remaining in the equipment. When it comes to equipment like computers, or high tech equipment, its remaining useful life may meet the rules but its value is so small that transportation costs to send it back may make the FMV purchase option look like a bargain. Therefore, some leasing companies are planning to request local secondary market vendors to retrieve the equipment instead of requiring its return.

Another idea is to increase the lease payment by a small amount and put the extra aside in an escrow account to pay for the return and the only responsibility the lessee would have is to prepare it for shipment. If the lessee elects the purchase option then the escrow account would be added to the return on the lease.

Some lessor require the lessee to store the equipment for up to three months for free giving them time to remarket the equipment without the costs of return.

The problem becomes a serious problem when in bankruptcy some opposing counsel wants to have your lease declared a disguised conditional sales contract so it comes under Article 9 and they may have a chance of gaining some benefits from over collateralization.

Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty years and can be reached at WindersConsulting@yahoo.com or 502-649-0448.

He invites your questions and queries.

Previous #102 Columns

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

Mr. Terry Winders available as Expert Witness. 35 years as a professional instructor to the top equipment leasing and finance companies in the United States, author of several books, including DVD's, as well as weekly columnist to Leasing News. He also performs audits of leasing companies as an expert on documentation, and has acted as an expert witness on leasing for litigation in legal and tax disputes, including before the IRS. He also has taught the senior bank examiners, how to review a bank leasing department, for the Federal Reserve in Washington D.C. and has trained the examiners for the FDIC on how to prepare a lease portfolio for sale.

Mr. Winders received his Master of Business Administration and his Bachelor of Science degrees from the College of Notre Dame. 502.649.0448/WindersConsulting@yahoo.com |

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

“What is the true goal of a resume?”

Career Crossroad---By Emily Fitzpatrick/RII

Question:

What is the true goal of a resume – why is it such a big deal if people know me in the industry?

Answer: In this competitive world of job hunting, you MUST have a comprehensive and compelling resume – It Is Necessary (good social media presence is also a MUST, but I will get into that at another time).

Just because an employer or hiring manager knows you is irrelevant and keep in mind, he/she is not the only one who will be making the hiring decision!

I hear often “I don’t need a resume; everyone knows me” – that is all well and good – but it is a different world than it was prior to 2008; additionally, this type of attitude displays a lack of professionalism: resumes are a part of the interviewing process-- and this process will never go away!

A resume is meant to provide hiring managers an overview of your Career Success and provide some KEY Answers in short order (it only takes 5 SECONDS for a decision to be made: pursue or pitch):

- Why should they “dig” deeper into your career history?

- What problems will you be able to solve?

- What you can bring to the table?

- Why should they hire YOU?

Your resume is your marketing tool! Hiring managers are keying in on detailed examples of your past performance – your resume MUST reflect this. They are used to screen people out rather than screen them in – so your resume must be all things to all people!

Where to start: Begin by examining past performance and choose key points to demonstrate via your resume – this will empower you to be a strong potential Candidate.

Keep in mind your resume is a direct reflection of you!

- Your resume must be all things to all people-

- Your resume must be easy to read and understand and have a universal appeal-

- Your resume must portray you as a problem solver

Hiring managers ARE NOT going to bother reading your resume if it’s:

- Sloppy

- Unorganized

- Not updated (all roles to date must be included)

- Unformatted or in old formatting (do not use .txt!)

Your goal is to catch the eye of the reader with fancy fonts, jazzy layouts and exciting but easy to understand language (not so for resumes to be uploaded – very different)

Feel free to contact us for more insight and tips!

Emily Fitzpatrick

Sr. Recruiter

Recruiters International, Inc.

Phone: 954-885-9241

Cell: 954-612-0567

emily@riirecruit.com

Invite me to Connect on LinkedIn

www.linkedin.com/pub/emily-fitzpatrick/4/671/76

Also follow us on Twitter #RIIINFO

Career Crossroads Previous Columns

http://www.leasingnews.org/Conscious-Top%20Stories/crossroad.html

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

Broker/Lessor Relationship Manager www.finpac.com |

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

Top Stories May 6-May 9

(You May Have Missed)

Here are the top stories opened by readers:

(1) Archives---May 9, 2000

---Bad News from Cindy Spurdle,

Former Executive Director of NAELB---

http://leasingnews.org/archives/May2013/5_09.htm#archives

(2) Newport Financial Partners, Newport Beach, California

Bulletin Board Complaint ---Update

http://leasingnews.org/archives/May2013/5_06.htm#newport_complaint

(3) Marlin Leasing 1st Quarter Interesting Facts

From 10-Q First Quarter, March 31, 2013 SEC Filing

http://leasingnews.org/archives/May2013/5_09.htm#marlin

(4) Last to Be Sentenced in Operation Fleece?

By Kit Menkin

http://leasingnews.org/archives/May2013/5_09.htm#last

(5) Leasing 102 by Mr. Terry Winders, CLP

“How to Sell Yourself”

http://leasingnews.org/archives/May2013/5_06.htm#sell

(6) Sterling Financial Corporation & Commerce National Bank

Announce Agreement for Sterling to Acquire

Commerce National Bank

http://leasingnews.org/archives/May2013/5_06.htm#sterling

(Tie) (7) Companies who utilize Evergreen Clauses

for Extra Lease Payments

http://leasingnews.org/archives/May2013/5_09.htm#evergreen

(Tie) (7) New Hires---Promotions

http://leasingnews.org/archives/May2013/5_09.htm#hires

(8) Scrivener’s* Error Results in $950,000 Error for Bank

(*Someone employed to make written copies of documents)

By Tom McCurnin, Leasing News Legal News Editor

http://leasingnews.org/archives/May2013/5_06.htm#error

(9) California Case Provides New Remedies in Injunction

Re: Fair Credit Reporting Act

By Tom McCurnin, Leasing News Legal News Editor

http://leasingnews.org/archives/May2013/5_09.htm#california

(10) Bank of the Ozarks is the most active failed-bank bidder

By Aarti Kanjani and Robert Clark, SNL Financial

http://leasingnews.org/archives/May2013/5_06.htm#snl

[headlines]

--------------------------------------------------------------

Leasing Attorneys

| Birmingham, Alabama The lawyers of Marks & Weinberg, P.C. have over 30 years experience in dealing with virtually every type of equipment financing and are recognized throughout the industry for prompt, practical solutions and exemplary service. They offer cost-conscious, effective lease enforcement and good counsel. Email: Barry@leaselawyer.com Website: www.leaselawyers.com |

California, National: city: Riverside Ellen Stern - get results, reasonable pricing; numerous industry contacts, nearly 30 yrs exp.in SoCal, 20 yrs equip.: CFL license specialist, documentation, work-outs, litigated collections, recoveries; deal-maker. Email: leaselaw@msn.com |

||

|

Connecticut, Southern New England: EVANS, FELDMAN & BOYER, LLC Collections, litigation, documentation, portfolio sales and financing, bankruptcy. We represent many of the national and local leasing companies doing business in this state. Past chairman EAEL legal committee. Competitive rates. email: rcfeldman@snet.net |

||

| Los Angeles, Southern CA Seasoned attorney representing secured creditors in auto finance and truck/equipment lease industry. Bankruptcy and State Court litigation. Vincent V. Frounjian (818) 990-0605 or email: vvf@pacbell.net. |

Encino, California: Statewide “ELFA” |

||

Los Angeles, Statewide: CA. "ELFA" Aggressive creditors rights law firm specializing in equipment leasing handling collection matters on a contingency, fixed fee or hourly cbasis. email:RGarwacki@prodigy.net |

Los Angeles -statewide: CA "ELFA" |

||

Los Angeles- Statewide, CA Lawyer specializing in banking and leasing issues statewide. Documents and litigation. Tom McCurnin, Barton, Klugman & Oetting. Voice: (213) 617-6129 Cell:(213) 268-8291 Email: tmccurnin@bkolaw.com |

|||

Long Beach, CA |

Long Beach CA. |

||

Illinois Website: www.trabaris.com. Blog:http://www.trabaris.com/info/blog/ |

Law Firm - Service, Dallas, TX. "ELFA" Mayer regularly practices in leasing, secured financing, project development and finance and corporate finance. email: dmayer@pattonboggs.com Website: www.pattonboggs.com |

||

| National: The OMEGA Network Group-nationwide legal representation of small and mid ticket equipment lessors-flat fee bankruptcy & replevin, contingent collection, billable litigation (704-969-3280) tong_92@yahoo.com |

National: Coston & Rademacher: Business attorneys serving the lease-finance industry since 1980. Transactional, documentation, corporate/finance, workouts, litigation, bankruptcy, portfolio management. Chicago-based national practice. Jim Coston, CLP (Members: ELFA, NEFA). |

||

| St. Louis County , MO. - statewide: Schultz & Associates LLP., collections, negotiation, and litigation. Also register and pursue recovery on foreign judgments. Contingency and reasonable hourly rates. Ronald J. Eisenberg, Esq. (636) 537-4645 x108 reisenberg@sl-lawyers.com www.sl-lawyers.com |

NJ,De,Pa: Specializing in leased equipment/secured transactions. Collections, replevins/workouts reasonable rates. Sergio Scuteri/Capehart & Scratchard, PAsscuteri@capehart.com / www.capehart.com | ||

| New York and New Jersey Peretore & Peretore, P.C. documentation, portfolio purchase & sale, replevin, workouts, litigation, collection, bankruptcy. Aggressive. Over 25 years experience.www.peretore.com |

Thousand Oaks, California: |

|

[headlines]

--------------------------------------------------------------

Great Pyrenees/Labrador Retriever

Fayetteville, Arkansas Adopt-a-Dog

Shea

Pet ID: 867798

"Shea is a wonderful 9 month old Great Pyrenees/ Labrador pups at the Fayetteville Animal Shelter at 1640 Armstrong 444-3456. Mom was a full blooded working Pyrenees who guarding sheep and her pups were with her 24 x 7 and have inherited her skills. From one of our volunteers: I took Shea and Saul outside to a dog park. They immediately starting patrolling the perimeter and any sound, commotion or car in the area they walked over and stood and watched / patrolled. They need a working home and they need to be together. They are going to be fantastic dogs. They are still young enough you could still train them to any livestock or your family protector. They are calm, lovable and serious about their job."

479-444-3456

Fayetteville Animal Shelter

1640 S Armstrong Rd

Fayetteville, AR 72701

The Fayetteville Animal Shelter is located off Highway 16 (15th Street) in the Industrial Park. Go south on Armstrong Road, and we are the second left. You will see our blue paw print sign with a dog and cat.

We are open Monday through Friday from 10AM to 5:30PM and 10AM to 4PM on Saturday. The shelter is closed on Sunday.

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

Mortgages rise for 1st time since March

http://www.bankrate.com/finance/mortgages/mortgage-analysis.aspx?ic_id=Top_Financial%20News%20Center_link_1

http://www.usatoday.com/story/money/business/2013/05/12/usa-today-second-quarter-economic-survey/2150719/

[headlines]

--------------------------------------------------------------

---You May Have Missed

The Posture Guru of Silicon Valley

http://www.nytimes.com/2013/05/12/business/soothing-back-pain-by-learning-how-to-sit-again.html?ref=business

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

SparkPeople--Live Healthier and Longer

The Best Fat-Burning Advice

http://www.sparkpeople.com/resource/fitness_articles.asp?id=847

[headlines]

--------------------------------------------------------------

![]()

Baseball Poem

The Base Stealer

Poised between going on and back, pulled

Both ways taut like a tight-rope walker,

Fingertips pointing the opposites,

Now bouncing tiptoe like a dropped ball,

Or a kid skipping rope, come on, come on!

Running a scattering of steps sidewise,

How he teeters, skitters, tingles, teases,

Taunts them, hovers like an ecstatic bird,

He's only flirting, crowd him, crowd him,

Delicate, delicate, delicate, delicate - Now!

----Robert Francis

[headlines]

--------------------------------------------------------------

Sports Briefs----

Woods Holds On to Win Players as Garcia Implodes

http://www.nytimes.com/reuters/2013/05/12/sports/golf/12reuters-golf-pga-winner.html?hp&_r=0

NBA fines Thibodeau $35,000 for comments

http://www.chicagotribune.com/sports/basketball/bulls/chi-chicago-bulls-thibodeau-fined-4-20130512,0,2864859.story

Golden State Warriors beat San Antonio Spurs in overtime

http://www.contracostatimes.com/warriors/ci_23228220/golden-state-warriors-beat-san-antonio-spurs-overtime

Kaepernick watches B.J. Daniels shine; Baalke observes Okoye in action

http://blogs.sacbee.com/49ers/archives/2013/05/kaepernick-watches-bj-daniels-shine-baalke-observes-okoye-in-action.html

Maloofs have backup deal to keep control of Kings, sources say

http://www.sacbee.com/2013/05/11/5413485/maloofs-will-refuse-to-sell-to.html

[headlines]

--------------------------------------------------------------

![]()

California Nuts Briefs---

Bay Bridge rod troubles extend to base

http://www.sfgate.com/bayarea/article/Bay-Bridge-rod-troubles-extend-to-base-4508623.php

The changing San Francisco waterfront — who’s in charge?

http://blog.sfgate.com/johnking/2013/05/12/the-changing-san-francisco-waterfront-whos-in-charge/

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

Turn a Colorblind Eye to Your Spring Wine

http://www.nytimes.com/2013/05/15/dining/turn-a-colorblind-eye-to-your-spring-wine.html?ref=dining

Mendocino Pinot Noir Specialist Londer Vineyards Is Closing

http://www.winespectator.com/webfeature/show/id/48399

Historic Mayacamas wine estate changes hands

http://napavalleyregister.com/lifestyles/food-and-cooking/wine/historic-mayacamas-wine-estate-changes-hands/article_90c3dec0-b8d3-11e2-959d-0019bb2963f4.html

Penfolds releases Icon collection including 100 point 2008 Grange

http://www.harpers.co.uk/news/news-headlines/13830-penfolds-releases-icon-collection-including-100-point-2008-grange-

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1607- the first permanent English settlement was established in Jamestown , VA. One hundred and five from Blackwell , England , on three ships. Most of them were 'gentlemen adventurers," gentlemen who did not work and brought servants., quite British, you know. Captains John Smith and Christopher Newport were among the leaders of the group of royally chartered Virginia Company settlers who had traveled from Plymouth , England , in three small ships: Susan Constant, Goodspeed and Discovery. The colony was named after England 's King James I on this date.

1612-tobacco cultivation was undertaken at Jamestown , VA by John Rolfe, the future husband of Pocahontas, who had arrived with the Jamestown settlement. Rolfe was the first settler to come up with a method of curing tobacco, which made it possible grow tobacco drops for export to England . The smoking, chewing, and snuff became very popular and soon was the most important export to Europe . Nicotine made this not only popular, but a daily necessity. It was definitely a "cash crop" for the New World .

1846- although fighting had begun days earlier, Congress officially declared war on - Mexico on this date. The struggle cost the lives of 11,300 American soldiers and resulted in the annexation by the US of land that became pads of Oklahoma , New Mexico , Arizona , Nevada , California , Utah and Colorado . The war ended in 1848.

1864-the first soldier buried at Arlington National Cemetery was a Confederate soldier.

http://memory.loc.gov/ammem/today/may13.html

1908-President Theodore Roosevelt declares "Conservation is a nationa

duty." (lower half of http://memory.loc.gov/ammem/today/may13.html)

1911-birthday of pianist Maxine Sullivan, Homestead , PA.

http://www.harlem.org/people/sullivan.html

http://www.ddg.com/LIS/InfoDesignF96/Ismael/jazz/1940/sullivan.html

1912- jazz arranger and composer Gil Evans was born in Toronto. Evans, whose career was almost entirely in the US, first became known for his innovative writing for the Claude Thornhill orchestra in the 1940's. In the following decade, Evans collaborated with trumpeter Miles Davis for such classic jazz LPs as "Miles Ahead," "Porgy and Bess" and "Sketches of Spain." He died in Mexico on March 20th, 1988. He is my favorite jazz composer/arranger. I have all his records; every one.

http://www.artistdirect.com/music/artist/bio/0,,428387,00.html

?artist=Gil+Evans

http://www.miles-davis.com/GilEvans/

http://gilevans.free.fr/biographie_us/biographie.htm

http://www.nprjazz.org/feature/gevans.html

http://www.chass.utoronto.ca/~chambers/miles.html

http://www.culturekiosque.com/jazz/miles/rhemiles4.htm

http://www.pbs.org/jazz/biography/artist_id_evans_gil.htm

http://www.melmartin.com/html_pages/Articles/miles.html

http://www.walmart.com/catalog/product.gsp?product_id=1540795&

sourceid=0100000010991440602498

http://www.edkeane.com/About

%20the%20Artists/Miles%20Evans/Mile-Evans.htm

http://www.cd-music.org/music/51379Helen-Merrill-w-Gil-Evans.html

1914-Birthday of Joe Louis, world heavyweight boxing champion, 1937-49, nicknamed the "Brown Bomber, Joseph Louis Barrow was born near Lafayette, AL. He died Apr 12, 1981, at Las Vegas, NV. Burial at Arlington National Cemetery. (Louis's burial there, by presidential waiver, was the 39th exception ever to the eligibility rules for burial in Arlington National Cemetery.)

http://www.cmgww.com/sports/louis/louis.html

1923-birthday of Pianist Red Garland, Dallas, TX.

http://www.allaboutjazz.com/bios/rxgbio.htm

http://rollingstone.com/artists/default.asp?oid=7408

http://www.amazon.com/exec/obidos/tg/stores/artist/glance/-

/41495/103-9368180-9796616

1926--Birthday of Beatrice Arthur, U.S. actor and singer. BA won Tony for best supporting actress in Mame (1966). Her TV series Maude was a hit during the 1970s and she was one of the Golden Girls, another long running TV hit series.

1930 - A man was killed when caught in an open field during a hailstorm northwest of Lubbock TX. It was the first, and perhaps the only, authentic death by hail in U.S. weather records.

1933-birthday of saxophonist Buddy Catlett, Long Beach, CA

http://www.ponyboyrecords.com/files/nova/trio/nova_trio.html

http://members.aon.at/jazzclub-life-salzburg/images/Musiker/

http://www.oldpop.net/musics/Donna.htm catlett.htm

1938-- Louis Armstrong records "When the Saints Go Marching In"

1941-50s rock 'n' roll singer Ritchie Valens was born in Pacoima, California. He was signed by Del-Fi Records in 1958, and had three big hits that year with "Come On, Let's Go," "Donna" and "La Bamba." Valens was killed in a plane crash with Buddy Holly and the Big Bopper in February 1959. There was a resurgence of interest in Valens' music in 1987 with the release of the movie biography "La Bamba." He died "...the day music died." Feb.3,1954

http://www.fiftiesweb.com/crash.htm

http://www.oldpop.net/musics/Donna-RichieVallens(LosLobos).htm

http://www.geocities.com/roger-brasil/rock/la_bamba.mid

1943- General Sir Harold Alexander telegraphed Winston Churchill, who was in Washington attending a conference, "It is my duty to report that the Tunis campaign is over. All enemy resistance has ceased. We are masters of the North African shores." About 250,000 Germans and Italians surrendered in the last few days of the campaign. This Allied victory in North Africa helped open Mediterranean shipping lines.

1943-birthday of singer Mary Wells, probably best known for her song, "My Guy." She was one of the group of black artists of the 60's who helped end musical segregation by being played on white radio stations.

Mary Wells died July 26, 1992,at Los Angeles, California at the age of 49.

http://www.cmgww.com/music/wells/

1949---Top Hits

Cruising Down the River - The Russ Morgan Orchestra (vocal: The Skyliners)

Forever and Ever - Perry Como

Careless Hands - Mel Torme

Lovesick Blues - Hank Williams

1950- Stevie Wonder, whose real name is Steveland Morris Hardaway, was born in Saginaw, Michigan. He sang and played the harmonica so well that Ronnie White of the Miracles brought him to Motown records, where Berry Gordy signed him on the spot. Wonder's third single, "Fingertips-Part Two," shot to the top of the Billboard Hot 100 in the summer of 1963. Since then, Stevie Wonder has developed into one of the greatest pop composers and vocalists of our time. His songs, such as "For Once in My Life," "Signed, Sealed, Delivered, I'm Yours" and "You Are the Sunshine of My Life," appeal to a wide range of the public taste. Almost all of his albums have sold enough to qualify for gold records. The one notable exception was 1977's "Journey Through the Secret Life of Plants," a mostly instrumental album which failed to catch on with the public.

http://www.motowndiscography.com/pages/Artists/Stevie.html

http://www.stevie-wonder.com/

1950-The Birthday of the Prophet Muhammad: Mawlid Al Nabi. Different methods of recalculating the visibility of the new moon crescent at Mecca are used by different Muslim groups.

US date may vary.

1954- President Dwight Eisenhower signed legislation authorizing US-Canadian construction of a waterway that would make it possible for oceangoing ships to reach the Great Lakes.

1954 - "The Pajama Game" made its debut on Broadway in New York City at the St. James Theatre. Harold Prince produced "The Pajama Game", his first Broadway endeavor. The show ran for 1,063 performances. John Raitt and Janis Paige starred in the leading roles. Carol Haney came to national fame for her rendition of the song, "Steam Heat". The movie version also starred Raitt -- along with Doris Day.

1955-At tonight's show in Jacksonville, FL, Elvis Presley tells the girls who make up the majority of the 14,000-plus crowd that he'll "see (them) backstage." The crowd proceeds to do just that, ripping the King's clothes, causing Elvis' first-ever riot and, reportedly, convincing Tom Parker about Elvis' popularity once and for all.

1957---Top Hits

School Day - Chuck Berry

A White Sport Coat (And a Pink Carnation) - Marty Robbins

So Rare - Jimmy Dorsey

All Shook Up - Elvis Presley

1957--Elvis begins filming his third movie, Jailhouse Rock, in Hollywood.

1958-Stan Musial of the St. Louis Cardinals got the 3,000th hit of his career, a pinch-hit double off Moe Drabowsky of the Chicago Cubs. Musial finished his career in 1963 with 3,630 hits, 1,815 at home and an equal number on the road.

http://www.stan-musial.com/

1960-- The juvenile delinquent movie Platinum High School, starring Conway Twitty, opens in New York.

1965-- Elvis Presley's sixteenth movie, Tickle Me, premieres in Hollywood.

1965---Top Hits

Mrs. Brown You've Got a Lovely Daughter - Herman's Hermits

Count Me In - Gary Lewis & The Playboys

Ticket to Ride - The Beatles

Girl on the Billboard - Del Reeves

1967-Slugging outfielder Mickey Mantle of the New York Yankees hit the 500th home run of his career against Stu Miller of the Baltimore Orioles. The homer propelled the Yankees to a 6-5 victory. Mantle finished his career in 1968 with 536 home runs.

http://www.mickeymantle.org/

1969--DUNAGAN, KERN W. Medal of Honor

Rank and organization: Major, U.S. Army, Company A, 1st Battalion, 46th Infantry, Americal Division. Place and date: Quang Tin Province, Republic of Vietnam, 13 May 1969. Entered service at: Los Angeles, Calif. Born: 20 February 1934, Superior, Ariz. Citation: For conspicuous gallantry and intrepidity in action at the risk of his life above and beyond the call of duty. Maj. (then Capt.) Dunagan distinguished himself during the period May 13 and 14, 1969, while serving as commanding officer, Company A. On May 13, 1969, Maj. Dunagan was leading an attack to relieve pressure on the battalion's forward support base when his company came under intense fire from a well-entrenched enemy battalion. Despite continuous hostile fire from a numerically superior force, Maj. Dunagan repeatedly and fearlessly exposed himself in order to locate enemy positions, direct friendly supporting artillery, and position the men of his company. In the early evening, while directing an element of his unit into perimeter guard, he was seriously wounded during an enemy mortar attack, but he refused to leave the battlefield and continued to supervise the evacuation of dead and wounded and to lead his command in the difficult task of disengaging from an aggressive enemy. In spite of painful wounds and extreme fatigue, Maj. Dunagan risked heavy fire on 2 occasions to rescue critically wounded men. He was again seriously wounded. Undaunted, he continued to display outstanding courage, professional competence, and leadership and successfully extricated his command from its untenable position on the evening of May 14. Having maneuvered his command into contact with an adjacent friendly unit, he learned that a 6-man party from his company was under fire and had not reached the new perimeter. Maj. Dunagan unhesitatingly went back and searched for his men. Finding 1 soldier critically wounded, Maj. Dunagan, ignoring his wounds, lifted the man to his shoulders and carried him to the comparative safety of the friendly perimeter. Before permitting himself to be evacuated, he insured all of his wounded received emergency treatment and was removed from the area. Throughout the engagement, Maj. Dunagan's actions gave great inspiration to his men and were directly responsible for saving the lives of many of his fellow soldiers. Maj. Dunagan's extraordinary heroism above and beyond the call of duty, are in the highest traditions of the U.S. Army and reflect great credit on him, his unit, and the U.S. Army.

1970--WINDER, DAVID F. Medal of Honor

Rank and organization: Private First Class, U.S. Army, Headquarters and Headquarters Company, 3d Battalion, 1st Infantry, 11th Infantry Brigade, Americal Division. Place and date: Republic of Vietnam, 13 May 1970. Entered service at: Columbus, Ohio. Born: 10 August 1946, Edinboro, Pa. Citation: Pfc. Winder distinguished himself while serving in the Republic of Vietnam as a senior medical aid man with Company A. After moving through freshly cut rice paddies in search of a suspected company-size enemy force, the unit started a thorough search of the area. Suddenly they were engaged with intense automatic weapons and rocket propelled grenade fire by a well entrenched enemy force. Several friendly soldiers fell wounded in the initial contact and the unit was pinned down. Responding instantly to the cries of his wounded comrades, Pfc. Winder began maneuvering across approximately 100 meters of open, bullet-swept terrain toward the nearest casualty. Unarmed and crawling most of the distance, he was wounded by enemy fire before reaching his comrades. Despite his wounds and with great effort, Pfc. Winder reached the first casualty and administered medical aid. As he continued to crawl across the open terrain toward a second wounded soldier he was forced to stop when wounded a second time. Aroused by the cries of an injured comrade for aid, Pfc. Winder's great determination and sense of duty impelled him to move forward once again, despite his wounds, in a courageous attempt to reach and assist the injured man. After struggling to within 10 meters of the man, Pfc. Winder was mortally wounded. His dedication and sacrifice inspired his unit to initiate an aggressive counterassault which led to the defeat of the enemy. Pfc. Winder's conspicuous gallantry and intrepidity in action at the cost of his life were in keeping with the highest traditions of the military service and reflect great credit on him, his unit and the U.S. Army

1971 - Aretha Franklin, the 'Queen of Soul', received a gold record for her version of "Bridge over Troubled Water", originally a Paul Simon and Art Garfunkel tune.

http://webhome.globalserve.net/ebutler/

http://www.rollingstone.com/artists/default.asp?oid=457

1973---Top Hits

Tie a Yellow Ribbon Round the Ole Oak Tree - Dawn featuring Tony Orlando

You are the Sunshine of My Life - Stevie Wonder

Little Willy - The Sweet

Come Live with Me - Roy Clark

1973 - Tennis star Bobby Riggs defeated Margaret Court in a televised tennis match that was seen worldwide. He went on to face Billy Jean King, in a typical "Don King" hype, after appearing on many radio and television shows saying a man tennis player can always beat a woman tennis player. At that time Billy Jean King, his opponent was still in the closet, and she whipped his butt at the Houston Astrodome. The event allegedly brought women's tennis to the forefront as a competitive sport with a growing legion of fans. It certainly made Riggs a lot of money, plus put him on a circuit for more as the man for women to beat. Died Oct. 27,1995

http://www.washingtonpost.com/wp-srv/sports/longterm/

memories/1995/95pass5.htm

1978- Paul Anka opened a disco in Las Vegas named after his early gospel-disco number "Jubilation."

1981---Top Hits

Morning Train (Nine to Five) - Sheena Easton

Just the Two of Us - Grover Washington, Jr./Bill Withers

Bette Davis Eyes - Kim Carnes

Am I Losing You - Ronnie Milsap

1981 - A tornado 450 yards in width destroyed ninety percent of Emberson, TX. People did not see a tornado, but rather a wall of debris. Homes were leveled, a man in a bathtub was hurled a quarter of a mile, and a 1500 pound recreational vehicle was hurled 500 yards. Miraculously no deaths occurred in the tornado.

1982-The Chicago Cubs, charter members of the National League won the 8,000th game in their history, beating the Houston Astros in the Astrodome,5-0. the Cubs began their existence as the Chicago White Stockings in the National Association (1871, 1874-75) and moved to the National League in 1876. The team changed its name to the Colts in 1890, to the Orphans in 1898, and the Cubs in 1902.

1984 - "The Fantasticks", playing at the Sullivan Theatre in Greenwich Village in New York City, became the longest-running musical in theatre history with performance number 10,000 on this night. "The Fantasticks" opened on May 3, 1960.

1985-During the siege of the radical group MOVE at Philadelphia, PA, police n a helicopter reportedly dropped a bomb containing the powerful military plastic explosive C-4 on the building in which the group was housed. the bomb and the resulting fire left 11 persons dead (including four children) and destroyed 61 homes.

1985 - Tony Perez became the oldest major-league baseball player to hit a grand slam home run. Perez hit the grand slam for the Cincinnati Reds -- helping the Reds to a 7-3 win over the Houston Astros. Perez was just a month shy of his 43rd birthday when he connected for the big dinger...

1985 - 'The Boss', Bruce Springsteen, married actress/model Julianne Phillips in ceremonies in Lake Oswego, OR. The couple went their separate ways in 1989. Springsteen's hit, "I'm on Fire", was in the top ten when the couple tied the wedding knot. Springsteen remarried in June of 1991, this time to a member of his E Street Band, Patti Scialfa. Despite his popularity, Springsteen has never had a number one song. His closest to the top of the pop music charts was a four-week stay at number two with "Dancing in the Dark" (June/July, 1984). Springsteen has had 11 hits in the top ten.

http://www.brucespringsteen.net/

http://www.springstomania.com/content.html

http://www.nj.com/springsteen/

1989---Top Hits

I'll Be There for You - Bon Jovi

Real Love - Jody Watley

Forever Your Girl - Paula Abdul

Is It Still Over? - Randy Travis

1989 - Thunderstorms developing along a warm front produced severe weather in the Southern Plains Region during the afternoon and night. A thunderstorm at Killeen TX produced wind gusts to 95 mph damaging 200 helicopters at Fort Hood causing nearly 500 million dollars damage. Another thunderstorm produced softball size hail at Hodges TX.

1990 - Thunderstorms developing ahead of a cold front spawned ten tornadoes from eastern Wyoming to northern Kansas, including seven in western Nebraska. Thunderstorms forming ahead of a cold front in the eastern U.S. spawned five tornadoes from northeastern North Carolina to southern Pennsylvania. Thunderstorms over southeast Louisiana deluged the New Orleans area with four to eight inches of rain between 7 AM and Noon.

1991-A way ahead of its time, Apple introduced an improved version of its Macintosh system software, called System 7.0, on this day in 1991. The new system let all Macintoshes share files in a network without the intervention of a server, and it also introduced "balloon help"-pop-up text windows offering helpful hints.

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------