Connect with Leasing News ![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() |

| ![]() Search |

Search | ![]() Stress Release

Stress Release

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

Wednesday, May 22, 2013

![]()

Today's Equipment Leasing Headlines

Lessons/Law of Trade Secrets/If a salesperson!

What Lessor Can Do to Stop Trade Secret Theft

By Tom McCurnin

Classified Ads---Collections

Commonwealth Capital Answers

Finra Charges Misuse Leasing Funds

Lease Finance Industry Confidence Improves in May

By Kit Menkin

Classified Ads---Help Wanted

Marlin Leasing Officers Exercises Stock Options

Specialty Funding, Albuquerque, New Mexico joins

Companies who notify lessee in advance of lease expiration

Four New CLP's from First American Equipment Finance

Bentsen-Gregg named to new posts

Scania hosts Captives Forum at its Swedish HQ

by Alan Leesmith

Classified ads—Asset Management

Great Pyrenees/Labrador Retriever Mix

Chadds Ford, Pennsylvania Adopt-a-Dog

News Briefs---

Apple CEO Tim Cook stands up to senators on company's tax policies

JPMorgan Defeats Effort to Split Top 2 Jobs at Bank

GE Looks Like It’s Becoming the Shareholder-Friendly Company

Huntington Bank Receives Award for Service Excellence

Mom gushes over billion-dollar Tumblr baby

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

You May have Missed---

SparkPeople--Live Healthier and Longer

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release” and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send Leasing News to a colleague and ask them to subscribe.

We are free!

[headlines]

--------------------------------------------------------------

Lessons/Law of Trade Secrets/If a salesperson!

What Lessor Can Do to Stop Trade Secret Theft

By Tom McCurnin

Leasing News Legal News Editor

Balboa Capital Tagged for Stealing Corporate Trade

Secrets of TimePayment Systems

[Part Two Of Two Parts]

Phil Silva President Balboa Capital |

|

Patrick Ontal Vice-President, Sales Balboa Capital |

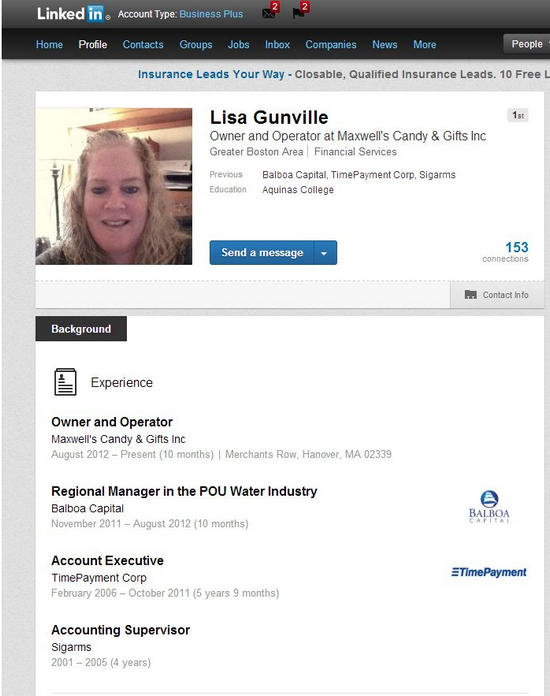

In the last edition of Leasing News, I described how Balboa Capital, Newport Beach, California, solicited and contacted its chief competitor’s leading employee, one Lisa Gargiulo formerly known as Lisa Gunville, to ply her away from TimePayment Systems, Burlington, Massachusetts. Gargiulo, after resignation and after acceptance of employment with Balboa Capital, Newport Beach, California, convinced her former co-worker at TimePayment Systems, one Jonathan McBride, to hack into the TimePayment computer system for her and surreptitiously email secret reports to her at Balboa Capital. The reports detailed thousands of customers and vendors, financial information, default rates, interest rates and contact names. *

All of these reports were disseminated to three of Balboa’s top officers. Balboa then issued a press release for the new hire, and started to work on getting the hacker to go over to the dark side.

In this part of the article, we learn how a computer forensic intelligent Boston lawyer for TimePayment Systems, Kent Sinclair, discovered the theft using sophisticated state of the art “E-Discovery.” Sinclair, in turn, prosecuted the case obtaining an injunction against Balboa, and favorable settlement for TimePayment Systems. Finally, this part of the article will discuss the law of trade secrets and how salesmen can legally contact former contacts, what companies can do to protect themselves from the theft of trade secrets, and for those companies hiring competitor’s employees, how they can insulate themselves from a pesky trade secrets lawsuit.

FACTS

In our last episode, Balboa Capital had completed the theft of the trade secrets and a key employee of its chief competitor. Now we will focus on how it was uncovered by computer forensic intelligent attorney Kent Sinclair.

TimePayment Systems Becomes Suspicious

TimePayment Systems became suspicious of Gargiulo and McBride and attorney Kent Sinclair examined Gargiulo’ s computer, and the computer activity of Gargiulo and McBride from October to December, 2011.

TimePayment noticed that right before she resigned, Gargiulo started downloading reports, including one such download the night before her interview with the president of Balboa Capital, Phil Silva. They also noticed that after she resigned, she tried to access the TimePayment Systems computer systems four times. Because she was close to TimePayment employee Jonathan McBride, they also looked at his download activity and noticed a large report downloaded and sent by his company email to his personal home email.

On December 23, 2011, TimePayment’s lawyer Kent Sinclair wrote Gargiulo a “cease and desist” letter. The letter informed Gargiulo that she had taken confidential trade secrets from TimePayment Systems, and demanded return of the information, as well as an inspection of her personal computers.

She immediately warned McBride that TimePayment Systems knew of the downloading and that he was going to get fired. In her deposition she stated:

“Q: Why did you warn [Mr. McBride] about the fact that he sent you a dealer list on October 25 was about to become public?

“A: Because I knew he was going to be fired.

“Q: Why did you know that?

“A: Because I would think that is a fireable offense that he sent that to me. “

(1)(page 31, Lisa Gargiulo deposition)

After the cease and desist letter, and while employed at Balboa, she also deleted her text messages to and from Mr. McBride (destruction of evidence), and then emailed Balboa Capital President Phil Silva about the cease and desist letter. Mr. Silva engaged counsel to handle the issue. In her deposition, Gargiulo implausibly denies discussing the stolen trade secrets with her boss Phil Silva on December 23 when discussing the cease and desist letter:

“Q: You’re speaking with the president of your employer, Balboa Capital on the phone about a cease and desist letter that makes specific allegations about [your] misappropriation of trade secrets, it is your testimony that the subject of whether or not you actually took confidential information form TimePayment never came up in the conversation?

“A: It could have. I cannot remember.”

(1) (Page 42, Lisa Gargiulo deposition))

Whether or not she took the reports would have been the first thing one would have discussed. Unless of course, Mr. Silva already had them. Certainly, Messrs. Patrick Ontal, vice-president of sales, and Chief Operating Officer Robert “Rob” Rasmussen had them, that much we do know.

While Gargiulo and Balboa Capital attempted to argue that the customer list was meaningless and “public knowledge,” that argument quickly went down the drain, with this deposition exchange between Gargiulo and TimePayment’s lawyer, Kent Sinclair:

“Q: You would agree with wouldn’t you that knowing the value of a competitor’s funded values is useful information to have?

“A: Yes, if it’s accurate.

“Q: You were well paid to develop those relationships?

“A: Yes

“Q: But you think they are yours for the taking?

“A: I think it was the easy way for me to contact these people…I could have found other ways.

“Q: But you decided to take the easy way?

“A: Yes

(1)(Page 75, Lisa Gargiulo deposition)

McBride resigned from TimePayment Systems in February 3, 2012, and sought employment from Balboa, but by that time, he was too hot of a commodity for Balboa to hire.

TimePayment filed suit against McBride two weeks later. The complaint is linked below. It was mediated and settled. TimePayment then filed suit against Balboa on March 12, 2012, and the complaint is also linked below.

(2)

TimePayment Systems sought a Temporary Restraining Order and Preliminary Injunction against Balboa, which was initially opposed by Balboa (on grounds that the information was readily available to anyone). However, once Gargiulo and McBride were deposed, TimePayment had Balboa cold. The injunction was stipulated to and case was settled on May 2012, just three months after it was filed. The settlement terms were confidential except for a permanent injunction against Lisa Gargiulo, McBride, and Balboa (3).

The settlement likely included the payment of TimePayment’s attorney and forensic expert’s fees, a permanent injunction prevent Balboa from contacting those names on the list, deletion of the names on the McBride reports, and a stiff six figure damage award. The original complaint was for a minimum of $200,000 plus attorney fees. (3)

The settlement includes a “non-disclosure” agreement, so what there is to go on are the facts from documents submitted that remain unsealed.

In Balboa Capital’s response to TimePayment, there were “Defendant without knowledge sufficient to either admit or deny allegations” over 68 times, denies 50 others but no actual response, and stipulated to authenticity of all the exhibits. (4)

The TimePayment presentation with over 30 exhibits in support of preliminary injunction, including the deposition of Lisa Gargiulo was quite compelling, but the main blow was the forensic expert of retrieving documents and email, with exhibits on all that Mr. Sinclair discovered from Gargiulo’s computer. (5)

In addition, the expertise of TimePayment attorney Kent Sinclair brought the case to a very speedy conclusion. Gargiulo and Balboa parted ways a few months later. So ultimately, what did she achieve by stealing those trade secrets? Nothing, except cost Balboa Capital a boatload of money.

(Lisa Gunville LinkedIn.com)

THE LAW OF TRADE SECRETS

Most States have enacted the Uniform Trade Secrets Act, which make it illegal to steal or possess the trade secrets of another company. What is a trade secret? A trade secret is any information that possesses economic value to the holder and is kept secret. While Gargiulo and Balboa Capital argued that customer lists, approval rates, financials, default rates and other information was either public or had no value, that argument is belied by Balboa’s attempt to secure it and common knowledge that such information would give a company a competitive advantage. There is also no question that TimePayment Systems vigorously tried to keep the information secret. So, I think it goes without question that the various reports given to Balboa were trade secrets.

Violation of the act can subject the thief to compensatory damages, lost profits, royalties, punitive damages, and even attorney fees. What if, the only appropriate legal target is the disloyal ex-employee, and you cannot prove any specific market harm caused by the misappropriation? Just because the target company cannot prove lost profits or any unfair gain by a competitor doesn’t mean it hasn’t suffered damage by the misappropriation. One federal appeals court has determined that the appropriate measure of damages in such a case was $735,000! Hallmark Cards v Murley No. 11-2855 (2013) In another case, Best Buy was tagged for $22 million in damages.

In additional to severe civil exposure, the taking of trade secrets is a crime. In one of California’s most famous trade secret criminal cases, U.S. v Noral, CR: 00237-EMC-1 (2013) just came back from the jury in April, 2013, and an executive recruiter was found guilty of hacking into his former employer’s computer system and obtaining customer lists, and is facing a five year prison sentence.

This raises the question of how a salesperson can exit a company without violating the Uniform Trade Secrets Act. The answer is that the salesperson does not have to get a lobotomy, he or she can make contact with all the contacts the employee had before, assuming there is not a non-solicitation agreement. The violation is taking the list, not the contact.

The company hiring a salesperson from a competitor should adopt certain policies which will insulate it from liability. First, new employees should be instructed to be “good leavers” from their old company –meaning that they should not take anything with them. Second, because offer letters can become litigation exhibits, the offer letter should instruct new hires not to bring any trade secrets of the former employer. Third, employee handbooks should contain similar provisions which prohibiting the possession of trade secrets. Finally, having such policies will enable the company to fire the offending employee immediately. I was curious why Balboa kept Ms. Gargiulo on another 8 months after her theft of trade secrets was uncovered.

While these policies are no guaranty that a trade secret lawsuit will not be filed, the policies will certainly lower the exposure of the company hiring a competitor’s salesperson.

LESSONS OF THE TIMEPAYMENT CASE

What are the lessons here? Well, it depends on the reader’s status.

If the Reader is a Salesperson:

First, if you think you are not going to get caught taking trade secrets, think again. Computer and cell phone forensic discovery is well developed, evidenced by the great job TimePayment’s lawyer did. If the reader is interested in how this is done, I authored an article on the subject two months ago, and the link is at the end of this article.

Second, there are serious consequences to theft of trade secrets. Do you think that downloading a confidential report is worth a few thousand dollars? Both salespersons were sued personally. Her employment at Balboa, for which she sold her soul, lasted only a few months. She now works for a candy store. Was it worth it?

Third, what does taking trade secrets really say about you, as an employee? Essentially you are stealing your employer’s property, a thief. Is that what you want your reputation to be? Really?

Fourth, there are legal ways to do this. The law does not require the salesman to get a lobotomy, and the salesman is free to contact all his or her prior contacts. I can’t see any reason why contacts information in your cell phone would not be portable. Just don’t steal paper.

The bottom line for salespersons is not to take short cuts. Don’t steal from your employer.

For the Lessor Trying to Stop Trade Secret Theft

First, follow TimePayment’s protocol and make it as difficult as possible to download reports. Some of the things a company can do include:

• Disable all USB ports on work stations, so all downloading had to be done by traceable email.

• Log and analyze all downloading activity.

• Use Microsoft Exchange to synchronize remote devices to the company server, so the company may read the employee’s email, even if deleted from the employee’s device.

• Convert all reports to pdf files so they can “read only” and encrypted with passwords. If passworded, would Balboa’s officers have still opened the file? I hope not.

• Make all terminals “dumb,” e.g., Windows is not loaded onto work stations, and instead, the workstations logon to the server and the employee runs Windows from the server location. This is what the defense department does.

• All employees should sign a confidentiality agreement.

• If the company has a BYOD policy, then consider giving that policy a fresh look. An article I drafted a few months ago is linked below

• Consider using a non-compete or non-solicitation agreement, but with national accounts, and some courts unwilling to enforce them on a national level, this may have limited utility. I’m not a big fan of these restrictions, because they enslave employees.

Second, follow TimePayment’s example and be aggressive in court. They really went after their two employees and Balboa, which will teach your existing employees and your competitors that there are big consequences to stealing trade secrets.

The bottom line to companies wanting to protect trade secrets is that the company must take certain steps to make them secret, and those steps will help the company uncover trade secret theft quickly.

If The Reader is a Company Which Wants to Raid a Competitor, Legally or Otherwise:

First, if offered confidential trade secret information by a prospective employee, run! If a prospective employee has stolen trade secrets from his or her old company, it is likely that that the employee will steal them from you, too.

Second, obtaining confidential trade secret information is a big deal, and could subject the company to compensatory damages, punitive damages, lost profits, royalties, and attorney fees. Is your company willing to take that risk for a few thousand contacts? I hope not.

Third, insulate the company from liability by not only making theft of trade secrets unacceptable, document the company’s policy in offer letters and employee handbooks. Of course, this presumes that your company wants to take the high road.

Fourth, tracing the theft of confidential information has suddenly become easier with the advent of computer forensic firms and smart phones. Companies should have in place strict policies regarding “Bring Your Own Mobile Device” (“BYOD”).

Fifth, if an allegation is made, and it turns out to have merit, do what Balboa did and quickly settle the case with a confidential settlement, hopefully before suit is filed and depositions are taken and made public.

Sixth,, putting aside the practicalities of getting caught, receiving stolen trade secret reports is wrong. Is that really the culture of your company? Do you actually want that kind of reputation amongst customers, vendors, and peers? I hope not.

---

(Coda: Boston attorney was so successful in this case, that he went to work for one of the country’s leading computer forensic firms, Stroz Frieberg, as a managing director:

www.strozfriedberg.com/category/professional_bio_id=214 )

-

Lisa Deposition

PDF/DepositionSilvaOntalRasmussen_52013.pdf

-

a. McBride Coplaint

b. Balboa Capital Complaint

PDF/TimepaymentMcBrideComplaint_5202013.pdf

PDF/TimepaymentMcBrideComplaint_5202013.pdf

c. Balboa Mediated

http://www.leasingnews.org/PDF/Mediation_5222013.pdf

d. McBride Mediated

http://www.leasingnews.org/PDF/McBrideSettlement_5222013.pdf

e. Stipulation of Dismissal

http://www.leasingnews.org/PDF/Stipulationdismissal_5222013.pdf

- Permanent injunction—Stipulated

PDF/PermanentInjunctionGargiulo_5222013.pdf

- Balboa Answers Allegations--Denies most

PDF/BalboaAnswersAllegations_5222013.pdf

- Forensic expert affidavit

PDF/Forensicsexpertaffidavit_5222013.pdf

*Balboa Capital Tagged for Stealing Corporate Trade

Secrets of TimePayment Systems—Part 1

By Tom McCurnin, Leasing News Legal Editor

archives/May2013/5_20.htm#balboa_stealing_secrets

Introduction

Balboa Capital Tagged for Stealing Corporate Trade

Secrets of TimePayment Systems

(E-Technology Changes Leasing Employment)

archives/May2013/5_17.htm#balboa_stealing

Related:

Does Your Company Have a Policy for

B.Y.O.D. Cell Phone Use

archives/May2013/5_17.htm#cellphone

E-Discovery Catches Up with Mobile Devices

/Apr2013/4_12.htm#ediscovery

Tom McCurnin is a partner at Barton, Klugman & Oetting in Los Angeles, California.

Tom McCurnin

Barton, Klugman & Oetting

350 South Grand Ave.

Suite 2200

Los Angeles, CA 90071

Direct Phone: (213) 617-6129

Cell (213) 268-8291

Email: tmccurnin@bkolaw.com

Visit our web site at www.bkolaw.com

Previous Tom McCurnin Articles:

http://www.leasingnews.org/Conscious-Top%20Stories/leasing_cases.html

Bookmark us

[headlines]

--------------------------------------------------------------

Classified Ads---Collections

(These ads are “free” to those seeking employment

or looking to improve their position)

Long Grove, Illinois Financial services professional with a proven track record of positively impacting corporate finances through effective management of cash flow, collections and financial assets. Strategic thinker capable of analyzing financial issues and processes in order to implement changes that improve efficiency and profit margins. Well-versed in all aspects of corporate financial affairs. roborgaard@aol.com | Resume |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

[headlines]

--------------------------------------------------------------

Commonwealth Capital Answers

Finra Charges Misuse Leasing Funds

The Financial Industry Regulatory Authority Inc. (Finra) filed a complaint against Commonwealth Capital Securities, Clearwater, Florida and Chadds Ford, Pennsylvania, for allegedly misusing $245,000 of investor money between December, 2008 and February, 2012. Kimberly Springsteen-Abbott, chief executive office and head of compliance, heads 22 registered representatives and conducts business in private placements and direct investments. Reportedly Commonwealth has distributed 13 equipment-leasing funds since 1978, raising more than $240 million in 12 to 36 month operating leases in 30 investment programs to thousands of investors.

According to Investment News, "The Finra complaint includes an exhibit of 27 pages of purchases from her and other company executives. It includes: $63.43 for a meal at a Hooter's restaurant in 2009; $1,971.11 for a family vacation in 2010 that included Ms. Springsteen-Abbott's husband, daughter, ex-son-in-law and two grandchildren at the Animal Kingdom Lodge in Orlando, Fla.; and $12,414 for a board meeting, also in 2010, at the Princeville St. Regis Hotel in Kauai, Hawaii.

"Last year, a sexual-discrimination suit was filed by a former Commonwealth Capital employee, Shannon Givler, who had contacted the Securities and Exchange Commission in 2010 as a whistle-blower.

"As part of the suit, which was filed in U.S. District Court in the Eastern District of Pennsylvania, she alleged that Ms. Springsteen-Abbott and other company executives “were misrepresenting investor return rates and misappropriating investor funds for lavish personal expenses.”

“Ms. Givler's attorney, William T. Wilson, said: ‘The case has been resolved,’ and Mr. Anderson, the general counsel for Commonwealth Capital, confirmed that the case had been settled.”

http://www.investmentnews.com/article/20130519/REG/305199983#

According to a statement issued by Commonwealth Capital Corp.:

"Ms. Springsteen-Abbott and CCSC have been and are absolutely committed to complying with all applicable statutes, rules, and regulations.

"Ms. Springsteen-Abbott and CCSC deny the allegations in the complaint concerning the misallocation of expenses. Although the FINRA staff raised questions during the examination concerning some of the expenses, in response to which Ms. Springsteen-Abbott directed that the allocation to the funds of most of those (and similar) expenses be reversed, even if she believed the expenses had been properly allocated to the funds, FINRA did not provide respondents with the list of expenses attached to the complaint, so respondents never had an opportunity to address those expenses. The list attached to the complaint includes expenses that Ms. Springsteen-Abbott believes were proper and were properly allocated to funds and expenses that had been allocated in error, but had already been adjusted and repaid to the affected funds. During the exam, based on conversations with FINRA, additional Written Supervisory Procedures were implemented to better document allocable expenses and approval procedures.

"With respect to the causes of action concerning the file memo that misdescribed the purpose of an $830.70 charge, the memo was prepared long before the FINRA audit, so clearly was not prepared for the FINRA audit. From the outset, the charge was allocated to the private parent leasing company, Commonwealth Capital Corp. ("CCC"), not to any of the funds, so there would have been no conceivable reason for Ms. Springsteen-Abbott to have falsified the memo. The misdescription was an innocent mistake, and, before FINRA filed the complaint, Ms. Springsteen-Abbott explained to the staff the circumstances she believes led to the mistake.

"In addition to the documentation Commonwealth believes it will be able to provide FINRA to support the expenses, it is important to note that the amount FINRA claims should not have been allocated to the funds pales in comparison to the self-initiated and voluntary financial support the funds received from CCC to which the Funds did not have a contractual right. Over five years, the Funds have received more than $2.6 million in financial support from CCC to which the funds were not entitled under their Operating Agreements or Limited Partnership Agreements. The voluntary financial support provided by CCC is comprised of waived fees and reimbursable expenses it was owed from the funds and capital contributions it made to the funds. In particular, since 2008, the funds have received $2,629,272 in such support as follows:

"Forgiveness of Reimbursable Expenses: $ 866,898

Waived Fees: $ 378,562

Capital Contributions: $1,383,812

"In addition to the financial support listed above, CCC has and continues to absorb 10% of all reimbursable expenses in the ordinary course of business. In short, even if FINRA's allegations had merit, Ms. Springsteen-Abbott and CCC believe the funds were not injured.

"Commonwealth would like to take this opportunity to clarify a statement made with regard to a claim brought by a former employee, which stated Commonwealth declined to comment on the allegations of the case. Both parties to the case are bound by a confidentiality agreement which prohibits them from discussing publicly any aspects of the lawsuit.

"Commonwealth has always viewed regulatory exams as a method of strengthening its processes and continues to implement those changes as a result of each exam. Ms. Springsteen-Abbott and CCSC intend to vigorously defend the proceeding, provide FINRA with a clearer understanding of the expenses at issue, and look forward to a fair resolution.

|

[headlines]

--------------------------------------------------------------

Equipment Lease Finance Industry Confidence Improves in May

By Kit Menkin

The Equipment Leasing & Finance Foundation reports the Equipment Finance Industry (MCI-EFI) confidence for May in the equipment finance market is 56.7, an increase from the April index of 54.0.

Many companies are becoming more aggressive, hiring more direct salesmen, as well as captive lessors compete for financing personnel in the market place. The independent broker market has not seen an influx as well-established guard their territory very tightly as well as develop more business loan connections.

Lessors are more optimistic despite the mixed economic message from Congress and the White House.

Aylin Cankardes

President, Rockwell Financial Group

“With strong liquidity in the market we are seeing lending extended to middle market credits again," Aylin Cankardes, President, Rockwell Financial Group, said " Lessees continue to renew leases but for shorter periods of time as they are now becoming more interested in financing capital equipment to replace existing assets.”

Valerie Hayes Jester

President, Brandywine Capital Associates, Inc.

“The industry continues to provide capital to fuel economic expansion," noted Valerie Hayes Jester, President, Brandywine Capital Associates, Inc. "We continue to think that the upswing in parts of the consumer economy will begin to impact the small businesses that have been reluctant to borrow for equipment needs.”

Russell Nelson, President

CoBank Farm Credit Leasing

“Continuation of low interest rates, and recent strength in the financial markets, housing and manufacturing sectors are encouraging increased capex and general optimism about the U.S. economy by individual customers and corporate CFOs." commented Russell Nelson, President, CoBank Farm Credit Leasing. "Growth potential for the industry throughout the remainder of 2013 should exceed earlier forecasts and could carryover to 2014.”

There remains a growing need to train new sales and operating personnel in this changing technological and accounting marketplace.

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

Please see our Job Wanted section for possible new employees

[headlines]

--------------------------------------------------------------

Marlin Leasing Officers Exercises Stock Options

Marlin Business Services Corp.

for Tuesday, May 21, 2013

End-of-day Price ($): 23.55

Change ($): -0.19

Change (%): -0.80

One Day Volume: 11,742

Day's High ($): 23.95

Day's Low ($): 23.44

Previous Close ($): 23.74

Exchange: NASDAQ

Periodically, when the timing is right meaning with the availability as well as a good selling price, key officers exercise the ability to improve their compensation with stock options, standard in the industry, definitely an incentive and reward for their contribution to the success of the company

5/16/2013

Daniel P. Dyer, Chief Executive Office

Sold 12,270 $23.60

Beneficially owned stock: 395,164

6/15/2013

George D. Pelose, Chief Operating Officer

Sold 13,059 $23.90

Beneficially owned stock: 178,156

Edward Siciliano, Chief Sales Officer

5/17/2013

Acquired 5,623 $9.52

Sold 5,523 $23.95

Sold 1,088 $23.96

Beneficially owned stock: 90,573

5/16/2013

Acquired 1,325 $14.37

Sold 1,325 $24.00

Acquired 377 $9.52

Sold 377 $24.00

There were other stock exercises in March, February, and January of this year:

http://www.snl.com/irweblinkx/insiders.aspx?iid=4089372

(This company appears in www.leasingcomplaints.com

http://leasingnews.org/archives/Apr2012/4_04.htm#marlin )

| Working Capital Loans for Small Businesses | |

Channel Partners is now offering a new Easy Rewards program that allows you to earn rewards on EVERY deal over $15,000 in EVERY state! |

|

[headlines]

--------------------------------------------------------------

Specialty Funding, Albuquerque, New Mexico joins

Companies who notify lessee in advance of lease expiration

Leasing News is proud to list Specialty Funding, Albuquerque, New Mexico, joining the "Companies who notify lessee in advance of lease expiration" group, and invites others also to join.

Specialty Funding Group Albuquerque, New Mexico Bob Underwood info@specialty-funding.com 505-797-7141 specialty-funding.com ELFA, NAELB, NAMB |

1998 35 |

9 |

Southwest |

10K |

Y |

Y |

N |

Y |

Y |

“As policy we notify the lessee of their options 90 days in advance of their lease term ending. We give them the last 60 days of their term to respond with their intentions. Should they fail to reach a decision or fail to respond to our request for end of term resolution we continue their contract on a month to month basis. This continues until they arrange a satisfactory termination or the FMV residual is satisfied.

“The same applies to our Vehicle Trac Lease program.”

Bob Underwood

President Specialty Leasing Group dba Specialty Funding

Full List:

http://www.leasingnews.org/Pages/lease_expiration.html

[headlines]

--------------------------------------------------------------

Four New CLP's from First American Equipment Finance

First American Equipment Finance, Fairpoint, New York, a City National Bank Company, brings four new Certified Leasing Professionals who have passed the exam.

The CLP designation identifies the individual as a knowledgeable professional to employers, clients, customers, and peers in the leasing industry. There are currently 173 Certified Lease Professionals in Good Standing.

Congratulations to:

Mike Bennett

Vice President

Project Manager

Courtney Dioguardi

Senior Vice President

Operations

TJ Flint

Assistant Vice President

Project Manager

Bill Guthrie

Vice President

Project Manager

"I feel the CLP designation sets me apart from others in my field and furthers my credibility with all those whom I work with," said Mark Bearden, CLP, Assistant Vice President, Syndications, First American Equipment Finance.

“The CLP process enabled me to further dedicate myself to the broad spectrum of leasing while also demonstrating the knowledge I’ve obtained throughout my career in this industry. Continual education and professional development is critical in a competitive workplace/industry, and the CLP designation allows you to display your commitment to those values”

Leasing Company Membership Count

- Financial Pacific Leasing (18)

- First American Equipment Finance (11)

- Orion First Financial (7)

- Arvest Equipment Finance (5)

- Bank of the West (5)

- Great American Insurance (5)

- ECS Financial Services (4)

-CLP Foundation Count

Why I Became a CLP---

http://www.leasingnews.org/CLP/Index.htm

[headlines]

--------------------------------------------------------------

Bentsen-Gregg named to new posts

Hon. Kenneth E. Bentsen, Jr.

Former Equipment Leasing and Finance Association president and US Representative Kenneth Bentsen, Jr. (D-Texas), has been named president of the Securities Industry and Financial Markets (SIFMA). He has been acting president and CEO since February, when former president and CEO Timothy Ryan left the trade group to run JPMorgan's regulatory affairs office. Reportedly SIFMA is one of Wall Street's largest lobbying trade associations.

SIFMA former President and CEO Timothy Ryan

New Chief Executive Officer is former U.S. Senator Judd Gregg (R-N.H.)

As the onetime ranking member of the Senate Banking, Housing and Urban Affairs Committee, he was reportedly a staunch defender of Wall Street and the financial sector throughout the 2008 financial crisis, helping to author the bill that bailed out the nation's largest banks. According to campaign records, the finance, insurance and real estate sector was a top contributor to his campaigns, donating more than $1 million since the 1992 election cycle.

American Banker reports, "Gregg served three terms as a Republican senator from New Hampshire and was a chairman of the Senate Budget Committee from 2005 through 2007. In 2009, he had reportedly accepted an offer from President Obama to become the next U.S. secretary of Commerce, but Gregg withdrew his nomination shortly afterward, citing disagreements with the administration over reforms to the census administration. Gregg did not seek re-election in 2010.

"Before joining the Senate, Gregg served two terms as New Hampshire's governor and four terms as a member of the U.S. House of Representatives. After leaving the Senate, he became an advisor to Goldman Sachs (GS).

"Bentsen had been Sifma's executive vice president of public policy and advocacy since 2009, before becoming interim CEO in February. He served as a Democratic congressman from Texas from 1995 through 2003, and was president of the Equipment Leasing and Finance Association before joining Sifma."

[headlines]

--------------------------------------------------------------

Scania hosts Captives Forum at its Swedish HQ

by Alan Leesmith

Members of The Captives Forum, the equipment manufacturers’ European trade association, held their second quarterly meeting of 2013 last week at the headquarters of Scania in Södertälje, just outside of Stockholm. Holding the meeting at that location emphasized the Forum’s deep rooted links to members manufacturing and sales parentage.

The meeting was a mix of presentations, discussions, social events, a factory tour and even an opportunity for all to try their hand at driving a Scania truck or bus. Add to that a three hour dinner cruise on Lake Mälaren on a warm sunny evening the night before and the whole event was a recipe for a highly successful meeting.

Chairman Elliot Lennick, commented, “Members consider the inclusion in our programme of opportunities to mix socially extremely important since it provides an opportunity to share their thoughts and challenges with colleagues in a similar manufacturing environment. The value of that should not be underestimated, given how much difference there is to working in a bank owned finance company.” The evening gave an ideal opportunity to welcome representatives from two new member companies and also to get to know several new representatives from existing members.

An early start the next day began with Scania Finance explain their business model and how it interfaced to the parent company’s business in order to assist increase their sales of trucks and buses.

Nils Jaeger, Vice-Chairman, explained “This is part of a regular series of presentations in which members are taking it in turn to explain the business models they use for their financing business, the particular challenges they face and how they deal with them. Although some member’s parent companies may compete, the finance companies do not as their operations are restricted to financing their parent companies products. All members recognize and accept that competitive issues must never be discussed.”

This was followed by welcoming Lars Bang and Kaupo Luhaäär from Nordea Finance who talked about the specific issues relevant to leasing in the Baltic and Scandinavian countries. They were already known to a number of members who deal with them on a regular basis. With the release by IASB and FASB of the Revised Exposure Draft for Leases on the same day as the meeting, it was inevitable that some time would be spent on that topic. The Boards’ discussions and decisions had been widely publicized during the review process and on that basis Ward van den Dungen, of consultancy firm IAA-Advisory, presented the latest expected situation and the specific implications for manufacturer’s finance companies. The fourth session of the day covered a range of topics of specific relevance to manufacturers and their captives.

The afternoon started with trip to the Scania driving circuit where members were able to experience driving Scania buses and trucks, including the largest models, fully loaded, and with trailers attached. Afterwards the group moved on to a tour of the Chassis Line, to see a production line that took seven hours to assemble a completed chassis. All trucks are made only to order and assembled by hand without robots.

The Forum’s Secretary, Alan Leesmith, commented that “Members had all felt that it had been very beneficial to get close to that sector of a business without which there would be no demand for captives and finance companies. There was unanimous agreement that the meeting had been a great success and as a result, this “hands on aspect” is something that we shall now target to repeat at least once each year. Given the very wide range of equipment our members manufacture this could lead to some further very interesting meetings.”

About Captives

The Trade Association of Manufacturers' Finance Companies is a not-for-profit company limited by guarantee. It was created to run the Captives Forum. The Captives Forum community is a coming together of Manufacturer owned finance companies whose main activity is to finance the acquisition of equipment, services or software for customers of the manufacturer. The ‘asset finance’ products range from equipment leasing to various types of ‘purchase/use over time’ products such as Hire purchase, Conditional Sale, operating leasing and rental. The Members are subsidiaries of a variety of global equipment manufacturers, whose aim is to assist those manufacturers in the financing of their products and to help sell more equipment.

Manufacturer owned Finance Companies with a European footprint have a dilemma as to how best to forge relationships within the Leasing and Asset Finance Industry. This is frequently done simply on a country by country basis via local Leasing Associations; however the Captives Forum solves the need for a “Pan European” solution enabling a coming together at the most senior level to discuss and express a European view. Quarterly meetings move around European capitals, reflecting the wide European membership. Meeting locations include; Brussels, London, Luxembourg, Paris and Stockholm.

The management of the Captives Forum is undertaken by IAA-Advisory. Alan Leesmith, IAA’s International Director, is the Captives Forum’s Secretary and Derek Soper is Advisor to the Captives Forum Board.

Alan Leesmith

alan.leesmith@captivesforum.org

Tel: +44 1444 417688

|

[headlines]

--------------------------------------------------------------

Classified ads—Asset Management

Leasing Industry Outsourcing

(Providing Services and Products)

Asset Management: Atlanta, GA |

Asset Management: Boston, MA Nationwide appraisals, remarketing, audits, inspections and more! Over 15-years industry experience and dedicated to deliver personal, prompt, professional services. Call Chris @ 508-785-1277 |

Asset Management: Minneapolis, MN |

Asset Management: Monroe, NC Recover a greater return on your investment. We specialize in the woodworking, pallet, sawmill and forestry industries. Carolinamachinerysales.com/ Melinda Meier (704)288-1904 x103 |

| Asset Management: Nationwide BUYER/LENDER BEWARE. Don't sign anything until Collateral Verifications Inc. goes onsite, knocks on the door and gets the facts. http://www.i-collateral.com Email: mark@i-collateral.com |

Nationwide |

Asset Management: NorthWest Sequent provides collateral recovery, remarketing, and storage services to lenders with assets located in the greater Pacific Northwest. Professional services at reasonable pricing. Contact rossr@sequentam.com |

Asset Management: Orange City, FL We help Lessors Liquidate un-wanted Assets valued at $750,000+. It's an effective method of Liquidating Assets such as Jets, Planes, Helicopters, Freighters, etc. Eric R. Sanders Tel 386-789-9441 www.ValuedAssetSales.com www.The-RandolphCapital.com EQPMNTLEASING@aol.com |

| Asset Storage/Re-Marketing: Ohio & surrounding states. Providing no cost warehousing, condition reports, digital photos and remarketing of off-lease forklifts & industrial equipment. NAFTA wide dealer network. Email to GCochran@OhioLift.com |  Asset Management Asset ManagementMelville, New York Auctions, Appraisals, National Repossessions. ALL asset classes. 20+ year team works for you. Spend less, Net More… Fast! Ed Castagna 516-229-1968 ecastagna@inplaceauction.com |

| Asset Management: South East US- AllState Asset Management Recovery, remarketing, inspections. 25 years experience, dedicated to deliver, prompt, professional services. Call Brian @ 704-671-2376 |

Asset Management: Global Specializing in Semiconductor and Electronic Test Equipment collateral. Lender services include Consignment Sales, Remarketing, Portfolio Purchases, Inspections, De-installation, Repairs and Warehousing. www.testequipmentconnection.com |

| Bulldog Asset Management provides recovery and remarketing services with a difference. Contingent repos, free storage and industry experts to remarket. Email:Jamie@bulldogasset.com www.bulldogasset.com |

Asset Management: Portsmouth, NH |

All "Outsourcing" Classified ads (advertisers are both requested and responsible to keep their free ads up to date:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing.htm

How to Post a free "Outsourcing" classified ad:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing-post.htm

John Kenny Receivables Management • Credit Investigations • Asset Searches • Skip-tracing • Third-party Commercial Collections john@jkrmdirect.com | ph 315-866-1167| www.jkrmdirect.com |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

Great Pyrenees/Labrador Retriever Mix

Chadds Ford, Pennsylvania Adopt-a-Dog

Jake

65 lbs.

Young

Male

Neutered

Up-to-date with routine shots

House trained

"Jake is a sweet Great Pyr mix who is in need of a home. He gets along with other dogs and likes to meet new people. Boyd weighs about 65 pounds. If you are interested in helping him, please submit an application.

Rescue Animal Placements (RAP), Chadds Ford, PA

please email: RescuePuppy@gmail.com

http://www.rescueanimalplacements.com/

Application

http://www.rescueanimalplacements.com/Application2AA.html

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

Apple CEO Tim Cook stands up to senators on company's tax policies

http://www.mercurynews.com/business/ci_23291853/apple-ceo-tim-cook-testifies-senators-tax-practices

http://finance.yahoo.com/news/irish-loophole-behind-apples-low-003322127.html

JPMorgan Defeats Effort to Split Top 2 Jobs at Bank

http://dealbook.nytimes.com/2013/05/21/jpmorgan-seen-to-defeat-effort-to-split-top-2-jobs-at-bank/?hp

General Electric Looks Like It’s Becoming the Shareholder-Friendly Company It Once Was

http://www.business2community.com/finance/general-electric-looks-like-its-becoming-the-shareholder-friendly-company-it-once-was-0500503

Huntington Bank Receives National Award for Export Service Excellence

http://www.marketwatch.com/story/huntington-bank-receives-national-award-for-export-service-excellence-2013-05-21

Mom gushes over billion-dollar Tumblr baby

html/businesstechnology/2021024095_tumblrceoxml.html

[headlines]

--------------------------------------------------------------

---You May Have Missed

Starbucks' Howard Schultz message to the restaurant industry

http://www.qsrmagazine.com/news/floor-howard-schultzs-balancing-act

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

SparkPeople--Live Healthier and Longer

10 Reasons You Eat When You're Not Actually Hungry

And What You Can Do About It!

http://www.sparkpeople.com/resource/nutrition_articles.asp?id=1660

[headlines]

--------------------------------------------------------------

How It All Started

Anonymous

It all started

when Pedro threw a no-hitter on Opening Day.

Nomar backed him up

with a triple play deep in the hole

and Manny Ramirez smashed

the first of 90 home runs.

Suddenly things got brighter.

Flowers sprang whole from the earth

and the cod swarmed to George's Bank.

The war ended. U.S. Marines

danced in the streets with handsome Fedayeen.

(Jerry Falwell married them off

while the Pope and the imams cheered.)

Israel and Palestine agreed

to share everything: beds, cities, streets,

temples and mosques,

falafel and coffee and tea.

Air pollution stopped

along with global warming and gum disease.

The Sox won it all of course,

beating the Yankees in three

and the Yankees in four

and the Yankees in five

(they lost one just to keep the Series alive).

Mia Hamm hit a grand slam

to put it away in the ninth.

Boston exploded with joy.

Babe Ruth signed the game-winning ball

and nobody sold it on E-bay.

That's how it all started.

At least, that's what I recall

[headlines]

--------------------------------------------------------------

Sports Briefs----

San Francisco wins bid for Super Bowl L

http://sports.yahoo.com/news/nfl--san-francisco-wins-bid-for-super-bowl-l-185056782.html

Bay Area to Host Super Bowl SF 49ers Press Release

newsantaclarastadium.com/headlines/bay-area-host-super-bowl-l

http://sports.yahoo.com/blogs/golf-devil-ball-golf/sergio-garcia-takes-spat-tiger-woods-ugly-place-033555597.html

Alex Smith practices pistol formation at Chiefs OTAs

http://www.sbnation.com/nfl/2013/5/20/4348648/alex-smith-pistol-formation-chiefs-otas

Prospective Kings owners are buying Downtown Plaza

http://www.sacbee.com/2013/05/21/5437872/prospective-kings-owners-are-buying.html

Pete Carroll on Seahawks' off-field problems: "It's real serious

http://seattletimes.com/html/seahawks/2021024133_seahawks21.html

Coach, start your pace car: Harbaugh will have ceremonial role at Indy 500

http://blog.sfgate.com/49ers/2013/05/21/coach-start-your-pace-car-harbaugh-will-have-ceremonial-role-at-indy-500/

Stan Musial slept here, and so can you — for $1.8 million

http://www.stltoday.com/news/local/stan-musial-slept-here-and-so-can-you-for-million/article_d369ea95-bd77-5723-b49e-33a0b94e6dc4.html

[headlines]

--------------------------------------------------------------

![]()

California Nuts Briefs---

One in six recent California law school grads can't find jobs

http://www.sacbee.com/2013/05/19/5432793/one-in-six-recent-california-law.html

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

Decanter World Wine Awards 2013 winners announced

http://www.decanter.com/news/wine-news/583904/decanter-world-wine-awards-2013-winners-announced

Moet & Chandon rolls out 2004 vintage of Dom Perignon

http://wine.drinks-business-review.com/news/moet-chandon-rolls-out-2004-vintage-of-dom-perignon-200513

Refreshing New Sangrias to Chase Away Bad Memories

http://www.nytimes.com/2013/05/22/dining/new-sangrias-that-refresh-and-revive.html?ref=dining&_r=0

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1798 -- Canada: Chippewa cede 28,000 acres in Ontario, including present-day site of Toronto, for 101 British pounds.

1802-Martha Washington, our first lady, passes away; quite a remarkable woman who was also “first in our hearts of her country”

http://memory.loc.gov/ammem/today/may22.html

1804 - The Lewis and Clark Expedition officially began as the Corps of Discovery departed from St. Charles, Missouri.

1807 -- Former Vice-President Aaron Burr on trial for "assembling an armed force...to seize the city of New Orleans...and to separate the Western from the Atlantic states."

1843-1,000 men, women, and children climbed aboard their wagons and steered their horses west out of the small town of Elm Grove, Missouri. The train comprised more than 100 wagons with a herd of 5,000 oxen and cattle trailing behind. Dr. Elijah White, a Presbyterian missionary who had made the trip the year before, served as guide. The first section of the Oregon Trail ran through the relatively flat country of the Great Plains. Obstacles were few, though the river crossings could be dangerous for wagons. The danger of Indian attacks was a small but genuine risk. To be on the safe side, the pioneers drew their wagons into a circle at night to create a makeshift stockade. If they feared Indians might raid their livestock-the Plains tribes valued the horses, though generally ignored the oxen-they would drive the animals into the enclosure. Although many neophyte pioneers believed Indians were their greatest threat, they quickly learned that they were more likely to be injured or killed by a host of more mundane causes. Obstacles included accidental discharge of firearms, falling off mules or horses, drowning in river crossings, and disease. After entering the mountains, the trail also became much more difficult, with steep ascents and descents over rocky terrain. The pioneers risked injury from overturned and runaway wagons.

The 1,000-person party that made the journey in 1843, the vast majority of pioneers on the trail survived to reach their destination in the fertile, well-watered land of western Oregon. The migration of 1844 was smaller than that of the previous season, but in 1845 it jumped to nearly 3,000. Thereafter, migration on the Oregon Trail was an annual event, although the practice of traveling in giant convoys of wagons gave way to many smaller bands of one or two-dozen wagons. The trail was heavily traveled until 1884, when the Union Pacific constructed a railway along the route.

1844- Mary Cassatt, only U.S. painter to exhibit with the French Impressionists. She is known for her paintings of women and children because, some say, such subject matter did not challenge any male egos and it was the price she had to pay to be accepted into the French impressionists school. In fact, she liked to paint women and children and it enabled her to expand in an un-crowded field. The natural posing of her subjects is still unsurpassed. She resided in France most of her life and in her late 50s began to have eye problems until forced to stop painting at age 70. Although often described as a "old maid," her diary reveals love affairs - some with women.

http://www.ibiblio.org/wm/paint/auth/cassatt/

http://www.metmuseum.org/explore/cassatt/html/indexl.html

http://www.boston.com/mfa/cassatt/

http://www.artcyclopedia.com/artists/cassatt_mary.html

http://www.nga.gov/collection/gallery/ggcassattptg/ggcassattptg-main1.html

1856 - Southern Congressman Preston Brooks savagely beats Northern Senator Charles Sumner in the halls of Congress as tensions rise over the expansion of slavery. Wielding the cane he used for injuries he incurred in a duel over a political debate in 1840, Brooks entered the Senate chamber and attacked Sumner at his desk, which was bolted to the floor. Sumner's legs were pinned by the desk so he could not escape the savage beating. It was not until other congressmen subdued Brooks that Sumner finally escaped. Brooks became an instant hero in the South, and supporters sent him many replacement canes. He was vilified in the North and became a symbol of the stereotypically inflexible, uncompromising representative of the slave power. The incident exemplified the growing hostility between the two camps in the prewar years. Sumner did not return to the Senate for three years while he recovered.

1861-the first Union solider killed in the Civil War was Bailey Thornsberry Brown, Company B, 2 nd West Virginia Volunteer Infantry. He was engaged in obtaining recruits and ambushed by Confederate pickets at Fetterman, near Grafton, WV.

http://www.callwva.com/facts/discover.cfm

1892--Birthday of Ralph Peer, the most notable talent scout of the 1920's, was born in Kansas City, Missouri. Peer, who discovered such artists as Jimmie Rodgers and the Carter Family, was appointed recording director for Okeh Records in 1920. He first began recording blues artists, but when the rival Victor Company scored a hit with Wendell Hall's hillbilly song, "It Ain't Gonna Rain No More," in 1923, he was authorized to organize field recording centers throughout the US South. Peer's first session with Fiddlin' John Carson proved to be a landmark in country music. By 1927, Peer was working for Victor records, and in August of that year assured himself a place in country music history by recording the first sessions of both Jimmie Rodgers and the Carter Family. In 1928, Peer formed the Southern Music Publishing Company, which continues today as the Peer-Southern Organization, a multi-million-dollar concern. Ralph Peer died in 1960.

1902-One of the world's deepest lakes, Crater Lake was first discovered in 1853. In 1885 William Gladstone Steele saw the lake and made it his personal goal to establish the lake and surrounding areas as a national park. His goal was attained 17 years late.

http://www.crater-lake.com/picture.htm

http://www.nps.gov/crla/

http://www.drizzle.com/~rdpayne/smithbros/

1902- Marie Poland Fish birthday, ichthyologist. At 21 she discovered where eels laid their eggs, a puzzle that for 2,000 years was one of the great mysteries of science. Eels are a staple food source in much of the world and the discovery enabled the enlargement of the crops. In later years she was awarded U.S. Navy's Distinguished Public Service Award for her work in oceanography and as a marine biologist. Her inventions enabled the Navy to distinguish between large schools of fish and enemy submarines with sonar.

http://www.gso.uri.edu/fishsounds/Notice.html

http://www.amazon.com/exec/obidos/ASIN/0801811309/fast-bkasin-20/

002-0667839-4443242

1911 - the temperature at Lewiston, Maine soared to 101 degrees. It was the hottest reading ever recorded in New England during the month of may.

1914-birthday of Herman (Sonny) Blout, better known as “Sun Ra,” a pioneering and innovative jazz musician whose avant garde performances mixed elements of theater with his surreal composition and performance style. Ra was born at Birmingham, Al, and died there May 30, 1993.

http://www.alamhof.org/sunra.htm

http://www.furious.com/perfect/sunra.html

1924-Birthday of French singer Charles Aznavour.

1928 –Singer Jackie Cain birthday.

http://www.fantasyjazz.com/catalog/cain_j_cat.html

http://www.jazzvalley.com/musician/jackie.cain

1930-Birthday of Harvey Bernard Milk, gay rights activist and San Francisco city Supervisor, (early nickname "Glimpy Milch, Woodmere, Long Island, New York.

http://www.imdb.com/title/tt1013753/

http://harveymilkstory.com/life.html

1934-Brithday of pianist and conductor Peter Nero.

1937-British jazz traditionalist Kenny Ball was born in Ilford, England. He had a string of hits during what was known as the "Traditional Jazz" (Dixieland) craze in Britain in the early 1960's. "Midnight in Moscow" was Ball's only hit in North America. A similar arrangement of the tune is used by Radio Moscow as its signature on English-language shortwave broadcasts.

1947-Congress approved the Truman Doctrine in order to contain Communism after World War II. It provided for US aid to Greece and Turkey. A corollary of this doctrine was the Marshall Plan, which began sending aid to war-torn European countries in 1948.

1950-- pop lyricist Bernie Taupin was born in Sleaford, England. Taupin has been closely linked throughout his career with rock star Elton John, and for most of the 1970's the two were a virtual hit factory, putting 23 singles in the Billboard Top 40, including five that made number one. Among the chart-toppers were "Crocodile Rock" and "Bennie and the Jets."

1950---Top Hits

My Foolish Heart - The Gordon Jenkins Orchestra (vocal: Eileen Wilson)

Bewitched - The Bill Snyder Orchestra

If I Knew You Were Comin' I'd've Baked a Cake - Eileen Barton

Birmingham Bounce - Red Foley

1952 - San Francisco's first Jazz Festival on Sunday Evening will be headlined by Luis armstrong and his troupe. Also on the program are the Dave Brubeck Quartet, Anita O'Day and the Four Freshman.

1953-Charlie Parker produces begins the recording session that produced some of his unforgettable albums with strings and voices This day he cut “Old Folks, “ “If I Love Again,” “ and “In the Still of the Night.” A jazz genius and performer. The background may sound “tinny” due to the recording abilities in those days, but Parker's alto saxophone solo's shine through today with brilliance and his melodies are quite apparent, something questioned in 1953. I listen to this album quite often and have never been bored hearing it again. In fact, it is really a classic, as each time I play it, I swear it is better and I hear something I did not before.

http://www.cmgww.com/music/parker/

http://www.kcpl.lib.mo.us/sc/bio/parker.htm

http://www.amazon.com/exec/obidos/ASIN/B0000046WK/inktomi-musicasin-20/

104-5094193-3483111

1955 – Comedian Jack Benny signed off his last live network radio broadcast after a run of 23 years. Joining Milton Berle and his best friend George Burns, his television shows became as popular as his radio shows, as he brought along with him his announcer Don Wilson; bandleader Phil Harris; Eddie ‘Rochester' Anderson; singer Dennis Day; and his wife, Mary Livingstone.

http://www.liketelevision.com/web1/classictv/jbenny/jbenny2.html

1955--Police in Bridgeport, Connecticut cancel a dance at the Ritz ballroom featuring Fats Domino. Authorities say the cancellation is because they discovered that "Rock and Roll dances might be featured" and justify their action by citing "a recent near riot at the New Haven Arena" where Rock and Roll dances were held.

1958-Jerry Lee Lewis arrives at London's Heathrow Airport to begin his first British tour, along with his new bride, 14 year old third cousin, Myra. Although advised not to mention it, Lewis answers all questions about his private life, truthfully. The public's shock over Lewis' marriage marks the start of a controversy which eventually ruins his career. The London Morning Star runs an editorial calling Lewis "an undesirable alien" and calls for his deportation, leading to his British tour being cancelled after just 3 of the scheduled 37 performances.

1961-the first revolving restaurant was dedicated, The Top of the Needle, located at the 500-foot level of the 500-foot-high steel and glass tower at the Century 21 exposition, Seattle, WA. It contained 260 seats and revolved 360 degrees in an hour. Above the restaurant was an observation deck and above that, a beacon. It was designed by John Graham and Company.

http://www.spaceneedle.com/

Today, there is the SpaceNeedle, privately owned and operated.

1958---Top Hits

All I Have to Do is Dream - The Everly Brothers

Return to Me - Dean Martin

Johnny B. Goode - Chuck Berry

Just Married - Marty Robbins

1958- singer Jerry Lee Lewis announced his marriage to his 14-year-old cousin, Myra, as he arrived in London. The resulting controversy caused Lewis to be booed off stage and forced the cancellation of all but three of the 37 scheduled concerts on his British tour. It would take years for Lewis's career to recover.

1963-Mickey Mantle of the New York Yankees hit a home run off Bill Fisher of the Kansas City Athletics as the Yankees beat the A's, 8-7. Mantle's blast caromed off the rooftop facade at Yankee Stadium and came within a few feet of becoming the only homerun ever hit out of that park.

1965-The Beatles attained their eighth Billboard number one hit with "Ticket To Ride", on which Paul McCartney, not George Harrison, played lead guitar.

1965 - The Beatles got their eighth consecutive number one hit as "Ticket to Ride" rode to the top of the singles list. The song topped the charts for one week.

1966- Bruce Springsteen and his band, the Castiles, recorded two songs co-written by Springsteen. The recordings, Springsteen's first, were never released. He and the Castiles did, however, perform several dates at New York's Cafe the following year.

1966---Top Hits

Monday Monday - The Mamas & The Papas

Rainy Day Women #12 & 35 - Bob Dylan

When a Man Loves a Woman - Percy Sledge

Distant Drums - Jim Reeves

1967-Premeire of “Mr. Rogers” on TV. “Won't You Be My Neighbor? “Presbyterian minister, Fred Rogers, hosted this long-running PBS children's program Puppets and human characters interacted in the neighborhood of make-believe. Rogers played the voices of many of the puppets and educated young viewers on a variety of important subjects. the last episodes of the program were filmed in 2001. Almost 2,000 episodes were produced over the show's history.

http://www.misterrogers.org/

1970 - The “Guess Who” from the Winnipeg, Canada area earned a gold record for both the album and single, "American Woman". It would be one of three million-seller awards for the group. Their other hits included, "These Eyes", "Laughing" and "No Sugar Tonight". The group, which dates back to 1963, disbanded in 1975, with several reunions since then.

http://www.canadianbands.com/btopage.html

http://home.golden.net/~flasher/

1972-President Richard Nixon became the first American president to visit Moscow. Four days later on May 26, Nixon and Soviet leader Leonid Brezhnev signed a t5reaty on antiballistic missile systems and an interim agreement on limitation of strategic missiles.

1972 - No. 1 Billboard Pop Hit: "Oh Girl," Chi-Lites.

1973 - President Nixon confessed his role in the Watergate cover-up.

1974---Top Hits

The Streak - Ray Stevens

Dancing Machine - The Jackson 5

The Entertainer - Marvin Hamlisch

Country Bumpkin - Cal Smith

1977-Janet Tuthrie became the first woman driver to qualify for the Indianapolis 500 with an average speed of more than 188 miles per hour. She lasted only 27 laps in the race, dropping out when her car broke a valve seal.

1979-Cheap Trick's "Live at Budokan" LP was certified gold in the US. It eventually sold more than one-million copies, delaying the release of the follow-up album, "Dream Police."

1982---Top Hits

Ebony and Ivory - Paul McCartney with Stevie Wonder

Don't Talk to Strangers - Rick Springfield

I've Never Been to Me - Charlene

Just to Satisfy You - Waylon & Willie

1985 - “Fortune” Magazine named Sears, Roebuck as the nation's largest retailer for the 21st year in a row.

1985 - No. 1 Billboard Pop Hit: "Everything She Wants," Wham!

1987 - A powerful (f4) tornado obliterated the small southwest Texas community of Saragosa, destroying 85 percent of the structures in the town. The tornado claimed 30 lives and injured 121 others in the town of only 183. The twister hurled trucks and automobiles through adobe and wood-frame homes with some blown over 500 feet. Many of the victims were parents or grandparents of children who died sheltering them from flying debris during a ceremony for head start for four-year-olds.

1990-The Cincinnati reds intentionally walked outfielder Andrew Dawson of the Chicago Cubs a record five times in a 16-inning game. Dawson's five free passes broke the record held by Roger Maris and Garry Templeton. Perhaps Barry Bonds will beat it this year.

1990-Microsoft unveiled Windows 3.0 at gala events in twenty cities around the world, linked by satellite to a theater in New York City. The show featured a speech by Bill Gates, as well as laser lights, videos, and surround sound. Microsoft spent $10 million publicizing the new release in what was generally regarded as the most expensive software introduction to date. While PIK, IMB,Apple and others tried to promote their operating system, even with 12 floppy disks, Microsoft sold three million copies of Windows 3.0 as it was quite “user friendly.”

1990---Top Hits

Vogue - Madonna

All I Wanna Do is Make Love to You - Heart

Hold On - Wilson Phillips

Walkin' Away - Clint Black

1992-After almost 30 years as host of the "Tonight" show, Johnny Carson hosted his last show. Carson became host of the late-night talk show, which began as a local New York program on Dumont than was purchased by NBC, and Steve Allen was the first on the network show. October 1,1962, Carson took over from Jack Paar with side kick Ed McMahon and Doc Severinsen, longtime band leader. In a split with the network, David Letterman went to CBS as Jay Leno was chosen to take over the spot.

1992-- Replacing Tom Runnells , Felipe Alou is named as the manager of the Expos. The eventual second-place Montreal club is 17-20 at the time the Colorado native firing.

1993-the first movie was broadcast on the Internet by its director David Blair. It was his cult science-fiction film “Wax: Or the Discovery of Television Among the Bees.” Blair uploaded the film in digital video format for viewing world-wide.

http://www.thekitchen.org/MovieCatalog/Titles/Wax.html

http://www.rc3.org/archive/inform/4/9.html

http://www.amazon.com/exec/obidos/ASIN/630303165X/inktomi-videoasin-20/

104-5094193-3483111

http://fusionanomaly.net/waxorthediscoveryoftelevisionamongthebees.html

1996- Garth Brooks celebrated his 60- millionth album sold with a 1960s theme party in Nashville. The Recording Industry Association of America said Brooks was the best-selling country artist of all-time and the second-highest selling artist ever in the US. Only the Beatles had sold more. Third place belongs to Billy Joel, who has not released a new song in a decade.

1997- The hit-making Fleetwood Mac lineup of Mick Fleetwood, John McVie, Christine McVie, Lindsey Buckingham and Stevie Nicks reunited for their first full-fledged public performance in 15 years. The show, on a soundstage at Warner Brothers studio in Burbank, California, was one of two taped for an MTV special and a live album. Nicks stopped the concert - twice - because she forgot the words to "Dreams," Fleetwood Mac's only number-one single.

2001--- For the second time this season, Barry Bonds homers in six consecutive games. His nine homers during this span games establishes a National League mark. Senators' slugger Frank Howard's 1968 feat of hitting 10 homers in six games major league is the major league record.

2003-- Arturo Moreno purchases the World Champion Angels from Walt Disney for $184 million to becoming the third owner in the 43-year history of the franchise. The 56-year-old outdoor advertising tycoon, who is a fourth-generation Mexican-American, is the first Hispanic to have a controlling interest in a major league club.

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------