Connect with Leasing News

![]()

![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() |

| ![]() Search |

Search | ![]() Stress Release

Stress Release

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Independent, unbiased and fair news about the Leasing Industry

kitmenkin@leasingnews.org

![]()

Monday, October 10, 2011

Today's Equipment Leasing Headlines

Chris Walker Chicago Marathon Results--“Thank You, Industry”

Hugh Swandel Raised Most Funds as Individual in Marathon

Swandel Elected President of NEFA

To Lead Association Out of Credit-Crisis Era

Classified Ads---Credit

Thank You, Rick Jones

Puget Sound Leasing Jury Verdict In---No One Wins

by Christopher Menkin

Only Eight Sentenced in Operation Lease Fleece--Why?

by Christopher Menkin

NAELB October 14-15 Conference Up-Date

Last Day to Be Included in Roster/Also Register OnLine

ELFA 50th Anniversary Conference, San Antonio Texas

Career Crossroad—“Unemployed—Lease Administration”

Classified Ads---Help Wanted

Leasing 102 by Mr. Terry Winders, CLP

“True Commercial Equipment Leasing”

Top Stories October 3--October 7

Bank Beat--Two Banks, 36 branches closed

SNL Financial Reports FDIC Branch Count Slumps/Deposits Jump

CLP Spotlight ---Steve Reid, CLP

Equirex acquires Bodkin and establishes Bennington Financial

ELFA’s Sutton to Keynote 2011 NEFA Expo in November

Seattle, Washington Adopt-a-Pet

News Briefs---

Steve Hudson Raising Capital to enter US Leasing Market

More About Hudson raising capital

Mortgage Rate Hits Historic Low

Regulators sue insiders at failed Alpharetta bank

Europe eyes buoying banks to weather debt storm

Germany and France Say Deal Near to Recapitalize Banks

In India, Starbucks set for cafe JV with Tatas

Koch Industries has pattern of violating ethics, environmental laws

Whitey Bulger’s life in exile

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

Paul McCartney, Nancy Shevell wed in London

You May have Missed---

Sports Briefs---

California Nuts Briefs---

Gimmie that wine---

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer. It is considered “bias” as it is the writer’s viewpoint.

John Kenny Receivables Management • Credit Investigations • Asset Searches • Skip-tracing • Third-party Commercial Collections john@jkrmdirect.com | ph 315-866-1167| www.jkrmdirect.com |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

Chris Walker Chicago Marathon Results—“Thank You, Industry”

Hugh Swandel Raised Most Funds as Individual in Marathon

On Friday night in Chicago the American Cancer Society hosted a Pasta dinner for the very large fund raising contingent set to run the Chicago Marathon and raise money for the fight against Cancer. The award for the most funds raised by an individual was presented to Hugh Swandel and he accepted on behalf of his colleagues in the leasing community who embraced an effort to honor our colleague Chris Walker and raise money in the battle to end Cancer.

From Hugh Swandel:

“It was a privilege to receive this award and truly and inspiration to hear from so many in the industry who supported this effort with donations. Many shared very personal stories about cancer battles and the scars it continues to leave on all of our lives. Donations came from far and wide and many from people who heard about the effort through Leasing News (Thank you Kit). This is a great industry that truly is a community that cares!

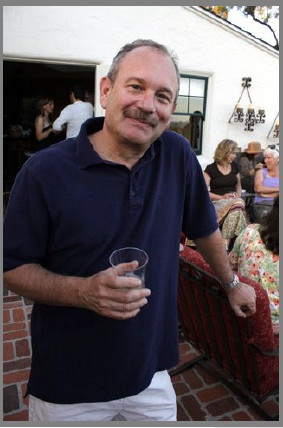

Chris Walker in better days, at his sister’s house in

Santa Barbara, California overlooking the Pacific.

"The Marathon itself was the toughest I have ever completed but the most satisfying. Conditions were elevated to Extreme as the Marathon started due to expected elevated temperatures.

"Thank you to all how donated and thanks to Leasing News to helping publish the cause."

Hugh Swandel

www.thealtagroup.com

204.477.0703 direct

204.996.4844 mobile

hswandel@thealtagroup.com

To View Hugh Swandel’s Page with Donor’s Listed:

http://main.acsevents.org/site/TR/DetermiNation/DNFY11IL?px=22131218&pg=personal&fr_id=35207#

Hugh Swandel Biography:

http://thealtagroup.com/north-america/about/hugh-swandel

[headlines]

--------------------------------------------------------------

#### Press Release############################

Swandel Elected President of NEFA

To Lead Association Out of Credit-Crisis Era

RENO, NEVADA, (OCT. 10, 2011)--Hugh Swandel, a managing director of The Alta Group, is the newly elected president of the National Equipment Finance Association’s (NEFA) board of directors. The NEFA is a U.S.-based association of equipment finance and leasing professionals. The announcement was made at NEFA’s annual funding conference held in Minneapolis, Minn. in late September.

Swandel heads the Canadian division for Alta, the global consultancy exclusively focused on equipment leasing and finance. He is a trusted advisor on business development, funding, and mergers and acquisition strategy.

Prior to joining The Alta Group, Swandel founded Swandel and Associates. Earlier in his career, he served as president and chief operations officer of Electronic Financial Group (EFG), a Canadian company that built and launched a multi-lending, web-based credit system. Swandel previously worked closely with Bruce Kropschot on mergers and acquisitions in North America and became involved with The Alta Group when Kropschot joined the consultancy.

In his new role as NEFA president, Swandel said he will help the association emerge from the credit crisis era. He also hopes to provide enhanced opportunities for the next generation of leaders while catering to the educational and networking needs of brokers and lessors who make up this community of business professionals.

“What makes NEFA unique,” said Swandel, “is how tight the community of smaller leasing companies and brokers are, and how dedicated they are to building the best companies possible.” Attendance at the last NEFA meeting was up 50 percent, he added.

Swandel has been an active member and board member of NEFA since it was formed from the merger of two regional leasing associations. Prior to that the consolidation, he was active in the UAEL. Swandel is also on the board of the Toronto-based Canadian Finance and Leasing Association, where he earned distinction as “Member of the Year” for his service work in 2006 and again in 2010. Swandel also is a member of the Equipment Leasing and Finance Association (ELFA), based in Washington, D.C., and has extensive contacts throughout North America.

“We are confident Hugh will provide the continuity of leadership and direction this organization needs,” said Gerry Egan, executive director of NEFA. “NEFA remains robust,” Egan added, “and its members are arranging for or providing funding and strategies for business growth, despite uncertainties in the global economy.”

#### Press Release #############################

[headlines]

--------------------------------------------------------------

Classified Ads--- Credit

(These ads are “free” to those seeking employment

or looking to improve their position)

Seasoned Small ticket Credit Manager with remote office based out of Chicago, IL willing to relocate seeks challenging high volume challenging position. Wgriffith61@yahoo.com | Resume |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

|

Please send to a colleague and ask them to subscribe.

We are Free!!!

[headlines]

--------------------------------------------------------------

Thank You, Rick Jones

Rick Jones, Associate Publisher, was responsible for Leasing News from September 20—October 5 and would like to thank him for a job very well done.

He is also the publisher of http://stanford.rivals.com/ and active in YahooSports.com.

Kit Menkin

[headlines]

--------------------------------------------------------------

Puget Sound Leasing Jury Verdict In---No One Wins

by Christopher Menkin

“Puget Sound Leasing president Louis Secord, Jr.,

and the future of our industry.”

Winter edition, 2000,

United Association of Equipment Leasing Newsline.

"First Sound Bank (OTC Bulletin Board: FSWA) (January 16, 2009) today announced that on January 14, 2009 it filed suit in federal court for fraud and breach of contract in connection with its March 1, 2008 purchase of certain assets from Puget Sound Leasing Co., Inc. The defendants to the suit are the sellers of the assets:

Larasco, Inc. (the business formerly known as Puget Sound Leasing Co., Inc.) and its owners, Richard Secord and Louis Secord.

"First Sound Bank's complaint alleges that the defendants violated federal and state securities laws by misrepresenting the extent to which the leases they sold to First Sound Bank were delinquent, and by failing to disclose Puget Sound Leasing Co., Inc. accounting irregularities that made the company appear more profitable than it was. The complaint also alleges that the defendants breached their contractual warranties to First Sound Bank."

http://www.leasingnews.org/archives/January%202009/01-16-09b.htm

Including the accusations from current and ex-employees regarding extra payments, applying lease payments, and changing purchase options, or the claim by First Sound Bank that Louis A. Secord and Richard A. Secord did not reveal the "real losses" in the sale of Larasco, the corporation owner of Puget Sound Leasing, the jury in First Sound Bank versus Larasco and both Secords, including Wells Fargo Equipment Finance versus Larasco and the Secords ruled in favor of First Sound Bank once "on its breach of contract claims against Larasco, Inc., Louis Secord, and Richard Secord based on the Asset Purchase Agreement" rewarding damages of $1,244,751.

However, they also ruled against the "breach of fiduciary duty" and "breach of contract claims" in favor of Larasco and the Secords, but they did rule in favor of Louis Secord breach of contract against First Sound Bank based on "employment agreement," awarding $2,077,767, and the same with Richard Secord, awarding $1,484,767.

They ruled against Wells Fargo claims in regard to lease purchase agreements and fraudulent misrepresentation claims, as well as "claim for indemnification based on personal guaranties.

They finally ruled against First Sound Bank on "its fraudulent transfer claim" against Larasco and the Secords.

So before the attorney fees, legal experts, accountants, deposition costs and other court case costs, not counting the time and energy of bank officers and personnel, after the damage claim: First Sound Bank owes the Secords $2,317,783.

Now before the Secords start celebrating, both had filed bankruptcy, as well as Larasco Corporation, with the claim they had disposed and hidden assets, which was never proven, and the bankruptcy trustee was informed legally of the jury verdict and awards to the Secords.

Now in the bankruptcy filing Louis Secord, Jr. lists $24.97 million in creditors ($13 million as possible First Sound Bank law suit) and $2.4 million in personal assets. Louis Secord reports income of $5,276 per month plus $3,029 in monthly Social security Payments for he and his two sons, Stone and Grey.

His brother indicates a monthly income of $6,035, but $12 million owed to creditors with $1.8 million exempt.

Whether the personal bankruptcies will be withdrawn, or if there are other law suits or pending lawsuits and their potential is not known.

Pugent Sound Leasing continues, and First Sound Bank has also survived.

During this period, the bank raised $3.2 million on an attempt for $6 million June 30, 2010. According to FDIC records, the bank lost slightly over $20 million year-end 2008 with $1.1 million in lease financing receivable charge offs, $300,000 commercial and industrial loans, $247,000 construction and land development. The previous year, the bank had made $1.5 million.

The bank saw a profit of $1.57 million in 2009.Charge offs in 2009 saw $5.3 million in lease financing receivables, $4.3 million in commercial and industrial loans, $504,000 in construction and land development.

2010 year-end showed a $7.9million loss. Charge offs in 2010 were $2.7 million in lease financing receivables, but $3.66 million in construction and land development, $2.1 in nonfarm nonresidential property and $3.95 million in commercial and industrial loans.

June 30, 2011 saw a $2.5 million loss with charge offs $470,000 in lease financing receivables, $1.5 million in nonfarm nonresidential properties, $493,000 commercial and industrial loans, and $239,000 in loans to individuals. Non-current loans were $12.86 million. Tier 1 risk-based capital ratio 5.41%. (A “C” grade).

Leasing News originally broke the story December, 31, 2008:“Puget Leasing, Bellevue, WA (12/08) Original owner no longer on bank board, questions being asked. (09/07) Sold to First Sound Bank. Bank president Don Hirtzel says Puget Sound Leasing generates roughly $8 million a month in new leases and has an average delinquency rate of less than 1 percent, it is reported.” Leasing News was told the board demanded he resign and leave the board. It seemed more a vendetta than a business judgment and whether the case is appealed, and more money washed down the drain, doesn't seem to matter as there were no winners in this case.

Perhaps the most revealing was the inside workings of Puget Sound Leasing according to depositions taken. Perhaps the practice is quite widespread in the industry among independent lessors:

“J’Accuse” by 12 employees of Puget Sound Leasing

http://www.leasingnews.org/archives/March%202009/03-09-09.htm#puget

Puget Sound Leasing Verdict:

http://leasingnews.org/PDF/PugetSoundVerdict_1011.pdf

Previous Stories:

http://www.leasingnews.org/Conscious-Top%20Stories/puget.html

[headlines]

--------------------------------------------------------------

Only Eight Sentenced in Operation Lease Fleece--Why?

by Christopher Menkin

(Copy of fax sent out to prospects)

Eight have been sentenced in what the FBI labeled "Operation Lease Fleece" in their arrest of 23 for their roles in a fraud scheme that allegedly caused more than $20 million in loses to several lending institutions that believed they were financing equipment leases. Many were disguised "sale/leasebacks" or leases that exceeded the "soft costs" such as software and installation. Many were on ghost equipment.

It appears the FBI and US Attorney General's Office considers this an "on going investigation."

It was not the dollar amount that grabbed everyone's attention, but the nabbing of the two bad boys in leasing, Mark McQuitty and Jim Raeder, late of CapitalWerks, along with Adam Zuckerman, the man accused of being a catalyst in the scheme. All three have pled guilty and await sentencing, since their court filings November 7, 2007; yes, going on for almost four years.

First before going into the list of the 19 not sentenced and the eight of the original 23 who have been sentence, there have been others added to the group since the date, and that appears to be the overall hold-up in all the up-dates to the story Leasing News has posted to date.

Neither the FBI nor Attorney General Offices provided any information and stated until the matter was complete, it was not their policy to comment on "on going investigations.” The information here comes from PACER, a public record of court documents, interviews, plus information from "first hand" and other sources.

Many of the cases have been moved to December 19, 2011, and those that are coming up this month and next will almost likely be moved forward to, as most of them have sealed documents in the cases; several have many sealed documents.

The reason I think the cases will get postponed again regards Chant & Sarkus Vartanian, who now have a status hearing February 27, 2012 with a trial set for March 6, 2012 before Judge Cormac J. Carney, who also is perhaps best known as a UCLA Football wide receiver Rose Bowl MVP.

Hon. Cormac J. Carney: Operation Lease Fleece judge:

http://www.leasingnews.org/archives/June%202008/06-27-08.htm#judge

Shant (Chant) Vartanian is president of ISystems Technology and Solutions, 3650 East Olympic Boulevard, Los Angeles, California, and his brother, Sarkus Vartanian, Vice-President, Marketing are reportedly still in business, as well as working with several Southern California leasing companies.

Several informed sources state the US Attorney General does not want to unseal the documents, and one can only guess it does not then help them with their case against the Vartanian, although in trials both sides need to present their case to the other side with evidence before the trial. Perhaps the real reason for the delay is the FBI has others they want to indict, part icularly one individual who was a long time salesman for CapitalWerks, and an "arrangement" has not been met with those who would testify.

One reader recently wrote Leasing News," I have some information with regards to Chant Vartanian (Isystems) who was connected to the "operation lease fleece" conducted by the FBI. Chant who was indicted back in Dec 2009 was still funding deals for a local broker who used to work for Capital Werks with Jim Raeder & Mark McQuitty.

“This broker was doing deals with Chant up until the day he was indicted for fraud. One of the transactions funded on Oct 30, 2009 and the other Dec 27, 2009....After the indictment the owner of this broker shop told his sales staff they needed to 'separate' themselves from I Systems fast. I would imagine if someone did some digging they would find ‘numerous’ transactions over the last 5 years this broker funneled through Isystems, this was 2 transactions within 60 days.

“I didn't want to get involved but this broker continues to give the industry a bad name and Ii think its time someone exposed him for the fraud he and his company really are. I have the name of the broker, the owner’s information, the name of the customer, date of application, date of funding, commissions paid and the amount of the deposit check collected... I don't know where to turn to get this information looked at so if you can direct me to the right place or know who I should contact that would be much appreciated...."

The information regarding John J. Callaghan of Warminster, Pennsylvania, one of the original 23 named has not been available. According to a well-informed source, it was Citibank officer John J. Callaghan involvement in the transactions that was brought to the FBI by Citibank.

These are changes in sentencing, chronologically, of those named (it should be noted the ages may not be correct, but are estimated from previous articles):

Mark McQuitty, 50, of CapitalWerks/Preferred Lease of Trabuco Canyon sentencing date continued January 30, 2012. It should be noted he has been arrested for three DUI's. He is reportedly been involved in the administration of the winding down of CapitalWerks.

Jim Raeder, 46, of CapitalWerks/Preferred Lease, formerly Mission Viejo, now living in Colorado, sentencing set for February 6, 2012. A condition of pretrial release was issued "...(a) do not use alcohol; (b) submit to drug and/or alcohol testing and outpatient treatment as directed by Pretrial Services; and (c) Comply with all conditions of probation for defendant's State of Colorado case." He has been recovering from cancer and reportedly is both writing a book, and making his living by buying assets off lease and then re-selling them.

Adam Zuckerman, 41, of BrickBanc, Laguna Beach sentencing set for October 24, 2011. I bet his sentencing will also be delayed. Mr. Zuckerman has been in the news in Southern California regarding an investment matter where he reportedly prevailed.

Brian Sime, 33, BrickBanc, Irvine also known as Joe Turner also known as Tonga sentencing continued until November, 28, 2011.

Leigh Dorand, 42, Tech Capital, Phoenix, Arizona sentencing continued until December 19, 2011.

Paul Arnold, 60, Brickbanc, Laguna Hills sentencing sent for December 19, 2011.

George Simon, 42, Advantage IT Solutions, Redondo Beach, sentencing sent for December, 19, 2011.

Kirk A. McMahan, 35, Brickbanc, Newport Beach sentencing continued until November 28, 2011.

Jeffrey Greenough, 52, Peniche, Laguna Beach sentencing continued to October 17, 2011.

Troy Worrell, 51, Peniche, Newport Beach, (many sealed documents, Oct. 3 sentencing, but seems to be continuing, no date given).

Geoffrey Silver, 39, of Silver Industries, Calabasas, sentencing continued until October 17, 2011.

Chance Nell Weaver, Axis Communications, Tarzana sentencing continued to January 23, 2012.

Michael Scott Grayson, Axis Communication, Tarzana sentencing continued February 6, 2012.

Michard Norris, 60, CapitalWerks/Preferred Lease, Los Angeles, sentencing sent for November 14, 2011.

Les Spitzer, 64, Pyramid Infinite, Grenada Hills, also known as Guy Amsalem continued until November 21, 2011.

Alphabetically, these people have already been sentenced:

James H Breedlove, 55, Santé Fe Equipment, Newport Beach: “12 months and 1 day imprisonment, with credit for time served. Pay $100 special assessment. Pay total restitution of $391,976.25. The defendant shall be held jointly and severally liable with convicted co-participants Mark McQuitty (Docket No. SACR 07-00236-CJC) and James Raeder (Docket No. SACR 07-00237-CJC) for the full amount of restitution ordered in this judgment. Interest on restitution ordered waived. 3 years supervised release under terms and conditions of US Probation Office and General Orders 318 and 01-05.”

Mark Castleman, 51, Industrial Information Systems, Chino Hills, indicted for mail fraud and November 19, 2008 pled guilty. “April 23, 2009. Hearing held before Judge Cormac J. Carney as to Defendant Mark P Castleman. Defendant Mark P Castleman (1), Count(s) 1, 1 day imprisonment, with credit for time served. Pay $100 special assessment. All fines are waived. 3 years supervised release under terms and conditions of US Probation Office and General Order 318. Bond Exonerated. Sixty (60) hours of community service with the first six months.

Douglas Cox, 42, CapitalWerks/Preferred Lease, Rancho Santa Margarita, placed on probation for 1 year under terms and conditions of US Probation Office and General Orders 318 and 01-05. Pay $100 special assessment

Harold Gold, 79, Leasing Services, Falmouth, Masschusetts, placed on probation for two years under terms and conditions of US Probation Office and General Orders 318 and 01-05. Pay $100 special assessment.

Lourey McComber, 57, Prescott Valley, Arizona, Peniche, appears to have had a medical problem, and last entry shows a Government motion to dismiss information without prejudice and signed by Judge Cormac J. Carney. There appears to be another entry made in Yuma, Arizona that was terminated.

Nohad Mousa, 44, Saut Wa Soora, Inc., Anaheim, pled guilty to 18:1341 MAIL FRAUD before Judge Cormac J. Carney. “JUDGMENT AND COMMITMENT by Judge Cormac J. Carney as to Defendant Nohad Mousa (1), Count(s) 1, 6 months imprisonment, time served. Pay $100 special assessment. Pay total restitution of $94,775. Interest on restitution ordered waived. Defendant shall be held jointly and severally liable with co-participant George Simon (Docket No 8:07CR00246) for the amount of restitution ordered in this judgment. All fines are waived. 3 years supervised release under terms and conditions of US Probation Office and General Orders 318 and 01-05. Signed by Judge Cormac J. Carney. “

Plea Agreement

http://leasingnews.org/PDF/NohadMousa.pdf

Leo J. Najera, 64, ECCI, Mission Vallejo, July 20th JUDGMENT AND COMMITMENT by Judge Cormac J. Carney as to Defendant Leo J Najera (1), Count(s) 1, Defendant is sentenced to 1 day imprisonment, which the Court determines has been served. Pay $100 special assessment. Pay total restitution of $396,251.22. The defendant shall be held jointly and severally liable with convicted co-participants Mark McQuitty (Docket No SACR 07-236-CJC) and James Raeder (Docket No SACR 07-237-CJC) for the full amount of restitution ordered in this judgment. Interest on restitution ordered waived. Placed on supervised release for 3 years under terms and conditions of US Probation Office and General Orders 318 and 01-05.

Anthony E. Watson, 65, CapitalWerks/Preferred Lease, Los Angeles, pled guilty before Judge Cormac J. Carney. 1 day imprisonment with credit for time served. Pay $100 special assessment. All fines are waived. 3 years supervised release under terms and conditions of US Probation Office and General Orders 05-02 and 01-05. (mt)

John J. Callaghan, 38, of Warminster, Pennsylvania, who worked at Citicapital, one of first 23 indicted, no record found.

John Budge, 38, of Sartell, Minnesota, who worked at Bach Business Credit, one of first 23 indicted, no record found.

Note: This list may not be complete as information gathered came from many different sources, including the original US Attorney General’s Press Release.

Previous Operation Lease Fleece Stories:

http://www.leasingnews.org/Conscious-Top%20Stories/Lease_Fleece.htm

((Please click on ad to learn more))

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

NAELB October 14-15 Conference Up-Date

Bob Fisher

Dwight Galloway

Six New Funders Joining the Presentation:

Ascentium Capital, LLC

Blue Bridge Financial, LLC

Facteon

First Federal Leasing

RLC Funding

TimePayment

Conference Story:

http://leasingnews.org/archives/Oct2011/10_06.htm#naelb

[headlines]

--------------------------------------------------------------

Last Day to Be Included in Roster/Also Register OnLine

ELFA 50th Anniversary Conference, San Antonio Texas

This is a business and networking and education conference you will not want to miss to survive and grow in this financial climate. It is also the 50th anniversary of the Equipment Leasing and Finance Association and all stops have been pulled out to make it not only one of the best, but one to remember.

The deadline for mail-in and on-line registration is today, Monday, October 10, 2011. Registrations will still be honored, but your name will not be included in the printed Attendee Roster. Registrations and substitutions can also be made onsite. Please note: there are no refunds of registration fees after this date.

Registration Forms:

http://www.elfaonline.org/pub/events/2011/ac/RegInfo.cfm

The fee includes all convention business sessions, social activities, breakfasts and luncheons.

Conference Brochure:

http://www.elfaonline.org/cvweb_elfa/cgi-bin/documentdll.dll/view?DOCUMENTNUM=321

Comprehensive personal property tax outsourcing services |

[headlines]

--------------------------------------------------------------

Career Crossroad—“Unemployed—Lease Administration”

Question:

Emily, I am unemployed … I was in a lease administration role before I was laid off. I am having a hard time finding a position in the Equipment Leasing Industry – what would you suggest?

Answer:

I am sorry to hear that you are having difficulty finding a new position … many are in the same predicament. Things seem to be picking up in the Leasing / Finance Industry, so hopefully you will be able to secure a new role soon.

I am confident that you have skills that are transferable from industry to industry – do some research in determining what other industries you may be interested in.

Additionally, you may want to develop your resume geared towards those industries; each version should focus on your transferable skills. This will lead to a few versions of your resume – that is okay.

In the meantime, brush up on your skills … e.g. take some classes, sign up for designations (CLP) within the industry – this will make you more marketable. Be open to consulting work or part-time opportunities which future employers will consider and admire.

Don’t forget to NETWORK with:

· Recruiters

· Staffing agencies (typically for consulting / temp work)

· Previous co-workers

· Previous managers

They may be aware of openings coming available …

I wish you luck and if you need more assistance, please feel free to contact me.

Emily Fitzpatrick

Sr. Recruiter

Recruiters International, Inc.

Phone: 954-885-9241

Cell: 954-612-0567

emily@riirecruit.com

www.riirecruit.com

[headlines]

--------------------------------------------------------------

NATIONWIDE SALES POSITIONS AVAILABLE |

Leasing Industry Help Wanted

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees

[headlines]

--------------------------------------------------------------

Leasing 102

by Mr. Terry Winders, CLP

True Commercial Equipment Leasing

What is a true lease? A question that involves a lot of “if’s”. Please remember that there are three sets of rules that govern leases:

-

Income tax

-

Legal

-

Accounting.

Therefore there are three answers to each set of lease parameters.

In this column, federal income tax requirements are explored. True leases are governed by the IRS to determine who has the right to capital recovery benefits (depreciation) or if the lessee has the right to deduct the rents?

The main criterion for income tax consideration revolves around the “intent” of the parties to the lease. A bargain purchase option shows intent to sell for less that its true value; hence the transaction is a security agreement/loan, often referred to as a “capital lease.”

Leasing the equipment for greater than 80% of the equipments useful life means the lessee has extracted most of the equipments use and has gained the right to ownership benefits through the payments of rent; hence it is a security agreement /loan. In addition the Lessor must show a meaningful residual value at lease termination. This does not mean they have to take a residual, but their records must show the assumed use value of the equipment at termination. Also if the rents and the purchase option equal the cash flow of a loan, then the economics prove it to be a loan.

The current 100% income tax depreciation benefit and section 179 benefits have confused the market place and a number of leasing companies have avoided the true lease market. In truth many lessees have opted out of the 100% depreciation and instead have assumed MACRS depreciation instead to avoid the tax hole in the next few years. Next year will be a strange year if congress takes away these tax incentives to reduce the deficit. True leasing will make a comeback.

Special arrangements have been made for business use auto and truck transportation equipment called a Terminal Rental Adjustment Clause (TRAC). So long as the lease meets the requirements of a true lease, the lessee can guarantee the residual by adding rent to cover any loss, on the sale of the equipment, or receiving a refund of rents paid equal to the value that exceeds the residual amount.

A non-profit “use” of the equipment requires a major loss in depreciation expense such as municipal leases and leases to the federal government and non-profits. No capital recovery benefits are allowed if the equipment is used outside the United States.

There are a few additional questions creeping into the discussions of how an equipment owner should show his “intent” in the lease, such as, is there an adjustment in the rent if the equipment is used harder than reported at lease commencement. How often does the Lessor inspect the equipment to make sure it is being used according to the lease agreement and is the maintenance being handled correctly? The loss of capital recovery benefits effects your lessee also--- as they lose the right to deduct the rents and must redo there income tax returns and assume depreciation.

For those who are moving from $1 option or bargain option leases to true leases with the advent of the changing accounting rules, it is wise for them to determine the full responsibilities of asset ownership. They also need to begin to review their lease agreement to include new language or forgotten language that covers all of the concerns of a true asset owner; such as the loss of the value of depreciation benefits, a change in corporate tax rates, return conditions, maintenance requirements and the quite enjoyment clause.

The last issue for consideration is the residual. The larger the residual, the more important the return conditions and the maintenance provisions. However, your return provisions cannot be so harsh, or the cost to return too high, to make even the fair market purchase option a bargain. This would disqualify the lease and make it a loan even though everything else met the rules.

Do your residual studies with the same interest that you give the credit issues and make sure that any fixed price purchase option can be supported as the future value and keep the booked residual value no greater than 80% of the Purchase option to avoid the economics test.

Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty-five years and can be reached at leaseconsulting@msn.com or 502-649-0448

He invites your questions and queries.

Previous #102 Columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.html

Mr. Terry Winders, CLP

December 12-14th The seminar will contain information on how to approach leasing in 2012 with the following subjects:

and a take home assignment to see how to propose a lease. Cost $450 per person sponsored by To request a complete outline contact: leaseconsulting@msn.com or for questions call 502-649-0448 |

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

Top Stories October 3--October 7

Here are the top ten stories opened by readers:

(1) Bob Fisher to attend NAELB Conference for

Ascentium Capital plus Dwight Galloway from RLC Leasing

http://leasingnews.org/archives/Oct2011/10_06.htm#naelb

(2) Banks and Creditors Could Just Cry

by Christopher Menkin

http://leasingnews.org/archives/Oct2011/10_06.htm#cry

(3) Career Crossroad

How do I know if it's right to move to another company?

http://leasingnews.org/archives/Oct2011/10_04.htm#crossroad

(4) Compensation Starts to Bounce Back

in Equipment Finance Industry

http://leasingnews.org/archives/Oct2011/10_04.htm#bounce

(5) Hugh Swandel This Sunday for Chris Walker

http://leasingnews.org/archives/Oct2011/10_06.htm#sunday

(6) Delivery and Acceptance Forms

Leasing 102 by Mr. Terry Winders, CLP

http://leasingnews.org/archives/Oct2011/10_04.htm#forms

(7) Classified Ads---Asset Management/Controller

http://leasingnews.org/archives/Oct2011/10_06.htm#ads_am

(8) New Hires---Promotions

http://leasingnews.org/archives/Oct2011/10_06.htm#hires

(9) Economy Shows Signs of Life on Manufacturing Rebound

http://leasingnews.org/archives/Oct2011/10_04.htm#signs

(10) Want to End the Year With More Revenue? Here's How!

Sales Make it Happen --- by Adrian Miller

http://leasingnews.org/archives/Oct2011/10_04.htm#revenue

[headlines]

--------------------------------------------------------------

Bank Beat--Two Banks, 36 branches closed

(The protestors against bank fees are just angry, and much of it is caused by banks that failed, such as Washington Mutual, who advertised on television "We aren't bankers." They gave away free checking accounts, overdraft charges, ATM fees, you name it, as they were raking it in real estate mortgages from people who should never have qualified. And now that the community banks have problems with real estate loans, what products are they left to stay in business? At one time they charged for checking, for overdraft, for services they offered, and to regulate that they can't charge for services rendered is un-American. The protestors should spend their energy looking for a job. Editor)

The 27 branches of Sun Security Bank, Ellington, Missouri were closed with Great Southern Bank, Springfield, Missouri, to assume all of the deposits. The bank was formed January 19, 1970 and when closed had 119 full time employees, compared to 2006 with 166 full time employees. By the dates of the opening of the offices, the bank started to expand in 2004 with ten new branches, five in 2005, and one in 2006. June 30, 2011 Tier 1 risk-based capital ratio: 2.36%

The bank went from a $10 million profit in 2006 to losing $17.5 million in 2008, all primarily from construction and land development loan charges offs, primarily from a couple of local developers.

Elmer Austermann, Jr.

Chairman, Sun Security

According to the St. Louis bizjournals.com, "Elmer Austermann, Jr., Sun’s chairman, controlled more than 90 percent of Sun Security’s shares (he lost a lot of money. editor). Shaun Hayes, a shareholder and president of the bank from 2008 to 2011, is facing a raft of lawsuits involving Sun and other banks. He is a defendant in 12 civil suits filed in St. Louis County Circuit Court this year. Another bank where Hayes has been a shareholder, Excel Bank in Sedalia, Mo., is one of those suing him.

"Recent troubles at Sun that have become public include two St. Charles County developers who pleaded guilty to bank fraud charges related to a development in St. Charles County. Thomas Colvin and Kristaq Gjordeni obtained a $5.1 million loan from Sun to purchase and develop 45 acres into 33 single-family lots at The Bluffs at Green Chutes. They began experiencing financial difficulties with their other projects and started using the Bluffs project loan to pay on unrelated loans and personal expenses, the U.S. attorney’s office said.

"In addition, BancorpSouth of Tupelo, Miss., has filed two lawsuits against Hayes, one seeking just shy of $1 million and another seeking $1.2 million."

(in millions, unless otherwise)

Net Equity |

|

| 2006 | $52.9 |

| 2007 | $48.8 |

| 2008 | $30.9 |

| 2009 | $20.9 |

| 2010 | $21.4 |

| 6/31 | $9.2 |

Profit |

|

| 2006 | $10 |

| 2007 | $458,000 |

| 2008 | -$17.5 |

| 2009 | -$13.5 |

| 2010 | $611,000 |

| 6/31 | -$15.1 |

Non-Current Loans |

|

| 2006 | $915,000 |

| 2007 | $17 |

| 2008 | $45.6 |

| 2009 | $25.5 |

| 2010 | $33.5 |

| 6/31 | $31.5 |

Charge Offs

2006 $229,000 ($243,000 construction andland development, recovered $19,000 C&I, consumer)

2007 $9.3 ($8.1 construction and land development, $1 nonfarm nonresidential, $8,000 consumer)

2008 $9.8 ($6.4 C&L, $2.2 nonfarm non res., $1.1 commercial and industrial, $9,000 consumer)

2009 $7.8 ($6.1 C&L, $755,000 nonfarm, $400,000 1-4 family, $300,000 farmland, $186,000 C&I)

2010 $4.0 ($2.9 C&L, $659,000 C&I, $384,000 1-4 family residential, recov. $54,000 nonfarm)

6/31 $9.1 ($7.2 C&L, $1.4 C&I, $427,000 1-4 family residential)

Construction and Land, 1-4 family multiple residential, Multiple Family Residential, Non-Farm Non-Residential loans.

As of June 30, 2011, Sun Security Bank had approximately $355.9 million in total assets and $290.4 million in total deposits. In addition to assuming all of the deposits of the failed bank, Great Southern Bank agreed to purchase essentially all of the assets.

The FDIC and Great Southern Bank entered into a loss-share transaction on $351.9 million of Sun Security Bank's assets.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $118.3 million.

http://www.fdic.gov/news/news/press/2011/pr11159.html

![]()

The six branches of The RiverBank, Wyoming, Minnesota were closed with Central Bank, Stillwater, Minnesota, to assume all of the deposits. The bank had 108 full time employees March 30, 2011 compared to 19 full time employees in 2006 and 115 full time employees in 2007 as this was the date Chisago State Bank, founded March 9, 1908 and the Bank of Osceola, founded in 1894 merged to become RiverBank. In 2007 opened four offices, one in in St. Crois, St. Croix Falls and Hudson. June 30, 2011 the bank had a Tier 1 risk-based capital ratio: 1.71%.

In 2009, the RiverBank received a cease-and-desist order from regulators, who were concerned about the high concentration of land and land-development loans the bank had made in outlying areas of the Twin Cities, as well as “operating with a board of directors that has failed to provide adequate supervision over management, operating with an inadequate level of capital, operating with an inadequate allowance for loans and lease losses, engaging in hazardous lending and lax collection practices and operating with inadequate policies to monitor and control asset growth.”

A history of the bank is still on line at press time:

http://www.theriverbank.com/aboutus/2-1.htm

Still on line is an independent site showing the bank owned real estate:

http://www.mw-property.com/

(in millions, unless otherwise)

Net Equity |

|

| 2006 | $12.4 |

| 2007 | $43.5 |

| 2008 | $42.3 |

| 2009 | $29.4 |

| 2010 | $14.9 |

| 6/31 | $7.0 |

Profit |

|

| 2006 | $1.0 |

| 2007 | $7.3 |

| 2008 | $539,000 |

| 2009 | -$19.8 |

| 2010 | -$14.8 |

| 6/31 | -$8.1 |

Non-Current Loans |

|

| 2006 | $544,000 |

| 2007 | $20 |

| 2008 | $31.6 |

| 2009 | $34.3 |

| 2010 | $35.7 |

| 6/31 | $41.9 |

Charge Offs

2006 $134,000 ($130,000 nonfarm non residential, $4,000 consumer loans)

2007 $714,000 ($219,000 commercial & industrial, $202,000 1-4 family, $105,000 indiv., $98,000

consumer)

2008 $4.0 ($2.6 C&L, $763,000 nonfarm, nonres., $362,000 1-4 family, $145,000 consumers)

2009 $16.0 ($8 C&L, $4.6 commercial/industrial, $1.3 1-4 fam., $903,000 nonfarm, $789,000 multifamily, $378,000 indiv.,)

2010 $13.6 ($9.0 C&L, $2.2 commercial/industrial, $801,000 nonfarm, $262,000 individual.

6/31 $1.4 ($479,000 1-4 family, $446,000 nonfarm-non res., $206,000 commercial/industrial)

Construction and Land, 1-4 family multiple residential, Multiple Family Residential, Non-Farm Non-Residential loans.

As of June 30, 2011, The RiverBank had approximately $417.4 million in total assets and $379.3 million in total deposits. In addition to assuming all of the deposits of the failed bank, Central Bank agreed to purchase essentially all of the assets.

The FDIC and Central Bank entered into a loss-share transaction on $339.3 million of The RiverBank's assets.

Central Bank will share in the losses on the asset pools covered under the loss-share agreement.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $71.4 million.

http://www.fdic.gov/news/news/press/2011/pr11158.html

List of Bank Failures:

http://www.fdic.gov/bank/individual/failed/banklist.html

Bank Beat:

http://www.leasingnews.org/Conscious-Top%20Stories/Bank_Beat.htm

[headlines]

--------------------------------------------------------------

SNL Financial Reports FDIC Branch Count Slumps/Deposits Jump

Key Points:

1. A preliminary look at the FDIC's 2011 Summary of Deposits data shows that the number of branches in the U.S. fell for the second consecutive year, while deposits jumped 7%.

2. According to the data, U.S. deposits rose to $8.25 trillion from 2010 to 2011, outstripping the 2% deposit growth that occurred between 2009 and 2010.

3. The number of U.S. branches declined to 98,202, down 315 from the 2010 count. This marks the second year of branch consolidation after years of expansion.

Click here for SNL Financial's ranking of the Top 15 Banks by Deposits:

http://www.snl.com/InteractiveX/article.aspx?CDID=A-13394978-12323&KPLT=2

[headlines]

--------------------------------------------------------------

CLP Spotlight ---Steve Reid, CLP

AN INTERVIEW WITH STEVE REID, CLP

Steve Reid, CLP

VP & Relationship Officer

Commerce National Bank

What is your favorite thing about the equipment finance industry?

Number one, it is the people, individuals I've met 30 years ago, and those that I have met within the past month. Our industry is comprised of many good people at all levels striving to succeed. The past three years have been unique and has offered challenges but the determined are still around and it is my pleasure to interact with them.

Background

After graduating from Cal State Northridge with a degree in Business, I started working at Burroughs selling what was referred to as a "mini-computer" for the purpose of doing billing and accounting functions. As the computer industry was rapidly changing, I looked for a change. Having utilized leasing in the selling of computers, I responded to an ad in the paper and went to work for Heritage Leasing Corporation in San Diego. After marketing on the streets" for a couple of companies I began working for a funding source, Cal Fed Credit in 1989 (aka California Thrift & Loan/Santa Barbara Bank & Trust then LEAF). After LEAF closed the doors, time was spent with an asset management company where I learned about the challenges of the back-end of deals "gone wrong." In June, an opportunity to return to the funding side of the business came about, and again I am enthusiastically working with brokers and lessors for Commerce National Bank.

Biggest Challenges

During the present time, we all (brokers, lessors and funding sources) face the same challenges, and that is finding enough quality transactions to meet our goals and objectives while maintaining an acceptable level of risk. What could be easier?

Interesting Hobby

As many people know my hobby is gold prospecting. Most people picture a person in high boots, faded Levis and a hat squatting next to a small creek in the mountains and swirling a pan. Living in Southern California, the majority of our prospecting is done in the Mojave Desert. To many, the desert is a giant barren sand box, but to those of us who wander the hills and valleys it is a wonderful area filled with wildlife and remnants of long ago residents. In the spring time the area is covered with blankets of yellow and purple flowers and little critters. Gold was discovered in the Mojave in the late1880's, and again worked during the depression of the 1930's and one can see the remnants of their activity scattered throughout the area. We study the geology and look for ancient stream beds. We move rocks and shovel dirt and sometimes swing a metal detector. What is exhilarating is being in the great outdoors, enjoying nature, being removed from civilization and enjoying the fellowship of other prospectors. We always find gold, though not the quantity we would like, but one never knows what the next shovel will hold.

Last Book I Read

The last book I read for pleasure was a book my wife bought while we were staying at a Bed & Breakfast in the town of Volcano, which is in the heart of the Mother Load. It is a 300 page diary by John Doble, a young man who came from the East coast through the Panama Jungles to strike it rich in the gold fields of California. This book was unusual as most miners, worked hard during the day and played harder at night. The majority of miners were not very literate and only a few kept any notes. John kept a daily diary describing in depth all facets of his life even down to the amount he spent on his meals, and who was wounded at one of the Spanish Dance houses after a small fracas. He never struck it rich and died of natural causes at the age of 38. His diary/writings were discovered by one of his distant relatives in the mid 1900's.

The last book I read for information was Decision Points. Whether you agreed with 'W" or not, this book paints a picture and provides an understanding of the decisions all Presidents must make when they occupy the oval office. What was intriguing is the amount of thought, turmoil, conflict and sacrifice that goes into most decisions. And in the end, half the population is not going to be happy just out of principle.

If you won $50 million in the lottery, what would you do with the money?

Federal and State taxes would take roughly 40% leaving me with about thirty million. Of the remainder, I would give 10% each to my daughter and son. Another 10% would go to charities, leaving about $20 million. Not being born with a silver spoon, I would enjoy life and live it to my new found means. My travels would be within the US, visiting most of the states and concentrating on their historical beginnings and sights. I'd fund some "extended family" vacations, and do my best to have life and the funds expire at the same time.

[headlines]

--------------------------------------------------------------

|

### Press Release ############################

Equirex acquires Bodkin and establishes Bennington Financial

Oakville, Larry Mlynowski, President and CEO of Equirex Leasing Corp., is pleased to announce the acquisition of the assets of Bodkin Capital Corporation and Bodkin Leasing Corporation. In line with a corporate strategy initiated in 2007, Mr. Mlynowski also announces the establishment of Bennington Financial Services Corp. to provide corporate support functions for the Equirex and Bodkin brands.

Larry Mlynowski, MBA

President & CEO

Mr. Mlynowski states, “This acquisition will make Bennington one of the largest independent commercial leasing companies in Canada. We will continue to provide the market with competitive and innovative leasing products with unique and creative solutions to assist new and existing businesses to finance their growth and their dreams”.

Equirex and Bodkin will each continue to service their clients in their particular market segments. Bennington will provide comprehensive corporate services for both brands in the areas of accounting, treasury, human resources, information technology, collections, asset recovery and legal support. According to Mr. Mlynowski, “This will allow Equirex and Bodkin to focus their resources on providing a superior leasing experience to their clients through a specialized team of highly experienced and creative associates”.

About Equirex Leasing Corp.

Equirex is a national, independent commercial equipment leasing company established in 1996. It is Canadian-owned and provides customized leasing solutions. Equirex specializes in the sub-prime market segment and is well-known for its unique products and services that are unmatched in the leasing industry. Equirex is “focused on solutions”.

About Bodkin Capital Corporation

Bodkin is one of Canada’s oldest equipment and vehicle leasing companies with more than 50 years of operation specializing in the prime and near-prime markets. President Paul Royds will continue at the helm of Bodkin. He notes that, “this affiliation will allow us to expand our ability to provide flexible leasing solutions to companies of all sizes”.

For further information contact:

Larry Mlynowski

President and Chief Executive Officer

Bennington Financial Services Corp.

Telephone: (905) 844-4424 ext. 224

Email: larrym@benningtonfsc.com

#### Press Release #############################

ELFA’s Sutton to Keynote 2011 NEFA Expo in November

Raleigh, NC – William G. Sutton, CAE, President and CEO of ELFA, will give the Opening Keynote Address at the 2011 Expo Regional Meeting of the National Equipment Finance Association, (NEFA), on November 7, at the Teaneck Marriott Glenpointe, in Teaneck, NJ.

Sutton will discuss the state of the equipment leasing and finance industry and its outlook for 2012, and provide his perspective on the Washington regulatory and political landscape.

“We’re very pleased to have Woody Sutton’s perspective on our industry,” said Gerry Egan, Executive Director of NEFA.

“Woody is an engaging presenter and has a unique combination of experiences from his distinguished Navy career where he rose to the rank of Rear Admiral, service as an aide to President Ronald Reagan, service in the U.S. Department of Commerce's International Trade Administration, and extensive service leading professional trade groups. His insights will be of special interest and value to our members at this time.”

NEFA’s Expo regional meeting continues a long tradition begun by EAEL, one of the predecessor organizations, along with UAEL, of today’s NEFA. “Many industry professionals, both from within our organization and from outside it, look forward to Expo every year and have for many years,” said Egan. “It was one of the first industry meetings I attended when I started in this business and that was more years ago than I sometimes care to think about!"

Expo kicks off with a reception the evening before, on Sunday, November 6th, then includes a full day of presentations and industry funding and services exhibits on Monday, the 7th. The full Agenda can be seen here: https://m360.nefassociation.org/frontend/event/schedule.aspx?EventId=35449.

About National Equipment Finance Association

The National Equipment Finance Association (NEFA) is a national association serving small to mid-sized independent equipment finance companies, lessors and brokers. NEFA is a strong association offering enhanced educational programs and premium networking opportunities with broad geographic and industry segment diversity. The mission of NEFA is to provide a forum for members to pursue personal and professional growth and promote ethical business practices through advocacy, networking and industry involvement. For more information, visit: www.NEFAssociation.org or call: 847-380-5050.

### Press Release ##############################

[headlines]

--------------------------------------------------------------

Seattle, Washington -- Adopt-a-Dog

Ashton

Name: Ashton

Breed: Schnauzer, Miniature / Mix

Gender: Male

Size: Small

Age: 3 years, 4 months

ID #: 13250655

Ashton is an adorable 3-year-old Miniature Schnauzer mix. He is incredibly cute, and he loves to chase balls and play with toys. Ashton also loves to play tug-of-war with his canine foster sibling, and enjoys the company of the resident cat in his foster home. Getting along with other animals seems to be easy for him! When it comes to human companionship, Ashton takes some time to warm up. Once he knows that you are someone he can trust, Ashton is one of the sweetest pups around!

Ashton is looking for an adopter he can depend on and would be happiest in a home with at least one other friendly dog or cat to show him the ropes and encourage him to play. Ashton's foster family reports that he has bonded with them and with his dog-walker, and that their relationships grow all the more each day! His foster family writes: "Ashton is a very curious, somewhat cautious boy. But he's really a big cuddle-bug, especially when it's bedtime. Ashton gets along well with our other dog and cat. He's potty trained and isn't destructive. We trust him fully alone in the house."

Ashton is currently in foster care and not at the shelter. To learn more about him call the Seattle Humane Society at (425)649-7563 or email adoption@seattlehumane.org.

As with all of our dogs, Ashton has been neutered, microchipped, vaccinated and behavior tested. He will go home with a certificate for an examination by a King County veterinarian and an identification tag. PLUS, most dog adoptions include six weeks of training in one of our on-campus dog behavior courses -- a great way to start off on the right paw!

Introduce to children over the age of 12. Resident dogs are required to visit with Ashton prior to adoption. Introduce to cats.

Open Seven Days a Week and New Extended Hours!

Thursday-Friday-Saturday: 11 a.m. - 8 p.m.

Sunday-Monday-Tuesday-Wednesday: 11a.m. - 6 p.m.

Seattle Humane Society

13212 SE Eastgate Way

Bellevue, WA 98005

Adoptions

Bellevue (425) 649-7563

Video:

http://www.youtube.com/watch?v=0PV_1BGd8hQ&feature=player_embedded#!

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

|

![]()

News Briefs---

Steve Hudson Raising Capital to enter US Leasing Market---Perhaps

http://business.financialpost.com/2011/10/06/a-new-chapter-for-hudson/

More About Hudson raising capital

http://leasingnews.org/PDF/SteveHudsonRaisingMoney_1011.pdf

Mortgage Rate Hits Historic Low

http://www.bankrate.com/finance/news/mortgage-rates-hit-another-record-low.aspx?ic_id=tsHed1

Regulators sue insiders at failed Alpharetta bank

http://www.ajc.com/business/regulators-sue-insiders-at-1196754.html

Europe eyes buoying banks to weather debt storm

http://www.chicagotribune.com/business/sns-rt-us-europe-bankstre797141-20111008,0,4887521.story

Germany and France Say Deal Near to Recapitalize Banks

http://www.nytimes.com/2011/10/10/business/3-countries-agree-on-bailout-of-european-bank.html?adxnnl=1&ref=business&adxnnlx=1318219879-SBNeIH59ZefGCsM+K773+Q

In India, Starbucks set for cafe JV with Tatas

http://timesofindia.indiatimes.com/business/india-business/-Starbucks-set-for-cafe-JV-with-Tatas/articleshow/10296554.cms

Koch Industries has pattern of violating ethics, environmental laws

http://seattletimes.nwsource.com/html/businesstechnology/2016406328_kochbribes09.html

Whitey Bulger’s life in exile

http://www.bostonglobe.com/metro/2011/10/08/whitey-bulger-exile/OSzdiDfmakqMxz9DMz24hM/story.xml

-----------------------------------------------------------------

You May Have Missed---

Paul McCartney, Nancy Shevell wed in London

http://www.usatoday.com/life/people/story/2011-10-09/paul-mccartney-wedding/50709532/1?csp=hf

Sports Briefs----

NBA negotiators meet in last-ditch effort

http://www.upi.com/Sports_News/2011/10/09/NBA-negotiators-meet-in-last-ditch-effort/UPI-15321318188461/

Fan throws hot dog at Tiger Woods at Frys.com Open

http://www.mercurynews.com/golf/ci_19077043

49ers off to best start since '02, rout Bucs 48-3

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2011/10/09/SP5S1LFGV5.DTL&type=sports

Chargers escape Tebow, Broncos with narrow win

http://www.signonsandiego.com/news/2011/oct/09/chargers-square-against-broncos/

At 4-0, Lions are making history and winning hearts in Detroit

http://www.washingtonpost.com/sports/redskins/at-4-0-lions-are-making-history-and-winning-hearts-in-detroit/2011/10/09/gIQANWAfYL_story.html

Slideshow: Oakland Raiders win for Al Davis

http://www.contracostatimes.com/news/ci_19076240

Green-Ellis runs for 2 TDs, Patriots beat Jets

http://www.usatoday.com/sports/football/nfl/story/2011-10-09/Jets-Patriots/50713476/1

The Huddle

http://content.usatoday.com/communities/thehuddle/index

![]()

California Nuts Briefs---

Gov. Jerry Brown signs farmworker bill

http://blogs.sacbee.com/capitolalertlatest/2011/10/jerry-brown-signs-farmworker-bill.html

![]()

“Gimme that Wine”

QR Codes Gain Popularity with Winemakers

http://leasingnews.org/PDF/QRCodesWine_1011.pdf

Napa Harvest Report: Sunshine, drying breezes needed

http://napavalleyregister.com/star/business/harvest-report-sunshine-drying-breezes-needed/article_1d7cc66a-efb8-11e0-bbd3-001cc4c002e0.html

Rains force California Central Coast growers scramble to harvest wine grapes

http://www.mercurynews.com/news/ci_19054843

Winery strategies change with grape supply

http://westernfarmpress.com/grapes/winery-strategies-change-grape-supply

Inside the Napa Estate of the Late Winemaker Robert Mondavi

http://curbed.com/archives/2011/10/07/inside-the-napa-estate-of-the-late-winemaker-robert-mondavi.php

[yellow tail] Toasts Its Role as America's 'Go-To' Wine

http://www.prnewswire.com/news-releases/yellow-tail-toasts-its-role-as-americas-go-to-wine-131210569.html

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

680 - Imam Hussein, grandson of Prophet Mohammed, was beheaded. He was killed by rival Muslim forces on the Karbala plain in modern day Iraq. He then became a saint to Shiite Muslims. Traditionalists and radical guerrillas alike commemorate his martyrdom as the ceremony of Ashura. The 10-day mourning period during the holy month of Muharram commemorates the deaths of Caliph Ali’s male relatives by Sunnis from Iraq.

732 - At Tours, France, Charles Martel killed Abd el-Rahman and halted the Muslim invasion of Europe. Islam's westward spread was stopped by the Franks at Poitiers.

1798 - Secretary Benjamin Stoddert, first Secretary of the Navy, sent the first instructions to cutters acting in cooperation with the Navy in support of the Quasi-War with France, via the various collectors of customs.

1804 - A famous snow hurricane occurred. The unusual coastal storm caused northerly gales from Maine to New Jersey. Heavy snow fell across New England, with three feet reported at the crest of the Green Mountains. A foot of snow was reported in the Berkshires of southern New England, at Goshen

1812---Birthday of Elizabeth Fries Lummis Ellet - U.S. author who was one of the first to record the lives of women. Her three volume Women of the American Revolution (vols 1 & 2 in 1848 and vol 3 in 1850) are masterpieces of research into primary sources. In all, 160 women are examined and saved for posterity. She wrote other books such as Domestic History of the American Revolution (which shows that real women were actually alive during those times ;-o) and Pioneer Women of the West. In all she wrote more than a dozen books that preserved a great deal of women's past

1845- the Naval academy was established at Windmill Point, Fort Severn , Annapolis , MD , on a nine-acre site. I t officially opened with 56 students. On July 1, 1850, the name was changed to the U.S. Naval Academy. The following year, the academy instituted a standard four-year program. From may 9, 1861 to September 9, 1865, while Maryland was part of the Confederacy, the academy was transferred to Newport , RI .

( lower half of: http://memory.loc.gov/ammem/today/oct10.html)

1850-The Chesapeake & Ohio Canal was completed and opened for business along its entire 184.5 mile length from Washington, DC to Cumberland, Maryland. Sections of the canal opened for navigation as they were completed; from

Georgetown

in Washington, DC to

Seneca

, Maryland in 1831; then to

Harpers Ferry

in 1833; to

Hancock

in 1839; and finally to

Cumberland

in 1850. Commerce traveled primarily on the water, not roads which were subject to weather and “poor” even in the best of times; and by wagon train.

http://memory.loc.gov/ammem/today/oct10.html

1855-A mob in Columbia hanged John S. Barclay. The sheriff there tried to save the unfortunate man from the noose, but was repulsed.

1874- Beatrice Moses Hinkle birthday- U.S. physician. As San Francisco 's city physician, she was the first U.S. woman to hold a public health post. She was one of the two physicians who established the nation's first psychotherapeutic clinic. She was among the earliest Jungian analysts in America , having rejected Freud with whom she'd personally studied. She was among the earliest practitioners of Jungian analysis in America , and contributed to the conceptual framework of the theory. Her Recreating of the Individual (1923) took a strong stand regarding women individuality. It was noted particularly for its chapters on women and artists.

http://www.webster.edu/~woolflm/hinkle.html

1881- Ethel Traphagen birthday- U.S. fashion designer, influential founder of Traphagen School of Fashion design.

http://askart.com/Biography.asp

http://costume.osu.edu/The_Collection/traphagencollection.htm

http://tirocchi.stg.brown.edu/essays/shaw_12.html

1886- Griswold Lorillard of Tuxedo Park, NY, fashioned the first tuxedo for men. Pierre Lorillard IV, heir to a tobacco fortune and the biggest landowner in town, asked his tailor to create four new formal black jackets modeled after the tailless red wool coats worn by English for hunters. Lorillard declined to wear the result, but his son Griswold Lorillard and three of his friends did along with waistcoats of scarlet satin, and the look caught on. Some say this is more fiction than fact, but history records the Tuxedo Club and Lorillard responding on wearing it that it was a Tuxedo.

http://www.invisibleheroes.com/hero.asp?issue=124

1900- Helen Hayes birthday - U.S. actress; the winner of every award possible for an actor on the stage, in the movies, and TV. She began her acting career at age 5 and continued it for more than 85 years winning Academy Awards, Tonys, and Emmys. She received The Medal of Freedom (1986), the Kennedy Center Honors (1981), and even had a Broadway theater was named after her. An award in her name established for achievement in professional theater. Died March 17, 1993

http://www.cmgww.com/stars/hayes/about/biography.html

http://www.cmgww.com/stars/hayes/

http://www.helenhayes.org/about/about_helen.html

http://www.stevemoore.addr.com/hayes.html

1902--- Kalamazoo, MI, mandolin maker Orville Gibson founds the Gibson Mandolin-Guitar Mfg. Co, Ltd. In 1936 it would create the first commercially successful electric guitar.

1905-birthday of Willie “The Devil” Wells, Baseball Hall of Fame short-stop born at Austin , TX . Wells is generally considered the greatest shortstop to play in the Negro Leagues. As manager of the Newark Eagles, he developed several players, who became major leaguers. Inducted into the Hall of Fame in 1997. Died at Austin , Jan 21, 1989..

1915- famous Count Basie trumpeter and soloist Harry “Sweets” Edison born, Columbus , Ohio

1917-October 10, Pianist/composer Thelonious Monk Birthday

http://www.monkinstitute.com/

1921-Birthday of bass player Monk Montgomery, Indianapolis , IL1920- Indians' Bill Wambsganss becomes the only player in World Series history to complete an unassisted triple play as he makes a leaping catch, steps on second base and then tags the runner from first base.

1923- In the first post season game ever played at Yankee Stadium, veteran Giant outfielder Casey Stengel breaks a 4-4 deadlock in the top of the ninth inning with an inside-the-park HR off Joe Bush. It is the first World Series game to be broadcast nationally

1928 - The temperature at Minneapolis, MN, reached 90 degrees, their latest such reading of record.

1928-Birthday of piano player Junior Mance, Chicago , IL

1933- Procter and Gamble, Cincinnati , OH developed the first synthetic laundry detergent, whose formula included a surfactant to emulsify dirt, and called it Deft. The first effective powdered detergent made for use in washing machines , and the first to contain a phosphate compound as a water softener, was Tide, developed by Procter and Gamble in 1946. 1943-Birthday of guitarist Steve Miller, Dallas , TX

1935-Premiere of Jazz opera Porgy and Bess, by George Gershwin. One of Gershwin's greatest works, the opera blended African American folk music, jazz, Tin Pan Alley, and classical styles. The show included the classic song "Summertime," among other classics, brought modern by Gil Evans and Miles Davis.

1939--The real Eleanor Rigby died in her sleep of unknown causes at the age of 44. The 1966 Beatles' song that featured her name wasn't really written about her, as Paul McCartney's first draft of the song named the character Miss Daisy Hawkins. Eleanor Rigby's tombstone was noticed in the 1980s in the graveyard of St. Peter's Parish Church in Woolton, Liverpool, a few feet from where McCartney and Lennon had met for the first time in 1957.

1941 - The destroyer USS Kearney is attacked by a German, submarine. In the attack, ten sailors are killed and scores injured. America suffers its first war casualties in World War II. Pearl Harbor is still seven weeks away.

1944-BONG, RICHARD 1. (Air Mission)

Rank and organization: Major, U.S. Army Air Corps. Place and date: Over Borneo and Leyte, 10 October to 15 November 1944. Entered service at: Poplar, Wis. Birth: Poplar, Wis. G.O. No.: 90, 8 December 1944. Citation: For conspicuous gallantry and intrepidity in action above and beyond the call of duty in the Southwest Pacific area from 10 October to 15 November 1944. Though assigned to duty as gunnery instructor and neither required nor expected to perform combat duty, Maj. Bong voluntarily and at his own urgent request engaged in repeated combat missions, including unusually hazardous sorties over Balikpapan, Borneo, and in the Leyte area of the Philippines. His aggressiveness and daring resulted in his shooting down 8 enemy airplanes during this period.

1944 - Nearly two hundred of Admiral Halsey's planes struck Naha, Okinawa's capital and principal city, in five separate waves. The city was almost totally devastated. The American war against Japan was coming inexorably closer to the Japanese homeland.

1948 -The largest crowd ever to attend an American League game, 86,288 fans, jam Cleveland's Municipal Stadium to witness Boston Brave hurler Warren Spahn beat Bob Feller and the Indians, 11-5 in Game 5 of the Fall Classic.

1950---Top Hits

Goodnight Irene - The Weavers

La Vie En Rose - Tony Martin

Bonaparte's Retreat - Kay Starr

I'm Moving On - Hank Snow

1953--Stan Freberg's "St. George and the Dragonet" hits #1

1956--Elvis Presley's "Love Me Tender" entered the Billboard chart for a 19 week stay. It was #1 for 5 of those weeks. The song, from Presley's first film of the same name, was adapted from the tune "Aura Lee", written in 1861.

1957- “Zorro” premiered on TV. Originally he appeared in a McCulley novel and several films. Don Diego de Ia Vega (Guy Williams), a Spanish nobleman, is summoned to California by his father, Don Alejandro (George J. Lewis), to fight for the people. Diego's alter ego is Zorro, a dashing and assertive defender of the people. My father Lawrence Menkin wrote several of these episodes. He was well known as a TV Western writer, serving as story editor for Wagon Train, writing for Bonanza, Death Valley Days, Cisco Kid, among many others. Although the last telecast of Zoro was Sept 24, 1959, the series reappeared in later years, first as a remake and then as a sequel, and once again was made as a movie, titled The Mask of Zorro, in 1998.

1958---Top Hits

It's All in the Game - Tommy Edwards

Rock-in Robin - Bobby Day

Tea for Two Cha-Cha - The Tommy Dorsey Orchestra

Bird Dog - The Everly Brothers

1959-- Paul McCartney helps to force the last non-Beatle member of the Quarrymen, Ken Brown, from the skiffle group after Brown gets paid for an engagement at Liverpool's Casbah Club for which he was too sick to perform. This leaves the Quarrymen as John, Paul, and George; by May of the following year, the group, now featuring Stu Sutcliffe and Pete Best, would be known as the "Beatals."

1959- Stan Kenton, June Christy, Four Freshman record Road Show album at Purdue University .

1960-A silly novelty song called "Mr. Custer" by Larry Verne was the number one single in America. The record told a story about a US cavalry trooper who tries to talk his way out of fighting the Sioux Indians at Little Big Horn in 1876.

1962- Bob Newhart Show” premiered on TV. This half-hour variety series was hosted by Bob Newhart, a successful stand-up comedian famous for his trademark “telephone conversation” monologues. Regulars included Jackie Joseph, Kay Westfall, Jack Grinnage, Mickey Manners, Pearl Shear, June Ericson, Andy Albin and announcer Dan Sorkin. The show was critically acclaimed, winning both an Emmy and a Peabody in its short time on the air. Newhart later starred in situation comedies. In “The Bob Newhart Show,” which aired 1972—78 he played a psychologist.

1965 - Ronald Reagan spoke at Coalinga Junior College and called for an official declaration of war in Vietnam.

1965-The Supremes make the first of many appearances on the Ed Sullivan Show.

1966—Top Hits

Cherish - The Association

Reach Out I'll Be There - Four Tops

96 Tears - ?(Question Mark) & The Mysterians

Almost Persuaded - David Houston

1970 - Neil Diamond reached the #1 spot on the pop music charts for the first time with "Cracklin' Rosie". In 1972, Diamond would reach a similar pinnacle with "Song Sung Blue".

1971- “Up-Stairs, Downstairs” premiered on TV.. The 52 episodes of this “Masterpiece Theatre” series covered the years 1903 to 1930 in the life of a wealthy London family (“Upstairs') and their many servants (“Downstairs”). Produced by London Weekend Television, cast members included Angela Baddeley, Pauline Collins, Gordon Jackson and Jean Marsh. Won a Golden Globe for Best Drama TV Show in 1975 and an Emmy for Outstanding Limited Series in 1976.The last episode aired May 1, 1977, though the series has been rerun several times on PBS.

1974—Top Hits

I Honestly Love You - Olivia Newton-John

Nothing from Nothing - Billy Preston

Then Came You - Dionne Warwicke & Spinners

I Love My Friend - Charlie Rich.

1979-Fleetwood Mac receives a star on the Hollywood Walk of Fame.

1979-A motion picture called The Rose, starring Bette Midler as a Rock singer, (transparently based on Janis Joplin) premieres in Los Angeles.

1982---Top Hits

Jack & Diane - John Cougar

Eye in the Sky - The Alan Parsons Project

I Keep Forgettin' (Every Time You're Near) - Michael McDonald

Yesterday's Wine - Merle Haggard/George Jones

1989 - Thunderstorms produced torrential rains along the northeast coast of Florida. Augustine was deluged with 16.08 inches of rain. The heavy rain caused extensive flooding of homes and businesses, and left some roads under three feet of water. Ten cities from South Carolina to New England reported record low temperatures for the date, including Concord NH with a reading of 23 degrees. Temperatures dipped into the 30s in the Carolinas.

1990---Top Hits

Close to You - Maxi Priest

Praying for Time - George Michael

Something Happened on the Way to Heaven - Phil Collins

Friends in Low Places - Garth Brooks

1992-Spiro Theodore Agnew became the second person to resign the office of vice present of the Untied States. Agnew entered a pleas of no contest to a charge of income tax evasion for contract kickbacks received while he was governor of Maryland and after he became vice president. He was sentenced to pay a $10,000 fine and serve three years probation Agnew was elected vice president twice, serving under President Richard M. Nixon.

1999-A charity auction selling Elvis Presley's belongings was held at The Grand Hotel in Las Vegas. His wristwatch sold for $32,500, a cigar box $25,000, an autographed baseball sold for $19,000 and his 1956 Lincoln Continental went for $250,000.

1999 -Scoring more than 19 NFL teams, the Red Sox establish a major league record for most runs and biggest margin of victory in a post-season game as they rout the Indians, 23-7 to tie the 5-game series at two games apiece.

World Series Champions This Date

1924 Washington Senators

1926 St. Louis Cardinals

1931 St. Louis Cardinals

1937 New York Yankees

1945 Detroit Tigers

1951 New York Yankees

1956 New York Yankees

1957 Milwaukee Braves

1968 Detroit Tigers

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm