![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial alternate financing,

bank, finance and leasing industries

kitmenkin@leasingnews.org

![]()

SALES POSITIONS AVAILABLE Positions are available for well experienced industry Please email your resume to sschachtel@bankozarks.com Bank of the Ozarks was recognized as the top performing bank 256 Offices, $18.5 billion in assets, second quarter www.bankozarks.com/equipment |

Thursday, October 13, 2016

Today's Equipment Leasing Headlines

Archives: October 13, 2004

- Dash off the Kuwait Coast

Loan/Lease Regulations --- Updated

“Don’t Have a License? Not Caught, You’re Lucky, so Far”

New Hires/Promotions in the Leasing Business

and Related Industries

Leasing Industry Ads---Help Wanted

Looking for Sales Superheroes

Developing Strong Leaders for the

Commercial Equipment Leasing/Financing Industry

Sales Makes it Happen by Scott Wheeler, CLFP

Leasing/Finance Conferences/Updated with Latest Information

—ELFA 962 Attendees—Registration Closes Friday, Oct. 21

Ascentium Capital Announces 30% Increase

Strong Third Quarter Originations

ECN Capital Confirms Growth and Capital Strategy

Focused on Becoming No. America Leader in Commercial Finance

NEFA Funding Symposium Draws Enthusiastic Crowd

New Officers Elected

Shawn Halladay London Conference Nov. 7th & 8th

Survive the New Accounting Changes

Queen of Katwe/Being 17/The Shallows

Beyond the Valley of the Dolls/Elevator of the Gallows

Film/DVD/Digital Reviews by Fernando Croce

Labrador Retriever & Boxer Mix

Mission Viejo, California Adopt-a-Dog

News Briefs---

Wells Fargo CEO John Stumpf Resigns Effective Immediately

Timothy J. Sloan Now President/CEO

LendingClub Corp (LC) Stock Has Learned a Lesson

— People Lie

Mortgage rates rise in another sign that,

yep, it's a global economy

Takeaways from the ELFA 2016 Lease & Finance

Accountants Conference

Yantra Financial Technologies Recognized Company to Watch

in American Banker and BAI’s 2016 FinTech Forward Rankings

Broker/Funder/Industry Lists | Features (writer's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

Leasing News Icon for Android Mobile Device

You May have Missed---

Baseball Poem

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send a colleague and ask them to subscribe. We are free.

Email kitmenkin@leasingnews.org and in subject line: subscribe

[headlines]

--------------------------------------------------------------

Archives, October 13, 2004

- Dash off the Kuwait Coast

My son Dash (short for Dashiell) is in the front row, in the middle.

While he is primarily a top electrician, among other duties, on the Arleigh Burke destroyer USS Preble, such as manning light machine guns, diving as second class diver. He is also part of the “boarding party” that guards the ABOT Oil Refinery. They do random checking of all vessels in the area, particularly looking for terrorists or bombs for docks, the oil refinery itself, or military locations or ships along the coastal area.

They board the vessels with light weapons, searching cargo holds and

all quarters. He says it is often 130 degrees and very humid.

(He saw a lot of action in the Middle East as a sailor and "brown sailor" on the ground).

TODAY

Chief Electrician

“Dad, this ship is an old ship... 48-year-old steam ship! I bet you will be surprised how many stories you get about the Ponce!?”

USS Ponce stays afloat in unique role as forward staging base

http://www.stripes.com/news/navy/uss-ponce-stays-afloat-in-unique-role-as-forward-staging-base-1.233134

Kit Menkin

[headlines]

--------------------------------------------------------------

Loan/Lease Regulations --- Updated

“Don’t Have a License? Not Caught, You’re Lucky, so Far”

In most states, banks are not required to have a leasing license as well as manufacturers. Banks are generally exempt because they are regulated by the FDIC.

The common thread among licensing statutes is that if the entity which should otherwise have a license, is licensed by another government agency (real estate brokers is one example), then no license is required.

An expert on this who has won cases against company’s not licensed in California, notably CMC Commercial Credit, Tom McCurnin, Barton, Klugman & Oetting, Los Angeles, California told Leasing News: “A property owner can sell his property on credit without a license or without usury issues. Its called the Time Price Doctrine or Time Price Differential.

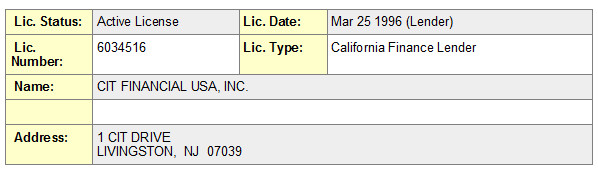

“CIT on the other hand doesn't own the stuff and is therefore making a loan and is required to have a license.

“A gray area might be for the leasing company to buy the stuff and have it shipped to them, and they, in turn re-ships to the customer. May not be required to have a license. Simple invoices and drop shipping probably would not pass muster.”

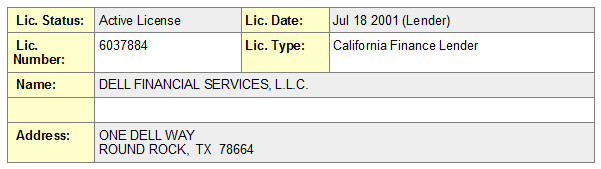

Captive Lessors are required to have a license, and all those that I checked do, such as Dell, who also sells other products than the ones they manufacture.

And while there are financial institutions that also have a bank, such as CIT, they hold a license.

In California, those engaged in true leases, such as Mar Vista, address, do not need to be licensed, but everyone who is involved in “capital leases” with a bargain purchase option, particularly a dollar, are required to be licensed. Without it, they may not accept a commission, engage with a licensed financial institution, and may find their leases in court dismissed for lack of a license. While the fines are not very much, the clout comes in immediate suspension from doing business in California, and while a hearing may be required or filed by an attorney, they may not engage in business during this time.

“NO BROKERAGE COMMISSIONS TO UNLICENSED BROKERS. California Administrative Code Title 10 §1451.”

Commissions may not be paid to unlicensed brokers. There are companies who use other companies’ documents and therefore believe they do not need to be licensed. This may be accurate in dealing with a bank, but not with another licensed financial institution or financial institution out of state that is not licensed in California.

If you are registered by license as a broker, lender, lessor in states that require it, you do not need a city business license (in most states). Cities that require a business license, also require a business license if you work out of your residence. Many cities now are using Schedule C from tax returns, such as in San Jose, California, to catch those without a city license, and they will go back several years as well as a fine, so best to get a license now in case they check your city.

While not all states require a lender's license, many require a license to accept a deposit or advance rental. And remember, a capital lease may be considered a loan as it is with the IRS in many states. If the state requires a license, and your company is not licensed, the transaction may be subject to usury laws.

46 states do not require the lessor to notify the lessee regarding the end of the original term of the lease and can invoke an Evergreen clause, except in these states that do require notification and if not, can void the residual as well as bring on a fine or worse, depending on the number of such transactions and complaints received.

States who require notification:

New York

Rhode Island

Texas

Wisconsin

Illinois

(In Illinois, Consumer law, but may affect commercial, especially a proprietorship, partnership or personal guarantee)

--Christopher Menkin

---Current Regulations

(Any up-dates or additions, please send

to kitmenkin@leasingnews.org)

Alaska: Money Service License. License required to have exemption from usury rates for loans of $10,000 to $25,000, and 24% rate for $850 to $10,000

http://commerce.state.ak.us/dnn/Portals/3/pub/MoneyservicesStatutes.pdf

Arizona: All "advance fee loan brokers" must register annually with the state. Includes "commitment fees." Stiff penalty and on line form for a complaint for the state to investigate. Arizona Revised Statutes, sec. 06-1303-1310 (1996)

Registration process: http://www.azdfi.gov/Licensing/Licensing-FinServ/ALB/ALB.html

Arkansas: All brokers of "a loan of money, a credit card or a line of credit" may not assess or collect an advance fee. In addition, all brokers must register with the Securities Commissioner, post a surety bond of $25.000 and have a net worth of $25,000.

Arkansas Code Annotate sec. 23-39-401 (1995)

California:On September 22, 2016, California Governor Jerry Brown signed SB 777 into law, a bill that restores a de minimus exemption to the California Finance Lenders Law (CFLL) to allow a person or entity that makes one commercial loan per year to be exempt from the CFLL's licensing requirement, regardless of whether the loan is "incidental" to the business of the person relying on the exemption.

"In addition to the lending authority provided by the law, the California Finance Lenders Law provides limited brokering authority. A "broker" is defined in the law as "any person engaged in the business of negotiating or performing any act as broker in connection with loans*made by a finance lender." Brokers licensed under this law may only broker loans to lenders that hold a California Finance Lenders license."

http://leasingnews.org/archives/May2016/05_02.htm#dob

(*any transaction that is not a true rent or meets the accounting and tax rules or is re-sold as a loan or discount or has a nominal purchase option is considered under this nomenclature. ) (2)

Delaware : License required for More Than 5 Loans Per Year.

http://banking.delaware.gov/services/applicense/llintro.shtml

Florida: Brokers of a "loan of money, a credit card, line of credit or related guarantee, enhancement or collateral of any nature" may not assess or collect an advance fee.

Florida Statues, Chapter 687.14 (1992)

Georgia: A broker of "loans of money, a credit card, a line of credit or related guarantee, enhancement or collateral of any kind or nature" may not assess or collect an advance fee unless such fee is for "actual services necessary to apply for the loan." Official Code of Georgia Annotated, sec. 7- 7-1 (1992)

Idaho: No fee may be collected unless a loan is actually made.

Idaho Code, sec. 26-2501 (1992)

Illinois: Code, 815 ILCS 175/15-5.03 Under the Act, a" loan broker" means any person who, in return for a fee from any person, promises to procure a loan for any person or assist any person in procuring a loan from any third party, or who promises to consider whether or not to make a loan to any person. 815ILCS 175/15-5- 15(a) specifically excluded from the application of the Act, however, are (1) any bank …regulated by any service loans for the Federal National Mortgage Association… (3) any insurance producer or company authorized to do business in [Illinois], (4) any person arranging financing for the sale of the person's product, (note that this exception does not apply to any person selling someone else's product and only applies to "the" person's product, implying the exception is for the owner of the product arranging for financing), (5) any person authorized to conduct business under the Residential Mortgage License Act of 1987 and (6) any person authorized to do business in [Illinois] and regulated by the Department of Financial Institutions or the Office of Banks and Real Estate. "In the event that the Act is violated by the broker, the Secretary of State is empowered by the statute to make investigations and examinations, suspend or revoke the broker's approval, subpoena witnesses, compel the production of books and records, order depositions and obtain temporary restraining orders and injunctions against the broker. In the vent that a violate is found, the Secretary of State may impose a fine in the amount of $10,000 for each violation and the broker shall be liable to any person damaged in the amount of tactual damages plus attorneys’ fees." This appears as standard language on most states.

Iowa: A broker of loans of "money or property" may not assess or collect an advance fee except for a "bona fide third-party fee" and a broker must obtain a bond or establish a trust account and file required documents with the Commissioner or Insurance.

Iowa Code, sec. 535C (19920)

Kansas : Broker is not exempt. Discounter or Lessor is exempt: " 'Creditor' means any person to whom a loan is initially payable on the face of the note or contract evidencing the loan" is exempt. Anyone who earns a fee or accept a deposit, except a bank, financial institution, discounter or lessor, must be registered.

http://www.securities.state.ks.us/rules/loan.rtf

Kentucky: Brokers of "a loan of money, a credit card, a line of credit or related guarantee, enhancement or collateral of any kind or nature" may not assess or collect an advance fee.

Kentucky Revised Statutes Annotated, sec. 367.380 (1992)

Louisiana: A broker of loans of "money or property…whether such agreement is styled as a loan, a lease or otherwise" must obtain a surety bond or establish a trust account in the amount of $25,000. A broker may not collect an advance fee but may collect an "advance expense deposit for commercial loans" only for actual expenses incurred in obtaining the loan. Louisiana Revised Statutes Annotated, sec. 9:3574 (1993); Louisiana Revised Statutes Annotated, Sec. 51:1910 (1992)

Non-Louisiana leasing companies, with or without offices in the state, must qualify to do business in Louisiana, and are subject to payment of state and local occupational license fees. See: Collector of Revenues v Wells Fargo Leasing Corp., 393 So.2d 1255 (La. App. 1981). Common misunderstanding of Louisiana law. Motor vehicle lessors, with or without offices in Louisiana, additionally are required to be licensed by the Louisiana Motor Vehicle Commission in order to lease a motor vehicle in the state. (La. R.S. 32:1254(N)) Common misunderstanding of Louisiana law.

Maine: No license required: "the regulation of commercial loan brokers does not fall under the jurisdiction of the Maine Bureau of Consumer Credit Protection. Transactions involving two businesses are legal/contractual in nature. Therefore, disputes involving a commercial loan between a business and commercial loan provider or broker must be settled in the court system."

http://www.maine.gov/pfr/consumercredit/faqs/loan_broker_faq.htm#j

Maryland: Lending threshold is $6,000 or less, so now need for license if over

this dollar amount

Massachusetts: Lending threshold is $6,000 or less, so now need for license if over this dollar amount.

Minnesota: License required for loans of $100,000 or less

Money Transfer License

http://mortgage.nationwidelicensingsystem.org/slr/PublishedState

Documents/MN-Money-Transmitter-Company-Description.pdf

Mississippi: A broker or loans of money may not assess or collect an advance fee and can be fined up to $5,000 for each violation. Mississippi Code Annotated, sec. 81-19-17 (1997)

Missouri: A broker of loans of "money or property" may not assess or collect an advance fee. Missouri Revised Statues, sec. 367 300 (19920

Nebraska: A broker of loans of money may not assess or collect an advance fee. Nebraska Revised Statutes, sec. 45-189 (1993)

Nevada: Foreign Corporations Foreign corporations engaged in activities in Nevada are subject to the provisions of Chapter 80 of the Nevada Revised Statutes. Specifically, NRS 80.010 through 80.055 set forth the requirements for a foreign corporation to qualify to do business in Nevada. Of primary importance are the statutes that establish (a) the filing requirements to qualify to do business (NRS 80.010); (b) the activities in which a foreign corporation may engage that do not constitute “doing business” so as to require qualification (NRS 80.015); and (c) the penalties to which a foreign corporation will be subject for failing to comply with the qualification provisions (NRS 80.055). The penalties for failure to comply with the qualification statutes include a fine (capped at $10,000) and/or denial of the right to maintain a court action. However, failure to comply will not impair the validity of contracts entered into by a foreign corporation nor prevent such corporation from defending itself in court. Foreign LLCs Foreign LLCs engaged in activities in Nevada are subject to the provisions of Chapter 86 of the Nevada Revised Statutes, specifically NRS 86.543 through 86.549. Foreign LLCs seeking to operate in Nevada must comply with the initial filing and registration requirements in NRS 86.544, and annual filing requirements of NRS 86.5461. The LLC must also maintain certain records, such as a list of current members and managers, in accordance with NRS 86.54615. Additionally, NRS 86.5483 lists the activities which do not constitute “doing business” in Nevada for purposes of the Chapter. Foreign LLCs that fail to comply with the Chapter risk penalties similar to those facing a non-compliant foreign corporation. Those penalties are outlined in NRS 86.548.

Nevada has no usury statue.

New Hampshire

Any person making small loans, title loans, or payday loans in New Hampshire must obtain a license from the bank commissioner. N.H. Rev. State. Ann. § 399-A:2. This law does not apply to banks, trust companies, insurance companies, savings or building and loan associations, or credit unions. Id. Any person who violates any provision of this chapter shall be guilty of a misdemeanor if a natural person, or a felony if any other person. N.H. Rev. Stat. Ann § 399-A:18.

New Jersey: Brokers of "loans of money" may not assess or collect an advance fee.

New Jersey Rev. Statutes, sec. 17:10B (1992)

Although New Jersey does not require a lessor to obtain a license to conduct a leasing business in the state, the New Jersey Corporation Business Activities Report Act requires foreign corporations to register with the state. See N.J. STAT. ANN. 14A:13-14. In particular, foreign corporations must file a Notice of Business Activities Report with New Jersey's Department of Taxation. Activities that trigger the requirement of a report include: (a) maintaining an office or other place of business in New Jersey; (b) maintaining personnel in New Jersey, even if the personnel is not regularly stationed in the state; (c) owing or maintaining real or tangible personal property directly used by the corporation in New Jersey; (d) owning or maintaining tangible and/or property in New Jersey used by others; (e) receiving payments from residents in New Jersey, or businesses located in New Jersey, that are greater than $25,000.00; (f) deriving any income from any source or sources within New Jersey; or (g) conducting or engaging in any other activity, property or interrelationships with New Jersey as may be designated by the Director of the Division of Taxation. See N.J.S.A. 14A:13-15. Corporations not required to file a report are those which either received a certificate of authority to do business, or filed a timely tax return under the Corporation Business Tax Act, or Corporation Income Tax Act. See N.J. STAT. ANN. 14A:13-16. Reports must be filed annually by April 15th.

New Mexico: New Mexico currently requires Brokers/Lessors to register for Licensing under the NM Mortgage loan Company or Loan Broker Act with the Financial Institutions Division of the State of New Mexico. Banks with Brick and Mortar within the State of New Mexico are exempt. Prior to licensing applicants must submit the Following:

Articles of Incorporation

Listing of all principals (including management)

A full financial Package (to meet their minimum requirements of liquidity)

Personal financial statements on all principals

Disclosure of all current or past suits (civil or criminal)

Attach a corporate surety bond

Include a $400.00 registration fee renewable yearly

New York: Leasing companies and brokers are required to be licensed in New York if they loan the principal amount of $50,000 or less or charge 16% or more for the loan. So this proposed regulation may have broad applicability. There are some narrow exemptions to being licensed in New York which are specific to narrow lending business models which is beyond the scope of this article. Readers who wish to determine whether they might qualify for one of these exemptions should consult counsel.

North Carolina: A broker of "loans of money or property…whether such agreement is styled as a loan, a lease or otherwise" must obtain a surety bond or establish a trust account in the amount of $25,000 and obtain a license. North Carolina General Statutes, sec. 66-106 (1992)

North Dakota:License Required “Money Broker’s License”. N.D. Cent. Code Ann. § § 13-04.1-02.1 and 13-04.1-01.1 http://www.nd.gov/dfi/regulate/index.html

Brokers may not accept an advance fee unless the broker is licensed. North Dakota Century Code, 13-04. 1-09.1 (1993) Ohio: Department of Commerce, Division of Financial Institutions

(Certificate to engage in the business of a credit services organization in accordance with the provisions of Sections 4712.01 to 4712.14 of the revised code of Ohio, subject to all the provisions thereof and to the regulations of the division.) Ohio Department of Taxation requires a "Vendor's License" under provision 5739.17 of the Revised Code (...is hereby authorized to sell tangible personal property and selected services at the retail location specified below.) This also makes the lessor responsible for all taxes with penalties for not doing so.

Ohio: Ohio law provides that no person may engage in the business of lending money, credit, or choses in action in amounts of $5,000 or less, or exact, contract for, or receive, directly or indirectly, on or in connection with any such loan, any interest and charges that in the aggregate are greater than the interest and charges that the lender would be permitted to charge for a loan of money if the lender were not a licensee, without first having obtained a license from the Division of Financial Institutions. O.R.C. 1321.02. This rule is applied to any person, who by any device, subterfuge, or pretense, charges, contracts for, or receives greater interest, consideration, or charges than that authorized by such provision for any such loan or use of money or for any such loan, use, or sale of credit, or who for a fee or any manner of compensation arranges or offers to find or arrange for another person to make any such loan, use, or sale of credit. O.R.C. 1321.02.

Rhode Island: Any person who acts as a lender, loan broker, mortgage loan originator, or provides debt-management services must be licensed. R.I. Gen Laws § 19-14-2(a). The licensing requirement applies to each employee of a lender or loan broker. R.I. Gen Laws § 19-14-2(b). No lender or loan broker may permit an employee to act as a mortgage loan originator if that employee is not licensed. R.I. Gen Laws § 19-14-2(b) R.I. Gen. Laws § 19-14-2 (2012) No person engaged in the business of making or brokering loans shall accept applications from any lender, loan broker, or mortgage loan originator who is required to be licensed but is not licensed. R.I. Gen Laws § 19-14-2(d). There is an exemption from the licensing requirement for a person who makes not more than 6 loans in the state within a 12-month period. R.I. Gen Laws § 19-14.1-10. Persons lending money without a license are guilty of a misdemeanor and can be fined not more than $1,000, or imprisoned for not more than 1 year, or both; each violation constitutes a separate offense. R.I. Gen Laws § 19-14-26.

South Carolina: A broker of "a loan of money, a credit card, a line of credit or related guarantee, enhancement or collateral of any kind or nature" may not assess or collect an advance fee. South Carolina Code Annotated, sec. 34-36-10 91992)

South Dakota: Money Lending License

Required for individuals or corporations to engage in the business of lending money, including creating and holding or purchasing and acquiring any installment loan ("Capital Lease" or EFA), single pay loan, or open-end loan which may be unsecured or secured by personal property. Requires filing a surety bond application. State and national banks, bank holding companies, other federally insured financial institutions, and the subsidiaries of those institutions are exempt from licensure. In addition, SD chartered trust companies are exempt from licensure. Any individual or corporation holding this license is required to pay the bank franchise tax.

Duration: 1 year

Cost: Application: $600

South Dakota has no usury status

Vermont: Commercial Loans

Commercial loan license would apply to EFA and "Capital Leases." Exemptions include transactions over $1 million, and brokers who do not engage in transactions more than $50,000 in one year at rates not exceeding 12 percent per annum.

Ontario, Canada: General Requirements: 1. Branch Operation If a foreign corporation wants to carry on business via a branch operation, without a Canadian corporate entity, it may have to obtain a provincial license in each province in which it intends to carry on business. Pursuant to the Ontario Extra-Provincial Corporations Act R.S.O. 1990 c. E.27 ("EPCA"), a class 3 extra-provincial corporation (a corporation that has been incorporated or continued under the laws of a jurisdiction outside Canada) is prohibited from carrying on business in Ontario without a license under the Act [s. 4(2)]. Failure to comply with this licensing requirement can lead to a maximum fine of $2,000 for a person and $25,000 for a corporation [s. 20(1)]. Directors, officers and any person acting as a representative of the corporation can be fined up to $2,000 for authorizing, permitting or acquiescing to an offence by the corporation [s. 20(2)]. For the purposes of the EPCA, an extra-provincial business is considered to be "carrying on business in Ontario" if: a. It has a resident agent, representative, warehouse, office or place where it carries on its business in Ontario; b. It holds an interest, otherwise than by way of security in real property situate in Ontario; or c. It otherwise carries on business in Ontario [s. 1(2)]. This last category is a catchall. Recent case law in the area stresses that it is very much a fact-specific analysis hinging on the extent to which business is actually conducted in Ontario. 2. Incorporation: a foreign corporation can also choose to incorporate a subsidiary, either federally or provincially. If a subsidiary is incorporated provincially in Ontario, it may have to obtain an extra-provincial license to carry on business in other provinces. An Ontario-incorporated company does not have to obtain a license to carry on business in Quebec but does have to make annual information filings. 3. Bank Act If the financing company is a bank and intends to carry on business in Canada, it must obtain appropriate approval under the Bank Act 1991 c. 46. Whether an entity will be considered a bank under the Bank Act needs to be reviewed on a case-by-case basis, as there are a number of relevant factors.

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Jennifer Gysel was hired as Vice President and Senior Account Manager, Western Canada Operations, Affiliated Financial Services, Winnipeg, Manitoba, Canada. Previously, she was VP Marketing, Western Operations, Money in Motion (June, 2005 – September, 2016); Sales Coordinator, National Leasing (2001 – 2005); Firearm Licensing Coordinator, Federal Firearm Licensing (1999 – 2000); Customer Service Representative, Belgian-Alliance Credit Union (1997 – 1999). Languages: French. Education: College Louis Riel, Red River College, Management, Business Administration and Management, General.

https://ca.linkedin.com/in/jennifer-gysel-422a8245

Cherie Milazzo was hired as Sr. Business Development Officer, Centergy Capital, Greater Atlanta area. Previously, she was Business Development Officer, Allied Financial Corporation (February, 2015 – September, 2016); Business Development Officer, Pinnacle Specialty Capital LLC (October, 2011 – October, 2014); Marketing, The Axel Group (September, 2009 – July, 2011); Account Manager, OFC Capital (March, 2007 – August, 2009). Education: University of South Alabama, Bachelor's degree.

https://www.linkedin.com/in/cherie-milazzo-51985a9

Preston Porter has returned to CIT as AVP - Regional Sales Manager,

Tampa/St. Petersburg, Florida Area. Previously, he was Senior Regional Sales Manager, Wells Fargo Equipment Finance, formerly GE Capital (August, 2011 – September, 2016); Senior Sales Manager, CIT Group (January, 2000 – August, 2011); Sales Manager, AT&T Capital (1998 – 2000); Sales, Becton, Dickinson and Company (1993 – 1995). Education: Florida State University, BS, Economics (1985 – 1988). Activities and Societies: Kappa Alpha Order.

https://www.linkedin.com/in/preston-porter-4a98b419

Kelli Roussos-Smith was hired as Associate Attorney at Shapiro Sher Guinot & Sandler, Baltimore, Maryland. Previously, she was Vice President of Operations/Attorney, MB Equipment Finance, LLC. (October, 2012 – August, 2016); Attorney, SunTrust Equipment Finance & Leasing, Corp. (March, 2010 – September, 2012); Law Clerk for the Hon. John C. Themelis, Circuit Court for Baltimore City (August, 2008 – March, 2010). Education: University of Baltimore, School of Law, Juris doctor (2005 – 2008.) Loyola College in Maryland, Bachelor's degree, English Language and Literature, General

(2001 – 2005.)

https://www.linkedin.com/in/kelli-roussos-smith-8bb52526

[headlines]

--------------------------------------------------------------

Leasing Industry Ads---Help Wanted Opportunity

Ascentium Capital/Bank of Ozarks Finance

SALES POSITIONS AVAILABLE Positions are available for well experienced industry Please email your resume to sschachtel@bankozarks.com Bank of the Ozarks was recognized as the top performing bank 256 Offices, $18.5 billion in assets, second quarter www.bankozarks.com/equipment |

[headlines]

--------------------------------------------------------------

Sales Makes it Happen by Scott Wheeler, CLFP

Developing Strong Leaders for the

Commercial Equipment Leasing/Financing Industry

Successful professionals in the commercial equipment leasing and finance industry know the power of mentorship. Whether you are a newcomer in the industry or a twenty-year veteran, it is helpful to have a confidante with whom to share your thoughts, suggestions, concerns, plans, and goals. Mentors can take many forms: co-workers, managers, uncles, business acquaintances, friends, etc. A mentor should be someone that you respect and are able to comfortably share your "true" thoughts. You want to have a mentor who is critical, understands your long-term goals, and is willing to encourage, challenge, and promote your success.

A twenty-year veteran in the industry recently summarized his rise in the industry by explaining how his long-time mentor continues to push him to the next level of achievement. He explained how this one-time co-worker pushed him at the beginning of his career to be a better sales person; how the mentor introduced him to new career opportunities; and how the mentor has always been there for him in good times and bad.

This veteran credits his success on a mentor relationship that started nearly twenty years ago and continues to this day. He specifically speaks of a dinner long ago when he was disillusioned in regards to the industry, his employment, and the economic times. His mentor calmly outlined the positives and negatives of his career and pointed to the significant opportunities that lie ahead. He and his mentor drew out a plan and he committed to execute the plan starting the very next day.

The originator's business improved significantly over the coming months, his career situation took a positive turn, and his income potential rose exponentially. This veteran is now mentoring several younger originators and has discovered that mentorship is a two-way street. He is gaining new knowledge through the experiences of those he is mentoring.

His mentorship has re-energized his own career and reinforced the tremendous potential offered by the commercial equipment leasing and finance industry.

Don't Go It Alone

https://www.surveymonkey.com/r/RQ2YXPS

Available Here:

https://www.createspace.com/5355516

Scott A. Wheeler, CLFP

Wheeler Business Consulting

1314 Marquis Ct.

Fallston, Maryland 21047

Phone: 410 877 0428

Fax: 410 877 8161

Email: scott@wheelerbusinessconsulting.com

Web: www.wheelerbusinessconsulting.com

Sales Makes It Happen articles:

http://www.leasingnews.org/Legacy/index.html

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

Leasing/Finance Conferences/Updated with Latest Information

—ELFA 962 Attendees—Registration Closes Friday, Oct. 21

Leasing/Finance Conferences --- 2016

October 23 -25th

2016 55th Annual Conference

Palm Desert Springs

Palm Desert, California

Attendance: 962 (10/12/16)

http://www.elfaonline.org/events/2016/ac/attend.cfm

Email and fax registrations will be accepted until Friday, Oct. 21. Download the registration form or visit the registration page at www.elfaonline.org/AC.

Registrations may also be made on-site.

Bruce Kropschot, Senior Managing Director andMerger & Acquisition Advisory Practice Leader –The Alta Group

“Bruce will be giving a conference report

with the assistance of Alta Group colleagues.”

Keynote speaker Joe Scarborough will provide timely analysis

and insight into the upcoming presidential and congressional elections.

Money20/20

October 23 – 26

Las Vegas, Nevada

The World's Largest Payments & Financial Services Innovation Event 10,000+ Attendees Including 1,000+ CEOs and 500+ Speakers from 3,000+ Companies and 75 Countries.

October 24-26, 2016

100th Anniversary Annual Meeting

American Financial Services Association

The Breakers Palm Beach

Palm Beach, Florida

Join us for the latest on the political landscape, compliance and regulatory challenges, business trends, and enjoy plenty of networking opportunities.

Sessions will cover the overall industry challenges as well as operational issues relevant to specific market sectors. The final day of the meeting - called Spotlight Compliance - will shine light on the ever changing legal, regulatory and compliance realms that are so important in today's financial businesses.

AFSA’s 350 members include consumer and commercial finance companies, vehicle finance/leasing companies, mortgage lenders, credit card issuers, industrial banks and industry suppliers. The association was founded in 1916 as the American Association of Small Loan Brokers. The group formed to promote state laws that would make small loans more readily available to average Americans, who had few options at the time to receive small personal loans.

November 11-12, 2016

2016 Western Regional Meeting

Doubletree by Hilton Hotel Anaheim-Orange County

Orange, CA

Exhibitors to Date (10/12/16)

Advantage Funding

American Leasing Insurance

Banc of California

Blackriver

BSB Leasing

Channel Partners

Dakota Financial

Financial Pacific

Fora Financial

InstaCover

North Mill Capital

Orange

Pawnee

Navitas

Rapid Advance

Quality

Join Ken Greene, Esq. and Jaime Kaneshina, CLFP, BPB

as they revisit the California Lenders Law

and discuss the following topics:

1. Updates to the Application Process

2. DBO Email

3. Doing business with banks and other exempt institutions

4. Annual Reports

5. Audits

For More Information, please clickhere

2016 EXPO Super Regional

Sunday, November 13 - Monday, November 14

Teaneck Marriott at Glenpointe

100 Frank Burr Blvd

Teaneck, New Jersey 07666

United States

Pricing (Early Bird ends Oct. 30th):

http://www.nefassociation.org/?page=16ExpoPricin

2016 Expo Chairperson, Tom Lockhart, Director of Broker Services for Marlin Equipment Finance, invites you to participate in one of the longest running networking and educational events for equipment and commercial finance professionals.

NEFA's New Jersey based, one-day Expo is famous as a place to make solid connections and pickup valuable business ideas.

Drawing from up and down the East Coast ─and from all across the country─ the Expo provides a top-quality networking opportunity and a chance to talk in-depth with some leading edge funding sources and service providers.

Because it's a small, intimate meeting, educational topics can drill down deep and the 2016 Expo is no exception.

(Leasing News provides this ad as a trade for appraisals

and equipment valuations provided by Ed Castagna)

[headlines]

--------------------------------------------------------------

#### Press Release #############################

Ascentium Capital Announces 30% Increase

Strong Third Quarter Originations

KINGWOOD, TX – Ascentium Capital, a national commercial lender providing comprehensive finance solutions announced strong growth in volume during third quarter 2016. The company obtained a 30% increase in originations over the same period last year.

Tom Depping

CEI

"We are investing in our product offering and delivery of exceptional service by implementing new technologies that enable us to capture new revenue in high-growth markets," said Tom Depping. "We will also continue to deploy capital to position Ascentium Capital as the financier of choice in the equipment leasing and small business financing sectors.”

Highlights for the quarter included sustained strength in key areas including technology, commercial vehicles and healthcare.

Richard Baccaro

Chief Sales and Marketing Officer

“The strategic investments in our diversified business model resonate with our equipment vendors and small business clients,” comments Richard Baccaro, Chief Sales and Marketing Officer.

Ascentium Capital continues national recruitment efforts for tenured financial sales professionals and has expanded the Orange County sales office to accommodate its rapid growth in California.

As a direct lender, Ascentium Capital LLC specializes in providing a broad range of financing, leasing and small business loans. The company’s offering benefits equipment manufacturers and distributors as well as direct to businesses nationwide. For more information, please visit AscentiumCapital.com.

#### Press Release #############################

[headlines]

--------------------------------------------------------------

##### Press Release ############################

ECN Capital Confirms Growth and Capital Strategy

Focused on Becoming No. America Leader in Commercial Finance

Toronto, Canada – – ECN Capital Corp. (TSX:ECN, “ECN Capital” or the “Company”) announced that by mutual agreement, INFOR Acquisition Corp. (TSX: IAC.A, IAC.WT) (“IAC”) and ECN Capital have terminated the previously announced qualifying transaction that would have resulted in the acquisition of all of the outstanding shares of IAC by ECN Capital (the “IACArrangement”). ECN Capital’s growth and capital strategy remains on track and focused on positioning the Company as a North American leader in commercial finance.

ECN Capital’s growth and capital strategy is based on a combination of three factors:

1. Driving profitable organic growth in each of its three core verticals where the Company has an established North American presence - Commercial & Vendor Finance, Rail Finance and Commercial Aviation Finance;

2. Transitioning the Commercial Aviation and Rail Finance verticals to a combined on-balance sheet and fund management business model that allows for the efficient redeployment of capital and improved equity returns; and

3. Positioning ECN Capital for tuck-in acquisitions in selected complementary segments in the North American commercial finance market that offer defendable growth opportunities and attractive yields.

Steven Hudson

ECN Capital CEO

“The IAC Arrangement was an attractively priced incremental option to capitalize this growth strategy,” said Steven Hudson, ECN Capital’s Chief Executive Officer. “As an investment-grade commercial finance company with more than $8.2 billion in owned and managed assets, ECN Capital is favourably positioned to access adequate internal and external funding sources to execute on its business plan and growth strategy. ECN Capital will continue its discipline as a prudent issuer of capital, respecting our shareholders’ interests,” added Mr. Hudson.

About ECN Capital Corp.

With total owned and managed assets of $8.2 billion, ECN Capital Corp. (TSX: ECN) is one of North America’s leading equipment finance companies. ECN Capital operates across North America in three verticals of the equipment finance market (Commercial & Vendor Finance, Rail Finance, and Commercial Aviation Finance).

##### Press Release ############################

|

[headlines]

--------------------------------------------------------------

#### Press Release ##############################

NEFA Funding Symposium Draws Enthusiastic Crowd

New Officers Elected

.

Bloomington, MN – 250 some equipment finance professionals gathered for NEFA’s 2016 Funding Symposium, in Bloomington, Minnesota, October 7th through October 9th.

Attendees at the 2016 Funding Symposium, held Thursday, October 6th through Saturday, October 8th, at the Radisson Blu Mall of America, just outside Minneapolis, Minnesota, enjoyed networking, service and funding source exhibits, educational breakout sessions and all the shopping, dining and entertainment the attached Mall of America has to offer.

Jim Peach

VP, Sales Manager

Stearns Bank

“We were thrilled with the turnout” said Jim Peach, CLFP, of Stearns Bank. “It was a very engaged group and they really got into the variety of breakout sessions my team of volunteers put together. That took care of the business side and the Mall of America being just 20 yards down the hallway from our exhibit area took care of the fun side.”

NEFA Executive Director, Gerry Egan, said “We’re very pleased with the turnout and the beautiful facility. Unfortunately, but understandably, we had some cancellations due to the hurricane and our thoughts are with the people who were impacted by that.”

The Funding Symposium also serves as the Annual Business meeting for the National Equipment Finance Association and Officers and Directors for the next twelve months were elected at the business luncheon on Friday, October 7th.

Stephanie Hall

Vice President, Third Party Originations

Bryn Mawr Funding

NEFA’s new President & Chairman of the Board is Stephanie Hall, CLFP, of Bryn Mawr Funding, and she’s joined on the Executive Committee by Mike Coon, of Axis Capital, Inc., as Vice President, Marc Keepman, CLFP, of KLC Financial, Inc., as Treasurer, and Dennis Dressler, of Dressler and Peters, LLC, as Secretary. Gary Souverein, of Pawnee Leasing Corporation, will remain on the Executive Committee as Immediate Past President.

Stephanie Hall said “I’m so pleased to be elected by the membership as President. NEFA is built around the concept of Community and that perfectly captures how I feel about it. It’s been a huge part of both my business and personal lives. I’m excited about playing a role in our continued development of programs dedicated to Community, Education and Professionalism.”

Re-elected as Directors of the association at this year’s Funding Symposium were Daryn Lecy, CLFP, of Stearns Bank; Gabe Jarnot, CLFP, of Northland Capital Financial Services, LLC; and Nick Ross, CLFP, of Bank of the West. Newly elected Directors were Shane Davis, of Dedicated Commercial Recovery, Inc.; Eric Alley, of LeaseTeam, Inc.; Kristian Dolan, CLFP, of Tamarack; Laura Carini, CLFP, of Financial Pacific Leasing, Inc.; and Joe Leonard, CLFP, of Oakmont Capital Services.

During the business luncheon, outgoing Officers and Directors, including Tara Aasand, of LeaseTeam, Inc.; Greg Nappi, of DDI Capital; Doug Houlahan, CLFP, of Maxim Commercial Capital, LLC; Kip Amstutz, CLFP, of 360 Equipment Finance; and Bryan Inman, of Great American Insurance were all honored for their service.

Also at the business luncheon, the Executive Committee awarded Bob Cohen, of Moritt Hock & Hamroff, LLP, the Chris Walker Memorial Member of the Year Award. Said Gary Souverein, Chairman of the Executive Committee, “Bob perfectly captures the spirit of NEFA for his constant support and cheerleading and his willingness to jump in and help NEFA at any opportunity.”

The CLFP Foundation also presented some of their own awards during the Funding Symposium business luncheon.

For extra fun, this year’s Funding Symposium included three additional networking events as fund raisers. On Friday night a large group headed into the famous of Mall of America to Skydeck Sports Grille and Lanes for a fun dinner and a night of games. That event raised funds for NEFA’s Chris Walker Education Fund. On the previous day a group headed into Minneapolis for a tour of the new stadium of the NFL’s Minnesota Vikings. In the afternoon, was a fun golf tournament at Mouse Mountain Adventure Golf, inside the Mall of America. The net proceeds from both of Thursday’s events, conceived by local Member, Shawn Smith, of Dedicated Commercial Recovery, Inc., will be donated by NEFA to Children International.

About National Equipment Finance Association

The National Equipment Finance Association (NEFA) is a national association serving small to mid-sized independent equipment finance companies, lessors and brokers. NEFA is a strong association offering enhanced educational programs and premium networking opportunities with broad geographic and industry segment diversity. The mission of NEFA is to provide a forum for members to pursue personal and professional growth and promote ethical business practices through advocacy, networking and industry involvement.

#### Press Release #######################

|

(Leasing News provides this ad as a trade for investigative

reporting provided by John Kenny)

[headlines]

--------------------------------------------------------------

#### Press Release #######################

Shawn Halladay London Conference Nov. 7th & 8th

Survive the New Accounting Changes

Shawn Halladay

Managing Director

Amembal & Halladay

Amembal & Halladay is pleased to present our newest seminar, “IFRS 16 – Managing the Changes to Lease Accounting”, being held in London, November 7 and 8, 2016. The seminar will be conducted by Mr. Shawn Halladay, Managing Director of Amembal & Halladay, the recognized global expert on lease accounting.

IFRS 16, Leases, the new set of lease accounting rules, affects every company that leases equipment, whether as a lessee or a lessor. After years of discussions, recommendations, reviews and revisions, the IASB is now requiring the asset and liability for almost all leases to be recognized on lessees’ balance sheets.

An important element of the seminar, of course, is to recap and explain the complex new lease accounting rules. The key objective, however, is to create participant value by going well beyond the basics and adding a strong, practical emphasis on implementing and applying the rules. Lessor sales teams, for example, will learn how to address customer concerns about the changes and how to add value by creating the most appropriate structures to offer their customers. Even though IFRS is effective January 1, 2019, the transition period between now and then is critical to fully understand the complex rules so as, particularly given the retrospective application of the standard.

A summary of the topics to be presented is:

- Overview

- Lessee Specific Issues

- Selling Leases under the New Rules

- Lessor Specific Issues

- Additional Accounting Circumstances

This seminar is geared for all leasing professionals including front office personnel – who need to creatively engage with the customer, as well as back office administrators and those charged with complying with and reporting leasing activities. Sales teams, CFOs, Finance Directors, Controllers, Accounting Policy personnel, lease administrators, financial analysts, corporate accountants, and regulators will all benefit from this program.

Amembal & Halladay, formed in 1978, was the first entity to serve the global equipment leasing industry and is the world's premier service provider to its many leasing industries and companies. Amembal & Halladay has trained over 75,000 leasing professionals in 80 plus countries and has authored 16 industry bestsellers. It also has provided consultancy services to over 20 governments as well as numerous well-known, blue chip leasing companies around the globe.

For more information, please contact:

Kelly Farnham, General Manager

Amembal & Halladay

kelly@amembalandhalladay.com

### Press Release ############################

[headlines]

--------------------------------------------------------------

Fernando's View

By Fernando F. Croce

A pair of vibrant dramas (“Queen of Katwe,” “Being 17”) comes to theaters, while new DVD releases offer stripped-down suspense (“The Shallows”), subversive satire (“Beyond the Valley of the Dolls”) and a moody thriller (“Elevator to the Gallows”).

In Theaters:

Queen of Katwe (Walt Disney Pictures): Vibrant director Mira Nair (“Salaam Bombay”) brings her colorfully humanist touch to this inspirational story, based on the life of Ugandan chess prodigy Phiona Mutesi. As she struggles in the slums of Katwe, 10-year-old Phiona (played by Madina Nalwanga) finds solace by learning chess at a local missionary program run by Robert Katende (David Oyelowo). Her interest in the strategies that go into these games allows her to expand her education, and contests soon grow in size and importance. With support from Robert as well as her mom Nakku (Oscar-winner Lupita Nyong’o), Phiona begins to expand her horizons beyond Katwe. The outline sounds like just another feel-good crowd-pleaser, yet Nair’s direction and the performances bring charm and joy to this tale of intelligence overcoming life’s hardships.

Being 17 (Stranded Releasing): A specialist in genteel yet passionate dramas for the past four decades, French filmmaker Andre Techine (“Wild Reeds”) serves up another impeccably modulated character study with this fine coming-of-age story, set in a small town by the Pyrenees mountains. At is center is the growing relationship between two teenage classmates, Tom (Corentin Fila) and Damien (Kacey Mottet Klein), who push beyond their initial antagonism to discover they harbor feelings for each other. Their newfound feelings are complicated by their respective families, including Damien’s emotionally volatile mother (Sandrine Kiberlain). With characteristic watchfulness and evocative insight, Techine paints a richly naturalistic view of adolescent highs and lows that resonates long after the closing credits. With subtitles.

Netflix Tip:With a questioning mind and a baroque style, Polish director Andrzej Wajda (1926-2016) crafted indelible snapshots of his nation in times of upheaval. So check out Netflix for some of his most powerful works, which include “Ashes and Diamonds” (1958), “Man of Marble” (1977), “Man of Iron” (1981), and “Danton” (1983). |

On DVD:

The Shallows (Sony): Action specialist Jaume Collet-Serra (“Unknown,” “Non-Stop”) serves up another bit of ingenious suspense with this lean account of primal survival, featuring a vivid turn by Blake Lively. Lively stars as Nancy, a young traveler from Texas who, getting away from some personal matters at home, hopes to find relaxation in an isolated beach in Mexico. The idyllic surf soon darkens, however, when a marauding shark circles the waters, leaving the heroine stranded on rocks. With only a wounded seagull by her side and the tide rising by the minute, Nancy can depend only on her own skills to make it out alive. Stripping plot down to the basics, Collet-Serra’s film creates a modestly scaled but undeniably visceral tale of primal fears and triumphs.

Beyond the Valley of the Dolls (Criterion): Gonzo cult filmmaker Russ Meyer goes (sort of) mainstream in this wild 1970 box-office hit, an uproarious Hollywood satire boasting a script from none other than legendary reviewer Roger Ebert. The kaleidoscopic view of the entertainment industry centers on an all-girl band called The Kelly Affair, whose young lead singer Kelly McNamara (Dolly Read) travels to Los Angeles to seek fame and fortune. She and her friends quickly fall in with the decadent L.A. scene, embodied by the enigmatic Z-Man (John Lazar), a powerful rock promoter with a few secrets up his sleeve. More of a send-up than a sequel to Jacqueline Susann’s campy “Valley of the Dolls,” Meyer’s movie is a subversive and outrageously entertaining time capsule that illustrates the director’s inimitably lecherous camera.

Elevator to the Gallows (Criterion): Part of the French New Wave group that changed the face of cinema in the late 1950s and early 1960s, director Louis Malle (“Atlantic City”) made his feature debut with this moody 1958 thriller, coming to DVD courtesy of Criterion. The Hitchcockian plot centers on the illicit affair between a married woman (portrayed by New Wave icon Jeanne Moreau) and one of her husband’s employees (Maurice Ronet), who becomes stuck in an elevator while attempting to leave the scene of a crime. The tension of their story is contrasted with another young couple off on an outlaw lark of their own. Featuring stylish views of Paris nightlife and scored to an improvised jazz score by the legendary Miles Davis, Malle’s film is ripe for rediscovery. With subtitles.

[headlines]

--------------------------------------------------------------

Labrador Retriever & Boxer Mix

Mission Viejo, California Adopt-a-Dog

Beauregard

Male

Age: 10-11 months

Neutered

Coast Length: short

Current on Vaccinations

Meet Beauregard! This happy pup is nothing short of adorable both in looks and personality. He is a young pup, probably about 10-11 months old and loves life. We can't say more positive things about this boy. Beauregard was saved from a high kill shelter where he was at risk of euthanasia simply because he ran out of time. We are thankful that we were able to save him and give him a second chance at life. Now he just needs a home! Beauregard cannot love people more and enjoys playing with dogs too! Since he is young he will need some guidance and training so that he can be the perfect and well behaved dog we know he can be. Contact us if you think he might be a match for you!

ADOPTION PROCESS:

Pets are visited by appointment (times are flexible). Please email adopt@thepetrescuecenter.org to arrange a meeting time. This process allows potential adopters to spend adequate time with their prospective pet and prevents long wait times.

All interested parties must fill out an Adoption Application, which will be reviewed to find the best possible match. You can find our application online at: http://www.thepetrescuecenter.org/adopt/adoption-application.html.

Completed applications can be submitted online, faxed to (949) 743-5878 or emailed to: adopt@thepetrescuecenter.org

Our adoption fee is $300 for dogs and includes neuter, microchip, flea treatment, deworming, veterinary exams, and current vaccinations while in our care. This fee helps to defray the costs incurred for these and other pre-adoption expenses.

The Pet Rescue Center

877-277-7938

25800 Jeronimo Road

Suite 100

Mission Viejo, CA 92691

adopt@thepetrescuecenter.org

[headlines]

--------------------------------------------------------------

![]()

News Briefs---

Wells Fargo CEO John Stumpf Resigns Effective Immediately

Timothy J. Sloan Now President/CEO

http://www.sfgate.com/news/article/Wells-Fargo-CEO-John-Stumpf-resigns-effective-9967431.php

LendingClub Corp (LC) Stock Has Learned a Lesson

— People Lie

http://investorplace.com/2016/10/lendingclub-corp-lc-stock-learns/#.V_10YeArJNc

Mortgage rates rise in another sign that,

yep, it's a global economy

http://www.bankrate.com/finance/mortgages/mortgage-analysis-101216.aspx?ic_id=Top_Financial%20News%20Center_link_1

Takeaways from the ELFA 2016 Lease & Finance

Accountants Conference

http://www.elfaonline.org/news/industry-news/read/2016/10/08/takeaways-from-the-2016-lease-finance-accountants-conference

Yantra Financial Technologies Recognized Company to Watch

in American Banker and BAI’s 2016 FinTech Forward Rankings

http://www.businesswire.com/news/home/20161012005807/en/Yantra-Financial-Technologies-Recognized-Company-Watch-American

[headlines]

--------------------------------------------------------------

--You May Have Missed It

42 Retailers Plus+ That Won’t Be Open on Thanksgiving

http://bestblackfriday.com/blog/stores-closed-on-thanksgiving-and-black-friday-2016/

--------------------------------------------------------------

Baseball Poem

SHORTSTOP |

Published: Boyd Mills Press (2003) |

The slits of his eyes |

[headlines]

--------------------------------------------------------------

Sports Briefs----

Kaepernick to start for 49ers in Buffalo

http://www.sacbee.com/sports/nfl/san-francisco-49ers/article107499337.html

Colin Kaepernick contract restructure is done

http://www.sacbee.com/sports/nfl/san-francisco-49ers/article107827367.html

Dallas Cowboys: Four Burning Questions as we approach Week Six

http://thelandryhat.com/2016/10/12/dallas-cowboys-burning-four-questions-week-six/

First Look: Oakland Raiders vs. Kansas City Chiefs

https://www.yahoo.com/sports/m/b4e54f45-07de-3400-a226-03393f8b14a1/first-look%3A-oakland-raiders.html

Cam Newton, Jonathan Stewart return to practice for Panthers

http://www.espn.com/nfl/story/_/id/17780070/cam-newton-carolina-panthers-practice-first-concussion

Pac-12 notes: Oregon Ducks are stuck in a rut

http://www.sltrib.com/home/4456748-155/pac-12-notes-oregon-ducks-are-stuck

[headlines]

--------------------------------------------------------------

![]()

California Nuts Briefs---

Calif. Rainfall Totals Released: Drought Persists, Data Shows

http://patch.com/california/saratoga/s/fwh28/calif-rainfall-totals-released-drou

See what California cities pay police, firefighters

http://www.sacbee.com/site-services/databases/article2573210.html

Sonoma imposes moratorium on new vacation rentals

http://www.northbaybusinessjournal.com/northbay/sonomacounty/6161045-181/sonoma-imposes-moratorium-on-new

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

Drought in California spurs early wine grape harvest

http://cvbj.biz/2016/10/11/wine-grape-harvest/

Is it Bordeaux, or isn’t it? Rules to know before you buy

http://www.sacbee.com/food-drink/wine/article107399097.html#emlnl=Todays_Top_Stories

King Estate Receives Demeter Certification

https://www.winebusiness.com/news/?go=getArticle&dataid=175648

There's a Weed-Infused Wine on the Market

— But There's a Catch

http://www.cosmopolitan.com/food-cocktails/a5274780/pot-wine-canna-vine/

Total Wine Tells All

Alcohol retailer plans to have 200 stores by 2018

http://www.winesandvines.com/template.cfm

?section=news&content=175612

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in American History

October 13

1670 - Virginia passed a law that blacks arriving in the colonies as Christians could not be used as slaves.

1754 - Birthday of Mary McCauley (McCulla or McKolly), is one of the choices to be the "real" Molly Pitcher. Other candidates are Molly Corbin, Anna Maria Lane, Elizabeth Canning . . . with many others contributing to the legends. There was no single Molly Pitcher . . . she is nothing more than a compilation of legends and popular histories that purport to describe the actions of a brave Molly Pitcher who defied convention (and hostile fire) to fire her husband's cannon...The term "Molly Pitcher" was probably what was used by soldiers in battle calling for the "water boy" (who was generally a woman) as men today say, "hey girl," (or "hey nurse" or "hey, waitress,") " or even "medic!" According to some legends, Mary Hay McCauley was a water carrier at the Battle of Monmouth June 28, 1778 where she loaded and fired a cannon after her husband was killed (some say collapsed from the heat).In an embellishment of the legend, a cannonball supposedly passed between her legs tearing her skirt (although the water carriers always tied their skirts up so they could move around. With skirts at the normal length, they'd trip or be much hampered in their movements.)

http://earlyamerica.com/earlyamerica/notable/pitcherm/

http://russell.gresham.k12.or.us/Colonial_America/Molly_Pitcher.html

http://sill-www.army.mil/pao/pamolly.htm

1775 - Second Continental Congress passed legislation authorizing the acquisition of ships and establishment of a navy. We were not called the United States at the time and the move was to name us the United Colonies of Columbia. Columbus was very popular at the time, and a compromise was finally reached to name the capital the District of Columbia and make it special, meaning it was not part of a state, as a compromise to call the new name as the United States of America, after Amerigo Vespucci. In 1972, The US Navy Chief of Naval operations declared that October 13 is the official birthday of the US Navy.

1792 - The presidential residence at 1600 Pennsylvania Avenue, NW, Washington, D.C., designed by James Hoban, was begun with the laying of the first cornerstone. The first presidential family to occupy it was that of John Adams in November, 1800. With three stories and more than 100 rooms, the White House is the oldest building in Washington. First described as the "presidential palace," it acquired the name "White House" about 10 years after construction was completed. Burned by British troops in 1814, it was reconstructed, refurbished and reoccupied by 1817. The original corner stone is allegedly missing, taken by a souvenir hunter, some claim the British.

http://memory.loc.gov/ammem/today/oct13.html

1843 - B'nai B'rith ("Sons of the Covenant") was established in New York City by a group of German Jews. 12 German-Jewish immigrants met at Sinsheimer's Café on Essex Street on New York's Lower East Side and founded B'nai B'rith - the world's first Jewish service organization and the first international service organization in the United States. It is both the oldest and the largest of the Jewish fraternal organizations.

http://www.bnaibrith.org/

1845 - A majority of the citizens of the independent Republic of Texas approve a proposed constitution, that when accepted by the Congress, will make Texas the 28th American state. The annexation of Texas finally became a reality after long political bickering. Antislavery forces were opposed to annexation because Texas was certain to become a slave state. Others wanted to act lest Great Britain or France develop a relationship with the Republic of Texas, whose independence Mexico refused to recognize. In April, 1844, President John Tyler submitted to the Senate a treaty of annexation, but the Senate rejected it in June. In December, Tyler offered a joint resolution to cover annexation. This required only a majority vote by both houses of Congress instead of the two-thirds vote needed to ratify a treaty. Action on the resolution was completed on February 28, 1845, when the House accepted it in revised form. On June 23, the congress of Texas accepted annexation. On October 13, the constitution was proposed and, on December 29, 1945, Texas was admitted to the Union.

1849 - California State Constitution approved by convention in Monterey

the motto of California is to be "Eureka."

1870 - Birthday of famous singer/actress Della May Fox (d. 1913), St. Louis, MO. She was one of the highest paid variety performers of her time. She toured the U.S. with her own company. She reportedly had bouts of ill health because of drugs and alcohol.

http://www.britannica.com/women/articles/Fox_Della_May.html

1893 - Debt, bankruptcy, and plummeting stock prices crippled numerous companies and ultimately gave way to one of the nation's most staggering fiscal panics. On October 13, Union Pacific, one of the nation's largest railroads, announced that it was in receivership.

1902 - Warren Wilbur Shaw (d. 1954), auto racer, born at Shelbyville, IN. Shaw was racing cars by age 18. An early crash led him to invent the crash helmet. After several years of frustration, he won the Indianapolis 500 three times, in 1937, 1939 and 1940, the first consecutive victories by one driver. He served as Indy's president and general manager after Tony Hulman bought the Speedway in 1945.

1903 - The Boston Pilgrims (later the Red Sox) won the first modern World Series, defeating the Pittsburgh Pirates, five games to three. The Pilgrims won Game 8, 3-0.

1910 - Jazz pianist Art Tatum birthday (d. 1956), Toledo, OH.

http://alevy.com/tatum.htm

http://www.pbs.org/jazz/biography/artist_id_tatum_art.htm

http://www.angelfire.com/ca/pianogod/

http://www.vh1.com/artists/az/tatum_art/bio.jhtml

1910 - Novelist and screenwriter Ernest K. Gann (d. 1991) was born in Lincoln, Nebraska. Gann served in the Army Air Force, Air Transport Command during WWII. Began writing novels in 1944 about flying. Five were made into films, including “Island in the Sky” (1944), “Fiddler's Green” (1950, filmed as “The Raging Tide” in 1951), “Soldier of Fortune” (1954), and “Twilight for the Gods” (1958).

1924 - Vibist Terry Gibbs was born Julius Gubenko, Brooklyn, NY.

1925 - The first full length play by an African-American writer to be performed in New York City was “Appearances,” by Garland Anderson, a three-act protest against lynching. It was produced by Lester W. Sager and lasted 23 performances.

1926 - Birthday of Jesse Leroy Brown in Hattiesburg, Mississippi. He was the first black American naval aviator and also the first black naval officer to lose his life in combat when he was shot down over Korea, December 4, 1950. On March 18, 1972, USS Jesse L. Brown was launched as the first ship to be named in honor of a black naval officer.

http://www.powells.com/biblio/28200-28400/0380976897.html

http://www.history.navy.mil/photos/pers-us/uspers-b/j-brown.htm

the full heroic story of two friends, one white, one black:

http://www.homeofheroes.com/brotherhood/hudner.html

1921 - In the first all New York World Series, the Giants beat the Yankees, 1-0 to win the baseball's championship in eight games.

1923 - Casey Stengel's home run is the difference as Giant hurler Art Neff out duels Sam Jones and the Yankees, 1-0, in Game 3 of the World Series.

1925 – Birthday of standup comic, social rebel, Lenny Bruce (d. 1966), born Leonard Alfred Schneider in Mineola, LI, NY. Imprisoned on obscenity charges and refused permission to enter Britain, his show was banned both in England and in Australia. Nightclub owners, fearing police harassment, began refusing to book him and his career collapsed. See his autobiography “How to Talk Dirty and Influence People”, and also Bob Fosse's award-winning film “Lenny” (1974). I saw him many times late in his life in San Francisco. Often he was not funny, but seemed high on heroin, but when he was hot, he was “hot.”

http://www.freenetpages.co.uk/hp/lennybruce/

http://www.ubqtous.com/lennybruce/

http://home.aol.com/dcspohr/lenny/lenny1.htm

http://www.bobdylan.com/songs/lenny.html

1926 - Bassist Ray Brown (d. 2002) born Pittsburgh, Pa

http://members.tripod.com/~hardbop/raybrown.html

http://www.amazon.com/exec/obidos/tg/stores/artist/glance/-/36421/

ref%3Dpd_simart_detail/103-5362656-4423850

1927 - Altoist Lee Konitz born Chicago, Ill.

http://www.enjarecords.com/LEE_KONITZ.htm

http://centerstage.net/chicago/music/whoswho/LeeKonitz.html

http://www.npr.org/programs/btaylor/pastprograms/lkonitz.html

1941 - Singer/songwriter Paul Simon born Newark, NJ.

http://www.paulsimon.com/index_main.html

http://www.simonandgarfunkel.com/

1943 - *OLSON, ARLO L., Medal of Honor

Rank and organization: Captain, U.S. Army, 1 5th Infantry, 3d Infantry Division. Place and date: Crossing of the Volturno River, Italy, 13 October 1943. Entered service at: Toronto, S. Dak. Birth: Greenville, lowa. G.O. No.: 71, 31 August 1944. Citation: For conspicuous gallantry and intrepidity at the risk of his life above and beyond the call of duty. On 13 October 1943, when the drive across the Volturno River began, Capt. Olson and his company spearheaded the advance of the regiment through 30 miles of mountainous enemy territory in 13 days. Placing himself at the head of his men, Capt. Olson waded into the chest-deep water of the raging Volturno River and despite pointblank machine-gun fire aimed directly at him made his way to the opposite bank and threw 2 hand grenades into the gun position, killing the crew. When an enemy machinegun 150 yards distant opened fire on his company, Capt. Olson advanced upon the position in a slow, deliberate walk. Although 5 German soldiers threw hand grenades at him from a range of 5 yards, Capt. Olson dispatched them all, picked up a machine pistol and continued toward the enemy. Advancing to within 15 yards of the position he shot it out with the foe, killing 9 and seizing the post. Throughout the next 13 days Capt. Olson led combat patrols, acted as company No. 1 scout and maintained unbroken contact with the enemy. On 27 October 1943, Capt. Olson conducted a platoon in attack on a strongpoint, crawling to within 25 yards of the enemy and then charging the position. Despite continuous machinegun fire which barely missed him, Capt. Olson made his way to the gun and killed the crew with his pistol. When the men saw their leader make this desperate attack they followed him and overran the position. Continuing the advance, Capt. Olson led his company to the next objective at the summit of Monte San Nicola. Although the company to his right was forced to take cover from the furious automatic and small arms fire, which was directed upon him and his men with equal intensity, Capt. Olson waved his company into a skirmish line and despite the fire of a machinegun which singled him out as its sole target led the assault which drove the enemy away. While making a reconnaissance for defensive positions, Capt. Olson was fatally wounded. Ignoring his severe pain, this intrepid officer completed his reconnaissance, Supervised the location of his men in the best defense positions, refused medical aid until all of his men had been cared for, and died as he was being carried down the mountain.

1944 - BURT, JAMES M., Medal of Honor

Rank and organization: Captain, U.S. Army, Company B, 66th Armored Regiment, 2d Armored Division. Place and date: Near Wurselen, Germany, 13 October 1944. Entered service at: Lee, Mass. Birth: Hinsdale, Mass. G.O. No.: 95, 30 October 1945. Citation: Capt. James M. Burt was in command of Company B, 66th Armored Regiment on the western outskirts of Wurselen, Germany, on 13 October 1944, when his organization participated in a coordinated infantry-tank attack destined to isolate the large German garrison which was tenaciously defending the city of Aachen. In the first day's action, when infantrymen ran into murderous small-arms and mortar fire, Capt. Burt dismounted from his tank about 200 yards to the rear and moved forward on foot beyond the infantry positions, where, as the enemy concentrated a tremendous volume of fire upon him, he calmly motioned his tanks into good firing positions. As our attack gained momentum, he climbed aboard his tank and directed the action from the rear deck, exposed to hostile volleys which finally wounded him painfully in the face and neck. He maintained his dangerous post despite pointblank self-propelled gunfire until friendly artillery knocked out these enemy weapons, and then proceeded to the advanced infantry scouts' positions to deploy his tanks for the defense of the gains which had been made. The next day, when the enemy counterattacked, he left cover and went 75 yards through heavy fire to assist the infantry battalion commander who was seriously wounded. For the next 8 days, through rainy, miserable weather and under constant, heavy shelling, Capt. Burt held the combined forces together, dominating and controlling the critical situation through the sheer force of his heroic example. To direct artillery fire, on 15 October, he took his tank 300 yards into the enemy lines, where he dismounted and remained for 1 hour giving accurate data to friendly gunners. Twice more that day he went into enemy territory under deadly fire on reconnaissance. In succeeding days he never faltered in his determination to defeat the strong German forces opposing him. Twice the tank in which he was riding was knocked out by enemy action, and each time he climbed aboard another vehicle and continued the fight. He took great risks to rescue wounded comrades and inflicted prodigious destruction on enemy personnel and materiel even though suffering from the wounds he received in the battle's opening phase. Capt. Burt's intrepidity and disregard of personal safety were so complete that his own men and the infantry who attached themselves to him were inspired to overcome the wretched and extremely hazardous conditions which accompanied one of the most bitter local actions of the war. The victory achieved closed the Aachen gap.

1945 - Top Hits

“Till the End of Time” - Perry Como

“If I Loved You” - Perry Como

“Along the Navajo Trail” - Bing Crosby and The Andrews Sisters

“You Two Timed Me One Time Too Often” - Tex Ritter

1953 - Top Hits

“Vaya Con Dios” - Les Paul and Mary Ford

“You, You, You” - The Ames Brothers

“No Other Love” - Perry Como

“I Forgot More Than You'll Ever Know” - The Davis Sisters

1958 - Warren Covington conducted the Tommy Dorsey Orchestra's recording of what would be the last big band song to climb the pop charts, "Tea for Two Cha Cha". While the song made it into the Top 10, it peaked at #7, signaling the end of the Big Band Era. Rock 'n' Roll was here to stay.

1960 - At Forbes Field in Pittsburgh, Bill Mazeroski's dramatic bottom of the ninth inning HR off Yankee hurler Ralph Terry breaks up a 9-9 tie and ends one of the most exciting seven game World Series ever played. Text of announcer Chuck Thompson's call: "There's a swing and a high fly ball going deep to left! This may do it! Back to the wall goes Berra; it is over the fence, home run -- the Pirates win! Ladies and gentlemen, Mazeroski has hit a one-nothing pitch over the left-field fence at Forbes Field to win the 1960 World Series for the Pittsburgh Pirates by a score of 10-9. Once again, that final score, the Pittsburgh Pirates, the 1960 world champions, defeat the New York Yankees, the Pirates 10 and the Yankees 9.''

1961 - Top Hits

“Hit the Road Jack” - Ray Charles

“Crying” - Roy Orbison

“Runaround Sue” - Dion

“Walk on By” - Leroy Van Dyke

1962 - Birthday of perhaps the greatest wide receiver in football, Jerry Lee Rice, Starksville, MS.

http://www.nfl.com/players/playerpage/1291

http://www.nfl.com/players/playerpage/1291

1962 - A 34-year-old Edward Albee brought his play, "Who's Afraid of Virginia Woolf", to a stage in New York. Four years later, Albee's play would become an Academy Award-winning film, garnering 6 Oscars, and starring Elizabeth Taylor as the female lead, Martha.