![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial alternate financing,

bank, finance and leasing industries

kitmenkin@leasingnews.org

![]()

SALES POSITIONS AVAILABLE Positions are available for well experienced industry Please email your resume to sschachtel@bankozarks.com Bank of the Ozarks was recognized as the top performing bank 256 Offices, $18.5 billion in assets, second quarter www.bankozarks.com/equipment |

Wednesday, October 19, 2016

Today's Equipment Leasing Headlines

Archives—October 19, 2000

51 Leasing Companies Major Changes

California Expands Exemption for Lender’s License

By Tom McCurnin, Leasing News Legal Editor

Leasing Industry Ads---Help Wanted

Now is the Time for a New Career

Sales Makes it Happen by Steve Chriest

"Rule 23"

September---The List

"The Good, the Bad and the Ugly"

Working Capital Loans

and the Working Capital Cycle

Paul J. Menzel – CLFP for 26 years

Celebrating Long Time Members

LinkedIn Advice on Passwords

I follow this advice strongly—Kit Menkin

Jazz Cruise Vancouver to Anchorage, Alaska

Book Now for Best Discount June 19-June 26, 2017

Labrador Retriever

Simi Valley, California Adopt-a-Dog

Attorneys Who Specialize in

Banking, Finance, and Leasing

News Briefs---

Canadian Small Business Lending Climbs in August

PayNet Index Rose to 123.2 in August from 118.8 Prior Month

San Francisco — Wells Fargo's Hometown

— Might Ditch the Bank

American Bankers Association Compliance, Security

and Mobile Top Bank's Tech Spending List

Broker/Funder/Industry Lists | Features (writer's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

Leasing News Icon for Android Mobile Device

You May have Missed---

Baseball Poem

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send a colleague and ask them to subscribe. We are free.

Email kitmenkin@leasingnews.org and in subject line: subscribe

[headlines]

--------------------------------------------------------------

Archives—October 19, 2000

51 Leasing Companies Major Changes

American Business Leasing (gone)

Balboa Capital (Founder Byrne "...office available any time he wants to use it”).

The Bancorp Group, Inc . (Southfield, MI) (no longer in business)

Bankvest (bankrupt)

Bombadier (reported having problems, not confirmed)

Charter Financial (purchased by Wells Fargo 9/5/2000)

Charter One (10/2000 $1.8 million leasing loss in third quarter)

Colonial Pacific (11/98) purchased by GE Capital Commerce Security (9/99 closed to leasing broker program )(11/99 last fundings)

Copelco (4/2000 sold to Citibank)

Creative Capital" of Bloomfield Hills, MI. (shut-down 3/2000)

Dana (sold off, active as captive)

DVI Capital (out of broker)

El Camino Leasing, Woodland Hills, California (10/2000 No longer taking broker business)

eLease (June/July/2000 senior management changes)

FMA Finance (reportedly closed to brokers)

Fidelity (4/2000 acquired by EAB, a wholly owned subsidiary of ABN AMRO Bank N.V., headquartered in the Netherlands , raising funds)

Finova (out of market place) (10/11/2000 Dow Jones headlines "Finova Stock Falls as Buyout Hopes

Wane) Franklin Bank (no more leases)

Golden Gate Funding (2/99 purchased by Westover Financial)

Heller Financial's Commercial Services Unit (10/99 purchased by CIT)

Imperial (sold portfolio) Irwin Financial (10/2000 "pre-tax loss of $0.6 million during the third quarter." Japan Leasing Credit claims (JLC --6/99 purchased by Oryx)

Lease Acceptance Corp- -- (ceases broker business 7/26/2000)

Leasing Solutions, San Jose, CA (bankrupt)

Liberty Leasing, Redwood City, CA (closed, California Company)

Linc Capital (out of vendor and broker business, Nasdaq halts stock sales, $13.4 loss last quarter)

Lyon Credit Corporation (9/99 purchased by Hudson United Bancorp)

Manifest Group- -(9/1/2000 purchased by US Bancorp Leasing and Financial, "...a win for all the parties involved," Brian Bjella.

Matsco Financial (purchased by Greater Bay Bank)

Merit Leasing (gone)

Metwest Leasing, Spokane, Wa . (6/2000 advising brokers that they have run out of funds so they are unable to fund a transaction we have there for funding.)

Metrolease --- 5/2000 reports closing operation, John Blazek at Evergreen Leasing, Hathcock losing assets, will not confirm nor deny; many serious rumors of fraud floating around the marketplace, confirmed off the record.)

NationsCredit, Business Leasing Group (1/29/99 sold to Textron**) *"The Business Leasing Group of Nations Credit was sold to Textron and we still do broker business," Jim Merrilees.

NIA National Leasing (3/2000 purchased by Lakeland Bancorp)

New England Capital (sold to Network Capital Alliance a division of Sovereign Bank . Sovereign did hire two people who will run a sales office in CT, doing basically the same deals with the same people as before. Little will change in that aspect.

Newcourt (sold off)

Onset Capital (Irwin buys 87% equity)

Orix 10/2000 "long-term Outlook has been revised from Stable to Negative" Credit Alliance has changed its name to ORIX Financial Services, 9/2000 Japanese Bank President Commits Suicide (Orix is a 14.7% shareholder in bank having problems), (8/2000 closes small ticket vendor division in Portland, Oregon, "Business as usual (in New Jersey and with brokers)," says Steve Geller)

Phoenix (5/2000 both divisions closed, 10/2000 pres. joins Pentech Financial, Campbell, Ca.)

Prime Capital (2/2000 purchased by Finatra Capital)

Republic Leasing, South Carolina 9/27/2000 (“The expected result will be a sale of Republic Leasing"---Dwight Galloway)

Rockford (sold to American Express)

Scripp Financial (6/29/2000 (purchased by US Bancorp)

SDI (closed to broker programs)

SFC Capital (9/15/2000 purchased by Trinity Capital)

SierraCities (post $7.7 million second quarter loss, rumors abound, including pending sale. Second Leasing News Report "addendum" on hold until announcement, maybe by Oct.19, stock problems from inside employ week of Oct 16/lot of venom posted on Yahoo bulletin board ) addendum to Special Report on hold until after announcement, now Oct. 19th? )

T&W (bankrupt, lost their listing)

Transamerica (6/99 sold to Aegon Corporation, N.V./put on block 2/2000, but "business as usual," Jason A. Gendron, VP, Transamerica Equip. Fin. Services)

Unicapital ( $11.4 million first quarter loss chairman, CEO, CFO resign, 38 employees cutback, 8/23 BSB to use other funders reported, rumor that BSB will be "spun off", not confirmed and appears to be in the rumor stage right now. Good news, 9/1 Bank of America extends revolving credit line to October 16, 2000. 9/29/2000 Many rumors floating around. 10/12 Prognosis is "challenging," at best.10/17 BofA gives them until Friday to complete "process." Leasing News holding special report until after announcement)

USA Capital Leasing (gone-bk)

|

[headlines]

--------------------------------------------------------------

California Expands Exemption for Lender’s License

By Tom McCurnin

Leasing News Legal Editor

Previously, There Was a Five Loan Per Year Limit If the Loan Was “Incidental to the Business” of the Lender. Now There is an Alternate One Loan Per Year for Lenders That Are Not in the Business of Lending

California SB 777 (R. Lara, D. Bell Gardens, CA) https://leginfo.legislature.ca.gov/faces/

billTextClient.xhtml?bill_id=201520160SB777

Several California legislators have taken upon themselves to take nips out of the California Lender’s law recently. About five years ago, the occasional use exemption of Financial Code § 22050 went from once a year to twice and it is now at five times per year. That exemption, often called the di minimis exemption, was generally used for lenders that did occasional loans as part of their business. The exact statutory phrase is that the loans must be “incidental to the business” of the lender. To me, that meant the lender had to be in the business of making loans and could make 5 California loans a year if the loans were part of the lender’s business.

In August, Governor Brown signed yet another nip out of the statute, a once a year exemption for non-lenders who make a single commercial loan unconnected with their business. It is not required to be “incidental to the business” of the lender. What this means to me is that a normal human could make a single commercial loan once a year to a friend or next door neighbor and not be in violation of the California lender’s law.

How does this impact equipment leasing?

Well, it really doesn’t. Consider these points:

• First, the fact that the lender might qualify for the five times a year exemption does not remove the loans from the usury statute. Any such loan over 10% would be struck down as usurious. The lender would still be able to recover its principal but interest would be struck down, and any interest paid for the year before filing suit, would be tripled. I know of no commercial lender that wants to risk this result.

• Second, what lender makes a single commercial loan in a year unconnected with its business? The answer is none, except perhaps for family, friends or the one-off deal. Again, just because the lender is exempt from licensing does not mean the lender is exempt from usury. So again, that lender, if it charges over 10% interest, would forfeit that interest and possibly be subject to treble damages.

• Third, only lenders may take advantage of either exemption. The statutory language does not exempt brokers.

The bottom line to this new amendments is that I am at a loss who it is supposed to benefit, except the occasional once year mom and pop commercial lender. And that loan better be under 10%, or mom and pop are at significant risk.

Tom McCurnin is a partner at Barton, Klugman & Oetting

in Los Angeles, California.

Tom McCurnin

Barton, Klugman & Oetting

350 South Grand Ave.

Suite 2200

Los Angeles, CA 90071

Direct Phone: (213) 617-6129

Cell (213) 268-8291

Email: tmccurnin@bkolaw.com

Visit our web site at www.bkolaw.com

Previous Tom McCurnin Articles:

http://www.leasingnews.org

Previous Tom McCurnin Articles:

http://www.leasingnews.org/Conscious-Top%20Stories/leasing_cases.html

[headlines]

--------------------------------------------------------------

Sales Makes it Happen by Steve Chriest

"Rule 23"

Rule #21

- Everyone in an organization is a salesperson.

Rule #22

- Not everyone believes rule number twenty-one.

Rule #23

- Everyone has customers.

The most successful, customer-centric organizations we encounter work hard to create a culture that champions all customers, including the company's employees.

Managers in these organizations recognize that they oversee a volunteer workforce and they realize that their success as managers depends, to a large degree, on their ability to persuade employees to work at fulfilling the company's mission.

We've noticed that these same managers faithfully follow their company's sales process when interacting with subordinates.

We don't think it is an accident that companies that are satisfied with their implementation of highly complex CRM (Customer Relationship Management) systems share a common approach to managing their employees.

Instead of simply announcing the arrival of new CRM software, managers solicited input from all affected business units during the project's planning phase, launched modules in stages to promote user adoption, and addressed the cultural shift issues that a major change in software often entails. In short, they approached their employees as customers of the new software system!

A willingness to accept the three rules that apply to all organizations today, and a commitment to treat everyone in the organization as a "customer," helps create a true customer-focused enterprise.

Steve Chriest is the CEO of Open Advance and author of “Selling to the E-Suite, The Proven System for Reaching and Selling Senior Executives and Business Acumen 101.” He recently re-named his company from Selling-Up. He produces video and radio blogs, as well as continuing as a columnist for Leasing News since 2005.

www.openadvance.com/contact/

925-263-2702

www.openadvance.com/

Sales Makes It Happen Articles:

http://www.leasingnews.org/Legacy/index.htm

[headlines]

--------------------------------------------------------------

Leasing Industry Ads---Help Wanted Opportunity

Ascentium Capital/Bank of Ozarks Finance

SALES POSITIONS AVAILABLE Positions are available for well experienced industry Please email your resume to sschachtel@bankozarks.com Bank of the Ozarks was recognized as the top performing bank 256 Offices, $18.5 billion in assets, second quarter www.bankozarks.com/equipment |

[headlines]

--------------------------------------------------------------

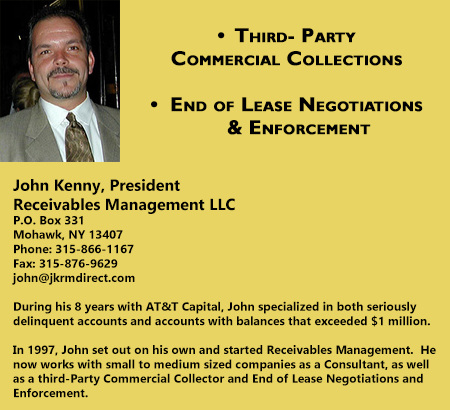

September---The List

"The Good, the Bad and the Ugly"

Navitas Credit Corp., Ponte Vedra, Florida (9/16) Completes third and largest term securitization of equipment loan and lease contracts, $205.1 Million. http://leasingnews.org/archives/Sep2016/09_30.htm#navitas

Windset Capital, Salt Lake City, Utah (9/16) To Discontinue Funding New Business Loans

http://leasingnews.org/archives/Sep2016/09_19.htm#windset

Balboa Capital, Irvine, California (9/16) Gets Win in Bait and Switch Purchase Option Case http://leasingnews.org/archives/Sep2016/09_07x.htm#balboa

CSI Leasing, St. Louis, Mo (9/16) Announces Organizational Structure Change, Executive Officer Promotions http://leasingnews.org/archives/Sep2016/09_02.htm#csi

|

Please Click on Bulletin Board to learn more information

Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police

[headlines]

--------------------------------------------------------------

Working Capital Loans

and the Working Capital Cycle

by Christopher Menkin

Unless you are familiar with financial statements, you may not realize the key factor of Working Capital Cycle is paramount to any business. While many are hawking loans as improving working capital, they don't really understand how it is calculated or its true value, as well

as the value of the Working Capital Cycle.

Working capital is simply "current assets" compared to "current liabilities." Current assets are most often cash, cash equivalents, and analyzing anything convertible to cash within one year's time. This often includes accounts receivable and inventory.

Current liabilities are debts due within one year: accounts payable, one year of long term debt, or other "short term" expenses, which could be sales tax, property tax.

A useful measure of liquidity (a measure that shows the business has enough current assets to keep operating smoothly) is the current ratio. Calculate the current ratio by dividing the total current assets by the total current liabilities.

This is useful because, no matter what the scale of an organization is, the relationship between total current assets and total current liabilities is revealing of the company’s financial condition. Borrowing on the short term increases cash available, but does not change the working capital ratio.

There are several means to increase the ratio, such as decreasing the accounts receivable time, reducing the amount of inventory (including sending back unmarketable goods to suppliers, negotiating longer accounts payment and payment times, increasing the time period of loans and leases), or otherwise creating a smaller monthly payment thereby increasing the working capital ratio with a smaller current year liability.

The advantage of a short term "working capital loan" is the infusion of liquidity, which results in increasing inventory, marketing, and meeting payroll, but does not improve the working capital ratio unless it creates sales and thus income above the money borrowed on a short term basis.

The working capital cycle (WCC) is the amount of time it takes to turn the net current assets and current liabilities into cash. The longer the cycle, the longer a business is tying up capital in its working capital without earning a return on it.

A higher working capital turnover ratio is better. It means that the company is utilizing its working capital more efficiently, i.e., generating more revenue using less investment.

It should be mentioned that industries all have different views of what is their sufficient working capital ratio should be.

[headlines]

--------------------------------------------------------------

Paul J. Menzel – CLFP for 26 years

Celebrating Long Time Members

Paul J. Menzel, CLFP

President & CEO

Financial Pacific Leasing, Inc., a subsidiary of Umpqua Bank

I became a CLP (now CLFP) in 1990 and participated in the development of the CLP Handbook by writing the original chapter on Portfolio Management. I also assisted in training and mentoring early candidates while also grading tests.

When asked why I became a CLFP, I answered:

“I’ve always seen myself as a lifetime learner as a means to keeping life interesting and furthering my career. I obtained my MBA by going to school in the evenings and on weekends and I taught myself how to prepare my own taxes since I was learning small business credit analysis in my first leasing job right out of college and I needed to understand how to interpret guarantor’s tax returns. I believe that ‘Knowledge is King’ in creating a positive outcome in any situation so I have lived by that tenet in advancing my leasing career. Pursuing the CLFP was just an early and beneficial step in that process.”

I arranged the sale of Financial Pacific Leasing to Umpqua Bank in 2013, establishing a bank leasing subsidiary operating in all markets of the leasing industry, from small-ticket to larger, middle-market transactions in the third party origination, vendor and direct channels. Umpqua has over $24 Billion in assets.

I joined Financial Pacific in 2008 after a 33-year career managing a small ticket leasing portfolio operation in Santa Barbara, California. I started in the leasing industry in 1975 with Puritan Leasing Company and managed the operation and its acquisition by Cal Fed Credit in 1986, by Pacific Capital Bank NA (fka Santa Barbara Bank & Trust) in 1996, and by LEAF Financial Corporation in 2007. As SVP of Community Lending for Pacific Capital Bank, I oversaw the Leasing, Small Business and Indirect Auto Lending units of the Bank managing over $750 MM in assets.

I am a past Board Member of the Equipment Leasing & Finance Association and have chaired their Code of Fair Business Practices and Small-Ticket Business Council Committees. I have also served on the Industry Future Council. In 2005 I was named “Leasing Person of the Year” by Leasing News. I earned my BS in Business Administration from UC Berkeley in 1974 and an MBA in Management from Golden Gate University.

Why I Became a CLP Series (now CLFP)

http://www.leasingnews.org/CLP/Index.htm

(Leasing News provides this ad as a trade for appraisals

and equipment valuations provided by Ed Castagna)

[headlines]

--------------------------------------------------------------

LinkedIn Advice on Passwords

I follow this advice strongly—Kit Menkin

• Make sure you update your password on LinkedIn (and any site that you visit on the Web) at least once every few months.

Most of us will never do this, until we are hacked. I change mine every other month.

• Do not use the same password for multiple sites or accounts.

I have many multiple passwords and I do not save any passwords or let the computer do so. I keep them in a "flash stick" and have them printed out should the "flash stick" fail

It happened to me once, and won't forget that. I have heard from many readers about their email address book being hacked and reports of intrusions. Don't save passwords at sites, have many multiple passwords, even though it is a big hassle.

• Create a strong password for your account, one that includes letters, numbers, and other characters.

I use these on all financial and sites I consider very important. I know a hacker can get in anywhere, but the more difficult, it will keep the amateurs out, is my thinking. I go to Google, create passwords, and they have web site programs that create these to the security situation choose.

• Watch out for phishing emails and spam emails requesting personal or sensitive information.

Most of the tricks are very obvious, so be very careful in what you open. I often reply and ask if the download is “virus free,” especially when sent to a group that includes my email address. As well as have an up-dated anti-virus/malware program.

• Get a pop-up you have been hacked, don’t believe it.

I go to “task manager” and delete it. One time it did not work using “task manager,” so I turned the computer off. When I turned it back on, the pop-up was gone. The gimmick is they want you to respond, so they can send in a program that requires you to pay to get it removed.

Also remember whatever you email or respond on the computer, stays there forever, you think you deleted it, but some program or server

never lets it go.

Kit Menkin

[headlines]

--------------------------------------------------------------

Jazz Cruise Vancouver to Anchorage on Crystal Serenity

Book Now for Best Discount June 19-June 26, 2017

Jeff Rudin of Quail Capital invites all his jazz aficionados to join him. On Board: Special Cruise Guest, Mark Cantor, Film Archivist & Jazz Historian. Mark Cantor is a well-known authority on the subject of jazz on film. As an Archivist, Mark’s private collection is one of the biggest worldwide, with over 5000 Jazz performance clips on a variety of media.

Musicians: Big Bad Voodoo Daddy

https://divinejazzcruise.com/artists/

Itinerary

https://divinejazzcruise.com/itinerary/

Sailing Crystal Serenity

https://divinejazzcruise.com/sailing-crystal/

https://divinejazzcruise.com/reservation/

[headlines]

--------------------------------------------------------------

#### Press Release ###########################

Fleet Financing Resources Records 32% Volume Growth

for the First Nine Months of 2016

Riverside, California, – Fleet Financing Resources (FFR) reports results for first nine months of 2016. New and used titled transportation equipment funded volume was $50million, up 32% for the reporting period; net income up 20% compared to same period prior year.

Dave Reynolds, President and Chief Executive Officer, commented on the 2016 financial results: “Strong customer loyalty and good expense discipline continues to drive positive growth. The subdued net income increase is primarily attributable to the adverse impact of keen market competition and rate compression. Additionally, reserves for losses were increased 7.5% in response to management concerns of broader industry delinquency trends, even though FFR portfolio performance exceeds expectations.

About Fleet Financing Resources - FFR offers financing and leasing for all new and used titled transportation equipment - specializing in buses of all sizes. Founded in 2002, Fleet Financing Resources has been successful in providing finance solutions to over 3,800 businesses nationwide. FFR offers a broad funding menu of products and services tailored to each client’s specific needs.

http://leasingnews.org/Ads/Completed/leasingews_maillist7.htm

### Press Release ############################

[headlines]

--------------------------------------------------------------

Labrador Retriever

Simi Valley, California Adopt-a-Dog

Mollie Promise

A sweet, petite, darling little bon-bon! Meet Mollie Promise, a 3- year old, precious compact Labby girl who will steal your heart! She is absolutely beautiful with her almost white coat, small frame, soulful eyes, and sweet expression.

Mollie came to us after her owners turned her into a high kill shelter because they didn't want a dog anymore. We saw her and rescued her immediately and we are glad we did. She is just a joy.

We are seeking a dog savvy experienced owner for Mollie as she has a couple quirks which we are working on.

Mollie knows her basic commands and likes to give you her paw. She is completely housebroken and uses a doggie door. She is not destructive and is a basically a medium energy calmer dog. She is easy on the leash and a nice walking companion.

She is great with other dogs and humans and loves to play! At first, however she can be fearful or anxious. We think she may have had some bad experiences in her former life. She is turning into a perfect dog in her foster home so we know she will do the same in her fur-ever home provided we start her out with a new owner who has experience, patience, and is dog savvy.

She is currently fostered with 5 other Labradors and loves them all. At first she was easily agitated at any obnoxious, overly playful behavior, especially if up in her face. She would sometimes growl or let the dogs know she didn't like it. After such a short time, she is now perfect with the dogs and loves playing with them. She'll even share a bed with any one of them. She's so petite she always fits!

Mollie loves people so she'll love her new owner, but takes a while to trust you totally. She'll need at least 2 weeks to get bonded to her new owner. Once she leaves her foster home she may once again be shy or fearful meeting new dogs, so her new owner needs to be committed to taking it slow, giving her time, and working with her.

Mollie is very affectionate and loves attention. However, she can be a tad aloof at times too preferring to be on her own. She loves car rides and will be a wonderful errand buddy on days when it's not too hot for a dog to stay in the car. She will do great even on long trips. She loves the car!

Mollie should go to an adult only home. She is afraid of all toddlers and children. Our goal is to put her in a home where she can settle at her pace and feel safe until she is fully acclimated. So no kids for this angel.

Because Mollie can be overwhelmed, she is not a candidate for a dog park at this time. A dog park is always a wild card due to the possibility of unknown dogs, sick dogs, aggressive dogs, or unaltered dogs showing up and causing problems.

Mollie's new owners will want to exercise her with walks or hikes or ball throwing which she absolutely loves! She has not gone into the pool yet at her foster home but seems curious and may like swimming once she tries it.

Mollie will do fine as an only dog. She will also do well with another friendly canine companion who is well balanced, not pushy, playful and sweet. However when going with another dog, the new owner will have to expect that it will take a little bit for Mollie to warm up to their dog.

Mollie is spayed, up to date on shots and microchipped.

Applications and Fees:

http://www.indilabrescue.org/applicationfees.html

Indi Lab Rescue

PO Box 941564

Simi Valley, CA 93094

info@indilabrescue.org

[headlines]

--------------------------------------------------------------

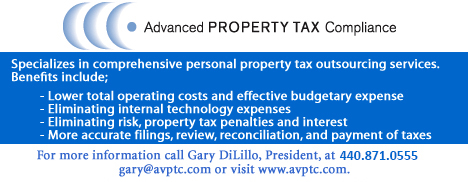

Attorneys Who Specialize in

Banking, Finance, and Leasing

| Birmingham, Alabama The lawyers of Marks & Associates, P.C. have over 30 years experience in dealing with virtually every type of equipment financing and are recognized throughout the industry for prompt, practical solutions and exemplary service. They offer cost-conscious, effective lease enforcement and good counsel. Email: Barry@leaselawyer.com Website: www.leaselawyers.com |

California, National: city: Riverside Ellen Stern - get results, reasonable pricing; numerous industry contacts, nearly 30 yrs exp.in SoCal, 20 yrs equip.: CFL license specialist, documentation, work-outs, litigated collections, recoveries; deal-maker. Email: leaselaw@msn.com |

||

|

Connecticut, Southern New England: EVANS, FELDMAN & BOYER, LLC Collections, litigation, documentation, portfolio sales and financing, bankruptcy. We represent many of the national and local leasing companies doing business in this state. Past chairman EAEL legal committee. Competitive rates. email: rcfeldman@snet.net |

||

| Los Angeles/Santa Monica Hemar & Associates, Attorneys at Law Specialists in legal assistance, including debt collection, equipment recovery, litigation for 35 years. Fluent in Spanish. Tel: 310-829-1948 email: phemar@hemar.com |

|||

| Los Angeles, Southern CA Seasoned attorney representing secured creditors in auto finance and truck/equipment lease industry. Bankruptcy and State Court litigation. Vincent V. Frounjian (818) 990-0605or email: vvf@pacbell.net. |

Encino, California: Statewide “ELFA” |

||

Los Angeles, Statewide: CA. "ELFA" Aggressive creditors rights law firm specializing in equipment leasing handling collection matters on a contingency, fixed fee or hourly cbasis. email:RGarwacki@prodigy.net |

Los Angeles, Statewide: CA "ELFA" |

||

Los Angeles- Statewide, CA Lawyer specializing in banking and leasing issues statewide. Documents and litigation. Tom McCurnin, Barton, Klugman & Oetting. Voice: (213) 617-6129 Cell:(213) 268-8291 Email: tmccurnin@bkolaw.com |

California & National Paul Bent – More than 35 years experience in all forms of equipment leasing, secured lending, and asset based transactions. Financial analysis, deal structuring, contract negotiations, documentation, private dispute resolution, expert witness services. (562) 426-1000 www.paulbentlaw.com pbent@paulbentlaw.com |

||

Illinois |

Law Firm - Service, Dallas, TX. "ELFA" Mayer regularly practices in leasing, secured financing, project development and finance and corporate finance. email: dmayer@pattonboggs.com Website: www.pattonboggs.com |

||

| Massachusetts (collection/litigation coast to coast) Modern Law Group focuses its practice on collections, lease enforcement and asset recovery. For the past five years, our attorneys have helped clients recover millions of dollars. We are able to cover your needs coast to coast. Email phone 617-855-9085www.modernlawgroup.com |

Michael J. Witt, experienced bank, finance, and leasing attorney, also conducts Portfolio Audits. Previously he was Managing Counsel, Wells Fargo & Co. (May, 2003 – September, 2008); Senior Vice President & General Counsel, Advanta Business Services (May, 1988 – June, 1997) Tel: (515) 223-2352 Cell: (515) 868-1067 |

||

| National: The OMEGA Network Group-nationwide legal representation of small and mid ticket equipment lessors-flat fee bankruptcy & replevin, contingent collection, billable litigation (704-969-3280) tong_92@yahoo.com |

National: Coston & Rademacher: Business attorneys serving the lease-finance industry since 1980. Transactional, documentation, corporate/finance, workouts, litigation, bankruptcy, portfolio management. Chicago-based national practice. Jim Coston, CLP (Members: ELFA, NEFA). |

||

| St. Louis County , MO. - statewide: Schultz & Associates LLP., collections, negotiation, and litigation. Also register and pursue recovery on foreign judgments. Contingency and reasonable hourly rates. Ronald J. Eisenberg, Esq. (636) 537-4645 x108 reisenberg@sl-lawyers.com www.sl-lawyers.com |

NJ, De, Pa: Specializing in leased equipment/secured transactions. Collections, replevins/workouts reasonable rates. Sergio Scuteri/Capehart & Scratchard, PAsscuteri@capehart.com / www.capehart.com | ||

New York and New Jersey Frank Peretore Chiesa Shahinian & Giantomasi West Orange, New Jersey http://www.csglaw.com/ biographies/frank-peretore Phone 973-530-2058 fperetore@csglaw.com Documentation, portfolio purchase & sale, replevin, workouts, litigation, collection, bankruptcy. Aggressive. Over 30 years experience. |

Thousand Oaks, California: |

(Leasing News provides this ad as a trade for investigative

reporting provided by John Kenny)

[headlines]

--------------------------------------------------------------

![]()

News Briefs---

Canadian Small Business Lending Climbs in August

PayNet Index Rose to 123.2 in August from 118.8 Prior Month

http://www.reuters.com/article/canada-economy-paynet-idUSL1N1CK1NQ

San Francisco — Wells Fargo's Hometown

— Might Ditch the Bank

http://www.businessinsider.com/san-francisco-wells-fargo-hometown-cut-its-ties-with-bank-2016-109

American Bankers Association Compliance, Security

and Mobile Top Bank's Tech Spending List

http://www.americanbanker.com/news/bank-technology/compliance-security-and-mobile-top-banks-tech-spending-list-1091742-1.html

[headlines]

--------------------------------------------------------------

--You May Have Missed It

Piecemeal regulation is hindering US FinTech

Sector is Booming in Europe

http://www.businessinsider.com/piecemeal-regulation-is-hindering-us-fintechs-2016-10?r=UK&IR=T

--------------------------------------------------------------

Baseball Poem

Tomorrow Mickey Mantle’s Birthday

I love Mickey

Mickey who? You know who...

The fella with the celebrated swing

I love Mickey

Mickey who? You know who...

The one who drives me batty ev'ry Spring

If I don't make a hit with him my heart will break in two

I wish that I could catch him and pitch a lttle woo oo

I love Mickey

Mickey who? Mickey you. Mickey me?

That's who oo oo oo oo oo oo oo

I love Mickey

Mickey who? You know who...

His muscles are a mighty sight to see

I love Mickey

Mickey who? You know who...

The one I want to steal right home with me

I'd sacrifice most anything to win his many charms

I'd like to be a fly ball and pop into his arms oo

I love Mickey

Mickey who? Mickey Mantle

Mm mm I love you

Who, me?

Mm mm I love you

Not Yogi Berra?

Mm mm I love you

[headlines]

--------------------------------------------------------------

Sports Briefs----

Lowell Cohn: 49ers are laughable and it starts with Jed York

http://www.pressdemocrat.com/sports/6201808-181/lowell-cohn-49ers-are-laughable

NBC's 'Sunday Night Football' has lowest ratings since 2011

http://www.theredzone.org/BlogDescription/tabid/61/EntryId/59345/NBC-s--Sunday-Night-Football--has-lowest-ratings-since-2011/Default.aspx

Indianapolis Colts RB Frank Gore: 'I didn't come here for this'

http://www.stltoday.com/sports/football/indianapolis-colts-rb-frank-gore-i-didn-t-come-here/article_c837d5ca-7c1e-58cb-86f9-5827539815dc.html

Bill Belichick ends war with his own tablet in comical tell-all

http://nypost.com/2016/10/18/bill-belichick-ends-war-with-his-own-tablet-in-comical-tell-all/

Two San Diego NFL stadium measures, big decisions confront voters

http://www.sandiegouniontribune.com/business/dan-mcswain/sd-fi-mcswain-chargers-nfl-stadium-measures-20161006-htmlstory.html

Donald Trump once considered purchasing Padres

http://www.sandiegouniontribune.com/sports/padres/sd-sp-padres-donald-trump-20161018-story.html

[headlines]

--------------------------------------------------------------

![]()

California Nuts Briefs---

$5.4 Million Healdsburg Estate is

a Wine Lover's Dream Come True

http://realestate.blogs.pressdemocrat.com/16153/healdsburg-estate-with-a-cave/

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

Constellation Brands offloads Canadian wineries,

buys Washington State brands

http://www.pressdemocrat.com/business/6201432-181/constellation-brands-offloads-canadian-wineries

Browne Family Vineyards Goes Big with its

Large-Format Bottle Program

https://www.winebusiness.com/newReleases/?go=getArticle&dataid=175865

The Expanding Wine Lists at Los Angeles LAX Airport

http://www.forbes.com/sites/tmullen/2016/10/17/the-expanding-wine-list-at-los-angeles-lax-airport/#3568aeec77a8

Montana’s alcohol license system has winners, losers

http://www.bozemandailychronicle.com/news/economy/montana-s-alcohol-license-system-has-winners-losers/article_8a6229d0-a06d-5862-8e5b-d07c97c745b2.htmlFree Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in American History

1739 - England declared war on Spain over borderlines in Florida. The War is known as the War of Jenkins' Ear because a Member of Parliament waved a dried ear and demanded revenge for alleged mistreatment of British sailors. British seaman Robert Jenkins had his ear amputated following a 1731 barroom brawl with a Spanish Customs guard in Havana and saved the ear in his sea chest.

1765 – The Stamp Act Congress, meeting in New York, drew up a declaration of rights and liberties. It was the first gathering of elected representatives from several of the American colonies to organize a unified protest against new British taxation, in this case, The Stamp Act, which required the use of specially stamped paper for legal documents, playing cards, calendars, newspapers and dice for virtually all business in the colonies, and was to take effect November 1. The Congress was organized in response to a circular letter distributed by the colonial legislature of the Province of Massachusetts Bay and consisted of delegates from nine of the eighteen British colonies in North America. All nine of the attending delegations were from the Thirteen Colonies that eventually formed the United States. Although sentiment was strong in some of the other colonies to participate in the Congress, a number of royal governors took steps to prevent the colonial legislatures from meeting to select delegates. The Congress discussed and united against the act, issuing a Declaration of Rights and Grievances in which they claimed that Parliament did not have the right to impose the tax because it did not include representation from the colonies. Members of six of the nine delegations signed petitions addressed to Parliament and King George III objecting to the Act's provisions.

1781 - Washington takes Yorktown. By 1780, the Continental Army had suffered its worst privations, it greatest defeats, and its darkest hours. October was a terrible month in 1780. It would continue to lose battles but, by this time, turned into a well-trained fighting force by European officers and aided by allied French forces, it endured. Historians consider the American Revolutionary War ended this day in 1781 when more than 7,000 English and Hessian troops, led by British General Lord Cornwallis, surrendered to General George Washington at Yorktown, Virginia, effectively ending the war between Britain and her American colonies. The military phase of the conflict ended at Yorktown as there were no more major battles, but the diplomatic struggle continued. Preliminary articles of peace were secured on November 30, 1782, after long and difficult negotiations. The Treaty of Paris, by which the war was officially ended and independence formally acknowledged by Great Britain, was not signed until September 3, 1783. Adding to the disagreements was communication by ship and even meetings locally were delayed as the pace of public transportation in the U.S. was painfully slow. It took Thomas Jefferson five days to travel from Philadelphia to Baltimore. The time delay also gave over 100,000 loyalists the time to fled the U.S. Also known as Tories, they had suffered various penalties for their loyalty to the Crown, including confiscation of property, removal from public office, and punitive taxation. Probably no more than 10% of the colonials were Tories, who were generally well-to-do, engaged in commerce or the professions, or public officials. Many fled to Canada, some to England. Some returned after the peace treaty was actually signed. After the conflict, many were also able to recover at least some of their confiscated property. The estimated colonial population was 2,781,000.

http://xroads.virginia.edu/~CAP/ROTUNDA/york_1.html

http://bluehawk.monmouth.edu/~library/mumford.html

1789 – John Jay was sworn in as the first Chief Justice of the US Supreme Court. He served until 1795. Jay served as the President of the Continental Congress (1778–79), an honorific position with little power. During and after the Revolution, Jay was Ambassador to Spain, a negotiator of the Treaty of Paris by which Great Britain recognized American independence, and Secretary of Foreign Affairs, helping to fashion US foreign policy. His major diplomatic achievement was to negotiate favorable trade terms with Great Britain in the Jay Treaty in 1794. Jay was a proponent of strong, centralized government and worked to ratify the US Constitution in New York in 1788 by pseudonymously writing five of “The Federalist Papers”, along with the main authors Alexander Hamilton and James Monroe. After the establishment of the U.S. government, Jay became the first Chief Justice.

1829 - The monument to George Washington was completed in Baltimore, MD. The cornerstone was laid on July 4, 1815, with a Masonic ceremony.

1833 - Edgar Allen Poe's "MS. Found in a Bottle" appears in "Baltimore Sunday Visitor." MS is shorthand for manuscript.

1842 - Military forces, believing war has begun, occupy Monterey, Mexico.

1844 - The famous "Lower Great Lakes Storm" occurred. Southwesterly winds were at hurricane force for five hours, driving lake waters into downtown Buffalo, NY. The storm drowned 200 persons.

1848 - John "The Pathfinder" Fremont moved out from near Westport, Missouri, on his fourth Western expedition--a failed attempt to open a trail across the Rocky Mountains along the 38th parallel. It was not until scout Christopher "Kit" Carson joined him that Fremont found the passage West.

1850 - Annie Smith Peck shocks society by wearing trousers when she climbed mountains. She had conquered every large mountain in the Western Hemisphere and, at age 85, she climbed Mount Madison in New Hampshire.

1876 - Birthday of Mordecai Peter Centennial “Three Finger” Brown (d. 1948) at Nyesville, IN. Baseball Hall of Fame pitcher, Brown won 239 games. His nickname came from a childhood injury that cost him one finger and misshaped others. Inducted into the Hall of Fame in 1949.

1885 - Charles E. Merrill, (d. 1985) the American investment banker who helped create the largest brokerage firm in the United States, was born in Green Cove Springs, Fla. In 1914, he founded the firm that grew into Merrill Lynch, Pierce, Fenner & Beane. One of the first New York stockbrokers to realize the importance of selling stocks and bonds to small investors by furnishing for them simple, conservative and sound financial advice, in 1928, Merrill and Roger Babson were almost alone in the financial community in sensing possible disaster in the stock market. He was convinced that the dizzy joy ride then under way would not last and his firm mailed out a market letter in which he said: "Now is the time to get out of debt….We do not urge you to sell securities indiscriminately, but we advise you in no uncertain terms that you take advantage of present high prices and put your own financial house in order. We recommend that you sell enough securities to lighten your obligations, or better yet, pay them entirely." It was estimated at the time of the stock market crash that Mr. Merrill's foresight had saved over $6,000,000 for his customers.

1895 - Historian Lewis Mumford (d. 1990) birthday, Flushing, NY.

1901 - Arleigh A. Burke, (d. 1996) admiral (World War II, Solomon Islands, Navy Cross), was born in Boulder, Colorado. Although unable to complete his high school education because the school was closed during the flu epidemic in 1917, he competed successfully for an appointment to the U.S. Naval Academy. Convinced that the inadequacies of his secondary education put him behind other Midshipmen in his class, Burke decided that he could only overcome this deficiency by working more diligently at his studies than the others. This plan paid great dividends, and he graduated in 1923 in the top sixth of his class. Taking this lesson strongly to heart, he remained a believer in the benefits of sustained hard work throughout his Navy career. During the interwar years, Arleigh Burke honed his skills as a surface warfare officer, serving initially in the battleship USS Arizona, obtaining a postgraduate degree in ordnance engineering, and rising eventually to command a destroyer. It was in this formative period of his career that he learned the importance of the Navy adage "loyalty up, loyalty down"--if you expect loyalty from your people you must be loyal to them in return. During World War II, Burke commanded Destroyer Squadron 23 (the "Little Beavers") during combat in the South Pacific. Developing successful tactics to overcome Japanese advantages in night surface operations, he earned fame as "31-knot" Burke during the 1943 battles of Empress Augusta Bay and Cape St. George. It was in this period that his belief in the importance of thorough training was validated--as he explained to his subordinates, in combat your outfit could expect to do only about as well as it had trained to do beforehand. During Dwight Eisenhower's terms as President in the 1950s, Arleigh Burke served as Chief of Naval Operations (CNO) for six years. While CNO he initiated efforts such as the submarine-launched Polaris ballistic missile program that tremendously strengthened the U.S. Navy's military capabilities.

1915 - Establishment of Submarine Base at New London, Connecticut. In 1868, Connecticut gave the Navy land and, in 1872, two brick buildings and a "T" shaped pier were built and officially declared a Navy Yard. Today the Naval Submarine Base New London (SUBASE NLON), located on the east side of Thames River in Groton, CT, proudly claims its motto to be "The First and Finest."

1917 - The first doughnut was fried by Salvation Army (who would found the United Service Organization) volunteer women for American troops in France during World War I. The first of a group of 250 Officers and Soldiers of The Salvation Army to be posted to France to serve with General John Pershing's American expeditionary force sailed from New York on August 12, 1917. General Pershing was far from convinced that The Salvation Army's presence at the Front Line would benefit his troops and at first, the Salvationists were treated with total indifference. At Demange, in the American first division sector, Salvationists toiled in pouring rain to build a hut 25 feet wide by 100 feet long for the troops benefit. No one gave them the time of day, much less a hand. What swung the troops to The Army's side was their practical example. No task was too menial, none too dangerous or difficult. But The Salvation Army won pride of place in American hearts by a brain wave born of sheer necessity. At Montiers, after 36 days of rain, supplies were almost exhausted. Only flour, lard and sugar remained. Ensign Margaret Sheldon, from the Chicago slums made a suggestion which was to go down in history. "Why don't we make them doughnuts?" They had no rolling pins or cake cutters and gales had blown down their tent but Salvationists thrive on challenges. Along with Ensign Helen Purviance, Margaret Sheldon crouched in the rain to prepare the dough. An empty bottle did duty as a rolling pin and in place of a cutter they used a knife to twist the doughnuts into shape. The first doughnuts cooked over a wood fire were triumph of improvisation. On the first day they served up some 150 doughnuts. The following days batch topped 300. The traditional hole now being punched out with the inner tube of a coffee percolator. The doughnuts made by The Salvation Army Lassies were an instant success with the troops. Some lining up for hours in appalling conditions for their daily supply. Soon the troops came to realize that even in the firing line The Salvationists would not neglect them. When Lassies like Ensign Florence Turkington crawled under shell fire to deliver coffee and doughnuts to troops in the trenches, letters praising the work of The Salvation Army began flooding back home. Overnight, the bewildered lassies found themselves national heroines. Although often in great danger The Salvationists displayed tremendous courage. At Baccarat they worked so close to the German lines that they couldn't even whisper for fear of being heard by the listening posts. The sermon that came with the coffee and doughnuts was a friendly squeeze on the shoulder. The Doughnut became a symbol of The Salvation Army in the U.S.A. Outside many of The Army rest rooms and hostels were hung giant "doughnuts". The Army, by selfless example, had won the hearts of a nation. At the end of the war the American people subscribed an unprecedented 13 million dollars to meet the debts incurred by The Salvation Army in its' war work.

1922 – Columnist Jack Anderson (d. 2005) was born in Long Beach, CA. Considered one of the fathers of modern investigative journalism, Anderson won the 1972 Pulitzer Prize for National Reporting for his investigation on secret American policy decision-making between the US and Pakistan during the Indo-Pakistani War of 1971. He also broke open the investigation and harassment by the Nixon administration of John Lennon during the fight to deport Lennon, the search for fugitive ex-Nazi officials in South America and the savings and loan crisis. He discovered a CIA plot to assassinate Fidel Castro and was credited for breaking the Iran-Contra affair, though he has said the scoop was "spiked" because the story had become too close to President Reagan. In the mid-1960s Anderson exposed the corruption of Senator Thomas J. Dodd and unearthed a memo by an ITT executive admitting the company paid off Richard Nixon’s campaign debt to stymie anti-trust prosecution. His reporting on Nixon-ITT corruption earned him a place on the Master List of Nixon’s Political Opponents. In 1972, Anderson was the target of an assassination plot in the White House. Two Nixon conspirators admitted under oath they plotted to poison Anderson on orders from senior White House aide Charles Colson. White House "plumbers" G. Gordon Liddy and E. Howard Hunt met with a CIA operative to discuss the possibilities, including drugging Anderson with LSD, poisoning his aspirin bottle, or staging a fatal mugging. The plot was aborted when the plotters were arrested for the Watergate break-in. Nixon had long been angry with Anderson, blaming Anderson's election eve story about a secret loan from Howard Hughes to Nixon's brother for Nixon's loss of the 1960 presidential election.

1926 - John C. Garand patented a semi-automatic rifle. Civil Service employee John Garand was in a class all by himself, much like the weapons he created. Garand was Chief Civilian Engineer at the Springfield Armory in Massachusetts. Garand invented a semiautomatic .30 caliber rifle, known as the M-1 or "the Garand," which was adopted in 1936 after grueling tests by the Army. It was gas-operated, weighed under 10 pounds, and was loaded by an 8-round clip. It fired more than twice as fast as the Army's previous standard-issue rifle and was praised by General George S. Patton, Jr., as "a magnificent weapon" and "the most deadly rifle in the world."

1932 – Robert Reed (d. 1992) was born John Robert Rietz, Jr. in Highland Park, IL. A television veteran, he became Mike Brady opposite Florence Henderson’s Carol Brady in “The Brady Bunch” (1969-74).

1938 - For Decca records, the Bob Crosby Orchestra recorded "I'm Free." Trumpet was provided by Billy Butterfield. A few years later the song would be retitled, "What's New."

1939 - One of Frank Capra's finest films, “Mr. Smith Goes to Washington,” opened in the United States. Starring James Stewart, Jean Arthur, Claude Rains, Harry Carey, Sr., and Edward Arnold, the film about a young idealist who discovers nothing but corruption in the government, did well at the box office. It received many Oscar nominations, including Best Picture, Best Actor, Best Supporting Actor, and Best Director, but was knocked out of most at awards' time due to “Gone with the Wind's” sweep; it did snag, however, Best Writing, Original Story for writer Lewis R. Foster, and Stewart received the New York Film Critics Circle Awards for Best Actor.

1940 – Larry Chance, lead singer of The Earls, was born Larry Figueiredo in Philadelphia. Upon moving to The Bronx, he originally formed his group as The Hi-Hatters. The group was eventually rechristened The Earls and he changed his last name to Chance, after the record label. In 1962, the Earls' single "Remember Then" was a huge national hit, reaching #24 on the Billboard charts. Other records entered the charts, including "Never" (top 5 on the local New York charts), "Life Is but a Dream" (top 10 on the local New York charts), and "I Believe", considered an East Coast classic. Other recordings include "Looking for My Baby" and "Kissing."

1943 – Streptomycin, the first antibiotic remedy for tuberculosis was isolated by researchers at Rutgers University.

1944 - US Navy opened to Black women.

1944 - HAJIRO, BARNEY F., Medal of Honor

for conspicuous gallantry and intrepidity at the risk of his life above and beyond the call of duty. Private Barney F. Hajiro distinguished himself by extraordinary heroism in action on 19, 22, and 29 October 1944, in the vicinity of Bruyeres and Biffontaine, eastern France. Private Hajiro, while acting as a sentry on top of an embankment on 19 October 1944, in the vicinity of Bruyeres, France, rendered assistance to allied troops attacking a house 200 yards away by exposing himself to enemy fire and directing fire at an enemy strong point. He assisted the unit on his right by firing his automatic rifle and killing or wounding two enemy snipers. On 22 October 1944, he and one comrade took up an outpost security position about 50 yards to the right front of their platoon, concealed themselves, and ambushed an 18-man, heavily armed, enemy patrol, killing two, wounding one, and taking the remainder as prisoners. On 29 October 1944, in a wooded area in the vicinity of Biffontaine, France, Private Hajiro initiated an attack up the slope of a hill referred to as "Suicide Hill" by running forward approximately 100 yards under fire. He then advanced ahead of his comrades about 10 yards, drawing fire and spotting camouflaged machine gun nests. He fearlessly met fire with fire and single-handedly destroyed two machine gun nests and killed two enemy snipers. As a result of Private Hajiro's heroic actions, the attack was successful. Private Hajiro's extraordinary heroism and devotion to duty are in keeping with the highest traditions of military service and reflect great credit upon him, his unit, and the United States Army.

1944 - Marlon Brando made his New York stage debut at age 20 in the hit Broadway play, “I Remember Mama.” Playwright John Van Druten adapted Kathryn Forbes' novel, “Mama's Bank Account.” The show will become one of television’s first big hits in the late 1940's.

1945 – Jeannie C. Riley was born Jeanne Carolyn Stephenson in Stamford, TX. She is best known for her 1968 country and pop hit "Harper Valley PTA", which missed (by one week) becoming the Billboard Country and Pop #1 hit at the same time.

1949 - No. 1 Billboard Pop Hit: “That Lucky Old Sun,'' Frankie Laine.

1950 - "The Adventures of Ellery Queen" premiered. My father, Lawrence Menkin, wrote many of the episodes. In each of the shows, Queen talked to the home audience at the show's climax to see if they were able to identify the killer. These people played Ellery Queen during the several year TV series: Lee Bowman, Hugh Marlowe, George Nader, Lee Phillips, Peter Lawford and Jim Hutton.

1951 - Top Hits

“Because of You” - Tony Bennett

“I Get Ideas” - Tony Martin

“Cold, Cold Heart” - Tony Bennett

“Always Late (With Your Kisses)” - Lefty Frizzell

1953 – One of the most popular singers of his time, Julius LaRosa, was fired on the air by Arthur Godfrey. "Julie lacks humility," Godfrey told the stunned audience, while putting his arm around LaRosa adding, "So, Julie, to teach you a lesson, you're fired!" This ended his career, and Godfrey also was never the same. Godfrey later held a press conference after the incident becomes a national scandal, claiming that by hiring his own manager, LaRosa had lost his "humility," but several historians claim that Godfrey was actually upset that the singer was beginning to receive more fan mail than the host.

1955 - For the first and only time, Elvis Presley and Pat Boone share the bill for a performance at the Circle Theatre in Cleveland, OH.

1956 - The U.S. Supreme Court unanimously strikes down two Alabama laws requiring racial segregation on public buses.

1957 - Maurice 'The Rocket' Richard of the Montreal Canadiens became the first player in the National Hockey League to score 500 goals when he tallied against the Chicago Blackhawks in a 3-1 Montreal victory. Richard finished his career with 544 goals and entered the Hockey Hall of Fame in 1961.

1957 - No. 1 Billboard Pop Hit: “Jailhouse Rock,'' Elvis Presley.

1959 – “The Miracle Worker,” based on the childhood training of deaf and blind Helen Keller, and starring Anne Bancroft and 12-year-old Patty Duke, opened on Broadway to favorable reviews.

1958 - Brenda Lee records "Rockin' Around The Christmas Tree." The song will be released as a single but will fail to chart in either 1958 or 1959. When it was re-released in 1960, it rose to #14 and has since become a Christmas standard, being ranked at #4 in the Top 10 All Time Christmas Songs.

1959 - Top Hits

“Mack the Knife” - Bobby Darin

“Put Your Head on My Shoulder” - Paul Anka

“Mr. Blue” - The Fleetwoods

“The Three Bells” - The Browns

1960 - The United States State Department embargoed the shipment to Cuba of all goods except medicine and food.

1960 - Martin Luther King, Jr. and 35 students choose jail after arrest for sit-in requesting service at the snack bar of Atlanta's Rich's department store.

1961 - At a show in Litherland Town Hall in Liverpool, England, two popular local groups combined on stage to form the Beatmakers, performing Jerry Lee Lewis' "Whole Lotta Shakin' Goin' On," Ray Charles' "What'd I Say?," the pop standard "Red Sails in the Sunset," and Charles' "Hit the Road, Jack." The groups? Gerry and the Pacemakers and the Beatles.

1963 - Buck Owens started a 16-week run at top of the U.S. Country chart with "Love's Gonna Live Here." It eventually became the biggest of all the Buck Owens hits.

1964 - The incredibly influential English concert called the "American Negro Blues Festival" kicks off, featuring Howlin' Wolf, Willie Dixon, Lightnin' Hopkins, and Sonny Boy Williamson, among others. It is the first glimpse of these bluesmen for many upcoming British R&B and rock legends.

1967 - Top Hits

“The Letter” - The Box Tops

“To Sir with Love” - Lulu

“Little Ole Man (Uptight-Everything's Alright)” - Bill Cosby

“I Don't Wanna Play House” - Tammy Wynette

1967 - The Jefferson Airplane perform at Loews Warfield Theatre on Market Street, San Francisco.

http://en.wikipedia.org/wiki/Jefferson_Airplane

http://grove.ufl.edu/~number6/Jefferson.Airplane/airplane.html

1967 - Tamla-Motown releases Smokey Robinson & the Miracles "I Second That Emotion." The record climbs to #4 on the pop chart and Number One of the R&B, making it their biggest hit since "Shop Around" in 1960.

1969 – Daryle "Mad Bomber" Lamonica passes for six touchdowns vs. Buffalo as the Oakland Raiders won, 50-21.

http://members.aol.com/FreeVee/index.html

1969 - No. 1 Billboard Pop Hit: “I Can't Get Next to You,'' The Temptations.

1970 - Working from a design sketched out by his wife and himself, Elvis Presley orders a dozen 14-karat gold pendants from a Beverly Hills jeweler featuring the letters "TCB" set around a lightning bolt. Designed as totems for the Memphis Mafia (and also for security issues), the symbol stands, in Elvis' words, for "Taking Care of Business in a Flash." They would eventually come to symbolize the '70s era for Presley.

1970 - The film “Ned Kelly,” starring Mick Jagger in the lead role, is released and the critics wasted no time in telling Mick he should stick to singing. One reviewer wrote: "He looks about as lethal as last week's lettuce." Predictably, the movie bombed at the box office.

1973 - Elvis and Priscilla Presley divorced after six years and one child, Lisa Marie.

1973 – President Nixon rejected an Appeals Court decision that he turn over the Watergate tapes.

1974 - Billy Preston went to the top of the US singles chart with "Nothing from Nothing," the singer's second and final number one.

1974 - Bachman-Turner Overdrive's “Not Fragile” hits #1

1975 - Dickie Goodman had the best-selling single in the US with the novelty tune, "Mr. Jaws," which mixed his rapid-fire mock interviews with answers that were snipped from contemporary hit singles. Goodman first entered the US charts in 1956 when he and his partner Bill Buchanan used a similar format on a record called "The Flying Saucer."

1975 - Top Hits

“Bad Blood” - Neil Sedaka

“Calypso/I'm Sorry” - John Denver

“Miracles” - Jefferson Starship

“Hope You're Feelin' Me (Like I'm Feelin' You)” - Charley Pri

1981 - LA Dodger Rick Monday hit a two-out homer in the ninth inning, leading the Dodgers to a 2-1 win over the Montreal Expos in the 5th game of their championship series. The Dodgers would go on to win the World Series title against the Yankees.

1981 - Martin Luther King, Jr. Library and Archives opens in Atlanta. Founded by Coretta Scott King, it is the largest repository in the world of primary resource material on King, nine major civil rights organizations, and the American civil rights movement.

1983 - The United States Senate passed a bill making Martin Luther King's birthday a public holiday.

1983 - Top Hits

“Total Eclipse of the Heart” - Bonnie Tyler

“Making Love Out of Nothing at All” - Air Supply

“Islands in the Stream” - Kenny Rogers & Dolly Parton

“Paradise Tonight” - Charly McClain & Mickey Gilley

1985 - "Take on Me," by a-ha, hit number one on the pop music charts. The video for the song was in regular rotation at MTV. The group is the first from Norway to have a No. 1 hit in the United States.

1986 - No. 1 Billboard Pop Hit: “True Colors,'' Cyndi Lauper.

1987 - The worst stock crash in the history of the New York Stock Exchange occurred when the Dow Jones industrial average fell 508 points, closing at 1738.74, a decline of 22.6%, nearly double the decline in 1929 that ushered in the Great Depression. The volume of stocks traded, 604,330,000, was nearly twice the previous record of 338,500,000 set on October 16. Computerized program trading and various factors in the national and international economy were blamed for the collapse of the market that had exhibited a case of the jitters in recent weeks. On October 23, the Dow Jones rose 102.27 points and trading set another new record for volume with 608,120,000 shares. In spite of the gain, largely confined to blue chip issues, many more stocks fell than rose. The Dow gained another 186 points the following day but dropped 77.42 points on October 22. The major markets set temporarily shorter hours in hopes of easing the tension, but on October 26, there was another drop of 158.83 points. After a short period of relative quiet, the Dow fell 5.052 on Nov 3, ending a five day

rally, and on Nov. 9 the average was down another 58.85 points, closing at 1900.20.

http://www.stocksatbottom.com/index2.html

1981 - Though it yielded only one minor hit single in "Backfired," "Koo Koo," the solo album by Blondie's Deborah Harry, goes gold today.

1989 - Record breaking snows fell across northern and central Indiana. Totals ranged up to 10.5 inches at Kokomo, and 9.3 inches was reported at Indianapolis. The 8.8 inch total at South Bend was a record for the month as a whole. Up to seven inches of snow fell in extreme southern Lower Michigan, and up to six inches fell in southwestern Ohio. The heavy wet snow downed many trees and power lines. Half the city of Cincinnati was without electricity during the morning hours. Temperatures dipped below freezing across much of the Great Plains Region. Twenty cities, including fourteen in Texas, reported record low temperatures for the date. North Platte, NE reported a record low of 11 degrees. In Florida, four cities reported record high temperatures for the date. The record high of 92 degrees at Miami also marked a record fourteen days of 90-degree weather in October, and 116 such days for the year.

1991 - Top Hits

“Emotions” - Mariah Carey

“Do Anything” - Natural Selection

“Romantic” - Karyn White

“Keep It Between the Lines” - Ricky Van Shelton

1998 - Microsoft and prosecutors for the U.S. Department of Justice and twenty states met in federal court. It was the beginning of the antitrust case against the Microsoft Corporation.

2000 - Dusty Baker, who led the Giants to a National League West flag with baseball's best record (97-65), reaches agreement with the Giants on a two-year contract extension. The pact makes, the two-time National League Manager of the Year the second highest-paid skipper in the Majors.

2005 - The Houston Astros earned the first World Series berth in the team's 44-year history with a 5-1 victory over the St. Louis Cardinals. Houston lost to the Chicago White Sox in the Series.

2006 - Rod Stewart's CD, "Still the Same...Great Rock Classics of Our Time," entered the Billboard Hot 200 album chart at #1.

2008 – The Tampa Bay Devil Rays advanced to the World Series for the first time in franchise history, defeating the Red Sox, 3-1, in Game 7 of the ALCS.

2013 - JPMorgan Chase tentatively settled on paying $13 billion to the U.S. Department of Justice for its role in selling bad mortgage loans to investors, which added to the Subprime mortgage crisis and the ensuing Great Recession in 2008.

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

![]()