|

|

|

Trinity Capital, a subsidiary of Bank of the West, is a national leader in the equipment financing industry with a consistent presence and superior reputation. |

Wednesday,

October 13, 2004

Headlines---

Pictures

from the Past---Winter, 1998

Archives—

Oct 12,2000—Fitch Revises Orix to “Negative”

“This Day in American

History”

What

Lessors Are Saying About…The IT Equipment Leasing Market

AmSouth

Bank Makes Settlement with Legal Authorities

Universal

Express $225M Equipment Trust Certificates

Fitch

Places Bombardier on Rating Watch Negative

Fitch:

U.S. Public Finance Credit Dips 3rd Q 2004

Robbins

Joins Republic's Aviation & Portfolio Group

######## surrounding the article denotes it is a “press

release”

---------------------------------------------------------------------------

Classified

Ads---Operations

Orange County, CA.

Operations/Credit Manager with 15 Years Experience, Middle & Large Ticket, initiated policies for Patriot Act and Sarbanes Oxley, Team Motivator.

E-mail: equiplender@aol.com

Experienced Credit, Collections, lease and Finance operations. Manager w/expertise in improving bottom line performance, excellent trainer, manager, motivator. Get result/keep the customer coming back.

Email: rgmorrill@comcast.net

New York, NY.

10+ years in equipment

leasing/secured lending. Skilled in management & training, documentation,

policy and procedure development & implementation, portfolio reporting.

Strong work ethic.

Email: dln1031@nyc.rr.com

New York/New Jersey

5+ years experience in leasing. Knowledge of positions: SMB Credit and Contract Administrator. Relocating to the NY/NJ area.

Email: LeaseOps2004@AOL.com

Wayne, NJ

20+ heavily experienced collection/recovery VP looking to improve someone's bottom line. Proven, verifiable track record. Knowledge of all types of portfolio. Will relocate

Email: cmate@nac.net

West Palm Beach,

FL.

Sales, credit, presentation

and placement. Seasoned lease professional, currently independent, looking

for a manufacturer,

Email: southernleasing@bellsouth.net

92 “Help” Wanted ads at:

http://64.125.68.90/LeasingNews/JobPostings.htm

---------------------------------------------------------------------------

Economic

Events This Week

October 13

Today

Presidential Debate

October 14

Thursday

Balance of Trade:

August

Weekly Jobless Claims

October 15

Friday

Capacity Utilization:

September

Industrial Production:

September

Inventory-Sales Ratio:

August

Producer Price Index:

September

Retail Sales: September

( Leasing News thanks

Mr. D. Paul Nibarger, CLP,

Nibarger Associates Rancho Palos Verdes, California

for contributing

his collection of past leasing association

and convention magazines

and material.

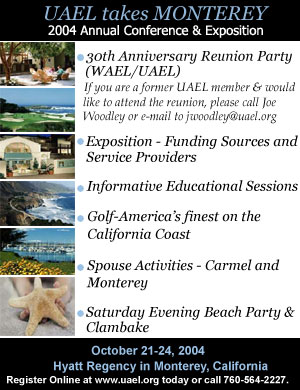

“I joined WAEL as

Nibarger Associates in 1986 as a favor to Ted Parker who was President

that year. I had been with the old United California Bank/First

Interstate Bank from 1971-1983. Ted

and I were Unit Managers. He

ran the middle market for everything outside of California and I ran

the large ticket, over $5MM, group.

I think the Bank joined WAEL in 1974 or 75 but I don't have any

of the older WAEL material.

“In the process of looking, I found about 10 ea. "banker

boxes" of old WAEL/UAEL, AAEL/ELA material and other assorted leasing

related articles, magazines etc. My

wife thinks I'm nuts to keep all of this stuff and wants me to throw

it out. Awhile back you made

an offer to pay shipping for old material.

Let me know if you want this material”.

As Stan Laurel would

say, “ It cert-tain-lee Is.”

This is the signature

to his e-mail:

“Nibarger Associates

is an investment banking firm which provides corporate finance advisory

services in mergers, acquisitions and divestitures of public and privately

held business. The firm has

a strong specialty in meeting the intermediate and long term financing

needs of its clients through equipment financing and leasing.

We also provide a strong commercial collection and investigation

service for our clients. We

are members of ELA, UAEL and NAELB with a CA Finance Lender/Broker license,

# 603-8622”

With Mr. Nibarger’s contribution, we not only have reference material,

but the ability to

go back to:

Pictures

from the Past---Winter, 1998

Regional

Holiday Meeting San Francisco

Susan Shumway, SSA

Capital, is pleased to received one of the

many door prices

given out by United Association of Equipment Leasing President-elect,

George J. Davis, CLP, Fortune Financial

Winter 1998 UAEL

Newsline Quarterly Journal

Steve Crane is Conference

Chair of the Monterey Conference.

|

|

-----------------------------------------------------------------------------

Archives—

Oct 12,2000—Fitch Revises Orix to “Negative”

##

Press Release #############################

ORIX

Credit Alliance Inc.'s Ratings "affirmed"; Outlook Revised

To Negative

(This

is a Press Release from Fitch )

NEW

YORK--(BUSINESS WIRE)--Oct. 12, 2000--ORIX Credit Alliance,Inc.'s (Credit

Alliance) long- and short-term debt ratings are affirmed at 'BBB+' and

'F2', respectively, by Fitch. The long-term Outlook has been revised

from Stable to Negative. Credit Alliance's ratings reflect the company's

good risk-adjusted capitalization, appropriate funding strategy, and

long operating history with consistent performance. Additionally, the

ratings consider the covenant protection provided by the company's bank

facilities and private placement loan agreements. Rating concerns center

on Credit Alliance's weakening asset quality and profitability measures,

its size relative to key competitors, the heightened competitive environment

in the commercial finance industry, and exposure to economically cyclical

industries. Approximately $2.1 billion of securities are affected by

this rating action.

Credit

Alliance announced today that it has changed its name to ORIX Financial

Services, Inc. (OFS). OFS will serve as holding company to its three

business groups: Equipment Finance, Business Credit, and the newly formed

Structured Finance group.

Historical underpinnings of the Credit Alliance ratings have been the company's conservative management, steady operating performance, and well-defined business model. However, in recent years, these strengths have been challenged by the increasingly competitive landscape within the commercial finance industry, resulting in weakening asset quality and reduced profitability. In an effort to regain operating momentum and improve its competitive position within the industry, Credit Alliance has made several significant changes over the past

18

months.

During

this period, the company consolidated its distribution network, re-assessed

its commitment to several industries and businesses, and appointed a

new chief executive officer. Credit Alliance will focus on diversifying

the business as well as improving the company's market position in its

core market over the near-term. As part of this strategy, the company

will strive to diversify its receivable base by investing in additional

equipment types/industries; develop a structured finance business that

will focus on larger transactions; establish a syndication capability;

extend its asset management expertise; and emphasize higher margin direct

originations.

Nevertheless,

continued weakness in asset quality and profitability measures coupled

with execution risk related to the company's aforementioned near-term

strategic objectives has caused Credit Alliance's Rating Outlook to

be revised from Stable to Negative.

In

recent years, Credit Alliance's asset quality measures have steadily

weakened due to recessions in several of the cyclical industries it

finances as well as a problem small-ticket leasing portfolio purchased

from Bankvest Capital Corp. Credit quality was also negatively impacted

by the company's 1999 branch consolidation...

Full press release at:

http://two.leasingnews.org/archives/October/10-12-00.htm

Current stories on

Orix are available:

http://www.leasingnews.org/Conscious-Top%20Stories/Orix.htm

### Press Release

##########################

---------------------------------------------------------------------------

|

----------------------------------------------------------------------------

Where

are the Duffy’s?

“Do know what’s going on with Summit National…the

software vendor? I tried to

call & got a recording saying something like the number is not operable…

I then went to their web site & it was gone!

Have they been acquired???”

(name with held )

Both father and son,

Ken Duffy and Ken Duffy,Jr. e-mail came

back, plus their

web site is no longer available.

At one time they

were active participants with investors in attempting to purchase International

Decision Systems in competition with CapitalStream. Anyone with knowledge about their status, please

contact: kitmenkin@leasingnews.org

-------------------------------------------------------------------------------

“This Day in American History”

----Now On Line by Date

This feature first started off as a signature to e-mail. It has evolved

from celebration of birthdays to celebration of American events in

history. The project is a

collaboration of Steve Chan, Brian Wong and

Maria Martinez-Wong, who transformed the feature now available

by date.

Days will be up-dated annually.

Any missing days will hopefully

be completed in the next twelve months.

http://www.leasingnews.org/American_History/default.htm

-------------------------------------------------------------------------------

Dash

of the Kuwait Coast

My son Dash ( short for Dashiell ) is in the front row, in the middle.

While he is primarily a top electrician, among other duties on the Arleigh Burke destroyer USS Preble,

such as manning light machine guns, diving as second class diver,

he is part of the “boarding party” that guards the Abot Oil Refinery. They do random checking of all vessels in the

area, particularly looking for terrorists or bombs for docks, the oil

refinery itself, or military locations or ships along the coastal area.

They board the vessels

with light weapons, searching cargo holds and

all quarters. He says it is often 130 degrees and very humid.

They

drink a lot of water

and go through sun screen like crazy.

I do send

him “care packages,”

which take about two weeks to reach him with

the sun screen he

likes, Clif bars which he devours in all flavors,

and other surprises. He does have access from time to time to

the internet. He says he knows nothing about what is happening

in the “states.” Many of the crew who were to be there six months

will be going in

over a year and they work all the time, many shifts,

in combat ready, as they are in war zone.

He says they are all “proud to be an American.”

I can tell you from

his e-mail he is “gung ho,” as

we used to say in

the Army. He never complains

about the work,

and likes to volunteer

for assignments and other duties. He

is a lot

like his father,

who likes to be busy, doing something.

I am very

proud of him.

Kit

Menkin

Classified

Ads---Leasing News

Brokers

|

About the company: SCL has been in business for 12 years. We are contracted with multiple funding sources which enables us to provide more competitive rates and flexible terms and conditions. |

Funding/Loan Processor

|

CFO / Leasing Sales Leader

|

Dealer Credit Finance Analyst / Dealer Credit Finance Services Supervisor

|

Dealer Credit Fin. Services Supervisor, Torrance, CA. Click here for full descrip. & to apply. To learn more about us, please visit: www.toyotafinancial.com/careers |

National Account Manager

|

Trinity Capital, a subsidiary of Bank of the West, is a national leader in the equipment financing industry with a consistent presence and superior reputation. |

Vendor Account Executive

|

About the Company: Lease Corporation of America is a well established, 16 year old, national equipment leasing company. |

What

Lessors Are Saying About…The IT Equipment Leasing Market

ELTnews

The Equipment Leasing

Association released the study by R.S. Carmichael & Co., Inc., Information

Technology Equipment Leasing: U.S. Market Dynamics and Outlook in July

2003. Among the study findings were a projected turnaround in 2003,

and a predicted market level of $28 billion by 2005, representing a

6.5 percent average annual rate of growth over the 2003-2005 period.

ELA wanted to revisit the IT equipment leasing market and ask lessors

how the market has performed since the IT study was published.

John Gougeon, USXL,

said his firm has seen a steady migration to bundled soft costs, including

software, installation and maintenance, in the business they are writing

currently. He said, “While we have seen a trend in IT spending, the

floodgates have not re-opened in capital spending. We are anticipating

a strong fourth quarter, as businesses close out the buying cycle.”

From a risk perspective, USXL is still fairly bullish on the strength

of the IT aftermarket, maintaining residual positions on a year-over-year

basis.

Tom Ellis, CitiCapital

Office Technology Solutions Group, said, "We saw a lift in overall

IT equipment spending starting in 2004, although that's started to tail

off in the second half of the year. We expect 2005 to start out soft,

especially among software companies.”

Ellis noted that

one significant and continuing trend among mid-to large sized businesses

acquiring IT equipment is an increased use of cash, and a correspondingly

decreased use of leasing. He said this is a reflection of the generally

strong cash position of mid-tier companies.

Another trend he

noted is an increased propensity to select fixed purchase option leases,

versus fair market value leases. Ellis said, “Companies have confidence

that the technology will be used for a greater period of time, due to

longer useful equipment life and less rapid obsolescence. We expect

this trend to continue as well.”

Ellis added, “Since

the beginning of 2004, IT manufacturers have pushed to increase sales,

relying on their captives to drive volume through aggressive pricing.

As a result, we've seen a compression in leasing margins."

Loni Lowder, ACC

Capital Corporation, said that ACC’s IT transactions were relatively

flat for the past six months. He said, “The IT portion of our portfolio

remains constant at about 20 percent.” Affirming other observations

about the use of cash for IT equipment acquisition, Lowder said, “Fiscal

and monetary policy during the last few years has created high amounts

of cash reserves within corporate America. Low interest rates and bonus

depreciation have allowed firms to pay cash for much of their IT needs.”

He added that a number of IT industry advisors have been recommending

that companies buy their IT equipment as opposed to

utilizing leasing.

Lowder believes that

it is very likely that these fundamentals will change over the next

year with bonus depreciation expiring and interest rates rising. He

said, “To combat the current trend we are introducing a new application-only

program for 100 percent software leases up to $100,000, and we are doing

a lot of lease vs. cash present value after-tax sensitivity analysis

for our customers.”

Nick Whittemore,

De Lage Landen Financial Services, said that overall the recent technology

finance market has been stable. Whittemore said, “Many companies’ revenues

have flat-lined across the board, remaining literally the same for three

years while select, better-run companies have been experiencing healthy

30 percent returns.” He noted that due to a large marketplace correction

that occurred three to six years ago, many weaker companies were weeded

out of the industry and disappeared, leaving today’s market with companies

that are either stable or improving while experiencing minimal fallout

or attrition.

Whittemore said that

although the outlook was bleak for 2002 and 2003, the 2004 leasing industry

is showing signs of encouragement in the small and medium ticket market.

“Many lessors believe that competitive pressures will lead to further

consolidation and a decreasing number of lessors over the next three

years,” he said. “Big-ticket lessors are showing signs of concern over

proposed legal and regulatory changes that are having a stifling impact

on leasing volume even before they become effective.”

Whittemore’s comments

on soft costs seemed to concur with John Gougeon’s, noting that transactions

involving soft costs and services are evolving as a trend affecting

the industry, up from 25 percent to 65 percent, making up a greater

percentage of today’s typical transaction. Whittemore also noted that

as functionality of products broadens, the blurring of SIC codes can

be looked at as another example of an emerging trend.

### Press Release

#########################

AmSouth Enters into Agreements with U.S. Attorney in Mississippi,

Federal Reserve and FinCEN

BIRMINGHAM, Ala.--( ----AmSouth Bancorporation (NYSE:ASO)

announced today that it and AmSouth Bank have entered into a deferred

prosecution agreement with the U.S. Attorney for the Southern District

of Mississippi relating to deficiencies in the bank's reporting of suspicious

activities under the Bank Secrecy Act. The matter initially arose out

of a previously disclosed fraudulent note scheme committed by two bank

customers, Louis Hamric and Victor Nance, beginning in 2000, but was

subsequently expanded to include certain other specific matters, including

AmSouth's general policies and procedures for Bank Secrecy Act compliance.

AmSouth has also entered into a cease and desist order with the Federal

Reserve and the Alabama Department of Banking, and an order with FinCEN

relating to deficiencies in AmSouth's compliance with the Bank Secrecy

Act.

Under the agreement with the U.S. Attorney, acting on behalf of the

Department of Justice, AmSouth has agreed to make a payment of $40 million

to the United States. In connection with the Federal Reserve and FinCEN

orders, AmSouth has been assessed a civil money penalty in the amount

of $10 million. Additionally, as a result of these settlements, AmSouth

will incur pretax costs of $4 million in professional and other related

fees in the third quarter.

AmSouth is committed to full compliance with the provisions of these

agreements. Provided AmSouth complies with its obligations under the

deferred prosecution agreement for a period of 12 months, the U.S. Attorney

has agreed not to take further action against the company in connection

with this matter. With respect to the cease and desist order, the Federal

Reserve has indicated it will restrict the company's expansion activities

until such time as it believes the company is in substantial compliance

with the requirements of the order.

As part of the agreements, AmSouth has agreed to take additional actions

to ensure compliance with the Bank Secrecy Act, including independent

third-party reviews of its activities, enhanced training of personnel,

submission of written plans, and adoption of approved policies and procedures.

C. Dowd Ritter, AmSouth's Chairman, President and Chief Executive Officer,

said, "AmSouth is committed to meeting the highest standards in

all aspects of its business. This is an obligation we take extremely

seriously. We have already taken a number of remedial actions, and are

committed to taking further actions, to ensure we are appropriately

responding to the bank's obligations. AmSouth is a strong regional bank

with a solid financial foundation, and we look forward to continuing

to meet the needs of our customers and deliver value to our shareholders

while meeting the highest standards of compliance."

At the time Hamric and Nance committed the fraud, Hamric was a practicing

attorney and Nance was a registered representative for a broker-dealer

affiliate of a national life insurance company. Beginning in 2000, Hamric

and Nance opened custody accounts at AmSouth Bank to hold fraudulent

notes issued by Hamric. In 2002 Hamric defaulted on promissory notes

issued to over 40 of their clients, triggering a number of civil lawsuits

against individuals and institutions, including Nance's former employer

and AmSouth. AmSouth, together with Nance's former employer, has settled

virtually all of these matters for amounts in excess of the principal

investment. Hamric, Nance and other individuals connected with them

pled guilty to criminal charges relating to the scheme in 2003.

AmSouth has filed the deferred prosecution agreement and the orders

on Form 8-K, which is available at the company's Investor Relations

Resource Center, www.amsouth.com/irrc and on the Securities and Exchange

Commission's website, www.sec.gov.

Questions and Answers Regarding AmSouth's Settlements

WHAT ARE BANKS' OBLIGATIONS TO DETECT AND REPORT SUSPICIOUS ACTIVITIES?

Under the Bank Secrecy Act, financial institutions are obligated to

file Suspicious Activity Reports, or SARs, on suspicious activities

involving the institution, including certain attempted or actual violations

of law as well as certain transactions that do not appear to have a

lawful business purpose or are not the sort of transaction in which

the particular customer would normally be expected to engage.

WHAT IS A SUSPICIOUS ACTIVITY REPORT?

For information on Suspicious Activity Reports and the requirements

for filing them, please refer to FinCEN's website: www.fincen.gov.

WHAT IS FinCEN?

The Financial Crimes Enforcement Network is an agency of the U.S. Treasury

Department whose mission is to support law enforcement investigative

efforts and foster interagency and global cooperation against domestic

and international financial crimes.

WHAT IS THE BANK SECRECY ACT?

The Bank Secrecy Act is the centerpiece of the federal government's

efforts to prevent banks and other financial institutions from being

used to facilitate the transfer or deposit of money derived from criminal

activity. The law was amended after 9/11 by the USA PATRIOT Act of 2001,

expanding the important role the government expects banks to play in

detecting and reporting suspicious activity.

WHAT DOES THE DEFERRED PROSECUTION AGREEMENT REQUIRE?

Under the terms of the deferred prosecution agreement with AmSouth,

the United States has filed a one count information in the United States

District Court for the Southern District of Mississippi charging AmSouth

with failing to file suspicious activity reports in a timely, complete

and accurate manner, in violation of 31 U.S.C. Sections 5318(g)(1) and

5322(b) and 31 C.F.R. Section 103.18. However, the Department of Justice

will recommend to the Court that the prosecution of AmSouth be deferred

for 12 months in light of AmSouth's acknowledgment of responsibility,

its continued cooperation, its willingness to comply fully with the

Bank Secrecy Act, its willingness to comply fully with any subpoenas

issued to it by any state or federal grand jury, and the assessment

of a monetary penalty.

If AmSouth is in full compliance with all of its obligations under the

agreement, the United States has agreed to seek dismissal of the information

with prejudice within 30 days of the end of the 12-month period set

forth in the agreement.

WHAT IS A "CEASE AND DESIST" ORDER FROM THE FEDERAL RESERVE?

HOW LONG DOES THE ORDER STAND?

The order is an enforcement action available to the Federal Reserve.

The order in this case requires that the bank take specific actions,

including steps to comply with the Bank Secrecy Act. The order is in

force until the Federal Reserve determines that the bank is in substantial

compliance with the requirements of the order. While an order such as

this is to be taken very seriously, we believe AmSouth has a solid financial

foundation on which to continue our business.

WHAT ACTIONS MUST AMSOUTH TAKE UNDER THE FEDERAL RESERVE'S ORDER AND

WHAT STEPS HAS THE COMPANY ALREADY TAKEN?

The order requires the bank to:

-- Commission an independent review of the bank's Bank Secrecy Act compliance

program and submit a program to ensure compliance;

-- Review and evaluate suspicious activity reporting, customer due diligence

and fraud detection programs and staff;

-- Conduct a review of account activity to determine whether suspicious

activity was properly identified and reported;

-- Strengthen the bank's internal controls;

-- Develop policies and procedures governing the conduct of the bank

and its personnel in regulatory matters; and

-- Submit monthly progress reports to the Federal Reserve.

The bank has already taken a number of actions, specifically:

-- Engaged a nationally known consultant to provide a comprehensive

review of our suspicious activity detection and reporting process;

-- Reorganized the Bank Secrecy Act compliance area to have a separate

unit devoted to the assessment and monitoring of high-risk customers;

-- Strengthened its enterprise-wide risk management structure;

-- Added additional staff for suspicious activity detection and reporting;

-- Instituted training customized by line of business for detecting

and reporting suspicious activities;

-- Improved processes for detecting and reporting suspicious activities;

and

-- Committed to purchase and operate state of the art technology for

detecting suspicious activities.

HAVE THE VICTIMS OF THE FRAUD COMMITTED BY LOUIS HAMRIC AND VICTOR NANCE

BEEN COMPENSATED?

In 2002 Hamric defaulted on promissory notes he issued to over 40 clients,

triggering a number of civil lawsuits against individuals (Hamric, Nance

and others) and institutions, including Nance's former employer and

AmSouth. AmSouth, together with Nance's former employer, has settled

virtually all of these matters for amounts in excess of the principal

investment.

WILL THE AGREEMENTS HAVE ANY EFFECT ON THE WAY AMSOUTH CONDUCTS BUSINESS?

The Federal Reserve has indicated that it will restrict AmSouth's expansion

activities until it believes the bank is in substantial compliance with

the requirements of the order. These agreements are an important step

in the process of putting this matter behind us. AmSouth is committed

to full compliance with the provisions of the agreements and to continuing

to strengthen its processes.

About AmSouth

AmSouth is a regional bank holding company with $48 billion in assets,

more than 670 branch banking offices and over 1,200 ATMs. AmSouth operates

in Florida, Tennessee, Alabama, Mississippi, Louisiana and Georgia.

AmSouth is a leader among regional banks in the Southeast in several

key business segments, including consumer and commercial banking, small

business banking, mortgage lending, equipment leasing, mutual fund sales,

and trust and investment management services. AmSouth also offers a

complete line of banking products and services at its web site, www.amsouth.com.

### Press Release #########################

Universal Express to Offer $225,000,000 In Equipment Trust Certificates

NEW YORK----Universal Express Inc. (OTCBB:USXP), announced today

that it will offer a series of fully collateralized, senior, fixed income

Equipment Trust Certificates. These non-pooled instruments, collateralized

by both a federally recorded lien and dedicated revenue on individual

cargo aircraft, are seven to ten years in term and return between six

(6) and seven (7) percent annually, paid either monthly or quarterly.

This investment is collateralized by the aircraft, which is fully insured

in the name of the certificate holder.

"Cargo aircraft valuation

has historically increased or been stable over the past decade and,

since revenues are paid directly to the investor through the Trust,

and is senior to any other debt, investors are fully collateralized

for our present and future purchased cargo aircraft," said Richard

A. Altomare, Chairman and CEO of Universal Express.

"In order to acquire

at least four additional regional cargo carriers this proven form of

transportation fund raising accomplishes three objectives: stand-by

funding, non-dilution of our common stock and an introduction of Universal

Express to institutional investors receiving 7% fixed return on their

investment," concluded Richard A. Altomare.

About Universal Express

Universal Express, Inc. owns

and operates several subsidiaries including Universal Express Capital

Corp., (including its USXP Cash Express division) Universal Express

Logistics, Inc. (including Virtual Bellhop, LLC and Luggage Express),

and the UniversalPost Network. These subsidiaries and divisions provide

the private postal industry and consumers with value-added services

and products, logistical services, equipment leasing, and cost-effective

delivery of goods worldwide.

Media: TransMedia Group Glen Calder, 561-750-9800

## Press Release ############################

Fitch

Places Bombardier on Rating Watch Negative

Fitch Ratings-New

York- Fitch Ratings has placed Bombardier's (BBD) and Bombardier Capital's

(BC) ratings on Rating Watch Negative. Fitch currently rates BBD's and

BC's senior unsecured debt and credit facilities 'BBB-', commercial

paper programs 'F3', and BBD's preferred stock 'BB+'. Due to the existence

of a support agreement and demonstrated support by the parent, BC's

ratings are linked to those of BBD. These ratings cover approximately

$6.1 billion of debt and preferred stock.

The Negative Rating Watch is based on significant uncertainties present in BBD's regional jet (RJ) operations and transportation unit (BT), as well as continuing weak operating margins. Fitch believes that it will be able to resolve the Negative Rating Watch in the next three to

six months.

Fitch is concerned that further production rate reductions are possible in BBD's RJ operations due to low backlog levels (1.5 years worth of production), poor order visibility, and backlog risks related to the weak financial conditions of several large airline customers, including Delta Airlines, US Airways, United Airlines, and Independence Air. Delta is currently formulating a restructuring plan that could lead to a bankruptcy filing. Other concerns related to BBD's RJ operation include competitive pressures from Embraer's new 70-100 seat aircraft family, the cash requirements of a possible 100-seat aircraft program, and the weak aircraft

financing market.

The fiscal 2006 (F2006)

production rate that BBD announced last week for CRJ200's was already

incorporated into Fitch's ratings, but Fitch had expected production

of CRJ700's and CRJ900's to be higher. Further production rate reductions

will not necessarily lead to negative rating actions, but will be evaluated

on the basis of several factors including how BBD manages the reductions

and the timing and magnitude of the reductions. RJ production reductions

will also be evaluated in the context of BBD's overall business, given

that business jet improvements and the BT restructuring could offset

the impact of lower RJ deliveries.

Margin improvement

continues to be a key credit issue for BBD's debt ratings. Margins at

BT were 2.8% in the second quarter, and the company has estimated that

margins will be approximately this level for the next six quarters.

At Bombardier Aerospace (BA), margins were negative (- 0.6%) for the

second consecutive quarter, but improved sequentially. BA's margins

continue to be pressured by sales incentives, foreign currency, increased

depreciation and amortization related to new business jet programs,

and higher interest expense allocation due to the debt issuance earlier

this year. Given BBD's level of debt compared to revenues, relatively

modest improvement in margins will drive noticeable improvement in credit

protection measures. However, failure to improve margins or the discovery

of additional problem contracts at BT will likely lead to a rating action.

Other general rating

concerns include low free cash flow, the potential need for further

restructuring actions, the uncertain timing of margin improvement, the

impact of exchange rate fluctuations on financial results and planning,

and the sizable pension deficit.

General factors supporting

the ratings include BBD's liquidity position, the improvement in the

business jet market, better-than-expected free cash flow in the first

half of F2005, significant progress on the multi-year restructuring

plan, leading market positions, the more conservative strategy at BC,

the large backlog at BT, new senior management, and the cost cutting

actions at both BA and BT.

BBD's liquidity remained

strong at the end of the second quarter, with $2.2 billion of cash and

$1.6 billion of credit facility availability. An additional $600 million

is available under BC's credit facilities. Fitch notes that approximately

$1.2 billion of the cash on hand at BBD is related to advances and subordinated

loans extended by BC to the parent. Fitch expects BBD to pay down some

of the advances in the third quarter so that BC can retire approximately

$500 million of maturing debt. Fitch anticipates that some additional

BC advances will be repaid in Q3 to fund increased assets, which declined

temporarily last quarter due to seasonal factors. Fitch expects BBD

to be cash positive in the second half and for the year despite likely

increases in capital expenditures and restructuring outflows during

the next two quarters.

BBD is seeing improved

demand and better pricing for its business jets, consistent with industry-wide

conditions. Orders were up significantly in the first half of the year,

and deliveries will likely exceed the company's plan this year. The

magnitude of the apparent recovery in BBD's business jet operations

is greater than the expectations incorporated into Fitch's ratings of

BBD, and the recovery could offset some of the risk related to BBD's

RJ operation.

Contact: Craig Fraser +1-212-908-0310, New York or Mark Oline, +1-312-368-2073,

(for Bombardier Inc.), Chicago or Philip S. Walker, Jr., CFA, +1-212-908-0624, or

Matthew D. Gallino

+1-212-908-0218 (for Bombardier Capital Inc.), New York.

### Press Release

#########################

Fitch:

U.S. Public Finance Credit Dips in Third Quarter 2004

Fitch Ratings-New

York- Fitch's forecast for the U.S. municipal market is cautious for

the remainder of 2004, following slower, but still positive, macroeconomic

trends and generally negative rating actions. During the third quarter

of 2004, Fitch upgraded 14 municipal issuers, or $36.7 billion in par,

and downgraded 20 issuers, comprising $11.4 billion, for a downgrade

to upgrade ratio of 1.43:1 on an issuer basis and 0.31:1 on a par basis.

However, the par amount upgraded was dominated by the State of California,

which accounted for over $34.2 billion, or over 93% of the total par

upgraded. Excluding the upgrade of California, the downgrade to upgrade

ratio increased to 4.53:1 on a par basis.

There were 14 credits

on Rating Watch Negative as of Sept. 30, 2004, which is unchanged as

of June 30, 2004. During this period, five credits were taken off Rating

Watch Negative in conjunction with a rating affirmation, one was taken

off in conjunction with a downgrade, and six credits were added. The

one credit on Rating Watch Positive as of June 30, 2004 remains on Rating

Watch Positive.

The tax-backed sector

had nine upgrades and eight downgrades in the third quarter of 2004

for an upgrade to downgrade ratio of 1.13:1, compared with 10 upgrades

and four downgrades in the second quarter. Importantly, the number of

tax-backed issuers with a Negative Rating Outlook continued to increase,

growing to 44 from 40, as of June 30, 2004, 25 as of Sept. 30, 2003,

and only 12 as of Dec. 31, 2002. Meanwhile, the number of tax-backed

credits with a Positive Rating Outlook has exhibited a much more stable

trend, hovering in the 20 to 25 range. As of Sept. 30, 24 credits had

a Positive Rating Outlook, as compared with 23 as of June 30, 2004,

25 as of Sept. 30, 2003, and 20 as of Dec. 31, 2002.

In health care, there was one upgrade and eight downgrades in the third quarter of 2004, a significant decline from the second quarter's three upgrades and two downgrades but more in line with first quarter results of nine downgrades and two upgrades. In other revenue sectors, there were two downgrades in transportation, one water/sewer upgrade, two upgrades to state revolving funds, one upgrade to a sports-related issuer, and two downgrades in

higher education.

The credit trend

at the state level seems to be slowly improving as the recent economic

upturn continues to take shape. However, the economic picture is not

uniform across the county, with Midwest state and local governments

still under significant pressure. The expectation for the majority of

state credits for the remainder of the year is for stability as the

improvement in the labor market and related revenue improvements are

beginning to help states grow their way out of current budget pressures.

This should ultimately translate into an improvement at the local level

as well. However, pension benefits and health care costs continue to

be pressure points.

Equity market and

state level improvements, in addition to tuition increases, portend

stability for the higher education sector. The equity markets, operational

improvements, and a continuation of good managed care reimbursement

have also added a stabilizing force to continuing care retirement communities

and acute care facilities.

The southeastern

U.S. experienced a significant increase in the number of hurricanes

that made landfall in 2004. In Fitch's opinion, the structural damage

to certain health care facilities, infrastructure projects, and port/airport

facilities should not result in any rating actions as emergency assistance

provided by the Federal Emergency Management Agency (FEMA), proceeds

from insurance claims, reserves, and/or project revenue should be sufficient

to cover a majority of the costs incurred.

Fitch will be publishing

a comprehensive report on credit trends in public finance in mid-October.

## Press Release

#######################

Robbins

Joins Republic's Aviation & Portfolio Group

Republic Financial

Corporation announced the addition

of Steven M. Robbins to their Aviation & Portfolio Group. As managing

director, equipment investments, Mr. Robbins is responsible for all

asset management duties for this group as well as the origination of

new business from Republic’s East coast office.

Most recently, Mr. Robbins was the vice president, asset management for Mizuho Corporate Bank (USA). In this role, Mr. Robbins was responsible for all aspects of equipment management across business lines within the IBJTC Business Credit Corporation

(formerly known as

IBJ Whitehall).

Prior to joining

IBJ Whitehall, Mr. Robbins held several Asset Management positions at

GE Capital – Vendor Financial Services in Danbury, CT including; manager

- business development under the centralized Asset Management Organization,

and manager - asset management and manager - residual and portfolio

analysis for the Diversified Industries Group. Each of these roles carried

varying Asset Management responsibilities from department management

to facilitation of Mergers and Acquisitions.

Prior to his employment

with GE Capital, Mr. Robbins was the director of asset management for

the Capital Markets Division of AT&T Capital in Morristown, NJ.

Here he was responsible for all Asset Management functions within that

division as well as providing global support. He has also been employed

by The CIT Group and MetLife Capital Credit Corporation where he began

his career in the leasing industry.

Mr. Robbins has been

directly involved with Asset Management for the past fifteen years.

He is currently a member of the Equipment Leasing Association Equipment

Management Committee and is a Candidate in the American Society of Appraisers

awaiting his ASA designation. He is a graduate of the State University

of New York at Cobleskill with secondary studies completed at Iona College.

Sites of Reference:

http://www.republic-financial.com

CONTACT:

Sara Meaney

Republic Financial

Corporation

Phone Number: 303-923-2516

Fax Number: 303-923-2116

E-mail: smeaney@republic-financial.com

### Press Release

##########################

News

Briefs---

Bush-Kerry Debate

Preview

http://atomfilms.shockwave.com/contentPlay/shockwave.jsp?id=

Intel

posts third-quarter profit gains despite weak PC demand

http://www.signonsandiego.com/news/business/

20041012-1424-ca-earns-intel.html

Servers, Wireless

Keep Intel in the Chips

http://www.internetnews.com/bus-news/article.php/3420971

-------------------------------------------------------------------------------

“Sports

Briefs---“

It's Not Perfect,

but the Yankees Will Take It

http://www.nytimes.com/2004/10/13/sports/baseball/

http://boston.com/dailynews/286/sports/Yankees_10_Red_Sox_7_:.shtml

SuperSonics

Defeat Lakers 87 – 80

http://www.nytimes.com/aponline/sports/AP-BKN-SuperSonics-Lakers.html

“Gimme

that Wine”

Major wine wholesalers

merge

http://www.newsday.com/business/ny-bzwine12400357

8oct12,0,5070273.story?coll=ny-business-headlines

U.S. Wineries Are

Booming in Number

http://www.winespectator.com/Wine/Daily/News/0,1145,2625,00.html

Revolutionary inventions

could 'transform' winemaking

http://www.decanter.com/news/58713.html

A Persian Palace

Opens in Napa

http://www.winespectator.com/Wine/Daily/News/0,1145,2626,00.html

Wine

Enthusiast Magazine Announces Winners of Annual WINE STAR AWARDS for

2004

http://www.winebusiness.com/news/SiteArticle.cfm?AId=

Winery

Index: Massachusetts

http://wine.about.com/library/wineries/bl_ma.htm

-----------------------------------------------------------------------------

|

This Day in American History

1754—Birthday

of Mary McCauley (McCulla - McKolly), is one of the choices to be the "real"

Molly Pitcher. Other candidates are Molly Corbin, Anna Maria Lane, Elizabeth

Canning . . . with many others contributing to the legends. There was

no single Molly Pitcher . . . she is nothing more than a compilation

of legends and popular histories that purport to describe the actions

of a brave Molly Pitcher who defied convention (and hostile fire) to

fire her husband's cannon...The term "Molly Pitcher" was probably

what was used by soldiers in battle calling for the "water boy"

(who was generally a woman) as men today say, "hey girl,"

(or "hey nurse" or "hey, waitress,") " or even

"medic!" According to some legends, Mary Hay McCauley was

a water carrier at the Battle of Monmouth June 28, 1778 where she loaded

and fired a cannon after her husband was killed (some say collapsed

from the heat).In an embellishment of the legend, a cannonball supposedly

passed between her legs tearing her skirt (although the water carriers

always tied their skirts up so they could move around. With skirts at

the normal length, they'd trip or be much hampered in their movements.)

http://earlyamerica.com/earlyamerica/notable/pitcherm/

http://russell.gresham.k12.or.us/Colonial_America/Molly_Pitcher.html

http://sill-www.army.mil/pao/pamolly.htm

http://pages.potpantiques.com/9/PictPage/1352499.html//9/PictPage/

1352499.html?mall=%2Fstores%2FpotpanditemKey=1352499andstore

=%2Fstores%2FpotpandcatId=theatricalrppcanditemNo=pc240

1775-

Second Continental Congress passed legislation authorizing the acquisition

of ships and establishment of a navy (we were not called the United States at the

time and the move was to name us the United Colonies of Columbia ). Columbus was very popular at the time, and

a compromise

1792-

the presidential residence at 1600 Pennsylvania Avenue, NW, Washington,

D.C., designed by James Hoban, was began with the laying of the first

cornerstone. The first presidential

family to occupy it was that of John Adams in November, 1800. With three stories and more than 100 rooms,

the White House is the oldest building in Washington. First described

as the "presidential palace," it acquired the name "White

House" about 10 years after construction was completed. Burned by British troops in 1814, it was reconstructed, refurbished

and reoccupied by 1817. The

original corner stone is allegedly missing, taken by a souvenir hunter,

some claim the British.

http://memory.loc.gov/ammem/today/oct13.html

1843-

B'nai B'rith ("Sons of the Covenant") was established in New

York City by a group of German Jews. 12 German - Jewish immigrants met

at Sinsheimer's Café on Essex Street on New York's Lower East Side and

founded B'nai B'rith - the world's first Jewish service organization

and the first international service organization in the United States

It is both the oldest and the largest of the Jewish fraternal organizations.

1845-

a majority of the citizens of the independent Republic of Texas approve

a proposed constitution, that when accepted by the Congress, will make

Texas the 28th American state. The

annexation of Texas finally became a reality after long political bickering.

Antislavery forces were opposed to annexation because Texas was certain

to become a slave state. Others

wanted to act lest Great Britain, or France develop a relationship with

the Republic of Texas, whose independence Mexico refused to recognize.

In April, 1844, President John Tyler submitted to the Senate a treaty

of annexation, but the Senate rejected it in June. In December Tyler

offered a joint resolution to cover annexation. This required only a

majority vote by both houses of Congress instead of the two-thirds vote

needed to ratify a treaty. Action on the resolution was completed on

February 28, 1845, when the House accepted it in revised form. On June

23, the congress of Texas accepted annexation. October 13 the constitution was proposed and

December 29 Texas was admitted to the Union, the 28th state.

1870—Birthday

of famous singer/actress Della

May Fox, one of the highest paid variety performer of her time. She

toured the U.S. with her own company. She reportedly had bouts of ill

health because of drugs and alcohol.

http://www.britannica.com/women/articles/Fox_Della_May.html

1893-

Debt, bankruptcy, and plummeting stock prices crippled numerous companies

and ultimately gave way to one of the nation's most staggering fiscal

panics. On October 13, Union Pacific, one of the nation's largest railroads,

announced that it was in receivership

1902-Warren

Wilbur Shaw, auto racer born at Shelbyville, IN. Shaw was racing cars

by age 18. An early crash led him to invent the crash helmet. After

several years of frustration, he won the Indianapolis 500 three times,

in 1937, 1939 and 1940, the first consecutive victories by one driver.

He served as Indy’s president and general manager after Tony Hulman

bought the Speedway in 1945. Died at Fort Wayne, IN, Oct 3, 1954.

1903-The

Boston Pilgrims (later the Red Sox) won the first modern World Series,

defeating the Pittsburgh Pirates, five games to three. The Pilgrims

won Game 8, 3-0.

1910—Jazz

pianist Art Tatum Birthday

http://www.pbs.org/jazz/biography/artist_id_tatum_art.htm

http://www.angelfire.com/ca/pianogod/

http://www.vh1.com/artists/az/tatum_art/bio.jhtml

1910

-- Novelist and screenwriter Ernest K. Gann born Lincoln, Nebraska.

Gann served in the Army Air Force, Air Transport Command during WWII.

Began writing novels in 1944, about flying. Five were made into films,

including Island in the Sky (1944), Fiddler's Green (1950, filmed as

The Raging Tide in 1951), Soldier of Fortune (1954), and Twilight for

the Gods (1958).

1924-Vibist

Terry Gibbs born Brooklyn, NY.

1925-The

first full length play by an African-American writer to be performed

in New York City was “Appearances,” by Garland Anderson, a three-act

protest against lynching. It

was produced by Lester W. Sager and lasted 23 performances.

1926-

birthday of Jesse Leroy Brown, born Hattiesburg Mississippi.

He was the first black American naval aviator and also the first

black naval officer to lose his life in combat when he was shot down

over Korea, December 4, 1950. On March 18,1972, USS Jesse L. Brown was

launched as the first ship to be named in honor of a black naval officer.

Brown was born at Hattiesburg, Mississippi, 1926.

http://www.powells.com/biblio/28200-28400/0380976897.html

http://www.history.navy.mil/photos/pers-us/uspers-b/j-brown.htm

the full heroic story

of two friends, one white, one black: http://www.homeofheroes.com/brotherhood/hudner.html

1921-

In the first all New York World Series, the Giants beat the Yankees,

1-0 to win the baseball's championship in eight games.

1923--

Casey Stengel's home run is the difference as Giant hurler Art Nerf

out duels Sam Jones

1925 – Birthday of standup comic, social rebel, Lenny Bruce. Imprisoned on obscenity charges and refused permission to enter Britain, his show was banned both in England and in Australia. Nightclub owners, fearing police harassment, began refusing to book him and his career collapsed. See his autobiography How to Talk Dirty and Influence People, and also Bob Fosse's award-winning film Lenny (1974). I saw him many times late in his life in San Francisco. Often he was not funny, but seemed high on heroin, but when he was hot, he was “hot.”

Died August 3, 1966.

http://www.freenetpages.co.uk/hp/lennybruce/

http://www.ubqtous.com/lennybruce/

http://home.aol.com/dcspohr/lenny/lenny1.htm

http://www.bobdylan.com/songs/lenny.html

1926-Bassist

Ray Brown born Pittsburgh, Pa

. http://members.tripod.com/~hardbop/raybrown.html

http://www.amazon.com/exec/obidos/tg/stores/artist/glance/-/36421/

ref%3Dpd_simart_detail/103-5362656-4423850

1927-Altoist

Lee Konitz born Chicago, Ill.

http://www.enjarecords.com/LEE_KONITZ.htm

http://centerstage.net/chicago/music/whoswho/LeeKonitz.html

http://www.npr.org/programs/btaylor/pastprograms/lkonitz.html

1941-singer/songwriter

Paul Simon born Newark, NJ.

http://www.paulsimon.com/index_main.html

http://www.simonandgarfunkel.com/

1945---Top

Hits

Till the End of Time

- Perry Como

If I Loved You -

Perry Como

Along the Navajo

Trail - Bing Crosby and The Andrews Sisters

You Two Timed Me

One Time Too Often - Tex Ritter

1953---Top

Hits

Vaya Con Dios - Les

Paul and Mary Ford

You, You, You - The

Ames Brothers

No Other Love - Perry

Como

I Forgot More Than

You’ll Ever Know - The Davis Sisters

1958

- Warren Covington conducted the Tommy Dorsey Orchestra's recording

of what would be the last big band song to climb the pop charts, "Tea

for Two Cha Cha". While the song made it into the Top 10, it peaked

at #7, signaling the end of the Big Band Era. Rock ’n’ Roll was there

to stay.

1960--The

Forbes Field, Bill Mazeroski's dramatic bottom of the ninth inning HR

off Yankee hurler Ralph Terry breaks up a 9-9 tie and ends one of the

most exciting seven game World Series ever played

"There's a swing

and a high fly ball going deep to left! This may do it! Back to the

wall goes Berra; it is over the fence, home run -- the Pirates win!

Ladies and gentlemen, Mazeroski has hit a one-nothing pitch over the

left-field fence at Forbes Field to win the 1960 World Series for the

Pittsburgh Pirates by a score of10-0. Once again, that final score,

the Pittsburgh Pirates, the 1960 world champions, defeat the New York

Yankees, the Pirates 10 and the Yankees 9.''

1961---Top

Hits

Hit the Road Jack

- Ray Charles

Crying - Roy Orbison

Runaround Sue - Dion

Walk on By - Leroy

Van Dyke

1962-Birthday

of perhaps the greatest wide receiver in football, Jerry Lee Rice, Starkville,Ms.

http://www.nfl.com/players/playerpage/1291

http://www.nfl.com/players/playerpage/1291

1962

- A 34-year-old Edward Albee brought his play, "Who’s Afraid of

Virginia Woolf", to a stage in New York. Four years later, Albee’s

play would become an Academy Award-winning film, garnering 6 Oscars,

and starring Elizabeth Taylor as the female lead, Martha.

1966-Defense

Secretary Robert S. McNamara declares at a news conference in Saigon

that he found that military operations have "progressed very satisfactorily

since 1965." McNamara had arrived in Saigon on October 11 for his

eighth fact-finding visit to South Vietnam. He conferred with General

William Westmoreland, the senior U.S. military commander; Ambassador

Henry Cabot Lodge; various military leaders; and South Vietnam's Premier

Nguyen Cao Ky and President Nguyen Van Thieu. McNamara said he was pleased

with the overall progress in South Vietnam, but he later revealed to

President Lyndon Johnson in private that he thought progress was "very

slow indeed" in the pacification program. McNamara wrote after

the war that he realized early on "the complexity of the situation

and the uncertainties of our ability to deal with it by military means."

Though he did understand the obstacles, he was dedicated to the U.S.

commitment to preventing Communist takeover of South Vietnam. By the

end of 1965, however, even McNamara had begun to doubt that a military

solution in Southeast Asia could be achieved. Still, as late as July

1967, he told President Johnson that the U.S. and South Vietnamese forces

were making headway in the war. Johnson tired of McNamara's vacillation

and eventually replaced him with Clark Clifford in February 1968.

1969---Top

Hits

Sugar, Sugar - The

Archies

Jean - Oliver

Little Woman - Bobby

Sherman

Since I Met You,

Baby - Sonny James

1969-

Nancy Kerrigan - U.S. figure skater. NK was the victim of a bungled

physical attack by the husband and friend of one of her rivals. The

attack mildly injured her leg and ruined the career of her rival. NK

later won the silver medal at the Olympics and ridiculed the young Russian

girl who edged her out for the gold. NK turned pro and is featured at

Disney shows.

1970

-- Angela Davis, 26, a former

faculty member at the University of California, Los Angeles, black militant,

and self-proclaimed Communist, is arrested in NY City in connection

with a shootout in a San Raphael, California, courtroom six days before.

Davis is accused

of supplying weapons to Jonathan Jackson, who burst into the Marin County

courtroom in a bid to free inmates on trial there, and to take hostages

he hoped to exchange for his brother, George, a prison revolutionary

in San Quentin. Police fired on Jonathan and he was killed along with

Superior Court Judge Harold Haley and two inmates. After a three-month

trial, Davis, was acquitted of all charges. I interviewed

her several times. She was involved,

but no one could

prove it.

http://www.clas.ufl.edu/users/ssmith/davisbio.html

http://drum.ncat.edu/~sister/davis.html

1971-The

first night game in World Series history matched the Pittsburgh Pirates

and the Baltimore Orioles. Pittsburgh

beat Baltimore, 4-3, behind three hits by Roberto Clemente, to tie the

Series at two games apiece.

1977---Top

Hits

Star Wars Theme/Cantina

Band - Maco

Keep It Comin’ Love

- KC and The Sunshine Band

You Light Up My Life

- Debby Boone

Heaven’s Just a Sin

Away - The Kendalls

1979

- Michael Jackson hit #1 for the second time with "Don’t Stop ’Til

You Get Enough". His first number one hit came on October 14, 1972,

when he was 14. The song, was "Ben."

1980-AC/DC

position themselves as the heirs to Led Zeppelin with "Back in

Black," which turns platinum on this date. The albums makes it

up to number four.

1984

- Hurricane Diana, after making a complete loop off the Carolina coast,

made landfall and moved across eastern North Carolina. Diana deluged

Cape Fear with more than eighteen inches of rain, and caused 78 million

dollars damage in North Carolina.

1985---Top

Hits

Oh Sheila - Ready

For The World

Take on Me - a-ha

Saving All My Love

for You - Whitney Houston

Meet Me in Montana

- Marie Osmond with Dan Seals

1987

-- First military use of trained dolphins (US Navy in the Persian Gulf).

1987 - Showers and thunderstorms produced heavy rain in the northeastern U.S. Flooding was reported in Vermont, New York, Pennsylvania and New Jersey. Greenwood NY received 6.37 inches of rain. A dike along a creek at Prattsburg NY gave way and a two million dollar onion crop left on the ground to dry was washed away. The prolonged rains in the eastern U.S. finally came to an end late in the day as a cold front began to push the warm and humid air mass

out to sea.

1988

- Hurricane Gilbert smashed into the Cayman Islands, and as it headed

for the Yucatan peninsula of Mexico strengthened into a monster hurricane,

packing winds of 175 mph. The barometric pressure at the center of Gilbert

reached 26.13 inches (888 mb), an all-time record for any hurricane

in the Caribbean, Gulf of Mexico, or the Atlantic Ocean. Gilbert covered

much of the Gulf of Mexico, producing rain as far away as the Florida

Keys

1989-Billy

Joel releases his album, “Storm Front.”

http://www.rollingstone.com/reviews/album/_/id/236527

http://www.rocktoys.com/394.htm

http://www.amazon.com/exec/obidos/tg/detail/-/B00000DCHL/

1989

- Unseasonably cool weather prevailed over the Central Plains Region,

with a record low of 29 degrees at North Platte NE. Unseasonably warm

weather prevailed across the Pacific Northwest, with a record high of

96 degrees at Eugene OR. Thunderstorms over south Texas produced wind

gusts to 69 mph at Del Rio, and two inches of rain in two hours.

1993-

At the Veterans Stadium, the Phillies win the National League pennant

by beating the Braves in Game 6 of the NLCS, 6-3. With Tommy Greene

out dueling Greg Maddux and the timely hitting of Darren Daulton, Dave

Hollins and Mickey Morandini, Philadelphia wins its third consecutive

game to dethrone the defending champs

1994

- Netscape Communications Corporation announced that it was offering

its new Netscape Navigator free to users via the Internet. The Internet

browser, developed by the six-month-old Silicon Valley company led by

Silicon Graphics founder Jim Clark and NCSA Mosaic creator Marc Andreessen,

was available for free downloading by “individual, academic and research

users.”

2000--

Extending his streak to 33 and a third innings, Mariano Rivera breaks

the 38-year-old record of Whitey Ford for consecutive scoreless frames

in postseason play as the Yankees defeat the Mariners, 8-2 in Game 3

of the ALCS. The Yankees' Hall of Fame lefty had established the record

from 1960 to 1962 with 33 innings as World Series starter.

2001---

Being down 2-0 in best-of-five series, the Yankees, thanks to the shut

out pitching Mike

2003---

A tearful 72-year-old Don Zimmer apologizes for his part in yesterday's

brawl during

Game 3 of the ALCS

between the Yankees and Red Sox . During the fourth-inning matinee melee

at Fenway, the Yankees' assistant to manager is thrown to the ground

after charging Pedro Martinez.

World Series Champions

This Date

1903

Boston Pilgrims

1906

Chicago White Sox

1914

Boston Braves

1915

Boston Red Sox

1921

New York Giants

1906-Pittsburgh

Pirates

Baseball Poem

Yankees

by

Anne Marie Macari

For beauty, the men came toward us across the field,

and when they stood trance-still, or when they backed

hard against the wall, it seemed part of some

greater design, or when one swung, twisting

his torso and bending his knees at the same time

as the ball flew and the crowd erupted,

I was in thrall to all of them, because they held

back

Then hit for their lives, because one gently lifted

his arm to meet the ball as if his own child

were falling toward him through thin air.

I even laughed at the men throwing beer

which drizzled onto my hair, and the one

yelling obscenities at the other team.

The blinding lights helped me see

their perfection, and I became a devotee-

not just for the sake of my sons, my arms around them-

though it was strange to be a women then,

to love them that much, the arena

filled me with men who were ready and had chosen

their weapons, so when the ball disappeared

for the last time all of us screamed

and rose from our seats so grateful

for our own violence which got us

this far without torture or mutilation,

and to one team brought to their knees,

and to the heroes, small in distance,

holding each other, rejoicing.

|

www.leasingnews.org |