Vendor/Dealer Leasing Professional, generous commission's package that can lead to base salary and benefits. Join a sales team that has all the right sales tools for developing a successful vendor program in many different industries.

Chris Chiappetta, Phone: 800-669-7527 ext. 1208,

chris@netlease.com

National Machine Tool Financial Corp., funding vendor

programs since 1986. We offer competitive rates and a

credit staff dedicated to vendor programs.

www.netlease.com

|

Monday, October 19, 2009

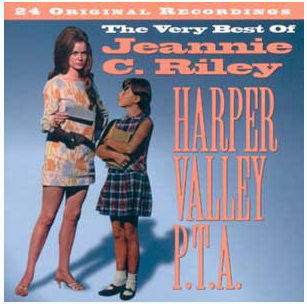

Singer Jeannie C. Riley (born Jeanne Carolyn Stephenson) on October 19, 1945 Anson, Texas: best known for her 1968 Country and Pop hit "Harper Valley PTA" (written by Tom T. Hall). She became the first woman to have a single become a Billboard Country and Pop number one hit at the same time; "The Girl Most Likely," "There Never Was A Time," "The Rib," "The Back Side of Dallas," "Country Girl," "Oh Singer," and "Good Enough to Be Your Wife." In the 1970s, she became a Born Again Christian and began recording gospel music.

http://www.jeanniec.com/Biography.html

http://www.youtube.com/watch?v=aOZPBUu7Fro&feature=related

|

Headlines---

Ted Pritchard, CLP, Passes Away

Classified Ads---Senior Management

Concord Financial Services Closes its Door

GE to continue "shrinking"

Cartoon---Two dogs discuss home economy

Leasing 102 by Mr. Terry Winders, CLP

Rate Fear

Bank Beat---Central California takes another hit

Commerce National Returns TARP

From Bankers View, Clouds Lifting over California

by Kevin Dobbs, SNL Financial

Leasing News Top Stories-October 12-16

Southern California Leasing Newsletter

CIT Amends Restructuring Plan

Changes to SBA Loan Program 650,000 jobs

IRS Arrests Dana Ray Reynolds

Portsmouth, New Hampshire ---"Adopt a Pet"

News Briefs----

Phillipine/Asia Leasing Business Up

Consumers Continue To Struggle, Cut Credit

Harvard loses $1.8B in operating cash

Foreclosures: Ex-Homeowners to Turn to Shelters

You May have Missed---

Sports Brief---

"Gimme that Wine"

Today's Top Event in History

This Day in American History

Baseball Poem

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

--------------------------------------------------------------

Ted Pritchard, CLP, Passes Away

Ted Pritchard, CLP

Smokey Mountain Funding, Inc.

Hunt Valley, Maryland

Ted Pritchard, CLP, son Tripp said his father died at age 67 at the Elizabeth House on Friday after a seven month ordeal of pancreatic cancer eventually took his life. There will be a funeral service in Hendersonville, North Carolina at his Church on Saturday, October 24th. Forest Lawn Mortuary will announce the arrangements. Leasing

News will print the details when received in the next edition.

From the web site:

"Ted Prichard, CLP, established Smokey Mountain Funding in 1988.He is a graduate from the Citadel and also a veteran. Ted served in Viet Nam. Ted has 35+ years of business and leasing experience. He is a Certified Leasing Professional who comes from a banking family. He brings a solid business and financial background to the company. Smokey Mountain Funding, Inc. is located in Hendersonville, NC.

"Ted also owns and operates a "sister" company called Smokey Mountain Mortgage, Inc. This is a full service mortgage company licensed in North and South Carolina handling commercial and residential real estate."

"Supporting the sales staff is Tripp Prichard, President of Smokey Mountain Funding, Inc. Tripp is a graduate of North Carolina State University and also brings a solid background of both sales and leasing experience."

http://www.smokeymountainfunding.com/history.php

[headlines]

--------------------------------------------------------------

Classified Ads---Senior Management

Philadelphia, PA

Executive that led vendor technology leasing start-ups for US Bancorp and Wells Fargo.

Hired and managed vendor teams in technology, office equipment, telecom and transportation.

Email: jjacee@verizon.net |

Europe

25+ yrs exper. management roles Chase, AT&T Capital, Heller Financial, SFS. Develop biz from "scratch to success". Looking for challenging & pioneering job.

Email: frans@alliedproperty.net |

Philadelphia, PA

27 yrs. exp. sales, ops., credit, strategy, P&L mngmet. Most recently created & executed the biz plans for 2 highly successful Bank-owned small ticket leasing subsidiaries.

email: mccarthy2020@comcast.net |

Philadelphia Metro Area - 30 Years experience Healthcare sales/ management- 3 years experience newly create "small-ticket" healthcare division.

Good success - Mitch Utz

215-460-4483

Email: mitutz@msn.com |

For a full listing of all "job wanted" ads, please go to:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

Other e-Mail Posting Sites:

http://www.leasingnews.org/Classified/Posting_sites.htm

[headlines]

--------------------------------------------------------------

Concord Financial Services Closes its Door

Moe Essa, President of Concord Financial Services, Long Beach, California, as informed Leasing News that he has closed his company.

[headlines]

--------------------------------------------------------------

GE to continue "shrinking"

Two quotes from GE-Q3 2009 General Electric Earnings Conference Call, Event Date/Time: Oct. 16, 2009 12:30pm GMT

Keith Sherin-General Electric-Vice Chairman

"I would like to start with a summary of the third quarter. On the left side is the summary for continuing operation. Revenues of $37.8 billion were down 20%. That is as we expected. Industrial sales at $25.1 billion ere down 12%. You saw in the press release organic growth was, on industrial, was down 9%. Financial Services revenue at $12.7 billion, down 20%. I ill explain more on that when I get to the Finance Services page. We earned $2.5 billion in net income, which was down 45% and for earnings per share, we earned $.022. That does include the cost of our preferred dividend...

"I will start with a few pages on Capital Finance. Mike Neal and the team continue to execute well in a very challenging environment. For Q3, the revenues of $12.2 billion were down 20%. That is driven by our assets being down $70 billion year-over-year. It also driven by the impact from deconsolidating Penske, which was about six points of revenue decline in the quarter. And we also had lower revenues because we have lower gains, principally in Real Estate and also form lower interest rates with our floating-rate book. Capital Finance earned $263 million. That was down 87% driven by higher credit costs. I will cover that in more detail. Lower gains and the impact of again shrinking the business."

Jeff Immelt-General Electric-Chairman & CEO

"So I want to reiterate one thing Keith said is that we are shrinking GE Capital faster than we had planned. We think that is on strategy as we do that, the GE Capital revenues decline accordingly. And so I think these are things we are doing proactively that are on the strategy where we view this as a positive execution point."

- GE continues to cut back on projects, employees, divisions, selling off assets.

- While press release and presentation are optimistic, is "shrinking" optimistic?

- While government looks to increase employment, GE is not

(perhaps as well as other companies are shrinking, too)

- Imagination at work?

GE Slogan Winners

http://www.leasingnews.org/archives/February%202009/02-04-09.htm#contest

Conference Call Transcript GE-Q# 2009 Earnings:

http://leasingnews.org/PDF/GE%20Conference%20Call.pdf

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Leasing 102

by Mr. Terry Winders, CLP

Rate Fear

The discussion about "what is my rate" confuses more lease sales people than it does the customer. I have written in the past that trying to be "honest" is not the issue. It is the type of lease that dictates the rate. Also the accounting requirements may be looked at differently by both lessee and lessor or the funding institution. It is wrong to respond to any request for a rate quote. Loans have interest, no lease has interest. So let's discuss the different types of leases and the question of rate.

A one dollar purchase option lease is easy to compute a standard rate but it will probably be wrong for the lessee because of the accounting requirements. The procedure for placing the transaction on the books of the lessee requires the accountant to use the customers "incremental borrowing rate" to discount the rent stream to obtain the "present value" of the payments. This present value is then subtracted from the total rent to determine the difference which is then charge as interest over the lease term. Unless your lease rate is exactly the same as the customers "incremental borrowing rate" your rate quote is wrong. There for you should tell the customer that there rate is what ever there "incremental borrowing rate" is and if they want to compare lease quotes they should compare payments.

Once you move to a purchase option greater that one dollar, due to your assuming a residual, the issue of rate is clearly going to be different than the customers "incremental borrowing rate". It is interesting to note that the customer's rate is the same irrespective of what residual you take because they must discount only the payment stream. Different residuals create different payment streams which create different discounted amounts and different amounts of interest; however they will all be at the same "rate". The customers "incremental borrowing rate" is always the rate. Different payment streams create different present values so it may important to ask the customer to compare present value along with the payments to compare lease quotes.

I know these sounds like a complex way to discuss rate with your customer but are you a professional or a rate card sales person? To look professional you need to understand the rules and be able to discuss the effect of the rules on the lessee. If you just discuss rate your competition will find a way to confuse the customer and disguise their rate and take the business from you.

A true lease, a non-profit lease or any lease with a residual requires this type of discussion because the amount of the payment stream is affected by so many additional factors. Also it is wise to remember the income tax rules because with the changes that are proposed by FASB leasing will return to selling tax leases. It appears that FASB wants to place everything on the balance sheet of the Lessee so the above discussion will become a necessity if you hope to sell leasing in the future. I recommend you obtain a copy of the proposed accounting changes and after reading them get involved in the fight to save our industry.

Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty years and can be reached at leaseconsulting@msn.com or 502-327-8666.

He invites your questions and queries.

Previous #102 Columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

(This ad is a "trade" for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

|

[headlines]

--------------------------------------------------------------

Bank Beat---Central California takes another hit

San Joaquin Bank, Bakersfield, California, became the 99th FDIC-insured institution to fail in the nation this year, and the tenth in California. The five branches and deposits were assumed by Citizens Business Bank, Ontario, California.

Central California has been hardest hit with real estate failures, caught in a boom era, coupled with agriculture problems and high unemployment for almost two years.

The bank had grown to 149 employees; net equity dropped $23 million to $47 million, June 30, 2009 with a loan loss allowance of $45 million. The bank reported a $19.7 million loss June 30, 2009, all according

to FDIC filings.

Federal regulators had given the bank until October 15th to raise $27 million in new capital. The 52 week high of bank stock was $21.50 and had fallen to $2.25, before the announcement was made. Bank President and CEO Bart Hill told bakersfield.com he had "... an offer by 11 private investors in India totaling $38 million, which would give them 62 percent ownership, though no single person would get more than 8 percent. Hill said $5.5 million of that money is now in Los Angeles but that the rest is awaiting the completion of background checks of the investors."

It never materialized. The FDIC and Citizens Business Bank entered into a loss-share transaction on approximately $683 million of San Joaquin Bank's assets. The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $103 million.

Bakersfield.com full story-closing of the bank and its affect

on the community:

http://www.bakersfield.com/news/business/economy/x1675932959/Regulators-shut-down-San-Joaquin-Bank

[headlines]

--------------------------------------------------------------

Commerce National Returns TARP

"Commerce National Bank was one of the few community banks that qualified for and also repaid TARP funds. I have attached a press release from our bank President that we as a small community bank consider newsworthy. We are also proud to state that our new Leasing Department recently completed our first full year. We have achieved most of our first year goals, we are growing, and we look forward to working with the leasing community for many years to come."

Bob Robichaud, CLP

Vice President Leasing Relations

Commerce National Bank

279 E. Orangethorpe Ave.

Fullerton, CA 92832

Tel: 714-882-7648

brobichaud@commercenatbank.com

#### Press Release ########

Commerce National Bank Announces Repayment of $5 million of TARP-CPP Capital

NEWPORT BEACH, CA. Commerce National Bank (OTCBB:CNBF.OB), a community business bank now in its sixth year of operation, announced it has redeemed the Preferred Stock issued to the United States Treasury Department (the "UST") by repaying the $5 million received from the UST in January 2009 under the term of the Troubled Asset Relief Program Capital Purchase Program (the "TARP CPP").

"When the TARP CPP was originally proposed, only strong, well capitalized banks could apply for it," stated Mark Simmons, the President & CEO. "However, after several changes were made to the program, the public perception of it changed to a negative idea that the program was supplying bailout money to troubled banks.

Mark E. Simmons

President & Chief Executive Officer

"The Board of Directors earlier this year decided that it was in the shareholders' best interest to repay the TARP CPP funds as the bank did not need them, and was not, and is not, a troubled or problem bank. With the redemption of the Preferred Stock, the Bank's equity is $28,588,492. That results in a Tier 1 capital to assets ratio of 12.7%, which is more than twice the minimum requirement to be well capitalized under applicable federal regulations. This ratio places Commerce National Bank among the best capitalized business banks operating in Orange County. The bank's Board of Directors, officers and staff will continue to focus on delivering the highest level of service to its business and professional customers and seek out new customers in the Orange County community."

With offices in Newport Beach near John Wayne airport and in the City of Fullerton, the Bank is well positioned to serve businesses, professionals and selected real estate customers in both the northern and southern areas of Orange County. The offices are staffed by experienced business bankers who are committed to providing exemplary service to their customers in the business community.

(Leasing News provides this ad "gratis" as a means

to help support the growth of Lease Police)

|

[headlines]

--------------------------------------------------------------

(While California had its tenth bank failure, most through residential

and commercial real estate foreclosures, here is an optimistic report

from SNL Financial, reprinted with their permission. Editor)

From bankers' view, clouds lifting over California

By Kevin Dobbs

In California, where banks have struggled mightily against the

backdrop of a pummeled housing market, fear is giving way to op-

timism, albeit with an undercurrent of caution.

Christopher Carey, the CFO of City National Corp., a bank with

about 90% of its assets in California, told investors recently that

loans to residential developers are "stabilizing at this point." He said

nonperformers in the area "actually went down" in recent months

and "it's more likely than not that we won't see" them rise again.

Carey, speaking at a September conference, acknowledged that

commercial real estate losses could still pose a significant threat and

that high jobless rates in California remain a pressing concern. But,

he said, the bank is now comfortable looking ahead to recovery with

the deepest housing-related troubles easing.

"We are not out of the woods yet, but housing prices have come

down significantly in most markets and the unsold homes are selling

at a pretty rapid clip," he said.

The latest S&P/Case-Shiller home price indexes, released Sept. 29,

provided fuel for hope. Home prices in both Los Angeles (up 1.8%)

and San Francisco (up 3.3%) improved in July from the previous

month. And while the measure of growth was negative on a year-

over-year basis in both cities, as well as nationally, declines narrowed

throughout the second quarter.

"In California, we are pretty confident that we are long past the

worst of the residential development and construction problems,"

Doyle Arnold, Zions Bancorp.'s CFO, said at a September confer-

ence.

Arnold acknowledged that the state is coming off painful lows.

But Arnold said that "in recent months we have seen a couple of

national home builders come back into that market and buy finished

lots ready for development at prices that were at or above more

recent other recent sale prices.

"Nobody's predicting a big housing boom," he added. But "there

is evidence that the home builders which sold a lot of land and a lot

of inventory at the end of Ô07 and Ô08 to realize tax losses, to get the

refunds, to hoard cash two years ago, are now beginning to deploy

that cash very selectively in high quality, well-located lots.

"So," Arnold said, "they've got some inventory on which to build

as some pickup in housing activity begins."

If that proves true, it could mark an important turning point for

the nation's most populated state if it eventually results in new

building and, by extension, new jobs. Amid the housing collapse, the

state lost about 500,000 jobs tied to construction in real estate,

banking, financial services and related industries, according to the

Center for Continuing Study of the California Economy. The center

estimates that total building levels peaked this decade in the state at

about $63 billion in 2005 and have since fallen more than 60%.

Timothy O'Brien, a bank analyst in Sandler O'Neill & Partners LP's

San Francisco office, told SNL that, much like the word from Zions,

community bankers have passed along to him anecdotal evidence

of national builders investing in California, which he called "a real

positive." It indicates, he said, that national builders are not only

confident in their own financial stability but also may be starting to

bet on a sustained turnaround in California.

O'Brien, who tracks developments in Western real estate and

their impact on banks, also said low interest rates are attracting

home buyers and driving mortgage volume for banks while a

national economy on the mend could result in an uptick in orders

for California-based businesses, which could in turn result in more

jobs.

A University of California, Los Angeles, forecast put quarterly eco-

nomic growth next year in California at 2%, on average.

All of which would be good news for banks in California, which

need to see stronger consumer and business activity to appear

in the form of not only more demand for credit but demand from

credit-worthy customers. And the state's recovery could prove a

harbinger for the nation, given that California's economy, if broken

off on its own for statistical measurement, would rank among the

world's top 10 economies, even after the effects of the latest reces-

sion, according to the Center for Continuing Study of the California

Economy.

"With all the shakeout we've seen, I think, the strong, relatively

healthy banks should actually benefit from the diminished competi-

tion and be able to see strong future growth," O'Brien said."We are

going to come back. É We are taking steps in the right direction."

He echoed similarly upbeat comments by executives at JPMorgan

Chase & Co., Wells Fargo & Co., U.S. Bancorp and other large banks

with sizable market share in California. But he also emphasized the

flipside.

"I think it's safe to say bankers are less uncertain now about their

ability to make a buck," O'Brien said. However, he added that "it's

important to note less uncertain. It's definitely a mixed bag right

now."

The state's economy, he said, remains in a tenuous position with

a fragile bottom.

He noted that homes sales in California have been driven, in part,

by seasonal upticks and by special tax credits for certain first-time

buyers credits that are slated to expire in a couple months. And,

of course, unemployment levels must level off before bankers in the

state can be comfortable that credit losses will be held in check, he

said. The state's unemployment rate hit 12.2% in August, well above

the national average of 9.7%.

But more bankers and analysts are increasingly confident that

housing, which drove California into a hole, has begun to stabilize

and will eventually help fuel its growth once again for banks and

the broader economy

August home sales increased 9% in California when compared

with the same month a year ago, according to the California Associa-

tion of Realtors. The median price of an existing home in California

in August was $292,960, down 16.9% from a year earlier but up 2.6%

from the previous month.

Donald van Deventer, chairman and CEO of credit and market risk

consultancy Kamakura Corp., told SNL that housing in San Francisco

and other relatively affluent areas of Northern California have little

healing to do relative to the rest of the state. And he said Orange

County, parts of the Los Angeles area and other densely populated

parts of Southern California are likely to recover faster than the hard-

hit Inland Empire, a central region that got punished particularly

harshly by the housing bust.

"But I'm now confident that it, too, will follow along and bounce

back," said van Deventer, who tracks market conditions on the West

Coast. "It's not false optimism."

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Southern California Leasing Newsletter

(you may need to click on this to make appear more

clear, depends on your settings. One of the best

newsletters sent consistently every month to clients,

friends, and colleagues.)

[headlines]

--------------------------------------------------------------

### Press Release ##########################

CIT Amends Restructuring Plan

NEW YORK----CIT Group Inc. (NYSE: CIT), a leading provider of financing to small businesses and middle market companies, announced that it has amended its restructuring plan to further build bondholder support. The amendments have been approved by CIT's Board of Directors and the Steering Committee of CIT's bondholders.

On October 1, 2009, CIT commenced a series of offers to exchange certain outstanding series of notes and concurrently began a solicitation for votes for a voluntary prepackaged plan of reorganization. Successful completion of either the exchange offers or plan of reorganization will generate significant capital and provide multi-year liquidity through the material reduction of CIT's outstanding debt.

"Over the last two weeks, we have continued to work constructively with the Steering Committee and believe that these amendments will further build bondholder support for our restructuring plan," said Jeffrey M. Peek, Chairman and CEO. "Through the completion of the exchange offers or an expedited in-court restructuring process, we will reduce the uncertainty around our business and further maximize the value of our franchise. Either approach is intended to ensure that CIT becomes a well-capitalized bank holding company that will serve as a source of strength for CIT Bank as we implement our new bank-centric funding model."

Amended Terms of the Restructuring Plan

The amended terms of the restructuring plan include, among others:

- A comprehensive cash sweep mechanism to accelerate the repayment of the new notes;

- The shortening of maturities by six months for all new notes and junior credit facilities;

- An increased amount of equity offered to subordinated debt holders reflecting agreements with holders of the majority of its senior and subordinated debt;

- The inclusion of the notes maturing after 2018 that had previously not been solicited as part of the exchange offer or plan of reorganization;

- An increase in the coupon on Series B Notes, to 9% from 7%, being issued by CIT Delaware Funding; and

- Provided preferred stock holders contingent value rights in the plan of reorganization, and modified the allocation of common stock in the recapitalization after the exchange offers, as part of an agreement with the United States Department of Treasury.

- The exchange offers expire at 11:59 pm, New York City time, on Thursday, October 29, 2009, with the exception of the additional notes maturing after 2018 for which there is an early acceptance date of October 29, 2009 and expiration date of November 13, 2009. Tendered securities may be validly withdrawn at any time prior to the expiration or early acceptance date.

NYSE Approval

On October 14, 2009, the New York Stock Exchange (the "NYSE") accepted CIT's application of the financial viability exception to the NYSE's shareholder approval policy in connection with the issuance of the New Preferred Stock should the Offers be consummated. The Audit Committee of the Company's Board of Directors has approved the use of this exception.

For Additional Information

The Company is filing an 8-K containing the amended Offering Memorandum, Disclosure Statement and Solicitation of Acceptances of a Prepackaged Plan of Reorganization with the Securities and Exchange Commission. Further information about the Company, its restructuring plan, including the amended offering memorandum, will be available at www.cit.com.

The Information Agent for the Offer is D.F. King & Co. Financial Balloting Group, LLC is serving as Exchange Agent for the Exchange Offers and Voting Agent for the Plan of Reorganization. Retail holders of notes with questions regarding the voting and exchange process should contact the information agent at (800) 758-5880 or +1 (212) 269-5550. Banks and brokers with questions regarding the voting and exchange process should contact the exchange and voting agent at +1 (646) 282-1888. BofA Merrill Lynch and Citigroup Global Markets are acting as financial advisors to the Company for purposes of this transaction.

Evercore Partners, Morgan Stanley and FTI Consulting are the Company's financial advisors and Skadden, Arps, Slate, Meagher & Flom LLP and Sullivan & Cromwell LLP are legal counsel in connection with the restructuring plan.

Individuals interested in receiving future updates on CIT via e-mail can register at http://newsalerts.cit.com.

About CIT

CIT (NYSE: CIT) is a bank holding company with more than $60 billion in finance and leasing assets that provides financial products and advisory services to small and middle market businesses. Operating in more than 50 countries across 30 industries, CIT provides an unparalleled combination of relationship, intellectual and financial capital to its customers worldwide. CIT maintains leadership positions in small business and middle market lending, retail finance, aerospace, equipment and rail leasing, and vendor finance. Founded in 1908 and headquartered in New York City, CIT is a member of the Fortune 500. www.cit.com.

[headlines]

--------------------------------------------------------------

### Press Release ############################

Changes to SBA Loan Program 650,000 jobs

WASHINGTON, The International Franchise Association urged Congress to make crucial changes to the Small Business Administration loan programs to help create as many as 650,000 new jobs.

"There is significant demand for more lending in the small business community," said IFA President & CEO Matthew Shay during testimony today before the House Small Business Committee. "Making SBA loan programs work better for entrepreneurs seeking capital to open, acquire or expand a business will allow the economy to recover faster and provide the necessary bridge to a functioning commercial lending market once the recovery is complete."

Shay explained that normally businesses could find financing from a number of sources, making the SBA loan program a lender of last resort for those who have trouble finding credit from traditional sources. However, during the current recession, commercial lenders have curbed their lending making the SBA an important lending source for all businesses. He said however, that many are not participating in SBA lending programs because either they lack expertise or they find the SBA's requirements too burdensome.

"Increasing the maximum Small Business Administration loan limits from $2 million to $5 million would make more credit available to franchise business owners who own between two and five units," Shay said. "Larger loan limits will enable some of these franchise small business owners to expand into new markets and help the U.S. create between 450,000 to 650,000 new jobs within the next 12 to 18 months."

In addition to increasing the loan limits, Shay urged the Committee to look at new ways to stimulate small business lending so that funds are available specifically for business start-up and expansion, including:

- Re-institute the borrower fees on all 7(a) loans with amortizations over 15 years while eliminating or reducing lender fees on all 7(a) loans with amortizations under 15 years or alternatively on true start-ups with all amortizations.

- Make the 90 percent guarantee permanent for all loans with amortizations under 15 years, and adding a 100 percent guarantee for first two years of a franchise start-up. For loans with amortizations over 15 years, restore the 75 percent guarantee.

- Improve SBA audit standards. Shay said that if the prevailing perception among lenders becomes a lack of faith in the SBA guarantee, then small business lending will decline further and entrepreneurs will face a much greater challenge to be the engine of economic recovery.

Franchised businesses play an important role in the economic health of the U.S. economy, Shay said, and they are poised to help lead the economy on the path to recovery. An IFA Educational Foundation report shows that the franchise industry consistently outperforms the non-franchised business sector, creating more jobs and economic activity in local communities across the country. Released in February 2008, Volume 2 of the Economic Impact of Franchised Businesses, documents that franchising grew at a faster pace than many other sectors of the economy from 2001 to 2005, expanding by more than 18 percent. During this time, franchise business output increased 40 percent compared to 26 percent for all businesses.

The findings of a 2009 study, Small Business Lending Matrix and Analysis, prepared by FRANdata for the IFA Educational Foundation, demonstrate that meaningful economic recovery and job creation can start with small business lending. In fact, the study determined that for every $1 million in new small business lending, the franchise business sector would create 34.1 sustainable jobs and generate $3.6 million in economic output.

Shay added that the stimulus bill passed earlier this year made some changes to the SBA program, such as temporarily increasing the loan guarantee and suspending loan fees for borrowers.

"These were crucial first steps and we urge Congress to ensure these temporary provisions are available through 2010," Shay said. "Taking additional steps to increase access to capital for franchise businesses will create jobs and lead us to a faster recovery."

About the International Franchise Association

The International Franchise Association, the world's oldest and largest organization representing franchising, is the preeminent voice and acknowledged leader for the industry worldwide. Approaching a half-century of service with a growing membership of nearly 1,300 franchise systems, 10,000-plus franchisees and more than 500 firms that supply goods and services to the industry, IFA protects, enhances and promotes franchising by advancing the values of integrity, respect, trust, commitment to excellence, honesty and diversity. For more information, visit the IFA Web site at www.franchise.org.

[headlines]

--------------------------------------------------------------

### Press Release ############################

Asset Protection Strategy Promoter Indicted on Tax Charges

Failed to report over $600,000 to the IRS

Los Angeles The operator of Repackaging America, Inc. and Incorporating You, Inc. appeared Friday in United States District Court in Los Angeles after having been arrested this morning by Internal Revenue Service agents on tax charges.

Dana Ray Reynolds was indicted yesterday afternoon on three counts one count of conspiracy to defraud the Internal Revenue Service and two counts of subscribing to false personal tax returns for the years 2002 and 2003.

According to the indictment, Reynolds developed strategies to conceal personal assets and income and to avoid the payment of liabilities, including income taxes, through the creation of corporations. Reynolds sold these strategies to the public through corporate entities, including Repackaging America, Inc. and Incorporating You, Inc. To market his concealment and avoidance strategies, Reynolds highlighted his own elaborate lifestyle made possible by following the plans he developed. In following his own strategies, Reynolds and an unindicted co-conspirator paid their personal and family expenses using monies taken from the corporations. Reynolds and the unindicted co-conspirator did not report the monies they used from the corporations as income to the IRS.

In addition to failing to report monies used from the corporations as income to the IRS, Reynolds and the unindicted co-conspirator conveyed title in assets they owned to corporations or used corporate entities to give the appearance that the assets were encumbered, in order to avoid having assets seized by the IRS or other creditors.

The indictment alleges that, for the tax years 2002 and 2003, Reynolds and the unindicted co-conspirator removed more than $600,000 from corporate accounts for their own personal benefit, income which they failed to report to the IRS.

An indictment contains allegations that a defendant has committed a crime. Every defendant is presumed to be innocent until proven guilty in court.

If convicted of the crimes alleged in the indictment, Reynolds faces a statutory maximum 11 years in federal prison and fines totaling $750,000.

The investigation of Reynolds was conducted by IRS-Criminal Investigation's Los Angeles Field Office in conjunction with the United States Attorney's Office for the Central Judicial District of California.

[headlines]

--------------------------------------------------------------

"Adopt a Pet"

http://www.nhspca.org/animals/dogs.html

The Society for the Prevention of Cruelty to Animals has many adoption centers. Look for one in year area on line. Many have web sites with dogs and cats available on line.

-------------------------------------------------------------

News Briefs----

[headlines]

---------------------------------------------------------------

You May have Missed---

[headlines]

----------------------------------------------------------------

Sports Briefs----

[headlines] ----------------------------------------------------------------

"Gimme that Wine"

Wine Prices by vintage

http://www.winezap.com

US/International Wine Events

http://www.localwineevents.com/

http://www.wine-searcher.com/

Winery Atlas

http://www.carterhouse.com/atlas/

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

The London International Vintners Exchange (Liv-ex) is an electronic exchange for fine wine.

http://www.liv-ex.com/

[headlines] ----------------------------------------------------------------

Today's Top Event in History

1781- Washington takes Yorktown. By 1780, the Continental Army had suffered its worst privations, it greatest defeats, and its darkest hours. October was a terrible month in 1780. It would continue to lose battles but, by this time turned into a well-trained fighting force by European officers and aided by allied French forces, it endured and historians consider the American Revolutionary War ended this day in 1781 when more than 7,000 English and Hessian troops, led by British General Lord Corwallis, surrendered to General George Washington at Yorktown, Virginia, effectively ending the war between Britain and her American colonies. The military phase of the conflict ended at Yorktown as there were no more major battles, but the diplomatic struggle continued. Preliminary articles of peace were secured on November 30, 1782, after long and difficult negotiations. The Treaty of Paris, by which the war was officially ended and independence formally acknowledged by Great Britain, was not signed until September 3, 1783. Adding to the disagreements was communication by ship and even meetings locally were delayed as the pace of public transportation in the U.S. was painfully slow. It took Thomas Jefferson five days to travel from Philadelphia to Baltimore. The time delay also gave over 100,000 "loyalist" the time to fled the U.S. Also known as Tories, they had suffered various penalties for their loyalty to the Crown, including confiscation of property, removal from public office, and punitive taxation. Probably no more than 10% of the colonials were Tories, who were generally well-to-do, engaged in commerce or the professions, or public officials. Many fled to Canada, some to England. Some returned after the peace treaty was actually signed. After the conflict, many were also able to recover at least some of their confiscated property. The estimated colonial population was 2,781,000

http://www.richardferrie.com/aboutbook.htm

http://www.lcweb.loc.gov/exhibits/treasures/trt022.html

http://xroads.virginia.edu/~CAP/ROTUNDA/york_1.html

http://bluehawk.monmouth.edu/~library/mumford.html

[headlines]

----------------------------------------------------------------

This Day in American History

1739 - England declared war on Spain over borderlines in Florida. The War is known as the War of Jenkins' Ear because a Member of Parliament waved a dried ear and demanded revenge for alleged mistreatment of British sailors. British seaman Robert Jenkins had his ear amputated following a 1731 barroom brawl with a Spanish Customs guard in Havana and saved the ear in his sea chest.

1781- Washington takes Yorktown. By 1780, the Continental Army had suffered its worst privations, it greatest defeats, and its darkest hours. October was a terrible month in 1780. It would continue to lose battles but, by this time turned into a well-trained fighting force by European officers and aided by allied French forces, it endured and historians consider the American Revolutionary War ended this day in 1781 when more than 7,000 English and Hessian troops, led by British General Lord Corwallis, surrendered to General George Washington at Yorktown, Virginia, effectively ending the war between Britain and her American colonies. The military phase of the conflict ended at Yorktown as there were no more major battles, but the diplomatic struggle continued. Preliminary articles of peace were secured on November 30,1782, after long and difficult negotiations. The Treaty of Paris, by which the war was officially ended and independence formally acknowledged by Great Britain, was not signed until September 3,1783. Adding to the disagreements was communication by ship and even meetings locally were delayed as the pace of public transportation in the U.,S. was painfully slow. It took Thomas Jefferson five days to travel from Philadelphia to Baltimore. The time delay also gave over 100,000 "loyalist" the time to fled the U.S. Also known as Tories, they had suffered various penalties for their loyalty to the Crown, including confiscation of property, removal from public office, and punitive taxation. Probably no more than 10% of the colonials were Tories, who were generally well-to-do, engaged in commerce or the professions, or public officials. Many fled to Canada, some to England. Some returned after the peace treaty was actually signed. After the conflict, many were also able to recover at least some of their confiscated property. The estimated colonial population was 2,781,000

http://www.richardferrie.com/aboutbook.htm

http://www.lcweb.loc.gov/exhibits/treasures/trt022.html

http://xroads.virginia.edu/~CAP/ROTUNDA/york_1.html

http://bluehawk.monmouth.edu/~library/mumford.html

1829The monument to George Washington was completed this day in Baltimore, MD. The cornerstone was laid on July 4, 1815, with Masonic ceremony.

1833 -- Edgar Allen Poe's "Ms. Found in a Bottle" appears in "Baltimore Sunday Visitor".

1842 -- Military forces, believing war has begun, occupy Monterey, Calif., Mexico.

1844 - The famous "Lower Great Lakes Storm" occurred. Southwesterly winds were at hurricane force for five hours, driving lake waters into downtown Buffalo NY. The storm drowned 200 persons.

1848 - John "The Pathfinder" Fremont moved out from near Westport, Missouri, on his fourth Western expedition--a failed attempt to open a trail across the Rocky Mountains along the 38th parallel. It was not until scout Christopher "Kit" Carson did Fremont find passage West.

1849 -- Elizabeth Blackwell became first woman in the country to receive medical degree.

1850-- Annie Smith Peck, shocks society by wearing trousers when she climbed mountains. She had conquered every large mountain in the Western Hemisphere and at age 85 she climbed Mount Madison in New Hampshire.

1876-Birthday of "Three Finger Brown;" Mordecal Peter Centennial, Baseball Hall of Fame pitcher born at Nyesville, IN. Brown won 239 games. His nickname came from a childhood injury that cost him one finger and misshaped others. Inducted inot the Hall of Fame in 1949. died at Terre Haute, IN. Feb 14, 1948.

1895 - Historian Lewis Mumford Birthday.

1901 - Arleigh A. Burke, admiral (WW II, Solomon Islands, Navy Cross), was born in Colorado. Although unable to complete his high school education because the school was closed during the flu epidemic in 1917, he competed successfully for an appointment to the U.S. Naval Academy. Convinced that the inadequacies of his secondary education put him behind other Midshipmen in his class, Burke decided that he could only overcome this deficiency by working more diligently at his studies than the others. This plan paid great dividends, and he graduated in 1923 in the top sixth of his class. Taking this lesson strongly to heart, he remained a believer in the benefits of sustained hard work throughout his Navy career. During the interwar years, Arleigh Burke honed his skills as a surface warfare officer, serving initially in the battleship USS Arizona, obtaining a postgraduate degree in ordnance engineering, and rising eventually to command a destroyer. It was in this formative period of his career that he learned the importance of the Navy adage "loyalty up, loyalty down"--if you expect loyalty from your people you must be loyal to them in return. During World War II, Burke commanded Destroyer Squadron 23 (the "Little Beavers") during combat in the South Pacific. Developing successful tactics to overcome Japanese advantages in night surface operations, he earned fame as "31-knot" Burke during the 1943 battles of Empress Augusta Bay and Cape St. George. It was in this period that his belief in the importance of thorough training was validated--as he explained to his subordinates, in combat your outfit could expect to do only about as well as it had trained to do beforehand. During Dwight Eisenhower's terms as President in the 1950s, Arleigh Burke served as Chief of Naval Operations (CNO) for six years. While CNO he initiated efforts such as the submarine-launched Polaris ballistic missile program that tremendously strengthened the U.S. Navy's military capabilities.

1915 - Establishment of Submarine Base at New London, Connecticut. In 1868, Connecticut gave the Navy land and, in 1872, two brick buildings and a "T" shaped pier were built and officially declared a Navy Yard. Today the Naval Submarine Base New London (SUBASE NLON), located on the east side of Thames River in Groton, CT, proudly claims its motto to be "The First and Finest."

1917 - The first doughnut was fried by Salvation Army (who would found the United Service Organization) volunteer women for American troops in France during World War I. The first of a group of 250 Officers and Soldiers of The Salvation Army to be posted to France to serve with General John Pershing's American expeditionary force sailed from New York on August 12th 1917. General Pershing was far from convinced that The Salvation Army's presence at the Front Line would benefit his troops and at first the Salvationists were treated with total indifference. At Demange, in the American first division sector, Salvationists toiled in pouring rain to build a hut 25 feet wide by 100 feet long for the troops benefit. No one gave them the time of day, much less a hand. What swung the troops to The Army's side was their practical example. No task was too menial, none too dangerous or difficult. But The Salvation Army won pride of place in American hearts by a brain wave born of sheer necessity. At Montiers, after 36 days of rain, supplies were almost exhausted. Only flour, lard and sugar remained. Ensign Margaret Sheldon, from the Chicago slums made a suggestion which was to go down in history. "Why don't we make them doughnuts?" They had no rolling pins or cake cutters and gales had blown down their tent but Salvationists thrive on challenges. Along with Ensign Helen Purviance, Margaret Sheldon crouched in the rain to prepare the dough. An empty bottle did duty as a rolling pin and in place of a cutter they used a knife to twist the doughnuts into shape. The first doughnuts cooked over a wood fire were triumph of improvisation. On the first day they served up some 150 doughnuts. The following days batch topped 300. The traditional hole now being punched out with the inner tube of a coffee percolator. The doughnuts made by The Salvation Army Lassies were an instant success with the troops. Some lining up for hours in appalling conditions for their daily supply. Soon the troops came to realize that even in the firing line The Salvationists would not neglect them. When Lassies like Ensign Florence Turkington crawled under shell fire to deliver coffee an doughnuts to troops in the trenches, letters praising the work of The Salvation Army began flooding back home. Over night the bewildered lassies found themselves national heroines. Although often in great danger The Salvationists displayed tremendous courage. At Baccarat they worked so close to the German lines that they couldn't even whisper for fear of being heard by the listening posts. The sermon that came with the coffee and doughnuts was a friendly squeeze on the shoulder.The Doughnut became a symbol of The Salvation Army in the U.S.A. Outside many of The Army rest rooms and hostels were hung giant "doughnuts". The Army, by selfless example, had won the hearts of a nation. At the end of the war the American people subscribed an unprecedented 13 million dollars to meet the debts incurred by The Salvation Army in its' war work.

1926 - John C. Garand patented a semi-automatic rifle. Civil Service employee John Garand was in a class all by himself, much like the weapons he created. Garand was Chief Civilian Engineer at the Springfield Armory in Massachusetts. Garand invented a semiautomatic .30 caliber rifle, known as the M-1 or "the Garand," which was adopted in 1936 after grueling tests by the Army. It was gas-operated, weighed under 10 pounds, and was loaded by an 8-round clip. It fired more than twice as fast as the Army's previous standard-issue rifle and was praised by General George S. Patton, Jr., as "a magnificent weapon" and "the most deadly rifle in the world."

1938 - For Decca records, the Bob Crosby Orchestra recorded "I'm Free". Trumpet was provided by Billy Butterfield. A few years later the song would be retitled, "What's New".

1939 - One of Frank Capra's finest films, Mr. Smith Goes to Washington, opened in the United States. Starring James Stewart, Jean Arthur, Claude Rains, Harry Carey, Sr., and Edward Arnold, the film about a young idealist who discovers nothing but corruption in the government did well at the box office. It received many Oscar nominations, including Best Picture, Best Actor, Best Supporting Actor, and Best Director, but was knocked out of most at awards' time due to Gone with the Wind's sweep; it did snag, however, Best Writing, Original Story for writer Lewis R. Foster, and Stewart received the New York Film Critics Circle Awards for Best Actor.

1949 - No. 1 Billboard Pop Hit: ``That Lucky Old Sun,'' Frankie Laine.

1944--1944--US Navy opened to Black women.

1944--HAJIRO, BARNEY F. --- Medal of Honor

for conspicuous gallantry and intrepidity at the risk of his life above and beyond the call of duty:

Private Barney F. Hajiro distinguished himself by extraordinary heroism in action on 19, 22, and 29 October 1944, in the vicinity of Bruyeres and Biffontaine, eastern France. Private Hajiro, while acting as a sentry on top of an embankment on 19 October 1944, in the vicinity of Bruyeres, France, rendered assistance to allied troops attacking a house 200 yards away by exposing himself to enemy fire and directing fire at an enemy strong point. He assisted the unit on his right by firing his automatic rifle and killing or wounding two enemy snipers. On 22 October 1944, he and one comrade took up an outpost security position about 50 yards to the right front of their platoon, concealed themselves, and ambushed an 18-man, heavily armed, enemy patrol, killing two, wounding one, and taking the remainder as prisoners. On 29 October 1944, in a wooded area in the vicinity of Biffontaine, France, Private Hajiro initiated an attack up the slope of a hill referred to as "Suicide Hill" by running forward approximately 100 yards under fire. He then advanced ahead of his comrades about 10 yards, drawing fire and spotting camouflaged machine gun nests. He fearlessly met fire with fire and single-handedly destroyed two machine gun nests and killed two enemy snipers. As a result of Private Hajiro's heroic actions, the attack was successful. Private Hajiro's extraordinary heroism and devotion to duty are in keeping with the highest traditions of military service and reflect great credit upon him, his unit, and the United States Army.

1944 - Marlon Brando made his New York stage debut at age 20 in the hit Broadway play, I Remember Mama. Playwright John Van Druten adapted Kathryn Forbes' novel, Mama's Bank Account. The show will become one of televisions first big hits in the late 1940's.

1950- "The Adventures of Ellery Queen" premiered. My father, Lawrence Menkin, wrote many of the episodes. In each of the shows Queen talked to the home audience at the show's climax to see if they were able to identify the killer. These people played Ellery Queen during the several year TV series: Lee Bowman, Hugh Marlowe, George Nader, Lee Phillips, Peter Lawford and Jim Hutton.

1951---Top Hits

Because of You - Tony Bennett

I Get Ideas - Tony Martin

Cold, Cold Heart - Tony Bennett

Always Late (With Your Kisses) - Lefty Frizzell

1953 - Popular singer of her time, Julius LaRosa, was fired on the air by Arthur Godfrey. "Julie lacks humility," Godfrey told the stunned audience, while putting his arm around LaRosa adding, "So, Julie, to teach you a lesson, you're fired!" This ended his career, and Godfrey also was never the same.

1956-- The U.S. Supreme Court unanimously strikes down two Alabama laws requiring racial segregation opublic buses.

1957Maurice "Rocket" Richard of the Montreal Canadiens became the first player in the National Hockey League to score 500 goals when he tallied against the Chicago Blackhawks in a 3-1 Montreal victory. Richard finished his career with 544 goals and entered the Hockey Hall of Fame in 1961.

1957 - No. 1 Billboard Pop Hit: ``Jailhouse Rock,'' Elvis Presley.

1959 - The Miracle Worker, based on the childhood training of deaf and blind Helen Keller, and starring Anne

Bancroft and 12-year-old Patty Duke, opened on Broadway to favorable reviews.

1958-Brenda Lee records "Rockin' Around The Christmas Tree". The song will be released as a single but will fail to chart in either 1958 or 1959. When it was re-released in 1960, it rose to #14 and has since become a Christmas standard, being ranked at #4 in the Top 10 All Time Christmas Songs.

1959---Top Hits

Mack the Knife - Bobby Darin

Put Your Head on My Shoulder - Paul Anka

Mr. Blue - The Fleetwoods

The Three Bells - The Browns

1960 - The United States State Department embargoed the shipment to Cuba of all goods except medicine

and food.

1960 -- Martin Luther King, Jr., & 35 students choose jail after arrest for sit-in requesting service at the

snack bar of Atlanta's Rich's department store.

1963 - Buck Owens started a 16-week run at top of the U.S. Country chart with "Love's Gonna Live Here". It eventually became the biggest of all the Buck Owens hits.

1967---Top Hits

The Letter - The Box Tops

To Sir with Love - Lulu

Little Ole Man (Uptight-Everything's Alright) - Bill Cosby

I Don't Wanna Play House - Tammy Wynette

1967 -- The Jefferson Airplane perform at Loews Warfield Theatre on Market Street, San Francisco.

http://en.wikipedia.org/wiki/Jefferson_Airplane

http://grove.ufl.edu/~number6/Jefferson.Airplane/airplane.html

1967-Tamla-Motown releases Smokey Robinson & the Miracles "I Second That Emotion." The record climbs to #4 on the pop chart and Number One of the R&B, making it their biggest hit since "Shop

Around" in 1960.

1969 -- US: "Mad Bomber" Lamonica passes football for six touchdowns vs Buffalo (50-21).

http://members.aol.com/FreeVee/index.html

1969 - No. 1 Billboard Pop Hit: ``I Can't Get Next to You,'' The Temptations.

1970-The film Ned Kelly, starring Mick Jagger in the lead role, is released and the critics wasted no time in telling Mick he should stick to singing. One reviewer wrote: "He looks about as lethal as last week's lettuce." Predictably, the movie bombed at the box office.

1973 - Elvis and Priscilla Presley divorced after six years and one child, Lisa Marie.

1974-Billy Preston went to the top of the US singles chart with "Nothing from Nothing", the singer's second and final number one.

1975-Dickie Goodman had the best selling single in the US with the novelty tune, "Mr. Jaws", which mixed his rapid-fire mock interviews with answers that were snipped from contemporary hit singles. Goodman first entered the US charts in 1956 when he and his partner Bill Buchanan used a similar format on a record called "The Flying Saucer".

1975---Top Hits

Bad Blood - Neil Sedaka

Calypso/I'm Sorry - John Denver

Miracles - Jefferson Starship

Hope You're Feelin' Me (Like I'm Feelin' You) - Charley Pri

1981 - LA Dodger Rick Monday hit a two-out homer in the ninth inning, leading the Dodgers to a 2-1 win over the Expos in the 5th game of their championship series. The Dodgers would win the World Series title.

1981 -- US: Martin Luther King, Jr. Library & Archives opens in Atlanta. Founded by Coretta Scott King, it is the largest repository in the world of primary resource material on King, nine major civil rights

organizations, & the American civil rights movement.

1983 - The United States Senate passed a bill making Martin Luther King's birthday a public holiday.

1983---Top Hits

Total Eclipse of the Heart - Bonnie Tyler

Making Love Out of Nothing at All - Air Supply

Islands in the Stream - Kenny Rogers & Dolly Parton

Paradise Tonight - Charly McClain & Mickey Gilley

1985 - "Take on Me", by a-ha, hit number one on the pop music charts. The video for the song was in regular rotation at MTV. The group is the first from Norway to have a No. 1 hit in the United States.

1986 - No. 1 Billboard Pop Hit: ``True Colors,'' Cyndi Lauper.

1987- The worst stock crash in the history of the New York Stock Exchange occurred when the Down Jones industrial average fell 508 points, closing at 1738.74, a decline of 22.6%, nearly double the decline in1929 that ushered in the Great Depression. The volume of stocks traded, 604,330,000, was nearly twice the previous record of 338,500,000set on October 16. computerized program trading, as well as various factors in the national and international economy, was blamed for the collapse of the market that had exhibited a case of the jitters in recent weeks. On October 230, the Dow Jones rose 102.27 points an trading set another new record for volume with 608,120,000 shares traded. In spite of the gain, largely confined to blue chip issues, many more stocks fell than rose The Down gained another 186 points the following day but dropped 77.42 points on October 22. The major markets set temporarily shorter hours in hopes of easing the tension, but on October 26, there was another drop

of 158.83 points. After a short period of relative quiet, the Dow fell 5.052 on Nov 3, ending a five day

rally, and on Nov. 9 the average was down another 58.85 points, closing at 1900.20.

http://www.stocksatbottom.com/index2.html

1981-Though it yielded only one minor hit single in "Backfired," "Koo Koo," the solo album by Blondie's Deborah Harry, goes gold today.

1989 - Record breaking snows fell across northern and central Indiana. Totals ranged up to 10.5 inches at Kokomo, and 9.3 inches was reported at Indianapolis. The 8.8 inch total at South Bend was a record for the month as a whole. Up to seven inches of snow fell in extreme southern Lower Michigan, and up to six inches fell in southwestern Ohio. The heavy wet snow downed many trees and power lines. Half the city of Cincinnati OH was without electricity during the morning hours. Temperatures dipped below freezing across much of the Great Plains Region. Twenty cities, including fourteen in Texas, reported record low temperatures for the date. North Platte NE reported a record low of 11 degrees. In Florida, four cities reported record high temperatures for the date. The record high of 92 degrees at Miami also marked a record fourteen days of 90 degree weather in October, and

116 such days for the year.

1991---Top Hits

Emotions - Mariah Carey

Do Anything - Natural Selection

Romantic - Karyn White

Keep It Between the Lines - Ricky Van Shelton

1998 - Microsoft and prosecutors for the U.S. Department of Justice and twenty states met in federal

court. It was the beginning of the antitrust case against the Microsoft Corporation.

2000-- Dusty Baker, who led the Giants to a National League West flag with baseball's best record (97-65), reaches agreement with the Giants on a two-year contract extension. The pact makes, the two-time National League Manager of the Year the second highest-paid skipper in the majors.

[headlines]

--------------------------------------------------------------

Baseball Poem

God Protects Fools with Curveballs

by Tim Peeler

Going after her

Was chasing

A bad pitch,

A sharp curve

That tailed off

Into the dirt,

Evaded the end

Of my whirling bat.

Thank goodness

I only looked stupid

On the first strike.

Touching All Bases

Poems from Baseball

Tim Peeler

www.mcfarlandpub.com

[headlines]

--------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

[headlines]

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

[headlines]

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

[headlines]

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

http://www.weather.gov/

[headlines]

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

[headlines] |

![]()

![]()

![]()

![]()