San Diego, California Second decade of business, providing sales incentives that require a |

Wednesday, September 8, 2010

Today's Equipment Leasing Headlines

Correction: Sunrise is "Open"

---"Changes in leasing accounting: good"

Correction: FDIC Consent Order to Main Street Bank

VACATION EDITION

Classified: Sales/Sales Manager/Senior Management

Bonus Depreciation Plan by President Obama

Leasing 102 by Mr. Terry Winders, CLP

How to Sell Leasing under the New Accounting Rules

Sales makes it Happen---by Christopher Menkin

New Top Ten Reasons to Leasing

MidWest Leasing Filed BK/as did Owner

Broker Referral Exchange---Up-Date

Classified Ads---Help Wanted

FBI gets Vendor to talk: $87MM Allied Health Fraud

Allied: Why did the banks fall for the alleged $87 fraud?

by Christopher “Kit” Menkin

Newark, New Jersey---Adopt-a-Dog

Mobile Internet Usage 2.6%, Double Last year

El Segundo Tax Return Preparer gets 24 Months in Jail

News Briefs---

Wells Fargo to beef up Chicago banking presence

Inflight Internet provider raises $38 Million

Gold hits new high as European debt woes rise

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer. It is considered “bias” as it is the writer’s viewpoint.

[headlines]

--------------------------------------------------------------

Correction: Sunrise is "Open"

---"Changes in leasing accounting: good"

The headline was correct:

Archive, August 30, 2006

Sunrise Closing its Doors/King retiring

The story when opened from the headline, which was correct, did not have the Archive, August 30, 2006 line as story linked directly to the original URL (up-dated on line, after readers brought to our attention, as well as Peter King), but not before many readers thought it was a “current” story.

From Peter King:

"4 years ago you published a nice article regarding Sunrise International Leasing. Apparently you highlighted it on Monday in your archives (2006). For some strange reason, we received several phone calls during this past week from firms expressing an interest in buying all or part of our portfolio.

"Since you published the 2006 article heralding the demise of Sunrise International Leasing Company, I thought you would be interested in the latest news.

"My son Russell King was promoted to President three years ago. He and the Board of Directors implemented several changes that are the anti-thesis of your archived article.

"With King Capital’s substantial cash reserves, borrowing capacity and back room capability, the company decided to reenter the leasing market with special emphasis on operating lease transactions.

“ The company is looking to purchase or invest in leasing companies that have access to operating leases but cannot fund the residual, buying leasing portfolio’s or vendor programs that have a preponderance of operating leases, special situations involving challenged credits and/or where creativity is necessary to serve a potential lessee’s situation.

“We strongly believe the anticipated changes in lease accounting rules will bring about a revival of interest in short term operating leases.

"As for me, I’m the Brett Favre of the leasing industry. While I’m obviously playing a lesser role in the operations of the company, I’m still around as Chairman."

Best Regards,

Peter King

pking@kingcapitalcorp.com

http://www.kingcapitalcorp.com/

Archive story:

http://leasingnews.org/archives/Aug2010/8_30.htm#archive_sunrise

[headlines]

--------------------------------------------------------------

Correction: FDIC Consent Order to Main Street Bank

Thomas J. Depping

(Leasing News Archives)

This was my error as editor and was corrected on line.

After the first line, I left out in posting the work for the web master the most important paragraph, which summed up why this was a major story:

First Paragraph:

"The FDIC issued a Consent Order to Main Street Bank, Kingwood, Texas '...with the STIPULATION, the bank consented, without admitting or denying any charges of unsafe or unsound banking practices or violation of law or regulation, relating to management effectiveness, loan and lease review rating'."

Second Paragraph added on line:

"Perhaps the strongest consent is the replacement of Thomas Depping as CEO, as the bank is given 90 days to find:

'A Chief Executive Officer with a demonstrated ability in managing a bank of comparable size and with experience in upgrading a low quality loan and lease portfolio.

a. Implement the provisions of this order

b. Act to restore the Bank to a safe and sound condition; and

c. Act as the "principal executive officer" of the Bank under Texas Financial Code 33.103 and 33.106'."

The FDIC was saying Depping was not doing a good job as CEO and the consent agreement was signed, agreeing with this, with the opinion about why the consent order: "Act to restore the Bank to a safe and sound condition" and "Act as the 'principal executive officer'."

Complete story:

http://leasingnews.org/archives/Sep2010/9_01.htm#fdic

[headlines]

--------------------------------------------------------------

VACATION EDITION

Kit Menkin, editor, will be on vacation from September 8th until September 14th without access to email and will not be calling in for telephone messages. The next edition will not be until September 15th

[headlines]

--------------------------------------------------------------

Classified: Sales/Sales Manager/Senior Management

Sales

| Cherry Hill, NJ College grad seeking entry level sales position for equipment leasing and financing in small to mid-size ticket markets. Have 6 months experience in the industry and self-motivated. Contact Matt at 609-280-2178 or email at mkuzan@gmail.com |

California |

| South Central, FL Years of exp in mid-ticket niched leasing. Not currently in leasing. Seek entry or other position with direct lender. David34983@att.net |

Minneapolis, MN |

| Montgomery, AL Individual with 10 years advertising sales exp. & 7 years insurance sales exp. Wants independent contractor situation in Alabama. Work with leasing company or broker. 334-590-5133 E-mail: billmcneal2003@yahoo.com |

Orange County, CA |

| Philadelphia Metro Area - 30 Years experience Healthcare sales/ management- 3 years experience newly create "small-ticket" healthcare division. Good success - Mitch Utz 215-460-4483 Email: mitutz@msn.com |

| Philadelphia, Pa 16 years small to large ticket sales exp., variety equip. w/vendor & direct. Top performer, building new and existing territories. Email at phillylease@hotmail.com |

| Pittsburgh , PA Aggressive self starter looking for leasing position w/10 plus yrs sales exp., plus banking experience 814-227-4592 mwiser500@hotmail.com |

Pittsburgh, PA |

San Francisco Bay Area: |

| Texas/Oklahoma 15 year lease vet looking for plact to take business.great references. all major equipment types. open to compensation. please contact if interested. E-mail: bankingdallas@yahoo.com |

Sales Manager

|

Bayville, NJ |

|

Fort Myers, Florida Very experienced and strong skills with both Captive and Specialty Sales Management. Over 25 years , will relocate and travel---successful and team player. e-mail: tlinspections@gmail.com |

Northeast Over 30 years experience working with Small and Mid-Ticket Brokers. Extensive current Broker and Customer Base available. sdunham@gwi.net |

Senior Management

Europe |

| Philadelphia, PA 27 yrs. exp. sales, ops., credit, strategy, P&L mngmet. Most recently created & executed the biz plans for 2 highly successful Bank-owned small ticket leasing subsidiaries. email: mccarthy2020@comcast.net |

| Philadelphia Metro Area - 30 Years experience Healthcare sales/ management- 3 years experience newly create "small-ticket" healthcare division. Good success - Mitch Utz 215-460-4483 Email: mitutz@msn.com |

| Southern CA 20 years exp. as hands-on leasing CFO, managing accounting, treasury, FP&A, including securitizations, Great Plains/FRx, budgets, risk management. MBA. Also available as interim Controller/CFO, consultant. Email: leasecfo@gmail.com |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

[headlines]

--------------------------------------------------------------

Bonus Depreciation Plan by President Obama

by Christopher Menkin

This actually sounds better than bringing back the ITC in 2011, as it is a great impetus to get business acquiring equipment, hopefully through leasing where a few months payments (depending on the time of the year, but over sixty months, still considerable), they can write off 100%.

Reportedly President Obama will call this bonus depreciation today, Wednesday, allowing businesses to deduct from their taxes through 2011 the full value of new equipment purchase, from computers to utility generators, to increase demand for goods and create jobs.

The upfront deduction would allow businesses of all sizes to keep more money now and would give large corporations, many of which are sitting on cash because of uncertainty about the economy, an incentive to spend and invest.

It would cost an estimated $200 billion in revenues, though the ultimate net loss would be $30 billion over 10 years, administration officials say, since businesses would eventually deduct the depreciated value of the equipment in any case.

Several believe it will not get business spending, but sounds like it may help the finance and leasing industry. Sure would be nice to have a good year in 2011.

It may also throw off December as companies defer delivery until after the first of the year, if they have already used up their 2010 depreciation allowance. Still, leasing is the best idea the last quarter to write off the allowance they have left in 2010 with only one or two monthly payments. And there always is 2011!!!

Yes, that is the point. Hope. Being Positive as Norman Vincent Peale to Zig Ziglar: a positive attitude; no red lights; don’t mess with Mr. Negativity.

|

[headlines]

--------------------------------------------------------------

Leasing 102

by Mr. Terry Winders, CLP

How to Sell Leasing under the New Accounting Rules

A Lessee will approach a “$1 out lease” or one with a bargain purchase option the same way they did before which makes the differences between leasing and lending much the same as before as it is now call a “right to use asset”. Of course, full financing is still an advantage when it includes freight, taxes, and set up charges that because of the discounting of the rent stream will be amortized over the equipments useful life. Not much will change except programs that have multiple lease terms to try and confuse the accountants, they are clearly gone. All lease terms must be part of the net present value.

Once again we will have to study the differences between the federal income tax rules and the new GAAP requirements to speak intelligently with Lessees about “why” a lease makes more sense than a loan.

A bonus depreciation plan definitely puts an advantage on a capital lease.

There still is a chance that some modifications regarding operating leases will appear as of December 15th if the uproar from the leasing industry is loud enough but it is very late in the game and I do not see any organized effort at this time. If it takes place in 2012, a shorter term has a tax advantage.

The great advantage still exists if the Lessor assumes a residual with no purchase option, no renewal option, or a purchase option that is not a bargain. The amortization of the net present value can be irregular instead of straight lined and be limited to the term of the lease provided the “use” of the equipment is irregular and recorded. It appears that the difference from current operating leases is that the whole payment was charged as an irregular expense and now the interest portion will be taken on the interest method and the net present value on the “per- use” basis. Both will appear on the balance sheet whereas now it is off balance sheet.

One major change was the elimination of the 90% rule. It appears that the question of the Lessor retaining all but a trivial amount of the risks and benefits associated with the entire underlying asset or retaining most of the risks and benefits associated with the entire underlying asset is yet to be determined. But it appears residuals and purchase options will play a big part in the decision because the requirements for net leasing where the lessee pays for insurance, taxes, and maintenance does not look to change for many Lessor’s.

The first major change is their requirement to discount the payment stream at their incremental borrowing rate. Therefore the lease rate will always be the same as their lending rate. By discounting the rent stream, if your yield is higher than their discount rate, the excess rate will become part of their net present value and be amortized on a straight line basis as part of the cost over the equipments actual useful life to the lessee.

Irregular means seasonal, per hour, per-use, per procedure, or any other use that can be justified and quantified. Many Lessee’s continue to prefer the major expense (net present value) to be near the cash flow or revenue stream to manage margins and cost control. The question remains however, will we be able to have higher payments in the beginning when no maintenance is required and lower in the future when maintenance becomes a serious cost and other programs that help a Lessee manage expenses. The answer lies in our ability to question equipment “use” and its effect on the revenue stream.

If you create an odd number of months (to terminate on a certain month or at the end of their fiscal year) there will be differences in cash flow. While they may have to straight line the net present value and take the difference as interest expense (using the interest method), the payments can still be established to match their irregular cash flow so they would not have to use funds from there line of credit when level payments are required in poor cash months. Perhaps “convenience” will still have some value in the small ticket market.

The question of renewals is a touchy one because “if” the Lessee believes they will release the asset they must include the renewal term in the net present value amount.

Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty years and can be reached at leaseconsulting@msn.com or 502-649-0448

He invites your questions and queries.

Proposed Accounting Standards Update for Lessor’s

http://leasingnews.org/archives/Aug2010/8_30.htm#standards

Proposed Accounting Standards Update for Lessee’s

http://leasingnews.org/archives/Aug2010/8_24.htm#standards_update

|

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

Sales Make it Happen

by Christopher Menkin

![]()

New Top Ten Reasons to Lease

Productivity can be increased,

Costs can be decreased---

The key is not who owns the equipment,

but the use of the equipment

Ten Advantages in Leasing:

1. Don't have the cash, lease it over time with option to purchase

2. Fixed rate of interest

3. Leaves other credit available for emergencies

4. Less hassle than going to my bank

5. May help cut overhead with better, faster equipment, computers, et. al.

6. May help in up-grading equipment sooner; better planning/results.

7. May increase my ability to acquire funds, plus does not dilute ownership.

8. Creates or maintains working capital for inventory, accounts receivable, other expenses.

9. Take advantage of current depreciation allowances

10. Who else is going to help me?

The latest survey indicates the Top Five Reasons for Choosing Leasing:

1. *99%----Cash flow---Better use of cash

2. *004%---Leasing companies are more accommodating than banks.

3. *003%----Dealer Convenience (if he wants to sell, better get me approved)

4. *002%--Rapid technological changes cause product obsolescence.

5. *001%--Tax implications (if I make a profit this year)

Sales Makes it Happen articles:

http://www.leasingnews.org/Legacy/index.html

![]()

[headlines]

--------------------------------------------------------------

MidWest Leasing Filed BK/as did Owner

February 1st, 2008 Curt MacRae announced he had purchased all outstanding stock of MidWest Leasing Group, a 15-year-old equipment leasing company, in Livonia, Minnesota from his partner, Lou Wright, a non-working partner in the business, he added.

(Photo: Leasing News Archive)

Wright, at the time also owned and operated a successful financial investment firm, Wright Asset Management Group, in Plymouth, MI, plans to concentrate the bulk of his time in that endeavor. He described Midwest Leasing Group (MLG) as a successful small ticket lessor/broker operates nationally, doing 60 per cent of their business in the Michigan - Ohio area, but having written leases in 46 states and Canada. He added he was a Master Member of National Association of Equipment Leasing Brokers.

September 11, 2002, Ken Goodman, CLP, announced he was setting up a West Coast office for Midwest Leasing: "I'm excited about the association. Midwest is a long established and well capitalized company," he said. “I’ve known their President, Curt MacRae, for some time and consider him one of the most ethical guys in the business.

The MacRael's

(Photo: huffingtonpost.com)

"I closed a 15-year-old equipment leasing company in late 2008 because of changes in banking appetites," MacRae told Huffingtonpost.com. “Banks quit lending, and since we acted as a broker for our 3,000 customers, our business went down approximately 75 percent. Add to that the cost of operating a business building, health care for my employees and the increasing write-offs from my own customers and I was forced to close and lay off my four remaining employees.

“Personal guarantees on my business credit forced me into a personal bankruptcy and I started searching for work at age 58."

"In early 2009, I started doing workshops for out-of-work people. It started with fellow church members, and has expanded to people I don't know who have simply heard of the workshops which we call "Get-To-Workshops." I write as well and have two columns posted online -- here and here -- about job searching. I sometimes speak to other groups or guest on podcasts to try and help people. I do this because it is important to others and helps my own state of mind.

"I still love to work, and I have the capability to do important work, but people don't like my age, and most aren't thrilled with entrepreneurs although I'm not sure why. It is embarrassing to go from owning and running a business and employing 5-10 people to having to search for any kind of meaningful work and wondering if I might have to start delivering pizzas."

Full Huffingtonpost.com story:

http://www.huffingtonpost.com/2010/09/04/unemployed-bankrupt-fathe_n_705782.html

[headlines]

--------------------------------------------------------------

Broker Referral Exchange---Up-Date

The Broker Referral Exchange is carried on the National Association of Equipment Leasing Brokers (NAELB) web page as a courtesy to its members, and is not sponsored by them. To utilize the Exchange you need to be a member, as well as abide by the code of ethics of the association.

At present, there are nine brokers with their sources listed on the site.

On this page you will find a geographical listing of NAELB brokers who have indicated that they have discovered special funding sources, perhaps not known to others or available to others. These brokers may be able to help other NAELB brokers secure funding. They may charge a fee for their services. The advantage, and purpose, is to help both new and experienced brokers with transactions as they have specific sources they believe would have a better chance of approval as they are not “cookie cutters.” Also what in reality comes with experience is knowing who takes what and why and placing them in these sources that they have cultivated.

It is only available to NAELB members and they do not plan to open to non-members.

The annual broker fee of NAELB is $295. They offer many benefits to their members. This is the only association devoted solely to brokers. Due to the fact that many funders closed their divisions to independent brokers, the Broker Referral Exchange was originally conceived and designed by several directors of the board as an answer to the ability to help members find new sources.

There is a disclaimer on the website:

This webpage is here for the use of NAELB members to help each other fund transactions. The NAELB does not guarantee the accuracy of the information provided to us about the funding sources. We are merely providing an organized, easy way to use the resources of our members. It is up to you to choose who you do business with as the NAELB makes no representations about the business practices of the member listings.

Member Benefits:

http://www.naelb.org/displaycommon.cfm?an=1&subarticlenbr=125

Website: NAELB.org

--------------------------------------------------------------

Leasing Industry Help Wanted

Chicago, Illinois |

San Diego, California Second decade of business, providing sales incentives that require a |

Sales Account Executives: Jacksonville, FL/Philadelphia, PA. Small ticket funder with broad funding and exceptional vendor service capabilities. E-mail resume to: garyshivers@navitaslease.com Navitas Lease Finance Corp is an innovator in the Small Ticket Leasing Industry. We offer solutions to small-to-medium-sized businesses looking to acquire and finance equipment. |

|

We offer great funding capacity, strong, experienced back office, keeping established vendor relationships happy. Looking for a home and have 5 years experience, contact: Jeff Rudin (818) 843-8686 x14. About the company: Quail Equipment Leasing 17 years in business with the ability to develop specialized programs for vendors and unique industries: $10K to $24MM. |

Territory Managers |

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

FBI gets Vendor to talk: $87 Million Fraud against Allied Health

The best reaction on Charles Schwartz being arrested for the alleged $87 million fraud comes from Daniel G. Flagstad, Co-Chief Executive Officer, Kingsbridge Holdings, LLC, Lake Forest, Illinois, who's bank was the first to file against Allied and was one of the three who forced the company into Chapter 7.

He said, "No horses where he is going."

The eight page criminal complaint against Charles K. Schwartz, as an individual, rather than as president of Allied Health Care Services Corporation, brought by Dale Wengler, Special Agent Federal Bureau of Investigation before the Honorable Madeline Cox-Arleo United States District Court, New Jersey, outlines testimony from Bruce Donner, Donner Medical, the “supplier.”

From the criminal complaint:

“At all times relevant to this Complaint, an individual who is named as a co-schemer but not as a defendant herein ("UC-1") was the sole owner of a New Jersey Corporation ("Company 1") which acted as a vendor of medical equipment…

3 At all times relevant to this Complaint, Defendant CHARLES K. SCHWARTZ utilized fraudulent documents to obtain millions of dollars in loans from various financial institutions. In order to carry out this scheme, Defendant CHARLES K. SCHWARTZ requested and obtained medical equipment invoices from Company 1 through UC-1, which invoices falsely stated that Company 1 was providing valuable medical equipment to Allied. Defendant CHARLES K. SCHWARTZ solicited and then used these fraudulent invoices from Company I in order to seek and secure millions of dollars from financial institutions, purportedly to finance Allied's leasing of the medical equipment from Company I. The financial institutions would, in turn, provide money directly to Company 1 to purchase the medical equipment, and Defendant

CHARLES K. SCHWARTZ would agree to lease the medical equipment from the financial institutions by making periodic lease payments to the financial institutions.

4. In fact, Company 1 provided no medical equipment to Defendant CHARLES K. SCHWARTZ or Allied. Instead, UC-1 transferred money obtained from the financial institutions to at least one company. named "C&C", which purported to be a distributor of medical equipment; in reality, this company was created and controlled by Defendant CHARLES K. SCHWARTZ for the purpose of carrying out the scheme to defraud.

5. UC-1 was compensated for his role in the scheme, in that he sent approximately 95-97% of the money received from the financial institutions to C&C, while keeping approximately 3-5% for UC-1's own benefit.

6. In order to repay the initial fraudulent money obtained as part of the scheme, Defendant CHARLES K. SCHWARTZ obtained additional money throughout the duration of the scheme in a similar fashion, each time using fraudulent invoices obtained from Company 1 through UC-1.

7. In furtherance of the scheme to defraud, and using the fraudulent invoice documents, Defendant CHARLES K. SCHWARTZ caused to be sent or delivered by mail various mail matter, including false invoices from Company 1 to Allied, false invoices from C&C to Company 1, and checks totaling more than $87 million in fictitious proceeds from Company 1 to C&C.

THE OBJECT OF THE SCHEME TO DEFRAUD

8 The primary object of the scheme and artifice to defraud was for Defendant

CI IARLES K. SCHWARTZ, through the use of false invoices issued from Company 1 to Allied, to induce financial institutions to loan and send money to UC-1, who would in turn provide that

money, less UC-1's payment, to Defendant CHARLES K. SCHWARTZ.

THE MEANS AND METHODS OF THE SCHEME TO DEFRAUD

9. At various times throughout the relevant time period of the Complaint, Defendant CHARLES K. SCHWARTZ told UC-1 that he had many different financial institutions that were willing to provide him financing, but that he needed UC-1's assistance to help secure this financing.

10. In order to initiate the scheme with regard to a particular financial institution, defendant CHARLES K. SCHWARTZ either placed telephone calls or sent facsimiles or text messages to UC-1 in order to request that UC-1 prepare and send an invoice from Company 1. In response to such requests, Company 1 thereafter generated phony invoices, which falsely stated that the medical equipment at issue had been shipped to Allied, when in fact it had not. Thereafter, the financial institutions routinely sent a check directly to UC-1 and Company 1. After negotiating that check, UC-1 thereafter deducted 3-5% of the total amount as his payment, and sent the remainder of the money to C&C via check.

11. As an example, in an undated letter, defendant CHARLES K. SCHWARTZ wrote to UC-1 "Here's What I Need . . . 250 for Brandywine dated April 9' 2008 . . ." Thereafter, on or about April 4, 2008, Company 1 issued invoice #4696, dated April 9, 2008 to Allied, purportedly reflecting the sale of 50 LifeCare Products PLV 102 Home Care Ventilators at a cost of $5,000 each, for a total invoice of $250,000. Thereafter, on or about April 21, 2008, Brandywine Capital Associates issued a check in the amount of $250,000 to Company 1, referencing -Inv. #4696 - Allied Health Care Services." On or about April 28, 2008, C&C issued invoice #30529 to Company 1 for $237,500 ($250,000 less 5% payment to UC-1).

12. As a further example, on or about July 13, 2009, Company 1 issued invoice #5896 to Max Leasing, USA, purportedly reflecting the sale of 100 LifeCare Products PLV 102 Home Care Ventilators at a cost of $5,000 each, for a total invoice of $500,000. The invoice specified that although the ventilators were "sold to" Max Leasing, USA, the ventilators were to be shipped to Allied. Thereafter, on or about July 23, 2009, Max Leasing, USA issued a $500,000 check payable to Company 1, referencing invoice #5896 and the invoice date of July 13, 2009. On or about July 24, 2009, C&C sent an invoice for $482,500 ($500,000 less 3.5% payment to UC-1) to Company 1 for 100 PLV home ventilators, and on or about that same date, UC-1 wrote a check from Company l's account to C&C for $482,500.

Copy of FBI Criminal Complaint, although not full record was available from Pacer at press time:

http://leasingnews.org/PDF/SchwartzCharles_Complaint.pdf

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

Allied: Why did the banks fall for the alleged $87 fraud?

by Christopher “Kit” Menkin

Readers have asked me why did so many banks fall for the phony leases from Allied Health Care Services, Orange, New Jersey that resulted in the FBI arrest for a $87 million and why hasn’t ex-convict Sheldon Player been arrested for his actions at Equipment Acquisition Services (E.A.R), Palatine, Illinois, which may be up to $100 million?

There has been one main thread in all the bank deceptions, the acceptance factor. Or "good old boy" factor. The sewer of the cloth knowing how to play this. Most hired a professional. A very good example is Sheldon Player of E.A.R. played the same game. He hired independent brokers, using the same scam that got him arrested at Greyhound and sent to jail, controlling the vendor invoice. He would hire an independent broker on his payroll who got a percentage from him, and often the leasing company and/or broker, who coordinated all of the placements, and as important, not sending to a company who had already seen the package.

When the broker ran out of sources, he replaced them. One of them was Timothy Nieder, TMN Financial, Park Ridge, Illinois. The last was a female broker, who is still a member of the National Association of Equipment Leasing Brokers and has appeared in their newsletter. Leasing News has copies of her emails to brokers and leasing companies coordinating packages, presenting them in the best light, as wells as testimony of brokers and leasing companies who sent packages to her to coordinate with Player.

Charles Schwartz played the same game. He built a list of leasing companies he was doing business with. If he had a $500,000 lease at one company paying on time, then another, all of a sudden he was "accepted," part of the "pre-approved group." Those who saw them were convinced the emperor was wearing clothes. They were presented by reputable companies, some he originally wrote Leasing News (and quoted on line) when we did the first alert that they had done $16 million, $18 million, just recently $6 million, another in New York doing 16 leases, and how could I malign such a company.

The bankers were blinded because the company had already been accepted by other banks and leasing companies, $15 million at Sun National Bank, and you also saw several $250,000 leases as part of portfolio's purchased by Bank of the West and Key, to name a few, so he then had a credit reference at Bank of the West for $3 million, and Key, paying on time. He was acceptable. Other banks found him acceptable, therefore he is acceptable to us.

Most of the transactions were $300,000 to $500,000, several a million dollars, and a few higher. Rates were 15% to 19% APR, some higher.

Tax returns were verified with the IRS by myself, on the vendor, lessee, and the individuals, as well as many of the banks also did a tax verification as well as many site inspections (all at Allied’s place of business.) And yes, the financial statements matched the tax returns, but they were not audited statements.

The no sales tax, no personal property tax, life saving equipment, were all part of the story, including site inspections to the office to view the equipment. The Health Insurance Portability and Accountability Act (HIPAA) would not allow them to inspect the equipment at the patient's location, he told them all, nor could they see the address of the location. When confronted, he also spun a story why the vendor worked out of his house and didn’t have a web site at the time. He even supplied the vendors business and personal federal income tax returns and allowed brokers to verify his and the vendors tax returns with the Internal Revenue Service.

Sheldon Player did the same thing, even getting caught at one with a fake serial number, which brought the story to Leasing News, as did Allied in the changing of a vendor noted by Lease Police. They all knew how to fool site inspections.

There are other examples, including NorVergence, who was the smartest of all, hiring a full time placer of leases with banks, Robert Fine, who became President of the late Eastern Association of Equipment Lessors, as well as so active with the then Equipment Leasing Association, they defended the early charges as well as criticized Leasing News for its stories about NorVergence and its practices. Both associations said Leasing News was “out of line.”

Another good example of playing the banks is Barry Drayer, president of RW Professional, who was arrested June 21, 2002, later went to jail. He specialized in medical leases and started playing games with payments early. Old Kent Bank caught him, and he told them he would pay 10% of what he owed if they signed a confidentiality agreement (they did), according to an ex-Old Kent Banker who was part of the group that negotiated the settlement. Drayer played the same game at CIT, where he paid $500,000 on $10 million they caught as fraudulent leases, according to the late Charlie Lester who not only knew Drayer very well but also wrote about how Drayer did in it a Leasing News article.

Drayer started small and built up portfolio's and then would go to one bank after another, showing that he had a line at Old Kent, then CIT, and Sierra Cities did a lot with him, too. He got caught in the change over going to American Express Business Finance. A bankruptcy notice was received on one physician’s accounts in the RW portfolio by the Sierra Cities collections department. Greg McIntosh went to the file and the lessee was paying like clockwork. It seemed very strange to Greg McIntosh, he told Leasing News. He had his staff look into it further. Surprisingly, the physician had filed bankruptcy a year earlier. A consumer credit report showed terrible trades, but the Sierra Cities payments were not only on time, but “anticipated.” American Express Business Finance filed a $20 million claim, cut him off, and then he couldn’t pay brokers or Banker’s Health, that also started a suit, but before it would go to court, including an insider banker being convicted for the deceptions, Drayer and his officers were arrested. Ironically American Express sold the portfolio to Key Corp., and it was these leases that John Otto told investors he was buying at HL Leasing that would give them a good interest return (a UCC search by Leasing News found very few leases, mostly to his other company, Heritage Leasing.)

It is interesting that Leasing News was threatened and deposed by RW Professional, Brican America, and Allied, including the inside information on the leader of the Operation Lease Fleece getting an “approval opinion” from an attorney very well known by the Equipment Leasing and Finance Association and Equipment Leasing and Finance Foundation, who originally recommended him. Leasing News printed the email.

CyberNet is another one in that category, growing as he has leases and loans that showed he could make payments on time and if he was accepted at this bank, why not ours? He had good financial statements. Of course, he did. Many even faked their tax returns. Allied's were verified with the IRS, as was E.A.R. But the tax returns were fake too, thus the E.A.R. is suing the IRS hoping to get back $4 million paid in taxes on equipment that never existed (Player paid his taxes, and so did Schwartz--although that saga is not over, believe me.) The IRS got the officers of CMC for tax evasion.

So what is the common thread? The acceptance of a company because he has a good record with the same dollar amount at another bank, who must have done their due diligence, so we should accept this, too. And so many banks and payments on time. The financials and situation must be good.

They all also had a sewer of the cloth, a professional, often hired to submit or control all the leases to be placed. I can't tell you how many bankers I spoke to in the Allied case who said the package came from a very reliable source. One called the party who sent it, "an icon in the leasing industry." (He certainly wasn't!)

Of course, there were many who could see the emperor was not wearing any clothes. This was true in all the cases mentioned above, especially Allied and NorVergence. Those who turned them down questioned not only the equipment, but the entire situation and wanted to have nothing to do with the transaction.

Why isn't Sheldon Player arrested by the FBI or officers of HL Leasing?

In most of these cases, the US Attorney General wants a strong case, especially one that is difficult to convince a jury or judge about how it was done. In the cases that I have seen, the FBI works to have a defendant turn evidence, as happened with RW Professional: Barry Drayer never took the stand, but his sister and brother-in-law and several of those involved turned evidence for a lesser sentence. The same with CMC Leasing where the daughter turned evidence for a lesser sentence and other deals were made, too. IRS, included. Operation Lease Fleece was a complicated matter that the FBI and US Attorney General were able to get over 22 to take a plea for a lesser sentence. They are working on the last group today. As for Allied, it is obvious the vendor Bruce Donner of Donner Medical, who was described in the FBI press release as the supposed supplier of the equipment as quoting what he earned as well as a remark in August: “financial institutions had fallen ‘hook, line, and sinker’ for the false explanation they had given to bank examiners who asked why the purported supplier used his home address on certain invoices. Also please see the actual complaint filing which spells out the reasons for the complaint and information from the “supplier.”

It is only a matter of time before one of the officers, if not the president decides to make a plea in the E.A.R. case. HL Leasing is more difficult, as the owner committed Suicide, but it is only a matter of time, as the FBI and US Attorney General build their case and one of those accused sees it is smarter to make a plea. The arrests will be made then. The FBI and US Attorney never disclose their hand to the news media. Their goal is conviction.

Bernie Boettingheimer, President of Leasing Police believes “The tell-tale signs were ignored and fabricated responses by Schwartz and Donner were accepted at face-value because the questioners wanted to believe.

October 23, 2009 Leasing News posted an alert from Lease Police:

“The lessees are a healthcare provider in New Jersey and a lab production equipment company in Louisiana. Both are heavy users of lease transactions using the power of their financials to selectively spread their exposure to the maximum with numerous funding sources. Ok, what's wrong with that? “

http://leasingnews.org/archives/October%202009/10-23-09.htm#Lease_Police

Clients of Lease Police would have learned the name and those banks and leasing companies who entered into transactions after this date would have saved a lot of money if they were Lease Police clients.

Allied was not named by Leasing News until: http://leasingnews.org/archives/Feb2010/2_19.htm#allied

It also asked questions, and didn't go into details, nor did it reference the Lease Police Alert.

The first hint at what was going on was:

Allied Health Care Services, Orange, NJ---Part I

http://leasingnews.org/archives/Mar2010/3_05.htm#allied

By then all the loans had been made. They slowed down after the February notice, but really not until April and March when the D&B showed slowness and I was talking with many of the brokers who had the packages as well as the bankers. I was on the phone for over two months returning over 50 telephone calls as I had stories to write, other news, and couldn't spend all this time on it, but was collecting a lot of information, including tax returns on both Allied and Donner and their principals, as well as QuikTrak inspections, invoices utilized, talking with many bankers, including bank presidents who were quite upset. There was a lot of work spent on this story.

It was Kingsbridge Holding, Lake Forrest, Illinois who brought the case forward, first with a suit in court:

http://leasingnews.org/archives/May2010/5_14.htm#kingsbridge

then as one of the three forcing Allied Health Care Services into Chapter 7, signed August 20, 2010:

http://leasingnews.org/PDF/Certificateofnotice.pdf

Without the action by the banks in bringing lawsuits, particularly De Lage Landen, I do not believe Bruce Donner would have provided the FBI with the specifics and evidence that it was all a sham. Credit should also go to the first person who contacted the FBI, which Leasing News has agreed to keep “off the record.”

Allied Stories:

http://www.leasingnews.org/Conscious-Top%20Stories/allied_health.html

CyberNet

http://www.leasingnews.org/Conscious-Top%20Stories/CyberNet.htm

HL Stories:

http://www.leasingnews.org/Conscious-Top%20Stories/heritage_leasing.htm

Operation Lease Fleece:

http://www.leasingnews.org/Conscious-Top%20Stories/Lease_Fleece.htm

NorVergence:

http://www.leasingnews.org/Conscious-Top%20Stories/Novergence_main.htm

RW Professional stories:

http://www.leasingnews.org/Conscious-Top%20Stories/RW_stories.htm

The Emperor's New Clothes by Hans Christian Anderson

http://www.mindfully.org/Reform/Emperors-New-Clothes.htm

|

[headlines]

--------------------------------------------------------------

Newark, New Jersey ---Adopt a Dog

Sugar-93435

French Bulldog, Terrier [Mix]

Medium Young Female Dog Pet ID: 93435

Meet our sweetie, Sugar who came to us as a stray the end of June. She is certainly a unique blend. but we're not sure what. At a mere year old, Sugar isn't sure just why she's here and why her family hasn't come for her. She is extremely sweet and gets along well with staff and visitors. Sugar has been with us since late June and has been the perfect lady. She is up to date on her shots, housebroken and will be altered and micro chipped upon adoption. Please come visit Sugar and our other orphans during our regular adoption hours.

’”We are open 7 days a week from 12pm-5:30pm; Sat & Sun from 12pm-5:00 for directions call 973-824-7080. There is an adoption donation required. The Society cannot accept personal checks but we do accept Visa, MC, AE, Discover and cash. As part of our adoption process, we must have proof of residency. Homeowners must show proof of ownership; landlord approval is required for renters before an adoption can be approved."

http://www.petfinder.com/shelters/NJ01.html

AHS At Newark, NJ

124 Evergreen Avenue

Newark Airport

Newark, NJ 07114

Phone: 973-824-7080

Fax: 973-824-2720

Email: AssociatedHumane@aol.com

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

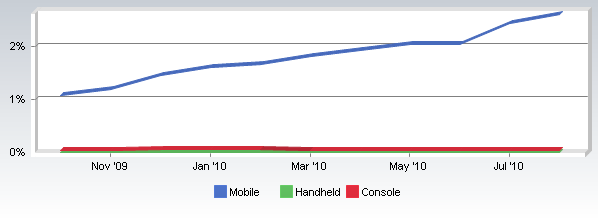

Mobile Internet Usage 2.6%, Double Last year

by Vince Vizzaccaro

netapplications.com

Mobile internet usage is exploding as can be seen in several NetMarketShare reports. The Browsing by Device Type report shows that mobile internet usage has now grown to 2.6% for August 2010. It was 0.94% for August 2009, so has more than doubled in a year’s time. It could easily surpass 5% by this time next year.

I believe the introduction of the original iPhone initiated the mobile browsing phenomenon. It just wasn’t easy enough or attractive enough to access the internet from mobile devices before the iPhone. Apple’s success has opened quite a few eyes from their competition, and Google Android-based devices have become the most serious competition to date (although Windows Phone 7 devices are coming soon).

So, how does the explosion in mobile affect search? Or, perhaps the better question is how do search engines respond to the explosion in mobile growth?

To date, Google owns an even greater market share in mobile search than it does when looking at all device types. That may simply be due to Google’s being available first on the iPhone, and being integrated with Android. But, Bing and other search engines trying to grow market share in mobile have an almost monopolistic market leader to take on in Google. They have to demonstrate markedly better features and/or performance to even make a dent at this point. Bing does have an opportunity if Windows Phone 7 devices can penetrate the smartphone market far better than previous Windows devices. Or, if there is a shift in search perception. With so many people spending so much more of their online time on Facebook and other social sites. Search from within social sites, and with a social focus, could be the largest threat to the Google search empire on any device type. The Windows Phone 7 demonstrations I’ve seen show a strong social focus, and if that can integrate search seamlessly along with market penetration, then Microsoft becomes an even greater search threat as well.

What does surprise me a bit is that Apple hasn’t come out with their own search engine. That would be a game changer as well because they have such tight control over iOS. They could simply ban other search engine apps, forcing users to run the browser to use a different search engine.

The mobile browsing market is just taking shape, and it will be quite intriguing to see what the tech titans offer in the future as well as how the market responds to these offers.

[headlines]

--------------------------------------------------------------

#### Press Release ##############################

El Segundo Tax Return Preparer Sentenced to 24 Months in Federal Prison for Filing False Claims with the IRS and for Failing to File His Personal Tax Returns

Los Angeles – An El Segundo tax return preparer was sentenced to spend 24 months in federal prison after previously pleading guilty to charges that he willfully failed to file his personal income tax return for 2005 and that he filed false claims for tax refunds on behalf of his clients.

Gene S. Wong, who operated a tax return preparation and bookkeeping business known variously as “TaxLAX”, “Tax 4 Less”, and “GW Accounting & Bookkeeping Center”, was also ordered by United States District Judge Christina A. Snyder to spend three years on supervised release after serving his prison sentence and pay restitution totaling $255,236 to the Internal Revenue Service.

According to his plea agreement, Wong filed at least 92 false claims for tax refunds with the Internal Revenue Service on behalf of third parties from February 2003 through April 2007. The false claims resulted in a tax loss to the government of more than $255,000.

The false claims for refunds filed by Wong claimed fraudulent tax credits including general business tax credits, fuel tax credits, and alternative vehicle tax credits. In his plea agreement, Wong admitted that there was no basis for the tax credits claimed on the false returns he prepared.

Wong admitted that, for the tax years 2003 through 2006, he willfully failed to file his personal income tax returns. According to court records, Wong received gross income in excess of the amounts necessary to trigger the requirement to file a return for those years.

In an effort to disguise his income and make it difficult for the IRS to identify him as the tax return preparer, Wong used the identifying information of nominees, including that of his own son, to identify the paid return preparer on more than 500 tax returns he personally prepared. Additionally, Wong used different business addresses for the same business location and, on tax returns he prepared for clients, he spelled his name in two different ways.

Judge Snyder ordered Wong to begin serving his sentence on October 12, 2010.

The investigation and prosecution of Wong was conducted by IRS – Criminal Investigation in conjunction with the Tax Division of the United States Attorney’s Office in Los Angeles.

#### Press Release###########################

|

[headlines]

---------------------------------------------------------------

![]()

News Briefs ---

Wells Fargo to beef up Chicago commercial, wealth banking presence

http://www.chicagotribune.com/business/ct-biz-0908-notebook-financial-20100907,0,4885310.story

Inflight Internet provider Row 44 raises $37 million for international expansion

http://latimesblogs.latimes.com/technology/2010/09/row-44-southwest-airlines-in-flight-broadband-.html

Gold hits new high as European debt woes rise

http://latimesblogs.latimes.com/money_co/2010/09/gold-record-high-europe-banks-euro-currency-dollar.html