![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

|

Wednesday, September 23, 2015

Today's Equipment Leasing Headlines

Archives: September 23, 2005

Dave Murray is Back!

Canadian Finance and Leasing Association

Annual Conference Report by Hugh Swandel

FinTech Revolution Pokes the Sleeping Giant

– Are You Ready?

Madison Capital Selects Odessa’s LeaseWave

Adds to eOriginal and DocuSign

Leasing Industry Ads---Help Wanted

Sales/Credit/Collections

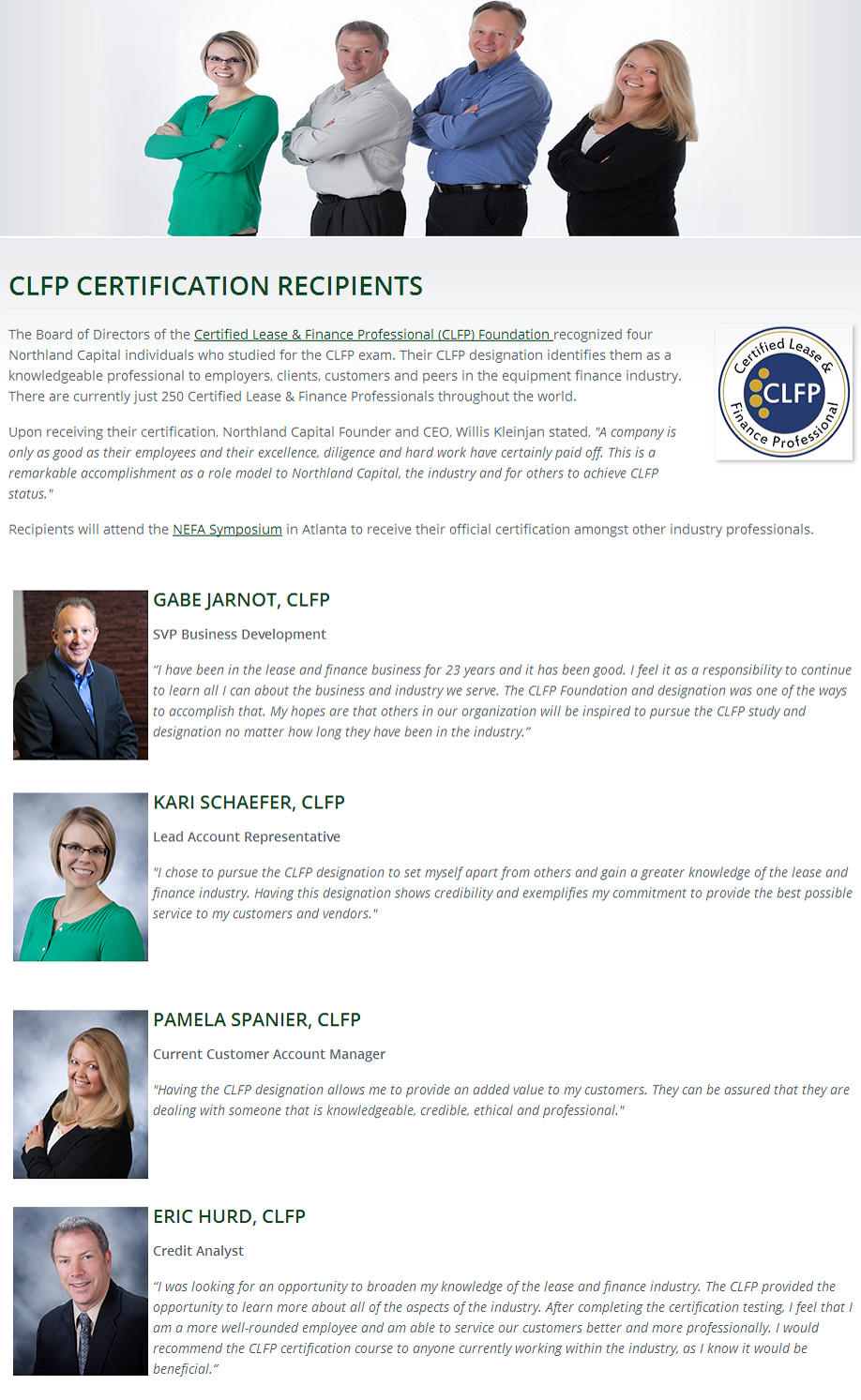

Northland Capital Financial Services

Four New CLFP and What it Means to Them

Letters? ---We get Email!

(Mostly chronological order)

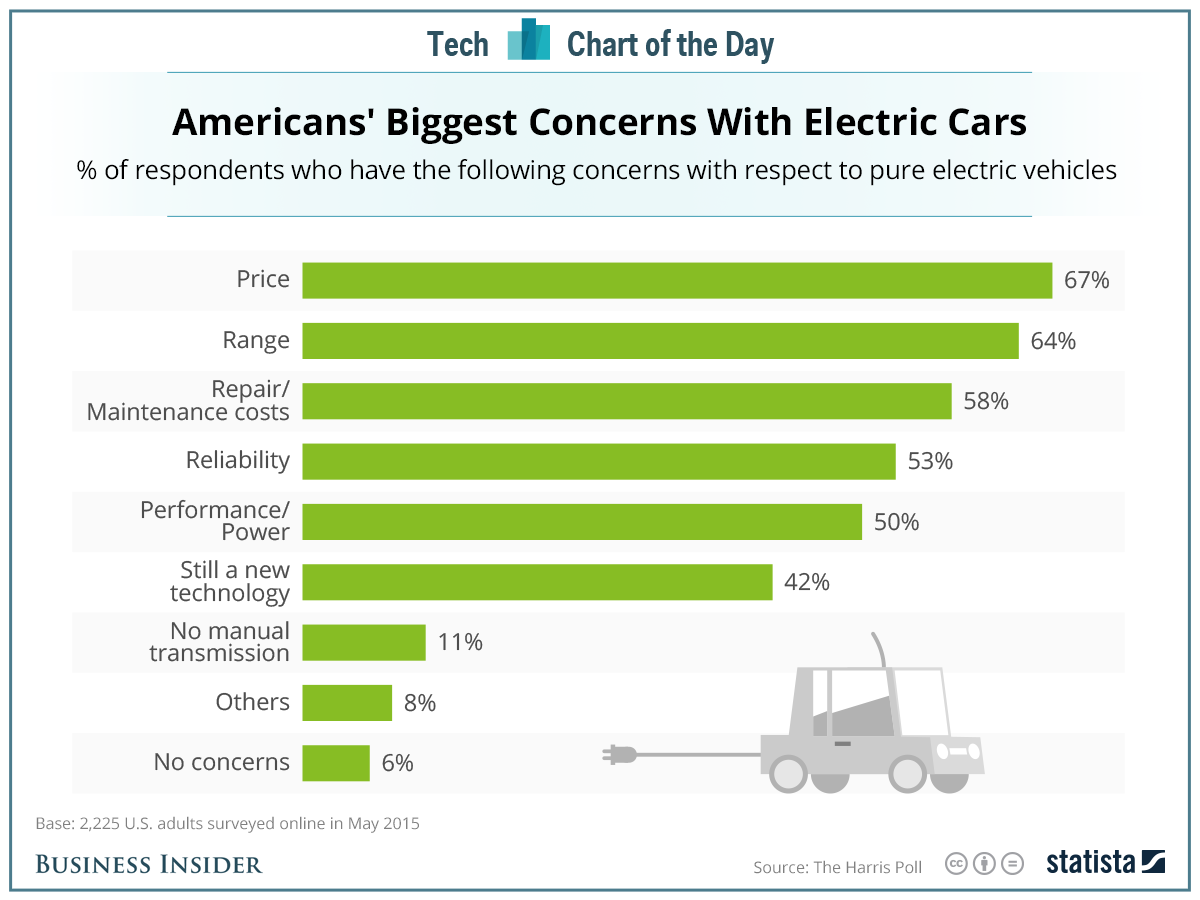

America's Biggest Concerns with Electric Cars

Chart--Respondents Concerns

Toyota Capital, Only Forklift Truck Leasing Company

in Book "Mexico Automotive Review 2015”

Border Collie Pup

San Francisco, California Adopt-a-Dog

Leasing Schools

Become Self Independent

News Briefs---

The 50 Best Fintech Innovators Report

50 Best Performers (65 pages)

ELFA Reports New Business Fell 18% from July

August $6.9 Billion Compared to $8.2 billion in July

Feds Approve PacWest Merge with Square 1 Financial, L.A., CA

Includes Square 1 Bank, Durham, North Carolina

Volkswagen says 11 million cars hit by scandal,

probes multiply

Bank of America Shareholders Allow Chief to Keep

Chairman Post

Microsoft launching Office 2016,

pitches updates for subscribers

Brian Williams returns to airwaves for Pope coverage

"... he deserves a second chance..."

Broker/Funder/Industry Lists | Features (writer's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

Leasing News Icon for Android Mobile Device

You May have Missed---

SparkPeople--Live Healthier and Longer

Poem

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release” and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send a copy of Leasing News to a colleague and ask them

to subscribe. It’s easy. All they have to do is put “subscribe” in

the subject line and email: kitmenkin@leasingnews.org

[headlines]

--------------------------------------------------------------

Archives: September 23, 2005

Dave Murray is Back!

"Dave Murray (Founder of Preferred Lease in Lake Tahoe) has started another leasing company: Denali Capital Corporation, located in San Clemente, CA. Rumor has it he has brought back some of the old employees from Preferred Lease. Does this mean another mass mailer of pre-approved credit cards?"

Preferred Lease was one of the first companies to mass telemarket and mail credit approvals to attract business, considered the "daddy" of them all. It was based on how they set up Direct Capital in New Hampshire. They hit the Perfect Storm, as did many of their major buyers from Advanta on up. Here is the story:

In June they closed all their branch offices (Crystal Bay, Nevada, San Diego, California, Dover, New Hampshire), it was reported. They were heavy in the mail marketing and telephone solicitation with the "Pre-approved" approach, selling mini-paper to GE/Colonial Pacific, Manifest, Commerce Security, up to over $10 million a month in their "hay day." Negative Cash Flow that has hit many others in the industry was reportedly the reason for the downsizing or consolidation, depending on your viewpoint.

David Murray and Louis Schneider were the principals. They considered themselves marketers, not brokers or lessors, and even treated their tax returns as they were a marketing company. (David Murray is no longer with the company, according to their receptionist---he was listed as the President in the UAEL directory). They would promote their young account reps into various management positions. There were no "leasing veterans".

Preferred DID generate a fair amount of loyalty to their employees due to some of the perks: free season pass to skiing, various company-paid outings (i.e. white water rafting) and bonuses (gave away a snowmobile once...) Their former employees are not talking much as everyone was very happy.

This was the premier "application only" operation. It was not basically "internet," but by telephone and mail where there was no relationship selling, just low quote, get the customer approved, change the rate or terms, a "boiler room" operation similar to one as by Republic Leasing of Anaheim, but not as "intense," more "turn the application around" and move on to the next one.

The approach was the same that was used by some of the salespeople at the Republic Group and Corporate Capital before they were acquired by First Sierra. Corporate Capital even issued a "credit card" to the end user, but did not check their credit for approval until an actual application was received.

The building in Tahoe City was full of little cubicles, each with a recent college graduate, none of whom knew anything about leasing, or sales for that matter. The sales program was very clever. The company bought mailing lists from D&B and other sources and sent solicitations to the prospects. The solicitation included what appeared to be a credit card and the prospect was informed that he/she had been "pre-approved" for up to $75,000. All that it would take to activate the credit line was a call to an 800 number. The system was taken almost directly from the type of letter you get from credit card companies. Naturally, when the prospect called, he had to provide a "little" additional information (again, a la credit card solicitations). Of course, there was never a "pre-approval". The prospect was "pre-qualified".

Today

“Having Fun in Tahoe”

Dave Murray

Dave & Mike Murray,

the Original Founders of Direct Capital

http://leasingnews.org/archives/Oct2014/10_22.htm#murray

[headlines]

--------------------------------------------------------------

Canadian Finance and Leasing Association

Annual Conference Report by Hugh Swandel

by Hugh Swandel

Senior Manager Director-Canada

The Alta Group

Over 400 industry professionals gathered in Canada’s capital to hear the latest industry developments and unique perspectives on a broad set of topics as the Canadian Finance and Leasing Association (CFLA) Annual Conference held at the Hilton Lac Leamy.

It was another extremely successful conference, attracting near record attendance and providing a unique and diverse agenda. It brought together professionals from both the auto and equipment financing industries and attracted attendees from both Canada and the United States. Responsibility for the conference rests with the long standing Education Committee who once again exceeded expectations with an event that provide excellent content and a great balance of networking time and relevant presentations.

Also included were additional non-industry presenters covering issues including innovation and how the revolutionary pace of change is challenging businesses to stay relevant. Industry specific presentations included a timely session on the threat cyber hacking poses to our industry, updates on legal issues that are confronting member firms, how to improve recruiting and a detailed insight into new and better data on delinquency, default and market size!

Hugh Swandel, left, with Canadian Astronaut Chris Hadfield

The highlight of the conference for many was the presentation from Canadian Astronaut Chris Hadfield entitled “An Astronaut’s Guide to Life on Earth”.

Many exiting this presentation could be heard saying that it was the best conference speaker they had ever seen! In addition to putting most resumes to shame Chris Hadfield was generous with his time including staying behind to pose for pictures with many grateful attendees.

At the Chairman’s Banquet, awards and acknowledgements were presented. This year time was taken to acknowledge 20 years of service of the CFLA President David Powel. David has been instrumental in transforming the association and continuing to adapt to an ever changing market. The Banquet culminated in the presentation of the CFLA Member of the Year Award which this year was presented to a company instead of an individual member.

PayNet was recognized as Member of the Year for the ongoing and significant contributions to industry data including the release of 53 new Indices which assist members in understanding their relative performance. Bill Phelan accepted the award and was visibly moved by the honor!

The conference ended with a panel of media pundits offering their opinions on the upcoming Canadian election and Canadian Politics in general. While Canada has no equivalent to Donald Trump, the discussion was lively and insightful but lacked the outrageousness of similar events held to the South of the Canadian border.

The Canadian economy has weakened with the decline in oil prices but the mood of attendees was upbeat and determined.

Hugh Swandel

The Alta Group

www.thealtagroup.com

204.477.0703 direct

204.996.4844 mobile

hswandel@thealtagroup.com

[headlines]

--------------------------------------------------------------

FinTech Revolution Pokes the Sleeping Giant

– Are You Ready?

by Charles Anderson

What do Peer-to-Peer Lending (Lending Club & Prosper), Big Data Credit Decisioning (ZestFinance), Social Media Underwriting / New Credit Scoring Models (OnDeck & Kabbage), Swipe Payment Processing (Square & Apple Pay), Financial Data Aggregators (Yodlee), and Crowdfunding (GoFundMe & Kickstarter) all have in common?

They are not explicitly targeting the $1 trillion equipment finance industry.

How is it possible that in the last 12 months, according to CB Insights, investors have risked approximately $14 billion on the FinTech sector but none this cash been exclusively focused on the massive Equipment Financing Market?

For example, Google Ventures has done 37 FinTech deals in the past 5 years, but no equipment finance companies; Visa has made sizeable investments across the payments sector including the well-publicized Square investment, but no equipment finance companies; AMEX has made significant bets on international payment start-ups such as the well-publicized Sum Up, but no equipment finance companies; and even Goldman Sachs recently announced that they would be using technology to address the highly competitive online consumer loans market , but they made no mention of the equipment financing industry.

Is our industry being left behind? For example, only 10% of equipment leasing companies rely on electronic chattel paper consistently but the vehicle financing industry closes more than half of their transactions electronically.

According to Stephen Bisbee, President and CEO of eOriginal, Inc, Baltimore-based creator of electronic-document management systems, “the vehicle finance arms of Nissan, Ford and Toyota are well over 50% of transactions being done electronically.” In fact, customers leasing a new Tesla can even e-sign their lease e-documents inside their car.

Nobody can deny that investor interest is high and that change is coming. In 2010, there were 223 unique investors in FinTech, today there are 894.

So, as a community, we need to ask ourselves, how many customers have we lost to tech-savvy competition?

The purpose of this Leasing News Tech Series is to start a FinTech discussion within the Equipment Financing industry. Over the next 8 weeks we will discuss topics such as eDocs, eNotary, instant credit decisioning, big data vs traditional credit scoring, social media underwriting, cutting edge companies to watch, peer-to-peer lending, crowd funding, online payment processing, social savvy fraud, and much more.

For the record, I’m not advocating reckless credit decisions or sloppy funding practices. Rather, I’m planning on leading us through a balanced and in-depth look at the ins and outs of today’s financial technology – evaluating the tools, costs, and benefits of these inevitable changes – and relating them back to our core equipment financing industry.

Change is coming – are you ready?

Charles Anderson

CEO – IMCA Capital, Enverto Investment Group, Express-Tech

http://www.imcacareers.com/

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

|

||||||||||||||||||||||||

| Press Release | ||||||||||||||||||||||||

|

|

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

Madison Capital Selects Odessa’s LeaseWave

Adds to eOriginal and DocuSign

Madison Capital, Owings Mills, Maryland, with territory covering the Canada, Puerto Rico and the United States, specializing in equipment vehicle leasing and financing, has made further strides in automating and streamlining its business processes by adding new features to its integrated Digital Transaction Management (DTM) solution powered by eOriginal and DocuSign, Inc.,(DocuSign®) --- and now selecting the LeaseWave platform from Odessa Technologies, to administer and streamline its lease management processes. Madison will also be implementing the LW Customer Portal, LW Vendor Portal and LW ReportBuilder.

Allan Levine

President/COO

Madison Capital

“In order to successfully execute our innovative growth strategy, we realized Madison had to replace both of our legacy systems with state of the art technology as well as undergo significant business process reengineering,” said Allan Levine, president and COO of Madison Capital. “With Odessa as a technology partner and LeaseWave as our core system, Madison will be well positioned to achieve our growth objectives.”

Jeff Lezinski

Sr. VP, Solutions Architecture

Odessa Technology

“LeaseWave was designed with our client’s changing needs in mind. Its configurable automation capabilities provide flexibility and efficiency,” said Jeff Lezinski, senior vice president of Solution Architecture at Odessa Technologies. “Madison Capital is focused on the origination of small ticket transactions in markets where delivery of custom financial solutions is a critical, value-added component of their sales proposition. LeaseWave’s dynamic functionality and workflow-based design will enable Madison Capital to reliably provide this business model.”

[headlines]

--------------------------------------------------------------

Northland Capital Financial Services

Four New CLFP and What it Means to Them

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

Letters? ---We get Email!

(Mostly chronological order)

(In Chronological Order as Received)

Purchase, Renewal, Return (“PRR”) Clauses

by Christopher Menkin

http://leasingnews.org/archives/Sep2015/9_21.htm#prr

“Kudos for describing PRR clauses. One takeaway here is that brokers, vendors and other originators who want continuing relationships with customers should really read the leases their funders give them.”

Barry S. Marks, Esq.

--

Interim Rent: Proper Accounting Function for

Short Term Advances --- Or Is It a Scam?

By Tom McCurnin, Leasing News Legal News Editor

http://leasingnews.org/archives/Sep2015/9_21.htm#interim

“Tom McCurnin also has some great points on interim rent, but I must point out that not all leases are full payout. If not, the interim period should not be free. Also, where the lessor has a Fair Market Value purchase option and calculates rent assuming a return value, a 29-day or 89-day interim use can impact the bottom line. Even in full payout $1 out or fixed purchase option leases, an interest-only charge in the interim is reasonable, as is a full rent payment offset by a reduction in the term at the back end. These take into account time value of money, assuming the lessor is paying the vendor on delivery and acceptance. In other words, not all interim rent is pure gravy. I hope we don't see some of these comments coming back at us, taken out of context, in lessee's counsel's court filings.”

Barry S. Marks, Esq.

(I believe Tom was primarily referring to “Capital Leases.” There basically is no balance at the end of a Fair Market Value lease where the lessee can return or purchase at a price to be determined. I spoke with him and he agreed with your comments. Editor)

--------

"Many Lessors use interim rent to cover progress payments on large lease lines or projects that take months to complete. The consequence is that the Lessor may collect interim rent for 6 months to over a year, while they are paying vendors involved in the project. And, because the language on the Master Lease Agreements is not clear, the Lessee often does not know that these initial payments do not reduce the principal."

John G. McManigal

(The CLFP Handbook defines a "master lease" as a lease document that allows a lessee to obtain additional leased equipment under the same basic lease terms and conditions agreed to, without having to renegotiate and executive a new lease contract with the lessor. Each new piece of equipment is listed on a separate schedule and the specific pricing, terms and conditions for that schedule are depending upon the polices of the lessor, the terms and conditions of the Master Lease and the cost of equipment."

(1)

(It basically depends on the size and duration of the "master lease."

These often require progress payments and it is not uncommon

to also include a promissory note along with the lease regarding

what is advanced before the actual lease begins. Many such instruments also require a "master lease fee," as a bank would for extending a line of credit, a loan fee and interest on the money that is drawn. 2% is common, in addition to interest, which may also be the lease factor to cover the extra work involved as often equipment is returned, replaced, or installation costs change. Larger transactions often have rate changes and other situations. They often are reviewed by the lessor’s attorney as well as the lessee’s attorney, especially if they have tax consequences for either party. Editor)

- Glossary Page 291—CLFP Handbook

http://www.clpfoundation.org/toolbox/clfp_handbook.php

-------

Reader Says Too Many Telephone Calls to Client

All Generated from UCC Filings

http://leasingnews.org/archives/Sep2015/9_10.htm#reader

“I also get these comments from customers.

“We all know the main offender(s) thanks to your newsletter.

“I don't think we can stop it, as it is a free country and our opinion would only encourage the offenders.

“I have a nice file of complaints that I use when confronted with these companies, and it helps a lot.”

Brian Carey

“Thanks again for your coverage!!”

Sales Makes it Happen by Christopher Menkin

Use UCC's to Call on Lessees Whose Lessor is Gone

http://leasingnews.org/archives/Sep2015/9_10.htm#sales_happen

“A great comment regarding the UCC filings and the use of them for marketing. Many years ago I tried the marketing technique and stopped using it for the reasons mentioned in the post. Hostility was in evidence even then.

“I still make note of the UCC's but never call them. I just note they are worthy of finance. For the future.”

Ted

Ted Pierce

Insta Lease

------

Leasing Conferences --- Full Update of Exhibitors

Women in Leasing LinkedIn Group Luncheon at NEFA

http://leasingnews.org/archives/Sep2015/9_18.htm#conferences

“Good morning Kit,

“Would you post this in the next newsletter for me?

“The Women in Leasing LinkedIn Group would like to cordially invite you to our October luncheon at Season’s 52 in Buckhead (Atlanta), Georgia on Wednesday October 7th, from 1:00pm – 3:30pm. The lunch is being co-sponsored by ECS Financial Services and Financial Pacific Leasing.”

Sincerely,

Shari L. Lipski, CLFP

SLipski@ECSFinancial.com

-------

How Many Types of Leases?

More than Three!

http://leasingnews.org/archives/Aug2015/8_17.htm#how

"I really do not agree with you. Actually there are only 2 basic types - financial and operational /with all the international variations in the name, these are according to IAS 17/. These are based on the ownership of the asset and respective BS booking. Since we are talking about "asset finance" this is what matters. All the rest are just variations from the above. You actually missed "Cross Border Lease", "Sale-Leaseback" and "Novation Lease", but they are also only just products, nothing more.

Stanislav Tanushev

Country Manager at NetBid Industrie

Auktionen AG, Bulgaria

(Novation Lease is more UK and Australia, and Cross Border Lease is where lessee and lessor are in separate countries. They are a type of lease, as is a Sale-leaseback, which was also not mentioned.

(In the United States, most leasing sales people present three types of leases: FMV, 10% or $1.00.

(It is a marketing tool in presenting their "rate" to the customer. In reality, there are more than three marketing approaches to presenting a lease finance plan, and that was the purpose of the article. A good sales person needs to have many types of lease finance plans to offer a customer. Listed were the many that a salesman should be aware

may be needed to close a sale. Editor.

[headlines]

--------------------------------------------------------------

(Leasing News provides this ad as a trade for appraisals

and equipment valuations provided by Ed Castagna)

[headlines]

--------------------------------------------------------------

#### Press Release ##############################

Toyota Capital, Only Forklift Truck Leasing Company

in Book "Mexico Automotive Review 2015"

Mexico City, September 22nd, 2015. Among the market leaders in Mexico, and as a captive financial services company specializing in leasing of lift truck fleets for the automotive industry, among other sectors, Toyota Material Handling Capital (“Toyota Capital”) will be present at the Mexico Automotive Summit 2015, to be held on September 24th in Mexico City.

The continued expansion of the automotive (light and heavy vehicles), direct and indirect suppliers, logistics and aftermarket industries in Mexico, require new ways to renovate their lift truck fleet, including through leasing strategies. The use of forklift trucks, both electric and internal combustion, improves the efficiency of the entire value chain of material handling, from small and medium enterprises that manufacture specific automotive parts, to large global corporations and OEMs who have settled in our country.

Eduardo Vega

Managing Director

Toyota Capital

"We are located in a strategic location to serve OEM’s assemblers of light vehicles and heavy vehicles and their supply value chain of the sector in the Bajio region and across the country. After selecting the adequate Toyota or Raymond lift truck fleet; Toyota Capital finances your fleet through an operating lease and / or capital lease, which impacts the efficiency of use of financial resources in the automotive sector companies, "said Eduardo Vega, Managing Director of Toyota Capital.

Toyota Capital offers operating leases and capital leases for Toyota and Raymond brands of all sizes and capabilities required for over 70 different manufacturing, retail and logistics sectors in Mexico. Since its inception, for over two years the company has focused on leasing of Toyota and Raymond brands; the two leading lift truck brands in the world market for its quality and performance. Both brands are part of the portfolio of products of Toyota Industries Corporation (TICO).

By the end of August, 2015, Toyoa Capital Maintains consistent growth in the financiing portfolio and leasing of units.

We are excited to participate in this summit which will bring together over 350 automotive industry leaders, a sector that is adding credibility and prestige to the Mexican economy, which now stands on par with any other country in terms of vehicle manufacturing” says Eduardo Vega.

Toyota Capital customers in Mexico from the automotive sector, are leading companies OEM’s assemblers of light and heavy vehicles, as well as direct and indirect suppliers, aftermarket and the auto parts logistics sector. In a demanding and quality based sector, such as the automotive industry, where decisions on the use of financial resources make the difference between good results and an extraordinary ones. Leasing a lift truck fleet can act as a differentiator within the industry value chain.

"A decisive factor for a company in deciding whether to lease or buy an asset is the availability of capital. Leasing is useful in maximizing the benefits of cash and maintaining liquidity and solvency. In the case of the global automotive industry, the actors in the value chain have established as a best practice, the leasing of its lift truck fleet. Toyota Capital offers a decisive advantage in that banks traditionally do not engage in operating leases. Additionally Toyota Capital offers in depth knowledge of financial services specialized in material handling equipment. Another reason to consider an operating lease is to eliminate the problem of selling a used lift truck when it is time to replace it with a new one and/or switch to a different capability lift, if the conditions of their material handling requirements change" Eduardo Vega comments.

Toyota Capital is the only captive leasing company specialized in material handling equipment and serving the automotive industry that will be featured in the upcoming edition of the book "Mexico Automotive Review 2015".

About Toyota Material Handling Capital (Toyota Capital)

About Toyota Material Handling Capital (Toyota Capital) Toyota Capital is a non-bank bank offering leasing and financial services for TMHNA material handling equipment brands Raymond, BT, and Toyota in Mexico and Latin America. Toyota Capital supports the sale of material handling equipment by becoming a single source financing solution for the end users of the Toyota, BT, and Raymond distributor and dealer networks in Mexico and LatAm. Toyota Capital offers leasing and financial solutions for material handling, logistics and supply chain equipment.

About Toyota Material Handling North America (TMHNA)

About Toyota Material Handling North America (TMHNA) TMHNA is comprised of Toyota Industrial Equipment Mfg., Inc. (TIEM), the Columbus, Ind.-based lift truck manufacturing plant; Toyota Material Handling, U.S.A., Inc., (TMHU), North America’s number one supplier of lift trucks; and The Raymond Corporation, the North American market leader in electric warehouse trucks.

#### Press Release ##############################

(Leasing News provides this ad as a trade for appraisals and equipment valuations provided by Ed Castagna)

[headlines]

--------------------------------------------------------------

Border Collie Pup

San Francisco, California Adopt-a-Dog

Cruz

Male

Age: 3 months

Weight: 15lbs. 6oz.

"I'm a curious pup looking for adopters that can commit to continuing my puppy education and socialization. I am ready for a home with snuggles and playtime and lots of puppy-love! I would love to attend puppy socials and meet other young dogs for fun and play. Ask a staff member or check our website for details/dates of our puppy parenting classes to learn how you can be my best family ever!"

San Francisco SPCA

2343 Fillmore Street

San Francisco, CA 94115

415-563-6700

Mon-Fri: 1 - 7pm

Sat-Sun: 10am - 6pm

Closed on major holidays

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

Leasing Schools/Franchisors

(For our "Financial and Sales Training" list, please click here)

| Global Leasing |

| NAELB |

| Wheeler Leasing School |

(does not include those specifically employed in training or education, but who have a similar program as the following entities:)

------------------------------------------------------------------

Global Financial Training Program

Over 35 Years of Experience Financing Businesses

Program Cost: $19,950.00

Phil Dushey

President & CEO

In 2001, Global Leasing founder Phil Dushey created a new company to train independent entrepreneurs who want to enter the lucrative field of business financing. Global Financial Training Program teaches all aspects of finance including Equipment Leasing, Accounts Receivable Financing, Cash Advance, Commercial Real Estate, SBA Loans and much more. Phil’s students have found great success with his program.

Mr. Dushey is a founding member of the National Association of Equipment Leasing Brokers. He has been a member and speaker at many leasing organizations for several years. He is also a founding member of the leasing news advisory board.

Global Financial Training Program provides students with everything they need to start making money immediately after four days of training. As a full-service finance company you will provide a valuable service for business owners that have difficulty getting financing from their local banks. The banks are turning down over 90% of business loan applications and you can approve at least 50% of the turndowns. After the training at their offices in New York City trainees are instantly approved with over 25 lenders, get a custom designed website, stationery package, 1000 leads and enough marketing to have their phones ringing the first week after the training and much more... It's easier than you think to fulfill your dreams of independence, living the life you deserve and enjoying the prestige of owning your own company.

You don't need prior experience. All you need is the desire to be your own boss, the ability to learn, good people skills, and a passion to succeed and make a lot of money.

How much, is up to you...

Philip Dushey

President & CEO

Global Financial Services

1 State Street, 21st Floor

New York NY 10004

Email phil@gbtsinc.com

www.globalfinancialtrainingprogram.com

Phone: 212-480-4900

The Global Group of independently owned companies are:

Global Financial Services | www.globaleasing.com

We have been actively providing financial services for 35 years

Global Church Financing | www.globalchurchfinancing.com

One of the largest independent companies financing equipment for churches nationwide

Global Financial Training Program | www.globalfinancialtrainingprogram.com

The oldest and most comprehensive training program for people who want to own their own finance company

Mr. Dushay is also on the Leasing News Advisory Board

http://www.leasingnews.org/Advisory%20Board/Dushay_Phil.htm

Moving America Forward is a business television show hosted by William Shatner, anchored by Doug Llewellyn. On this episode we talk to Phil Dushey about his business opportunity and Global.

----------------------------------------------------------------

NAELB Leasing School

Program Cost:

Standard Class: $18,950

Premium Package: $28,450

(Faculty and Staff include Charles “Bud” Callahan, CLFP, BPB, School Director, with Linda Kester, Marketing Director, Gary Greene, CLFP, BPB, Executive Director and Joseph G. Bonanno, Esq., CLFP, attorney)

http://www.naelbschool.com/bio/

NAELB Leasing School teaches entrepreneurs how to own, operate

and succeed in their own equipment leasing and finance brokerage business.

The National Association of Equipment Leasing Brokers is the only major leasing association to offer an equipment leasing program to become a leasing broker.

The National Association of Equipment Leasing Brokers offers the most comprehensive specialty financial educational symposium in the industry, providing:

- A week long intensive hands-on learning experience with after-hours discussions of real-world leasing situations and valuable course materials including handbooks, industry software and more

- Real-world training by experts in the field (our instructors have been active in the industry for at least 25years each)

- Training week concludes with FREE admission to the following NAELB Conference, offering the perfect opportunity to expand your networking with lenders, industry service providers and fellow brokers who are eager to provide support as you develop your business

- One full year of mentoring from experienced NAELB brokers who help you navigate the pitfalls and point you toward business solutions

- One full year of membership in the NAELB, the nation’s largest leasing broker association formed by brokers for brokers, and use of all member benefit programs

- Graduates are able to deal directly with multiple quality funding sources -‐ no obligation to split fees with the school or school mentors

Although many other schools spend less than 1 day discussing the ins and outs of leasing, we spend approximately 40 hours focused on commercial equipment leasing in its modern variations. We don't take any of our students' time discussing commercial mortgages, LBO's, SBA loans or any of the dozens of other financial products taught at other training programs.

The standard class price is $18,950. Hotel, airfare allowance, meals, NAELB membership, COURSE MATERIALS, INDUSTRY TOOL KITS, and mentorship, are all included at this price. A premium package, priced at $28,450, includes 5 options selected by the student from a menu of available upgrades. We offer a $2,000 discount for 'early bird' registration (60+ days in advance of the selected class). Interested students should call 855-411-ELBS to inquire about other discounts which may be available.

For more information, please visit www.NAELBSchool.com or call 855‐411‐Equipment Leasing Broker School (3527)

---------------------------------------------------------------

Program Cost: $18,500

Overview

Wheeler Business Consulting L.L.C. provides training and continuous support to individuals seeking to enter the leasing/financing industry. The leasing/financing industry provides much needed funds to businesses looking to acquire essential equipment. Entrepreneurs nationwide are originating equipment financing and leasing transactions assisting small, medium and large companies. It is estimated that 80% of all businesses have leased equipment and that nearly one-third of all equipment purchased by corporations is funded by independent finance and leasing agreements.

There are tremendous opportunities to enter the leasing/financing industry. There are few barriers to entry. Individuals who are properly trained, who are networked with local, regional and national funding sources can arrange transactions for their corporate clients in the range of a few thousand dollars to multi-million dollars.

As with most businesses, the establishment of a lease brokering operation is a long term proposition. However, with the proper training, support and encouragement, an individual can start making above average incomes relatively quickly. Within two to five years an individual should expect to generate an income which is well in the six figure range.

With quality training, individuals will be able to offer consistent, high spirited customer service to their commercial clients. Successful lease brokers can build a business from a small home based operation to a full service office in a relatively short period of time.

My goal is to share my thirty plus years of industry experience with others who are serious about learning and succeeding in the leasing/financing industry.

Contact Information:

Wheeler Business Consulting LLC 1314 Marquis Ct.

Fallston, Maryland 21047

Phone: 410-877-0428

Fax: 410-877-8161

email: scott@wheelerbusinessconsulting.com

Website: www.wheelerbusinessconsulting.com

Receivables Management LLC • Third-Party Commercial Collections john@jkrmdirect.com | ph 315-866-1167 |

(Leasing News provides this ad as a trade for investigative

reporting provided by John Kenny)

[headlines]

--------------------------------------------------------------

![]()

News Briefs---

The 50 Best Fintech Innovators Report

http://www.leasingnews.org/PDF/Fintech2015.pdf

ELFA Reports New Business Fell 18% from July

http://www.businessinsider.com/r-us-business-borrowing-for-equipment-falls-in-august-elfa-2015-9

Feds Approve PacWest Merge with Square 1 Financial, L.A., CA

Includes Square 1 Bank, Durham, North Carolina

http://www.leasingnews.org/PDF/PacWestMerger.pdf

Volkswagen says 11 million cars hit by scandal, probes multiply

http://www.reuters.com/article/2015/09/22/us-usa-volkswagen-idUSKCN0RL0II20150922

Bank of America Shareholders Allow Chief to Keep Chairman Post

http://www.nytimes.com/2015/09/23/business/dealbook/bank-of-america-shareholders-allow-ceo-to-keep-chairmans-role.html?ref=business

Microsoft launching Office 2016, pitches updates for subscribers

http://www.seattletimes.com/business/microsoft/microsoft-launching-office-2016-pitches-updates-for-subscribers/

Brian Williams returns to airwaves for pope coverage

"... he deserves a second chance..."

http://www.pressdemocrat.com/entertainment/4516773-181/brian-williams-returns-to-airwaves?gallery=4515693

[headlines]

--------------------------------------------------------------

--You May Have Missed It

comScore 2015 U.S. Mobile App Report

Smartphone and Tablet (51 pages)

http://images.go.comscore.com/Web/comScoreInc/%7Bb3599096-2157-4e3f-90a5-655109106100%7D_2015_US_Mobile_App_Report.pdf

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

Healthy Flying Tips for Families

http://www.sparkpeople.com/blog/blog.asp

?post=healthy_flying_tips_for_families

[headlines]

--------------------------------------------------------------

Stop Action

Slowly as in an underwater dance

the shortstop dips to take the ball

on a low hop, swings back his arm, balancing

without thought, all muscles intending

the diagonal to the first baseman's glove.

As the ball leaves his hand, the action stops —

and, watching, we feel a curious poignancy,

a catch in the throat. It is not this play only.

Whenever the sweet drive is stopped

and held, our breath wells up like the rush

of sadness or longing we sometimes feel

without remembering the cause of it.

The absolute moment gathers the surge

and muscle of the past, complete,

yet hurling itself forward — arrested

here between its birth and perishing.

Written by Conrad Hilberry, published in

“Line Drives,” 100 Contemporary Baseball

Poems edited by Brooke Horvath and Tim Wales,

published by Southern Illinois University Press

[headlines]

--------------------------------------------------------------

Sports Briefs----

Cowboys acquire Matt Cassel from Bills

http://espn.go.com/dallas/nfl/story/_/id/13719437/dallas-cowboys-acquire-matt-cassel-buffalo-bills

Raiders' newfound wealth at receiver paying off early

http://www.insidebayarea.com/raiders/ci_28860004/raiders-newfound-wealth-at-receiver-paying-off-early

Young Raiders may 'have a real shot' at resurgence in 2015

http://www.usatoday.com/story/sports/nfl/raiders/2015/09/22/young-raiders-may-have-real-shot-resurgence-2015/72631206/

Crushing loss makes Game 1 win seem like an illusion

http://www.pressdemocrat.com/sports/4507971-181/lowell-cohn-crushing-loss-makes

Colts coach Chuck Pagano suggests the front office hasn't built a good enough team around Andrew Luck

http://www.sfgate.com/technology/businessinsider/article/Colts-coach-Chuck-Pagano-suggests-the-front-6521900.php

Oregon Ducks quarterback Travis Jonsen out for season after medical 'procedure'

http://www.oregonlive.com/ducks/index.ssf/2015/09/

oregon_quarterback_travis_jons_1.html#incart_2box

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

Jerry Brown signs new post-redevelopment bill

http://www.sacbee.com/news/politics-government/capitol-alert/article36193152.html

Roseville faces once-a-week water restrictions

http://www.sacbee.com/news/state/california/water-and-drought/article36221520.html

Samsung opens state-of-the-art campus that can help transform north San Jose

http://www.siliconbeat.com/2015/09/22/samsung-opens-state-of-the-art-campus-that-can-help-transform-north-san-jose/

Jerry Brown signs bill to keep kids in rear-facing car seats until 2

http://www.sacbee.com/news/politics-government/capitol-alert/article36026244.html

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

End of grape harvest already in sight for many Sonoma County growers

http://www.pressdemocrat.com/business/4511552-181/end-of-grape-harvest-already

Jackson Family Wines shows off UV waterless tank cleaner

http://www.northbaybusinessjournal.com/northbay/sonomacounty/4513963-181/jackson-family-wines-shows-off#zvf32yuhEdr59gSc.97

Butte Fire Claims Two Foothills Vineyards

http://www.winesandvines.com/template.cfm?section=news&content=157935

Berger: Don’t ignore grenache!

http://www.pressdemocrat.com/lifestyle/4495399-181/berger-dont-ignore-grenache

Champagne Forgotten Varieties Could Thrifve as Temperature Rise

http://www.lepanmedia.com/champagnes-forgotten-varieties-could-thrive-as-temperatures-rise/

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in American History

1595 - Spain launched an intensive missionary campaign in the American Southeast. During the next two years, about 1,500 Indians were converted to the Catholic faith.

1642 – The first commencement exercises for Harvard College.

1779 - John Paul Jones, commanding the “Bonhomme Richard”, defeated and captured the “Serapis”, a British man-of-war commanded by Capt. Richard Pearson. It was during the engagement that Jones, when asked if he had struck his colors, (surrendered), replied, “I have not yet begun to fight”. After three hours of brutal fighting, Pearson surrendered to Jones. The Americans transferred the Serapis from their own ship, which sank a day later.

1780 - British spy John Andre was captured along with papers revealing Benedict Arnold's plot to surrender West Point to the British.

1800 - Birthday of William Homes McGuffy (1800-73) at Washington County, PA. American educator and author of the famous, “McGuffey Readers”.

1806 - Lewis & Clark return to St Louis from the Pacific Northwest

1815 - The Great September Gale moved through New England on a path similar but just east of the Great 1938 Hurricane. The storm made landfall on Long Island and again at Old Saybrook, CT. Extensive structural damage was done. Providence, RI was flooded and 6 people were killed. This hurricane is rivaled only by the 1938 hurricane in New England History.

1838 - Birthday of Victoria Chaflin Woodhull (1838-1927) at Homer, OH. American feminist, reformer and first female candidate for the presidency of the US.

1845 - The Knickerbocker Club of New York was officially organized by Alexander Joy Cartwright, the man who laid out the diamond-shaped baseball field and gave the game its modern form. Duncan F. Curry was the club's first president. The club played its first game in June, 1846, losing 23-1. A previous team that played an earlier form of baseball was the Olympic Club of Philadelphia, PA, which played “cat ball”, also known as town ball, from July 4, 1833 to 1860, when they changed to standard baseball. Town ball, a game similar to the British game of rounders, was the immediate forerunner of regular baseball in the United States.

1846 - Discovery by German astronomer Johann Galle of the planet Neptune, 2,796,700,000 miles from the sun (about 30 times as far from the sun as Earth). Eight planets from the sun, Neptune takes 165.8 years to revolve around the sun. Diameter is about 31,000 miles compared to earth at 7,927 miles.

1862 - Lincoln's Emancipation Proclamation was published in Northern newspapers. He issued it the day before to take effect on January 1, 1863. It declared that “all persons held as Slaves” in all the Confederate states, excepting a number of counties under federal control, were considered “forever free”. It also enjoined members of the federal armed forces from returning fugitive slaves to their owners. The Emancipation Proclamation in its final form was signed on January 1, 1863.

1863 - Birthday of Mary Church Terrell (1863-1954) was born in Memphis, TN. Educator, political activist, and first President of the National Association of Colored Women.

http://memory.loc.gov/ammem/today/sep23.html

1867 - Birthday of John Lomax (1867-1948), Goodman, MS. American folk-song collector and founder of the American Folklore Society at the Library of Congress

1879 - Richard S. Rhodes of River Park, IL, received a patent for the Audiphone, a hearing aid other than ear trumpets. It was a fanlike device held against the teeth.

1905 – Detroit Tigers rookie, Ty Cobb, hit the first HR of his career, an inside-the-park homer against Washington.

1907 - Birthday of piano player Albert Ammons (d. 1949), Chicago, IL

1908 - In the decisive game between the Chicago Cubs and the New York Giants, the National League pennant race erupted in controversy during the bottom of the ninth with the scoretied 1—1, at the Polo Grounds, New York, NY. New York was at bat with two men on. Thebatter hitsafely to center field, scoring the winning run. Chicago claimed that the runner on first, Fred Merkle, seeing the winning run scored, headed toward the dugout without advancing to second base. TheChicago second baseman, Johnny Evers, attempted to get the ball and tag Merkle out, but was prevented by the fans streaming onto the field. Days later, Harry C. Pulliam, head of the National Commission of Organized Baseball, decided to call the gamea tie. The teams were forced to play a post-season playoff game which the Cubs won 4—2. Fans invented the terms “boner” and “bonehead” in reference to the play and it has gone down in baseball history as “Merkle's Boner”.

1912 – Mack Sennett presented the first Keystone Cops film “Cohen Collects a Debt”.

1926 - Birthday of Tenor Saxophone player John Coltrane (d. 1967), Hamlet, NC.

1926 – Gene Tunney beat Jack Dempsey in 10 rounds in Philadelphia for the heavyweight boxing title.

1928 - Birthday of Tenor-composer Frank Foster (d. 2011), Cincinnati, Ohio. Foster collaborated frequently with Count Basie, wrote “Shiny Stockings,” “Blues Backstage”, and worked as a bandleader from the early 1950s.

1930 - Birthday of singer/piano player Ray Charles Robinson (d. 2004), Albany, GA.

http://www.history-of-rock.com/ray_charles.htm

1935 - Birthday of jazz piano/organ player Les McCann, Lexington, KY.

He was very popular in the late 1950's and early 1960's, and my friends and I saw him often in jazz clubs in Hollywood. My trumpet friend Warren Luening could listen once and play his music with solos on the piano the next day. I remember it added to our enthusiasm to go see him and Mose Allison more often.

http://www.lesmccann-officialwebsite.com/biography.html

1939 - Jan Savitt records “720 in the Books” (Decca 2771).

1942 - SLATON, JAMES D., Medal of Honor

Rank and organization: Corporal, U.S. Army, 157th Infantry, 45th Infantry Division. Place and date: Near Oliveto, Italy, 23 September 1943. Entered service at: Gulfport, Miss. Born: 2 April 1912, Laurel, Miss G.O. No.: 44, 30 May 1944. Citation: For conspicuous gallantry and intrepidity at the risk of life above and beyond the call of duty in action with the enemy in the vicinity of Oliveto, Italy, on 23 September 1943. Cpl. Slaton was lead scout of an infantry squad which had been committed to a flank to knock out enemy resistance which had succeeded in pinning 2 attacking platoons to the ground. Working ahead of his squad, Cpl. Slaton crept upon an enemy machinegun nest and, assaulting it with his bayonet, succeeded in killing the gunner. When his bayonet stuck, he detached it from the rifle and killed another gunner with rifle fire. At that time he was fired upon by a machinegun to his immediate left. Cpl. Slaton then moved over open ground under constant fire to within throwing distance, and on his second try scored a direct hit on the second enemy machinegun nest, killing 2 enemy gunners. At that time a third machinegun fired on him 100 yards to his front, and Cpl. Slaton killed both of these enemy gunners with rifle fire. As a result of Cpl. Slaton's heroic action in immobilizing 3 enemy machinegun nests with bayonet, grenade, and rifle fire, the 2 rifle platoons who were receiving heavy casualties from enemy fire were enabled to withdraw to covered positions and again take the initiative. Cpl. Slaton withdrew under mortar fire on order of his platoon leader at dusk that evening. The heroic actions of Cpl. Slaton were far above and beyond the call of duty and are worthy of emulation.

1943 - Birthday of singer Julio Iglesias, Madrid, Spain. He alternated playing professional football with studying law at the CEU San Pablo University in Madrid. In the earliest years of his young adulthood, he was a goalkeeper for Real Madrid Castilla. His professional football career ended when he had a serious car accident, due to which he was unable to walk for two years. His recording career has easily eclipsed these early endeavors.

1943 - Birthday of Martin Edward “Marty” Schottenheimer, football coach and former player, born Canonsburg, PA.

1946 - Al Couture recorded the quickest knockout in boxing history, flooring Ralph Walton with only half a second gone in the first round. Couture threw the knockout punch while Walton was still sitting in his corner adjusting his mouthpiece.

1949 - Top Hits

“You're Breaking My Heart” - Vic Damone

“Let's Take an Old Fashioned Walk” - Perry Como

“Someday” - Vaughn Monroe

“Slipping Around” - Ernest Tubb

1949 - Birthday of singer/songwriter Bruce Springsteen, Freehold, NJ. “The Boss” was lead singer of The Castilles, then the E-Street Band: “Born in the U.S.A.”, “Born to Run”, “Hungry Heart”, “Dancing in the Dark”, “Cover Me”, “I'm on Fire”, “Glory Days”, “My Hometown”, “War”; songwriter: “Blinded by the Light” [Manfred Mann's Earth Band], “Fire” [The Pointer Sisters]. Inducted into the Rock and Roll Hall of Fame 3-15-99.

1952 - Rocky Marciano became the world heavyweight boxing champion by knocking out Jersey Joe Walcott in the 13th round in Philadelphia PA. It was Rocky's 43rd consecutive victory. He is the only heavyweight boxing champ to go undefeated, with a pro record of 49 bouts and 49 victories, including 43 by knockout. This was the first Pay Television for sporting events, coast to coast, in 49 theatres in 31 cities.

1952 - The first use of television in a national campaign, when Vice-Presidential candidate Richard M. Nixon gave his famous “Checkers Speech.” Nixon was found “clean as a hound's tooth” in connection with a private fund for political expenses, and he declared he would never give back the cocker spaniel dog, Checkers, which had been a gift to his daughters. Other dogs prominent in American politics: Abraham Lincoln's dog, Fido; Franklin 0. Roosevelt's much-traveled terrier, Fala; Harry S. Truman's dogs, Mike and Feller; Dwight D. Eisenhower's dog, Heidi; Lyndon Johnson's beagles, Him and Her; Ronald Reagan's dogs, Lucky and Rex; and George Bush's dog, Millie.

1955 - The first world heavyweight boxing champion to retire undefeated was Rocky Marciano, who won all his 49 professional bouts, notably the heavyweight championship in Philadelphia, PA. Marciano retired following the sixth defense of his heavyweight title, in which he knocked out Archie Moore at Yankee Stadium on September 21, 1955.

1957 - Nine black students at Little Rock Central High School in Arkansas are forced to withdraw because a white mob had formed outside. The following day racial violence in Little Rock prompted Pres. Eisenhower to send a force of some 1000 U.S. Army paratroopers to enforce the desegregation of Central High School. The President said that violence had caused the removal of nine black students in the newly integrated school. The students eventually entered the guarded school on September 25.

1957 - Top Hits

“Tammy” - Debbie Reynolds

“Diana” - Paul Anka

“Mr. Lee” - The Bobbettes

“My Shoes Keep Walking Back to You” - Ray Price

1957 - Buddy Holly and The Crickets scored their only number one hit with their first Billboard chart maker, "That'll Be the Day", issued today. Holly would later reach the Top Ten with "Peggy Sue" and "Oh, Boy!" and crack the Top 20 with "Maybe Baby" and "It Doesn't Matter Anymore".

1962 - Maury Wills of the Los Angeles Dodgers stole his 96th and 97th bases of the season to tie and then broke Ty Cobb's record for most stolen bases in a season, set in 1915. Wills finished the year with 104 stolen bases and won the National League’s Most Valuable Player award.

1962 - “The Jetsons” premiered on television. “Meet George Jetson, His boy Elroy, Daughter Judy, Jane his wife...” These words introduced us to the Jetsons, a cartoon family living in the twenty-first century, The Flintstones of the Space Age. We followed the exploits of George and his family, as well as his work relationship with his greedy, ruthless boss Cosmo Spacely. And who can forget Astro, the family dog. New episodes were created in 1985, which also introduced a new pet, Orbity.

1965 - Top Hits

“Help!” - The Beatles

“Eve of Destruction” - Barry McGuire

“You Were on My Mind” - We Five

“Is It Really Over?” - Jim Reeves

1967 - The Box Tops from Memphis hit #1 with "The Letter". Though the song was #1 for four weeks and remained on the charts for 13 weeks. The Box Tops reorganized right after that first hit and never made it to #1 again.

1967 - The song "To Sir with Love" by Lulu, from the film of the same name, entered the Billboard Hot 100, where it eventually reached #1.

1970 - The first New York City Marathon was held. Queens fireman Gary Muhrcke won the race, which consisted of four laps around Central Park. The course was later changed to run from Staten Island to Central Park.

1972 - It was announced that for the first time in U.S. history, the birth rate dropped to 2.1 children per family.

1972 - "Baby Don't Get Hooked on Me" by Mac Davis topped the charts and stayed there for 3 weeks.

1973 - Top Hits

“Let's Get It On” - Marvin Gaye

“We're an American Band” - Grand Funk

“Loves Me like a Rock” - Paul Simon

“You've Never Been This Far Before” - Conway Twitty

1975 - Hurricane Eloise made landfall between Fort Walton Beach and Panama City, FL with sustained winds of 125 mph and a peak gust of 155 mph. This was the first direct hit by a storm in that area this century. Tides were 12 to 16 feet above normal. A total of 21 people were killed and damages mounted to $490 million. The remains of Hurricane Eloise merged with a stationary front over New York, Pennsylvania and Maryland producing major flooding.

1976 - The first presidential election debate between an incumbent president a challenger to be televised as three networks pooled their efforts to telecast a debate between President Gerald Rudolph Ford, a Republican, and Jimmy Carter, the Democratic candidate, at the Walnut Street Theatre, Philadelphia, PA. The debate, limited to domestic issues, was sponsored by the League of Women Voters. A second debate took place on October 6, 1976 from the Palace of Fine Arts Theatre, San Francisco, CA. A third was held at Phi Beta Kappa Hall on the campus of the College of William and Mary, Williamsburg, VA. Each confrontation was 90 minutes long.

1981 - Top Hits Today:

“Endless Love” - Diana Ross & Lionel Richie

“Queen of Hearts” - Juice Newton

“Stop Draggin' My Heart Around” - Stevie Nicks with Tom Petty & The Heartbreakers

“You Don't Know Me” - Mickey Gilley

1983 - The earliest report of measurable snow at Snowshoe, WV.

1983 – The Phillies’ Steve Carlton became the 16th 300-game winner in MLB history, defeating the team that traded him to Philadelphia, the St. Louis Cardinals. Lefty finished with a 326-244 record, 11th highest win total in history, and four Cy Young Awards.

1984 - San Francisco SF 49er QB Joe Montana misses his 1st start in 49 games

1984 – Manager Sparky Anderson became the first manager in Major League history to win 100 games in each league. Anderson managed the Cincinnati Reds (1970-78) and the Detroit Tigers (1979-95), winning three World Series championships. His 2,194 career wins are the 6th most for a manager in Major League history. He was named American League Manager of the Year in 1984 and 1987. Anderson was elected to the Baseball Hall of Fame in 2000.

1986 - NBC-TV won the ratings race for the 52-week season (1985-1986). "The Cosby Show" and "Family Ties" rated #1 and #2 respectively that year. NBC repeated the feat the following year and "The Cosby Show" remained number one through the 1989-1990 season.

1988 - Jose Canseco of the Oakland A''s became the first player ever to hit 40 home runs and steal 40 bases in the same season. In a game against the Milwaukee Brewers, he hit his 41st homer of the season and stole two bases, #s 39 and 40. The A's won, 9-8, in 14 innings.

1989 - "Girl I'm Gonna Miss You" by Milli Vanilli topped the charts and stayed there for 2 weeks.

1989 - Top Hits

“Girl I'm Gonna Miss You” - Milli Vanilli

“Heaven” - Warrant

“If I Could Turn Back Time” - Cher

“Above and Beyond” - Rodney Crowell

1990 - PBS begins an 11 hour miniseries on The Civil War.

1992 - 20-year-old Manon Rheaume became the first woman to play in an NHL game when the Tampa Bay Lightning took on the St. Louis Blues in an exhibition. Rheaume led the Lightning onto the ice, made seven saves in one period of action and left with the game tied, 2-2.

1996 - Montreal Expos outfielder Moises Alou flied out to right field against the Atlanta Braves to make the final out in the final regular season game ever played at Atlanta-Fulton County Stadium. The Braves won, 3-1. Alou's out completed an unusual family coincidence. In the first game played at the same park on April 12, 1966, Moises’ uncle, Matty Alou, was the first batter for the visiting Pittsburgh Pirates. His father, Felipe Alou, was the Brave's first batter. Pittsburgh won that game, 3-2, in 13 innings.

2001 - Hitting his 66th round tripper of rookie Jason Middlebrow, Barry Bonds ties Sammy Sosa for the second-most home runs in a season. The Giants' left fielder also sets a Major League record with 34 road homers passing Babe Ruth (1927) and Mark McGwire (1998), who both had 32 dingers away from home.

2001 - Hitting #'s 56, 57, and 58 off Astros' rookie Tim Redding, Sammy Sosa sets a Major League record with his third three-homer game of the season. Sammy also accomplished the feat against August 9 (Rockies) and August 22 (Brewers).

2001 – The Texas Rangers’ SS Alex Rodriguez’ 48th home run breaks Ernie Banks' Major League record for most in a season by a shortstop which 'Mr. Cub' established in 1957. The homer also tied A-Rod with Frank Howard (1969 as a Senator) for the franchise record for home runs in a season. The Senators moved to Texas in 1961.

2001 - By saving New York's 5-4, 10-inning win over the Orioles at Camden Yards, Yankee closer Marino Rivera establishes a franchise single-season record with his 47th save. The previous record was held by Dave Righetti who has 46 saves in 1986.

2002 - In the last public event in 32-year old Cinergy Field, over 40,000 fans attend a softball game featuring Reds greats of the 'Big Red Machine' against an all-star team of players made up from the same era. Because the game is not affiliated with Major League baseball, Pete Rose is allowed to play and he receives a tremendous ovation from the Cincinnati fans.

2002 - The first public version of the web browser Mozilla Firefox ("Phoenix 0.1") is released.

2012 - Four genetically different types of breast cancer are identified by researchers; the study, part of the Cancer Genome Atlas, will help scientists understand how to cure breast cancer in the future.

2014 - Sulaiman Abu Ghayth, son-in-law of Osama bin Laden, was sentenced in the U.S. to life in prison for providing support to al-Qaeda after the 9/11 attacks; Abu Ghayth commented that hundreds of young Muslims would rise up as a result of his imprisonment.

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

![]()