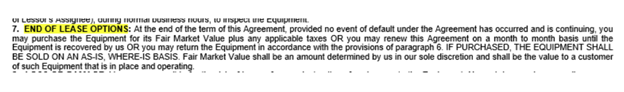

Companies who utilize Evergreen Clauses These companies use language in their lease documents regarding purchase options to confuse, perhaps to deceive, resulting in an automatic continuation for an additional twelve months of payments. Often, they win transactions with lower monthly payments because the lessee does not carefully read and prepare for the end-of-lease notification requirement (many are on ACH payments). In addition, they don't write certified letters or DocuSign in advance of the expiration. Several also require both parties to agree, which leaves the lessor basically able to decide what they will accept as "fair market value." There are three common terms on what is “fair market value,” according to Edward Castagna, CEO InPlaceAuction, LLC: The 3 terms we use are: "The inherent difference of each value is "time to sell." Forced is immediate, orderly has more time, and fair is all the time in the world. "To my experience, the term most used for true leases and capital leases, Purchase Options is Fair Market Value. "I'd like to review before I quote a price if the request involves an official appraisal report or list of assets to be appraised. Edward Castagna, CEO Coda: Ed has been extremely helpful in resolving Bulletin Board complaints received by Leasing News regarding the actual “fair market value” of the purchase option quoted by the leasing customer to the lessee. Editor. -------- Onset Financial, South Jordan, Utah ACC Capital, Midvale, Utah---This company is no longer in business, although its portfolio is being wound down, according to its owner Loni Lowder; the receivables are being collected by creditors. Lowder today is an employee, manager, Stalwart Contract Finance, Salt Lake City, Utah.

All Evergreen Clause complaints have not been satisfied, but were when the company was active. De Lage Landen, Wayne, Pennsylvania -- $34,560 in lease payments were collected illegally, although the lease contract had an Evergreen clause that if the lessee did not notify in 90 days before expiration, the payments would continue. It appears this went on for almost three years. The purchase option was 10%. What makes it even more shameless is a collection agency was involved after payments stopped, but wait, it gets worse: the lessee has settled with the funder and the funder's collection agency, but the lessor, who sold the lease to the funder, De Lage Landen (DLL,) remains in the suit as being party, or “in collusion,” with the Evergreen clause collection matter. The fact is the lessor was not directly involved in the collection of payments or received any remuneration, as well as the suit continues, now solely against the lessor. IFC Credit, Morton Grove, Illinois---This company is in bankruptcy, appeared many times in the Leasing News Bulletin Board prior to filing bankruptcy, but engaged in Evergreen Clauses, and unfortunately a recent example is a complaint to the trustee, stemming from M&T Bank lease assignment expiring and notify the lessee that they did not notify about the residual, which was a $1.00. This has happened many times with other banks who have taken over the IFC Credit Corporation portfolio. This company is no longer in business. Jules and Associates, Los Angeles, California--- Jules and Associates, Los Angeles, California---A repeat customer, who notified Jules and Associates on a lease, but was not before the 180 day expiration, so Jules and Associates instead of the 1% due for the residual ($2,308.79) charged six more payments or $40,463.94, and if 1% is not paid in this time, they will be subject to another three months. LEAF Financial Group, Philadelphia, Pennsylvania--- There have been complaints about the Evergreen Clause, including one this year for an Equipment Finance Agreement. People's United Bank, N.A., Bridgeport, Connecticut, purchased LEAF Commercial Credit. Crit DeMent became Chairman and CEO. LEAF Financial Group, Philadelphia, Pennsylvania. https://www.prnewswire.com/news-releases/peoples-united-bank-acquires-leaf-commercial-capital-inc-one-of-the-largest-independent-commercial-equipment-finance-companies-in-the-us-300490921.html Marlin Business Leasing, Mount Laurel, New Jersey---The actual SEC filings state the profit earned from Evergreen Clause, primarily from copier leases. Bulletin Board Complaints have been received about this practice in addition to the SEC financial statement filings. (9) Marlin Response to posting When the company was bought and became Pacific Western Equipment Finance (a division of Pacific Western Bank) he maintained the same position. It was noted his old company was still on the list, and a request of his "master lease" was made. "Our docs are the same as when we were with Marquette. Because we’re public now, it is very difficult to get documents released." I asked him if he could send to a broker wanting to do business with him, "Sorry, can’t forward to you or your brokerage." A search of PACER, a national index for U.S. district, bankruptcy and appellate courts brought up a number of Marquette cases, and the first one hit pay dirt: Merchants & Farmers Bank, a Mississippi Corporation versus Marquette Equipment Finance and Applied Financial. It was a similar case and while "dismissed with prejudice" (6), it had the arguments regarding the purchase option and a copy of the complete contract with a similar PPR as with Mazuma Capital: "(g) Lessee's Options at End of Initial Period. At the end of the Initial Period of any Lease, Lessee shall, provided at least one-hundred-eighty (180) days prior written notice is received by Lessor from Lessee via certified mail, do one of the following: (1) purchase the Property for a price to be determined by Lessor and Lessee, (2) extend the Lease for twelve (12) additional months at the rate specified on the respective Schedule, or (3) return the Property to Lessor at Lessee's expense to a destination within the continental United States specified by Lessor and terminate the Schedule; provided, however, that for option (3) to apply, all accrued but unpaid late charges, interest, taxes, penalties, and any and all other sums due and owing under the Schedule must first be paid in full, the provisions of Sections 6(c) and (d) and 7(c) hereof must be specifically complied with, and Lessee must enter into a new Schedule with Lessor to lease Property which replaces the Property listed on the old Schedule. With respect to options (1) and (3), each party shall have the right in its absolute and sole discretion to accept or reject any terms of purchase or of any new Schedule, as applicable. In the event Lessor and Lessee have not agreed to either option (1) or (3) by the end of the Initial Period or if Lessee fails to give written notice of its option via certified mail at least one-hundred-eighty (180) days prior to the termination of the Initial Period, then option (2) shall apply at the end of the Initial Period. At the end of the extension period provided for in option (2) above, the Lease shall continue in effect at the rate specified in the respective Schedule for successive periods of six (6) months each subject to termination at the end of any such successive six-month renewal period by either Lessor or Lessee giving to the other party at least ninety (90) days prior written notice of termination." The first option is to purchase the equipment for a price to be determined by Lessor and Lessee and requires a certified letter 180 days prior. This sounds like a fair market purchase option, but the “price to be determined” language means that the Lessor can set any price it wants. This option is illusory in my opinion. The second option is to continue the lease for an additional 12 months, the “Evergreen” period. No notice of this provision is given to the lessee either in advance of signing or prior to exercising this option. Republic Bank purchases these 12 month extensions in advance of their exercise. How would the bank know that the lessee is going to exercise this option, unless everyone knows it is the only practical option for the lessee to exercise? Republic Bank President Boyd Lindquist confirmed in a telephone call that he “buys” these extensions from Mazuma and has for quite some time. The third option is to return the equipment, but the clause is draped with the condition that the lessee has to re-lease identical equipment for a similar term. It also has 180 day certified letter requirement, and applies to the second option of 12 months, but also has the clause of an automatic six month option. So what is the point of exercising this option? At the end of this re-lease, there would be the same three identical options, so the lessee would be required to re-lease and re-lease. It’s just like Groundhog Day. Leasing News is working on obtaining information on other companies so named to add to the list, including follow-up on the master lease for Pacific Western Equipment Finance. If you have a copy, please send and will keep your name “off the record.” ((7) See for Copy of Filing, including contract.) Mazuma Capital Corp, Draper, Utah Several routie "end of lease agreements, as alleged in Unified Container and Anderson Dairy (1) "8. The basic scheme involves the inclusion of a purchase, renewal, return (“PRR”) provision in the lease. The lessor assures the customer they will be able to purchase the equipment at the end of the initial term in the lease for a reasonable or nominal price. Often, the lessor promises the equipment can be purchased at a fixed percentage of the total amount financed. However, at the end of the initial lease term, the lessor refuses to honor the agreed upon purchase price or negotiate in good faith regarding a purchase price, but instead, insists the lease automatically renews for an additional term (usually twelve months). 9. The inclusion of the purchase and return options in the lease are entirely illusory and intended only to give the customer the false impression that it can exercise any of the three options at the end of the initial lease term, when in fact, the lessor will only allow an automatic renewal at the end of the initial lease term.) There are other exhibits. This case was settled "out of court." H. Jared Belnap, President & CEO, Mazuma Capital Corp., takes exception on beingon the Evergreen list. His full letter and Leasing News Response is at (5). Mazuma Capital was acquired by Onset Financial, South Jordan, Utah. Onset Financial, South Jordan, Utah --- Onset contract, which contained: ((8) See for Copy of Onset Contract with PPR purchase option.

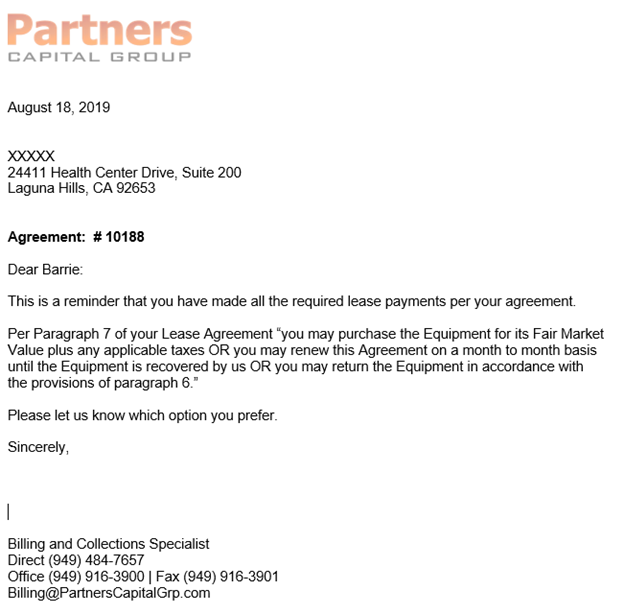

Dorran Sampson, then Vice-President/Broker Relations, Marquette Equipment Finance, now Vice President Broker Relations Pacific Western Equipment Finance told Leasing News when the company was bought and became Pacific Western Equipment Finance (a division of Pacific Western Bank) they maintained the same position as Marquette. "Our docs are the same as when we were with Marquette. Because we’re public now, it is very difficult to get documents released." I asked him if he could send to a broker wanting to do business with him, "Sorry, can’t forward to you or your brokerage. Leasing News has obtained a copy of a Pacific Western Equipment Finance agreement, and confirms the same procedures as their former company Marquette utilized: “14. LESSEE’S OPTIONS AT END OF INITIAL PERIOD. At the end of the Initial Period of any Lease, Lessee shall, provided at least one-hundred-eighty (180) days prior written notice is received by Lessor from Lessee via certified mail, do one of the following: (1) purchase the Property for a price to be determined by Lessor and Lessee, (2) extend the Lease for twelve (12) additional months at the rate specified on the respective Schedule, or (3) return the Property to Lessor at Lessee’s expense to a destination within the continental United States specified by Lessor and terminate the Schedule; provided, however, that for option (3) to apply, all accrued but unpaid late charges, interest, taxes, penalties, and any and all other sums due and owing under the Schedule must first be paid in full, the provisions of Sections 6(c) and (d) and 7(c) hereof must be specifically complied with, and Lessee must enter into a new Schedule with Lessor to lease Property which replaces the Property listed on the old Schedule. With respect to options (1) and (3), each party shall have the right in its absolute and sole discretion to accept or reject any terms of purchase or of any new Schedule, as applicable. IN THE EVENT LESSOR AND LESSEE HAVE NOT AGREED TO EITHER OPTION (1) OR (3) BY THE END OF THE INITIAL PERIOD OR IF LESSEE FAILS TO GIVE WRITTEN NOTICE OF ITS OPTION VIA CERTIFIED MAIL AT LEAST ONE-HUNDRED-EIGHTY (180) DAYS PRIOR TO THE TERMINATION OF THE INITIAL PERIOD, THEN OPTION (2) SHALL APPLY AT THE END OF THE INITIAL PERIOD. At the end of the extension period provided for in option (2) above, the Lease shall continue in effect at the rate specified in the respective Schedule for successive periods of six (6) months each subject to termination at the end of any such successive six (6) month renewal period by either Lessor or Lessee giving to the other party at least thirty (30) days prior written notice of termination” (10) (Also see Marquette listing) (10) http://leasingnews.org/PDF/PacificWesternEquipmentFinance.pdf Was formerly Marquette Equipment Finance. BofI Acquires Certain Assets of Pacific Western Equipment Finance. “The Bank acquired certain assets and will operate on an ongoing basis the equipment lending operations of EQF as follows: The Bank acquired approximately $140 million of equipment leases diversified across 36 states and Canada and over 50 industries The Bank will retain approximately 25 existing employees, including EQF’s entire senior management team The EQF team will become a part of the Bank’s C&I lending group and continue to conduct equipment lending operations at existing loan production and servicing office in Utah Partners Capital Grouputilizes theWintergreen Clause, an offshoot of the Evergreen Clause. Instead of an automatic 12-month renewal clause, the payments continue until the purchase option is received or release of the contract by the return of the equipment in satisfactory order is confirmed by the lessor. Pacific Capital Group responded in August 2020: “Here: is the language in our docs and below that the letter we mail every customer at the end of term. We don't require any notification or any kind nor do we charge any processing fees:”

In reviewing this, Leasing News responded, "It is not mailed 90 days in advance of the termination, as well as it does not state what the "fair market value" is, or how the "fair market value" is obtained. It is basically a “Wintergreen lease termination." The company response:

For those customers who do still use the equipment and do not want to trade it in, our asset department will reach out to the original vendor and maybe a few others to get a value on the asset. Customer has the option to purchase the equipment at the “Fair Market Value” or simply return it. 90% of all our business comes from vendors, the remaining 10% is repeat customers. We must do all we can before, during and after every lease and loan to make sure all our customers are happy because if we have just one upset customer for any reason, the vendor is going to hear about it and we do not want to lose a vendor program over a billing issue. Republic Bank, Bountiful, Utah Purchases and participates in extended Evergreen clause agreements. They are legal in all states, except four states require advance notification be given to the lessee regarding termination of the lease and its residual (Four states: New York Rhode Island, Texas, Illinois (In Illinois, Consumer law, but may affect commercial, especially a proprietorship, partnership or personal guarantee)" Tetra Financial Group, Salt Lake City, Utah Several routine "end of lease agreements, as alleged in Unified Container and Anderson Dairy (1) “22. Mazuma Capital is associated with Republic Bank and obtains financing for its leases containing PRR provisions from Republic Bank. 23. Like what took place at Amplicon, Inc., the PRR scheme utilized by Matrix, Applied Financial, LLC, Mazuma Capital, Tetra Financial Group, LLC and others has begun to be exposed through litigation and negative press. See Deseret News (2) articles attached hereto as Exhibits B (2) and C. (3)” Here is a case where New York courts threw out the Evergreen Clause as not legal in New York, even though venue appears to be Utah. (4)) (1) 36 main pdf (2) Deseret News (3) Exhibit C (4) Salon Management case (6) Order to Dismiss with Prejudice (7) Copy of filing, including contract (8) Copy of Onset Contract with PPR purchase option

Companies who notify lessee in advance of lease expiration

|

|

|