Final---Five Point Capital, San Diego, California

Bulletin Board Complaint Up-Date

Financial Pacific, Federal Way, Washington

Co-Bulletin Board Complaint

Leasing News was informed yesterday by Amy Quadagno, president Commercial Technologies, Inc., that the title was coming to her and no money is required. It looks like this will be resolved when the title is received.

Attorney Donald R. Coblentz of Dunn, McGee & Allen, Worcester, Massachusetts forwarded to her this email:

"Pursuant to our conversation of today, Five Point Capital considers this matter closed and will not be seeking any additional funds..."

Sincerely

,Michael Losey | Director of Portfolio Management

Five Point Capital

From Amy Quadagno to Leasing News:

"I am so glad you assisted with this. BTW – it was a salesman from Paramount Leasing that referred you when I told him to go away b/c of my experience with Five Point.

"I am almost ready to call him back and lease some new equipment:)"

================================

Five Point Capital, San Diego, California

Bulletin Board Complaint Up-Date

Financial Pacific, Federal Way, Washington

Co-Bulletin Board Complaint

by Christopher Menkin

2005 Ford E-250

It is the role of Leasing News to determine if the complaint is legitimate and attempt to act as an ombudsman.

This concerns the lease of a 2005 Ford E-250 van for 48 months accepted March 23, 2007 that expired in March, 2011 and was subsequent to an Evergreen Clause of 12 months in addition without notice. As stated in the compliant by Commercial Technology attorney Donald R. Coblentz,” I understand that (Financial Pacific), without any basis or notice to my client, caused the vehicle’s plates and registration to be cancelled by the Massachusetts Registry of Motor Vehicles. As the result of this unwarranted action, my client is unable to re-register or use the vehicle despite being held financially responsible for on-going rental payments.”

After two and a half months of frantic telephone calls and other communication to resolve the problem to both Five Point Capital and Financial Pacific, the lessee Commercial Technology hired an attorney, and then without a response, contacted Leasing News, who in turn contacted both Five Point Capital and Financial Pacific to learn who was holding the title and to help the lessee who was obviously being damaged financially for not having use of the vehicle for thier business.

This was the response from Financial Pacific:

"My understanding is that this complaint was resolved by Five Point right away after learning of it from FinPac and Leasing News. Their recent move of their offices apparently affected communication and led to the client’s frustration. FMV renewals and the ‘evergreen’ issue cannot be resolved with a broad brush approach. Individual lease terms and circumstances are unique and not always apparent to outside parties. Leasing News’ spotlight on the issue however has been beneficial to our industry. It is important that we self regulate and the transparency you bring to the issue will help us do just that more effectively. The accelerating attempts by various States to regulate our industry is disconcerting. Hopefully we can get it right and eliminate the need for government to keep us in line."

Paul Menzel, CLP, President, Financial Pacific

The specific questions of who had the title and help in registering the vehicle was not answered.

This email was received by Leasing News from Five Point Capital:

"The letter you forwarded to me from Mr. Coblentz dated June 1st was also received in our office on June 20th. The delayed delivery time was most likely related to the letter being sent to our old address and then forwarded to our new location.

"Upon receipt of Mr. Coblentz’s letter our portfolio management department proceeded to look into this matter further. We have had a conversation with Mr. Coblentz and the matter has been resolved to his satisfaction. "

Greg Wells, President, Five Point Capital

The original lack of response to Amy Quadagno, president

Commercial Technologies, Inc. inquiries were not addressed, nor who had the title nor who was helping to get the vehicle registered before Leasing News contacted Five Point Capital and Financial Pacific. For these reasons the complaint is legitimate.

This also was the second complaint involving the use of Evergreen clause by Five Point Capital. In response to the previous one, Mr. Wells stated:

"We are reviewing our processes and procedures in an effort to better value assets and to better communicate our findings to customers."

This is a lease that expired in March, 2011 with calls up to the date that Leasing News got involved. It should have been resolved months before and the registration of the vehicle should have been made to the creditor regardless of the residual, especially if a twelve payment structure is the claim.

The Greg Wells response to the date of the attorney letter as well as Paul Menzel, CLP, bringing up the company move, misses why the lessee was forced to obtain an attorney. The date of the letter is June 1 and evidently made its way to a new address, if that is the case. If this was brought to the attention by Leasing News June 22, it is difficult to believe it took that long to forward a letter. Perhaps 3-5 days from Massachusetts to California, and 3-5 days to forward, or let’s say 10 days. That would be June 15.

More importantly, what about the calls to the company by the customer to both Five Point Capital and Financial Pacific since the lease expired?

At press time, the lessee who made the complaint for Leasing News to investigate does not appear to have the van registered or has any time line or has finalized whether there are damages to her business to be involved in the complaint. The question who cancelled the registration,or the handling of the pink slip was never answered, but what was obvious to me is that it was more important to claim 12 monthly additional payments than to resolve a customer’s complaint.

Five Point Capital, San Diego, California

Bulletin Board Complaint

http://leasingnews.org/archives/May2011/5_04.htm#fivepoint_bbc

Five Point Capital, San Diego, California

Bulletin Board Complaint

http://leasingnews.org/archives/Jun2011/6_24.htm#fivept_complaint

============================

Five Point Capital, San Diego, California

Bulletin Board Complaint

by Christopher Menkin

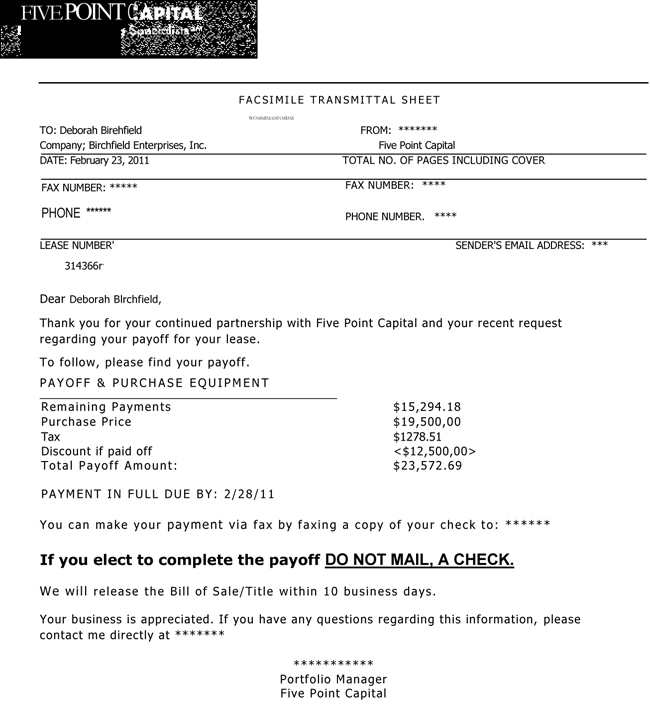

Here is the basis of the complaint, a Five Point invoice regarding a gas and a diesel Altec Industries wood chipper sent to Deborah Birchfield, President, Birchfield Enterprises, Riverside, California, in the tree service for 15 years:

(sender name and phone number deleted)

The remaining payments do not match the leasing payments and sales tax for the "Evergreen Clause" and may include other charges.

The discount is the approximately nine remaining payments, including sales tax, from the “Evergreen Clause" of 12 months extended payments. Birchfield Enterprises had made three more monthly payments than the original lease contract.

This appears to be a standard procedure at Five Point Capital.

While the issue starts at what the residual is, whether it was "fair market value" or a $1.00, the equipment was never worth 50% of the value. While the complaint may include whether it is or isn’t, the actual complaint also includes two others that over ride the claim of the signer of the documents.

It appears the routine by Five Point Capital is to evoke the "Evergreen Clause" calling for an additional 12 payments. It is their routine. While they have already made from 15% to 18% commission on the transactions from Financial Pacific ( confirmed), where they discounted the transaction, including charging a $550 documentation fee, it does not appear to be an "operating lease" or "true lease" for tax purposes as discounted to Financial Pacific non-recourse. as well as the profit was high, including a $550 documentation fee. Perhaps the most important is the claim of a $19,500 purchase option, plus sales tax. There does not appear to be any “due diligence” to find the actual cost of the equipment today. As important, it appears the routine is to go after the twelve months payments.

Leasing News first contacted Five Point to find the salesman. Five Point never gave any information except he had worked for the company. They did not know when. Readers gave us Chad Faust telephone number was we contact him. He had worked for Five Point Capital from December 2004 – March 2007 (2 years 4 months). He now is in a different marketplace, Fortune 500 companies or companies with audited financial statements for large dollar leases, he explained. He did not remember the transaction. He said there should be a residual form, and to ask Five Point Capital for a signed copy, if it is not in the documents provided by Birchfield Enterprises. He said the equipment or not, would not be worth the $19,500 as they originally were sold for $21,000 each and this would be 50%.

Leasing News contacted the president of Five Point, Greg Wells, who said he would get back to us.

Let's assume that the residual is a not a $1.00 despite 31 pages of signed documents and not one is a residual form, a lot to sign and look for what a salesman told you over the telephone.

Leasing News contacted Altec Industries, who manufactured the equipment and sold it, who told Leasing News a new emission laws made the equipment obsolete. They are a national company with a financing division, Altec Capital, who are members of the Equipment Leasing and Finance Association.

A call to the executive office found Glenn Maier, Manager for Altec Direct Environmental Products Division, who also told Leasing News this model was no longer compliant with emissions laws and requires a new engine, which would cost $12,000. Asked what the 2005 Chipper would be worth after putting in a new engine, he answered, "$12,000."

Leasing News talked with Deborah Birchfield, who confirmed this fact and stated the company had a compliance certificate until 2012 before putting in a new engine. She sent a copy of the compliance document. This information may be have been given to Greg Wells, and to insure that was, a copy of the compliance form was emailed to him by Leasing News.

Leasing News requested a statement from Greg Wells, President, Five Point Capital:

"First, I’d like to clarify a comment in your message to me. I did not say there was ‘no fair market value document’. To restate what was said in my earlier response, at the time this lease originated in 2006, our lease agreement, signed by the customer, stated that this was an FMV lease unless there is a separate purchase option agreement that stipulates otherwise. This lease did not have the mentioned addendum. The contract also had a notice provision, which was not met, and as a result called for additional payments. The customer called for a payoff and one was provided.

"As I mentioned before, we are an evolving organization constantly looking to improve. The manner and process we used in determining fair market value in this case shows this is an area that has opportunity for improvement. We are reviewing our processes and procedures in an effort to better value assets and to better communicate our findings to customers.

"I cannot comment on the ‘intention’ of the original lease structure, the pricing or other matters since I was not here at that time. The person who did the lease (who has not worked here since 2007) states he does not remember the transaction. After the customers call to us, she subsequently filed a BBB complaint. We take customer satisfaction very seriously and after her elevated concern twice attempted to reach her in an effort to learn more and see what can be done. We also heard from you, at which point I called Mrs. Birchfield to hear her concerns first hand. My belief is that it's more productive when people work directly with each other. We had what I believed to be a productive call and I was under the impression we had resolved her issue. It now appears that your role has shifted from raising a compliant to more of “negotiator”. I can appreciate your intention to help. However, my preference is to work out customer issues directly with the customer and will be once again reaching out to her on Monday in an attempt to resolve her concerns."

Leasing News role is as an "ombudsman" in "negotiating" or "mediating" or "resolving" a complaint, similar to what printed newspapers and TV stations may have as "Action Line."

Most complaints here involve keeping an "advance rental" when a lease does not happen, or a residual and "Evergreen Clause," which Leasing News has seen on $1.00 purchase options as well as promises made by a salesman but not in the documentation sent back to the lessee.

This complaint centers on the "abuse" of the Evergreen Clause, in my opinion, and its obvious use as there appears to a lack of effort to find the value of the equipment, but to use the 12 month payment to bully the client.

Mr. Wells explains in his statement, he got involved, called Deborah Birchfield, and the latest has been to offer to "waive" the residual, but to keep the three extra payments made on the lease under the "Evergreen Clause," legal in the State of California.