![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

Credit Manager www.pawneeleasing.com |

3. Fort Collins-Loveland, Colo.

Well-Being Index score: 71.1

Pct. adults with college degree: 44.7%

Pct. smokers: 16.9%

Median household income: $55,890

“Fort Collins residents are among the most content American workers. More than 66% of those surveyed said they felt treated like a partner at work, a higher percentage than in all but two metro areas. Much of the work in the area demands high skills and education, which could explain people’s satisfaction. The area is home to a large number of high-tech manufacturers, as well as Colorado State University, a major research institution. Residents, too, were among the healthiest in the country — the area had one of the lowest obesity rates in the nation. Residents also were more likely than those elsewhere to practice healthy behaviors, with more than 61% of people exercising regularly, the second highest rate in the nation. Last year, 58.6% of people surveyed in the Fort Collins area stated they were thriving, more than in all but a few other metro areas.”

http://247wallst.com/special-report/2014/03/25/americas-most-content-and-miserable-cities-2/3/

Wednesday, April 2, 2014

Today's Equipment Leasing Headlines

Ascentium Capital and Element Financial Merge!

Classified Ads---Senior Management

Tom Kelly Passes Away

WorldLeasingNews Has Ceased Operation

(Not an April Fool’s Joke: www.worldleasingnews.com)

Sudhir Amembal London May 6 & 7

Operating Leases-Maximizing Profits, Minimizing Risks

LEAF Financial Income Fund III Complaints

10K Gives Numbers

Classified Ads---Help Wanted

Letters?---We get eMail!

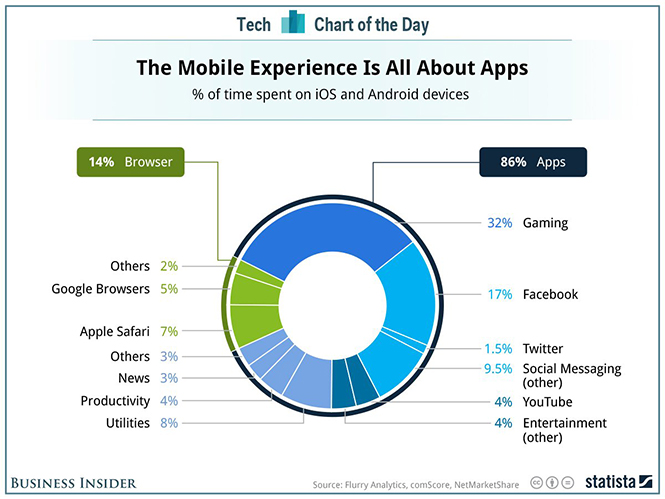

The Mobile Experience is All About Apps

Spring 2014 CLP Circular Now Available

Advantage Funding Brings New Finance Program

to “Buy Here- Pay Here” and “Lease Here-Pay Here” Lenders

Hitachi Capital Canada Acquires CLE Canadian Leasing Ent.

Element Multi-Year Program Agreement w/Celadon Group

and Acquires US $53 million Lease Portfolio

Dutch Shepherd Mix

Toronto, Canada Adopt-a-Dog

Classified ads—Back Office

News Briefs---

Federal Reserve Board Approves Umpqua Sterling Bank Acquisition

Fed Reserve Board Approves PacWest Bank CapGen Capital Acquisition

CIT Study Finds U.S. Middle Market Energy Executives Upbeat

Boeing blames pilots for Asiana 777 crash; airline faults software, too

Windows XP: Old Platforms Die Hard, Security Risks Live On

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

You May have Missed---

SparkPeople--Live Healthier and Longer

Poem

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send to a colleague and ask them to subscribe.

We are free.

[headlines]

--------------------------------------------------------------

#### Press Release#############################

Ascentium Capital and Element Financial Merge!

Kingwood, Texas; Toronto, Canada – April 1, 2014 – Equipment finance industry titans Element Financial Corporation (TSX:EFN) one of North America’s leading equipment finance companies, and Houston-based Ascentium Capital Corporation, America’s fastest growing independent equipment lessor, announced today they have entered into a definitive merger agreement. The combined firm will employ Ascentium’s leading edge information technology platform and Element’s demonstrated ability to raise low cost debt to fund the expanded operation. Each operation will retain their own branding, but will merge into a newly formed U.S. corporation Ascentium-Element Information, Operations, and Underwriting and will trade under the stock symbol AEIOU. Separately, AEIOU has announced execution of a confidential non-public letter of intent to acquire the North American equipment finance operations of GE Capital. The transaction includes all rights to the name GE Capital in the North American equipment finance markets and copyrights to all combinations of vowel abbreviations used in the equipment finance market. GE executives declined to comment citing confidentiality of the agreement.

CEO Tom Depping

Tom Depping announced he has bought Bank of America, buying the stock of a well-known BofA investor who said he has had it with banking. He said he knew how he felt.

Steve Hudson, Chairman/CEO

Steven Hudson, FCA, B.B.A., Chairman & CEO of Element stated he had signed an agreement not to buy a bank and compete with Bank of America. He also offered Depping a job at AEIOU, but he responded he would be too busy making changes to make Bank of America more successful. Hudson has his eye on JP Morgan Chase and reportedly has hired fellow Canadian businessman Kevin O’Leary Montreal, Quebec, Canada] most prominently known for his leading role on NBC’s hit show Shark Tank had agreed to write a non-compete agreement. Industry sources report O’Leary had reached out to fellow Shark Tank investor Mark Cuban and the two tentatively arranged for a charity six-round shoot-out between Hudson and Depping to resolve the dilemma. The shoot-out will be held at the American Airlines Center, the home of Cuban’s Dallas Mavericks. The contest will be broadcast live on Cuban’s HDTV cable network AXS TV and netcast by satellite by the TheGadgetProfessor.com via Multimedia Communications (Scottsdale, AZ) to various of Cuban’s Landmark Theatre locations. Ticket proceeds will be contributed to a charity of the runner-up's choice.

Joe Rice, President of Rice Restaurants, Inc. and operator of two Papa Murphy’s Take ‘n’ Bake Pizza Shops, announced that if he can recover his disputed interim charge from Balboa Capital, he will contribute a like amount of pizzas for the event.

About Element Financial Corporation

With total assets in excess of $4 billion, Element Financial Corporation is one of North America’s leading equipment finance companies. Element operates across North America in five verticals of the equipment finance market – Commercial Finance, Vendor Finance, Aviation Finance, Railcar Finance and Fleet Management.

About Ascentium Capital Corporation

Ascentium Capital, as a direct lender, specializes in providing equipment financing and leasing solutions that drive growth and profit for equipment manufacturers, distributors as well as direct financing to businesses nationwide. The company is backed by the strength of leading private investment firms Vulcan Capital and LKCM Capital Group, LLC. For more information, please visit AscentiumCapital.com.

PracticalPranks initiated this transaction and acted as financial advisor to no one. Closing is subject to routine and customary denials and misstatements. Our boat sank notwithstanding all applicable safe harbor provisions.

Forward Looking Statements

This release includes forward-looking statements regarding Element, Ascentium, AEIOU and the wild-alphabet bunch and their respective businesses. Such statements are based on the current expectations and views of future events of management, with or without eyes wide open. In some cases the forward-looking statements can be identified by words or phrases such as “may”, “will”, “expect”, “plan”, “anticipate”, “intend”, “potential”, “estimate”, “believe”, "think", "wonder", "hope and pray", "guess", or the negative of these terms (such as "we really blew it", "what were we thinking", "OMG", and "holy-$#@!", or other similar expressions intended to identify backward-thinking forward-looking statements. The forward-looking events and circumstances discussed in this release may not occur and could differ materially as a result of known and unknown risk factors and uncertainties, including the recent legalization of recreational marijuana in the states of Colorado and Washington, or simply the author fessing up and admitting this is all a prank. Risks include risks regarding the equipment finance industry, economic factors and many other factors beyond the control of anyone foolish enough to believe this release. No forward-looking statement can be guaranteed other than tonight's weather forecast of darkness followed by partial light in the morning breaking into a full dawn (credit to Al Roker, Today Show). Forward-looking statements and information by their nature are based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statement or information, or different from what we will actually report. A discussion of the material risks and assumptions associated with this outlook can be found in various financial filings all of which have been filed on SEDAR, EDGAR, and FINDMEIFYOUCAN. Accordingly, readers should not place undue reliance on any forward-looking statements or information. Except as required by applicable securities laws, forward-looking statements speak only as of the date on which they are made and whoever wrote this in whatever state of mind undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, wild dreams, bald-assed guesses or otherwise. If you have read this far you have too much time on your hands and should go sell something.

#### Press Release #############################

The above was sent to Leasing News by long time reader David Rabinovitz… drabinovitz@gmail.com

[headlines]

--------------------------------------------------------------

Classified Ads---Senior Management

(These ads are “free” to those seeking employment or looking

to improve their position)

Tampa, FL |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

|

[headlines]

--------------------------------------------------------------

Tom Kelly Passes Away

“Long time lessor- Tommel Financial Services, Inc., Tom Kelly died March 31, 2014. I worked with him for 10 years during my tenure at Padco Financial Services, Inc. I believe he last resided in Naperville, Il.

His son Dustin will be releasing the obituary.”

Bill Griffith, Portfolio Manager

TAB Bank

[headlines]

--------------------------------------------------------------

Has Ceased Operation

(This is not an April Fool’s Joke: www.worldleasingnews.com)

Leasing Icon Sudhir Amembal told Leasing News he is closing World Leasing News to concentrate more on his lectures, private consulting, and conference appearances, working out of Portland, Oregon. Many may not know that Sudhir has been involved in worldwide animal protection, serving as consultant to many animal rights and humane societies. For the past year he has also been pro bono CEO of FIAPO, which is the apel animal protection organization in India.

Simply he enjoyed the “on line news,” along with co-publisher Lisa Rafter, former editor of The Monitor, but his main occupation has gotten very busy.

Leasing News will continue to publish Mr. Amembal’s announcements of his lectures, conferences, and appearances, as he has contributed very much to the leasing industry as well as other endeavors.

This was posted on his web site:

“Thank You – World Leasing News Wishes You All Continued Success--

“Effective April 1, 2014, World Leasing News (WLN) will cease publishing the daily/weekly e-newsletter and accompanying website, www.worldleasingnews.com.

“Since 2008, WLN has been a daily e-newsletter with industry news, information and articles. In addition, WLN has published special reports, leadership profiles & interviews and other timely, relevant information.

“Sudhir Amembal and Lisa Rafter, the co-publishers of World Leasing News, recently concluded that the industry has a plethora of daily news sources as well as several websites and printed publications dedicated to equipment leasing and finance. Thus, there has been duplication of efforts and information that perhaps is no longer necessary for industry professionals.

“Sudhir and I have enjoyed serving the equipment leasing and finance industry immensely over the past several years,’ said Lisa Rafter, WLN co-publisher. “We both have been in the industry for over 25 years and have developed many important relationships. Publishing WLN provided us an opportunity to add value to the industry through our combined experience as well as to stay connected to industry professionals. We will miss publishing WLN but we are confident the other industry publications will continue serving the industry with valuable, relevant news and information.”

“Lisa Rafter will continue to publish digital and print magazines through her company, R&W Publishing Associates. She currently publishes Newsline magazine for National Equipment Finance Association (NEFA) and Commercial Finance magazine for International Finance Association (IFA).

Sudhir Amembal, through his company Amembal & Associates, will continue to provide lease training, consultancy and publications to leasing economies throughout the world, as he has done since 1978.

“WLN would like to thank its readers, subscribers, and advertisers for all of their support over the years – we greatly appreciate it.”

[headlines]

--------------------------------------------------------------

*****Announcement***************************************

Sudhir Amembal London May 6 & 7

Operating Leases-Maximizing Profits, Minimizing Risks

London

May 6 & 7, 2014

Why Operating Leases?

The operating lease is here to stay! It is increasingly being offered in emerging markets. It is evolving to “managed services” in mature markets. All of this dispels the myth that the forthcoming accounting changes will adversely impact the product – this and much more will be covered in the seminar.

Why Amembal & Associates?

Amembal & Associates is the world’s foremost authority in lease training, consultancy and publications. Mr. Sudhir Amembal, its CEO, has been at the helm of the company since he co-founded it in 1978. With regards to training, over 75,000 leasing professionals have attended varied seminars/conferences held throughout the world; and, with regards to publications, the firm has authored and published 16 industry best-sellers.

In particular, having to do with operating leases, Mr. Amembal authored “A Complete Guide to Operating Leases”, the only publication of its kind. Mr. Amembal recently organized the first-ever conference solely dedicated to operating leases. This was held in November, 2012 – it was a sell-out! Based on feedback received, it was one of the best leasing conferences ever held. The conference was successfully repeated in November 2013.

For detailed brochure and registration form:

Contact Kelly Farnham at kelly@amembalandassociates.com

*****Announcement***************************************

|

[headlines]

--------------------------------------------------------------

LEAF Financial Income Fund III Complaints

10K Gives Numbers

Leasing News for several years has been receiving complaints from investors in LEAF Financial (the management firm started LEAF Commercial Credit) and the fund is part of Resource America.

This is from the 2013 Year-end 10-K:

“To date, limited partners have received total distributions ranging from approximately 25% to 35% of their original investment, depending upon when it was made. Our General Partner is working to maximize the amount that can be distributed to limited partners in the future. Future cash distributions are not guaranteed and are solely dependent on our performance and are impacted by a number of factors which include lease and loan defaults by our customers, accelerated principal payments on our debt facilities required per our agreements, and prevailing economic conditions. Distributions to our limited partners were made at a rate of 2.0% of their original capital invested in 2012. As the shrinking portfolio could no longer support a 2% monthly distribution, beginning with the December 2013 distribution check, which our investors received in January 2014, the regular monthly distributions were lowered to 1%.

“Our General Partner has deferred our payment of fees and reimbursement of expenses totaling approximately $18.1 million from inception through December 31, 2013, in order to preserve cash for us. Additionally, our General Partner waived approximately $600,000 in management fees for the 12 month period ended December 31, 2013 and has waived approximately $6.0 million on a cumulative basis. The General Partner has also waived all future management fees.

“At the time of our commencement, the United States economy was experiencing strong growth, an abundance of liquidity in the debt markets, and historically low credit losses. However, it is widely believed that the United States economy over the past few years has suffered through the worst economic recession in over 75 years. The recession has been severe and with broad consequences. Many well-known major financial institutions failed and others had to be bailed out. Unemployment soared to generational highs and has remained at such levels. Recently, banks became much more reluctant to lend, and when they did, it became more expensive to borrow. If existing loans came up for renewal and were extended, they were written for reduced amounts and at higher interest rates. Also, lenders insisted on ever-tighter covenants around delinquencies and write-offs that made it more difficult to remain in compliance. As our primary credit facilities matured and we had to extend, renew or refinance them, our costs increased. Most significantly, we had to reduce our debt on the leases previously financed. The money to pay down the debt had to come from lease payments and those amounts were no longer available to re-invest in new leases. The lenders' higher fees and costs also had to be paid from funds that were then unavailable to re-invest in new leases. All of this happened while losses increased. The small businesses that represent our typical leasing customer have suffered through the recession. The increase in write-offs created an additional burden on the cash available to re-invest.”

http://www.hispanicbusiness.com/2014/

3/31/leaf_equipment_leasing_income_fund_iii.htm

“Our commercial finance operations underwent significant restructuring and recapitalization during 2011. These transactions provided substantial amounts of equity and debt financing to the lease origination and servicing platform, which is now held by LEAF Commercial Capital, Inc., or LEAF. Our subsidiary, LEAF Financial Corporation, retained the partnership management operations. As a result of the recapitalization and subsequent equity issuances, our equity interest in LEAF was reduced to 15.7% on a fully diluted basis, and we have deconsolidated LEAF from our financial statements as of November 16, 2011. We currently account for our interests in LEAF as an equity method investment. Following November 16, 2011, the equity losses we recorded from LEAF reduced our investment to zero. In addition, we recorded provisions for credit losses of $6.6 million during 2013 on our receivables due from three of our commercial finance investment funds based on reductions in their projected cash flows.”

--

page 21

“In April 2013, under the terms of the partnership agreement, we entered the liquidation phase, are now unable to acquire new assets, and have commenced our orderly wind down. We are expected to continue our operations until all of our leases are collected and debts are paid, at which time any excess funds will be distributed to the partners.

“Gain on Deconsolidation of LEAF. In November 2011, due to the additional investment in LEAF by a third-party private investment firm, we determined that we no longer control LEAF and deconsolidated it for financial reporting purposes. We recorded a $7.0 million gain to bring the value of our negative investment in LEAF to zero. In addition, based on a third-party valuation, our investment in LEAF was valued at $1.7 million. The valuation utilized several approaches, including discounted expected cash flows, market approach and comparable sales transactions to estimate the fair value of our investment in LEAF as a result of the transaction. These approaches required assumptions and estimates of many critical factors, including revenue and market growth, operating cash flows, market multiples, and discount rates, which were based on existing economic environment and credit market conditions. Accordingly, we recorded a total gain of $8.7 million in conjunction with the deconsolidation of LEAF.”

--

10-K page 32

Resource America 2013 10-K (approximately 150 pages)

http://www.leasingnews.org/PDF/RAIInvestorRelationsSEC_42014.pdf

Resource America 4th Quarter/Year-end Press Release

http://www.leasingnews.org/PDF/RAIInvestorRelations_42014.pdf

Articles on LEAF and Resource America

http://leasingnews.org/Conscious-Top%20Stories/leaf_resource.html

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

Credit Manager www.pawneeleasing.com |

[headlines]

--------------------------------------------------------------

Letters?---We get eMail!

Intro & Two Columns: Interim Rent: Proper Accounting Function for

Short Term Advances --- Or Is It a Scam?

http://leasingnews.org/archives/Mar2014/3_31.htm#introduction

“Interim rent is not a scam, if set up properly. I did this for customers who needed delivery by a certain date, but also required the payments to be set up on a specific date each month.”

Craig Stewart

Senior Vice President of Financial Solutions, a Division of Reunion Financial Services Corporation

------

“Interim rent is absolutely appropriate to match outflows of cash. If a company lays out cash and does not get a payment for 30 days and if interest was not figured in arrears, the leasing co.’s yield will change (lower).

“Do not confuse that with a lease that has progress payments and the lease starts with the first outflow of cash. There may be a higher yield as the lease would start and the leasing company has not paid out all the cash.

“Yield is yield. Although interest rate, in most leases is not disclosed and many buy payments (mostly small ticket clients). Today, clients always ask what is the rate and many figure out that rate. Therefore, inflows and outflows whether disclosed to a client or they figure it themselves, translates to a rate. That rate may be disclosed, not disclosed, or the client may calculate that rate himself/herself. Regardless, a leasing/finance company is entitled to the agreed return. Everyone pays their first mortgage payment, interest only, and never complains. That raises yield, albeit ever so slightly due to the length of the mortgage.

“Good transactions are what the lender and client agree to and are happy with; that is, whether a lease or loan, whether there is interim rent, prefunding fees, etc. What is important is full disclosure not interim rent that very well may be justified. Before one should focus on interim rent, I would look at usurious doc, termination, evergreen, and origination fees. There are probably more issues there. One can argue those fees raise yield. Others will say, they are real costs to process. In any case, it all boils down to fair charges, fees, and rate.

“There are costs to book a lease and there are costs when a company pays out money before receiving a payment. That is, unless that outlay is figured in the payments.”

Allan Levine

President

alevine@madisoncapital.com

-----

Customer Satisfaction and Operational Considerations for Interim Rent

“There were two excellent articles regarding the definition and legal issues surrounding interim rent. While these addressed the topic of potential abuses of interim rent, we have used this where it can be a benefit for both the lessor and customer.

“The most common situation is for customers that have multiple lease schedules installing over a period of time. We often had nation-wide customers that had hundreds of lease schedules. These customers had office and IT equipment in their distributed locations. Rarely did all the equipment have the same installation date due to logistical reasons or new locations being added over time.

“To avoid the administrative burden of multiple invoices going out on different days throughout the month, we consolidated these leases to the first of the month. This simplified billing to a single invoice, which benefited both the customer and our servicing team. To assist the customer in their internal cost allocations, they were able to add information such as their asset ID or cost-center to their invoice. We billed many of these electronically on a worksheet.

“Most of these accounts were large customers, such as Fortune 500s, transportation and logistics companies as well as school systems. We did not hide our interim rent process; we actually explained it in detail as a customer service benefit. Rarely did we have issues with the customer as they understood the administrative benefits. The interim rent helped offset our additional costs in administering these multiple schedule leases.

“The second situation is bundled leases that included vendor maintenance. In a Captive environment, we often included a service component in our lease. The vendor’s service contract was based on an annual contract starting on the first of the month, which also included a stub period of maintenance. The vendor’s rationale was the same as the lessor as it simplified large account administration. It was necessary to align our billing dates with the vendor which was done with an interim rent period.

“We did have guidelines for applying interim rent. We limited it to FMV option leases to avoid any apparent usury issues with the customer. Also, we capped the number of days of interim rent. If a lease started within the first few days of the month we would not bill interim rent. We rarely did quarterly invoicing with interim rent and we addressed these on a case by case basis. And with respect to bundled vendor maintenance, there had to be a clear understanding with the vendor of when and how much service based interim rent would be due.

“Interim Rent can be a significant income enhancement; however, when used judiciously and transparently, it can be a benefit to customers and lessors.”

Marc Gingold

Marc Gingold has had extensive Senior Management and Operational responsibilities, most recently at Canon Financial Services and Océ Financial Services.

marc_gingold@yahoo.com

-----

Kevin M. Collins, CLP, Passes away

http://leasingnews.org/archives/Mar2014/3_28.htm#collins

“He was a good soul.

“Thank you. Not too many people are shakers and market makers on Chicago Leasing. We are lost souls in Chicago after the IFC fiasco. It's a nuclear waste land the fall out is still occurring. Lakeside, community state bank Elmhurst, west suburban 1st personal bank will not do leasing all thanks to RDT.

“I am working at School Dist. 21 because no one wants to do broker business.

“Oh well, when the Global Currency Reset hits and some foreign cash investments occur, I will get back in the game

“Jim Bailey who ran and owned MidStates Financial worked with Dale at AEL and now has his own little place still has no one to put in equity into his plan. Everyone here has been made into geldings.”

Tom Nars

-----

Balboa Capital Papa Murphy’s Bulletin Board Complaint

http://leasingnews.org/archives/Mar2014/3_26.htm#balboa

“It is not 100% clear from the article in your newspaper today, but it seems as if this was either an EFA/loan or a dollar-out. It seems Balboa charged interim rent. If this is true, then the charge of ‘interim rent’ on this transaction was is theft, pure and simple. On a loan or a dollar-out, the lender can charge per diem interest for each day prior to the commencement of the scheduled term, but not "interim rent" (which includes a principal component, in addition to an interest component). These people at Balboa know better. Balboa is one of the few bad actors in the industry that reflect poorly on the industry as a whole.”

Michael J. Witt

WITT LAW

4342 Oakwood Lane

West Des Moines, IA 5026

-----

“I have a Sales Person working for me, interview with them once. Immediately, they started calling his vendors.....NOT GOOD! My deepest sincerity goes out to their hard working Sales Staff; I wish them the best in future endeavors!”

Sincerely,

Martina Stone

President

OneWorld Business Finance - MI

By Martina Stone

-----

“I had heard yesterday from a reliable source that three (3) senior level guys (EVP, SVP & VP) from the AIG Commercial Finance (ELFA Member Company) in Plano, TX had been let go last Friday. Off the record can you let me know about this?"

(Sorry, have not been able to confirm or get it denied. Editor)

-----

Balboa Capital Loses Decisively

to Put Regents Capital Out of Business Right Now!

http://leasingnews.org/archives/Mar2014/3_18.htm#balboa

(One of our regular readers who will be obvious to those who know him though he requested we not use his name)went througha similar experience, as Don Hansen of Regents Capital is now experiencing, withhis former employer (Graphics Leasing Corporation) shortly after he started Champion Credit Corporation in 1991 (acquired by BankVest Capital effective 1/1/98).

(Ironically at age 75,Harold Gold, the founder of Graphics,was one of those arrested and made a plea in the Operation Fleece escapade.Gold hadvisited "Club Fed" previously for 21 months for defrauding his funding source, CFX Funding, LLC and had IRS problems for skimming residuals and tax evasion. Leasing industry characters are never boring! See links below (1). Editor)

“Open Letter to Don Hansen of Regents Capital

“Leasing News caused a flashback today (March 18, 2014) to the early 1990s. I am out of the leasing business but still read Leasing News each morning (anyone seeking a top-flight syndication / buy-desk manager with superior analytical skills?).

“In the 1980s I was employed by Graphics Leasing Corporation; owned and managed by the infamous Harold Gold. Graphics was well known and active in the Eastern Association of Equipment Lessors. Leasing people knew Harold and Graphics in the 90s but time marches on and new players and personalities come to dominate controversial headlines. Graphics was a great training ground and Harold was, for all his faults, very intelligent, very organized, and a very demanding but disciplined teacher. Louis Schneider, Dave Murray, Nelson Smith, Paul Levine, Bill Magner, and others were part of that class of the 1980s. Graphics spawned Direct Capital, Preferred Leasing, and a couple smaller players including Nationwide Leasing, MBO Leasing, Beacon Funding and Champion Credit Corporation. I left Friday, June 28, 1991, to start my own firm. It still remember the day.

“Soon after we left Graphics Harold sued in a similar manner as the Balboa-Regents dispute. Harold had warned us in an infamous "power and money" speech that anyone who left and started their own firm would be crushed either by litigation, the expense of the battle, or crushing K1s with no distributions which would lead to a tax lien.

“We left, they sued and alleged we had stolen their "confidential and trade-secret" customer (vendor) list. Graphics would spend the next year and a half to two years attempting to drive us out of business. It was a very stressful time: new company, young family, payroll to staff, big lawsuit from a well-funded adversary. Every Friday, their attorneys would show up in our office, park themselves in our conference room, and review discovery materials. (Applying an excellent strategy, they attempted to crush us with discovery requests. The judge agreed the request was permissible but burdensome so we were allowed to produce files for inspection at our office. A young associate in their downtown Boston law firm must have drawn the short straw for that assignment.)

“To exacerbate the pain Graphics deposed the national distribution accounts that had followed us to Champion. The strategy appeared to be if they couldn't find a hook to win the complaint, they would torture the vendors and make us radioactive to national account programs. It all failed one afternoon (the grand flashback).

“Graphics' attorneys were deposing a national account and pushing them to admit their dealer list was a confidential trade secret. [The Graphics vendor list was a compilation of numerous national dealer lists within the printing industry. The dealer lists were provided by the manufacturers when a national account program was signed.] The account kept pointing out everyone in the industry knew whose dealers were whose. Product advertisements would list dealer names. Graphics' attorneys responded that none of the ads listed every dealer name, just a few and pushed for an admission that the list was intended to be confidential.

“Finally in frustration from the incessant badgering the national account thoughtfully responded that none of their dealers names could truly be confidential trade secrets since they sold product to the U.S. Government and therefore their Government Services Administration (GSA) contract required they file their authorized dealer list. He then dropped the bomb by pointing out the GSA contract was a public record available in the Library of Congress to anyone inclined to go look it up. The deposition stopped, Graphics' attorneys asked a couple feeble questions and recessed. When the deposition resumed ten minutes later there were a few more less energetic questions and the attorneys concluded.

“Graphics settled with us shortly thereafter. As I recall, Graphics paid our legal bills and I insisted they pay me all of my residual commissions which they did by transferring to me a long list of residual accounts. It was a six-figure sum that allowed us to start funding our own portfolio. (Six figures was worth a lot more 20 years ago).

“Don Hansen, hang in there and focus on growing your business. I remember standing in the rather nice residential condo of the founder of Eaton Financial Corporation (one of the first major public big ticket lessors) overlooking the Charles River in Boston as he advised us that fighting these kinds of problems is always a lot easier when you're making money and admonishing us to focus on growing our business and not be distracted by the litigation (always easier to say when you're not in the cross hairs).

“Don, if your argument is about end users and Balboa files UCCs, I suspect all the end user names are a matter of public record and available through UCC searches (which can now be done on line) or ordered (at least one used to be able to do this) from D&B using the UCC creditor filing field as the search criteria.”

(1)

a. Pleads Guilty at age 79, Operation Fleece

http://leasingnews.org/archives/Dec2012/12_19.htm#sentences

b. Defrauding Funding Source

http://openjurist.org/30/f3d/251/resolution-trust-corporation-fa-v-gold

c. Tax Evasion

http://www.thefreelibrary.com/Sudbury+Executive+Pleads+

Guilty+to+Tax+Evasion,+U.S.+Attorney's...-a019248743

| Working Capital Loans $10,000-$250,000 | |

|

|

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Spring 2014 CLP Circular Now Available

http://www.leasingnews.org/PDF/CLPCircularSpring2014_42014.pdf

Mr. Terry Winders available as a consultant regarding assisting attorneys in resolving disputes or explaining procedures or reviewing documents as utilized in the finance and leasing industry. He is the author of several books, including DVD's, as well as weekly columnist to Leasing News. He also performs audits of leasing companies as an expert on documentation, and has acted as an expert witness on leasing for litigation in legal and tax disputes, including before the IRS. He also has taught the senior bank examiners, how to review a bank leasing department, for the Federal Reserve in Washington D.C. and has trained the examiners for the FDIC on how to prepare a lease portfolio for sale. 502.649.0448/terrywinders11@yahoo.com |

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

##### Press Release ############################

Advantage Funding Brings New Finance Program

to “Buy Here- Pay Here” and “Lease Here-Pay Here” Lenders

TUCSON, ARIZONA, ---A unique new funding program offered by Advantage Funding, an independent transportation lender, is helping more automobile dealerships expand customer financing by reducing roadblocks to credit approvals.

Ed Kaye, President

“The largest hurdle for dealers looking to enter the subprime lending space is access to capital,” Ed Kaye, president of Advantage Funding, told members of the National Vehicle Leasing Association (NVLA) today at NVLA’s annual conference here. “With the ‘Lease Here-Pay Here’ Program, we are removing that hurdle for many dealers across the country.”

Advantage Funding worked with LHPH, LLC, a San Diego-based lease service provider, for more than one year to develop a dealer finance model that is profitable and easy for dealers to use. “The ‘Lease Here-Pay Here’- (LHPH) finance structure works for both subprime loans and leases,” Kaye said, “enabling dealers to fund the cost of the vehicle, plus a small mark up, at below-market interest rates.”

Lease Here Pay Here is considered an affordable, legal, and highly profitable vehicle lease program, notes Kaye. “Using this program, dealers no longer have to deploy their own capital to fund sub-prime transactions,” Kaye said. “They can also generate positive cash flow on every subprime deal, every month.”

LHPH features short-term financing and low monthly payments. Dealers retain ownership of the vehicles throughout the lease period, and customers return the vehicles to the dealer at lease end. As a recourse line of credit, any default on the underlying contract is guaranteed by the dealer and must be paid off within 30 days of the default.

“The Advantage Funding LHPH program allows dealers to receive quick funding, drive positive cash flow, and maintain control of their customers—all in an affordable, consumer-compliant environment supported by industry experts,” Kaye said.

About Advantage Funding

Advantage Funding is a leading non-captive lender to the U.S. ground transportation industry. It is a subsidiary of Marubeni America Corporation, the multibillion-dollar, multinational general Japanese trading company.

About NVLA

NVLA represents the vehicle leasing industry, providing educational opportunities, promoting responsible legislation, and communicating with members on developments and trends in vehicle leasing. The association promotes the leasing concept while encouraging the highest ethical and professional standards.

### Press Release ############################

• Contract Negotiations • Fraud Investigations john@jkrmdirect.com | ph 315-866-1167| www.jkrmdirect.com |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

### Press Release ############################

Hitachi Capital Canada Acquires CLE Canadian Leasing Ent.

Hitachi Capital Canada Corp. (Hitachi) a 100% owned subsidiary of Hitachi Capital America Corp., announced today that it has signed a share purchase agreement to acquire 100% of the shares of CLE Canadian Leasing Enterprise Ltd., (CLE). CLE has been a trusted business partner of Hitachi in Canada since 2012. The acquisition of CLE strengthens Hitachi’s Canadian business base while improving Hitachi’s ability to grow financing activity in Canada. CLE will add assets of $198.4 million and annual originations of $129.6 million to Hitachi Capital Canada.

Bill Besgen, President/CEO

“CLE is an excellent company with an extensive sales network across Canada. They have been an excellent partner for Hitachi and this acquisition provides us with the ability to further increase our service and support to our manufacturing relationships with operations in Canada,” stated Bill Besgen, President and CEO of Hitachi Capital Canada.

Luc Robitaille, CEO

Luc Robitaille, CEO of CLE added, “We are very pleased to join Hitachi Capital Canada. Hitachi has a global reputation as a top competitor in the commercial equipment finance industry. We are confident that this acquisition will give CLE many new opportunities for growth and improved performance.”

The boards of both companies have approved the transaction. Completion of the acquisition is expected within the next 45 days.

About Hitachi Capital America

Hitachi Capital America Corp. was incorporated in October 1989 and commenced business operations in April 1990. We are headquartered in Norwalk, CT and are wholly owned by Hitachi Capital Corporation, Tokyo, Japan. Our parent was founded in 1957 as a subsidiary of Hitachi Ltd., and has become one of the leading financial institutions in Japan. Through our sister companies located in the United Kingdom, Singapore, Hong Kong, Thailand, Malaysia, Indonesia and China, Hitachi Capital has established a presence in the global market place to better serve our customers and our Hitachi group of companies worldwide.

About CLE Leasing

CLE Canadian Leasing Enterprise Ltd. is an independent financial institution who understands the reality of the business world. Since its foundation in 1979, CLE has been supporting very small, small and medium businesses as well as the self-employed and owner operators by offering financing solutions that are tailored to their unique requirements. CLE is synonymous with simplicity, speed and efficiency. Its’ staff is both attentive and creative when it comes to finding a personalized solution and supporting brokers, vendors and clients throughout the financing acquisition process.

Advisors

Cassels Brock served as legal counsel to Hitachi. The Alta Group Canada served as the lead financial advisor to Hitachi and Three Keys Capital Advisors LLC served as financial advisor to Hitachi Capital America Corp. Fasken Martineau served as legal counsel and National Bank Financial served as lead financial advisor to CLE.

#### Press Release #############################

|

--------------------------------------------------------------

#### Press Release #############################

Element Multi-Year Program Agreement w/Celadon Group

and Acquires US $53 million Lease Portfolio

Toronto, Canada – Element Financial Corporation, announced today that it has entered into a multi-year Program Agreement (the “Program Agreement”) with Indianapolis-based Celadon Group, Inc. (“Celadon”), one of the largest and most progressive transportation and logistics companies in North America, under which Element will provide financing for the renewal and expansion of the transportation assets operated by independent lessees under contract to Celadon.

As part of this transaction, Element has also entered into a Portfolio Purchase and Sale Agreement (the “Portfolio Agreement”) under which Element has invested US$53 million to acquire a portfolio of equipment leases backed by transportation assets currently operated by independent lessees under contract to Celadon.

### Press Release #############################

[headlines]

--------------------------------------------------------------

Dutch Shepherd Mix

Toronto, Canada Adopt-a-Dog

Animal ID: 20294574

Breed: Dutch Shepherd/Mix

Age: 2 years 3 months 7 days

Sex: Male

Size: Medium

Color: Brindle

Neutered

Declawed: No

Housetrained: Unknown

No Small Kids

Site: Toronto Humane Society

Location: Back Hall

Intake Date: 6/24/2013

Adoption Price: $180.00

Dutch Shepherd Mix - 2 Years Old - Neutered Male - "Go Getter" "Meet Max! A young Bulldog mix with tons of potential - he's just looking for that perfect family that can help him reach it! With lots of exercise, a structured routine, and positive training, Max will become that perfect gent!" Please note: In order to ensure a smooth and successful adoption, please remember to check all the basic requirements for adopting before coming in to the shelter.

http://www.torontohumanesociety.com/adopt_process.htm

Thank you and we hope to see you soon!

The Toronto Humane Society

11 River Street, Toronto, Ontario, M5A 4C2

Phone: 416.392.2273

Fax: 416.392.9978

Hours:

Monday to Friday - 11am to 6pm (animal viewing until 7pm)

Saturday and Sunday - 10am to 5pm (animal viewing until 6pm)

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

Classified ads—Back Office

Leasing Industry Outsourcing

(Providing Services and Products)

| Back Office: Atlanta, GA Let Tax Partners handle your sales and use tax compliance duties w/less risk and cost than in-house. Largest tax compliance firm in US E-mail:sales@taxpartners.com |

Back Office: 58 Calif. counties Property tax, assessment appear representation and consulting, including hearing appearances. www.rpcpropertytax.com Ken Sullivan 800-540-3900 |

| Backoffice: Dallas, TX Property Tax and sales and use tax administration services performance is guaranteed and we will save you time and money or our service is free. E-mail: info@osgsolutions.com |

|

| Back Office: Gig Harbor, WA Orion First Financial provides comprehensive lease/loan account servicing, collection/workout solutions and strategic advisory services. Contact David T. Schaefer 253-857-9610 dtschaefer@orionfirst.com |

Back Office: Laughlin, NV 20 years experience on funder/broker sides. Looking for a relationship where I act as credit shop for smaller brokers when financial statements are involved. E-mail:batarista@laughlin.net |

| Back Office: National Property Tax Compliance Services to the leasing industry. Over 60-years experience and fifty Lessors as clients. References and free quotes available, (216) 658-5618, E-mail gary@avptc.com |

Back Office – National Spending too much time on processing credit applications, preparing lease documents and other administrative tasks and not enough time marketing and growing your business? Call us! 407.964.1232 dee@leasebrokerassistant.com |

| Backoffice: New Rochelle, NY Proactive management/administration of commercial/consumer vehicle lease/finance portfolios covering insurance, titles, registrations, sales/property taxes, tickets, collections, accounting, vehicle disposition. Since 1975 E-mail: Barrett@BarrettCapital.com |

Back Office: Northbrook, IL Our staff of CPA's and lease professionals can handle any or all portfolio responsibilities incl. portfolio mgmt, invoicing, sales/property/income tax, accounting, etc. 800-826-7070 E-mail: ngeary@ecsfinancial.com |

| Back Office: San Rafael, CA We can run your back office from origination to final payoff. 30 years experience in commercial equipment lease and loan portfolio management. E-mail:gmartinez@phxa.com |

Back Office - Portland, OR Keep more of your hard-earned commissions! Middle-Market, Small-Ticket for brokers, nationwide, 20+years experience, negotiable splits. Contact us for more information at (888)745-9481 or bev@alliedpacific.net |

| Back Office -Portland Portfolio Financial Servicing Company is a leading provider of private label primary and backup servicing for lease and loan contracts. 800-547-4905 sales@pfsc.com |

Portfolio Servicing: Portsmouth, NH |

All "Outsourcing" Classified ads (advertisers are both requested and responsible to keep their free ads up to date:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing.htm

How to Post a free "Outsourcing" classified ad:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing-post.htm

John Kenny • Fraud Investigations • Credit Investigations • Asset Searches • Skip-tracing • Third-party Commercial Collections john@jkrmdirect.com | ph 315-866-1167| www.jkrmdirect.com |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

Federal Reserve Board Approves Umpqua Sterling Bank Acquisition

http://www.leasingnews.org/PDF/Umpqua_42014.pdf

Fed Reserve Board Approves PacWest Bank CapGen Capital Acquisition

http://www.leasingnews.org/PDF/PacWestApprovedGapGen_42014.pdf

CIT Study Finds U.S. Middle Market Energy Executives Upbeat

http://online.wsj.com/article/PR-CO-20140331-906010.html

Boeing blames pilots for Asiana 777 crash; airline faults software, too

http://seattletimes.com/html/businesstechnology

/2023272500_boeing777sfcrashxml.htm

Windows XP: Old Platforms Die Hard, Security Risks Live On

http://online.wsj.com/news/articles/SB100014

24052702304157204579473821528178710?mod=LS1

|

((Please Click on Bulletin Board to learn more information))

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

--You May Have Missed It

Ore. Pizza Delivery Man Gets His Own Shocking Special Delivery

http://gma.yahoo.com/blogs/abc-blogs/ore-pizza-delivery-man-gets-own-shocking-special-161644970--abc-news-Recipes.html

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

Eggs are Egg-cellent

Healthy or Not? We Crack the Case

http://www.sparkpeople.com/resource/nutrition_articles.asp?id=126

[headlines]

--------------------------------------------------------------

Spring Poem

The Bean Eaters

by Gwendolyn Brooks

They eat beans mostly, this old yellow pair.

Dinner is a casual affair.

Plain chipware on a plain and creaking wood,

Tin flatware.

Two who are Mostly Good.

Two who have lived their day,

But keep on putting on their clothes

And putting things away.

And remembering . . .

Remembering, with twinklings and twinges,

As they lean over the beans in their rented back room that

is full of beads and receipts and dolls and cloths,

tobacco crumbs, vases and fringes.

From The Bean Eaters by Gwendolyn Brooks, published by Harpers. © 1960 by Gwendolyn Brooks. Used with permission. All rights reserved.

[headlines]

--------------------------------------------------------------

Sports Briefs----

DeSean, Cully and the Moss Line

http://110percent.blogs.pressdemocrat.com/10115/desean-cully-moss-line/

Tiger has back surgery, to miss Masters

http://sports.yahoo.com/news/woods-back-surgery-miss-masters-161154881--golf.html

Desean Jackson not involved in gang activity says LAPD

http://www.washingtonpost.com/blogs/early-lead/wp/2014/03/29/desean-jackson-not-involved-in-gang-violence-lapd-says/

Ten most significant QB moves this off-season

http://sportsillustrated.cnn.com/nfl/news/20140401/2014-nfl-free-agency-quarterbacks-josh-mccown/?eref=sihp

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

California's $425M Powerball winner comes forward

http://news.msn.com/us/californias-dollar425m-powerball-winner-comes-forward

San Diego employment at record high

http://www.utsandiego.com/news/2014/apr/01/employment-jobs-great-recession-recovery-hiring/

Despite recent storms, Sierra snowpack remains well below normal

http://www.sacbee.com/2014/04/01/6286757/despite-recent-storms-sierra-snowpack.html

Leland Yee corruption case: State senator faces uphill fight against strong FBI evidence

http://www.marinij.com/ci_25453464/leland-yee-corruption-case-state-senator-faces-uphill

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

Spring tasting in Carneros

http://www.pressdemocrat.com/article/20140401/lifestyle/140339916

New Winerist Survey Reveals Wine & Food Travel is Most in Demand in 2014

http://www.prweb.com/releases/2014/winerist/prweb11711462.htm

Top Ten Most Powerful Wine Brands

http://www.thedrinksbusiness.com/2014/03/top-10-most-powerful-wine-brands/

Geyser Peak Opens New Tasting Room in Healdsburg

Location Off Westside Road Reinforces Sonoma County Heritage for Historic Winery

http://www.winebusiness.com/news/?go=getArticle&dataid=130342

Wine Dreams 101

http://www.pressdemocrat.com/article/20140325/lifestyle/140329762

Foley Family Wines Buys Four Graces Winery in Oregon

Third Major Wine Company Extends Reach to Oregon

http://www.winebusiness.com/news/?go=getArticle&dataid=130404

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1513- Juan Ponce de Leon discovered Florida, landing at the site that became the city of St. Augustine. He claimed the land for the King of Spain.

1792-the first US Mint was established at Philadelphia, PA, as authorized by an act of Congress. Copper coins were authorized in one cent and half-cent (coined until 1857). Gold coins in $10 Eagles, $5 half-eagles, and quarter eagles $2.50. It was not until 1849 that $20 double eagles and $1 gold pieces were authorized. All gold coins were discontinued by the Gold Reserve Act of January 30, 1934 that stated “no gold shall hereafter be coined.” Silver coins were the half dollar, quarter dollar, dime, and half dime, until 1873, when Congress enacted what was known as

“the crime of 73”, that made gold the sole monetary standard. The first paper money was issued by Native Americans in Oregon, the Araphos. Paper money was not authorized until July 17, 1861 and August 5, 1861 by Congress

1829-the Bank deposit insurance law was enacted in the state of New York, assessing banks one-half percent of capital stock until 3 percent was set aside " ...for the benefit of the creditors”. Banks, their officers, and their servants were required to be examined under oath at least once every four months.

1850-First masquerade ball in San Francisco with 600 guests. The event was organized by Tiffany Shlain and in 1898 moved to the Palace of Fine Arts with 2,000 guests.

1860--The birthday of Mary Raymond Shipman Andrews, author of “The Perfect Tribute” (1906) which sold more than 600,000 copies. It recounts the fictionalized meeting of Lincoln and a dying Confederate soldier during which Lincoln finds out the popularity of the Gettysburg Address. Her son became dean of the College of Law of Syracuse University.

1863- Richmond, Virginia Bread Riot: Women marched through the streets of Richmond, Virginia, demanding food. Facing them, Confederate President Jefferson Davis was equally adamant: If the protesters did not disperse, they would be shot. Indicative of conditions in the Confederate capital of Richmond, VA, an angry mob's demands for bread from a bakery wagon escalated into the destruction of nearby shops. Confederate president Jefferson Davis, in a bold move, stepped into the angry crowd and stated, "We do not desire to injure anyone, but this lawlessness must stop. I will give you five minutes to disperse, otherwise you will be fired upon." The mob dispersed without bloodshed.

http://americanhistory.about.com/library/prm/blrichmondbreadriots1.htm

1865-the evacuation of Richmond, VA, was urged by General Robert E. Lee, who informed Confederate President Davis that he himself must withdraw from Petersburg, VA. Davis left the city that night with his cabinet, retreating to Danville. The now small Confederate army began evacuation of Petersburg. Many believe it was General Grant and his troops that burned Richmond down, but that is not correct, according to historians and records of the time. “Richmond, meanwhile, burned, as fires set by fleeing Confederates and looters raged out of control.”

http://memory.loc.gov/ammem/today/apr02.html

1866- Civil War Officially Ends. The state of “insurrection” was declared over by presidential proclamation in Georgia, South Carolina, Virginia, North Carolina, Tennessee, Alabama, Mississippi, Louisiana, Arkansas, and Florida. It was not until August 2 that the president announced that the “insurrection” was at an end in Texas, and that civil authority existed in the United States.

1902 – First motion picture theatre, Electric Theatre, opens in Los Angeles.

1908-the first professional to manage a city, now called “City Manager” and the most prevalent form of city government in the United States, was Charles Edward Ashburner of Richmond, VA. He was elected general manager by the city council of Staunton, VA. Prior to this time, the mayor was the manager of each city. This was the first “professional city manager”, who’s first year salary was $2,000; the second year salary, $2,500. He served until July, 1911.

1908 – Mills Committee declares that baseball was invented by Abner Doubleday.

1909-Birthday of Hymie Schertzer. Alto player with Bunny Berrigan, Benny Goodman.

1917 – Jeannette Rankin (Rep-MT) begins her term as the first woman member of the US House of Representatives.

1918- birthday of the renowned African-American artist, Charles White, who began his professional career by painting murals for the WPA during the Depression. He was influenced by Mexican muralists Diego Rivera and David Alfaro Siquieros. Among his most notable creations are: “J'Accuse” (1966), a series of charcoal drawings depicting a variety of African-Americans from all ages and walks of life; the “Wanted” posters (c. 1969), a series of paintings based on old runaway slave posters; and “Homage to Langston Hughes” 1971.

http://www.charleshwhite.com/

1928-vocalist/songwriter Marvin Gaye born Washington, DC. Sang in his minister father's church. With Harvey Fuqua in re-formed Moonglows. To Detroit in 1960. Session work as a Motown studio drummer. First recorded for Tamla in 1961. To Columbia in 1982. Fatally shot by father during quarrel on 4/1/84 in Los Angeles. Inducted into Rock and Roll Hall of Fame in 1987. http://www.rollingstone.com/artists/bio.asp?oid=3020&cf=3020

http://www.soul-patrol.com/soul/marvibd.html

1931-Jackie Mitchell, 17, became the first woman to pitch in a professional baseball game after she was signed to a contract by the Chattanooga Lookouts of the Southern Association. In an exhibition game against the New York Yankees, Mitchell struck out Babe Ruth ( who took strike three) and Lou Gehrig (who gallantly missed three straight pitches) before Tony Lazzeri walked.

1932 -- Charles Lindbergh pays over $50,000 ransom for his kidnapped son.

1935--The birthday of Georgia Geyer, distinguished recipient of many journalistic and writing awards. She was imprisoned at one time because of her reportage. Her autobiography is part of the distinguished Radcliffe College series of outstanding American women.

1942-Glenn Miller records patriotic “American Patrol.”

1942 – Aircraft carrier, USS Hornet, departs San Francisco with Col. Jimmy Doolittle’s squadron of B-25s. This launched the surprise air attack on Tokyo at a time during WWII that was desperate for good news. This was later made famous in the movie, “Thirty Seconds Over Tokyo”, starring Spencer Tracy, June Allyson, and Van Johnson. Many consider it a turning point in the war, with the Battle of Midway. Although the damage inflicted on Japan in its back yard was minimal, it pierced their feelings of invincibility, and provided a morale boost to all of America.

1947--Country singer Emmylou Harris was born in Birmingham, Alabama. She first hit the country charts in 1975 with a remake of the Louvin Brothers "If I Could Only Win Your Love," which went all the way to number one. Her other number-one country songs include "Together Again" and "Sweet Dreams," both from 1976. Although her early albums contained a mixture of country, ballads and rock, Harris has never been able to register a significant pop hit. In 1979, she began concentrating on pure country material, much of it produced by her husband, Brian Ahern. Harris was part of the hit "Trio" album with Dolly Parton and Linda Ronstadt in 1987.

1948---Top Hits

Now is the Hour - Bing Crosby

I’m Looking Over a Four Leaf Clover - The Art Moonie Orchestra

Beg Your Pardon - Francis Craig

Anytime - Eddy Arnold

1954 – Walt Disney announces plans to build Disneyland outside Los Angeles.

1956-“As the World Turns” premiered on TV, one of the longest-running soaps currently on the air, "ATWT" premiered on CBS. The series is set in Midwestern Oakdale and revolves around the Hughes family and their neighbors. Irma Phillips was the show's creator and head writer. Some of its cast members who made it big are: Meg Ryan, Julianne Moore, Michael Nader, Steven Weber and Swoosie Kurtz.

1956-"The Edge of Night" premiered on CBS. Though the plots initially revolved around crime and courtroom drama, the serial's format soon developed along more conventional soap story lines of romance. The soap shifted to ABC in 1975 but was cancelled in 1984. Larry Hagman, Dixie Carter, Lori Loughlin, Willie Aames and Amanda Blake were some of the show's most prominent players.

1956---Top Hits

The Poor People of Paris - Les Baxter

Heartbreak Hotel - Elvis Presley

Rock Island Line - Lonnie Donegan

Blue Suede Shoes - Carl Perkins

1957--- Elvis Presley played two concerts before 23,000 people at Maple Leaf Gardens in Toronto. Presley performed outside the US only four times in his career - the two concerts in Toronto, one the next night in Ottawa and a later performance in Vancouver. The 15,000 fans who attended the second Toronto show was the largest audience the 22-year-old Elvis had faced. But before Presley came on, people had to sit through an hour of warm-up acts, including an Irish tenor, a rock 'n' roll tap dancer, and a comedian who did an imitation of a woman taking off a girdle.

1961- Trial of Adolf Eichmann begins in Jerusalem

http://www.us-israel.org/jsource/Holocaust/eichmann.html

1963 -- Reverend Dr. Martin Luther King begins the first non-violent campaign in Birmingham, Alabama, followed by a sit-in on April 3rd.

http://en.wikipedia.org/wiki/Bull_Connor

1964-The Beach Boys record "I Get Around", which will become their first US #1 single by the following July, selling nearly two million copies.

1964---Top Hits

She Loves You - The Beatles

Twist and Shout - The Beatles

Suspicion - Terry Stafford

Saginaw, Michigan - Lefty Frizzell

1965-Freddie And The Dreamers record "Do The Freddie", a song that was put together quickly after American audiences wanted to know more about the swaying motion that lead singer Fred Garrity seemed to do on stage.

1966-- Herb Alpert and the Tijuana Brass set a chart record when four of their albums make the Top 10 of the Billboard album chart at the same time.

1969 - The Milwaukee Bucks of the National Basketball Association signed Lew Alcindor for a reported $1,400,000 five-year contract. Alcindor soon changed his name to Kareem Abdul-Jabbar and was later traded to the Los Angeles Lakers.

1969-Frank Sinatra's version of "My Way" entered the Billboard Hot 100 where it would rise to #27. In the UK, the song would spend an amazing 75 weeks in the Top 40, peaking at #5.

1971--- Janis Joplin's LP “Pearl” hits #1

1971-Ringo Starr releases his solo hit, "It Don't Come Easy." It would become his first top-10 hit.

1972---Top Hits

A Horse with No Name - America

Puppy Love - Donny Osmond

Mother and Child Reunion - Paul Simon

My Hang-Up is You - Freddie Hart

1973 – CBS launches 24 hour news programming for the first time.

1974 - 46th Annual Academy Awards presentation at the Dorothy Chandler Pavilion in Los Angeles! Hosting the film industry celebration were John Huston, David Niven, Burt Reynolds, and Diana Ross. Pictures this year included: "Serpico", "The Exorcist", "Jonathan Livingston Seagull", "The Day of the Jackal", "American Graffiti", "Papillion", "Jesus Christ Superstar", "Last Tango in Paris", "Live and Let Die", "Cinderella Liberty". And this list doesn’t even include The Best Picture of the Year, "The Sting" (producers: Tony Bill, Michael Phillips, Julia Phillips). "The Sting" won six additional Oscars: Director (George Roy Hill); Art Direction (Henry Bumstead)and Set Decoration (James Payne); Costume Design (Edith Head); Film Editing (William Reynolds); Scoring/Original Song Score/Adaptation: (Marvin Hamlisch); Writing/Original Story/Screenplay based on Factual Material or Material Not Previously Published or Produced (David S. Ward); plus three additional nominations. Nor does it include these Oscar winners: Best Actor: Jack Lemmon for "Save the Tiger"; Best Actress: Glenda Jackson for "A Touch of Class"; Best Supporting Actor: John Houseman for "The Paper Chase"; Best Supporting Actress: Tatum O’Neal for "Paper Moon"; and Best Music/Song: "The Way We Were" -- Marvin Hamlisch (music), Alan and Marilyn Bergman (lyrics) from the movie of the same title.

http://www.infoplease.com/ipa/A0149268.html

1975 - The northeastern U.S. was in the grips of a severe storm which produced hurricane force winds along the coast, and two to three feet of snow in Maine and New Hampshire. Winds atop Mount Washington NH gusted to 140 mph.

1975 - The biggest snowstorm of record for so late in the season paralyzed Chicago, IL. Up to 20 inches of snow fell in extreme northeastern Illinois, and 10.9 inches of snow closed Chicago's O'Hare Airport.

1977 - "Sir Duke," Stevie Wonder’s tribute to Duke Ellington, was released.

1978-“Dallas” premieres on TV: Oil tycoons battled for money, power, women, and prestige in this prime-time CBS drama that ran for nearly 13 years. The Ewings and Barneses were Texas's modern-day Hatfields and McCoys. Larry Hagman starred as the devious, scheming womanizer J.R. Ewing. When J.R. was shot in the 1980 season-ending cliffhanger, the revelation of the mystery shooter was the single-most watched episode of its time (it was Kristin, J.R.'s sister-in-law, played by Mary Crosby, Bing’s daughter). Cast members included Jim Davis, Barbara Bel Geddes, Donna Reed, Ted Shackelford, Joan Van Ark (who, along with Shackelford, starred in the spin-off "Knots Landing"), Patrick Duffy, Linda Gray, Charlene Tilton, David Wayne, Keenan Wynn, Ken Kercheval, Victoria Principal and Steve Kanaly.

http://timstvshowcase.com/dallas.html

1979-Nickelodeon, the cable TV channel for kids owned by MTV Networks, debuted on this date.

1980---Top Hits

Another Brick in the Wall - Pink Floyd

Working My Way Back to You/Forgive Me, Girl - Spinners

Call Me - Blondie

I’d Love to Lay You Down - Conway Twitty

1980- Anne Murray won four Juno Awards, including best single for "I Just Fall in Love Again." Show host Burton Cummings was named top male vocalist.

1982 - Severe thunderstorms spawned fifty-six tornadoes in the central U.S., including seventeen in the Red River Region of Texas and Oklahoma. The tornadoes claimed thirty lives, and injured 383 other persons. A violent tornado near Messer OK left only the carpet tack strips on the slab of a house it destroyed, and carried a motel sign thirty miles.

1984 - John Thompson became the first black coach to lead his team to the NCAA college basketball championship. Georgetown’s Hoyas defeated Houston 84-75 in Seattle for the win. Thompson’s team in 1982 had finished second to North Carolina for the championship.

1985 - One day after its release, the album, "We are the World" was certified gold, when its sales reached an excess of 500,000 copies.

1985 - The NCAA Rules Committee adopted the 45-second shot clock for men’s basketball, to begin in the 1986 season. It was an effort to thwart the end-of-game stalls that kept opposing teams from scoring in close contests.

1986 – NCAA adopts the 3-point basket for shots that are sunk from a new semi-circular arc of 19’9”.

1987 - Eleven cities in Florida reported record low temperatures for the date, including Tallahassee with a reading of 31 degrees. The low of 48 degrees at Key West smashed their previous record for the date by 13 degrees

1987-- Canadian country rocker k.d. lang made her Los Angeles debut at The Roxy nightclub. Among the audience of 1,200 people were reviewers for the major newspapers and record industry executives. Lang's appearance came as her "Angel with a Lariat" was beginning its climb up the Billboard country chart.

1988---Top Hits

Man in the Mirror - Michael Jackson

Get Outta My Dreams, Get Into My Car - Billy Ocean

I Want Her - Keith Sweat

Love Will Find Its Way to You - Reba McEntire

1989 - Strong and gusty winds prevailed from California to Colorado and Wyoming. Winds gusted to 50 mph at Lancaster CA, and reached 85 mph at Berthoud Pass CO. Snow and high winds created blizzard conditions in the Colorado Rockies.

1990 - Thunderstorms produced severe weather in North Carolina and Virginia during the afternoon and evening. Thunderstorms produced golf ball size hail, and spawned a tornado near Chester, VA which caused half a million dollars damage. A storm system produced snow and gale force winds across northern Michigan, with 8.3 inches of snow reported at Marquette. Temperatures in the north central U.S. soared from morning lows in the 20s and 30s to afternoon highs in the 60s and 70s. Eight cities reported record highs for the date, including Havre, MT with a reading of 77 degrees.

1996- Tiger first baseman Cecil Fielder steals the first base of his eleven-year career. The swipe of second comes in the 1,097th game of 'Big Daddy's career, establishing the longest duration a player has ever gone without a stolen base.

1996-In a Chicagoland Collegiate Athletic Conference baseball game, St. Francis of Illinois humiliated Robert Morris, 71-1, in a game that Robert Morris coach Gerald McNamara declared over after four innings. St. Francis scored 26 runs in the first inning, 22 in the second, 4 in the third, and 19 in the fifth. The Fighting Saints broke a dozen NCAA Division II records and tied four others.

2001 - On Opening Day, Yankee fireballer Roger Clemens becomes the all-time AL career strikeout leader, passing Walter Johnson as he Ks Royals’ Joe Randa for his 3,509 Junior circuit victim. Passing the 'Big Train’, the 'Rocket' now takes over the seventh spot in major league history.

2001- For the first time in major league history, a Japanese-born position player participates in a regular-season major league game. Ichiro Suzuki, hitless in his first three at-bats, singles in the seventh inning to ignite a two-run rally and bunts for a hit in the eighth in his Seattle Mariner debut at Safeco Field.

2001—Duke University wins the NCAA Basketball Championship

http://sportsillustrated.cnn.com/basketball/college/2001/ncaa_

2003- Mike Bordick's record streak for games and chances without an error by a shortstop ends as Yankee outfielder Bubba Trammell's third inning grounder tips off his glove. After converting a fielder's choice in the first inning, he misplays his second chance of the game, thus ending the streak at 544 chances and 110 consecutive games without an error, a new major league mark for shortstops.

2003- Todd Zeile homers in first at-bat as a Yankee, becoming the only major leaguer to hit a home run for ten different teams. In addition to homering with the Bronx Bombers, the infielder has also gone deep for the Cardinals, Cubs, Phillies, Orioles, Dodgers, Marlins, Rangers, Mets, and Rockies.

NCAA Basketball Champions This Day

1984---Georgetown

1990—UNLV

2001---Duke

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------